Organizations and Markets in Emerging Economies ISSN 2029-4581 eISSN 2345-0037

2019, vol. 10, no. 2(20), pp. 335–355 DOI: https://doi.org/10.15388/omee.2019.10.17

Size Effect in Market-wide Liquidity Commonality: Evidence from the Indian Stock Market

Dr Namitha K. Cheriyan (Corresponding author)

Department of Commerce, CHRIST (Deemed to be University), Bangalore, India

namicheriyan@gmail.com

Dr Daniel Lazar

Department of Commerce, Pondicherry University, India

lazard.com@pondiuni.edu.in

Abstract. Liquidity commonality and the co-movements in trading costs related to such commonality have remarkable implications in market microstructure. Analyzing and identifying such commonality will enable the investor and policy maker to discover evidence regarding the inventory risks and asymmetric information influencing individual securities’ liquidity. Thus, this study aims at documenting the liquidity commonality and measuring its extent in the Indian stock market. Employing fourteen liquidity measures attributed to the cost, quantity, time, and multidimensional aspects of liquidity, it empirically proves the existence of co-movements among market-wide liquidity and the individual securities’ liquidity. The study also shows the presence of a size effect in liquidity commonality in Indian stock market. It is found that the slope coefficient indicating the interface between market-wide liquidity and individual securities’ liquidity generally increases with size.

Keywords: liquidity, commonality in liquidity, NIFTY 50, liquidity measures

JEL Classification: G12, G15

Received: 4/13/2019. Accepted: 11/5/2019

Copyright © 2019 Namitha K. Cheriyan, Daniel Lazar. Published by Vilnius University Press. This is an Open Access article distributed under the terms of the Creative Commons Attribution Licence, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

1. Introduction

Liquidity commonality can be defined as the presence of a common component in liquidity across the market. It is a scenario where the liquidity of individual securities co-moves with the aggregate market-wide liquidity. The empirical research in market microstructure has diverted its attention from examining the liquidity of individual securities towards analyzing the existence of common elements attributed to such co-movements in liquidity (Chordia et al., 2000; Hasbrouck & Seppi, 2001; Huberman & Halka, 2001; Brockman & Chung, 2002). They emphasize the significance of market microstructure as a decisive factor in determining the extent of commonality (Fabre & Frino, 2004).

Liquidity commonality indicates the impact of a common, market-wide factor on the liquidity of an individual security. Understanding such commonality is of great significance for the investors across the globe, given that the empirical studies prove the systematic or market-wide liquidity as a priced factor (Amihud & Mendelson, 1986; Pastor & Stambaugh, 2003) that can influence the investor strategies aimed at minimizing the impact of liquidity on trades (Chordia et al., 2001).

The earlier studies concerning the determinants and pattern of liquidity were largely centered on the cross-sectional variations in liquidity. However, the recent literature has diverted its attention to a more relevant aspect, that is, the time series properties of liquidity. Such studies analyse whether the movements in liquidity share any mutual element in the stock markets which is regarded as commonality in liquidity in the market microstructure literature. For instance, Krishnan and Mishra (2013), while analyzing the intraday liquidity patterns in the Indian stock market, analyze the marketwise liquidity by estimating the commonality among liquidity measures. Though the study establishes a U-shaped pattern for most of the volume and spread related liquidity measures similar to a quote driven market, it shows only weak evidence of liquidity commonality in Indian market.

Chordia et al. (2000) is one among the earlier studies empirically documenting the commonality in liquidity. The study presents liquidity as more than a mere characteristic of a single asset and finds the co-movements in individual measures of liquidity. It provides for the existence of significant commonality in the New York Stock Exchange even after controlling for the most prominent individual determinants of liquidity, viz. trading volume, volatility and price of securities. They prove that there is a significant mutual element in liquidity at market level as well as at industry level. Hasbrouck and Seppi (2001) provide additional support to this by analyzing intraday, 15-minutes trade and quote data pertaining to thirty stocks from the Dow Jones Index.

The liquidity measures are proved to be exhibiting time-varying and cross-sectional movements arising from common factors (Huberman & Halka, 2001; Karolyi, Lee & Van Dijk, 2012; Wang, 2013; Rösch & Kaserer, 2013). Such temporal fluctuations tend to exhibit significant correlations with stock returns and volatility. The countries demonstrating higher market volatility are found to be exhibiting greater commonality in liquidity. Similarly, increased commonality is witnessed during the periods of higher market volatility, precisely during large market declines. Commonality is also found to increase with increased presence of international investors as well as increased correlated trading activity.

There is robust evidence for the existence of commonalities in individual stocks’ liquidity by means of different liquidity measures. For instance, using the data pertaining to the developed market of Japan, UK and the US, Stahel (2005) discloses the presence of a common global component to which the individual stock liquidity is related and co-moves within countries and industries. It suggests global liquidity as a prominent element driving the liquidity of individual stocks. Brockman, Chung and Pérignon (2009) also find significant commonality in liquidity as measured by quoted spread and depths on majority of exchanges from developed as well as emerging market.

From an emerging market perspective, Pukthuanthong-Le and Visaltanachoti (2009) examine the liquidity in the Thailand stock market. They provide robust evidence of market-wide commonality in liquidity across different measures of liquidity. They identify stronger industry-wide commonality than market-wide commonality in liquidity. In similar lines, Narayan et al. (2011) test four hypotheses pertaining to the liquidity commonality in the Chinese stock market and provide strong evidence of liquidity commonality. They emphasize the impact of industry-wide liquidity in explaining the liquidity of individual stocks. However, they do not find any evidence of the size effect in liquidity commonality. Bai and Qin (2015) also analyze the commonality in liquidity from emerging markets’ perspective. Considering eighteen emerging markets, they find that the liquidity of individual stocks is greatly influenced by the market volatility, rather than the firm-specific volatility. They document the presence of a robust geographic factor influencing the commonality in liquidity across emerging markets.

In the Indian context, contrary to the weak evidence of commonality provided by Krishnan and Mishra (2013), Syamala et al. (2014) show strong evidence of liquidity commonality in spot as well as derivatives market. Controlling for market returns and the volatility of individual firms, they reveal strong market-wide and industry-wide commonality. Kumar and Misra (2018) support these findings by analysing 50 mid-cap stocks from the National Stock Exchange of India. They conclude that the liquidity of individual stocks strongly co-moves with the market and industry liquidity.

In spite of a good number of attempts to document the presence of commonality in liquidity, a review of such studies reveals that most of the studies are centered on developed markets. There is only a limited number of studies analyzing the commonality in liquidity and its determinants in emerging markets, including India. It is of utmost significance to analyze the existence and extent of commonality and its impact in such markets given that the increase in commonality may result in market-wide liquidity dry-ups leading to financial market contagion driving the spread of financial crisis from one market to the other (Rösch & Kaserer, 2013). Furthermore, the studies in emerging markets are found to be restricted to the analysis of liquidity commonality using a limited number of measures. However, it is evident in literature that a measure that works finely for one market does not necessarily work perfectly in other markets. Given this, it is imperative to spot that no single universal proxy can comprehend liquidity of a stock market. Therefore, the objective of this study is to examine the existence of market-wide liquidity commonality in the Indian stock market by employing multiple measures covering various dimensions of liquidity. It also empirically tests for a size-factor in determining the liquidity commonality in the market.

2. The measures of liquidity employed

Liquidity of a security or market is essentially three dimensional. It encompasses three aspects, viz., cost, quantity and time. Taking this into account, our study uses measures capturing each of the three dimensions. It also employs certain multidimensional measures which are more sophisticated hybrid measures formed by combining two or more dimensions of liquidity. It uses a total of fourteen measures. A brief description of each of these measures is provided below.

2. 1 Cost dimensional measures of liquidity

Cost dimensional measures, commonly known as spread related measures, are the most widely employed proxies to quantify the transaction cost element of liquidity in the stock market. The bid-ask spread is the most popular one among such measures used extensively in the market microstructure literature as a proxy for liquidity (Amihud & Mendelson, 1986). From an investor perspective, the excess of ask price over bid price denotes the cost that may be incurred if trading in the market. Apart from the simple bid-ask spread, there are certain related measures calculated using bid prices and ask prices carrying similar implications of bid-ask spread. The higher value in such measures points out to lesser liquidity in the market. Such higher values are attributed to the fixed trading costs, the costs arising from adverse selection, and the cost of holding inventory. The following are the cost dimensional measures used in this study.

(i) Quoted Spread (St). It is the simplest measure of cost dimensional aspect of liquidity that determines the excess of ask price over the bid price for any security in the market. It essentially indicates the extent to which the maximum price that a buyer is ready to pay for a security exceeds the minimum price that is acceptable for the seller in order to sell the security.

St = PA – PB (1)

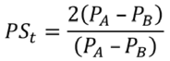

(ii) Proportional Quoted Spread (PSt ). It is another commonly used cost dimensional measure of liquidity which is popularized by McInish and Wood (1992). It denotes the relative spread, which is arrived at by dividing the simple bid-ask spread by the mid-price of bid price and ask price.

(2)

(2)

(iii) Effective Spread (ESPR). It is a measure devised to quantify the actual cost of trading that significantly affects the liquidity of a security or the market as a whole. Chordia et al. (2000) provided lesser values in effective spread as compared to the quoted spread as an indication of occurrence of transactions within the quoted spread. Some researchers in market microstructure consider this measure as the most eloquent liquidity measure (Hasbrouck, 2009). The periodical reporting of the descriptive statistics of effective spread by the market centres is even mandated by the U.S. Securities and Exchange Commission (SEC). It is calculated as follows:

ESPR = 2|Pt – PM| (3)

where Pt denotes the price at which the last trade occurred before time t, and PM denotes the mid-value of bid price and ask price last quoted before time t.

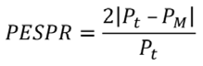

(iv) Proportional Effective Spread (PESPR). It refers to the ratio between effective spread and the last traded price. It can be arrived at as follows:

(4)

(4)

2.2 Quantity dimensional measures of liquidity

The quantity or volume dimensional measures are continued to be popular liquidity measures even today, given the prominence of trading based on algorithms, resulting in high frequency transactions in the market (Chordia, Roll, & Subrahmanyam, 2001; Hasbrouck, 2009). Such measures essentially reveal the magnitude of transactions per unit of time. Higher values in quantity dimensional measures of liquidity imply the occurrence of trade in greater volumes in lesser time. Lee and Swaminathan (2000) showed these measures as the linkage concerning the momentum and the strategies to enhance the value. Therefore, greater values in these measures are generally regarded as an indication of greater liquidity. The following are the quantity dimensional measures used in the study.

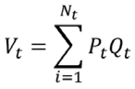

(i) Turnover (Vt ). The following formula is used to calculate the turnover per unit of time:

(5)

(5)

where Pt is the price at which the last trade happened before time t, and Qt implies the quantity traded at the price Pt .

The market microstructure offers indecisive evidence regarding the relationship between return and spread which is considered as an important motive behind developing turnover as a measure of liquidity (Marshall, 2006). This has a wide theoretical support as well. For instance, Amihud and Mendelson (1986) found that the liquidity exhibits significant correlations with the frequency with which the trading occurs in a security or the market as a whole, at equilibrium. On the other hand, the cross-sectional studies aimed at examining the returns pose suspicions with regard to the ability of turnover as an efficient measure of liquidity. Such suspicions arise from the inverse relationship established in the literature between the anticipated returns of low performing securities and turnover as against its significant positive correlation with the returns of well performing securities (Subrahmanyam, 2005). Therefore, turnover cannot be regarded as the best quantity dimension measure of liquidity. However, it is widely used in the literature as a measure of liquidity.

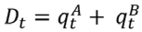

(ii) Depth (Dt ). It is among the most traditional measures used to quantify liquidity of a security or the market as a whole. The depth exhibits the quantity traded in a market. It is a measure that is very much related to spread. For instance, Corwin (1999), aiding depth as a measure of liquidity, demonstrates that it differs considerably among specialist firms and thus suggests significant differences in transaction costs among such firms. The following formula is employed to calculate the depth in the market:

(6)

(6)

where  denotes the quantity asked and

denotes the quantity asked and  represents the quantity demanded at time t.

represents the quantity demanded at time t.

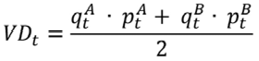

(iii) Value depth (VDt). The study also employs a Rupee-denominated depth for the Indian stock market. It is calculated in terms of currency analogously to average depth as given below:

(7)

(7)

where  indicates the best ask price and

indicates the best ask price and  denotes the best bid price at any given time t.

denotes the best bid price at any given time t.

2.3 Time dimensional measures of liquidity

Time dimensional measures of liquidity indicate quickness in the market in executing the transactions. Similar to quantity dimensional measures, these measures reveal the frequency with which transactions occur. Higher values of time dimensional measures denote greater liquidity in the market. This study employs two time dimensional measures which are discussed below.

(i) Number of transactions per unit time (Nt ). It is a measure having similar implications to quantity dimensional measures that takes into account the number of transactions occuring between time t–1 and t. This measure essentially reveals the quickness in the trading of a security or the market as a whole.

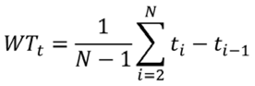

(ii) Waiting time (WT). This is another time-related measure of liquidity that is obtained by inversing the number of transactions per unit time. It is calculated using the following formula:

(8)

(8)

where ti and ti–1 represent the time of the current trade and previous trade respectively. Therefore, waiting time for a specific time space is calculated as an average time between two trades as provided by Ranaldo (2001).

2.4 Multidimensional measures of liquidity

Multidimensional measures are those that combine two or more individual dimensions of liquidity to have more composite measures. The market microstructure literature emphasizes the need for using such hybrid measures. For instance, Chordia et al. (2001), employing data pertaining to NYSE stocks, used a simple bid-ask spread as well as quoted depth in order to examine the relationship among various macroeconomic factors and liquidity prevailing in the market. Similarly, Goldstein and Kavajecz (2000) employed bid-ask spreads combined with depth to investigate the movements in liquidity in the limit order book. Our study uses the following multidimensional measures:

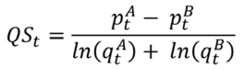

(i) Quote slope (QSt ). It is a measure that aggregates aspects of depth and tightness in order to have a more useful hybrid measure. This measure first appeared in the seminal work of Hasbrouck and Seppi (2001). It is calculated by dividing simple spread by log depth. A higher slope indicates lesser liquidity. Below is the mathematical expression of quote slope:

(9)

(9)

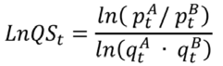

(ii) Log quote slope (LnQSt). It was also introduced by Hasbrouck and Seppi (2001). It employs the logarithmic relative spread in the numerator as expressed below:

(10)

(10)

The quote slope as well as log quote slope will always be positive. They return a flatter slope when the market is more liquid, which further reveals narrower bid-ask spread. They are generally viewed as the measures that sum up the supply curve of quoted liquidity. Greater values of  and

and  lead to flatter slopes indicating better liquidity in the market.

lead to flatter slopes indicating better liquidity in the market.

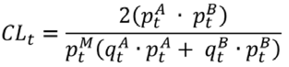

(iii) Composite liquidity (CLt ). Introduced by Chordia et al. (2001), composite liquidity is a measure that incorporates the attributes of spread as well as depth. It is essentially a measure that quantifies the slope of liquidity function. Greater values of composite liquidity point out the lesser liquidity in the market. This measure can be mathematically defined as follows:

(11)

(11)

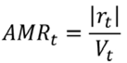

(iv) Amihud measure (AMR). It is one of the widely accepted liquidity measures in the recent market microstructure literature that captures the link between the absolute price change and the volume traded in the market. In order to capture absolute price changes, it employs non-zero returns as expressed in the following formula:

(12)

(12)

Amihud (2002) states that a security can be considered as illiquid if its prices fluctuate in response to slighter movements in the volume of trade, which leads to greater value of Amihud measure. Using this measure, Amihud (2002) suggests that the anticipated returns from a security represent a premium for illiquidity, by reporting positive correlations between the anticipated illiquidity in the market over time and the expected excess returns from a security. Though this is considered as a popular measure, empirical literature cautions the possibility of extreme values in the measure.

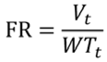

(v) Flow ratio (FR). Recommended by Ranaldo (2001), it is a measure that quantifies the relationship between turnover (V1 t ) and waiting time (WTt ). It combines the quantity and time dimensions of liquidity. A higher flow ratio denotes greater liquidity. The ratio can be mathematically expressed as follows:

(13)

(13)

3. Data and methodology

The study employs one-minute trade and quote data of fifty securities constituting NIFTY 50 Index for a period from 1st January 2016 to 31st December 2016 comprising 246 trading days. The data is sourced from Bloomberg database. The 1-minute sampling frequency provides for 374 data points from 9:16 am, to 3:29 pm, resulting in a total of 92,004 trading observations per stock. Fourteen liquidity measures are calculated for each security using the trade and quote data during each time interval. In order to remove the possible noise in the data, which is a peculiarity of intraday data, each measure of liquidity is averaged across the daily trades for every security as provided by Chordia et al. (2000), Fabre and Frino (2004), and Narayan et al. (2015).

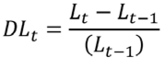

Correlations of cross-sectional means are estimated. Change in each liquidity variable over consecutive trading days is computed and the absolute value of daily proportional change is arrived at. The descriptive statistics of the absolute measures are calculated. The multiple regression models are run to establish the existence of market-wide commonality in liquidity in general as well as market-wide commonality in liquidity by size.

3.1 Establishing market-wide liquidity commonality

Simple market model regressions for time-series are used to establish the market-wide liquidity commonality. The daily percentage changes in each of the liquidity measures of an individual security are regressed on market-wide measures of liquidity using the following equation:

DLj,t = αj + BjDLM,t + εj,t (14)

DLj,t is the daily percentage change in individual liquidity measure for a security, j. DLM is the change in corresponding market-wide liquidity measure. To calculate DLM , the daily changes in individual liquidity measure of all the securities except security, j is averaged by assigning equal weight to all the securities.

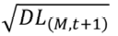

One lead and one lag of the average market-wide liquidity (i.e.,  and DL(M,t+1) ) along with the concurrent market return, leading and lagged market returns, and concurrent change in squared return of individual security are considered as additional regressors. The leads and lags are expected to apprehend any leading or lagged correction in liquidity commonality. In order to eliminate the presence of any spurious dependence arising from association between the returns and measures of liquidity, the market return is used. Such associations have precise significance for the cost dimensional measures of liquidity as they are essentially derived from the transaction price. Changes in these measures are therefore the functions of individual returns which are recognized to be considerably correlated with the market returns. Finally, in order to account for volatility of individual security returns, the squared returns are included, which is more of a nuisance variable that can probably affect liquidity. The explanatory variable in the regression equation may be slightly dissimilar for each security, j’s time series regression as security j is not considered in computing the market-wide liquidity measure, DLM. This is aimed at removing a possibly deceptive constraint on average regression coefficients. Even though removing one security from a group of 50 for calculating market-wide measures makes a minor difference in the slope coefficients of any individual regression equation, such negligible differences can accrue to a material sum when they are averaged across all the individual equations.

and DL(M,t+1) ) along with the concurrent market return, leading and lagged market returns, and concurrent change in squared return of individual security are considered as additional regressors. The leads and lags are expected to apprehend any leading or lagged correction in liquidity commonality. In order to eliminate the presence of any spurious dependence arising from association between the returns and measures of liquidity, the market return is used. Such associations have precise significance for the cost dimensional measures of liquidity as they are essentially derived from the transaction price. Changes in these measures are therefore the functions of individual returns which are recognized to be considerably correlated with the market returns. Finally, in order to account for volatility of individual security returns, the squared returns are included, which is more of a nuisance variable that can probably affect liquidity. The explanatory variable in the regression equation may be slightly dissimilar for each security, j’s time series regression as security j is not considered in computing the market-wide liquidity measure, DLM. This is aimed at removing a possibly deceptive constraint on average regression coefficients. Even though removing one security from a group of 50 for calculating market-wide measures makes a minor difference in the slope coefficients of any individual regression equation, such negligible differences can accrue to a material sum when they are averaged across all the individual equations.

3.2 Establishing the market-wide liquidity commonality by size

Using a similar regression model, Chordia et al. (2000) and Fabre and Frino (2004) reported a size effect that could be a potential factor determining the extend of liquidity commonality. Chordia et al. (2000) showed that the simple bid-ask spreads of larger securities tend to exhibit greater reaction to the market-wide changes in spreads. However, they failed in finding such size effects for liquidity as measured by depth. Their results imply that the market specialists more often incline to revise the spreads for larger securities than for smaller ones. They further attribute such results to the predominance of institutional investors in larger securities. Both the studies divide the sample into quantiles based on market capitalization. Chordia et al. (2000) find statistically significant coefficients in all the quantiles which are reported to be steadily increasing with firm size. On the other hand, Fabre and Frino (2004) report different results. They show that only the largest quantile exhibits liquidity commonality which is statistically significant across all liquidity measures. However, Brockman and Chung (2002) report the third quantile as the one exhibiting the highest sensitivity to liquidity commonality. They account larger securities as lesser responsive to market-wide liquidity movements than medium securities.

Our study sorts and partitions the securities into three groups, viz., small, medium, and large, based on their market capitalization, which ranges from 4,206,864 Million to 186,484 Million, unlike the studies partitioning the samples into quantiles. As a result, these groupings of small, medium and large size contain 17, 16 and 17 stocks, respectively.

4. Results and discussions

4.1 Correlation between liquidity measure pairs

Table 1. Correlation between liquidity measure pairs

|

|

St |

PSt |

ESPR |

PESPR |

Vt |

Dt |

VDt |

Nt |

WT |

QSt |

LnQSt |

CLt |

AMR |

|

PSt |

0.271 |

||||||||||||

|

ESPR |

0.158 |

0.256 |

|||||||||||

|

PESPR |

0.038 |

0.192 |

0.741 |

||||||||||

|

Vt |

0.016 |

0.013 |

0.365 |

0.397 |

|||||||||

|

Dt |

0.044 |

0.003 |

0.062 |

0.015 |

0.427 |

||||||||

|

VDt |

0.106 |

0.026 |

0.267 |

0.229 |

0.751 |

0.816 |

|||||||

|

Nt |

0.046 |

0.085 |

0.352 |

0.338 |

0.703 |

0.473 |

0.656 |

||||||

|

WT |

-0.061 |

-0.053 |

-0.425 |

-0.373 |

-0.536 |

-0.393 |

-0.568 |

-0.847 |

|||||

|

QSt |

0.979 |

0.223 |

0.153 |

0.063 |

0.018 |

0.054 |

0.114 |

0.061 |

-0.074 |

||||

|

LnQSt |

0.322 |

0.852 |

0.195 |

0.143 |

0.073 |

0.052 |

0.092 |

0.031 |

-0.058 |

0.293 |

|||

|

CLt |

0.113 |

0.265 |

0.305 |

0.169 |

0.075 |

0.027 |

0.105 |

0.137 |

-0.180 |

0.116 |

0.156 |

||

|

AMR |

0.024 |

0.036 |

0.236 |

0.091 |

-0.326 |

-0.336 |

-0.432 |

-0.494 |

-0.701 |

0.006 |

0.108 |

0.094 |

|

|

FR |

0.051 |

0.046 |

0.212 |

0.260 |

0.866 |

0.572 |

0.701 |

0.665 |

-0.461 |

0.057 |

0.003 |

0.025 |

0.326 |

Source: Authors’ own calculation

Table 1 presents the correlation between various measures of liquidity employed in the study. It is evident from the table that the cost dimensional measures of liquidity, viz., quoted spread (St), proportional quoted spread (PSt), effective spread (ESPR), and proportional effective spread (PESPR), exhibit a positive relationship with each other. These measures possess a positive relationship with the quantity dimensional measures, viz., turnover (Vt), trading volume (Qt), depth (Dt), and value depth (VDt). A similar relationship is evident in the case of the number of transactions (Nt), indicating that the increase in the number of trades widens the spread. Most of the multidimensional measures also exhibit a positive relationship with cost dimensional measures of liquidity.

4.2 Summary statistics of daily absolute proportional changes in liquidity measures

The summary statistics of daily absolute percentage changes in the liquidity measures used in the study are presented in Table 2. The mean values reported in the table exhibit the average absolute proportional change in each liquidity measure per day. For instance, the cross-sectional average of the absolute proportional change in the effective spread (|DESPR|) is 33.14 percent per day. The cross-sectional standard deviations of absolute proportional changes in each liquidity measure are found to be rather modest, indicating significant time series variability common to many securities. Absolute proportional changes in Amihud measure (|DAMR|) and Depth (|DDt|) are found to be more volatile across time than cost dimensional measures of liquidity.

Table 2. Statistics of daily absolute proportional changes in liquidity measures

|

|

Mean |

Median |

SD |

|

|DSt| |

0.3620416 |

0.33541 |

0.0842233942 |

|

|DPSt| |

0.3746622 |

0.34213 |

0.07986856 |

|

|DESPR| |

0.3314493 |

0.29541 |

0.173247234 |

|

|DPESPR| |

0.3311987 |

0.294746 |

0.177726508 |

|

|DVt| |

0.4644092 |

0.402677 |

0.179841347 |

|

|DDt| |

0.3248424 |

0.302139 |

0.285220597 |

|

|DVDt| |

0.3263977 |

0.29782 |

0.086406372 |

|

|DNt| |

0.2581877 |

0.241967 |

0.072880849 |

|

|DWT| |

0.3502503 |

0.341421 |

0.07625972 |

|

|DQSt| |

0.360302 |

0.350788 |

0.197757822 |

|

|DLnQSt| |

0.2319489 |

0.215651 |

0.149146397 |

|

|DCLt| |

0.3899922 |

0.326822 |

0.21844698 |

|

|DAMR| |

0.8335801 |

0.715197 |

0.309573092 |

|

|DFR| |

0.7384386 |

0.577351 |

0.185080089 |

Source: Authors’ own calculation

4.3 Empirical evidence of market-wide liquidity commonality

The empirical expedition provides evidence pertaining to the existence of empirical co-movements among liquidity of individual security and market-wide liquidity. The study calculates ‘market model’ time series regression coefficients in which daily percentage changes in liquidity measures pertaining to each security are regressed on market-wide liquidity measures. Daily proportional changes in a particular liquidity measure for an individual security are regressed in time-series on daily proportional changes in the market-wide liquidity arrived at by taking equally weighted average of all securities in the sample. ‘D’ preceding the abbreviation of each liquidity measure, e.g., DESPR, represents the relative change in the variable across consecutive trading days, i.e., for any liquidity measure, L,

,

,

for any given trading day, t. The dependent variable security is not included in the market-wide liquidity while calculating each individual regression. Table 3 reports the cross sectional mean values of time series regression coefficients. The t-statistics is reported in parentheses. The same, next, and previous observations in daily market-wide liquidity are represented by ‘Concurrent’, ‘Lead’, and ‘Lag’ respectively. ‘% (+)’ indicates the proportion of regression coefficients with positive values, whereas ‘% Sig.’ provides the proportionate slope coefficients with t-statistics higher than 1.645, which is the table value in a one-tailed test at the 5 percent critical level. ‘Sum’ refers to the sum total of ‘Concurrent’, ‘Lead’, and ‘Lag’ slope coefficients.

Table 3 reports the statistics about the regression coefficients. The study employed one lead, DL(M,t+1), and one lag of average market liquidity, DL(M,t–1) , along with the market returns (concurrent, one leading and one lagged) as well as concurrent fluctuations in squared returns of a security indicating the volatility of its returns as regressors.

Table 3 provides enough evidence of market-wide liquidity commonality in the Indian stock market. All the measures are found to exhibit such commonality. For instance, the change in percentage quoted spread, DSt, exhibits an average concurrent regression coefficient of 0.682, with a t-statistic of 32.36. The table also shows that 88 percent of individual regression coefficients of DSt are positive. 62 percent of the individual regression coefficients corresponding to DSt exceed one-tailed 5 percent critical value. The cross-sectional t-statistics are calculated across mean regression coefficients based on the presumption that the estimation errors in regression coefficients are independent and identically distributed.

Table 3. Market-wide liquidity commonality

|

|

DSt |

DPSt |

DESPR |

DPESPR |

DVt |

DDt |

DVDt |

DNt |

DWT |

DQSt |

DLnQSt |

DCLt |

DAMR |

DFR |

|

Concurrent |

0.682 |

0.757 |

0.546 |

0.651 |

0.299 |

0.732 |

0.601 |

0.257 |

0.146 |

0.651 |

0.607 |

0.199 |

0.693 |

0.299 |

|

(32.36) |

(36.54) |

(20.82) |

(15.5) |

(14.54) |

(48.23) |

(31.62) |

(12.62) |

(8.98) |

(31.62) |

(42.58) |

(9.86) |

(26.53) |

(2.06) |

|

|

% (+) |

88.00 |

86.00 |

78.00 |

80.00 |

70.00 |

84.00 |

82.00 |

64.00 |

60.00 |

88.00 |

86.00 |

54.00 |

90.00 |

60.00 |

|

% Sig. |

62.00 |

70.00 |

68.00 |

70.00 |

58.00 |

74.00 |

66.00 |

56.00 |

50.00 |

74.00 |

64.00 |

42.00 |

68.00 |

38.00 |

|

Lead |

0.068 |

0.018 |

0.063 |

0.082 |

0.063 |

0.082 |

0.031 |

0.076 |

0.063 |

0.082 |

0.003 |

0.063 |

0.082 |

0.003 |

|

(2.13) |

(0.72) |

(2.37) |

(2.64) |

(1.21) |

(2.98) |

(1.06) |

(2.64) |

(2.53) |

(3.58) |

(0.81) |

(2.74) |

(4.68) |

(0.76) |

|

|

% (+) |

44.00 |

52.00 |

48.00 |

56.00 |

46.00 |

52.00 |

48.00 |

42.00 |

36.00 |

58.00 |

56.00 |

46.00 |

54.00 |

40.00 |

|

% Sig. |

8.00 |

0.00 |

2.00 |

0.00 |

2.00 |

6.00 |

0.00 |

4.00 |

8.00 |

0.00 |

0.00 |

6.00 |

0.00 |

0.00 |

|

Lag |

0.080 |

0.058 |

0.046 |

0.045 |

0.015 |

0.043 |

0.042 |

0.028 |

0.105 |

0.098 |

0.098 |

0.028 |

0.119 |

0.090 |

|

(3.36) |

(1.64) |

(1.98) |

(2.02) |

(1.65) |

(1.6) |

(0.49) |

(0.8) |

(1.56) |

(0.98) |

(0.86) |

(0.56) |

(2.49) |

(1.39) |

|

|

% (+) |

56.00 |

60.00 |

54.00 |

48.00 |

36.00 |

52.00 |

46.00 |

38.00 |

40.00 |

42.00 |

48.00 |

44.00 |

58.00 |

36.00 |

|

% Sig. |

0.00 |

1.00 |

0.00 |

0.00 |

0.00 |

8.00 |

2.00 |

0.00 |

0.00 |

2.00 |

2.00 |

0.00 |

0.00 |

4.00 |

|

Sum |

0.831 |

0.833 |

0.655 |

0.779 |

0.377 |

0.857 |

0.674 |

0.361 |

0.314 |

0.831 |

0.708 |

0.290 |

0.894 |

0.391 |

|

(28.86) |

(32.96) |

(21.82) |

(25.46) |

(21.07) |

(22.89) |

(12.87) |

(9.38) |

(27.56) |

(31.42) |

(24.56) |

(8.21) |

(22.67) |

(8.96) |

|

|

Adj-R2 Mean |

0.22 |

0.19 |

0.23 |

0.12 |

0.17 |

0.21 |

0.08 |

0.07 |

0.04 |

0.14 |

0.11 |

0.05 |

0.26 |

0.03 |

Source: Authors’ own calculation

The table also reports leading and lagged average coefficients for each liquidity measure. Though they are often found significant, the average magnitude is reported to be negligible. The combined ‘Concurrent’, ‘Lead’, and ‘Lag’ coefficients are reported as ‘Sum’ in the penultimate panel. The t-statistics of such combined coefficients are revealed to be highly significant in most of the cases confirming the existence of co-movements in liquidity in the Indian stock market. However, it is found that the explanatory power of individual regressions employed is not very much impressive as the average adjusted R2 is as low as 13 percent. It clearly points out to the existence of large noise elements and other influences associated with daily fluctuations in the measures of an individual security’s liquidity.

4.4 Empirical evidence of market-wide liquidity commonality by size

Table 4 demonstrates the size effects. It stratifies the 50 securities considered in the study into three groups, viz., large, medium and small, based on their market capitalization. The regression coefficients are then estimated for each measure of liquidity. The slope coefficients resulting from regression equation are found to be increasing, generally depending upon the size for most of the liquidity measures considered in the study. For instance, cost dimensional measures of larger securities are found to be exhibiting greater response to the market-wide fluctuations in such measures.

The results reported in Table 4 show that larger securities exhibit considerably higher market-wide slope coefficients when liquidity is measured in terms of quoted spread, consistent with Chordia et al. (2000). However, unlike Chordia et al. (2000), the results report commonality in liquidity by size for depth as well. In most of the liquidity measures, the largest size grouping is found to be the most responsive to the fluctuations in market wide liquidity. Contradicting Chordia et al. (2000) but consistent with Brockman and Chung (2002), the quote slope (QSt) of the median-sized securities’ group tends to exhibit the most sensitivity to the concurrent market-wide fluctuations. For quoted spread as well as proportional quoted spread, the securities in large and medium groups exhibit greater receptiveness to the concurrent market-wide fluctuations followed by small size securities. Similar results can be apprehended for most of the other liquidity measures used in the study. It is evident from Table 4 that the investors respond to systematic, market-wide changes in liquidity by revising spreads, volume, as well as depth. However, spreads are found to be revised to a greater magnitude in larger securities. Chordia et al. (2000) speculate such greater commonality in liquidity of larger securities compared to smaller securities as attributable to the herding behaviour of institutional investors around the securities with greater market capitalization.

Table 4. Market-wide liquidity commonality by size

|

|

Concurrent |

Lead |

Lag |

Sum |

Adj-R2 Mean |

|||||||||||

|

Mean |

t-stats |

% (+) |

% Sig. |

Mean |

t-stats |

% (+) |

% Sig. |

Mean |

t-stats |

% (+) |

% Sig. |

Mean |

t-stats |

|||

|

DSt |

L |

0.884 |

24.56 |

100.00 |

47.06 |

-0.016 |

-2.32 |

23.53 |

0.00 |

0.032 |

2.01 |

52.94 |

0.00 |

0.900 |

14.68 |

0.42 |

|

M |

0.825 |

22.94 |

100.00 |

37.50 |

-0.023 |

-2.21 |

18.75 |

0.00 |

0.180 |

0.98 |

56.25 |

0.00 |

0.982 |

12.14 |

0.42 |

|

|

S |

0.703 |

20.84 |

100.00 |

35.29 |

-0.028 |

-2.05 |

29.41 |

0.00 |

0.210 |

0.65 |

58.82 |

0.00 |

0.885 |

13.62 |

0.41 |

|

|

DPSt |

L |

0.996 |

22.18 |

100.00 |

29.41 |

-0.015 |

-2.51 |

17.65 |

0.00 |

-0.004 |

-0.79 |

23.53 |

0.00 |

0.977 |

14.89 |

0.37 |

|

M |

0.894 |

20.27 |

100.00 |

25.00 |

-0.032 |

-1.06 |

25.00 |

0.00 |

0.014 |

0.41 |

50.00 |

0.00 |

0.876 |

13.90 |

0.52 |

|

|

S |

0.812 |

27.34 |

100.00 |

23.53 |

-0.038 |

-1.12 |

11.76 |

0.00 |

0.008 |

0.25 |

47.06 |

0.00 |

0.782 |

16.71 |

0.58 |

|

|

DESPR |

L |

0.621 |

29.48 |

94.12 |

47.06 |

-0.029 |

-1.82 |

29.41 |

0.00 |

0.017 |

0.86 |

58.82 |

0.00 |

0.609 |

18.61 |

0.73 |

|

M |

0.397 |

26.97 |

100.00 |

43.75 |

-0.026 |

-1.79 |

12.50 |

0.00 |

0.019 |

0.64 |

43.75 |

6.25 |

0.390 |

19.60 |

0.35 |

|

|

S |

0.365 |

23.96 |

94.12 |

29.41 |

-0.017 |

-1.82 |

23.53 |

0.00 |

0.008 |

1.02 |

52.94 |

0.00 |

0.356 |

19.22 |

0.30 |

|

|

DPESPR |

L |

0.641 |

19.45 |

100.00 |

58.82 |

-0.014 |

-1.32 |

35.29 |

5.88 |

0.012 |

0.43 |

64.71 |

0.00 |

0.819 |

12.03 |

0.24 |

|

M |

0.594 |

18.30 |

100.00 |

37.50 |

-0.019 |

-1.09 |

31.25 |

6.25 |

0.023 |

0.87 |

56.25 |

0.00 |

0.598 |

16.91 |

0.48 |

|

|

S |

0.613 |

16.88 |

100.00 |

41.18 |

-0.011 |

-2.66 |

17.65 |

5.88 |

0.011 |

0.59 |

41.18 |

0.00 |

0.613 |

13.74 |

0.27 |

|

|

DVt |

L |

0.652 |

23.92 |

100.00 |

35.29 |

0.007 |

1.64 |

29.41 |

0.00 |

0.022 |

0.49 |

47.06 |

0.00 |

0.681 |

17.90 |

0.23 |

|

M |

0.653 |

21.06 |

100.00 |

25.00 |

0.014 |

1.92 |

25.00 |

0.00 |

0.019 |

0.32 |

50.00 |

0.00 |

0.686 |

13.62 |

0.10 |

|

|

S |

0.431 |

22.58 |

100.00 |

23.53 |

0.020 |

1.08 |

23.53 |

0.00 |

0.048 |

0.97 |

52.94 |

0.00 |

0.499 |

15.07 |

0.19 |

|

|

DDt |

L |

0.786 |

27.96 |

100.00 |

47.06 |

-0.017 |

-1.04 |

23.53 |

0.00 |

0.013 |

1.26 |

47.06 |

0.00 |

0.782 |

15.62 |

0.59 |

|

M |

0.595 |

12.52 |

100.00 |

43.75 |

0.047 |

1.21 |

37.50 |

0.00 |

0.034 |

1.40 |

56.25 |

0.00 |

0.676 |

10.36 |

0.52 |

|

|

S |

0.308 |

13.40 |

100.00 |

41.18 |

-0.006 |

-1.46 |

11.76 |

0.00 |

0.015 |

1.09 |

58.82 |

11.76 |

0.317 |

9.82 |

0.45 |

|

|

DVDt |

L |

0.540 |

21.80 |

100.00 |

47.06 |

-0.044 |

-2.13 |

11.76 |

11.76 |

0.009 |

0.51 |

47.06 |

0.00 |

0.505 |

14.39 |

0.42 |

|

M |

0.382 |

14.25 |

100.00 |

25.00 |

0.019 |

0.83 |

31.25 |

12.50 |

0.014 |

0.87 |

43.75 |

12.50 |

0.415 |

12.51 |

0.38 |

|

|

S |

0.315 |

15.86 |

100.00 |

41.18 |

0.011 |

1.09 |

41.18 |

11.76 |

0.028 |

0.36 |

47.06 |

5.88 |

0.354 |

11.83 |

0.46 |

|

|

DNt |

L |

0.613 |

18.19 |

88.23 |

41.18 |

0.003 |

1.26 |

29.41 |

0.00 |

0.034 |

1.04 |

58.82 |

0.00 |

0.650 |

9.74 |

0.38 |

|

M |

0.312 |

17.23 |

100.00 |

31.25 |

-0.014 |

-2.11 |

12.50 |

0.00 |

0.002 |

1.87 |

37.50 |

0.00 |

0.300 |

9.04 |

0.70 |

|

|

S |

0.301 |

21.58 |

94.12 |

35.29 |

-0.010 |

-1.93 |

5.88 |

0.00 |

0.017 |

1.63 |

47.06 |

0.00 |

0.308 |

8.62 |

0.48 |

|

|

DWT |

L |

0.574 |

10.96 |

94.12 |

47.06 |

0.008 |

1.34 |

52.94 |

0.00 |

0.019 |

1.41 |

52.94 |

0.00 |

0.601 |

11.52 |

0.14 |

|

M |

0.289 |

7.85 |

93.75 |

37.50 |

-0.016 |

-1.67 |

18.75 |

0.00 |

0.011 |

0.62 |

56.25 |

0.00 |

0.284 |

21.07 |

0.27 |

|

|

S |

0.267 |

7.06 |

94.12 |

47.06 |

-0.009 |

-1.09 |

29.41 |

0.00 |

0.026 |

0.98 |

47.06 |

0.00 |

0.284 |

20.05 |

0.29 |

|

|

DQSt |

L |

0.786 |

29.63 |

100.00 |

35.29 |

0.030 |

1.26 |

23.53 |

0.00 |

0.022 |

0.73 |

47.06 |

0.00 |

0.838 |

19.63 |

0.30 |

|

M |

0.825 |

31.82 |

100.00 |

43.75 |

0.006 |

1.68 |

43.75 |

0.00 |

0.016 |

0.42 |

37.50 |

0.00 |

0.847 |

11.56 |

0.19 |

|

|

S |

0.803 |

30.45 |

100.00 |

35.29 |

0.032 |

2.03 |

17.65 |

0.00 |

0.009 |

0.36 |

47.06 |

0.00 |

0.844 |

8.62 |

0.08 |

|

|

DLnQSt |

L |

0.640 |

22.12 |

88.23 |

47.06 |

0.028 |

2.54 |

47.06 |

0.00 |

0.014 |

1.06 |

41.18 |

0.00 |

0.682 |

8.31 |

0.13 |

|

M |

0.796 |

24.65 |

100.00 |

18.75 |

0.017 |

2.31 |

37.50 |

0.00 |

0.021 |

1.92 |

43.75 |

0.00 |

0.834 |

9.47 |

0.09 |

|

|

S |

0.782 |

23.52 |

100.00 |

41.18 |

0.021 |

1.42 |

29.41 |

0.00 |

0.029 |

1.13 |

52.94 |

0.00 |

0.832 |

6.65 |

0.14 |

|

|

DCLt |

L |

0.461 |

19.14 |

82.35 |

35.29 |

0.029 |

1.76 |

41.18 |

0.00 |

0.017 |

1.01 |

47.06 |

0.00 |

0.507 |

17.52 |

0.17 |

|

M |

0.382 |

15.89 |

100.00 |

37.50 |

0.014 |

1.71 |

31.25 |

0.00 |

0.038 |

0.49 |

50.00 |

0.00 |

0.434 |

17.20 |

0.10 |

|

|

S |

0.379 |

12.78 |

94.12 |

29.41 |

0.013 |

1.06 |

35.29 |

0.00 |

0.034 |

0.72 |

47.06 |

0.00 |

0.426 |

14.37 |

0.28 |

|

|

DAMR |

L |

0.986 |

32.36 |

100.00 |

41.18 |

0.028 |

1.28 |

29.41 |

0.00 |

0.290 |

0.14 |

52.94 |

0.00 |

1.304 |

16.46 |

0.45 |

|

M |

0.902 |

30.81 |

100.00 |

43.75 |

0.030 |

1.35 |

25.00 |

0.00 |

0.002 |

0.68 |

56.25 |

6.25 |

0.934 |

18.67 |

0.27 |

|

|

S |

0.891 |

29.43 |

100.00 |

29.41 |

0.017 |

1.79 |

17.65 |

0.00 |

0.016 |

0.75 |

41.18 |

0.00 |

0.924 |

17.18 |

0.38 |

|

|

DFR |

L |

0.536 |

19.26 |

88.23 |

29.41 |

0.010 |

0.97 |

47.06 |

0.00 |

0.042 |

1.65 |

64.71 |

0.00 |

0.588 |

12.09 |

0.13 |

|

M |

0.412 |

16.14 |

93.75 |

31.25 |

-0.018 |

-1.61 |

12.50 |

0.00 |

0.037 |

1.50 |

43.75 |

0.00 |

0.431 |

11.24 |

0.07 |

|

|

S |

0.394 |

9.03 |

100.00 |

29.41 |

-0.004 |

-0.92 |

35.29 |

0.00 |

0.030 |

0.18 |

47.06 |

0.00 |

0.420 |

15.31 |

0.26 |

|

|

Source: Authors’ own calculation |

||||||||||||||||

However, we can only speculate on the reason for such differences in the extent of commonality among larger and smaller securities. It may possibly have something to do with the predominance of institutional herd transactions associated with larger securities. It looks less likely to be arising from the prevalence of asymmetric information explicit to smaller securities. That would disseminate lower explanatory power in the regression coefficients of smaller securities but not really in smaller regression coefficients themselves. Alternatively, there is a possibility for the prevalence of a ‘size factor’ in liquidity measures used in the study, which corresponds to the small minus big (SMB) factor recognized in the case of individual stock returns by Fama and French (1992). Although it is beyond the scope of this study, such possibilities would certainly be a fascinating issue for further research.

Therefore, from the results it can be inferred that there exists market-wide liquidity commonality by size as well, which points out that the large size securities are more prone to liquidity commonality. These results have important implications for the portfolio management strategies of common investors. It is not advisable to invest in those larger securities having their liquidity co-move with market-wide liquidity by size, which contrasts to the general conception among the common investors that investing in large-sized stocks will bring more liquidity to their investments. The market-wide commonality by size proves that such securities are more exposed to the market-wide fluctuations in liquidity. This has a cautious notion, particularly when the market liquidity drains out.

5. Conclusion

The study aimed at examining the commonality in liquidity in the Indian stock market. It provides ample evidence of liquidity commonality in the market. For instance, the change in the percentage proportional quoted spread, DPSt, shows a mean value of 0.757 for the concurrent 𝛽𝑗 with a t-statistic of 36.54; 86 percent of such individual regression coefficients are found to be positive, whereas 70 percent of the coefficients exceed the 5 percent critical value of one-tailed test. However, the explanatory power of the individual regressions is not very much remarkable. The size effect demonstrated indicates that for most of the measures of liquidity, the slope coefficients largely increase with size in such a way that liquidity of larger securities has greater reaction to market-wide fluctuations in liquidity.

Liquidity is, thus, much more than the characteristic of a single security, and the liquidity of individual securities moves in tandem with the market-wide liquidity. Commonality is found to exhibit significant influence even after controlling for the most commonly regarded individual determinants of liquidity, viz., volatility and price. Understanding the presence of such significant market-wide commonality in liquidity offers additional evidence to prove the implications of asymmetric information on the liquidity of individual securities in such a way that the vicissitudes in the magnitude of commonality can possibly be attributed to the availability of asymmetric information pertaining to the corresponding security.

The liquidity commonality also suggests that the transaction costs might be managed in a better way with appropriate timing of transactions. The turnover of managed portfolios can be improved by transacting when the spreads are low without forgoing the performance. However, it is yet to know whether higher commonality witnessed in cost dimensional measures is accompanied by other market phenomena, including price swings that are capable enough to offset the benefits of trading managed for the element of time.

When the components of a portfolio are changed frequently, it may result in the accumulation of transaction costs, which in turn leads to relatively huge decrease in the total returns of the portfolio. If the portfolio manager fails to account the liquidity shocks and to diversify portfolio accordingly, the sensitivity of an individual security to such shocks arising from market-wide commonality in liquidity could persuade the investors to demand for a greater average return from their portfolios. For instance, a greater return expectation would definitely be associated with securities having greater average trading costs, but there can possibly be an additional anticipated return required for the securities that are more sensitive to the market-wide liquidity shocks.

Thus, it can be concluded that the evidence of commonality presented in this study is of significant importance to the investors. It indicates that the liquidity shocks in the market can significantly affect the liquidity of individual stocks. Thus, liquidity becomes a systematic element, which is common to the market as a whole, rather than a feature of individual stocks. Therefore, it demands a higher premium for holding stocks whose liquidity co-moves with that of the market. Regarding the commonality by size, the liquidity of larger firms is found to exhibit higher association with the market-wide liquidity. Thus, the investors preferring larger stocks expecting transactions in greater volumes that offer comparatively higher liquidity need to be extremely cautious given that these stocks bear additional risk of having greater co-movements with the market-wide liquidity on the account of their large size. Thus, future research can be focused to examine the cross-sectional and time-series determinants of commonality in liquidity premium.

References

Amihud, Y. (2002). Illiquidity and stock returns: cross-section and time-series effects. Journal of Financial Markets, 5(3), 31–56. https://doi.org/10.1016/s1386-4181(01)00024-6

Amihud, Y., & Mendelson, H. (1986). Liquidity and stock returns. Financial Analysts Journal, 42(3), 43–48. https://doi.org/10.2469/faj.v42.n3.43

Bai, M., & Qin, Y. (2015). Commonality in liquidity in emerging markets: Another supply-side explanation. International Review of Economics & Finance, 39, 90–106. https://doi.org/10.1016/j.iref.2015.06.005

Brockman, P., & Chung, D. Y. (2002). Commonality in liquidity: Evidence from an order‐driven market structure. Journal of Financial Research, 25(4), 521–539. https://doi.org/10.1111/1475-6803.00035

Brockman, P., Chung, D. Y., & Pérignon, C. (2009). Commonality in liquidity: A global perspective. Journal of Financial and Quantitative Analysis, 44(4), 851–882. https://doi.org/10.1017/s0022109009990123

Chordia, T., Roll, R., & Subrahmanyam, A. (2000). Commonality in liquidity. Journal of Financial Economics, 56(1), 3–28. https://doi.org/10.1016/s0304-405x(99)00057-4

Chordia, T., Roll, R., & Subrahmanyam, A. (2001). Market liquidity and trading activity. The Journal of Finance, 56(2), 501–530. https://doi.org/10.1111/0022-1082.00335

Corwin, S. A., & Schultz, P. (2012). A simple way to estimate bid‐ask spreads from daily high and low prices. The Journal of Finance, 67(2), 719–760. https://doi.org/10.1111/j.1540-6261.2012.01729.x

Fabre, J., & Frino, A. (2004). Commonality in liquidity: evidence from the Australian stock exchange. Accounting & Finance, 44(3), 357–368. https://doi.org/10.1111/j.1467-629x.2004.00117.x

Fama, E. F., & French, K. R. (1992). The cross‐section of expected stock returns. The Journal of Finance, 47(2), 427–465. https://doi.org/10.2307/2329112

Goldstein, M. A., & Kavajecz, K. A. (2000). Eighths, sixteenths, and market depth: changes in tick size and liquidity provision on the NYSE. Journal of Financial Economics, 56(1), 125–149. https://doi.org/10.1016/s0304-405x(99)00061-6

Hasbrouck, J. (2009). Trading costs and returns for US equities: Estimating effective costs from daily data. The Journal of Finance, 64(3), 1445–1477. https://doi.org/10.1111/j.1540-6261.2009.01469.x

Hasbrouck, J., & Seppi, D. J. (2001). Common factors in prices, order flows, and liquidity. Journal of Financial Economics, 59(3), 383–411. https://doi.org/10.1016/s0304-405x(00)00091-x

Huberman, G., & Halka, D. (2001). Systematic liquidity. Journal of Financial Research, 24(2), 161–178. https://doi.org/10.1111/j.1475-6803.2001.tb00763.x

Karolyi, G. A., Lee, K. H., & Van Dijk, M. A. (2012). Understanding commonality in liquidity around the world. Journal of Financial Economics, 105(1), 82–112. https://doi.org/10.1016/j.jfineco.2011.12.008

Krishnan, R., & Mishra, V. (2013). Intraday liquidity patterns in Indian stock market. Journal of Asian Economics, 28, 99–114. https://doi.org/10.1016/j.asieco.2013.05.005

Kumar, G., & Misra, A. K. (2018). Commonality in liquidity: Evidence from India’s national stock exchange. Journal of Asian Economics, 59, 1–15. https://doi.org/10.1016/j.asieco.2018.09.001

Lee, C., & Swaminathan, B. (2000). Price momentum and trading volume. The Journal of Finance, 55(5), 2017–2069.

Marshall, B. R. (2006). Liquidity and stock returns: Evidence from a pure order-driven market using a new liquidity proxy. International Review of Financial Analysis, 15(1), 21–38. https://doi.org/10.1016/j.irfa.2004.09.001

McInish, T. H., & Wood, R. A. (1992). An analysis of intraday patterns in bid/ask spreads for NYSE stocks. The Journal of Finance, 47, 753–764. https://doi.org/10.1111/j.1540-6261.1992.tb04408.x

Narayan, P. K., Zhang, Z., & Zheng, X. (2015). Some hypotheses on commonality in liquidity: new evidence from the Chinese stock market. Emerging Markets Finance and Trade, 51(5), 915–944. https://doi.org/10.1080/1540496x.2015.1061799

Pástor, Ľ., & Stambaugh, R. F. (2003). Liquidity risk and expected stock returns. Journal of Political Economy, 111(3), 642–685. https://doi.org/10.1086/374184

Pukthuanthong-Le, K., & Visaltanachoti, N. (2009). Commonality in liquidity: Evidence from the Stock Exchange of Thailand. Pacific-Basin Finance Journal, 17(1), 80–99. https://doi.org/10.1016/j.pacfin.2007.12.004

Ranaldo, A. (2001). Intraday market liquidity on the Swiss stock exchange. Financial Markets and Portfolio Management, 15(3), 309–327. https://doi.org/10.1007/s11408-001-0303-z

Rösch, C. G., & Kaserer, C. (2013). Market liquidity in the financial crisis: The role of liquidity commonality and flight-to-quality. Journal of Banking & Finance, 37(7), 2284–2302. https://doi.org/10.1016/j.jbankfin.2013.01.009

Stahel, C. W. (2005). Liquidity across developed and emerging markets. Working paper.

Subrahmanyam, A. (2005). Distinguishing between rationales for short‐horizon predictability of stock returns. Financial Review, 40(1), 11–35. https://doi.org/10.1111/j.0732-8516.2005.00091.x

Syamala, S. R., & Reddy, V. N. (2013). Commonality in Liquidity and its Determinants: An Empirical Examination of Stocks Listed on National Stock Exchange of India. Available at SSRN 2255383. https://doi.org/10.2139/ssrn.2255383

Wang, J. (2013). Liquidity commonality among Asian equity markets. Pacific-Basin Finance Journal, 21(1), 1209–1231. https://doi.org/10.1016/j.pacfin.2012.06.003

Appendix 1. List of securities included in the study and their market capitalization

|

Sl. No. |

Ticker |

Name |

Market |

|

1 |

TCS IS Equity |

Tata Consultancy Services Ltd |

4206863581184.00 |

|

2 |

RIL IS Equity |

Reliance Industries Ltd |

3247146008576.00 |

|

3 |

HDFCB IS Equity |

HDFC Bank Ltd |

3033152880640.00 |

|

4 |

ITC IS Equity |

ITC Ltd |

2729210281984.00 |

|

5 |

ONGC IS Equity |

Oil & Natural Gas Corp Ltd |

2377570582528.00 |

|

6 |

INFO IS Equity |

Infosys Ltd |

2099866763264.00 |

|

7 |

SBIN IS Equity |

State Bank of India |

1997750796288.00 |

|

8 |

HDFC IS Equity |

Housing Development Finance Corp Ltd |

1975732142080.00 |

|

9 |

COAL IS Equity |

Coal India Ltd |

1916384968704.00 |

|

10 |

HUVR IS Equity |

Hindustan Unilever Ltd |

1774465056768.00 |

|

11 |

SUNP IS Equity |

Sun Pharmaceutical Industries Ltd |

1660378284032.00 |

|

12 |

ICICIBC IS Equity |

ICICI Bank Ltd |

1528692473856.00 |

|

13 |

MSIL IS Equity |

Maruti Suzuki India Ltd |

1490629165056.00 |

|

14 |

TTMT IS Equity |

Tata Motors Ltd |

1490286673920.00 |

|

15 |

KMB IS Equity |

Kotak Mahindra Bank Ltd |

1412317184000.00 |

|

16 |

NTPC IS Equity |

NTPC Ltd |

1270625992704.00 |

|

17 |

LT IS Equity |

Larsen & Toubro Ltd |

1239151280128.00 |

|

18 |

BHARTI IS Equity |

Bharti Airtel Ltd |

1215009783808.00 |

|

19 |

AXSB IS Equity |

Axis Bank Ltd |

1123566223360.00 |

|

20 |

WPRO IS Equity |

Wipro Ltd |

1094799720448.00 |

|

21 |

HCLT IS Equity |

HCL Technologies Ltd |

1075137413120.00 |

|

22 |

PWGR IS Equity |

Power Grid Corp of India Ltd |

961304592384.00 |

|

23 |

UTCEM IS Equity |

UltraTech Cement Ltd |

939332206592.00 |

|

24 |

BPCL IS Equity |

Bharat Petroleum Corp Ltd |

926849368064.00 |

|

25 |

APNT IS Equity |

Asian Paints Ltd |

870711754752.00 |

|

26 |

MM IS Equity |

Mahindra & Mahindra Ltd |

757173714944.00 |

|

27 |

BJAUT IS Equity |

Bajaj Auto Ltd |

752209559552.00 |

|

28 |

BHIN IS Equity |

Bharti Infratel Ltd |

664841682944.00 |

|

29 |

IIB IS Equity |

IndusInd Bank Ltd |

638458331136.00 |

|

30 |

LPC IS Equity |

Lupin Ltd |

636968435712.00 |

|

31 |

HMCL IS Equity |

Hero MotoCorp Ltd |

598603202560.00 |

|

32 |

BOS IS Equity |

Bosch Ltd |

565360066560.00 |

|

33 |

EIM IS Equity |

Eicher Motors Ltd |

560961224704.00 |

|

34 |

ADSEZ IS Equity |

Adani Ports & Special Economic Zone Ltd |

540104228864.00 |

|

35 |

GAIL IS Equity |

GAIL India Ltd |

525847330816.00 |

|

36 |

DRRD IS Equity |

Dr Reddy‘s Laboratories Ltd |

517249892352.00 |

|

37 |

YES IS Equity |

Yes Bank Ltd |

476422504448.00 |

|

38 |

CIPLA IS Equity |

Cipla Ltd/India |

442364526592.00 |

|

39 |

TECHM IS Equity |

Tech Mahindra Ltd |

440163827712.00 |

|

40 |

Z IS Equity |

Zee Entertainment Enterprises Ltd |

431625666560.00 |

|

41 |

ARBP IS Equity |

Aurobindo Pharma Ltd |

421409882112.00 |

|

42 |

ACEM IS Equity |

Ambuja Cements Ltd |

388094361600.00 |

|

43 |

BOB IS Equity |

Bank of Baroda |

376038850560.00 |

|

44 |

GRASIM IS Equity |

Grasim Industries Ltd |

375971217408.00 |

|

45 |

TATA IS Equity |

Tata Steel Ltd |

367167995904.00 |

|

46 |

HNDL IS Equity |

Hindalco Industries Ltd |

343923359744.00 |

|

47 |

BHEL IS Equity |

Bharat Heavy Electricals Ltd |

304481435648.00 |

|

48 |

IDEA IS Equity |

Idea Cellular Ltd |

255477039104.00 |

|

49 |

ACC IS Equity |

ACC Ltd |

242808930304.00 |

|

50 |

TPWR IS Equity |

Tata Power Co Ltd |

186484195328.00 |