Ekonomika ISSN 1392-1258 eISSN 2424-6166

2024, vol. 103(1), pp. 44–55 DOI: https://doi.org/10.15388/Ekon.2024.103.1.3

Does Uncertainty in Climate Policy Affect Economic growth? Empirical Evidence from the U.S.

Burcu Savaş Çelik

İstanbul Gelişim University, International Trade and Management Department, İstanbul, Turkiye,

Email: bsavas@gelisim.edu.tr

ORCID: https://orcid.org/0000-0002-3896-5858

Başak Özarslan Doğan

İstanbul Gelişim University, International Trade and Management Department, İstanbul, Turkiye

Email: bozarslan@gelisim.edu.tr

ORCID: https://orcid.org/0000-0002-5126-7077

Abstract. This study aims to empirically investigate the short- and long-term effects of climate policy uncertainty on economic growth in the U.S. for the years 1990-2020. In the study, total workforce, foreign direct investments, and financial development variables were also selected as control variables, and the effects of these variables on economic growth were examined. The study used the ARDL bounds test approach to investigate the cointegration between the variables. The findings confirm the existence of a positive and statistically significant relationship between climate policy uncertainty and economic growth in the sample period in the U.S. In addition, the effects of total labor force, foreign direct investments, and financial development on economic growth were found to be positive and statistically significant in the study.

Keywords: Climate policy uncertainty, Economic growth, Labor force, Financial development, ARDL bounds test

_________

Received: 06/09/2023. Revised: 03/11/2023. Accepted: 10/03/2024

Copyright © 2024 Burcu Savaş Çelik, Başak Özarslan Doğan. Published by Vilnius University Press

This is an Open Access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

1. Introduction

Climate change is one of today’s most challenging elements and can potentially affect the lives of almost every living thing on Earth. In addition, climate change can interfere directly and indirectly with the economic and financial system (Daniel et al., 2020).

Nordhaus (1977), who investigated the relationship between climate change and economic growth for the first time, stated that fossil fuels are vital for production. Still, these fuels will cause greenhouse gasses and negatively affect economic performance in the coming years. The researcher also stated that climate change has the power to affect many financial factors and that researchers and policymakers should do the necessary studies on the effects of climate change on financial markets.

Studies have focused on the micro and macro-based effects of climate change policy, such as tourism, employment, agriculture, health, foreign direct investment, stock market, and economic growth (Atasoy & Atasoy, 2020), and revealed that climate change directly affects the economy. The research report by Moody’s Analytics (2019) revealed that the cost that the U.S., responsible for 14% of global greenhouse gas, had to endure due to hurricanes due to climate change in 2017 was 300 billion U.S. dollars. In the report prepared by Earths Future (2018), it is emphasized that in case of non-compliance with the Paris Climate Agreement, the long-term cost of Australia will be 126 billion USD, and the global cost may be 23 trillion USD (İklim Değişikliği Modülü, 2019). While the effects of climate change on the economy are so significant, its relationship with financial assets, which is one of the essential sub-dimensions of the economy, is inevitable. However, studies on the impact of climate change on the macroeconomics are still quite limited.

Climate policies set goals to reduce CO2 emissions at the global level and to increase sustainable energy resources. However, research and agreements between countries in recent years show that there are still uncertainties in implementing climate policies. The climate policy uncertainty index (CPU), introduced to the literature by Gavriilidis (2021), has been a topic of discussion for scholars and researchers. According to the author, CPU is the most important index, which follows the established methodology of Baker et al. (2016) and their EPU index. The index was created according to the frequency of use of some essential concepts related to ecology in 8 different newspapers in the U.S. between the periods 2000.01- 2021.03. Gavriilidis (2021) found climate policy determination has a strong and negative effect on CO2 emissions. Because of that, many studies list the economic elements most affected by climate change policy.

In recent years, with the impact of CPU factors such as the COVID-19 epidemic (Ebi et al., 2021) and the industry sectors (He & Zhang, 2022; Lv & Li, 2023; Dinç, 2022), financial speculation and financial behavior (Guo et al. al., 2022; Chen, 2023) and stock market (Basaglia et al., 2021; Xu et al., 2023).

This study examines the effects of climate policy uncertainty on the total workforce, foreign direct investments, and financial development using ARDL analysis for the U.S. from 1990-2020. There are numerous reasons to examine the U.S. First, according to the financial globalization index, the U.S. has 80% financial influence. In this way, the U.S. can both affect the world conjuncture and be affected by the world conjuncture. According to Moody’s Analytics Report (2019), the U.S. is responsible for 14% of global greenhouse gas.

Our study proceeds as follows. The second part examines the sample literature to determine the relations between CPU and macroeconomic factors. In the third part, we prepared the dataset and model used in our empirical analysis. In the fourth part, we present the empirical findings. In the final part, we present conclusions based on empirical findings.

2. Literature review

In the literature, many studies have studied the effects of climate change on various sub-branches of the economy (Huang, 2023; Chang et al., 2018; Liu et al., 2022). Estimating climate change’s possible economic effects is significant for policy decisions (Pretis, 2020). For this result, governments must make policy decisions to ensure sustainable growth and reduce CO2 emissions. However, economic policy uncertainty (EPU) leads to uncertainty of the climate policy (CPU) and also causes economic factors to be highly affected by the uncertainty in climate change (Huang, 2023).

The CPU, introduced to the literature by Gavriilidis (2021), has been a topic of discussion for governments and researchers. According to the author, CPU is the most important index, which follows the established methodology of Baker et al. (2016) and their EPU index (Gavriilidis, 2021). The climate policy uncertainty index based on the frequency of repetition of climate-related words in the keywords of 8 significant newspapers operating in the U.S. Based on this index, Gavriilidis found climate policy uncertainty has a strong and negative effect on CO2 emissions. Because of that, many studies list the economic elements most affected by climate change in terms of agriculture, tourism, energy, labor sectors, and stock financial markets.

The studies in the literature can be divided into two groups for examination. The first category includes studies of the role of a CPU in agriculture, tourism, energy, and labor markets. The second category encompasses studies of the role of a CPU on Gross Domestic Product (GDP), the stock market (S.M.), and Foreign Direct Investment (FDI). But in this study, we only review relevant studies on the impact of CPU on the total workforce, GDP F.D., and FDI.

2.1. Economic and Financial Impact of Climate Policy Uncertainty

Some scholars have verified the linkage between the climate change policy and the stock market. Chang et al. (2020), one of the studies on the relationship between the CPU and the stock market, studied the relationship between coal, oil, gas, and stock return in 18 countries. In this study, while a negative correlation was found between three fossil sources and stock market return in the U.K., the highest positive correlation was between coal emissions and the stock market in Japan. The highest positive correlation was detected between oil emission and stock return in Norway and the highest negative correlation between oil emission and stock return in Germany. Statistically, all the findings show that the stock market returns to CO2 emissions from coal, oil, and gas are unidirectional. Basaglia et al. (2021) determine the relationship between the increase in CPU and the U.S. stock market volatility. He found that the increase in CPU is related to prices of stocks with relatively lower prices.

Some scholars have researched the effects of climate policy uncertainty on Foreign Direct investment and GDP. Jorgenson et al. (2022) researched the relationship between Gross Domestic Product (GDP), Foreign Direct Investment, stock market, and climate change using Prais-Winsten regression models with panel analysis in 77 countries. Results showed that CO2 and GDP is positively associated with foreign direct investment. Pao and Tsai (2011) analyzed the relationship between CO2 emissions, energy consumption, Foreign Direct Investment, and GDP in BRICS countries. They found a solid bidirectional relationship between CO2 emissions, Foreign Direct investment, and a unidirectional strong relationship from output to Foreign Direct investment. Dinç (2022) analyzed the relationship between the index of climate policy uncertainty, energy consumption, and economic growth in the U.S. via symmetric causality. He found that the relationship between climate policy uncertainty and CO2 emissions and energy consumption varies across sectors.

Our paper presents several main contributions to the literature. First, there is a limited number of research examining the impact of the CPU on macroeconomic variables. Second, no studies examine the causality relationship between CPU and total labor workforce, financial development index, foreign direct investment, and gross domestic product. Thirdly, to address the gap in the literature, we applied the ARDL test to examine the relationship between variables.

3. Data and Method

The time series data used in the study examining the relationship between climate policy uncertainty and economic growth in the U.S. covers the period 1990-2020. Economic growth, the study’s dependent variable, is represented by GDP and the fixed 2015 prices expressed in U.S. dollars. On the other hand, climate policy uncertainty (CPU) is represented by the climate policy uncertainty index, which is calculated by Gavrilidis (2021) based on newspaper reports on the leading U.S. emissions regulations, global strikes, and the U.S. president’s statements on climate change. Other variables used in the study are total workforce (L.B.), foreign direct investment (FDI), gross domestic product (GDP), and financial development index (F.D.). L.B., FDI, and GDP variables were taken from the World Bank, and the F.D. variable was taken from the IMF database.

3.1. Model Specification

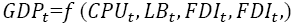

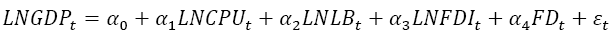

The form representing the empirical framework of the study examining the impact of climate policy uncertainty on economic growth in the U.S. is expressed in Equation 1.

(1)

(1)

The modified and transformed version of Equation 1 is expressed in Equation 2 below:

(2)

(2)

In Equation 2, LNGDP represents the logarithm function of economic growth, LNCPU represents the logarithm function of climate policy uncertainty, LNLB represents the logarithm function of the total labor force, and finally, LNFDI represents the logarithm function of foreign direct investment.

In addition to climate policy uncertainty, the labor force, foreign direct investment, and financial development variables used in the study were chosen because they are also the basic growth dynamics. The model is based on the Neoclassical Growth Model developed by Solow (1956). According to Solow (1956), the most fundamental determinants of economic growth are capital investments and the labor force. Accordingly, using the labor force variable is the expectation that an increase in the productive workforce will positively contribute to economic growth. Foreign direct investments are included in the model because this variable is considered one of the essential measures of the level of economic growth. The increase in foreign direct investment will also increase economic growth. On the other hand, the reason for choosing financial development is that having more financial instruments and intermediaries in a financially developed system means that every segment of society can invest.

3.2. Estimation Techniques (Autoregressive Distributed Lag (ARDL))

To obtain the short- and long-term effects of climate policy uncertainty on economic growth in the United States, Peseran et al. (2001) Autoregressive Distributed Lag (ARDL) method was used. The ARDL method is more valuable than traditional cointegration methods such as Engle-Granger and Johansen-Juselius, as it gives more useful results for small samples (Chandio et al. 2020) and removes the requirement that the stationarity levels of the variables are the same. For this reason, the ARDL bounds test was preferred in the study.

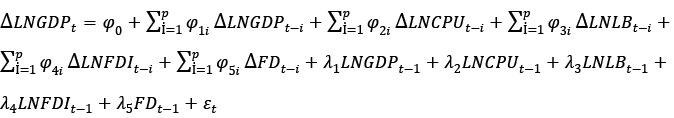

The ARDL bounds test model, created to obtain the long-term coefficients of the study, is expressed in equation 3 below.

(3)

(3)

The ARDL bounds test method uses the Wald (F-stat) test for long-term cointegration between variables. At this point, Pesaran et al. (2001) calculated the upper bound and lower bounds based on the F-test statistics. If the estimated value of the F test is less than the lower limit, there is no long-term significant relationship between the variables. On the other hand, the fact that the F-test value is higher than the upper limit proves the existence of a long-term relationship between the variables. However, the fact that the calculated F-test statistics are within the specified limits means that the results are unstable (Chandio et al., 2020).

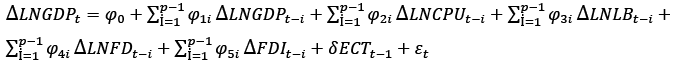

The ARDL error correction model (ECM) is expressed by equation 4 below to estimate the short-run relationship between the variables:

(4)

(4)

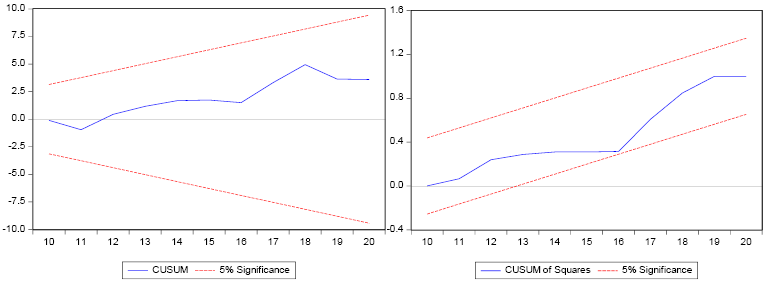

In Equation 4, ECTt–1 denotes the error correction term and δ the error correction coefficient. In the study, the stability of the variables used in the ARDL bounds test was checked with a serial correlation test and a heteroskedasticity test. In contrast, the CUSUM and CUSUMSQ tests were used to investigate the stability of the ARDL model.

4. Results and Discussion

4.1. Unit Root Test Results

In studies using time series, a unit root test should be performed to determine the stationarity of the variables before testing the existence of the cointegration relationship. In this study, AugmentedDickey–Fuller (ADF) and Phillips–Perron (P.P.) unit root tests, frequently used in the literature, were used to test the stationarity of the variables, and the stationarity results are presented in Table 1. According to the test results, GDP, CPU, L.B., and FDI variables are stationary at the first difference I(1), and the F.D. variable is stationary at the level I(0). The ADF and P.P. unit root test results show that the ARDL method can evaluate both short-term and long-term relationships between variables.

Table 1. ADF and P.P. Unit Root Test Results

|

ADF |

PP |

|

|

LNGDP |

-0.4896(0.9784) |

-0.6759(0.9659) |

|

DLNGDP |

-3.8337(0.0290) ** |

-3.5410(0.0535) ** |

|

LNCPU |

-0.3830(0.8999) |

-0.3830(0.8999) |

|

DLNCPU |

-5.3051(0.0002) *** |

-6.7634(0.0000) *** |

|

LNLB |

-0.8682(0.9468) |

-0.8682(0.9468) |

|

DLNLB |

-3.5967(0.047) ** |

-3.5967(0.047) ** |

|

LNFD |

-5.8615(0.0002) *** |

-5.9889(0.0002) *** |

|

FDI |

-2.5775(0.2923) |

-2.1665(0.4900) |

|

DFDI |

-5.9151(0.0002) *** |

-8.2096(0.000) *** |

Note: **, *** indicate 5% and 10% significance, respectively.

4.2. Cointegration Testing Results

Table 2 shows the estimation results showing the cointegration relationship of the variables in the ARDL model. Accordingly, the estimated values of the F-test and the critical values were compared, and it was seen that the calculated F statistical value (22,23) was more significant than the critical values. In this case, it can be interpreted that there is a cointegration relationship between the variables.

Table 2. Results of cointegration bound test.

|

K |

F statistic |

Lower limit 5% |

Upper limit 5% |

|

4 |

22.23 |

2.56 |

3.49 |

4.3. Long-Run and Short-Run Estimates

Table 3 shows the results of the long and short-term ARDL model. While economic growth (GDP) was used as the dependent variable, the total labor force (L.B.), foreign direct investments (FDI), and financial development index (F.D.) were used as independent variables in the study.

Table 3. Long-Run and Short-Run Results (4,4,4,4,4)

|

Variables |

Coefficient |

Std. Error |

T-Statistic |

Prob. |

|

Long Term Estimation |

||||

|

LN(CPU) |

0.2057 |

0.0516 |

3.9833 |

0.0576*** |

|

LN(LB) |

1.6523 |

0.2723 |

6.0676 |

0.0261** |

|

LN(FD) |

0.0593 |

0.0108 |

5.4873 |

0.0316** |

|

FDI |

0.3221 |

0.0958 |

3.3610 |

0.0783*** |

|

Note: **, *** indicate 5% and 10% significance, respectively. |

||||

|

Statistical Tests |

||||

|

R2 |

0.999 |

F-statistic |

4280.928 |

|

|

Adj R2 |

0.999 |

Prob(F-statistic) |

0.0002 |

|

|

Log-likelihood |

155.4449 |

|||

|

Short term Dynamics |

||||

|

LN(GDP(-1)) |

-0.5841 |

0.0762 |

-7.6632 |

0.0166 |

|

LN(GDP(-2)) |

0.3854 |

0.0605 |

6.3682 |

0.0238 |

|

LN(GDP(-3)) |

0.9486 |

0.0759 |

12.4920 |

0.0063 |

|

LN(CPU) |

0.0292 |

0.0026 |

11.2272 |

0.0078 |

|

LN(CPU(-1)) |

-0.1561 |

0.0072 |

-21.4995 |

0.0022 |

|

LN(CPU(-2)) |

-0.1306 |

0.0065 |

-19.9090 |

0.0025 |

|

LN(CPU(-3)) |

-0.1008 |

0.0073 |

-13.6889 |

0.0053 |

|

LN(LB) |

1.8967 |

0.2158 |

8.7854 |

0.0127 |

|

LNLB (-1)) |

3.9769 |

0.3639 |

10.9264 |

0.0083 |

|

LNLB (-2)) |

-1.9027 |

0.1854 |

-10.2629 |

0.0094 |

|

LNLB (-3)) |

-1.6971 |

0.1648 |

-10.2945 |

0.0093 |

|

LN(FD) |

0.0226 |

0.0015 |

14.9632 |

0.0044 |

|

LN(FD(-1)) |

-0.0218 |

0.0016 |

-13.5495 |

0.0054 |

|

LN(FD(-2)) |

-0.0422 |

0.0020 |

-20.8897 |

0.0023 |

|

LN(FD(-3)) |

-0.0530 |

0.0037 |

-14.1660 |

0.0049 |

|

(FDI) |

0.0226 |

0.0015 |

14.9632 |

0.0044 |

|

(FDI(-1)) |

-0.0218 |

0.0016 |

-13.5495 |

0.0054 |

|

(FDI(-2)) |

-0.0422 |

0.0020 |

-20.8897 |

0.0023 |

|

(FDI(-3)) |

0.0530 |

0.0037 |

-14.1660 |

0.0049 |

|

ECM(-1)* |

-0.8924 |

0.0412 |

-21.6106 |

0.0021 |

According to the results in Table 3, a statistically significant and positive relationship was found between climate policy uncertainty and economic growth in the U.S. On the one hand, mass production increased with the intensification of mechanization after the Industrial Revolution. On the other hand, urbanization, changes in the consumption structure, and population growth increased the daily need for energy. Along with globalization, the desire for more economic growth in all countries, especially the developed ones, has increased the need for energy. The energy need is mostly met by fossil fuels such as coal, oil, and their derivatives (Donaghy, 2023: 2). Although the U.S. is an essential country for renewable energy sources, it still uses fossil fuels in most of its production today. The study results show that the uncertainties in the climate policy during the sampling period in the U.S. put the use of alternative sources in the background. In other words, uncertainties in climate policy in the U.S. increase carbon emissions, and the reason for increasing carbon emissions can be expressed as increased economic activity. As a result, environmental emissions and, accordingly, economic growth increase. In short, the study shows that the dynamics that provide growth in the U.S. are carbon-intensive sectors, and the predominance of carbon-intensive sectors in economic growth explains the lack of complete certainty in climate policy and the positive relationship found at the end of the study. The study findings are consistent with those of Memiş and Aydın (2023) and Pao and Tsai (2011).

The other variable whose effect on economic growth is examined in the study is the total labor force. A positive and statistically significant relationship was found between the total labor force and economic growth. In this context, the fact that the U.S. has a high labor force in the period examined contributes to the increase in employment and economic growth by reducing the cost of the labor force.

Another variable whose effect on economic growth is examined is foreign direct investments. The study found a positive and statistically significant relationship between foreign direct investments and economic growth. The increase in foreign direct investments increases production and positively contributes to economic growth.

Financial development is the last variable whose effect on economic growth is examined in the study. In the results obtained, a statistically significant and positive relationship was found between financial development and economic growth. Countries with a financially developed system have more efficient markets and make it easier for investors to shift their resources from traditional sectors to modern ones. Thus, investments directed toward more productive areas positively affect economic growth.

In addition, the value of R2 was found to be 0.99 in the study. This value shows that approximately 99% of the economic growth in the study can be explained by the selected independent variables. Finally, if the F test is significant, our model is meaningful. The error correction coefficient (ECT(-1)) in Table 2 for the short-term obtained as a result of the study was found to be -0.89, as expected, and it is statistically significant.

4.4. Diagnostic Tests

Table 4 includes the Breusch-Godfrey and Breusch-Godfrey LM Tests that were conducted to check the ARDL estimation results. While the Breusch-Godfrey test investigates the problem of autocorrelation between variables, the Breusch-Godfrey LM test investigates the problem of heteroskedasticity. Accordingly, according to the Breusch-Godfrey test, it is seen that there is no autocorrelation problem among the variables, and according to the Breusch-Godfrey LM test, there is no heteroscedasticity problem.

In Figure 1, the CUSUM test, which expresses the cumulative sum of consecutive errors, and the CUSUM of Squares test, which expresses the square of the cumulative sums of consecutive errors, are expressed. Accordingly, it can be said that the parameters are stable within the critical limits at the 5% significance level.

Table 4. Diagnostic checking of the ARDL model.

|

Test |

F-statistic |

Prob. |

|

Breusch- Godfrey LM Test |

0.2109 |

0.7259 |

|

Breusch- Godfrey Test |

0.1427 |

0.9960 |

Figure 1. Cusum and Cusum of Square Test Results

5. Conclusions

In recent years, climate change has been expressed as one of the most essential disasters discussed by the whole world. In this context, many scientists state that all countries should take measures to eliminate the effects of climate change and draw attention to this issue. Climate change policies of countries should be stable and long-term. However, in this way, the policies implemented by countries in the fight against climate change are of great importance in preventing this problem. In this context, the study examines the relationship between climate policy uncertainty and economic growth in the USA with the help of the ARDL bounds test with annual data for the period 1990-2020.

In the study, Climate policy uncertainty (CPU) is represented by the climate policy uncertainty index calculated by Gavrilidis (2021) based on newspaper reports on the U.S.’s leading emissions regulations, global strikes, and the U.S. president’s statements on climate change. In addition, total workforce, foreign direct investments, and financial development were used as control variables in the study, and the effects of these variables on economic growth were examined. The study results show that the relationship between climate policy uncertainty and economic growth in the U.S. is positive and statistically significant. Many developed countries, such as the U.S., want to increase their economic growth rates daily and need more energy. Although the U.S. is an essential country in using alternative energy sources, today, it mostly meets the energy it needs from fossil fuels. In this context, the study results show that the dynamics that provide growth in the U.S. are carbon-intensive sectors. Thus, the predominance of carbon-intensive sectors in economic growth explains the lack of certainty in climate policy and the positive relationship found at the end of the study. In addition, the study found that total workforce, foreign direct investments, and financial development had a positive and statistically significant effect on economic growth. It is necessary to introduce new economic models to combat climate change. It is seen that some economic models that have been applied so far and continue to be applied are insufficient.

In line with the results obtained from the study, some policy suggestions can be offered to policymakers:

• First, climate changes and the climate policies put forward against these changes are effective in all sub-branches of the economy. However, it is understood that the applicability of these climate policies should be increased, and policymakers should internalize the issue.

• In addition, specific practices need to be disseminated locally and internationally, covering various areas such as agricultural activities resulting from climate change, minimizing disaster risk, ecosystems, water, and waste management.

• In addressing climate change and the uncertainties arising from it, governments and policymakers should consider social factors, as well as macroeconomic factors. At this point, public awareness on this issue should be increased, and practices that allow sectors that cause climate change to be less preferred should be implemented.

• Finally, it is thought that changes in climate policy uncertainty should be prioritized in the economic models put forward by governments, considering their direct effects on country economies. Only in this way will the uncertainties in climate policy become more accessible to governments and policymakers.

Although the study is thought to make significant contributions to the literature, it also has some limitations. The most important limitation of the study is that the climate policy uncertainty index variable is calculated only for the United States. Calculating the variable in question in other countries in the coming years will allow for a comparative analysis between countries.

References

Agovino, M., Casaccia, M., Ciommi, M., Ferrara, M., & Marchesano, K. (2019). Agriculture, climate change and sustainability: The case of EU-28. Ecological Indicators, 105, 525-543. https://doi.org/10.1016/j.ecolind.2018.04.064

An, Q., Zheng, L., Li, Q., & Lin, C. (2022). Impact of transition risks of climate change on Chinese financial market stability—frontiers in Environmental Science, 10, 991775. https://doi.org/10.3389/fenvs.2022.991775

Atasoy, M., & Atasoy, F. G. (2020). The impact of climate change on tourism: a causality analysis. Turkish Journal of Agriculture-Food Science and Technology, 8(2), 515-519. https://doi.org/10.3389/fenvs.2022.991775

Baker, S. R., Bloom, N., & Davis, S. J. (2016). Measuring economic policy uncertainty. The quarterly journal of economics, 131(4), 1593-1636. https://doi.org/10.1093/qje/qjw024

Barro, R. J. (2015). Environmental protection, rare disasters, and discount rates. Economica 82 (325), 1–23. doi:10.1111/ecca.12117

Basaglia, P., Carattini, S., Dechezleprêtre, A., & Kruse, T. (2021). Climate policy uncertainty and firms’ and investors’ behavior. Unpublished manuscript.

Chandio, A. A., Jiang, Y., Rauf, A., Ahmad, F., Amin, W., & Shehzad, K. (2020). Assessment of formal credit and climate change impact on agricultural production in Pakistan: a time series ARDL modeling approach. Sustainability, 12(13), 5241. DOI: 10.3390/su12135241

Chang, C. L., Ilomäki, J., Laurila, H., & McAleer, M. (2020). Causality between CO2 emissions and stock markets. Energies, 13(11), 2893. https://doi.org/10.3390/en13112893

Cleary, P., Harding, W., McDaniels, J., Svoronos, J. P., & Yong, J. (2019). Turning Up the Heat: Climate Risk Assessment in the Insurance Sector. Bank for International Settlements, Financial Stability Institute. ISBN 978-92-9259-309-4.

Daniel, K. D., Litterman, R. B., & Wagner, G. (2019). Declining CO2 price paths. Proceedings of the National Academy of Sciences, 116(42), 20886-20891. https://doi.org/10.1073/pnas.1817444116.

Dinç, M. (2022). İklim Politikası Belirsizliği CO2 emisyonunu etkiler mi? ABD’den Ampirik Kanıtlar. Ankara Hacı Bayram Veli Üniversitesi İktisadi ve İdari Bilimler Fakültesi Dergisi, 24 (3) , 1077-1108 . DOI:10.26745/ahbvuibfd.1105745.

Donaghy, T. Q., Healy, N., Jiang, C. Y., & Battle, C. P. (2023). Fossil fuel racism in the United States: How phasing out coal, oil, and gas can protect communities. Energy Research & Social Science, 100, 103104. https://doi.org/10.1016/j.erss.2023.103104

Ebi, K. L., Bowen, K. J., Calkins, J., Chen, M., Huq, S., Nalau, J., ... & Rosenzweig, C. (2021). Interactions between two existential threats: COVID-19 and climate change. Climate Risk Management, 34, 100363. Doi:10.1016/j.crm.2021.100363.

Engle, RF and Granger, CWJ. (1987). Cointegration and error-correction: representation, estimation and testing. Econometrica, 55: 251–76. https://doi.org/10.2307/1913236

Fauzel, F., Seetanah, B., Sannassee, R., & Nunkoo, R. (2019). Investigating the impact of climate change on the tourism sector of SIDS. BEST EN Think Tank XVII Innovation and Progress in Sustainable Tourism. Doi: 10.1108/TR-12-2017-0204

Gavriilidis, K. (2021). Measuring climate policy uncertainty. http://dx.doi.org/10.2139/ssrn.3847388

He, M., & Zhang, Y. (2022). Climate policy uncertainty and the stock return predictability of the oil industry. Journal of International Financial Markets, Institutions and Money, 81, 101675. https://doi.org/10.1016/j.intfin.2022.101675

Huang, H., Ali, S., & Solangi, Y. A. (2023). Analysis of the Impact of Economic Policy Uncertainty on Environmental Sustainability in Developed and Developing Economies. Sustainability, 15(7), 5860. Doi: 10.3390/su15075860

Huang, K., Zhao, H., Huang, J., Wang, J., & Findlay, C. (2020). The impact of climate change on the labor allocation: Empirical evidence from China. Journal of Environmental Economics and Management, 104, 102376. Doi: 10.1016/j.jeem.2020.102376

IAASB (2020). The consideration of climate-related risks in an audit of financial statement. Staff Audit Practice Alert. https://www.ifac.org/system/files/publications/files/IAASB-Climate-Audit-Practice-Alert.pdf

İklim Değişikliği Eğitim Modülleri Serisi 9 (2019). İklim Krizi İle Mücadelenin Makroekonomik Yüzü, Ankara. chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://www.iklimin.org/wp-content/uploads/egitimler/seri_09.pdf

Jatuporn, C., & Takeuchi, K. (2023). Assessing the impact of climate change on the agricultural economy in Thailand: An empirical study using panel data analysis. Environmental Science and Pollution Research, 30(3), 8123-8132. http://dx.doi.org/10.1007/s11356-02222743-0.

Johansen, S., & Juselius, K. (1990). Maximum likelihood estimation and inference on cointegration—with appucations to the demand for money. Oxford Bulletin of Economics and statistics, 52(2), 169-210. https://doi.org/10.1111/j.1468-0084.1990.mp52002003.x

Jorgenson, A., Clark, R., Kentor, J., & Rieger, A. (2022). Networks, stocks, and climate change: A new approach to the study of foreign investment and the environment. Energy Research & Social Science, 87, 102461. DOI:10.1016/j.erss.2021.102461

Krogstrup, S., & Oman, W. (2019). Macroeconomic and financial policies for climate change mitigation: A review of the literature. ISBN: 9781513511955/1018-5941

Lv, W., & Li, B. (2023). Climate policy uncertainty and stock market volatility: Evidence from different sectors. Finance Research Letters, 51, 103506. https://doi.org/10.1016/j.frl.2022.103506

Memiş, O. B., & Aydin, R. (2023). İklim Değişikliğinin Ekonomik Büyüme Üzerine Etkisi: Türkiye Örneği. Third Sector Social Economic Review, 58(2), 1065-1080. doi: 10.15659/3.sektor-sosyal-ekonomi.23.04.2098

Moody’s Analytics (2019). The Economic Implications of Climate Change. ed. Lafakis, C., Ratz, L., Fazio, E., & Cosma, M. Canada.

Nordhaus WD. (1977). Economic growth and climate: the carbon dioxide problem. An Econ. Rev. 67(1):341–46. https://ideas.repec.org/a/aea/aecrev/v67y1977i1p341-46.html

Pao, H. T., & Tsai, C. M. (2011). Multivariate Granger causality between CO2 emissions, energy consumption, FDI (foreign direct investment) and GDP (gross domestic product): evidence from a panel of BRIC (Brazil, Russian Federation, India, and China) countries. Energy, 36(1), 685-693.

Pesaran, M. H., Shin, Y., & Smith, R. J. (2001). Bounds testing approaches to the analysis of level relationships. Journal of applied econometrics, 16(3), 289-326. https://doi.org/10.1002/jae.616

Pretis, F. (2020). Econometric modelling of climate systems: The equivalence of energy balance models and cointegrated vector autoregressions. Journal of Econometrics, 214(1), 256-273. Doi:10.1016/j.jeconom.2019.05.013

Zanardo, S., Nicotina, L., Hilberts, A. G., & Jewson, S. P. (2019). Modulation of economic losses from European floods by the North Atlantic Oscillation. Geophysical Research Letters, 46(5), 2563-2572. Doi: 10.1029/2019GL081956