Ekonomika ISSN 1392-1258 eISSN 2424-6166

2025, vol. 104(4), pp. 78–94 DOI: https://doi.org/10.15388/Ekon.2025.104.4.5

Emrah Doğan

Istanbul Gelisim University, Istanbul-Türkiye

E-mail: emdogan@gelisim.edu.tr

ORCID: https://orcid.org/0000-0001-9870-5719

Abstract. In recent years, the global economy has increasingly focused on sustainability and environmental responsibility, and green innovation has emerged as a critical driver of productivity. Therefore, understanding the relationship between green innovation and the Total Factor Productivity (TFP) has gained significant importance. This study aims to empirically examine the relationship between total factor productivity and green innovations in Türkiye from 1998 to 2019, by using the ARDL bounds test. Additionally, the study investigates the effects of foreign direct investments, carbon emissions, financial development, and fixed capital investments on the total factor productivity as control variables. The findings indicate that green innovations have a positive and statistically significant impact on the total factor productivity. Furthermore, the consistency of these results was tested by using the FMOLS estimator, confirming that green innovations positively affect the total factor productivity. The findings of the study provide insights into the potential of green innovation as a driver of productivity growth. The findings contribute to the ongoing discussion on how emerging economies, such as Türkiye, can achieve productivity growth.

Keywords: Green innovation, Total factor productivity, carbon emissions, ARDL bounds test.

________

Received: 18/12/2024. Accepted: 21/09/2025

Copyright © 2025 Emrah Doğan. Published by Vilnius University Press

This is an Open Access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

In a century marked by limited resources and increasing demands due to population growth, industrialization, and globalization, economies that strive to enhance and maintain welfare prioritize productivity. Recently, the global economy has placed a greater emphasis on sustainability and environmental responsibility. In this context, green innovation has become a crucial driver of productivity growth. The number of studies in this area is on the rise, accompanied by the development and dissemination of productivity techniques.

Several concepts, such as capital, labor, and the Total Factor Productivity (TFP), are used to measure productivity. Among these, TFP is especially important as it assesses output by considering all production factors. This comprehensive approach helps understand the sources of productivity improvements. According to the Republic of Türkiye (TR) Ministry of Industry and Technology (2023), an increase in TFP offers valuable insights into the sustainability and long-term potential for economic growth in countries.

The total factor productivity (TFP) also represents a portion of output that cannot be explained by the amount of input used in the production process. Consequently, TFP levels are influenced by the efficiency and intensity with which inputs are utilized (Comin, 2010). In other words, TFP reflects the levels of knowledge, technology, and innovation in production. It is a crucial element affecting countries’ growth rates, welfare levels, and global competitiveness (Alakbarov et al., 2018).

This study focuses on Türkiye as a sample group. The primary reason for selecting Türkiye as the focus of this study is that it represents a developing economy, thus making it a potential model for other similar countries. Scientific studies regarding the Turkish economy generally agree that Türkiye’s potential growth rate is approximately above 5 percent. If Türkiye can sustain this potential growth, it may escape the middle-income trap and have the opportunity to join the ranks of developed countries. However, an examination of Türkiye’s average GDP growth rates from 1980 to 2019 reveals an average of around 4.5 percent, which is close to the 5 percent target but still falls short of the anticipated level of enrichment. This situation raises questions about the sustainability and efficiency of Türkiye’s growth. To understand this issue thoroughly and to propose effective policies, a detailed analysis and interpretation of the total factor productivity are essential.

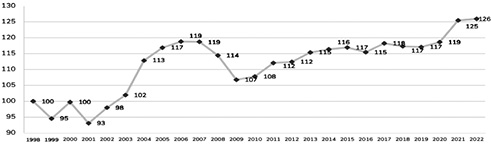

Figure 1 illustrates the statistics for Türkiye’s total factor productivity from 1998 to 2022. It shows that TFP generally increased by approximately 1 percent over this period. TFP began to grow in 2001 but experienced a decline in 2006. The structural reforms and investments carried out in the relevant years had a significant effect on the rise in the early 2000s. However, a decrease in this positive effect of the structural reforms after 2006, an increase in imports due to the excessive appreciation of the Turkish Lira in the 2006–2010 period, and the difficulty of domestic production were the main reasons that decreased the total factor productivity. The decreasing external demand due to the global economic crisis breaking out in 2008 negatively affected industrial production and investments. As a result, the total factor productivity has been on a downward trend since 2009. As the effects of the 2008 global financial crisis began to ease after 2010, the total factor productivity started to rise again after 2010. During this period, Türkiye’s exports revived, and industrial production accelerated after an increase in global demand was observed. In addition, the spread of digitalization and automation investments that increase productivity has been one of the main determinants of the upward trend in the total factor productivity in the period after 2010.

Compared to other countries, Türkiye does not face a significant problem with GDP growth, but it does struggle with ensuring the sustainability of that growth and channeling it toward development. This indicates that the root of the issue lies in the lack of technological advancements and structural improvements, which are crucial determinants of economic growth. In particular, the increase in the total factor productivity (TFP) within the Turkish economy has been limited and insufficient (Alakbarov et al., 2018).

Green innovations not only lower production costs but also boost productivity by promoting an efficient use of natural resources. According to Hojnik and Ruzzier (2016), these innovations enhance a company’s cost structure, primarily through their ability to reduce energy consumption, and encourage more efficient production processes. As a result, this leads to an increase in the total factor productivity.

Green innovations also promote technological advancements, leading to the use of more efficient technologies in production processes and the emergence of new business models. Dangelico and Pontrandolfo (2015) argue that green innovations facilitate the development of innovative and efficient technologies, which, in turn, enhances the total factor productivity of businesses. Specifically, energy-efficient technologies and renewable energy sources enable companies to achieve greater output while using fewer resources in production. Lastly, an important aspect of green innovations can be understood through the lens of the circular economy model. This model enables more effective management of waste and recycling processes. Geissdoerfer et al. (2017) noted that when circular economy is combined with green innovations, it enhances resource efficiency and contributes to the overall productivity. By minimizing waste and extending the use of resources, circular economy lowers production costs and increases efficiency.

This study aims to empirically investigate how green innovation affects the increase in the total factor productivity in Türkiye. Analyzing the impact of green innovation on the total factor productivity in Türkiye – which is our main objective in this article – can provide valuable insights that may help shape policies and practices in other developing economies. ‘Green innovation’ refers to technological innovations that aim to protect the environment through new products or processes contributing to sustainable development and environmental protection (Bernauer et al., 2007; Schiederig et al., 2012; Chaudhary et al., 2022; Zhao et al., 2022).

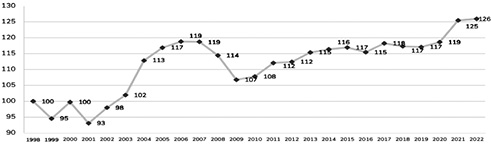

Therefore, it is essential to explore how to utilize green innovation resources more effectively, and how this concept can support the improvement of TFP in Türkiye. Addressing these issues is crucial for accelerating innovation-oriented sustainable development and growth. Figure 2 below presents the main framework of this article, which will empirically examine the relationships between green innovation, foreign direct investments, gross fixed capital, the financial development index, CO2 emissions, and the total factor productivity.

Although many studies on the total factor productivity (TFP) have already been delivered in the economic literature, there is still a need for more research focusing on the relationship between TFP and green innovation. This study aims to explore the relationship within the context of Türkiye. It has the potential to make significant contributions to the existing literature and is intended to serve as an exemplary model for similar developing countries, by using the example of Türkiye as a case study. The following sections of the study will follow this structure: a summary of the national and international literature on total factor productivity; an introduction to the study model and the variables used; a presentation of the study findings; and, finally, conclusions and policy recommendations.

Previous studies have extensively explored the impact of innovation on the total factor productivity (TFP). For instance, Porter and Van der Linde (1995) argued that environmental regulations stimulate firms to become more innovative, potentially leading to increased productivity in the long run. Similarly, Costantini and Mazzanti (2012) investigated the effects of green innovation on TFP in European economies and found that adoption of environmentally friendly technologies and innovations enhances productivity by boosting sectoral competitiveness.

However, research specifically examining the impact of green innovation on TFP remains limited. This study aims to address this gap in the literature by empirically analyzing the effects of green innovation on TFP. The analysis employs Autoregressive Distributed Lag (ARDL) and Fully Modified Ordinary Least Squares (FMOLS) models, which allow for a better understanding of the long-term nature of this relationship. Additionally, this study broadens the scope of the already existing literature by incorporating foreign direct investment, financial development, fixed capital investment, and carbon emissions into the model while evaluating the influence of green innovation. In doing so, we contribute to academic discussions by supporting the framework established by previous research regarding the relationship between green innovation and TFP, specifically within the Turkish context.

Table 1 below summarizes the international and national studies conducted in the literature within the scope of the study.

|

Author(s) |

Country/Region |

Term |

Model |

Results |

|---|---|---|---|---|

|

Wu et al. (2024) |

Chinese A-share listed companies |

2010-2020 |

Heckman Two-Stage Model |

Research shows that Green Technology Innovation (GTIC) significantly enhances Total Factor Productivity (TFP) in companies. |

|

Ge et al. (2024) |

China |

2005-2018 |

Spatial econometric model |

The study results indicate that while the overall productivity of the green factor can be enhanced, there may be an increase in pollution emissions. The findings suggest that these outcomes can be influenced by green innovation, resource misallocation, and strategic interactions. |

|

Hunjra et al. (2024) |

275 Chinese cities |

2004-2022 |

Two-way fixed, spatial Durbin, threshold, and mediation effect models |

Results indicate that green innovation enhances green total factor productivity, and this finding is consistent even after robustness tests. |

|

Vërbovci et al. (2024) |

Western Balkans |

2010-2022 |

Ordinary least squares (OLS) model, Fixed Effect (FE) model, Random Effect (RE) model, and Hausman Taylor (HTH) model |

The research indicates that countries in the Western Balkans should focus on promoting innovation as a key factor that positively influences green economic growth. |

|

Dai et al. (2022) |

Shanghai technological enterprises |

2009-2017 |

Panel Data Models |

Positive and significant relationships between each element of effective R&D capital and total factor productivity (TFP). |

|

Zhao (2022) |

263 cities in China |

2006-2018 |

Two-stage least squares (2SLS) |

The results indicate that green innovation has a significant positive impact on the green total factor productivity (TFP). |

This study aims to explore the relationship between green innovation and the total factor productivity (TFP). We will outline the variables utilized in the study model. The analysis covers the years from 1998 to 2019. This study has chosen to use data up to 2019 due to concerns about data availability and consistency. Although more recent datasets are available, including them could introduce methodological challenges, such as inconsistencies in data collection methods or incomplete records. By limiting the analysis to data up to 2019, we can achieve a more stable and reliable examination of long-term trends, while avoiding potential distortions caused by extraordinary events like the COVID-19 pandemic. Future research may build on this study by incorporating data from after 2019 so that to investigate the evolving relationship between green innovation and the total factor productivity in Türkiye.

The time series data were obtained from various databases, including FRED, OECD, WDI, Our World in Data, and the IMF. In this study, TFP serves as the dependent variable, while the independent variables include green innovation, foreign direct investment, carbon emissions, the financial development index, and fixed capital investment. Notably, only the logarithm of fixed capital investment is used among these variables, and the model was developed without logarithmically transforming the other variables. Table 2 provides a summary of the dependent and independent variables, along with their explanations and sources.

|

Variables |

Logarithmic forms |

Abbreviation |

Source |

|

|

Dependent variable |

Total factor productivity – TFP by years (1998=100) |

- |

TFP |

FRED |

|

Main independent variable |

Patents related to environmental technologies % of technologies |

- |

GI* |

OECD |

|

Control Variables |

Foreign direct investment, net inflows (% of GDP) |

- |

FDI |

WDI |

|

Per capita CO2 emissions (Carbon dioxide (CO₂) emissions from fossil fuels and industry) |

- |

CO2 |

Our World in Data |

|

|

Financial development Index |

- |

FD |

IMF |

|

|

Gross fixed capital (constant 2015) |

LnGFC |

GFC |

WDI |

This empirical research observes the relationship between regressors such as green innovation, total factor productivity, foreign direct investments, carbon emissions, and fixed capital investments. For this purpose, Türkiye was selected as a sample in 1998–2019. The relationship between the variables was examined with the help of the ARDL Bounds test and the FMOLS estimator. The study utilizes the ARDL and FMOLS methods due to their effectiveness in analyzing both long-term and short-term relationships in time-series data. The ARDL approach is particularly advantageous for handling variables with mixed-order integration, while FMOLS effectively addresses issues of endogeneity and serial correlation in cointegration analysis.

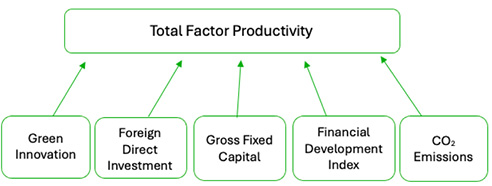

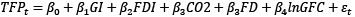

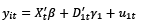

The relationship between the variables presented in Table 1 can be expressed through Equation 1:

(1)

(1)

In Equation 1, β1, β2, β3 and β4 are coefficients. β0 is the constant term, and εt is the error term. Equation 1 indicates a significant relationship between green innovation, foreign direct investments, carbon emissions, financial development, fixed capital investments, and the total factor productivity.

In studies that utilize time series methods, the stationarity of the data is critically important. Time series analysis has multiple applications across various sectors, and establishing the optimal trend for the data is fundamental to basic econometric research (Mushtaq, 2011; Alam & Hossain, 2024). Since this study employs time series analysis, assessing the stationarity of the variables is essential to prevent issues such as spurious regression. In the current study, the stationarity of the variables was evaluated by using the ADF (Augmented Dickey-Fuller) and PP (Phillips-Perron) tests, which are the most commonly used unit root tests in the literature. The results obtained are presented in Table 3.

|

Variables |

ADF Test |

PP Test |

||

|

Level-I(0) |

First Difference-I(1) |

Level-I(0) |

First Difference-I(1) |

|

|

TFP |

-2.520124 |

-5.286238*** |

-2.729546 |

-5.286238*** |

|

GI |

-4.940027*** |

- |

-5.925076*** |

- |

|

FDI |

-2.524082 |

-4.071795** |

-2.221650 |

-4.100053** |

|

FD |

-3.002533 |

-6.359724*** |

-2.913577 |

-23.34699*** |

|

CO2 |

-2.233604 |

-4.462934** |

-2.233604 |

-4.458625** |

|

LnGFC |

-2.326031 |

-4.607993*** |

-2.443363 |

-4.610923*** |

The results from the unit root test shown in Table 3 indicate that all variables, except for the GI variable, are stationary when their first differences are taken, which means that they are stationary at the I(1) level. In contrast, the GI variable is stationary at the level, or I(0) level. The difference in stationarity levels among the variables is a key factor in selecting the ARDL method for this study.

This study utilized the ARDL bounds test to investigate the relationship between green innovation and the total factor productivity. The ARDL method offers several advantages compared to other techniques. For instance, it is suitable for variables with mixed degrees of stationarity, specifically, I(0) and I(1). However, it does not accommodate a second degree of integration, namely, I(2), for any time series (Pesaran et al., 2001). In other words, the ARDL bounds test is frequently employed for series with mixed integration orders.

Moreover, the ARDL bounds test is particularly effective for smaller sample sizes, specifically, when N is less than 50 (Adebayo & Akinsola, 2021; Alam & Hossain, 2024). Additionally, this method can be applied to develop a dynamic Error Correction Model (ECM), which allows for the simultaneous examination of short-term and long-term dynamics (Shahid et al., 2024). The functional form of the ARDL equation is presented below:

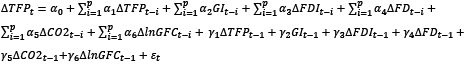

(2)

(2)

In Equation (2), α1, α2, α3, α4 and α5 express the short-term dynamics of variables. On the other hand, γ1, γ2, γ3, γ4, γ5 and γ6 represent the long-term estimates. The ARDL bounds testing method requires many steps in short-term and long-term dynamics. The first step is the bounds test for cointegration, which establishes the long-term relationship by comparing F and t statistics with critical values. The second step is to establish an ECM (error correction) model for short-term estimates of variables. The equation expressing the short-term ARDL relationship is given in Equation 3 below:

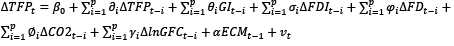

(3)

(3)

The short-term Error Correction Coefficient (ECT) helps to determine the speed of adjustment towards long-term equilibrium conditions in case of a shock in the short term. Table 4 presents the findings indicating the cointegration relationship between the variables.

|

K |

Value of F-statistic |

Lower bound %5 |

Upper bound %5 |

|

5 |

16.01703 |

2.39 |

3.38 |

The results shown in Table 4 indicate that our calculated long-term F-statistic values are significantly higher than the critical levels for the upper and lower bounds at the 5% significance level. This finding leads us to reject the null hypothesis, which posits that there is no long-term relationship between the variables. Consequently, this result confirms that a long-term cointegration exists between the variables included in the model. The ARDL long-term coefficients obtained after determining the appropriate lag length using the AIC criterion as the model selection criterion created to estimate the relationship between green innovation and the total factor productivity are expressed in Table 5.

|

Variable |

Coefficient |

Std. Error |

T-Statistic |

Prob. |

|

GI |

0.003488 |

0.001687 |

2.067864 |

0.0775* |

|

FDI |

0.028403 |

0.004812 |

5.901877 |

0.0006*** |

|

FD |

-0.673710 |

0.132195 |

-5.096339 |

0.0014*** |

|

CO2 |

-0.093449 |

0.022340 |

-4.183085 |

0.0041*** |

|

LnGFC |

0.150483 |

0.035963 |

4.184417 |

0.0041*** |

According to the results presented in Table 5, green innovation has a statistically significant and positive effect on the total factor productivity (TFP). An examination of modern growth theories reveals that technological development and innovation are fundamental to growth and TFP (Akkoç et al., 2018). Therefore, increases in productivity driven by technological advancements and innovations are expected to enhance the total factor productivity. In this context, it is anticipated that technological innovations aimed at environmental protection, as well as green innovations that reflect high productivity and advanced technology, will contribute positively to the total factor productivity.

The study also investigates Foreign Direct İnvestment (FDI) as a variable influencing TFP. It identifies a statistically significant and positive relationship between FDI and TFP. FDI facilitates the transfer of knowledge, skills, and technology to the host country (Savrul & Yağış, 2019), thereby boosting the total factor productivity through enhanced productivity.

When examining the relationship between financial development and TFP, the study finds a statistically significant but negative relationship. In the economic literature, the relationship between financial development and TFP is typically seen as positive. However, the opposite can be observed in some developing economies (Li & Liao, 2020). In the context of Türkiye, the study suggests that the effect of financial development on capital allocation is not positive. This aligns with the findings of Buera and Shin (2013), who noted that, in certain developing countries, or in those denoted by rapid economic growth, innovative high-tech small and medium enterprises (SMEs) face short capital accumulation periods and lack sufficient collateral. Consequently, obtaining financing in these countries is challenging, and resource mismatches due to inadequate financial development hinder the total factor productivity growth.

The study also explores the impact of carbon emissions on the total factor productivity. It finds that carbon emissions have a statistically significant and negative effect on TFP. Numerous studies, including the one conducted by Wen et al. (2018), suggest that a reduction of carbon emissions can enhance TFP. In Türkiye, higher carbon emissions signify greater resource consumption, which is associated with lower productivity. This result also supports the findings of the studies of Ma and Wu (2022) and Liu et al. (2023).

Lastly, the study examines fixed capital investments, discovering a statistically significant positive relationship between these investments and TFP. Similar to FDIs, fixed capital investments are key drivers of technological development (Suiçmez, 2015) and an increase in TFP by enhancing efficiency.

|

Variable |

Coefficient |

Std. Error |

T-Statistic |

Prob. |

|

D (TFP (-1)) |

0.191907 |

0.046507 |

4.126443 |

0.0044 |

|

DLn(GFC) |

0.212575 |

0.010679 |

19.90503 |

0.0000 |

|

D(FD) |

0.111199 |

0.060561 |

1.836153 |

0.1090 |

|

D(GI) |

0.002954 |

0.000692 |

4.266156 |

0.0037 |

|

D(GI(-1)) |

-0.001536 |

0.000618 |

-2.487669 |

0.0417 |

|

D(FDI) |

0.010158 |

0.002226 |

4.563027 |

0.0026 |

|

ECT (-1) |

-0.702451 |

0.048680 |

-14.42988 |

0.0000*** |

The coefficient of ECM (−1) measures the adjustment speed from short term to long term. At a 1% significance level, the value of 0.70 for the lagged error correction term, which refers to the adjustment of the previous year’s imbalance, is statistically highly significant. This means that any short-term shock to TFP in Türkiye exhibits an annual adjustment rate of 70%. In simpler terms, this indicates that approximately 70% of the imbalances caused by the shock in the previous year can be adjusted towards the long-term balance in the next year.

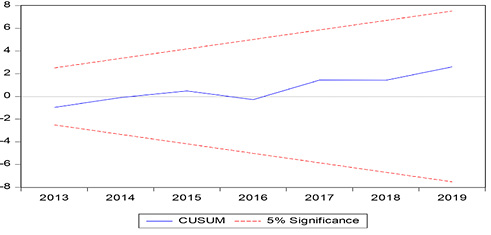

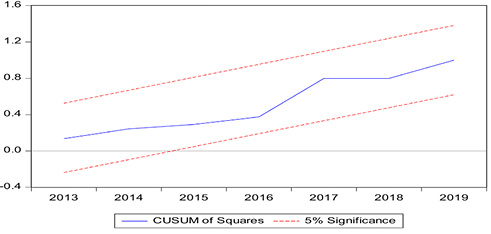

In the study, the Breusch-Godfrey LM test was used to test the existence of autocorrelation, and the Breusch-Pagan-Godfrey test for heteroskedasticity was used to check the goodness of fit of our ARDL model. Additionally, CUSUM and CUSUM-SQ statistics were examined to evaluate the strength of the regression estimates used in the model.

|

R2 |

0.981947 |

|

Adjusted R2 |

0.973615 |

|

Log-likelihood |

79.98930 |

|

Breusch-Godfrey LM Testi |

1.834710 (0.2526) |

|

Breusch-Pagan-Godfrey |

1.476752 (0.2797) |

According to the test results presented in Table 7, it is evident that there is no auto-correlation problem as a result of the Breusch-Godfrey LM test, and there is no problem of varying variance as a result of the Breusch-Pagan-Godfrey test, whereas the explanatory power of the model with R2 is 0.98, while adjusted R2 is 0.97.

In the study, we examined the stability of the model by using the Cumulative Sum (CUSUM) and the Cumulative Sum of Squares (CUSUM square), as illustrated in Figures 3 and 4. When the blue line in both figures stays within the orange lines at a significance level of 5%, we can conclude that the model is stable. If the blue lines deviate from the designated boundaries, the model cannot be considered stable. Our analysis shows that the blue lines in both the CUSUM and CUSUM square tests remain within the orange lines, thereby confirming that the regression coefficients are stable, and that the model is stable at a significance level of 5%.

In the study examining the relationship between green innovation and the total factor productivity, the Fully Modified Ordinary Least Squares (FMOLS) method developed by Phillips and Hansen (1990) was employed to verify the consistency of the results from the main model. The FMOLS method was introduced as an improvement over the Ordinary Least Squares (OLS) method because OLS can produce biased results when estimating series with long-term relationships. The FMOLS method addresses issues of endogeneity and autocorrelation by using a non-parametric approach (Vergil & Ayaş, 2009, p. 105; Üçler & Kızılkaya, 2014, p. 36). Furthermore, the FMOLS method accommodates significant heterogeneity among sections and takes into account the correlations between the constant term, the error term, and the differences among the independent variables (Kok & Şimşek, 2006).

The FMOLS method, as developed by Phillips and Hansen (1990), is expressed in Equation 4 below:

(4)

(4)

In Equation 4, Dt = (D'1t, D'2t)' explains the deterministic trend regressors. On the other hand, Xt values are governed by the system of equations, and β represents the long-term cointegration vector that needs to be estimated. The table below presents the FMOLS estimation results.

|

Variables |

Coefficient |

Std. error |

T-statistic |

Prob. |

|

GI |

0.000795 |

0.000283 |

2.811225 |

0.0132** |

|

FDI |

0.027735 |

0.000581 |

47.70192 |

0.0000*** |

|

FD |

0.144256 |

0.026171 |

5.511942 |

0.0001*** |

|

CO2 |

-0.142786 |

0.003184 |

-44.84026 |

0.0000*** |

|

LnGFC |

0.126613 |

0.004006 |

31.60377 |

0.0000*** |

Upon examining the FMOLS test results presented in Table 8, it is evident that green innovation has a positive impact on the total factor productivity (TFP), which is consistent with the main model, and this effect is statistically significant. Additionally, foreign direct investment (FDI) and gross fixed capital (GFC) and financial development (FD) also have a positive influence on TFP, while carbon dioxide (CO2) emissions negatively affect TFP. The coefficients for all these variables are statistically significant.

The Total Factor Productivity (TFP) refers to the portion of output that cannot be explained by the quantity of inputs used in production. It is determined by how efficiently and intensively these inputs are utilized. In this sense, TFP serves as a foundational element for a country’s welfare improvement and sustainable growth. Recent technological advancements have highlighted TFP as a critical indicator for explaining growth disparities between nations.

This study empirically examines the effects of green innovation – defined as technological innovations, high productivity, and advanced technologies aimed at environmental protection – on the total factor productivity. It also investigates the impacts of foreign direct investment, financial development, carbon emissions, and fixed capital investments on TFP. The analysis covers the time range between the years 1998 and 2019. The main model used is the ARDL bounds test, which is a widely recognized method for estimating long-run relationships in econometrics. To ensure the accuracy of the results from the ARDL bounds test, the study also employs the FMOLS estimator, which estimates the long-run relationships in a cointegrating system.

The findings of the study indicate that green innovation has a positive effect on the total factor productivity in both models examined. This finding indicates that green innovation enhances resource efficiency by optimizing production processes. This study is consistent with the research conducted by Acemoglu et al. (2012) in England, which found that investments in sustainable energy projects, particularly the transition to low-carbon technologies, enhance productivity in production processes and generate long-term positive effects on the total factor productivity (TFP). The studies conducted by Zhang and Li (2020) on the Chinese economy and Smith and Silva (2021) on the Brazilian economy reinforce the findings of this study. Both studies highlight that green innovations not only offer environmental benefits but also significantly enhance economic efficiency.

Additionally, both models show that foreign direct investments and fixed capital investments positively influence the total factor productivity, whereas carbon emissions have a negative impact. This finding suggests that direct foreign investment and fixed capital investment lead to the modernization of production processes and accelerate the transfer of knowledge and technology, thereby ultimately increasing the total factor productivity (TFP). Foreign direct investments (FDI) play a significant role in promoting green innovation and environmentally friendly technologies. They are crucial for technological advancement and knowledge transfer, particularly in developing countries such as Türkiye. The introduction of green technologies and practices through FDI contributes to the overall productivity growth.

Conversely, carbon emissions impose both economic and environmental costs, which can negatively impact TFP in the long run. Increases in carbon emissions lead to a decline in environmental quality and the depletion of natural resources. This situation creates negative externalities on the total factor productivity (TFP) by reducing resource efficiency in production processes and increasing environmental costs. Energy-intensive and carbon-based production models, along with heightened environmental damage and delays in adopting green technologies, can adversely affect green innovation activities. Consequently, improvements in TFP may be limited if the development of green innovations is obstructed. These findings align with the research conducted by Zhang and Li (2020) and Smith and Silva (2021). In their study of the Chinese economy, Zhang and Li (2020) demonstrated that carbon-intensive sectors negatively impact TFP, and this effect can only be alleviated through investments in green innovation. Likewise, Smith and Silva (2021) found that, in Brazil, productivity growth slows down during periods of significant environmental degradation, but green transformation can reverse this trend.

Interestingly, the study finds that financial development negatively affects TFP according to the ARDL model but has a positive effect according to the FMOLS estimator. The negative results obtained from the ARDL model suggest that ineffective credit distribution in Türkiye is contributing to a financial system that favors speculative sectors or allocates resources to low-productivity areas, which negatively affects the total factor productivity (TFP). In contrast, the FMOLS estimation results indicate that the financial system is maturing, the credit allocation mechanism is improving, and there is an increase in funding for innovation and productivity. As a result, the impact on TFP could become positive in the long run. All coefficients were statistically significant in both models.

To sum up, the findings support the assertion that green innovation plays a vital role in enhancing the total factor productivity and the overall productivity in Türkiye. The study offers several policy recommendations:

This study addresses a critical gap in the literature on the impact of green innovation on the total factor productivity, though it has some limitations. The primary limitation is the dataset, which covers the period from 1998 to 2019 and is consistent for all variables. In the future, as new data become available, this timeframe can be extended. Future research could extend this study by incorporating cross-country comparisons in order to better understand how Türkiye’s experience aligns with or diverges from other emerging economies facing similar challenges.

Acemoglu, D., Aghion, P., & Zilibotti, F. (2012). Green innovation and economic growth: The case of the UK. Journal of Economic Growth, 17(3), 253–280.

Adebayo, T.S., Akinsola, G.D. (2021). Investigating the causal linkage among economic growth, energy consumption and CO2 emissions in Thailand: an application of the wavelet coherence approach. Int. J. Renew. Energy Dev., 10(1), 17–26. https://doi.org/10.14710/ijred.2021.32233

Aitken, B. J., & Harrison, A. E. (1999). Do Domestic Firms Benefit from Direct Foreign Investment? Evidence from Venezuela. American Economic Review, American Economic Association, 89/3, 605-618.

Akkoç, G. K., Akkoç, U., & Yücel, Ö. F. (2018). BRICS-T ülkelerinde toplam faktör verimliliği ve teknoloji transferi. Uluslararası İktisadi ve İdari İncelemeler Dergisi, (21), 101-118.

Alakbarov, N., Gündüz, M., & Erkan, B. (2018). Türkiye’de ekonomik büyümenin belirleyicisi olarak toplam faktör verimliliği. Dumlupınar Üniversitesi Sosyal Bilimler Dergisi, (57), 253–270.

Alam, M. B., & Hossain, M. S. (2024). Investigating the connections between China’s economic growth, use of renewable energy, and research and development concerning CO2 emissions: An ARDL Bound Test Approach. Technological Forecasting and Social Change, 201, 123220.

Bernauer, T., Engel, S., Kammerer, D., & Sejas Nogareda, J. (2007). Explaining green innovation: ten years after Porter’s win-win proposition: how to study the effects of regulation on corporate environmental innovation? Politische Vierteljahresschrift, 39, 323-341.

Buera, F. J., Kaboski, J. P., and Shin, Y. (2011). Finance and development: a tale of two sectors. Am. Econ. Rev., 101(5), 1964–2002. https://doi.org/10.1257/aer.101.5.1964

Chaudhary, S., Kaur, P., Talwar, S., Islam, N., & Dhir, A. (2022). Way off the mark? Open innovation failures: Decoding what really matters to chart the future course of action. Journal of Business Research, 142, 1010–1025. https://doi.org/10.1016/j.jbusres.2021.12.062

Comin, D. (2010). Total factor productivity. In Economic growth (pp. 260-263). London: Palgrave Macmillan UK.

Costantini, V., & Mazzanti, M. (2012). On the green and innovative side of trade competitiveness: The impact of environmental innovations on market shares and trade flows. Research Policy, 41(9), 1615–1628. https://doi.org/10.1016/j.respol.2012.04.008

Dai, L., Zhang, J., & Luo, S. (2022). Effective R&D capital and total factor productivity: Evidence using spatial panel data models. Technological Forecasting and Social Change, 183, 121886.

Dangelico, R. M., & Pontrandolfo, P. (2015). Being ‘Green and Competitive’: The Impact of Environmental Actions and Collaborations on Firm Performance. Business Strategy and the Environment, 24(6), 413–430. https://doi.org/10.1002/bse.1828

Ge, T., Li, C., Li, J., &Hao, X. (2023). Does neighboring green development benefit or suffer from local economic growth targets? Evidence from China. Economic Modelling, 120, p.106149. https://doi.org/10.1016/j.econmod.2022.106149

Geissdoerfer, M., Savaget, P., Bocken, N., & Hultink, E. (2017). The Circular Economy – A new sustainability paradigm? Journal of Cleaner Production, 143, 757–768. https://doi.org/10.1016/j.jclepro.2016.12.048

Han, J., & Shen, Y. (2015). Financial development and total factor productivity growth: Evidence from China. Emerging Markets Finance and Trade, 51(sup1), S261-S274.

Hojnik, J., & Ruzzier, M. (2016). What drives eco-innovation? A review of the literature. Environmental Economics and Policy Studies, 18(1), 7–34. https://doi.org/10.1016/j.eist.2015.09.006

Hunjra, A. I., Zhao, S., Tan, Y., Bouri, E., & Liu, X. (2024). How do green innovations promote regional green total factor productivity? Multidimensional analysis of heterogeneity, spatiality and nonlinearity. Journal of Cleaner Production, 142935. https://doi.org/10.1016/j.jclepro.2024.142935

Kızılkaya, O., & Üçler, G. (2019). Kadın İstihdamının Boşanma ve Doğurganlık Üzerine Etkileri: Türkiye Üzerine Bölgesel Panel Veri Analizi. The Journal of Academic Social Science, (4), 28–43.

King, R.G., and R. Levine. (1993). Finance and Growth: Schumpeter Might Be Right. Quarterly Journal of Economics ,108, 717–738.

Kök, R., & Şimşek, N. (2006). Endüstri-içi dış ticaret, patentler ve uluslararası teknolojik yayılma. Türkiye Ekonomi Kurumu Uluslararası Ekonomi Konferansı, 11, 13.

Liu, J., Wang, S., & Wang, S. (2023). Impact of FDI inflows on green TFP based on carbon emissions transmission mechanism. Economic research-Ekonomska istraživanja, 36(3). https://doi.org/10.1080/1331677X.2023.2191688

Ma, A., & Wu, Y. (2022). Total factor productivity of land urbanization under carbon emissionconstraints: A case study of Chengyu urban agglomeration in China. Economic Research-Ekonomska Istrazivanja, 35(1), 4481–4499. https://doi.org/10.1080/1331677X.2021.2013280

Mushtaq, R. (August 17, 2011). Augmented Dickey Fuller Test. https://dx.doi.org/10.2139/ssrn.1911068

Pesaran, M. H., Shin, Y., & Smith, R. J. (2001). Bounds testing approaches to the analysis of level relationships. Journal of applied econometrics, 16(3), 289–326. https://doi.org/10.1002/jae.616

Phillips, P. C., & Hansen, B. E. (1990). Statistical Inference in Instrumental Variables Regression with I (1) Processes. The Review of Economic Studies, 57(1), 99–125.

Phillips, P. C., & Moon, H. R. (1999). Linear regression limit theory for nonstationary panel data. Econometrica, 67(5), 1057–1111.

Plakaj Vërbovci, M., Gara, A. and Abazi Alili, H. (2024). Role of Innovation on Green Economic Growth: Empirical Analysis from the Countries of the Western Balkans. Ekonomika, 103(2), 109–122. doi:10.15388/Ekon.2024.103.2.6.

Porter, M. E., & Van der Linde, C. (1995). Toward a new conception of the environment-competitiveness relationship. Journal of Economic Perspectives, 9(4), 97–118.

Sanayi ve Teknoloji Bakanlığı, 2023, https://verimlilikkutuphanesi.sanayi.gov.tr/Library/ShowPDF/1526

Satoglu, E. B., & Gümüş, O. (2023). Doğrudan Yabancı Yatırımlar ve Toplam Faktör Verimliliği: Gelişmekte Olan Ülkeler Örneği. Optimum Ekonomi ve Yönetim Bilimleri Dergisi, 10(1), 225–244.

Savrul, B. K., & Yağış, O. (2019). Doğrudan Yabancı Yatırımların Faktör Verimliliği Üzerindeki Etkileri: Yükselen Piyasa Ekonomileri İçin Panel Veri Analizi. Sciences, 5(21), 1355–1366.

Schiederig, T., Tietze, F., & Herstatt, C. (2012). Green innovation in technology and innovation management–an exploratory literature review. R&d Management, 42(2), 180–192. https://doi.org/10.1111/j.1467-9310.2011.00672.x

Shahid, R., Shahid, H., Shijie, L., & Jian, G. (2024). Developing nexus between economic opening-up, environmental regulations, rent of natural resources, green innovation, and environmental upgrading of China-empirical analysis using ARDL bound-testing approach. Innovation and Green Development, 3(1), 100088.

Smith, J., & Silva, R. (2021). Green Innovation and Productivity in Developing Economies: Evidence from Brazil. Journal of Sustainable Development, 25(3), 120-135. https://doi.org/10.1016/j.jsd.2021.03.005

Suiçmez, H. (2013). Verimlilik Ekonomisi ve Politika Arayışları. Verimlilik Dergisi, (4), 33-77.

Vergil, H., & Ayaş, N. (2009). Doğrudan yabancı yatırımların istihdam üzerindeki etkileri: Türkiye örneği. Iktisat Isletme ve Finans, 24(275), 89–114. https://doi.org/10.3848/iif.2009.275.9912

Wen, J., Wang, H., Chen, F., & Yu, R. (2018). Research on environmental efficiency and TFP of Beijing areas under the constraint of energy-saving and emission reduction. Ecological indicators, 84, 235–243. https://doi.org/10.1016/j.ecolind.2017.08.069

Zhang, X., & Li, Y. (2020). Green innovation and total factor productivity growth in China. Journal of Environmental Economics, 45(2), 215–230. https://doi.org/10.1016/j.jeec.2020.02.005

Zhao, X., Nakonieczny, J., Jabeen, F., Shahzad, U., & Jia, W. (2022). Does green innovation induce green total factor productivity? Novel findings from Chinese city level data. Technological Forecasting and Social Change, 185, 122021.