Organizations and Markets in Emerging Economies ISSN 2029-4581 eISSN 2345-0037

2020, vol. 11, no. 2(22), pp. 367–388 DOI: https://doi.org/10.15388/omee.2020.11.38

The Effect of Financial Performance and Innovation on Leverage: Evidence from Indonesian Food and Beverage Sector

Perdana Wahyu Santosa

Faculty of Economics and Business YARSI University, Indonesia

pwsantosa@gmail.com

https://orcid.org/0000-0002-0221-3910

Abstract. This article aims to investigate the determinants of firm’s capital structure (debt ratio) such as asset structure, profitability, agency cost, innovation and technology, and firm size as a moderating variable. This study used quarterly data from the financial statements of food and beverage firms at the Indonesia Stock Exchange with a purposive sampling method that met the research criteria with panel data analysis. The findings show that firm size and asset structure affect leverage positively; however, profitability and innovation and technology negatively affect the debt ratio, while agency cost does not affect leverage. All findings are in line with the hypotheses except agency cost. The firm size as a moderating variable shows strengthening of the interaction between agency cost and innovation with leverage. However, interacting with firm size weakens the effect of the relationship between assets structure and profitability with the debt ratio. Managerial implications of the target of debt ratio that creates the value of the firm need to be flexible and controlled by the interaction of the firm size with firm characteristics and innovation to achieve an optimal firm value of F & B sector.

Keywords: leverage, assets structure, profitability, agency cost, innovation and technology, firm size

Received: 18/2/2020. Accepted: 9/6/2020

Copyright © 2020 Perdana Wahyu Santosa. Published by Vilnius University Press. This is an Open Access article distributed under the terms of the Creative Commons Attribution Licence, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

1. Introduction

The development of the food and beverage sector in Indonesia, which supports the growth of national economic activity, is quite interesting to be examined and further investigated. Food security and quality play an essential role and raise critical concern of the entire population, especially in the F&B business (Oluwafemi & Okon, 2018) Besides, the food and beverage sector attracts investors, because this sector is one of the sectors that can survive amid Indonesia’s economic conditions and is known as defensive stocks, along with consumer goods (Mahardika, 2018; Suhendra, 2014). In the period 2014 to 2018, the CAGR of the food and beverage industry reached 2.92 percent. Contributions from the food and beverage industry to Indonesian GDP of non-oil and gas processing sectors were the biggest from 2014 to 2018. Furthermore, investment in F&B firms is increasingly expected to provide profitable business prospects in matching the needs of the community. Not only is the prospect of this F & B sector outstanding, but also it is ready to face industry 4.0 (Mahardika, 2018; Kanita, 2014).

The company’s goal is to maximize the welfare of the owner by increasing the value of the firm, and the most important thing that must be considered by the company to achieve these goals is the substantial aspect of capital related to leverage (Prieto & Lee, 2019; Peng Chow, 2019). The aspect of capital structure is very closely related to business activities and financial distress because the company runs and develops well if management has sufficient capital according to the business expansion and working capital needs (Santosa, Tambunan, & Kumullah, 2020). Management use capital expenditure for investment and operations that comes from the internal funds. However, with the increasingly limited sources of internal company funds (paid-in-capital and retained earnings) for developing its firm business, management must seek alternative external funding through bank loans and capital markets (Ozkan, 2001; Horvathova, Mokrisova & Dancisinova, 2018).

The correlation between capital structure and its determinants both theoretically and empirically, especially in F&B industry, is still a discussion that is far from final and tends to be controversial (Suhendra, 2014). Therefore, there are many academics who still doubt it, theoretically. Based on this consideration, the approach used in this article is more empirical and aims to determine the significance of the variables used, especially in the F&B sector in Indonesia (Kanita, 2014). Some empirical studies of the capital structure theories have focused on the effect of factors on leverage and the firm value (Baule, 2019; Ben-Nasr, Boubaker & Rouatbi, 2015). Some research compared pecking order theory and trade-off theory to analyze which one better affects the leverage (Zunckel & Nyide, 2019; Arsov & Naumoski, 2016).

Furthermore, some analyzed the dynamic capital structure by targeting leverage as well as the speed of adjustment (Li, Wu, Xu& Tang, 2017; Abdeljawad& No>r, 2017; Rani, Yadav & Tripathy, 2019). All the results present some novelty and the appropriate variables of leverage. Management expects the company to have proportional and optimal solvency of the firm so that the maximum value creation provides maximum prosperity for its shareholders. Some other factors that are considered influential in financial performance are asset structure, profitability, agency cost, innovation and technology, and company size (Prieto & Lee, 2019; Vo, 2017; Baker et al., 2016).

The problems and research gaps indicated from some previous studies led to the development of a grand theoretical model to explain the controversy of the impact of firm characteristics and innovation and technology on leverage using firm size as a moderating variable. The objectives of this study are to analyze the determinants that influence capital structure, which becomes a management concern, including internal or external sources of funds, and what other factors affect leverage of the F&B sector. Moreover, this study observed the existing research gap in several approaches. First, the firm size was included as an independent variable to the correlation to leverage itself and as a moderating variable to the relationship between firm characteristics and leverage. Second, the innovation and technology was applied to the model specification. Third, the effect of firm size as a moderating variable on the relationship between all independent variables and capital structure was examined.

The primary purposes of this article are classified into two main analyses, which are Model 1 that describes internal factors including innovations and technology, and Model 2, the analysis made more interesting by adding the firm size as a moderating variable. We need to know the differences of significance between the model including the moderating variable of the firm size and that without it.

2. Literature Review

The leverage policy in capital structure conducted by management, in addition to being influenced by weighted average cost of capital itself, is related to other factors that can generally affect funding sources, including company size, dividend payments, sales, company assets, company growth, profitability, tax benefits (tax shield), the target of leverage, liquidity, business risk and corporate governance itself (Ross, Westerfield, Jaffe & Jordan, 2017; Santosa et al., 2020). The effect of some factors on capital structure and financial performance is not the same empirically because it depends on the type of company or the respective business fields in which the company operates (Santosa & Puspitasari, 2019).

The size of the company is one crucial factor that is considered in making decisions related to capital structure. Generally, some previous studies classified the firm size into two groups: large and small firms. Management must have reliable funding sources to finance the activities and investment of large companies, and in meeting the need of these funds, one alternative is issuing debt. Thus, the size of a company directly influences the company’s capital structure policy (Graham, Leary & Roberts, 2015; Sanil, Noraidi & Ramakrishnan, 2018).

Asset structure is the relative composition of fixed assets owned by a firm. In a company, the asset structure shows the assets used for operational activities — the bigger the fixed assets, the higher the expected operational results of the company. An increase in assets followed by an increase in operating results adds to the confidence of outsiders towards companies such as creditors and investors (Suhendra, 2014; Sanil et al., 2018). With the increasing creditor confidence in the company, the proportion of debt, especially long-term debt, is higher than equity capital (shares). This debt depends on the creditor’s trust in the capital invested in the company that is guaranteed by the number of assets owned by the company as collateral (Ardalan, 2017; Ghosh, Cai & Fosberg, 2017).

According to Brealey, Myers and Marcus (2020), profitability is the net profit from a series of policies and decisions. Increased profitability has the potential to increase retained earnings, according to pecking order theory, which has the first funding preference with internal funds in the form of retained earnings so that the capital component itself increases (Sutomo, Wahyudi, Pangestuti & Muharam, 2020).

Another factor is agency costs. The separation of management and ownership functions is very vulnerable to agency conflicts between the parties. Agency conflict occurs when managers tend to make decisions that benefit themselves rather than the interests of shareholders (Kyriazopoulos, 2017; Vo, 2017). This problem certainly creates conflict with shareholders because it is not under corporate objectives, namely maximizing the prosperity of shareholders. With the onset of agency conflict, agency costs arise, namely the costs of supervision and monitoring, internal control, and the provision of appropriate incentives to managers to prevent moral hazard (Buvanendra, Sridharan & Thiyagarajan, 2017). Furthermore, agency conflict can occur between ultimate shareholders and retail shareholders, between shareholders and creditors, between controlling shareholders and other stakeholders, including suppliers and employees. However, this research is limited to agency conflict between managers and shareholders (Vijayakumaran & Vijayakumaran, 2019; Lim, 2012).

Suhendra (2014) and Kanita (2014) show that the variables like company size, asset structure, and profitability affect the capital structure. They also state that profitability, sales stability, firm size, liquidity, and capital structure have a positive effect on capital structure. Kasmiati and Santosa (2019), and Jermias and Yigit (2019) concluded that profitability and asset structure negatively affect the leverage of corporate, while company size and business risk do not affect the capital structure, whereas sales growth has a positive effect on leverage (Arsov & Naumoski, 2016). Some previous studies show that asset structure, company size, profitability, and sales growth simultaneously do not affect capital structure. Then, profitability partially affects the capital structure, while the asset structure, company size, and sales growth do not affect the capital structure (Xuan Anh, Tuan & Phuong, 2018; Nguyen & Rern, 2016; Vo, 2017).

Yoo and Wu (2019) used data from the Korean stock market and applied SEM to analyze the determinants of leverage to find that asset structure (+) and profitability (-) retain robust relationships with leverage (market leverage, book leverage). Firm size shows a positive effect on leverage and, in line with some recent studies, maintains a stable relationship with capital structure. Yang, Albaity and Hassan (2015) found significant solvency determinants, namely growth (-), firm size (+), profitability (-), and asset structure (+). Titman and Wessels (1988), Mustilli, Campanella and D’Angelo (2018), and Sanil et al. (2018) predicted that leverage negatively correlated to uniqueness (innovations), firm size (+), and profitability (-). However, the correlations are weak. The other four variables, such as non-debt tax shield, growth, volatility, and collateral value were not significantly related to solvency. In a specific situation, the companies with leverage problems generally experience higher volatility and more frequent overreaction (Santosa & Hosen, 2011; Santosa, 2020).

2.1. Hypotheses Development

2.1.1 Relationship between Asset Structure and Leverage

Asset structure is the determination of the amount of allocation for each component of assets, both in current assets and in fixed assets. A company that has a high asset structure is considered as having substantial fixed assets. In general, companies that have collateral to cover the debt have better chances to access capital than companies that do not (Santosa, 2019). Brealey et al. (2020) and Chow (2019) stated that companies with long-term fixed assets are more prominent, then the management tends to use long-term debt, with the expectation that these assets can cover debts. Conversely, companies whose assets are mostly in the form of receivables and inventories whose value is highly dependent on the sustainability of the profitability of each company are not so dependent on long-term debt financing and are more dependent on short-term financing (Yoo& Wu, 2019; Titman & Wessels, 1988). Based on the description, it is concluded that the asset structure variable has a positive effect on leverage.

H1: Asset structure positively affects leverage (+).

2.1.2 Relationship of Profitability to Leverage

Profitability is the return on capital investment, which is calculated from net profit divided by investment. Some previous studies show that firms with high returns on investment or assets use relatively smaller debt (Jermias& Yigit, 2019; Santosa et al., 2020). The high profitability enables management to finance most of its investment internally with its retained earnings. The higher profit firm, the more abundant source of internal capital the management has to reduce its debt (Santosa, 2019). Moreover, if retained earnings increase, the debt ratio automatically decreases, assuming that the management does not add debt. In other words, there is a negative effect of profitability variables on capital structure (Prieto & Lee, 2019; Chang, Wang, Lee & La, 2014).

H2: Profitability negatively affects Leverage (-).

2.1.3 Relationship between Agency Cost and Leverage

The higher institutional ownership, the more reliable external control over the company and reduced agency costs, so the company uses dividends determined by controlling shareholders. With tight controls, they cause managers to use debt at a reasonable level to anticipate the possibility of financial distress and the risk of bankruptcy (Rashid, 2016; Hasan, Ahsan, Rahaman & Alam, 2014). Nguyen (2020), and Forte, Barrosand Nakamura (2013) explained that an insider-controlled firm uses large amounts of debt to fund companies. With significant ownership, an insider wants to maintain effective control of the firm. The supply hypothesis explains that insider-controlled companies have a small debt agency cost, thereby increasing the use of debt (Rashid, 2016).

H3: Agency cost negatively affects Leverage (-).

2.1.4 Relationship of Innovations and Technology to Leverage

F&B companies generally produce something unique that is difficult for their competitors to copy, or difficult to replace in the short term. Operationally, this indeed makes it difficult for workers and suppliers to change their operating systems and technology (Castro, Tascón & Amor-Tapia, 2015; Titman & Wessels, 1988). Therefore, companies in this sector spend large amounts of capital resources on training skilled workers and continuing to innovate in developing various F&B products that customers need. This use of food technology and product innovation is essential for companies to maintain their competitive position, reduce business risk, and avoid bankruptcy due to the low competitiveness of innovation. Thus, management tends to reduce the use of excessive debt to maintain excellent solvency (Arifin, Firmanzah, Fontana & Wijanto, 2016; Prieto & Lee, 2019).

H4: Innovations and technology negatively affect Leverage (-).

2.1.5 Relationship of Firm size to Leverage

Large established firms more easily obtain capital in the capital market than small firms because they have ease of access and greater flexibility. After all, big firms have more trust in getting funding, making it easier to get credit from outside parties. Therefore, the size of a large company is a positive signal for creditors to provide loans. So the firm size positively influences leverage. Suhendra (2014) and Sutomo et al. (2020) examined the effect of company size on capital structure, and the results indicate that company size has a negative effect on capital structure. However, Prieto and Lee (2019) studied the effect of company size on capital structure and showed that company size has a positive and significant effect on capital structure. Larger firms tend to have more diversified sources of capital so that the size is representative of the possibility of bankruptcy, hence the size has a positive impact on the use of debt (Kanita, 2014; Tan & Yang, 2016).

H5: Firm size positively affects leverage (+).

3. Data and Methods

3.1 Population and Sample

This study focuses on non-financial firms, so we excluded financial firms such as banks, insurance companies, and stock companies due to the different nature of these businesses. We also exclude all stocks with negative market-to-book ratios.

There are several criteria for companies to be included in the sample:

1. The food and beverage firms are listed on the consumer goods index at Indonesia Stock Exchange.

2. There is no delisting and new listing from the stock exchange during 2013-2018.

3. The company issues financial statements which are audited, and the financial statements used as samples are those issued as of March 31, June 30, September 30 and December 31.

The sampling technique involves the purposive sampling technique with specific considerations. Therefore, the sample chosen must be representative, meaning that all population characteristics should be reflected in the selected sample.

3.2 Panel Data Regression Analysis

To get the relevant results to accomplish our objectives, it is necessary to apply data analysis techniques. The data used for research is panel data of food and beverage companies on the Indonesia Stock Exchange in the 2013-2018 period. According to Gujarati and Porter (2013), panel data is a combination of cross-section type data and time-series data (i.e., several variables are observed over some categories and collected within a specific period).

Panel data is data collected in a cross-section and followed at a particular time (time series). Cross-section data is data collected at one time against many individuals. The panel data was analyzed using Eviews 10 software. The advantages of panel data regression analysis have implications for not testing classical assumptions in the panel data model, according to some literature (Baltagi, 2013). Panel data analysis was conducted through 3 types of approaches: the common effect approach (pooled least square), the fixed-effect model, and the random effect model (Gujarati & Porter, 2013).

Data analysis techniques determine the effect of company size, asset structure, profitability, and agency cost on the capital structure using panel data estimation with econometric analysis models (Sutomo et al., 2020; Suhendra, 2014; Prieto & Lee, 2019; Kyriazopoulos, 2017; Cstro et al., 2015).

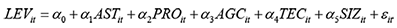

Model 1:

(1)

(1)

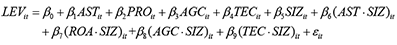

Model 2:

(2)

(2)

where:

LEV: Capital Structure; AST: Asset Structure; PRO: Profitability; AGC: Agency Cost; SIZ: Firm size; TEC: Innovation and Technology; αo; βo: Constants or intercepts; α1, α2, ... αn; and β1, β2 ... βn: Parameters; i: Observed company; t: Research period; ɛ: error term.

3.3 Variable description

The variables used in this study are described in Table 1.

Tabel 1. Variables description

|

Variable |

Notation |

Measurement |

References |

|

Dependent: |

|||

|

Leverage |

LEV |

Total debt to equity |

Vo (2017); Prieto & Lee (2019); Sutomo et al. (2019) |

|

Independent: |

|||

|

Assets structure |

AST |

Fixed assets to total assets |

Prieto & Lee (2019); Suhendar (2014); Titman & Wessel (1998) |

|

Profitability |

ROA |

Net income to total assets |

Vo (2017); Sutomo et al. (2019); Kyriazoupoulos (2017) |

|

Agency cost |

AGC |

Operation cost to revenue |

Hasan et al. (2014); Nguyen (2020); Forte et al. (2013) |

|

Innovation & Tech |

TEC |

Patent and intellectual property rights to sales |

Arifin et al. (2016); Vo (2017); Castro et al. (2015) |

|

Moderating: |

|||

|

Firm size |

SIZ |

Log natural of total assets |

Prieto & Lee (2019); Vo (2017); Suhendar (2014) |

4. Analysis and Findings

4.1 Data Description

Based on descriptive statistical analysis, the following characteristics of the samples are used in this study: mean, median, minimum value, maximum value, and standard deviation for each variable. Table 2 shows the results of observations on food and beverage companies listed on the Indonesia stock exchange in the 2013-2018 period.

Table 2. Descriptive analysis results

|

|

LEV |

AST |

ROA |

AGC |

TEC |

SIZ |

|

|

Mean |

0.8632 |

0.4812 |

0.0640 |

0.1685 |

0.0386 |

27.8663 |

|

|

Median |

0.8305 |

0.5000 |

0.0450 |

0.1385 |

0.0402 |

26.0914 |

|

|

Maximum |

1.7110 |

0.8440 |

1.1570 |

0.7340 |

0.0835 |

32.1510 |

|

|

Minimum |

0.0660 |

0.0790 |

-0.0690 |

0.0050 |

0.0216 |

20.2713 |

|

|

Std. Dev. |

0.3465 |

0.1492 |

0.0916 |

0.1103 |

0.0225 |

20.8355 |

|

|

N (Data) |

384 |

|

|

|

|

|

|

Table 2 presents that the value of the lowest (minimum) capital structure is 0.0660, and the highest (maximum) value is 1.711. Besides, the value of the capital structure shows an average value (mean) of 0.8632, with a standard deviation of 0.3465. Because the standard deviation is smaller than the mean, this shows that the capital structure variable has a low level of fluctuation. The lowest asset structure value is 0.0790, and the highest asset structure value is 0.8440. Besides, the mean value (mean) of the asset structure shows a value of 0.481268, with a smaller standard deviation value of 0.1492. The analysis finds that the standard deviation is smaller than the mean. This finding indicates that the distribution of the data on the structure of the assets is low data variation.

The lowest profitability value is -0.0690, and the highest is 1.1570. Besides, the average value of profitability is 0.0640, with a standard deviation of 0.0916. Data of profitability that have a standard deviation higher than the mean indicate that the variation is high. The lowest agency cost value is -0.0050, and the highest is 0.7340. Then the mean value of the agency cost shows a value of 0.1685, with a standard deviation of 0.1103. This result shows that the fluctuation of agency variable data is low. Besides, the mean value of the innovations and technology is 0.0386, with a standard deviation of 0.0225. Because the standard deviation is smaller than the mean, this shows that the TEC variable has good distribution data. The lowest firm size value is 20.2713, and the highest value is 32.15100. Also, firm size indicates a mean value of 27.8663, with a standard deviation of 20.8355. The standard deviation is smaller than the mean, this indicates that the firm size variable has a low data distribution.

4.2 Classical Assumption Testing

4.2.1 Normality test

Testing the normality of data was conducted using the Kolmogorov-Smirnov procedure, which found the Kolmogorov-Smirnov statistical test value was 0.088, and insignificant at α=0.05. These findings indicate that the residual data are normally distributed, and the results are consistent with the previous histogram graph.

4.2.2 Multicollinearity Test

The multicollinearity tests were performed with an indication of the value of Tolerance and Variance Inflation Factor (VIF). In general, the Tolerance threshold is 0.10, and the VIF threshold is 10. If the Tolerance value is below 0.10, or the VIF value is above ten, then the model has the potential for multicollinearity (Santosa & Hidayat, 2014). The test results show that the tolerance value of independent variables that have a tolerance value of less than 0.10 does not occur, which means there is no multicollinearity. Besides, the results of the Variance Inflation Factor (VIF) test also showed that there was no independent variable that recorded a VIF higher than 10%, indicating no multicollinearity between the independent variables (Baltagi, 2013).

Table 3. Multicolinearity test results

|

Variables |

Tolerance |

VIF |

|

AST |

.628 |

1.608 |

|

PRO |

.787 |

1.427 |

|

AGC |

.752 |

1.416 |

|

SIZ |

.698 |

1.568 |

|

TEC |

.846 |

1.022 |

4.2.3 Autocorrelation and Heteroscedasticity Test

The autocorrelation test shows that Asymp. Sig. (2-tailed) is 0.136, more than 0.05, which means that the residual is random, or there is no autocorrelation between residual values. The scatterplot shows that heteroscedasticity does not form a specific and systematic pattern; thus, the test concluded that there is no heteroscedasticity in the panel model.

4.3 Panel Data Estimation: Model 1

The results of the panel Model 1 and Model 2 present some findings that are quite interesting to be studied more deeply. Data analysis was conducted using software Eviews-10 and showed the results presented in Tables 4 - 9. Most of the results are in line with the predicted hypotheses. One of the most interesting results is the influence of mediating by company size, which showed a significant effect on other independent variables such as agency cost and innovations and technology. Each result of the hypotheses analysis is explained more deeply below.

Table 4. The Results of the Panel Data of Model 1

Table 4 covers the period 2013-2018 in quarterly and includes the Food and Beverages firms listed in IDX. The missing data of financial statements or not applicable observations were excluded. AST is assets structure; PRO is profitability; AGC is the agency cost; TEC is the innovations and technology (patent and property right); SIZ is the Log natural of total assets.

|

|

|

CEM |

FEM |

REM |

|||

|

Variables |

Predicted |

COEFF |

Sig |

COEFF |

Sig |

COEFF |

Sig |

|

C |

|

-0.5477 |

0.0024* |

-0.9812 |

0.0003* |

-0.8764 |

0.0001* |

|

AST |

+ |

1.0791 |

0.0000* |

0.4078 |

0.0017* |

0.5686 |

0.0000* |

|

PRO |

- |

-0.7854 |

0.0321** |

-0.5984 |

0.0285** |

-0.6313 |

0.0322** |

|

AGC |

+ |

0.1394 |

0.3744 |

-0.1472 |

0.4845 |

-0.0071 |

0.9689 |

|

TEC |

- |

0.0027 |

0.0742*** |

-0.0077 |

0.0640*** |

-0.0038 |

0.0768*** |

|

SIZ |

+ |

0.0329 |

0.0003* |

0.0614 |

0.0000* |

0.0544 |

0.0007* |

|

R2 |

|

0.4887 |

|

0.6913 |

|

0.4887 |

|

|

Adj R2 |

|

0.4626 |

|

0.6702 |

|

0.4792 |

|

|

F-statistic |

|

51.391 |

|

32.797 |

|

51.391 |

|

|

Prob F-stat |

|

0.0000 |

|

0.0000 |

|

0.0000 |

|

|

D-W |

|

0.3658 |

|

1.8822 |

|

0.4827 |

|

Note: *significant at α=1%; ** significant at α=5%; ***significant at α=10%.

4.3.1 Testing of Model 1: Chow testing

To choose the better panel data estimation model between CEM or FEM, a Chow-test is conducted. The hypotheses used are:

Ho: Common Effect Model

Ha: Fixed Effect Model.

Decision making follows the path:

If the probability of the Chi-square value> 0.05, then Ho is not rejected.

If the probability of the Chi-square value <0.05, then the value of Ho is rejected.

Table 5. Results of Chow-Test

|

Effects Test |

Statistic |

d.f. |

Prob. |

|

Cross-section F |

14.453023 |

(10.205) |

0.0000 |

|

Cross-section Chi2 |

151.001663 |

10 |

0.0000 |

Table 5 shows that the probability value of the Chi-square value is 0.0000, and it is smaller than 0.05, then Ho is rejected. Thus the Chow-test determines that the panel estimation is fixed effect model (FEM).

4.3.2 Testing of Model 1: Hausman testing

The Chow-test above shows that FEM is a better panel data estimation model than CEM. So we compare between FEM and REM using the Hausman test. In this test, the hypotheses used are:

Ho: Random Effect Model

Ha: Fixed Effect Model.

Decision making is based on the following:

If the probability of the Chi-square value> 0.05, then Ho is accepted.

If the probability of the Chi-square value <0.05, then Ho is rejected.

Tabel 6. Hausman-test Result

|

Test Summary |

Chi-Sq. statistic |

Chi-Sq. d.f. |

Probability |

|

Cross-section random |

22.622191 |

4 |

0.0002 |

Table 6 presents the results of the Hausman test: the probability value of the Chi-square is 0.0002, which is smaller than 0.05, then Ho is rejected. This finding indicates that the FEM panel data estimation model is better than that of REM. Thus, according to the Chow test and the Hausman test, the FEM model is better than the CEM and REM model, respectively.

4.4 Panel Data Estimation: Model 2

Model 2 analysis aims to determine the effect of moderating firm size variables that interact with four main variables, namely asset structure, profitability, agency cost and technology. The effect of moderating firm size has the potential to strengthen or weaken the effect of main variables so that this study finds more in-depth results as presented in Table 7.

Table 7. The Results of the Panel Data of Model 2

Table 7 covers the period 2013-2018 quarterly and includes the Food and Beverages firms listed in IDX. The missing data of financial statements or not applicable observations were excluded. AST is assets structure; PRO is profitability (proxy: ROA); AGC is the agency cost; TEC is the innovations and technology (patent and property right); SIZ is the Log natural of total assets. This test used SIZ as a mediating variable applied on AST, PRO, AGC and TEC, respectively.

|

|

|

CEM |

FEM |

REM |

|||

|

Variables |

Predicted |

COEFF |

Sig |

COEFF |

Sig |

COEFF |

Sig |

|

Constant |

|

0.1427 |

0.0036* |

1.8124 |

0.0005* |

1.7766 |

0.0011* |

|

AST |

+ |

3.6211 |

0.0000* |

2.8518 |

0.0012* |

2.7687 |

0.0008* |

|

PRO |

- |

-0.4834 |

0.0226** |

-0.2924 |

0.0311** |

-0.1882 |

0.0385** |

|

AGC |

- |

0.6824 |

0.4472 |

-0.5572 |

0.5543 |

-0.0481 |

0.8682 |

|

TEC |

- |

0.1582 |

0.0642*** |

0.1684 |

0.0562** |

0.1318 |

0.0611*** |

|

SIZ |

+ |

0.0732 |

0.0002* |

0.1314 |

0.0006* |

0.1668 |

0.0004* |

|

AST·SIZ |

+ |

1.6629 |

0.0072* |

3.4452 |

0.0032* |

3.2738 |

0.0062* |

|

PRO·SIZ |

+ |

0.2212 |

0.0112** |

0.1364 |

0.0126** |

0.1248 |

0.0302** |

|

AGC·SIZ |

+ |

0.1277 |

0.0664*** |

-0.1165 |

0.0553*** |

-0.1772 |

0.0720*** |

|

TEC·SIZ |

+ |

0.0252 |

0.0472** |

0.0248 |

0.0453** |

0.0372 |

0.0527*** |

|

R2 |

|

0.5266 |

|

0.7338 |

|

0.5652 |

|

|

Adj R2 |

|

0.5021 |

|

0.7182 |

|

0.5477 |

|

|

F-statistic |

|

72.354 |

|

43.552 |

|

65.932 |

|

|

Prob F-stat |

|

0.0000 |

|

0.0000 |

|

0.0000 |

|

|

D-W |

|

0.4772 |

|

1.8941 |

|

0.6833 |

|

Note: *significant at α=1%; ** significant at α=5%; ***significant at α=10%.

4.4.1 Testing of Model 2: Chow testing

To choose the better panel data estimation model between CEM or FEM, the Chow test is conducted. The hypotheses used are:

Ho: Common Effect Model

Ha: Fixed Effect Model.

Basic decision making follows the assumptions:

If the probability of the Chi-square value is > 0.05, then Ho is accepted.

If the probability of the Chi-square value is <0.05, then the value of Ho is rejected.

Tabel 8. Results of the Chow Test

|

Effects Test |

Statistic |

d.f. |

Probability |

|

Cross-section F |

18.6771 |

(10.812) |

0.0000 |

|

Cross-section Chi2 |

122.6258 |

10 |

0.0000 |

Table 8 shows that the probability value of the Chi-square value is 0.0000, and it is smaller than 0.05, then Ho is rejected. The Chow test thus determines that the data panel estimation is a fixed effect model.

4.4.2 Testing of Model 2: Hausman testing

Because the Chow test shows that FEM is a better panel data estimation model, a comparison is made between FEM and REM using the Hausman test. The hypotheses in this test are as follows:

Ho: Random Effect Model

Ha: Fixed Effect Model.

Decision making is based on the following assumptions:

If the probability of the Chi-square value is > 0.05, then Ho is accepted.

If the probability of the Chi-square value is <0.05, then Ho is rejected.

Tabel 9. The Hausman test result

|

Test Summary |

Chi-Sq. statistic |

Chi-Sq. d.f. |

Probability |

|

Cross-section random |

26.2321 |

4 |

0.0005 |

From the results of the Hausman test in Table 9, it was found that the probability value of the Chi-square value is 0.0005, which is smaller than 0.05, so Ho is rejected. This finding concludes that the fixed effect model estimation model is better than the random effect model.

4.5 The Results of Hypotheses

4.5.1 The Result of Hypothesis 1

The result of Hypothesis 1 presents that the variable assets structure has a positive coefficient of 0.4078 at significance level of 0.0017. It means assets structure does significantly affect leverage (debt ratio). Thus this result indicates that the asset structure positively and significantly influences the company’s capital structure because the size of the asset structure makes the creditor more confident in the company’s collateral for default risk and encourages the management to make more debt.

4.5.2 The Result of Hypothesis 2

The second hypothesis of variable profitability shows the coefficient of -0.5984 and significance level of 0.0285, which is in line with the hypothesis. A profitability that is proxied by ROA showed negative influence on leverage of company, which means that the increase in net income and EPS will increase the retained earnings (on targeted dividend payout) to reduce the leverage. This result supported the research hypothesis.

4.5.3 The Result of Hypothesis 3

Variable agency cost has no influence on the firm leverage because of the significance level of 0.4845 with the coefficient of -0.1472. This result means that the agency cost does not affect firm leverage. Theoretically, the increase of agency cost, which means increasing the control of shareholders to management, will decrease tendency to make more debt. The moral hazard of management related to debt risk will decrease. However, this result does not support the hypothesis.

4.5.4 The Result of Hypothesis 4

Innovation and technology show the negative influence with coefficient −0.0077 and significance at 0.0640 (α=10%), meaning this variable will inversely affect the debt ratio of the company. It negatively affects the firm leverage, which means that increased innovation and tech (number of patents and property rights) in companies will cause decline in insolvency because the company is paying more attention to innovation and tech and considers more carefully the risk of debt making.

4.5.5 The Result of Hypothesis 5

Firm size shows the positive effect of the panel regression coefficient of 0.0614 with a significance level of 0.000 (at α=5%), meaning this variable will strengthen influence on the increase of the solvency of the company. It positively affects the leverage, which means that the increase of the size (number of total assets) will cause an increase in leverage because the company is making more debt related to assets as collateral of bank loan and debt (bonds). This result supports Hypothesis 5.

4.5.6 The Result of Hypothesis 6

Firm size as a moderating variable that is used as interaction with other main independent variables shows the effect of strengthening and weakening the influence or relationship between four main independent variables and leverage (debt ratio). Table 7 shows the results of the Model 2 panel regression between independent variables, with leverage and firm size as mediating variables. The interaction effect between firm size and assets structure with coefficient 1.6629 and sig. 0.0072 means that firm size weakens the effect of assets structure on leverage. Firm size as a mediating variable between profitability and leverage relationship shows the change in coefficient to 0.1364 and sig. 0.0126, which means that the firm size weakens the relationship of profitability and leverage because an increase in firm size triggers an increase in the debt ratio that is not covered by retained earnings in addition to internal equity. An interesting finding occurred in the agency cost that was moderated by the firm size, which previously showed insignificant results that turned out to be significant with coefficient of -0.1165 and significance level of 0.0553 (α=10%). With firm size interaction, the effect of agency cost becomes significant and negative, which shows that the increase in agency cost results in a decrease in the debt ratio. The effect of firm size moderation on the correlation between innovations and technology with leverage shows strengthening with a coefficient of 0.0248 and significance level of 0.0453 (α=5%). Firm asset support triggers more efficient production and operation than before.

5. Discussion

5.1 Effect of Asset Structure on Leverage

The results of this study are not under the Trade-off Theory but support the Pecking Order Theory. The main problem of the Pecking Order theory lies in non-systematic information, and asset structure is the variable that determines the firm size of this problem. When a company has a higher proportion of tangible assets, the valuation of its assets becomes more manageable so that the information asymmetry problem is lower (Ross et al., 2017). So management reduces their use of debt when the proportion of tangible assets increases. This finding means that management uses the position of fixed assets as a basis for debt policymaking. This policy is related to the tendency that management is more careful in using and making new debt decisions so that the obligations of firms are getting smaller (Suhendra, 2014; Lim, 2012). The higher the structure of assets (the greater the number of fixed assets), the higher the use of own internal capital so that the use of foreign capital is less than before, and the leverage is lower than the optimal target. This result confirming the positive relationship between tangibility and leverage is in line with some studies conducted by Prieto and Lee (2019) and Sanil et al. (2018).

5.2 Effect of Profitability on Leverage

Concerning the profitability variable, profitability has a negative influence on capital structure, which means that a company that has a high level of profitability will reduce capital dependence on outside parties. The higher level of profit allows the management to obtain most of its internal funding of retained earnings before the firm uses external funding sources such as debt (Prieto & Lee, 2019; Rani et al., 2019). This finding shows that higher profits of the company and more inner equity source will be obtained so that the portion of the debt will be smaller and affect debt policy. The results of this study are in line with research conducted by Tan and Yang (2016), Jiahui (2015), and Forte et al. (2013).

5.3 Effect of Agency Cost on Leverage

Agency cost has a negative correlation with leverage or capital structure but does not affect firm leverage significantly. This finding does not support agency theory that the correlation between agency cost and leverage is significant, but is in line with previous research by Santosa et al. (2020) and Kyriazopoulos (2017). Besides, Vijayakumaran and Vijayakumaran (2019) state that agency costs in industries or business sectors that have been transparent and apply the principles of good corporate governance tend to be stable and decline. A stable agency cost encourages management to make leverage decisions more rational and measured following a healthy debt ratio target.

5.4 Effect of Innovations and Technology on Leverage

Innovations and technologies that make unique and innovative products in F&B negatively and significantly affect leverage. Customers demand continuous product innovation so that management not only has to do research and development strategically but also prepares a budget to facilitate it (Suhendra, 2014). In this situation, management tends to limit debt ratios and increase investment in intangible assets such as patents and intellectual property rights in food technologies to support innovative products and win the business competition (Castro et al., 2015). This argument is empirically proven where the relationship between innovation and technology with leverage is negative and significant.

5.5 Effect of Firm Size on Leverage

The large firms or the immense asset of the company influence funding decisions as large companies tend to get external funding easier in the form of debt or issuance of shares because large companies usually have more excellent asset guarantees, so it is easy to get external funding (Prieto & Lee, 2019; Eldhose & Kumar, 2019). A large firm uses more debt so that it enlarges the capital structure, while small companies use less debt to minimize the company’s capital structure (Sanil et al., 2018). Some of the statements above lead to the conclusion that company size has a positive relationship with leverage.

5.6 Effect of Moderating by Firm size on Leverage

The results of the analysis of the influence of moderate firm size variables provide some interesting findings which can either strengthen or weaken the effect of each independent variable on leverage. The relationship between asset structure and leverage weakens after being interacted by firm size due to the influential role of total assets compared to tangibility (Prieto & Lee, 2019). Weakening of the moderating variable effect also occurs in the relationship of profitability and leverage; even the relationship that was initially negative changed the direction to positive. This finding is influenced by intense moderating from the firm size that encourages management and creditors to increase the company’s debt portion due to the availability of adequate asset collateral (Onaolapo & Kajola, 2010). Another interesting finding is the relationship between agency cost and leverage that was not significant changed to be significant after interaction with firm size. This result is due to the influence of firm size, which is more dominant than the value of relatively low agency costs (Ghosh et al., 2017). Furthermore, the relationship between innovation and technology variables also gets stronger after mediation by firm size. Firm size mediation encourages management to improve research and development facilities to strengthen the influence of this variable on leverage (Muzir, 2011).

6. Conclusion

The correlation between capital structure, firm characteristics and capital expenditure on innovation and technology has attracted more attention than the classical factors of leverage. So far, the empirical results are varied, thus leaving the gap topic for future research. This study re-examines the determinants of leverage in an equity market that has undergone a prolonged depreciation of assets and a disruption from global capital markets.

Assets structure shows a partially positive and significant effect on the capital structure, thus it may be concluded that large firms influence financing decisions. The larger assets structure of the firm has the potential to get more accessible external capital both in the form of debt (bond) and the issuance of new shares (right issue) because it has more significant asset guarantees, credibility, business expansion-sustainability, and high bargaining power.

Profitability has a negative and significant effect on capital structure, partially. This condition indicates that in general, management decisions reduce the use of debt when the profitability increases. This situation is in line with the pecking order theory, where management chooses financing from within to increase its capital requirements. The management uses debt if the financing from the internal funds is not sufficient to cover the required capital needs for working capital, capital expenditure and business expansion.

The results showed that agency costs as proxied by the ratio of operating expenses to sales did not affect leverage decisions because corporate governance practices in the F&B sector were supported by reasonable management control so far. This finding is due to the relatively low and stable agency costs as a reflection of the low potential for agency problems.

Furthermore, innovation and technology present a partially negative and significant effect on the capital structure. It is concluded that intangible assets provide a guarantee of higher quality product innovation and fulfil the needs of the modern customer. So, in general, for firms that have increased the budget of innovation and technology such as patents, brand, trademark and goodwill it is much easier to attain the target of sales and be more efficient in the production line. Adding budget to innovation and technology produces higher quality and innovative food and beverage products which create intangible value and brand image for the customers.

Finally, the effect of firm size as a moderation variable weakens both the relationship between assets structure and leverage, and profitability with debt ratio, but strengthens the interaction of the agency cost, innovation and technology variables with capital structure. Thus the firm size can be concluded to be an independent variable and, at the same time, a mediation variable that has a significant influence on debt policy decisions, especially in the foods and beverages sector in Indonesia.

Limitations and avenue for future research

This study has three limitations, namely aspects of the independent variable, the period of research, and the limited sectors analyzed. The next research can add several other variables, especially control variables such as investment and auditor quality, and some macroeconomic variables such as inflation, interest rates, or exchange rates. Periods and sectors should be extended to obtain more representative results.

Acknowledgment

I am grateful to the editor of Organizations and Markets in Emerging Economies review, peer reviewers and some colleagues for their suggestions and comments, which led to a significant improvement in this paper.

References

Abdeljawad, I., & Mat Nor, F. (2017). The capital structure dynamics of Malaysian firms: timing behavior vs adjustment toward the target. International Journal of Managerial Finance, 13(3), 226–245. https://doi.org/10.1108/IJMF-09-2015-0170

Ardalan, K. (2017). Capital structure theory: Reconsidered. Research in International Business and Finance, 39, 696–710. https://doi.org/10.1016/j.ribaf.2015.11.010

Arifin, Z., Firmanzah, Fontana, A., & Wijanto, S. H. (2016). The determinant factors of technology adoption for improving firm’s performance: An empirical research of Indonesia’s electricity company. Gadjah Mada International Journal of Business, 18(3), 237–261. https://doi.org/10.22146/gamaijb.16898

Arsov, S., & Naumoski, A. (2016). Determinants of capital structure: An empirical study of companies from selected post-transition economies. Journal of Economics and Business, 34(1), 119–146. https://doi.org/10.18045/zbefri.2016.1.119

Baker, M., Wurgler, J., Forte, D., Barros, L. A., Nakamura, W. T., Brav, O., … Paudyal, K. (2016). How and when do firms adjust their capital structures toward targets? The Journal of Finance, 25(1), 165–182. https://doi.org/10.1108/JRF-06-2015-0060

Baltagi, B. H. (2013). Econometric Analysis of Panel Data (5th ed.). Wiley. Retrieved from https://www.wiley.com/en-gb/Econometric+Analysis+of+Panel+Data%2C+5th+Edition-p-9781118672327

Baule, R. (2019). The cost of debt capital revisited. Business Research, 12(2), 721–753. https://doi.org/10.1007/s40685-018-0070-6

Ben-Nasr, H., Boubaker, S., & Rouatbi, W. (2015). Ownership structure, control contestability, and corporate debt maturity. Journal of Corporate Finance, 35, 265–285. https://doi.org/10.1016/j.jcorpfin.2015.10.001

Brealey, R., Myers, S., & Marcus, A. (2020). Fundamentals of Corporate Finance (10th ed.). Retrieved from https://www.mheducation.com/highered/product/fundamentals-corporate-finance-brealey-myers/M9781260013962.html

Buvanendra, S., Sridharan, P., & Thiyagarajan, S. (2017). Firm characteristics, corporate governance and capital structure adjustments: A comparative study of listed firms in Sri Lanka and India. IIMB Management Review, 29(4), 245–258. https://doi.org/10.1016/j.iimb.2017.10.002

Castro, P., Tascón, M. T., & Amor-Tapia, B. (2015). Dynamic analysis of the capital structure in technological firms based on their life cycle stages. Revista Espanola de Financiacion y Contabilidad, 44(4), 458–486. https://doi.org/10.1080/02102412.2015.1088202

Chang, F.-M., Wang, Y., Lee, N. R., & La, D. T. (2014). Capital Structure Decisions and Firm Performance of Vietnamese SOEs. Asian Economic and Financial Review, 4(11), 1545–1563.

Eldhose, K. V., & Kumar, S. S. (2019). Determinants of financial leverage: An empirical analysis of manufacturing companies in India. Indian Journal of Finance, 13(7), 41. https://doi.org/10.17010/ijf/2019/v13i7/145534

Forte, D., Barros, L. A., & Nakamura, W. T. (2013). Determinants of the capital structure of small and medium sized Brazilian enterprises. Brazilian Administration Review, 10(3), 347–369. https://doi.org/10.1590/S1807-76922013000300007

Ghosh, A., Cai, F., & Fosberg, R. H. (2017). Capital structure and firm performance. Capital Structure and Firm Performance, 15(2), 1–131. https://doi.org/10.4324/9781315081793

Graham, J. R., Leary, M. T., & Roberts, M. R. (2015). A century of capital structure: The leveraging of corporate America. Journal of Financial Economics, 118(3), 658–683. https://doi.org/10.1016/j.jfineco.2014.08.005

Gujarati, D. N., & Porter, D. C. (2013). Basic Econometrics (4th ed.). https://doi.org/10.1126/science.1186874

Hasan, M. B., Ahsan, A. F. M. M., Rahaman, M. A., & Alam, M. N. (2014). Influence of Capital Structure on Firm Performance: Evidence from Bangladesh. International Journal of Business and Management, 9(5), 184–195. https://doi.org/10.5539/ijbm.v9n5p184

Horvathova, J., Mokrisova, M., & Dancisinova, L. (2018). Modelling of capital structure in relation to business performance maximization. Investment Management and Financial Innovations, 15(2), 292–304. https://doi.org/10.21511/imfi.15(2).2018.26

Jermias, J., & Yigit, F. (2019). Factors affecting leverage during a financial crisis: Evidence from Turkey. Borsa Istanbul Review, 19(2), 171–185. https://doi.org/10.1016/j.bir.2018.07.002

Jiahui, M. (2015). Relationship Between Capital Structure and Firm Performance: Evidence From Growth Enterprise Market in China. Management Science and Engineering, 9(1), 1–8. https://doi.org/10.3968/6322

Kanita, G. G. (2014). Pengaruh Struktur Aktiva dan Profitabilitas terhadap Struktur Modal Perusahaan Makanan dan Minuman. Trikonomika, 13(2), 127–135. https://doi.org/10.23969/trikonomika.v13i2.608

Kasmiati, M., & Santosa, P. W. (2019). The effect of earning information, cash flow components, financing decision, and Stock Return: Empirical Evidence on Indonesia stock exchange. Journal of Economics, Business & Accountancy Ventura, 22(2), 157–166. https://doi.org/http://sci-hub.tw/10.14414/jebav.v22i2.1638

Kyriazopoulos, G. (2017). Corporate governance and capital structure in the periods of financial distress: Evidence from Greece. Investment Management and Financial Innovations, 14(1), 254–262. https://doi.org/10.21511/imfi.14(1-1).2017.12

Li, W., Wu, C., Xu, L., & Tang, Q. (2017). Bank connections and the speed of leverage adjustment: evidence from China’s listed firms. Accounting and Finance, 57(5), 1349–1381.

Lim, T. C. (2012). Determinants of Capital Structure Empirical Evidence from Financial Services Listed Firms in China. International Journal of Economics and Finance, 4(3), 191–203. https://doi.org/10.5539/ijef.v4n3p191

Mahardika, R. B. (2018). Mengenal industri makanan dan minuman di era 4.0. Jogyakarta.

Mustilli, M., Campanella, F., & D’Angelo, E. (2018). Measuring determinants and effects of firms’ financial structure in a deleverage setting: Evidence from Italy. International Journal of Financial Research, 9(2), 23. https://doi.org/10.5430/ijfr.v9n2p23

Muzir, E. (2011). Triangle Relationship among Firm Size, Capital Structure Choice and Financial Performance. Journal of Management Research, 11(2), 87–98.

Nguyen, T. H., & Rern, J. H. (2016). Determinants of Capital Structure of the Listed Companies on Vietnam Stock Market. The International Journal of Business & Management, 4(6), 27–35. Retrieved from http://www.theijbm.com/wp-content/uploads/2016/06/5.-BM1606-018_Updated.pdf

Nguyen, V. C. (2020). Human capital, capital structure choice and firm profitability in developing countries: An empirical study in Vietnam. Accounting, 6(2), 127–136. https://doi.org/10.5267/j.ac.2019.11.003

Onaolapo, A. A., & Kajola, S. O. (2010). Capital structure and firm performance: Evidence from Nigeria. European Journal of Economics, Finance and Administrative Sciences, 4(25), 70–82.

Ozkan, A. (2001). Determinants of capital structure and adjustment to long run target: Evidence from UK company panel data. Journal of Business Finance and Accounting, 28(1–2), 175–198. https://doi.org/10.1111/1468-5957.00370

Peng Chow, Y. (2019). Sectoral Analysis of the Determinants of Corporate Capital Structure in Malaysia. Organizations and Markets in Emerging Economies, 10(2), 278–293. https://doi.org/10.15388/omee.2019.10.14

Prieto, A. B. T., & Lee, Y. (2019). Internal and External Determinants of Capital Structure in Large Korean Firms. Global Business and Finance Review, 24(3), 79–96. https://doi.org/10.17549/gbfr.2019.24.3.79

Rani, N., Yadav, S. S., & Tripathy, N. (2019). Capital structure dynamics of Indian corporates. Journal of Advances in Management Research, 17(2), 212–225. https://doi.org/10.1108/JAMR-12-2017-0125

Rashid, A. (2016). Does risk affect capital structure adjustments? The Journal of Risk Finance, 17(1), 80–92. https://doi.org/10.1108/JRF-06-2015-0060

Ross, S., Westerfield, R., Jaffe, J., & Jordan, B. (2017). Corporate Finance: Core Principles and Applications (5th ed.). Retrieved from https://www.mheducation.com/highered/product/corporate-finance-core-principles-applications-ross-westerfield/M9781259289903.html

Sanil, H. S., Noraidi, A. A. A. bin, & Ramakrishnan, S. (2018). The Impact of Different Firm Sizes on Capital Structure Determinants among Listed Consumer Product Firms In Malaysia. Journal of Economic Info, 5(2), 1–6. https://doi.org/10.31580/jei.v5i2.104

Santosa, P. W., & Hosen, M. N. (2011). Probability of price reversal and intraday trading activity for low banking sector at Indonesia stock exchange. International Research Journal of Finance and Economics, 79(2), 31–42. Retrieved from http://www.internationalresearchjournaloffinanceandeconomics.com

Santosa, P. W. (2019). Financial performance, exchange rate and stock return: Evidence from manufacturing sector. Jurnal Manajemen Teknologi, 18(3), 205–217. https://doi.org/10.12695/jmt.2019.18.3.5

Santosa, P. W. (2020). Determinants of price reversal in high-frequency trading: empirical evidence from Indonesia. Investment Management and Financial Innovations, 17(1), 175–187. https://doi.org/10.21511/imfi.17(1).2020.16

Santosa, P. W., & Puspitasari, N. (2019). Corporate Fundamentals, Bi Rate And Systematic Risk: Evidence From Indonesia Stock Exchange. Jurnal Manajemen, 23(1), 40–53. https://doi.org/10.24912/jm.v23i1.443

Santosa, P. W., Tambunan, M. E., & Kumullah, E. R. (2020). The role of moderating audit quality relationship between corporate characteristics and financial distress in the Indonesian mining sector. Investment Management and Financial Innovations, 17(2), 88–100. https://doi.org/10.21511/imfi.17(2).2020.08

Suhendra, E. S. (2014). Factors Impacting Capital Structure in Indonesian Food and Beverage Companies. International Conference on Eurasian Economies 2014, 75–82. https://doi.org/10.36880/c05.00896

Sutomo, S., Wahyudi, S., Pangestuti, I., & Muharam, H. (2020). The determinants of capital structure in coal mining industry on the Indonesia Stock Exchange. Investment Management and Financial Innovations, 17(1), 165–174. https://doi.org/10.21511/imfi.17(1).2020.15

Tan, Y., & Yang, Z. (2016). Contingent capital, capital structure and investment. The North American Journal of Economics and Finance, 35, 56–73. https://doi.org/10.1016/j.najef.2015.10.016

Titman, S., & Wessels, R. (1988). The Determinants of Capital Structure Choice. The Journal of Finance, 43(1), 1–19. https://doi.org/10.1111/j.1540-6261.1988.tb02585.x

Vijayakumaran, S., & Vijayakumaran, R. (2019). Corporate Governance and Capital Structure Decisions: Evidence from Chinese Listed Companies. The Journal of Asian Finance, Economics and Business, 6(3), 67–79. https://doi.org/10.13106/jafeb.2019.vol6.no3.67

Vo, X. V. (2017). Determinants of capital structure in emerging markets: Evidence from Vietnam. Research in International Business and Finance, 40, 105–113. https://doi.org/10.1016/j.ribaf.2016.12.001

Xuan Anh, T. T., Tuan, L. Q., & Phuong, B. N. (2018). Impact of ownership structure on capital structure-empirical evidence from listed firms in Vietnam. DLSU Business and Economics Review, 28(1), 128–149.

Yang, Y., Albaity, M., & Hassan, C. H. Bin. (2015). Dynamic capital structure in China: Determinants and adjustment speed. Investment Management and Financial Innovations, 12(2), 195–204.

Yoo, S., & Wu, J. (2019). Capital structure and stock returns: Evidence from Korean stock markets. Global Business and Finance Review, 24(4), 8–23. https://doi.org/10.17549/gbfr.2019.24.4.8

Zunckel, S., & John Nyide, C. (2019). Capital structure of small, medium and micro enterprises: major factors for a developing economy. Problems and Perspectives in Management, 17(2), 124–133. https://doi.org/10.21511/ppm.17(2).2019.09