Organizations and Markets in Emerging Economies ISSN 2029-4581 eISSN 2345-0037

2020, vol. 11, no. 2(22), pp. 348–366 DOI: https://doi.org/10.15388/omee.2020.11.37

Financial Performance, Exchange Rate, and Firm Value: The Indonesian Public Companies Case

Yulita Setiawanta (corresponding author)

Dian Nuswantoro University, Indonesia

youseewhy70@dsn.dinus.ac.id

https://orcid.org/0000-0001-8207-0552

Dwiarso Utomo

Dian Nuswantoro University, Indonesia

dwiarso.utomo@dsn.dinus.ac.id

Imam Ghozali

Diponegoro University, Indonesia

imam.ghozali@live.undip.ac.id

Jumanto Jumanto

Dian Nuswantoro University, Indonesia

ilhamj@dsn.dinus.ac.id

https://orcid.org/0000-0002-0963-8970

Abstract. Transactions between countries require a stable exchange rate. When the exchange rate of the country experiences uncertainty, then this will influence the company’s financial performance and even affect the company’s market value. This study aims to look for the direct influence of the company’s financial performance as an independent variable and the firm value as a dependent variable within the investor perspective, also including the exchange rate factor as a moderating variable. Investors could probably learn about information on the ups-and-downs of the Indonesian rupiah against foreign currencies before their investment decisions, even though financial performance substantially influences the company’s market value. The sample in this study was 50 companies within four years of observation. Data processing was carried out by the Eviews statistical application. The results showed that the financial performance, which is proxied by the capital structure, affects firm value, but not profitability. The impact of exchange rate moderation also occurs in the relationship of capital structure and firm value, while the moderation effect on profitability and firm value is not proven. This study provides information that exchange rates influence investment interests upon investors’ analysis of the financial performance of the capital structure, but not profitability.

Keywords: exchange rate, capital structure, profitability, firm value.

Received: 15/1/2020. Accepted: 13/7/2020

Copyright © 2020 Yulita Setiawanta, Dwiarso Utomo, Imam Ghozali, Jumanto Jumanto. Published by Vilnius University Press. This is an Open Access article distributed under the terms of the Creative Commons Attribution Licence, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

1. Introduction

Companies that run international trades today have been of significant interest for many researchers, especially the companies with trade business on the sea, also noted as seaborne trades. Seaborne trading has experienced growth and trade volume showing an increase in 2014, and then after the level of growth, global gross domestic product (GDP) also increased (Munim & Schramm, 2018). It indicates a strong correlation between global trade and gross domestic product (Manurung, 2014). Furthermore, trends in production processes in complex non-financial industries have increased exports and imports on the sea in global supply chains (Hart, Lukpszova & Rasner, 2012). Marine transportation is the core of international trades. The advantages of current marine transportation in Indonesia have increased, especially in transportation of goods directly from factories (Manurung, 2014). It is seen from the efforts or intensive use of container transport services (Lau, Ng, Fu & Li, 2013). Therefore, the existing facilities at the seaports should be more updated so that exporters or importers get more interested in sending their merchandise by using sea transportation services (UNCTAD, 2015).

Besides, within the ASEAN region, studies on shipping connectivity and trade facilities have received attention, including tariff rate reductions among the member countries (Susilowati, Utomo & Setiawanta, 2017). Thus, the emergence of the Connectivity Relativity and Trade (CRT) concept is essential for regional development integration of specific regions. The purpose of CRT use is to check the relationship between connectivity and trading volume (Lun & Hoffmann, 2016). Based on the competitiveness rank, Indonesia is still in a lower position than Singapore, Brunei, and Malaysia, and, slightly, Thailand. Besides, the trade level of Indonesia is also lower than that of ASEAN countries. The total number of Indonesia’s exports to the ASEAN countries is slightly over 20% (Tristiarini, Utomo & Setiawanta, 2019). The Indonesian government’s favorable response to the global conditions has yielded positive developments, i.e., the government has generated many infrastructure development programs, one of which is the noted construction of sea-toll networks. The government has built the sea-toll development program under the presidency of Joko Widodo. The purpose of this program is to provide facilities for companies in trading goods so that sea-borne exports and imports can be realized and positive growth will take place (Schwarz, 2015).

The foreign exchange rate is theoretically very related to the financial performance of the non-financial company industry, especially in sectors that have international trade transactions. In the manufacturing industry, there is also an urgent need for raw materials to be transformed into excellent products to be consumed. In demand and supply theory, when a manufacturing company is unable to exploit the raw materials available within its own country, it usually prefers to import raw materials from overseas. Therefore, exchange rate fluctuations significantly affect the amount of cash spent to meet production levels in manufacturing companies. In the current global market, companies are composed of competitors, regardless of industry (Marimuthu, Arokiasamy & Ismail, 2009). With the spread of international trades, the authors strongly believe that global businesses have an impact on the financial performance of the company, and this has relevance to the exchange rate of a country. We can commonly imagine that when companies do trades, they need to carefully calculate the roles of corporate finance needs and consider the hedging of transactions, so the company does not face losses. It makes sense when the exchange rate of a country experiences uncertainty. It will affect the financial performance of companies within their international transactions (Kang & Dagli, 2018) and, worse, will even impact the value of a company. When currency movements influence the companies’ trading activities, the exchange rate will affect all trading activities, even in domestic trade events, for example, a small firm in Pakistan (Rashid, 2010). Several studies have examined changes or firm value elasticities in relation to changes in exchange rates, such as changes in stock returns due to changes in exchange rates (Bodnar & Wong, 2000).

Research on the direct relationship between exchange rates and company value was carried out by Choi and Prasad (1995). Raymond Donnellyc (1996) study of large exporters also pointed out a relationship between foreign exchange rates and market value. Glaum, Brunner and Himmel (2000) also showed that the corporate value in Germany is significantly affected by changes in the level of the US dollar. A relationship between stock markets and foreign exchange markets was observed in Ghana (Adjasi, Harvey & Coast, 2008; Allayannis & Weston, 2001; Bodnar, Marston & Guy, 2000). Meanwhile, opposite results on financial markets at the Nairobi Securities Exchange Market were found by Obura and Anyango (2016), and Allayannis and Ofek (1998). Other similar findings on the relationship between exchange rate and stock market were shown by Alagidede, Panagiotidis and Zhang (2010); Giannellis, Papadopoulos and Kanas (2010); and Tabak (2006). The relationship between exchange rate and stock price was studied by Maheen Jamil (2013) and Yau and Nieh (2009).

Some other researchers finally put the exchange rate as a moderating variable. It has been proven through research conducted by Mantari and Nuryasman (2017), the results of which show that the exchange rate (rupiah) against the dollar can moderate the relationship between the company’s financial performance, such as profitability and leverage to firm value. The research suggests that the intervention of the exchange rate can weaken the company’s financial performance information to firm value. However, Sutriani (2014) expressed a different opinion based on the research results: the exchange rate cannot moderate the relationship between profitability and leverage to firm value.

Research related to the exchange rate as one of the macroeconomic indicators itself has been carried out by researchers in Indonesia or others outside Indonesia. Jubaedah, Yulivan and Hadi (2016) explain that the depreciation of Indonesian rupiah will increase firm value, and the appreciation of it will increase the company’s value as measured by the price book value. Existing research outside Indonesia, for example, in Mexico, has found that there is a significant negative relationship between foreign exchange rate exposure and firm value measured using consumer purchasing power at international sales level (Flota, 2014). It is similar to the research conducted by Inylama and Ozouli (2014), which states that foreign exchange rates affect the company’s value measured using the company’s revenue in the brewing industry in Nigeria.

Aggarwal and Padhan (2017) and Mantari and Nuryasman (2017) explain that in a few years, several studies obtained different results; one of them mentions that capital structure has a negative effect on company value. We can see that the capital structure of the company increases and looks perfect when the capital structure is used for operational production or marketing. On the other hand, when the capital structure obtained from external parties is only partially or even entirely used to pay off the debt burden of the previous year, this can be a probable sentiment of news or information that may be poorly interpreted by investors. It is considered reasonable because candidates or investors will understand the optimization of capital structure for production in the company. This interpretation assumes that the company will tend to produce a significant level of profitability. It comes from productive activities carried out or, partially, from the company’s management strategy. The impact can be considered sufficient to increase firm value.

At a time when the company’s profitability is increasing with a small operational portion or relatively low debt burden, the dividends or profit-sharing will increase so that the hope of bonuses or profit-sharing will also increase. It will be a positive signal for the company’s value. The candidates or investors will capture the positive sign, and they will seek to own the company’s stock by buying the amount or the psychological cost of the capital. They can receive as much as they expect in the stock market. These efforts will be related to the activity of obtaining the value and quantity of shares under the transaction. This situation may be pushing the increase in the stock price of the company for each sheet significantly. This opinion comes from the research conducted by Rasyid (2015), which found a positive influence of the profitability of the company on the value of companies listed on the Indonesia Stock Exchange (IDX). Meanwhile, the research conducted by Chen and Chen (2011) states that profitability has a negative direction on the value of companies listed in Hong Kong.

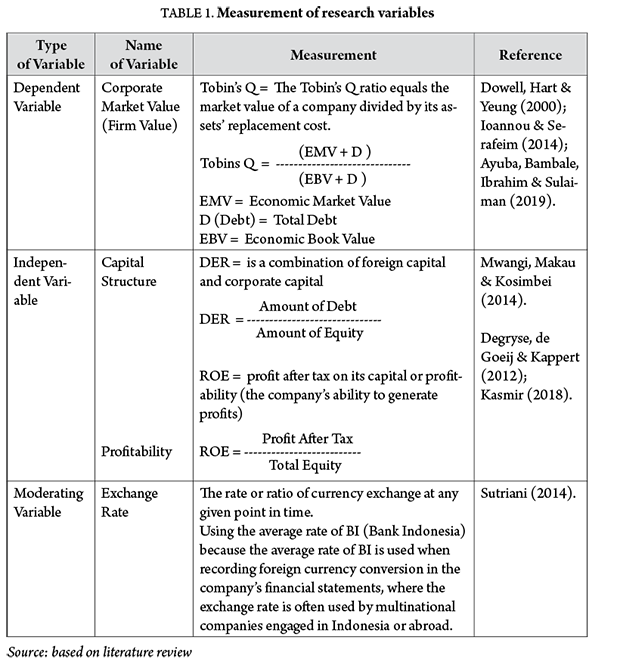

This research begins by predicting whether it is possible or not that the exchange rate can be used as a moderating variable to examine the direct relationship between the financial performance variable, which is proxied by profitability and measured by return on equity (ROE) and the solvability measured by debt to equity ratio (DER), and the firm value measured by Tobin’s q. If the moderation relationship in this study can be proven, it can give a little new and future thinking space as a reference for the development of similar research for industrial cases not only in Indonesia but also probably outside Indonesia. In this context, financial performance is a proxy for two variables, namely the solvability and profitability of the company. The results of inconsistent previous studies have made the authors interested in researching financial performance in the context of corporate profitability and solvability from funding through debts from other companies.

With an explanation of the above descriptions, this study attempts to re-examine the direct link between financial performance and firm value for cases in Indonesia. The additional component of the exchange rate as a moderating variable is obtained by contrasting the relationship between the two variables based on the findings from several previous studies. The companies employed as samples in this study are all non-financial companies listed on the stock exchange of Indonesia on December 31, 2017. The secondary research data are available in Indonesia Capital Market Directories (ICMD) or at the IDX web online. The results of this study indicate that capital structure is a concern of shareholders and investors, and the rise or fall of the exchange rate dramatically affects the increase or decrease in the composition of the company’s capital structure, especially in the sample companies. It has practical implications that the formation of the capital structure becomes important for shareholders when it is informed to external parties, especially when the exchange rate is depreciating. This maintains the rationality of investment decisions from potential investors as a result of the information.

2. Literature review and hypotheses development

By thoroughly considering previous research, Modigliani and Miller (1958) emphasize that capital structure is part of the proxy for financial solvency performance variables. Solvency in this research is considered as a message or signal product of a company. The product will be an excellent information signal to external parties or, in this case, to investors. Since the emphasis is placed on the success of the information or the sign itself, signaling theory provides the basis for this research.

The signaling theory deals with the information conveyed by the management of the company to the investor (Wagenhofer, 2010). The information in the previous research is divided into two types, that is, the right information and the wrong information (Hartono, 2017). Signaling theory is a description of behavior between related parties to access the existence of information even though the way that they use can be different from one another (Connelly, Certo, Ireland, & Reutzel, 2011). Kothari (2001) states that one infers from an event, such as an earnings announcement, and conveys new information to market participants as reflected in changes in the level of variability of security prices or trading volume over a short period around the event. Meanwhile, another announcement is that high-performing firms have incentives to disclose more information to investors to signal that the firm has better performance than rival firms (Abdullah, Shukor, Mohamed & Ahmad, 2015). In this study, the signaling theory was used to test whether the signal sent by sample companies through financial performance information can be appropriately captured by investors without information distortion. It is in line with the thinking and concept of the development of signaling theory conducted by Connelly, Certo, Ireland and Reutzel (2011) and also Wagenhofer (2010).

The agency theory is the leading theory used to predict the relationship between the principal and the agent. The principal and agent relationships themselves often experience a conflict of interest. The principal, as the owner of the company, has the benefit of dividends. In contrast, the agents, as managers of companies, have interests or expectations that they will get a bonus or reward for their performance in managing the company. Agency theory describes that the agency relationship of a company is a collection of contracts (nexus of contracts) between the owners of economic resources (principal), and managers (agents) who take care of the use and control of these resources (Jensen & Meckling, 1976). A conflict resides in that agency theory predicts self-interest as the role basis for economics (Riahi-Belkaoui, 2002). Another statement by Abdullah et al. (2015) is that the disclosure practice can also be explained based on agency theory, which posits that managers tend to disclose voluntary information to better signal for corporate governance mechanisms and reduce agency conflicts. For this reason, the agency theory is used in this research. How do management and owners reduce conflict with each other for a common goal? They are concerned about giving a good signal to investors so that their perception of the company will be useful, along with a good book value for the company. That is why the measurement of company value used is Tobin’s Q, not price to book value (PBV). Tobin’s Q is a ratio designed by James Tobin of Yale University, the Nobel Prize laureate in economics, who hypothesized that the combined market value of all companies in the stock market should be about the same as the cost of their replacement. The Q ratio is calculated as the market value of the company divided by the replacement value of the company’s assets (Ogolmagai, 2013).

The statement of the company’s capital structure is usually expressed in the form of a mixture of long-term debt, short-term debt, and the company’s internal equity (Gharaibeh & Sarea, 2015). Capital structure is a combination of foreign capital and corporate capital. The debt measures the proportion of capital structure to equity ratio (DER). A comparison between long-term debt, short-term debt, and equity itself is a definition of capital structure. Usually, the proportion of debt is used as a reference in calculating the level of corporate leverage (Mwangi, Makau & Kosimbei, 2014). DER is the company’s ability to meet the total debt with the company’s capital (Mantari, 2016). More debt reduction happens when the profit earned by the company increases. When the retained earnings are above the list of preferences to finance the investment or when the profit earned by the company can provide funding for the placement of the company, the higher profits can reduce the need to increase debt (Degryse, de Goeij & Kappert, 2012). Based on this, it can be stated that the information or signal of the company’s financial performance measured by the composition of the debt has been responded well by investors. Based on this, the hypothesis proposed is as follows:

Hypothesis 1: The financial performance proxied by the capital structure affects the company or firm value negatively.

The profitability of the company itself can be measured by using profit after tax on its capital and can be defined as the company’s ability to generate profits (Kasmir, 2018). Meanwhile, Foerster et al. (2013, as cited in Jubb (2016) has found that disclosure of earnings by Canadian company management is positively related to firm value in two aspects: reducing confidence and changes in investor perceptions of future cash flows. The firm value in this research is measured using Tobin’s Q, which explains that the cost of a firm is the combined value of tangible assets and intangible assets (Tahir & Razali, 2011). Various studies on the effect of ROE on company value have been conducted in Indonesia. One of them is Hariri, Ain and Setijaningsih (2013), which aimed to determine the effect of financial performance as measured by ROE on firm value. The results showed that ROE has an effect on firm value. Based on this, the hypothesis proposed is:

Hypothesis 2: The financial performance proxied by profitability has a positive effect on the company or firm value.

The exchange rate is defined as the rate or ratio of currency exchange at any given point in time (Evans, 2014). The critical role of future expectations of money supply and money demand is the behavior in determining the current exchange rate, in contrast to a simple monetary model that focuses on current money supply and current money demand as a determinant of exchange rates. The importance of exchange rates in an open economy lies in the fact that exchange rates affect the price of commodity goods or services, interest rates, the balance of payments, and current transactions. Cooperation between countries in the field of trade and the economy becomes one focus of macroeconomic studies because it will affect the economy as a whole. Previous research results indicate that the exchange rate can moderate the effect of financial performance on firm value. Glaum, Brunner and Himmel (2000) have also shown that the corporate value in Germany is significantly affected by changes in the level of the US dollar (see also Adjasi, Harvey & Coast, 2008; Allayannis & Weston, 2001). The relationship between exchange rate and stock price was established by Maheen Jamil (2013), and Yau and Nieh (2009). Based on this, the hypotheses proposed are:

Hypothesis 3: The exchange rate can moderate the relation of capital structure to company or firm market value.

Hypothesis 4: The exchange rate can moderate the relationship of profitability to company or firm market value.

The existence of foreign transactions indeed correlates with the exchange rate of currency as a means of payment. So, companies usually calculate the effective exchange rate using the calculation with an emphasis on the weight of particular money (Simorangkir, 2004). One way is to use the average rate of Bank Indonesia or BI (Bank Indonesia) because the BI average rate is often used when recording the conversion of foreign currencies to Indonesian rupiah in the financial statements. This conversion is commonly used by multinational companies engaged in Indonesia or abroad. Since the authors cannot directly get the average exchange rate information at the website of the Bank Indonesia (BI) as an independent central bank, the average exchange rate needs to be calculated in advance. The formula for calculation of the average rate of BI follows the pattern proposed by a previous researcher in Indonesia (Sutriani, 2014), which is by summing up the selling rate with the buying rate of foreign exchange then dividing it by two.

3. Methodology

The companies employed in this research are those listed in the Indonesia Stock Exchange (BEI) on December 31, 2017, with the number of 539 companies. Using purposive sampling to identify the criteria that have been set, the authors involve non-financial companies as samples in this study. The total number of observed data in this research is 50 companies each year, for four years. There is one observation item to be an outlier because it has extreme characteristics, so the data analysis only applies to 199 companies. The data can be assumed to belong to the sample companies. The criteria used in this study can be seen in Table 2 below.

TABLE 2. Determination of Samples by Purposive Sampling

|

No |

Description of Criteria |

|

1 |

Companies listed on December 31, 2017 (Populations) |

|

2 |

Companies that have revenues or sales fluctuate and decline for four years and companies that do not have data on Return on Equity and Debt Equity Ratio on the company's performance summary in 2014 to 2017 (removed from sample data) |

|

3 |

Companies that have total minus equities and companies that do a stock split in 2014 to 2017 (removed from sample data) |

|

4 |

Companies that have asset growth above 30% and companies that do not report audited financial statements at the end of 2014 to 2017 (removed from sample data) |

|

5 |

Companies included in finance companies listing on BEI (removed from sample data) |

Source: characteristics determined by researchers

Data processing uses Eviews statistical application Version ten. The Chow and Hausman test was used to see the best model generated from data processing. Still, when an accurate model is not found, the Lagrange Multiplier (LM) Test will be applied as the final determination for the best model produced. This research model is used to see how independent variables affect the dependent variable, and to see the relationship of the moderating variables that are influencing the independent and dependent variables. We must understand that one of the tests of moderating effects in research follows the opinions of Baron and Kenny (1986), although other researchers may use the opinions of other experts. This difference is naturally reasonable in the academic beliefs held by each researcher. Baron and Kenny (1986) state that testing for moderation effects can be done when the main impact or direct relationship between the independent variable and the dependent variable is significant. When this does not happen, then moderation effect testing cannot be continued. The moderation variable itself is a variable that can strengthen or weaken the relationship between independent variables and dependent variables. Moderated Regression Analysis (MRA) is a specialized application of multiple linear regression wherein the regression equation contains an element of interaction (multiplication of two or more independent variables) (Ghozali, 2016). Multiplying the moderation variables with the independent variables will result in the relation between these variables (Baron & Kenny, 1986; Puck, Hödl, Filatotchev & Wolff, 2016).

4. Empirical results

The validity of the results of research is carried out with test procedures for data quality. Classical assumption tests are required for a moderated regression analysis to get the estimators of the unbiased model called BLUE (Best Linear Unbiased Estimators), which are expected to strengthen the results of research. It is necessary to transform several variables related to unique data in this study using Natural Logarithms, as suggested by Ghozali (2016). Deletion of data item with extremely small value will result automatically in the outlier data, and in this case, there is only one company.

4.1. Heteroscedasticity test

The Heteroscedasticity test is carried out with the explanation below.

TABLE 3. Panel Period Heteroskedasticity LR Test

|

|

Value |

Df |

Probability |

|

Likelihood ratio |

17.39736 |

50 |

1.0000 |

Source: Data processing results

Based on Table 3 above, we can see that the probability value is 1.0000, and, therefore, the data of this study are free from heteroscedasticity problems.

4.2. Panel Data Regression Model Selection Test

Model Fit Test in this study includes three model tests conducted, namely the Chow Test, the Hausman Test, and the Lagrange Multiplier (LM) test. If the results of the Chow and Hausman tests can find one model that fits among the common effect, random effect, and fixed-effect models, then no Lagrange Multiplier (LM) test is needed. In the case when a fit model is not found, the Lagrange Multiplier (LM) test must be done.

4.2.1. Chow Test

TABLE 4. Redundant Fixed Effects Tests

|

Effects Test |

Statistic |

d.f. |

Prob. |

|

Cross-section F |

11.713770 |

(49.145) |

0.0000 |

|

Cross-section Chi-square |

318.617401 |

49 |

0.0000 |

Source: Data processing results

The Chow test is a test to determine the Common Effect (OLS) or Fixed Effect model that is most appropriate in estimating panel data. Based on the table above, it is concluded that the best model results between Common Effects (CE) and Fixed Effects (FE) are Fixed Effects. The results are based on the value of probability <0.005 in the table above.

4.2.2. Hausman Test

TABLE 5. Correlated Random Effects - Hausman Test

|

Test Summary |

Chi-Sq. Statistic |

Chi-Sq. d.f. |

Prob. |

|

Cross-section random |

11.198687 |

4 |

0.0244 |

Source: Data processing results

The Hausman Test is a test to determine the Random Effect model (OLS) or Fixed Effect that is most appropriate in estimating panel data. Based on the table above, it can be concluded that the best model results between Random Effect (CE) and Fixed Effect (FE) are Fixed Effects. These results are derived from the value of probability <0.005 in the table above. Thus, we can see that based on the results of the Chow and Hausman Tests, the best model result obtained is a fixed effect.

TABLE 6. Fixed Effects Model

|

Variable |

Coefficient |

Std. Error |

t-Statistic |

Prob. |

|

C |

58.85899 |

24.07745 |

2.444569 |

0.0157 |

|

LN_DER |

6.225147 |

2.505741 |

2.484353 |

0.0141 |

|

ROE |

-0.026446 |

0.023891 |

-1.106944 |

0.2702 |

|

LN_DER_ER |

-6.564741 |

2.511840 |

-2.613519 |

0.0099 |

|

LN_ROE_ER |

0.545832 |

0.296774 |

1.839216 |

0.0679 |

Source: Data processing results

Table 6 shows that the value of F-statistic is 14.06199, and the probability value is 0.000. The probability value is below the significance value α = 0.05. We can conclude that there is an influence of capital structure and profitability on firm value. Based on Table 6 above, the equation of moderated regression analysis of independent variables to the dependent variables is as follows:

Firm Value = 58.85899 + 6.225147 (LnDER) - 0.026446 (ROE) –

– 6.564741 (LnDER*ER) + 0.545832 + 0.545832 (LnDER*ER) + e1-4

The capital structure variable (LnDER) has the result with a significance level equal to 0.0141, which means <0.05, so it is concluded that the first hypothesis is accepted. The profitability variable was obtained with a significance level of 0.2702, which means >0.05, so it can be concluded that the second hypothesis is rejected. The third hypothesis states that the exchange rate can moderate the relationship of the capital structure to company or firm value. Based on the findings, which show the negative direction at the coefficient value -6.564741, and a significance level of 0.0099, it can also be accepted. The fourth hypothesis, which states that the exchange rate can moderate the relationship of profitability to company or firm valueer is rejected, as results show a positive direction at Coefficient value 0.545832, with a significance level of 0.0679.

4.3. Coefficient of Determination (Adjusted R-Square)

The coefficient of determination (Adjusted R-Square) is mainly to measure how far the the model is able to explain the variation of the dependent variable. An adjusted R-square value close to one means that the independent variables can provide almost all the information needed to predict the dependent variable (see Table 7 below).

TABLE 7. Coefficient of Determination

|

Cross-section fixed (dummy variables) |

|||

|

R-squared |

0.837131 |

Mean dependent var |

2.656985 |

|

Adjusted R-squared |

0.777599 |

S.D. Dependent var |

2.932206 |

|

F-statistic |

14.06199 |

Durbin-Watson stat |

2.585488 |

|

Prob(F-statistic) |

0.000000 |

|

|

Source : Data processing results

Based on Table 7 above, the Adjusted R-Square (R2) value is 0.777599. It shows that the percentage of the contribution of the influence of independent variables to the dependent variable is 77.75%. It can also be interpreted that the independent variable used in the model can explain 77.75% of the dependent variable. Other factors outside the regression model influence the remaining 22.25%.

5. Conclusion

The first hypothesis is accepted, i.e., the negative significant coefficient of the relationship suggests that an increase in debt ratio (leverage) decreases the firm value (Gharaibeh & Sarea, 2015). It indicates that when the capital structure of the firm’s debt rises, investors will feel worried because they may doubt whether the company can meet all its obligations or not. It will cause the company’s value within the investor’s perspective to decrease, and the shareholders will wait for a better sentiment about the company’s significant efforts to pay off all its long-term or short-term obligations (Setiawanta, Ghozali, Rohman & Purwanto, 2020). In developing countries, the distinction between a bank and market-based financing is complicated by extensive government ownership and regulation of the financial system.

Capital structure decisions have a strategic role in owner welfare and company survival (Masidonda, Idrus, Salim & Djumahir, 2013). However, there were also controls on the issue price of equity, which might have forced many companies to issue convertible debt to recoup part of their loss due to equity underpricing. The results of this study are in line with a series of research (Horizons, Chowdhury & Chowdhury, 2010; Gharaibeh & Sarea, 2015; Aggarwal & Padhan, 2017; Setiawanta, Purwanto & Hakim, 2019, but against the findings of Antwi, Mills and Zhao (2012). This result supports the existence of the signaling theory revealed by Spence (1973), which claims that the company’s management gives a signal or a sign and provides relevant information that can be utilized by the investor. Then, the investor will adjust his decision according to his understanding of the message. This theory was re-developed by Ross (1977), explaining that company executives who have better information about their companies will be compelled to convey this information to investors. The success of data or the signal position of the company’s debt composition can bring a significant reaction to the sample company investors, and this proves that the distortion of information from the sender of information to the recipient of the information is relatively small (Connelly, Certo, Ireland & Reutzel, 2011).

The results obtained from profitability variables are not significant. Based on the findings of this study, when a company gets high profits from its transaction activities, it will have an impact on increasing company value. It happens because investors have a perception when the company receives the maximum profitability. The opportunity for shareholders to get a share of the profits (dividends) will be higher, although, unfortunately, the results of this study did not prove it. Signaling theory that describes the urge of the firm to provide reliable financial information to investors and creditors since there is the asymmetry of information (Purwanto & Agustin, 2017) was not proven either. It illustrates that the signaling theory is probably not able to work well on this research model. A typical disadvantage of signaling models from an empirical perspective is that they have a multiple number or, sometimes, an infinite number of equilibria. It is easy to tell a cause-and-effect story of higher disclosure to increase stock prices. Better exposure will increase company value. The disclosure after controlling for predicted financial variables can raise share prices, including investment and profitability growth (Ararat, Black & Yurtoglu, 2017). However, this did not happen in this study. The results of this study are consistent with the research conducted by Karaca and Savsar (2012) and Ayuba et al. (2019). Meanwhile, this research is not in line with the studies undertaken by Chen and Chen, (2011); Marlina (2013); Mantari and Nuryasman (2017); Purwanto and Agustin (2017) and Hutabarat, Fitrawaty and Nugrahadi (2018), which suggest that profitability has a significant effect on firm value.

The third hypothesis, which states that the exchange rate can moderate the relationship of capital structure to firm value on the financial issuer with negative direction, can be accepted. It shows that the moderating variable of the exchange rate can moderate the relationship between capital structure and firm value in a negative direction. The result of this study is in line with Mantari and Nuryasman (2017) but contrasts with the research conducted by Sutriani (2014), which states that the exchange rate is unable to moderate the relationship between capital structure and firm value. The existence of the exchange rate as an investor consideration in making investment decisions was found in the case of the sample companies of this study. The rises and falls of the exchange rate are significant, and so is the material for the composition of the companies capital structure. Hence, investors firmly believe that when the rupiah exchange rate falls against foreign currencies, and the capital structure of the company increases, the investor’s interest in the company’s share ownership will decrease. The pressure from stakeholders, namely the investors in this regard, needs to be considered for its existence. The force has an impact on the efforts made by companies to increase the market value of the company (Setiawanta & Purwanto, 2019). Pressure also occurs when companies want to make changes to the composition of capital structure even though the exchange rate has not been stable.

The test results of the interaction of corporate profitability with firm value indicate that the exchange rate moderation variable is not able to moderate the relationship between profitability and firm value. From the researcher’s perspective, the exchange rate risk will create profits or losses in a multinational corporation (MNC). Gains and losses due to changes in exchange rates will affect the reaction of the capital market or the interest of investors to buy or invest their capital, which will also affect the stock return of the company. The risks in business that can affect the profits or losses of the company will theoretically affect the profitability of the company. Primarily, when a company’s source of income depends on the ups and downs of an exchange rate, it can cause a negative perspective of investors because investors are probably worried when the exchange rate is unpredictable and will affect the profitability of the company they invest. Due to things like these, investors may be inclined not to invest their capital into a company under this situation. This view may be the cause of the company’s value in the eyes of investors, as they consider the company not having a good prospect because it has a dependence on corporate earnings with foreign exchange. This study follows the research conducted by Sutriani (2014) which shows that the exchange rate cannot moderate the relationship between the company’s profitability and firm value.

The independent variables used in this research simultaneously affect firm value, and it can be stated that the model used in the study is very appropriate. But based on the results and discussion above, the partial financial performance from the perspective of the capital structure of the company has a dominant influence on firm value, in addition to financial performance such as profitability, which does not influence corporate value. Given the moderating variables, the exchange rate cannot affect the financial performance of the firm’s profitability, except the financial performance of the capital structure of the company listed on the Indonesia Stock Exchange. In this context, the investors can pay more attention to information on the company’s capital structure than to the profitability of financial companies recorded in Indonesian securities.

The exchange rate variable’s ability to moderate the relationship between the capital structure to the firm value in this study also seems to provide some explanation that the research data should include the sample companies with material dependence on international trade transactions. The companies have accounts receivable or payable in foreign currency, which, at the time of reporting, was converted into rupiah currency. The companies have export-oriented products, not supplying domestic needs. These companies may have been part of the samples in this study, so they may contribute to the exchange rate’s ability to moderate the relationship between capital structure and firm value.

Investors probably have confidence that the period of observation of the exchange rate in a rising and falling position is not very significant or that the value of the rupiah is so fundamental that it is considered stable enough by investors.

Conceptually, the existence of the exchange rate (especially the rupiah against foreign currencies) is not a critical motivating factor. It is based on the inability of the exchange rate factor to moderate the effect of profitability on the firm value. Or should it be assumed that the majority of publicly-traded investors in Indonesia want a rate of return on investment also in the form of rupiah? It certainly requires further research. Practically, this result can also be used for investment decision making, especially in non-financial public companies in Indonesia. Some of the accounts above deserve a further in-depth study to develop this research on future occasions. Future research may prove that profitability as the variable of financial performance can affect firm value, with exchange rates as the variables of moderation. Within this study, the authors have not been able to prove that the exchange rate moderation variable can moderate the relationship between the variable profitability financial performance of the company to firm value. Is it possible that solvency information on publicly traded companies in emerging markets is more of a concern to investors than profitability information It would be interesting for future research to explore the same case in the developed market in the ASEAN region and whether the behavior of investors in the two different markets is the same or shows surprising results. Besides, future research may involve other research variables or use other analytical methods in the study.

References

Abdullah, M., Shukor, Z. A., Mohamed, Z. M., & Ahmad, A. (2015). Risk management disclosure: A study on the effect of voluntary risk management disclosure toward firm value Maizatulakma. Journal of Applied Accounting Research, 16(3), 400–432.

Adjasi, C., Harvey, S. K., & Coast, C. (2008). Effect of Exchange Rate Volatility on the Ghana Stock Exchange. Banking, 3(3), 28–47.

Aggarwal, D., & Padhan, P. C. (2017). Impact of capital structure on firm value: Evidence from Indian hospitality industry. Theoretical Economics Letters, 7(1), 982-1000-2086. https://doi.org/10.4236/tel.2017.74067

Alagidede, P., Alagidede, P., Panagiotidis, T., & Zhang, X. (2010). Causal Relationship between Stock Prices and Exchange Rates Stirling Economics. Stirling Economics Discussion Paper 2010-05. Online at http://www.economics.stir.ac.uk Causal Relationship between Stock Prices and Exchange Rates.

Allayannis, G., & Ofek, E. (1998). Exchange Rate Exposure, Hedging, and the Use of Foreign Currency Derivatives. Retrieved from http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.198.2125&rep=rep1&type=pdf

Allayannis, G., & Weston, J. P. (2001). The Use of Foreign Currency Derivatives and Firm Market Value. The Review of Financial Studies, 14(1), 243–276.

Antwi, S., Mills, E. F. E. A., & Zhao, X. (2012). Capital structure and firm value: Empirical evidence from Ghana. International Journal of Business and Social Science, 3(22), 103–111.

Ararat, M., Black, B. S., & Yurtoglu, B. B. (2017). The effect of corporate governance on firm value and profitability: Time-series evidence from Turkey. Emerging Markets Review, 30(November 2014), 113–132. https://doi.org/10.1016/j.ememar.2016.10.001

Ayuba, H., Bambale, A. J., Ibrahim, M. A., & Sulaiman, S. A. (2019). Effects of Financial Performance, Capital Structure and Firm Size on Firms’ Value of Insurance Companies in Nigeria. Journal of Finance, Accounting and Management, 10(1), 57–74.

Baron, R. M., & Kenny, D. A. (1986). The Moderator-Mediator Variable Distinction in Social The Moderator-Mediator Variable Distinction in Social Psychological Research: Conceptual, Strategic, and Statistical Considerations. Journal of Personality and Social Psychology, 51(6), 1173–1182. https://doi.org/10.1037/0022-3514.51.6.1173

Bodnar, G. M., Marston, R. C., & Guy, J. R. F. (2000). Exchange Rate Exposure : A Simple Model. Finance Wharton School University of Pennsylvania.

Bodnar, G. M., & Wong, M. H. F. (2000). Estimating Exchange Rate Exposures: Some “Weighty” Issues. NBER Working paper 7497 DOI 10.3386/w7497

Chen, L., & Chen, S. (2011). The influence of profitability on firm value with capital structure as the mediator and firm size and industry as moderators. Investment Management and Financial Innovations, 8(3), 121–129.

Chen, L. J., & Chen, S. Y. (2011). The influence of profitability on firm value with capital structure as the mediator and firm size and industry as moderators. Investment Management and Financial Innovations, 8(3), 121–129.

Choi, J. J., & Prasad, A. M. (1995). Exchange Risk Sensitivity and Its Determinants: A Firm and Industry Analysis of U.S. Multinationals. Financial Management, 24(3), 77. https://doi.org/10.2307/3665559

Connelly, B. L., Certo, S. T., Ireland, R. D., & Reutzel, C. R. (2011). Signaling theory: A review and assessment. Journal of Management, 37(1), 39–67. https://doi.org/10.1177/0149206310388419

Degryse, H., de Goeij, P., & Kappert, P. (2012). The impact of firm and industry characteristics on small firms’ capital structure. Small Business Economics, 38(4), 431–447. https://doi.org/10.1007/s11187-010-9281-8

Dowell, G., Hart, S., & Yeung, B. (2000). Do Corporate Global Environmental Standards Create or Destroy Market Value? Management Science, 46(8), 1059–1074. https://doi.org/10.1287/mnsc.46.8.1059.12030

Evans, G. R. (2014). Exchange rates (2nd ed.). https://www.pdffiller.com/jsfiller-desk13/?requestHash=63225bffc89e524198040f7e9daeeb3224a72d0284ab3f04bf1ffc9b78d347a3&et=l2f&projectId=589686865#f19f4b84d191c3ad4c0dd47e5ae8b212

Flota, C. (2014). The Impact of Exchange Rate Movements on Firm Value in Emerging Markets: The Case of Mexico. American Journal of Economics, 4(2(a)), 51–72. https://doi.org/10.5923/s.economics.201401.05

Gharaibeh, A. M. O., & Sarea, A. M. (2015). The impact of capital structure and certain firm specific variables on the value of the firm: Empirical evidence from Kuwait. Corporate Ownership and Control, 13(1CONT10), 1191–1200.

Ghozali, I. (2016). Desain Penelitian Kuantitatif dan Keualitatif untuk akuntansi, Bisnis dan Ilmu sosial lainya (1st ed.). Yoga Pratama.

Giannellis, N., Papadopoulos, A. P., & Kanas, A. (2010). Asymmetric Volatility Spillovers between Stock Market and Real Activity : Evidence from UK and US. Panoeconomicus, 57(4), 429-445.

Glaum, M., Brunner, M., & Himmel, H. (2000). The DAX and the dollar: The economic exchange rate exposure of German corporations. Journal of International Business Studies, 31(4), 715–724. https://doi.org/10.1057/palgrave.jibs.8490931

Hariri, S., Ain, H., & Setijaningsih, H. T. (2013). Pengaruh return on asset (ROA), return on equity (ROE) dan kepemilikan manajerial terhadap nilai perusahaan ( studi empiris pada perusahaan manufaktur di bursa efek Indonesia (BEI) Periode 2009-2011. E_Bina Nusantara, 1(1), 1–8.

Hart, M., Lukpszova, X., & Rasner, J. (2012). Contemporary supply chain trends and world’s freight traffic. Studia Economiczne, 121, 99-111.

Hartono, J. (2017). Teori Portofolio dan analisis Investasi (Vol. Cetakan Pe). Yogyakarta: BPFE-Yogyakarta.

Hutabarat, S. H., Fitrawaty, & Nugrahadi, E. W. (2018). An analysis of asset growth, profitability and capital structure effect through risk on price to book value (PBV) in banking companies, Indonesia. International Journal of Business and Management Review, 6(2), 29–44.

Inylama, O. I., & Ozouli, C. N. (2014). Interactions between Exchange Rate and Financial Performance Indicators in Nigeria Beer Industry : Evidence from Nigeria Breweries Plc. Academic Journal of Interdisciplinary Studies, 3(6), 341–352. https://doi.org/10.5901/ajis.2014.v3n6p341

Ioannou, I., & Serafeim, G. (2014). The Consequences of Mandatory Corporate Sustainability Reporting. Working paper 11-100, Havard Business School. https://doi.org/10.2139/ssrn.1799589

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305–360. https://doi.org/10.1016/0304-405X(76)90026-X

Jubaedah, Yulivan, I., & Hadi, R. A. A. (2016). The Influence of Financial Performance, Capital Structure and Macroeconomic Factors on Firm ’ s Value – Evidence from Textile Companies at Indonesia Stock Exchange. Applied Finance and Accounting, 2(2), 18–29. https://doi.org/10.11114/afa.v2i2.1403

Jubb, C. A. (2016). Risk disclosure, cost of capital and bank performance. International Journal of Accounting and Information Management, 24(4), 476-494. https://doi.org/10.1108/IJAIM-02-2016-0016

Kang, J. W., & Dagli, S. (2018). International trade and exchange rates. Journal of Applied Economics, 21(1), 84–105. https://doi.org/10.1080/15140326.2018.1526878

Karaca, S. S., & Savsar, A. (2012). The effect of financial ratios on the firm value: Evidence from Turkey. Journal of Applied Economic Science, 7(1), 56–63. https://doi.org/10.5958/0973-9343.2015.00026.5

Kasmir. (2018). Analsis Laporan Keuangan. Jakarta: PT Rajagrafindo Persada.

Kothari, S. P. (2001). Capital markets research in accounting. Journal of Accounting and Economics, 31(1-3), 105-231.

Lau, Y.-Y., Ng, A. K. Y., Fu, X., & Li, K. X. (2013). Evolution and research trends of container shipping. Maritime Policy & Management, 40(7), 654–674. https://doi.org/10.1080/03088839.2013.851459

Lun, Y. H. V., & Hoffmann, J. (2016). Connectivity and trade relativity: the case of ASEAN. Journal of Shipping and Trade, 1(11), 1–13. https://doi.org/10.1186/s41072-016-0015-1

Maheen Jamil, N. U. (2013). Impact of Foreign Exchange rate on stock prices. Journal of Business and Management, 7(3), 45–51.

Mantari, J. S. (2016). Moderating Effect of Monetary Indicators on The Packing order Theory Validity in Indonesia Stock Exchange (BEI). International Journal of Economics, Commerce and Management, IV(7), 1–15.

Mantari, J. S., & Nuryasman. (2017). Moderation Effect of Exchange Rate to Signaling Theory Validity in Indonesia Stock Exchange. Business and Management Studies, 3(1), 80. https://doi.org/10.11114/bms.v3i1.2259

Manurung, H. (2014). Joko Widodo National Leaderships on Indonesia’s World Maritime Policy. SSNR (January 2014). https://doi.org/10.2139/ssrn.2510986

Marimuthu, M., Arokiasamy, L., & Ismail, M. (2009). Human Capital Development and Its Impact on Firm Performance: Evidence from Developmental Economics. The Journal of International Social Research, 2(8), 265–271. https://doi.org/10.1017/CBO9781107415324.004

Marlina, T. (2013). Pengaruh Earning Per Share, Return On Equity, Debt To Equity Ratio dan Size Terhadap Price To Book Value. Jurnal Ilmiah Akuntansi Kesatuan, 1(1), 59–72. Retrieved from http://digilib.mercubuana.ac.id/manager/t!@file_artikel_abstrak/Isi_Artikel_715653482132.pdf

Masidonda, J., Idrus, M. S., Salim, U., & Djumahir. (2013). Determinants of Capital Structure and Impact Capital Structure on Firm Value. IOSR Journal of Business and Management, 7(3), 23–30. https://doi.org/10.9790/487x-0732330

Modigliani, F., & Miller, M. H. (1958). The cost of capital, corporation finance and the theory of investment. The American Economic Review, 48(3), 261–297.

Munim, Z. H., & Schramm, H.-J. (2018). The impacts of port infrastructure and logistics performance on economic growth: the mediating role of seaborne trade. Journal of Shipping and Trade, 3(1), 1. https://doi.org/10.1186/s41072-018-0027-0

Mwangi, L. W., Makau, S. M., & Kosimbei, G. (2014). Relationship between Capital Structure and Performance of Non- Financial Companies Listed In the Nairobi Securities Exchange, Kenya. Global Journal of Contemporary Research in Accounting, Auditing and Business Ethics (GJCRA), 1(2), 72–90. https://doi.org/10.11648/j.jfa.20130103.11

Obura, J., & Anyango, C. (2016). Moderating Effect of Interest Rates on Relationship between Foreign Exchange Rate Fluctuation and Performance of Nairobi Securities Exchange Market. Universal Journal of Accounting and Finance, 4(2), 27–34. https://doi.org/10.13189/ujaf.2016.040201

Ogolmagai, N. (2013). Leverage pengaruhnya terhadap nilai perusahan pada industri manufaktur yang go publik di Indonesia. EMBA, 1(3), 81–89.

Puck, J., Hödl, M. K., Filatotchev, I., & Wolff, H. (2016). Ownership mode, cultural distance, and the extent of parent firms’ strategic control over subsidiaries in the PRC. Asia Pacific Journal of Management, 33(4),1075–1105. https://doi.org/10.1007/s10490-016-9471-2

Purwanto, P., & Agustin, J. (2017). Financial performance towards value of firms in basic and chemicals industry. European Research Studies Journal, 20(2), 443–460.

Rashid, A. (2010). The Economic Exchange Rate Exposure : Evidence for a Small Open Economy, The IUP Journal of Monetary Economics, VIII(4), 46–59.

Rasyid, A. (2015). Effects of ownership structure, capital structure, profitability and company’s growth towards firm value. International Journal of Business and Management Invention. http://www.ijbmi.org/papers/Vol(4)4/E044025031.pdf

Raymond Donnelly, E. S. (1996). The Share Price Reaction of U.K. Exporters to Exchange Rate Movements: An Empirical Study. Journal of International Business Studies, 27(1), 157–165.

Riahi -Belkoui, A. (2002). Behavioral management accounting. Greenwood Publishing Group.

Ross, S. A. (1977). The Determination of Financial Structure: The Incentive-Signalling Approach. The Bell Journal of Economics, 8(1), 23. https://doi.org/10.2307/3003485

Setiawanta, Y., Ghozali, I., Rohman, A., & Purwanto, A. (2020). Are Financial Statements (Less) Fundamental to Investor’s Decisions?: Study of Indoesian Stock Exchange. Scientific Papers of The University of Pardubice Series D, XXVIII(I), 150–161.

Setiawanta, Y., & Purwanto, A. (2019). Stakeholder power, Sustainability Reporting, and Corporate Governance: A Case study of Manufacturing Industry at Indonesia’s Stock Exchange. Scientific Papers of The University of Pardubice Series D, 46(2), 147–158.

Setiawanta, Y., Purwanto, A., & Hakim, M. A. (2019). Financial Performance and Firm Value Lesson from Mining Sub-sector Companies on the Indonesia Stock Exchange. Jurnal DInamika Akuntansi, 11(1), 70–80.

Simorangkir, I. (2004). Sistem dan Kebijakan Nilai Tukar. In Seri Kebanksentralan (pp. 53–47). Pusat Pendidikan dan Studi Kebanksentralan (PPSK) BI, 2004.

Spence, M. (1973). Job market signaling. The Quarterly Journal of Economics, 87(3), 355. https://doi.org/10.2307/1882010

Susilowati, E., Utomo, S. D., & Setiawanta, Y. (2017). Blue Ocean Strategy: An Investigation of the Effect of Business Strategy, Information Accounting Management System, Mental Model Implementation on Managerial Performance. Advanced Science Letters, 23(8), 7239–7242. https://doi.org/https://doi.org/10.1166/asl.2017.9340

Sutriani, A. (2014). Pengaruh Profitabilitas, Leverage dan Likuiditas terhadap Return Sahan dengan Nilai Tukar sebagai Variabel Moderasi pada Saham LQ-45. Journal of Business and Banking, 4(1), 67–80.

Tabak, B. M. (2006). The Dynamic Relationship between Stock Prices and Exchange Rates: Evidence for Brazil. Working Paper Series 124. (Central Bank of Brazil, Research Department).

Tahir, I. M., & Razali, Ahmad R. (2011). The Relationship Between Entreprise Risk Management ( ERM ) and Firm Value: Evidence from Malaysian Public Listed Companies. International Journal of Economics and Management Sciences, 1(2), 32–41, NaN-6359.

Tristiarini, N., Utomo, S. D., & Setiawanta, Y. (2019). The Capability of Risk as a Corporate Reputation Driver to increase Market Value. QUALITY Access to Success, 20(168), 54.

UNCTAD. (2015). Freight Rate and Maritim Transport costs. In Review of Maritime Transport 2015 (pp. 45–64).

Wagenhofer, A. (2010). Discussion of ‘Signaling firm value to active investors.’ Review of Accounting Studies, 15(1), 620–628. https://doi.org/10.1007/s11142-010-9123-6

Yau, H. Y., & Nieh, C. C. (2009). Testing for cointegration with threshold effect between stock prices and exchange rates in Japan and Taiwan. Japan and the World Economy, 21(3), 292–300. https://doi.org/10.1016/j.japwor.2008.09.001