Ekonomika ISSN 1392-1258 eISSN 2424-6166

2019, vol. 98(1), pp. 6–18 DOI: https://doi.org/10.15388/Ekon.2019.1.1

The R.B.Q. (Rational, Behavioral and Quantified) Model

Constantinos Challoumis*

National Kapodistrian University of Athens, Greece

Abstract. This paper is about the classic methods used in the analysis of economics. More precisely, the R.B.Q. (Rational, Behavioral, and Quantified) model is about rational economics and behavioral economic analysis in conjunction with the quantification procedure (Q.E. method). Therefore, in this work are submitted the most common methodological approaches used in economics including a form of their combination. What follows is a critical examination that extendedly scrutinizes the terminology of axiomatic methods. One of the aims of this paper to represent the special characteristics of rational economics in comparison to the case of behavioral economics. Then provided is an analysis wherein the issues relevant to this are represented, and on the basis of which the main differences between the two concepts are showed. Hence, the aim here is to show the crucial attributes of these concepts. This study also uses a quantification method to show the behavior of these two economic theories within their relation to one another, demonstrating a complete view of them in a single economic model.

Keywords: rational/behavioral, Keynesian, Neoclassical, axiomatics, quantification (Q.E. method).

* Corresponding author:

National and Kapodistrian University of Athens, 1 Sofokleous Str., Athina 105 59, Greece.

Email: challoumis_constantinos@yahoo.com

Received: July 2018. Revised: February 2019. Accepted: February 2019

Copyright © 2019 Constantinos Challoumis. Published by Vilnius University Press

This is an Open Access article distributed under the terms of the Creative Commons Attribution Licence, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

1. Introduction

The aim of this paper is to show that a combination of rational and behavioral economics could be plausible using quantification methods. According to rational economics, the assumptions and confirmations of these methods are crucial for the acceptance of each economic theory. However, diversions occur between assumptions and confirmations. Behavioral economics estimate these anomalies, are moreover critical of them, and can be used identify the causes of the results of each theory. This analysis shows that the combination of rational and behavioral economics yields better results in a form shared between the two methods, through a quantified approach.

2. Literature Review and Methodology

Axiomatics represent that a model is confirmed and is then approved by a theory, expressing a general rule about the issue of this study. The Keynesian methodology is based on the rational model, but there are some issues regarding the purity of the rationality of this methodology that is used by Keynes. The reason is in some of the occurring controversies.

These controversies lie in the behavioral and rational approach of the Keynes methodology (this section presents a scrutinization of the rational economic approach, and the behavioral approach is further scrutinized as well)1 (Camerer 2003). Keynes uses as a methodology the aspects of long-term expectations, conventions, and animal spirits2 (Pech & Milan 2006). Rationality is then, according to the Keynesian approach, identified in assumptions (hypotheses). The approach of the animal spirits is defined by Dow and specifies that the long-term expectations are generated by a conventional optimizing procedure, which uses rational criteria. This procedure is not able to model a theory using irrational criteria. Also, Keynes uses the Babylonian methodology. The interpretation of the Babylonian method is that any approach to any issue could be made using a variety of starting points. Therefore, any hypothesis that can be made should lead to the same result. The R.B.Q. (Rational, Behavioral, and Quantified) model is based on that the Q.E. methodology. Then, based on these theoretical structures, we determine the behavior of the economic-mathematical model to extract the conclusions about the behavior of this model, using quantification and mathematical tools (Q.E. method).3

It should be noted that the mathematics approach creates a range of data. The initial determination of the upper and lower limits of value is a crucial factor for the clarification of the independent variables; it is therefore irrelevant to the range of data. Then, for this reason, it is not possible to acquire a mathematical determination from the range of data. Technically, it would be plausible to make a different approach, but it is out of the scope of this methodology (from a strict point of view, at least). Thus, each study of the quantification of quality data has as an initial point of mathematical determination, which comes from the theoretical approach. For this reason, the mathematic equation consists of a hypothesis. This means that after the application of this methodology, the consistency of the theory with the transformation of quantitation should be checked. Otherwise, appropriate adjustments should be made in order to comply with mathematical analysis and the theoretical principles. Under different circumstances, if the theory is not determined and the key point is the mathematical point of view, the analysis must be initiated with a different approach. However, we always receive feedback both before and after the application of the Q.E. methodology. The collateral of this procedure is the consistency between the results and the hypothesis, and this happens through feedback, which always should be considered after the establishment of a theory using a hypothesis or a check of an existing theory. Therefore, we may conclude the three basic points that the hypothesis and the mathematical determination need for the establishment of quality data:

• The first step is about dealing with the hypothesis. Hence, at this point, the scholar should answer what it is the underthought and the aim of the scientific analysis. Thus, the mathematical determination is the main point of this step.

• The second step is about the generator, which produces the values for the independent variable. The key element is the upper and the lower limit, which are used for the production of values under randomization. This technique allows the formation of the variables in a quantity control, which is not directed by the scientist. Thereupon, after a critical number of irritations, it becomes plausible to sketch the mathematical equation as much as was concluded by the behavior of the equation. This procedure requires at least one mathematical equation, but an appropriate analysis needs at least two mathematical equations with either a lack of some variables or more variables added to an existing equation in order to understand how the equation reacts in different forms.

• The third step is very critical, as it is the point where it becomes plausible to determine the conclusions and make feedback with the first step, and with that it becomes possible to either proceed with a confirmed existing theory or to submit a new thesis.

These three steps are used for the confirmation of a model. The application of this method in real economics is discussed in another paper, where the Q.E. method was applied to the case of the health factor on the economy (Challoumis 2018) The way to apply the Q.E. method was also described on a separate occasion (Challoumis 2017).

3. The Fundamental Principles of Axiomatics

Axiomatics rest on the assumption that we are not aware of the result of the hypothesis. This is the key to the scrutiny of the economic theory that is under examination. The hypothesis of an economic theory is the basis for the further study of each economic model that is under examination. Therefore, axiomatics are used to disclose the background of economic analysis and confirm that the initial hypothesis of a model is satisfied. If the hypothesis is satisfied, then the model is considered consistent with the principles of the model that is under examination. Thence, there are two cases for the results of the axiomatics. According to the first case, the axiomatics are satisfied because the hypothesis of the model, after the examination of the model, is satisfied. The second case deals with such an incident when the axiomatics are not satisfied, because the initial hypothesis of the model had not been satisfied.4 Therefore, in this case, we conclude that the economic model is not sufficient. Then, the main concept of axiomatics stands on the correspondence of the initial hypothesis with the mathematical and economic result of the scrutiny. As much as possible, the scholar must clarify the theory about the chosen model. There are a series of attributes regarding axiomatics:

• The consistency of axiomatics. The consistency of axiomatics placed on the issue of the hypothesis. The interpretation is that the hypothesis and the axioms used in the economic model are consistent with the proposed theory. Consistency depends on the result of the economic analysis. If the conclusions are satisfying the initial assumptions of the economic model, the theory exists; otherwise, the theory does not exist. The proven connection between the hypothesis and the results is crucial for the definition of the theory. If there is no connection, the scientist should reexamine and appropriately reestablish the theory (Challoumis 2018).

• The contradictions of axiomatics. Contradictions serve as evidence the theory and the analysis of the economic model need reform. If contradictions are present, the scientist should reconsider the assumptions or the data that are used for the study. A classic instance is when a system of equations is used for the scrutiny of the economic model. In most cases there are more conditions that support the system of equations that are under examination. If the results are not complying with the mathematical structure of the model in combination with the theory, a contradiction occurs then. In such a case, there should be adjustments either in the theoretical background or in the mathematical conditions used in the economic model. If the model needs adjustments, this is an indicator that we have contradictions, meaning that the hypothesis and the results of the economic model do not comply. Then, the two more or less classic ways to readjust the system of equations of the model is to either add more conditions or subtract some the conditions. If there are modified conditions used in combination with the equations of the analysis, this needs to be done as much as required by the economic model so that it becomes consistent.

• The completeness of axiomatics. The term of the completeness of axiomatics in economic theory is about the uniqueness of the solutions that are derived after the analysis. By that we mean that the system of equations, which is used in the economic model, should give a different result when changing the input values to the system. This makes the economic model complete, as the results are unique and accord to the changes in the variables. Thus, if there is the same solution with different inputs to the model, a reconsideration of the system of equations is probably due, which should also be a subject to the conditions that were used in that particular model.

• The weakness of axiomatics. Axiomatics should be as weak as possible. The interpretation regarding this is that the axioms should be as general as possible. The reason for this is that the economic model should represent one economic situation as widely as possible, because that way it could be more possible to clarify the rule about the subject of examination.

• The independence of axiomatics. The independence of axiomatics is placed on condition that none of the axioms should be the products of the other, expressing with that any repetitiveness between them (Boland 1991; Gihman & Skorohod 1972). Thus, the main idea is that the axioms should not contain any parts of the other axioms that were used in the model. As a result, the results can specifically allow the scientist to draw precise conclusions.

The consistency and the completeness of the economic model are the most crucial elements in the analysis, as they are strongly connected with the hypothesis and the results of the model. If something is wrong with these two aspects, readjustments should be made in the conditions of the economic model. This could be done by adding or subtracting the mathematical conditions or in any other way that would transform the model in such a way that the theory would comply with the assumptions of the model. After that, the aim is to clarify that the initial assumptions of the economic theory were adequate and well-chosen. Also, after the examination of the prior two elements, studied should also be the compliance of weakness and of independence.

4. Direct/Indirect Testability and the Testing Logic in Economic Models

The satisfaction of the assumptions can be conducted by testing the equations chosen for the purposes of the model that is under examination (Gihman & Skorohod 1974; Martin 1971). It should be mentioned that there exists a distinction between the methods used for the tests of the assumptions. Then, we have the case of the direct tests and the case of the indirect tests:

• The direct tests are for the assumptions of the applied theorists. This means that the researchers of the applied science have a strong concern regarding the testability of their results – as much as the scientists are testing the limits of the applicability of their general theories.

• The indirect tests are the assumptions of pure theorists. This means that the researchers of the theoretic sciences need to find out the testability of a system of ideas to clarify their theories. In this way, the pure theorists are checking the veracity of their theories.

Therefore, we obtain that depending on the subject of the study, the researchers do their estimations using different ways to come to the results of the assumptions. But, in any case, the results should comply with the initial hypotheses, as this is the key element of the adequacy of the chosen economic models. We then have some basic logic rules that must be followed to determine if the assumptions comply with the results:

• If all of the chosen premises comply with the results of the economic analysis, then the model is fine to proceed.

• If any of the conclusions are not fine with the theoretical background, then one of the premises need readjustment.

• If any premise is not appropriate, then we will not have the appropriate results.

• If the conclusions are fine, this does not without a doubt mean that the premises are also fine.

This is followed by a true-or-false logic regarding the results and the hypotheses of the economic model, which are responsible for the final conclusions. Therefore, the connection between the assumptions and the results is the source for the researcher to anticipate if the economic model can meet the set requirements. The hypotheses and the results are thus the navigators for determining the adequacy of a study.

The mathematical and non-mathematical economic approaches are fundamentally the same. Both of them try to cover the initial assumptions in the final results. Therefore, the mainstream idea is the same for both of these approaches. The difference between the two methods stands on mathematical methods. This means that the mathematical economic approaches use mathematical analysis to determine whether the results are the same as those of the mathematical hypotheses. On the other hand, the non-mathematical economic approaches use words to establish whether the conclusions are fine with the assumptions through a reasoning processes. (Chiang 2005).

5. The Cartesian/Euclidean Modes and Axiomatics

Axiomatics are the basic tool to use for assumptions, as they permit the application of the Cartesian/Euclidean approach. This means that without axiomatics it is not possible to proceed to further study. Thence, we have two crucial points in the analysis of rational economics. We have the starting point and the final point, which, accordingly, are the assumptions and the confirmations. The form of the Cartesian/Euclidean approach in economics is a hypothesis (assumption) where the study stands for atomism or reductionism, and it uses dualism5 in combination with general analysis (it may or may not also employ mathematics) to find the answer that would confirm the assumption.

6. The Methodology of Neoclassical Economics

The Neoclassical economics use rational methodologies, as the assumptions for the confirmation of any theory. Therefore, the Neoclassical theory is based on the Cartesian/Euclidean approach. This means that the axioms are the basis of any analysis. Then, using axioms and deductive logic, theorems are extracted. Hence, the axioms should be true or at least self-evident, meaning that the assumptions would be able to be confirmed. The analysis of axioms based on the Cartesian/Euclidean approach has two significant features that are derived from the aim of building a closed system.

• The first feature is known as atomism, or otherwise as reductionism.

• The second feature is dualism. Dualism6 (Crocco, 1998) declares that always only one choice is plausible, for instance – true or false, logical or illogical, etc., excluding with that any form of middle ground , .

Thence, the two elements for building a rational theorem are going through atomism/reductionism and dualism. In mainstream economics, the Cartesian/Euclidian approach could be determined as the known theory of deductivism/positivism. Then, in mainstream economics, the key is in the constant conjunctions that allow rational predictions.7 The use of atomism and dualism allow scrutiny in economics, and, especially in mainstream economics.

7. The Methodology Keynesian Economics as a Behavioral Theory

The Keynesian methodology, as mentioned previously, has different interpretations depending on the school of thought. Then, from the view of psychology, it could find application in the role of individuals. According to Winslow, Keynes rejected atomism and used the organic approach.8 Additionally, according to Carabelli, Keynes uses the opinions and the beliefs of the economic agents (Pech & Milan 2006). Therefore, the theory of Keynes includes certain psychological aspects. Keynes himself uses psychological aspects to underline his theory. Therefore, in the General Theory of Keynes, referred are phrases like “psychological laws,” “psychological effect,” “psychological motives,” “psychological characteristics,” “psychological influences,” etc. .9 We have three basic views that show how Keynes used behavioral aspects in his approach:

• Individualism is clearly avowed by Keynes, but individualism per se is not ignored. Keynes seems to have avowed atomic individualism but philosophically remained an individualist in the interpretation of Paley’s dictum.10 Therefore, significant behavioral insights exist in Keynes’s work.

• The conventions are the second crucial element that shows that Keynes uses behavioral tools in his analysis. In situations of uncertainty, economic agents use conventions to determine their actions. But in this case, it is identified that conventions are considered rational if they comply with uncertainty in a successful manner.

• The third element is about the thoughts that Keynes had about the behavioral approach. This also relates to Keynes’s comments on psychology. Additionally, another element that reveals Keynes’s behavioral approach lies in the affirmations toward psychology. Moreover, with a comparison of Keynes’s works, it is revealed that Keynes is affiliated with behavioral and experimental economics (Camerer 2003).

Hence, Keynesian theory uses elements from the psychological and behavioral approaches, which shows that only rationalism exists in Keynes’s analysis (Challoumis 2018).

8. Heuristics and Behavioral Economics

Mainstream economics, as mentioned in the Neoclassical and Keynesian approach, stand on axioms, the Cartesian/Euclidian approach, the rational choice for the maximization of utility, individualism, etc. But cognitive limitation, social preferences, the self-control problem, etc. are not included in the rational approach. Neoclassical economics do not involve the choice of consumers and the behavioral explanation. Heuristics claim that based on the Keynesian approach, an entrepreneur uses the information that is more representative of the situation and the information that is easier to retrieve based on its availability and the confidence of entrepreneurs (Pech & Milan 2006). It is plausible to perceive human actions as systematic behaviors, not as random actions. This is the point of view where Keynes clarified that perfect rationality is not possible, as the heuristic rationality is not possible, too, because there are biases in the judgment subject to uncertainty (Ariely, Loewenstein, & Prelee 2003). Uncertainty is the key to the behavioral approach of Keynesian theory. In animal spirits, the basic view is in the source of instability to commit economic decisions and, more precisely, in the decisions regarding investments. Overconfidence is another thing that makes the analysis of the Keynesian approach show that it has elements of behavioral economics. The degree of confidence determines long-term expectations. There is a divergence between the belief of how confident a person is and the accuracy of the positivity of this person. This condition is the point for the application of behavioral economics.

Approximation is an attribute of rational modeling. The assumptions and the axioms that are used in rationalism are basically approximations. The two crucial characteristics of rational economics are perfect competition and perfect information in economics. These are considered in behavioral economics as cases that should be remodified. There is a series of things that show that rational economics omit economic parameters according to behavioral economics, which are the following:

• The field tests are elements that are important for the application of laboratory experiments. Experiments allow the study of alternative explanations. Therefore, the study of economics using field tests allows scholars to examine the causes of the results.

• The element of self-awareness is crucial for the limitation of rationality. The reason for the limitation of rationality is that economists might possibly think that they have the appropriate level of self-awareness, but the truth is that people, when under pressure or surrounded by special conditions, have a different level of self-awareness. The self is not the self; it is an interaction of a series of mechanisms in complicated forms.

• The endogenous institutions that are firms’ investments and advertising reveal the changes of consumers brought on by these firms. Thus, behavioral economics provide a critical examination about the impact that these firms have. Without the behavioral approach, the understanding of the impact of these firms on consumers would be left unidentified.

• The missing element psychology is one more aspect that is not included in rational economics. Psychology is inserted into rational economics because it affects the choice models and preferences. The impact of the anomalies on rational choice appears as a result of the lacking examination of what causes the results. Moreover, another thing that is also included in behavioral economics is limited attention. Limited attention affects rational decisions. This is the reason why advertising and organizational structure used to stimulate attention appropriately and manipulate decision-making.11

• Neuroscience tries to delve deeper into the causes of decisions. The interpretation of this approach is that the study of the brain allows scholars to understand the preferences from a neurological approach. Neuroscience reminds us that the mind is extremely complex and allows us to examine why we make specific, concrete decisions, indexing the right level of decision-making (Camerer 2003).

From the previous list of the behavioral elements of economics, we conclude that all of them are attempts to critically explain the results of economic analysis. On the other hand, mainstream economics, based on axiomatics and the Cartesian/Euclidean approach, declare the validation of any economic theory.

9. The Conjunction between Rational and Behavioral Economics

through the Q.E. Method

The analysis of rational and mainstream economics is based on two points – the hypothesis (assumption) and the confirmation. On the other hand, behavioral economics cover the middle field, which is all about the methods that are used to define the behavior of the consumers. Thence, we could declare four steps that are crucial for the conjunction of (i) rational economics (ii), behavioral economics, and (iii) the Q.E. theory – a conjunction that could be made using this third element. Therefore, the way to apply the Q.E. method in rational and behavioral economics is reliant on the study of both. Behavioral economics should provide their own results, the rational economics – their respective results, and finally, with the simulation of the Q.E. method, it would be possible to adjust the appropriate model based on all of these elements. We are presented with the following attributes:

• Rational economics use hypotheses and confirmations to establish studies (the axiomatics procedure). This means that it is supposed that the consumers (or the economic subject of a given study) are making always a rational choice.

• Behavioral economics have a completely different approach, as they use experiments to find the way that the consumers (or the economic subject of study) act under real economic conditions.

• The Q.E. method uses a simulation procedure that is based on iterations and on feedback until it discovers the appropriate model that compiles the initial hypothesis with the final result after a series of modifications of the initial model (the multiple-axiomatics procedure).

• The R.B.Q. model is based on the results of the rational and behavioral approaches, and through the Q.E. method follows a modification on their results with a procedure of iterations using the feedback. Thus, it is able to find the adequate equation of the model of a study using rational, behavioral, and quantity data.

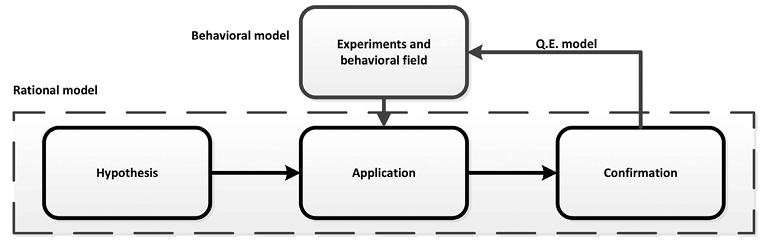

According to the prior bullets, it would be plausible to proceed to a schematic representation of this exegesis. Here we have the next scheme:

Figure 1. The R.B.Q. model, a schematic representation.

In the prior figure, we obtain the conjunctions between these three approaches, rational economics, behavioral economics, and the Q.E. methodology. The key element is that in the R.B.Q. model, the feedback is not between the confirmation and the hypothesis but between the confirmation and the behavioral model. This means that this intermediate level allows to fix the deviations between the hypothesis (assumptions) and the confirmation.

10. Application of the Q.E. method to the R.B.Q. Economic Model

The mathematical equation that describes the R.B.Q. model is the following:

c = h ± ( α ∓ β) (1)

Where, a, b take values between 0 and 1 (2)

To the prior equations, c represents the confirmation, h is about the hypothesis, α is the application of the rational approach, and β is the behavioral approach. It ought to be noted that the interpretation of equation (1) is from that factors α and β have influence on the model. The feedback of the Q.E. model permits the behavioral approach to eliminate the deviation between the factors α and β, as there are imperfections that have been identified in behavior economics (as shown in the previous sections). Therefore, the ideal case where the hypothesis exactly confirms the confirmation and no deviation exists is represented by the equation:

c = h (3)

The prior equation is the ideal case, where no disturbances or imperfections appear in the model. By applying the Q.E. method and choosing the appropriate values for the coefficients, we have the following table:

Table 1. Compiling coefficients.

|

Factors |

Coefficient values |

|

h |

0.8 |

|

α |

0.7 |

|

β |

0.7 |

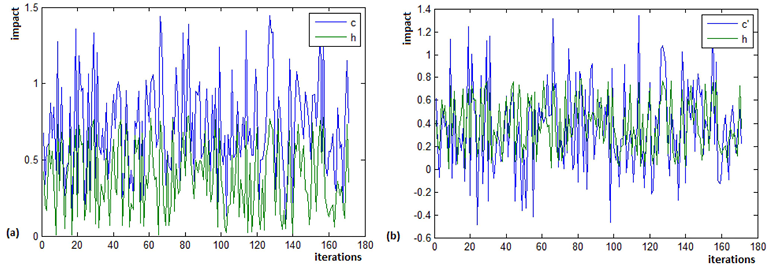

The generator of this procedure used the coefficients that appeared in the previous table. This means that it generated the prior equations with the values of these coefficients and extracted the next diagrams. Thus, we have that these factors have an upper limit of 1 and a lower limit 0, but c and h may possibly receive values greater than one, as their mathematical structure allow this. After 171 iterations using the Q.E. methodology, extracted were the following diagrams:

Figure 2: Impact factor (a) without the behavioral approach and (b) with the behavioral approach.

In the scheme above to the case of Figure (a), we see that the confirmation has c deviation from h. The reason is that in this form, we do not have the factor of β, which comes from the behavioral approach; however, the factor of α from the rational economics approach is maintained. In the case of Figure (b), the factor of the behavioral approach is used as therefore we conclude that the hypothesis and the confirmation are closer. This means that behavioral economics, in conjunction with rational economics through the Q.E. method, improve the results. Moreover, we examine, according to quantification methodology, the frequency of the model for these two cases:

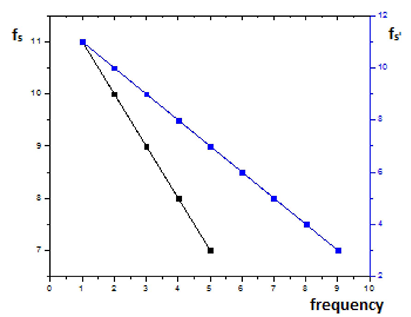

Figure 3: The frequency impact factor (a) fs and (b) fs'.

Case (a) represents the situation where the behavioral approach is omitted in the model. We obtain that the impact factor of frequency fs is not as high (black line). Pertaining to Case (b), here is represented the situation where the behavioral approach, through the Q.E. method, is included in the model. Then we have that fs' is higher, and the reason for this is the increase in the impactor factor of the frequency, and thus in factor y of the model. Therefore, the presence of the Q.E. approach, with the combination of rational and behavioral economics, improves the model, and the conclusions in economics are made more accurate than using only one approach.

11. Conclusions

This paper showed the mainstream idea of the economic methods that based their analyses in axiomatics. Therefore, the assumptions and the results are the key elements of the adequacy of the method of axiomatics. This is plausible through the consistency and the completeness of axiomatics. So, there are special characteristics to rational and to behavioral economics and differences between them. Rational economics estimate the confirmation of the assumptions, which rely on axiomatics. On the other hand, behavioral economics use psychology and laboratories to define the decision-making process of the consumers. The approaches between the two cases are different. In any case, both of them have the same aim – to declare each theoretical model in their own way. Their economic tools are not the same. The assumptions and axioms are easier to apply. At the same time, rational economics estimate two points – the assumption and the confirmation. Then, the assumption has a concrete starting point from the Cartesian/Euclidean approach or multiple starting points from the Babylonia view. However, both of them have the aim to confirm the initial point of view (the assumption). Behavioral economics aim at the middle step, meaning the procedure and not so much the initial and final point (the assumption and confirmation accordingly). Therefore, the target remains the same for rational and behavioral economics, but the economic tools are different.

The use of the RBQ model shows that the Cartesian/Euclidean theorem could be applied better, as the combination of the Q.E. method with rational economics and behavioral economics has better precision and accuracy in its results. Finally, the deviations of the rational model are eliminated through the application of the behavioral approach.

Reference

Ariely, D., Loewenstein, G., & Prelee, D. (2003). Coherent arbitrariness: Stable demand curves without stable preferences. Quarterly Journal of Economics(118), 73-105. https://doi.org/10.1162/00335530360535153

Boland, L. A. (1991). The Methodology of Economic Model Building. London and New York: Routledge.

Camerer, C. F. (2003). The behavioral challenge to economics: Understanding normal people. Federal Reserve of Boston meeting “How Humans Behave”, Caltech, Pasadena CA 91125, 1-34.

Challoumis, C. (2017). Quantification of Everything (A Methodology for Quantification of Quality Data with Application and to Social and Theoretical Sciences). SSRN. https://doi.org/10.2139/ssrn.3136014

Challoumis, C. (2018). Analysis of Axiomatic Models in Economics. SSRN.

Challoumis, C. (2018). Rational Economics in Comparison to the Case of Behavioral Economics (Keynesian, and Neoclassical Approaches). SSRN. https://doi.org/10.2139/ssrn.3209295

Challoumis, C. (2018). The impact factor of health on the economy using the cycle of money. Bulletin of the Transilvania University of Brasov, Series V: Economic Sciences Vol. 11 (60) No. 1 – 2018.

Chiang, A. A. (2005). Fundamental Methods of Mathematical Economics. McGraw-Hill(0-07-010813-7).

Crocco, M. (1998). Investement Decision and methodology: Keynes and Neoclassical. Est. Econ., Sao Paolo, 28(2), 283-315.

Gihman, J., & Skorohod, A. V. (1972). Stochastic Differential Equations. Springer-Vertang inc. New York. https://doi.org/10.1007/978-3-642-88264-7

Gihman, J., & Skorohod, A. V. (1974). The theory of Stochastic Processes. Springer-Vertag Inc. New York.

Gihman, J., & Skorohod, A. V. (1975). The theory of Stochastic Processes. Springer-Vertang, 1.

Martin, L. J. (1971). Uncertainty and Optimal Consumption Decisions. Econometrica, 39.

Pech, W., & Milan, M. (2006). behavioral economics and the economics of Keynes. Wofford College, University of Wisconsin-Parkside.

1 The Keynesian theory involves elements of rational and behavioral methodologies, as mentioned in a paper by Colin F. Camerer, “The Behavioral Challenge to Economics: Understanding Normal People.” The paper aims to explain the issues that are related with behavioral and rational economics.

2 Animal spirits, according to Keynes’s definition, are a “spontaneous urge to action rather than inaction.”

3 See Challoumis, Constantinos, “Quantification of Everything (A Methodology for Quantification of Quality Data with Application and to Social and Theoretical Sciences),” (November 12, 2017). Available at SSRN: https://ssrn.com/abstract=3136014 or http://dx.doi.org/10.2139/ssrn.3136014.

4 This analysis is based on a working paper: Challoumis, Constantinos, An Analysis of Axiomatic Methods in Economics (April 24, 2018). SSRN: https://ssrn.com/abstract=3168087 or http://dx.doi.org/10.2139/ssrn.3168087.

5 Dualism means that there must always be one answer, e.g., true or false, rational or irrational, etc.

6 Dualism is referred by Dow as “concepts, statements and events according to duals, as belonging to only one of two all-encompassing categories: true or false, logical or illogical, positive or normative, fact or opinion and so one.”

7 See Challoumis, Constantinos, “Rational Economics in Comparison to the Case of Behavioral Economics” (Keynesian and Neoclassical Approaches) (July 6, 2018). Available at SSRN: https://ssrn.com/abstract=

8 The organic approach means that Keynes embraced the opinions of the prior agents in his theory.

9 According to Keynes, “we can sometimes regard our ultimate independent variables as consisting of the three fundamental psychological laws, namely, the psychological propensity to consume, the psychological attitude to liquidity and the psychological expectation of future yield from capital-assets […].” Subsequently, Keynes chooses to embrace the psychological factors of the economy.

10 Based on Paley’s dictum, “although we speak of communities as of sentient beings and ascribe to them happiness and misery, desires, interests and passions, nothing really exists or feels but individuals.” Then, it is obvious that based on dictum, atomism has a significant role in the analysis of Keynes.

11 Camerer represented these factors as the elements of the behavioral approach, which are not included in the scrutiny of the rational economics.