Organizations and Markets in Emerging Economies ISSN 2029-4581 eISSN 2345-0037

2020, vol. 11, no. 2(22), pp. 276–304 DOI: https://doi.org/10.15388/omee.2020.11.34

Intellectual Capital Disclosures and Corporate Governance in Gaining the Firms’ Non-Discretionary Profits and Market Value in ASEAN-5

Saarce Elsye Hatane (corresponding author)

Petra Christian University, Indonesia

elsyehat@petra.ac.id

https://orcid.org/0000-0002-3797-1623

Felicia Nathania

Petra Christian University, Indonesia

felitania2199@yahoo.com

https://orcid.org/0000-0001-9467-2745

Jocelyn Lamuel

Petra Christian University, Indonesia

jocelynlm98@gmail.com

https://orcid.org/0000-0001-6882-811X

Fenny Darusman

Petra Christian University, Indonesia

fenny.darusman@yahoo.com

https://orcid.org/0000-0003-4152-177X

Devie

Petra Christian University, Indonesia

dave@petra.ac.id

https://orcid.org/0000-0003-3955-4513

Abstract. This study aims to find the effect of Intellectual Capital Disclosure (ICD) and Corporate Governance (CG) on firm performance in ASEAN countries. Firm performance is divided into accounting-based performance and market-based performance. The accounting-based performance consists of Non-Discretionary Net Income (NDNI) and Cash Flow Operations (CFO), while market-based performance consists of Tobin’s Q and Market-to-Book Ratio (MBR). The measurement of ICD components uses a scoring system. The sample of this research is 112 firms in the industrial technology listed in the stock exchange of ASEAN-5 between 2011 and 2018. This study finds that NDNI increases when firms increase RCD quality. No ICD components are capable of affecting CFO. On the other hand, SCD is a variable that decreases NDNI value. BGEN is found to reduce NDNI and CFO values. RCD is also the only ICD component that can increase market-based performance, especially MBR. HCD consistently lowers the values of MBR and Tobin’s Q. BSIZE holds a significant role in raising Tobin’s Q score, and BGEN lowers MBR instead. BIND has no part in the market-based performance, but it significantly lowers NDNI value. This study adds another view to ICD’s benefits from two firm performance perspectives, accounting-based performance and market-based performance, especially in ASEAN-5.

Keywords: non-discretionary net income, accounting-based performance, market-based performance, intellectual capital disclosure, good corporate governance.

Received: 11/1/2020. Accepted: 15/5/2020

Copyright © 2020 Saarce Elsye Hatane, Felicia Nathania, Jocelyn Lamuel, Fenny Darusman, Devie. Published by Vilnius University Press. This is an Open Access article distributed under the terms of the Creative Commons Attribution Licence, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

1. Introduction

Investment in Intellectual Capital (IC) is currently seen as the leading value creator for firms and economy sectors (Zéghal, 2015) and may positively influence investment decisions and firm value (Yang, 2018). IC is the knowledge, information, and practical experience which can be used to generate wealth for firms and thus become the foundation for competitiveness and is acknowledged as an essential asset to business performance (Cabrita et al., 2017). Up until now, there is no official standard that regulates Intellectual Capital Disclosure (ICD) (Schiemann et al., 2015; Guthrie, 2017; Hatane et al., 2019). Consequently, firms tend to have low awareness in disclosing IC. ICD reporting, w hich consists of Human Capital Disclosure (HCD), Structural Capital Disclosure (SCD), and Relational Capital Disclosure (RCD), aims to fulfill the information needs of stakeholders. As a result, to meet market demands, firms start to voluntarily supplement narrated non-financial details into their traditional financial reporting (Haji & Ghazali, 2013). Components of ICD can’t act individually, but the interaction between them can generate value for the company. Changing business environment needs to create creative and innovative plans to increase competitiveness and sustain in the market places, so that is why companies need to evaluate ICD and its components then develop its performance (Simion & Tobă, 2018). With the systematic ICD, the information can reduce bias towards corporation value and provide information for investors regarding anticipation of uncertainty in the future and help measure corporate value (Hatane et al., 2019).

RQ 1: Do ICD and CG have a role in accounting-based performance?

With the addition of ICD, information disclosure in financial reporting will become comprehensive and potentially reduce bias on firm value (Hatane et al., 2019). Therefore, ICD is vital to lower information asymmetry (Yang, 2018). Information asymmetry is a condition where one party has more and better information than the other. Information asymmetry in a company more often happens in agent-principal relationships, which may cause Earnings Management (EM) practice (Bendickson et al., 2016). EM is defined as management‘s actions in managing earnings in order to gain the desired profit, and so can mislead stakeholders on firm performance through the reported accounting numbers (Yang, 2018). Besides ICD, Corporate Governance (CG) is also another element that may limit EM occurrences. CG can be defined as a system, rules, and principles created to manage the interest between stakeholders so that the company can perform better (Tarigan, Hervindra, & Hatane, 2018).

A good CG can build credibility, transparency, and accountability that enhances firm performance. A strong CG structure will also control managerial decision-making and improve financial reporting quality, thereby increasing firm value (Kumari & Pattanayak, 2017). In its implementation, CG must recognize the rights of shareholders, including employees, suppliers and customers (Kolsi & Grassa, 2017). CG relationships such as the board of directors (BOD) and supervisory board are expected to provide accountability for managerial actions and support the firms‘ sustainability in an increasingly competitive market (Liu, Qu, & Haman, 2018). One type of EM is accrual-based EM. A high DA means there exist EM practices (Ho & An, 2018). In order to value actual performance, Subramanyam (1996) expressed two forms of non-DA profits: Non-Discretionary Net Income (NDNI) and Cash Flow Operation (CFO). Several studies have used NDNI and CFO to detail a company’s real profit (Subramanyam, 1996; Siregar & Utama, 2008; Suprianto & Setiawan, 2018; Hatane et al., 2019).

RQ 2: Do ICD and CG have a role in market-based performance?

Prior research related to the effect of ICD and CG on firm performance in ASEAN-5 countries is still limited. Cheng et al. (2010) examined the effect of IC on profitability (ROA, ROE) in the US (United States) health industry and US pharmaceutical companies. Furthermore, Mondal and Ghosh (2012) discussed the relationship between IC and profitability (ROA, ROE) in the Indian banking industry. Then, Salehi et al. (2014) also revealed the relationship between IC and profitability (ROA, ROE) of chemical and pharmaceutical companies in Iran.

In previous studies, the majority of researchers used IC measurements with Value Added Intellectual Coefficient (VAIC) and questionnaires (Bontis, 1997; Salehi et al., 2014; Nimtrakoon, 2015). According to Nimtrakoon‘s research (2015), VAIC measurement provides weaknesses in IC, where VAIC is more focused on HC components such as labor efficiency and corporate capital investment rather than IC. The absence of a definite causal relationship between HC and value explains that the relationship between various IC components is less reflected in the VAIC model. Thus, IC measurements in this study were carried out using the ICD index, which is unique for this study because the majority of previous studies used VAIC and questionnaires. In addition, Malik and Makhdoom‘s research (2016) discussed the influence of CG (BSIZE, BIND) on profitability (ROA) of companies incorporated in Fortune 500 Global. Bhatt and Bhatt (2017) also examined the effect of CG on profitability (ROA, ROE) in Malaysia. Based on the background description above, it draws the attention of the author to conduct further research in ASEAN-5 and the industrial technology sector.

This study uses data from one hundred and twelve firms in the technology sector which were listed in the stock exchange of ASEAN-5 from 2011 to 2018. Except for Singapore, all are among the most prominent emerging economies in ASEAN. ASEAN is the third-largest economic association in the world and a geopolitical and economic organization in Southeast Asia. In 2015, the ASEAN Economic Community (AEC) was formed, resulting in economic policy improvement. AEC aims to develop a single market and production base in a highly competitive, globally-integrated economic zone. AEC provides freedom to collaborate in exchanging goods, services, investments, labor, and capital flow (ASEAN Economic Community, 2014b).

Nowadays, ASEAN-5 countries mainly engage in electronics as their primary source of export and import activities. Southeast Asia is prepared to do a cross-sector technological transformation, such as e-commerce and financial services (Gnirck, 2017). Financial risks in ASEAN-5 countries are considered to be controlled and are generally lower in comparison to the global financial system, as a proof to the benefits of strong reform efforts that have been under way for decades. As a result of strong reform in ASEAN-5, monetary policy in ASEAN-5 must continue to adjust to new conditions in the form of uncertain and rapidly changing global conditions (Corbacho & Peiris, 2018).

The study focuses on the effect of ICD and CG on accounting-based and market-based performance in ASEAN-5. Accounting-based performance is measured through NDNI and CFO, while market-based performance is measured with Tobin‘s Q and Market-to-Book Ratio (MBR). NDNI and CFO have direct impact on stakeholders in determining the firm performance and are used for the investor in making decisions whether they will invest or not (Hatane et al., 2019). This research adds another view regarding the benefits of ICD and CG on two firm performance perspectives, on companies engaged in the technology sector in ASEAN-5.

The contribution of this study is to provide an overview of the benefits of ICD and CG on firm performance in ASEAN countries. The firm performance in this study focuses on NDNI and CFO as the accounting-based performance, also Tobin’s Q and MBR as market-based performance. Lately, there are still many firms that do not have any concern in disclosing IC. The result of this study shows that NDNI increases when firms increase RCD quality. No ICD components are capable of affecting CFO. On the other hand, SCD is a variable that decreases NDNI value. BGEN is found to reduce NDNI and CFO values. RCD is also the only ICD component that can increase market-based performance, especially MBR. HCD consistently lowers the values of MBR and Tobin’s Q. BSIZE holds a significant role in raising Tobin’s Q score, and BGEN lowers MBR instead. BIND has no part in market-based performance, but it significantly lowers NDNI value. The remainder of this paper is organized as follows. Section 2 provides related literature review and hypotheses development. Section 3 presents the research design and methodology. Section 4 shows the empirical results, and Section 5 provides conclusion, limitations, and suggestions.

2. Literature Review and Hypotheses Development

2.1 Relevant Literature

Intellectual Capital Disclosure (ICD). HCD refers to knowledge, experience, motivation and creativity attached to an individual (Gates, 2010). Besides, SCD helps establish intellectual wealth through human contribution, including information technology and organizational procedure and system, to support employees‘ productivity. Then, RCD is a firm’s disclosure on its relationship with stakeholders, representing all resources related to the external relations of the company or company’s business relationships (Simion & Tobă, 2018). Empirical studies show that a company that does not disclose IC causes information asymmetry and a lack of transparency, thereby losing the relevance of its financial reporting (Yang, 2018). Financial reporting relevance depends on the capacity of accounting information in explaining the firm value, which can be derived from the firm‘s share price (value relevance) (Vafaei et al., 2011). Thus, ICD must be reflected in the company’s share price (Gamerschlag, 2013). ICD can provide investors with value relevant information, otherwise the investors can’t determine the companies’ value-adding potential (Vafaei et al., 2011). This is consistent with signaling theory that companies should disclose more information and provide relevant information in order to address problems arising from information asymmetry (An, Davey, & Eggleton, 2011). Despite the increasing importance of IC for the companies, ICD on annual reports is still very limited (Nadeem et al., 2017). ICD on annual reports is a form of voluntary disclosure, which actually could give some benefits for organizations, such as helping companies in formulating strategies and enhancing transparency (Hatane et al., 2019).

Corporate Governance (CG). The board of directors (BOD) is a part of CG that is responsible for supervising, compensating, and approving major strategic projects. Consequently, BOD is considered to be an instrument in reducing agency problems (González & García-Meca, 2014). Agency theory is the dominant or underpinning theory in strategy, especially in CG (Bendickson et al., 2016). Agency theory is based on the relationship between the principal and the agent. The assumption of agency theory is that the agent will behave opportunistically, especially if their interests conflict with the principal (Mitchell & Meacheam, 2011). There are two CG mechanisms, internal and external; however, this research only utilizes CG‘s internal mechanism: Board size (BSIZE), board independence (BIND), and board gender (BGEN). The internal mechanism in CG is an IC component that plays a role in improving firm performance in order to expand the company’s intangible assets (Mishra & Kapil, 2018).

The structure of the board, including BSIZE and BGEN, is an aspect of the structural asset (Zéghal, 2015). The more members there are, the more activities make it possible to increase intangible assets, which in turn delivers a positive effect on firm value (Haji & Ghazali, 2013). BGEN can also affect the business decision-making process and problem-solving, which influences firm performance (Ben-Amar et al., 2013). The presence of BIND in the CG mechanism is useful to enhance the supervising function in a principal-agent relationship (Siagian et al., 2013) and so may control the quality of reported profit (Nagar & Raithatha, 2016).

Non-Discretionary Net Income (NDNI) and Cash Flow Operation (CFO). The profit reported in Profit or Loss Statement is accounting profit, which contains accrual aspects. This aspect is the instrument used by management to conduct EM. Subramanyam (1996), Siregar and Utama (2008), and Suprianto and Setiawan (2018) introduced NDNI and CFO as actual profit performances independent from the effect of EM. Zhu et al. (2015) provided evidence that EM tends to affect the firm‘s future performance negatively. To measure the transparency of a company, an indicator frequently used by investors is profitability (Hatane et al., 2019). ROA, one of the measurements of profitability, is classified as the accounting based measurement of financial performance. The positive result of ROA means that the asset owned can generate income for the company (Masa’deh et al., 2015). Hatane et al. (2019) found that ICD components are positively associated with NDNI, and that NDNI and CFO directly affect stakeholders in determining firm performance and making decisions. As such, these two measurements are considered to be the most reliable.

Tobin’s Q and Market-to-Book Ratio (MBR). Market value is seen to be a reliable performance measurement. In certain situations, it is more relevant as it reflects long-term firm value, it is more comfortable with verifying and harder to manipulate. Tobin‘s Q and MBR are used to assess the prospects of the firm’s actual value (Siddiqui, 2015). Tobin‘s Q can predict future firm performance even though it computes historical data. The current value of the expected profit in the future can also be forecasted. This ratio shows investment value in a company. A Tobin‘s Q value >1 shows that the firm is experiencing value increase and that it has been managed efficiently, while also implying a higher economic performance (Hejazi et al., 2016), and also suggests that the firm has intangible assets associated with future growth opportunities (Marinova et al., 2015). On the other hand, MBR acts as an image for the company’s accounting information usefulness (Mangena et al., 2014).

2.2 Hypotheses Development

The Effect of Intellectual Capital Disclosure (ICD) on Accounting-based Performance. The relation between ICD and profitability is stated in resource-based theory, with IC as a means to increase profitability and affect firm performance positively (Cuozzo et al., 2017). The resource-based theory explains that effective and efficient utilization of both tangible and intangible assets will establish an excellent firm performance (Alfraih, 2018). Besides, agency theory also explains the relation between ICD and profitability. Agency relationships arise when the principal employs agents to provide services and make decisions. This relationship can lead to a condition of information imbalance (information asymmetry) because the agent is in a position that has more information about the company than the principal (Bendickson et al., 2016).

Assuming that individuals act to maximize their own interests (Mitchell & Meacheam, 2011), information asymmetry will encourage agents to hide information that is not known to the principal, thereby reducing management‘s efforts to maximize corporate profits. Agency theory suggests that higher profitability can be illustrated through more information disclosure in the annual report. This will help management to convince shareholders that the company can maintain their position and stability (Khlif & Souissi, 2010). Empirical studies found a significant positive association between ICD and profitability (Cheng et al., 2010; Mention & Bontis, 2013; Salehi et al., 2014; Jordão & Almeida, 2017). Voluntary ICD lowers EM and increases NDNI reporting quality (Subramanyam, 1996; Siregar & Utama, 2008; Suprianto & Setiawan, 2018). The hypotheses are, therefore, as follows:

H1a: Human Capital Disclosure affects Non-Discretionary Net Income.

H1b: Structural Capital Disclosure affects Non-Discretionary Net Income.

H1c: Relational Capital Disclosure affects Non-Discretionary Net Income.

A company that generates more profit will disclose more IC in order to highlight itself from other companies. A part of the profitability that is used to evaluate firm transparency is CFO (Hatane et al., 2019). Kiattikulwattana (2014) found a significant positive relationship between ICD and profitability, while Boujelben and Fedhila (2011) failed to find any association between HCD and CFO, and Hejazi et al. (2016) did not find any significant positive connection between SCD and profitability. According to Rahman (2012), companies that have a greater level of ICD will tend to have better profitability (ROA, ROE). Joshi et al. (2013) investigated ICD in the Australian financial sector and found that HCD has a large influence on the ability to create profitability (ROA). Lopes et al. (2016) examined the impact of HCD and SCD on profitability. As a result, it was found that the level of profitability was driven by the factors that make up HCD and SCD, which is BSIZE. The hypotheses are, therefore, as follows:

H2a: Human Capital Disclosure affects Cash Flow Operation.

H2b: Structural Capital Disclosure affects Cash Flow Operation.

H2c: Relational Capital Disclosure affects Cash Flow Operation.

The Effect of Intellectual Capital Disclosure (ICD) on Market-based Performance. In evaluating firm performance, signaling theory states that in ICD, a company will try to push their competitive advantage in HCD, SCD, and RCD (Henry, 2013). According to signaling theory, companies want to avoid the problem of investors finding out that there is inadequate information, therefore investors prefer Big 4 firms because of their market name, reputation and competence, so it can help to monitor the auditors’ performance and raise investors’ trust regarding earnings information quality (Abdallah, 2018). Signaling theory suggests that high quality companies should signal their advantages to the market, so investors and stakeholders can make more favorable decisions to the companies. This theory also suggests voluntary disclosure of IC that can improve corporate image, attract potential investors and improve their relationships with stakeholders (An, Davey, & Eggleton, 2011).

ICD can affect a firm‘s financial costs and value creation, measured through the value of its tangible assets, which is Tobin‘s Q. Profitability tends to have a definite link with Tobin‘s Q as a profitable firm should have lower financial risk (Orens et al., 2009). Nadeem et al. (2017) found a positive relation between RCD and SCD on Tobin‘s Q. Hamdan (2018) found a negative relation between HCD and Tobin‘s Q. Structural capital covers knowledge and experience on the company processes, information, structures, and internal procedures (Simsek & Heavey, 2011). Thus, if SCD grows and improves, the firm‘s market-based performance will also increase. The hypotheses are, therefore, as follows:

H3a: Human Capital Disclosure affects Tobin’s Q.

H3b: Structural Capital Disclosure affects Tobin’s Q.

H3c: Relational Capital Disclosure affects Tobin’s Q.

ICD has a positive effect on market-based performance, which is used to value firm performance (Inkinen, 2015). SCD aims to support employees‘ productivity and increase market value to get a better market position (Simion & Tobă, 2018). Better ICD in the company’s annual report is consistent with better market performance, measured with MBR. Practical implication of ICD is to make managers aware of the positive and significant effect of IC information on market performance, which may encourage companies to develop better disclosure policies (Alfraih, 2018). Nimtrakoon (2015) mentioned that there is a direct link between ICD with financial performance and market value. It is in line with the legitimacy theory, which states that external parties will demand more disclosure to reduce information asymmetry, such as by conducting ICD (Orens et al., 2009). The hypotheses are, therefore, as follows:

H4a: Human Capital Disclosure affects Market-to-Book Ratio.

H4b: Structural Capital Disclosure affects Market-to-Book Ratio.

H4c: Relational Capital Disclosure affects Market-to-Book Ratio.

The Effect of Corporate Governance (CG) on Accounting-based Performance. Based on the concept of agency theory, agents are more selfish, so the board is tasked with facilitating and empowering management by closely monitoring. The board‘s role is as a controller to prevent management from prioritizing personal interests (Kabir & Thai, 2017). CG mechanism becomes important because of the emergence of public companies, especially the role of BOD and remuneration committee (Bendickson et al., 2016). Agency theory states that better firm performance can be facilitated by BIND (which consists of a majority of outsiders) (Mishra & Kapil, 2018). Agency theory also suggests that a firm needs to invent a CG mechanism that pushes behavior to align with the result as desired by the owner (Bendickson et al., 2016).

Kumari and Pattanayak (2017) found that weak CG and EM practices are the initial signs that point to the weakening of the firm‘s financial health and increased risk of bankruptcy. Daghsni et al. (2016) found a negative association between CG and NDNI, while Buniamin et al. (2012) discovered a positive relationship between CG and EM through DA, where a large number of women on board can increase DA. Several studies also found that BGEN, measured with the percentage of women on board, has a positive impact on financial performance (Kilic & Kuzey, 2016; Gordini & Rancati, 2017). However, BIND does not affect it. Thus the increase of DA signifies the decreasing NDNI. The hypotheses are, therefore, as follows:

H5a: Board Independence affects Non-Discretionary Net Income.

H5b: Board Size affects Non-Discretionary Net Income.

H5c: Board Gender affects Non-Discretionary Net Income.

Each CG mechanism will affect EM and CFO. CFO is often tied with the funding done by companies to increase their growth. Low BIND and BSIZE would increase cash flow manipulation due to low control, causing information asymmetry (Nagar & Raithatha, 2016). The study by Baum et al. (2012) found that higher funding and poor CG in a firm lead to the worsening of firm operational performance, and CG shows long-term goal orientation of the managers, so it can improve FV. The relation between CG, NDNI, and CFO is that CG influences companies’ accounting-based performance, such as profitability. It means that the implementation of strong CG improves the firm performance, measured with profitability, and gives clear evidence for incorporating governance rules and practices in companies (Wahyudin & Solikhah, 2017). The hypotheses are, therefore, as follows:

H6a: Board Independence affects Cash Flow Operations.

H6b: Board Size affects Cash Flow Operations.

H6c: Board Gender affects Cash Flow Operations.

The Effect of Corporate Governance (CG) on Market-based Performance. The separation of ownership and control is the underlying issue of agency theory as it is a CG mechanism used to protect shareholders from the owner and management, both of whom have their interests. With the emergence of public companies, CG becomes even more critical, primarily through the role of the BOD (Bendickson et al., 2016). A better firm performance may also be facilitated by separating the position of board chairman and CEO (Mishra & Kapil, 2018). Kumar and Singh (2013) detected a negative association between BSIZE and Tobin‘s Q. However, Singh et al. (2017) discovered a positive relation between BSIZE and Tobin’s Q, where larger BSIZE means more diverse views in making the company’s strategic plans in the face of a problem, thus improving firm performance.

Besides, Mishra and Kapil (2018) did not find any effect of BIND on firm performance through Tobin‘s Q. It is contrasted with agency theory since higher BIND should have been able to reduce agency costs and raise firm performance. Siddiqui (2015), using Tobin‘s Q and MBR as firm value measurements, showed a significant positive relationship between BGEN and market-based performance. Fidanoski et al. (2014) defined BGEN in terms of gender, education and nationality diversity on board. His research finally concluded that companies with members on the board consisting of educated members and women were more profitable on the market than those companies with more foreigners on the board. However, Marinova et al. (2015) found no relationship between BGEN and firm performance when measured using Tobin‘s Q. The hypotheses are as follows:

H7a: Board Independence affects Tobin’s Q.

H7b: Board Size affects Tobin’s Q.

H7c: Board Gender affects Tobin’s Q.

Siddiqui’s (2015) study demonstrated that CG has a significant relationship with market value. Anderson and Gupta (2009), using MBR as measurement, revealed that a firm with better CG has higher market valuation. Companies with low BIND can encourage managers to take over company resources for personal gain, due to poor monitoring and improper governance action, negatively affecting firm value (Ahmed-Sheikh et al., 2013). The findings of Ahmed-Sheikh et al. (2013) supported the positive relationship between BSIZE and MBR. If BSIZE has an optimal number, firm performance will be maximal (Mishra & Kapil, 2018). The number of women on board (BGEN) can affect the quality of voluntary disclosure in financial reporting, resulting in a higher firm share price (Fidanoski et al., 2014; Anifowose et al., 2017). The research by Kumari and Pattanayak (2017) stated that BIND affects market performance and improves sustainable business growth. The hypotheses are as follows:

H8a: Board Independence affects Market-to-Book Ratio.

H8b: Board Size affects Market-to-Book Ratio.

H8c: Board Gender affects Market-to-Book Ratio.

3. Research Design and Methodology

3.1. Research Setting

The study uses ASEAN-5 nations that have the largest GDPs in Southeast Asia. This region has experienced an average growth of 5.3% since 2000, far above the global average of 3.8%. ASEAN envisions the creation of an integrated regional economy and involvement with global partners. ASEAN is expected to undergo an increase from 67 million households to around 125 million households in 2025 (ASEAN as The Architect for Regional Development Cooperation, 2018). ASEAN-5 also enabledsurviving the global financial crisis well, as well as the recent commodity price cycle and low-inflation through the transition to a more consistent forward-looking framework. In addition, ASEAN-5 is gradually moving towards a flexible exchange rate regime, which has strengthened monetary independence and facilitated adjustments to external shocks. Modern technology in ASEAN-5 could bring benefits but also risks to financial systems, such as cryptocurrencies. ASEAN-5 countries have adopted a variety of regulatory responses for dealing with this kind of risk, for example, the Central Bank in ASEAN-5 prohibited all payment using virtual currencies and warned consumers and investors about the risks (Corbacho & Peiris, 2018).

3.2. Sample Selection

Table 1. Summary-of-Observed-Samples

|

Sample-Criteria |

Singapore |

Thailand |

Indonesia |

Philippines |

Malaysia |

Total Samples |

|

Firms-listed-in-Stock-Exchange |

86 |

50 |

12 |

12 |

47 |

207 |

|

Firm-IPOs-which-do-not-meet-requirements |

(21) |

(0) |

(2) |

(2) |

(12) |

(37) |

|

Firms-with-incomplete-financial-report |

(13) |

(25) |

(3) |

(8) |

(1) |

(50) |

|

Financial-reports-which-do-not-use-English |

(0) |

(1) |

(4) |

(0) |

(0) |

(5) |

|

Number-of-samples |

52 |

24 |

3 |

1 |

32 |

112 |

|

Years-observed |

8 years |

|||||

|

Available-research-sample |

416 |

192 |

24 |

8 |

256 |

896 |

The sample in this study uses companies engaged in the technology sector listed in the stock exchange of ASEAN-5 from 2011 to 2018, as seen in Table 1. These nations are Singapore (SGX), Thailand (SET), Indonesia (IDX), Philippines (PSE), and Malaysia (BM). The technology sector was chosen because currently ASEAN countries tend to move in the electronics sector as the main source of export and import activities. The type of data used is qualitative and quantitative data.

3.3. Research Method

The content analysis method is employed in collecting the ICD scores. The data analysis technique used in this study is Ordinary Least Square (OLS) analysis. Multiple linear regression is used because this study has more than one independent variable. The classic assumption test used in this research is the multicollinearity and heteroscedasticity test. Normality test was not carried out in this study because data having n> 30 (large sample) can be assumed to have normal distribution. The autocorrelation test was not carried out in this study because the autocorrelation test was only used for time-series data (Gujarati, 2012), while the data used in this study were panel data. The model selection is done by conducting the Chow test, the Breusch-Pagan test, and the Hausman test. The Chow Test is used to choose the best between common effect models and FEM. The Breusch-Pagan Test is used to choose the best between the common effect model and REM. The Hausman test is used to choose the best between REM and FEM (Gujarati, 2012). The results of the Hausman test will determine the panel data regression that will be used.

The study employs panel data regression with a random effect model to test the accounting-based performance-related hypotheses, and Weighted Least Squares (WLS) model to test hypotheses related to market-based performance. The use of random effect models indicates that the residual variable is thought to have a relationship between individuals (cross section) and between time (time series). In other words, REM is used to assume errors that are random. Meanwhile, OLS method is known to be vulnerable to the influence of data outliers. Therefore we need another method that is robust or resistant to the influence of outliers. The robust method is WLS. The random effect model can overcome the weakness of the fixed-effect model, which uses dummy variables, therefore achieving a more efficient and unbiased result. The random effect shows the specific role of individual firms, where each one has a different intercept (Mourshed & Quddus, 2009). Besides, WLS is capable of neutralizing the consequences of violating the heteroscedasticity assumption (Mustafa et al., 2015). Furthermore, testing is carried out to determine the feasibility of the model and ensure that the coefficients are estimated according to the theories or hypotheses prepared. This test includes the coefficient of determination (R2), the overall regression coefficient test (F-test), and the partial regression coefficient test (t-test). R2, also called as the Goodness of Fit, functions to describe the magnitude of the variation of the dependent variable that can be explained by the independent variable, the F-test was carried out to show the effect of the independent variables together (simultaneously) on the dependent variable, and the t-test was conducted to determine the significant effect of each independent variable on the dependent variable.

3.4. Variable Measurement

Table 2 (see p. 288) displays the dependent, independent, and concomitant variables in this study. The data source is secondary data extracted from the annual reports of firms observed in the study, and Bloomberg.

Table 2. Variable measurement

|

Variable |

Measurement |

|

Non-Discretionary Net Income (NDNI) |

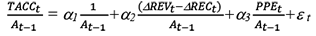

The difference from net income with DA Subramanyam (1996), Siregar & Utama (2008), and Suprianto & Setiawan (2018) used DA obtained from decomposing the total accruals into components of discretionary and non-discretionary, using the Jones (1991) model. DA is the residuals of total accruals.

where: TACCt = Total accruals in year t divided by total assets in year t-1 ΔREVt = Revenues in year t minus revenues in year t-1 ΔRECt = Delta revenues in year t minus delta net receivables in year t-1 PPEt = Gross Property plant and equipment in year t At-1 = Total Assets in year t-1 α1, α2, and α3 = Parameters ε t = Residual in year t |

|

Cash Flow Operations (CFO) |

Net cash flows from operating activities reported in the Statement of Cash Flows |

|

Tobin‘s Q |

Amount of total debt and total market capitalization scaled by total asset |

|

Market-to-Book Ratio (MBR) |

Total market capitalization scaled by total equity |

|

Intellectual Capital Disclosure (ICD) |

ICD measured through 57 components using a scaled scoring system of 0-3, where: 0: no disclosure 1: disclosure in a narrative form 2: disclosure in a numerical form 3: disclosure in a monetary (currency) form |

|

Board Independence (BIND) |

Total number of independent boards |

|

Board Size (BSIZE) |

Total number of boards |

|

Board Gender (BGEN) |

Percentage of women in the total number of boards |

|

Firm Size (SIZE) |

Natural logarithm of total assets |

|

Firm Leverage (LEV) |

Total debt over total equity |

3.5. Research Model

The dependent variables are accounting-based and market-based performance, while the independent variables are ICD and CG. Additional analysis is done by adding concomitant variables, SIZE and LEV, to strengthen the relationship between the two independent variables toward firm performance.

Research problem (RQ1) used in this study can be reflected in hypotheses 1a, 1b, 1c, 2a, 2b, 2c, 5a, 5b, 5c, 6a, 6b, and 6b, which focus on accounting-based performance that are measured using NDNI and CFO. To answer RQ1, Model 1 and Model 2 are used as follows:

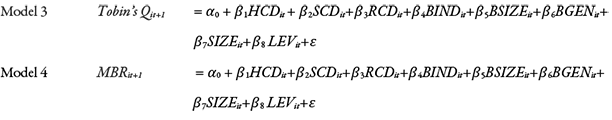

Meanwhile, research problem (RQ2) in this study can be reflected in hypotheses 3a, 3b, 3c, 4a, 4b, 4c, 7a, 7b, 7c, 8a, 8b, 8c, which focus on market-based performance measured with Tobin’s Q and MBR. To answer RQ2, it used Model 3 and Model 4, which can be stated as follows:

4. Empirical-Results

4.1. Descriptive Analysis

Table 3 exhibits the order of ICD percentage, from the highest to the lowest, namely Indonesia, Malaysia, Singapore, Thailand, and the Philippines. The ICD mean shows the average amount of IC disclosures made by companies per country for 8 years. The highest yield is owned by Indonesia, which is 1.32. This might be because the sample used in Indonesia consisted of only 3 companies and all of them had done the ICD well. The lowest yield is owned by Philippines, which is 0.18, however, this is because the Philippines sample only consists of 1 company, so there is no other comparison to evenly distribute ICD results in Philippine companies. The HCD, SCD, and RCD mean shows the average amount of HC, SC, and RC disclosures made by companies per country for 8 years. As seen from the percentage of HCD, SCD, and RCD, Singapore, Thailand, Indonesia, and Malaysia have nearly-equal-percentages, whereas the Philippines has an HCD percentage that is much higher than its SCD and RCD. Singapore has the highest-HCD, followed by Indonesia and the Philippines, while Thailand and Malaysia own the highest RCD. On average, HCD is the highest, with RCD and SCD after that.

Table-3. Extent-of-ICD-(8-years)

|

|

n |

ICD-Mean |

SD |

% |

HCD-Mean |

SD |

% |

SCD-Mean |

SD |

% |

RCD-Mean |

SD |

% |

|

Singapore |

52 |

0.78 |

0.85 |

33 |

0.8 |

0.79 |

34 |

0.78 |

0.82 |

33 |

0.77 |

0.98 |

33 |

|

Thailand |

24 |

0.75 |

0.77 |

33 |

0.75 |

0.84 |

33 |

0.73 |

0.77 |

32 |

0.78 |

0.63 |

35 |

|

Indonesia |

3 |

1.32 |

0.77 |

33 |

1.39 |

0.82 |

35 |

1.3 |

0.76 |

33 |

1.28 |

0.66 |

32 |

|

Philippines |

1 |

0.18 |

0.48 |

33 |

0.32 |

0.64 |

58 |

0.07 |

0.25 |

12 |

0.16 |

0.37 |

30 |

|

Malaysia |

32 |

0.79 |

0.77 |

33 |

0.77 |

0.76 |

32 |

0.77 |

0.73 |

32 |

0.85 |

0.85 |

35 |

Tables 4 to 6 contain ICD items that are compiled from several research papers by Nimtrakoon (2015), Zéghal (2015), Cabrita et al. (2017) and Yang (2018). The-disclosure column-in these tables indicates how often a firm discloses IC. It can be seen that the country with the most ICD is-Indonesia, while the Philippines has the lowest ICD percentage. Results-show that-the most disclosed items in HCD are benefits and bonuses to employees, which means that sample firms have given bonuses proportionate to the benefits their employees have provided them. For SCD and RCD, the most disclosed items are a system of auditing and internal control, and customers. It proves that the ASEAN-5 have-an audit system and internal control that supports the performance of a firm and has built a good relationship with customers.

Table-4. Items-of-HCD

|

|

Singapore |

Thailand |

Indonesia |

Philippines |

Malaysia |

|

|

|

Items |

disc. |

disc. |

disc. |

disc. |

disc. |

|

HCD1 |

Education |

83.65% |

43.75% |

100% |

100% |

84.77% |

|

HCD2 |

Know-how |

97.12% |

96.35% |

100% |

100% |

93.75% |

|

HCD3 |

Work-related-knowledge |

80.53% |

93.75% |

100% |

100% |

94.14% |

|

HCD4 |

Academic-qualifications |

97.12% |

76.04% |

100% |

0% |

44.53% |

|

HCD5 |

Professional qualifications |

82.69% |

62.50% |

100% |

25% |

63.28% |

|

HCD6 |

Value-added-by-employee |

41.35% |

20.31% |

58.33% |

0% |

35.94% |

|

HCD7 |

Training |

89.90% |

94.79% |

100% |

100% |

99.22% |

|

HCD8 |

Competences |

84.62% |

35.42% |

100% |

0% |

84.38% |

|

HCD9 |

Number-of-Employees |

56.25% |

69.79% |

100% |

0% |

16.41% |

|

HCD10 |

Employee-diversity |

50% |

59.38% |

100% |

0% |

71.48% |

|

HCD11 |

Employee-relation |

44.95% |

42.71% |

100% |

0% |

33.20% |

|

HCD12 |

Employee-attitudes |

24.04% |

36.98% |

95.83% |

0% |

42.97% |

|

HCD13 |

Employee-motivation |

92.42% |

47.92% |

100% |

0% |

91.37% |

|

HCD14 |

Labor-turnover-rate |

13.70% |

38.02% |

87.50% |

0% |

8.24% |

|

HCD15 |

Employee-productivity |

34.86% |

21.88% |

100% |

0% |

50.20% |

|

HCD16 |

Employee-development |

71.63% |

54.45% |

100% |

0% |

80.86% |

|

HCD17 |

Employee flexibility |

48.56% |

22.40% |

12.50% |

0% |

27.45% |

|

HCD18 |

Absenteeism-rate |

44.95% |

16.67% |

0% |

25% |

34.38% |

|

HCD19 |

Employee-social-activities |

34.13% |

92.71% |

100% |

0% |

69.53% |

|

HCD20 |

Employee-features |

28.61% |

2.08% |

100% |

0% |

50.78% |

|

HCD21 |

Employee-bonuses |

99.28% |

98.44% |

100% |

100% |

96.88% |

|

HCD22 |

Professional-experience |

98.80% |

55.21% |

100% |

0% |

75.39% |

|

HCD23 |

Employment-safety |

33.41% |

73.96% |

100% |

25% |

78.91% |

Table-5. Items-of-SCD

|

|

Singapore |

Thailand |

Indonesia |

Philippines |

Malaysia |

|

|

|

Items |

disc. |

disc. |

disc. |

disc. |

disc. |

|

SCD1 |

Intellectual-property |

38.22% |

65.10% |

95.83% |

0% |

42.19% |

|

SCD2 |

Corporate-culture |

84.62% |

59.38% |

100% |

0% |

65.63% |

|

SCD3 |

IT-systems |

68.51% |

60.42% |

95.83% |

0% |

86.33% |

|

SCD4 |

Networking-systems |

86.78% |

100% |

100% |

0% |

92.97% |

|

SCD5 |

Management-process |

93.51% |

69.27% |

70.83% |

0% |

78.52% |

|

SCD6 |

Management-philosophy |

77.88% |

53.13% |

100% |

13% |

78.52% |

|

SCD7 |

Financial-relations |

96.63% |

81.25% |

100% |

25% |

76.95% |

|

SCD8 |

Organization-structure |

53.85% |

61.64% |

100% |

0% |

63.28% |

|

SCD9 |

Energy-usage |

35.34% |

28.65% |

100% |

0% |

29.69% |

|

SCD10 |

R&D |

67.31% |

63.02% |

75% |

0% |

84.77% |

|

SCD11 |

Customer-support-function |

29.33% |

28.13% |

100% |

0% |

33.20% |

|

SCD12 |

Quality-management |

51.44% |

50% |

95.83% |

0% |

45.31% |

|

SCD13 |

Accreditations- (certificate) |

73.32% |

53.65% |

100% |

0% |

83.98% |

|

SCD14 |

Evaluation-of-performance-systems |

51.92% |

85.94% |

95.83% |

0% |

58.20% |

|

SCD15 |

Installation-and-Dismantle- (I&D) |

61.54% |

35.42% |

91.67% |

0% |

35.16% |

|

SCD16 |

Market-share |

31.97% |

50.52% |

100% |

0% |

56.23% |

|

SCD17 |

Number-of-projects |

73.56% |

40.10% |

100% |

0% |

77.34% |

|

SCD18 |

Knowledge-sharing |

38.94% |

38.02% |

100% |

0% |

66.02% |

|

SCD19 |

Auditing-and-internal-control |

91.83% |

98.44% |

100% |

100% |

97.27% |

|

SCD20 |

Number-of-accidents |

6.73% |

42.19% |

12.50% |

0% |

23.44% |

Table-6. Items-of-RCD

|

|

Singapore |

Thailand |

Indonesia |

Philippines |

Malaysia |

|

|

|

Items |

disc. |

disc. |

disc. |

disc. |

disc. |

|

RCD1 |

Brands |

46.88% |

52.60% |

100% |

0% |

57.03% |

|

RCD2 |

Customers |

99.52% |

98.44% |

100% |

0% |

99.61% |

|

RCD3 |

Company-reputation |

26.68% |

66.15% |

100% |

0% |

62.11% |

|

RCD4 |

Customer-satisfaction |

16.11% |

76.56% |

91.67% |

0% |

35.94% |

|

RCD5 |

Customer-loyalty |

9.62% |

67.19% |

45.83% |

100% |

50.39% |

|

RCD6 |

Distribution-channels |

62.98% |

69.79% |

91.67% |

0% |

76.56% |

|

RCD7 |

Business-collaboration |

63.70% |

63.54% |

91.67% |

0% |

86.33% |

|

RCD8 |

Licensing-agreements |

54.81% |

42.19% |

100% |

25% |

60.94% |

|

RCD9 |

Customer-relation |

53.37% |

61.78% |

100% |

0% |

56.64% |

|

RCD 10 |

Stakeholders-relation |

75.24% |

98.44% |

100% |

0% |

67.19% |

|

RCD 11 |

Company‘s-growth |

91.35% |

87.50% |

100% |

100% |

100% |

|

RCD 12 |

Company-awards |

34.13% |

68.23% |

100% |

0% |

76.56% |

|

RCD 13 |

Public-relation |

24.28% |

69.27% |

100% |

0% |

7.81% |

|

RCD 14 |

Suppliers-relations |

31.01% |

52.60% |

100% |

0% |

51.56% |

Table 7 illustrates the classic assumption and data panel test. The test is done by first testing the robust standard errors. The goodness of fit test uses data panel regression, which is a random-effect model and WLS model. Table 7 proves that no variable passes the heteroscedasticity-test, as all variables have Chi-square-values >0.05. NDNI and CFO have a p-value from the Hausman test >0.05; thus, the model should use the random-effect model. At the same time, Tobin‘s Q and MBR-have p-value from Hausman test <5%, so the model is fixed-effect. However, both also have heteroscedasticity problems; accordingly, the most appropriate model is WLS.

Table 7. Ordinary-Least-Squares Robustness-Panel-Model-Tests

|

|

NDNI |

CFO |

Tobin‘s Q |

MBR |

|

Heteroskedasticity (p-value-from-chi-square) |

0.000 |

1.08E-03 |

0.000 |

0.000 |

|

Fixed-Estimator-(p-value) |

4.10E-74 |

4.73E-28 |

2.31E-87 |

1.48E-07 |

|

Breusch-Pagan-Test-(p-value) |

5.43E-136 |

4.08E-41 |

1.37E-153 |

0.0004 |

|

Hausman-Test-(p-value) |

0.769934 |

0.0552738 |

0.0455344 |

4.43E-07 |

|

Summary |

Random-Effect |

Random-Effect |

Weighted-Least-Square |

Weighted-Least-Square |

Notes : statistical significance is at the following levels: ***1%, **5%, *10%

Table 8 shows the mean, standard deviation, minimum, and maximum-values of the variables used in this study. HCD results show a mean value of 0.778 and standard deviation value of 0.241, which means that most of the companies disclosed in a narrative form. The highest HCD is 1.522 owned by MTDL (IDX) and the lowest is 0 owned by HANA (SET). On the other side, SCD results show a mean and standard deviation value of 0.762 and 0.263. It means that SCD was mostly disclosed in a narrative form. The highest SCD is 1.45 owned by THCOM (SET) and EXCL (IDX) in 2015, while the lowest is 0.05 owned by the HANA (SET) and IMP (PSE). RCD has a mean value of 0.787 and standard deviation value of 0.272. Just as HCD and SCD, it means that RCD was also mostly disclosed in a narrative form. The highest RCD is 1.714 owned by SAMART (SET) in 2014, while the lowest is 0 owned by HANA (SET). BIND in this study has a mean value of 0.461 and a standard deviation of 0.154. This shows that the average number of independent boards is 46.1% of all independent board members. The highest number of BIND was 0.917 owned by T39 (SGX) in 2012, while the lowest BIND was 0 owned by C76 (SGX) in 2011 and J03 (SGX) in 2011 - 2012. On the other hand, BSIZE in this study has a mean value of 7.161 and a standard deviation of 2.007. This means that the average number of boards owned by the sample companies is 7 people. The highest number of BSIZE was 14 owned by E16 (SGX) companies in 2011 - 2012 and INET (SET) companies in 2011, while the lowest BSIZE was 3 owned by 5BI (SGX) companies in 2017. The mean and standard deviation of BGEN in this study were 0.102 and 0.115, respectively. This indicates that the average proportion of women on board in the sample companies is 10.2%. The highest value of BGEN is 0.857 owned by TIMECOM (BM) companies in 2014, while the lowest value of BGEN is 0, which is dominated by Singapore and Malaysia state companies.

Table 8. Descriptive-Statistics-of-Research-Variables

|

Variable |

Mean |

S.D. |

Min |

Max |

|

HCD |

0.778 |

0.241 |

0 |

1.522 |

|

SCD |

0.762 |

0.263 |

0.05 |

1.45 |

|

RCD |

0.787 |

0.272 |

0 |

1.714 |

|

BIND |

0.461 |

0.154 |

0 |

0.917 |

|

BSIZE |

7.161 |

2.007 |

3 |

14 |

|

BGEN |

0.102 |

0.115 |

0 |

0.587 |

|

NDNI |

0.032 |

0.293 |

-1.729 |

1.603 |

|

CFO |

0.059 |

0.219 |

-3.392 |

1.070 |

|

Tobin‘s-Q |

1.229 |

1.455 |

0.138 |

19.316 |

|

MBR |

1.864 |

3.974 |

-43.964 |

35.453 |

|

LEV |

0.542 |

1.321 |

-13.847 |

11.344 |

|

SIZE |

12.167 |

0.712 |

10.074 |

14.663 |

Table 9. Coefficient of Correlations Matrix

|

Correlations Matrix |

||||||||||||

|

|

HCD |

SCD |

RCD |

BIND |

BSIZE |

BGEN |

SIZE |

LEV |

Model 1 NDNIt+1 |

Model 2 CFO t+1 |

Model 3 Tobin‘s Q t+1 |

Model 4 MBR t+1 |

|

HCD |

1 |

|

|

|

|

|

|

|

|

|

|

|

|

SCD |

.579*** |

1 |

|

|

|

|

|

|

|

|

|

|

|

RCD |

.585*** |

.572*** |

1 |

|

|

|

|

|

|

|

|

|

|

BIND |

-.002 |

.058 |

-.021 |

1 |

|

|

|

|

|

|

|

|

|

BSIZE |

.032 |

-.113*** |

.132*** |

-0.21*** |

1 |

|

|

|

|

|

|

|

|

BGEN |

-.063 |

.010 |

.133*** |

-.266*** |

.011 |

1 |

|

|

|

|

|

|

|

SIZE |

.227*** |

0.07* |

.377*** |

-.016 |

.332*** |

.206*** |

1 |

|

|

|

|

|

|

LEV |

-.026 |

.005 |

.046 |

.016 |

-.007 |

.010 |

.046 |

1 |

|

|

|

|

|

NDNIt+1 |

.036 |

-.049 |

.076* |

-.008 |

-.015 |

-.062 |

.102*** |

.025 |

1 |

|

|

|

|

CFOt+1 |

.034 |

-.032 |

0.065* |

-.028 |

.082* |

-.092** |

.256*** |

0.064* |

.411*** |

1 |

|

|

|

Tobin‘sQt+1 |

-0.061* |

-.020 |

-.053 |

-.017 |

.123*** |

-0.059* |

-.056 |

-.142*** |

.012 |

-.093*** |

1 |

|

|

MBRt+1 |

-.037 |

-.017 |

0.062* |

.013 |

.077* |

-.036 |

.072** |

.119*** |

.578*** |

.047 |

.578*** |

1 |

|

*** Correlation is significant at the 0.01 level (2-tailed). ** Correlation is significant at the 0.05 level (2-tailed). * Correlation is significant at the 0.1 level (2-tailed). |

||||||||||||

Meanwhile, NDNI results show a mean value of 0.032 and a standard deviation value of 0.293. It means that the average actual profit that is independent from the influence of EM on the sample companies is equal to 3.2%. The highest number of NDNI is 1.603 owned by ADVANCE (SET) in 2014, while the lowest NDNI is -1.729 owned by JAS (SET) -in 2016. CFO in this study has a mean and standard deviation of 0.059 and 0.219. This shows that the average ability of assets to generate operating cash flows in the sample companies is 5.9%. The highest CFO is 1.07 owned by AWX (SGX) companies in 2017. This means that in this study, the highest peak non-accrual profit was owned by AWX companies in 2017. The lowest CFO is -3.392 owned by DIGISTA companies ( BM) in 2013. Then, the mean and standard deviation for Tobin’s Q were 1.229 and 1.455. This value illustrates that the company is valued the same as the value of the listed company with the value of the company in the market. The highest value is 19.316 owned by 5NK (SGX) in 2011, while the lowest of Tobin’s Q is 0.138 and owned by TIMECOM (BM) in 2016. Table 8 also shows that the mean and standard deviation of MBR were 1.864 and 3.974. The highest value of MBR is 35.453 owned by 5NK (SGX) in 2011 and BKY (SGX) in 2013, while the lowest of MBR is -43.964 owned by 5NK (SGX) in 2016.

LEV results in this study have a mean value of 0.542 and a standard deviation of 1.321. This means that companies in ASEAN-5 use funding from debt amounting to 54.2% of total equity. This is consistent with the results of research showing that most sample companies have a high amount of LEV. Thus, it can be seen that more companies use LEV for corporate funding compared to equity. The highest LEV is owned by BBW (SGX) in 2015, with a value of 11.344. The lowest LEV is owned by 5NK (SGX) companies in 2017, with a value of -13.847. This negative result is due to the fact that in 2017 the company suffered a loss so that the company‘s total capital was negative. SIZE has mean and standard deviations of 12.167 and 0.712. Thus, it can be seen that the average natural logarithm of the company‘s total assets is 12.17, whose value is equivalent to 1,469,090,808,239 rupiahs. The maximum value of SIZE is 14.663 owned by the company Z74 (SGX) in 2017, the value of which is equivalent to 460,776,323,189,952 rupiahs, while the minimum value of SIZE is 10.074 owned by the 5NK (SGX) company in 2011, which is equivalent to 11,860,075,649 rupiahs. The regression test in Table 10 shows that the coefficient of determination (R2) is 2.84% for NDNI, 9.55% for CFO, 21.51% for Tobin‘s Q, and 22.51% for MBR. This shows that the independent variables of this study (HCD, SCD, RCD, BIND, BSIZE, BGEN) are able to explain 2.84% of NDNI variables, 9.55% of CFO variables, 21.51% of Tobin‘s Q variables, and 22.51% of MBR variables, while the remaining 97.16% (NDNI), 90.45% (CFO), 78.49% (Tobin‘s Q), and 77.49% (MBR) are influenced by other variables outside the study.

Table 9 shows the results of the correlation coefficient between variables, using the Pearson Correlation Matrix. It can be seen that the coefficients are in an acceptable range (Gujarati, 2012), indicating that the variables used in the study did not experience multicollinearity problems. The results show that control variables (LEV and SIZE) have a positive relationship with NDNI, CFO, and MBR. This is in line with Mokhtar‘s (2017) study, which revealed that companies with high LEV are expected to disclose more information to increase public trust in companies. This indicates that debt can also have a positive effect on earnings due to public confidence that the company is able to manage their cash well (Dalci, 2018). Related to SIZE, Nimtrakoon (2015) states that larger companies have more resources than smaller companies, which means that the greater the size of a company, the greater the company‘s access to enter the capital market. In addition, the large size of the company that continues to experience growth can reflect the level of profitability of the company in the future.

4.2. Hypotheses-Testing-and-Discussions

The summary of the study can be seen in Table 10, showing the early hypotheses and their correlation with t-test results, and also whether a hypothesis is accepted or not. The p-values of the Durbin Watson tests show that the errors in Random Effect Models (or Generalized Least Square) have no autocorrelation problem. Moreover, the panel regression model may have heteroscedastic as well as correlation problems. Hence, weighted least squares (WLS) model is an alternative to solve the problems (Zyl & Schall, 2012).

Based on the regression result, it was found that HCD has no significant relationship with NDNI; thus, hypothesis 1a is rejected. The result runs counter to the findings of Salehi et al. (2014), in which there is a significant relationship between firm performance and HCD. It signifies that human resources in ASEAN nations only have a small role in affecting firm profitability, which may be caused by the lack of HC disclosure in all five countries.

At the same time, SCD and RCD are found to have a significant relationship with NDNI, and so hypotheses 1b and 1c are accepted. The result proves that SCD negatively affects NDNI. Several studies discovered that the research and development factor in SCD impacts firm performance (Scafarto et al., 2016). Hence, the negative association between SCD and NDNI might be caused by R&D cost in ASEAN-5, which is higher than the increase in profit. The influence of RCD towards NDNI is found in a positive sign. It is in line with Jordão and Almeida (2017) and Cheng et al. (2010), both of whom found that the higher the costs incurred to maintain relationships with customers, the higher the positive impact on firm performance. Additionally, using a data survey, a study found that RCD consistently has a positive impact on firm performance (Mention & Bontis, 2013). It implies that firms in ASEAN manage to preserve a strong relationship with their customers, improve their loyalty towards the firm, and eventually increase NDNI.

In this research, ICD is not found to have a significant influence on CFO. For this reason, hypotheses 2a, 2b, and 2c are all rejected. Inefficient training activities in a firm may cause an insignificant relationship. The result corresponds to the findings by Boujelben and Fedhila (2011) and Hejazi et al. (2016) but does not fit Rahman (2012), Joshi et al. (2013), Kiattikulwattana (2014) and Lopes et al. (2016) findings, who stated that there is a positive relationship between ICD and CFO.

Based on the regression test result, HCD and SCD have significant relationships with Tobin‘s Q, so hypotheses 3a and 3b are accepted. On the contrary, there is no significant relation between RCD and Tobin’s Q, which means hypothesis 3c is rejected. The findings do not match Nadeem et al. (2017), who found a positive relation between RCD and Tobin‘s Q. The influence of HCD towards Tobin‘s Q is negative and significant. It is similar to Hamdan (2018), who used Tobin‘s Q as a measurement to find that firms with a high rate of HCD will reach lower market-based performance. In theory, a firm with good HCD will have high productivity, earnings, and market value (Hejazi et al., 2016). Test result demonstrates that employee competence is more often disclosed compared to employee commitment; accordingly, a highly competent employee with low commitment will negatively affect firm performance. Nadeem et al. (2017) also supported the significant positive influence of SCD towards Tobin‘s Q.

The relationship between HCD and MBR is negative and significant, with a significance rate <1%, so hypothesis 4a is accepted. It is possibly due to the ineffectiveness of training and the development programs in creating the market value. There is an indication that costs incurred by training and compensating employees are not proportional to expected market-based performance output. The relationship between SCD and market-based performance is not significant; hence, hypothesis 4b is rejected, indicating the organization structure‘s inability to support employee performance in creating an excellent market performance. The result contradicts Inkinen (2015) and Nimtrakoon (2015), both of whom found a positive relationship between ICD and firm performance. Lastly, the link between RCD and MBR is positive and significant, with a significance rate below 1%, so hypothesis 4c is accepted.

The results from the relationship between CG – which consists of BIND, BSIZE, and BGEN – and NDNI indicate there is no significant relationship between them, and therefore, hypotheses 5a, 5b, and 5c are rejected. It suggests that the CG of ASEAN firms is still incapable of resolving information asymmetry, preventing EM, and so could not generate a good NDNI. Daghsni et al. (2016) identified negative relationships between BIND, BSIZE, and BGEN with NDNI, while Buniamin et al. (2012) found a negative link between BGEN and NDNI, but detected no relationship between BIND and NDNI.

The result also shows that BIND and BSIZE have insignificant relationships with CFO, and as a result, hypotheses 6a and 6b are rejected. It implies that BIND and BSIZE are ineffective in controlling management and thus do not significantly influence CFO, which corresponds with the findings of Nagar and Raithatha (2016). However, BGEN harms CFO, so hypothesis 6c is accepted. It supports Buniamin et al. (2012), who suggested that a higher number of women on board can raise DA and reduce CFO, as the link between DA and CFO is negative.

This study demonstrates that the relationship between BIND and Tobin‘s Q is not significant; therefore, hypothesis 7a is rejected. The lack of board meetings causes the company not to focus on the crucial problems at hand (e.g., EM practices) and pay less attention to management planning (Mishra & Kapil, 2018). The BSIZE has a significant favorable influence on Tobin‘s Q; thus, hypothesis 7b is accepted. It means that more board members in a company may help increase market-based performance since there would be more parties responsible for the company. The result is consistent with Siddiqui (2015), Singh et al. (2017), and Mishra and Kapil (2018), who found a positive relation between BSIZE and market-based performance when measured with Tobin‘s Q; yet it does not fit Kumar and Singh‘s (2013) study, which showed a negative link between BSIZE and Tobin‘s Q. Besides, BGEN has a significant negative influence on Tobin‘s Q, so hypothesis 7c is accepted. It is due to the lack of women on board in the research sample. The finding contradicts Siddiqui (2015), who argued that BGEN positively influences MBR.

As with Tobin‘s Q, the relationship between BIND and MBR is not significant; thus, hypothesis 8a is rejected. The result is against the finding by Kumari and Pattanayak (2017), who stated a positive connection between BIND and market performance. However, BSIZE and MBR demonstrate a significant positive relationship, which means hypothesis 8b is accepted. The finding agrees with Ahmed-Sheikh et al. (2013), who stated a positive association between BSIZE and MBR. Additionally, the relationship between BGEN and MBR is negative and significant; therefore, hypothesis 8c is accepted. The result contradicts Fidanoski et al. (2014) and Anifowose et al. (2017), who found a positive association between BGEN and the firm‘s share price.

The results of this research show that the associations between SIZE with NDNI and Tobin‘s Q are rejected. The SIZE of a company does not affect the cause of information asymmetry and is not capable of illustrating the company‘s fundamental aspects or how the market perceives the company. The relation between SIZE and CFO and MBR is accepted. SIZE influences the company‘s financial practices, so larger firms can increase their CFO and MBR. Furthermore, the connection between LEV and NDNI is accepted with a negative relationship, where a high LEV will decrease information asymmetry. Meanwhile, the relations between LEV and CFO, Tobin‘s Q, and MBR are rejected. These contradict Memon et al. (2018), who found negative impact of LEV towards CFO, Tobin‘s Q, and MBR.

In the panel data, there are two model categories: The model with individual effects (fixed and random effect) and the model without individual effects (common effect). The most appropriate panel models for NDNI and CFO are the random effect models. Hence, NDNI and CFO have individual roles which can be observed through the difference of constants per unit for each individual, whereby the constants demonstrate the ability of the prediction model that is used in the study on sample firms. Table 11 displays the list of companies from the five sample countries with the lowest residual values. It is found that the five companies have similar CG characteristics, with large BSIZE numbers and small BGEN numbers. It implies that the firm’s BSIZE is large and dominated by males. Conversely, the lowest residual value based on the difference of prediction value and actual CFO has small BIND. From the five sample nations, the NDNI model prediction gives the most robust result on B26 and SGX. The CFO model prediction granted a strong result to PENTA and BM since its residual values are the lowest.

Table-10. Hypotheses-and-Regression-Results

|

Variable |

NDNI |

Hypotheses |

CFO |

Hypotheses |

Tobin‘s Q |

Hypotheses |

MBR |

Hypotheses |

|

Constant |

-0.260 |

|

-1.175*** |

|

0.437 |

|

-1.484*** |

|

|

HCD |

0.000 |

H1a rejected |

-0.042 |

H2a |

-0.284*** |

H3a |

-0.834*** |

H4a |

|

SCD |

-0.147** |

H1b |

-0.043 |

H2b |

0.152* |

H3b |

0.139 |

H4b |

|

RCD |

0.131* |

H1c |

-0.004 |

H2c |

0.005 |

H3c |

0.759*** |

H4c |

|

BIND |

-0.055 |

H5a |

-0.097 |

H6a |

0.145 |

H7a |

0.005 |

H8a |

|

BSIZE |

-0.006 |

H5b |

-0.007 |

H6b |

0.083*** |

H7b |

0.127*** |

H8b |

|

BGEN |

-0.028 |

H5c |

-0.044*** |

H6c |

-0.085*** |

H7c |

-0.221*** |

H8c |

|

SIZE |

0.031 |

Rejected |

0.116*** |

Accepted |

0.002 |

Rejected |

0.162*** |

Accepted |

|

LEV |

-0.015* |

Accepted |

0.005 |

Rejected |

-0.017 |

Rejected |

0.085 |

Rejected |

|

F-test & Asymptotic test Statistic-(p-value) |

0.0963685 |

2.97759E-07 |

1.78E-36 |

1.42E-38 |

||||

|

Durbin Watson (p-values) |

2.0667 (0.87293) |

2.0698 (0.90346) |

– |

- |

||||

|

Adjusted- |

0.0283461 |

0.0955486 |

0.215065 |

0.22507 |

||||

Notes: statistical significance is at the following levels: ***1%, **5%, *10%

Table-11. Individual-Effect-Intercepts

|

|

Company |

Country |

Alpha |

Per-Unit-Constant |

Predicted-Value |

Actual-Value |

Residual-Value |

|

|

NDNI |

MIN |

B26 |

Singapore |

-0.25979 |

-0.01641 |

0.02877 |

0.02872 |

0.00005 |

|

NDNI |

MIN |

KCE |

Thailand |

-0.25979 |

-0.27990 |

-0.21155 |

-0.21342 |

0.00187 |

|

NDNI |

MIN |

MTDL |

Indonesia |

-0.25979 |

0.02210 |

0.06316 |

0.06533 |

0.00217 |

|

NDNI |

MIN |

IMP |

Philippines |

-0.25979 |

-0.03658 |

-0.01690 |

-0.01562 |

0.00128 |

|

NDNI |

MIN |

EDARAN |

Malaysia |

-0.25979 |

0.00675 |

-0.01213 |

-0.01333 |

0.00120 |

|

CFO |

MIN |

S558 |

Singapore |

-1.17482 |

0.05669 |

0.13807 |

0.13844 |

0.00037 |

|

CFO |

MIN |

MFEC |

Thailand |

-1.17482 |

-0.00285 |

0.05962 |

0.05931 |

0.00031 |

|

CFO |

MIN |

EXCL |

Indonesia |

-1.17482 |

-0.05118 |

0.17881 |

0.17752 |

0.00129 |

|

CFO |

MIN |

IMP |

Philippines |

-1.17482 |

-0.01368 |

-0.01583 |

-0.01493 |

0.00090 |

|

CFO |

MIN |

PENTA |

Malaysia |

-1.17482 |

0.09929 |

0.08689 |

0.08682 |

0.00007 |

5. Conclusion, Limitations, and-Suggestions

This-study-aims-to-provide-the-empirical-results-on-ICD, CG, and firms’ performances of 112 listed companies in ASEAN-5, particularly from the technology sector. The study discovers the significant effect between ICD components and CG on firms‘ performances variously. The regression result shows that RCD has a significant positive effect on NDNI, while SCD is negatively significant to NDNI. ICD does not have any significance on CFO. In addition, BGEN has a significant negative impact on CFO, yet it is negatively insignificant on NDNI. RCD is the only ICD component that can raise the market value, especially MBR, while HCD consistently lowers MBR and Tobin‘s Q values. BSIZE is found to hold a significant positive influence on Tobin‘s Q, and BGEN has a significant adverse effect on MBR. BIND has no role in influencing market-based performance, but it is significant in reducing the NDNI score. In building this relationship, the one significant concomitant variable for most regression models is SIZE; LEV is only significant when measuring NDNI. For external parties, these results imply that NDNI, CFO, Tobin’s Q, and MBR are components that stakeholders can rely on in valuing firm performances and also be used by the investors as a consideration in making investment decisions. The stakeholders need information regarding companies‘ activities in developing intangible assets. As for internal parties, such as companies, these results imply that ICD and CG are the two main components that have a significant effect on firm performance. Hence, disclosure and application of ICD and CG need to be maximized.

The study has several limitations. First, the samples are limited to the stock exchanges of ASEAN-5. Second, the research is only limited to the technology subsector within the sector of the technological industry. They are also limited to the ones that have annual reports in English. Third, the study discusses CG only on BIND, BSIZE, and BGEN. Future studies may enlarge the research samples by adding other Asian countries or grouping the countries in the emerging market. It may enrich the empirical results in ICD and CG topics. Furthermore, accounting-based performance should also be discussed more extensively. Finally, there are still many more CG factors other than BIND, BSIZE, and BGEN, which can be added as variables in the subsequent studies. Fourth, there is the unavailability of annual reports and the use of non-international languages. Fifth, there is only one sample in the Philippines that meets the sample criteria. Sixth, this study does not distinguish developed countries and emerging countries in ASEAN - 5. Seventh, the number of sample companies per country is not balanced. Thus, further research is expected to conduct research by classifying ASEAN-5 into the categories of developed and emerging countries. In addition, further research is expected to use research samples with balanced proportions.

References

Abdallah, S. (2018), External auditor type, discretionary accruals and investors’ reactions, Journal of Accounting in Emerging Economies, 8(3), 352-368.

Ahmed-Sheikh, N., Wang, Z., & Khan, S. (2013). The impact of internal attributes of corporate governance on firm performance: evidence from Pakistan. International Journal of Commerce and Management, 23(1), 38-55.

Alfraih, M. M. (2018). Intellectual capital reporting and its relation to market and financial performance. Journal of Ethics and Systems, 34(3), 266-281.

An, Y., Davey, H., & Eggleton, I. R. (2011). Towards a comprehensive theoretical framework for voluntary IC disclosure. Journal of Intellectual Capital, 12(4), 571-585.

Anderson, A., & Gupta, P. (2009). A cross-country comparison of corporate governance and firm performance: Do financial structure and the legal system matter? Journal of Contemporary Accounting & Economics, 5(2), 61-79.

Anifowose, M., Abdul Rashid, H. M., & Annuar, H. A. (2017). Intellectual capital disclosure and corporate market value: does board diversity matter? Journal of Accounting in Emerging Economies, 7(3), 369–398.

ASEAN as The Architect for Regional Development Cooperation. (2018, September). From Asia Foundation: https://asiafoundation.org/wp-content/uploads/2018/09/ASEAN-as-the-Architect-for-Regional-Development-Cooperation.pdf

ASEAN Economic Community. (2014b). From ASEAN: www.asean.org/communities/asean-economic-community/

Baum, C., Chakraborty, A., Han, L., & Liu, B. (2012). The effects of uncertainty and corporate governance of firms’ demand for liquidity. Applied Economics, 44(4), 515-525.

Ben-Amar, W., Francoeur, C., Hafsi, T., & Labelle, R. (2013). What Makes Better Boards? A Closer Look at Diversity and Ownership. British Journal of Management, 24, 85-101.

Bendickson, J., Muldoon, J., Liguori, E., & Davis. (2016). Agency theory: the times, they are a-changin’. Management Decision, 54(1), 174-193.

Bhatt, P. & Bhatt, R. (2017). Corporate governance and firm performance in Malaysia. Corporate Governance, 17(5), 896-912.

Bontis, N. (1997). Intellectual capital questionnaire. Hamilton, Canada: Institute for Intellectual Capital Research Inc.

Boujelben, S., & Fedhila, H. (2011). The effects of intangible investments on future OCF. Journal of Intellectual Capital, 12(4), 480-494.

Buniamin, S., Johari, N., Rahmen, N., Abd R., & Abdul, F. (2012). Board diversity and discretionary accruals of the top 100 Malaysia corporate government (MCG) index company. African Journal of business management, 6(29), 8496-8503.

Cabrita, M. D., de Silva, M. L., Rodrigues, A. M. G., & Dueñas, M. D. (2017). Competitiveness and disclosure of intellectual capital: an empirical research in Portuguese banks. Journal of Intellectual Capital, 18(3), 486-505.

Cheng, M.-Y., Lin, J.-Y., Hsiao, T.-Y., & Lin, T. (2010). Invested resource, competitive intellectual capital, and corporate performance. Journal of Intellectual Capital, 11(4), 433-450.

Corbacho, A., & Peiris, S. J. (2018). The ASEAN Way: Sustaining Growth and Stability. Washington, DC: International Monetary Fund.

Cuozzo, B., Dumay, J., Palmaccio, M., & Lombardi, R. (2017). Intellectual capital disclosure: a structured literature review. Journal of Intellectual Capital, 18(1), 9-28.

Daghsni, O., Zouhayer, M., & Mbarek, K. (2016). Earnings management and board characteristics: Evidence from French listed firms. Arabian Journal of Business and Management Review, 6(5), 1-9.

Fidanoski, F., Simeonovski, K., & Mateska, V. (2014). The Impact of Board Diversity on Corporate Performance: New Evidence from Southeast Europe. Corporate Governance in the US and Global Settings, 17, 81–123.

Gamerschlag, R. (2013). Value relevance of human capital information. Journal of Intellectual Capital, 14(2), 325–345.

Gates, S. (2010). Human capital measures, strategy and performance: Human resources managers perception. Accounting, Auditing & Accountability Journal, 23, 111–132.