Ekonomika ISSN 1392-1258 eISSN 2424-6166

2020, vol. 99(2), pp. 59–75 DOI: https://doi.org/10.15388/Ekon.2020.2.4

Institutional Ownership and Firm Value: A Study on the Bist Manufacturing Index

Assoc. prof. Mesut Doğan

Afyon Kocatepe University, Turkey

E-mail: mesutdogan07@gmail.com

Abstract. The aim of this research is to test the relation between institutional ownership and firm value. To accomplish this aim, data from 104 firms listed in the BIST (i.e. Borsa Istanbul) industrial index between 2006 and 2018 have been used. Studies on the structure of ownership have problems with endogeneity. In order to avoid these problems, this study adopted Durbin-Wu-Hausman test with advanced econometric techniques, Ordinary Least Squares (i.e. OLS), and Two-Stage Least Squares (i.e. 2SLS). As a result of the simultaneous equation system improved in this study, a positive relation between institutional ownership as an endogenous variable, and firm value has been located. Besides, it has been found that institutional investors are more interested in the firms that have a higher market performance.

Keyword: institutional ownership, firm value, endogeneity

Received: 18/03/2020. Revised: 30/09/2020. Accepted: 05/10/2020

Copyright © 2020 Mesut Doğan. Published by Vilnius University Press

This is an Open Access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

Introduction

Institutional investors support today’s financial markets significantly and emerge as an essential part of equity markets (Gillan & Starks, 2003). Institutional investors have an important role, not only in developed markets but also in developing markets in the world. It is estimated that more than 50% of the shares of the firms listed in the Stock Market of London belong to institutional investors. Similarly in America, around 5% in 1945, 8% in 1950, 33% in 1980, 45% in 1990, 60% in 2003, and 67% in 2010 of these firms were owned by institutional investors, and the shareholding of institutional investors is increasing continuously (Blume & Keim, 2012). Institutional investors manage more than 45 billion dollars of all financial assets, and more than 20 billion of this constitutes of equities. Therefore, institutional investors became more effective and distinguishable in important decisions of firms (IMF Report, 2005; Tahir, Saleem & Arshad, 2015).

Traditionally, institutional investors are not directly involved in corporate management decisions. Instead, when they are not satisfied with the stock performance and administration, they can find a way out such as selling the stakes (Bathala, Moon & Rao, 1994). For institutional investors who own a significant proportion of a firm, it costs less to sell the stock than having a controversy with the management in case of a poor stock performance (Coffee, 1991; Charfeddine & Elmarzougui, 2010). One of the incentive factors for the institutional investors to inspect management is the size of the shareholders. If institutional investor shareholdings are high, an institutional investor has a stronger incentive to monitor a firm’s management. On the contrary, if the institutional investor holds few shares of the firm, it has less incentive control, and it can easily liquidate its portfolio when the firm performs poorly (Maug, 1998).

Institutional investors, when compared to other types of investors, are more interested in corporate management; because they have a significant ownership of equity, and they attempt to influence the top management for the management of the long-term interests of shareholders (Holderness, Kroszner & Sheehan, 1988; Brickley, Lease & Smith, 1998). In other words, it is possible that institutional investors take on a more effective monitoring role in the corporate governance arena. As a result, institutional investors may further influence top-management decisions, and, accordingly, on the firm performance (Charfeddine & Elmarzougui, 2010; Chaganti & Damanpour, 1991).

Pound (1988) studied the effects of institutional ownership on firm performance. In this study, he offered three hypotheses about institutional investors and firm performance, which are “Efficient-Monitoring Hypothesis”, “Conflict of Interest Hypothesis”, and “Strategic- Alignment Hypothesis”. In Efficient-Monitoring Hypothesis, it is expressed that institutional investors have more expertise, and they can monitor the management with lower costs than small atomistic shareholders. Therefore, this argument predicts a positive relation between institutional ownership and firm performance. Indirectly, this suggestion assumes that the only relation between firms and institutional shareholders is an investment. Conflict of Interest Hypothesis means that institutional investors will be forced to vote in support of the management because of profitable businesses in firms. For example, an insurance company can hold a significant portion of a firm’s stock in a firm while working as the main insurance company for the same firm. If it votes for the opposite, although there is no penalty for not supporting the management, it can have a crucial (negative) effect on business relations of the firm. Strategic- Alignment Hypothesis means that the institutional investors and the managers are in cooperation based on their reciprocal benefits. Generally, this cooperation reduces the beneficial impacts of the inspections by large shareholders (Bhattacharya & Graham, 2009: 371-372). In conclusion, the Conflict of Interest Hypothesis and Strategic- Alignment Hypothesis argue that there is a negative relation between institutional ownership and firm performance.

Studies that invest the relation between institutional ownership (INST) and firm performance have distinctive findings. There exist various studies which have found positive, negative and insignificant relations between INST and firm performance or firm value. In local literature, there is no study that investigates the relation between INST and financial performance or firm value. In global literature, the relation between financial performance and INST has been studied; however, the problem with endogeneity has been ignored by most of these studies. This study contributes to the local and global literature by testing the relation between firm value and INST in a large data set taking the endogeneity problem into consideration. It will also inform and guide the firms in BIST. Furthermore, the findings of this current research will help the top management who focuses on decreasing company bankruptcies, protecting the shareholders’ welfare, and providing institutional managerial reforms. Therefore, this study is a crucial one for the field.

In this study, the relation between institutional ownership and firm value will be researched. This study has used data from 104 firms listed in the BIST industrial index between 2006 and 2018. Studies on the structure of ownership have problems with endogeneity. In order to avoid these problems, this study adopted Durbin-Wu-Hausman test (DWH), Ordinary Least Squares (i.e. OLS), and Two-Stage Least Squares (i.e. 2SLS)

This paper consists of five main sections. This first part has introduced the theoretical background and the rationale of the study. The second part summarizes the studies which investigate the relation between INST and financial performance, followed by the third part on methodology. The fourth part presents the results of OLS and 2SLS regression. The final part makes a general conclusion of the study, and gives insights for the future studies.

Literature review

When studies on ownership structure are reviewed, researchers such as Kuznetsov and Muravyev (2001), Oxelheim and Randøy (2003), Cheung et al. (2007), Lam and Lee (2008), Lee (2009), Reyna and Encalada (2012), Alimehmeti and Paletta (2012), and Kang and Kim (2012) found that ownership structure is influential on financial performance. On the contrary, some other researchers such as Jacob and Salomonsson (2004), Beiner et al (2006), Choi, Park and You (2007), Rose (2007), Wang ve Clift (2009), Arosa, Iturralde and Maseda (2010), Vo and Phan (2013), and Cook (2013) argue that ownership structure is not influential on financial performance.

Institutional investors are suppose to be one of the important actors in the market. Despite that, there are studies that locate a positive or negative relation between INST and firm performance. Besides, there are studies that investigate the effects of institutional ownership on accounting and market- based indicators, or earning management. These studies will be summarised below.

Pound (1988) tested the relation between institutional ownership and firm value in 100 firms listed in the USA adopting regression method. As a result of this study which uses the data between 1981 and 1985, he claims that the mentioned ownership has a positive effect on the firm performance when the institutional investors observe and monitor the firm efficiently. However, he also states that institutional investors damage the firm performance when they behave according to their own benefit and interest. Similarly, McConnell and Servaes (1990) researched the effects of institutional ownership on firm value. As a result, they found a positive relation between INST and firm value. They proposed that institutional investors have to monitor inspect and force the management, in order to improve the market value of the firm to the max.

In their study, Chaganti and Damanpour (1991) examined the effects of institutional ownership on firm performance in 80 firms listed in the USA between 1983 and 1985. The results of the analysis indicate that institutional ownership has a positive effect on ROE. They associate these findings with that institutional investors monitor the firms effectively. Another study conducted by Lowenstein in the same year (1991) found a low correlation between INST and firm performance.

Agrawal and Knoeber (1996) tested the relation between institutional ownership and firm performance by examining the data of 383 of the biggest 500 firms in the USA, with OLS method. As a result of the models developed in this study, no significant relation was found between INST and firm performance. Despite that, Han and Suk (1998) pointed to a positive relation between INST, and stock returns and performance indicators.

Duggal and Millar (1999) examined the effects of institutional ownership on firm performance from the perspective of the firms in the S&P 500 index using data between 1985 and 1990. According to the estimated results of the model, there is an insignificant relation between INST and firm performance. Other studies by Craswell, Taylor, and Saywell (1997), Faccio and Lasfer (2000), and Mollah, Farooque and Karim (2012) also came up with similar results.

Clay (2001) examined the relation between institutional ownership and firm value in 8951 firms listed in the USA, using OLS and 2SLS methods. As a result of the model developed in this study, it is discovered that institutional ownership has a positive and significant effect on Tobin’s Q, which is used for measuring firm value. Similarly, Tsai and Gu (2007) found that there is a positive relation between institutional ownership and Tobin’s Q, which is an indicator of market performance. Moreover, they also state that the firm performance increases when the institutional investors monitor the management.

Using inclusive data from 27 countries, Ferreira and Matos (2008) searched the role of institutional investors in the world. Using the Three-Stage Least Squares method, they found a positive relation between INST and firm performance. They argue that the higher number of institutional ownerships, the higher firm value, and the better operational performance. They also found that firm performance is influential on institutional ownership. Despite this, Bhattacharya and Graham (2009) researched the effects of institutional ownership on firm performance using the data of Finnish firms. They asserted that the institutional investors who have investment and business connections with these firms have a negative effect on firm performance.

Elyasiani and Jia (2010) researched the relation between institutional ownership stability and firm performance. In this study, they used data from 1532 firms between 1992 and 2001. They suggested that shareholding proportion and shareholding stability are important for monitoring the effectiveness of the institutional investor. They also suggest that long-term institutional investors are influential on better firm performance.

In their study on 35 firms listed in the French stock market between 2001 and 2006, Charfeddine and Elmarzougui (2010) examined the relation between INST and firm performance. Empirical results of this study show that institutional ownerships have endogeneity, and they support the discussions on endogeneity in the previous ownership structure.

Fazlzadeh, Hendi and Mahboubi (2011) conducted a research on the effects of institutional ownership on firm performance in 137 firms listed in the Iranian stock market between 2001 and 2006. As a result of the analysis, they observed that institutional investors affect the firm performance in a positive way. Studies by other researchers such as Guercio and Hawkins (1999), Smith (1996), Nesbitt (1994), and Demiralp, D’Mello, Schlingemann and Subramaniam (2011) reveal similar results.

Ruiz-Mallorqui and Santana-Martin (2011) examined the effect of bank and investment fund ownership on the firm value for the firms listed in Securities Stock Market of Spain. As a result of the analysis, investment fund ownership was found to have a positive effect on firm value while bank ownership was found to have a negative effect on firm value.

Alfaraih, Alanezi and Almujamed (2012) studied the effect of institutional ownership on firm performance based on data from 134 firms listed in the Securities Stock Market of Kuwait. In consequence of the regression models developed for this study, they found a positive relation between INST, and Tobin’s Q and ROA. Similarly in 2012, Fauzi and Locke examined the effect of ownership structure on financial performance in 79 firms listed in the Securities Stock Market of New Zealand between 2007 and 2011. As a result of this study, institutional ownership was found to have a positive effect on firm performance.

Mokhtari and Makerani (2013) inspected the relation between institutional ownership, and earning management and firm value in 50 firms listed in the Securities Stock Market of Tehran between 2009 and 2011. The results of the analysis indicate that there is a positive relation between earning management and INST, while there is an irrelevant relation between firm value and INST.

Thanatawee (2014) studied the relation between firm value and INST in 323 firms listed in the Securities Stock Market of Taiwan between 2007 and 2011. The results of the analysis show that there is a positive relation between domestic INST and firm value; however, the same results also show that there is a negative relation between international INST and firm value. Similarly, Hsu and Wang (2014) found that the increase in the stability of institutional ownership is closely related to a better financial performance for the firms listed in the Securities Stock Market of Taiwan. They relate these results to the fact that long term institutional ownership is useful for the firm as INST monitors and controls it.

Arouri, Hossain and Muttakin (2014) found a positive relation between INST and bank performance in countries which are members of the Gulf Cooperation Council (GCC). Despite that, Zouari and Taktak (2014) located a negative relation between INST and bank performance for Islamic banks in the country.

Al-Najjar (2015) conducted an empirical study on the relation between INST and financial performance of 82 firms out of the finance sector, between 2005 and 2013. Panel data analysis is used in this study, and ROA and ROE are used as indicators of financial performance. As a result of the fix effect model, no strong relation was detected between INST and firm performance. On the other hand, Saleem and Arshad (2015) conducted a study on 21 Pakistani firms in Securities Stock Market of Karachi30 index who were out of the finance sector between 2008 and 2013. They guessed the effect of institutional ownership, on ROA and ROE with the aid of OLS and 2SLS methods. As a result of the models developed in this study, a positive and significant relation between INST and financial performance has been observed. Finally, Masry (2016) investigated the effects of institutional ownership on firm performance in 73 firms listed in Egypt between 2007 and 2014. As a result of the regression model, it was found that institutional ownership positively affects firm performance.

Tsouknidis (2019) investigated the relationship between corporate investor and firm performance on shipping companies listed on the US stock exchange. The analysis revealed a negative relationship between the percentage of institutional ownership and firm performance, which is primarily attributed to non-strategic rather than strategic institutional investors. Sakawa and Watanabe (2020) investigated the impact of corporate shareholders of Japanese companies operating between 2010 and 2016. The analysis found that institutional shareholders contribute to enhancing sustainable firm performance and constructing sustainable corporate governance mechanisms in a stakeholder-oriented system.

Methodology

Aim of the Research and Research Questions

The two main aims of this study on the relation between institutional ownership and firm value are:

1. To examine the effect of institutional ownership on firm value.

2. To examine the effect of firm value on institutional ownership.

To meet these aims, this study will seek answers for the following questions:

1. What is the role of institutional ownership on increasing the firm value?

2. What is the role of firm performance for institutional investors?

3. What is the role of systematic risk and percentage for institutional investors?

Data Set

In this study, data from 104 firms in BIST (Borsa Istanbul) manufacturing index between 2006 and 2018 was used. Besides, only firms listed in the BIST manufacturing index are used, for the generalisability of the findings, and in order to maintain the uniformity of the tables that will be used. The financial data of the firms which were analysed were obtained by Finnet financial analysis programme. The data about institutional ownership is obtained from the Central Registry Agency.

Variables

For this study, seven variables were used in total. One of these variables is the Tobin’s Q rate which is used to measure the firm value. Dividend payout ratio and Beta parameter are used to define if these indicators are effective on institutional ownership. Debt ratio, firm size, and firm age are included in the study as control variables.

Table 1. Variables Used in Analysis

|

Definitions |

|

|

Institutional Ownership |

The percentantage of outstanding shares held by institutions. |

|

Debt ratio(DEBT) |

The debt rate in the total assets. |

|

Firm Size (SIZE) |

The natural logarithm of total assets. |

|

Firm Age(AGE) |

The gap between the year of foundation and the current year. |

|

Dividend Payout (DIV) |

Dividend is divided by Net Profit. |

|

Systematic Risk (BETA) |

Beta coefficient. The covariants of market profit and share profit are devided by the variant of market profit. |

|

Tobin’s Q Rate (TOBIN) |

The proportion of the firm’s market value to its book value. |

Hypotheses

The literature review has shown that institutional ownership and financial performance indicators are related. For the firms listed in the BIST industrial index, institutional investors can affect the firm value positively if they efficiently monitor the firm. However, the mentioned ownership structure may harm the firm value if the institutional investors behave according to their own benefit and interest. Moving from here, this study has developed the following hypotheses:

H1: Institutional ownership is effective on firm value.

Tahir, Saleem and Arshad (2015) has found that firm performance has a positive effect on INST. On the contrary, Charfeddine and Elmarzougui (2010) stated that there is a negative relation between INST and financial performance. Moreover, Elyasiani and Jia (2010) claimed that shareholding proportion and shareholding stability are important for monitoring the effectiveness of the institutional investor, and that long-term institutional investors are related to better firm performance. In the light of this information, the following hypotheses are developed:

H2: Firm value has a positive and significant effect on institutional ownership.

The Model of the Research and the Theoretical Background

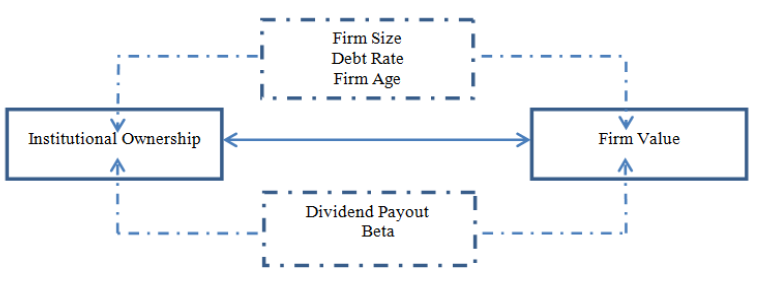

Based on the literature review and variables described above, the theoretical background of the study is shown below:

Figure 1. Theoretical Framework

Source: Authors

In order to test the hypothesis of this research, the following models are developed using OLS and 2SLS methods.

TOBIN= α + β1INST+ β2DEBT+ β3SIZEi+ β4AGE+E1

INST= α + β1TOBIN+ β2DEBT+ β3SIZE+ β4AGE+ β5DIV+ β6BETA + E2

Research Method

The data used in this study carry features of stable panel data because it covers 10 year-long data from 104 firms. The data used in this study are analysed with Stata 11.0 software. In this study, initially, descriptive statistics, t-test, and correlation analysis are used. For the unit base analysis, the Fisher ADF Base Test is used. As a result of this test, it was found that the variables are appropriate for econometric analysis. The existence of the endogeneity problem is tested using the Durbin-Wu-Hausman test. After this, OLS and 2SLS methods are used.

Endogeneity and Durbin-Wu-Hausman Test

In this part of the study, the relation between institutional ownership and financial performance are tested considering the possible endogeneity problem. In other words, institutional ownership may be effective on financial performance, or firms with high financial performance may be preferred by institutional investors. In order to understand this situation, the Durbin-Wu-Hausman (DWH) test is used.

Some researchers such as Demsetz (1983), Loderer and Martin (1997), Cho (1998), Holderness, Kroszher and Sheehan (1999), and Demsetz and Villalonga (2001) studied the relation between ownership structure and firm performance, and as a result, they state that the variables in ownership structure carry problems with endogeneity. Similarly, in this study, the variable of institutional ownership is used as an endogeneous variable. İn most of the studies that researched the relation between institutional ownership and firm value, Tobin’s Q rate is used as a dependent variable (Clay, 2001; Bhattacharya and Graham, 2009; Alfariah, Alanezi and Almujamed, 2012; Mokhtari and Makerani, 2013). Besides, the Durbin Wu-Hausman test is used in the mentioned studies in order to measure the relation between Tobin’s Q Rate and institutional ownership, and locate the endogeneity problems (Tsai & Gu, 2007; Charfeddine & Elmarzougui, 2010; Thanatawee, 2014; Tahir, Saleem & Arshad, 2015). In order to test the speculative endogeneity variable, the following models are developed, and the rest are recorded as (INST_res).

INST = α + β1TOBIN+ β2DEBT+ β3SIZE+ β4AGE+ β5DIV+ β6BETA + β7 INST _res

TOBIN= α + β1 INST + β2DEBT+ β3SIZEi+ β4AGE+ β6 INST _res+ E3

If the t statistical value is different from null and is statistically significant after the INST_res coefficient equation is recorded, it shows that OLS results are biased and inconsistent, and means that 2SLS has to be implemented. On the other side, OLS results are unbiased and consistent, and means that 2SLS cannot be implemented (Cong, 1999).

Findings

This part of the study covers the empirical findings on the relation between institutional ownership and firm value measured by regression models.

Table 2. Descriptive Statistics

|

Variables |

Mean |

Median |

Std. Dv. |

Min |

Max |

N |

|

Institutional Ownership |

0.247 |

0.194 |

0.212 |

0,00 |

0.982 |

1352 |

|

Debt ratio |

0.419 |

0.407 |

0.205 |

0,02 |

0,892 |

1352 |

|

Firm Size |

19.72 |

19.58 |

1.392 |

16.2 |

23.83 |

1352 |

|

Firm Age |

40.20 |

41.00 |

11.89 |

9,00 |

79,00 |

1352 |

|

Systematic Risk |

0.675 |

0.688 |

0.210 |

0.03 |

1.860 |

1352 |

|

Dividend Payout |

0.261 |

0.112 |

1.298 |

-23.0 |

16.08 |

1352 |

|

Tobin’s Q Rate |

2.022 |

1.253 |

3.921 |

0,17 |

74.59 |

1352 |

Table 2 shows the descriptive statistical results of the variables used for the analysis. The mean Tobin’s Q rate of the firms listed in the BIST industrial index, and are examined for the analysis is found to be 2.01. This rate was calculated to be 1.53 for English firms by Guest (2009), 2.11 for Indian firms by Saravanan (2012), 3.08 for American firms by Obradovich and Gill (2013).

The mean for the other variable of this study, which is institutional owneship, is calculated to be 24.7%. Charfeddine and Elmarzougui (2010) calculated the INST mean as 57.1% for 35 firms listed in the French stock market between 2002 and 2005. Fazlzadeh, Hendi and Mahboubi (2011), on the other hand, calculated the INST mean as 56.91% for 137 firms listed in the Iranian stock market between 2001 and 2006. Outside of the finance sector, Thanatawee (2014) calculated the same rate as 41.65% for 323 firms listed in the Taiwanese Stock Exchange Market. Najjar (2015) defined that the mean of institutional ownership is 44.32% for 82 firms out of the finance sector in Jordan between 2005 and 2013. Finally, Fazlzadeh, Hendi and Mahboubi (2011) found that the mean of INST for 21 firms in the Pakistan stock market 30 index was 26.43%. Deriving from the countries and firms mentioned above, it is seen that firms in the BIST industrial index have the lowest rate of institutional ownership.

Table 3. The Results of T-Test

|

Variables |

Institutional Ownership |

N |

Mean |

Std. Dv. |

Mean Difference |

Sig. |

|

Debt ratio |

Below |

560 |

0,410 |

0,191 |

-0,0159 |

0,252 |

|

Above |

560 |

0,426 |

0,219 |

|||

|

Firm Size |

Below |

560 |

19,64 |

1,444 |

-0,0588 |

0,522 |

|

Above |

560 |

19,70 |

1,345 |

|||

|

Firm Age |

Below |

560 |

41,58 |

10,21 |

2,558 |

0,000 |

|

Above |

560 |

39,02 |

12,35 |

|||

|

Tobin’s Q Rate |

Below |

560 |

1,892 |

1,992 |

-0,2651 |

0,272 |

|

Above |

560 |

2,157 |

5,151 |

|||

|

Dividend Payout |

Below |

560 |

0,285 |

0,092 |

0,0481 |

0,542 |

|

Above |

560 |

0,237 |

1,454 |

|||

|

Systematic Risk |

Below |

560 |

0,652 |

0,229 |

-0,046 |

0,001 |

|

Above |

560 |

0,698 |

0,223 |

In Table 3, the t-test results related to institutional ownership structure are given. In this table, the rate of institutional ownership is divided into two groups, based on its place according to the median (19.4%); below or above. It is also decided if there is any difference between these two groups according to the variables used. There is a statistically significant difference between the two groups according to firm age and systematic risk variables. The firms that have higher institutional ownership than the medium are younger, and have less systematic risk. Besides, although it is not statistically significant (P=0,272), the firms that have higher INST than the medium have a higher Tobin’s Q rate than the ones that are lower in table 3.

Table 4 shows the results of correlation analysis that shows the relation between INST and firm value. When the correlation results are examined, there is a positive relation between Tobin’s Q rate and INST, leverage rate and firm age while there is a negative relation between Tobin’s Q rate and firm size. Moreover, there is a positive relation between INST and systematic risk and leverage rate; however, there is a negative relation between INST and firm age. At the same time, there is no significant relation is observed between the independent variables in the correlation table. This increases the reliability of the model.

Table 4. Correlation Analysis

|

[1] |

[2] |

[3] |

[4] |

[5] |

[6] |

[7] |

|

|

[1] Institutional Ownership |

- |

||||||

|

[2] Debt ratio |

,184 |

- |

|||||

|

[3] Firm Size |

-,014 |

,067 |

- |

||||

|

[4] Firm Age |

-,075 |

-,019 |

,212 |

- |

|||

|

[5] Tobin’s Q Rate |

,055 |

,137 |

-,094 |

,028 |

- |

||

|

[6] Systematic Risk |

,060 |

,061 |

,114 |

-,095 |

,002 |

- |

|

|

[7] Dividend Payout |

-,055 |

-,089 |

,075 |

,061 |

-,003 |

-,003 |

- |

Table 5. DWDH Test Results for Institutional Ownership

|

Independent Variables |

Coefficient |

Std. Dv |

t-statistics |

p-value |

|

(Constant) |

2.022 |

1.822 |

-30.02 |

0.258 |

|

Institutional Ownership |

16.20 |

2.91 |

5.22 |

0.000 |

|

Debt ratio |

-0.398 |

0.723 |

-0.53 |

0.687 |

|

Firm Size |

-0.285 |

0.075 |

-3.45 |

0.000 |

|

Firm Age |

0.038 |

0.012 |

3.76 |

0.000 |

|

INST_res |

-16.88 |

3.03 |

-5.53 |

0.000 |

H0: Variables are external.

H1: Variables are internal.

Table 5 shows the results of the DWH test. It is understood from these results that t statistical value is different from null (t= -5.76, p= 0.000) for INST _res variable, and it is statistically significant. According to the results of the test, the variable is internal, and the H0 is denied. The 2SLS regression results give unbiased and consistent results for the internal variable, INST.1

Table 6. DWDH Results for Tobin’s Q Rate

|

Independent Variables |

Coefficient |

Std. Dv |

t-statistics |

p-value |

|

(Constant) |

-9.85 |

1.61 |

-6.22 |

0.000 |

|

Tobin’s Q Rate |

1.551 |

2.40 |

6.45 |

0.000 |

|

Debt ratio |

-4.22 |

6.75 |

-6.21 |

0.000 |

|

Firm Size |

0.55 |

8.23 |

6.18 |

0.000 |

|

Firm Age |

-0.02 |

5.71 |

-5.56 |

0.000 |

|

Systematic Risk |

-1.39 |

1.42 |

-0.89 |

0.345 |

|

Dividend Payout |

4.55 |

119,2 |

0.02 |

0.906 |

|

TOBIN _res |

-1.55 |

2.38 |

-6.22 |

0.000 |

H0: Variables are external.

H1: Variables are internal

Table 6 shows the DWH test results, and the results indicate that the t statistical value for TOBIN_res variable is different from null (t= -6.10, p= 0.000), and is statistically significant. According to the results, the variable is internal, and the H0 is denied. The 2SLS regression results give unbiased and consistent results for the internal variable, Tobin’s Q rate.

Table 7. Regression Results of Performance Equation

|

Variables |

OLS |

2OLS |

||

|

t-statistics |

p-value |

t-statistics |

p-value |

|

|

Institutional Ownership |

2.12 |

0.044 |

3.92 |

0.000 |

|

Debt ratio |

4.35 |

0.000 |

5.88 |

0.000 |

|

Firm Size |

-3.59 |

0.000 |

-2.75 |

0.005 |

|

Firm Age |

2.15 |

0.0381 |

2.85 |

0.003 |

|

C |

3.48 |

0.000 |

1.01 |

0.205 |

|

F statistics |

11.66 |

0.000 |

13.01 |

0.000 |

|

Adjusted R2 |

0.044 |

0.047 |

||

In Table 7, there are the OLS and 2SLS results that show the relation between INST and firm value (Tobin’s Q Rate). It is seen that Model F statistical rate is statistically significant, and the model has sufficient illustration power. Furthermore, around 4% of the change in Tobin’s Q rate is explained by the independent variables. When the results of both methods are examined, institutional ownership as an independent variable makes a positive and statistically significant contribution to the firm value. In other words, the increase in the institutional ownership affects the market performance of the firms positively.

There is a positive and statistically significant relation between Tobin’s Q rate, and the other variables which are leverage rate and firm age. Notwithstanding, there is a negative relation between firm size and Tobin’s Q rate. These results overlap with most of the earlier studies.

Table 8. The Regression Results of Institutional Ownership Equation

|

Variables |

OLS |

2OLS |

||

|

t-statistics |

p-value |

t-statistics |

p-value |

|

|

Tobin’s Q Rate |

2.31 |

0.044 |

3.32 |

0.000 |

|

Debt ratio |

4.52 |

0.000 |

5.85 |

0.000 |

|

Firm Size |

0.28 |

0.754 |

1.03 |

0.385 |

|

Firm Age |

-1.99 |

0.045 |

-2,89 |

0.003 |

|

Systematic Risk |

1,93 |

0.084 |

1.85 |

0.087 |

|

Dividend Payout |

-1.02 |

0.202 |

-1.12 |

0.252 |

|

C |

3.75 |

0.000 |

2.41 |

0.019 |

|

F statistics |

17.20 |

0.000 |

16.75 |

0.000 |

|

Adjusted R2 |

0.0452 |

0.0435 |

||

In Table 8, the factors that define the institutional ownership are estimated by OLS and 2SLS methods. It is seen that the Model F statistical rate is statistically significant, and the model has sufficient illustration power. Furthermore, around 4.26% of the change in institutional ownership is explained by the independent variables. When the results of both methods are examined, there is a positive relation between institutional ownership and firm value. In other words, when the market performance increases, institutional ownership increases as well.

There is a positive and statistically significant relation between INST and other variables which are systematic risk and leverage rate. Despite that, there is a negative relation between firm age and INST. At the same time, dividend payout rate and firm size are not effective on institutional ownership.

Results and conclusion

Institutional investors are important actors in the market. The share of institutional investors in the stock market of developed countries is over 60%. For example, it is around 70% in the USA, and 60% in England and France. In countries that are relatively less developed (e.g. Iran, Jordan, and Taiwan), the share of institutional investors is over 50%. Notwithstanding, in Turkey, the share of institutional investors in the firms in the BIST industrial index is around 25%. This can be explained with the fact that most firms in BIST are family businesses, and the capital is held by a particular group, family, or administrative board.

In this study, the relation between INST and firm value are examined. In this research, data from 104 firms consist of those listed in the BIST industrial index between 2006 and 2018. The relation between INST and firm value are tested keeping the endogeneity problem in mind. In other words, while institutional investors can increase the firm value, firm value can also increase the share of institutional investors. In order to understand this, a DWH test is implemented. As a result of this test, it was understood that institutional ownership is an internal variable, and 2SLS regression results are unbiased and consistent.

As a result of the simultaneous equation system developed in this study, it was found that firm value is effective on institutional ownership. In other words, good firm value can increase the number of institutional investors, and institutional investors become more interested in firms with high market performance. There is a positive but not so statistically significant relation between the other variable of the model – systematic risk – and INST. It can also be claimed that the systematic risk and volatilities of the shares are important for institutional investors. Another variable in the study which is has a positive and significant effect on institutional ownership. In other words, when the rate of foreign resources in entities increases, the amount of institutional ownership increases too. However, dividend payout rate and firm size has no effect on institutional ownership. There is a negative relation between the last variable (i.e. firm age) and INST. That is, INST decreases as the firm age increases. The results of the t-test also support this finding. This situation can be associated with the possibility of the firm becoming a family business as it gets older, or with the increase in the fund concentration.

There are some limitations in this study, which examined the relation between institutional ownership and firm value. Initially, the results should be interpreted according to the BIST industrial index. Besides, the dependent and independent variables used for this study are the other limitations of the study. Further studies can be conducted considering other performance indicators such as return-on-assets, return on equity, earning management, bankruptcy risk, etc. Moreover, further studies can make a distinction between domestic and foreign INSTs, or establish the stability of institutional investors to test their distinctive effects on firm performance. Finally, the effect of different ownership types such as CEO, foreigner, family, government, etc. on financial performance can be researched keeping the endogeneity problem in mind.

References

Agrawal, A. and Knoeber, C.R. 1996. Firm Performance and Mechanisms to Control Agency Problems Between Managers and Shareholders. Journal of Financial and Quantitative Analysis, 31(3), 377-397.

Al- Najjar D. 2015. The Effect of Institutional Ownership on Firm Performance: Evidence from Jordanian Listed Firms. International Journal of Economics and Finance, 7(12), 97-105.

Alfaraih, M., Alanezi, F. and Almujamed, H. 2012. The Influence of Institutional and Government Ownership on Firm Performance: Evidence from Kuwait. International Business Research, 5 (10), 192-200.

Alimehmeti, G. and Paletta, A. 2012. Ownership Concentration and Effects Over Firm Performance: Evidences From Italy. European Scientific Journal, 8(22), 39- 49.

Andersson, J., Jacob, N. and Salomonsson, D. 2004. The Link Between Ownership Structure and Firm Performance: Evidence From Sweden’s Listed Companies, https://gupea.ub.gu.se/bitstream/2077/2266/1/gbs_thesis_37.pdf, 02.03.2014.

Arouri, H., Hossain, M. and Muttakin, M.B. 2014. Effects of Board and Ownership Structure on Corporate Performance: Evidence from GCC Countries. Journal of Accounting in Emerging Economies, 4(1), 117- 130.

Arosa B., Iturralde T. and Maseda, A. 2010. Outsiders on The Board of Directors and Firm Performance: Evidence from Spanish Non-Listed Family Firms. Journal of Family Business Strategy, 1(4), 236–245.

Bathala, C.T., Moon, K.P and Rao, R.P. 1994. Managerial Ownership, Debt Policy and the Impact of Institutional Holdings: An Agency Perspective. Financial Management, 23(3), 38-50.

Beiner, S., Drobetz, W., Schmid, M.M. and Zimmermann, H. 2006. An Integrated Framework of Corporate Governance and Firm Valuation. European Financial Management, 12(2), 249- 283.

Ben Slama Zouari, S. and Boulila, T.N. 2014. Ownership Structure and Financial Performance in Islamicbanks: Does Bank Ownership Matter? International Journal of Islamic and Middle Eastern Finance and Management, 7(2), 146-160.

Bhattacharya, P. S. and Graham, M. A. 2009. On Institutional Ownership and Firm Performance: Adisaggregated View. Journal of Multinational Financial Management, 19(5), 370-394.

Blume, M.E. and Keim, D.B. 2012. Institutional Investors and Stock Market Liquidity: Trends and Relationships. https://www.researchgate.net/publication/256034545_Institutional_Investors_and_Stock_Market_Liquidity _Trends_and_Relationships, 15.06.2016.

Brickley, J.A., Lease, R.C. and Smith, C.W. 1998. Ownership Structure and Votingon Antitakeover Amendments. Journal of Financial Economics, 20(1), 267-291.

Chaganti, R. and Damanpour, F. 1991. Institutional Ownership, Capital Structure and Firm Performance. Strategic Management Journal, 12(7), 479-491.

Charfeddine, L. and Elmarzougui, A. 2010. Institutional Ownership and Firm Performance: Evidence from France. The IUP Journal of Behavioral Finance, 7, 35-46, https://www.researchgate.net/publication/228293240_Institutional_Ownership_and_Firm_Performance_Evi dence_from_France, 15.06.2016.

Cheung, Y.L., Connelly, J.T., Limpaphayom, P. and Zhou, L. 2007. Do Investors Really Value Corporate Governance? Evidence from the Hong Kong Market. Journal of International Financial Management and Accounting, 18(2), 86-122.

Cho, M.H. 1998. Ownership Structure, Investment and The Corporate Value: An Empirical Analysis. Journal of Financial Economics, 47(1), 103-121.

Choi, J.J., Park, S.W. and Yoo, S.S. 2007. The Value of Outside Directors: Evidence from Corporate Governance Reform in Korea. Journal of Financial and Quantitative Analysis, 42(4), 941- 962.

Clay, D.G. 2001. Institutional Ownership, CEO Incentives and Firm Value. Ph.D.Dissertation, University of Chicago.

Coffee, J.C.J. 1991. Liquidity Versus Control: The Institutional Investor as Corporate Monitor. Columbia Law Review, 9(1), 1277-1368.

Cong, R. 1999. How do I Test Endogeneity? How do I Perform a Durbin-Wu-Hausman Test?, http://www.stata.com/support/faqs/statistics/durbin-wu-hausman-test/, 15.06.2016.

Cook, R. 2013. The Relationship between Corporate Governance Practices and Firm Performance in the Junior Canadian Life Sciences Sector, Saint Mary’s University, Master of Business Administration, Halifax, Nova Scotia, Canada.

Craswell, A.T., Taylor, S.L. and Saywell, R.A. 1997. Ownership Structure and Corporate Performance: Australian Evidence. Pacific-Basin Finance Journal, 5(3), 301-323.

Demiralp, I.D., Mello, R., Schlingemann, F.P. and Subramaniam, V. 2011 . Are there Monitoring Benefits to Institutional Ownership? Evidence from Season Edequity Offerings. Journal of Corporate Finance, 17,1340-1359, http://www.tulane.edu/~vencat/instn.pdf, 15.06.2016.

Demsetz, H. 1983. The Structure of Ownership and the Theory of the Firm. Journal of Law and Economics, 26 (2), 375–390.

Demsetz, H. and Villalonga, B. 2001. Ownership Structure and Corporate Performance. Journal of Corporate Finance, 7(3), 209-233.

Duggal, R. and Millar, J.A. 1999. Institutional Ownership and Firm Performance: The case of Bidder Returns. Journal of Corporate Finance, 5 (2), 103-117.

Elyasiani, E. and Jia, J. 2010. Distribution of Institutional Ownership and Corporate Firm Performance. Journal of Banking and Finance, 34 (3), 606-620.

Faccio, M. and Lasfer, M.A. 2000. Do Occupational Pension Funds Monitor Companies in which they Hold Large Stakes?. Journal of Corporate Finance, 6(1),71-110.

Fauzi, F. and Locke, S. 2012. Board Structure, Ownership Structure and Firm Performance: A Study of New Zealand Listed-Firms. Asian Academy of Management Journal of Accounting and Finance, 8(2), 43– 67.

Fazlzadeh, A., Hendi, A. and Mahboubi, K. 2011. The Examination of the Effect of Ownership Structure on firm Performance in Listed Firms of Tehran Stock Exchange Based on the Type of the Industry. International Journal of Business and Management, 6(3), 249-266.

Ferreira, M. A. and Matos, P. 2008. The Colors Ofinvestors’ Money: The Role of Institutional Investorsaround the World. Journal of Financial Economics, 88(3), 499-533.

Gillan S. L. and Starks L.T. 2003. Corporate Governance, Corporate Ownership, and the Role of Institutional Investors: A Global Perspective. Journal of Applied Finance, 13(2), 4-22.

Guercio, D. And Hawkins, J. 1999. The Motivation and Impact of Pension Fundactivism. Journal of Financial Economics, 52(3), 293-340.

Guest, P.M. 2009. The Impact of Board Size on Firm Performance: Evidence From The UK. The European Journal of Finance, 15(4), 385-404.

Holderness, C.G., Kroszner, R.S. and Sheehan, D.P. 1999. Were the Good Old Daysthat Good? Evolution of Managerial Stock Ownership and Corporate Governance Since the Great Depression. Journal of Finance, 54(2), 435-469.

Hsu, M.F. and Wang, K. 2014. The Level and Stability of Institutional Ownership and Firm Performance: Evidence from Taiwan. Emerging Markets Finance and Trade, 50(2), 159-173.

IMF, 2005. Global Financial Stability Report: Market Developments and Issues. http://www.imf.org/external/pubs/ft/gfsr/2005/01/, 15.06.2016.

Kang, Y.S. and Kim, B.Y. 2012. Ownership Structure and Firm Performance: Evidence from the Chinese Corporate Reform. China Economic Review, 23(2), 471–481.

Kuznetsov, P. and Muravyev, A. 2001. Ownership Structure and Firm Performance in Russia: The Case of Blue Chips of the Stock Market, http://dev3.cepr.org/meets/wkcn/7/748/papers/kuznetsov-muravyev.pdf, 05.03.2014.

Lam, T.Y. and Lee, S.K. 2008. CEO Duality and Firm Performance: Evidence From Hong Kong. Corporate Governance, 8(3), 299-316.

Lee, S. 2009. Corporate Governance and Firm Performance. (Doctor of Philosophy). The University of Utah.

Loderer, C. and Martin, K. 1997. Executive Stock Ownership and Performance Tracking Faint Traces. Journal of Financial Economics, 45(2), 223-225.

Lowenstein, L. 1991. Why Managers Should (and Should Not) Have Respect for Their Shareholders. Journal of Corporation Law, 17, 1-27.

Masry M. 2016. The Impact of Institutional Ownership on the Performance of Companies Listed In the Egyptian Stock Market, IOSR Journal of Economics and Finance (IOSR-JEF) 7(1), 5-15.

Maug, E. 1998. Large Shareholders as Monitors: Is There a Trade-off between Liquidity and Control? Journal of Finance, 53, 65-98.

McConnell, J.J and Servaes, H. 1990. Additional Evidence on Equity Ownership and Corporate Value. Journal of Financial Economics, 27(2), 595-612.

Mokhtari, Z. and Makerani, K.F. 2013. Relationship of Institutional Ownership with Firm Value and Earnings Quality: Evidence from Tehran Stock Exchange. International Journal of Economy, Management and Social Sciences, 2(7), 495-502.

Mollah, S., Farooque, O.A. and Karim, W. 2012. Ownership Structure, Corporate Governance, and Firm Performance. Studies in Economics and Finance, 29, 301-319.

Nesbitt, S.L. 1994. Long-term Reward from Shareholder Activism: A study of the CalPERS Effect. Journal of Applied Corporate Finance, 6(4), 75-80.

Obradovich, J. D. and Gill, A. 2013. The Impact of Corporate Governance and Financial Leverage on the Value of American Firms. International Research Journal of Finance and Economics, 91, 1-13.

Oxelheim, L. and Randøy, T. 2003. The Impact of Foreign Board Membership on Firm Value. Journal of Banking and Finance, 27(12), 2369–2392.

Pound, J. 1988. Proxy Contests and the Efficiency of Shareholder Oversight. Journal of Financial Economics, 20(1- 2), 237-65.

Reyna, J.M.S.M. and Encalada, J.A.D. 2012. Ownership Structure, Firm Value and Investment Opportunities Set: Evidence from Mexican Firms. Journal of Entrepreneurship, Management and Innovation (JEMI), 8(3), 35-57.

Rose, C. 2007. Does Female Board Representation Influence Firm Performance? The Danish Evidence. Journal of Corporate Governance: An International Review, 15, 404-413.

Ruiz-Mallorquí, M.V. and Santana-Martín, D.J. 2011. Dominant Institutional Owners and Firm Value. Journal of Banking and Finance, 35(1), 118-129.

Sakawa, H. and Watanabel, N. 2020. Institutional Ownership and Firm Performance under Stakeholder-Oriented Corporate Governance. Journal of Sustainability, 12, 1021; doi:10.3390/su12031021.

Saravanan, P. 2012. Corporate Governance and Company Performance- A Study With Reference to Manufacturing Firms in India. http://www.nfcgindia.org/pdf/cor_gover_manu_firms.pdf, 10.12.2013.

Smith, M.P. 1996. Shareholder Activism by Institutional Investors: Evidence from CalPERS. Journal of Finance, 51(1), 227-252.

Wang, Y. and Clift, B. 2009. Is There a “Business Case” for Board Diversity?. Pacific Accounting Review, 21(2), 88-103.

Vo, D. and Phan, T. 2013. Corporate Governance and Firm Performance: Empirical Evidence From Vietnam, http://www.murdoch.edu.au/School-of-Management-and-Governance/_document/Australian-Conferenceof- Economists/Corporate-governance-and-firm-performance.pdf, 03.12.2013.

Tahir, S.H., Saleem, M. and Arshad, H. 2015 Institutional Ownership And Corporate Value: Evidence From Karachi Stock Exchange (Kse) 30-Index Pakistan, Praktinimenadiment, 11(1), 41-49.

Thanatawee, Y. 2014. Institutional Ownership and Firm Value in Thailand, Asian Journal of Business and Accounting, 7(2), 1-22 .

Tsai, H. and Gu, Z. 2007. The Relationship Between Institutional Ownership and Casino Firm Performance. International Journal of Hospitality Management, 26 (3), 517-530.

Tsouknidis, D. 2019. The effect of institutional ownership on firm performance: the case of U.S.-listed shipping companies. Journal Maritime Policy & Management, 46(5), 509-528.