Apskaitos ir analitinių valdymo sistemų formavimo tendencijos skaitmeninėje ekonomikoje

SerhiiHushko

Universitetas “Polonia”

(Lenkija)

dep.director_edu@kneu.edu.ua

https://orcid.org/0000-0002-4833-3694

VolodymyrKulishov

Universitetas “Polonia”

(Lenkija)

kulishov_vv@kneu.dp.ua

https://orcid.org/0000-0002-8527-9746

YaroslavIzmaylov

Kijevo nacionalinio

ekonomikos Vadym Hetman vardo universiteto

Institutas “Kryvyi Rih

Economic” (Ukraina)

izmaylov_yo@kneu.dp.ua

https://orcid.org/0000-0003-4853-205X

RasaSubačienė

Vilniaus universitetas,

Lietuva

rasa.subaciene@evaf.vu.lt

https://orcid.org/orcid.org/0000-0001-6559-8478

Anotacija. Naujausios visa apimančios skaitmenizacijos tendencijos kelia iššūkius, ieškant naujų būdų taikant ir tobulinant informacijos formavimo sistemas įvairiose srityse. Šios tendencijos taip pat daro įtaką įprastų stereotipų apie apskaitos metodus, apskaitos procedūras, finansinių ataskaitų formas ir t.t. vystymosi tendencijai, kuri galėtų būti įvardinama solidirizavimusi. Apskaitos sistemų solidirizavimasis iš esmės yra apskaitos tarptautiniame lygmenyje harmonizavimo problemos sprendimas, nors reikėtų atsižvelgti į tai, jog, greičiausia, neįmanoma pasiekti visiško solidarizavimosi. Tačiau viskas, kas yra daroma šia kryptimi nacionaliniame lygmenyje apskaitos sistemose (atskaitomybės standartizavimas, nacionalinių ir tarptautinių teisės aktų harmonizavimas, vertinimo ir kontrolės sistemų konvergencija ir t.t.) atspindi teigiamas tendencijas apskaitos sistemų solidarizavimo ir harmonizavimo procesuose. Tyrimo tikslas – įvertinti apskaitos ir analitinių valdymo sistemų (AAVS) formavimo tendencijas skaitmeninėje ekonomikoje. Tyrimo metodai: informacijos palyginimas, sisteminimas ir apibendrinimas. Straipsnyje nustatyti pagrindiniai organizacijos apskaitos sistemos elementai tokie, kaip apskaitos organizavimo ir vykdymo algoritmas, apskaitos ir vidaus kontrolės formavimo metodologija. Išskirtas poreikis generalizuoti šiuolaikinius pasiekimus AAVS konstravimui, formuoti organizacijos vystymosi strategiją, atsižvelgiant į darbo skaitmeninėje ekonomikoje ypatybes. Straipsnyje taip pat įvertinta taikomos organizacijos apskaitos sistemos modifikavimas ir modernizavimas, atsižvelgiant į naujus, besikeičiančius apskaitos informacijos vartotojų poreikius. Nustatyta, jog organizacijos AAVS tobulinimas padidintų jos ekonominės veiklos efektyvumą bei produktyvumą.

Reikšminiai žodžiai: apskaita, skaitmeninimas, globalizacija, informacija, apskaitos organizavimas, sistema, valdymas, analizė

JEL klasifikacija: M40

Copyright © 2019 Serhii Hushko, Volodymyr

Kulishov, Yaroslav Izmaylov, Rasa Subačienė. Published by Vilnius University

Press

This is an Open Access journal

distributed under the terms of the Creative Commons

Attribution Licence, which permits

unrestricted use, distribution, and reproduction in any medium, provided the

original author and source are credited.

Pateikta / Submitted

01/04/2019

Introduction

The development of digitalization and globalization processes, increased competition and rapid changes in market conditions involve making effective managerial decisions which ensure positive results of the activity of not only a single company, but society as a whole. It can be possible only by obtaining timely, complete, accurate, unbiased information on the business activities of the company, which AAMS can provide on the way of implementing the concept of sustainable development.

European and world experience shows that the state is not always able to create a single, detailed regulation system of accounting and reporting of economic entities. The use of the two-level mechanism of accounting management is considered to be more rational: the first level - laws, regulations and guidance materials; the second level - internal documents, standards and instructions of economic entities.

An orderly accounting and reporting system is the result of a coherent set of work of different executives, aimed at a certain result, the achievement of which is anticipated and expected by the management. Consequently, there is a direct correlation between the positive results of the implementation of the decisions made by the management and the rational organization of the company's accounting system.

Rapid changes in the external and internal environment of business entities, uncertainty in terminological approaches, ongoing development of the software determine the relevance of systemic considering and solving this scientific and practical problem.

The purpose of the research is to evaluate the trends of forming the accounting and analytical management system in the digital economy. The research methods are comparison, systematisation and summarisation of information.

1. Development trends of accounting and analytical management system

The article provides consideration of theoretical and methodological foundations and justification of the AАMS organization influence on generating the information concerning making effective management decisions in the digital economy.

Under conditions of the digital economy and globalization of the world economy, business management has become much more difficult, which reduces the time which is necessary to choose the optimal management solution.

Information resources have become the basis of emerging society. It is expedient to consider the digital economy as part of the post-industrial economy, which is determined by the progress of science and technology and forms the basis of technical and economic development, namely, high technologies. Thus, D. Bell identified the most important features of a post-industrial society:

- consumption of intellectual services;

- new intellectual technologies;

- shortage of information and time;

- the economy can be characterized as informational (digital).

This suggests that the basis of this type of economy is the transformation of information products and services into the object of production and consumption.

Europe is experiencing a turning point in its economic development. The strategic goal: to create in Europe ‘the most dynamic and competitive information economy in the world was set at the session of the European Council in Lisbon in 2000 (Lisbon European council 23 and 24 march 2000 presidency conclusions, 2010). To achieve their goal, the countries’ economic policy is aimed at the partnership with the private sector in the following areas:

- political and legal environment;

- infrastructure environment;

- investments in the development of human resources;

- interaction of the state and business;

- support for entrepreneurship.

The development of the digital economy in Europe is driven by the interest and commitment of enterprise leadership, which is embodied in the adoption of clear concepts and strategies. Such a management system is necessary to ensure the formation of proper information infrastructure. Governments need to allocate finance and resources and organize partnerships with the private sector and other stakeholders.

European governments have come to the realization that their countries will not get all the benefits from the information economy in the absence of state support for a fast, reliable, secure and multi-channel information infrastructure in one form or another. The deployment of such infrastructure requires substantial capital expenses, a large proportion of which is carried out by business. However, the state plays a decisive role in ensuring the legislative framework, shaping the market structure, regulating prices and quality of networks and, if necessary, stimulating demand.

The issues of accounting and reporting are widely and thoroughly covered in the writings of many international experts and scholars.

J. Bebbington, S. Russell, I. Thomson (2017) consider the role of accounting organization in the sustainable development of the economy.

For rational organization of the economic activity accounting it is necessary to establish a forward and backward connection (cooperation) between owners, managers, accountants, analysts and controllers in order to make the business entity to function as a single organism. There is a problem of compliance on the part of accounting experts of the Ethics Code of the International Federation of Accountants. It includes the following key criteria for the effectiveness of the accountant work: reliability of information, professionalism, a provision of quality services in accordance with consumer requirements, user and community trust (Code of ethics for professional accountants, 2019).

E. S. Hendriksen and M. F. Van Breda (1997) argue that the basis of accounting organization and the provision of equitable distribution of financial results are property relations. By the accounting organization the authors understand the set of activities oriented to the regulation of the accounting work carried out by the enterprise on behalf of the owner with the purpose to ensure the implementation of accounting tasks at the appropriate stage of the society development.

M. Shields (2018) defines the great role of the accounting organization in the system of management accounting development. The accounting organization is considered in the aggregate of three constituents: construction of the accounting system; an important management function; accounting staff management.

V. Yakimtsov (2018) interprets the accounting organization as a rational system of reflection of operations and results of activities with due regard to the economic and organizational characteristics of the enterprise, the implementation results of which will be the credibility and usefulness of information for making operational and strategic decisions. One can fully agree with the author's view that the accounting organization tends to achieve a synergistic effect through the implementation of "organizational synergy", which arises through the methodological unification and harmonization of accounting subsystems, the effective use of information technologies and the productivity of accounting and economic personnel.

In her scientific work E. Suprunova (2018) defines the accounting organization as an ordered, interconnected in time set of tools and components, including workers with appropriate professional competence, capable of forming the accounting data and information necessary to ensure the effectiveness of the business entity functioning.

John A. Pendley (2018) argues that computer systems and accounting technologies have become an integral part of the corporate automated information management environment for economic activity management. They build up a more qualitative level of cooperation, coordination and communication of the information links for the accounting unit and enterprise as a whole.

A performance analysis of the company's management systems in the digital economy shows that a lot of problems that arise during their functioning are generated by the imperfection of organizational and management structures (OMS), which, in their turn, result from the imperfection of their design methods.

In the existing management theory there is no fixed definition for the organizational and management structure. The most expanded definition is given by B.Z. Milner: ‘The dynamic, constantly reproducing in the attitudes of people, formal and informal division of tasks, powers, responsibilities, establishment of influences, connections and relationships between members of a team, prone to evolution, imperceptible, but sometimes very significant changes’ (Millner, 1983).

Defining the main parameters which characterize the organizational structure needs additional attention. Since the structure reflects the relationship between elements and subsystems, its main characteristic is the existing types of connections in the system and their intensity.

Rapoport V.S. (1983) points out that ‘although the structure itself is only the order of certain relations, it is impossible to describe, analyse and modify this order in isolation from the carriers of these relations – elements and units of the system. Consequently, when considering the OMS, it is always necessary to take into account the features of the organizational components’ (Rapoport, 1983).

In order to determine basic principles, goals and other theoretical basis of influence on the organizational and management structure, it is necessary first to study directly the management of the enterprise as a whole, that is, to determine its basis, and then, based on them, to formulate the theoretical basis for the mechanism of information support of accounting and analytical management system (AAMS).

Accordingly, it is logical and expedient to multilaterally study the development of the methodological base of the accounting and analytical management system, covering elements of accounting, analysis and control methods as well as related management activities, which ensures the adequacy of their information products to existing and new tasks.

2. Conceptual model of accounting and analytical management system of the company

Taking into account the definitions given by leading scholars, under the accounting organization it is suggested to understand a specific type of activity, which through a coordinated system of measures will provide a positive synergistic effect on managing the accounting process and increasing various positive indicators of the business entity. Improving the accounting organization at enterprises will enable to increase efficiency and raise productivity of the economic activity.

It is possible to state that due to the diversity of users’ requests for accounting information, the primary task is to provide complete, accurate and timely information to investors and other interested users.

Innovative orientation of the digital economy development and the necessity to harmonize accounting systems into a single economic space contributed to the development of accounting and analytical systems based on the integration of different types of accounting. The implementation of this trend requires the development of modern integrated accounting and reporting methodology that would combine the elements of the classical approach and modern information capabilities.

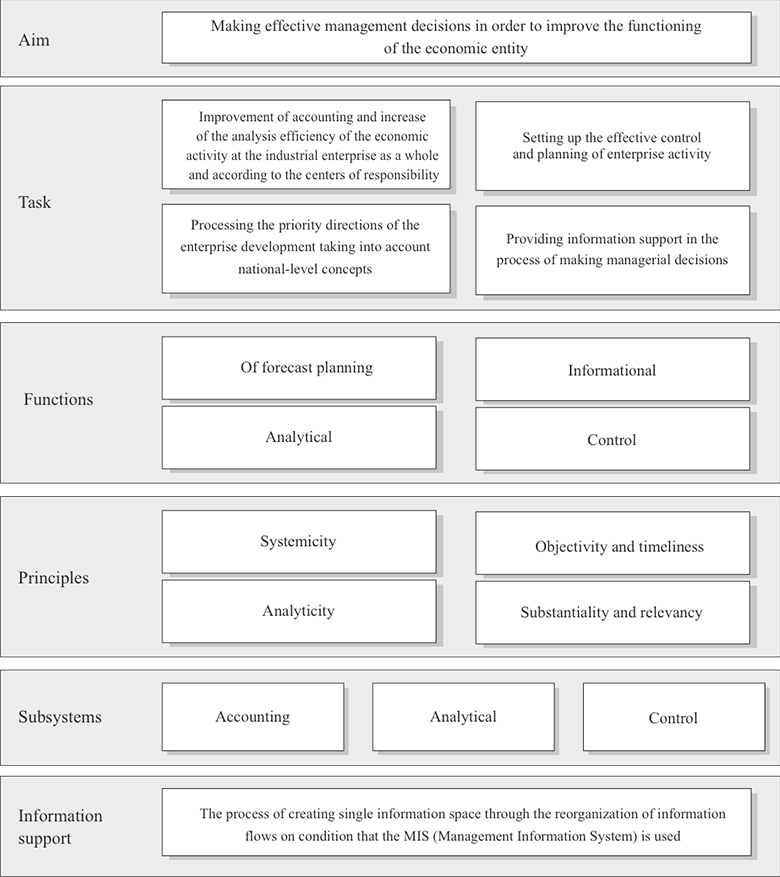

The formation of effective AAMS involves the implementation of the following main tasks:

- providing information support in the process of making managerial decisions and establishing effective control and planning of the company’s activities;

- improving the accounting and increasing the efficiency of the analysis of economic activity as a whole and according to the centres of responsibility;

- elaborating priority directions of the company’s development with

due account for national concepts.

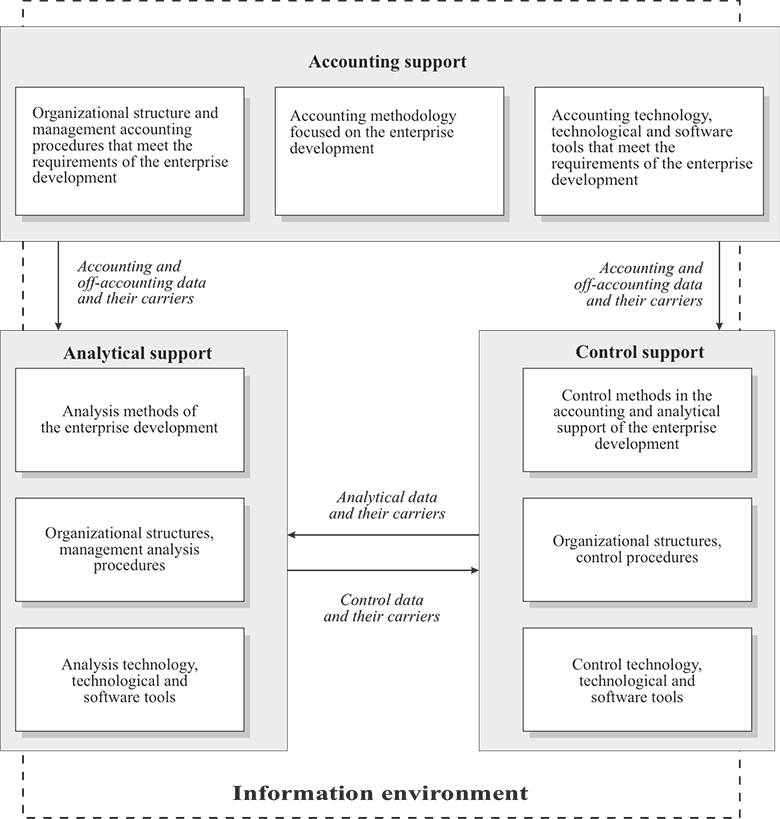

The accounting and analytical management system should carry out information, control, analytical functions and functions of predictive planning in order to make effective decisions at all levels of management (Fig. 1):

- information function – providing management with all necessary information, which involves collecting, processing, grouping and transmitting accounting data as intended;

- function of predictive planning – forming the basis for drawing up both current and prospective business plans and promoting the formation of an effective management system within a specific economic entity;

- analytical function – identifying the impact of individual business operations on the process of profit of generation, through a thorough and comprehensive assessment of the results of the business entity, which will allow preventing financial risks;

- control function – a subsystem of the control maintenance over the

implementation of management decisions, which promotes the preservation

of commodity and property values in the course of their movement and the

legality of financial and business operations as well as officials’ and

financially responsible persons’ actions.

All the elements of accounting, analytical and control subsystems have different goals, tasks, objects, methods and are intended for different information users. However, the important feature that brings them together is that the use of this information is intended to ensure making effective management decisions in the company.

Modern aspects of the AAMS formation include accounting, analysis and control of not only internal business operations in the context of business processes, but also the analysis of the parameters of the external macro environment. The AAMS should reflect both direct and feedback relationships that allow the system to adapt to the requirements of internal and external information users that may change.

In order to determine the main principles, goals and other theoretical foundations of the AAMS, it is necessary first to consider directly the enterprise management as a whole, that is, to determine its basis, and then, based on them, to formulate a theoretical basis, in particular for accounting and analysis.

The study of the principles of the AAMS formation proved that the proposed principles are determined by the specification of AAMS subsystems. The proposed generalization principles of AAMS in Fig. 1 involve:

- satisfaction of existing information requirements in reference to the reflection of production processes;

- cohesion of information coming from a variety of sources;

- efficiency and comprehensiveness of the accounting and analytical information display with the possibility of obtaining on its basis the necessary performance indicators;

- analysis of the total amount of primary information on its more effective use, including that one for the purposes of intra-firm planning;

- adjustment of the primary data encoding process with the purpose to improve data communication;

- forecasting the possibilities for the company’s effective functioning;

- practical implementation of the obtained results of analytical support.

Fig.1 Outline pattern for the accounting and analytical management system

Source: compiled by authors

The starting point in the general theory of management is the general theory of systems. That is why in the most general view management can be defined as ordering of a system. So, systematisation is a leading general methodological principle, while AAMS is one of the thematic control subsystems. The implementation of this principle represents the AAMS as a unit which encompasses logically interrelated components of the lower order, and at the same time, is an integral part of a higher-level system in which the AAMS interacts with other subsystems.

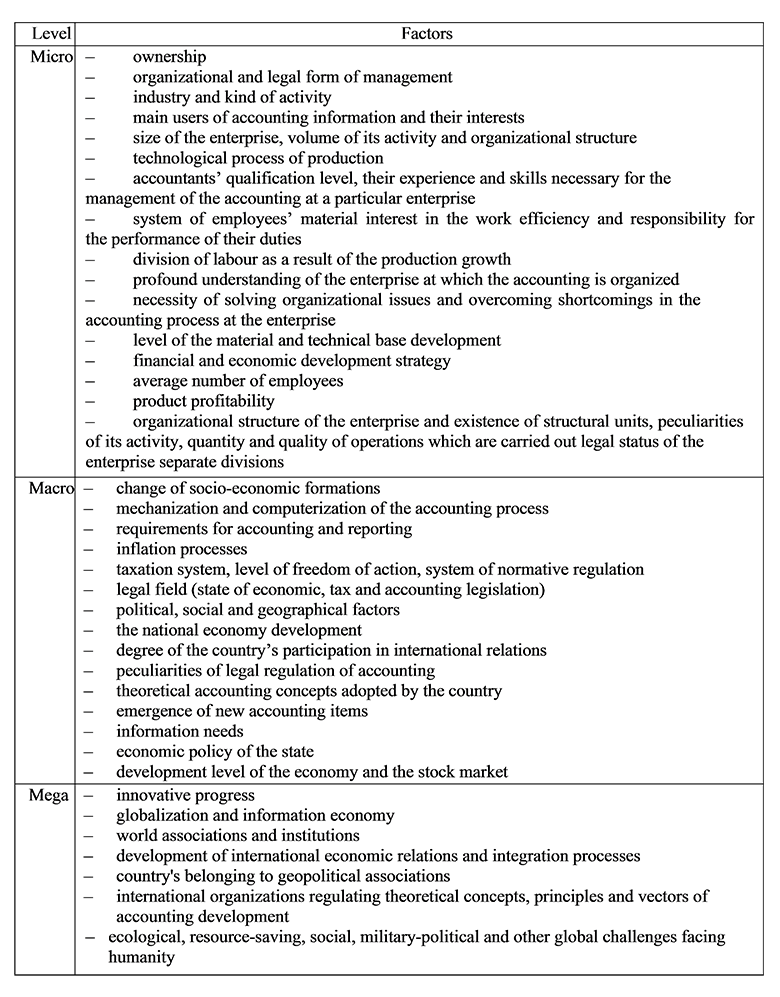

An important element of the AAMS formation is the study of the factors of influence on the micro-, macro- and mega-levels, which are presented in Table 1.

The list of factors represented in Table 1 allows the management due to deliberate management actions to reduce negative influence and maximize positive factors of micro-, macro- and mega-level on the development of business entities.

In present-day conditions of the digital economy development a modification of the existing and the emergence of new tasks for the AAMS organisation are taking place. It is caused by the reorientation of accounting and reporting data for new users, the transformation of the motives and requests of all economic agents interested in the accounting information, which is provided through official sites on the Internet. It is desirable to consider the components of the AAMS organization in the knowledge society through the prism of relations on two levels: 1) internal (which characterises relations within the company between accountants, other employees, managers, investors, etc.); 2) external (which characterises relations with buyers, suppliers, potential investors, competitors, state bodies, namely, fiscal services, local authorities, ministries and departments of all levels, a pension fund, social funds, environmental inspection, etc.).

The authors have developed and proposed for public discussion the characteristics of the components and tasks for improving the AAMS organization (see Table 2).

Table 1. Factors of micro-, macro- and mega-levels affecting the AAMS organization of the company

Source: compiled by authors

Table 2. Characteristics of the components and tasks for improving the AAMS organization

Constituents

Tasks

Manifestation at the internal and external levels

Inside the company

Competitors, contractors, the state

1

2

3

4

TECHNOLOGY OF ORGANIZING AND MAINTAINING ACCOUNTING

Organization of the movement of primary documents and accounting registers for documenting the facts of economic life

Affects the internal relationship between business units and electronic or paper flow of documentation. Due to the use of information systems accelerates the information flow and decision-making

Affects the construction of economic relations with contractors. Shows the controlling bodies the legality of the economic activity of the enterprise. Influences the information for stock and other markets concerning capital raising

Development and approval of plans for synthetic and analytical accounts of business and financial accounting

Organization of the use of information systems, technologies and computerization in the accounting

Organization of information security

Organization of the form and order for the contract filling

METHODOLOGICAL SUPPORT FOR BUSINESS ACCOUNTING

Selection of methods for the write-down of inventories

Affects the accounting procedure for economic processes and phenomena. Provides complete, reliable and prompt information to managers and investors for decision making

Affects the parameters of information necessary for public authorities at local, regional, and state levels

Determining the order of evaluation and accounting of property and sources of its formation

Organization of normative accounting issues

Development and organization of accounting systems for incomes, expenses and calculation of cost

Organization of labour cost accounting

ORGANIZATION OF THE ACCOUNTANT'S WORK

Determining of rights and responsibilities for the employees of the accounting department

Determines the relationship between management and employees of the accounting department, specifying their range of responsibilities, competencies, structure of service, work order, etc.

Defines a list of competencies and working conditions for potential applicants for an accountant position

Organization of the accounting service work

Rationalization of the employees’ number and work at the accounting department

Organization of the accounting service structure

ORGANIZATION OF BUSINESS

ACCOUNTING DEVELOPMENT

Provision of research works and preparatory courses

Determines the basic principles for the development of the accounting system at the enterprise and development of accountants’ abilities

Affects the parameters of information that can be provided by an accountant who has mastered additional competencies on an updated material and technical base, which enables attracting new investors, buyers, partners, increases social

Preparation of material and technical base in terms of technical means and information support; determination of a range of auxiliary procedures for the accounting development

Organization and provision of scientific trips

Establishing links with state and public organizations for cooperation

Application of a more rational model of the organizational structure of the accounting service; the composition improvement of the structural units of the accounting service

Organization of employees’ intellectual and social development

ORGANIZATION OF DOMESTIC MONITORING

Organization of internal control

Affects the order of accounting, control, audit and revision of economic activity. Performs a protective function for the enterprise. Provides managers and investors with information on the preservation and use of enterprise resources. Informs control bodies about thefts and ineffective use of capacity utilization to enable those to make rational managerial decisions.

Improves economic relations with contractors.

Affects the parameters of information necessary for public authorities.

Effective control organization provides the opportunity to attract new investors, buyers, partners, increases social significance and image of the enterprise.

Organization of accounting control

Organization of internal audit and revision

Source: compiled by authors

All of the above-mentioned subgroups of the tasks for improving the AAMS organization in the conditions of modern development of the world economy are focused on the formation of information management space, which is crucial for the development of both a separate accounting entity and the state as a whole. Original accounting tasks may be changed in accordance with the specifics of the internal and, above all, the external environment. As a matter of fact, it is the specificity of socio-economic relations that determines the requests of users for accounting and reporting information and their priorities.

That is why the following groups of tasks determine the key points of the theoretical and methodological design of the AAMS organization. In accordance with the established tasks, the priority of the objects of the accounting organization changes, there is a transformation of the elements of the organization method and the principles which determine the directions of their use.

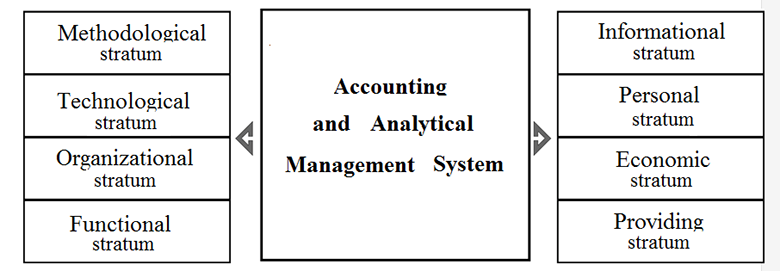

One of the ways to explore the AAMS synchronization and the organizational and management structure of the company is the proposed stratified approach.

Stratification involves identification of the models, each of which describes the behavior of the AAMS in terms of different levels of abstraction. For each level there is a set of characteristic features, due to the use of which the behavior of the system is described. These levels are called stratums.

According to the principles of stratification, it is suggested to distinguish the following significant stratums: methodological, informational, functional, providing, organizational, technological, personnel and economic (see Fig. 2).

Fig.2 Multidimensional model of the AAMS stratified representation

Source: compiled by authors

The purpose of creating the AAMS stratified representation is generation and information modeling of the data obtained in various subsystems of accounting and analysis, their synthesis and analysis on the basis of conceptual requirements for the financial reporting of economic entities and preparation of reports in various formats. These include multi- purpose reporting, which is formed in accordance with the general user’s requests and reporting on requests that are generated according to specific requests of individual users. Namely, it is recommended that:

- the methodological stratum consider the possibility of solving a certain set of problems, the sequence of which may be different depending on the general condition of the AAMS at a specific company;

- the functional stratum consider the functions which must be performed by the AAMS;

- the organizational stratum deal with the structural aspects of the AAMS interaction, its external and internal links;

- the technological stratum deal with the aspects of the AAMS interaction and the particularities of production technology;

- the providing stratum consider technical means, software system support, application software, a database;

- the personnel stratum consider the requirements for the personnel that directly perform functions in the context of the AAMS implementation, certification procedure and advanced training;

- the economic stratum deal with costs and revenues in terms

of value that are conditioned by the setting up and functioning of the

AAMS.

So, the proposed methodology of the stratified approach allows allocating any number of stratums. It reveals new opportunities for the AAMS influence on the organizational and management structure of the company from the standpoint of the system approach.

The emergence of a large number of users with different information requests requires the use of a systematic approach to the formation of the AAMS based on the procedures of information filtering, regulating the information flows, creating a system of accounting and analytical indicators through the allocation of components which directly affect the process of its preparation and presentation.

Such components are, firstly, the regulation of accounting and reporting; secondly, the circle of users, their general and specific requests for reporting information; and thirdly, the combination of the used information sources.

Complimented by the growing demands of users for quantitative and qualitative reporting characteristics, the expansion of the range of financial and non-financial indicators in the explanations to the reporting, the AAMS, in addition to accounting information, should include normative, prospective, legal, evaluative, analytical and statistical one.

Strict requirements for corporate management, reporting and providing investors with information can not only streamline the decision-making system at all levels, but also often become a stumbling point for many emitters who are not ready for ongoing monitoring of internal processes and the disclosure of large volumes of information which is mostly considered to be strictly confidential.

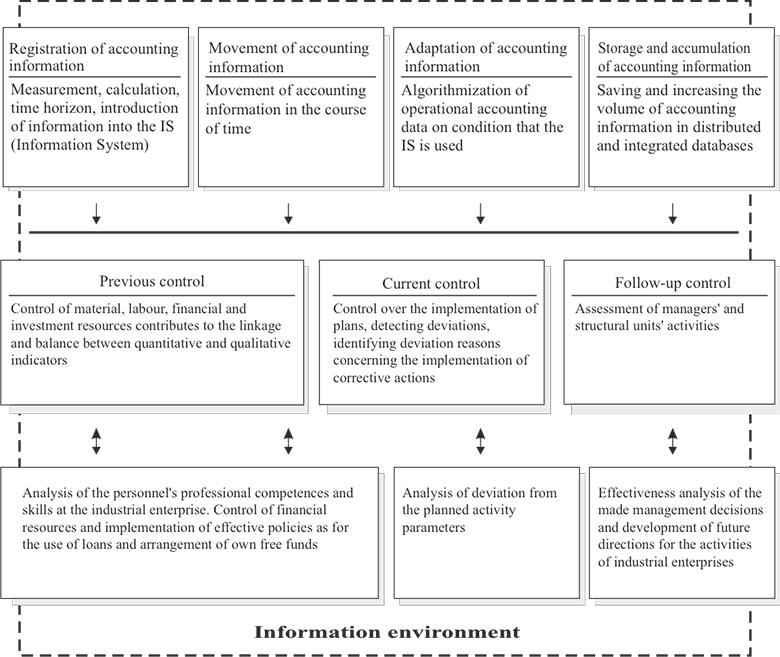

The process of improving the accounting, control and analytical procedures of the company management depends on the correct selection and application of the whole methodological arsenal of those principles and methods that are most correspondent to the objectives of increasing the efficiency of the accounting process with the designation of control procedures in coordination with analytical ones (see Fig. 3).

Fig. 3 Accounting, control and analytical procedures of the company management from the point of view of the system approach

Source: compiled by authors

This will facilitate the approbation of the proposed stratified approach in regard to the impact of the AAMS on the organizational and managerial structure of the company from the point of view of the system approach.

In the future, this will allow to combine differently vectored directions of work of different structural divisions of the holding in the course of the development of a general management strategy, coordinate operational activities, and implement the concept of a multi-level monitoring system as a system for continuous diagnostics of the company's economic condition, providing that the process approach is used and taking into account the formation of sector clusters. This is a key factor which ensures the financial transparency of the company.

The mechanism of information support for the accounting and analytical management system is the unity of accounting, analysis and control systems, integrated by information flows for the management of economic processes (see Fig. 4).

Fig. 4. Model of the information support mechanism for the accounting and analytical management system in the digital economy

Source: compiled by authors

Inclusion of the information subsystem in the AAMS will create the essential conditions for the operation of the company's management system; provide means for receiving, searching, accumulating, storing, transmitting and processing information; guarantee the organization of accounting and off-balance data.

The content of the company’s AAMS is disclosed in a specially-oriented model, which, according to each type of security (accounting, analytical, control, informational), describes in detail the organizational structures, management procedures, methods and technologies.

Accounting and analytical management support is determined by the structure of the accounting and analytical system and is the core and part of the information support. Creation of accounting and analytical support for the management of the company’s business processes will allow creating a basis for rational management decisions, which in its turn will promote the decrease of the production cost, the increase of the activity efficiency, its competitiveness, and the accounting efficiency in the digital economy.

Conclusions and perspectives for further research

The article systematizes the scientists’ views, analyses and theoretically substantiates the improvement of the methodology of companies’ AAMS organization in the context of globalization processes and digitalization of the economy.

Firstly, the article presents the original interpretation of the accounting organization, recommended to conceive as a specific type of activity, which through a coordinated system of measures will provide a positive synergistic effect from the accounting process management and the increase of various benefits for the business entity. The improvement of the companies’ accounting organization will enable to raise the efficiency and increase the effectiveness of business activities.

Secondly, presented and classified factors at micro, macro and mega-levels influencing the accounting organization need to be taken into account in the development and implementation of strategic management actions.

Thirdly, the proposed component system of the AAMS organization will allow improving the theoretical basis of the accounting organization, arranging the activities of the company’s structural divisions; receiving immediate, complete and reliable information, which will create an opportunity to manage effectively on the whole.

Fourthly, the article defines the main components of the accounting organization, among which there is a technique of organizing and maintaining accounting, methodical accounting support; organization of the accounting development and internal control.

To summarise, in the current context of globalization and digitalization of the economy, there is a modification of the existing and emergence of new tasks for the accounting organization due to a focus on new users, transformation of motives and requests of all interested in the accounting information participants of economic relations.

Further research is recommended in the direction of the development of qualitative accounting and analytical support for companies’ business activity in view of its role in managing the sustainable development of the world's economies in the digital economy.

References

- Bebbington, J., Russell, S., Thomson, I. 2017. Accounting and sustainable development: Reflections and propositions. Critical Perspectives on Accounting. Vol. 48, 21-34. https://doi.org/10.1016/j.cpa.2017.06.002

- Cleary, P. 2017. Introduction to Accounting Information Systems. The Routledge Companion to Accounting Information Systems. 3-12. https://doi.org/10.4324/9781315647210-1

- Code of ethics for professional accountants. 2019. Retrieved from: http://www.ifac.org/Ethics/index.tmpl

- Durler, M. G. 2015. Integrating a Comparison of Enterprise Resource Planning (ERP) and Accounting Software into the Accounting Information Systems Course. Journal of Business and Economics. 6(7), 1277-1284. https://doi.org/10.15341/jbe(2155-7950)/07.06.2015/004

- Hendricksen, E., Van Breda, M. 1997. Accounting Theory. Moscow: Finance and Statistics, 576.

- Hushko S.V. 2010. Methodological and organizational aspects of accounting, analysis and audit in the management of enterprises of the mining and metallurgical complex. [Monograph]. Kyiv: State University "KNEU named after V. Hetman", 332.

- Kristandl, G. 2017. Technologies underpinning Accounting Information

Systems. The Routledge Companion to Accounting Information

Systems. 24-38. https://doi.org/10.4324/9781315647210-3

- Lisbon European council 23 and 24 march 2000 presidency conclusions. 2010. [Electronic resource]. Retrieved from http://www.europarl.europa.eu/summits/lis1_en.htm

- Milner, B.Z., Evenko, L.I., Rapoport, V.S. 1983 System approach to management organization. Moscow: Economics, 224.

- Pendley, J. A. 2018. Finance and Accounting Professionals and

Cybersecurity Awareness. Journal of Corporate Accounting &

Finance. Vol. 29 issue 1, 53-58. https://doi.org/10.1002/jcaf.22291

- Rozhelyuk, V. 2018. Organization of accounting of enterprises engaged in processing agricultural products, dissertation. doctor econ Sciences: 08.00.09. 439. [Electronic resource]. Retrieved from: https://ecj.oa.edu.ua/articles/2016/n29/27.pdf .

- Shields, M. 2018. A Perspective on Management Accounting Research. Journal of Management Accounting Research. Vol. 30 issue 3, 1-11. https://aaapubs.org/doi/abs/10.2308/jmar-10618

- Suprunova, E. 2018. Transformation of new types accounting in the context of globalization and digitalization of the economy. International Accounting. Vol. 21 issue 8, 870-886. https://doi.org/10.24891/ia.21.8.870

- Svirko, S. 2006. Accounting in budget institutions: methodology and organization: abstract dissertation. doctor econ Sciences: 08.06.04. KNEU, 42.

- Yakimtsov, V. 2018. Time factors for determining the complex

synergetic efficiency of enterprises. Problems of systemic approach

in the economy. https://doi.org/10.32782/2520-2200/2018-5-27

Serhii Hushko Prof. DSc, First Deputy Director for Scientific, Academic and Educational Work, Visiting Professor of Polonia University in Czestochowa. Adress of insitution: 4/6 Pulaskiego street PL 42-200, Czestochowa, Poland.

Volodymyr Kulishov Prof. DSc, Kryvyi Rih Economic Institute of Kyiv National Economic University named after Vadym Hetman: Kryvyi Rih, Ukraine, Visiting Professor of Polonia University in Czestochowa. Adress of insitution: 4/6 Pulaskiego street PL 42-200, Czestochowa, Poland.

Yaroslav Izmaylov Associate Professor, DSc at Kryvyi Rih Economic Institute of Kyiv National Economic University named after Vadym Hetman: Kryvyi Rih, Ukraine.

Rasa Subačienė: Professor, doctor of social sciences, management and administration. Scientific interests - financial accounting, management accounting, analysis of activity of enterprises. Vilnius university, Faculty of Economics and Business Administration, department of Accounting and Audit. Adress of insitution: Saulėtekio av. 9, II building, LT-10222, Vilnius. Tel. (+370 5) 263 61 53.

Pateikta / Submitted 01/04/2019