Ekonomika ISSN 1392-1258 eISSN 2424-6166

2019, vol. 98(2), pp. 33–54 DOI: https://doi.org/10.15388/Ekon.2019.2.3

To Work or not to Work: Factors Affecting Bridge Employment Beyond Retirement, Case of Lithuania

Kristina Zitikytė*

Vilnius University, Lithuania

Abstract. This paper investigates bridge employment beyond retirement, as nowadays it is one of solutions often mentioned to stabilize pension systems in the context of an aging population. The aim of this paper is to identify individual, financial, and other factors that influence retirees to work beyond retirement in Lithuania. This research was done using unique administrative Lithuanian data, allowing to analyze post-retirement employment in Lithuania for the first time. The sample consists of 26,000 new old-age pension recipients from 2015 to 2017. By applying binary models of the probability of being employed beyond retirement, it is found out that a greater acquired retirement record, a higher average wage before retirement, and living in a bigger city with a higher employment rate were positively associated with accepting bridge employment, while a higher sickness rate, higher old-age pension, and earlier receipt of an unemployment benefit were inversely related to accepting such employment. Moreover, being a professional or manager increases the likelihood of bridge employment in comparison to unskilled workers. This probability increases even more if a person works in the public sector. Finally, some social groups were excluded, finding that widows with disabilities or widowed women with worse health are not likely to work beyond retirement and are consequently under a bigger risk of poverty. To sum up, retirees who should stay in the labor market in their old age because of their bad financial situation are less likely to do it. This suggests that persons with bigger needs, lower-skilled workers, and women deserve particular attention in labor market reforms.

Keywords: bridge employment, post-retirement employment, work after retirement, old-age pension, aging

* Corresponding author:

Department of Quantitative Methods and Modeling, Faculty of Economics and Business Administration, Vilnius University, 9 Saulėtekio Ave., LT-10222, Lithuania

Email: kristina.zitikyte@evaf.vu.lt

Received: 10/10/2019. Revised: 27/10/2019. Accepted: 30/10/2019

Copyright © 2019 Kristina Zitikytė. Published by Vilnius University Press

This is an Open Access article distributed under the terms of the Creative Commons Attribution Licence, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

1. Introduction

A low fertility rate, increasing life expectancy, and a high emigration rate accelerate demographic change in the world. The resulting demographic forecast is characterized by a rapid aging of the working age population, as well as an increasing share of people above retirement age. These trends negatively affect pension and health systems, and the labor market too. Social security is facing shortfalls, resulting in lower benefits and replacement rates, while individuals are confronted with reduced pension income and the risk of living in old-age poverty.

To secure the financial sustainability of pension systems in European countries and to ensure higher pensions, structural reforms were proposed, such as shifting from the defined benefit to defined contribution schemes and moving from single to multi-tiered pension systems to lower the share of pay-as-you-go pensions. Moreover, many countries started to increase the retirement age and discourage early retirement arrangements because easy early labor market exit would create growing imbalances between active years and years in retirement. However, the financial and economic crisis highlighted weaknesses in some pension systems and denied the myth that specific type of pension system can cope with demographic changes by itself, whereas increasing pension age is also not enough to reduce negative aging impact on pension systems.

As one of the solutions to resource the needs of an aging population is the encouragement of individuals to stay in the labor market for longer, avoiding labor shortages for employers, providing employees with bigger income in old age, and ensuring the stability of pension and health systems. The choice to work beyond the retirement can be very individual and depend on different factors.

The aim of this paper is to find out what factors affect the choice of retirees to work beyond the retirement in Lithuania in order to elaborate reasonable recommendations to the Lithuanian pension system and labor market policies. The results of this research can allow to design customized reforms to uniquely support individuals in retirement. To understand the factors affecting bridge employment, statistical analysis and binary models of probability were employed.

The biggest benefit and at the same time the biggest limitation of this research is the use of administrative data. On the one hand, using unique Lithuanian social security data allows to treat not a sample, as in the cases of other authors, but to treat the whole population. The majority of social science studies on older workers and retirement transitions use survey data, such as the Survey of Health, Aging and Retirement in Europe project (Dingemans et al. 2016; Komp et al. 2010; Dingemans, Möhring 2018; Dingemans, Henkens 2018; Kalwij, Vermeulen 2008; Börsch-Supan et al. 2013), European Union Labour force survey (Aliaj et al. 2016) or questionnaires surveys (Shackloc et al. 2009). So, this research will have a valuable contribution to researches in this area.

On the other hand, not all factors that could be very interesting to investigate, were possible to include. For example, no administrative data is accessible about a person’s marital status or spouse’s employment, although it is known from previous studies that these factors do affect a the retiree’s choice to work beyond retirement.

Without the introduction and the conclusions, this paper is constructed of five main sections. The second section reveals the literature review, where different attitudes on bridge employment are provided, including employers’ and employees’ positions. The third section provides an analysis of retirees’ employment in Lithuania. The fourth section deals with the hypotheses for possible factors affecting the choice to work beyond the retirement. In the fifth section, methodological issues of binary probability models have been presented. In the sixth section of this paper, the results of probability models are presented.

2. Literature review

In line with the increasing trend toward old-age employment, a new term – “bridge employment” – is used. The definition of bridge employment proposed in this study is slightly different from that in United States, where “bridge employment” is often defined as participation in a paid job (part-time, temporary, full-time or self-employment) after exit from a full-time career job; in other words, it signifies the “bridge” from pre-retirement employment to full retirement (Gobeski, Beehr 2009; Feldman 1994; Dingemans et al. 2016). In European countries, where part-time employment is relatively common in all stages of a career, especially among female employees, this definition would be controversial (Sandor 2011). Like Dingemans et al. (2016), in this paper, bridge employment is defined as the participation in paid work by those who are entitled to old-age pension.

Longer (2006) highlights that encouraging older workers to remain in work longer could result in a triple dividend: (1) it would boost labor force growth and help offset the negative impact of population aging on economic growth; (2) it would improve public finances through reduced public expenditures associated with early retirement while increasing tax revenues; (3) and it would also help employers by smoothing the pace at which they will have to replace retiring workers with new entrants. It is obvious that policymakers can only win from the choice of retirees to work. But how this process can affect employers and employees separately and what prevailing attitudes are among these groups of society?

Increased expenditure of health, pension and care for elderly people, and labor shortage are some of the negative implications of population aging that pose serious threats to macroeconomic performance. With an increasing share of dependent older people in society, fiscal expenditures on health care, long-term care, and pensions increase, while they must be financed through the contributions and taxes paid by the increasingly smaller younger age groups. To avoid these consequences, European countries aim to strengthen employment, including older women and men aged 55–64. The new employment strategy, as part of the Europe 2020 strategy, explicitly includes promoting active aging in the sense of increasing labor force participation, working for more years and remaining at work for longer (EC-European Commission 2010).

Individual motives to work beyond the retirement. Most often two different motives of individuals for bridge employment are distinguished in the literature. Firstly, retirees in better a financial situation may choose to work beyond the retirement to get life satisfaction, not to lose social relationships (Dingemans, Henkens 2018; Sandor 2011), and to earn income, augmenting the social security pension income (Cahill et al. 2006). The argument supporting this statement is that retiring people face the feeling that they are no more useful to their society, although in many cases, they would be motivated to continue working and maintain social relationships.

On the other hand, bridge jobs may reflect the financial necessity to avoid poverty risk, especially those at the lower end of the socioeconomic scale (Cahill et al. 2006; Maestas, Zissimopoulos 2010; Aliaj et al. 2016; Komp et al. 2010; Longer 2006). Older persons face an increasing risk of poverty, and they may counter this by working longer.

Consequently, individuals may not want to work longer, but they may need to work in order to support their consumption and avoid poverty. However, older workers may face a few difficulties in keeping their jobs. They may be less productive than younger ones, as they have been trained through a different educational system; the quality of their human capital might be lower; and, even if they have acquired experience, it is often not useful in new, expanding sectors (Bussolo et al. 2015). Older workers may be less mobile, less entrepreneurial, and generally less flexible. Moreover, the hiring policies of firms may be biased against older, possibly less productive but more expensive workers.

Attitudes of employers to older workers. Many authors agree that increasing attention is needed for the potential of older workers because of labor shortages (Schalk et al. 2010; Maestas, Zissimopoulos 2010; Cahill et al. 2006). Maestas and Zissimopoulos (2010) note that older workers are becoming closer skill substitutes for younger workers, which in turn should raise demand for older workers, particularly in jobs where the productivity return to experience is high. Shalk et al. (2010) argues that the lower maximum capacities with age are becoming less and less important because of automation in physical work and the computerization of cognitive work, especially of memory and computation-related tasks.

Increasing attention is needed for the potential of older workers. Companies should consider this potential, but do they really do this? Longer (2006) courageously states that employers are part of the problem in terms of restricting job opportunities for older workers because of negative attitudes.

The main finding why employers do not rehire older employees is the downward wage flexibility. Employers are considerably more likely to rehire employees who are prepared to accept a significantly lower wage after mandatory retirement because they probably want the post-retirement wage to be more related to workers’ productivity (Mulders et al. 2014). It is generally acceptable that older workers become less productive, but at the same time, their experience makes it possible to get reasonably bigger wage.

It is clear enough that as the labor force shrinks, more and more employers will face the problem of labor force shortage, but the question is if they find it advantageous to hire older workers and devise new mechanisms for retaining older workers. Here public policy should make information campaigns, guidelines, and age-discrimination legislation, although it must be said that public measures only have a limited role in changing employer practices, since they cannot directly force employers to hire or retain older workers. Thus, the public policy needs more research on post-retirement employment.

3. Analysis of retirees’ employment in Lithuania

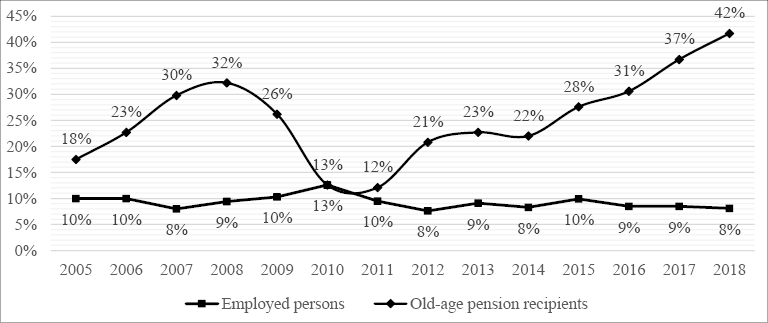

The financial situation of retirees in Lithuania is not easy. The at-risk-poverty-rate1 of old-age pension recipients was decreasing during the period of 2008–2010, but since 2010, with increasing wages and frozen pensions, the situation started to go worse (FIGURE 1). In 2018, the at-risk-poverty-rate of old-age pension recipients stood at 42% and, compared to 2011, grew by 30 percentage points, while the at-risk-poverty-rate of employed persons stayed at the same level.

The government in Lithuania takes measures to reduce poverty among older people, such as the indexation of old-age pensions (since 2018), premiums for minimum pension recipients (since 2019), onwards or the conversion of pensions for retirees with more than 30 years of an obligatory retirement record. People are encouraged to accumulate retirement savings in private pension funds (pension reforms in 2004, 2014, 2019).

Figure 1. The at-risk-poverty-rate of employed persons and old-age pension recipients, %

Source: The Lithuanian Department of Statistics

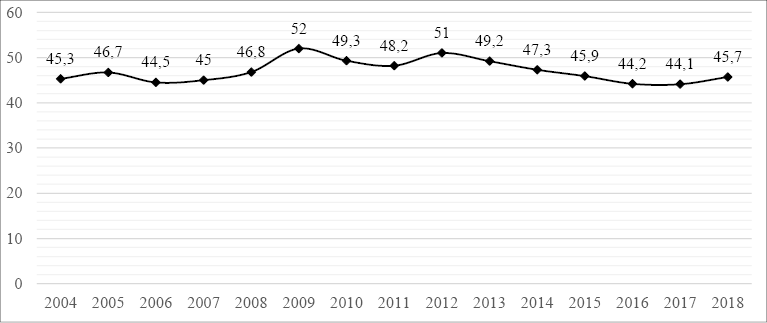

Financial situation of retirees can be analyzed through the replacement ratio of old-age pensions, which, in this paper, is defined as the average pension paid for those who have an obligatory pension record, divided by the net average wage, taking into account personal income taxes and social security contributions paid by workers and pensioners. Despite all the measures, the replacement ratio of old-age pension remains low (FIGURE 2).

In 2018, the replacement ratio of old-age pension paid for retirees who have an obligatory pension record in Lithuania was 45.7%. In the period of 2007–2009, this ratio increased and reached 52% in 2009. The increase in the replacement ratio of old-age pension was determined by the decrease of the average net wage during the crisis year. In 2012, the indicator grew due to an increase in the average retirement benefit, since in that year, the reduced first- and second-degree state pensions to the victims, officials, soldiers, scientists, and judges were restored. In the recent years, the replacement ratio of old-age pension paid for retirees who have an obligatory pension record returned to the previous level – at about 45%.

Figure 2. Replacement ratio of old-age pension, having obligatory pension record

Source: The Social Insurance Fund Board and The Lithuanian Department of Statistics

As a person gets older, they can or sometimes must make different choices related to pension: to take early retirement pension before retirement age comes, to retire when retirement age comes, to work and receive their old-age pension, or to defer the payment of pension.

To take early retirement pension. In Lithuania, a person is eligible for early retirement pension if they are less than 5 years from their retirement age, have the obligatory retirement record, have no other income, and do not receive any other pension or benefit. The early retirement pension is decreased by 0.4% per each early retirement month. After reaching the standard retirement age, the reduction is recalculated according to the number of months for which an early pension was paid – therefore, receiving an early retirement pension decreases the income in retirement. Mostly, people who lose their jobs shortly before retirement and cannot find another job apply for this pension. They are mostly lower-skilled workers, for example, cleaners, housekeepers, or shop sellers, who are paid less than the average wage of a country. In Lithuania, about 7 thousand people each year opt for early old-age pensions, and this represents about 1% of all retirees. In 2018, the average early retirement pension was 230,70 euro, and it was one-third lower than the average old-age pension paid for retirees who have an obligatory pension record.

To retire when retirement age comes. In Lithuania, 608,7 thousand people receive old-age pension. The average old-age pension in 2018 was 319,35 euro. The average old-age pension paid for retirees who have obligatory retirement record in 2018 was 337,50 euro. Many retirees have an obligatory retirement record; however, the share of retirees not having a required retirement record is increasing. In 2008, 5,4% of retirees did not have an obligatory retirement record, while in 2018, this share increased to 10%.

To defer the payment of pension. If a person is entitled to an old-age pension, a retiree may defer it. The payment of the old-age pension may be deferred for a full year, but for a maximum of 5 years. At the end of the deferment period, the old-age pension is increased by 8% for each full year of deferment. In Lithuania, about 1 thousand people receive their old-age pensions, which were deferred. Most people who choose to defer their pension are those with a high income. On average, deferred old-age pension is 60% higher than the average old-age pension paid for retirees who have an obligatory pension record. This shows that people who defer the payment of pension are those with high incomes and those who would receive a higher pension anyway.

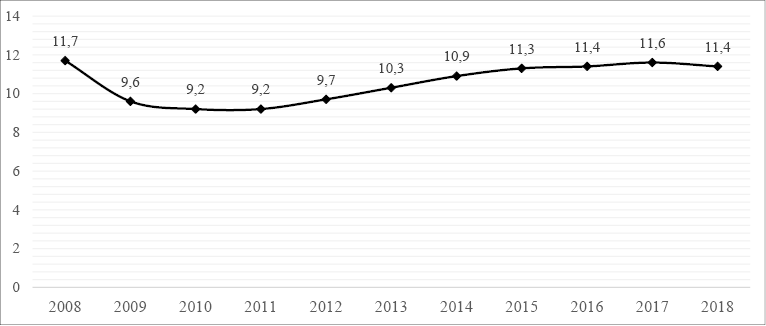

To work and receive a pension. In Lithuania, the law guarantees that old-age pension recipients can earn additional income without losing or decreasing their pensions. This is a great incentive to work and retire together. Therefore, there is a growing number of retirees in Lithuania who decide to stay in the labor market after retirement and receive old-age pensions (FIGURE 3). The employment rate among old-age pension recipients in Lithuania increased from 9.2% in 2010 to 11.4% in 2018.

Figure 3. Share of working retirees in December of 2008-2018

Source: Social Insurance Fund Board

The share of working retirees increased due to the choice of new old-age pension recipients to work. As we can see from TABLE 1, the share of working retirees increased 9 percentage points from 39% in 2010 to 48% in 2017.

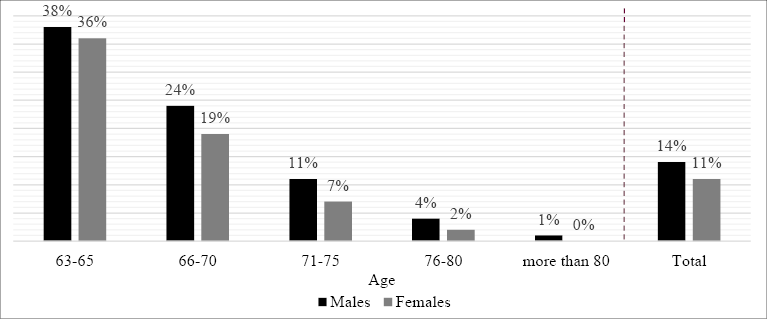

Statistical data show that the differences of bridge employment exist between men and women, finding that women are less likely to work beyond retirement in Lithuania. Statistically, 14% of retired men and 11% of retired women work, whereas women receive lower wages during their whole careers and have a lower workforce participation rate due to childcare. They are less active in retirement, too.

Table 1. Share of new old-age recipients working 6 and 12 months after their retirement

|

Years |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

|

New recipients, thousands |

21.8 |

22.0 |

16.7 |

16.0 |

15.3 |

16.3 |

16.2 |

16.1 |

|

after 6 mths: |

|

|||||||

|

employed, thousands |

9.0 |

9.9 |

8.1 |

8.0 |

7.7 |

8.4 |

8.2 |

8.2 |

|

after 12 mths: |

|

|||||||

|

employed, thousands |

8.5 |

9.4 |

7.7 |

7.5 |

7.2 |

7.9 |

7.5 |

7.7 |

Source: Social Insurance Fund Board

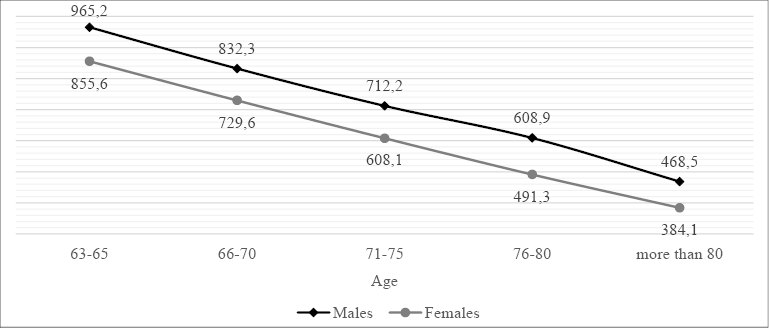

In a group of people aged 63–65 years, 38% of men and 36% of women work. However, labor market activity declines with age. In a group of people aged 66–70 years, only 24% of men and 19% of women work, until eventually their activity reduces to a minimum in the ages 76–80.

Figure 4. Share of employed retirees by age, in December of 2018

Source: Social Insurance Fund Board

Statistical data show that retirees mostly work for a lower than average wage. In December 2018, the average wage of people who were 63 and older was 819 Eur, and it was 17 percentage points less than average wage of all insured persons.

Figure 5. Average wage of employed retirees, in December of 2018

Source: Social Insurance Fund Board

There are some reasons for the downward wage. First, retirees are more likely to work part-time jobs. Second, the employment after retirement is in the hands of employers. As Mulders (2014) points out, employers are considerably more likely to rehire employees who are prepared to accept a significantly lower wage after mandatory retirement because they probably want the post-retirement wage to be more related to workers’ productivity. Thus, as age increases, wages fall.

4. Hypotheses

Studying the participation of retirees in the labor force introduces various possible determinants of post-retirement employment, which were grouped by the author into individual, financial, family and other factors (Table 2). Factors included into regressions in empirical part are marked with the “+” sign.

Table 2. Factors affecting bridge employment beyond the retirement.

|

Individual factors |

Financial factors |

Family factors |

Other factors |

|

Age (-) Gender (+) H1 Health (+) H2 Education (-) Occupation (+) H3 Work history (+) H4 Sector (+) H5 |

Wage (+) H6 Old-age pension (+) H7 Wealth (-) |

Marital status (-) Spouse’s employment (-) Family context (-) |

Region (+) H8 Employment rate in region (+) H9 Unemployment benefit recipient (+) H10 Disability pension recipient (+) H11 Widow pension recipient (+) H12 Macroeconomic situation (+) H13 Prevalence of pension deferment (-) Prevalence of early retirement (-) Prevalence of private pensions (-) |

Source: grouped by the author.

Individual factors. A well-known and important predictor of bridge employment is gender, with men being more likely to work in bridge jobs (Komp et al. 2010; Maestas 2010; Kim, Feldman 2000; Damman, Henkens 2018; Damman et al. 2015; Pleau 2010; Maestas, Zissimopoulos 2010; Shacklock et al. 2009). Most authors agree that women’s labor force participation rate is lower than men’s rate because of social norms and women’s responsibility for familial caregiving (Hult 2008; Komp et al. 2010; Pleau 2010). Many women perceive a conflict in the choice between paid work and child rearing (Hult 2008). Unlike male retirees, female retirees face not only the discrimination of age but also the discrimination of sex (Shacklock et al. 2009). However, women increasingly face direct incentives for continued work at later ages because additional work may raise their social security benefits (Maestas, Zissimopoulos 2010). However, in the light of the foregoing, the following hypothesis is formulated:

Hypothesis 1. Women are less likely to work bridge jobs than men.

Many studies showed that two most important motivators for retirees to work are financial pressure and good health, with financial pressure making retirees feel that they should engage in bridge employment and good health making it possible to do (Wang et al. 2008). Older workers may be particularly at risk from exposure to difficult working conditions – such as heavy physical work or restrictive postures – as these can amplify the natural deterioration of the body related to the aging of sensorial and physical capacities (Ilmarinen 2005). However, new studies show that working beyond retirement can also positively affect health by increasing retirement and life satisfaction and ensuring active aging. In any way, the following hypothesis states:

Hypothesis 2. Good health will be positively related to participation in bridge employment.

Occupation can be one of the factors that will determine whether a person decides to work in old age. Villosio (2008) finds that older workers in sectors such as manufacturing, construction, and agriculture are most exposed to physical risks. Workers in the hotels and restaurants sector should also be added to this list, especially due to the heavy loads and difficult work positions entailed in such work, while lower levels of exposure to risks are experienced by people working in real estate, financial intermediation, and public administration and defense. Probably, people who do more manual work are more likely to stay in the labor market for shorter periods.

Komp et al. (2010) finds out that occupations with high job autonomy and a low stress-level motivate persons to work longer and that the effect of occupational prestige is strong among both men and women. The higher the occupational prestige, the more likely an older person is to engage in paid work because persons in prestigious occupations usually have more autonomy in their work tasks, and this makes paid work more agreeable for them. Komp et al. (2010) also adds that persons in prestigious occupations often have specialized skills, which make these employees more valuable for their employers, motivating them to prevent early retirement. To measure the impact of occupation on bridge employment, Lithuanian Classification of Occupations is used, where they are grouped from the most skilled to the least skilled occupations. Related to this, the next hypothesis is formulated:

Hypothesis 3. Higher-skilled workers, such as managers and professionals, are more likely to work longer than unskilled workers.

Also, it can be assumed that a person who is in the labor market for longer is more likely to work beyond their retirement than somebody who is in the labor market for a shorter period, because they may have got more experience, better work skills, and may have bigger chances to stay in the labor market for longer. In the light of the foregoing, the following hypothesis is formulated:

Hypothesis 4. The more years a person has worked, the greater the likelihood of post-retirement employment.

The analyzed articles do not study the impact of the sector on employment beyond the retirement. However, it can be assumed that there may be different opportunities to stay in the labor market when a person works in the public and private sector. Workers in the public sector may have better conditions for staying in the labor market for longer because in the private sector, employers will be willing to hire younger workers and will be more likely to dismiss older people. In the case of using administrative data about a sector a working person, the next hypothesis is formulated:

Hypothesis 5. Individuals who had worked in the public sector are more likely to bridge employment in comparison to individuals from the private sector.

Financial factors. Broadly speaking, retirees work because they need to or because they want to. The financial situation may play a crucial role in choosing to continue working or not. A better financial position is associated with an increased likelihood to retire fully rather than to continue working. To measure economic preferences, two indicators are used: the amount of old-age pension and the average wage of the last three years prior to individual’s retirement.

The wage factor is not widely discussed in literature and by default is considered to have an inverse relationship with bridge employment. Kim and Feldman (2000) find in their study that the higher a retiree’s wage, the less likely a person was to engage in any type of bridge employment. Also, they show that the main source of retirees’ income – pensions – are not significantly related to bridge employment. Old-age pensions and wages in the Lithuanian case may have bigger significance, where the pension replacement rate is relatively low. Whereas old-age pensions are low in Lithuania, a higher retiree’s wage will mean that a person will want to maintain their level of lifetime consumption and will work in order not to live solely from a low pension. Also, a higher wage will let to assume that a person has got a better work position and better opportunities to continue working, even after retirement. On the other hand, a low old-age pension will signal that a person will work out of necessity to avoid the risk of poverty. Related to this, it can be concluded up with the following hypotheses:

Hypothesis 6. The higher a retiree’s average wage was, the more likely a retiree is to engage in bridge employment.

Hypothesis 7. The less the old-age pension is, the bigger probability that a retiree will work beyond the retirement.

Other factors. Sometimes the choice to work beyond the retirement can depend on a region the person lives in, because the employment rate is bigger and more industrial centers are in a city than in a district. In the light of the foregoing, the following hypotheses are formulated:

Hypothesis 8. Individuals who live in cities are more likely to bridge employment in comparison to individuals living in districts.

Hypothesis 9. A person living in a region with a lesser employment rate is less likely to work beyond retirement.

There are some other characteristics about a person which can be important trying to evaluate the probability of bridge employment. There are some different social groups, which can have different opportunities to post-retirement employment. For example, a person who was unemployed or has any disabilities is likely to have more difficulties to stay in the labor market for longer. Finally, widows could be more interested in bridge employment because they are more likely to be under risk of poverty after the death of a spouse. Thus, information on receiving social security benefits was included in the models. For this reason, hypotheses 10–12 are formulated:

Hypothesis 10. A person who has received an unemployment insurance benefit earlier before retirement is less likely to work beyond retirement.

Hypothesis 11. A person who has received a disability pension earlier before retirement is less likely to work beyond retirement.

Hypothesis 12. A person who receives a widow pension is more likely to work beyond retirement.

After all, strong macroeconomic conditions and well-functioning labor markets are especially important for underpinning higher participation rates among older people (Longer, 2006). To analyze a possible effect of macroeconomic factors on the employment of retirees, data about GDP growth are used.

Hypothesis 13. The better economic situation, the higher the GDP growth is when a person retires, the more likely they are to work.

Next, the sample and methods of the research are presented.

5. Methods

Sample

The analyzed sample consists of 26,000 new old-age pension recipients from 2015 to 2017. This research was done by using unique Lithuanian social security data, which allows to investigate not a sample, as in the cases of other authors, but the whole population. Using data about new recipients does not allow to analyze how the age factor affects the choice of bridge employment, because all persons in research are of the same age.

Models

To answer the question which factors influence post-retirement employment, linear probability, logit, and probit models are applied. The dependent variable in these models is an indicator of whether a man stays in the labor market beyond retirement or not.

The two standard binary outcome models, the logit, and the probit models, specify different functional forms for this probability as a function of regressors.

The logit model specifies:

Li=Λ [β1 + β2experience + β3experience2+ β4 log(pension) + β5sickL + β6sickH + β7 log(average wage) + β8sector + β9sector × occupation1+ β10sector × occupation2+ β11sector ×occupation3 + β12sector × occupation5 + β13sector × occupation7 + β14sector × occupation8 + β15region + β16unemp_benefit + β17disability × widow pension + β18widow pension × gender × dum wage × sickL + β19employment rate],

where Λ is the cumulative distribution function of the logistic function. The response variable regresses and denotes the employment status in retirement and adopts the value 1 for being employed and 0 for being unemployed.

An alternative model is the probit model, which specifies:

Ii = Λ [β1 + β2 experience + β3experience2 + β4 log(pension)+β5sickL + β6sickH + β7log(average wage) + β8sector + β9sector × occupation1 + β10sector × occupation2 + β11sector × occupation3 + β12sector ×occupation5 + β13sector × occupation7 + β14sector × occupation8 + β15region + β16unemp_benefit + β17disability × widow pension + β18widow pension × gender × dum wage × sickL + β19employment rate + ε].

In both regressions, the form of the factors included in the regression is visible. The factor experience means years of acquired retirement record. Next, the experience of second power is used in order to evaluate the decreasing influence of the retirement record. It is likely that with increasing the retirement record, the likelihood of bridge employment will increase (factor experience). However, at a relatively high retirement record, its influence is less pronounced (factor experience2).

To see how a percentage change in wage and pension affect the probability of bridge employment, pension and average wage factors are logarithmic.

The dummy variable of the sick variable is created where sickL means that a person was sick less than 10 times during the last ten years before retirement, and the factor sickH means that a person was sick more than 10 times during the last ten years before retirement.

Next, the dummy variable of sector is included, with being 1 if a retiree works in the public sector and being 0 if a retiree works in the private one. This factor is included in the regressions along with the occupation factor with the hope that it will better reflect differences between people of the same profession but working in different sectors. Supposedly, a manager in the budget sector is more likely to remain in retirement than a manager in the private sector. Occupation1 denotes managers, occupation2 – professionals, occupation3 – technicians and associate professionals, occupation5 – service and sales workers, occupation7 – craft and related trades workers, occupation8 – machine operators and assemblers. Such occupations as elementary workers and skilled agricultural, forestry and fishery workers are not included because both occupations are more common in the private sector.

Region is also dummy variable, and it adopts the value 1 for a retiree living in a city and 0 for a retiree living in a district. The variable employment rate shows the employment rate in a specific region. Variables unemp_benefit, disability, widow pension are also dummies with being 1 when a retiree has received a relevant benefit or a pension and 0 if a retirees has never got such a benefit or a pension. Such combinations as disability × widow pension or widow pension ×gender × dum wage × sickL are included into regressions to evaluate the situation of those retirees who both receive disability and widow pension or those who are widowed women getting less than the average wage in order to determine whether more socially vulnerable groups in society are more likely to work or not.

When estimating probit and logit models, it is common to report the marginal effects after getting the coefficients. Next, the main calculations of marginal effects for logit and probit models are presented, because they are estimated later in the research. For linear probability models, the marginal effects are the coefficients, and they do not depend on x:

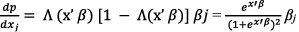

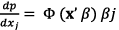

For the logit and probit models, the marginal effects are calculated as:

Marginal effects for the logit model:

Marginal effects for the probit model:

Further in the work, like in most papers, marginal effects at the mean will be calculated and interpreted.

6. Results

Descriptive results. From the statistical analysis of the data, it is found that retirees who have a higher acquired pension record, higher wage, and receive a higher old-age pension are more likely to work beyond the retirement (TABLE 3).

Table 3. Characteristics of employed and not employed retirees

|

|

Employed |

Not employed |

|

Average wage prior to retirement, Eur |

684 |

547 |

|

Average wage beyond retirement, Eur |

736 |

0 |

|

Amount of average pension, Eur |

308 |

284 |

|

Average experience, years |

39 |

37 |

|

Share of worked in public sector, % |

34% |

27% |

Source: Social Insurance Fund Board

The average wage prior to retirement of the employed retirees was 25% higher than of those who were not employed beyond the retirement. Employed retirees had a higher acquired pension record, 39 years, while not employed had acquired pension record of 37 years; 34% of employed retirees before retirement worked in the public sector, while in the private sector, this share was only 27%.

At first glance, one might get the impression that the average wage beyond the retirement was higher than average wage prior to retirement. However, it should be noted that the average wage prior to retirement was counted as the average wage of the last three years before the retirement. If the wage growth is eliminated, the average wage prior or beyond the retirement would be similar.

Moreover, higher-skilled workers are more likely to work after retirement. Almost one third of the employed retirees were professionals, 14% managers, and 14% craft and related trades workers2 (TABLE 4). The majority of unemployed retirees, about 24%, were unskilled workers (TABLE 5).

Table 4. Employed retirees

|

Occupations |

Share, % |

|

Professionals |

27,3 |

|

Managers |

13,7 |

|

Craft and related trades workers |

13,6 |

|

Elementary occupations |

13,2 |

|

Plant and machine operators |

11,4 |

|

Service and sales workers |

9,2 |

|

Technicians |

6,2 |

|

Clerical support workers |

5,0 |

|

Skilled agricultural workers |

0,5 |

Source: Social Insurance Fund Board

Table 5. Unemployed retirees

|

Occupations |

Share, % |

|

Elementary occupations |

23,6 |

|

Professionals |

19,3 |

|

Craft and related trades workers |

16,7 |

|

Plant and machine operators |

11,0 |

|

Service and sales workers |

9,5 |

|

Managers |

7,6 |

|

Technicians |

6,2 |

|

Clerical support workers |

5,4 |

|

Skilled agricultural workers |

0,8 |

Source: Social Insurance Fund Board

Results of the models. TABLE 6 presents the estimates of the linear probability model (LPM), logit and probit models explaining participation in bridge employment versus full retirement based on individual, financial, and other factors.

Table 6. Results of the models

|

|

LPM |

Logit |

Probit |

|||

|

intercept |

-0,01 |

0,08 |

-3.62*** |

0.44 |

-2.27*** |

0.27 |

|

experience |

0,06*** |

0,004 |

0.29*** |

0.02 |

0.17*** |

0.01 |

|

experience2 |

-0,0007*** |

0,00005 |

-0.003*** |

0.0003 |

-0.002*** |

0.0001 |

|

log(pension) |

-0.2*** |

0.02 |

-1.17*** |

0.09 |

-0.67*** |

0.05 |

|

sick low |

0.01 |

0.008 |

0.07 |

0.04 |

0.04 |

0.02 |

|

sick high |

-0.07*** |

0.01 |

-0.31*** |

0.07 |

-0.18*** |

0.04 |

|

log (average wage) |

0.10*** |

0.006 |

0.50*** |

0.03 |

0.30*** |

0.02 |

|

sector |

-0.03* |

0.01 |

-0.13 |

0.05 |

-0.08* |

0.03 |

|

sector × managers |

0.05** |

0.02 |

0.26** |

0.10 |

0.15** |

0.06 |

|

sector × professionals |

0.04** |

0.01 |

0.19** |

0.06 |

0.12** |

0.04 |

|

sector × technicians |

0,06** |

0.02 |

0.31** |

0.11 |

0.19** |

0.07 |

|

sector × service and sales workers |

0,09*** |

0.02 |

0.43*** |

0.10 |

0.27*** |

0.06 |

|

sector × craft and related trades workers |

0,11** |

0.04 |

0.54** |

0.18 |

0.33** |

0.11 |

|

sector × machine operators |

0.12** |

0.04 |

0.65*** |

0.19 |

0.40*** |

0.11 |

|

region |

0.07*** |

0.006 |

0.14*** |

0.04 |

0.08*** |

0.02 |

|

unemployment benefit |

-0. 3*** |

0.008 |

-1.52*** |

0.04 |

-0.93*** |

0.02 |

|

disability × widow pension |

-0,08 |

0.05 |

-0.38 |

0.22 |

-0.23 |

0.13 |

|

widow pension × gender × dum_wage × sick_l |

-0,06** |

0.02 |

-0.31** |

0.10 |

-0.18** |

0.06 |

|

employment rate |

0,004*** |

0.0006 |

0.02*** |

0.003 |

0.01*** |

0.002 |

Source: estimated by the author

By applying the binary models of the probability of being employed beyond retirement, it is found out that a higher obligatory pension record, a higher average wage before retirement, and living in a bigger city with a higher employment rate were positively associated with accepting bridge employment, while a higher sickness rate, old-age pension, and an early receipt of the unemployment benefit were inversely related to accepting such employment.

Moreover, being a professional or manager increases the likelihood of bridge employment in comparison to unskilled workers. This probability increases if a person works in the public sector. Finally, people who are widows with disabilities or widowed women with worse health are not likely to work beyond retirement and they are under a bigger risk of poverty. However, these coefficients of logit and probit models in TABLE 6 are not suitable to interpretation yet. For the interpretation, marginal coefficients at the mean must be calculated (TABLE 7).

Table 7. Marginal effects of the models

|

|

LPM |

Logit |

Probit |

|

intercept |

-0,01 |

-0.73 |

-0.52 |

|

experience |

0,06 |

0.06 |

0.04 |

|

experience2 |

-0,0007 |

-0.0007 |

-0.0004 |

|

log (pension) |

-0.2 |

-0.24 |

-0.15 |

|

sick low |

0.01 |

0.01 |

0.01 |

|

sick high |

-0.07 |

-0.06 |

-0.04 |

|

log (average wage) |

0.10 |

0.10 |

0.07 |

|

sector |

-0.03 |

-0.03 |

-0.02 |

|

sector × managers |

0.05 |

0.05 |

0.04 |

|

sector × professionals |

0.04 |

0.04 |

0.03 |

|

sector × technicians |

0,06 |

0.06 |

0.04 |

|

sector × service and sales workers |

0,09 |

0.09 |

0.06 |

|

sector × craft and related trades workers |

0,11 |

0.11 |

0.08 |

|

sector × machine operators |

0.12 |

0.13 |

0.09 |

|

region |

0.07 |

0.03 |

0.02 |

|

unemployment benefit |

-0.3 |

-0.31 |

-0.21 |

|

disability × widow pension |

-0,08 |

-0.08 |

-0.05 |

|

widow pension × gender × dum_wage × sick_l |

-0,06 |

-0.06 |

-0.04 |

|

employment rate |

0,004 |

0.004 |

0.003 |

Source: estimated by the author

Individual factors. All individual factors including health, occupation, experience, and sector were significant in the models except for the gender factor. Because of the one-year timeframe for checking whether a person works or not after retirement, it has been found that the same share of women and men choose to work. Thus, no gender factor was included in the final model. However, statistical data shows that women are less likely to work than men. And this correlates with the conclusions of other authors (Komp et al. 2010; Maestas 2010; Kim, Feldman 2000; Damman, Henkens 2018; Damman et al. 2015; Pleau 2010; Maestas, Zissimopoulos 2010; Shacklock et al. 2009). As it was mentioned earlier, women receive a lower wage during their whole careers and have a lower workforce participation rate due to childcare or the care of other family members (Hult 2008; Komp et al. 2010; Pleau 2010); they are less active in retirement, too. Finding that men’s life expectancy in Lithuania is lower than women’s, and that women’s pensions are lower, women are those who are likely to be under the risk of poverty in their old age. To solve this problem, some measures can be taken in Lithuania, starting from the greater involvement of men in child-rearing, enabling women to return to the labor market more rapidly, and ending with reducing the gender pay gap.

Support was found for Hypothesis 2, namely that a higher sickness rate was related to a lower likelihood of participating in bridge jobs. Bridge employment was less likely with being sick in ten cases or more in the period of the last ten years. Individuals who were sick more than ten times in the period of last ten years were 7% less likely to work than those who were sick less. According to Wang (2008), the health status is one of two most important factors of bridge employment. The fact that this study included only cases of illness with certificates of incapacity, and that these variables were significant, shows that the health status is very closely related to bridge employment.

When the occupation factor was included in the models, estimations showed that people employed in elementary occupations or skilled agricultural workers were about 20% less likely to work in comparison to managers, while technicians, clerical support workers, and plant and machine operators were about 14% less likely to work. The factor of the sector in which a person worked was included into regressions with the hypothesis saying that people in the public sector should be more likely to work in retirement in comparison to private sector. The estimations of the models showed that working in the public sector increases the likelihood of post-retirement work, and this can be related to a person’s occupation.

After the factors occupation and sector were combined, the results showed that managers in the public sector are more likely to work than those in the private one. These estimations show that people in the public sector are more assured of job opportunities in old age and can continue working more successfully beyond the retirement age, while in the private sector, young workers are more in demand with older ones being less attractive to employers. When occupation and sector factors were combined such variables as elementary workers and skilled agricultural, forestry and fishery workers, they were insignificant because both occupations are more common in the private sector. Therefore, these combinations were not included in the final model. Thus, even though this study did not allow the sector to be distinguished by economic activity as in Villosio’s (2008) work, the results were very similar, finding that people working in public administration or working less physical jobs stay longer in the labor market than those who work in manufacturing or agriculture.

Logit and probit models showed that a higher acquired pension record is related to a higher likelihood of working bridge jobs, which supports Hypothesis 4. For each year of pension record, individuals are 6% more likely to work. However, since then the acquired pension record is high, it does not increase and even decreases the likelihood of working.

Financial factors. In contrast to the work of Kim and Feldman (2000), the pension variable was significant in the case of Lithuania. As expected, the pension benefit was inversely related to doing bridge jobs, which supports Hypothesis 7. With one percent increase in pension, individuals are 0,2 percent less likely to work.

Moreover, a higher average wage during an individual’s last three years prior to retirement increases the likelihood of participating in the labor market after retirement, which supports Hypothesis 6. With one percent increase of the average wage, individuals are 0,1 percent more likely to work. Kim and Feldman (2000) examined the wage a retiree receives beyond the retirement and got an inverse relationship with bridge employment. In this research, the pre-retirement wage was included in the models, and this led to different results. The main interest of this research was to determine if a better work position before retirement helps to ensure workplace after retirement. And the results show that a person who had earned a higher average wage before retirement is more likely to stay in the labor market for longer.

Other factors. The results of this study listed until here are very close to results of other authors, but what sets this work apart from others is the inclusion of factors such as being a beneficiary of various social insurance benefits and pensions. The models showed that people who received unemployment, disability, or a widow pension are less likely to work after retirement. Widows with disabilities or widowed women with worse health are not likely to work beyond the retirement and are under a bigger risk of poverty. This research shows that people with disabilities are not likely to work in old age. One of the reasons can be the long period of being unemployed, because if a person receives benefits for long time, it is likely that they will not start working beyond retirement. On the other hand, these results can show that people with disabilities have less opportunities to work, although they are motivated enough. This research cannot answer these questions, but it is clear that the financial situation of these people in old age strongly depends on the size of their benefits.

Probability models showed that the unemployment of a person during their working age can have big influence on their bridge employment. A person who has ever received unemployment benefits in their working age are 30% less likely to enter post-retirement employment than a person who has not.

Moreover, the region in which a retiree lives and the employment rate of the region can influence the choice whether to work or not. Living in city municipalities increases the likelihood of bridge employment by 7%. This also explains the importance of the employment rate of the municipality a retiree lives in. The results showed that if a retiree lives in a municipality where the employment rate is higher, they will be more likely to work. Therefore, not only the individual factors, such as occupation and health status, are important, but also the place where a retiree lives. This may pose greater challenges in the future, as the gap between districts and major cities will increase as the population ages.

Finally, the time when a person retires can be important too. Finally, macroeconomic factors such as GDP growth were insignificant, which rejects Hypothesis 13, but in some variants of the model, GDP growth was significant with a positive sign, showing that retirees will be more likely to work beyond the retirement in good economic times than in bad ones. This correlates with the situation seen in FIGURE 3, where the share of working retirees decreased in 2009–2011, when the economy was in a crisis. This shows that retired people are among the first to be laid off during a crisis.

7. Conclusions

As one of the solutions to resource the needs of an aging population, the encouragement of individuals to stay in the labor market for longer is proposed. The results indicate that bridge employment in Lithuania strongly depends on individual factors such as gender, health status, occupation, work history, and the sector a retiree works in. Like the works of other authors, this paper shows that older worker’s health is one of the major factors on the ability to stay in the labor market beyond retirement. Although the study included only cases of illness with certificates of incapacity, but this did not preclude the health factor from being significant. Moreover, this study confirmed that lifelong careers have a big impact on choices in old age. People doing more mental work and occupying higher positions have bigger opportunities to work in old age, while those who do physical work are less likely to continue their career after retirement. Lithuanian data also showed that people are more likely to work after retirement if they work in the public sector. However, people are less likely to enter bridge employment if they lose their job at an older age, and this suggests that working conditions for older workers in Lithuania should be improved.

Post-retirement employment is also strongly related to financial factors. Retirees with higher pre-retirement wages are more likely to choose to work in retirement as well. This is not surprising, because higher wages are associated with higher-skilled jobs. If a person does a job that requires more skills, they are more demanding in the job market and not as easily replaced. However, a pension benefit was inversely related to doing bridge jobs, and this brought some confusion. This suggests that two types of employed retirees can be distinguished: ones who are well-paid and decide to work because of life satisfaction and good position in the labor market, and the others, who are in a bad financial situation and work in retirement because of poverty risk avoidance.

Paid work in old age is also the domain of persons with high socioeconomic status. Widows, people with disabilities, and women are in a worse financial situation than others and they are less likely to work.

There are three suggestions in this line of research. First, given the findings for the present study, it would be important to increase the employment rate of women, because they are less likely to work beyond the retirement despite the fact that they are more likely to be under risk of poverty in their retirement, especially given the fact that women live longer than men and have to live more years alone. Second, this research clearly shows that people with higher valued occupations have bigger opportunities to stay in the labor market for longer. This encourages thinking about creating more high-value jobs in Lithuania and enabling people to retrain. Finally, policymakers should focus on developing a good healthcare system and good work conditions, because their health statuses can prompt older people to withdraw from work. Because if a retiree has poor health, no matter how bad the financial situation will be, one will not be able to stay in the labor market and all job offers will be unworkable.

References

Aliaj, A., Flawinne, X., Jousten, A., Perelman, S., & Shi, L. (2016). Old-age employment and hours of work trends: empirical analysis for four European countries. IZA Journal of European Labor Studies, 5(1), 16. Retrieved from: https://doi.org/10.1186/s40174-016-0066-1

Börsch-Supan, A., Brandt, M., Hunkler, C., Kneip, T., Korbmacher, J., Malter, F., & Zuber, S. (2013). Data resource profile: the Survey of Health, Aging and Retirement in Europe (SHARE). International journal of epidemiology, 42(4), 992-1001. Retrieved from: https://doi.org/10.1093/ije/dyt088

Bussolo, M., Koettl, J., & Sinnott, E. (2015). Golden aging: Prospects for healthy, active, and prosperous aging in Europe and Central Asia. The World Bank. Retrieved from: https://doi.org/10.1596/978-1-4648-0353-6

Cahill, K. E., Giandrea, M. D., & Quinn, J. F. (2006). Retirement patterns from career employment. The gerontologist, 46(4), 514-523. Retrieved from: https://doi.org/10.1093/geront/46.4.514

Damman, M., & Henkens, K. (2015). Postretirement Work Role Residuals: The Role of Prior Work in the Lives of Fully Retired Individuals. Retrieved from: http://dx.doi.org/10.2139/ssrn.2710700

Damman, M., & Henkens, K. (2018). Gender differences in perceived workplace flexibility among older workers in the Netherlands: A brief report. Journal of Applied Gerontology, 0733464818800651. Retrieved from: https://doi.org/10.1177/0733464818800651

Dingemans, E., & Henkens, K. (2018). Life satisfaction of working retirees in Europe. Netspar Discussion Papers, (DP 06/2018-032). Retrieved from: https://www.netspar.nl/en/publication/life-satisfaction-of-working-retirees-in-europe/

Dingemans, E., Henkens, K., & van Solinge, H. (2016). Working Beyond Retirement in Europe. An Investigation of Individual and Societal Determinants Using SHARE. (Netspar Discussion Paper; No. 06/2016-022). Tilburg: Network for Studies on Pensions, Aging and Retirement (NETSPAR). Retrieved from: http://dx.doi.org/10.2139/ssrn.2796625

Dingemans, E., & Möhring, K. (2018). Do work histories explain the decision to work after retirement? Evidence from Europe. Netspar Discussion Papers, (DP 09/2018-037). Retrieved from: https://www.netspar.nl/publicatie/do-work-histories-explain-the-decision-to-work-after-retirement-evidence-from-europe/

EC-European Commission. (2010). Communication from the Commission “Europe 2020 A strategy for a smart, sustainable and inclusive growth” (COM (2010) 2020 final). European Commission, Brussels. Retrieved from: https://doi.org/10.1007/s12290-010-0123-5

Feldman, D. C. (1994). The decision to retire early: A review and conceptualization. Academy of management review, 19(2), 285-311. Retrieved from: https://doi.org/10.5465/amr.1994.9410210751

Gobeski, K. T., & Beehr, T. A. (2009). How retirees work: Predictors of different types of bridge employment. Journal of Organizational Behavior: The International Journal of Industrial, Occupational and Organizational Psychology and Behavior, 30(3), 401-425. Retrieved from: https://doi.org/10.1002/job.547

Hult, C. (2008). Gender, culture and non-financial employment commitment in Great Britain and Sweden. European Societies, 10(1), 73-96. Retrieved from: https://doi.org/10.1080/14616690701592573

Ilmarinen, J. (2005). Towards a longer worklife: aging and the quality of worklife in the European Union. Finnish Institute of Occupational Health, Ministry of Social Affairs and Health. doi: 10.1026/0932-4089.52.1.47

Kalwij, A., & Vermeulen, F. (2008). Health and labour force participation of older people in Europe: what do objective health indicators add to the analysis? Health economics, 17(5), 619-638. Retrieved from: https://doi.org/10.1002/hec.1285

Kim, S., & Feldman, D. C. (2000). Working in retirement: The antecedents of bridge employment and its consequences for quality of life in retirement. Academy of management Journal, 43(6), 1195-1210. Retrieved from: https://doi.org/10.5465/1556345

Komp, K., van Tilburg, T., & van Groenou, M. B. (2010). Paid work between age 60 and 70 years in Europe: a matter of socio-economic status? International journal of aging and later life, 5(1), 45-75. Retrieved from: https://doi.org/10.3384/ijal.1652-8670.1051

Longer, O. L. (2006). Work Longer. Aging and Employment Policies. Amsterdam: OECD Publishing. Retrieved from: http://www.oecd.org/employment/livelongerworklonger.htm

Maestas, N., & Zissimopoulos, J. (2010). How longer work lives ease the crunch of population aging. Journal of Economic Perspectives, 24(1), 139-60. Retrieved from: https://doi.org/10.1257/jep.24.1.139

Mulders, J. O., van Dalen, H. P., Henkens, K., & Schippers, J. (2014). How likely are employers to rehire older workers after mandatory retirement? A vignette study among managers. De Economist, 162(4), 415-431. Retrieved from: https://doi.org/10.1007/s10645-014-9234-8

Pleau, R. L. (2010). Gender differences in postretirement employment. Research on Aging, 32(3), 267-303. Retrieved from: https://doi.org/10.1177/0164027509357706

Sandor, E. (2011). Part-time work in Europe: European company survey 2009. Publications Office of the European Union. Retrieved from: https://doi.org/10.2806/116

Shacklock, K., Brunetto, Y., & Nelson, S. (2009). The different variables that affect older males’ and females’ intentions to continue working. Asia Pacific Journal of Human Resources, 47(1), 79-101. Retrieved from: https://doi.org/10.1177/1038411108099291

Schalk, R., Van Veldhoven, M., De Lange, A. H., De Witte, H., Kraus, K., Stamov-Roßnagel, C., & Bertrand, F. (2010). Moving European research on work and aging forward: Overview and agenda. European journal of work and organizational psychology, 19(1), 76-101. Retrieved from: https://doi.org/10.1080/13594320802674629

Villosio, C., Di Pierro, D., Giordanengo, A., Pasqua, P., & Richiardi, M. (2008). Working conditions of an aging workforce. Luxembourg: Office for Official Publications of the European Communities. ISBN 978-92-897-0815-9

Wang, M., Zhan, Y., Liu, S., & Shultz, K. S. (2008). Antecedents of bridge employment: A longitudinal investigation. Journal of applied Psychology, 93(4), 818. Retrieved from: http://dx.doi.org/10.1037/0021-9010.93.4.818

1 The share of persons with an equivalized disposable income below the risk-of-poverty threshold, which is set at 60 % of the national median equivalized disposable income (after social transfers).

2 Occupations are presented according to the Lithuanian Classification of Occupations, where at the end of the list are such occupations as elementary occupations, plant and machine operators, craft and related trades workers, and at the top of the list there are such occupations as managers, professionals, and technicians.