Organizations and Markets in Emerging Economies ISSN 2029-4581 eISSN 2345-0037

2019, vol. 10, no. 2(20), pp. 356–377 DOI: https://doi.org/10.15388/omee.2019.10.18

Foreign Ownership and Stock Return Volatility in Vietnam: the Destabilizing Role of Firm Size

Anh Tho To (Corresponding Author)

Department of Economics, Graduate School of Social Sciences, Hiroshima University, Japan

University of Finance - Marketing, Ho Chi Minh City, Vietnam

anhtho27@gmail.com

Yoshihisa Suzuki

Department of Economics, Graduate School of Social Sciences, Hiroshima University, Japan

Bao Ngoc Vuong

Department of Economics, Graduate School of Social Sciences, Hiroshima University, Japan

Quy Nhon University, Quy Nhon City, Binh Dinh Province, Vietnam

Quoc Tuan Tran

University of Finance - Marketing, Ho Chi Minh City, Vietnam

Khoa Do

University of Finance - Marketing, Ho Chi Minh City, Vietnam.

Abstract. This study aims to examine the relevance of foreign ownership to stock return volatility in the Vietnam stock market over ten years (2008 - 2017). After applying the fixed effects regressions and the extended instrumental variable regressions with fixed effects, we find that foreign ownership decreases the volatility of stock returns. However, the stabilizing impact of foreign ownership on stock return volatility becomes weaker in large firms since the coefficient of the interaction term between firm size and foreign ownership turns out to be significantly positive. The estimated results remain robust when we use the future one-year volatility, other than the current one, as an alternative measure of the dependent variable.

Keywords: corporate governance, foreign ownership, volatility, firm size.

Received: 4/27/2019. Accepted: 0/7/2019

Copyright © 2019 Anh Tho To, Yoshihisa Suzuki, Bao Ngoc Vuong, Quoc Tuan Tran, Khoa Do. Published by Vilnius University Press. This is an Open Access article distributed under the terms of the Creative Commons Attribution Licence, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

1. Introduction

Foreign ownership has gradually become an inevitable trend in the era of international economic integration, in which stock markets play a supporting role in promoting foreign capital investments into domestic companies (Foong & Lim, 2016). Foreign ownership has in turn contributed to the development of capital markets and has become an essential factor in diversifying ownership structure in many listed companies. The question of whether foreign ownership relates to the development and stability of stock markets has drawn the attention of academics and policy-makers. However, current literature has mixed findings on the association between foreign ownership and the fluctuation of stock returns.

Several studies indicated a negative impact (Wang, 2007; Li et al., 2011; Vo, 2015). Wang (2007) gives two economic interpretations of a negative relationship between foreign investment and volatility. First, attracting foreign investors is considered to widen the investor base for a stock, which leads to greater risk-sharing and lowers volatility (Mitton, 2006; Wang, 2007). It is an investor base-broadening effect which is identified by Merton (1987). Second, more substantial ownership of foreign shareholders reduces the capital cost of a firm under the well-known leverage effect theory. In other words, companies can take advantage of foreign investments instead of debts, which helps to reduce the financial burdens and risks. Besides, foreign investors could improve the information quality in local stock markets, provide better corporate control and reporting standards, enhance the corporate governance environments and thus significantly reduce transaction costs and informational costs (Li et al., 2011; Vo, 2015). Indeed, foreign investors usually choose well-managed companies to invest, and this should further accelerate improvement in corporate governance (Leuz et al., 2009). Another explanation is that foreign investors will appoint representatives or seek experts to coordinate and monitor corporate governance. Min and Bowman (2015) also believe that foreign investors place considerable merit on the appointment of independent directors in the firms listed on the Korea Exchange.

On the contrary, many other studies showed a positive impact of foreign investment on firm-level volatility (Bae et al., 2004; Bohl & Brzeszczynski, 2006; Han & Singal, 2000). Bae et al. (2004) suggest that foreign ownership can cause significant firm-level return volatility in an emerging market because it makes stock returns more vulnerable to the world market risk. In other words, the local stock markets are very volatile with foreign capital movements because emerging markets are not very liquid and transparent (Han & Singal, 2000). Besides, many foreign investors pursue short-term or speculative investment strategies (Bohl & Brzeszczynski, 2006; Stiglitz, 2000), which promotes frequent trading activities. According to Zhang (2010), a higher trading volume creates price movements and reflects a higher level of volatility. Also, portfolio adjustments by large foreign institutional investors are likely to result in significant price fluctuations (Bae et al., 2004).

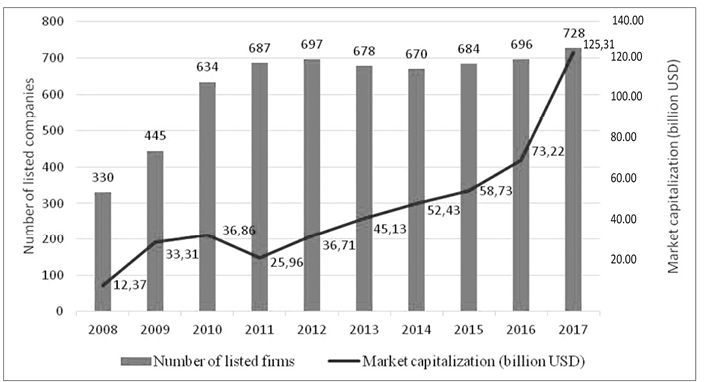

In Vietnam, economic reforms under “Doi Moi” policy, which was launched in 1986 to transition the country from a centralized economy to a market-oriented economy, created a wave of equitization of state-owned enterprises (SOEs) and broadened opportunities for foreign investors. In the 1990s, the Vietnam stock market had not yet been established, so restructuring was implemented by focusing on the small-sized and medium-sized SOEs, and by integrating plural SOEs into groups. At the end of 2001, there were 18 large-scale general corporations under the management of the Prime Minister and 78 small-scale general corporations managed by various ministries and provincial governments. Until 2000, the first stock exchange was launched in Ho Chi Minh city with only two listed companies, which made its milestone in the transitional process of Vietnam’s economy. Five years later, another stock market was established in Hanoi. After 17 years of development, the total number of listed companies was 728, and market capitalization was 125.31 billion USD, as shown in Figure 1.

Under international economic integration, the gradual removal of the restrictions on foreign ownership has boosted foreign capital inflows into the Vietnam stock market (My & Truong, 2011). Notably, the Decree No. 60/2015/ND-CP permits foreign investors to own up to 100 percent of the equity (instead of 49 percent as promulgated before) in most public Vietnamese companies, except for companies in specific restricted sectors. The increased presence of foreign investors is expected to improve transparency for listed companies and hence provide stock price stabilization. Therefore, it drives us to investigate whether attracting more foreign ownership can be considered as a mechanism to control stock return volatility for the listed firms.

Figure 1. Number of listed companies and market capitalization in Vietnam

Source: https://data.worldbank.org

However, foreign investors in many large listed companies in the Vietnam stock market are usually large financial institutions. Their high proportions of equity can promote them to become large shareholders with the opportunities to divert firm resources for their private benefits at the expense of minority shareholders (entrenchment effect). To hide their self-serving behaviors, entrenched large shareholders usually withhold unfavorable information or selectively disclose information (McConnell & Servaes, 1990), which can lead to more information asymmetries. The impact of foreign investors on stock return volatility in such firms should be thus evaluated with more caution.

To the best of our knowledge, most studies related to foreign ownership in Vietnam mainly focus on its impact on performance rather than stock return volatility, except for Vo (2015). However, our study provides a more general empirical investigation for the entire Vietnamese stock market, while Vo (2015) only focuses on studying the firms listed on the Ho Chi Minh City stock exchange, which is one of the two largest stock exchanges in Vietnam. More significantly, we do not only examine the direct influence of foreign ownership on the volatility of stock returns but also further consider this association in relation to firm size. It helps to bring a thorough explanation of foreign investors’ participation in stock return volatility in the context of an emerging market.

The main results of this study regarding the influence of foreign ownership on stock return volatility are as follows. The estimated regressions show a negative effect of foreign ownership on stock return volatility after controlling for firm characteristics and potential endogeneity problems. It indicates that the increased presence of foreign investors contributes to stabilizing the firm-level fluctuation of stock returns because they have many advantages (such as substantial capital, investment experiences) to manage risks, as well as enhance a better corporate governance environment. From a different perspective, foreign investors in Vietnam tend to invest long-term and hold more strategic portfolios, which also explains the low return volatility. However, the negative influence of foreign ownership becomes weaker in large firms because large foreign investors in such firms tend to become majority shareholders and have the power for entrenchment.

The paper process is as follows: In Section 2, we review the impact of foreign ownership on stock return volatility in the Vietnam stock market and the destabilizing influence of firm size. In Section 3, we present the model and data. Section 4 shows the results of the empirical analysis. A conclusion is provided in Section 5.

2. Literature review

2.1. The impact of foreign ownership on stock return volatility

in the Vietnam stock market

Vietnam’s securities law was issued in 2006 and amended in 2010 but did not cite foreign ownership limits. However, Decision No. 238/2005/QD-TT on the percentage of foreign parties’ participation in the Vietnam securities market was considered as a big step towards attracting foreign investment capitals, by raising the limit on foreign holding of listed companies’ stocks from 30 percent to 49 percent. Then, it was replaced by Decision No. 55/2009/QD-TT on holding rates of foreign investors in the Vietnam securities market, but the 49 percent foreign ownership cap on most local companies remained in force until 2015.

As an effort to attract more foreign investors in the Vietnam stock market, the government issued Decree No. 60/2015/ND-CP on 26 June 2015, amending and supplementing several articles of Decree No. 58/2012/ND-CP dated 20 July 2012 providing details and implementation guidelines on several articles of the Law on Securities. Among the changes, the most welcomed amendment is that public companies operating in unconditional sectors can remove foreign ownership limits. Although the move helped the listed companies to remove the limit and seek more foreign investors, only a handful of firms, including Vinamilk, Domesco Medical Import Export, and DHG Pharma, raised the limits.

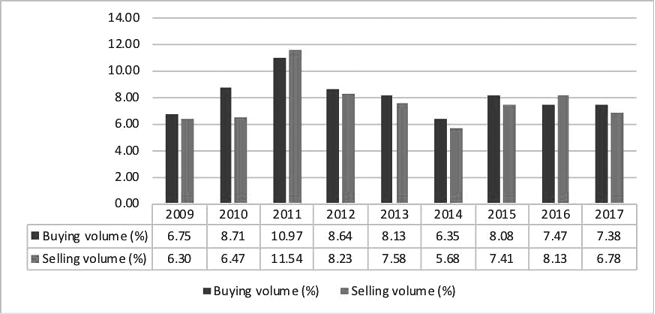

Figure 2. The percentage of foreign trading volume over the whole market

Source: Data from Ho Chi Minh Stock Exchange

Foreign ownership is expected to provide better corporate governance and transparency improvement in the listed companies. First, many large firms in the Vietnam stock market have historically been inefficient state-owned companies, so the equitization (i.e. partial privatization) and divestment of state-owned enterprises to foreign investors aim to promote their efficiency. Second, foreign investors in Vietnamese listed companies tend to be institutions (such as mutual funds, hedge funds, and foreign investment banks) with a long history of successful investment in many other stock markets. The annual reports of the Vietnam Security Depository (www.vsd.vn) also prove that the growth of foreign institutional trading accounts is higher than that of foreign individual trading accounts. The total number of foreign trading accounts rose from 11,257 accounts in 2008 up to 22,561 accounts in 2017 (a 2-fold increase), of which the number of foreign institutional trading accounts increased from below 1,000 accounts in 2008 to 2,865 accounts in 2017 (more than 2.8 times). Such financial institutions are expected to improve the corporate governance environments as well as control stock price volatility better.

Another study by Vo (2016b) adds that foreign investors in the Vietnam stock market focus on long-run perspectives rather than short-term gain by investigating the impact of foreign ownership on the corporate risk-taking activity for a sample of 263 Vietnamese listed companies in the 2007-2014 period. In other words, they pursue an inactive buy-and-hold investment strategy, which reduces the need for frequent trading for price discovery (Batten & Vo, 2015; Nguyen, 2017). Their low proportions of the trading volume and tendency towards the net purchase, as shown in Figure 2, also support this strategy. Also, their trading activities tend to become the pattern for domestic investors (Nguyen, 2017). These findings also contribute to explaining the stability of stock prices from a trading perspective.

From the above arguments, the first hypothesis is formulated as follows:

H1: Foreign ownership has a negative impact on stock return volatility.

2.2 Firm size, foreign ownership, and stock return volatility

Many previous studies indicate that foreign investors favor large and well-operated firms (Dahlquist & Robertsson, 2001; Kang & Stulz, 1997; Lin & Shiu, 2003). First, small-size firms are usually limited in their resources and experience to attract foreign investors, while large firms have more financial and technical capabilities, the economies of scope (Damanpour, 2010). Second, large firms tend to have fewer competitors thanks to their monopoly power. Tsang (2005) also finds that the level of foreign ownership should be negatively associated with the degree of industrial competition. Third, large firms usually have good financial performance and high transparency, which attracts a significant interest from foreign investors, especially in emerging stock markets. Another reason is that small-sized firms’ market capitalization is too small for large institutional investors, which drives foreign investors to narrow their options to larger firms. Batten and Vo (2015), who investigate the determinants of foreign ownership in the Vietnam stock market, also indicate that foreign investors allocate a disproportionately high share of their capitals to large firms.

Holding a high proportion of equity, large financial institutions in Vietnam tend to become majority shareholders and increase control over corporate decisions to serve their own interests against those of other investors under the entrenchment effect perspective. Brockman and Yan (2009) claim that the increase in foreign ownership can also cause more information asymmetries. Besides, Vo (2016c) states that firms with substantial foreign ownership have a close tie with local governments, especially in emerging markets with weak corporate governance and poor institutional aspects. Hence, we propose the second hypothesis as follows:

H2: The stabilizing effect of foreign ownership on the fluctuation of stock returns becomes weaker in large firms.

3. Data and methodology

3.1 Model specification

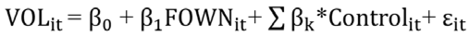

According to Chen et al. (2013) and Vo (2015), the impact of foreign ownership on stock return volatility is presented as follows:

(1)

(1)

Furthermore, we also want to further investigate this relationship under the destabilizing effect of firm size. Consequently, the above model is restructured in the equation (2):

(2)

(2)

Following Cosset et al. (2016) and Hasan et al. (2017), we use two measures of stock return volatility (VOLit): (i) the standard deviation of daily stock returns on a fiscal year basis and (ii) the standard deviation of the residuals from the market model: Rit = αi + βiRMt + εit on a fiscal year basis (Rit donates the daily stock returns; RMt represents the daily market returns based on the VN-index; the εi,t stands for the residuals). FOWNit is the proportion of shares held by foreign investors. Controlit are controlling variables.

Our regression model also incorporates other variables that previous studies suggest might affect VOL.

Firm size (FSIZE) is calculated as the natural logarithm of total assets. According to Vo (2015), stock return volatility is driven by firm characteristics, particularly firm size. Pástor & Veronesi (2003) also find a negative relation between return volatility and firm size.Leverage (LEV) is measured as the ratio of total liabilities to total assets. The stock price of highly leveraged firms tends to be more volatile since these firms are supposed to have higher bankruptcy risk (Wei & Zhang, 2006; Chen et al.,2013). Returns on equity (ROE) is defined as net income divided by shareholders’ equity. Both Pastor and Veronesi (2003) and Wei and Zhang (2006) confirm that firms with lower ROE are expected to experience higher stock return fluctuations.Two control variables to capture board composition characteristics: Non-executive director ratio (NON_EX) is measured as the number of non-executive directors to total board members, and board size (lnBSIZE) is calculated as the natural logarithm of total members on board. Many studies such as Cheng (2008), Pathan (2009), Nakano and Nguyen (2012), Huang and Wang (2015) prove that corporate risk is related to board size and board independence. State ownership (STATE) is the number of shares held by the state to the total number of shares outstanding. This variable is included in the model because Vietnam historically installed a centralized economy characterized by state ownership. Moreover, state ownership tends to offer policy and resource benefits (Zhou et al., 2017) which allow state-owned companies to reduce volatility. Price to book value (PB) is the ratio of the market value of equity to the book value of equity, which is a proxy for growth opportunity. Stock liquidity (LIQ) is calculated as the proportion of trading days in one year in which the stock return is non-zero. This variable should be controlled in the model because the movements of the stock price are highly associated with trading activities (Zhang, 2010).Firm age (lnFAGE) is also included because the corporate risk is found to be higher for younger firms (Bartram et al., 2012; Rubin & Smith, 2009). We also include industry and year fixed effects to control for industry-specific and aggregate time-varying factors.

3.2 Data

Our research sample comprises 160 non-financial companies listed on Vietnamese stock markets (including HNX – Hanoi Stock Exchange and HOSE – Ho Chi Minh Stock Exchange) from 2008 to 2017. The listed companies are classified according to the Industry Classification Benchmark (ICB) 2008 applied in Vietnam.

Our data was collected from various sources: governance-related variables such as foreign ownership, state ownership, and non-executive director ratio were manually collected reviewing annual reports which are available on the www.vietstock.vn (a leading website providing financial information, market data, and investing tools for institutional and individual investors in Vietnam). Other financial variables were collected from DataStream. Any additional data or information is directly gathered from companies’ websites if necessary. From DataStream, we downloaded a list of companies whose stock price is available from January 1, 2008. Our sample consisted of 219 companies after we excluded financial companies such as banks, securities, insurance, and financial services because these companies act as market makers. Additionally, the foreign ownership restrictions in the listed banks are stricter than other listed companies. For a long time, Vietnam imposed restrictions on foreign ownership in domestically listed firms: up to 49 percent of the equity for the listed companies and up to 30 percent for the listed banks. Since the Decree No. 60/2015/ND-CP took effect, the government has removed the existing 49 percent foreign ownership cap on the listed firms, but the foreign ownership limit in the banking industry has remained unchanged at 30 percent. In the process of collecting the governance-related data, we continued to exclude 59 companies due to too many missing observations.

4. Results and discussions

4.1. Descriptive statistics and correlation

Table 1 presents the summary statistics on board and ownership structure of our sample, as well as firm characteristics. The mean (median) of foreign ownership in the sample is 11.91% (4.84%), quite close to the reported figures (12.29% and 5.98%) by Vo (2015) for a sample of 268 non-financial firms listed on the Ho Chi Minh stock exchange in the 2006-2012 period. The two volatility measures do not have much difference in their mean values (3.03 and 2.75) and standard deviations (1.14 and 1.12).

Table 1. Description statistics

|

|

Obs |

Mean |

SD |

Min |

25th percentile |

50th percentile |

75th percentile |

Max |

|

VOL1 (%) |

1600 |

3.03 |

1.14 |

1.06 |

2.35 |

2.98 |

3.58 |

32.99 |

|

VOL2 (%) |

1600 |

2.75 |

1.12 |

0.93 |

2.14 |

2.62 |

3.27 |

33.05 |

|

FSIZE |

1600 |

20.30 |

1.44 |

16.31 |

19.27 |

20.19 |

21.23 |

24.69 |

|

LEV |

1600 |

0.48 |

0.22 |

0.02 |

0.30 |

0.50 |

0.66 |

0.95 |

|

ROE |

1600 |

0.13 |

0.16 |

-2.32 |

0.06 |

0.12 |

0.19 |

3.34 |

|

PB |

1589 |

1.13 |

0.91 |

0.13 |

0.60 |

0.91 |

1.40 |

12.95 |

|

LIQ |

1600 |

0.73 |

0.19 |

0.02 |

0.65 |

0.78 |

0.88 |

0.99 |

|

NON_EX |

1600 |

0.57 |

0.20 |

0.00 |

0.40 |

0.60 |

0.75 |

1.00 |

|

BSIZE |

1600 |

5.52 |

1.18 |

2 |

5 |

5 |

6 |

11 |

|

FAGE |

1600 |

6.79 |

3.30 |

1 |

4 |

7 |

9 |

17 |

|

STATE (%) |

1593 |

31.63 |

22.85 |

0 |

8.19 |

34.71 |

51.00 |

84.44 |

|

FOWN (%) |

1340 |

11.91 |

14.67 |

0 |

1.37 |

4.84 |

17.39 |

65.16 |

Notes: The table presents descriptive statistics among the variables of this study, where VOL1 and VOL2 are the two measures of the stock return volatility, FOWN is the proportion of shares held by foreign investors, FSIZE is the natural logarithm of total assets, LEV is the ratio of total liabilities to total assets, ROE is return on equity, PB is the ratio of the market value of equity to the book value of equity, LIQ is the proportion of trading days in one year in which the stock return is non-zero, NON_EX is the percentage of non-executive directors on board, BSIZE is the total number of directors on board, STATE is the proportion of shares held by state shareholders, FAGE is the number of years from the time the company is listed for the first time in the Vietnam stock market. For interpretation purposes, the descriptive statistics of board size and firm age are calculated on the basis of levels instead of logarithmic form.

As reported in Table 2, FOWN is negatively related to VOL1 and VOL2, which is consistent with the above expectation. The correlation matrix gives no suggestion to any serious multicollinearity concerns since none of the correlation coefficients among independent variables are larger than the value of 0.8. We also calculate the variance inflation factors (VIFs) to check again for any multicollinearity issues in our model, but all VIFs are low, with a mean of 1.46 (not reported in the table). It is supported by Chatterjee and Hadi (2015), who suggest that a value of VIF larger than 10 indicates the presence of a multicollinearity problem.

Table 2. Correlation matrix

|

|

VOL1 |

VOL2 |

FOWN |

FSIZE |

LEV |

ROE |

NON_EX |

lnBSIZE |

STATE |

PB |

LIQ |

VIFs |

|

FOWN |

-0.30 |

-0.31 |

1.77 |

|||||||||

|

FSIZE |

-0.34 |

-0.37 |

0.42 |

2.11 |

||||||||

|

LEV |

0.10 |

0.10 |

-0.28 |

0.26 |

1.42 |

|||||||

|

ROE |

-0.10 |

-0.14 |

0.18 |

0.08 |

-0.11 |

1.13 |

||||||

|

NON_EX |

-0.04 |

0.00 |

0.10 |

0.11 |

-0.08 |

-0.04 |

1.09 |

|||||

|

lnBSIZE |

-0.17 |

-0.19 |

0.36 |

0.33 |

-0.04 |

0.04 |

0.02 |

1.25 |

||||

|

STATE |

-0.02 |

-0.05 |

-0.15 |

0.05 |

0.07 |

0.06 |

0.07 |

-0.17 |

1.17 |

|||

|

PB |

-0.13 |

-0.14 |

0.38 |

0.19 |

-0.17 |

0.25 |

0.10 |

0.11 |

0.02 |

1.24 |

||

|

LIQ |

-0.01 |

-0.21 |

0.19 |

0.37 |

0.00 |

0.18 |

-0.03 |

0.17 |

-0.05 |

0.07 |

1.73 |

|

|

lnFAGE |

-0.23 |

0.01 |

0.11 |

0.13 |

-0.04 |

-0.17 |

0.21 |

0.01 |

-0.17 |

0.02 |

-0.44 |

1.64 |

Note: The table presents correlation matrix among the variables of this study, where VOL1 and VOL2 are the two measures of the stock return volatility, FOWN is the proportion of shares held by foreign investors, FSIZE is the natural logarithm of total assets, LEV is the ratio of total liabilities to total assets, ROE is return on equity, PB is the ratio of the market value of equity to the book value of equity, LIQ is the proportion of trading days in one year in which the stock return is non-zero, NON_EX is the percentage of non-executive directors on board, lnBSIZE is the natural logarithm of the total number of directors on board, STATE is the proportion of shares held by state shareholders, lnFAGE is the natural logarithm of firm age. VIFs are variance inflation factors.

4.2. The impacts of foreign ownership and firm size

Table 3 provides the estimated results of foreign ownership on stock return volatility by using year and industry fixed effects regressions with firm-level clustered standard errors. We use both current and one-year future volatility as proxies for the dependent variable. According to Wang (2013), the future one-year volatility helps to better confirm the causal effect of foreign ownership on stock return volatility. After controlling for some board characteristics (such as board independence, board size, state ownership) and other firm characteristics, we find that the coefficients on FOWN are statistically negative. This result implies the role and benefits of foreign investors in enhancing better corporate governance and reducing information asymmetries, especially when many listed firms in the Vietnam stock market have historically been inefficient state-owned companies. Foreign investments in Vietnamese firms also play an essential role as an alternative financial source under well-known leverage effect theory. From a trading behavior perspective, the negative impact of ownership can be explained by the buy-and-hold investment strategy because there tend to be long-term investors, rather than short-term speculators.

The obtained result supports the first hypothesis, indicating that a high proportion of foreign ownership plays as one of the determinants to mitigate the fluctuation of stock returns. Our finding is in line with that of the previously published studies in other emerging countries. Wang (2013) showed the calming effect of foreign ownership on stock return volatility for a sample of Indonesian firms listed on the Jakarta Stock Exchange from 1996 to 2000. Another study by Li et al. (2011) confirms that the stabilizing effect of large foreign ownership is present in 31 emerging markets. Both Wang (2013) and Li et al. (2011) imply that establishing an ownership structure towards international liberalization and integration is crucial to risk management.

Regarding the effect of firm size, the coefficients on FSIZE are negative and significant in all regressions, thereby confirming that large firms tend to reduce stock return volatility due to their better governance and less information asymmetry. The negative relationship also supports the viewpoint of Damanpour (2010) that larger companies have more advantages to control stock price fluctuations.

4.3. The destabilizing role of firm size

Regarding the destabilizing effect of firm size on the relationship between foreign ownership and stock return volatility, the estimated coefficient on the interaction term between FOWN and FSIZE turns out to be positive at the significance level of 0.01 in Table 3. The converse results on FOWN suggest that firm size tends to weaken the foreign ownership-volatility relationship. In other words, the presence of foreign investors in large firms helps to decrease the stability of stock prices. It is because most of the foreign shareholders in such firms are large financial institutions whose high proportion of equity is associated with board membership. As majority shareholders and corporate insiders, such foreign investors tend to retain weak corporate governance or deter the release of specific-firm information to the market on purpose of easily facilitating their potential expropriation. Such inadequate information disclosure causes more information asymmetries between minority and majority shareholders, which leads to more volatility.

In line with the viewpoint, Viet (2013) also made two significant contributions to explain foreign investors’ behavior in the Vietnam stock market by using a sample of 407 non-financial listed firms from 2006 to 2010. First, foreign investors seem to prefer firms with a large size and higher market reputation. Second, there exists an inverted U-shaped relationship between foreign ownership and firm performance, which indicates that the negative effects of foreign shareholders on firm performance may occur if their ownership reaches a certain high level. He explains that too high level of foreign ownership can allow foreign investors to influence several vital aspects of invested firms and weaken firm efficiency.

To investigate the second hypothesis in more detail, we split our sample into two sub-samples, corresponding to small and large firms, by comparing the firm size of each firm operating in a given industry in a given year with the average firm size of all firms operating in the same industry during that year. The estimates presented in Table 4 show that foreign ownership has a weaker significant impact on current volatility and insignificant impact on future volatility in large firms. Moreover, the negative coefficients on FSIZE have smaller absolute values for large firms. All these results confirm the destabilizing role of firm size.

4.4. Potential endogeneity and robustness tests

Although unobservable heterogeneity can be eliminated by the application of the fixed effects model, the estimated coefficients may still be biased if the dependent variable and explanatory variables are simultaneously determined. According to Roberts and White (2012) and Wintoki et al. (2012), this endogeneity problem should be taken into more consideration because it can undermine causal inference in corporate governance studies. The studies by Vo (2015), Li et al. (2011), and Chen et al. (2013) examining the impact of foreign ownership on stock return volatility in emerging markets mention the possibility of endogeneity problem in their model by referring to the previous studies in developed countries such as Kang and Stulz (1997) and Dahlquist and Robertsson (2001). However, all their results are not changed after they apply first-difference regressions, IV regressions, and GMM regressions to address the potential endogeneity. Chen et al. (2013) even conclude that their study is less subjective to the potential endogeneity problems. Despite that, we still decide to re-estimate our model by instrumental variable regressions with industry and year fixed effects to check the robustness of our estimates.

Besides, according to Adams and Ferreira (2007) and Raheja (2005), high information asymmetry discourages firms from increasing the monitoring activities from independent directors because it is costly to transfer firm-specific information to outsiders, especially when the supervising role of independent directors is proved to be not inefficient in an emerging market like Vietnam (Van Tuan & Tuan, 2016). The positive coefficients on NON_EX in Table 3 also support this viewpoint. In other words, high return volatility in a period may lead to a change in the non-executive ratio. Thus, NON_EX variable is likely to be another endogenous variable.

To address the potential problems, we use FOWNt-1 (the lagged value of foreign ownership) as an instrument for FOWN (Han et al., 2015). Another potential instrument for FOWN is DIR_EXP (the average working years of the directors in the company) because boards with long-serving members tend to be averse to strategic change and reluctant to internationalization (Golden & Zajac, 2001), which deters foreign investment. According to Li (1994) and Mak and Li (2001), board size has a negative impact on the composition of outside board members. Besides, individual director attributes (such as directors’ age, experience, and so on) are associated with the environment in which non-executive directors perform their duties. Therefore, we decide to use ∆lnBSIZEt-1 (the lag of the change in lnBSIZE), DIR_EXP (the average working years of the directors in the company), DIR_AGE (the average age of the directors on board) as instrumental variables for NON_EX. Then, F-tests and Hansen tests of over-identifying restrictions are necessary to confirm the validity of these instruments.

Table 3. Industry and year fixed effects regressions

|

|

Current volatility |

Future one-year volatility |

||||||

|

VOL1 |

VOL2 |

VOL1(t+1) |

VOL2(t+1) |

|||||

|

FOWN |

-0.00985*** |

-0.0818*** |

-0.00847*** |

-0.0733*** |

-0.00860** |

-0.0868*** |

-0.00776** |

-0.0789*** |

|

(-2.95) |

(-3.38) |

(-2.63) |

(-2.93) |

(-2.41) |

(-3.12) |

(-2.25) |

(-2.79) |

|

|

FSIZE |

-0.210*** |

-0.259*** |

-0.261*** |

-0.305*** |

-0.179*** |

-0.232*** |

-0.239*** |

-0.288*** |

|

(-5.40) |

(-6.51) |

(-6.42) |

(-7.13) |

(-5.63) |

(-6.19) |

(-7.21) |

(-7.37) |

|

|

FOWN*FSIZE |

0.00345*** |

0.00311*** |

0.00376*** |

0.00342*** |

||||

|

(3.11) |

(2.69) |

(2.93) |

(2.62) |

|||||

|

LEV |

0.593** |

0.633** |

0.655** |

0.691** |

0.502 |

0.550* |

0.575* |

0.618** |

|

(2.04) |

(2.23) |

(2.31) |

(2.48) |

(1.56) |

(1.74) |

(1.82) |

(1.99) |

|

|

ROE |

-0.504*** |

-0.502*** |

-0.432*** |

-0.431*** |

-0.730** |

-0.719** |

-0.654** |

-0.644** |

|

(-4.17) |

(-4.10) |

(-3.88) |

(-3.80) |

(-2.38) |

(-2.35) |

(-2.20) |

(-2.17) |

|

|

NON_EX |

0.343** |

0.361** |

0.358** |

0.374** |

0.453*** |

0.474*** |

0.450*** |

0.470*** |

|

(2.18) |

(2.30) |

(2.32) |

(2.40) |

(2.72) |

(2.83) |

(2.78) |

(2.86) |

|

|

lnBSIZE |

-0.389** |

-0.417** |

-0.368** |

-0.394** |

-0.350* |

-0.366* |

-0.331 |

-0.346 |

|

(-2.12) |

(-2.33) |

(-2.00) |

(-2.16) |

(-1.66) |

(-1.79) |

(-1.55) |

(-1.64) |

|

|

STATE |

-0.00236 |

-0.00210 |

-0.00213 |

-0.00190 |

-0.00257 |

-0.00231 |

-0.00201 |

-0.00177 |

|

(-0.96) |

(-0.87) |

(-0.88) |

(-0.80) |

(-1.02) |

(-0.93) |

(-0.82) |

(-0.73) |

|

|

PB |

0.00427 |

-0.0121 |

-0.00412 |

-0.0189 |

-0.0312 |

-0.0482 |

-0.0368 |

-0.0522 |

|

(0.11) |

(-0.31) |

(-0.11) |

(-0.50) |

(-0.60) |

(-0.89) |

(-0.72) |

(-0.99) |

|

|

LIQ |

0.239 |

0.258 |

-0.168 |

-0.151 |

-0.476** |

-0.458* |

-0.710*** |

-0.693*** |

|

(0.65) |

(0.70) |

(-0.44) |

(-0.39) |

(-2.00) |

(-1.92) |

(-2.84) |

(-2.77) |

|

|

lnFAGE |

-0.170 |

-0.128 |

-0.143 |

-0.106 |

-0.0902 |

-0.0455 |

-0.0507 |

-0.0100 |

|

(-1.46) |

(-1.16) |

(-1.20) |

(-0.91) |

(-0.71) |

(-0.38) |

(-0.39) |

(-0.08) |

|

|

Constant |

7.799*** |

8.722*** |

8.731*** |

9.563*** |

7.459*** |

8.438*** |

8.508*** |

9.399*** |

|

(12.48) |

(11.81) |

(13.45) |

(12.13) |

(10.46) |

(9.54) |

(11.73) |

(10.37) |

|

|

Observations |

1329 |

1329 |

1329 |

1329 |

1188 |

1188 |

1188 |

1188 |

|

Year fixed |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

|

Industry fixed |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

|

F-statistics |

22.27 |

23.08 |

26.65 |

26.47 |

17.14 |

16.24 |

21.78 |

20.52 |

|

P-value |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

|

R-squared |

0.2400 |

0.2434 |

0.2313 |

0.2340 |

0.2209 |

0.2245 |

0.2349 |

0.2379 |

Note: This table presents industry and year fixed effects regressions to examine the relationship between foreign ownership and stock return volatility. VOL1 and VOL2 are the two measures of the stock return volatility, FOWN is the proportion of shares held by foreign investors, FSIZE is the natural logarithm of total assets, LEV is the ratio of total liabilities to total assets, ROE is return on equity, NON_EX is the percentage of non-executive directors on board, lnBSIZE is the natural logarithm of the total number of directors on board, PB is the ratio of the market value of equity to the book value of equity, LIQ is the proportion of trading days in one year in which the stock return is non-zero, STATE is the proportion of shares held by state shareholders, lnFAGE is the natural logarithm of firm age. Robust t-statistics adjusted for firm-level clustering are reported in parentheses. ***, **, and * denote significance at the 1%, 5%, and 10% levels, respectively.

Table 4. Industry and year fixed effects regressions with sub-samples

|

|

Current volatility |

Future one-year volatility |

||||||

|

Large firms |

Small firms |

Large firms |

Small firms |

|||||

|

VOL1 |

VOL2 |

VOL1 |

VOL2 |

VOL1(t+1) |

VOL2(t+1) |

VOL1(t+1) |

VOL2(t+1) |

|

|

FOWN |

-0.00849** |

-0.00642* |

-0.0133** |

-0.0131** |

-0.00526 |

-0.00392 |

-0.0132** |

-0.0136** |

|

(-2.42) |

(-1.98) |

(-2.51) |

(-2.49) |

(-1.48) |

(-1.17) |

(-2.39) |

(-2.44) |

|

|

FSIZE |

-0.127** |

-0.205*** |

-0.337*** |

-0.372*** |

-0.112** |

-0.202*** |

-0.275*** |

-0.319*** |

|

(-2.58) |

(-3.95) |

(-3.58) |

(-3.90) |

(-2.42) |

(-4.13) |

(-3.58) |

(-4.18) |

|

|

LEV |

0.871*** |

0.914*** |

0.663 |

0.699 |

0.857*** |

0.925*** |

0.522 |

0.559 |

|

(4.20) |

(4.35) |

(1.34) |

(1.44) |

(3.98) |

(4.30) |

(1.04) |

(1.13) |

|

|

ROE |

-0.376*** |

-0.298*** |

-0.894** |

-0.733* |

-0.289** |

-0.239* |

-1.845*** |

-1.770*** |

|

(-3.76) |

(-3.32) |

(-2.14) |

(-1.76) |

(-2.19) |

(-1.79) |

(-3.70) |

(-3.59) |

|

|

NON_EX |

0.270 |

0.284* |

0.366 |

0.364 |

0.424** |

0.420** |

0.402 |

0.378 |

|

(1.60) |

(1.73) |

(1.50) |

(1.52) |

(2.56) |

(2.55) |

(1.58) |

(1.52) |

|

|

lnBSIZE |

-0.433** |

-0.342* |

-0.356 |

-0.392 |

-0.138 |

-0.107 |

-0.454 |

-0.441 |

|

(-2.22) |

(-1.70) |

(-1.01) |

(-1.14) |

(-0.70) |

(-0.52) |

(-1.13) |

(-1.11) |

|

|

STATE |

-0.00135 |

-0.00166 |

-0.00358 |

-0.00282 |

-0.000770 |

-0.000741 |

-0.00336 |

-0.00227 |

|

(-0.64) |

(-0.76) |

(-0.82) |

(-0.67) |

(-0.38) |

(-0.36) |

(-0.75) |

(-0.52) |

|

|

PB |

0.00498 |

0.0135 |

-0.00726 |

-0.0321 |

-0.0552 |

-0.0374 |

0.0120 |

0.00290 |

|

(0.15) |

(0.43) |

(-0.07) |

(-0.29) |

(-1.21) |

(-0.86) |

(0.11) |

(0.03) |

|

|

LIQ |

0.440 |

-0.436 |

0.504 |

0.184 |

-0.874*** |

-1.451*** |

0.0433 |

-0.129 |

|

(1.50) |

(-1.52) |

(0.82) |

(0.29) |

(-3.34) |

(-5.17) |

(0.13) |

(-0.37) |

|

|

lnFAGE |

-0.0995 |

-0.118 |

-0.0938 |

-0.0244 |

-0.0786 |

-0.0537 |

0.0739 |

0.130 |

|

(-0.95) |

(-0.99) |

(-0.58) |

(-0.16) |

(-0.76) |

(-0.45) |

(0.42) |

(0.74) |

|

|

Constant |

5.629*** |

7.457*** |

9.987*** |

10.59*** |

5.626*** |

7.574*** |

9.039*** |

9.740*** |

|

(5.51) |

(7.04) |

(6.93) |

(7.40) |

(6.06) |

(8.01) |

(5.51) |

(6.02) |

|

|

Observations |

634 |

634 |

695 |

695 |

569 |

569 |

619 |

619 |

|

Year fixed |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

|

Industry fixed |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

|

F-statistics |

20.44 |

18.06 |

7.35 |

7.14 |

20.22 |

23.46 |

5.47 |

5.65 |

|

P-value |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

|

R-squared |

0.5299 |

0.4495 |

0.1579 |

0.1524 |

0.5068 |

0.4945 |

0.1492 |

0.1545 |

Note: This table presents industry and year fixed effects regressions to examine the relationship between foreign ownership and stock return volatility. VOL1 and VOL2 are the two measures of the stock return volatility, FOWN is the proportion of shares held by foreign investors, FSIZE is the natural logarithm of total assets, LEV is the ratio of total liabilities to total assets, ROE is return on equity, NON_EX is the percentage of non-executive directors on board, lnBSIZE is the natural logarithm of the total number of directors on board, PB is the ratio of the market value of equity to the book value of equity, LIQ is the proportion of trading days in one year in which the stock return is non-zero, STATE is the proportion of shares held by state shareholders, lnFAGE is the natural logarithm of firm age. Robust t-statistics adjusted for firm-level clustering are reported in parentheses. ***, **, and * denote significance at the 1%, 5%, and 10% levels, respectively.

Table 5. Instrumental variable regressions with year and industry fixed effects

|

|

Current volatility |

Future one-year volatility |

||||||

|

First stage |

Second stage |

First stage |

Second stage |

|||||

|

NON_EX |

FOWN |

VOL1 |

VOL2 |

NON_EX |

FOWN |

VOL1(t+1) |

VOL2(t+1) |

|

|

Instruments |

||||||||

|

∆lnBSIZE(t-1) |

-0.107** |

2.194 |

-0.0987* |

3.216* |

|

|||

|

(-1.97) |

(1.43) |

(-1.82) |

(1.90) |

|

||||

|

FOWN(t-1) |

0.000121 |

0.886*** |

0.000245 |

0.876*** |

|

|||

|

(0.12) |

(35.01) |

(0.23) |

(30.26) |

|

||||

|

DIR_EXP |

-0.134*** |

-0.536* |

-0.135*** |

-0.633* |

|

|||

|

(-7.68) |

(-1.67) |

(-7.34) |

(-1.88) |

|

||||

|

DIR_AGE |

0.252** |

2.029 |

0.306*** |

2.132 |

|

|||

|

(2.39) |

(0.87) |

(2.71) |

(0.83) |

|

||||

|

Instrumented |

||||||||

|

NON_EX |

1.714** |

1.551** |

2.385** |

2.225* |

||||

|

(2.43) |

(2.27) |

(2.01) |

(1.89) |

|||||

|

FOWN |

-0.0109** |

-0.0103** |

-0.0109** |

-0.0102** |

||||

|

(-2.37) |

(-2.38) |

(-2.04) |

(-2.05) |

|||||

|

Control variables |

||||||||

|

FSIZE |

0.00616 |

0.575** |

-0.197*** |

-0.238*** |

0.00434 |

0.571** |

-0.156*** |

-0.210*** |

|

(0.49) |

(2.55) |

(-4.09) |

(-4.92) |

(0.34) |

(2.49) |

(-3.20) |

(-4.37) |

|

|

LEV |

-0.0754 |

-1.776 |

0.574* |

0.608* |

-0.0764 |

-2.240* |

0.514 |

0.559 |

|

(-1.29) |

(-1.64) |

(1.70) |

(1.85) |

(-1.23) |

(-1.92) |

(1.36) |

(1.53) |

|

|

ROE |

-0.0255 |

1.646* |

-0.463*** |

-0.395*** |

-0.0316 |

1.403 |

-0.559** |

-0.498** |

|

(-0.61) |

(1.75) |

(-3.90) |

(-3.51) |

(-0.54) |

(1.27) |

(-2.38) |

(-2.14) |

|

|

lnBSIZE |

0.0674 |

2.162* |

-0.404* |

-0.394* |

0.0703 |

2.516* |

-0.370 |

-0.369 |

|

(1.08) |

(1.76) |

(-1.74) |

(-1.77) |

(1.03) |

(1.87) |

(-1.23) |

(-1.28) |

|

|

STATE |

0.00135** |

-0.0114 |

-0.00518 |

-0.00497 |

0.00133** |

-0.00772 |

-0.00541 |

-0.00512 |

|

(2.52) |

(-1.38) |

(-1.59) |

(-1.58) |

(2.31) |

(-0.89) |

(-1.33) |

(-1.30) |

|

|

PB |

0.0151* |

0.691*** |

-0.0251 |

-0.0280 |

0.0161 |

0.828*** |

-0.0788 |

-0.0774 |

|

(1.74) |

(3.75) |

(-0.47) |

(-0.53) |

(1.35) |

(3.25) |

(-0.98) |

(-0.99) |

|

|

LIQ |

0.0470 |

-0.576 |

0.0894 |

-0.289 |

0.0535 |

-0.848 |

-0.697** |

-0.910*** |

|

(0.85) |

(-0.49) |

(0.21) |

(-0.67) |

(0.92) |

(-0.68) |

(-2.37) |

(-3.08) |

|

|

lnFAGE |

0.145** |

-0.703 |

-0.297 |

-0.238 |

0.132** |

-0.833 |

-0.253 |

-0.226 |

|

(2.42) |

(-0.69) |

(-1.14) |

(-0.95) |

(2.22) |

(-0.81) |

(-0.76) |

(-0.70) |

|

|

Observations |

1092 |

1092 |

1092 |

1092 |

959 |

959 |

959 |

959 |

|

Year fixed |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

|

Industry fixed |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

|

F test of excluded instruments: |

||||||||

|

F-statistics |

18.21 |

372.73 |

15.72 |

283.96 |

||||

|

P-value |

0.000 |

0.000 |

0.000 |

0.000 |

||||

|

Overidentification test of all instruments |

||||||||

|

Hansen J-statistics |

2.766 |

3.008 |

3.065 |

2.617 |

||||

|

P-value |

|

|

0.2508 |

0.2222 |

|

|

0.2160 |

0.2702 |

Note: This table presents instrumental variable regressions with industry and year fixed effects to confirm the relationship between foreign ownership and stock return volatility. FOWN and NON_EX are treated as potentially endogenous variables. ∆lnBSIZEt-1 (the lag of the change in lnBSIZE), FOWNt-1 (the lag of foreign ownership), DIR_EXP (the average working years of the directors in the company), DIR_AGE (the average age of the directors on board) are instrumental variables. Other variables are defined as in Table 3. The first-stage F test is used to test for the joint significance of the instruments. Hansen test for overidentifying restrictions is tested with the null hypothesis that the excluded instruments are not correlated to the error term. Robust t-statistics adjusted for firm-level clustering are reported in parentheses. ***, **, and * denote significance at the 1%, 5%, and 10% levels, respectively.

Table 6. Instrumental variable regressions with year and industry fixed effects for the model including an interaction term

|

Current volatility |

Future one-year volatility |

|||||||||

|

First stage |

Second stage |

First stage |

Second stage |

|||||||

|

NON_EX |

FOWN |

FOWN*FSIZE |

VOL1 |

VOL2 |

NON_EX |

FOWN |

FOWN*FSIZE |

VOL1(t+1) |

VOL2(t+1) |

|

|

Instruments |

||||||||||

|

∆lnBSIZE(t-1) |

-0.105* |

2.243 |

45.48 |

-0.0964* |

3.314* |

68.77* |

|

|||

|

(-1.95) |

(1.46) |

(1.39) |

(-1.77) |

(1.94) |

(1.89) |

|

||||

|

FOWN(t-1) |

0.0138 |

1.380*** |

9.494** |

0.0147 |

1.488*** |

12.09** |

|

|||

|

(1.44) |

(6.46) |

(2.00) |

(1.48) |

(6.62) |

(2.41) |

|

||||

|

FOWN(t-1)*FSIZE |

-0.000651 |

-0.0236** |

0.428* |

-0.000691 |

-0.0293*** |

0.292 |

|

|||

|

(-1.43) |

(-2.28) |

(1.84) |

(-1.47) |

(-2.65) |

(1.18) |

|

||||

|

DIR_EXP |

-0.134*** |

-0.536 |

-11.59* |

-0.135*** |

-0.608* |

-13.07* |

||||

|

(-7.66) |

(-1.64) |

(-1.66) |

(-7.26) |

(-1.77) |

(-1.78) |

|||||

|

DIR_AGE |

0.262** |

2.387 |

56.12 |

0.310*** |

2.326 |

53.50 |

||||

|

(2.50) |

(0.99) |

(1.08) |

(2.77) |

(0.87) |

(0.93) |

|||||

|

Instrumented |

||||||||||

|

NON_EX |

1.700** |

1.538** |

2.401** |

2.238* |

||||||

|

(2.43) |

(2.27) |

(2.01) |

(1.89) |

|||||||

|

FOWN |

-0.108*** |

-0.0929** |

-0.118** |

-0.0998* |

||||||

|

(-2.84) |

(-2.49) |

(-2.15) |

(-1.86) |

|||||||

|

FOWN*FSIZE |

0.00463*** |

0.00396** |

0.00518** |

0.00432* |

||||||

|

(2.61) |

(2.27) |

(2.01) |

(1.72) |

|||||||

|

Control variables |

||||||||||

|

FSIZE |

0.0161 |

0.937*** |

21.71*** |

-0.272*** |

-0.301*** |

0.0149 |

1.019*** |

23.61*** |

-0.239*** |

-0.280*** |

|

(1.11) |

(3.14) |

(3.26) |

(-5.12) |

(-5.67) |

(0.99) |

(3.15) |

(3.28) |

(-3.61) |

(-4.27) |

|

|

LEV |

-0.0836 |

-2.073* |

-44.82* |

0.634* |

0.659** |

-0.0854 |

-2.622** |

-56.65** |

0.588 |

0.620* |

|

(-1.43) |

(-1.84) |

(-1.86) |

(1.94) |

(2.07) |

(-1.37) |

(-2.14) |

(-2.17) |

(1.62) |

(1.78) |

|

|

ROE |

-0.0258 |

1.633* |

34.08 |

-0.461*** |

-0.393*** |

-0.0335 |

1.323 |

25.32 |

-0.534** |

-0.477** |

|

(-0.63) |

(1.69) |

(1.64) |

(-3.77) |

(-3.37) |

(-0.57) |

(1.19) |

(1.10) |

(-2.29) |

(-2.06) |

|

|

lnBSIZE |

0.0701 |

2.263* |

52.30* |

-0.446** |

-0.430* |

0.0699 |

2.498* |

57.44* |

-0.398 |

-0.392 |

|

(1.15) |

(1.77) |

(1.88) |

(-1.98) |

(-1.95) |

(1.05) |

(1.82) |

(1.95) |

(-1.37) |

(-1.38) |

|

|

STATE |

0.00129** |

-0.0137 |

-0.318* |

-0.00471 |

-0.00456 |

0.00127** |

-0.0104 |

-0.245 |

-0.00492 |

-0.00472 |

|

(2.47) |

(-1.55) |

(-1.68) |

(-1.50) |

(-1.50) |

(2.25) |

(-1.13) |

(-1.25) |

(-1.25) |

(-1.24) |

|

|

PB |

0.0180** |

0.796*** |

17.84*** |

-0.0499 |

-0.0492 |

0.0193* |

0.962*** |

21.60*** |

-0.109 |

-0.103 |

|

(2.22) |

(3.86) |

(3.91) |

(-0.89) |

(-0.90) |

(1.67) |

(3.63) |

(3.76) |

(-1.25) |

(-1.21) |

|

|

LIQ |

0.0380 |

-0.900 |

-20.35 |

0.153 |

-0.234 |

0.0445 |

-1.229 |

-26.98 |

-0.631** |

-0.854*** |

|

(0.71) |

(-0.75) |

(-0.81) |

(0.37) |

(-0.55) |

(0.78) |

(-0.95) |

(-1.00) |

(-2.22) |

(-2.99) |

|

|

lnFAGE |

0.136** |

-1.020 |

-21.34 |

-0.238 |

-0.188 |

0.123** |

-1.211 |

-26.28 |

-0.190 |

-0.174 |

|

(2.35) |

(-0.95) |

(-0.92) |

(-0.99) |

(-0.79) |

(2.14) |

(-1.12) |

(-1.15) |

(-0.62) |

(-0.57) |

|

|

Observations |

1092 |

1092 |

1092 |

1092 |

1092 |

959 |

959 |

959 |

959 |

959 |

|

Year fixed |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

|

Industry fixed |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

|

F test of excluded instruments: |

||||||||||

|

F-statistics |

14.75 |

373.70 |

346.39 |

13.44 |

299.69 |

273.94 |

||||

|

P-value |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

||||

|

Overidentification test of all instruments |

||||||||||

|

Hansen J-statistics |

3.615 |

3.704 |

3.099 |

2.628 |

||||||

|

P-value |

|

|

|

0.1641 |

0.1569 |

|

|

|

0.2124 |

0.2687 |

Note: This table presents instrumental variable regressions with industry and year fixed effects to confirm the destabilizing role of firm size. FOWN, FOWN*FSIZE, and NON_EX are treated as potentially endogenous variables. ∆lnBSIZEt-1 (the lag of the change in lnBSIZE), FOWNt-1 (the lag of foreign ownership), DIR_EXP (the average working years of the directors in the company), DIR_AGE (the average age of the directors on board), and FOWNt-1*FSIZE are instrumental variables. Other variables are defined as in Table 3. The first-stage F test is used to test for the joint significance of the instruments. Hansen test for overidentifying restrictions is tested with the null hypothesis that the excluded instruments are not correlated to the error term. Robust t-statistics adjusted for firm-level clustering are reported in parentheses. ***, **, and * denote significance at the 1%, 5%, and 10% levels, respectively.

We observe that the negative relationship between foreign ownership and volatility does not change in Table 5 and Table 6. All the coefficients on FOWN are significantly negative, confirming the risk-controlling role of foreign investors as well as their long-term investment strategy. Regarding the second hypothesis, the destabilizing role of FSIZE remains valid because all the estimated coefficients on the interaction term are still significantly positive in Table 6. Besides, the validity of our instruments can be justified by the obtained F-statistics of more than 10 in the first-stage regression, and Hansen tests of over-identifying restrictions indicate that the instruments are not correlated with the error term. All the diagnostics tests support the conclusion that the instruments used are reasonable, and the regression results are consistent.

5. Conclusion

Stock market liberalization has gradually become a global trend, forcing the governments in emerging markets to gradually remove restrictions on foreign ownership. By allowing foreign investors to participate in the Vietnam stock market under Decision No. 238/2005/QD-TT and relaxing foreign ownership rules to attract capital and support local companies under Decree No. 60/2015/ND-CP, the Vietnam stock market has witnessed a significant inflow of foreign investments. Therefore, investigating the impact of foreign ownership on stock return volatility in the Vietnam stock market contributes to shedding light on the role and investment behavior of foreign ownership in the context of an emerging market.

The corporate governance literature usually focuses on explaining the stabilizing impact of foreign ownership but does not consider the association in relation to firm characteristics. By using a sample of 160 companies listed in the Vietnam stock markets in the period 2008-2017, we observe a negative influence of foreign ownership on stock return volatility, but notably, the calming impact of foreign ownership becomes weaker in large firms. Our findings prove to be consistent when we apply instrumental variable regressions and use the future one-year volatility as an alternative measure of the dependent variable.

However, our study was limited to the detailed identification of foreign investors’ characteristics. It would, therefore, be interesting to investigate the impact of foreign institutional ownership or large foreign shareholders’ ownership on the volatility in emerging markets. Such further studies could contribute to a more in-depth understanding of the role of foreign investors in the stability or the Vietnam stock market.

Finally, our findings also offer some implications of corporate governance in Vietnam as well as in emerging countries. First, attracting foreign investors should be considered as a risk control mechanism, but its effectiveness may depend on firm size. Second, improving the regulations on corporate governance towards removing the restrictions on foreign ownership is essential to enhance the quality of governance systems and risk management. In brief, the effect of foreign ownership on stock return volatility in Vietnamese listed companies will give more significant insights into the role of foreign investors in emerging markets.

References

Adams, R. B., & Ferreira, D. (2007). A theory of friendly boards. The Journal of Finance, 62(1), 217–250.

Bae, K. H., Chan, K., & Ng, A. (2004). Investability and return volatility. Journal of Financial Economics, 71(2), 239–263. https://doi.org/10.1016/s0304-405x(03)00166-1

Bartram, S. M., Brown, G., & Stulz, R. M. (2012). Why are US stocks more volatile?. The Journal of Finance, 67(4), 1329–1370. https://doi.org/10.1111/j.1540-6261.2012.01749.x

Batten, J. A., & Vo, X. V. (2015). Foreign ownership in emerging stock markets. Journal of Multinational Financial Management, 32, 15–24. https://doi.org/10.1016/j.mulfin.2015.05.001

Bohl, M. T., & Brzeszczyński, J. (2006). Do institutional investors destabilize stock prices? Evidence from an emerging market. Journal of International Financial Markets, Institutions and Money, 16(4), 370–383. https://doi.org/10.1016/j.intfin.2005.05.005

Chatterjee, S., & Hadi, A. S. (2015). Regression analysis by example. John Wiley & Sons.

Chen, Z., Du, J., Li, D., & Ouyang, R. (2013). Does foreign institutional ownership increase return volatility? Evidence from China. Journal of Banking & Finance, 37(2), 660–669. https://doi.org/10.1016/j.jbankfin.2012.10.006

Cheng, S. (2008). Board size and the variability of corporate performance. Journal of Financial Economics, 87(1), 157–176. https://doi.org/10.1016/j.jfineco.2006.10.006

Cosset, J. C., Somé, H. Y., & Valéry, P. (2016). Credible reforms and stock return volatility: Evidence from privatization. Journal of Banking & Finance, 72, 99–120. https://doi.org/10.1016/j.jbankfin.2016.07.004

Dahlquist, M., & Robertsson, G. (2001). Direct foreign ownership, institutional investors, and firm characteristics. Journal of Financial Economics, 59(3), 413–440. https://doi.org/10.1016/s0304-405x(00)00092-1

Damanpour, F. (2010). An integration of research findings of effects of firm size and market competition on product and process innovations. British Journal of Management, 21(4), 996–1010. https://doi.org/10.1111/j.1467-8551.2009.00628.x

Foong, S. S., & Lim, K. P. (2016). Stock market liberalization and cost of equity: firm-level evidence from Malaysia. Asian Academy of Management Journal of Accounting & Finance, 12.

Golden, B. R., & Zajac, E. J. (2001). When will boards influence strategy? Inclination× power= strategic change. Strategic Management Journal, 22(12), 1087–1111. https://doi.org/10.1002/smj.202

Han Kim, E., & Singal, V. (2000). Stock market openings: Experience of emerging economies. The Journal of Business, 73(1), 25–66. https://doi.org/10.1086/209631

Hasan, M. M., & Habib, A. (2017). Firm life cycle and idiosyncratic volatility. International Review of Financial Analysis, 50, 164–175. https://doi.org/10.1016/j.irfa.2017.01.003

Huang, Y. S., & Wang, C. J. (2015). Corporate governance and risk-taking of Chinese firms: The role of board size. International Review of Economics & Finance, 37, 96–113. https://doi.org/10.1016/j.iref.2014.11.016

Kang, J. K. (1997). Why is there a home bias? An analysis of foreign portfolio equity ownership in Japan. Journal of Financial Economics, 46(1), 3–28. https://doi.org/10.1016/s0304-405x(97)00023-8

Leuz, C., Lins, K. V., & Warnock, F. E. (2008). Do foreigners invest less in poorly governed firms?. The Review of Financial Studies, 22(8), 3245–3285. https://doi.org/10.1093/rfs/hhn089

Li, D., Nguyen, Q. N., Pham, P. K., & Wei, S. X. (2011). Large foreign ownership and firm-level stock return volatility in emerging markets. Journal of Financial and Quantitative Analysis, 46(4), 1127–1155. https://doi.org/10.1017/s0022109011000202

Li, J. (1994). Ownership structure and board composition: A multi-country test of agency theory predictions. Managerial and Decision Economics, 15(4), 359–368. https://doi.org/10.1002/mde.4090150409

Lin, C. H., & Shiu, C. Y. (2003). Foreign ownership in the Taiwan stock market—an empirical analysis. Journal of Multinational Financial Management, 13(1), 19–41. https://doi.org/10.1016/s1042-444x(02)00021-x

Mak, Y.T., & Li, Y. (2001). Determinants of corporate ownership and board structure: Evidence from Singapore. Journal of Corporate Finance, 7(3), 235–256. https://doi.org/10.1016/s0929-1199(01)00021-9

McConnell, J. J., & Servaes, H. (1990). Additional evidence on equity ownership and corporate value. Journal of Financial Economics, 27(2), 595–612. https://doi.org/10.1016/0304-405x(90)90069-c

Merton, R. C. (1987). A simple model of capital market equilibrium with incomplete information. The Journal of Finance, 42(3), 483–510. https://doi.org/10.2307/2328367

Min, B. S., & Bowman, R. G. (2015). Corporate governance, regulation, and foreign equity ownership: Lessons from Korea. Economic Modelling, 47, 145–155. https://doi.org/10.1016/j.econmod.2015.02.030

Mitton, T. (2006). Stock market liberalization and operating performance at the firm level. Journal of Financial Economics, 81(3), 625–647. https://doi.org/10.1016/j.jfineco.2005.09.001

My, T. N., & Truong, H. H. (2011). Herding behavior in an emerging stock market: Empirical evidence from Vietnam. Research Journal of Business Management, 5(2), 51–76. https://doi.org/10.3923/rjbm.2011.51.76

Nakano, M., & Nguyen, P. (2012). Board Size and Corporate Risk Taking: Further Evidence from Japan. Corporate Governance: An International Review, 20(4), 369–387. https://doi.org/10.1111/j.1467-8683.2012.00924.x

Nguyen, T. M. (2017). The Impact of Foreign Investor Trading Activity on the Vietnamese Stock Market. International Journal of Marketing Studies, 9(1), 109–118. https://doi.org/10.5539/ijms.v9n1p109

Pástor, Ľ., & Pietro, V. (2003). Stock valuation and learning about profitability. The Journal of Finance, 58(5), 1749–1789. https://doi.org/10.1111/1540-6261.00587

Pathan, S. (2009). Strong boards, CEO power, and bank risk-taking. Journal of Banking & Finance, 33(7), 1340–1350. https://doi.org/10.1016/j.jbankfin.2009.02.001

Raheja, C. G. (2005). Determinants of board size and composition: A theory of corporate boards. Journal of Financial and Quantitative Analysis, 40(2), 283–306. https://doi.org/10.1017/s0022109000002313

Roberts, M. R., & Whited, T. M. (2012). Endogeneity in empirical corporate finance [Working Paper No. FR 11–29]. Simon School.

Rubin, A., & Smith, D. R. (2009). Institutional ownership, volatility, and dividends. Journal of Banking & Finance, 33(4), 627–639. https://doi.org/10.1016/j.jbankfin.2008.11.008

Stiglitz, J. E. (2000). Capital market liberalization, economic growth, and instability. World Development, 28(6), 1075–1086. https://doi.org/10.1016/s0305-750x(00)00006-1

Tsang, E. W. (2005). Influences on foreign ownership level and entry mode choice in Vietnam. International Business Review, 14(4), 441–463. https://doi.org/10.1016/j.ibusrev.2005.03.001

Van Tuan, N., & Tuan, N. A. (2016). Corporate governance structures and performance of firms in Asian markets: A comparative analysis between Singapore and Vietnam. Organizations and Markets in Emerging Economies, 7(2). https://doi.org/10.15388/omee.2016.7.2.14210

Viet, P. (2013). Foreign ownership and performance of listed firms: evidence from an emerging economy. The Bulletin of the Graduate School of Commerce, 77, 285–310.

Vo, X. V. (2015). Foreign ownership and stock return volatility–Evidence from Vietnam. Journal of Multinational Financial Management, 30, 101–109. https://doi.org/10.1016/j.mulfin.2015.03.004

Vo, X. V. (2016a). Does institutional ownership increase stock return volatility? Evidence from Vietnam. International Review of Financial Analysis, 45, 54–61. https://doi.org/10.1016/j.irfa.2016.02.006

Vo, X. V. (2016b). Foreign investors and corporate risk-taking behavior in an emerging market. Finance Research Letters, 18, 273–277. https://doi.org/10.1016/j.frl.2016.04.027

Vo, X. V. (2016c). Foreign ownership and stock market liquidity-evidence from Vietnam. Afro-Asian Journal of Finance and Accounting, 6(1), 1–11. https://doi.org/10.1504/aajfa.2016.074540

Wang, J. (2013). The impact of foreign ownership on stock volatility in Indonesia. Asia‐Pacific Journal of Financial Studies, 42(3), 493–509. https://doi.org/10.1111/ajfs.12022

Wei, S. X., and C. Zhang. (2006). Why Did Individual Stocks Become More Volatile?. Journal of Business, 79, 259–2. https://doi.org/10.1086/497411

Wintoki, M. B., Linck, J. S., & Netter, J. M. (2012). Endogeneity and the dynamics of internal corporate governance. Journal of Financial Economics, 105(3), 581–606. https://doi.org/10.1016/j.jfineco.2012.03.005

Zhang, C. (2010). A reexamination of the causes of time-varying stock return volatilities. Journal of Financial and Quantitative Analysis, 45(3), 663–684. https://doi.org/10.1017/s0022109010000232

Zhou, K.Z., Gao, G.Y., Zhao, H., (2017). State ownership and firm innovation in China: an integrated view of institutional and efficiency logics. Administrative Science Quarterly, 62(2), 375–404. https://doi.org/10.1177/0001839216674457