Ekonomika ISSN 1392-1258 eISSN 2424-6166

2020, vol. 99(2), pp. 76–91 DOI: https://doi.org/10.15388/Ekon.2020.2.5

Impact of Environmental Information Disclosure on Cost of Equity and Financial Performance in an Emerging Market: Evidence from Turkey

Oguz Yusuf Atasel

Faculty of Economics and Administrative Sciences,

Karadeniz Technical University, Turkey

E-mail: oguzatasel@ktu.edu.tr; oguzatasel@hotmail.com

ORCID: 0000-0003-1654-9850

Yusuf Guneysu

Faculty of Economics and Administrative Sciences,

Karadeniz Technical University, Turkey

E-mail: yusufguneysu@ktu.edu.tr; yusuf.guneysu@hotmail.com

ORCID: 0000-0002-6809-1995

Huseyin Unal

Faculty of Economics and Administrative Sciences,

Karadeniz Technical University, Turkey,

E-mail: huseyin.unal@ktu.edu.tr; huseyinunal02@gmail.com

ORCID: 0000-0001-6323-1322

Abstract. Nowadays, firms are evaluated not only based on their financial reports but also on their corporate social responsibility and environmental disclosures. These disclosures are generally included in corporate social responsibility, environmental, and sustainability reports. Firms provide transparent and accountable information to shareholders and stakeholders through these reports. Therefore, information disclosures can be effective in enhancing the corporate image of companies and achieving their financial goals (reducing the cost of equity, increasing financial performance, and so on). In this context, the purpose of this study is to explore the impact of information disclosure, including environmental disclosures, within the context of sustainability on the cost of equity (COE). At the same time, the study examines the effect of information disclosure on financial performance in terms of firm value and profitability. In doing so, the study employs BIST100 data of non-financial firms from 2010 to 2019, and uses panel regression models for Turkey. As a result, it was found that information disclosure negatively impacts the COE while positively affecting firm value and profitability.

Keywords. environmental information disclosure, sustainability report, cost of equity, firm value, firm profitability.

Received: 01/09/2020. Revised: 30/10/2020. Accepted: 17/11/2020

Copyright © 2020 Oguz Yusuf Atasel, Yusuf Guneysu, Huseyin Unal. Published by Vilnius University Press

This is an Open Access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

Introduction

The increase in environmental awareness, beginning from the mid-1990s and particularly following the Kyoto Protocol adopted in 1997, has pushed firms to disclose non-financial information regarding environmental protection and management while giving rise to environmental reporting (Dejean and Martinez, 2009; Dhaliwal et al., 2014; Robaina et al., 2019). In this regard, it is indicated that environmental information disclosure (EID) and corporate social responsibility (CSR) disclosure would decrease information asymmetry and, therefore, the COE (Dhaliwal et al., 2011). In other words, the surge in EID would pave the way for a reduction in information asymmetry between managers and investors; therefore, it would contribute to a reduction in the COE (Lopes and Alencar, 2010). This fundamentally aims to direct relevant individuals to such statements by using voluntary disclosure (environmental, social, and so on) to decrease the conflict of interest between shareholders and managers. That is, from the manager’s viewpoint, voluntary disclosure (environmental, sustainability, and so on) is a signal that diverts the attention of shareholders from issues for which they can punish managers. Such actions of managers can be explained with the agency theory and signaling theory (Sun et al., 2010). However, it would not be accurate to handle EID based on these two theories and solely on the perspectives of managers and shareholders.

Regarding the stakeholder theory, CSR in certain studies and is emphasized as an indispensable and integral component for achieving a healthy dialog between a firm and its stakeholders. Within this context, an assessment of the subject matter from the perspective of the legitimacy theory leads to the statement that, in line with the legitimacy of firm activities is concerned, training and information (financial, social, environmental, and so on) provided in line with changing perceptions and expectations must be shared with stakeholders (Gray et al., 1995; Michelon and Parbonetti, 2012). Likewise, Ullmann (1985) demonstrated that CSR activities help with gaining support from and winning the trust of various groups of stakeholders, positively impact image among stakeholders, and provide economic benefits from a strategic point of view. Given these findings, it is possible to claim that Ullmann (1985) pioneered the legitimacy theory (Sun et al., 2010).

Various studies in the academic literature take definitions of information disclosure based on different concepts, such as CSR, environment, and sustainability, as the starting point. Essentially, as stated by Gray (2005), environmental disclosure is the result of CSR activities. This study considers EIDs. EID criteria for firms are based on the environmental performance principles included in the GRI G4 Sustainability Reporting Guidelines (from GRI 301 to GRI 308); certain analyses were made for compliance with relevant documents and systems concerning the environment published by the ISO. A multitude of studies (Cormier and Magnan, 2007; Dejean and Martinez, 2009; Clarkson, 2013; Plumlee et al., 2015; Fonseka et al., 2019) was employed while formulating the criteria.

Environmental disclosures in Turkey are based on mandatory disclosure and voluntary disclosure. Although the principle of mandatory varies according to the sector in which the firm operates, it is based on the regulations within the Ministry of Environment and Urbanization (e.g. the Monitoring, Reporting and Verification of Greenhouse Gas Emissions are a legal obligation for the manufacturing sector). On the other hand, the voluntary principle is generally carried out to provide accountable and transparent information to the stakeholders of the firm (e.g. Firms prepare sustainability reports within the framework of the GRI Sustainability Reporting Guidelines, Carbon Disclosure Project Report, and so on.).

More information disclosure facilitates firms’ access to finance from capital markets in two ways: i) Through contributing to reduced agency costs from more effective stakeholder engagement, thereby increasing the firm’s revenue or profit potential; and ii) Decreasing information asymmetry between firm and investors by increasing transparency levels (Cheng et al., 2014). In other words, more information disclosure contributes to the increase in the liquidity of firms’ stocks, which in turn reduces transaction and cost of equity and improves financial performance (Wang et al., 2020). Therefore, information disclosures are important in terms of the firm’s cost of equity and financial performance. Accordingly, the present study researches the effect of information disclosure on the COE and financial performance in terms of firm value and profitability. For the aims of this study, non-financial firms in the BIST100 index between 2010 and 2019 were considered.

This study is expected to contribute to the current literature in three different ways: i) A review of the literature on the subject matter reveals that studies conducted to explore the correlation between EID and the COE concern mainly firms in developed markets (for instance, Botosan and Plumlee (2002), Dhaliwal et al. (2011), and Plumlee et al. (2015) studied the US; Hail (2002) examined Switzerland; Kristandl and Bontis (2007) dealt with Austria, Germany, Sweden, and Denmark; Dejean and Martinez (2009) examined France; Reverte (2012) studied Spain), while studies on emerging markets are limited in number (for example, Embong et al. (2012) examined Malaysia; Lopes and Alencar (2010) studied Brazil; Fonseka et al. (2019) and Yao and Liang (2019) dealt with China). In this context, the present study concerns the question of whether information disclosure reduces the COE for firms within emerging markets in addition to those within developed markets. ii) The research found that even though many studies have been conducted on the effect of information disclosure on the COE, the number of studies handling the effect of information disclosure on financial performance is limited (Cormier and Magnan, 2007; Gregory et al., 2014; Plumlee et al., 2015; Atan et al., 2018). Therefore, this study also investigates the impact of EID on both the COE and the firms’ financial performance, including firm value and profitability. iii) The study presents findings for firms in Turkey concerning the correlation between EID and the COE and financial performance for the first time.

The remaining chapters of this study are as follows: The second chapter includes the literature review and hypothesis development for the study. The third chapter explains the data set and methodology, while the fourth chapter presents the findings of the study. The final chapter contains the conclusion and an assessment of the research.

Related Literature and Hypothesis Development

The negative correlation between disclosure and the COE can be explained in two ways. First, greater levels of disclosure induce a surge in stock market liquidity, consequently reducing transaction costs or increasing the demand for the securities of a firm and therefore lowering the COE. Second, more disclosure reduces the non-diversifiable estimation risk (Botosan, 1997). Similarly, Diamond and Verrecchia (1991) revealed in their study that information disclosed to the public to decrease information asymmetry results in an increase in the liquidity of the stocks of the firm in question and, therefore, might reduce the cost of capital through this surge in the demand for the stocks. Within this framework, even though most studies in the previous literature found the correlation between information disclosure and the COE to be negative (Botosan and Plumlee, 2002; Hail, 2002; Chen et al., 2003; Francis et al., 2005; Lopes and Alencar, 2010; Dhaliwal et al., 2011; Reverte, 2012; Fonseka et al., 2019), some (Richardson and Welker, 2001; Kristandl and Bontis, 2007; Atan et al., 2018) claim the correlation to be positive.

Various studies exist in the literature regarding the relationship between information disclosure, including CSR disclosure and EID, and the COE. Richardson and Welker (2001) tested the correlation between the financial and social disclosure and the COE of 324 firms operating in Canada for the period between 1990 and 1992. As a result, the researchers found that, regarding the COE, a negative correlation exists with financial disclosure, and a positive correlation exists between social disclosures. Botosan and Plumlee (2002) studied the relationship between the COE and types of information disclosure for firms registered in the stock market in the US for the period between 1986 and 1996 using the method of least squares. Their study demonstrated that while the COE decreases through annual report disclosure, information disclosed in shorter intervals (e.g., quarterly reports) is positively correlated with the COE. Furthermore, they found no correlation between investor relations and the COE.

Hail (2002) examined the impact of the voluntary information disclosure policies on the COE for 73 firms operating in Switzerland using reports for 1997 through the method of least squares and revealed the correlation between information disclosure and the COE to be negative. A different study conducted in Europe by Kristandl and Bontis (2007) assessed the correlation between information disclosure and the COE for 95 firms registered in the stock markets of Austria, Germany, Sweden, and Denmark based on the data from 2005 through multiple regression analysis. They found that the COE is negatively correlated with future-oriented information disclosure, while it is positively correlated with historical information disclosure.

Chen et al. (2003) studied the relationship between the information disclosure and other corporate mechanisms of 545 firms in the nine emerging economies in Asia for 2000 and 2001 and the COE. The analysis conducted via the method of least squares revealed a negative correlation between information disclosure and corporate management and the COE. Similarly, Francis et al. (2005) tested the impact of the voluntary disclosures of 484 firms from 34 countries for the period of 1991–1993 on the need for external financing and the cost of capital (liabilities and equities). The results obtained from the method of least squares revealed that voluntary disclosure increases as the need for external financing increases, resulting in a decrease in the cost of capital.

Lopes and Alencar (2010) studied the relationship between disclosure and the COE using the data for publicly traded firms in Brazil from 1998, 2000, 2002, 2004, and 2005 using the approach of panel data analysis. The study demonstrated that the increase in disclosure relates to lower costs of equity, particularly for firms that were less in the scope of analysts. Embong et al. (2012) aim to examine the role of firm size in the relationship between information disclosure and the COE using the data from 460 publicly traded firms in Malaysia between 2004 and 2006. The results of their study revealed that a negative correlation exists between disclosure and the COE for larger firms, whereas the correlation is not significant for smaller ones.

Some studies in the literature examine the relationship between EID, one type of information disclosure, and the COE. Dejean and Martinez (2009) employed the method of regression analysis to assess 120 publicly traded French firms in 2006 and found that the number of financial analysts, firm size, and leverage is the determinants of environmental disclosure. However, they also found that EID does not impact the COE. On the other hand, Fonseka et al. (2019) assessed the correlation in question for energy firms operating in China during the period between 2008 and 2014, considering the impact of energy types. The results of the regression analysis revealed that EID negatively affects the COE. Furthermore, they found that some energy types (hydroelectric, solar, and wind) negatively impact the COE, while others (gas, fossil-fired thermal energy production, and oil) have a positive effect. Similarly, Yao and Liang (2019) tested the relationship discussed throughout this study based on the data from the period between 2004 and 2011 for publicly traded firms in China, taking the role of analyst following in considering the use of the method of least squares. The study revealed that analyst following might increase EID and reduce the COE.

In addition to environmental disclosure, various other studies examine the impact of CSR disclosure on the COE. In this context, a study by Reverte (2012) tested the correlation in question for 26 publicly traded firms in Spain between 2003 and 2008 via regression analysis. The study found a negative correlation between the quality of CSR reporting and the COE while claiming the correlation to be more evident for firms operating in more environmentally conscious sectors. Dhaliwal et al. (2011) researched the impact of CSR disclosure on the COE for 213 firms between 1993 and 2007 using the method of least squares, discovering that CSR disclosure reduces the COE. Similarly, Dhaliwal et al. (2014) tested this correlation using data for selected firms from 31 countries between 1995 and 2007. They reached the conclusion that information about social issues is negatively correlated with the COE and that this correlation is stronger in stakeholder-oriented countries. Another study by Wang et al. (2013), focusing on different countries, tested the subject matter based on the data for firms from 35 countries in five continents between 2002 and 2010. The results of the multiple regression analysis reveal that a negative correlation exists between the COE and the CSR performance in North America and Europe, while the correlation is positive in Asia.

Moreover, some studies in the literature evaluate the correlation between disclosure and the COE based on firm value and profitability. Cormier and Magnan (2007) studied the effect of environmental reporting on the market value of firm returns and, indirectly, the COE. The results of the least-squares analysis based on the data from publicly traded firms in Canada, Germany, and France between 1992 and 1998 indicate that while EID affects the market value of German firms, it does not significantly impact the market values of French and Canadian firms. In line with these findings, the authors stated that environmental reporting reduces the COE for German firms, whereas it does not affect French and Canadian firms. A similar study by Plumlee et al. (2015) researched the relationship between the quality of environmental disclosure of 474 publicly traded American firms between 2000 and 2005 and their firm value components (expected future cash flows and the COE). The results of the regression analysis indicated that disclosure quality is significantly correlated with firm value. Gregory et al. (2014) aimed to determine the source of firm value by studying the impact of CSR on firm value, profitability, growth, and the COE. In line with this research objective, at the end of the regression analysis that was conducted with the data for firms operating in the US for the period between 1992 and 2009, they found that the positive valuation effect of CSR stems from higher long-term growth expectations and lower costs of equity. Atan et al. (2018) examined the impact of environmental, social, and corporate governance (ESG) factors on the performance of 54 publicly held firms in Malaysia in terms of profitability, firm value, and the cost of capital. The results of the panel data analysis reveal that the ESG factors do not affect firm profitability and firm value, while the integrated factors positively and significantly impact the cost of capital. Finally, Wang et al. (2020) investigated the impact of environmental information disclosure on the financial performance of 289 Chinese firms for the period between 2013 and 2017 using the EKK method and concluded that the disclosure of environmental information positively affected financial performance.

The following hypotheses are proposed in light of studies within the literature:

H1: The level of information disclosure and the COE are negatively correlated.

This hypothesis is divided into two sub-hypotheses:

H1a: The level of EID and the COE are negatively correlated.

H1b: The publication of sustainability reports and the COE are negatively correlated.

H2: The level of Information disclosure and financial performance are positively correlated.

This hypothesis is divided into four sub-hypotheses:

H2a: The level of EID and firm profitability are positively correlated.

H2b: The level of EID and firm value are positively correlated.

H2c: The publication of sustainability reports and firm profitability are positively correlated.

H2d: The publication of sustainability reports and firm value are positively correlated.

Data and Methodology

The present study considers non-financial firms traded in the BIST100 index from 2010–20191 to examine the impact of information disclosure on the COE and financial performance. Thirty-nine non-financial firms, the data of which were fully accessible for the said period, were included in the study sample within this framework.

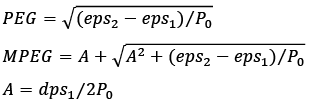

The study employs the PEG and MPEG models developed by Easton (2004) to measure the COE for firms. Therefore, the COE for each firm is calculated as follows:

where PEG and MPEG are COE, respectively; eps1 and eps2 are analysts forecast of next-year earnings per share of firm and two years ahead, respectively; dps1 is analyst-forecast of next-year dividend per share of firm; and P0 is the share price.

The principles of environmental performance included in the Global Reporting Initiative-GRI G4 Sustainability Reporting Guidelines (from GRI 301 to GRI 308) were used to measure the EID scores.2 Within this framework, a content analysis was conducted using the criteria presented in Table 1 regarding EID. Each EID takes a value 0 to 3 (0 = no information, 1 = general [qualitative] information, 2 = detailed [qualitative] information, and 3 = monetary or quantitative information in addition to others),3 and the final EID score (with a maximum value of 18) is calculated by adding the values for each of the contents.

In the literature on the determinants of COE generally firm characteristics such as profitability, size, leverage, growth, age, tangibility ratio, cash flow, independent directors, market-book value, internationalization and market risk are used as explanatory variables (Francis et al., 2005; Cormier and Magnan, 2007; Dejean & Martinez, 2009; Lopes & Alencar, 2010; Dhaliwal et al., 2011; Reverte, 2012; Gregory et al., 2013; Dhaliwal v., 2014; Plumlee et al., 2015; Fonseka et al., 2019; Yao & Liang, 2019). Therefore, it is understood that these variables have a significant effect on the COE. The information disclosures subject to the study are included in the models with these control variables.

Table 1. Components of EID

|

Components |

Categories Definitions |

Mapping to GRI |

|

I1 |

Pollution/Greenhouse Gas Emissions (GHG) |

GRI 305 |

|

I2 |

Recycling/Cycle Analysis of Products and Waste Management |

GRI 301 GRI 303 GRI 306 |

|

I3 |

Energy/Electricity Consumption and Renewable Energy |

GRI 301 GRI 302 |

|

I4 |

Natural Resources/Biodiversity and Conservation of Resources |

GRI 304 GRI 305 GRI 307 |

|

I5 |

Certification/Compliance with ISO Certificates |

- |

|

I6 |

Other Information Disclosures |

GRI 308 |

We include return on assets (ROA) in the model to control the impact of financial performance, and a negative relationship has been found between COE and ROA in prior studies (Francis et al., 2005; Fonseka et al., 2019). Therefore, the coefficient of the ROA variable is expected to be negative. We include firm size (SIZE) because firm size is inversely proportional to equity risk. Gregory et al. (2013) found a negative relationship between COE and SIZE. Therefore, the coefficient of the SIZE variable is predicted to be negative. Financial leverage (LEV) is included to control the risk of financial distress. A positive relationship was found between COE and LEV in prior studies (Dhaliwal et al., 2014; Fonseka et al., 2019). Thus, the coefficient of the LEV variable is expected to be positive. We include sales growth (GROWTH) to control growth opportunities. Because firms with more growth opportunities are more likely to provide information to access finance (Lopes & Alencar, 2010). Therefore, the coefficient of the GROWTH variable is expected to be negative. Market book value (MBV) and market risk (BETA) are included, and in the study of Reverte (2012), there is a positive correlation between COE and BETA, while MBV and COE are negatively related. Hence, the coefficient of the BETA variable is expected to be positive and the coefficient of the MBV variable to be negative. Firm age (AGE), tangibility ratio (TANGI) and number of independent directors (INDD) are included and Fonseka et al. (2019) revealed that the COE has a negative and positive association with AGE and TANGI, respectively. Therefore, it is expected that the coefficients of the AGE and the INDD variables are negative and the coefficient of the TANGI variable is positive. In addition, operating cash flow (OCF) and international diversification (INT) variables were included to control their possible effects on COE (Dejean & Martinez, 2009; Yao & Liang, 2019). Accordingly, it is expected that the coefficient of the OCF variable is positive and the INT variable is negative.

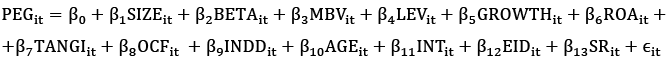

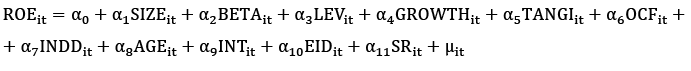

The present study considers said determinants; however, what separates this study from other studies in the literature is that in its initial stage, it considers environmental disclosure and the publication of sustainability reports together and includes them in the model and that, in the second stage; it examines the impact of information disclosure on financial performance (firm value and profitability). Within this context, it formulates the following panel regression models to test the H1 alternative hypothesis, which alleges the existence of a negative correlation between information disclosure and the COE, as was the case in other studies in the literature.

(1)

(1)

(2)

(2)

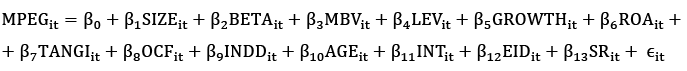

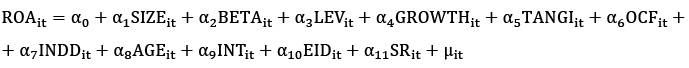

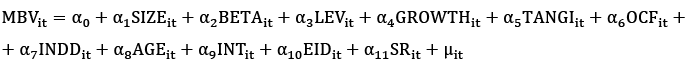

The second stage tests the H2 alternative hypothesis, which claims that a correlation exists between disclosure and financial performance, using the panel regression models below.

(3)

(3)

(4)

(4)

(5)

(5)

the symbols i and t indicate the unit and time dimensions of the data, respectively. Table 2 presents the descriptions and measurement of the variables used in these panel regression models.

As the period from 2010–2019 was considered in terms of the variables described in Table 2, for limiting the time dimension of the data, the static panel data method was employed for model estimation. The static panel data model is an analysis method in which neither the lagged of the values of the dependent variable nor the lagged values of the independent variables are included in the model as explanatory variables. Classic pooled least squares, fixed effects (FEs), and random effects (REs) estimators are used while estimating static panel models. If units do not have unique qualities, the classic pooled least square model is used. In the case of qualities unique to the unit and/or time, fixed or random effect models are preferred. Unit effects being correlated with explanatory variables causes the application of the fixed effects model to be more effective and valid, whereas the absence of such a correlation does the same for the random effects model (Baltagi et al., 2010).

Table 2. Summary Variables

|

Variables |

Definitions |

Measurement |

|

COEa |

Cost of equity |

PEG by using equation (1) |

|

MPEG by using equation (2) |

||

|

EIDb |

Environmental information disclosure |

Score of EID is calculated as sum of values for each component. Table 1 shows the components. |

|

SR |

Sustainability report |

It equals 1 if the firm publishes a standalone SR during the financial year, and 0 otherwise |

|

ROAa |

Return on asset |

Net income/total assets |

|

ROEa |

Return on equity |

Net income/total common equity |

|

MBVa |

Market book value |

Market value of equity/book value of equity |

|

BETAa |

Market risk |

It is calculated with 60 monthly returns |

|

SIZEa |

Firm size |

Natural logarithm of the total assets |

|

LEVa |

Leverage |

Total debt/total assets |

|

GROWTHa |

Sales growth |

(Salest—Salest-1)/Salest-1 |

|

TANGIa |

Tangibility ratio |

Tangible assets/total assets |

|

OCFa |

Operating cash flow |

Operating cash flow/total assets |

|

INDDb |

No. of independent directors |

Total independent member of the board of directors |

|

AGEb |

Firm age |

Financial data year—the date of incorporation |

|

INTa |

International diversification |

It takes the value of 1 if firm has foreign sales, and 0 otherwise |

a It was obtained from DataStream database.

b It was obtained from Annual Reports.

Findings

The present study analyzed the effect of information disclosure on the COE and financial performance of non-financial firms traded in the BIST100 index between 2010 and 2019. Initially, the presence of unit effects unique to the unit was detected by conducting the likelihood-ratio test (LR) for the estimated regression models. Afterward, the question of whether these effects are fixed or random was addressed through the Hausman test. The test results indicated that the suitable models for this context were fixed effects models. The fixed effects models selected for this study were then subjected to certain basic assumptions following their estimation. In this respect, the fixed effects models were found to have heteroscedasticity, autocorrelation, and cross-sectional dependence problems. The Driscoll-Kraay robust estimator, which rendered the parameter variances effective, was employed to resolve these problems.

The initial stage of the application involved the estimation of the impact of information disclosure, including environmental disclosure and publications of sustainability reports on the COE. Table 3 displays the results of this estimation. For the second stage, the impact of information disclosure on financial performance (firm value and profitability) was examined. Table 4 presents the outcomes of this examination.

Table 3. Panel Regression Estimation Results for the COE

|

Variable |

PEG |

MPEG |

||

|

Model 1a |

Model 1b |

Model 2a |

Model 2b |

|

|

C |

-0,2130 (0,118) |

-0,2316 (0,111) |

-0,2743** (0,029) |

-0,3014** (0,021) |

|

SIZE |

-0,0057 (0,567) |

-0,0040 (0,696) |

0,0046 (0,594) |

0,0068 (0,441) |

|

BETA |

0,0706*** (0,000) |

0,0652*** (0,000) |

0,0656*** (0,001) |

0,0596*** (0,001) |

|

MBV |

-0,0018 (0.249) |

-0,0018 (0,283) |

-0,0002 (0,909) |

-0,0001 (0,954) |

|

LEV |

0,1095*** (0,000) |

0,1036*** (0,000) |

0,0892*** (0,005) |

0,0821*** (0,010) |

|

GROWTH |

-0,0231 (0,425) |

-0,0202 (0,522) |

-0,0338 (0,250) |

-0,0306 (0,345) |

|

ROA |

-0,0126 (0,880) |

-0,0296 (0,738) |

-0,0410 (0,583) |

-0,0587 (0,453) |

|

TANGI |

-0,0021 (0,978) |

0,0019 (0,981) |

-0,0254 (0,708) |

-0,0202 (0,778) |

|

OCF |

-0,0107 (0,861) |

-0,0083 (0,892) |

-0,0669 (0,323) |

-0,0640 (0,329) |

|

INDD |

-0,0121*** (0,001) |

-0,0127*** (0,001) |

-0,0147*** (0,000) |

-0,0153*** (0,000) |

|

AGE |

0,0084*** (0,000) |

0,0075*** (0,006) |

0,0075*** (0,000) |

0,0066*** (0,004) |

|

INT |

0,0539** (0,014) |

0,0414** (0,029) |

0,0665*** (0,001) |

0,0519*** (0,001) |

|

EID |

-0,0043*** (0,010) |

- |

-0,0048*** (0,002) |

- |

|

SR |

- |

-0,0191*** (0,000) |

- |

-0,0233*** (0,000) |

|

No of Observations |

390 |

390 |

390 |

390 |

|

No of Groups |

39 |

39 |

39 |

39 |

|

R2 |

0,1257 |

0,1207 |

0,1352 |

0,1309 |

|

F-Statistic (Prob.) |

65,21*** (0,000) |

62,66*** (0,000) |

109,57*** (0,000) |

75,56*** (0,000) |

|

Hausman Test (Prob.) |

37,26*** (0.000) |

35,46*** (0,000) |

23,03** (0,027) |

735,08*** (0,000) |

Note: ***Significance p-value <1%; **significance p-value<5%; *significance p-value<10%.

The analysis of Table 3 reveals that the F-tests examining the joint significance of the models are statistically significant and that the fixed effects models are more effective and valid based on the results of the Hausman test. According to the estimated panel regression models, a positive and significant correlation exists between the COE of a firm and the market risk (BETA), firm leverage (LEV), firm age (AGE), and international diversification (INT). Therefore, a 1-unit increase in the variables of market risk (BETA) and firm leverage (LEV) would yield an increase of around 0.065 and 0.109 units in the COE, respectively. Furthermore, the COE of firms that create international diversification is approximately 0.054 units higher than firms that do not create international diversification. In contrast with these findings, it was revealed that a negative and significant correlation exists between the COE and EID, sustainability reports (SR), and the number of independent board members (INDD). Thus, an increase in information disclosure would decrease the COE for the firm in question. These findings confirm the H1 hypothesis in alignment with the existing literature. Conversely, the coefficients of firm size (SIZE), market book value (MBV), sales growth (GROWTH) and return on asset (ROA) variables are negative in line with the literature (Francis et al., 2005; Lopes & Alencar, 2010; Reverte, 2012; Gregory et al., 2013; Fonseka et al., 2019), but it was found to be statistically insignificant in the period examined. Differently from the literature (Fonseka et al., 2019 and Yao & Liang, 2019), the coefficients of the tangibility ratio (TANGI) and operating cash flow (OCF) variables were found to be negative, but these variables are statistically insignificant.

Table 4 indicates that F-tests are significant and that the fixed effects models are more effective and valid. The examination of the models reveals that firm size (SIZE) positively impacts the return on equity (ROE) and negatively and significantly impacts the firm value (MBV). It was seen to negatively affect profitability and positively and significantly affect firm value. The growth rate of sales (GROWTH) was found to positively and significantly impact profitability, yet it did not have a significant effect on firm value. A negative and significant correlation was detected between tangible assets (TANGI) and firm value. The correlation between operating cash flow (OCF) and profitability was positive, yet it was revealed to be negative and significant with firm value. The results indicate that market risk and firm age significantly affect the return on equity, while the negative impact of international diversification is of low significance. Information disclosure positively and significantly impacts the return on assets and firm value, whereas its positive effect on the return on equity is of low significance. The outcomes described above generally confirm the H2 hypothesis, which tests the positive correlation between information disclosure and financial performance. However, no a significant correlation between the publication of sustainability reports and the return on equity was found.

Table 4. Panel Regression Estimation Results for Financial Performance

|

Variable |

ROA |

ROE |

MBV |

|||

|

Model 3a |

Model 3b |

Model 4a |

Model 4b |

Model 5a |

Model 5b |

|

|

C |

0,0198 (0,834) |

0,0203 (0,812) |

0,2386 (0,515) |

0,1625 (0,650) |

20,1367*** (0,000) |

22,0296*** (0,000) |

|

SIZE |

0,0137 (0,101) |

0,0129 (0,121) |

0,0548** (0,027) |

0,0562** (0,019) |

-1,2292*** (0,000) |

-1,3220*** (0,000) |

|

BETA |

-0,0170* (0,051) |

-0,0123 (0,131) |

-0,0999*** (0,001) |

-0,0937*** (0,002) |

0,1565 (0,631) |

0,3385 (0,193) |

|

LEV |

-0,1009*** (0,000) |

-0,0986*** (0,000) |

-0,1849** (0,031) |

-0,1889** (0,027) |

2,7765*** (0,001) |

3,0380*** (0,000) |

|

GROWTH |

0,0383*** (0,001) |

0,0365*** (0,002) |

0,1742*** (0,000) |

0,1729*** (0,000) |

0,0640 (0,723) |

-0,0292 (0,907) |

|

TANGI |

-0,1348*** (0,001) |

-0,1395*** (0,001) |

-1,0223** (0,050) |

-1,0238** (0,050) |

-2,7358* (0,092) |

-3,0329* (0,083) |

|

OCF |

0,1302*** (0,002) |

0,1302*** (0,001) |

0,4434* (0,051) |

0,4446** (0,047) |

-3,0260** (0,029) |

-3,0545* (0,057) |

|

INDD |

-0,0009 (0,678) |

-0,0003 (0,900) |

0,0070 (0,363) |

0,0083 (0,287) |

0,2502** (0,018) |

0,2623** (0,013) |

|

AGE |

-0,0020 (0,139) |

-0,0010 (0,417) |

-0,0106*** (0,008) |

-0,0083** (0,040) |

-0,0291 (0,635) |

-0,0172 (0,759) |

|

INT |

-0,0320 (0,343) |

-0,0237 (0,500) |

-0,1147* (0,063) |

-0,1152* (0,055) |

0,3353 (0,493) |

0,9380** (0,026) |

|

EID |

0,0036*** (0,001) |

- |

0,0037* (0,099) |

- |

0,1646*** (0,000) |

- |

|

SR |

- |

0,0104** (0,043) |

- |

-0,0186 (0,301) |

- |

1,1864*** (0,000) |

|

No of Observations |

390 |

390 |

390 |

390 |

390 |

390 |

|

No of Groups |

39 |

39 |

39 |

39 |

39 |

39 |

|

R2 |

0,1969 |

0,1822 |

0,1566 |

0,1564 |

0,1321 |

0,1520 |

|

F-Statistic (Prob.) |

38,62*** (0,000) |

226,95*** (0,000) |

29,66*** (0,000) |

145,10*** (0,000) |

237,79*** (0,000) |

211,50*** (0,000) |

|

Hausman Test (Prob.) |

57,96*** (0,000) |

91,49*** (0,000) |

28,80*** (0,001) |

25,81*** (0,004) |

272,12*** (0,000) |

94,18*** (0,000) |

Note: ***Significance p-value <1%; **significance p-value<5%; *significance p-value<10%.

Conclusion

The present study aimed to research the impact of information disclosure, including environmental disclosure and SR publication, on the COE and financial performance. In this respect, it tested data from the period between 2010 and 2019 for BIST100 non-financial firms in Turkey, an emerging market, via panel regression models. The first step of the analysis involved an examination of the impact of information disclosure on the COE of the firm in question. It was revealed at the end of this step that information disclosure negatively affects the COE of the firm; in other words, the results indicated that information disclosure reduces the COE. This outcome is compatible with other studies within the existing literature (Botosan and Plumlee, 2002; Hail, 2002; Chen et al., 2003; Francis et al., 2005; Lopes and Alencar, 2010; Dhaliwal et al., 2011; Reverte, 2012; Fonseka et al., 2019). As stated by Ullmann (1985), information disclosure, which reduces the COE of firms, positively impacts image among stakeholders, builds trust among and gathers support from various groups of stakeholders, contributes to the corporate image, and ultimately introduces strategic economic benefits. Similar to the findings of Ullmann (1985) on information disclosure, the outcome of the present study fundamentally supports the stakeholder and legitimacy theories. In other words, this study is in accordance with the theory (Diamond ve Verrecchia, 1991; Botoson, 1997; Lopes ve Alencar, 2008; Dhaliwal vd., 2011) that increasing the level of environmental information disclosure will reduce the information asymmetry between the firm and investors and increase the liquidity of the firm’s stocks and thus decrease the cost of capital through the increase in demand for stocks.

The second stage of this study included an analysis of the impact of information disclosure on financial performance in terms of firm value and profitability. At the end of this stage, a generally positive correlation between information disclosure and financial performance was detected. This outcome is compatible with the study conducted by Wang et al. (2020). However, no significant correlation between the publication of SR and the ROE was found. The outcomes of this study can be interpreted as follows: information disclosure by a firm improves financial performance and might signify the minimization of information asymmetry among the stakeholders of the firm. In fact, Morris (1987) claims that firms tend to disclose more information to reduce asymmetric information and demonstrate the positive performance of the firm to information users. Therefore, the findings of this second stage support the signaling theory.

When assessed as a whole, the findings of this study reveal that the reducing impact of information disclosure on the COE of firms operating in developed markets holds true for firms in Turkey, an emerging market, as well. Furthermore, information disclosure was generally found to increase the financial performance of firms. In this respect, the findings of the study support the two research hypotheses. Accordingly, it can be stated that the disclosure of more information reduces the cost of equity and increases the financial performance of firms. Thus, the study suggests that firms improve their environmental policies and increase the level of EID to improve their financial performances (i.e., to reduce their COE).

References

Agyemang, A. O., Yusheng, K., Ayamba, E. C., Twum, A. K., Chengpeng, Z., Shaibu, A. (2020). Impact of board characteristics on environmental disclosures for listed mining companies in China. Environmental Science and Pollution Research, 27, 21188–21201. https://doi.org/10.1007/s11356-020-08599-2

Atan, R., Alam, M. M., Said, J., Zamri, M. (2018). The impacts of environmental, social, and governance factors on firm performance: Panel study of Malaysian companies. Management of Environmental Quality: An International Journal, 29(2), 182-194. https://doi.org/10.1108/MEQ-03-2017-0033

Baltagi, B. H., Jung, B. C., Song, S. H. (2010). Testing for heteroskedasticity and serial correlation in a random effects panel data model. Journal of Econometrics, 154(2), 122-124. https://doi.org/10.1016/j.jeconom.2009.04.009

Borges, M. L., Anholon, R., Cooper Ordoñez, R. E., Quelhas, O. L. G., Santa-Eulalia, L. A., Leal Filho, W. (2018). Corporate Social Responsibility (CSR) practices developed by Brazilian companies: an exploratory study. International Journal of Sustainable Development & World Ecology, 25(6), 509-517. https://doi.org/10.1080/13504509.2017.1416700

Botosan, C. A. (1997). Disclosure level and the cost of equity capital. The Accounting Review, 72(3), 323-349.

Botosan, C. A., Plumlee, M. A. (2002). A re-examination of disclosure level and the expected cost of equity capital. Journal of Accounting Research, 40(1), 21-40. http://dx.doi.org/10.1111/1475-679X.00037

Chen, K. C. W., Chen, Z., Wei,,K. C. J. (2003). Disclosure, corporate governance, and the COE capital: evidence from Asia’s emerging markets. Working paper, Hong Kong University of Science and Technology. http://dx.doi.org/10.2139/ssrn.422000

Cheng, B., Ioannou, I., Serafeim, G. (2014). Corporate social responsibility and access to finance. Strategic Management Journal, 35, 1-23. https://doi.org/10.1002/smj.2131

Chiu, C. L., Zhang, J., Li, M., Wei, S., Xu, S., Chai, X. (2020). A study of environmental disclosures practices in Chinese energy industry. Asian Journal of Sustainability and Social Responsibility 5(9), 1-21. https://doi.org/10.1186/s41180-020-00036-1

Clarkson, P. M., Fang, X., Li, Y., Richardson, G. (2013). The relevance of environmental disclosures: Are such disclosures incrementally informative?. J. Account. Public Policy, 32(5), 410-431. http://dx.doi.org/10.1016/j.jaccpubpol.2013.06.008

Cormier, D., Magnan, M. (2007). The revisited contribution of environmental reporting to investors’ valuation of a firm’s earnings: An international perspective. Ecological Economics, 62(3-4), 613-626. https://doi.org/10.1016/j.ecolecon.2006.07.030

Dejean, F., Martinez, I. (2009). Environmental disclosure and the cost of equity: the French case. Accounting in Europe, 6(1), 57-80. https://doi.org/10.1080/17449480902896403

Dhaliwal, D. S., Li, O. Z., Tsang, A., Yang, Y. G. (2011). Voluntary nonfinancial disclosure and the COE capital: the initiation of corporate social responsibility reporting. The Accounting Review, 86(1), 59–100. https://doi.org/10.2308/accr.00000005

Dhaliwal, D., Li, O. Z., Tsang, A., Yang, Y. G. (2014). Corporate social responsibility disclosure and the cost of equity capital: The roles of stakeholder orientation and financial transparency. Journal of Accounting and Public Policy, 33(4), 328-355. https://doi.org/10.1016/j.jaccpubpol.2014.04.006

Diamond, D. W., Verrecchia, R. E. (1991). Disclosure, liquidity, and the cost of capital. The Journal of Finance, 46(4), 1325-1359. https://doi.org/10.1111/j.1540-6261.1991.tb04620

Easton, P. D. (2004). PE ratios, PEG ratios, and estimating the implied expected rate of return on equity capital. The Accounting Review, 79(1), 73-95. https://doi.org/10.2308/accr.2004.79.1.73

Embong, Z., Mohd-Saleh, N., Hassan, M. S. (2012). Firm size, disclosure and cost of equity capital. Asian Review of Accounting, 20(2), 119-139. https://doi.org/10.1108/13217341211242178

Fonseka, M., Rajapakse, T., Tian, G. L. (2019). The effects of environmental information disclosure and energy types on the cost of equity: evidence from the energy İndustry in China. Abacus, 55(2), 362-410. https://doi.org/10.1111/abac.12157

Francis, J. R., Khurana, I. K., Pereira, R (2005). Disclosure incentives and effects on cost of capital around the world. The Accounting Review, 80(4), 1125–1162. https://doi.org/10.2308/accr.2005.80.4.1125

Gray, R. (2005). Taking a long view on what we now know about social and environmental accountability and reporting. Electronic Journal of Radical Organisation Theory, 9(1), 6-36.

Gray, R., Kouhy, R., Lavers, S. (1995). Corporate social and environmental reporting: A review of the literature and a longitudinal study of UK disclosure. Accounting, Auditing and Accountability, 8(2), 47–77. https://doi.org/10.1108/09513579510146996

Gregory, A., Tharyan, R., Whittaker, J. (2014). Corporate social responsibility and firm value: disaggregating the effects on cash flow, risk and growth. Journal of Business Ethics, 124(4), 633-657. https://doi.org/10.1007/s10551-013-1898-5

Hail, L. (2002). The impact of voluntary corporate disclosures on the ex-ante cost of capital for Swiss firms. European Accounting Review, 11(4), 741-773. http://dx.doi.org/10.1080/0963818022000001109

Kristandl, G., Bontis, N. (2007). The impact of voluntary disclosure on cost of equity capital estimates in a temporal setting. Journal of Intellectual Capital, 8(4), 577-594. https://doi.org/10.1108/14691930710830765

Lopes, A. B., Alencar, R. C. (2010). Disclosure and cost of equity capital in emerging markets: The Brazilian case. The International Journal of Accounting, 45(4), 443–464. https://doi.org/10.1016/j.intacc.2010.09.003

Mendes, J. V., Oliveira, G. R., De Souza Campos, L. M. (2019). The G-Index: a sustainability reporting assessment tool. International Journal of Sustainable Development & World Ecology, 26(5), 428–438. https://doi.org/10.1080/13504509.2019.1589595

Michelon, G., Parbonetti, A. (2012). The effect of corporate governance on sustainability disclosure. The Journal of Management and Governance, 16(3), 477–509. https://doi.org/10.1007/s10997-010-9160-3

Morris, R. D. (1987). Signalling, agency theory and accounting policy choice. Accounting and Business Research, 18(69), 47-56. https://doi.org/10.1080/00014788.1987.9729347

Plumlee, M., Brown, D., Hayes, R. M., Marshall, R. S. (2015). Voluntary environmental disclosure quality and firm value: Further evidence. Journal of Accounting and Public Policy, 34(4), 336-361. http://dx.doi.org/10.1016/j.jaccpubpol.2015.04.004

Reverte, C. (2012). The impact of better corporate social responsibility disclosure on the cost of equity capital. Corporate Social Responsibility and Environmental Management, 19(5), 253-272. https://doi.org/10.1002/csr.273

Richardson, A. J., Welker, M. (2001). Social disclosure, financial disclosure and the cost of equity capital. Accounting, Organizations and Society 26(7-8), 597–616. https://doi.org/10.1016/S0361-3682(01)00025-3

Robaina, M., Varum, C., Francisco, A. (2019). Complete decomposition analysis of CO2 emissions in the health sector in Portugal. International Journal of Environmental Research, 13, 977–990. https://doi.org/10.1007/s41742-019-00230-8

Silvestre, W. J., Antunes, P., Amaro, A., Filho, W. L. (2015). Assessment of corporate sustainability: study of hybrid relations using Hybrid Bottom Line model. International Journal of Sustainable Development & World Ecology, 22(4), 302–312. http://dx.doi.org/10.1080/13504509.2015.1045955

Sun, N., Salama, A., Hussainey, K., Habbash, M. (2010). Corporate environmental disclosure, corporate governance and earnings management. Managerial Auditing Journal, 25(7), 679-700. https://doi.org/10.1108/02686901011061351

Ullmann, A. A. (1985). Data in search of a theory: a critical examination of the relationships among social performance, social disclosure and economic performance of US firms. Academy of Management Review, 10(3), 540-57. https://doi.org/10.5465/amr.1985.4278989

Wang, M. L., Feng, Z. Y., Huang, H. W. (2013). Corporate social responsibility and cost of equity capital: a global perspective. Journal of Behavioral Finance, 9:85-94.

Wang, S., Wang, H., Wang, J., Yang, F. (2020). Does environmental information disclosure contribute to improve firm financial performance? An examination of the underlying mechanism. Science of the Total Environment, 714 (136855), https://doi.org/10.1016/j.scitotenv.2020.136855

Yao, S., Liang, H. (2019). Analyst following, environmental disclosure and cost of equity: research based on industry classification. Sustainability, 11(2), 300. https://doi.org/10.3390/su11020300

1 The increased publication of activity, environmental, corporate social responsibility, and sustainability reports so on for environmental information disclosure starting from 2010 was one of the reasons behind the selection of the period in question. Furthermore, as the financial crisis in 2008 evidently took its toll on firms, hence the lack of environmental information before and after the financial crisis, the year 2010 was determined as beginning point because the sustainability reports with the highest volume of environmental information disclosure in Turkey were published after the financial crisis (2009). Besides, Turkey became a party to the Kyoto Protocol, recognised as one of the most significant environmental regulations in the world, in 2009.

2 For examples: Silvestre et al. (2015), Borges et al. (2018), and Mendes et al. (2019).

3 The study makes use of studies by Fonseka et al. (2019), Clarkson et al. (2013), Dejean and Martinez (2009), and Cormier and Magnan (2007) for the content analysis and the evaluation and scoring of the environmental information disclosure criteria. In addition, different studies (Chiu et al. 2020, and Agyemang et al. 2020) in the literature made use for environmental information disclosure criteria.