(1)

(1)Ekonomika ISSN 1392-1258 eISSN 2424-6166

2025, vol. 104(4), pp. 113–131 DOI:https://doi.org/10.15388/Ekon.2025.104.4.7

Faycal Chiad

Department of Finance, College of Business, Imam Mohammad Ibn Saud Islamic University (IMSIU),

Riyadh, Saudi Arabia

E-mail: fchiad@imamu.edu.sa

ORCID: https://orcid.org/0000-0002-5537-3221

Abstract. With the great development in digitalization, ICT tools are increasingly being integrated into banking and financial services, reshaping the contemporary financial system. This study examines the impact of ICT on the banking stability in the Gulf Cooperation Council countries (GCC) from 2004 to 2023. This paper uses several econometrics methods (the fixed effects model, the system GMM, FMOLS, DOLS), and pairwise Dumitrescu causality tests. The study found that ICT is crucial in increasing banking stability. The coefficient of ICT is significantly positive, both when internet and mobile are used as explanatory variables. For instance, a 1% increase in mobile subscriptions (internet users) leads to approximately 0.012% (0.019%) increase in banking stability. Furthermore, the advantages of internet users outweigh those of mobile subscribers. The findings reveal the presence of significant positive relationship between economic growth, market capitalization, and banking stability. Whereas, cost to income has a negative impact on banking stability. These findings offer more insights into how ICT affects the stability of the banking industry.

Keywords: Internet, mobile, banking, stability, GCC.

_________

Funding Statement. “This work was supported and funded by the Deanship of Scientific Research at Imam Mohammad Ibn Saud Islamic University (IMSIU) (grant number IMSIU-DDRSP2504)”

Received: 26/12/2024. Accepted: 21/09/2025

Copyright © 2025 Faycal Chiad. Published by Vilnius University Press

This is an Open Access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

The growth of ICT is one of the main pillars of the knowledge economy. Policymakers and researchers have been increasingly interested in studying the impact of ICT on business and economic environments in recent years (Elsayed et al., 2024). However, recent studies have found strong evidence that ICT improves both macro and microeconomic gains. It has been shown that sectors that use ICT extensively have increased their productivity and efficiency (Bloom et al., 2012); this also increases GDP (Magoutas et al., 2024), improves entrepreneurship (Cornet et al., 2023), and is an important driver of human development (Bala, 2024). It also contributes to achieving the Sustainable Development Goals (Slimani et al., 2024).

Technological advancements have triggered a global digital revolution, altering the behavior of individuals, institutions, and countries, as well as reshaping the nature and structure of business and finance; technological innovations have created new business opportunities and fundamentally altered the way that banking and financial services are provided (Chien et al., 2020). These advancements have contributed to the development of numerous financial products by improving the flow of information and data and removing information asymmetry (Marszk & Lechman, 2021). ICT has also helped to improve commercial and financial efficiency, expand the consumer base, and overcome time and distance barriers.

All banks are paying more and more attention to the application of ICT technologies and policies to banking services; in fact, it has become an essential requirement for maintaining local and international competitiveness. ICT tools have an impact on the way how banking and financial decisions are made, as well as on how services and goods are delivered. It has persisted in altering the composition and operations of banks, boosting productivity and raising the caliber and speed of their output. While ICT appears to be important in the banking sector, especially in terms of cost reduction, the findings of certain research have not conclusively addressed the technology’s contribution to bank performance enhancement (Ho & Mallick, 2010).

Governments and authorities have increased their focus on financial stability and on how to measure and manage financial risks after the global financial crisis (Danisman & Tarazi, 2024) The significance of achieving financial stability became clear in: 1) mitigating the effects of financial shocks; 2) enhancing levels of performance and efficiency, as financial stability contributes to improving the efficiency of the economic system (Luo & Bu, 2016) ; 3) improving transparency and reducing information asymmetry. Also, 4) financial stability is positively linked to financial inclusion, because the latter provides the appropriate services and products to all segments of society, especially women and rural residents (Chatterjee, 2020).

Despite the above-outlined advantages, developments in financial innovation also carry risks and challenges. Disruptive technology appears to be the main source of risks to banking operations in the digital environment. Moreover, technological developments facilitate the spread of contagion and accelerate the spread of risks in the market, thus disrupting financial stability, helping to increase cyber-attacks, as well as system failures (Elsayed et al., 2024). However, it has become necessary for banks to invest more in technology because FinTech innovations have allowed financial services to expand while becoming significantly cheaper and, simultaneously, while offering greater convenience, thereby affecting the traditional banks’ profits and their market share (Vives, 2019). In addition, these technological changes have led to the development of new business models (Pompella & Costantino, 2021).

The reason to focus on the GCC is due to the significant growth in the number of internet users and mobile subscription rates along with the strong financial infrastructure, and the large financial surpluses from oil and gas revenues. This prompts us to study the role of ICT in building a strong banking and financial system that helps achieve economic diversification, which all GCC countries aim to achieve within their future plans.

Although there is no concrete proof that ICT can increase the financial stability and lower the risks involved, the subject of ICT’s effects on the banking sector has drawn extensive scholarly attention (Berger, 2003; Casolaro & Gobbi, 2007; Hasan et al., 2012).

There are very few studies that dealt with the impact of ICT on the banking stability. Within the limits of the researcher’s knowledge, there are only a few studies that investigate the impact of ICT on the banking stability, and, among them, (Cicchiello et al., 2021; Del Gaudio et al., 2021) can be mentioned. These studies were applied to the European banking sector. Complementing the previous studies, the present study analyzes the impact of ICT on the stability of banks in the GCC countries.

The aim of this paper is to analyze the relationship between ICT indicators and banking stability in a sample of GCC countries for the period of 2004–2022. In addition, the study attempts to provide insights into the ongoing debate on the role of technological changes in banking and finance. Our primary hypothesis is that ICT promotes banking stability by improving financial inclusion, facilitating communication, and offering cutting-edge services that satisfy consumer needs.

Most previous studies have focused on the role of the ICT sector in supporting economic growth and improving productivity (Bakry et al., 2023; Hussain et al., 2023; Wang et al., 2023), improving energy consumption (Talan et al., 2023), enhancing financial development (Raifu et al., 2024), and creating economic diversification (Owolabi et al., 2023).

ICT can drive economic growth by increasing company efficiency, creating new sectors, and bridging the social and economic gap between developing and developed countries. It creates jobs (Haftu, 2019), enables economies of scale, and improves access to education and public services, making it a crucial source of income for many countries (Del Gaudio et al., 2021; Nair et al., 2020; Owusu-Agyei et al., 2020). Cheng et al. (2021) investigated 72 countries between 2000 and 2015 in an effort to determine how the financial sector, the spread of ICT, and economic growth are related. They found that ICT improves economic growth in the developed countries, but the effect is not entirely clear in other countries.

Chien et al. (2020) examined how ICT affected 81 nations’ financial development from 1990 to 2015 in both linear and nonlinear ways. They concluded that the mobile and the internet positively affect the financial development, especially for developing countries. Information technology affects banking organization by delegating decisions and granting more authority in the decision to grant loans to local branch managers, which would reduce the agency problems (Mocetti et al., 2017).

The adoption of the internet improves the profitability of banks by increasing revenues from deposit services charges (DeYoung et al., 2007). By using daily data, Cicchiello et al. (2021) investigated the consequences of the diffusion of ICT on bank stock returns, default swaps (CDS), and market volatility pre- and post-COVID. They discovered that investors are highly susceptible to the shifts brought about by the spread of ICT, and the spread of the internet is highly inked with an increase in the abnormal returns of banks. Berger (2003) indicates that ICT enhances the profitability of banks and reduces banking costs.

According to Bower and Christensen (1995), one of the most significant causes for leading enterprises’ failure to remain at the top of their industries is their inability to keep up with technological advances. With the emergence of innovative technologies, there has been a fundamental change in the structure and competitiveness of the banking sector. Banks must utilize ICT in order to remain competitive and respond to new dynamic trends. ICT adoption by banks has contributed to improving their services and products, facilitating the processing of customer data and market conditions, and making banks’ performance more efficient and less risky, which enhances banking and financial stability (Berger & Mester, 2003).The spread of the internet in banking has a positive impact on the banking performance of Spanish banks, through the channel of reducing costs and thus increasing profitability (Hernando & Nieto, 2007). Ayadi et al. (2024) showed that the efficiency of European banks is improving due to investments in ICT.

In fact, ICT makes it easier to provide and quickly analyze information in the banking sector, allowing banks to rate borrowers more effectively (Crawford et al., 2018). Therefore, improved information sharing could lower bank failures and improve bank stability. Despite the benefits, the adoption of ICT in the financial sector is accompanied by security challenges and risks such as cybercrime (Pham et al., 2021). Some studies claim that financial innovations pose systemic risks to the financial stability and credibility. Numerous scholars have determined that the primary cause of the most recent financial crisis in 2007 was financial innovations (Gennaioli et al., 2012).

Banks can use ICT to store and process data in the shortest and fastest possible time, as well as process payments faster and with fewer resources. Banks have benefited from the economies of size associated with ICT-enabled procedures by offering customized goods and value-added services (Marinč, 2013). Furthermore, Scott et al. (2017) revealed that the benefits of adopting ICT include lower operational risks, and a safer transaction environment. Thus, enhanced customer satisfaction and regulatory compliance was determined. However, the rationale for using ICT as a medium to supply banking services is based on the anticipated cost savings. Indeed, ICT dissemination has the ability to reduce or eliminate the need for physical branches and associated costs (Del Gaudio et al., 2021). According to DeYoung (2005), online digital services can enhance economies of scale for banks, thereby making their services more competitive.

ICT has only been receiving limited attention in the academia despite its significance and effects on the banking sector (Beccalli, 2007; Casolaro & Gobbi, 2007; Scott et al., 2017). There are currently insufficient empirical studies on the impact of ICT diffusion on banking risk. Therefore, this study aims to fill this gap in the literature by researching the impact of ICT on the stability of the banking industry in the Gulf countries.

The study develops an econometric model describing the effect of ICT on banking stability, by employing annual data for six GCC countries between 2004 and 2023. The variable of banking stability is measured by the Z-score (Elfeituri, 2022; Luu et al., 2023). ICT is represented by two indicators: individuals using the internet, and mobile cellular subscriptions (Antwi & Kong, 2023; Bala, 2024). CIR is the cost-to-income ratio. Market capitalization is the total value of traded stocks to GDP. The concentration is the assets of the three biggest banks as a percentage of all commercial banks’ assets. Data on ICT and GDP are sourced from WDI. Data on the other variables are retrieved from the Financial Structure Database. Table 1 provides definitions and the corresponding measurements.

|

Variable |

Symbol |

Measurement |

|

Banking stability |

ZSC |

Bank Z-score: the ratio of ROA+(equity/assets))/standard deviation (ROA) |

|

ICT |

INT |

Number of internet users (% of population) |

|

MOB |

Mobile subscriptions (per 100 people) |

|

|

Bank cost-to-income ratio (%) |

CIR |

Operating cost /operating income |

|

Concentration |

CON |

The assets of the three biggest banks as a percentage of all commercial banks’ assets |

|

Economic growth |

GDP |

GDP growth (annual %) |

|

Market capitalization |

MKT |

Market capitalization of listed domestic companies (% of GDP) |

|

Inflation |

INF |

Consumer prices index |

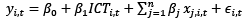

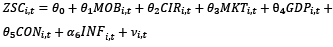

The study runs regressions on two indicators of ICT diffusion at the aggregate level. The following is the specification for the baseline regression model:

(1)

(1)

is a vector of control variables, and ε is the random error term.

is a vector of control variables, and ε is the random error term.

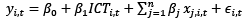

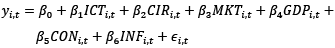

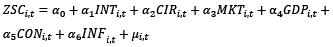

By using a panel estimation method, the association between ICT and banking stability in the GCC countries is investigated. Specifically, the dependent variables of banking stability are regressed on two measures of ICT diffusion: internet users and mobile subscriptions. The baseline regression model is specified as follows.

(2)

(2)

Where i denotes a country (i=1, 2, …..6), t is the time dimension representing the study period. yi;t refers to bank stability (i.e. Z-score). ICTt refers to both ICT proxies. CIRt represent cost to income ratio. MKTt is the market capitalization. The following two regressions are estimated:

(3)

(3)

(4)

(4)

To account for attributes of the banking sector, control variables are included, alongside proxies for the banking industry efficiency, such as the cost-to-income ratio (CIR). Furthermore, the concentration ratio, which serves as an indicator of the banking industry’s concentration level, is incorporated. Country-specific factors are addressed by including Gross Domestic Product (GDP), the market capitalization of listed domestic companies (MKT) and the inflation (INF) in the model. However, certain variables, including the ATM ratio, the non-performing loans-to-total-loan ratio, and the Boone Index, were unavailable, and were thus omitted from the analysis.

In Equation (1), the primary coefficient of interest is B1, which pertains to bank stability (ZSC). A positive (negative) value for the B1 coefficient signifies that Information and Communication Technology (ICT) has a positive (negative) impact on bank stability.

Descriptive statistics for the study data and the correlation matrix are first examined. The average ratio of internet users to the total population is approximately 40%, while the average number of mobile phone subscribers per 100 people is around 92%. The average GDP growth rate is 4.92%, and the average ZSC (bank stability) is 19.58. Table 2 provides the descriptive statistics for the sample data across six GCC countries. The average ZSC ratio is 19.5, with a maximum value of 37.78. Mobile subscriptions exhibit significant variability (standard deviation of 64.05). The highest value for internet users is 98%. The average GDP growth rate is 68.01%, with a standard deviation of 6.5%.

|

Variable |

Mean |

Std.Dev |

Min |

Max |

|

CIR |

36.83005 |

7.0948 |

22.6835 |

55.3179 |

|

ZSC |

19.5857 |

5.6895 |

9.7598 |

37.8783 |

|

INT |

40.008 |

32.7686 |

0.02673 |

98 |

|

MOB |

92.5078 |

64.05774 |

0.67064 |

212.639 |

|

MKT |

68.01005 |

31.7401 |

19.922 |

156.248 |

|

GDP |

4.9206 |

6.5670 |

-20.7602 |

43.3414 |

|

CON |

71.6815 |

13.3119 |

44.0874 |

93.134 |

|

INF |

2.778 |

3.242 |

-4.86 |

15.05 |

The pairwise correlation matrix is shown in Table 3. The correlation coefficient variables show no problem of multicollinearity.

|

ZSC |

MOB |

CIR |

INT |

MKT |

GDP |

CON |

INF |

|

|

ZSC |

1 |

|||||||

|

MOB |

0,289* |

1 |

||||||

|

CIR |

-0,415* |

-0,178* |

1 |

|||||

|

INT |

0,343* |

0,893** |

-0,1858* |

1 |

||||

|

MKT |

-0,021 |

-0,0278 |

-0,483* |

-0,081 |

1 |

|||

|

GDP |

0,286* |

-0,0483 |

-0,206* |

0,117* |

0,307* |

1 |

||

|

CON |

-0,047 |

-0,0582 |

-0,039 |

0,0182 |

0,383* |

0,1539* |

1 |

|

|

INF |

0.167 |

-0.198* |

-0.124** |

-0.415* |

-0.0711* |

0.093 |

0.0526* |

1 |

The correlation matrix indicates a positive relationship between the Information and Communication Technology (ICT) index and financial stability. Likewise, Gross Domestic Product (GDP) displays a positive correlation with financial stability. Conversely, inflation shows a statistically insignificant association with the Z-score of financial stability (ZSC), while concentration exhibits a negative, though statistically insignificant, relationship. These associations will be further explored through the estimation model and causality analysis in the subsequent sections.

In comparison to mobile subscriptions (MOB), internet usage (INT) demonstrates the strongest correlation with financial stability (0.343), thereby reflecting a significant positive relationship. This suggests that higher levels of internet usage are associated with an enhanced ZSC.

In order to obtain robust estimates and avoid spurious regression, the panel unit root tests were conducted for all study variables. Table 4 shows the results of the panel unit root tests.

The Levin–Lin–Chu (2002) and Harris–Tzavalis (1999) tests (LLC and HT) are applied, with the null hypothesis that all panels contain a unit root.

|

Variable |

LLC |

HT |

||

|

T-stat (level) |

T-stat(first diff) |

Z-statistic |

Z-statistic (first diff) |

|

|

CIR |

-1.4967* |

-4.9353*** |

||

|

ZSC |

-2.6016*** |

-4.3488*** |

||

|

INT |

1.7379 |

-2.9911*** |

2.8355 |

-10.3398*** |

|

MOB |

-2.7868*** |

1.693 |

-8.8492*** |

|

|

MKT |

-1.5104* |

-2.879*** |

||

|

GDP |

-4.6578*** |

-20.0945*** |

||

|

CON |

-1.684** |

-1.9217** |

||

|

INF |

-0.949 |

-3.668*** |

-3.535*** |

|

It can be concluded that some of the study variables were stationary at level and some were stationary when taking the first difference. Which means that it is a mixture of integration I(0) and I(1). Thus, one might expect long-run links between these variables. The next step involved checking the co-integration test, which was conducted via the Kao co-integration test. The results of the Kao test are presented in Table 5.

|

Westerlund test for cointegration |

Statistic |

|

Variance ratio |

-1.915** |

|

Kao test for cointegration |

Statistic |

|

Modified Dickey-Fuller t |

-5.472*** |

|

Dickey-Fuller t |

-5.103*** |

|

Augmented Dickey-Fuller t |

-3.819*** |

|

Unadjusted modified Dickey-Fuller t |

-5.412*** |

|

Unadjusted Dickey-Fuller t |

-5.146*** |

After performing the Kao and Westerlund tests for panel co-integration, it was obvious that the Kao statics were significant at 5%. The Westerlund test results lead to the rejection of the null hypothesis of no cointegration, suggesting a long-term relationship among the variables. The test statistics, accompanied by their corresponding p-values, reject the null hypothesis of no cointegration, supporting the alternative hypothesis of a cointegrating relationship among the variables.

The next step involves determining whether a fixed effects or random effects model is appropriate. The Hausman test is employed to distinguish between the two models, which is a critical step to identify the most efficient model for the study data. For the first model, the chi-square statistic is 75.36 with a p-value of 0.000, and, for the second model, the chi-square statistic is 87.4 with a p-value of 0.000. The null hypothesis posits that the random effects model is preferred, while the alternative hypothesis supports the fixed effects model. Given that the p-value is below 5%, the Hausman test results indicate that the fixed effects model should be adopted.

|

Coefficient |

t-statistic |

|

|

CIR |

-0.1285** |

-1.92 |

|

INT |

0.069** |

2.87 |

|

MKT |

0.0178* |

1.48 |

|

GDP |

0.1161** |

2.14 |

|

CON |

-0.0311 |

-0.61 |

|

INF |

-0.0628* |

-1.5 |

|

Constant |

19.983*** |

4.63 |

|

R2= 0.834 |

The Fixed Effects model was used as a baseline regression to account for the effect of country characteristics on the results (heterogeneity).

|

Coefficient |

t-statistic |

|

|

CIR |

-0.1042* |

-1.547 |

|

MOB |

0.057*** |

4.80 |

|

MKT |

0.0207* |

1.76 |

|

GDP |

0.1229** |

2.35 |

|

CON |

-0.0702 |

-1.39 |

|

INF |

-0.0537* |

-1.22 |

|

Constant |

21.27*** |

5.028 |

|

Rho =0.841 |

The coefficient of ICT is significantly positive, both when the internet and mobile are used as explanatory variables. For instance, a 1% increase in mobile subscriptions leads to approximately 0.057% increase in banking stability, whereas a 1% increase in internet users will increase the banking stability ratio by 0.069%. Moreover, the positive effects of internet users are greater than the effects of mobile subscriptions. Consistent with economic theory, economic growth and market capitalization were statistically significant and had a positive effect on financial stability. Additionally, banking stability increased by 0.12% to 0.10% when the cost-to-income ratio decreased by 1%. Furthermore, the high explanatory power of the model implies that ICT indicators with the other explanatory variables explain a relatively large portion of the variation in our Z-score measure. The two models explain around 83% of the variations of the banks’ Z-score.

The previous estimation results in the baseline model raise several issues, the most important of which is the problem of endogeneity, which may appear due to the failure to include some independent variables that have an impact on financial stability. Or else, the presence of reverse causality may be involved, which will give inaccurate results. The system-generalized method of moments (SGMM) was used to solve these issues.

The GMM refines the first-difference estimator proposed by Arellano and Bond (1991) by positing that first differences of instrumental variables are uncorrelated with fixed effects. This dynamic econometric approach, which incorporates both level and first-difference series as instruments, demonstrates an enhanced efficiency compared to static models. The present research employs the two-step system GMM estimator, which exhibits superior asymptotic efficiency relative to its one-step counterpart, particularly in contexts characterized by heteroskedasticity. By leveraging this methodology, the study effectively mitigates key econometric issues, including endogeneity, bias, measurement errors, unobserved heterogeneity, serial correlation, and reverse causality. These challenges are inadequately addressed by static models and the first-difference estimator, especially in scenarios involving persistent series and weak instruments, thereby underscoring the robustness and analytical precision of the SGMM approach in dynamic panel data analysis (Arellano & Bond, 1991; Arellano & Bover, 1995; Blundell & Bond, 1998).

|

Model 1 |

Model 2 |

||

|

ZSC_1 |

0.217** |

ZSC_1 |

0.144* |

|

CIR |

-0.076** |

CIR |

-0.0683* |

|

INT |

0.0305** |

MOB |

0.027*** |

|

MKT |

0.125* |

MKT |

0.0114* |

|

GDP |

0.088** |

GDP |

0.137** |

|

CON |

-0.194 |

CON |

-0.048 |

|

INF |

-0.083* |

INF |

-0.059* |

|

constant |

14.35* |

constant |

12.903* |

|

AR(1) p-value |

0.0072 |

AR(1) p-value |

P>z=0.068 |

|

AR(2) p-value |

0.73 |

AR(2) p-value |

P>z=0.85 |

|

Hansen test p-value |

0.696 |

Hansen test p-value |

0.762 |

The Generalized Method of Moments (GMM) provides consistent and efficient estimators when specific conditions are satisfied. Firstly, the instruments employed must be relevant, demonstrating a correlation with the endogenous explanatory variables. Secondly, these instruments must be exogenous, exhibiting no correlation with the error term. Thirdly, the moment conditions, as derived from the underlying economic model, must be correctly specified. In the present study, the dynamic relationship between Information and Communication Technology (ICT) and banking stability is modeled, with the lagged values of the Z-score of financial stability (ZSC) utilized as an instrument, reflecting the influence of prior observations. A notable limitation of the GMM approach lies in its sensitivity to sample size and the quality of instruments, where weak or invalid instruments may lead to biased parameter estimates.

To ensure model validity, the Arellano and Bond AR(2) test examines autocorrelation in differenced residuals, where the absence of second-order autocorrelation is crucial. The Hansen test evaluates instrument validity, with failure to reject the null indicating potential misspecification. Additionally, the presence of first-order autocorrelation supports model robustness.

The findings in the two models clearly show that the estimated coefficients on ICT indicators are statistically significant at a 5% level, which suggests that mobile subscriptions and internet users play a positive role in boosting the financial stability of the GCC countries. The results of using the SGMM confirm that the sign of the explanatory variables remained unchanged, as the effect of the internet and mobile phones is positive and significant, and also, that the GDP has a positive effect on financial stability. Meanwhile, the cost-efficiency and banking concentration were inversely related to ZSC.

The GMM findings indicate that the INT coefficient is 0.0305, which is significant at a 5% level, and the MOB coefficient is 0.027, which is significant at a 1% level. Relative to the baseline regression, the GMM coefficients are generally lower than those in the static panel data model, which is consistent with the findings of Tsouli (2022).

From the null hypothesis of the Hansen test of over-identification restrictions, and the Arellano-Bond serial correlation test, it follows that there is no overidentification or serial correlation, respectively. The results indicate the acceptance of the null hypothesis for the second-order Arellano-Bond autocorrelation test (AR(2)). On the other hand, the p-values of the Hansen’s over identification tests indicate values of 0.696 in the first model, and 0.762 in the second model, which indicates that the instruments are appropriate.

The model was reestimated again by using the panel FMOLS and the panel DOLS approach. The results of these estimations are reported in Tables 9 and 10.

The FMOLS method considers a constant term and potential correlations between the the error term and regressor differences (Phillips & Hansen, 1990). However, DOLS uses parametric corrections to adjust static regression errors by relating residuals to the first differences of regressor leads, lags, and current values, thus ensuring unbiased long-run parameter estimates (Stock, James & Watson, 1993).

The robustness analysis, as provided in Tables 9 and 10, utilizing fully modified ordinary least squares (FMOLS) and dynamic ordinary least squares (DOLS), yields valuable insights into how different factors affect the model’s outcomes. Firstly, INT has a significant positive effect on financial stability (ZSC), with coefficients of 0.051 (FMOLS) and 0.058 (DOLS), suggesting that higher INT levels enhance ZSC. Secondly, MOB also shows a significant positive impact on ZSC, with coefficients of 0.0103 (FMOLS) and 0.023 (DOLS).

In contrast, inflation shows a negative relationship, as reflected by significant coefficients of -1.2438 (FMOLS) and -1.0467 (DOLS). This suggests that higher levels of inflation are detrimental to financial stability.

Conversely, inflation demonstrates a negative association with financial stability, as indicated by significant coefficients of -0.083 and -0.059 in the FMOLS models and -0.077 and -0.063 in the DOLS models. These findings imply that elevated inflation levels adversely impact financial stability.

Overall, the FMOLS and DOLS models show consistency in their results, with mobile subscriptions, internet users, and economic growth having significant and positive impacts, while inflation and costs present a negative influence. Market capitalization also contributes positively – but with moderate significance.

|

Model 1 |

Model 2 |

|

|

CIR |

-0.147* (-2.56) |

-0.073 (-1.039) |

|

MOB |

/ |

0.0103*** (0.123) |

|

INT |

0.051*** (0.345) |

/ |

|

MKT |

0.039 (0.58) |

0.041 (0.696) |

|

GDP |

0.328***(3.471) |

0.259 ***(2.75) |

|

CON |

-0.032 (-0.49) |

-0.024 (-0.72) |

|

INF |

-0.083*(-1.79) |

-0.0592*(-1.43) |

|

Model 1 |

Model 2 |

|

|

CIR |

-0.194* (-2.487) |

-0.158(-1.7) |

|

MOB |

/ |

0.023**(0.276) |

|

INT |

0.058** (0.89) |

/ |

|

MKT |

0.034* (0.283) |

0.0157 (0.174) |

|

GDP |

0.167* (1.09) |

0.127*(0.86) |

|

CON |

-0.0438* (0.387) |

-0.036(-0.39) |

|

INF |

-0.0772*(-1.48) |

-0.063*(-1.38) |

The empirical findings indicate that Information and Communication Technology (ICT), as proxied by internet users and mobile subscriptions, exerts a statistically significant positive influence on the Z-score of financial stability (ZSC). Specifically, the results from the Fully Modified Ordinary Least Squares (FMOLS) and Dynamic Ordinary Least Squares (DOLS) estimations reveal that a 1% increase in the two ICT proxies leads to an enhancement in financial stability ranging from 0.012% to 0.06%. Additionally, economic growth was found to positively contribute to financial stability. In conclusion, the long-run estimations using FMOLS and DOLS confirm that ICT fosters financial stability in the Gulf Cooperation Council (GCC) countries, though the magnitude of this effect varies by country.

A notable limitation of the Fully Modified Ordinary Least Squares (FMOLS) approach is its requirement for large sample sizes. The Dynamic Ordinary Least Squares (DOLS) method augments the baseline regression model by including multiple leads and lags of the first differences of explanatory variables. While this augmentation introduces additional terms to mitigate biases, it also heightens the complexity of both estimation and interpretation.

To evaluate the robustness of the estimation outcomes, we employ an alternative indicator of financial stability: non-performing loans (NPLs). The findings, as presented in Table 11, indicate that the two coefficients for (ICT) are negative and statistically significant at the 5% level across both models. This underscores the constructive influence of ICT in mitigating NPLs, thereby enhancing financial stability.

Digital advancements enhance the oversight of bank loans and their operational processes, especially in managing risks and evaluating borrowers’ creditworthiness. Moreover, ICT fosters proactive management practices within banks and supports the implementation of early warning systems. Through digital platforms and applications, ICT broadens the reach of financial services. However, despite the advantages of digital financial inclusion, it is not without challenges, notably, the risk of excessive credit extension without adequate evaluation, which may precipitate an increase in loan defaults (Chiad et al., 2021).

|

Model 1 |

Model 2 |

|

|

Coefficients |

Coefficients |

|

|

CIR |

0.1732* |

0.0081* |

|

INT |

-0.0074** |

/ |

|

MOB |

/ |

-0.0068** |

|

MKT |

0.1103 |

0.058 |

|

GDP |

-0.037** |

-0.1049** |

|

CON |

0.191 |

0.1737 |

|

INF |

0.0922* |

0.1398* |

|

Constant |

7.361** |

9.856** |

|

R2= 0.76 |

Rho =0.73 |

Non-performing loans (NPLs), signal banking sector distress and broader economic issues like reduced credit, slower growth, and low investor confidence. High NPLs tighten lending standards, limiting credit for risky sectors, which stifles innovation by restricting capital for technological advancements and creative projects (Arnone et al., 2024). High NPLs reflect borrowers’ struggles, thereby straining banks’ balance sheets and limiting lending. This curbs credit access, while slowing growth and financial innovation. Low NPLs, however, create stability, encouraging banks to invest in new technologies and innovative financial products, which leads to fostering economic progress (Sánchez Serrano, 2021).

This research uses the Dumitrescu causality test (Dumitrescu & Hurlin, 2012) to examine the directional relationships between financial stability and the independent variables. The test enhances the analysis by revealing causal patterns, providing valuable insights for economic policies aimed at enhancing financial stability.

|

w̅ |

z̅ |

z̅ tilde |

|

|

ZSC≠INT |

2.64 |

2.84 |

2.11** |

|

ZSC≠MOB |

2.32 |

2.29 |

1.67* |

|

ZSC≠CIR |

0.8 |

-0.33 |

-0.44 |

|

ZSC≠GDP |

5.71 |

8.17 |

6.41** |

|

ZSC≠CON |

2.93 |

3.35 |

2.52 |

|

ZSC≠MKT |

0.96 |

-0.06 |

-0.22 |

|

ZSC≠INF |

0.68 |

-0.55 |

-0.61 |

|

GDP≠ZSC |

1.28 |

0.49 |

0.22* |

Evidently, both ICT proxies enhance financial stability. This is driven by the automation of banking and financial operations, an increased transparency and regulatory oversight, and an improved framework for risk management and prompt decision-making through artificial intelligence and big data analytics. Additionally, ICT broadens digital financial inclusion for low-income and rural populations, thereby expanding the customer base (Tsouli, 2022; Voptia & Stukalina, 2024).

Furthermore, causality test indicates that economic growth enhances financial stability by generating higher revenues and liquidity, enabling better loan repayment and lowering default rates (Laeven & Valencia, 2018). Strong economic growth also boosts confidence, spurring both domestic and foreign investment.

Consequently, the study is conducted by using the Z-score as a measure of banking stability. Findings in Table 5 reveal that there is a positive association between the level of ICT and the stability of banks. To be more specific, all indicators of ICT diffusion have a considerable impact on the banking system’s stability. According to (Sarma & Pais, 2008), the access of internet services to a large number of the population is a useful indicator of improved financial stability. Improved information exchange could lower the danger of bank insolvency and increase the stability of financial institutions. The association is in line with the previous findings. Moreover, the stability of the banking sector is affected by the level of technological infrastructure (Mustafa, 2024).

These findings confirm that ICT has a positive effect on banks’ stability, which means that higher ICT adoption is associated with higher banking stability levels. This reinforces the importance of ICT as a strategic need. Adoption of increasingly ICT infrastructures becomes a structural component of competition, performance, and stability in the banking sector. These findings are in line with (Tsouli, 2022) who found a positive impact of internet users on financial inclusion which is linked to stability, as shown by (Chatterjee, 2020). Whereas, the nexus between concentration and banking stability is less clear. No significant relationship is identified between the banking stability measure and the concentration ratio in either of the two models.

ICT significantly influences financial stability by providing technical infrastructure. Facilities like mobile exchange capacity support financial systems, while telecommunications services drive innovation in financial products and enhance electronic trading efficiency (Wu & Wang, 2023). Additionally, high penetration rates of broadband internet increase access to financial services, fostering financial inclusion via mobile banking, expanding market participation and enhancing transaction accuracy.

ICT is the primary catalyst for electronic transactions. Increasing ICT penetration provides a robust foundation for the creation and ongoing advancement of innovative, technology-driven financial instruments (Marszk & Lechman, 2021).

Despite the lack of a substantial correlation, the GCC countries’ banking stability is unaffected by banking concentration. This conclusion results from the fact that banks in GGC are not subject to strict oversight or regulation, and that the stability of the banking system is not significantly impacted by their level of concentration (Ben Ali, 2022). The outcomes show that the number of internet users is slightly more related to banking stability than the numbers of mobile subscribers, but with a slight difference. This is due to the fact that, in the GGC countries, where the population is denoted by high income and prosperity, the internet connection is usually used with various devices, including mobile phones. However, due to the presence of a large number of foreign laborers in the GGC countries, not all people can access the mobile technology for financial usage, and the connectivity is primarily accessed through other devices rather than mobile phones.

More financial stability should generally arise from improvements in the banking sector’s cost efficiency rates; hence, a lower cost-to-income ratio ought to be associated with more stable banking. Berger and DeYoung (1997) also assert that those banks that are more efficient are better at controlling their credit risks. The idea that a lower cost-to-income ratio increases bank profitability when higher profitability is linked to an improved stability is further supported by pertinent research. A healthy and profitable banking sector will be better able to withstand adverse shocks and support the stability of the financial system as a whole (Athanasoglou et al., 2008). In addition, the improvement in GDP levels enhances the financial stability, which is consistent with other studies (Chiad & Gherbi, 2024).

The ICT industry is one of the most significant and rapidly expanding economic sectors. Today, it is widely recognized that investing in affordable, universal and unconditional access to ICTs is essential to driving sustainable development. The recent developments in ICT have significantly improved the banking industry’s performance by providing innovative services and products based on advanced technology. This allowed banks to provide various services to customers (such as mobile banking, electronic payment, online financial services, etc.), which reduces the costs of operation. In light of this trend, it is evident that ICT can positively impact GCC banks’ stability.

ICT tools offer a great potential for restructuring the banking business. ICT tools, strategies and policies should be an essential component of the overall strategy of bank operators in their pursuit to ensure better performance and financial stability. It gives a great opportunity for banks to offer innovative products and services. The results showed that ICT in banking can enhance financial stability in the GCC countries. This study posits that digitization in the banking sector, through the provision of financial products and services, enhances the resilience of banks.

Following the findings, ICT indicators (internet users, mobile subscribers), economic growth, cost-to-income ratio, and stock market capitalization are among the key drivers of banking stability in the GCC countries. In line with this outcome, it is assumed that, with an improved digital infrastructure, there will be an improvement in banking stability as well. Furthermore, the banking stability is linked to the growth of the stock market because the financial market can enhance financial stability by diversifying financial resources and thus reducing the credit risks (Chiad & Sahraoui, 2022). Furthermore, Z-score is negatively impacted by the cost-to-income ratio, while banking concentration has a significant negative relationship.

Since the positive role of technology contributes to banking stability, this would pose a challenge to banking management in their attempts to train the employees on technological tools and policies, and update the banking structures, applications and products so that to keep pace with technological developments, and reach new customer segments while also providing the latest financial innovations, as well as new tools and systems. Policy makers need to reduce barriers by adopting a flexible regulatory approach, which would be appropriate to technological developments. The study recommends that banks should emphasize policies that will promote the use of modern technological developments. In addition, banks need to intensify the development of ICT infrastructure, particularly in rural areas, by providing the necessary digital tools for rural populations so that to facilitate access to financial services. Hence, investments in ICT infrastructure in rural regions will enhance financial inclusion in the GCC states. The implications of our research findings for the GCC countries are the necessity to strengthen the banking sector, support investments in the ICT infrastructure, increase internet penetration, and improve the integration of electronic financial legislation.

Al-Smadi, M. O. (2018). The role of financial inclusion in financial stability: Lesson from Jordan. Banks and Bank Systems, 13(4), 31–39. https://doi.org/10.21511/bbs.13(4).2018.03

Antwi, F., & Kong, Y. (2023). Investigating the impacts of digital finance technology on financial stability of the banking sector: New insights from developing market economies. Cogent Business and Management, 10(3). https://doi.org/10.1080/23311975.2023.2284738

Arellano, M., & Bond, S. (1991). Some tests of specification for panel data:monte carlo evidence and an application to employment equations. Review of Economic Studies, 58(2), 277–297. https://doi.org/10.2307/2297968

Arellano, M., & Bover, O. (1995). Another look at the instrumental variable estimation of error-components models. Journal of Econometrics, 68(1), 29–51. https://doi.org/10.1016/0304-4076(94)01642-D

Arnone, M., Costantiello, A., Leogrande, A., & Magazzino, C. (2024). Financial Stability and Innovation : The Role of Non-Performing Loans. FinTech, 3(4), 496–536. https://doi.org/https://doi.org/10.3390/fintech3040027

Athanasoglou, P. P., Brissimis, S. N., & Delis, M. D. (2008). Bank-specific, industry-specific and macroeconomic determinants of bank profitability. Journal of International Financial Markets, Institutions and Money, 18(2), 121–136. https://doi.org/10.1016/j.intfin.2006.07.001

Bakry, W., Nghiem, X. H., Farouk, S., & Vo, X. V. (2023). Does it hurt or help? Revisiting the effects of ICT on economic growth and energy consumption: A nonlinear panel ARDL approach. Economic Analysis and Policy, 78, 597–617. https://doi.org/10.1016/j.eap.2023.03.026

Bala, P. (2024). The Impact of Mobile Broadband and Internet Bandwidth on Human Development—A Comparative Analysis of Developing and Developed Countries. In Journal of the Knowledge Economy (Issue 0123456789). https://doi.org/10.1007/s13132-023-01711-0

Beccalli, E. (2007). Does IT investment improve bank performance? Evidence from Europe. Journal of Banking and Finance, 31(7), 2205–2230. https://doi.org/10.1016/j.jbankfin.2006.10.022

Ben Ali, M. S. (2022). Digitalization and Banking Crisis: A Nonlinear Relationship? Journal of Quantitative Economics, 20(2), 421–435. https://doi.org/10.1007/s40953-022-00292-0

Berger, A. N. (2003). The Economic Effects of Technological Progress: Evidence from the Banking Industry. Journal of Money, Credit, and Banking, 35(2), 141–176.

Berger, A. N., & Mester, L. J. (2003). Explaining the dramatic changes in performance of US banks: Technological change, deregulation, and dynamic changes in competition. Journal of Financial Intermediation, 12(1), 57–95. https://doi.org/10.1016/S1042-9573(02)00006-2

Bloom, N., Sadun, R., & Van Reenen, J. (2012). Americans Do IT Better: US Multinationals and the Productivity Miracle. American Economic Review, 102(1), 167–201. https://doi.org/10.1257/aer.102.1.167.Available

Blundell, R., & Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics, 87, 115–143. https://doi.org/10.1016/j.jeconom.2023.03.001

Casolaro, L., & Gobbi, G. (2007). Information Technology and Productivity Changes in the Banking Industry. Economic Notes, 36(1), 43–76. https://doi.org/10.1016/0305-0483(84)90018-5

Chatterjee, A. (2020). Financial inclusion, information and communication technology diffusion, and economic growth: a panel data analysis. Information Technology for Development, 26(3), 607–635. https://doi.org/10.1080/02681102.2020.1734770

Chiad, F., Aouissi, A. ;, & Lahsasna, A. (2021). Financial Inclusion and Economic growth: An International Evidence. Empirical Economics Letters, 10(20), 1793–1812.

Chiad, F., & Gherbi, A. (2024). the Role of Islamic Banks in Promoting Economic Growth and Financial Stability: Evidence From Saudi Arabia. Investment Management and Financial Innovations, 21(3), 357–369. https://doi.org/10.21511/imfi.21(3).2024.29

Chiad, F., & Sahraoui, H. H. (2022). Macroeconomic Determinants of Stock Market Development: Evidence from Panel Data Analysis. New Innovations in Economics, Business and Management Vol. 4, 113797, 79–88. https://doi.org/10.9734/bpi/niebm/v4/2819e

Chien, M. S., Cheng, C. Y., & Kurniawati, M. A. (2020). The non-linear relationship between ICT diffusion and financial development. Telecommunications Policy, 44(9), 102023. https://doi.org/10.1016/j.telpol.2020.102023

Cicchiello, A. F., Cotugno, M., Monferrà, S., & Perdichizzi, S. (2021). Exploring the Impact of Ict Diffusion in the European Banking Industry: Evidence in the Pre- and Post-Covid-19. Journal of Financial Management, Markets and Institutions, 9(2). https://doi.org/10.1142/S2282717X21500109

Cornet, D., Bonnet, J., & Bourdin, S. (2023). Digital entrepreneurship indicator (DEI): an analysis of the case of the greater Paris metropolitan area. Annals of Regional Science, 71(3), 697–724. https://doi.org/10.1007/s00168-022-01175-1

Crawford, G. S., Pavanini, N., Schivardi, F., & Lasserre, G. (2018). Asymmetric information and imperfect competition. American Economic Review, 108(7), 1659–1701.

Danisman, G. O., & Tarazi, A. (2024). Economic policy uncertainty and bank stability: Size, capital, and liquidity matter. Quarterly Review of Economics and Finance, 93(May), 102–118. https://doi.org/10.1016/j.qref.2023.11.008

Del Gaudio, B. L., Porzio, C., Sampagnaro, G., & Verdoliva, V. (2021). How do mobile, internet and ICT diffusion affect the banking industry? An empirical analysis. European Management Journal, 39(3), 327–332. https://doi.org/10.1016/j.emj.2020.07.003

DeYoung, R., Lang, W. W., & Nolle, D. L. (2007). How the Internet affects output and performance at community banks. Journal of Banking and Finance, 31(4), 1033–1060. https://doi.org/10.1016/j.jbankfin.2006.10.003

Dumitrescu, E. I., & Hurlin, C. (2012). Testing for Granger non-causality in heterogeneous panels. Economic Modelling, 29(4), 1450–1460. https://doi.org/10.1016/j.econmod.2012.02.014

Elfeituri, H. (2022). Banking stability, institutional quality, market concentration, competition and political conflict in MENA. Journal of International Financial Markets, Institutions and Money, 76(January 2011), 101476. https://doi.org/10.1016/j.intfin.2021.101476

Elsayed, A. H., Guedira, I., Alghussein, T., Almheiri, H., Alomari, M., & Elmassri, M. (2024). The impact of FinTech technology on financial stability of the UAE. Heliyon, 10(19), e38255. https://doi.org/10.1016/j.heliyon.2024.e38255

Gennaioli, N., Shleifer, A., & Vishny, R. (2012). Neglected risks, financial innovation, and financial fragility. Journal of Financial Economics, 104(3), 452–468. https://doi.org/10.1016/j.jfineco.2011.05.005

Haftu, G. G. (2019). Information communications technology and economic growth in Sub-Saharan Africa: A panel data approach. Telecommunications Policy, 43(1), 88–99. https://doi.org/10.1016/j.telpol.2018.03.010

Hasan, I.; Schmiedel, H.; Song, L. I. 2012. (2012). Returns to retail banking and payment. Journal of Financial Services and Research, 41, 163–195. http://dx.doi.org/10.1007/s10693-011-0114-y

Hernando, I., & Nieto, M. J. (2007). Is the Internet delivery channel changing banks’ performance? The case of Spanish banks. Journal of Banking and Finance, 31(4), 1083–1099. https://doi.org/10.1016/j.jbankfin.2006.10.011

Ho, S. J., & Mallick, S. K. (2010). The impact of information technology on the banking industry. Journal of the Operational Research Society, 61(2), 211–221. https://doi.org/10.1057/jors.2008.128

Hussain, S., Gul, R., & Ullah, S. (2023). Role of financial inclusion and ICT for sustainable economic development in developing countries. Technological Forecasting and Social Change, 194(September 2022), 122725. https://doi.org/10.1016/j.techfore.2023.122725

Laeven, M. L., & Valencia, M. F. (2018). Systemic Banking Crises Revisited. International Monetary Fund, 7(2). https://doi.org/10.5089/9781484376379.001

Luo, Y., & Bu, J. (2016). How valuable is information and communication technology? A study of emerging economy enterprises. Journal of World Business, 51(2), 200–211. https://doi.org/10.1016/j.jwb.2015.06.001

Luu, H. N., Nguyen, C. P., & Nasir, M. A. (2023). Implications of central bank digital currency for financial stability: Evidence from the global banking sector. Journal of International Financial Markets, Institutions and Money, 89(December 2022), 101864. https://doi.org/10.1016/j.intfin.2023.101864

Magoutas, A. I., Chaideftou, M., Skandali, D., & Chountalas, P. T. (2024). Digital Progression and Economic Growth: Analyzing the Impact of ICT Advancements on the GDP of European Union Countries. Economies, 12(3), 1–17. https://doi.org/10.3390/economies12030063

Marszk, A., & Lechman, E. (2021). Reshaping financial systems: The role of ICT in the diffusion of financial innovations – Recent evidence from European countries. Technological Forecasting and Social Change, 167(May 2020). https://doi.org/10.1016/j.techfore.2021.120683

Mocetti, S., Pagnini, M., & Sette, E. (2017). Information Technology and Banking Organization. Journal of Financial Services Research, 51(3), 313–338. https://doi.org/10.1007/s10693-016-0244-3

Mustafa, J. A. (2024). From Innovation To Stability: Evaluating the Ripple Influence of Digital Payment Systems and Capital Adequacy Ratio on a Bank’S Z-Score. Banks and Bank Systems, 19(3), 67–79. https://doi.org/10.21511/bbs.19(3).2024.07

Nair, M., Pradhan, R. P., & Arvin, M. B. (2020). Endogenous dynamics between R&D, ICT and economic growth: Empirical evidence from the OECD countries. Technology in Society, 62(June), 101315. https://doi.org/10.1016/j.techsoc.2020.101315

Owolabi, O. A., Adedeji, A. O., Aderounmu, B., Oku, A. R. O., & Ogunbiyi, T. (2023). Do Information and Communications Technology (ICT) and financial development contribute to economic diversification? Evidence from sub-Saharan Africa. Journal of Economic Structures, 12(1), 1–14. https://doi.org/10.1186/s40008-023-00299-7

Owusu-Agyei, S., Okafor, G., Chijoke-Mgbame, A. M., Ohalehi, P., & Hasan, F. (2020). Internet adoption and financial development in sub-Saharan Africa. Technological Forecasting and Social Change, 161(September), 120293. https://doi.org/10.1016/j.techfore.2020.120293

Pham, T. T., Dao, L. K. O., & Nguyen, V. C. (2021). The determinants of bank’s stability: a system GMM panel analysis. Cogent Business and Management, 8(1). https://doi.org/10.1080/23311975.2021.1963390

Phillips, P. C. B., & Hansen, B. E. (1990). Statistical inference in instrumental variables regression with i(1) processes. Review of Economic Studies, 57(1), 99–125. https://doi.org/10.2307/2297545

Pompella, M., & Costantino, L. (2021). Financial innovation and technology after COVID-19 a few directions for policy makers and regulators in the view of old and new disruptors. Ekonomika, 100(2), 40–62. https://doi.org/10.15388/EKON.2021.100.2.2

Raifu, I. A., Okunoye, I. A., & Aminu, A. (2024). The effect of ICT on financial sector development in Africa: does regulatory quality matter? Information Technology for Development, 30(3), 424–451. https://doi.org/10.1080/02681102.2023.2233458

Sánchez Serrano, A. (2021). The impact of non-performing loans on bank lending in Europe: An empirical analysis. North American Journal of Economics and Finance, 55(June 2020). https://doi.org/10.1016/j.najef.2020.101312

Sarma, M., & Pais, J. (2008). Financial Inclusion and Development: A Cross Country Analysis. In Annual Conference of the Human Development and Capability Association, New Delhi, 168(10–13), 1–30. https://doi.org/10.1002/jid

Scott, S. V., Van Reenen, J., & Zachariadis, M. (2017). The long-term effect of digital innovation on bank performance: An empirical study of SWIFT adoption in financial services. Research Policy, 46(5), 984–1004. https://doi.org/10.1016/j.respol.2017.03.010

Slimani, S., Omri, A., & Abbassi, A. (2024). International capital flows and sustainable development goals: The role of governance and ICT diffusion. Socio-Economic Planning Sciences, 93(March), 101882. https://doi.org/10.1016/j.seps.2024.101882

Stock, James H & Watson, M. W. (1993). A Simple Estimator of Cointegrating Vectors in Higher Order Integrated Systems. Econometrica, Econometric Society, 61(4), 783–820.

Talan, A., Rao, A., Sharma, G. D., Apostu, S. A., & Abbas, S. (2023). Transition towards clean energy consumption in G7: Can financial sector, ICT and democracy help? Resources Policy, 82(March), 103447. https://doi.org/10.1016/j.resourpol.2023.103447

Tsouli, D. (2022). Financial Inclusion, Poverty, and Income Inequality: Evidence from European Countries. Ekonomika, 101(1), 37–61. https://doi.org/10.15388/Ekon.2022.101.1.3

Vives, X. (2019). Competition and stability in modern banking: A post-crisis perspective. International Journal of Industrial Organization, 64, 55–69. https://doi.org/10.1016/j.ijindorg.2018.08.011

Voptia, E. B. K., & Stukalina, Y. (2024). Financial Inclusion in Sub-Saharan Africa: The Case of Mobile Money. Ekonomika, 103(4), 81–96. https://doi.org/10.15388/Ekon.2024.103.4.5

Wang, W., Ning, Z., Shu, Y., Riti, M. K. J., & Riti, J. S. (2023). ICT interaction with trade, FDI and financial inclusion on inclusive growth in top African nations ranked by ICT development. Telecommunications Policy, 47(4), 102490. https://doi.org/10.1016/j.telpol.2023.102490

Wu, B., & Wang, Y. (2023). Does information communication promote financial development? Empirical evidence from China. Borsa Istanbul Review, 23(1), 136–148. https://doi.org/10.1016/j.bir.2022.09.007