Ekonomika ISSN 1392-1258 eISSN 2424-6166

2019, vol. 98(2), pp. 97–111 DOI: https://doi.org/10.15388/Ekon.2019.2.7

Universal Model of Lost Profits Calculation

Rimas Butkevičius*

Forensic and Investigation Services, Lithuania

Abstract. Consequential (or indirect) losses in the form of lost profits are usually suffered and claimed in civil cases of breaches of supply or service contracts, unfair competition, bankruptcy cases, and other instances where a defendant’s wrongful actions cause lost profits to the plaintiff’s performance.

In litigation practice, we see a quite different approach, when the lost profits are calculated as gross margin less income tax, and in others – by multiplying the lost revenues by the company’s net profit ratio.

Methods of indirect loss calculation applied do not consider the cost structure of the plaintiff and the impact of the variation of variable and fixed costs to the lost profit calculation before and after the wrongful action of the defendant. In case lost revenues would have been received, fixed costs would remain the same, while variable (incremental) costs, which were avoided, would be generated to receive lost revenues.

Based on the international experience and practices, this article provides for a Universal Model of lost profits calculation as well as a mathematical formula of the method.

Keywords: damage, indirect loss, lost profits, lost revenues, incremental costs.

* Corresponding author:

Forensic and Investigation Services, UAB, J.Jasinskio str. 4-17, LT-01112 Vilnius, Lithuania

Tel. +37069839151

Email: rimas@forensic.lt

Received: 17/05/2019. Revised: 09/10/2019. Accepted: 10/11/2019

Copyright © 2019 Rimas Butkevičius. Published by Vilnius University Press

This is an Open Access article distributed under the terms of the Creative Commons Attribution Licence, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

Introduction

Companies do not seldom suffer damages caused by illegal actions of former employees, managers, or shareholders, and the calculation of such damages becomes an important issue for the companies. The amount of damages calculated is often the trigger for the decision-making whether it is worth to have dispute in the court.

Usually companies consequentially (indirectly) calculate the damages by a) multiplying lost revenues by the company’s net profit ratio or, more rarely, as a 2) gross margin less income tax.

Courts in their proceedings have noticed that in the case a company’s business bears losses, no damages would be calculated in the case a) above. Courts also noticed that the same fixed operating costs are to be allocated to the declined revenues, which means that in case the lost revenues have been received, no additional costs would be incurred. The overall problem is that companies do not take into account that part of the costs in case of lost revenues would be avoided, although it might be that some others would be gained and that a thorough examination of cost structure should be carried out.

The article pursues the aim of analysis of the internationally recognized methods of calculation of indirect losses (lost profits) and designing of the model relevant to the practice of Lithuanian companies with the typical breakdown of revenue and costs accounts.

The article provides for a mathematical formula of the consequential (or indirect) loss calculation for the companies.

The basic purpose of this article is to provide litigation parties, plaintiff, and defendant in the first instance with the approach, basic principles, and guidelines of analysis and calculation of economic damages (indirect losses) incurred from a wrongful act of the defendant and to work out the mathematical formula for a universal model of the calculation of indirect losses suffered by the legal entities.

Legal concepts and requirements in this article are used solely with aim of the completeness of presentation of the damages calculation process and do not claim to be any legal advice.

Author of the article intentionally uses the concept of the model but not of the methodology, which should be understood as a way how damages were to be calculated in the case of a particular unique engagement. Working out the specific methodology based on the model and relevant to the case is the matter of each separate investigation.

1. Concept of damages

The Free Dictionary by Farlex provides the following definition of damages:

“Monetary compensation that is awarded by a court in a civil action to an individual who has been injured trough the wrongful conduct of another party.”

According to the Civil code of the Republic of Lithuania, losses are the financial expression of the damage.

In our case, indirect losses are damages which bear compensational purpose, i.e., to restore an injured party (plaintiff) to the position the party was in before the defendant’s wrongful actions have been carried out. This article deals with the indirect losses suffered only by the legal entities and does not take into account the damages suffered by natural persons. Hereinafter, if we will refer to the lost profits cases, it would mean litigation between legal entities as regards the compensation of consequential (indirect) losses.

Litigation practice provides for that plaintiff should prove that there was a wrongful act of the defendant, actual damage has been suffered, there is a cause-and-effect relationship between the wrongful act of the defendant and losses suffered, and the amount of the losses can be estimated with reasonable certainty.

2. Types of cases in which lost profits are calculated

The following list of cases is not exhaustive and provides examples when lost profits are calculated:

• Breach of the service, supply contracts, franchise licence agreement obligations;

• Non-competition disputes with former employees;

• Trademark and patent infringement;

• Trade secret misappropriation;

• Other.

It should be noted that different jurisdictions would imply different litigation practices and therefore different denomination of cases.

3. Beggining and duration of loss period

As follows from the definition of the damages, the loss period over which lost profit could be claimed should begin no earlier than wrongful actions have been carried out. It depends from the type of the case, laws, and specific circumstances of the particular case for how long the loss period is defined. In practice, it varies much, but usually claims over non-compete disputes loss period begin soon after the former employees have left the company and the fact of the wrongful action-caused damages becomes known.

4. Overview of the methods of lost profit calculations

As indicated in the Practice Aid 06-4 “Calculating Lost Profits” issued by AICPA Business Valuation and Forensic and Litigation Services Section (Practice Aid 06-4, 2006) p. 3:

“Only lost „net“ profits are allowed as damages. Lost „net“ profit is computed, in general, by estimating gross revenue that would have been earned but for the wrongful act reduced by avoided costs. Avoided costs are defined as those incremental costs that were not incurred because of the loss of the revenue. After the net lost profits are determined, any actual profits earned are deducted to compute the damages.”

The definition provided implies several conclusions:

• only net profits should be treated as damage; it corresponds to the provision that the defendant should compensate to the plaintiff only actual damages;

• while carrying out an analysis of the damages beared, “but for” gross revenue should be estimated and actual revenues subtracted;

• concept of avoided costs provided.

AICPA approach suggests to determine net lost profits and afterwards to subtract actual profits coming to damages. We see the problem in the application of concepts, basically that net lost profits should be damages themselves, otherwise we should use the concept of “but for” net profits, which would mean that “but for” net profits actually incorporate earned plus lost net profits because of the wrongful actions of the defendant.

Literature on damages (Morones, 2017; Morones, 2018) promote the “but for” method, saying that to answer what amount of profits would the plaintiff have earned but for the actions of the defendant, a damage expert should analyse at least five pillars of a lost profits analysis, namely: lost revenues, avoided costs, extraordinary costs, the damage period, and the time value of money.

The following formula represent the net lost profits calculation (Morones, 2017):

Lost Revenues – Avoided Costs + Extraordinary Costs = Lost Profits Before Interest + Prejudgement Interest on Past Losses – Present Value Discount on Future Losses = Net Lost Profits

The definition foresees Extraordinary Costs, which might be costs beared by the plaintiff because of the wrongful actions of the plaintiff, which would not be the case in the situation “but for.”

Some authors (Practice Aid 06-4, 2006; Ellingboe & McCloskey, 2014) refer to as the basic method for calculating lost profits to subtract avoided (incremental) costs from lost revenues. In order to determine lost revenues, a party must calculate “but for” revenues and subtract actual revenues, as well that to determine the avoided costs, a plaintiff must determine the costs that would have been incurred to obtain lost revenues.

As we can see, there are differences between the approaches of AICPA (Practice Aid 06-4, 2006) and other authors (Ellingboe & McCloskey, 2014 ); in the first case, Practice Aid 06-4 provides for to subtract actual net profits from the lost net profits, and in the latter – to subtract actual revenues from “but for” revenues.

Below we will see that our Universal model 1.0 will clearly and explicitly address these issues.

5. Cost – volume – profit analysis

It is relevant for the purposes of this article to remember the basics of a cost – volume – profit relationship.

Literature provides for the classical relationship of cost-volume-profit (CVP) (Drury, 2004, p.270) as follows:

Net profit = (units sold x unit selling price) – [(units sold x unit variable cost) + total fixed costs].

The equation in mathematical terms is presented as follows:

NP = Px – (a+bx), where

NP – net profit;

x = units sold;

P = selling price;

b = unit variable cost;

a = total fixed costs.

The formula above is used to calculate the break-even point [(P-b)x = a], but it is not the subject of our article.

For the purposes of our article, we will modify the formula as follows:

NP = Px – (a+bx) = Px – bx – a = (P – b)x – a; (5.1)

Where P-b is the selling price minus the unit variable cost (or in accounting terms – cost of goods sold), which equals to the gross margin or gross profit. Although C. Drury (2004) presents the CVP relationship as an example of the selling of certain units, for us of great importance is the mathematical approach in the form of a linear equation. The formula demonstrates that Net Profit is a function of units sold (volume) - variable x, whereby P, b and a have constant values.

6. Steps of the damage calculation process

Process flow of damages calculation is presented in the diagram below.

Fig. 1. Process flow of damages calculation

6.1. First step – Determining lost revenues

Lost revenues (Morones, 2017) make up the most material component of a lost profits calculation, and every other component represents only a fraction of lost revenues. Because of this, lost revenues evaluation is the most significant item.

All authors studied (Morones, 2017; Ellingboe & McCloskey, 2014) agree on the same methods of lost revenues determination as provided for by AICPA (Practice Aid 06-4, 2006).

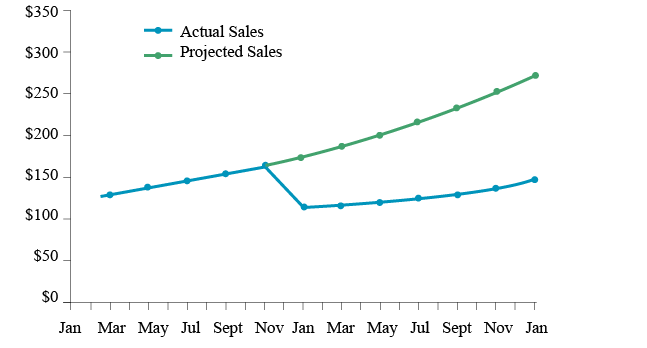

The “before and after” method. This method is based on the historical performance of the plaintiff and is evidently appropriate in case the track record of sales is available. The idea behind this method is that “but for” the defendant’s action, the plaintiff would have earned the same or close to the same level of revenues and subsequently profits. Morones (2017) provides a diagram, which is presented below.

Fig. 2. “Before and After” Approach

Source: Serena Morones, Five pillars of a Lost Profits Analysis. Pillar One: Lost Revenues.

In the diagram above, the blue line represents actual sales, while the green line would imply what sales could be earned but for wrongful actions of the defendants.

The strengths of the method are that with historical performance, the plaintiff is able to demonstrate and prove the capacity and potential to produce the same volume of goods or services, because they did it before most recently; and if the same market conditions prevail, it is most likely that there could be minor differences in volumes, prices, and costs of the plaintiff but for the wrongful actions of the defendant. But a damage expert must perform a thorough analysis of these factors in each separate case.

The weakness of this method is that if the plaintiff has no historical performance records, there is no reference point which could be used for the calculation of damages.

Some important hints while using this method:

• The damage expert should find out if there are no other factors which could cause the declining of revenues, and if they exist – to evaluate to what extent which factor could cause a drop of revenues;

• The damage expert should evaluate the possible impact of macroeconomic factors by consulting industry experts on the conditions and trends in the industry; at the very least, the damage expert should study the available statistical industry data;

• Most industries have seasonal fluctuations so it is important to take into account seasonal differences;

• It should be noted that there are different appoaches in practice using this method: some experts take all historical performance (sales) and calculate monthly average on which underly their assumptions for “but for” period, others use the data of the last financial period as most recent information is more comparable with period under investigation.

Yardstick or benchmark method. As provided for by the AICPA (Practice Aid 06-4, 2006) this metod utilizes a “yardstick” that is used to estimate what revenues and profits of the affected business would have been. Damage expert in estimating lost revenues using “yardstick” method is looking for comparable product, service or company within the industry and presumes that plaintiff company would have performed as well as “yardstick” chosen but for wrongful act of the defendant.

Practice Aid presents the following examples of possible yardsticks:

• The performance of the plaintiff at a different location;

• The plaintiff’s actual experience versus past budgeted results;

• The actual experience of a similar business unaffected by the defendant’s actions;

• Comparable experience and projections by nonparties;

• Industry averages;

• Pre-litigation projections.

Some important hints while using this method:

• The main challenge in using this method is to prove that the “yardstick” is comparable to the plaintiff’s operations and possible performance, same geographical location, similar conditions for operations;

• Like in the “back and after” method, it is needed to consult industry specialists as well as to analyse the situation in the industry from statistical bulletins;

• Like in the “back and after” method, the damage expert should find out if there are no other factors which could cause the declining of the revenues, and if they exist – to evaluate to what extent which factor could cause a drop of revenues;

• Benchmarking should involve an analysis of not only the general company’s performance but an analysis of the particular products and groups. For example, in one specific case on non-competition in a logistics and transportation business, the defendant was arguing that the decline of the plaintiff’s revenues was because of the global 2008–2009 crisis, whereby the plaintiff’s actual performance figures have demonstrated that sales in transportation in the line West Europe-Russia have increased.

Calculation based on the terms of the contract. In some cases, it is possible to calculate lost revenues according to the provisions of the specific contract if the elements such as price, number of units to be sold, and other are determined.

An accounting of defendant’s profit. This method usually is used in the cases of unfair competition and misapropriation of trade secrets and presumes that defendant would disgorge the amounts of profit atributable to the wrongful actions of the defendant, whereby not surrendering profits earned otherwise.

Other methods. The AICPA Practice Aid provides for that other approaches could be carried out depending on particular facts and circumstances of the case. General principles underlying the methods discussed above should be considered in the development of the specific lost revenues determination models.

6.2. Second step – Analysis of costs and determination of avoided costs

It is essential to understand cost structure (elements of costs) of plaintiff in order to obtain knowledge of how costs and revenues will vary with different levels of activity or volume. We can find in management accounting literature the terms “variable,” “fixed,” “semi-variable” and “semi-fixed” to describe how costs react to changes in activity or volume.

Drury (Drury, 2004, p. 34) provides for that “variable costs vary in direct proportion to the volume of activity; that is, doubling the level of activity will double the total variable cost. Consequently, total variable costs are linear and unit variable cost is constant. Fixed costs remain constant over wide ranges of activity for a specified time period. Examples of fixed costs include depreciation of the factory building, supervisor’s salaries and leasing charges for cars used by the saleforce.”

In order to determine the amount of avoided costs, the damage expert needs to study and understand plaintiff’s cost drivers (factors, triggers) upon which depends the behaviour of the costs in relation to the activity or volume of sales.

As described above, the avoided costs are defined as those incremental costs that were not incurred because of the loss of the revenue and in the estimation of lost net profit should be subtracted from the amount of established lost revenues. In other words, avoided costs are those costs that would have been incurred if lost revenues would have been earned. On the other hand, the plaintiff may have actually incurred costs which would not have been incurred in the absence of the wrongful actions of the defendant – if this is a case, those costs should be offset against avoided costs. Avoided or incremental costs in the terms of management and cost accounting are variable costs.

There are different nonstatistical methods of cost analysis listed by the AICPA (Practical Aid 06-4, 2006) as follows:

• Account analysis involves a detailed inspection of the general ledger or chart of accounts. The damage expert should obtain an understanding of which accounts account for fixed or variable costs. Availability at the plaintiff’s company of accounting policy providing for description of classification of the cost accounts would be very helpful as well as pricing rules or product costing rules;

• Direct assignment involves the identification by the damage expert of the direct costs of activity – direct labor and materials;

• Accounting estimates – this method estimates the cost of a product using plaintiff’s experience with similar or related products;

• Cost accounting allocations – this method apportions costs that are not specific to a particular product or activity based on some objective measure, such as revenues, labor hours, or units sold;

• Ratio analysis is used to allocate the cost of a particular product or activity in proportion to some other measure, such as labor hours or units of production;

• Graphical approaches – this method involves the plotting of the cost of a particular product or activity over time or against some other measure;

• Industrial engineering method is used if an industrial engineering study may be available that addresses the costs associated with the various processes involved in the production of the product at issue.

There are statistical methods of cost estimation, such as regression analysis, survey data and atribute sampling, but they do not relate to the purposes of our article.

As was identified above, lost profits are calculated from lost revenues by deducting avoided costs. Morones (Morones, 2018) concludes that “fixed costs are typically not deductible to arrive at lost profits. Only those direct expenses that would have been paid to generate the sales qualify as avoided expenses. Avoided costs are also commonly referred to as variable costs, meaning that when sales increase these expenses increase and vice versa.”

According to generally accepted accounting principles (GAAP), usually direct expenses, costs of goods sold, or manufacturing costs include the following:

• direct material;

• direct labor and manufacturing overhead.

Direct expenses mostly are variable costs and increase in direct proportion to the increased volume of production.

Non-manufacturing costs (sometimes referred to as “administrative overhead” or “operational expenses (OPEX)” or “period costs”) represent a company’s expenses that occur apart from the actual manufacturing function. In accounting and financial terminology, costs include Selling, General and Administrative (SG&G) expenses and Interest Expense. Non-manufacturing costs are reported on the Income Statement at the time they are incurred. Typically non-manufacturing costs are of fixed costs.

6.3. Third step – Lost profits calculation

After the cost structure of the plaintiff is analyzed and the variable and fixed costs are identified and distinguished, the net lost profit is calculated by deducting the avoided costs from lost revenues.

7. Review of literature and discussions

It should be noted that the literature reviewed as regards lost profit calculation usually has two aspects:

• legal, when the fact of wrongdoing is analyzed and the causation to lost profits incurred is proved in order to treat losses as damages, assessing the damage period, too;

• economical, where damages are calculated by applying the methods known to lost revenues calculation and explaining what principles of cost structure analysis should be as well as calculating the present value of future damages.

The legal aspect in our article has only ilustrative nonauthoritative aspect and our considerations are limited to the need to have all links in the chain going through the process of lost profits calculation.

The review of the literature revealed that there is already space for further developments of specific parts of the lost profit calculation. Namely, Ellingboe and McCloskey (Ellingboe & McCloskey, 2014) provide for an additional method of the calculation of lost revenues to those listed by the AICPA (Practice Aid 06-4, 2006). Authors include method of calculation of lost revenues by plaintiff using volumes of sales earned by defendant during the damages period. We came across in practice with this issue for usually in the courts of Lithuania benefits earned by defendands are calculated as damages using financial figures of the defendant in cases of unjust enrichment but not in cases of lost profits. It should be agreed that method of calculating lost revenues by the plaintiff using sales figures of defendant provides for more objective results because of factual data of sales volumes for lost revenues are available. But it should be considered and taken into account that, e.g. in the cases of unfair competition the defendant is able to offer lower prices for the buyers because he is aware of the prices of the products or services provided as well as the costs beared by the plaintiff. That is why it should be more accurate to adjust defendants sales using defendant‘s factual sales in units using prices of the plaintiff during the period under the investigation.

Morones (Morones, 2018) notices that the most common way to identify avoided costs is to read the expense accounts descriptions on the income statement, trial balance or chart of accounts and identify cost categories that are likely to be variable. Income statement (also known as profit and loss statement) is the report of a company’s financial performance over a specific accounting period and provides for net income of the company during a particular period as a result from revenue, expense, gain and loss transactions. We agree with the author’s consideration, but it should be mentioned that the author does not provide any further analysis of costs related to specific income statement items, which should be covered by the model described in this paper. Because the chart of accounts vary from company to company, the issue of the methodology of analysis of costs in every particular case should be analyzed according to the circumstances of the specific case.

As mentioned above, in litigation practice in Lithuania, we see that lost profits are calculated as gross margin less income tax, in others – multiplying lost revenues by the company’s net profit ratio, and lawyers disagree whether the gross margin or net profit should be treated as damages. The initial idea of the model was to get an answer to this question and to find out what triggers of damages calculation there are. As provided for in the literature analyzed, as well as in this paper, we see that criteria to come to lost profits is not gross margin or net profit itself but economic behavior of costs – variable versus fixed.

The model itself is an innovative approach to the lost profit calculation, for it encompasses or uses three frameworks:

a) lost profit calculation principles known (lost revenue assessment, costs behavior analysis: variable versus fixed) and provided in the literature analyzed;

b) cost accounting theory on costs behavior (see [6]); and

c) financial accounting and reporting standards.

8. Defining of the Universal Model of Indirect Loss Calculation

Prior to coming to the Universal Model of Indirect Loss Calculation, we will go through the elements of Income Statement as described by Kieso, Weygant and Warfield (2018):

1. Sales or Revenue section presents sales, discounts, allowances, returns, and other related information. Its purpose is to arrive at the net amount of sales revenue.

2. Cost of Goods Sold section shows the cost of goods sold to produce the sales.

Gross profit: Revenue less cost of goods sold.

3. Selling Expenses section reports expenses resulting from the company’s efforts to make sales.

4. Administrative or General Expenses section reports expenses of general administration.

Selling Expenses and Administrative expenses together are called Operating expenses (abbr. OPEX).

5. Other Income and Expense. Includes most other transactions that do not fit into the revenues and expenses categories provided above. Items such as gains and losses on the sales of long-lived assets, impairment of assets, and restructuring charges are reported in this section. In addition, revenues such as rent revenue, dividend revenue, and interest revenue are often reported.

Income from Operations reports company’s results from normal operations.

It shoud be noted that approaches to the Income statement format and treating of Operations could differ. Some authors Other Income and Expense take as non-operating section.

6. Financing Costs – a separate item that identifies the financing costs of the company, hereinafter referred to as interest expense.

Income before Income Tax - the total income before income tax.

7. Income tax – section reporting taxes levied on income before income tax.

Income from Continuing Operations. A company’s results before before any gain or loss on dicontinued operations. If the company does not have any gain or loss on discontinued operations, this section is not reported and this amount is reported as net income.

8. Discontinued Operations. Gains or losses resulting from the disposition of a component of a company.

Net Income – the net result or net profit of the company’s performance over a period of time.

Presumptions of the Universal model:

1. Damage period (“but for” period) or period under investigation will coincide with the period for which financial statements with actual revenues, expenses, and income are available.

2. For the simplification of the model, we will suppose that there are no discontinued operations as well as other income and expense and financing costs; however, we will provide some consequent conclusions on these types of expenses.

3. We will presume that in our model, Gross profit less Operating expenses make income before income tax, and subsequently, by subtracting the income tax, we come to a net income or net profit.

4. In our model, we presumed that the total amount of income before taxes should be taxed with the income tax rate TR. In reality, income tax calculation is a complex matter, taking into account not taxable revenues as well as tax losses from previous years.

The following symbols were used to represent the items in the equations below:

• Symbols with the index 1 refer to the actual situation for the investigation or damage period where profit has been lost because of wrongful acts;

• Symbols with the index 2 refer to the “but for” situation, which means that what would have been if wrongful acts of the defendant would have been absent.

S1 – actual sales revenues;

S2 – sales revenues in “but for” situation (lost revenues);

CGS1 – actual cost of goods sold;

CGS2 – cost of goods sold in “but for” situation;

GP1 – actual Gross profit (S1 – CGS 1);

GP2 – Gros profit in “but for” situation (S2 – CGS 2);

OE1 – actual Operating expenses;

OE2 – Operating expenses in “but for” situation;

NP1 – actual net profit;

NP2 – net profit in “but for” situation;

NPΔ – variation of net profit (NP2 – NP1) which is lost profit;

TR – income tax rate.

Equations of net profit in mathematical terms are presented as follows:

NP1= S1 - CGS1 - OE1 - (S1 - CGS1 - OE1) x TR (1) (actual situation)

NP2= S2 - CGS2 - OE2 - (S2 - CGS2 - OE2) x TR (2) (“but for” situation)

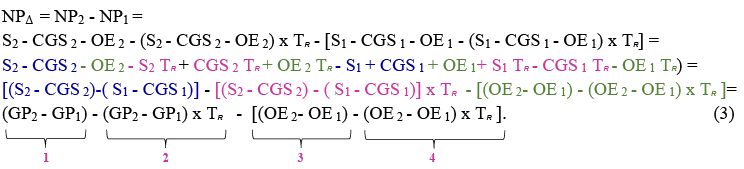

Equation for lost profit is presented below:

Figures represent:

1 – changes of gross profit;

2 – income tax on changes of gross profit;

3 – changes of operational expenses;

4 – income tax on changes of operational expenses.

Guidance on applying the model formula in specific cases of lost profit calculation:

1. As mentioned above, all figures with index 1 represent an actual situation and are already known.

2. In order to to get the result – the lost profit amount – we should determine the values of GP2 and OE2. Because it is an universal model but not a methodology, we can only provide the guidance on the principles of calculation as follows:

a) GP2 represents Gross profit in “but for” situation and is equal to S2 – CGS 2, where S2 is sales revenues in “but for” situation or lost revenues.

Different methods of determination of lost revenues are described in details in section 7 above and should be applied in estimating S2 in specific cases.

Cost of goods sold (CGS2) should be estimated and determined in specific cases after a thorough examination of the description of cost accounts, chart of accounts, and income statements of the company under investigation.

There are two things to take into account:

• the cost of goods sold in a specific case may include manufacturing direct (variable) costs but manufacturing indirect costs also, which may vary not in direct proportion to volume increase (e.g., depreciation of manufacturing equipment);

• after the identification of variable costs component in costs of goods sold, the calculation of “but for” value is of great importance. It will be a question to answer what is more likely: that the value of variable costs would be the same as actual or arithmetic or weighted averages for the period should be used.

b) OE2 are Operating expenses in “but for” situation.

Usually operating expenses are of a fixed origin but it should be thoroughly examined in a specific case, for it could be in a “but for” situation that sales expenses, in the form of the salaries and renumeration of the sales personnel, could be of variable or semi-variable type, or that additional advertising costs could be the case.

c) Although in the presumptions for the model we have admitted that financing expenses, other gains and losses, discontinuing operations are not the subject of our analysis, but, using the same analysis principles as described above in a specific case, it should be investigated if in a “but for” situation costs could have been avoided. If so, they should be subtracted from the lost revenues. For example, we may need additional financing in a “but for” situation, and therefore additional financing expenses could have been incurred.

Conclusions

The article provides for a Universal model of consequential (indirect) loss calculation in company cases together with the mathematical formula of the model, accompanied with guidance on applying the model in specific litigation cases. The universal model was designed in the agreement of the international experience and practice and in particular with the Practice Aid of Calculating Lost Profits of the American Institute of Certified Public Accountants. The universal model is designed on the underlying idea that cost structure of the plaintiff should be analyzed by identifying the variable and fixed costs. An income statement, together with cost accounts descriptions, the chart of accounts, and trial balances are basic information sources while carrying out cost behaviour analysis. The universal model’s income statement elements approach provides a sound and logic direction of lost profits calculation by applying generally accepted accounting principles as well as elements of the theory management and cost accounting. The universal model has not only theoretical value but could be very useful to all litigation parties in the challenging process of the calculation of lost profits.

References

Civil Code of the Republic of Lithuania. (2000). Official Gazette. 2000, No 74-2262.

Ellingboe D.A., Mccloskey F.M. (2014). Methodologies and Challenges in Calculating and Proving Damages. Retrieved from: http://www.minncle.org/webcasts/122211501resources/ProvingDamages.pdf.

American Institute of Certified Public Accountants’ Practice Aid 06-4. (2006). Calculating Lost Profits.

American Institute of Certified Public Accountants’ Practice Aid 06-1. (2006). Calculating Intellectual Property Infringement Damages.

The Free Dictionary by Farlex. (n.d). Damages.

Retrieved from: https://legal-dictionary.thefreedictionary.com/damages.

Drury, C. (2004). Management and Cost Accounting. Sixth Edition, 2004.

Dunn, R.L. (2009). Recovery of Damages for Lost Profits. 6th Edition. Lawpress Corporation,

2009.

Dunn, R.L. (2004). Recovery of Damages for Fraud. 3rd Edition. Lawpress, 2004.

Weil, R.L., Michael, J., Wagner, M.J., Frank, P.B. (2007). Litigation Services Handbook. The Role of the Accountant as Expert Witness. John Wiley & Sons, 2007.

Dunn, R.L. (2004). Expert Witness Law and Practice. Lawpress, 2004.

Kieso, D.E., Weygant, J.J., Warfield, T.D. (2018). Intermediate Accounting: IFRS Edition, Wiley & Sons, Inc., 2018.

Pratt, S.P. (2007). Valuing a Business: The Analysis and Appraisal of Closely Held Companies. 5th Edition. McGraw-Hill Library of Investment and Finance, 2007.

Federal Rules of Evidence Numbers 701 – 706.

Federal Rules of Evidence: Committee Notes to Rule 702.

The American Law Institute. (2010). Restitution and Unjust Enrichment, Restatement of Law 3rd, 2010.

Johnson, C.N. (1998). Assessing Damages for Misappropriation of Trade Secrets. Colorado Lawyer, August 1998.

Rosenhouse, M.A. (2010). Proper Measure and Element of Damages for Misappropriation of Trade Secret.” 11 A.L.R.4th 12 (2010).

Morones, S. (2017). Five Pillars of a Lost Profits Analysis. Pt. 1. Pillar One: Lost Revenues.

Retrieved from: https://moronesanalytics.com/lost-profits-analysis-five-pillars-1/.

Morones, S. (2018). Five Pillars of a Lost Profits Analysis. Pillar Two: Avoided Costs. Retrieved from:https://moronesanalytics.com/avoided-costs/.

Averkamp, H. (n.d). Manufacturing Overhead. Retrieved from: https://www.accountingcoach.com/manufacturing-overhead/explanation.