Ekonomika ISSN 1392-1258 eISSN 2424-6166

2021, vol. 100(2), pp. 40–62 DOI: https://doi.org/10.15388/Ekon.2021.100.2.2

Financial Innovation and Technology after COVID-19

A few directions for Policy Makers and Regulators in the view of old and new disruptors

Maurizio Pompella

University of Siena

Email: pompella@unisi.it

Lorenzo Costantino

IDP European Consultants

Email: l.costantino@idpeuropa.com

Abstract. Innovation and technology have led to the redefinition of business models and development of new ones in many bricks and mortar sectors. Similarly, blockchain and fintech have impacted the finance and banking industries, leading some media to coin the expression ‘Uberization of banking’ and are expected to further affect them in the future. The authors extrapolate from sharing economy models to conclude that while blockchain and fintech are poised to advance finance and banking, there are no disruptive features that corroborate the term. By analogy and successive approximation, this article identifies the limitations of the arguments for disruption in finance and banking. Besides, hinging upon stylized facts, the article establishes similarities with sharing economy models to identify potential threats stemming from financial innovations such as Tokenomics, tagged as ‘no-ABSs’. Eventually, after an empirical analysis devoted to explore the first impact of pandemic, the authors identify entry points and ways forward arising from the COVID-19 for policy makers and regulators to regain their pivotal role in policing the market and ensuring transparency while driving innovation.

Keywords: Uberization, Disruption, Fintech, Blockchain, Tokenomics, Nothing-Baked-Securities, COVID-19

__________

Received: 12/10/2020. Revised: 26/02/2021. Accepted: 17/03/2021

Copyright © 2021 Maurizio Pompella, Lorenzo Costantino. Published by Vilnius University Press

This is an Open Access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

1. Introduction

The research objective of this article is to question the hype of the disruptive advent of technology to banking and finance, confirm the positive role of ICT and technological innovation in finance and banking while scaling down the excessive expectations of disruption. The authors give credit to the considerable innovations in finance and banking put forward by technology, and wish to warn about potentially negative distortions that may trigger bubbles and crisis, for instance the phenomenon of tokenomics. The article also points to the role of the COVID-19 pandemic in revealing such distortions without letting the bubbles burst.

The article represents one of the few attempts to question the similarities between sharing economy models that have disrupted traditional sectors and the advent of blockchain and fintech, and their impact to the finance and banking sectors. The authors selected the concept of “Uberization of banking” as a starting point precisely due to its non-academic nature, and use in media contexts. They relied upon the analogical method, thus extrapolating lessons, examples and trends from the sharing economy and applying them to finance and banking. Uber did not disrupt urban transportation; Airbnb did not disrupt hospitality and lodging. Those sharing economy models definitely led to the re-definition of business models and development of innovative ones, to which even the incumbents of those “brick and mortar” sectors are slowly adjusting. As such, the sharing economy produced benefits in newly defined markets and segments, while generating socio-economic challenges pertaining for instance to employment and safety. Nonetheless, the lack of regulation – and the fact that regulators tended to follow industry trends rather than anticipating them – did also prevent a complete transformation of the relevant traditional sectors.

Having scaled back the disruptive impact of latest technologies, then the authors – by successive approximation, and according to a combined inductive bottom-up / deductive approach – introduce the concept that COVID-19 is creating room for regulators to regain their central role in providing certainty in the market while supporting industry innovation. The starting point of the authors is the overview at macro-level of the advent of blockchain and fintech (paragraph 3) to then delve into the different technology waves and adoption in finance and banking (paragraph 4, where also the literature review is provided, and a few seminal papers are reminded). Then the “micro-level” or operational domain of blockchain and fintech applications is reached, by means of a few paradigmatic examples such as Tokenomics and Initial Coin Offerings. After that the empirical analysis is presented, and regulatory context is discussed at the end.

The process and concept of “uberization of banking” remains circumstantial: the observations and data analysis tend to confirm how rather than a plethora of small start-ups and operators disrupting traditional banking, we are witnessing a modernization process in which banks are embracing financial innovation and technology. Such a modernization process is happening gradually, at different paces and with varying depth, in which incumbents of traditional banking and finance remain a stronghold of intermediation.

The advent of COVID-19 triggered a chain reaction in the fintech space, coupled with a process of natural selection with more careful valuations and attention from investors and users on the many fintech and blockchain ventures that hitherto triggered euphoria. The pandemic hit all the actors involved in finance, banking and fintech irrespective of their size, sector and geography; nevertheless, a few sectors appear to be more resilient than others in the fintech space. As the outcome of the Principal Component Analysis in Section 6 shows, the stocks of companies in banking are more “static” and do not necessarily follow the dynamic movements of the stocks of pure fintech companies. At the same time, the analysis allows to distinguish between segments of the fintech space, singling out the payment and eCommerce sectors as opposed to financial intermediation and lending.

We expect that the results of this analysis to be coherent with the working assumptions that Uberization of banking is an “anecdotal” observation rather than a reality that is poised to disrupt banking and finance and that therefore regulatory authorities and policy makers may adopt a more proactive role and behavior towards transparency and consumer protection than in the past.

2. From Financial Defilement to Biological Contagion

An analysis of how blockchain and fintech are poised to advance finance and banking and not necessarily disrupt them as some observers pointed out was the first aim at the onset of the research. The authors were mainly concerned at this stage with discerning whether the concept of “Uberization of banking” holds. Uberization of banking emerged since a few years now, to describe the possible impact of blockchain and fintech to banking derived from models of sharing economy that have impacted mobility and lodging. The sharing economy proved instrumental in redefining business models, or even the development of completely innovative practices, in very traditional sectors; the emergence of regulatory issues and challenges triggered also the need to intervene at policy level. Such renewed model represented the premise for the authors’ interest in validating the disruption potential of innovation and technology adoption in the finance and banking domains.

While completing such analysis, the COVID-19 pandemic stroke, affecting each and every social and economic domain. Leaving aside the social and health impact, the pandemic seems to generate economic shocks with deeper and wider implications than any other crisis since the Great Depression. Such economic shocks are affecting also the blockchain and fintech space, with a dual positive effect. Considering the unfolding of the events and impact of the first six months of COVID-19, the pandemic can be seen on the one hand as enhancing the visibility of useful applications while on the other hand as ridding the sector of “fancy ones”.

The authors hence investigated the potential, and counterintuitive, positive impact of COVID-19 on the blockchain and fintech domains as the wave that rids the system from what could be described as extravagant initiatives and fantasy valuations.

Back to the beginning of the story, the advent of increased computing and processing capability, cloud technologies and enhanced connectivity led to the development of blockchain technologies and applications. The adoption of blockchain in various fields – from logistics to health and finance – also generated increased expectations on their potential to not only improve but even disrupt sectors as a whole. The phenomenon of “sharing economy” in industries like hospitality and urban mobility have spurred such expectations, leading to the development of concepts like “uberization of banking” to describe the inevitable disruption of “mainstream” banking and financial sectors thanks to blockchain applications and fintech solutions.

As such, blockchain and fintech have been often referred to as the “silver bullet” applications that could revolutionize the processes behind financial intermediation and unhinge the role of financial intermediaries and banks – both central and commercial. Such expectations were based on the genuine belief that the new “ecosystem” based on blockchain and fintech was bringing about enhanced transparency, safe data flows and trusted sharing of information, coupled with real-time capabilities and a truly decentralized mechanism of securing transactions. The enhanced security that comes with the mechanism of blockchain, by which not one single participant can “control” or manipulate the transactions, increased the expectation.

A booming economy together with euphoric investors contributed to the escalation of such expectations to a hype for anything that was blockchain and fintech related. By this new mantra, distributed ledgers were destined to break the conventional wisdom not only in financial intermediation, but also innovative business models, new ventures, and so on. Nonetheless, as in many waves of innovation, blockchain and fintech generated opportunities also for less virtuous initiatives, opening the door for creative means and ways to take advantage of unaware market participants, and potentially generating opportunities for recklessness.

While generating virtuous mechanisms that address information asymmetries (the transparency and seamless sharing of information), blockchain and fintech also increased the role of regulatory and supervisory agencies.

One of our primary concerns – part of our research problem – hinges on the interest in gauging whether the technological developments and innovations that are bringing about new patterns of banking and financial intermediation equate to the developments and disruptions observed in the sectors of mobility and lodging and understanding whether such a comparison is at all meaningful. But we try, at the same time, to address the questions about the consequences on Fintech of the current COVID-19 emergency; that is why coronavirus does matter.

Once we conclude – below here – that sharing economy models have the potential of affecting (both negatively and positively) but not disrupting the finance and banking sectors, the advent of COVID-19 led us to dare into another comparison and use the term of “pandemization of economy” rather than limiting our scope to gauging the “Uberization of banking”. The COVID-19 virus is leaving its mark with almost 112 million infections and 2.5 million deaths globally1. While everybody is vulnerable, the virus is particularly dangerous for the elderly and those affected by pre-existing chronic conditions.

The pandemic has also badly hit economic actors: not only individuals, but also legal entities (i.e. companies) are impacted. Also in this case, no sector is immune and no market is shielded by the economic impact of the pandemic: companies in retail, transportation, energy, travel and leisure have either closed or significantly reduced their business. Regardless of social implications and costs (loss in employment, GDP contribution and value creation), the “pandemization of the economy” is a process by which only the healthiest companies sail through the crisis and survive, while those with “chronic conditions” succumb. The health of a company may lie in its business model, value proposition, management structure, human resource management strategy and cash-flow. In the domain of banking and finance, the actors that are best poised to survive the pandemization of the economy are those with robust business models, credibility (vis a vis consumers, regulators, industry peers, etc.), secure technology stronghold and ability to respond to fast changing operational settings.

Still running the health analogy, pandemization of the economy requires strong and credible authorities (regulators and policy makers) that can provide reliable information and guidance while commanding credibility by setting rules. The availability of common and reliable diagnostic mechanisms is imperative to monitor the evolution of the disease: in the case of banking and finance, stress-test methodologies are used to gauge the robustness of market actors. Moreover, therapies are being experimented with for the COVID-19; similarly, remedy measures are available in the financial sector to deal with inefficiencies in the system (at both individual intermediary and systemic levels).

The concept of pandemization of the economy may lead to the concept of developing a vaccine for those market operators in the domains of fintech and blockchain: in this case not a vaccine to avoid harm to self, but a remedy to prevent harm to others and the systems as a whole.

The pandemic represents the external shock thus, that leads to the selection process that strengthens the virtuous applications and ventures while revealing the inefficiencies of the others. The pandemic is functioning as the “reset button” for the sector: the pandemic is “filtering” the industry, tantamount to the dot-com bubble for the ICT sector in the late 1990s/early 2000s and to the Great Financial Crisis for the banking and financial sectors in the late 2000s.

In a sense, COVID-19 is triggering market selectivity and investors’ decisions towards those applications that prove useful at the expense of applications that are appealing but not necessary. Hence, blockchain and fintech applications emerge and consolidate to secure and accelerate supply/value chains’ viability, promote and facilitate health surveillance, secure data processing and sharing, provide continuity to education and health services, as well as promote eCommerce and financial intermediation.

3. The world on Fintech and Blockchain arrival

That is not the first time that information technology and the engineering of procedures populate the world of finance. This time, however, the process follows new channels and pursues different objectives. The spread of structured finance that followed the former applications of ICT, has shown all its limits with the lack of information (asymmetric information) derived from a poorly intelligible innovation (and consequently useless, or even harmful, from a social perspective). The benefits brought about by the opportunities and the variety of products made possible by ICT reached only a few market actors, at the same time imposing huge costs on the community, as a result of the financial crisis.

From this perspective, the diffusion of the “culture of distributed databases” (better, of the Distributed Ledger Technology - DLT) represents a revolutionary philosophy, because its foundation lies in the immediate, simultaneous and shared dissemination of information related to any “market fact”, so making information asymmetries virtually impossible, or reducing them drastically. Nevertheless, the most known blockchain applications relate for instance to cryptocurrencies that already provide ground for information asymmetries to materialize widely.

According to the new logic, which applies to an endless series of economically relevant cases, the role of networks (networking) becomes predominant. The “ledger”, which traces the transactions and retains a memory which may be relied on against third parties (thus validating any transaction), passes from the hands of the individual certifier (bank, insurance, public register, etc.) to a series of nodes (servers), thus making the process irreversible and frauds impossible, as well as misappropriation of funds. Everyone knows everything about each transaction, at the moment when it is finalized.

Given that ICT for Finance and “Fintech” are intimately connected, they do represent two different phenomena. While ICT means the use of informatics in the financial sector, Fintech identifies some sort of business model, some sort of revolutionary way of intermediating funds and influence markets, a new philosophy.

Fintech and the Blockchain technologies developed at different paces in various ecosystems in Western Europe, the United States of America, China and Russia, just to mention a few of the global hubs of these technologies.

Most articles and volumes that have been produced by academics tend to become obsolete in a relatively short time, so that the literature related to this topic is often not qualitatively reliable. Nevertheless, as a consequence of the interest by innovators, investors and financial markets’ participants, the literature about crypto-currencies has been developing during the last few years. Crypto-currencies represent a somehow marginal implementation of Blockchain as a concept and technology. This is why this contribution would be original in comparison with previously published works, as it deals with Fintech (as a business model) and the technology behind cryptocurrencies, and not just with crypto-currencies themselves.

As mentioned, many observers, especially from the fintech sector and mass media, have found inspiration in similarly disruptive technologies and applications in other industries, such as mobility and lodging, to describe the disruption potential of DLT and blockchain on banking and finance.2 Indeed, such considerations were more common and relevant before the global attention of industry participants, scholars, practitioners and most importantly public opinion and consumers were diverted towards the pandemic. COVID-19 played the important effect of scaling-back and refocusing the attention towards safety and health, rather than secondary topics such as technology disruption in banking or whether Airbnb and Uber could be the precursor of peer-to-peer forms of financial intermediation.

Some have even gone further to predict a revolutionizing disruption of the banking and financial systems, mimicking the impact of Uber and Airbnb on traditional sector that were transformed and “disrupted”. This line of thought has led to the expression of “Uberization of banks”, by which it is expected that traditional banking will be disrupted in the same way Uber transformed – and is transforming – the mobility sector.

Here we will refer to Uber as the symbolic representative of the cohort of Transportation Network Companies that rely on Internet technologies to connect mobility service providers (often unlicensed) to users. There is a plethora of Transport Network Companies that operate on the concept of “sharing economy” and use technology platforms to connect drivers with users, such as Bolt, Cabify, Careem, DiDi, Gett, Grab, Haxi, Lyft, Pathao, Uber. By the same token, we refer to Airbnb as representative of the short-term rental and accommodation facilitation companies such as FlipKey, HomeAway, HomeToGo, HouseTrip, Tripping.com, VRBO, Wimdu. Irrespective of labels and names, Uberization is becoming a neologism to describe a technology-based disruption affecting a brick-and-mortar industry. Aware of this, the authors will use the similarities upon which disruption is forecasted for banking and finance.

The raise in the phenomenon of the “sharing economy” empowered by technology applications and “always on connectivity” is spurring creativity and innovation in several sectors, among which on-demand services, fashion and food delivery seem to land themselves to potential creative disruptions3.

At first sight, one should recognize that similarities do exist and also provide for interesting examples of user-driven mechanisms such as monitoring and feedback loops4.

Let’s assess then the real implications and changes that the second wave of technological innovation is brining into the banking and financial systems and put forward a method to evaluate the impact of new technologies, their actual degree of disruption and potential regulatory implications. We wish to stir actually the debate on the disruptive impact of innovation on the banking and financial sectors and, with a certain provocative attitude to deflate the hype while providing options to gauge the disruptive (or rather, innovative) impact that new technologies and practices can have on financial innovation.

4. Stylized Facts and a few Reference Papers

Since the 1950s, the debate about the role and function of financial intermediaries revolved around the key themes of the optimal resources allocation, agency costs, asymmetric information, delegated monitoring, and so on. But also on social role of banks, their relevance and capability to contribute to socio-economic development (Gurley, J.G. and Shaw, E.S. (1960), from a walrasian perspective; Jensen M.C. and Meckling W.H. (1976), emphasizing the role of moral hazard; Leland H. and Pyle D.H. (1977), about asymmetric information as well; Diamond D.W. (1984), about delegated monitoring; and more. 5 In academic circles, innovative – and at times, provocative – thinking led to questioning the essence of banks, suggesting even the option of not needing banks in the first place, representing a useless layer of intermediation in the circulation of money and facilitation of credit. This innovative and provocative thinking was also gaining momentum on the premise of growing concerns about the issue of asymmetry of information that have always characterized the debate about the role of financial intermediaries and facilitation of financial intermediation, that took place at a later stage since the 1970s and 1980s.

Later, over the nineties, and the latest twenty years, the debate about financial innovation and risk transfer - in both banking and (now the) insurance field - was mostly focused on Structured Finance, Asset Backed Securities and Securitization (before, and more explicitly after the 2007 crisis). But also on convergence of Insurance and Financial Markets (Babbel D.F. and Santomero A.M., 1997; Cummins J.D. & M.A. Weiss 2009),6 Alternative Risk Transfer (e.g. Banks E. 2004; Culp C. 2011), and Financial Reinsurance. This until you get the current literature concerned with Peer to Peer lending (Suryono R.R., Purwandari B., Budi I., 2019),7 P2P Insurance, Insurance Linked Securities, then Cryptocurrencies, Fintech, Blockchain, and now (let’s remind them in random order) Unicorns, Tokenomics, new Payment Platforms, and other related, let’s say “genius findings”. It should be noted anyway that there is a considerable intersection between some of these topics, and that the most comprehensive is Fintech, followed by Blockchain.8

The above mentioned “provocative thinking” about the role of the banks is currently being revamped by the second wave of technological developments that is investing the financial and banking sector with innovations such as blockchain, fintech and peer-to-peer intermediation that have an impact on banks as well as Non-Banking Financial Intermediaries, users, etc. Such phenomenon is not relegated only to financial intermediation and banking services, but interests also the non-banking financial intermediaries, above all the insurance sector that is poised to being affected by technology applications such as big-data and Internet of Things.

The first wave of technological development of the 1980s and 1990s (often referred to as “FinTech 1.0”) changed the financial and banking sector by providing innovative tools and solutions that made intermediation easier and faster, led to new business models and interaction modalities between banks and clients.9

In some instances, the technological advancements led to the fast obsolescence of what were considered successful applications: above all the example of phone banking that was, in a relatively short period of time, replaced by the advent of faster and more reliable connectivity coupled with – almost – ubiquitous ICT hardware. Specifically, the advent of smartphones allowed the introduction of “home banking”, and more specifically “mobile banking”, superseding “phone banking” thanks to increased convenience for customers and cost-cutting opportunities for providers.10

The first technology revolution of the industry changed the way banks and clients interacted and accelerated the development of new products. On the one hand, technologies led to the categorization of functions within the banking sector, defining clearer boundaries and interactions between the so-called front-office and back-office. On the other, technologies allowed to by-pass “internal intermediaries” within the financial institutions between the bank and the client (automated transactions through machines and personal computers) as well as developing new products (electronic payment systems that are also challenging the validity and use of plastic money, although credit cards remain the underlying and backing mechanism for such innovative payments).

Another considerable impact of the first wave of technological change came from the advancements in computational capacity that allowed the development of innovative financial products thanks to enhanced means and methods to gather, collate, crunch and process large amounts and flows of data. Technological advancements coupled with innovative modelling techniques led to the proliferation of financially engineered products that, in different forms and for various reasons, paved the way to the financial crisis with the banks and financial intermediaries as the main perpetrators. Nonetheless, the origin and motivation for derivatives was a virtuous (since the 1920s in the Chicago trading floor) mechanism for hedging operational and business risks. The evolution of such instruments lead to financial engineering and structured finance strictu sensu that resulted in a mechanism to rise funds irrespective of the credit worthiness of companies beyond the scope of conventional forms of “on balance sheet securities” (bond, debt and equity)11, reversing the innate purpose of structured finance.

Thanks to technological advancements, the introduction of innovations in forms of payment such as credit/debit cards and automation in transaction intermediation such as phone and e-Banking were accompanied by innovation in financial products. Such innovative products covered the whole cycle of banking services and financial intermediation, from saving and investment products like ETFs and structured products, lending that was enhanced by automated credit scoring and algorithms to accelerate credit worthiness assessment and risk management techniques that used derivatives and asset securitization.

Securitization and related financial products were soon deemed the main culprit of the financial crisis, notwithstanding that financial innovation was just one prong of a multifaceted system that led to the global financial crisis (i.e. excessive risk taking by financial firms, uncontrolled information asymmetries, increased complexity of structured financial products combined with weak corporate governance systems and laxed regulatory oversight and/or lagging regulation.

The second wave of technology innovations that are now interesting the financial sector and banks are the above mentioned DLTs and blockchain (often referred to as “FinTech 2.0”). Such innovations are poised to redefine the way financial intermediation is structured and carried out, potentially overcoming barriers to access to financial services, facilitating interaction and by-passing intermediaries.

Ledgers have been used since ancient times to keep track and record transactions, ensure certainty and provide transparency in commerce and finance. In the financial industry, each bank and financial intermediary keeps their own repository of information and data about transactions, assets and actors.

This requires the presence of intermediaries that ensured interoperability, transparency and certainty of transaction, such as clearing houses. The most relevant technological revolution in banking and financial intermediation was the introduction of electronic ledgers that informatized and automated the crucial function within banks to keep track and record transactions.

The FinTech 2.0 technologies promise to transforming the way information about assets and transactions are collected, collated, stored, processed and shared: the concept of distributed ledgers allows the processing of data across shared ledgers (record of data) across different parties that are linked through the Internet. This generates a network that, coupled with cryptography and algorithms, allows to process and record data in an absolute manner, as none of the participants in the network can revert operations and none of the participants in the network has the sole control of information, data and processes.

This epitomizes the value of DLTs as the “magic wand” to overcome the steps and actors of traditional intermediation and the need for a third party that centralizes interactions with inevitable layers and associated transaction costs and processing time.

As such, the DTL seems to have the potential of eliminating the need for intermediaries breaking the silos of individual repositories of information, replacing them with a transparent and safe mechanism.

Table 1. Technology Revolutions in Banking and Finance: a Comparison of Features

|

Traditional Banking |

First ICT Innovations |

Blockchain & Banks |

|

|

Consumer Experience |

- Uniform scenarios - Homogenous service - Poor customer experience |

- Rich scenarios - Personalized service - Good customer experience |

- Rich scenarios - Personalized service - Good customer experience |

|

Efficiency |

- Many intermediate links - Complex clearing process - Low efficiency |

- Many intermediate links - Complex clearing process - Low efficiency |

- Point-to-point transmission, disintermediation - Distributed ledger, transaction= clearing - High efficiency |

|

Cost |

- Large amount of manual inspection - Many intermediate links - High costs |

- Small amount of manual inspection - Many intermediate links - High costs |

- Completely automated - Disintermediation - Low costs |

|

Safety |

- Centralized data storage Can be tampered - Easy to leak users’ personal information - Poor safety |

- Centralized data storage can be tampered - Easy to leak users’ personal information - Poor safety |

- Distributed data storage Cannot be tampered - Use of asymmetric encryption, - Users’ personal information is more secure - Good safety |

Own elaboration based on World Economic Forum, 2016

These innovative features of DLT and blockchains are triggering a vivid debate among practitioners and academia on the potentially disruptive impact on traditional banking and finance.12

The topics for debate all revolve around the key themes of safety, stability, consumer protection, need for regulation and depth of public sector intervention, role of governing bodies and regulatory authorities such as Central Banks and so on. Some of them (depth of public sector involvement and role of Central Banks) being always debated upon by practitioners and scholars.

5. Old Tricks and New Tools, from Securitization to Tokenomics

As mentioned above referring to the role assigned to securitization in the context of the global financial crisis, the “financialization” and financial engineering changed the playing field of traditional fundraising and risk management for both corporate and retail financial intermediation. This phenomenon paved the way to a new paradigm shift from “risk warehousing” to externalization.

The use of DLTs spurred the development of innovative financial services and products, among which the one that goes under the name of “tokenomics”, the framework in which digital tokens are used by blockchain projects to raise capital. Tokenomics hence is an innovative form of fundraising that hinges on blockchain technology: a new model of Initial Coin Offering (ICO) is gaining momentum especially in the sphere of innovative start-ups in high-tech sectors.

In “tokenomics” an initiator (i.e. a company) launches the creation of tokens to raise capital through an ICO for a business proposition that is based on the use of the tokens. As opposed to an Initial Public Offering (IPO) by which investors acquire shares of a company, in an ICO the investor purchases tokens that may become tradable at a later stage (this would be a “security token” that entitles to a share of the company once the business becomes operational) and/or entitles the bearer to access products or services provided by the company (in this case it would be a “utility token”). Tokens are denominated in a cryptocurrency that then allows for the trading and exchange of the tokens within and outside the ICO’s ecosystem for which they were created.

Notwithstanding the increasing popularity of ICOs, uncertainty persists with regards to the nature of the tokens, often referred to as “crypto assets”, which are difficult to classify as a commodity, currency or investment/security. Such uncertainty has relevant ramifications for various elements of investors’ protection, liability, and so on. The definition of “crypto-asset” in itself is deceiving and is dangerously close to the neologisms of structured finance, such as alternative, hybrid, grey, repackaged, synthetic, contingent, collateralized, parallel, backed, linked and even the most commonly used “over the counter”.

The interest in tokenomics stems from its ability to capture and represent the features of the eternal struggle between virtuous and bad finance. Being virtuous finance represented by the quest for tools and solutions that enhance transparency, increase intermediation, lower risks and ultimately provide for stability with virtuous redistribution mechanisms. And bad finance, on the other hand, being represented by those products and processes that end up generating unnecessary risks and funnel money through channels and mechanisms that ultimately lead to shocks and crisis that not only halt development, but also limit innovation while triggering uneven redistribution.

The innovative instrument of ICOs has raised interest as an alternative means for SME financing and its potential has been initially investigated in a recent OECD study that highlights a few salient challenges, in particular in the domain of valuation of tokens.13

If tokens are considered as currencies, their valuation would hinge on the cash and/or cryptocurrency of reference: this would lead to instability due to the high volatility of the cryptocurrencies (just as a reference, Bitcoin recently traded at 49,800 $, down from its peak of 57,539 $ of February 15, 2021 and from just above 5,000 $ in March 2020).

If the ICO issues utility tokens, their value would be based on the commercial value of the service/product to be launched by the initiator: this would imply a high degree of uncertainty as a function of the type of service/product whose value can be of difficult estimation.

If the token is an investment (security or equity stake), the value of the token would rely upon the company’s valuation, and also in this case there is a high degree of uncertainty as ICOs’ initiating companies are seldom valuated using traditional corporate finance techniques and investment metrics.

ICOs are an innovative instrument, and it is hence too early to draw conclusions on their robustness and validity. Nonetheless, recent studies of ICO examples raise concerns about their viability. While in principle tokens valuation should follow market dynamics to establish a “fair value”, initial comparative studies indicate that tokens’ valuation hinges upon simplistic indicators, such as such as Twitter followers and social media activity, rather than robust business metrics.

Moreover, the same research provides interesting insights on returns and survival rates of ICOs, with average returns of 179% between ICO price and the value of the token on its first day of trading, while less than 50% of projects surviving after 120 days from ICO.

The purpose here is not to delve into the aspects of ICOs and tokenomics, reference to which is made to lead to a key message of concern: tokenomics and ICOs provide worrisome similarities to the misuse of securitization that contributed to triggering the global financial crisis, in combination with excessive risk taking, dramatic information asymmetries, complexity of financial products, weak governance mechanisms and loose regulatory oversight.

Using the lenses of a skeptical reader, ICOs may provide dangerous entry points for reckless initiatives. In the same way securitization proved to be in the past, tokenomics appear as “no-asset-backed securities” (or “Nothing-Backed Securities”, NBSs) denominated in cryptocurrencies in a mostly unregulated environment.

As such, notwithstanding the great merit of ICOs as innovative financial instruments that are poised to provide new forms of intermediation, it appears that tokenomics is a mechanism still in its infancy that requires a clear definition of actors, products and services for it to materialize their potential.

The above considerations lead to the vexing issue about regulatory frameworks and attitudes for DLTs, blockchain and crypto-currencies.

Tokenomics up to the Facts

|

In addition to funding pressures and lower investors’ confidence, increased regulatory scrutiny is putting DLG, blockchain and tokenomics under pressure. The case of the unregistered ICO launched by Telegram to finance the Telegram Open Network (TON) is a crucially relevant case that promises to shed light over ICOs and tokenomics. Back in the spring of 2018, Telegram raised approximately $ 1.7 billion from investors globally, including professional investors from the USA*. In October 2019, the SEC filed a legal complaint** against Telegram and halted the sale on the grounds that the ICO was a vehicle to issue securities. Specifically, the SEC alleges that the “gram tokens” are unregistered securities: paragraph 3 of the complaint clearly profiles the grams as securities and not digital currency as at the moment of issuance there were no products and services that could be purchased with the grams. Moreover, the SEC claims that investors’ expectations to profit from the TON categorizes the grams as securities. With a March 24, 2020 order***, the Court agrees with the SEC that Telegram’s Grams is an offering of securities under the so called “Howey test”. The order also granted an immediate injunction preventing Telegram from distributing Gram tokens to investors. The legal case is evolving with the parties engaging in fruitful dialogue. According to a court order of May 8, 2020 Telegram has agreed to collaborate with the SEC and will disclose relevant documentation of the 2018 ICOs as well as provide information. The proceedings and results of this legal case will surely set a precedent for the industry as a whole and provide guidance to ICOs and develop the concept of tokenomics. Operationally, the setbacks of the TON ICO led Telegram to further delay the launch of TON to 2021. The case of the TON ICO is gaining attention and traction for the entire fintech industry. Irrespective of the outcome, regulators are sending clear messages that the attention is high and that innovation does not necessarily mean disruption at all costs. The fundamentals of regulation, investors protection and oversight remain. What this example puts forward is the need to investigate the adequacy of norms and regulations that were developed for different times and products. The debate should also focus on whether the advent of technology and financial innovation could strive in the current regulatory environment, always with the ultimate goal of promoting innovation, generating efficiencies while protecting investors and consumers. |

* According to SEC filings, the ICO involved 31 US-based investors for a total of $ 424.5 million raised.

** Complaint 19 Civ. 9439 (PKC) United States District Court, Southern District Of New York

Securities and Exchange Commission, Plaintiff, against TELEGRAM GROUP Inc. and TON ISSUER Inc. Defendants

https://www.sec.gov/litigation/complaints/2019/comp-pr2019-212.pdf

*** Securities and Exchange Commission v. Telegram Group Inc. et al, No. 1:2019cv09439 - Document 227 (S.D.N.Y. 2020)

https://cases.justia.com/federal/district-courts/new-york/nysdce/1:2019cv09439/524448/227/0.pdf?ts=1585128306

6. Trends and Dynamics of the Fintech Space Before and During COVID-19

The results of a brief empirical analysis are now presented, to assess how the fintech space developed over the latest two years, one year before, and one year after COVID-19. Our “hidden aim” is to try to ascertain whether the fintech sector is somehow resilient, and more so whether there are companies (or subsets of companies within the fintech sector) that are moving together at different paces.

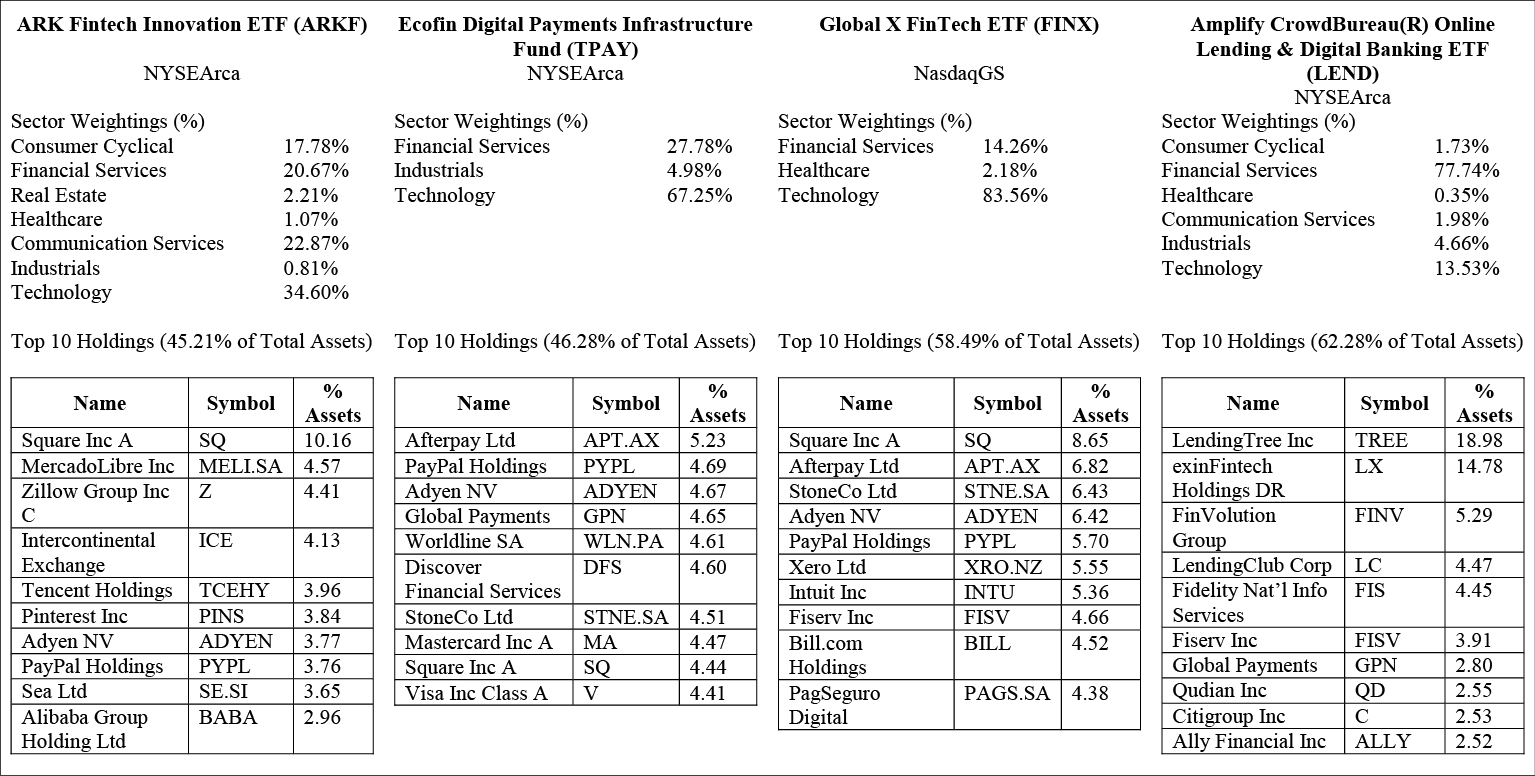

We used four ETFs listed on the US stock markets as a proxy to capture the trends of fintech: the four ETFs have different compositions and holdings (Table 2.). This allows the sample to cover the whole spectrum of fintech products and services, ranging from payment and financial services to electronic commerce and technology infrastructure. The ETFs also include companies representing the traditional banking sector who are embarking on fintech activities as well as companies in consumer and retail services.

Table 2. Selected Fintech Related ETFs

Source:Yahoo Finance

Of the four ETFs one is characterized by traditional banking sector that is embracing fintech; this choice is to capture the effectiveness of the current strategies of incumbents in approaching fintech.

Moreover, the ETFs have a composition that allows to capture global trends: while the ETFs are composed of US stock markets’ listing, the companies represent geographical diversity with operations not only in the US and Western European markets but also global operations as well as China, Latin America and Asia.

As mentioned, the ETFs’ performance was observed over a period of roughly one year before and after March 2020 corresponding to the shocks in the western financial markets due to the outbreak of COVID-19 in Europe and USA.

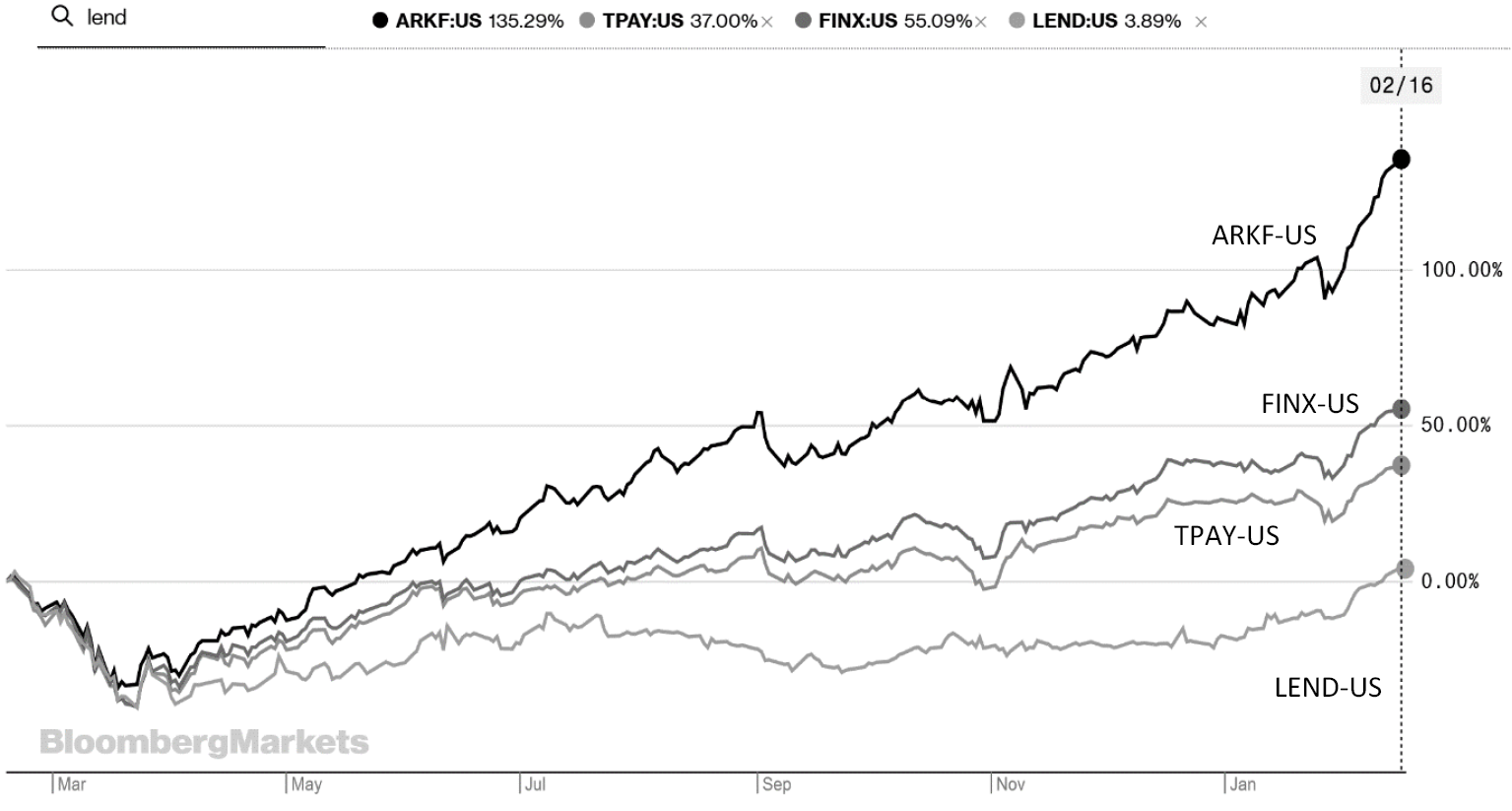

Tracking the performance of the ETFs provides the trajectory of growth of the fintech stocks, with a significant increase for the ETF more exposed to payment services and technologies that greatly benefited from the shift towards digital for both financial intermediation, commerce and retail. The immediate differential in performance between the ARKF and LEND are due to the composition and diversification of the ETFs. While LEND is strongly based on fintech focused on lending and also biased towards traditional banking intermediaries, in fact, the ARKF gained particularly thanks to the structure of the basket of holdings, designed to maximize the growth trends in the financial, technology and eCommerce spaces.

When considering the individual stocks comprised in the four ETFs, a total of 28 stocks were identified, with some stocks being represented in more than one ETF. This process allowed to observe the performance, trends and trajectories of the individual stocks.

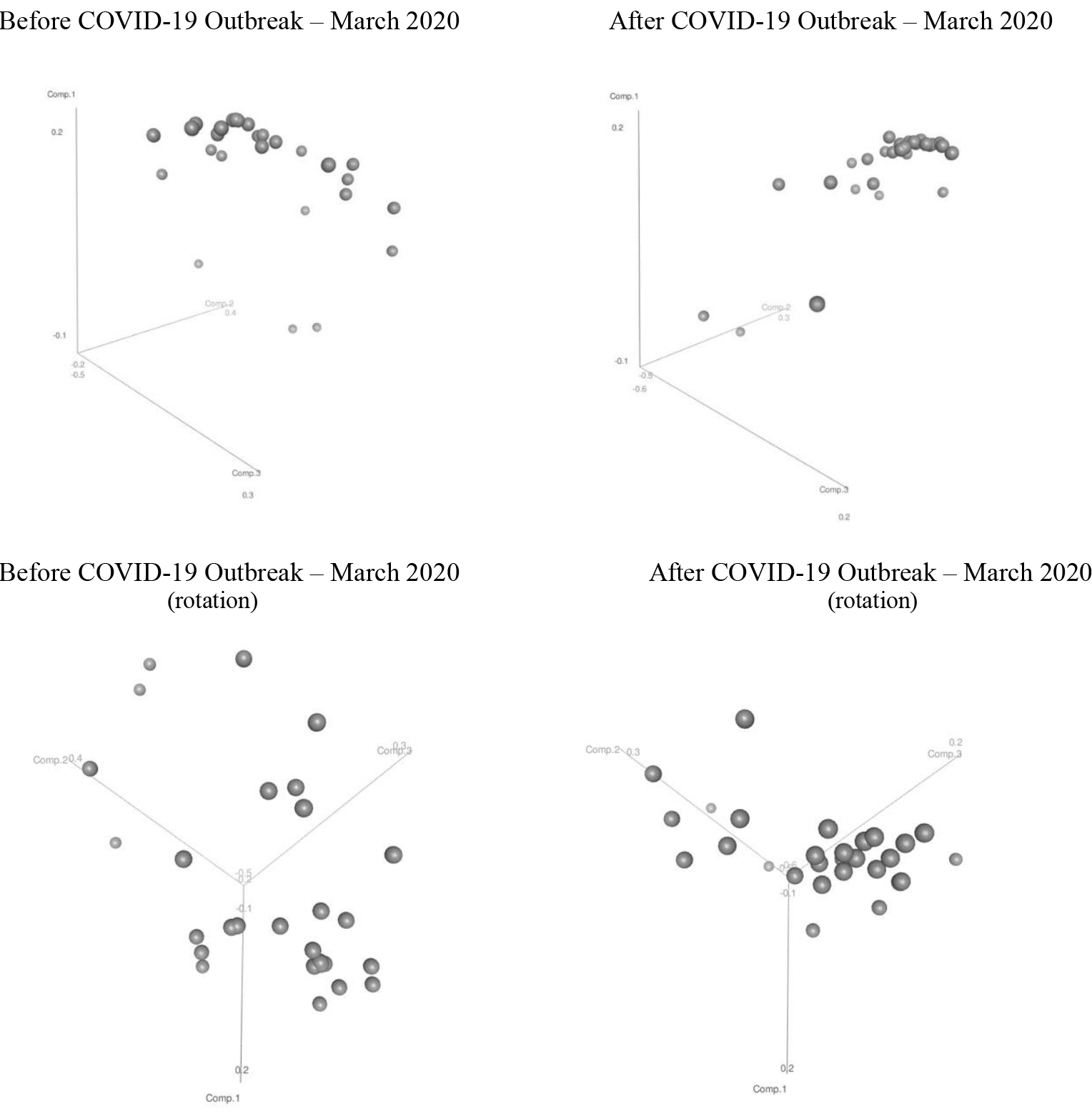

The individual stocks were isolated and observations carried out for the total period of approximately 2 years (February 2019 to February 2020). Once isolated, the individual stocks valuations for the observation period were averaged out, and standardized to allow for comparability, and processed in order to carry out a Principal Component Analysis (PCA). The Exhibits below (2.a / 2.b and 3. from three different perspectives) provide a visual evolution of the stocks baking the ETFs (28 of them) in the Principal Components 3D space, obtained by applying the PC-Mahalanobis approach (Pompella M., Dicanio A. 2016) at the series of individual stocks14. It shows a trend of concentration of the fintech-related stocks, and a clear convergence.

Exhibit 1. Fintech-related ETFs’ Performance February 2020 – 2021

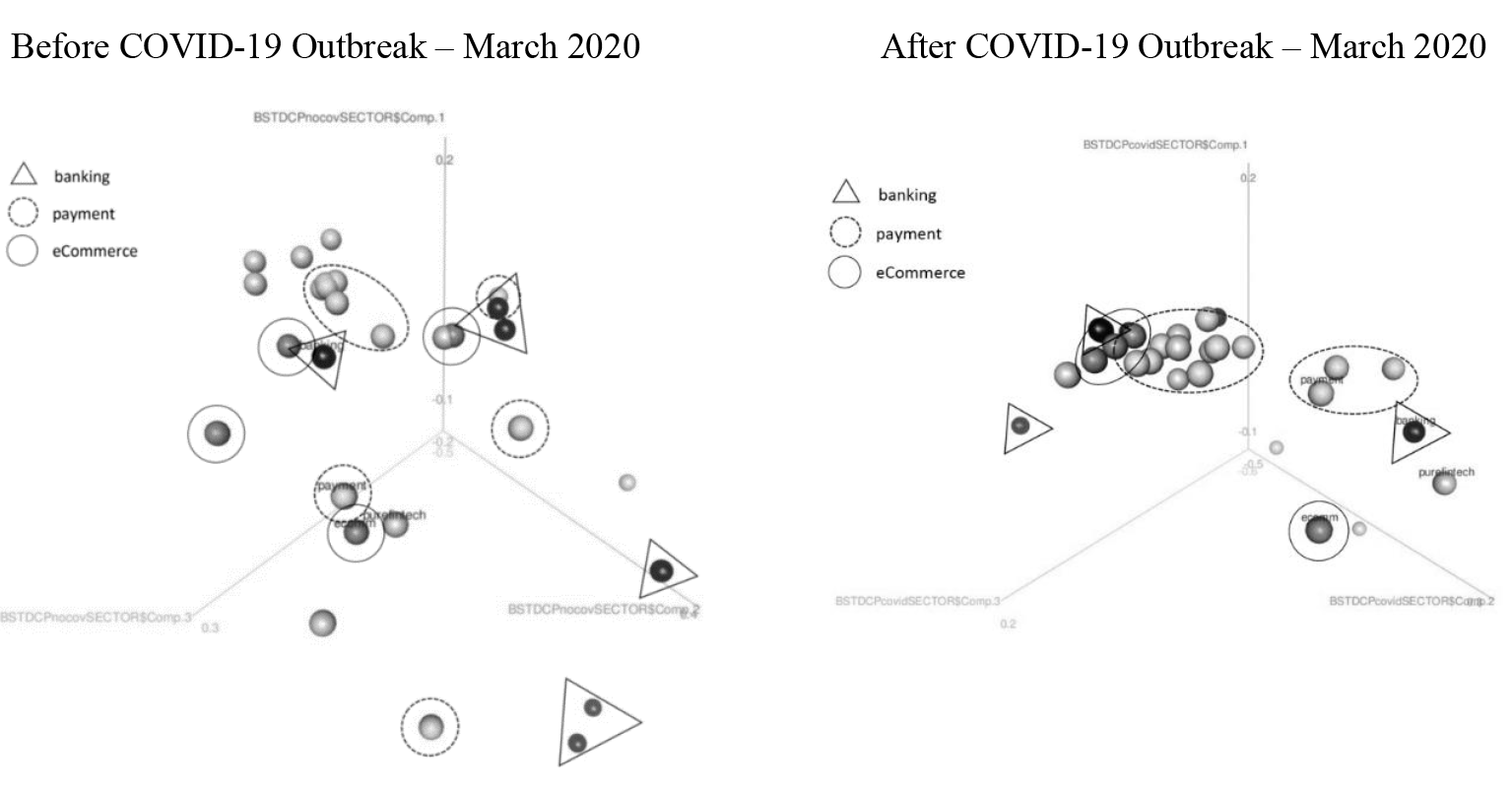

When isolating the individual stocks by category, the trends provide a clear connotating difference in the growth paths within the fintech industry. The segment of payment has shown more dynamic trends of growth in fact, followed by the eCommerce segment, both of them concentrating in a limited space, while the fintech-related stocks that are more correlated with traditional financial intermediation and banking services were characterized by slower growth trends. The Exhibit 3. below distinguishes by fintech connotation of specific stocks, showing banking, payment, and eCommerce segments.

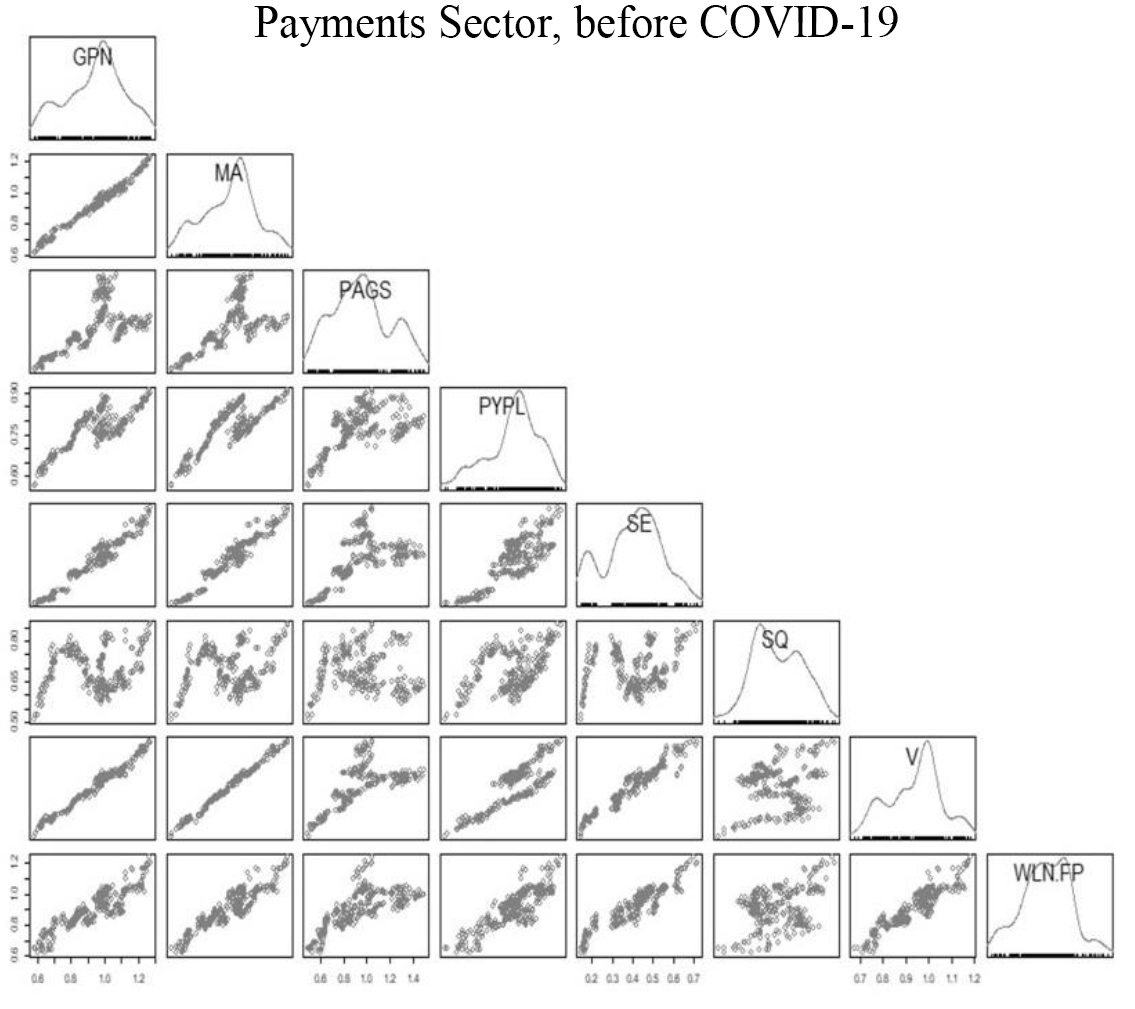

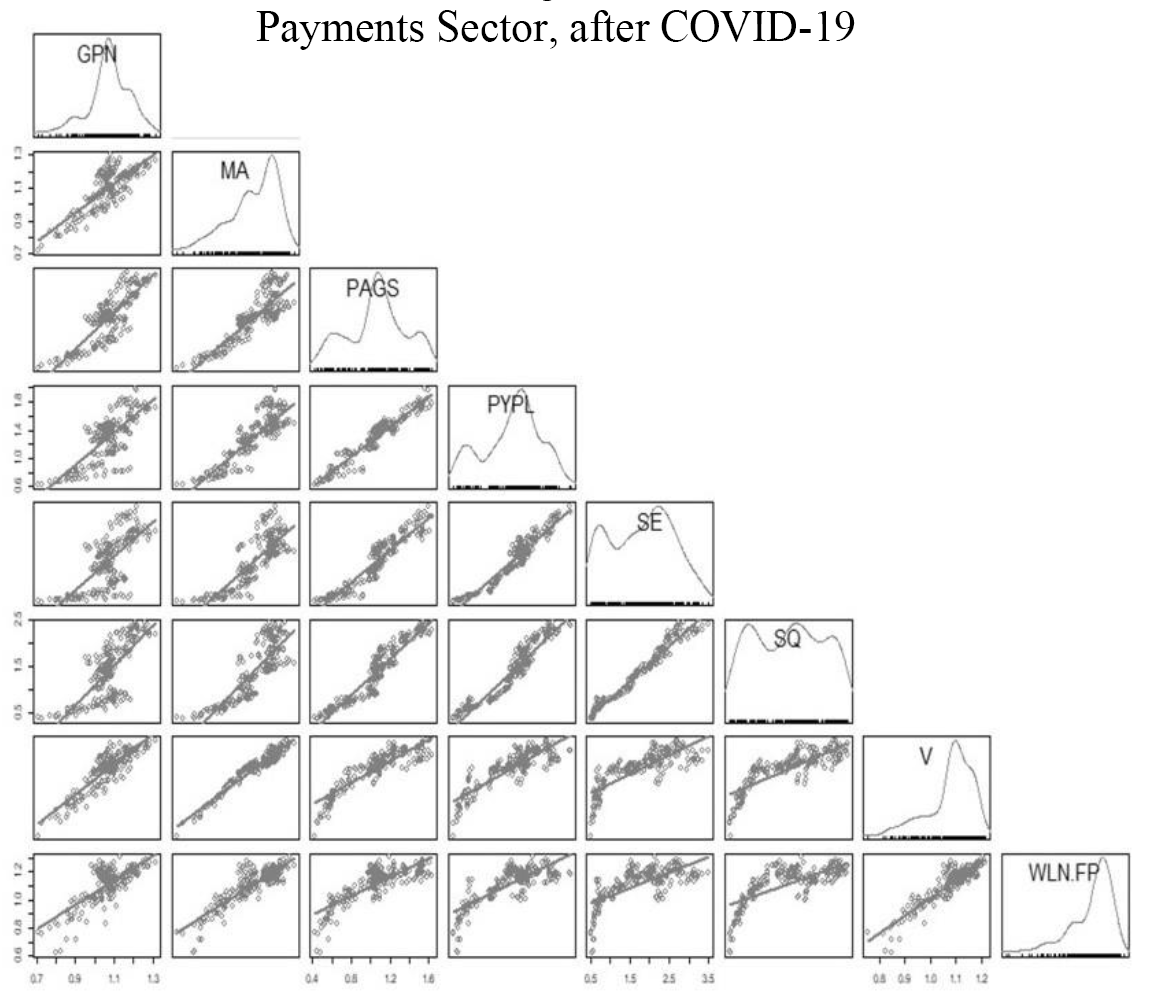

Those tendencies of aggregation and common trend of growth are also visible when the stocks of fintech companies more involved in the segment of payment are taken into consideration using dispersion analysis and scattering. The Exhibit 4. and 5. below depict the matrix of scatter plots capturing the behavior of the stocks of companies most related to payment services before and after the outbreak of COVID-19.

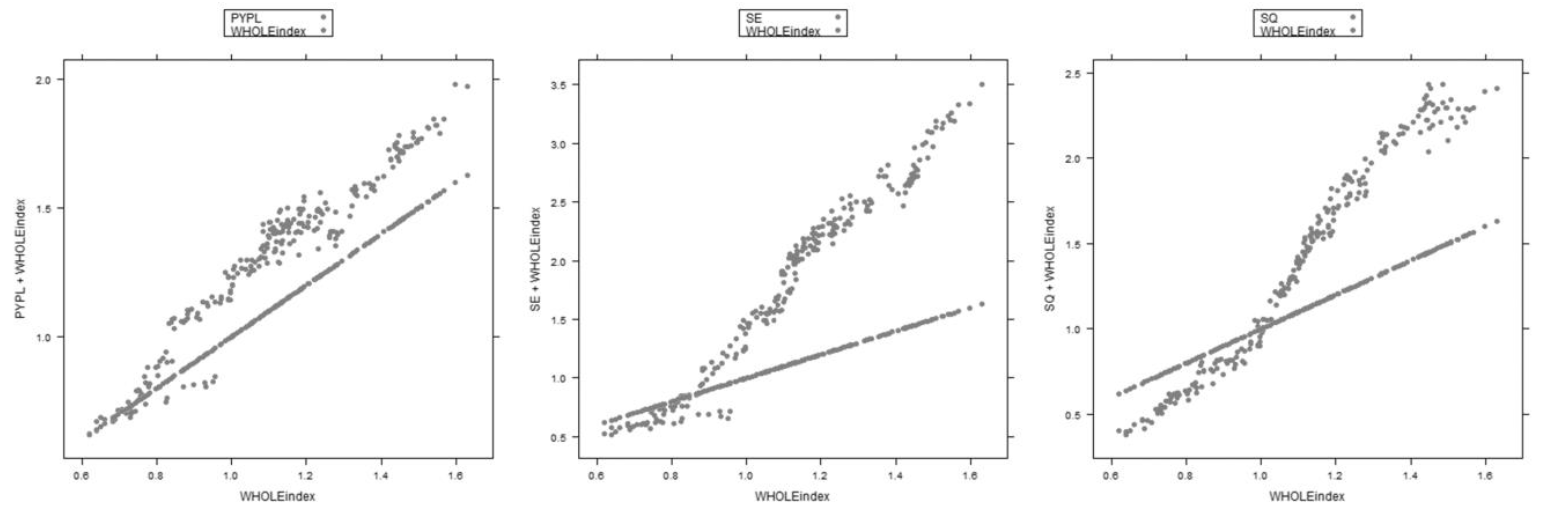

Consolidating all the stocks held by the four ETFs allowed to create a mean-index that was then used as a benchmark to gauge the trend of the stocks more related to banking and payment. Exhibits 3. confirms the trend shown in Exhibit 1. of a differential between the segments of fintech; whereas scatter diagrams provide more granularity in describing the payment sector before and after COVID-19,15 and the performance of the individual stocks vis à vis the benchmark and the role of the individual stocks in driving the performance of the ETFs.

Exhibit 2.a / 2.b. Fintech stocks in the PC space, before and after COVID-19

Exhibit 2.a / 2.b. Fintech stocks in the PC space, before and after COVID-19

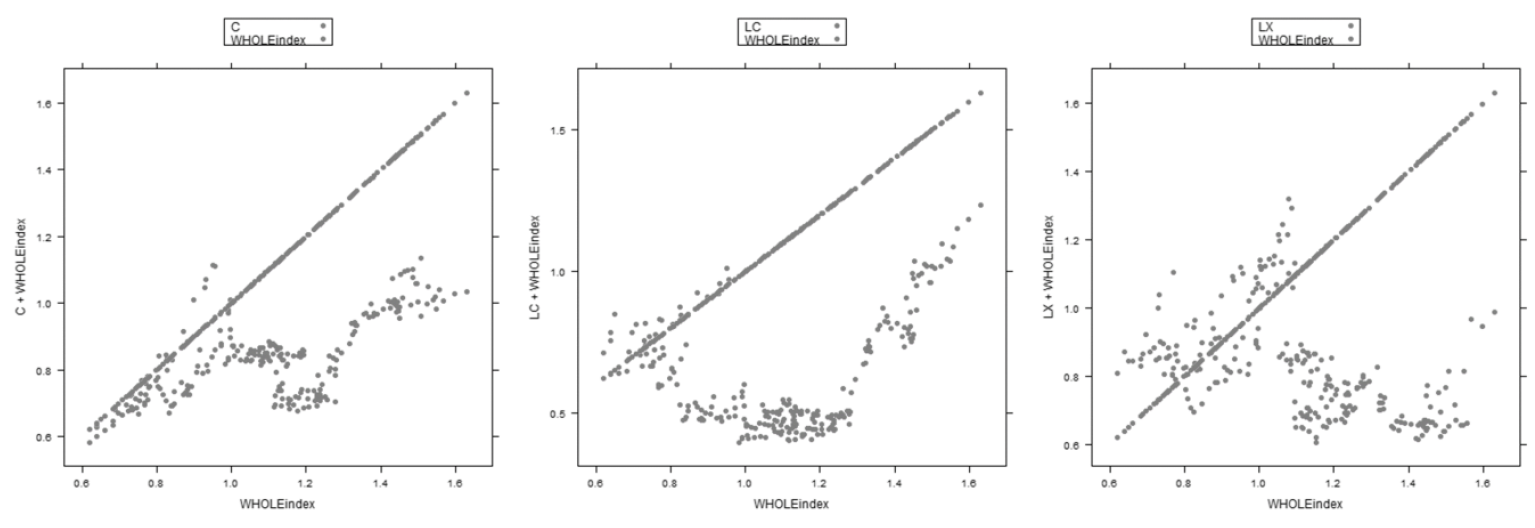

Exhibits 6. and 7. Below, in fact, provide the position of the stock in relation to WHOLEindex (the benchmark) during COVID-19: the three stocks more related to banking appear to underperform while the stocks related to payment appear to considerably outperform the index.

While the pictures do not provide for the time dimension of the relative performance, it is in any case possible to conclude – looking at the lower frequency (the increasing trend) proved by the same Exhibit 1. – that the fintech companies of the payment segment have definitely performed better than those of banking segment.

Exhibit 3. Fintech stocks in the PCs space, before and after COVID-19, by sector

Exhibit 4. Scatter Diagrams Matrix

Exhibit 5. Scatter Diagrams Matrix

Exhibit 6. Banking-related Fintech Stocks compared to the benchmark, during COVID

While the above does not establish an inherent resilience of the payment related segment of fintech sector, the relatively long observation period can lead to the conclusion that the payment segment was the more robust in the COVID-19 and post-pandemic periods. Moreover, the observation period was long enough to discount for possible high frequency (“volatility”) of the stock due to speculative movements that in any case did not interest – neither directly nor indirectly – the stocks held by the ETFs considered (i.e. cryptocurrencies or other very volatile stocks like Gamestop Corporation).

The sampling and differentiation between the various actors of the fintech space seems to suggest that the traditional banking and financial service companies are still struggling to embrace fintech and are not reaping fully the benefits of the recent growth.

Exhibit 7. Payment-related Fintech Stocks compared to the benchmark, during COVID

7. Concluding Remarks

The analysis represents one of the few attempts to explore the similarities between sharing economy in traditional sectors systematically, and the impact of innovation and technology in the finance and banking sectors. Authors extrapolate from the evolutions in brick and mortar sectors of mobility and lodging to ascertain the realistic disruptive nature of financial innovation in banking.

By mean of a few successive approximations, and by analogy, the authors achieved the research objective of suggesting that the concept of “Uberization of banking” is purely anecdotal and does not hold in operational terms if one wanted to describe it as disruptive for the finance and banking sectors. In other words, it could be hardly supported that lending activity will stop being a matter of human evaluation; AI may have a huge but still ancillary role. On the other hand, our analysis confirms that innovation, irrespective of the type, operational setting and industry, requires regulation and oversight to accompany and sustain its positive impact.

Notwithstanding the social and economic consequences of the pandemic, the advent of COVID-19 (whose primary impact we called “pandemization of the economy”) offers at least two opportunities. On one hand it allows to evaluate vulnerability, or resilience of both fintech and fintech-related industries (which is the main finding of our empirical analysis). On the other hand it provides for possible entry-points for regulators and policy makers to regain their pivotal role in ensuring certainty and predictability while driving innovation in the field of technology and innovation in finance and banking. Pandemization of the economy, as we mentioned above, requires strong and credible regulators and policy makers that can provide reliable information and guidance while commanding credibility by setting new rules.

The health emergency and its economic implications are leading most governments to launch traditional rescue measures and recovery packages instead, that span from tax deferrals to outright grants. The latest technological revolution is the key. Policy makers could consider the deployment of blockchain and fintech specific support programmes in fact, that could entail guidelines for beneficiaries, so establishing a mechanism for the bottom-up introduction of rules and terms that industry would otherwise not consider.

Being inspired by the way the pandemic has also changed the way policy makers and government agencies interact with private sector stakeholders and market participants, one could draw examples from the interaction between regulators, policy makers and the pharmaceutical industry. Such models of open dialogue and financial support within a clear “policy-defined” framework of interaction could be mutated for the blockchain and fintech domains.

Furthermore, market and industry innovation should also be mirrored in government and public policy innovation. While many governments and regulatory agencies (particularly Central Banks) have been equipping themselves to better tackle the innovations brought about blockchain and fintech, there seems to be an opportunity for a better structured approach at both institutional and competence levels. The trend of establishing “Innovation Offices” has proven effective in certain policy domains. Nonetheless, a model of Innovation Office describing the tasks, composition, functions and working of such units would greatly benefit policy makers and regulators. International fora could be the preferred setting to develop such models and gather global good practices and lessons learned.

References

Ali, O., Ally, M., Clutterbuck P., Dwivedid, Y. (2020). The state of play of blockchain technology in the financial services sector: A systematic literature review, International Journal of Information Management, Vol. 54, 102199, https://doi.org/10.1016/j.ijinfomgt.2020.102199

Akhtaruzzaman, M., Boubaker S., Sensoy, A. Financial contagion during COVID–19 crisis, Finance Research Letters, 23 May 2020, 101604, https://dx.doi.org/10.1016%2Fj.frl.2020.101604

Babbel, D.F. & Santomero, A.M. (1997). Risk Management by Insurers: An Analysis of the Process, Center for Financial Institutions Working Papers 96–16, Wharton School Center for Financial Institutions, University of Pennsylvania.

Bank for International Settlements, Distributed ledger technology in payment, clearing and settlement: An analytical framework, February 2017.https://www.bis.org/cpmi/publ/d157.pdf

Banks E. (2006). Alternative Risk Transfer: Integrated Risk Management through Insurance, Reinsurance, and the Capital Markets. Hoboken, New Jersey: Wiley, 238 p.

Bech M. & Garrat R. (2017). Central Bank Cryptocurrencies, BIS Quarterly Review, September. https://www.bis.org/publ/qtrpdf/r_qt1709f.pdf

Culp C.L. (2011). Structured Finance and Insurance: The ART of Managing Capital and Risk. Hoboken, New Jersey: Wiley, 912 p.

Cummins J.D. & Weiss, M.A. (2009). Convergence of Insurance and Financial Markets: Hybrid and Securitized Risk-Transfer Solutions. Journal of Risk & Insurance, Vol. 76, issue 3, p. 493–545, https://doi.org/10.1111/j.1539-6975.2009.01311.x

Del Río C. A. (2017). Use of distributed ledger technology by central banks: A review.http://oaji.net/articles/2017/1783-1513601983.pdf

Deutsche Bundesbank Monthly Report September 2017. Distributed ledger technologies in payments and securities settlement: potential and risks.https://www.bundesbank.de/resource/blob/707710/3f3bd66e8c8a0fbeb745886b3f072b15/mL/2017-09-distributed-data.pdf

Diamond D.W. (1984). Financial Intermediation and Delegated Monitoring, University of Chicago. The Review of Economic Studies, Vol. 51, issue. 3, p. 393–414.

EBA Report 9 January 2019. Report with advice for the European Commission on crypto-assets. https://eba.europa.eu/documents/10180/2545547/EBA+Report+on+crypto+assets.pdf

Distributed Ledger Technology. (2016). ECB - IN FOCUS, issue 1.

Egelund-Müller B., Elsman M., Henglein F., Ross O. (2017). Automated Execution of Financial Contracts on Blockchains. Business & Information Systems Engineering, Vol. 59, issue 6, p. 457–467. https://link.springer.com/article/10.1007/s12599-017-0507-z

Geissinger A., Laurell C., Sandströmbde C. (2020). Digital Disruption beyond Uber and Airbnb - Tracking the long tail of the sharing economy. Technological Forecasting and Social Change, Vol. 155, June, 119323, https://doi.org/10.1016/j.techfore.2018.06.012

Gurley, J.G. & Shaw, E.S. (1960). Money in Theory of Finance. Washington DC: Brookings Institution.

Jensen M.C. & Meckling W.H. (1976). Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure. Journal of Financial Economics (JFE), Vol. 3, issue 4, 78 p.

Jobst A., What Is Structured Finance? previously published in The Securitization Conduit, Vol. 8 (2005/6) and Journal of Financial Risk Management (2007).

Kharpal A., Banking’s ‘Uber moment’ is a ‘big threat’CNBC www.cnbc.com/2016/01/22/bankings-uber-moment-is-a-big-threat.html. Published Fri, Jan 22 2016.

Kima K., Baek C., Lee J-D. (2018). Creative destruction of the sharing economy in action: The case of Uber, Transportation Research Part A: Policy and Practice, Vol. 110, April, p. 118–127.

(The) Law Library of Congress, Global Legal Research Center Regulation of Cryptocurrency Around the World, 2018. https://www.loc.gov/law/help/cryptocurrency/cryptocurrency-world-survey.pdf

Leland H. and Pyle D.H. (1977). Informational Asymmetries, Financial Structure, and Financial Intermediation, Journal of Finance, Vol. 32, issue 2, p. 371–387.

Milian E.Z., M. de M. Spinola, de Carvalho M.M. (2019). Fintechs: A literature review and research agenda. Electronic Commerce Research and Applications, Vol. 34, March–April, 100833, https://doi.org/10.1016/j.elerap.2019.100833

Liu J., Li X., and Wang S. (2020). What have we learnt from 10 years of fintech research? a scientometric analysis. Technological Forecasting & Social Change, Vol. 155, June 2020, 120022, https://doi.org/10.1016/j.techfore.2020.120022

Norden, L., Buston, C. & Wagner, W. (2014). Financial innovation and bank behavior: Evidence from credit markets. Journal of Economic Dynamics and Control, Vol. 43, p. 130–145, https://doi.org/10.1016/j.jedc.2014.01.015

Pescatori A., Solé J. March 2016, IMF Working Paper “Securitization and Monetary Policy: Watch Out for Unintended Consequences”.

Pinto F., Sobreira R., Financial innovations, crises and regulation: some assessments, Journal of Innovation Economics & Management 2010/2 (n° 6).

Pompella M., & Dicanio A. (2016). Ratings based Inference and Credit Risk: Detecting likely-to-fail Banks with the PC-Mahalanobis Method. Economic Modelling, Elsevier, Vol. 67(C), p. 34–44, https://doi.org/10.1016/j.econmod.2016.08.023

Shankar A., Rishi B. Convenience matter in mobile banking adoption intention?, Australasian Marketing Journal, 2020, in press.

Shehzad K., Xiaoxing L., & Kazouz H. (2020). COVID-19’s disasters are perilous than Global Financial Crisis: A rumor or fact? Finance Research Letters, Vol. 36, October, 101669, https://doi.org/10.1016/j.frl.2020.101669

Suryono R.R., Purwandari B., Budi I. (2019). Peer to Peer (P2P) Lending Problems and Potential Solutions: A Systematic Literature Review. The Fifth Information Systems International Conference 2019, Procedia Computer Science 161 (2019) 204–214.

Tashjian, E. & McConnell, J. (1989). Requiem for a market: an analysis of the rise and fall of a financial futures contract. Review of Financial Studies, Vol. 2, issue 1, p. 1–23.

Turbeville, W. (2013). Innovation in the era of financial deregulation. Financial Pipeline, Vol. 3, p. 1–43.

UK Government Chief Scientific Adviser, Distributed Ledger Technology: Beyond Block Chain, 2016.

Wall Street Journal, April 2016, “The Uberization of Banking”, https://www.wsj.com/articles/the-uberization-of-banking-1461967266. Digital Disruption: Banks Have Their Uber Moment.

World Bank, FinTech Note 1, 2017, Distributed Ledger Technology and Blockchain.

World Bank (2018). Cryptocurrencies and Blockchain. Europe and Central Asia Economic Update (May), Washington, DC: World Bank. https://doi.org/10.1596/978-1-4648-1299-6

1 As of February 24, 2021, there have been 111,762,965 confirmed cases of COVID-19, including 2,479,678 deaths, reported to WHO; source “WHO Coronavirus Disease (COVID-19) Dashboard”.

2 “The Uberization of Banking”, Wall Street Journal, April 2016, https://www.wsj.com/articles/the-uberization-of-banking-1461967266. Digital Disruption: Banks Have Their Uber Moment, https://www.digitalistmag.com/customer-experience/2016/10/18/digital-disruption-banks-uber-moment-04579272. Banking’s ‘Uber moment’ is a ‘big threat’ Published Fri, Jan 22 2016, https://www.cnbc.com/2016/01/22/bankings-uber-moment-is-a-big-threat.html.

3 See: “Digital Disruption beyond Uber and Airbnb - Tracking the long tail of the sharing economy”; A. Geissingerab, C. Laurell, C. Sandströmbde; In Technological Forecasting and Social Change, 2018. Wall Street Journal, 2015, “There‘s an Uber for everything now”, www.wsj.com/articles/theres-an-uber-for-everything-now-1430845789.

4 One of the theoretical underpinnings of this article is the delegated monitoring theory in fact, by which individuals delegate the role of monitoring to a bank / intermediary rather than independently monitoring borrowers. Cfr. Diamond D.W. (1984), Financial Intermediation and Delegated Monitoring, University of Chicago.

5 Gurley, J.G. and Shaw, E.S. (1960) Money in Theory of Finance. Brookings, Washington DC.; Jensen M.C. and Meckling W.H. (1976) Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure, Journal of Financial Economics (JFE), Vol. 3, No. 4; Leland H. and Pyle D.H. (1977), Informational Asymmetries, Financial Structure, and Financial Intermediation, Journal of Finance, vol. 32, issue 2, 371-87; Diamond D.W. (1984) again; and many others.

6 A couple of seminal papers about this couldn’t be ignored, like i- David F. Babbel & Anthony M. Santomero, 1997 („Risk Management by Insurers: An Analysis of the Process“ Center for Financial Institutions Working Papers 96-16, Wharton School Center for Financial Institutions, University of Pennsylvania); ii- Cummins J.D. & M.A. Weiss 2009 (Convergence of Insurance and Financial Markets: Hybrid and Securitized Risk-Transfer Solutions), Journal of Risk & Insurance 76(3), 493-545.

7 One of the latest contributions about P2P lending is the one by Suryono R.R., Purwandari B., Budi I. (2019), Peer to Peer (P2P) Lending Problems and Potential Solutions: A Systematic Literature Review, providing a magnificent synopsis of problems and potential solutions of P2PL.

8 Liu J., Li X., and Wang S. (2020) offer an interesting scientometric analysis devoted to identify the latest hot topics in Fintech. This is done by mean of a bibliometric research on Fintech business model research. Hot topics in Fintech turn out to be mobile payment, microfinance, peer-to-peer lending and crowdfunding; which is also suggesting which fields outside the list of these “keywords” ought to be further investigated from both practical and academic perspective.

9 For a good literature review refer both to Ali O., Ally M., Clutterbuck P., Dwivedid Y. (2020), and Milian E.Z., M. de M. Spinola, de Carvalho M.M. (2019)

10 Which is still a topic under research; see for instance: Shankar A. and Rishi B., Convenience matter in mobile banking adoption intention?, Australasian Marketing Journal, 2020, in press.

11 Jobst A., What Is Structured Finance?, Andreas A. Jobst, previously published in The Securitization Conduit, Vol. 8 (2005/6), and Journal of Financial Risk Management (2007).

12 This was also a “hot topic” at the institutional level. See for instance: i- ECB Article, “Distributed ledger technology: hype or history in the making?” https://www.ecb.europa.eu/paym/intro/mip-online/2016/html/mip_qr_1_article_3_distributed_ledger_tech.en.html; ii- IMF Staff Discussion Note, 2017 “Fintech and Financial Services: Initial Considerations”; iii- EPRS European Parliamentary Research Service, 2016, “Distributed ledger technology and financial markets”; iv- Board of Governors of the Federal Reserve System, “Distributed ledger technology in payments, clearing, and settlement”, Finance and Economics Discussion Series 2016-095; and v- EBA Report, 2016, “Prudential Risks and Opportunities Arising for Institutions from Fintech”.

13 Initial Coin Offerings (ICOs) for SME Financing, OECD, 2019.

14 Only the stock quotations available during the whole period considered were included. Dataset source: Bloomberg@

15 In the exhibit 5. individual stocks are also plotted against themselves.