Ekonomika ISSN 1392-1258 eISSN 2424-6166

2022, vol. 101(2), pp. 6–21 DOI: https://doi.org/10.15388/Ekon.2022.101.2.1

Application of Qualitative Characteristics to Evaluate Misstatements in Financial Statements: Evidence from Factual Audit Data

Audrius Masiulevičius

Faculty of Economics and Business Administration, Vilnius University, Vilnius, Lithuania

Email: audrius.masiulevicius@evaf.vu.lt

Vaclovas Lakis

Faculty of Economics and Business Administration, Vilnius University, Vilnius, Lithuania

Email: vaclovas.lakis@evaf.vu.lt

Abstract. The auditor should use qualitative characteristics, which describe the essence of misstatement, while assessing identified misstatements. Final decision depends on the professional judgment made by the auditor, however, auditors may make erroneous decisions or be biased. Previous theoretical research highlighted problems with the application of qualitative characteristics. However, factual audit data is confidential and usually not available for researchers to examine, therefore previous research mostly relied on surveys or experiments and there is little evidence on how auditors behave during real audits (rather than simulations). One audit company agreed to provide us with factual data for this research. The aim of the research is to examine the application of primary qualitative characteristics based on factual audit data. During the research, the audits performed in one Lithuanian audit company for the financial years 2019–2020 were examined as well as summarized official (publicly available) data about audit companies in Lithuania and audits performed by them for 2018–2020 financial years were examined. Firstly, most important primary qualitative characteristics, as well as secondary commonly used characteristics, were singled out. Our further investigation, based on received 2019–2020 factual audit data revealed that some auditors still do not apply primary qualitative characteristics in all cases. Even though we investigated one company and we cannot directly extrapolate results for the whole audit market, but our results are in line with the official and publicly available information about audit companies in Lithuania. Thus, we conclude that our results partly reflect truthful view of factual behavior of audit companies in Lithuania. These results also confirm theoretical research that qualitative characteristics are not sufficiently appreciated.

Keyword. qualitative characteristics; audit; misstatement; financial statements; users.

__________

Received: 20/10/2021. Revised: 10/01/2022. Accepted: 30/06/2022

Copyright © 2022 Audrius Masiulevičius, Vaclovas Lakis. Published by Vilnius University Press

This is an Open Access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

Introduction

Users of financial statement information rely on the information presented in the financial statements while making economic decisions, so it is important to ensure that the statements are free from material misstatements of which they are unaware. An audit of financial statements is one of the ways to do this. However, a major difficulty faced by auditors is in evaluating the misstatements identified. Some misstatements may be minor and immaterial, while others may be material to the users of financial statements. In making the assessment, the auditor should use both quantitative (mathematical level of misstatement) and qualitative characteristics. Qualitative characteristics describe the essence of misstatement, e.g., the company does not comply with the law, the company becomes unprofitable, the company does not disclose important facts, and so on.

There is no comprehensive list of rules for determining materiality (quantitative and qualitative misstatement characteristics) (Acito et. al., 2019), so the final decision on the materiality of an identified misstatement depends on the professional judgment made by the auditor. However, auditors have different experiences and abilities, and there is a risk that auditors may make erroneous decisions or be biased in evaluation the qualitative characteristics of misstatements. The scientific literature notes that it is important to understand how auditors apply qualitative characteristics in real audits, especially when even immaterial errors may be important to investors due to qualitative characteristics (Choudhary et. al., 2021).

While qualitative misstatement characteristics are not a new concept, they have not received much attention from scientists so far. Most of the theoretical research has focused on situation analysis, i.e. trying to determine whether auditors apply qualitative misstatement characteristics. And although the performed research highlighted problems with the application of qualitative characteristics, it did not suggest how to address them. What is more important, the research only relied on surveys or experiments, but there is little factual data on how auditors behave during real audits (rather than simulations).

The aim of the research is to examine the application of primary qualitative characteristics based on factual audit data. Object of the research: during the research, the audits performed in one Lithuanian audit company for the financial years 2019–2020 were examined as well as summarized official data about audit companies in Lithuania and audits performed by them for 2018–2020 financial years were examined.

1. Literature review on the application of qualitative characteristics

Researchers have begun to examine the qualitative characteristics of misstatements. The initial considerations of qualitative characteristics in literature began around 1970 (Wahdan and Hassan, 2019). Nevertheless, more detailed research has been carried out only recently. The main and most recent research of or related to qualitative characteristics are presented in Table 1.

Table 1. Recent research related to the application of qualitative characteristics

|

Year |

Title |

Authors |

Methods |

References to qualitative characteristics |

Aim of the |

Results related to the qualitative characteristics |

|

2015 |

Materiality Guidance of the Major Public Accounting Firms |

Eilifsen and Messier |

Document content analysis (audit methodologies of audit firms) |

AS 2810 (2017) SAB 99 (1999) ISA 450 (2009) |

Materiality methodologies for the top eight U.S. audit firms. |

Qualitative characteristics are considered in evaluating the identified misstatements. |

|

2015 |

Judgment in an auditor’s materiality assessments |

Kristensen |

Literature analyses |

ISA 450 (2009) |

Analyses of professional materiality judgment |

Materiality depends on quantitative concerns, but also on qualitative concerns. |

|

2019 |

A Comparative Analysis of Investor and Auditor Materiality Judgments |

DeZoort et al. |

Experiment |

SAB 99 (1999) |

Compare the materiality decisions of an informed and uneducated investor with the auditor’s decisions. |

Investor materiality decisions differ from auditors. Investor decisions are smaller than auditors’. The auditor focuses more on quantitative characteristics. |

|

2019 |

The Materiality of Accounting Errors: Evidence from SEC Comment Letters |

Acito et al. |

Document content analysis (1 151 publicly available corrections of audit misstatements) |

SAB 99 (1999) |

Assessment of the materiality of identified misstatements |

All 9 qualitative characteristics (according to SAB 99) were considered in the 52 percent. studied cases. At least one qualitative characteristic in 40 percent. of the investigated cases that would lead to the assessment of the misstatement as material was not observed. |

|

2019 |

Materiality judgments in an integrated reporting setting: The effect of strategic relevance and strategy map |

Green and Cheng |

Experiment |

- |

The professional judgment of auditors regarding the materiality of non-financial information |

Auditors are more likely to reduce the materiality when quantitative characteristics are less important than to increase materiality when qualitative characteristics are important. |

|

2019 |

Kokybiniai reikšmingumo veiksniai |

Raziūnienė and Verbickaitė |

Document content analysis |

ISA 450 (2009); SAB 99 (1999) |

Reveal the basic regulation of qualitative materiality factors |

Qualitative characteristics can have a greater impact on the decisions of users of financial statement information than quantitative ones. |

|

2020 |

The Costs of Waiving Audit Adjustments |

Choudhary et. al. |

Document content analysis |

SAB 99 (1999) |

Examination the frequency with which management records vs. waives auditor-proposed adjustments |

Auditors and their |

|

2021 |

Auditor Judgements after Withdrawal of the Materiality Accounting Standard in Australia |

David, and Abeysekera |

Literature analyses |

SAB 99 (1999) |

Literature to examine how the materiality concept is located in the regulatory framework |

The qualitative approach to materiality auditing takes on increasing importance in the contemporary enterprise environment. |

Source: Compiled by the authors, based on the sources listed in the table.

Although the aims and objects of the research differed, the repeated results by various researchers highlight the fundamental problem of applying qualitative characteristics – auditors prefer quantitative misstatement characteristics and qualitative characteristics are not sufficiently appreciated (Acito et. al., 2019; DeZoort et. al., 2019; Commerford et. al. 2018; Messier and Schmidt, 2018; Green and Cheng, 2019; Choudhary et. al, 2020). Even though the researched auditors agree that the audit opinion should be modified if qualitative characteristics are being compromised, however, one recent study of qualitative factors (Acito et. al., 2019) found that management of companies under audit consider all qualitative characteristics (according to the characteristics presented in SAB 99, 1999) only in a fraction of situations, while as many as 40 percent of the investigated cases did not adhere to at least one qualitative characteristic. The results of other researchers (DeZoort et. al., 2019; Green and Cheng, 2019) also show that auditors rely more on quantitative characteristics and that insufficient attention is given to qualitative characteristics. On the other hand, there are opposite research results. In 2015 Eilifsen and Messier (2015) found that qualitative characteristics are being considered by auditors when assessing identified misstatements, but Eilifsen and Messier investigated just the methodologies that auditors apply, not the factual audit data.

What is more, another research trend can be distinguished. All studies examined in the first table were based on experiments, analysis of publicly available limited data, surveys, or simulations. Audit working papers are confidential and often inaccessible, so research on the application of qualitative characteristics to date has focused on auditor surveys or situation simulations. Thus, it suggests, that results those scientists got are based on assumptions what auditor would do, what qualitative characteristics would consider, rather than what is actually done in factual audits performed by auditors. While auditors could share depersonalized data for scientific purposes, such situations are rare. Auditors protect all the data according to confidentiality requirements, so it is very difficult to get access to such data, even for scientific reasons.

Eilifsen and Messier (2015), analyzed only the methodologies of audit firms, i.e. how auditors should act, but did not analyze the actual data. The authors point out that the main limiting factor of the study is the lack of factual data. Even when various disadvantages or advantages of applying qualitative characteristics are identified, uncertainty remains as to how auditors behave during actual audits.

There is little data on the actual decisions that auditors make when evaluating qualitative characteristics, which is why such studies are particularly relevant to improving audit quality, especially when the audit profession has been criticized in recent years (Peterson, 2019; Sjam, 2020; Athira and Baag, 2021). Currently, there is an open gap between the theoretical knowledge on application of qualitative characteristics and what is actually done by auditors. The research carried out in this article on actual audits in one Lithuanian audit company for the financial years 2019–2020 can help reduce the gap between theoretical and practical research.

2. Research methodology

The research method used in the study is based on the analysis of historical data (observation of the past). Although this method has some drawbacks, the advantages of the method, such as the accuracy and reliability of the data collected and the absence of dependence on the respondent (in this case, the auditor), will help answering the question if auditors use qualitative characteristics during factual audits. The research process is divided into three stages. In the first stage, based on the literature analysis, the main (primary) and secondary qualitative characteristics are identified. In the second stage, an analysis is made whether the main (primary) qualitative characteristics are being applied by the auditors during actual audits. Lastly, summarized official (publicly available) data about audit companies in Lithuania and audits performed by them for 2018–2020 financial years were examined as well to check out if our results are in line with official data. One medium size audit company operating in Lithuania provided data on the performed audits for the financial years 2019–2020. For reasons of confidentiality, the data provided were depersonalized (leaving no possibility to identify individual companies).

3. Primary qualitative characteristics among infinite number of characteristics

The activities of enterprises are different, and therefore the qualitative misstatements identified by the auditor may vary widely. It is difficult to compile a unified list of qualitative characteristics that is suitable for all cases. For example, IAS 450 (2009, par. A16) provides examples of qualitative characteristics, but states that “... the list is not necessarily final.”.

However, although it is difficult to compile a single list of specific characteristics, the main (primary) and secondary qualitative characteristics can be distinguished based on the qualitative characteristics mentioned in the literature. Until now, researchers have subjectively selected one or another qualitative characteristic when examining audit materiality issues. E.g., Asare et al. (2019) applied the change in income to loss, the characteristics of meeting expectations or meeting credit conditions. Hamilton (2016) chose the qualitative characteristics of the achievement of expectations, the change in income trends, and the results that determine bonuses. However, to the knowledge of the authors of this article, no researcher has tried to group all qualitative characteristics or to divide them into main (primary) and secondary ones, so the following grouping below is one of the first attempts to do so.

Most of the researchers, examining qualitative characteristics, refer to the examples provided in the practical literature (SAB 99, IAS 450, AS 2810) (Eilifsen and Messier, 2015; Kristensen, 2015; DeZoort et. al., 2019; Acito et. al., 2019; David and Abeysekera, 2021; Altiero et. al., 2021), therefore the professional audit literature could be used as a primary source of information for identifying qualitative characteristics. After reviewing the professional and scientific literature, six main sources of information were identified, providing detailed examples of qualitative characteristics.

• US SEC Staff Accounting Bulletin No. 99. “Materiality” – 9 examples of qualitative characteristics (SAB 99, 1999).

• Public Company Accounting Oversight Board released AS 2810 “Evaluating Audit Results” – 16 examples of qualitative characteristics (AS 2810, 2017).

• International Auditing and Assurance Standards Board released ISA 450 “Evaluation of Misstatements Identified During the Audit” – 11 examples of qualitative characteristics (ISA 450, 2009).

• International Auditing and Assurance Standards Board released ISAE 3000 “Assurance Engagements Other than Audits or Reviews of Historical Financial Information” – 13 examples of qualitative characteristics (ISAE 3000, 2015).

• American Institute of Certified Public Accountants released SAS 122 “Materiality in Planning and Performing an Audit” – 3 examples of qualitative characteristics (SAS 122, 2012).

• American Institute of Certified Public Accountants released SAS 107 “Audit Risk and Materiality in Conducting an Audit” – 16 examples of qualitative characteristics (SAS 107, 2006).

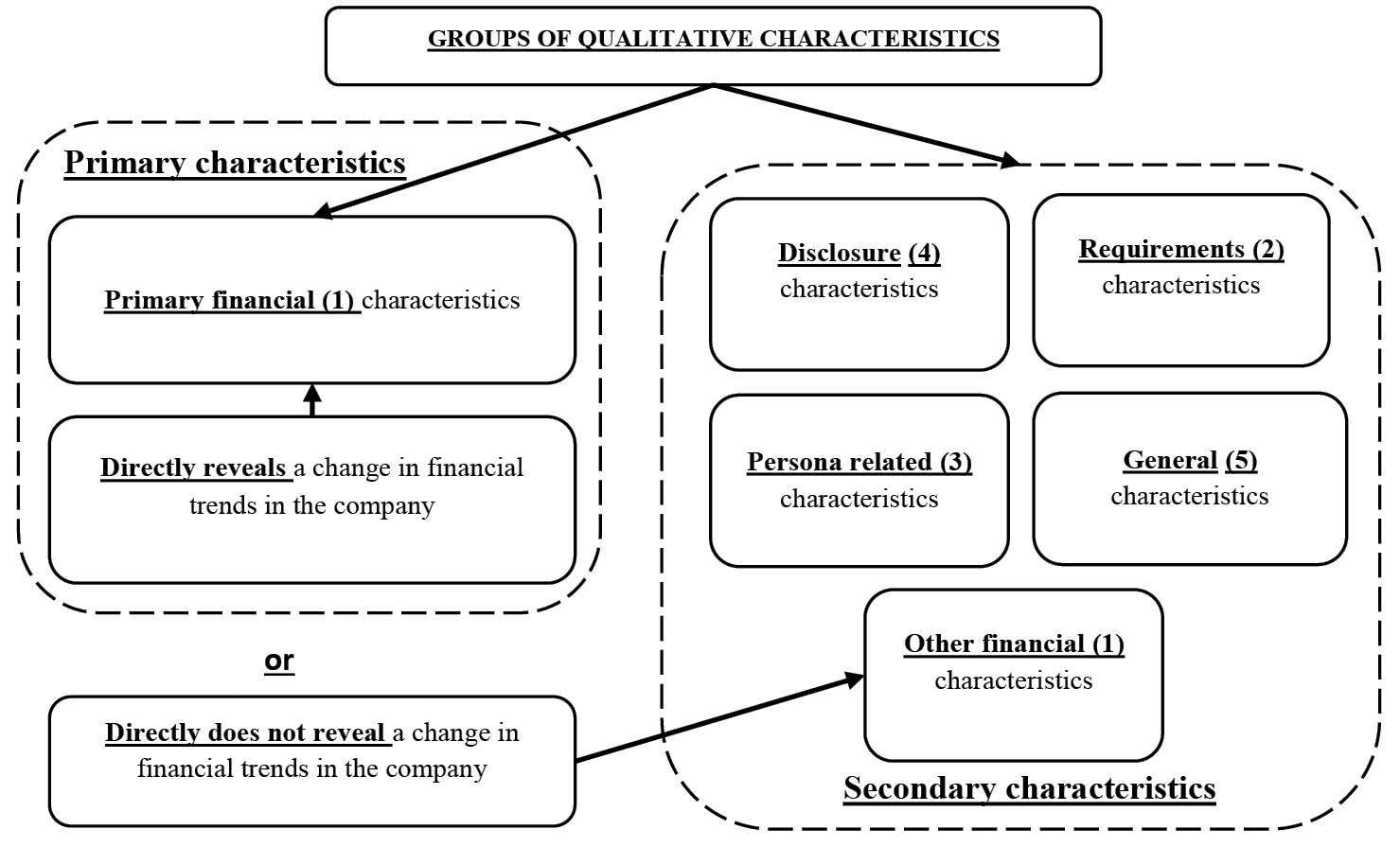

By comparing and grouping the qualitative characteristics presented in the above documents (also Tables 2–3 below in the text), five main groups of qualitative characteristics were distinguished: (1) financial; (2) requirements; (3) persona related; (4) disclosure; and (5) general. See Figure 1 below.

Figure 1. Grouping of qualitative characteristics.

Source: Compiled by the authors, based on (SAB 99, 1999; AS 2810, 2017; ISA 450, 2009; ISAE 3000, 2015; SAS 122, 2012).

One of the main goals of for-profit companies is to create economic benefits for its shareholders. Shareholders base their decisions on the company’s ability to make a profit now or/and in the future. Financial position or/and profitability are key for investors (Sederavičiūtė, 2020; Betti and Consolandi, 2018). It is the financial indicators and their trends that directly show the company’s financial ability and future prospects; therefore, the financial characteristics can be grouped as the main ones. For example, a study by Rupar (2017) found that the alignment of financial expectations and the real data increases the value of a firm in the eyes of investors.

Some financial characteristics are more important (as mentioned above) because they reveal a change in financial trends; however, not all financial characteristics reveal such change, so they can also be broken down into primary and secondary. For example, a company becomes unprofitable. This can indicate a negative cash flow balance or even a risk of going concern. Accordingly, the economic decisions of users of financial statements may change significantly. Or a reversal of an upward trend in revenue growth may indicate various financial problems (e.g., declining market share, declining production, etc.). Also, if a company meets the expectations of revenue, earnings or other financial indicators set by analysts, such a company, according to Rupar (2017), is considered more favorable by the investors. Such financial characteristics, which reveal the change in financial trends, can be considered as primary qualitative characteristics (Table 2).

Table 2. Primary financial qualitative characteristics

|

No. |

Qualitative characteristics |

(SAB 99, 1999 |

(AS 2810, 2017): |

(ISA 450, 2009) |

(ISAE 3000) |

(SAS 122, 2012) |

SAS 107, 2006 |

Type |

|

1 |

Misstatement hides a failure to meet analysts’ consensus expectations |

✓ |

✓ |

✓ |

✓ |

|

✓ |

Primary characteristic |

|

2 |

Misstatement masks a change in earnings or other trends |

✓ |

✓ |

✓ |

|

|

✓ |

Primary characteristic |

|

3 |

Misstatement changes a loss into income or vice versa |

✓ |

✓ |

|

|

|

✓ |

Primary characteristic |

Source: Compiled by the authors, based on (SAB 99, 1999; AS 2810, 2017; ISA 450, 2009; ISAE 3000, 2015; SAS 122, 2012; SAS 107, 2006).

On the other hand, some of the qualitative financial characteristics do not reveal a change in financial trends. For example, “Misstatement affects the indicators used to measure an entity’s financial position, performance or cash flows.” In other words, a misstatement of one hundred euros will affect the financial indicators but will not necessarily change the trends in the financial data. Suppose shareholders expect a net return of 10 percent. By registering or not registering a misstatement, an entity may still exceed analyst expectations and the misstatement would not have a material effect on users of the financial statements. Accordingly, such characteristics, which do not lead to a change in financial trends, should be classified as secondary.

Other qualitative characteristics can be grouped into requirements, persona, disclosure and general characteristics (Table 3). These characteristics do not directly reveal a change in the company’s financial trends. The consequences for the company, if such characteristics are breached, may be different and require additional assessment in each case. For example, a misstatement found may lead to a company not complying with loan covenants (loan agreement with credit institution), but it may also simply lead to the imposition of a fine on the company, the importance of which would already be assessed in terms of quantitative characteristics. The impact of all the qualitative characteristics in the table below on the company and its finances may be different and may depend on the specific misstatement. Unlike financial characteristics, which clearly describe the change in the company’s financial trends, the characteristics in Table 3 below require additional professional judgment and are therefore classified as secondary qualitative characteristics.

Requirements group includes characteristics that indicate the various requirements for the company, its finances and general activities. For example, the requirements set by the bank (in loan agreements) or the statutory regulatory requirement to provide timely reports.

Persona related group includes characteristics that are related to specific individuals. All operating companies have at least one employee who has an impact on the company’s operations and finances. The larger the company, the bigger the number of employees is likely to be. Company employees, and especially management, have a significant influence on the company’s operations, company vision, or future prospects, so characteristics related to different individuals can be grouped as personal.

Disclosure characteristics group. It is important for users of financial statements to know the various facts about the entity, both financially and the current or planned future activities. Information can be completely undisclosed in financial statements, may be incomplete, and may even be misleading. Qualitative characteristics describing all such misstatements are included in this group.

General characteristics are those which do not have the characteristics to be assigned to one of the above groups, but which also do not have similar characteristics to be assigned to a separate group. Such characteristics, which do not have clear attributes, can be combined into a separate group of general characteristics.

The list of various qualitative characteristics is extensive, but five main groups stand out. Each group has certain attributes. Some financial characteristics (primary ones) are essential for users of financial statements because they directly disclose the financial position or prospects of an enterprise. Some financial characteristics may be of lesser importance to users of financial statements, but characteristics that reveal a change in an enterprise’s financial trends are primary.

4. Research results and discussion

First of all, the grouping of the obtained factual audit data was performed. Not material (by auditors’ consideration) misstatements (meaning they were not corrected in financial statements) were found in fourteen audits (out of all audits performed by one audit company for 2019–2020 financial years). These are misstatements that indicate that there are misstatements of a quantitative and/or qualitative nature, but in the auditor‘s professional judgment they do not affect users of the financial statements and are therefore not corrected in the financial. As the purpose of the study is to assess whether there are in fact primary qualitative characteristics that the auditors would not consider, only these fourteen companies with unrecorded misstatements were selected for the second phase of the study (Table 4).

In the second phase, unrecorded misstatements were specifically analyzed in more details. All unaccounted-for audit misstatements were compared with the three main financial qualitative characteristics (primary ones) identified in the theoretical part (Table 2) of this research and it was analyzed whether the misstatements “breached” any of them. In most cases (Table 4, companies 5–14) only quantitative violations were detected, i.e. the misstatements were only directly related to the mathematical magnitude of the misstatement. Misstatements of the remaining companies (Table 4, 1–4 companies) were related to the qualitative characteristics, but the qualitative misstatement of company No. 4 was not related to the primary financial qualitative characteristics. The final data obtained revealed that the qualitative misstatements identified in companies No. 1–3 during an audit are related to primary qualitative characteristics (see Table 5).

Table 4. A depersonalized summary of data obtained for the study.

|

Year |

No. * |

Revenue |

Assets |

Uncorrected financial statement misstatements |

Misstatements relate to qualitative characteristics |

Audit opinion |

|

2020 |

Company 1 |

4 000 001–20 000 000 EUR |

700 001–8 000 000 EUR |

Yes |

Yes |

Unmodified |

|

2020 |

Company 2 |

4 000 001–20 000 000 EUR |

700 001–8 000 000 EUR |

Yes |

Yes |

Unmodified |

|

2019 |

Company 3 |

4 000 001–20 000 000 EUR |

700 001–8 000 000 EUR |

Yes |

Yes |

Unmodified |

|

2020 |

Company 4 |

0–350 000 EUR |

0–700 000 EUR |

Yes |

Yes |

Unmodified |

|

2020 |

Company 5 |

4 000 001–20 000 000 EUR |

700 001–8 000 000 EUR |

Yes |

No |

N/A |

|

2020 |

Company 6 |

4 000 001–20 000 000 EUR |

8 000 001–40 000 000 EUR |

Yes |

No |

N/A |

|

2020 |

Company 7 |

4 000 001–20 000 000 EUR |

700 001–8 000 000 EUR |

Yes |

No |

N/A |

|

2020 |

Company 8 |

350 001–4 000 000 EUR |

700 001–8 000 000 EUR |

Yes |

No |

N/A |

|

2020 |

Company 9 |

350 001–4 000 000 EUR |

700 001–8 000 000 EUR |

Yes |

No |

N/A |

|

2020 |

Company 10 |

350 001–4 000 000 EUR |

700 001–8 000 000 EUR |

Yes |

No |

N/A |

|

2019 |

Company 11 |

350 001–4 000 000 EUR |

700 001–8 000 000 EUR |

Yes |

No |

N/A |

|

2019 |

Company 12 |

4 000 001–20 000 000 EUR |

8 000 001–40 000 000 EUR |

Yes |

No |

N/A |

|

2019 |

Company 13 |

0–350 000 EUR |

0–700 000 EUR |

Yes |

No |

N/A |

|

2019 |

Company 14 |

4 000 001–20 000 000 EUR |

700 001–8 000 000 EUR |

Yes |

No |

N/A |

|

*Indication of company 3 and 5; company 10 and 11; company 4 and 13 represent the same company which was audited for 2019 and 2020 financial years. |

||||||

Source: Compiled by the authors based on data provided by the audit company (not disclosed).

Table 5. The actual misstatements found that are related to primary qualitative characteristics.

|

Primary qualitative characteristics |

(SAB 99, 1999 |

(AS 2810, 2017): |

(ISA 450, 2009) |

(ISAE 3000) |

(SAS 122, 2012) |

SAS 107, 2006 |

Qualitative characteristics group |

Company 1 |

Company 2 |

Company 3 |

|

Misstatement hides a failure to meet analysts’ consensus expectations |

✓ |

✓ |

✓ |

✓ |

|

✓ |

Financial characteristics |

✓ |

|

|

|

Misstatement changes a loss into income or vice versa |

✓ |

✓ |

|

|

|

✓ |

Financial characteristics |

✓ |

✓ |

✓ |

Source: Based on research by the authors.

If the misstatements identified during the audit of Company No. 1 were to be accounted for, they would lead to a result that the expectation for the business (to be profitable) was not reached. Profitable activities would also become unprofitable. If in companies No. 2–3 misstatement would be accounted for, then profitable activities would become unprofitable.

We inquired audit company whether these misstatements should be accounted as material, especially when they relate to primary qualitative characteristics. The audit firm commented that, although the qualitative characteristics were identified, a professional decision was made after a thorough analysis that the misstatements were not material and would not change the economic decisions made by users of the financial statements. Audit company did not provide more detailed information on the auditor’s additional considerations, so for this research it was not possible to assess the correctness of the decisions made by the auditors.

Auditing standards oblige the auditor to consider qualitative characteristics, but there are no more detailed guidelines on how this should be done and which characteristics, if any, are essential. Also, the data obtained for the research were limited due to confidentiality, therefore we could not perform a more detailed analysis or identify and analyze the reasons that led to such professional decisions of the audit firm’s employees. It cannot be said that the auditors made erroneous professional decisions (although there is such a risk), but it can be concluded that there are qualitative characteristics that auditors, at least some of them, do not follow blindly.

Also, it is worth to consider the data limitation for this research. As mentioned before, factual audit data is confidential and usually not available for researchers to examine. Still, one audit company agreed to provide data for this research. As it is only one audit company, inevitably the question arises as to whether the results of this study can be trusted. It is difficult to answer the question, whether the results of the research demonstrate the specific professional culture or the way of performance only inherent to this exact audit company under investigation. However, indirect additional factual audit data gives us support, that practices of different audit companies have flaws, not only the company, which was investigated. The authority of audit <…> of the Republic of Lithuania provides summarized official data about audit companies in Lithuania and audits performed by them. The most recent analyses for 2018–2020 financial years (Finansinių…, 2021) revealed, that seven different auditors did not set audit materiality (which include qualitative and quantitative judgment) correctly. Materiality was set by auditors’ professional decision, however, no justification was provided. Even though indirectly, but it gives us insights, that materiality (qualitative and quantitative) is still a challenging concept for auditors to correctly apply in practice. It gives us additional assurance, that our results on investigated audit company are hardly an exception, but reflection of factual audit practices. Therefore, we conclude, with precaution of data limitation in mind, that the results we got based on factual audit data confirm theoretical research, that auditors do not thoroughly comply to all the qualitative characteristics.

To sum up final thoughts, the information should be understood in the same way by all users of financial statement information. The same is true of the professional decisions made by auditors. The final results of the audit should not depend on the chosen auditor and his professional decision (otherwise, the requirements of independence and objectivity will not be maintained). The work performed by different auditors and the results obtained should all lead to the same conclusions. However, different auditors could make different professional decisions, and there is no layer of protection as financial statement users are not involved in decision making process. Users have to trust in auditors’ decisions. Future studies could focus on ways how to reduce the risk of wrong professional decisions (regarding the application of qualitative characteristic) made by the auditors.

5. Improving the application of qualitative characteristics

One possibility to improve the application of qualitative characteristics lies in the mandatory application of primary qualitative characteristics. Theoretical research to date has revealed that auditors do not apply qualitative characteristics enough. This study of the factual application of primary qualitative characteristics in this article also found that auditors do not always apply these characteristics in practice.

As auditing standards do not require mandatory application of primary qualitative characteristics, auditors are free to use qualitative characteristics as they see them fit or ‘comfortable’ based on their professional experience. Auditors may be pressured by clients to make one or another professional decision that may not meet the needs of users of financial statement information. Asare et al. (2019) analyzed how auditors’ materiality decisions are affected by audit fees. Both quantitative and qualitative misstatement characteristics were used in the study. The results have revealed that the motivation of auditors (e.g., high fees for audit services) leads to a more open approach to the identified misstatements. This can compromise the quality of both the financial statements and the audit.

Misstatements that the auditor considers to be immaterial are not exposed to users of financial statements and unreliable data will reach users of financial statements if the auditor makes a mistake. One untapped opportunity to address this issue is the search for balance. This article highlights the primary qualitative characteristics that directly reveal the change in financial trends. These are the most important qualitative characteristics that are of interest to users of financial statements.

At present, as the study reveals, there are cases where auditors do not apply these qualitative characteristics. However, classifying the characteristics listed in Table 2 as primary, requiring their mandatory application, would be one way to alleviate the current problem of insufficient application of qualitative characteristics. In such a case, auditors would be required to apply primary characteristics and if it is determined that misstatements affecting primary qualitative characteristics do not affect the economic decisions of users of financial statements, they should still disclose such misstatements by eliminating the risk of professional misconduct.

Conclusions and recommendations

Thus, even the slightest misstatement of qualitative characteristics can have a material effect on the economic decisions of users of financial statements. It is important that auditors properly analyze the qualitative characteristics, their impact on the audited entity and the users of the financial data.

Professional auditing standards, while providing examples of qualitative characteristics, do not specify which characteristics are primary and which are secondary. No explanation is given as to how they should be applied, and full responsibility is left to the professional judgment of the auditor. After grouping the qualitative characteristics, five main groups of qualitative characteristics were distinguished: (1) financial; (2) requirements; (3) persona; (4) disclosure; and (5) general. All groups have unique attributes, and a general group combines individual unaccounted-for characteristics.

Three financial characteristics that reveal the change in the trends of the company’s financial data are singled out as the main (primary) ones: (1) the misstatement leads to the achievement of the set expectations; (2) the misstatement changes the trends in the financial data and (3) the misstatement changes the loss-making activities of the enterprise into a profitable one or vice versa. These characteristics reflect a material change in the entity’s financial trends, and all misstatements, even the smallest ones, which result in these “breaches” of the characteristics should be disclosed to users of the financial statements.

A study of factual audits on the application of primary qualitative characteristics, together with the performed analyses of summarized and most recent official data about audit companies in Lithuania and audits performed by them for 2018–2020 financial years, revealed that auditors, at least some of them, do not apply primary qualitative characteristics in all cases. Even though we investigated one company and we cannot directly extrapolate results for the whole audit market, but our results are in line with the official and publicly available information about audit companies in Lithuania, thus we conclude that our results partly reflect truthful view of factual behavior of audit companies in Lithuania. These results also confirm theoretical research that qualitative characteristics are not sufficiently appreciated. The auditors’ experience, skills, or objectivity vary, so users of financial statements cannot be assured that the auditors’ assessment of the materiality of misstatements is correct, especially when users do not have the measurement data and assumptions used. The primary qualitative characteristics set out in this article should be mandatory. This would ensure the application of these characteristics and eliminate the risk of an auditor’s professional misconduct.

References

Acito, A. A., Burks, J. J., Johnson, W.B. (2019). The Materiality of Accounting Errors: Evidence from SEC Comment Letters // Contemporary Accounting Research. Vol. 36, No. 2, p. 839 - 868. https://doi.org/10.1111/1911-3846.12458.

Altiero, C. E., Kang, Ju Y., Peecher, E. M. (2021). Motivated Perspective Taking: Why Prompting Auditors to Take an Investor’s Perspective Makes Them Treat Identified Audit Differences as Less Material // Contemporary Accounting Research. Accepted, 56 p. https://doi.org/10.1111/1911-3846.12721

Athira, A. (2021). Literature Review on Methodological Aspects of Audit Independence & Materiality Perspective // AIMS International Journal of Management. Vol. 15, No. 2, p. 73-87. https://doi.org/10.26573/2021.15.2.1

AS 2810 (2017): Evaluating Audit Results // Public Company Accounting Oversight Board (PCAOB).

Asare, K. S., Buuren, van P. J., Majoor, B. (2019). The Joint Role of Auditors’ and Auditees’ Incentives and Disincentives in the Resolution of Detected Misstatements // Auditing: A Journal of Practice & Theory. Vol. 38, No. 1, p. 29 - 50. https://doi.org/10.2308/ajpt-52153.

Betti, G., Consolandi, C., Eccles, R. G. (2018). The Relationship between Investor Materiality and the Sustainable Development Goals // Sustainability. Vol. 10, 23 p. https://doi.org/10.3390/su10072248.

Choudhary, P., Merkley, K., Schipper, K. (2021). Immaterial Error Corrections and Financial Reporting Reliability // Contemporary Accounting Research. Accepted, 59 p. http://dx.doi.org/10.2139/ssrn.2830676.

Choudhary, P., Merkley, K., Schipper, K. (2020). The Costs of Waiving Audit Adjustments // SSRN. Electronic Journal, 70 p. http://dx.doi.org/10.2139/ssrn.3112957

Commerford, B. P., Hatfield, R. C., Houston, R. W. (2018). The Effect of Real Earnings Management on Auditor Scrutiny of Management’s Other Financial Reporting Decisions // The accounting review. Vol. 93, No. 4, P. 145 - 163. https://doi.org/10.2308/accr-52032.

David, R., Abeysekera, I. (2021). Auditor Judgements after Withdrawal of the Materiality Accounting Standard in Australia // Journal of Risk and Financial Management. Vol. 14, p. 1 - 20. https://doi.org/10.3390/jrfm14060268.

DeZoort, F. T., Holt, T. P., Stanley, J. D. (2019). A Comparative Analysis of Investor and Auditor Materiality Judgments // Auditing: A Journal of Practice & Theory. Vol. 38, No. 3, p. 149 - 166. https://doi.org/10.2308/ajpt-52318.

Eilifsen, A., Messier, W. F. Jr. (2015). Materiality Guidance of the Major Public Accounting Firms // Auditing: A Journal of Practice & Theory. Vol. 34, No 2, p. 3 - 26. https://doi.org/10.2308/ajpt-50882.

Finansinių ataskaitų audito kokybės peržiūrų metu nustatytų audito trūkumų apžvalga (2018-2020 M.) (2021) // The authority of audit, accounting, property valuation and insolvency management under the ministry of finance of the republic of Lithuania. https://avnt.lrv.lt/uploads/avnt/documents/files/2018-2020%20m_%20ap%C5%BEvalga_%20A2-39%202021-05-12.pdf.

Green, W. J., Cheng, M. M. (2019). Materiality judgments in an integrated reporting setting: The effect of strategic relevance and strategy map // Accounting, Organizations and Society. Vol. 73, p. 1 - 14. https://doi.org/10.1016/j.aos.2018.07.001.

Hamilton, E. L. (2016). Evaluating the Intentionality of Identified Misstatements: How Perspective Can Help Auditors in Distinguishing Errors from Fraud // AUDITING: A JOURNAL OF PRACTICE & THEORY. Vol. 35, No 4, P. 57 - 78. https://doi.org/10.2308/ajpt-51452.

International Standard on Auditing (ISA) 450 (2009): Evaluation of Misstatements Identified During the Audit // International Auditing and Assurance Standards Board (IAASB).

ISAE 3000 (2009), Assurance Engagements Other than Audits or Reviews of Historical Financial Information // International Auditing and Assurance Standards Board (IAASB).

Kristensen, R. H. (2015). Judgment in an auditor’s materiality assessments // Danish Journal of Management & Business. Vol. 79, No 2, P. 53 -65.

Messier, W. F. Jr., Schmidt, M. (2018). Offsetting Misstatements: The Effect of Misstatement Distribution, Quantitative Materiality, and Client Pressure on Auditors’ Judgments // The accounting review. Vol. 93, No. 4, p. 335 – 357.

Peterson, J. (2019). Failure Study. A Needed addition to the accounting toolkit // The CPA journal. , p. 6-9.

Rupar, K. (2017). Significance of Forecast Precision: The Importance of Investors’ Expectations // Contemporary Accounting Research. Vol. 34 No. 2, p. 849 – 870. https://doi.org/10.1111/1911-3846.12279.

SAS 107 (AU Section 312) (2006): Audit Risk and Materiality in Conducting an Audit // American Institute of Certified Public Accountants (AICPA).

SAS 122 (AU-C Section 320) (2012): Materiality in Planning and Performing an Audit // American Institute of Certified Public Accountants (AICPA).

SEC Staff Accounting Bulletin (SAB): No. 99 – Materiality (1999)) // Securities and exhange commission (SEC).

Sederavičiūtė, Ž. (2020). KPI Rodikliai – Alternatyva Įmonių Finansinės Veiklos Vertinimui // Science and Studies of Accounting And Finance: Problems And Perspectives. Vol. 14, No 1., p. 58 - 66. https://doi.org/10.15544/ssaf.2020.06.

Sjam, J., Yadiati, W., Winarningsih, S., Rosdini, D. (2020). Audit Quality Influenced by Auditor Competence and Audit Task Complexity // Talent Development & Excellence. Vol. 12, No. 1, p. 4228-4246.

Raziūnienė, D., Verbickaitė, G. (2019). Kokybiniai reikšmingumo veiksniai // Buhalterinės apskaitos teorija ir praktika. No. 19, p. 6. https://doi.org/10.15388/batp.2019.4

Wahdan, M. A., Hassan, M. (2019). Automatic Assessment of Materiality: A Knowledge-based Approach // International Journal of Computer Auditing. Vol. 1, No. 1, p. 64 - 91.