Ekonomika ISSN 1392-1258 eISSN 2424-6166

2020, vol. 99(1), pp. 79–92 DOI: https://doi.org/10.15388/Ekon.2020.1.5

The Evaluation of the Impact of Macroeconomic Indicators on the Performance of Listed Real Estate Companies and Reits

Dr. Viktorija Cohen

Department of Economic Policy, Faculty of Economics and Business Administration

Vilnius University

Email: viktorija.cohen@evaf.vu.lt

Dr. Arūnas Burinskas

Department of Economic Policy, Faculty of Economics and Business Administration

Vilnius University

Email: arunas.burinskas@evaf.vu.lt

Abstract. Using quarterly data from 2006:Q1 to 2019:Q3 (55 observations), this paper examines 18 Eurozone macroeconomic variables that represent monetary policy, external and construction sectors’ performance, economic growth, investment, households’ earnings, inflation and assesses their impact on the performance of the European listed real estate companies and REITs. Empirical results demonstrate that the European listed real estate market is strongly influenced by the supply side: the construction sector and the inflation of producers’ prices; while the demand side is strongly affected by the expansionary monetary policy of ECB. Furthermore, some primary findings propose that US expansionary monetary policy shocks have an effect on the European listed real estate market. This conclusion demands further thorough research.

Keywords: Real Estate Investment Trusts, European listed real estate securities, macroeconomic determinants, EPRA index

Received: 23/04/2020. Revised: 08/05/2020. Accepted: 18/05/2020

Copyright © 2020 Viktorija Cohen, Arūnas Burinkas. Published by Vilnius University Press

This is an Open Access article distributed under the terms of the Creative Commons Attribution Licence, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

Introduction

Global integration of the financial markets has enormously increased investment opportunities in different geographical areas through securitized vehicles such as Real Estate Investment Trusts (REITs). REITs is a widely used financial instrument in global listed real estate securities and proved to be very effective not only in regard to the benefits of diversification but also in terms of the market accessibility, lowering transaction costs, providing better liquidity. Offering high stability real estate portfolios display an efficient inflation-hedging tool (Sebastian and Schätz, 2009) and stronger diversification reimbursement, questions in this particular context keep arising from different perspectives. On the other hand, real estate sectors do not function in a vacuum and its performance is associated with the performance of the economy and capital markets (Baum, 2009; Akinsomi et al., 2018). REITs prices, in particular, are very sensitive to cash flows dependent networking through rental income, occupation demand, capitalization rates and capital values. The investments of this sector are generally fixed, long-term and illiquid, so investors seek to understand the drivers of commercial real estate and returns before making a decision about investments. The issue of the macro-economic drivers influencing the price and direction of investments to listed real estate securities has been studied by a number of scientists and experts (Sebastian and Schätz, 2009; Stevenson, 2016; Akinsomi et al., 2018). One of the most important pieces of knowledge that comes along with the investment in global listed real estate securities is an understanding of macroeconomic factors and determinants that strongly correlate with real estate securities’ returns (Ling and Naranjo 2002, Bond et al. 2003, Hoskin et al., 2004, Ewing and Payne, 2005, Edelstein et al 2011).

However, there is little statistically examined performance on the broader basis of macroeconomic influence; the majority of studies concentrate only on productivity and economic growth, inflation, unemployment, firms’ financial performance, capital markets and interest rates. However, the macroeconomic theory suggests a much more extensive range of possible macroeconomic determinants that might affect the real estate market. Therefore, the purpose of this paper is to contribute to the existing literature by examining Europe’s REITs market on a broader basis of macroeconomic factors, by including 18 Euro Area macroeconomic variables that represent the monetary policy, external and construction sectors’ performance, economic growth, investment, households’ earnings and inflation. We employ a linear regression analysis in order to identify remote in time relationships between the FTSE EPRA NAREIT Developed Europe index1 and a number of macroeconomic variables. This paper concludes with the identification of the most prevailing macroeconomic factors in terms of their influence on the European listed real estate market. This study reveals that for the time series, from 2006 up to the second quarter of 2019, the statistically most significant factors of EPRA index dynamics were central bank assets, total construction and inflation of producers’ prices. However, for the time series, from 2006 up to the fourth quarter of 2015, the real effective euro exchange rate prevailed against inflation of producers’ prices.

Literature review

Property market sector is one of the major sectors of every developed or developing nation. In fact, it reports to 54 percent of the global financial capital (Oreagba, 2010). However, this is not the only reason why the property market has received increasing attention over the past several decades. Questions in this market are raised particularly by those who search for investment alternatives and substitutes that could suggest stronger benefits to returns. There are a number of studies suggesting greater returns of geographically diversified commercial properties (Newell and Webb, 1996, Case et al., 1997, Eichholtz et al., 1998, Goetzmann and Wachter, 2001). In the recent past, due to global processes and technological development (Connor, Liang, 2000) possibilities for investors have extended largely from direct real estate to such alternatives as indirect real estate investments that propose investors benefits in diversification for their portfolios (Sebastian and Schätz, 2009). REITs, being a part of investment diversification possibilities as an easier way for investors (in particular, individual or private) to participate in the progress of the property sector, has received considerable attention over the past decades. Typically, REITs specialize in operating properties of different types (hotels, office buildings, retail centres, warehouses, apartment complexes, data centres, health care facilities) that generate income. For individual investors provisions of REITs allow them to own shares (or a portion of a property) in commercial property portfolios and receive a dividend-based income.

The global REITs market has proved to be extremely effective (Pham, 2013). It has witnessed skyrocketed growth in global REITs market capitalization from US$734b in 2010 to US$1.7t in 2016 (EPRA, 2016). Literature has been flooded with analyses of REITs performance. Earlier studies on the macro-perspective have documented that trade and financial liberalization lead to an increase in the correlations between equity markets of trading partners (Ross, 1989) and benefits from diversifying across global real estate security markets (Eichholtz, 1996; Stevenson, 2000; Hoesli et al., 2004). Recent studies conclude that REITs in general offer not only diversification benefits and easier market accessibility but also lower transaction costs, liquidity and corporate governance (Olanrele et al., 2015). Crow and Krisbergh (2010) propose that REITs are more transparent due to the real-time pricing mechanisms that are used to determine the real market value. Bhuyan et al. (2015) discover that REITs offer better diversification to common stocks, yet Asteriou and Bogiazi (2013) suggest a positive correlation between REITs returns and the general stock market.

Studies on macroeconomic determinants show that the productivity of the economy positively affects the demand for property assets (DiPasquale and Wheaton, 1992). Strong economy influences a region’s ability to attract investments in real estate (Chin et al. 2006), GDP growth, inflation, unemployment, vacancy rates and available stock in the market correlate with property return (Hoskin et al., 2004; De Wit and Van Dijk, 2003). Van Doorn (2003) concludes that GDP per capita is one of the strategic variables used in real estate asset allocation decisions. There are certain commonalities in commercial property market returns that are driven by macroeconomic factors, such as interest rates, bond yields, inflation and capital markets (Macregor and Schwann, 2003). More recent findings reveal similar results that REITs positively correlate with market capitalization, interest rate and inflation rate (Mai’n et al., 2016). Stevenson (2016), examining the drivers of correlation dynamics across global listed real estate markets, suggests that both financial and macroeconomic risk factors impact the degree of co-movement in real estate markets globally. Several authors (Kohlert, 2010; Park and Bang, 2012) examining the Korean market and the UK market find that economic indicators are the dominant drivers of the returns. In fact, developed markets are more stable and thus macroeconomic indicators, such as unemployment rate, inflation, interest rates tend to be less volatile. Several studies highlighted that the REITs of emerging markets are more sensitive to macroeconomic variables compared to the REITs of developed markets due to large spreads and high volatility in inflation, unemployment and interest rates; therefore, that emerging markets are fundamentally different to developed markets (Loo et al., 2016; Akinsomi et al., 2018).

Lieser and Groh (2014), using augmented random effect panel regression methodology, in their proposed model identify 6 key drivers that determine the attractiveness of real estate markets, note that an economic country’s activity is a main factor, together with real estate investment opportunities, the depth and sophistication of capital markets, investor protection and legal framework, administrative burdens and regulatory limitations, and the socio-cultural and political environment. There are studies theorizing that apart from macroeconomic determinants, institutional factors have an impact on returns, such as corporate governance, the legal system, accounting standards (Fulghieri and Suominen, 2006; Doidge et al., 2007; Aggarwal et al., 2009; Edelstein et al 2011).

Less being analyzed is the impact of monetary and macro-financial indicators on the REITs. Crowe and Dell’Ariccia (2012) in their research on the performance of real estate over real estate booms and busts found that monetary policies and macro-financial tools have a significant direct impact on the performance of the real estate market. In fact, these factors (such as limits on loan-to-value ratios) often work as a stimulus for real estate cycles, much like the majority of real estate activities, whether it is an investment, acquisitions, developments, etc. that encompass the borrowing of funds.

In summary, there is strong evidence that the property market is strongly influenced by general macroeconomic factors. However, the majority of analyzed studies narrowed the scope of research to some “traditional” macroeconomic variables such as inflation or economic growth, while, we believe, the macroeconomic theory calls for a broader approach.

While many aforementioned studies have taken into consideration various macroeconomic variables, so far, to our knowledge none of them have tested which of these variables are more reliable and suitable for further analysis and forecasting purposes. Therefore, this study aims to fill this methodological gap.

Methodological Framework and Data

To analyze the dynamic interactions between the selected macroeconomic variables and the EPRA index this study applies one of the state space models – the dynamic linear model (DLM) described in detail by Petris, G. et al. (2009). We follow a simple dynamic regression analysis procedure that allows time-varying regression coefficients and employs time series transformations for modelling the linear relationship between the dependent variable and regressors. Also, the model assumes a Gaussian distribution. Therefore, altogether, the model satisfies all assumptions applied for simple linear regression models, while it remains applicable for testing dynamic interactions.

Testing EPRA index linear relationships with 18 variables up to 20 lags, we address endogeneity among regressors pursuing the procedure as follows. First, we take out statistically insignificant lags of each variable separately. Second, we eliminate all regressors whose variance inflation factor exceeds 5. And, finally, we remove all remaining statistically insignificant regressors.

In the empirical analysis, we test how in the logarithmic scale the difference of FTSE EPRA Nareit Developed Europe Index (EPRA index) has been influenced by the related macroeconomic variables in almost the last two decades. We have chosen this index as a proxy of real estate market performance because the FTSE EPRA/NAREIT Developed Europe Index is a Market Capitalization-Weighted Index consisting of the most heavily traded real estate stocks in Europe. It is designed to reflect the stock performance of companies engaged in specific aspects of the European Real Estate Business as perceived by institutional investors. It has a base date of 31 December 1999 and a base of 1000.

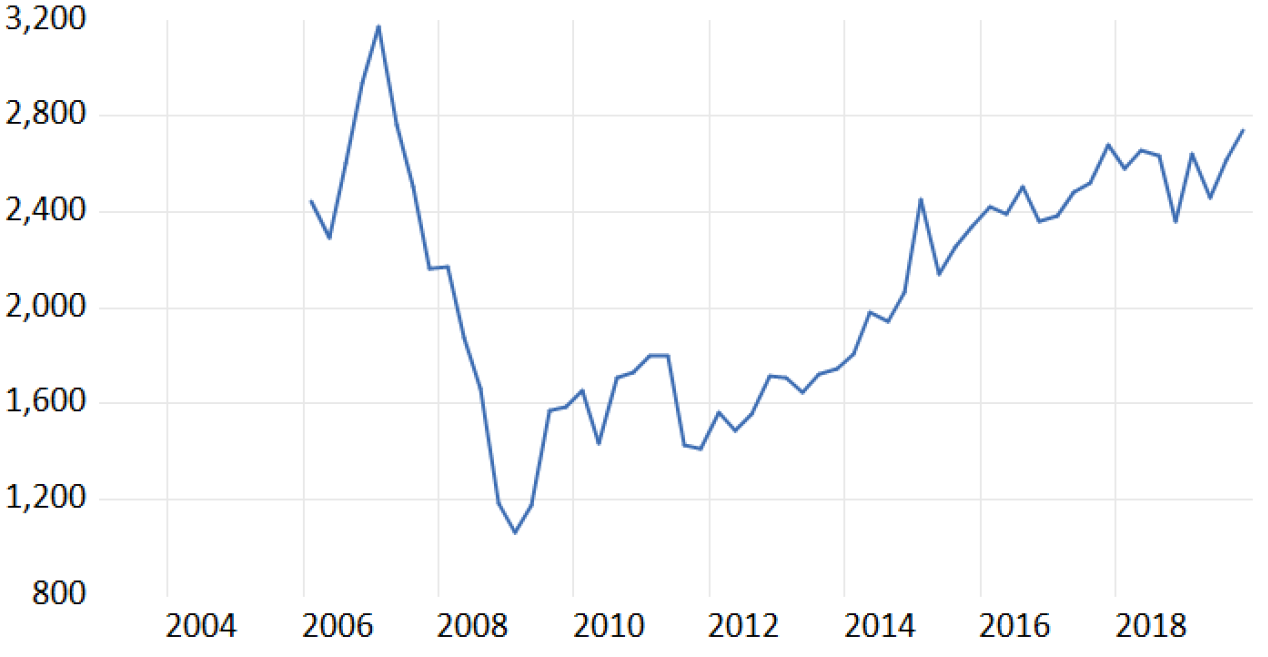

Apparently, the listed real estate sector of developed Europe, as reflected by th EPRA index, has expanded considerably over the last fifteen years, as we can observe it from Figure 1.

Despite the Great Depression of 2008 and sharp decline, the overall market capitalization of the EPRA Index since then has been increasing gradually, although still has not reached its highs that were before the Great depression of 2008.

The evidence that the property market sector has experienced substantial recovery and steady growth has contributed to an increased investment incentive of institutional investors and pension fund managers in understanding that real estate sector follows up to increasingly improving macroeconomic environment.

Figure 1. The FTSE EPRA Nareit Developed Europe Index

Source: Investing.com

Inevitably, the EPRA index development has been accompanied by the rapid growth of the macroeconomic environment. Despite the mainstream of the related literature that indicates only inflation and real gross domestic product growth as the main factors that affect real estate markets, the intuition that the range of such factors might be much broader is based on the macroeconomic theory and our herein below revealed findings of such kind relationships. To test the influence of the macroeconomic environment on the EPRA index, we employ the following variables: Central Bank assets of the Euro Area; 10-year German government bond yields (with adjusted inflation); M3 money; Euro real effective exchange rate; real net export; current account balance as a percentage from GDP; total construction; sales value of manufactured durable consumer goods; real GDP; gross fixed capital formation; total industry production excluding construction; business tendency surveys for manufacturing (orders inflow); gross investment rates of non-financial corporations and households; purchasing managers index; hourly earnings of the private sector; indexes of consumers (harmonized) and producers prices.

For that purpose, we collected the quarterly data of macroeconomic variables from the databases of Federal Reserve Economic Data (FRED) in the time range from the first quarter of 2006 up to the third quarter of 2019 (55 observations).

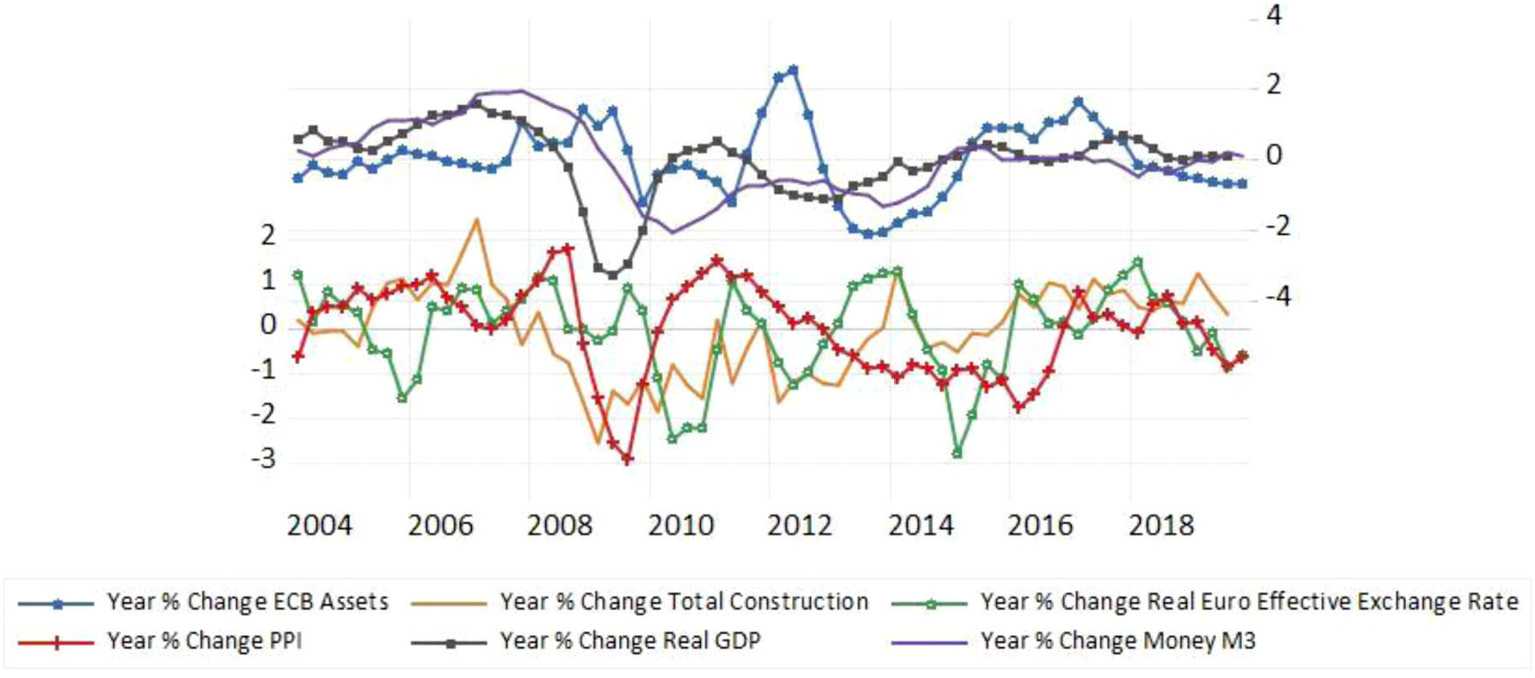

Our choices are based on macroeconomic theory and are tested in terms of EPRA index correlation with the lags (up to 20) of the chosen macroeconomic variables. We rely on the New Keynesian model used widely by central banks across the globe (Gertler, M., Karadi, P., 2015). Within this framework, aggregate spending depends on the current and expected future short-term real interest rates. At the same time, the transmission of monetary policy works due to some form of nominal price and wage rigidities. Therefore, the supervision of the nominal rate gives the central bank control over current and expected future real rates. It is this leverage that allows the central bank to influence aggregate spending that in turn, translates into movements in output and inflation, and subsequently to shifts in the real estate market. Also, we rely on the demand and supply equilibrium theory. Furthermore, we test such supply-side variables as total construction, manufactured durable consumer goods; and demand variables such as gross fixed capital formation and private investment (but financial institutions) rates. Besides, we expect that business expectations in terms of confidence and future inflation will work out according to expectations theory; and arbitrage theory suggests that some variables related with the external sector might be in play also.Having tested all these variables, we found out that eleven of them demonstrated statistically significant relations with the EPRA Index. They are as follows: ECB Assets; Total Construction; The Inflation of Harmonized Consumer Prices (HCPI); 10-year German Government Bond Yields with Adjusted Inflation; Manufactured Durable Consumer Goods; Gross Fixed Capital Formation; Total Industry Production Excluding Construction (IPEXCON_EA); Money M3; The Inflation of Producers Prices (PPI); Real Euro Effective Exchange Rate and Real GDP (Table 1). The dynamics of the most significant variables are represented in Figure 2.

Figure 2. The dynamics of the selected macroeconomic variables (normalised scale)

Source: FRED Economic Data

It is the expansion of the ECB assets that followed the real GDP contractions starting both from 3rd quarter in 2008 and 3rd quarter in 2011. A steady (although sluggish) recovery of economic growth, in time, boosted construction performance in 1st quarter of 2013, while producers’ prices had not recovered until the economic recovery did not show steady positive numbers in 2016. However, starting with the 3rd quarter of 2018, producers’ prices plummeted and have been decreasing, possibly following Brexit crises and the contraction of manufacturing performance in Germany.

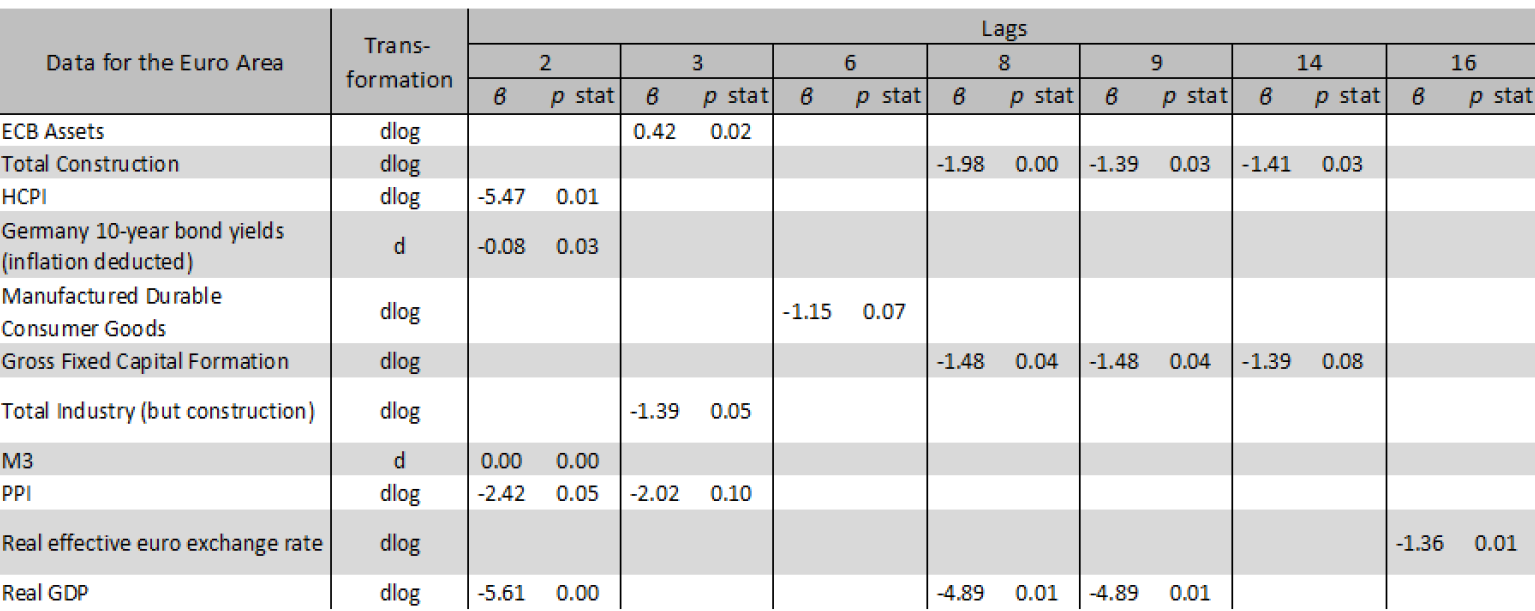

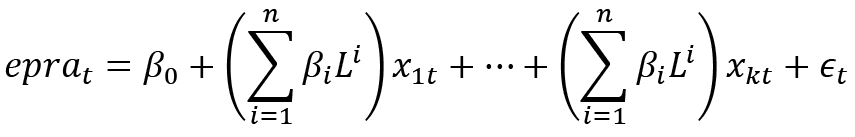

Table 1 depicts the results of testing relationships of EPRA index (dlog) with each variable that demonstrated a strong enough correlation therewith.

Table 1. The results of the separate linear dynamic regressions

Apparently, variables that demonstrated strong correlation with the EPRA index in growth terms might be divided into two groups. One of them is the relation of which lasts no more than one year, while the second group demonstrated a much longer lasting effect on EPRA index. The first group consists of ECB Assets that have a positive effect on the EPRA index in 3 quarters, while consumers’ and producers’ prices, adjusted Germany 10-year bond yields and total industry performance have negative impact on EPRA index growth in the 2–3 quarters. The second group negatively affects EPRA index in 2–4 years’ time period and consists of total construction, gross fixed capital formation and real Euro effective exchange rate. The real GDP stands out among all variables with both short- and longer-term negative impact.

Looking for the relationships that prevail in their influence on EPRA index fluctuations, we further perform the linear dynamic regression analysis for all lags of the variables (presented in Table 1) against the EPRA index under the specification as follows:

(1)

(1)

where: L – a lag operator of a variable k; k – a number of variables; n – a number of specific (selected) lags; i – a selected lag of a variable; t – a number of time periods.

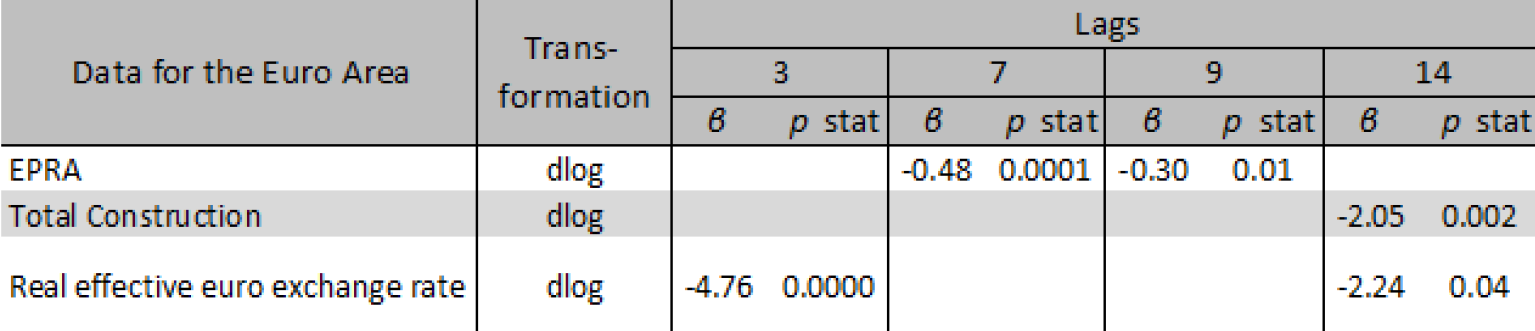

In our next step, from the list of variables identified in Table 1, we eliminate all variables with the most significant variance inflation factor (more than 5). Тhereafter, we drop out all the variables whose coefficients do not demonstrate tolerable statistical significance (p>0,10). The remaining variables are presented in Tables 2 and 3. In time horizons before and after the fourth quarter of 2015, the obtained results differed significantly in terms of identified statistically significant remaining variables. Therefore, in order to identify possible reasons of such division in the outcome, we concentrate our further attention on a more thorough analysis of the dynamics of these remaining variables.

Our dynamic regression analysis tested negatively against autocorrelation (Breusch-Godfrey Serial Correlation LM tests: p>0.10) and heteroskedasticity (White and ARCH tests: p>0.10).

Empirical Results and Discussion

Our findings suggest that macroeconomic variables that drive the EPRA index and mostly prevail in terms on influencing it are the construction volume, producers’ price inflation, ECB reserve.

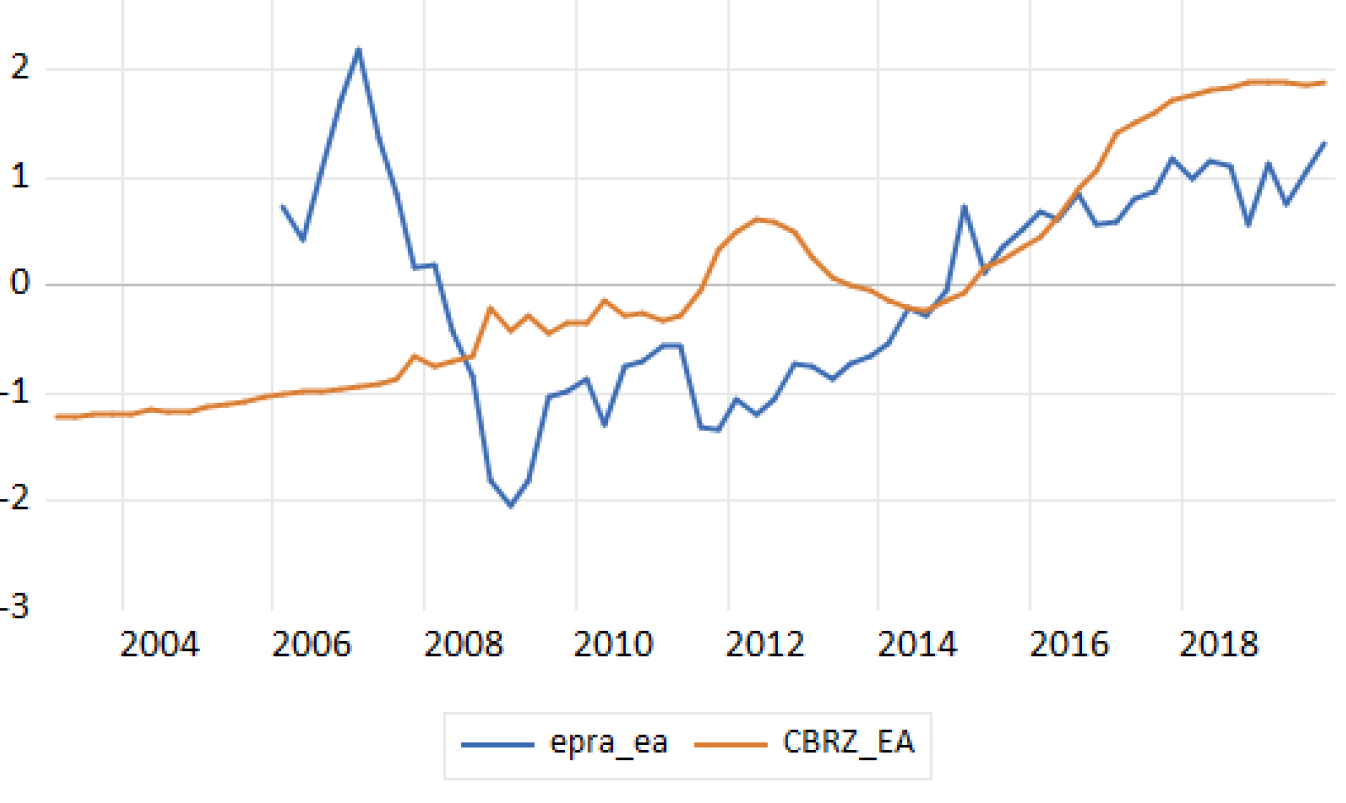

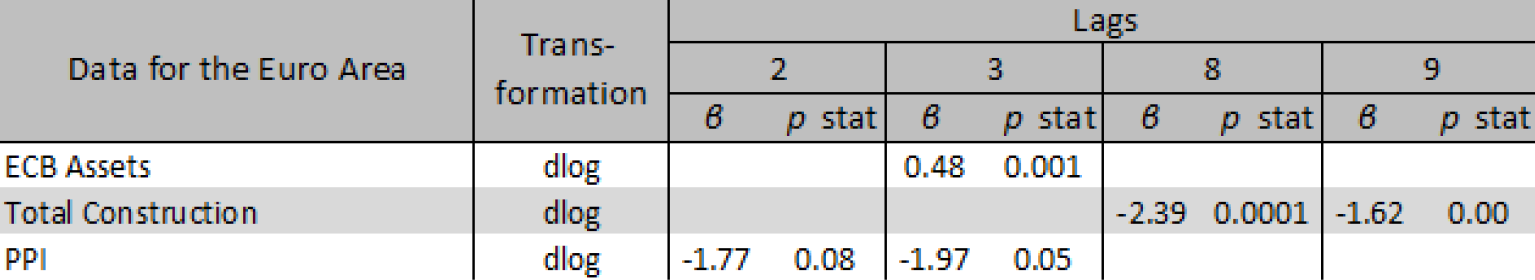

The construction volume is the main variable correlated with the EPRA index negatively. Though it takes more than two years for EPRA index to react to the fluctuations thereof, the statistical relationship proves to be exceptionally strong. Results are reported in Table 2, Table 3 and Figure 3.

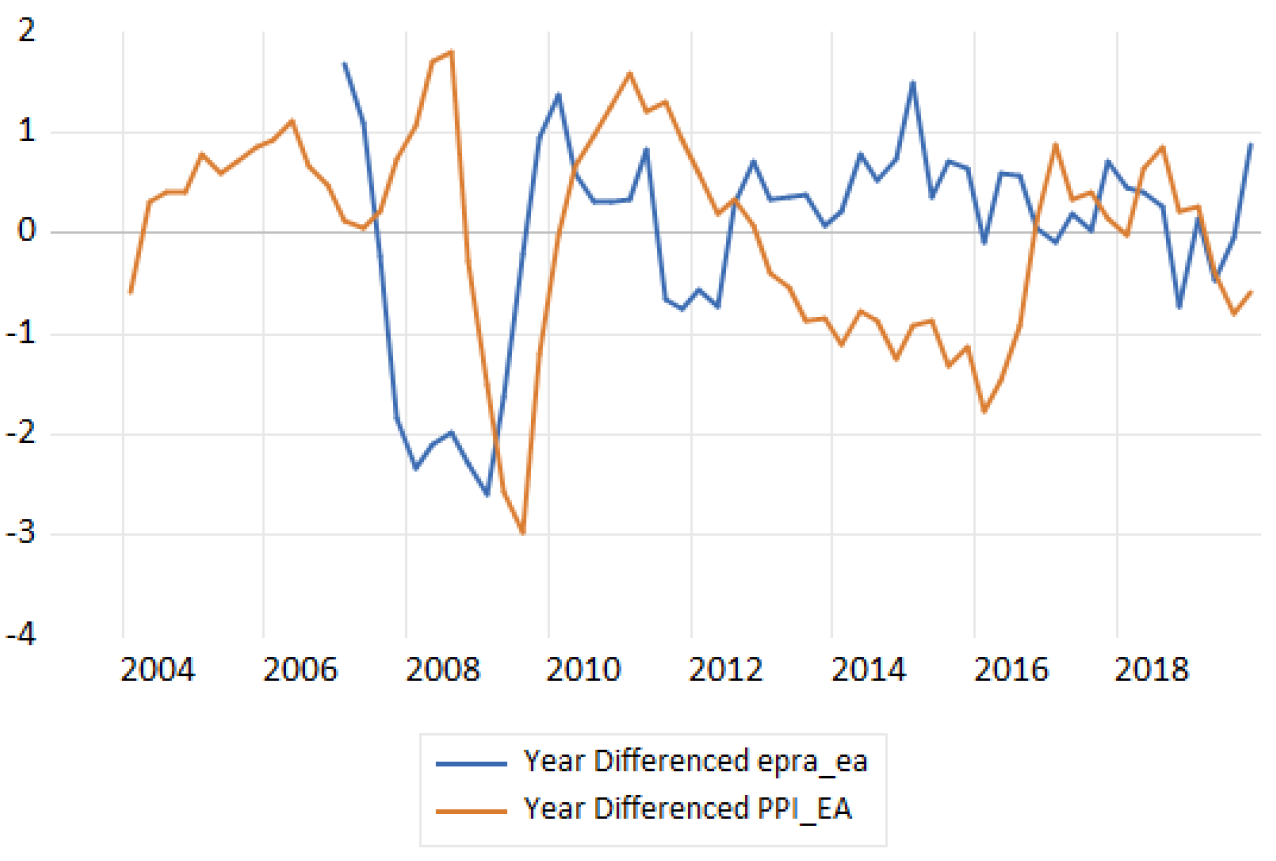

Table 2. The results of the linear dynamic regression for the time window up to the second quarter of 20192

This evidence of the highly significant impact of the construction sector on the European-listed real estate market points out how heavily the real estate market relies on the supply side. Therefore, the volumes of the construction sector and its relationship with the European listed real estate market should be examined further and thus should be included in the models that explain and forecast EPRA index. Apparently, there is a relative scarcity of research of this relationship at the moment.

Figure 3. The dynamics of EPRA index and the construction in the Euro Area (normalized scale)

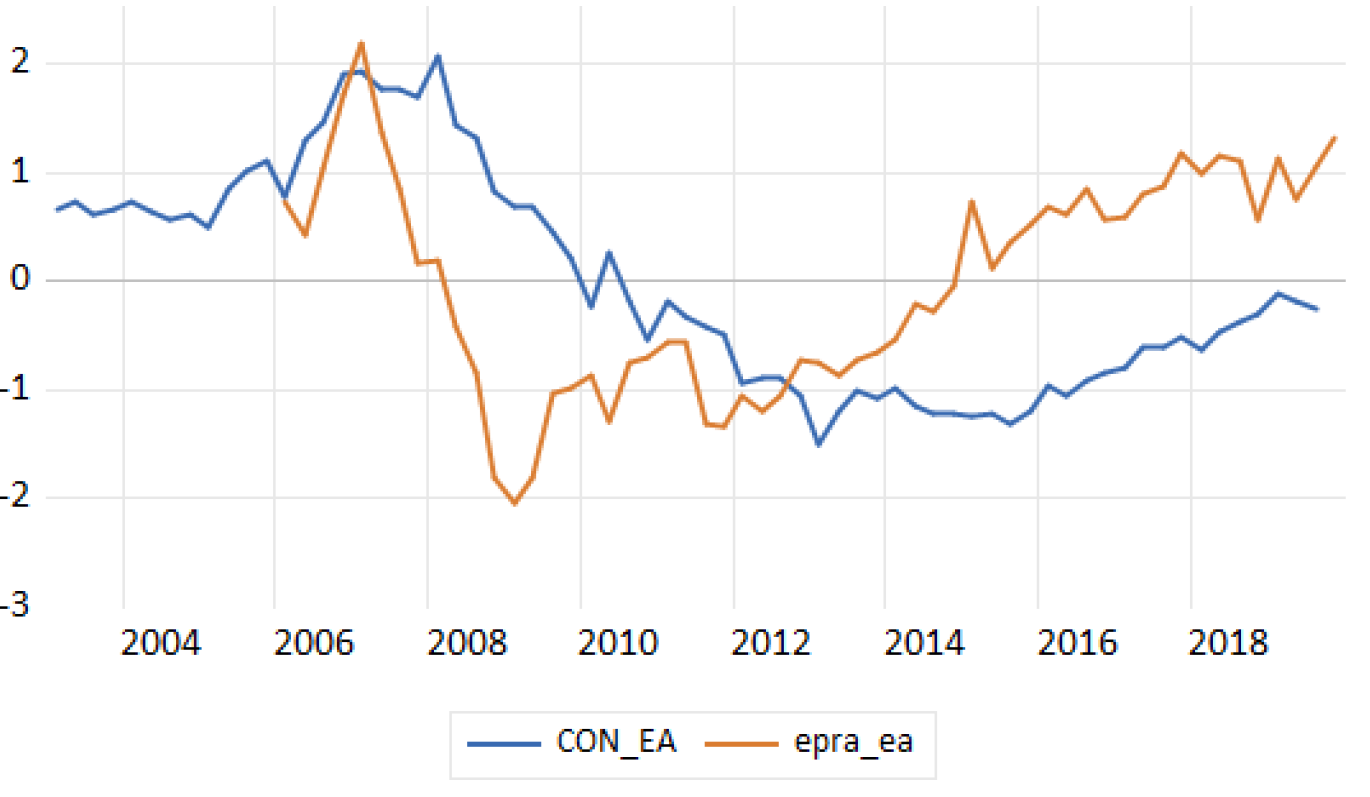

Producers’ price inflation is another prevailing macroeconomic variable. The results of a dynamic regression analysis suggest that its relationship with the EPRA index proves to be negative too.

As shown in Figure 4, it supported the supply side of the real estate market because of the continually reducing prices from around 2012 close to 2017, when they began to rise again. The deflation of producers’ prices that occurred in this period together with the rising EPRA Index could result in higher profits of construction firms.

Reserves of ECB. The results reveal a powerful and positive influence of monetary policy expansion, which can be clearly seen from the constant and enormous growth of central bank reserves that has been taking place for the past decade (Table 2 and Figure 5).

The positive and solid correlation between the EPRA index and ECB reserves verifies that the expansionary monetary policy of the ECB apparently carries out the demand side of the European listed real estate market. The empirical results consistently demonstrate that expansionary monetary policy tends to accelerate the growth not only of the housing market (Xiaoqing and Chen, 2011), but also the growth of the listed real estate market.

Figure 4. The dynamics of the EPRA index and the producers’ price index in the Euro Area (normalized scale)

However, the opposite policy trends and effects should also be kept in mind. The restrictive or contractionary monetary policy affects the real estate market exactly in the opposite direction; therefore, it might result in the contraction of the listed real estate market.

Similar results suggest such studies as, e.g., Hayo and Uhlenbrock (2000), Vargas-Silva (2008), Wadud et al. (2012), pointing out that the contractionary monetary policy may result in the decreasing of real estate prices and it might exert a significant negative effect on the market output. Although it is suggested that the housing market, and the residential investment especially, respond negatively to the contractionary monetary measures, we conclude that monetary measures are the key variable on the change of listed real estate prices. However, the magnitude of the impact depends on the extent and horizon of measures applied by the central bank.

Figure 5. The dynamics of EPRA index and the reserves of ECB (normalized scale)

In our study, we observe that in 2016 the real estate market of the Euro Area experienced some changes; therefore, we further test for the dynamic regression results by narrowing our data window up to the fourth quarter of 2015. The results reveal the prevailing negative effect of the real effective exchange rate of the Euro (Table 3).

Table 3. The results of the linear dynamic regression for the time window up to the fourth quarter of 20153

As Rey (2016) argues, US monetary policy shocks are transmitted internationally and affect financial conditions of even inflation-targeting countries that enjoy flexible exchange rates, i.e., the flexible exchange rates that do not guarantee full monetary autonomy. Therefore, we suspect it due to the US monetary policy shocks that affected the European listed real estate market through the real effective euro exchange rate. Enjoying the highest correlation with the real effective dollar exchange rate, the later one could serve as a channel for the shocks transmission of US expansionary monetary policy that took place much earlier than in the Euro area.

Conclusions

In recent years, literature has been flooded with the analysis of REITs performance. The majority of these studies examined how real estate markets were affected by some of such variables as productivity and economic growth, inflation, unemployment, firms’ financial performance, capital markets and interest rates. While many of these and other related macroeconomic variables are endogenous against each other, none of the studies has tested which of these variables are the most reliable and suitable for further analysis and forecasting purposes. Thus, this paper aimed to identify the macroeconomic variables with the most valid influence on the real estate market. To this purpose, we evaluated a broader range of possible macroeconomic factors against the European listed real estate market, including such variables as ECB assets; construction volumes; inflation; real interest rate; manufactured durable consumer goods; gross fixed capital formation; money M3; real effective exchange rate and GDP, etc.

Being focused on the European listed real estate market, our research reveals that it is strongly influenced by the dynamics of the construction sector, producers’ price level and the expansionary monetary policy of the ECB. In the recent decade, the later one resulted in enormously expanded assets; therefore, it has been supporting and still carries out the demand side of the European listed real estate market by influencing aggregate spending. Apparently, following expanding demand, the construction sector has been increasing in volumes and was additionally motivated by producers’ price deflation in the period from around 2012 and close to 2017. Concluded findings also suggest some worries of possible negative impact of the contractionary monetary policy on the European listed real estate market if it took place in the Euro area.

Also, our findings suggest that up to 2015, the European listed real estate market experienced a very strong correlation with the real effective euro exchange rate, proposing the idea that some foreign influence occurred on the European-listed real estate market. Our primary suspicion here is the shocks of US expansionary monetary policy that had been initiated much earlier than the one in the Euro Area; though further research is needed for conclusive evidence.

References

Aggarwal, R., Erel, I., Stulz, R., & Williamson, R. (2009). Differences in governance practices between U.S. and foreign firms: Measurements, causes and consequences, Review of Financial Studies, 22(8), 3131– 3169, https://doi.org/10.1093/rfs/hhn107.

Akinsomi O., Mkhabela N & Taderera M. (2018). The role of macro-economic indicators in explaining direct commercial real estate returns: evidence from South Africa, Journal of Property Research, 35:1, 28-52, https://doi.org/10.1080/09599916.2017.1402071.

Asteriou, D., and Begiazi, K. (2013). Modeling of daily REIT returns and volatility, Journal of property Investment and Finance, 31(6), 589-601, https://doi.org/10.1108/jpif-06-2013-0035.

Baum, A. (2009). Commercial real estate investment (2nd ed.). London: Routledge.

Bhuyan, R., Kuhle, J., Al-Deehani, M. T., and Mahmood, M. (2015). Portfolio diversification benefits using real estate investment trusts: An experiment with US common stocks, equity real estate investment trusts, and mortgage real estate investment trusts, International Journal of Economics and Financial, 5(4), 922-928, https://doi.org/10.1515/9783110402780.33.

Chin, W., Dent, P., Roberts, C., et al. (2006). An explanatory analysis of barriers to investment and market maturity in Southeast Asian cities, Journal of Real Estate Portfolio Management, 12(1), 49–57.

Connor, P Liang, Y. (2000). Four Forces Shaping the Commercial Real Estate Industry. Pramerica Financial Research, November.

Crowe, S., and Krisbergh, D. (2010). Listed property performance as a predictor of direct real estate performance. Cohen and Steers Capital Management Incorporated, 1-21.

Crowe, C., & Dell’Ariccia, G. (2012). Policies for macrofinancial stability: Managing real estate booms and busts. Washington, DC: International Monetary Fund.

De Wit, I., & Van Dijk, R. (2003). The global determinants of direct office real estate returns. Journal of Real Estate Finance and Economics, 26(1), 24–45, https://doi.org/10.1023/a:1021518130915.

DiPasquale, D., & Wheaton, W. C. (1992). The markets for real estate and space: a conceptual framework, Journal of the American Real Estate and Urban Economics Association, 20(1), 181–197, https://doi.org/10.1111/1540-6229.00579.

Doidge, C., Karolyi, G. A., & Stulz, R. M. (2007). Why do countries matter so much for corporate governance? Journal of Financial Economics, 86(1), 1–39, https://doi.org/10.3386/w10726.

Edelstein R, Qian W, Tsand D. (2011). Institutional Factors and International Real Estate Returns. Journal of Real Estate Finance and Economics, 43, 139–151, https://doi.org/10.1007/s11146-010-9245-4.

Eichholtz, P.M.A. (1996). Does International Diversification Work Better for Real Estate than for Stocks and Bonds. Financial Analysts Journal, January-February, 56-62.

EPRA (2016). Global REIT Survey. European Public Real Estate Association. Fama, E. F. (1981). Stock returns, real activity, inflation, and money, The American Economic Review 71(4): 45-565.

Ewing, B. T., Payne, J. E. (2005). The Response of Real Estate Investment Trust Returns to Macroeconomic Shocks. Journal of Business Research, 58,293-300, https://doi.org/10.1016/s0148-2963(03)00147-4.

FRED Economic data. (2020). Retrieved from: https://fred.stlouisfed.org/.

Fulghieri, P., Suominen, M. (2006). Corporate governance, finance and the real sector. Working Paper: University of North Carolina at Chapel Hill.

Gertler, M., Karadi, P. (2015). Monetary policy surprises, credit costs, and economic activity. American Economic Journal: Macroeconomics, 7(1), 44-76, https://doi.org/10.1257/mac.20130329.

Hayo, B., Uhlenbrock, B. (2000). Industry effects of monetary policy in Germany. In Regional aspects of monetary policy in Europe (pp. 127-158). Springer, Boston, MA.

Hoesli, M., J. Lekander, and W. Witiewicz (2004). International Evidence on Real Estate as Portfolio Diversifier. Journal of Real Estate Research, 26, 161-206, https://doi.org/10.2139/ssrn.410741.

Hoskin, N., Higgins, D., Cardew, R., et al. (2004). Macroeconomic variables and real estate returns: an international comparison, The Appraisal Journal, 122, 163–170.

Kohlert, D. (2010). The determinants of regional real estate returns in the United Kingdom: A vector error correction approach. Journal of Property Research, 27(1), 87–117, https://doi.org/10.1080/09599916.2010.500816.

Investing.com. (2020). FTSE EPRA Nareit Developed Europe Index. Retrieved from: https://www.investing.com/indices/ftse-epra-nareit-developed-europe-historical-data.

Lieser K. and Groh P. G. (2014). The Determinants of international commercial real estate investment, Journal of real estate finance and economy, 48: 611-659, https://doi.org/10.1007/s11146-012-9401-0.

Loo, W. K., Annuar, M. A., and Ramakrishan, S. (2016). Integration between Asian REIT markets and macroeconomic variables. Journal of property Investment and Finance, 34(1), 68-82, https://doi.org/10.1108/jpif-12-2014-0070.

Macgregor, B. D., & Schwann, G. M. (2003). Common features in UK commercial real estate returns. Journal of Property Research, 20(1), 23–48, https://doi.org/10.1080/09599910210155518.

Olanrele, O. O., Said, R., and Daud, N. M. (2015). Comparison of REIT dividend performance in Nigeria and Malaysia. African Journal of Business Management 9(16), 608-614

Oreagba, F. (2010). Position paper on implementation of REIT in Nigeria (N- REIT): A seminar on Real Estate Investment Trust (REIT): Nigerian Stock Exchange.

Park, Y. W., & Bang, D. W. (2012). Direct commercial real estate as an inflation hedge: Korean evidence. Journal of Real Estate Portfolio Management, 18(2), 187–203.

Petris, G., Petrone, S., & Campagnoli, P. (2009). Dynamic linear models. In Dynamic Linear Models with R (pp. 31-84). Springer, New York, NY.

Pham A. K. (2013). An empirical analysis of real estate investment trust in Asia: Structure, performance and strategic investment implication. Published Ph. D. Thesis, University of Western Sydney (March)

Rey, H. (2016). International channels of transmission of monetary policy and the Mundellian trilemma. IMF Economic Review, 64(1), 6-35, https://doi.org/10.1057/imfer.2016.4.

Sebastian S., A. Schätz (2009). Real Estate Equities – Real Estate or Equities? European Public Real Estate Association Research, International Real Estate Business School, December 2009

Stevenson, S. (2000). International Real Estate Diversification: Empirical Tests using Hedged Indices. Journal of Real Estate Research, 2000, 19, 119-49.

Stevenson S. (2016). Macroeconomic and financial determinants of co-movement across global real estate security market Jоurnal of Real Estate Research, Vol. 38, No.4, 595-623

Van Doorn, L. (2003). Investing in Europe: The way to diversify. In IPD Compendium of Real Estate Papers, paper presented at IPD European Property Strategies Conference, Wiesbaden.

Vargas-Silva, C. (2008). Monetary policy and the US housing market: A VAR analysis imposing sign restrictions, Journal of Macroeconomics, 30(3), 977-990, https://doi.org/10.1016/j.jmacro.2007.07.004.

Wadud, I. M., Bashar, O. H., Ahmed, H. J. A. (2012). Monetary policy and the housing market in Australia, Journal of Policy Modeling, 34(6), 849-863, https://doi.org/10.1016/j.jpolmod.2012.06.002.

Xiaoqing, X., Chen, T (2011). The effect of monetary policy on real estate price growth in China, Pacific-Basin Finance Journal, 20 (1), DOI: 10.1016/j.pacfin.2011.08.001.

1 The FTSE EPRA Nareit Developed Europe Index is a subset of the FTSE EPRA Nareit Developed Index and is designed to track and represent the performance of listed real estate companies and REITS. By making the index constituents free-float adjusted, liquidity, size and revenue screened, the series is suitable for use as the basis for investment products, such as derivatives and Exchange Traded Funds (ETFs).

2 R2 – 0,50; F-statistic – 9,65; Durbin-Watson stat. – 2,00.

3 R2 – 0,68; F-statistic – 13,98; Durbin-Watson stat. – 1,70.