Ekonomika ISSN 1392-1258 eISSN 2424-6166

2023, vol. 102(2), pp. 108–129 DOI: https://doi.org/10.15388/Ekon.2023.102.2.6

Implementation of Non-state Pension Provision in Ukraine in the System of Strengthening Social Protection

Oksana Cheberyako

Taras Shevchenko National University of Kyiv, Ukraine

Email: cheberyako@ukr.net

https://orcid.org/0000-0002-1563-9611

Zakharii Varnalii

Department of Finance, Taras Shevchenko National University of Kyiv, Ukraine

Email: vzs1955@gmail.com

https://orcid.org/0000-0002-6654-8760

Viktoriya Hurochkina

Department of Economics Entrepreneurship and Economic Security, State Tax University, Ukraine

Email: viktoriav2005@ukr.net

https://orcid.org/0000-0001-8869-0189

Nataliia Miedviedkova

Department of Finance, Taras Shevchenko National University of Kyiv, Ukraine

Email: nsmedvedkova@gmail.com

https://orcid.org/0000-0001-6359-561X

Abstract. This paper is devoted to identifying the features and finding solutions to the problems of the formation and improvement of the non-state pension provision of Ukraine in the system of strengthening social security and preventing the degradation of the social structure. It presents the results of a study of emergent dynamics of the main performance indicators of non-state pension provision in Ukraine and the behavioural aspects of its beneficiaries when choosing a financial intermediary in the implementation of a new metadata specification based on three areas: banking institutions, non-state pension funds (NPFs) and life insurance companies. These results are the following: identification of key trends in non-state pension provision in Ukraine; disclosure of problems, obstacles, and major shortcomings of an organizational and legal nature; determination of directions for solving problems and the dominant factors in the development of non-state pension provision in Ukraine.

Keywords: pension system, banks, non-state pension funds (NPFs), insurance companies, social security.

_________

Acknowledgment. The article was prepared within the framework of the National Research Foundation of Ukraine project “New geostrategic threats to human social security in a hybrid war and ways to prevent them” № 2021.01 / 0239 and University of Zielona Góra.

Received: 16/01/2023. Revised: 20/03/2023. Accepted: 21/06/2023

Copyright © 2023 Oksana Cheberyako, Zakharii Varnalii, Viktoriia Нurochkina, Nataliia Miedviedkova. Published by Vilnius University Press

This is an Open Access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

1. Introduction

Under the conditions of the approach of a new large-scale economic crisis caused by the Russia–Ukraine War in Europe, as well as the consequences of the pandemic and record inflation over the last decade, a considerable deficit of budget funds, including the financial support of the pension system of Ukraine is observed. Significant losses of human capital associated with the migration of the economically active population to EU countries and mortality due to the military invasion of the territory of Ukraine by Russian troops worsened the state of economic security and significantly affected the nation’s aging indicators. Nowadays, Ukraine and other EU countries are considering the issue of implementing a pension reform to settle issues of financial protection of the population and provision of the pension system in the future. The design of social security and pension programs is complicated by the presence of a shadow economy since workers avoid state taxation and are not entitled to its benefits.

Over the past century, the dominance of the Ukrainian solidary pension system based on the principle of distribution, in the context of an increased demographic burden on the working population by the elderly and a chronic budget deficit of the Pension Fund Ukraine, is not effective enough. In particular, due to the unsatisfactory demographic situation, “shadow” employment, and tendencies to avoid paying taxes, there is a problem of shortfall in funds based on the insurance principle. It led to an imbalance in the budget and a chronic deficit in the Pension Fund of Ukraine. As a result, the low level of financial ability provokes a low level of pension payments, when about 2/3 of pensioners receive a pension at a level below the average indicator per year in Ukraine. Therefore, the population has an urgent subjective need to secure their old age at the expense of an additional pension to the solidarity pension by participating in individual-funded pension programs. Since the system of compulsory state pension insurance remains financially unstable, the implementation of non-state pension insurance in Ukraine is relevant in the context of further reform of the pension system. A citizen can realize this need in practice by concluding a pension contract with an NPF, a pension insurance contract with a life insurance company, or opening a pension deposit account with a banking institution and, thus, become a participant of a non-state pension provision.

The pension system performs a dual role: on the one hand, it plays an important role in creating well-being and preventing poverty among people of incapacitated age by replacing lost income with a pension, and on the other hand, it serves as a mechanism for accumulating financial resources ‒ investment in the economy. Thus, the formation of an efficient and financially sustainable pension system is a significant factor in sustainable economic growth, which contributes to strengthening the social security of an individual and the state. Since the declared three-tier pension system in Ukraine still cannot properly provide a decent standard of living for pensioners, not only the reform of the solidarity system and the implementation of mandatory funded insurance but also the search for solutions to the interest of the population in non-state pension provision remains relevant.

This study is based on a scientific and methodological approach using corresponding statistical data with financial technologies in the field of non-state pension provision, which is dominated by the offer of opening a pension deposit account with full payment and an attractive taxation system to strengthen the insurance security of the client. Statistical, comparative, and systematic methods were based on the NSSMC’s reports for the analytical development of the Pension Fund budget data and information related to non-state pension provision. These methodological approaches will allow us to answer the question: What are the features and problems in forming non-state pension provision in Ukraine for strengthening social security?

Thus, the purpose of the paper is to study the features and problems of non-state pension provision in Ukraine in the system of strengthening social security in order to avoid a real (or potential) threat of a social explosion and to prevent the degradation of the social structure. The main tasks are as follows: firstly, theoretical acquaintance with the concept of non-state pension provision and consideration of the structure of the pension system in the system of strengthening human social security; secondly, an overview of the specifics of the activities of banking institutions, private pension funds, and life insurance companies in the field of non-state pension provision; thirdly, identifying the problems of non-state pension provision and vectors for further reforming the pension system of Ukraine.

2. Literature review

Interdisciplinary research in modern science is provided with the instrumental capabilities of the big data hardware and software system, which allow interpreting research results from the standpoint of methodological rationality of cognitive theory and science.

Riccardo (2016) highlighted the importance of cognitive theory in science in his scientific writings, presented adherents of methodological rationality in scientific works, and noted that science is dominated solely by the context of the discovery. Analysing the dynamics of scientific change could only be done by reducing scientific “facts” to their social, cultural, and economic causes.

The scientific method should be classified as a universal method (Blachowicz, 2009), which provides for a certain fixed procedure with stages ranging from observation, description, formulation of a hypothesis, design, conduct of experiments, analysis of results, and conclusion. In recent years, the use of the scientific method in scientific research has caused some resonance, as some scientists consider it to be somewhat “outdated” (Anderson, 2008; Carrol & Goodstein, 2009), primarily due to the accelerated development of hardware and software for scientific research. For a detailed consideration of this topic, it is advisable to turn to extensive data, which is a digital sign of the development of modern society. This is the line of research and its methods are relevant for identifying the level of social security in the context of social security and using big data to strengthen scientific credibility. Social security should be understood as an objective economic reality inherent in a modern socialized economy (Novikova et al., 2018), expressing its inner essence, the social orientation of the development of society (Varnalii et al., 2020), the economic and social goals of the state and the desire of the general population.

Bishnu, Guo & Kumru (2019) note that social security programs can have regressive outcomes even though the benefits of the program are designed to be progressive. The large-scale quantitative OLG model calibrated to the US economy to compare aggregate and welfare implications of the US- type PAYG, a non-progressive PAYG, and a means-tested pension program are presented. Results clearly indicate that incorporating differential mortality into the model changes the welfare implications of social security programs. Tang (2019) proposed a model that is built on the basis of the assets of the three parts of the social insurance fund: stocks, debt, and cash. The results of the model show that: 1) when only considering cash, stock, and bond, the impact of the economic cycle on the allocation of large categories of social security fund assets is not severe, but it has a significant impact on the style and industry rotation of large categories of assets; 2) according to the calculation of the model, the cash assets of social security fund are deposited. In case of overmatching, it should be adjusted to the level near the minimum limit of 10%. So, this proves that China is now in a recession, and the trend of the business cycle in the next ten years is divided into five stages, which can roughly be considered as a sequential evolution of the Juglar cycle. A considerable part of the assets of the social security fund is treasury bond assets with strong liquidity. Therefore, we believe that the cash of the social security fund is overmatched and can be replaced by bond assets in subsequent operations to create better investment income.

Cai & Yue (2020) proved in their study that income inequality of the population decreases after the transfer of state social security to private social security, and there is no decrease in total income inequality if the scale and distribution of existing public transfers of social security increases. Jappelli, Marino & Padula (2021), when developing a social security life cycle model in Italy, which provides a link between increased demand for retirement savings and the level of expected future social security payments, found greater participation in private pension funds among those who expect lower and more uncertain social security benefits.

At the same time, Slavov et al. (2019), looking at typical neoclassical life cycle models that assume a large and negative impact of social security on private savings, argued the opposite position, which contains little evidence to support the theoretical model’s predictions of an empirical relationship between social security and private saving. The attention has been drawn to the developed model where people face the risk of uninsurable longevity and wage differentials, while Social Security provides benefits as a life annuity with higher replacement rates for the poor.

We support the opinion of McKinnon (2020) and The International Social Security Association (ISSA), noting that there can be “no social justice with social security,” while the instruments of social protection are favourable social policies and the free choice of social security beneficiaries, based on their needs. The formation of non-state pension funds has a positive relationship with the innovative activity of employees. Thus, Liu & Zhang (2016) give examples of the formation of two long-term preferred funds – the Social Security Fund and the Insurance Fund on corporate innovation. The results of the study showed that the Social Insurance Fund and the Insurance Fund play a positive role in improving corporate innovation performance in non-state enterprises, although they do not significantly improve the innovation performance of state-owned enterprises. These empirical findings highlight the positive impact of the Social Security Fund and the Insurance Fund on corporate innovation and will be useful to policymakers in emerging markets in assessing important drivers of corporate innovation capacity.

It is important to prevent different types of risks in the social insurance fund and the relationship between them for effective management decision-making. To ensure the high-quality functioning of the social insurance fund system in countries, modern scientists use different modelling techniques that provide clear forecasting data for the further functioning of economic systems. For example, Yang (2021) presented an interpretative structure model based on the application of the RBF neural network, illustrating the construction of a risk correlation hierarchy diagram and providing a scientific method for managing risks for a social insurance fund. This made it possible to create a prediction model based on the advanced ANT colony-RBF neural network, which makes the model more accurate and provides a more reliable basis for decision-making.

In addition to the general risks of the social insurance fund, there are also specific ones. Long & Yi (2020) note that the financial resources of the social insurance fund will continue to expand under the influence of the continuous development of China’s national economy. With the continuous development of rich data technology and cloud audit technology, the company has provided relevant technical support for the development of social security fund audit technology. For this purpose, the authors propose risk control and management measures to ensure the effective risk management of the financial data of social security funds in China.

Social protection is a polysystemic phenomenon. In our opinion, human social security (level) should be understood as the degree (level) of protection of the vital socio-economic interests of a person, his/her rights, freedoms, and values against internal and external, real and potential threats. Social security ensures the protection of life, health and well-being, and also creates the prerequisites for the formation and development of the individual. It is determined by the state of the economy, the nature of demographic actions, environmental anthropogenic causes, the state of the social sphere, the degree of social tension, the nature of social policy and the behaviour of the population. Human social security is a complex problem that affects different values of personal existence, and the level of pension provision is an indicator of the economic and social situation of the country’s population.

At the present stage of development of non-state pension provision in Ukraine, the banking institutions that are not involved in non-state pension provision remain the least involved, since it usually comes down only to the storage of pension assets. In accordance with the Law of Ukraine “On Non-State Pension Provision” (Zakon, 2003b), banking institutions directly participate in non-state pension provision by concluding agreements on opening pension deposit accounts for accumulating pension savings within the amount determined for reimbursement of deposits by the Deposit Guarantee Fund (up to UAH 200 thousand was before the war). That is, pension deposit accounts are opened for the payment of pension payments to their participants upon reaching retirement age.

On April 1, 2022, the Verkhovna Rada adopted the Law of Ukraine №2180-IX “On Amendments to Certain Laws of Ukraine on Ensuring the Stability of the Deposit Guarantee System for Individuals.” During martial law and 3 months thereafter, the Fund is obliged to reimburse each depositor in the full amount of his contribution, taking into account the interest accrued as of the end of the day preceding the withdrawal of the bank from the market. After 3 months from the date of termination or abolition of martial law, the maximum amount of reimbursement of funds on deposits of individuals in the bank (regardless of the number of deposits in this bank) will be increased to UAH 600 thousand.

3. Research methodology

The methodological basis for writing a scientific paper was the general scientific methods of cognition: dialectics, analysis, synthesis, consistency, scientific abstraction, and scientific and critical understanding of legislative and scientific sources.

A method for analysing the theoretical foundations for the formation of a new philosophy of pension provision and a new structure of social security is available for research at present thanks to the use of information technologies, and, first of all, technologies of extensive data. The novelty of the presented study is due to the results of rethinking the global process of non-state pension provision in Ukraine, which allows us to interpret social security and protection in a new way and use it both in philosophical and socio-economic practice. Nowadays, the universality of extensive data, making it possible to interpret the software and hardware complex from the point of view of its instrumental capabilities, is very relevant for modern science, especially in interdisciplinary research.

The hallmark of the scientific method is the achievement of values in the products of science (knowledge, prediction, control), such as objectivity, reproducibility, simplicity, or past success. However, there are certain fuzzy differences in the scientific method, such as changes in beliefs about the validity, relevance, or fallacy of scientific knowledge.

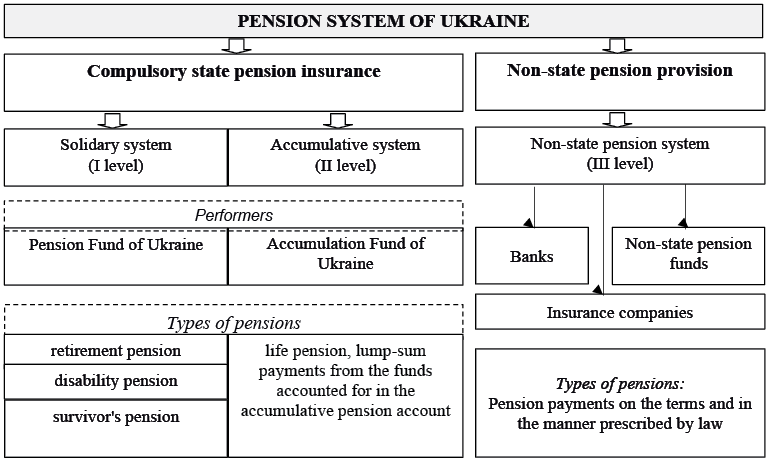

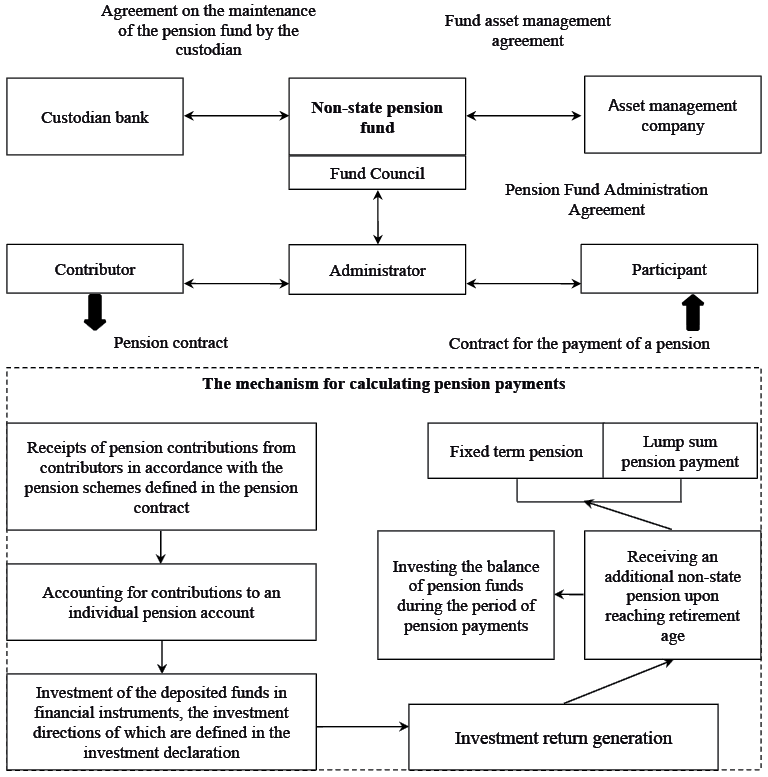

The structural-functional method (structural functionalism) was used, firstly, to disclose the structure of the pension system in Ukraine, and its elements interacting with each other. We choose this method since it allows us to see the study object (pension system) as a complex system whose parts work together to promote solidarity and stability. Moreover, structural functionalism is a macro theory that examines how all structures or institutions in the study object (pension system) work together. A famous scholar of sociology Talcott Parsons used structural-functionalism to portray institutions as being parts of a larger, smoothly functioning system (Parsons, 1951). In our research, we divided the pension system of Ukraine into 2 groups: compulsory state pension insurance and non-state pension provision. For each subgroup, subspecies with an indication of levels, performers, and types of pensions were identified. Secondly, structural functionalism was used for describing the scheme of functioning and accrual of pension payments of a non-state pension fund, including the mechanism for calculating payments and interactions between the participants in this process.

The systematic approach was used to find the benefits and shortcomings of life insurance companies and non-state pension funds in the system of non-state pension provision. This method was designed by C. West Churchman (1968) and refers to the idea of dealing with systems ‘as a whole.’ The systematic approach is a method of managing a complex system from a global perspective, rather than focusing on details. Thus, our research made it possible to understand the distinctive features and place of non-state pension funds in the system of non-state pension provision.

Statistical, comparative, and systematic methods were used for the analytical development of the Pension Fund budget data and basic information related to non-state pension provision. Thus, statistical and comparative methods were used for comparing the number of contributors and participants of the non-state pension provision system, as well as contributors’ pension contributions to NPFs during 2014–2021. This method was used during the review of the non-state pension provision system in Ukraine: we used the indicator of dynamics of insurance companies in the FI Register, dynamics of contributors’ pension contributions to NPFs, and dynamics of assets and the main performance indicators of NPFs.

4. Data, analysis and empirical findings

A key feature of the development of modern society is the socialization of all spheres of human life and their subordination to social goals. In any democratic society, the interests of the social security of a person and the state should generally correlate and be harmoniously balanced. There is no official definition of the category “social security” in the legal field of Ukraine, and the term “social security” has relatively recently entered scientific and political circulation and has found its concrete expression in several international documents. Among them, first of all, it is necessary to single out the World Social Declaration, adopted in 1995 at the World Conference on Social Development, in which the minimum tasks for ensuring social security were formulated.

It is worth noting that a pension deposit account as an instrument of voluntary pension accumulation is a pension one only in theory, the possibility of early withdrawal of funds on such an account classifies it as a deposit account. It works with a legislative restriction that the number of pension contributions, together with interest, cannot exceed the amount of reimbursement of retirement savings guaranteed by the Deposit Guarantee Fund.

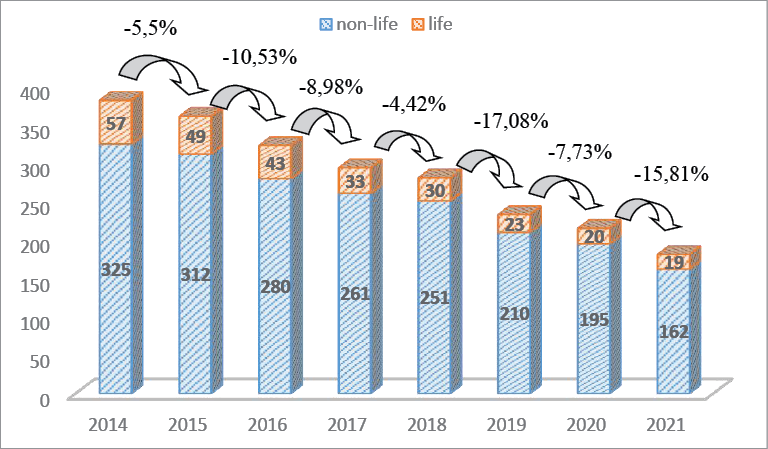

According to the State Register of Financial Institutions (FI Register), the number of insurance companies in Ukraine decreases annually and there were 185 companies by the end of 2021, 162 of which carried out “non-life” insurance, and compared to 2014, the indicator decreased by 201 companies (Figure 1).

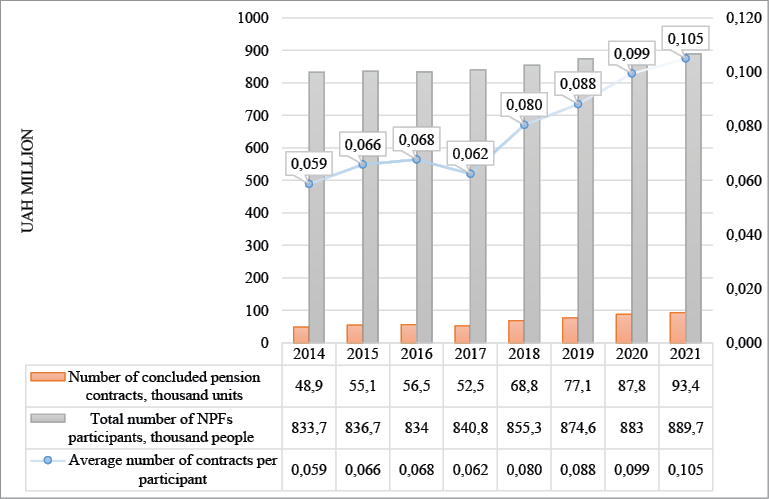

In Ukraine, 93.4 thousand pension contracts with administrators of NPFs for 889.7 individual participants entitled to receive pension payments based on a pension agreement with an administrator according to the mechanism of functioning of the NPF, have been concluded by the end of 2021 (Figure 2). NPFs remain the main subjects of non-state pension provision in Ukraine.

Figure 1. Number of insurance companies in the FI Register, as of the end of the year.

Source: compiled by the authors on the basis of (NSSMC, 2022).

Figure 2. Dynamics of the total number of contributors and participants of the non-state pension provision system in 2014-2021.

Source: compiled by the authors based on (NSSMC, 2022).

The general trend in the average number of contracts per participant ranges from 0.059–0.105, which means that most participants in open NPFs have savings accounts in these funds, but do not make pension contributions. The average number of pension contracts is growing and the indicator has increased by 0.046 units per person over the past 8 years.

In 2021, the number of concluded pension contracts is 93.4 thousand units, depositors are dominated by legal entities (more than 84.69% of the total as of the end of 2021), and the average number of contracts per participant is 0.105. In 2020, the number of concluded pension contracts is 87.8 thousand units and the average number of contracts per participant is 0.099.

According to the official data, as of August 31, 2021, 889.7 thousand people, or 5.56% of the employed population aged 15–70 years (16 million people), are participants of the non-state pension system, which is 0.96% more than the number of participants of the non-state pension system in 2014 (the actual total number of which was 833.7 thousand people, or 4.6% of the employed population aged 15–70 years (18,1 million people)).

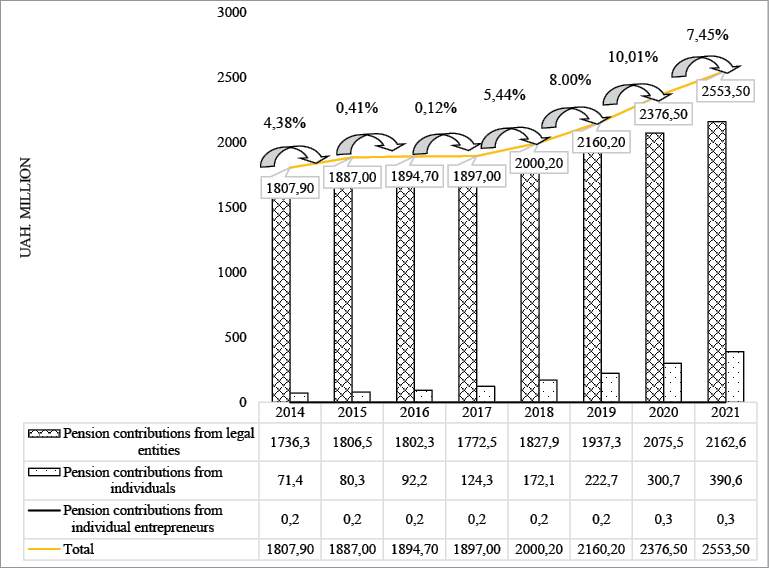

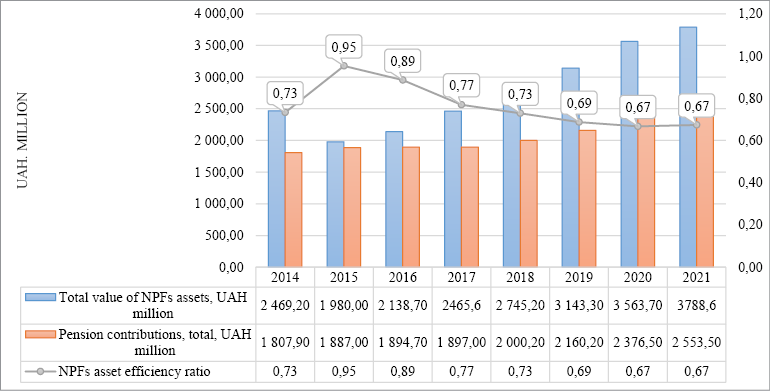

Thus, the growth trend of NPF contributors and participants is positive, since the population’s interest in the voluntary pension system is growing, but it is advisable to study the dynamics of pension contributions by NPF contributors (Figure 3).

Figure 3. Dynamics of contributors’ pension contributions to NPFs in 2014-2021, as of the end of the year.

Source: compiled by the authors based on (NSSMC, 2022).

By the end of 2020, contributors paid UAH 2553.5 million in pension contributions, which is 41.24% more than at the end of 2014 (this growth was due to the positive growth dynamics of contributions from individuals – by 35.02% in 2020, 29.40% – in 2019, 38.45 % – in 2018 and 34.81% in 2017, as well as an increase in their weight in the total cost of contributions – from 3.94% in 2014 to 12.65% in 2020. Other equally important indicators of the functioning of the non-state pension in Ukraine are pension payments and the share of participants who received these payments in the total number of participants in non-state pension funds.

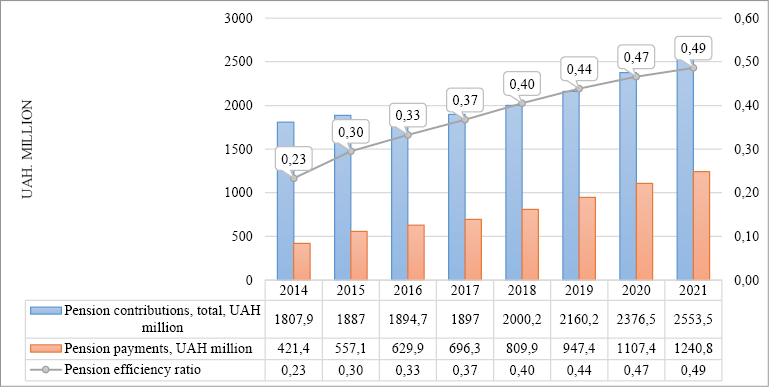

From the above histogram, it can be seen that pension contributions and fixed-term pension payments increased significantly for the researched period. The pension efficiency ratio is 0.49 in 2021, which is 0.25 more in comparison with 2014 (Figure 4). The number of participants of pension funds who received pension payments in 2021 is 93.4 thousand people, so the percentage for the studied 8 years ranges from 10% in 2021 to 9.1% in 2014, which indicates that every tenth participant receives pension payments.

Figure 4. Structure of pension payments made by NPFs in 2014–2021.

Source: compiled by the authors based on (NSSMC, 2022).

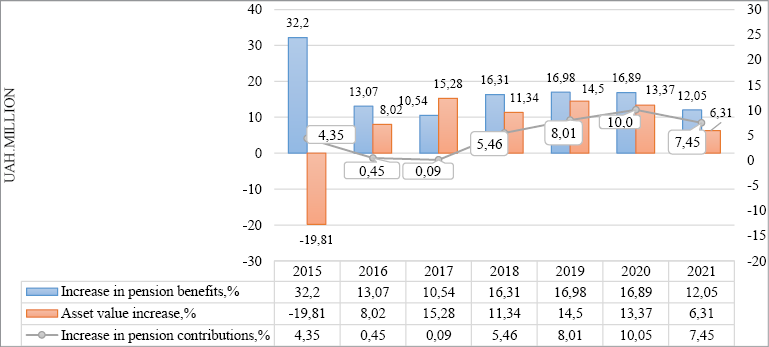

It should be noted that analytical indicators can be indicators of the average amount of pension payments per participant who received pension payments and the number of pension contributions made by one contributor. The activity of NPFs is to accumulate assets, the total amount of which by the end of 2021 amounted to UAH 3788.6 million with an efficiency ratio for the use of NPF assets of 0.67, which indicates the underdevelopment of non-state pension provision (Figure 5).

Through analysis of the main performance indicators of NPFs, namely pension assets, pension contributions (Figure 6), and payments, positive trends in their emergent development were noticed. Thus, in 2021, pension contributions grew by an average of 10.05%, pension payments – by 16.89%, and the average annual growth rate of assets – by 13.37%.

Figure 5. Dynamics of assets of NPFs in 2014–2021 and the efficiency ratio of their assets.

Source: compiled by the authors based on (NSSMC, 2022).

Figure 6. Emergent dynamics of the main performance indicators of NPFs during the period of 2014–2021 in Ukraine.

Source: compiled by the authors based on (NSSMC, 2022).

The study showed that the non-state pension provision is changing significantly in Ukraine, although it is only in its infancy, reaching only 4%. The pension savings of participants in non-state pension provisions were protected from depreciation and inflationary impact due to their investment mainly in conservative financial instruments. However, the full-scale war of Russia against Ukraine calls into question the emergent development of non-state pension provisions, which will lead to a deterioration in social security due to unemployment, a decrease in the already low incomes of the population, and the propensity to save.

Thus, the system of non-state pension provision has been in stagnation for eight years, as evidenced by insignificant growth rates of pension contributions and assets, which limits their investment opportunities. However, the dynamics is growing, which enhances the importance of NPFs for the socio-economic development of the country. Although world practice shows that increasing the amount and term of payment of contributions is not enough if there is no main component – a positive long-term net investment income, taking into account inflation and administrative costs.

The problem of the small number of NPF members and the irregular payment of contributions to accumulate pension savings could be solved in the long term by introducing automatic enrollment in funds and an automatic increase in the size of contributions. Automated pension plans are a concept implemented by the US and Australia in the early 1990s. In the 2000s, Italy, New Zealand, and the United Kingdom introduced such plans.

However, in Ukraine, the system of individual retirement savings can be implemented only if certain prerequisites are met:

- the public should have a good understanding of and trust in non-government financial institutions and instruments;

- there must be sound financial instruments and financial markets to stimulate domestic investment and job creation;

- due to the high administrative requirements of the funded system, the private sector must have significant administrative capacity.

The Cabinet of Ministers of Ukraine could also create new public financial instruments with inflation protection, the nominal value of which is adjusted in accordance with the consumer price index (CPI). Inflation-protected government securities could be issued electronically for up to 5, 10, and 20 years.

In order to identify the impact of the effectiveness of the implementation of the country’s social policy for the purposes of developing social capital, it is possible to use a four-factor model of the effectiveness and return on financial support for the development of social capital. It makes it possible to identify the most significant factors of influence (Нurochkina et al. 2021), which will help to carry out the managerial function of strategic planning of the country’s social policy.

Consequently, the system of non-state pension provision is only at the stage of development and does not encourage the population to save effectively for retirement. It is too expensive and does not provide adequate investment income. The participation of the population in it is scanty, and the perception by the majority of citizens is negative. However, in the case of successful implementation of the pension reform, one can expect its rapid development in Ukraine. In the short term, given the time it takes to develop capital markets and reliable financial instruments for investing pension assets, the government should consider introducing tax-free, voluntary, automatic individual savings accounts in banks. Such accounts could be modelled after the simple Individual Retirement Account (IPA) system in the United States.

International experience suggests that the design of retirement savings systems should be based on five elements:

1. Soft enforcement in the form of automatic inclusion and automatic increase in contributions can increase the number of participants in defined contribution pension schemes and help participants reach an acceptable contribution level. To get people to save for retirement, you need to use the force of inertia.

2. Well-designed automatic default options (for passive investors) help people who can’t or don’t want to choose their contribution rate, pension fund, investment strategy, or pension product.

3. Simplification of information and choice encourages the population to make the best choice. This can be achieved through web-based applications, reducing the pool of investment options, improving disclosure, or facilitating the comparison of available options.

4. To promote participation in private pension provision, it is advisable to expand the use of financial incentives, since their strength is based on the human nature of responding to immediate benefits.

5. Pay attention to fees to financial intermediaries that reduce real investment income from pension investments.

5. Discussion

The system of pension provision in Ukraine is de jure three-level (Furdak, 2021), the levels of which include two systems: the system of compulsory state pension insurance (the first and second levels) and the system of funded pension provision (the second and third levels) (Cheberyako & Bykova, 2020, p.45; Castro-González et al., 2020; Bednarczyk et al., 2021). The first level – the solidarity system – provides a basic income for a person after his/her retirement. The second level is individual pension accounts, on which pension contributions of citizens will be taken into account during their working life (Besedin& Berezina, 2017; Stashkevich, & Krasilnikova, 2018). The third level is voluntary non-state pension provision, which can be provided by the following financial intermediaries: banks, life insurance companies, and non-state pension funds (Figure 7).

However, currently, only the solidary pension insurance system and non-state pension provision are functioning. The issue of implementing the second pillar has remained open so far, and Ukrainians can only accumulate for retirement in a voluntary form. The obstacle to the beginning of the transfer of insurance premiums to the Accumulation Fund from January 1, 2019, was the requirements of the International Monetary Fund for approval in the Memorandum of Cooperation with the IMF dated December 5, 2018. According to the official text of the Memorandum, “We (Ukraine) will refrain from implementing the funded second pillar of the pension system” (Zakon, 2016). This agreement was related to the fact that the government of Ukraine should achieve a deficit-free budget for the Pension Fund, and even under this condition, it is possible to divert financial resources to create a second level of the pension system.

Figure 7. Structure of the pension system in Ukraine

Source: compiled by the authors based on (Zakon, 2003a).

It is worth noting that, supporting the opinion of the IMF, the International Labor Organization also opposed the implementation of funded pension insurance in 2018–2019, given the negative experience of the functioning of this system in Latin America and Eastern Europe. It happened because pension fund deficits grew, administration costs of funds were higher than predicted, and expectations regarding the promotion of the development of capital markets did not materialize (Babenko-Levada & Morozova, 2020).

The overall goal of the non-state pension provision system is to increase the efficiency of the pension system by forming pension savings in banks (Maj-Waśniowska & Jedynak, 2020; Achkasova et al., 2021), non-state pension funds (Levchenko, 2015; Achkasova, 2018; Luchko et al., 2019; Pukala et al., 2020; Jedynak, 2022) and insurance companies (Ostrowska-Dankiewicz, 2019; Płonka et al., 2020; Polinkevych et al., 2021) for citizens to receive additional pension payments through contributions and profits to increase their social security (Lutsyshyn et al., 2019; Jedynak, 2020). In case of using the international assessment of the poverty level of the population, according to which the cost of daily consumption is set at USD 5 (up to 4300 UAH per month), then 85.4% of Ukrainian pensioners as of January 01, 2021, received a pension in the amount lower, or at the level of this limits – up to UAH 5000.

Other subjects of the non-state pension provision system are NPFs and insurance companies, the advantages and disadvantages of which are systematised in Table 1.

The advantages of insurance companies in comparison with NPFs are the possibility of obtaining a redemption amount, a wide range of insurance products, guaranteeing investment income at the level of up to 4%, as well as the payment of a pension in the form of a life annuity, which in its content plays the role of pension provision, and the available elements of insurance protection. The advantage of NPFs is that their assets are diversified between various financial instruments, which ensures risk minimization and protection of pension savings. However, since deposits are only possible in the national currency, in the case of devaluation, the positive effect will be levelled and participants will lose the amount of accumulated investment income.

Table 1. Advantages and disadvantages of life insurance companies and non-state pension funds in the system of non-state pension provision

|

Non-state pension funds |

Life insurance companies |

|

|

Advantages |

performed operations are associated with a lower degree of risk, since the directions for investing pension funds are clearly defined; |

the possibility of providing loans to individuals on terms that are more favourable compared to bank lending; |

|

availability of tax benefits; |

no link to retirement age |

|

|

no link to retirement age; |

insurers, in accordance with the purchased life insurance policy, can guarantee the minimum amount of the future pension; |

|

|

is not a profitable organization, it has only a current account, therefore it subjectively has an advantage when choosing. |

the possibility of making a lifelong payment of pensions, which is more familiar in terms of the essence of pension provision; |

|

|

possibility to choose investment currency; |

||

|

the availability of a redemption amount, that is, the opportunity to receive funds in the case of early termination of the life insurance contract. |

||

|

Disadvantages |

Non-state pension funds |

Life insurance companies |

|

no guarantee of the amount of investment income received on pension assets; |

is a profitable organization established in the form of a joint-stock company; |

|

|

it is not possible to provide life-long payments to fund participants, only urgent (for a certain period), thus the essence of pension provision is lost; |

||

|

do not have tools for assessing the size of a future pension, since it directly depends on the profitability of pension resources concluded by an asset management company; |

ownership of pension savings comes gradually, depending on the terms of the contract, in NPFs and banks, where pension savings immediately become the property of the depositor. |

|

|

the number of contributions is tied only to UAH, as a result, there may be loss of safety because of the depreciation of the UAH. |

Source: compiled by the authors.

Thus, due to the volatility of the economy in Ukraine, as well as the lack of reliable instruments for investing pension assets for NPFs and insurance companies, banking institutions are the most promising. The reason is that in the case of bankruptcy of this institution, the Deposit Guarantee Fund will reimburse the amount of the deposit pension account in the amount of UAH 600 thousand.

On the one hand, the advantage of the bank is that it can guarantee profitability, and on the other hand, the disadvantage is that the amount of income will be limited. However, when participating in non-state pension provisions through the opening of a pension deposit account, the client’s insurance coverage is fully payable, unlike insurance companies and NPFs. In addition, the pension deposit account is attractive, since its amount is not included in the taxable income of citizens in accordance with subparagraph 41, paragraph 1, article 165 of the Tax Code of Ukraine.

From the standpoint of providing insurance protection, a life insurance contract is the most similar product in terms of its economic essence, and from the standpoint of obtaining a higher investment income from investing pension assets is NPF. In addition, a special role is assigned to the NPF in the context of pension reform as a subject of funded state pension provision, in which individual pension accounts of a second-tier participant can be opened (Zakon, 2003a). Despite the rather low level of development of NPFs, it is considered inappropriate to contradict these norms, since the involvement of NPFs in state savings programs is a fairly common foreign practice.

According to the Ukrainian typology, NPFs are divided into open, closed, and corporate ones, which differ depending on the participants and founders. The main goal of the refinery is to improve the efficiency of the pension system. The functioning and calculation of NPF pension payments are shown in more detail in Figure 8.

Needless to say, that the study of non-state pension provision associated with the vulnerability of the solidary system to political and demographic risks, should be continued in the direction of not only a review of the features of voluntary non-state pension provision, which is vulnerable to inflation and bankruptcy. This will contribute to the choice of subjects of non-state pension provision in terms of the reliability of financial instruments into which pension assets will be financed, the possibility of guaranteeing the payment of accumulated funds and contributions in the case of the institution’s liquidation. It is so crucial to strengthen the social security of an individual and the state since in any democratic society the interests of social security of states and individuals should be correlated and harmoniously balanced.

6. Conclusion

The study allowed us to define the problems, obstacles, and major shortcomings of an organizational and legal nature, and suggest recommendations for solving problems in the development of non-state pension provisions in Ukraine.

Figure 8. Scheme of functioning and accrual of pension payments of a non-state pension fund

Source: compiled by the author based on (Zakon, 2003b).

Ukraine needs to rethink its funded non-state pension system (3rd pillar) to prevent a future pension crisis, and Ukrainian citizens need to focus on generating pension savings to strengthen their social protection since the Ukrainian pension before the war was the lowest in Europe: USD 460 in Poland and EUR 1,000 in France, while citizens of Ukraine over 60 receive an average of USD 100.

The structural-functional method helped us to realize the place of the non-state pension provision in the Pension system of Ukraine and the importance of its implementation. The deal is that, currently, only the solidary pension insurance system and non-state pension provision are functioning, while the issue of implementing the second pillar has remained open so far. The need for structural reform of the pension system is also exacerbated under the influence of such negative factors as the low level of income of the country’s population and inflation processes.

Analysis of the activities of banks, insurance companies, and NPFs in Ukrainian realities showed us that there is such a shortcoming as an impossibility for consumers to access financial services from non-state pension provisions due to some reasons: firstly, the lack of public confidence, secondly, unpopularity among the population, thirdly, territorial inaccessibility for the population, since non-state pension funds operate only in 8 regions.

The systematic method helped us to reveal the advantage of NPFs – their assets are diversified between various financial instruments, which ensures risk minimization and protection of pension savings, however, since deposits are only possible in the national currency, in the event of devaluation, the positive effect will be levelled and participants will lose the amount of accumulated investment income. Taking into account the volatility of the economy in Ukraine and the lack of reliable instruments for investing pension assets for NPFs and insurance companies, banking institutions are the most promising, since in case of their bankruptcy, the Deposit Guarantee Fund will reimburse the amount of the deposit pension account in the amount of UAH 600 thousand.

Statistical, comparative, and systematic methods showed us that the growth trend of NPF contributors and participants is positive since the population’s interest in the voluntary pension system is growing. The pension contributions and fixed-term pension payments also increased significantly. But the system of non-state pension provision has been in stagnation for seven years, as evidenced by insignificant growth rates of pension contributions and assets, which limits their investment opportunities. However, the dynamics is growing, which enhances the importance of NPFs for the socio-economic development of the country.

Although world practice shows that increasing the amount and term of payment of contributions is not enough if there is no main component – a positive long-term net investment income, taking into account inflation and administrative costs.

The problem of the small number of NPF members and the irregular payment of contributions to accumulate pension savings could be solved in the long term by introducing automatic enrollment in funds and an automatic increase in the size of contributions.

The obstacles affecting the development of non-state pension provision, in our opinion, are as follows: low financial awareness of the population and the low degree of spread of financial services; distrust of clients to banking institutions, insurance companies, and NPFs; low purchasing power (income) of potential participants in non-state pension provision, which is associated with an unsatisfactory macroeconomic situation; lack of awareness of clients about the possibility of participating in non-retained pension provision.

In the short term, given the time it takes to develop capital markets and reliable financial instruments for investing pension assets, the government should consider introducing tax-free, voluntary, automatic individual savings accounts in banks. In addition, the government could create new inflation-protected public financial instruments that are denominated in line with the consumer price index (CPI).

International experience suggests that the design of retirement savings systems should be based on five elements: soft enforcement in the form of automatic inclusion in the system and automatic increase in the level of contributions, well-designed automatic default options (for passive investors), simplification of information and choice, application of financial incentives, payment to financial intermediaries.

Thus, the prospects for the development of non-state pension provision in Ukraine are associated with the advantages and disadvantages of the activities of its subjects, choosing between which a potential participant in the system of non-state pension provision, first of all, pays attention to the reliability of this institution (the NPF cannot be bankrupt) and the guarantee of receiving pension payments in case of its bankruptcy (deposits are guaranteed only by banking institutions), as well as the possibility of receiving funds in case of early termination of the contract (redemption amount under a life insurance policy).

Further research is needed for theoretical and practical aspects of the study of non-state pension provision in Ukraine under the war, which is accompanied by a deterioration in the socio-economic situation in the country. This is reflected in the increase in the number of those who have lost their ability to work and need social protection, and thus it leads to an additional burden on the state budget. Since one of the obstacles to the introduction of non-state pension provision is the low level of income of the population and its negative trend, further research should be focused on finding ways for increasing entrepreneurial activity (especially special support of small and medium-sized businesses) and trust in financial institutions – participants in the system of non-state pension provision. These areas of research and accordingly developed measures to improve non-state pension provision should be reflected in the state strategy for reforming the national pension system.

References

Achkasova, S. (2018). Ensuring financial security of non-governmental pension funds in Ukraine. Ikonomicheski Izsledvania, 27(1), 152–172. https://www.iki.bas.bg/Journals/EconomicStudies/2018/2018-1/7_Achkasova_f-f.pdf

Achkasova, S., Bezrodna, O., & Ohorodnia, Y. (2021). Identifying the volatility of compliance risks for the pension custodian banks. Banks and Bank Systems,16(3), 113-129. http://dx.doi.org/10.21511/bbs.16(3).2021.11

Anderson, C. (2008). The end of theory: The data deluge makes the scientific method obsolete. Available at: https://www.wired.com/2008/06/pb-theory/

Babenko-Levada, V., & Morozova, A. (2020). Protses vprovadzhennia nakopychuvalnoi systemy strakhuvannia v Ukraini [The process of implementation of accumulative insurance system in Ukraine]. Efektyvna ekonomika- Effective economy, 12. (In Ukrainian). Available at: https://doi.org/10.32702/2307-2105-2020.12.70

Bednarczyk, T., Skibińska-Fabrowska, I., & Szymańska, A. (2021). An empirical study on the financial preparation for retirement of the independent workers for profit in Poland. Risks, 9, 160. https://doi.org/10.3390/risks9090160

Besedin, V. Berezina, S. (2017). Suchasni problemy i tendentsii v pensiinomu zabezpechenni naselennia Ukrainy [Modern problems and trends in the provision of pensions to the population]. Universytetski naukovi zapysky - University Science Notes, 61, 131-140. (In Ukrainian). Available at: http://www.irbis-nbuv.gov.ua/cgi-bin/irbis_nbuv/cgiirbis_64.exe?I21DBN=LINK&P21DBN=UJRN&Z21ID=&S21REF=10&S21CNR=20&S21STN=1&S21FMT=ASP_meta&C21COM=S&2_S21P03=FILA=&2_S21STR=Unzap_2017_1_17

Bishnu, M., Guo, N. L., & Kumru, C. S. (2019). Social security with differential mortality. Journal of Macroeconomics, 62. Available at: https://doi.org/10.1016/j.jmacro.2018.11.005

Blachowicz, J. (2009). How science textbooks treat scientific method: A philosopher’s perspective. The British Journal for the Philosophy of Science, 60 (2): 303–344. Available at: https://www.jstor.org/stable/25592003

Castro-González, S., Rey-Ares, L., Fernández-López, S., & Daoudi, D. (2020). The effect of self-control upon participation in voluntary pension schemes. Economics and Sociology, 13(1), 11-23. doi:10.14254/2071-789X.2020/13-1/1

Cheberyako, O., & Bykova, V. (2020). Modeli pensiinoho zabezpechennia: zarubizhna ta vitchyzniana praktyka [Models of the pension system: international experience and local practice]. Visnyk Kyivskoho natsionalnoho universytetu imeni Tarasa Shevchenka-Bulletin of Taras Shevchenko National University of Kyiv. Economics, 5(212), 43-51. (In Ukrainian). Available at: https://doi.org/10.17721/1728-2667.2020/212-5/6

Churchman, C. West (1968). The systems approach. New York: Delta. Worldcat. URL: https://csl4d.wordpress.com/2017/07/12/a-summary-of-the-systems-approach/

Furdak, M. (2021). Systema pensiinoho zabezpechennia v Ukraini – deiaki aspekty reformuvannia [The Pension System in Ukraine – Some Aspects of Reforming]. Business Inform, 6, 176–183. (In Ukrainian). Available at: https://doi.org/10.32983/2222-4459-2021-6-176-183

Jedynak, T. (2020). Is it still possible to receive an adequate income from pensions in the era of ageing societies? - The Great Pension Gap Challenge in Europe. Eurasian Studies in Business and Economics, 13(1), 53–70.

Jedynak, T. (2022). Does the formulation of the decision problem affect retirement? - Framing effect and planned retirement age. International Journal of Environmental Research and Public Health 19 (4): 1977. Available at: https://doi.org/10.3390/ijerph19041977

Koval, O. (2012). Perspektyvy vprovadzhennia zahalnooboviazkovoi nakopychuvalnoi pensiinoi systemy v Ukraini: vplyv na ekonomichnu bezpeku : monohrafiia [Prospects for the implementation of a mandatory funded pension system in Ukraine: the impact of economic security: a monograph]. Kyiv: National Institute for Strategic Studies. (In Ukrainian). Available at: https://niss.gov.ua/sites/default/files/2012-10/monogr_Koval-7c603.pdf

Levchenko, V. (2015). Non-banking financial services market efficiency evaluation. Problems and Perspectives in Management, 13(1), 78-84. Available at: https://www.businessperspectives.org/index.php/journals/problems-and-perspectives-in-management/issue-47/non-banking-financial-services-market-efficiency-evaluation

Long, H., & Yi, T. (2020). Research on the Social Security Fund Risk Control and ManagementMeasures Based on Cloud Audit and Big Data Era. Modern Economics & Management Forum, 1(1). Available at: https://doi.org/10.32629/memf.v1i1.105

Luchko, M., Lew, G., Ruska, R., & Vovk, I. (2019). Modelling the optimal size of investment portfolio in a non-state pension fund. Journal of International Studies, 12(1), 239-252. doi:10.14254/2071-8330.2019/12-1/16

Lutsyshyn, Z., Klapkiv, Y., Kucher, T., Svirskyi, V. (2019). Development of innovative instruments in the financial market of Ukraine. Espacios, 40(28). Available at: https://www.revistaespacios.com/a19v40n28/a19v40n28p22.pdf

Liu, N., & Zhang, A. (2016). The Impact of Social Security Fund & Insurance Fund on Corporate Innovation. In 2016 13th International Conference on Service Systems and Service Management, ICSSSM 2016. Institute of Electrical and Electronics Engineers Inc. Available at: https://doi.org/10.1109/ICSSSM.2016.7538635

Maj-Waśniowska, K, & Jedynak, T. (2020). The Issues and Challenges of Local Government Units in the Era of Population Ageing. Administrative Sciences, 10(2):36. Available at: https://doi.org/10.3390/admsci10020036

McKinnon, R. (2020, July 1). Introduction: Social security, inclusive growth and social cohesion. International Social Security Review. Blackwell Publishing. Available at: https://doi.org/10.1111/issr.12242

Novikova, O., Sydorchuk, O. & Pankova, O. (2018). Stan ta perspektyvy sotsialnoi bezpeky v Ukraini: ekspertni otsinky: monohrafiia [State and prospects of social security in Ukraine: expert assessments: monograph]. Lviv Regional Institute of Public Administration of the National Academy of Public Administration; National Academy of Sciences of Ukraine, Institute of Industrial Economics. Kyiv, Lviv. (In Ukrainian). Available at: https://iie.org.ua/wp-content/uploads/2018/11/Novikova_Sydorchuk_Pankova.pdf

Nssmc (2021). Pidsumky rozvytku systemy nederzhavnoho pensiinoho zabezpechennia stanom na 31.12.2020 [Results of the development of non-state pension provision as of December 31, 2020]. Natsionalna komisiia z tsinnykh paperiv ta fondovoho rynku - National Commission on Securities and Stock Market. (In Ukrainian). [Electronic resource]. – Mode of access: http://surl.li/ektfb.

Ostrowska-Dankiewicz, A. (2019). Consumer protection policy in the Polish life insurance market in the aspect of current legal regulations. Investment Management and Financial Innovations, 16(4), 168-180. doi:10.21511/imfi.16(4).2019.15

Parsons, T. (1951), The Social System, New York: Free Press.

Płonka, M., Jedynak, T., & Trynchuk, V. (2020). Retirement behavior strategies: the attitudes of students from Poland and Ukraine towards the old-age risk. Problems and Perspectives in Management, 18(2), 350-365. http://dx.doi.org/10.21511/ppm.18(2).2020.29

Polinkevych, O., Glonti, V., Baranova, V., Levchenko, V., & Yermoshenko, A. (2021). Change of business models of Ukrainian insurance companies in the conditions of COVID-19. Insurance Markets and Companies, 12(1), 83-98. http://dx.doi.org/10.21511/ins.12(1).2021.08

Pukala, R., Vnukova, N., Achkasova, S., & Gorokhovatskyi, O. (2020). The application of weighted decision matrix for the selection of non-state pension provision strategy. CEUR Workshop Proceedings, 2631, 268-279. Available at: http://ceur-ws.org/Vol-2631/paper20.pdf

Riccardo, V. (2013). Methodological Cognitivism. Vol. 2, Cognition, Science, and Innovation. Publisher: Springer. DOI:10.1007/978-3-642-40216-6

Scullion, L., & Curchin, K. (2022). Examining Veterans’ Interactions with the UK Social Security System through a Trauma-Informed Lens. Journal of Social Policy, 51(1), 96–113. Available at: https://doi.org/10.1017/S0047279420000719

Slavov, S., Gorry, D., Gorry, A., & Caliendo, F. N. (2019). Social Security and Saving: An Update. Public Finance Review, 47(2), 312–348. Available at: https://doi.org/10.1177/1091142118770199

Stashkevich, N., & Krasilnikova, K. (2018). Prespektyvy vprovadzhennia nakopychuvalnoho rivnia pensiinoi systemy Ukrainy [Prospects for implementing the accumulative level of the pension system of Ukraine]. Visnyk sotsialno-ekonomichnykh doslidzhen - Socio-economic research bulletin, 2(66), 223‒231. (In Ukrainian). Available at: https://doi.org/10.33987/vsed.2(66).2018.223-231.

Tang, Z. (2019). Economic cycle and the large-scale asset allocation strategy of Chinese National social security Fund. Asian Economic and Financial Review, 9(12), 1405–1418. Available at: https://doi.org/10.18488/journal.aefr.2019.912.1405.1418

Varnalii, Z., Bilyk, R. & Khmelevskiy, M. (2020). Sotsialna bezpeka Ukrainy: sutnist, problemy ta shliakhy zabezpechennia [Social security of Ukraine: summary, problems and ways of ensuring]. Ekonomichnyi visnyk universytetu - University Economic Bulletin, 45, 105-114. (In Ukrainian). https://doi.org/10.31470/2306-546X-2020-45-105-114. Available at: https://economic-bulletin.com/index.php/journal/article/view/662/674

Yang, L. (2021). Risk Prediction Algorithm of Social Security Fund Operation Based on RBF Neural Network. International Journal of Antennas and Propagation, 2021. Available at: https://doi.org/10.1155/2021/6525955

Zakon (2003a). Zakon Ukrainy Pro zahalnooboviazkove derzhavne pensiine strakhuvannia [On compulsory state pension insurance: Law of Ukraine dated July 9, 2003 No. 1058-IV]. [Electronic resource]. Mode of access: https://zakon.rada.gov.ua/laws/show/1058-15

Zakon (2003b). Zakon Ukrainy Pro nederzhavne pensiine zabezpechennia [On non-state pension provision: Law of Ukraine dated July 9, 2003 No. 1057-IV]. [Electronic resource]. Mode of access: https://zakon.rada.gov.ua/laws/show/1057-15

Zakon (2016). Ukraina: Lyst pro namiry [Letter of Intent to the International Monetary Fund. Memorandum on economic and financial policy dated September 1, 2016 No. 14168/0/2-16]. [Electronic resource]. Mode of access: https://zakon.rada.gov.ua/laws/show/v2-16500-16#Text

Нurochkina, V., Reshmidilova, S., Bohatchyk, L., Telnov A., Skorobogata L., & Riabinina, N. (2021). Modeling effectiveness of financial support for the social capital development in economic emergence. WSEAS Transactionson Environmentand Development, 17, 262-270. https://doi.org/10.37394/232015.2021.17.27