Ekonomika ISSN 1392-1258 eISSN 2424-6166

2020, vol. 99(1), pp. 69–78 DOI: https://doi.org/10.15388/Ekon.2020.1.4

Model of a Second-Hand Goods Resale Exchange under Transactional Pricing Strategy

Iuliia Iarmolenko

Taras Shevchenko National University of Kyiv

Kyiv, Ukraine

Email: yu.yarmolenko@gmail.com

Galyna Chornous

Taras Shevchenko National University of Kyiv

Kyiv, Ukraine

Email: chornous@univ.kiev.ua

Abstract. A modern effective business model involves the use of an appropriate pricing strategy. However, what matters is not only short-term profitability but also the long-term loyalty of clients. The main purpose of this paper is to present a specific transactional pricing strategy for a second-hand goods resale exchange platform that allows to avoid the possible negative outcomes of being associated with consumer discrimination. Using a simulation modeling approach, it was shown how customer segmentation combined with transactional pricing can help gain higher profitability. The model is based on the work of intelligent agents that recreate the full product lifecycle. Changing the input parameters of the model, it is possible to simulate different scenarios of a company’s activity and market conditions. The model supports the inclusion of any number of products, while its intelligent agents’ methods are still flexible to be replaced with other techniques. The simulation model has shown that the use of transactional pricing can increase the profitability of a business while keeping its clients loyal.

Keywords: Transactional Pricing, Pricing Strategy, Simulation Modeling, Consumer Discrimination.

Received: 02/04/2020. Revised: 26/04/2020. Accepted: 02/03/2020

Copyright © 2020 Iuliia Iarmolenko, Galyna Chornous. Published by Vilnius University Press

This is an Open Access article distributed under the terms of the Creative Commons Attribution Licence, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

1. Introduction

Pricing strategies have become very sophisticated with the coming of the big data era. However, what should have become the biggest advantage of contemporary pricing strategies, often plays a bad trick with companies and their goodwill. Dynamic, and, especially, customized pricing (the synonymic term is “personalized pricing”) can be perceived as a client’s discrimination by geography, income, sex, marital status, and other features. Even social medias, which operate, first of all, as advertising platforms, are instantly experiencing the change of policies, aiming to minimize the impact of discrimination while targeting their users. For example, the latest “Lead Adverts” Policy by Facebook (2019) prohibits targeting by financial information, criminal history, health and insurance information, political affiliation, etc.

The advantages of using customized pricing seem to be evident. Considering the main economic Supply-Demand equilibrium principle, a company tries to sell a unit of production for the maximum price that a certain buyer is ready to pay. Each offer of purchase is relevant, since the personal demand price is not exceeded; on the other hand, the sale is not unprofitable when a customer pays the maximum price, and it is acceptable for the seller. Thus, the company fully gets customer surplus and gains its short-term profitability goals. However, this manipulation is quite dangerous for the long-term company’s position: customers’ loyalty may tend to decrease dramatically.

The theoretical background for the two optimization problems we are aiming to solve lays behind two big topics: ethical aspects of pricing and price modeling techniques. Let us take a deeper look at respective fundamental studies and recent investigations.

One of the first studies in dynamic pricing as a tool for defining optimal product price was presented by Weatherford and Bodily (1992). More findings on conditions, impact, and other theoretical aspects of dynamic pricing, as well as implementation techniques, can be found in the works of Kannan and Kopalle (2001), Sahay (2007), Den Boer (2015), Dolgui and Proth (2010), Faruqui (2010), Tong, Wang and Zhou (2018). Beside the term “dynamic pricing,” there is another one having a wider meaning – “customized pricing” (or “personalized pricing”). In the work of Obermiller, Arnesen, and Cohen (2012), customized pricing is defined as a strategy when “identical products are delivered, regardless of time or situation, to different consumers at different prices” (p. 14).

Obermiller, Arnesen, and Cohen (2012) have elaborated on the theoretical and ethical aspects of customized pricing and described some classic examples of its use. In the study by Elmachtoub, Gupta, and Hamilton (2018), personalized pricing is described as a strategy for establishing prices based on personal information using machine learning techniques. Also, papers by the Office of Fair Trading (2013) and the Organization for Economic Co-operation and Development (2018) state that customized pricing is a practice of discriminating clients by their features. There is more unanimity in the definition of “customized pricing” than in the case of “dynamic pricing”: the authors agree that the phenomenon is related to price discrimination, but they do not clearly define the purpose of this practice.

For defining the contemporary pricing approaches in today’s information economy and applying the pricing strategies to E-commerce, we have given a new definition to the term “transactional pricing” (Ponomarenko & Klebanova, 2018, pp. 128). This term can be found in the literature with different context and meanings. In some scientific researches, it can be found with the meaning of a cost of renewing a product subscription. Gladkih (2013) defines “transactional pricing” as the price of a transaction based on price-list, considering discounts, payment terms, and other circumstances. It was shown in the study by Ponomarenko and Klebanova (2018) how applying the term “transactional” towards pricing can cause several effects: defining market features and transaction parameters with its direct and indirect components.

Various economic and mathematical methods, models, and information technologies are used to determine the price level for implementing all of these pricing strategies. Recent studies have shown that different statistical, mathematical and econometric approaches can be effective for solving the task with personalized price modeling and forecasting: stochastic differential equations in the research by Liu, Liu, and Chan (2018), the random forest method was presented by Tyralis (2017), ARIMA models – by Carta, Medda, Recupero, and Saia (2018), also signal processing methods were investigated by Tseng, Lin, Zhou, Kurniajaya, and Li (2017), etc.

The main purpose of this paper is to present a practical tool for creating an optimal pricing strategy for a specific business model: a second-hand goods resale exchange. For gaining the purpose we should consider multiple optimization criteria: long-term profit maximization combined with long-term customer loyalty.

2. Basic Concepts

In this research, the use of a transactional pricing strategy as a part of a self-sustaining trade ecosystem is explained. According to authors’ definition, “transactional pricing is a process of setting individual prices for each transaction while considering its direct and indirect features for gaining a company’s commercial goals” (Ponomarenko & Klebanova, 2018, p. 128). The direct features of a transaction include such attributes as the timestamp, amount, merchant, and geolocation. Indirect features include customer and product attributes, objective market conditions, etc.

The main idea of this strategy is to set a price based on customer purposes and their willingness to cooperate with a trading company. This type of pricing is not perceived as price discrimination in a general case and we will later explain why.

The model of this trading system aims to answer the following questions:

1. Which pricing approach and strategy is more effective in terms of expected incomes?

2. How to effectively distribute financial flows and predict required funding?

This problem can be solved with the help of simulation modeling. This approach works best for analyzing a system under certain conditions and it is very flexible in terms of possibility to include different components and imitate the work of intelligent agents. The simulation model should have the same set of criteria to optimize as a real company does:

• Long-term profit maximization;

• Long-term customer loyalty optimization.

3. Methodology

3.1. System description, participants, and roles

The system of goods resale is based on the idea of the uniqueness of every traded item in this system. The platform itself can handle the following operations:

• The exchange can buy and sell goods (with a unique identifier);

• Alternatively, the exchange can be a mediator and put up the goods for sale and get a commission per deal;

• The exchange can buy goods from the sellers for an agreed bid. It can also offer to put it on sale on the platform.

Thus, the exchange has two sources of income: speculative incomes and commissions for sale.

The sides of the process and their roles:

1. Broker – the company itself;

2. Sellers – people offering personal items. There are 2 possible options for sale:

a. The broker offers a price at which he is ready to buy the product and put it up for sale on his own, the seller immediately receives his money, and the product becomes the property of the broker;

b. If the broker has failed to agree – the seller offers a price, bids on the platform and waits for a purchase offer.

3. Buyers – users of the platform who buy the offered products;

4. Item – a certain piece of good on sale, always in a single copy.

The service user can be a seller and a buyer at the same time.

In this business model, it is possible to use transactional and dynamic pricing on two different stages: for the first time when an item is purchased by the broker, and the second time is during its sale (provided that the seller did not take part in auction but sold the item directly to the broker). Transactional pricing can be used at the time of purchase since each item has a unique cypher, and therefore it is possible to set a price for a single item, not a group of similar goods. At the time of sale, only dynamic pricing can be used, because we assume that buyers have information about the price at which a particular item was offered to other buyers.

3.2. Algorithm Description

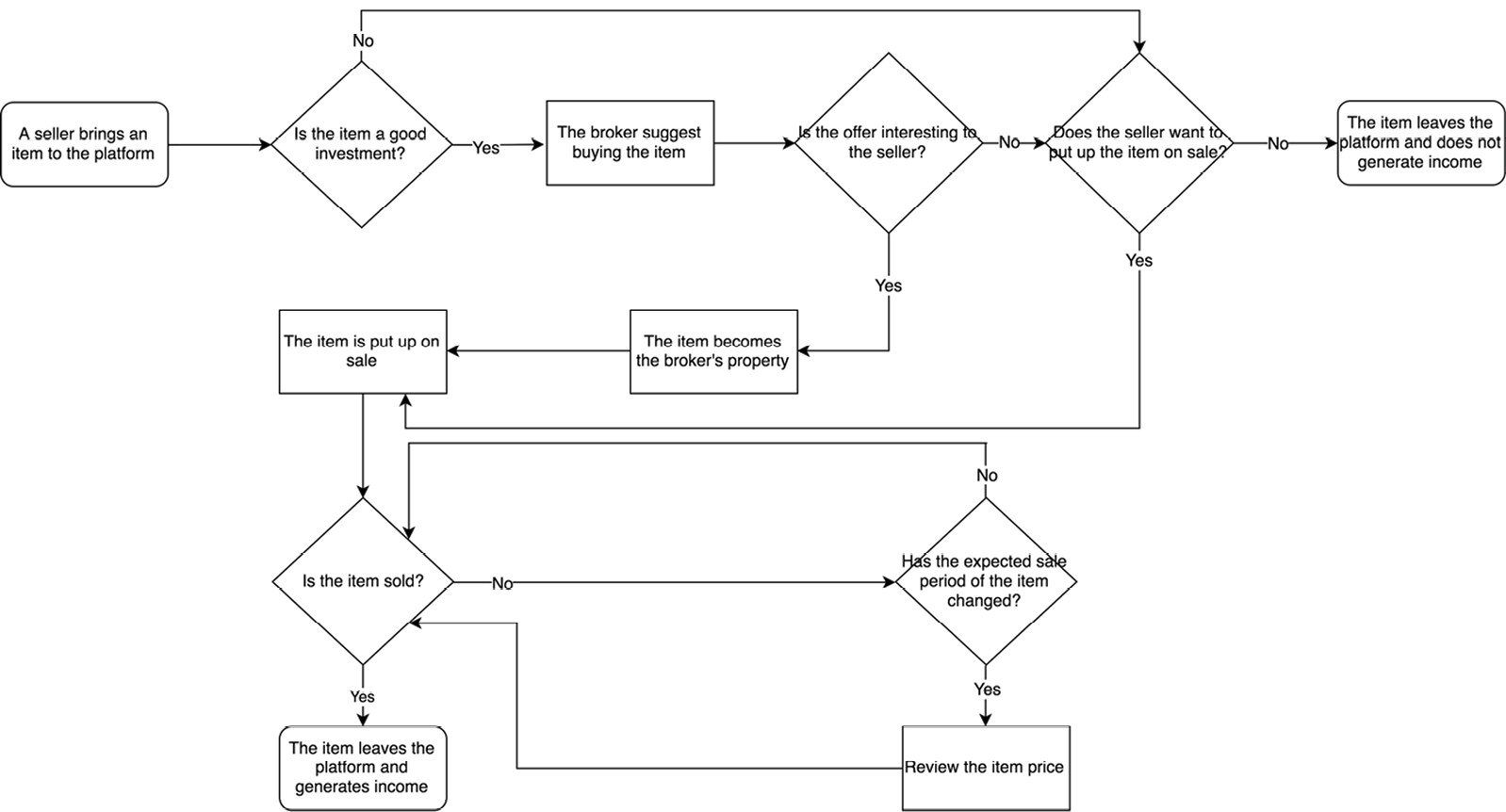

The exchange system itself can be perceived from two points of view. The first approach is to imitate the work of the process participants: the broker, buyers, and sellers. The second one is model processes on the item side. Since the number of items in the system is finite, and the size of the market and its participants is unlimited, it is logical to accept the second method and build the model from the item prospective. The original logic block-diagram of an item lifecycle is presented by authors (Fig. 1).

Fig. 1. Logic block diagram of an item lifecycle. Compiled by authors.

Let us consider conditional decision blocks of the process.

Condition “Is the item a good investment?”

To answer this question, the following item features should be evaluated:

• What is the expected lifetime of the given product (by lifetime we understand a period between the sale start date and the purchase date)? It should be evaluated using a lifetime prediction model.

• What is the average expected supply price? (Supply price forecasting model)

If the broker forecasts the item’s price to increase till the expected purchase date, and this increase is significant – this item is interesting for investment and the broker should buy it immediately for further resale.

In case the above condition is not fulfilled – the broker offers the seller to put the item on sale for the commission.

Action “The broker suggests buying the item”

If the deal is interesting in terms of investment, the broker should offer the seller an appropriate price to redeem the item. This is the step when the use of transactional pricing is possible. Since the price is established for a certain item with its unique identifier and features (one of the most fluent on price is a condition), the prices within a group of similar items can vary, and not be a sign of discrimination. Moreover, the seller can decide whether they want to sell the item directly to the broker or put it on sale.

Condition “Is the offer interesting to the seller?”

The seller should accept the offer if the price is no less than the minimum accepted price – the minimum amount for which the seller agrees to give away the item. At this stage, it is rational to segment the platform’s users on groups depending on their goals. Let us describe the possible objects of the sellers and the logic behind their decisions.

The first group – “wealthy sellers.” For these clients, an item is no more relevant for several possible reasons. The model might have gone out of style; an item is no more interesting and attractive to the seller, etc. The seller is not interested in closing up the position quickly and can wait till finds a buyer for a good price because they appreciate the quality of the item or a “history” behind it.

The second group – those who want to sell an item quickly (we will call them “quick sellers”). The reasons may be different: from a simple need to earn money quickly to a desire to just get rid of useless things. We should note that such sellers tend to dump the initial price during the selling process.

The third group are resellers. A distinctive feature of this group is the analytical approach to the sale of goods, based on the expectations of changes in the market. The same as the broker does, a reseller tries to predict future fluctuations of supply and demand. Let us call this group the “speculators.” Such sellers will not open an uptrend position but will try to sell the item at the peak of its value or during a downward trend.

For these three groups, it is easy to arrange the mathematical expectations of the minimum selling price:

P (“quick sellers”) < P (“wealthy sellers”) < P (“speculators”)

Knowing a seller belongs to one of these groups will let the broker set the transactional price automatically. Based on statistical distributions of the minimum expected price and a seller’s customer group, the broker has an opportunity to increase pricing effectiveness.

Action “The item becomes the broker’s property”

In case the seller accepts the offer, the item is transferred to the broker for the declared price. Now the broker can decide independently when to put up the item on sale and for which price.

Condition “Does the seller want to put up the item on sale?”

If the broker has not offered an interesting price to the seller or did not want to buy the item at all, the item can be either put on sale or leave the platform. Similarly, at this stage, the seller may end the cooperation with the broker, because he is not ready to wait for the goods to be sold on the general terms of the exchange.

Action “The item is put up on sale”

Depending on who is the owner of the item right now, the good’s price is established either by the seller or the broker. The commission fee from a deal is set by the broker. In case the item is a broker’s property, the selling price is established based on the evaluation of the item lifetime and future price forecasts.

Condition “Is the item sold?”

It is a check on the item been sold at a certain time.

Condition “Has the expected sale period of the item changed?”

This condition refers to the popularity dynamics of the item since this metric has a significant impact on the lifetime period together with other product features. Weak popularity dynamics cause an increase of expected lifetime. On the contrary, a higher interest in the item decreases the evaluated metric.

Action “Review the item price”

Even if the expected lifetime period of the item has changed, it does not mean that the supply price should also be recalculated. The possible scenarios vary depending on who owns the item. The details can be found in Table 1.

Table 1. The possibility of price change depending on the item popularity dynamics

|

Owner |

Rising popularity |

Declining popularity |

|

The broker |

High possibility of price increase |

Low possibility of price decrease |

|

“Speculator” |

High possibility of price increase |

Low possibility of price decrease |

|

“Wealthy seller” |

Low possibility of price increase |

Low possibility of price decrease |

|

“Quick seller” |

Low possibility of price increase |

High possibility of price decrease |

Note: compiled by authors.

3.3. Simulation model

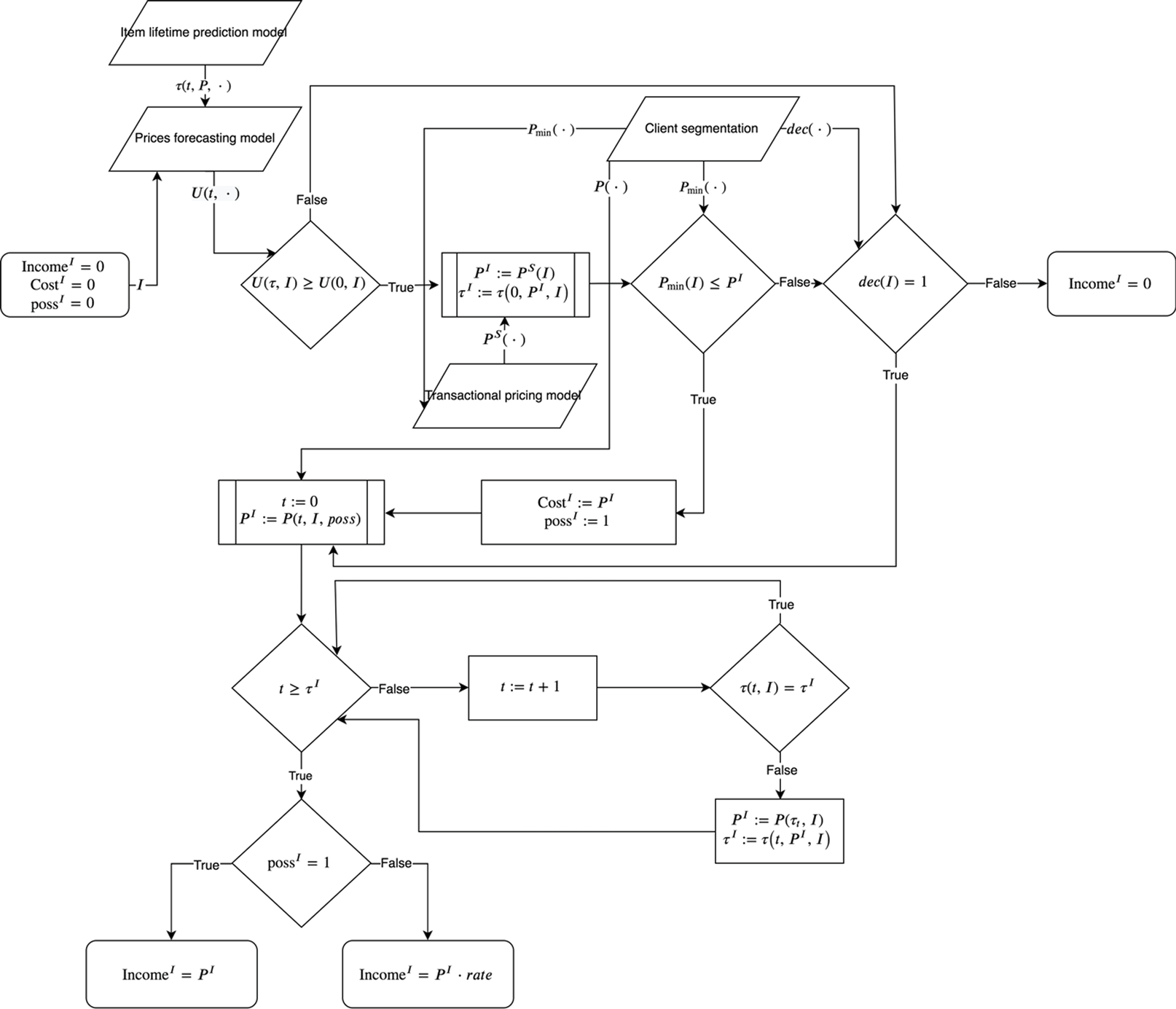

For simulating each of the stages in an item’s lifecycle and building a simulating model, different mathematical, statistical, and modeling approaches were used. The logic block-diagram on Fig. 2 is an algorithm for simulating the whole product lifecycle.

Fig. 2. The algorithm for simulating the whole product lifecycle. Compiled by authors.

I – a set of unique customer and item features;

Variables IncomeI, CostI are respective attributes of item I, possI – a variable of Boolean type, which defines the possession of the item (0 – if the item belongs to the seller, and 1 – it belongs to the broker);

t – a current time period;

PI, τI, – an established item price and a predicted lifetime;

τ(t, PI, ·) – a function for predicting lifetime value;

U(t, ·) – a function for predicting the item’s future price;

PS(·) – a price established by the broker;

P(·) – a function for establishing price by a seller;

Pmin(·) – the minimum price at which the seller agrees to sell the item to the broker;

dec(·) – a function of the seller’s decision to put up the item on sale (0 – if the seller wants to leave the platform, 1 – if agrees to continue).

Experiment – is the outcome of one cycle of the algorithm, considering given parameters for rules, distributions used for modeling random processes, and specific modeling approaches for intelligent agents’ decisions.

The simulation model involves experimenting many times for getting distributions of respective parameters of interest, in our case they are: income and profit, required capital, and respective confidence intervals.

3.4. Results and Discussion

We can show the model results by the example of a simulation process for the exchange market model with the next input parameters:

• 1 product available on the market with an initial price of 10 conditional units at time t=0;

• The simulated period is 100 units of time;

• Average product life expectancy is 20 units of time;

• Average expected daily product supply – 10 units;

• Platform commission rate – 20%.

The results of simulation under different pricing and segmentation strategies and market fluctuation circumstances are presented in Table 2. For each scenario, we conducted 300 simulations.

Table 2. Simulation modeling output results

|

Strategy |

M(π) |

[πmin, πmax] |

M(K) |

|

No segmentation, no transactional pricing |

1,591 |

[1,438; 1,781] |

– |

|

No segmentation, transactional pricing |

1,628 |

[1,421; 1,798] |

983 |

|

Segmentation, transactional pricing |

1,656 |

[1,432; 1,815] |

1,930 |

Note: calculated and compiled by authors.

Where M(π) – a mathematical expectation of profit; [πmin, πmax] – minimum and maximum observed values of profit; M(K) – a mathematical expectation of capital for covering cash flow needs.

It is worth noting that the effectiveness of a pricing strategy depends a lot on the quality of product analysis and market movement forecasts. As we can see, the use of transactional pricing and transactional pricing combined with segmentation in different scenarios can increase profit within the same model in average up to 2.3% and 4%, respectively. The use of these strategies, however, requires additional capital for covering cash flow debts. Also, the use of transactional pricing widens confidence intervals for expected profit value.

4. Conclusions

A raised ethical issue with customer discrimination forces companies to find new ways of keeping their clients satisfied. Even though pricing strategies are often associated with consumer discrimination, we showed one that does not affect clients’ loyalty. Transactional pricing, as a pricing strategy in E-commerce, which considers direct and indirect transaction features, can be profitable and, under certain circumstances, minimize the unwanted effects of discrimination observed in other pricing approaches.

The authors have presented a modeling technique for choosing a pricing strategy, which fits business requirements in terms of risks and required capital. The simulation model recreates all stages of a product lifecycle with the help of intelligent agents. This approach can deal with any number of different products, different segmentation strategies, and the work of an agent does not stick to one certain algorithm. The model can predict the profitability of exchange and helps define business priorities.

To sum up, the simulation model has shown that the use of transactional pricing at a certain step of a product lifecycle can bring some extra profit; however, it would still need a predictable amount of cash flow to cover the expenses. Three different simulated scenarios have shown that transactional pricing works best in a combination with customer segmentation; however, these predictions still require a quality market movement analysis and forecasting.

References

Carta, S., Medda, A., Pili, A., Recupero, R., & Saia, R. (2018). Forecasting E-Commerce Products Prices by Combining an Autoregressive Integrated Moving Average (ARIMA) Model and Google Trends Data. Future Internet, 11(5). doi: https://doi.org/10.3390/fi11010005

Den Boer, A. V. (2015). Dynamic Pricing and Learning: Historical Origins, Current Research, and New Directions. Surveys in operations research and management science, 20(1), 1-18. doi: https://doi.org/10.1016/j.sorms.2015.03.001

Dolgui, A., & Proth, J.-M. (2010). Supply Chain Engineering: Useful Methods and Techniques. New York, NY: Springer.

Elmachtoub, A. N., Gupta, V., & Hamilton, M. (October 1, 2018). The Value of Personalized Pricing. Retrieved from https://ssrn.com/abstract=3127719. doi: https://doi.org/10.2139/ssrn.3127719

Facebook. (2019). Advertising Policies. Retrieved from https://www.facebook.com/policies/ads/

Faruqui, A. (2010). The Ethics of Dynamic Pricing. The Electricity Journal, 23(6), 13-27. doi: https://doi.org/10.1016/j.tej.2010.05.013

Gladkih, I. V. (2013). Tsenovaia strategiia kompanii: oriientatsiia na potrebitielia [A Customer Oriented Pricing Strategy of a Company]. Saint-Petersburg: Vysshaiia Shkola Menedzhmenta.

Kannan P. K., & Kopalle, P. K. (2001). Marketing in the E-Channel. International Journal of Electronic Commerce, 5(3), 63-83. doi: https://doi.org/10.1080/10864415.2001.11044211

Liu, W. W., Liu, Y., & Chan, N. H. (2018). Modeling EBay Price Using Stochastic Differential Equations. Journal of Forecasting, 38(3), 63-72. doi: https://doi.org/10.1002/for.2551

Obermiller, C., Arnesen, D., & Cohen, M. (2012). Customized Pricing: Win-Win or End Run? Drake Management Review 1(2), 12-28.

Office of Fair Trading. (2013). Personalized Pricing: Increasing Transparency to Improve Trust. Retrieved from https://one.oecd.org/document/DAF/COMP(2018)13/en/pdf

Organization for Economic Co-operation and Development. (2018). Personalized Pricing in the Digital Era. Retrieved from http://www.oft.gov.uk/shared_oft/markets-work/personalised-pricing/oft1489.pdf

Ponomarenko, V. S., & Klebanova, T. S. (2019). Tools for Modeling Systems in the Information Economy. Kharkiv: VSHEM-KHNEU.

Sahay, A. (2007). How to Reap Higher Profits with Dynamic Pricing. MIT Sloan Management Review, 48(4), 53-60.

Tong, Y., Wang, L., Zhou, Z., Chen, L., Du, B., & Ye, J. (2018). Dynamic Pricing in Spatial Crowdsourcing: A Matching-Based Approach. Special Interest Group on Management of Data, Jun 10-15.

Tseng, K.-K., Lin, R. F.-Y., Zhou, H., Kurniajaya, K.J., & Li, Q. (2017). Price Prediction of E-Commerce Products Through Internet Sentiment Analysis. Electronic Commerce Research, 18(1), 65-88. doi: https://doi.org/10.1007/s10660-017-9272-9

Tyralis, H., & Papacharalampous, G. (2017). Variable Selection in Time Series Forecasting Using Random Forests. Algorithms, 10(4), No. 114. doi: https://doi.org/10.3390/a10040114

Weatherford, L. R., & Bodily, S. E. (1992). A Taxonomy and Research Overview of Perishable-Asset Revenue Management: Yield Management, Overbooking, And Pricing. Operations Research, 40(5), 831-844. doi: https://doi.org/10.1287/opre.40.5.831