A Simple Model for the Integration of Goods and the Capital Market with Unionized Labor Markets

Domenico Buccella

Kozminski University in Warsaw,

Poland

Department of Economics, Kozminski University in Warsaw,

57/59 Jagiellońska Str., 03301 – Warsaw, Poland.

Email: buccella@kozminski.edu.pl

Abstract. The present work analyzes the effects of goods and capital market integration on welfare. In an imperfectly competitive industry with unionized labor, openness to competition via exports, the possibility of holding minority stakes into a rival company and undertaking Greenfield Foreign Direct Investment (FDI) exemplify product and capital market liberalization, respectively. Challenging the “lieu commune” that liberalization a priori improves the social welfare of an economy, making use of a game-theoretic approach, it is shown that a domestic government should design the appropriate interventions in product and capital markets depending on the precise pattern of economic integration.

Keywords: market integration, cross-ownership, labor union, oligopoly, fixed wage, welfare.

Received: August 2018.

Revised: January 2019. Accepted: January 2019

Copyright ©

2019 Domenico Buccella. Published by Vilnius

University Press

This is an Open Access article distributed under

the terms of the Creative Commons

Attribution Licence, which permits unrestricted use, distribution, and

reproduction in any medium, provided the original author and source are

credited.

1. Introduction

Economic theory has traditionally stressed the potential gains that countries have when participating in international integration; empirical data related to historical trends seem to prove that the integration of markets has been one of the main drivers of worldwide economic wealth growth (see, e.g., Dreher 2006).

Despite the undeniable benefits of product and capital market integration, in the aftermath of the 2008 global financial and subsequent economic crisis, several governments started questioning the effectiveness of the globalization process. In a recent report, the Economist (2013) claims that, today, the world economy is a “gated globe.” In other words, increasing state interventions with the rise of new nationalist models identify a new pattern in the global flow of goods and capitals. Conventional trade protectionism has been avoided; however, hidden protectionism prospers. With regard to the capital markets, capital controls and restrictions on foreign direct investment (FDI) are increasing, especially related to investments in the form of acquisitions in companies operating within industries considered strategic. In fact, these operations may take place only after the observance of rigorous regulations, sometimes hindering the acquisition of other firms’ stakes.

Nonetheless, the acquisition of firms’ stock by other firms, often by their rivals, is a widespread and observed phenomenon in the real world. Alley (1997) describes the cases of the Japanese and the US automotive industries, while Barcena-Ruiz and Olaizola (2007) report the case of the French automotive company Renault, which acquired a 36.8% equity stake in Nissan Motor in 1999. Another illustrative example of an international acquisition of a minority stake is the case of the US company Gillette, a global leader in the wet shaving razor blade market, which acquired 22.9% of the nonvoting stock and approximately 13.6% of the debt of the British company Wilkinson Sword, one of its largest market rivals (Gilo and Spiegel 2003). Cross-ownership does not exist exclusively in the automotive industry; it is also abundant in several Japanese industrial sectors. In the broadcasting industry, for example, Fuji TV had a 12.4% participation share in NBS, while NBS had 22.5% in 2005 (The Economist, 2005). Other examples of complex, multilateral cross-ownership are global airlines (Airline Business, 1998) and the global steel industries (Spiegel and Gilo 2003).

Alley (1997) provides a series of reasons firms acquire passive participation shares in other firms: first, a company would like to get access to other firm-specific technology, managerial competencies, and expertise; second, through participation, the firms may reshape the degree of competition in the industry, share relevant information, and plausibly harmonize output and price decisions. Moreover, firms may buy rivals’ stock as passive investments to differentiate their financial portfolio, thus earning a share of the rivals’ profits without being involved in their rivals’ prices and output decisions (Gilo, Moshe, and Spiegel 2006; Fanti 2014).

Another example of evidence is the presence of unionized labor markets in imperfectly competitive sectors in the most advanced economies, which can be characterized by different bargaining structures and scopes (a monopoly union, e.g., Dunlop 1944; efficient bargaining, e.g., McDonald and Solow 1981; right-to-manage, e.g., Nickell and Andrews 1983; Naylor 2000). The presence of labor unions implies that the cost of the labor input is no longer exogenous, but rather the result of strategic interactions between the firm(s) and the union(s).

From the point of view of a domestic government wishing to improve the overall state of social welfare, a few questions arise related to market integration policies and labor market interventions. It is a widely established result that product market integration contributes to curbing union power and, therefore, labor market distortions; however, capital market integration, with the possibility of partial and cross-ownership, entails potential anticompetitive effects. Therefore, to what extent does welfare benefit an international market integration-oriented policy for the domestic country? Excluding political aspects, does the idea of supporters of nationalist models to restrict capital flows have solid economic grounds?

Determining an answer to the above questions is central to the task of shedding light on the recent developments in the political economy interventions of several countries, particularly with regard to capital markets, and trying to substantiate the rationale for such policy measures. To do so, the present work develops a partial equilibrium model with an oligopolistic market with partial cross-ownership in the presence of unionized labor markets. A limited number of works in the literature have considered such a framework. Notable exceptions are Symeonidis (2008), Mukherjee (2010), and Fanti (2013; 2014; 2016).

Symeonidis (2008) builds a model in which decentralized unions (input suppliers) bargain with firms over wages (input prices). He shows that, in the case of negotiations over a uniform wage (input price), the firms’ cooperation in the product market, modeled by reciprocal cross-ownership, increases welfare when products are close substitutes and the unions (upstream agents) have strong relative bargaining power. On the other hand, if the unions have little bargaining power, social welfare is higher when the firms compete á la Cournot. In the case of bargaining over a two-part wage (tariff), an increase in the firm’s participation share raises the consumers’ surplus and total welfare.

Mukherjee (2010) investigates the influence of product market cooperation in the presence of an industry-wide labor union. A duopoly characterizes the industry in which the firms produce homogeneous goods and compete à la Cournot. According to Symeonidis (2008), cooperation in the product market is modeled through reciprocal cross-ownership shares. The union bargains over wages separately but simultaneously with the firms. The author demonstrates that the union’s disagreement utility during the bargaining process has a crucial impact on welfare levels; depending on the definition of the outside option and the relative parties’ bargaining power, product market cooperation may improve or worsen social welfare. However, the contributions of Symeonidis (2008) and Mukherjee (2010) concentrate on the cooperation of the firms and do not consider alternative interventions in the labor market.

The studies of Fanti (2013; 2014; 2016) are the closest to the present work. Fanti (2013) investigates the consequences of an increase in a reciprocal cross-ownership share in a Cournot duopoly with differentiated products and monopoly unions active at the firm level. The analysis is limited to the effects of unionized labor on profits. On the other hand, Fanti (2014) extends his previous model and investigates the consequences of an increase in the cross-ownership share with monopoly unions active at the firm level in a Cournot duopoly with homogeneous goods, pointing out the impact of a unionized labor market on overall social welfare. In the presence of a competitive labor market, cross-ownership leads to a lower degree of competition; therefore, despite an increase in industry profits with increasing cross-participation, consumers’ surplus and social welfare fall. On the other hand, in the presence of labor unions that are sufficiently wage-oriented, consumers’ surplus and social welfare is positively correlated with cross-ownership, although the share of cross-participation lessens the degree of product market competition. Finally, Fanti (2016) investigates the effects of reciprocal cross-ownership structures in a Cournot duopoly in the presence of firm-specific monopolistic unions. Contrary to the common wisdom that mutual cross-participations imply less competition and, therefore, lower consumer surplus and social welfare, in a context in which the labor market is unionized, both consumer surplus and social welfare increase with the share of cross-ownership. This result occurs not only when unions are wage-aggressive but also if they have a low degree of “risk-adversity.” Consequently, interlocking cross-ownership can lead to a socially preferred outcome when the labor market in oligopolic industries is unionized.

Albeit the existing literature has analyzed the linkages between partial cross-ownership, unionization, and welfare, none of the previous works have contextualized those relations in a wider market integration framework. The present paper aims to contribute to the extant literature in this direction. In fact, in contrast to Symeonidis (2008), Mukherjee (2010), and Fanti (2013; 2014), who abstract from international competition, the present work considers the impact that the key aspects of the internationalization of markets have on the overall economy.

To fulfill these objectives, this study first analyzes a benchmark case of a monopolist facing a monopoly union in a closed economy. Then, the analysis introduces a foreign firm competing in the domestic market to exemplify product market integration: the market moves from a monopoly to a Cournot duopoly. The foreign entrant may compete in the domestic market either via exports or by setting up a production facility in the domestic country via Greenfield FDI. The latter represents the first form of capital market integration. When the foreign company enters the domestic market via exports, further capital market integration is modeled by the possibility for the domestic and foreign firms to hold shares of the rival company. To simplify the analysis, the model does not consider sunk and transportation costs.

The structure of the model is a two-stage game solved in the usual backward fashion. In the first stage, wage formation takes place. In the second stage, in the case of market integration, the domestic and foreign firms compete à la Cournot in the domestic product market. Bughin and Vannini (1995) suggest that the domestic labor union considers the wage paid by the foreign company as exogenously given. On the other hand, in the absence of market integration, the monopolist sets the output level. The analysis focuses on the domestic country and, given the welfare outcomes, the national government evaluates the most suitable policy.

The key results of the paper are as follows. If a monopoly union characterizes the labor market, the foreign firm’s ownership of a minority stake in the domestic firm can be welfare-damaging for the domestic country after product market integration. The union always suffers from market integration, while profits and consumers’ surplus with foreign participation can exceed autarky levels. As a consequence, in a circumscribed set of the model’s parameters, the social welfare of the domestic country is higher without market integration. This result challenges the conventional wisdom that liberalization a priori always improves welfare for the domestic economy of a country. On the whole, acquisitions of minority stakes have different effects on union utility and domestic firm profits; a foreign (domestic) participation share is largely advantageous (disadvantageous) for the union; however, the opposite can be said for the profitability of the domestic firm. Domestic participation shares and cross-ownership are more profitable than a monopoly for the domestic firm in the presence of medium-high foreign wage levels. Nonetheless, when the foreign wage level is adequately high, cross-ownership is more profitable for the domestic firm than partial domestic participation; a similar finding applies for overall social welfare. It is noteworthy is that the domestic firm’s ownership of the rival’s minority stake, as well as cross-ownership, always ensure a level of social welfare higher than simple product market integration.

The remainder of the paper is organized as follows. Section 2 provides the structure of the model and presents the results for every possible situation that may arise in the product and capital markets. Moreover, the last subsection provides an extensive social welfare analysis, and some policy insights are also briefly discussed. Finally, Section 3 summarizes the main results and implications and suggests directions for further research on the topic.

2. The Model and Its Results

This section develops a partial equilibrium model to analyze the impacts of market integration and labor market reform on national welfare. In the home country, an imperfectly competitive sector is characterized by a monopolist firm. Labor, l, is the sole input factor. Workers are organized in a labor union that is assumed to be large enough to meet the firm labor demand, with N exogenously given members, that is l ≤ N. It is assumed that the union has full bargaining power and therefore fixes wages unilaterally. The labor union is risk-neutral and maximizes the wage bill. The production technology presents constant returns to scale, such that q = l, where q is the monopolist’s output. The (inverse) linear market demand curve is

p = 1 – q. (1)

The home government aspires to enhance the overall social welfare and considers the following action: to open up the process of international market integration, allowing a foreign firm to compete in the domestic market. For the sake of simplicity, neither sunk nor transportation costs are reported. As Bughin and Vannini (1995) note, the foreign firm’s bargaining outcome is considered to be exogenous, mainly with reference to the wage paid to its employees. This applies both when the foreign competitor serves the domestic market by exports and the direct sales of the subsidiary in the home country. The latter case would reflect the practice widely observed in the real world of foreign firms opting out from national/sector collective bargaining in favor of company-wide agreements (Eurofund, 2009). This set of hypotheses makes irrelevant the fact that the foreign firm becomes established in the home market or elsewhere. Then, it may be that the foreign firm acquires a (minority) stake in the domestic firm, while the domestic firm acquires an exogenous (minority) stake in the foreign firm, or the firms engage in cross-ownership.

The model is a two-stage game solved in the usual backward fashion. In the first stage, the wage formation takes place. In the second stage, firms compete à la Cournot in the home product market, determining production in the case of market integration, and the monopolist decides output production in the absence of market integration. The analysis focuses on the home country.

2.1 Benchmark: Monopoly in autarky

To begin, let us consider the case of autarky. Using (1), the firm profit function is

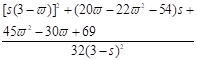

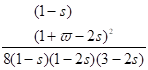

![]() (2)

(2)

Where w is the fixed wage per worker set by the union, and the upper script M stands for “Monopoly.” The union maximizes the total wage bill taking output as given

![]() . (3)

. (3)

With the outlined hypotheses, the consumers’ surplus measure is

![]() .

(4)

.

(4)

The general definition of the home welfare is given by the sum of the profits of the domestic firm, the domestic union utility, and the consumers’ surplus; formally

![]() . (5)

. (5)

Table 1 summarizes the results.

Table 1: Summaries of the relevant variables in Home country

|

|

|

|

|

|

|

Monopoly Fixed Wage |

|

|

|

|

|

|

Duopoly, entry |

|

|

|

|

|

|

Duopoly, foreign firm participation |

|

|

|

|

|

|

Duopoly, domestic firm participation |

|

|

|

|

|

|

Duopoly, cross-ownership |

|

|

|

|

|

|

2.2 Market Integration

Entry

In the case of market integration, the industry passes from a monopoly to a duopoly due to the entry of a foreign firm. The firms produce homogeneous goods. As a consequence, the demand function in the home country becomes

![]()

Where q1 and q2 are the domestic and foreign firm output levels, respectively. Thus, the profit function for the domestic firm is

![]() , (6)

, (6)

while for the foreign firm it is

![]() , (7)

, (7)

Where ϖ < 1 is the wage the foreign competitor pays to its employees, and the upper script D stands for “Duopoly.” FOCs from the maximization of (6) and (7) lead to the following (standard) reaction functions:

![]() ,

, ![]() (8)

(8)

Substituting each expression in (8) into each other, the following is obtained:

![]() ,

, ![]() .

(9)

.

(9)

With regard to the labor market, the union maximizes the utility function

![]() , (10)

, (10)

taken the foreign competitor’s wage as exogenously given when it sets its own wage. Consequently, the equilibrium wage is

![]() . (11)

. (11)

It is

immediately derived that ![]() : an increase in the

wage paid by the foreign company implies an increase in the wage claims of

the domestic union; that is, wages are strategic complements. Substituting

(11) into (9), the equilibrium outputs are

: an increase in the

wage paid by the foreign company implies an increase in the wage claims of

the domestic union; that is, wages are strategic complements. Substituting

(11) into (9), the equilibrium outputs are

![]() ,

, ![]() . (12)

. (12)

with ![]() and

and ![]() : a wage

increase in the foreign firm leads to an increase in the production of the

domestic firm and reduces the output produced by the foreign firm. Moreover,

the non-negativity condition, q2 ≥ 0, implies that

: a wage

increase in the foreign firm leads to an increase in the production of the

domestic firm and reduces the output produced by the foreign firm. Moreover,

the non-negativity condition, q2 ≥ 0, implies that ![]() ; otherwise, the foreign rival does not find it profitable to

compete in the home market.

; otherwise, the foreign rival does not find it profitable to

compete in the home market.

The general measure of the consumers’ surplus is now

![]() . (13)

. (13)

Using

(11) and (12) and the definition of the consumers’ surplus in (13), the

relevant findings in Table 1 are derived. An analytical observation

indicates that ![]() and

and ![]() ; a rise

in the foreign wage is beneficial for the domestic firm and its union. In

fact, the competitive position of the domestic firm improves output expands;

thus, labor demand increases, which is, in turn, advantageous for the union.

However,

; a rise

in the foreign wage is beneficial for the domestic firm and its union. In

fact, the competitive position of the domestic firm improves output expands;

thus, labor demand increases, which is, in turn, advantageous for the union.

However, ![]() : an increase in the

foreign wage boosts domestic wage demand, raising the price of the goods.

Nonetheless, closer inspection reveals that the increment of the consumers’

surplus component drives the overall rise of the social welfare. This is

because the price of the goods is lower than in a monopoly due to the

increasing competition of the foreign rival.

: an increase in the

foreign wage boosts domestic wage demand, raising the price of the goods.

Nonetheless, closer inspection reveals that the increment of the consumers’

surplus component drives the overall rise of the social welfare. This is

because the price of the goods is lower than in a monopoly due to the

increasing competition of the foreign rival.

Case 1: Foreign Participation in the Domestic Firm

After entry in the

industry, the first situation that may occur is the acquisition of a

minority fraction of shares in the domestic firm by the foreign competitor

while retaining control over its activities. The exogenous parameter ![]() denotes the fraction of shares owned. Under these assumptions,

the profit functions become

denotes the fraction of shares owned. Under these assumptions,

the profit functions become

![]() , (14)

, (14)

![]() , (15)

, (15)

for the domestic and the foreign firms, respectively. The upper script DFP stands for “Duopoly with foreign participation.” The FOCs of (14) and (15) yield the reaction functions

![]() ,

, ![]() (16)

(16)

As Fanti (2013; 2014) underlines, given that s > 0, the reaction functions are downward sloping; in other words, under the Cournot hypothesis, products are strategic substitutes. Fanti (2011; 2013) also remarks that the firm that owns the rival’s shares is less “reactive” (the best-reply function is steeper) and, therefore, its (expected) production is lower than the competitor.

Inserting each expression in (16) into each other, the following is obtained:

![]() ,

, ![]() .

(17)

.

(17)

Consequently, the union maximizes the utility function

![]() , (18)

, (18)

taking the foreign competitor’s wage as exogenously given. The equilibrium wage is thus

![]() (19)

(19)

with ![]() . Substituting (19)

into (17), the equilibrium outputs are

. Substituting (19)

into (17), the equilibrium outputs are

![]() ,

, ![]() (20)

(20)

which implies ![]() to satisfy the

non-negativity condition q2 ≥ 0. It follows that the

foreign firm has to pay lower wages than the situation of entry to sell

goods in the home market. Differentiation leads to

to satisfy the

non-negativity condition q2 ≥ 0. It follows that the

foreign firm has to pay lower wages than the situation of entry to sell

goods in the home market. Differentiation leads to ![]() and

and ![]() as in the previous case,

as in the previous case, ![]() and

and ![]() ; an

increase of the foreign participation in the domestic firm raises the output

produced in the home country by the domestic firm, while it decreases the

production of the foreign firm.

; an

increase of the foreign participation in the domestic firm raises the output

produced in the home country by the domestic firm, while it decreases the

production of the foreign firm.

Using (19), (20), and the definition

of the consumers’ surplus in (13), the relevant expressions in Table 1 are

derived. Differentiation indicates that ![]() , as in the case of

entry, and

, as in the case of

entry, and ![]() ; increasing foreign

participation share is beneficial for the labor union, because part of the

production of the foreign firm is shifted to the domestic company. As a

consequence, the labor demand of the domestic firm increases, and this has a

positive impact on union utility. On the other hand,

; increasing foreign

participation share is beneficial for the labor union, because part of the

production of the foreign firm is shifted to the domestic company. As a

consequence, the labor demand of the domestic firm increases, and this has a

positive impact on union utility. On the other hand, ![]() because

because

![]() . Moreover, it can be easily checked that

. Moreover, it can be easily checked that ![]() and

and ![]() : an increase of the foreign wage raises the domestic wage as

well, leading to high prices and, consequently, the reduction of the

consumers’ surplus. Increasing foreign participation reduces the total

quantity sold in the home market and, therefore, the consumers’ surplus.

: an increase of the foreign wage raises the domestic wage as

well, leading to high prices and, consequently, the reduction of the

consumers’ surplus. Increasing foreign participation reduces the total

quantity sold in the home market and, therefore, the consumers’ surplus.

Case 2: Domestic Participation in the Foreign Firm

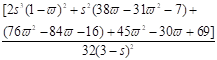

The second situation that may take place after entry is the acquisition of a minority fraction of shares of the foreign competitor by the domestic firm while retaining control over its activities. In this case, the profit functions are

![]() , (21)

, (21)

![]() , (22)

, (22)

for the domestic and the foreign firms, respectively. The upper script DDP stands for “Duopoly with domestic participation.” The FOCs of (21) and (22) lead to the following reaction functions:

![]() ,

, ![]() (23)

(23)

As before, given that s > 0, the reaction functions are downward-sloping; products are strategic substitutes. Moreover, the previous considerations concerning the “reactiveness” of the best reply applies here, too.

Putting each expression in (23) into each other leads to

![]() ,

,![]() .

(24)

.

(24)

As a consequence, the domestic union maximizes the following utility function:

![]() , (25)

, (25)

taking the foreign competitor’s wage as exogenously given. The equilibrium wage is

![]() (26)

(26)

with

![]() and

and ![]() ; an increase of the

participation share moderates the union wage demand because production can

be partially shifted in the foreign company. Substituting (26) into (24),

the equilibrium outputs are

; an increase of the

participation share moderates the union wage demand because production can

be partially shifted in the foreign company. Substituting (26) into (24),

the equilibrium outputs are

![]() ,

, ![]() (27)

(27)

which implies, for the foreign company, that![]() to

satisfy the non-negativity condition q2 ≥ 0. The foreign

firm pays lower wages with respect to entry; however, in the case of the

domestic firm’s participation, the foreign company pays wages higher than

when it participates in the domestic firm to sell the goods in the home

market.

to

satisfy the non-negativity condition q2 ≥ 0. The foreign

firm pays lower wages with respect to entry; however, in the case of the

domestic firm’s participation, the foreign company pays wages higher than

when it participates in the domestic firm to sell the goods in the home

market.

Differentiation leads to ![]() and

and ![]() , as in

the previous case, and

, as in

the previous case, and ![]() if

if ![]() while

while

![]() if

if ![]() . A rise of the

participation share of the domestic firm in the foreign company increases

(decreases) its (the rival’s) production when

. A rise of the

participation share of the domestic firm in the foreign company increases

(decreases) its (the rival’s) production when ![]() , while the opposite

results hold when

, while the opposite

results hold when ![]() .

.

Making use

of (26) and (27) and the definition of the consumers’ surplus in (13), the

relevant expressions in Table 1 are derived. An analytical inspection

reveals that ![]() , as in the case of

entry and foreign participation; however, contrariwise

, as in the case of

entry and foreign participation; however, contrariwise ![]() .

Increasing the domestic participation share is disadvantageous for the labor

union because of (1) lower wage demand and that (2) part of the production

of the domestic firm can be shifted toward the foreign company. These two

elements have a negative impact on labor union utility. With regard to

profits, it is obtained that

.

Increasing the domestic participation share is disadvantageous for the labor

union because of (1) lower wage demand and that (2) part of the production

of the domestic firm can be shifted toward the foreign company. These two

elements have a negative impact on labor union utility. With regard to

profits, it is obtained that ![]() if

if ![]() , and

, and

![]() . While participation increases profits because of the

restricting output effect, the impact of the foreign wage level can be

detrimental for the profitability of the domestic firm if this is low

enough. Furthermore, it can be verified that

. While participation increases profits because of the

restricting output effect, the impact of the foreign wage level can be

detrimental for the profitability of the domestic firm if this is low

enough. Furthermore, it can be verified that ![]() , while

, while ![]() ; similarly to the case previously discussed, both an increase

of the foreign wage and an increase of the domestic company’s participation

in the foreign firm imply that the consumers’ surplus lessens.

; similarly to the case previously discussed, both an increase

of the foreign wage and an increase of the domestic company’s participation

in the foreign firm imply that the consumers’ surplus lessens.

Case 3: Cross-ownership

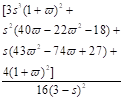

Finally, firms can be engaged in cross-ownership: each company holds a minority fraction of the shares of the rival while retaining control over their own activities. For the sake of simplicity, as given by Fanti (2016) and generally provided in the literature, an identical two-sided cross-ownership share, s, is assumed. In fact, in the presence of exogenously given mutual shares, the model gains in algebraic tractability that could be generated by potentially asymmetric endogenous shares. The profit functions are

![]() (28)

(28)

![]() (29)

(29)

for the domestic and the foreign firm, respectively, where the upper script DCP indicates “Duopoly with cross participation.” From the maximization of (28) and (29), FOCs yield the reaction functions

![]() ,

, ![]() . (30)

. (30)

It can

be verified that, in the case of cross-ownership, the firms are relatively

more “reactive” (the best-reply function is less steeper) than when only one

firm owns the rival’s shares; more formally, ![]() and

and ![]() . This

is because, in the case of cross-ownership, each firm takes into account the

negative spillover effects of potentially moving part of their production

toward the rival. Therefore, the overall (expected) production is larger

than the case in which only one firm holds a minority stake of the

competitor. Substituting each expression in (30) into each other, one can

obtain

. This

is because, in the case of cross-ownership, each firm takes into account the

negative spillover effects of potentially moving part of their production

toward the rival. Therefore, the overall (expected) production is larger

than the case in which only one firm holds a minority stake of the

competitor. Substituting each expression in (30) into each other, one can

obtain

![]() ,

, ![]() .

(31)

.

(31)

It follows that the domestic union maximizes

![]() , (32)

, (32)

with the foreign competitor’s wage taken as exogenously given. In equilibrium, the wage is

![]() (33)

(33)

with

![]() and

and ![]() . The substitution of

(34) into (32) leads to the equilibrium outputs

. The substitution of

(34) into (32) leads to the equilibrium outputs

![]() ,

, ![]() (34)

(34)

which requires that ![]() for the foreign

company to satisfy the non-negativity condition q2 ≥ 0. It

can be verified that the foreign company pays lower wages than when only one

company holds shares of the rival to sell in the home market; the rationale

for this result is that the domestic firm, with cross-ownership, expands its

production more than in the abovementioned cases.

for the foreign

company to satisfy the non-negativity condition q2 ≥ 0. It

can be verified that the foreign company pays lower wages than when only one

company holds shares of the rival to sell in the home market; the rationale

for this result is that the domestic firm, with cross-ownership, expands its

production more than in the abovementioned cases.

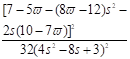

A differentiation

of (34) shows that ![]() and

and ![]() as in the

previous two cases, and

as in the

previous two cases, and ![]() , while

, while ![]() . A rise of the participation share of the domestic (foreign)

firm in the foreign (domestic) company increases (decreases) its production,

plausibly driven by the wage differential. Making use of (33), (34), and the

definition of the consumers’ surplus in (13), the expressions reported in

Table 1 are obtained.

. A rise of the participation share of the domestic (foreign)

firm in the foreign (domestic) company increases (decreases) its production,

plausibly driven by the wage differential. Making use of (33), (34), and the

definition of the consumers’ surplus in (13), the expressions reported in

Table 1 are obtained.

A direct analysis reveals that ![]() , while

, while

![]() if

if ![]() . An increasing

participation share can be advantageous (detrimental) to the labor union if

the foreign wage level is high (low) enough. This is the result of two

opposite forces: increasing participation has a positive impact on domestic

production and a negative impact on union wage demand. The magnitude of the

foreign wage level determines the dominating effect. Concerning profits, a

differentiation shows that

. An increasing

participation share can be advantageous (detrimental) to the labor union if

the foreign wage level is high (low) enough. This is the result of two

opposite forces: increasing participation has a positive impact on domestic

production and a negative impact on union wage demand. The magnitude of the

foreign wage level determines the dominating effect. Concerning profits, a

differentiation shows that ![]() and

and ![]() . Both

the foreign wage level and the participation share increase the

profitability of the domestic firm. Finally, as in the previous cases, it is

obtained that

. Both

the foreign wage level and the participation share increase the

profitability of the domestic firm. Finally, as in the previous cases, it is

obtained that ![]() and

and ![]() . A rise

of the foreign wage and participation share in the foreign firm implies a

diminution of the consumers’

surplus.

. A rise

of the foreign wage and participation share in the foreign firm implies a

diminution of the consumers’

surplus.

2.3 Welfare Analysis and Policy Implications

This section compares the outcomes of the various cases to analyze the effects of the firms’ behavior on the economic variables and welfare in the home country under the outlined policies.

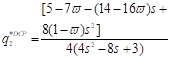

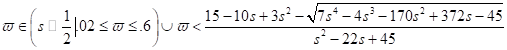

As pointed out in subsection 2.2, in the case of market integration, the foreign firm faces a non-negativity constraint to compete in the home market. However, this constraint differs depending on the distinct cases. Therefore, to make possible a comparison of all the proposed scenarios, the subsequent analysis imposes the following restriction on the value of the foreign wage, ϖ.

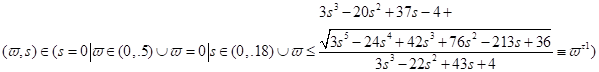

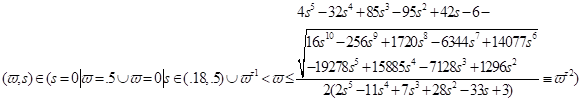

Restriction 1. ![]() .

.

Restriction

1 defines the range of the foreign wage level, which allows the foreign firm

to sell its product in the home market in all the cases of market

integration (![]() ); it represents the

lowest non-negativity constraint value of ϖ, which is associated with

the

); it represents the

lowest non-negativity constraint value of ϖ, which is associated with

the ![]() scenario. The following proposition summarizes the findings

concerning the overall level of welfare that emerged in the previous

subsections.

scenario. The following proposition summarizes the findings

concerning the overall level of welfare that emerged in the previous

subsections.

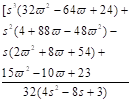

Proposition 1 For ![]() , the following

relations hold:

, the following

relations hold:

a. ![]() for

for  ,

,

![]() for

for

b. ![]() for

for

;

;

![]() for

for ![]() .

.

Proof: A direct comparison of the payoffs in Table 1.

The overall analysis related to the single welfare components is quite complex, and to limit the mathematical notation in the text, the relevant payoff rankings are reported in the Appendix. However, some general observations can be addressed.

After market integration and entry,

foreign participation in the domestic firm can be detrimental to the level

of welfare of the home country. For a wide set of the parameters, union

utility in autarky is larger than in the presence of market integration;

only for relatively high foreign wages and participation shares is the

domestic union utility larger in the presence of cross-ownership.

Furthermore, while the union utility in the presence of cross-ownership can

be larger or smaller than with unidirectional participation with low foreign

wages and percentage share, it turns out that ![]() always (see the

Appendix). This is because an increasing foreign participation share shifts

part of the production toward the domestic company and, as a consequence,

rising labor demand drives high wage claims. Hence, unionized workers should

welcome a foreign direct investment in the domestic company. On the other

hand, profits and consumers’ surplus after foreign participation can be

larger or smaller than in the presence of autarky with a monopoly union and

fixed wages. As a consequence, for a set of parameters,

WDFP ≤ WM. In peculiar circumstances, this finding

seems to legitimize the advocates of nationalist models.

always (see the

Appendix). This is because an increasing foreign participation share shifts

part of the production toward the domestic company and, as a consequence,

rising labor demand drives high wage claims. Hence, unionized workers should

welcome a foreign direct investment in the domestic company. On the other

hand, profits and consumers’ surplus after foreign participation can be

larger or smaller than in the presence of autarky with a monopoly union and

fixed wages. As a consequence, for a set of parameters,

WDFP ≤ WM. In peculiar circumstances, this finding

seems to legitimize the advocates of nationalist models.

Market integration without partial ownership is beneficial for social welfare if the labor market remains characterized by a monopolist union setting fixed wages. However, the labor union always suffers from market integration. Subsequent acquisitions of minority stakes have a different impact on union utility and profits. While foreign (domestic) participation is generally beneficial (damaging) for the union, the opposite holds for the domestic company. Nonetheless, when the domestic firm has participation shares in the foreign rival, social welfare is larger than when the foreign rival has participation shares in the domestic company. Domestic participation and cross-ownership are more profitable for the domestic company than a monopoly when the foreign wage is medium-high. Furthermore, when the foreign wage is sufficiently high, cross-ownership is more advantageous than domestic participation only for the home firm. A similar result holds true for overall social welfare. It is remarkable that domestic participation and cross-ownership always ensure higher welfare than market integration without partial ownership. This result seems to suggest that, after product market integration, the home government should, at first, stimulate the domestic company to engage in foreign operations. With regard to domestic consumers, except for the case of extremely low foreign wage levels in the presence of foreign participation, they always benefit from market integration.

These findings seem to suggest the following policy insights. If a market integration policy is undertaken, it has to be oriented toward sufficient liberalization so as to attain all of the potential benefits. In fact, once a foreign competitor enters the home market, the government should encourage the domestic firm to undertake direct investment in the rival without concurrently drawing the line at any potential investment in the opposite way. Second, the home government may use interventions in the product and capital markets as complementary policies; an appropriate policy mix may constitute a suitable combination for overally improving social welfare.

3. Conclusion

This study has developed a simple model for analyzing how government intervention with regards to market integration and the labor market can improve social welfare in an economy. The starting point of the analysis has been a monopolistic sector (such before integration) with the workers organized in a monopoly union. Then, the paper considered the following two aspects of market integration. First, the opening of the product market to foreign competition, and second, within the capital market, the possibility for each firm, after entry, to hold a minority stake in the rival company. Given this framework, several cases arise; nevertheless, the sequence of the actions is similar in all circumstances. First, the wage formation occurs; the union unilaterally sets the fixed wage, taking the foreign wage as given after entry. Second, production decisions take place: the monopolist chooses output when there is no entry, or, in the case of entry, firms compete á la Cournot.

The main points of the paper are as follows. The product market structure, the labor market institutions, the foreign wage level, as well as the participation shares, affect the whole state of social welfare. If a monopoly union characterizes the labor market, a foreign firm’s possession of a minority stake in the domestic firm after entry can be detrimental to the welfare of the domestic country. The union suffers from market integration; it is always better off in autarky while profits and consumers’ surplus with foreign participation can overtake autarky levels. Consequently, in a delimited case, domestic welfare is higher without market integration. Acquisitions of minority stakes mostly have a different impact on union utility and profits. While foreign (domestic) participation is broadly advantageous (harmful) for the union, the opposite can be said for the profitability of the domestic company. Domestic participation and cross-ownership are more profitable than having a monopoly for the domestic firm when the foreign wage is medium-high. However, when the foreign wage is high enough, cross-ownership is more advantageous than partial domestic participation and similarly advantageous for overall social welfare. Moreover, domestic participation and cross-ownership always ensure a higher level of welfare than a simple product market integration.

These findings provide some policy insights. When a government pursues an international integration policy, it has to be oriented toward a high degree of liberalization. Product market integration in the presence of capital market restrictions implies that all of the potential welfare gains cannot be achieved. Second, a government can improve social welfare with an opportune policy mix in the product and capital markets, considering the intervention tools as complements rather than substitutes.

The results of this work are, however, based on a simplifying assumption. For example, neither trade barriers nor sunk costs have been considered. A direct extension could be to evaluate the impact of these market integration frictions. Furthermore, the results may be sensitive to an alternative bargaining agenda, such as the Efficient Bargaining model. These remarks may constitute food for thought and inspire future research.

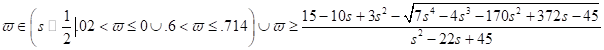

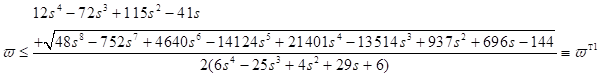

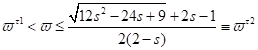

Appendix

Relevant payoff

rankings in Table 1 for ![]() .

.

1) ![]() for

for ![]() ;

;

![]() for

for ![]() ;

;

![]() for

for ![]() ;

;

![]() for

for ![]() ;

;

![]() for

for ![]() ;

;

![]() for

for ![]() ;

;

2) ![]() .

.

3) a. ![]() for

for ![]() ;

;

![]() for

for  ;

;

![]() for

for ![]()

![]() for

for ![]() .

.

4) a. ![]() for

for  ;

;

![]() for

for ;

;![]() for

for ![]() ;

;

![]() for

for ![]()

5) ![]() for

for ![]() ;

;

![]() for

for ![]() ;

;

![]() for

for ![]() ;

;

![]() for

for ![]() ;

;

![]() for

for ![]() .

.

References

Airline Business, 1988. “Airlines with Ownership by Other Carriers.” June 1998, News, Vol. 48.

Barcena-Ruiz, J.C. and Olaizola, N. (2007). Cost-saving production technologies and partial ownership. Economics Bulletin 15 (6): 1–8.

Bughin, J. and Vannini, S. (1995). Strategic direct investment under unionized oligopoly. International Journal of Industrial Organization 13(1): 127-145. https://doi.org/10.1016/0167-7187(94)00447-a

Dreher, A. (2006). Does globalization affect growth? Evidence from a new index of globalization. Applied Economics 38(10): 1091-1110. https://doi.org/10.1080/00036840500392078

Dunlop, J. (1944). Wage Determination under Trade Unions, New York: Macmillan.

European Foundation for the Improvement of Living and Working Conditions (Eurofound) (2009). Multinational companies and collective bargaining. Retrieved from http://www.eurofound.europa.eu/eiro/studies/tn0904049s/tn0904049s.htm

Fanti, L. (2013) Cross-ownership and unions in a Cournot duopoly: When profits reduce with horizontal product differentiation. Japan and the World Economy 27: 34–40. https://doi.org/10.1016/j.japwor.2013.03.005

Fanti, L. (2014). Welfare effects of cross-ownership in a unionised duopoly. Economia e Politica Industriale – Journal of Industrial and Business Economics, 41(2): 21-41. https://doi.org/10.3280/poli2014-002002

Fanti, L. (2016). Interlocking cross-ownership in a unionised duopoly: when social welfare benefits from “more collusion”. Journal of Economics, 119(1): 47-63. https://doi.org/10.1007/s00712-016-0485-5

Gilo, D., Moshe, Y. and Spiegel, Y. (2006). Partial cross ownership and tacit collusion. The Rand journal of economics 37(1): 81-99. https://doi.org/10.1111/j.1756-2171.2006.tb00005.x

McDonald, I. M. and Solow, R. M. (1981). Wage Bargaining and Employment. American Economic Review, 71 (5): 896-908.

Mukherjee, A. (2010). Product market cooperation, profits and welfare in the presence of labor union. Journal of Industry, Competition and Trade, 10, 151-160. https://doi.org/10.1007/s10842-009-0063-4

Naylor, R. (2000). Trade and wages when the trade regime is determined endogenously. Review of International Economics 8(3): 556-565. https://doi.org/10.1111/1467-9396.00241

Nickell, S. and Andrews, M. (1983). Unions, Real Wages and Employment in Britain 1951-79. Oxford Economic Papers, 35: 183-206. https://doi.org/10.1093/oxfordjournals.oep.a041610

Symeonidis, G. (2008). Downstream competition, bargaining, and welfare. Journal of Economics & Management Strategy, 17(1), 247-270. https://doi.org/10.1111/j.1530-9134.2008.00177.x

Spiegel, Y. and Gilo, D. (2003). Partial cross ownership and tacit collusion (No. 0038). CSIO working paper/Northwestern University, Center for the Study of Industrial Organization. https://doi.org/10.2139/ssrn.422840

The Economist (2005). Clearer signal. January, 20, 2005.

The Economist (2013). The gated globe. Special report: the world economy. October, 12, 2013.