Organizations and Markets in Emerging Economies ISSN 2029-4581 eISSN 2345-0037

2020, vol. 11, no. 1(21), pp. 69–82 DOI: https://doi.org/10.15388/omee.2020.11.24

Effects of Remittances on Poverty: Evidence in CEE Countries

Mindaugas Butkus

Institute of Regional Development, Siauliai University, Lithuania

mindaugas.butkus@su.lt

https://orcid.org/0000-0003-2381-5440

Kristina Matuzevičiūtė (Corresponding author)

Institute of Regional Development, Siauliai University, Lithuania

kristina.matuzeviciute@su.lt

https://orcid.org/0000-0003-0573-0072

Kotryna Raupytė

Institute of Regional Development, Siauliai University, Lithuania

kotryna.raupyte@gmail.com

Abstract. The countries with a transition economy in the EU have experienced a rapid growth of labour migration and remittance flows during the last two decades. Remittances are improving household economic welfare, so it is important to evaluate how these financial flows may affect the poverty situation, as CEE countries are facing levels of poverty and inequality above the EU average. The paper examines the impact of remittances on poverty, using the panel of seven CEE countries conside red as advanced transition economies, over the period of 2006-2015. Pooled OLS, fixed effects, random effects, and 3-stage least squared estimators are used to estimate the poverty effects of remittances. The results show that remittances have a significant impact on three out of four poverty measures. Taking into consideration the endogeneity problem, it is estimated that a 10-per cent increase in remittances to GDP ratio will lead to a decline, on average, by 5.5 per cent in poverty headcount, and also by 3.7 per cent in poverty gap and 0.6 per cent in the risk of poverty. These results can be important for defining the policy measures on providing more efficient management of remittances.

Keywords: remittances, poverty, transition economies

Received: 7/9/2019. Accepted: 12/20/2019

Copyright © 2020 Mindaugas Butkus, Kristina Matuzevičiūtė, Kotryna Raupytė. Published by Vilnius University Press. This is an Open Access article distributed under the terms of the Creative Commons Attribution Licence, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

1. Introduction

The socio-economic situation as a result of historical and political circumstances has led to poverty and high emigration rates in transition economies. The United Nations (UN) declares poverty reduction as the first objective of sustainable development, so the problem of poverty is relevant to the progress of transition economies. According to the latest data of the World Bank (World Bank Group, 2018), the highest flow of remittances was recorded in 2018. The inflow of remittances in 2018 amounted to 528 billion USD, it increased by 10.8 per cent over the year and over 3 times exceeded the Official Development Assistance (ODA). The remittance flows have attracted the attention of scientists since the size of remittances is the second major external financial flow after foreign direct investments in the balance of payments of the receiving countries. Remittances are considered to have a significant, poverty-reducing effect in the countries of origin. Similarly, remittances can mitigate or offset the negative effects of emigration on the economy in the country of origin and stimulate its growth. Various international organizations (World Bank (WB), International Monetary Fund (IMF), and UN) have contributed to the research of the impact of remittances on poverty and developed the guidelines of econometric modelling on this issue. According to Kakhkharov (2015), when evaluating the impact of remittances on poverty, it is even more relevant to investigate this phenomenon by distinguishing between countries and grouping them according to similar economic development.

Following the IMF’s and UN’s contributions on modelling the impact of remittances on poverty, we are aiming to assess the impact of remittances on poverty in advanced transition economies that have already joined the European Union and are transiting from developing to developed economies. Undergoing a process to move from a planned to a market economy, these countries have been experiencing a drastic decline in the economy, which in turn has led to high levels of poverty and emigration. Since the 1990s, poverty has been considerably decreasing in Central and Eastern European countries, but it still remains at rather high levels, compared with the developed EU countries. At the same time, emigration flows remain considerably high and show the trend of increase, bringing up the question of possible positive outcomes, at least, on poverty.

In this paper, we are aiming to supplement the contributions that quantitatively evaluate the impact of remittances on poverty in the emerging (transition) European countries. We have contributed to the previous research in the following ways: (i) contrary to Mehedintu et al. (2019) and similarly to Pekovic (2017), we have applied a model developed by IMF and UN with a 3-stage least squares estimator to address endogeneity issue, but we have included advanced transition economies of the EU; (ii) we have used not only Foster–Greer–Thorbecke family of poverty metrics which measure absolute poverty, but also the risk of poverty index as a measure of relative poverty.

The rest of the paper is organized as follows: Section 2 presents a literature review focusing on the impact of remittances. Section 3 discusses the model specification based on the one developed by IMF and UN. Section 4 presents estimates of the effect of remittances on four alternative variables to measure poverty. The last section concludes the paper.

2. Literature review

From a theoretical perspective, emigrant remittances are viewed as controversial as they can have both positive and negative consequences for the economy of the country of origin. Their effects can be analysed from the microeconomic and macroeconomic perspective. On the positive side, emigrant remittances alleviate poverty by increasing household income and raising their quality of life (Adams & Page, 2005a; Slddiqui & Kemal, 2006; Gupta et al., 2009; Iheke, 2012). Cattaneo (2005) points out that emigrant remittance reduces poverty by creating a mechanism of divergence that occurs when the benefits of migration come not only for migrant families but also for the community not directly involved in the migration process. In the short term, remittances sent back to the country of origin could stimulate the economy through a multiplier of consumption. As household consumption increases, boosting demand for local goods and services encourages small business start-ups, creating new jobs. The multiplier effect ensures that the income increases not only in households receiving remittances but also in non-emigrant households. As household incomes increase, part of the funds goes to saving and investing. Families receiving remittances can undertake activities that were previously inaccessible due to lack of financial resources, increasing demand for financial instruments for savings and investment, and transfer funds can be used as start-up capital to start a business. At the macroeconomic level, the development of the financial sector is stimulated, the real estate market becomes more active, and small and medium-sized business initiatives increase. Investments can have a long-term impact on a country’s economy. Kašinskis (2009) notes that a country benefits when emigrant remittances are used to finance higher education. Moreover, emigrant remittances finance the creation of new businesses and other areas with high added value. Cattaneo (2005) adds that the increase in financial resources for investment reduces poverty in the country. Kakhkharov (2016) observes that the situation where wealthier households reach more emigrant remittances than poorer ones is characteristic of Eastern Europe and other countries of the former Soviet Union. Emigrant remittances do not function as a means of poverty alleviation when they are received by wealthier households (Cattaneo, 2005).

The research identifies different channels of negative remittance impact. It may occur if most of the emigrant remittances are spent on consumption rather than on investment, creating a potentially risky economic situation. When emigrant remittances are spent on consumer goods, services and speculations in real estate market, price levels and inflation may rise. Consumption promotes GDP growth only in the short term, which artificially inflates the country’s economy (Matuzeviciute & Balciunas, 2012). There is evidence in Latin America suggesting that remittances have negative impact on exchange rate, which can cause “Dutch Disease” (Bourdet & Falck, 2006). Maimbo & Ratha’s (2005) analysis of the remittance in developing countries implied that economic dependency on remittances promotes economic stagnation, which does not lead to long-term poverty reduction. Javid et al. (2012) and Vacaflores (2018) confirmed the negative impact of remittances on poverty. Chami et al. (2003) emphasized the moral hazard problem of remittances, which leads to reduced labour effort, and increased investment risk leading to reducing economic growth. Chami et al. (2008) explored the problem of higher future debt levels, which are associated with increased government spending in remittance dependent countries.

The results of empirical research on the impact of remittances on poverty point towards positive outcomes. However, the estimated impact scale differs, and this could be caused by data quality, used research sample, and applied methods, as well as economic, social and cultural differences in the analysed regions or countries that can lead to different effects of remittances on poverty and other macroeconomic factors.

TABLE 1. The research results of the impact of emigrants’ remittances on poverty

|

Reference |

Research sample |

Method |

The poverty |

The poverty |

Poverty |

Poverty |

|

|

Geographical |

Period |

||||||

|

Adams & Page, 2005b |

74 developing countries |

1980-1998 |

OLS |

$1 |

1.16%* |

2.05%** |

2.14%** |

|

Gupta et al., 2007 |

76 developing countries |

1980-2006 |

3SLS |

$1 |

1.5%*** |

1.1%** |

0.8% |

|

Anyanwu & Erhijakpor, 2010 |

33 African countries |

1990-2004 |

GMM |

$1 |

2.9%*** |

2.9%*** |

2.8%*** |

|

Das et al., 2011a |

77 developing countries |

1980-2008 |

3SLS |

$1.25 |

0.9%** |

0.9% |

- |

|

United |

21 developing country, when remittance share is ≥ 5% /GDP |

1980-2008 |

3SLS |

$1.25 |

3.1%* |

3.1% |

- |

|

Pekovic, 2017 |

9 transition economy countries |

2002-2013 |

LSDV |

$3.1 |

4.7%*** |

5.2%*** |

5.8%*** |

|

Yoshino et al., 2017 |

10 Asian countries |

1981-2014 |

POLS |

$1.90 |

8.5% |

22.6%** |

16.0%** |

Note: *, **, *** indicate statistical significance at the 10%, 5%, and 1% levels, respectively.

The first attempt to analyse the relationship between remittance and poverty was conducted by Adams and Page (2003a; 2003b; 2005a; 2005b), including data from 74 developing countries from around the world. The results show that a 10 per cent increase in per capita remittances reduces the share of people living below the poverty line of 1 $ per day by 1.6 per cent, and that the depth and severity of poverty declines by 2 per cent. Similar results were found by a number of researchers (Gupta et al., 2007, 2009; Vargas-Silva et al., 2009; Anyanwu & Erhijakpor, 2010; Ratha et al., 2011; Das et al., 2011; Ratha, 2013; Imai et al., 2014; Akobeng, 2016; Inoue & Hamori, 2016; Azam et al., 2016; Huay & Bani, 2018; Wagle & Devkota, 2018; Shirazi et al., 2018; Inoue, 2018; Bouoiyour & Miftah, 2018; Mehedintu et al., 2019; Ali et al., 2019; Azizi, 2019). Some authors, on the contrary, found no impact (Cattaneo, 2005) or even negative impact on poverty (Javid et al., 2012; Vacaflores, 2018).

Remittances have a greater impact on poverty investigating the effect in individual regions rather than globally. For example, in 33 African countries, Anyanwu and Erhijakpor (2010) found that if remittances increased up to 10 per cent as a share of GDP, poverty depth and severity would decrease by 2.9 and 2.8 per cent, respectively. The estimations by Pekovic (2017), who studied the impact of remittances in 9 transition economies from the CIS and the Balkan region, suggest that increase in remittances’ flow per capita by 10 per cent would result in a 4.7 per cent reduction in poverty headcount (the poverty threshold of 3.1 $ PPP per day), the depth of poverty would be reduced by 5.2 per cent, and the poverty severity by 5.8 per cent. By examining Asian countries, Yoshino et al. (2017) found that with a 10 per cent increase in emigrants’ money transfers, the spread of poverty in the Asian region would decrease by 8.5 per cent, the poverty gap by 22.5 per cent, and the poverty severity by 16 per cent.

The majority of previous studies analyse developing countries in Africa (Bouoiyour & Miftah, 2014; Shirazi et al., 2018; Tolorunju et al., 2018 among others), Asia (Yoshino et al., 2018; Wagle & Devkota, 2018; Kumar, 2019 among others), and only the studies by Pekovic (2017) and Mehedintu et al. (2019) analyse emerging (transition) countries in Europe. With the development of globalization and integration processes, transition countries in the EU have faced the rapid growth of labour migration, which was the consequence of lower development, compared with old EU member states. As a result of growing labour migration, remittance flows tend to increase in origin countries, and their outcomes on receiving countries have attracted the interest of researchers.

We can conclude that the impact of remittances on poverty and its significance depends on the socio-economic conditions of each country. Empirical research shows that with an increase of remittances by 10 per cent, global poverty is reduced, on average, by 1-2 per cent, with individual regions being more affected. However, Maimbo and Ratha (2005) state that remittances are not a panacea because the poverty-reducing effect must be treated with caution, as the above-mentioned research does not take into account the impact on the countries’ economies if emigrants stay in their destination country forever.

3. Model

In this section, we introduce the data and the model of our research. The data for the research was extracted from Eurostat, WB’s specialized database on poverty – PovcalNet, and World Development Indicators. The panel data on CEE countries cover the period of 2006–2015, i.e. ten years for which the most recent data on poverty is available. We included seven CEE countries – Bulgaria, Estonia, Lithuania, Latvia, Poland, Romania, and Slovakia. These countries along with Slovenia, Hungary, Czechia and Croatia (for which balanced and uniform1 data on poverty is not available) are considered as advanced transition economies. We assume that seven out of eleven countries will allow generalizing on poverty effects of remittances in CEE transition economies.

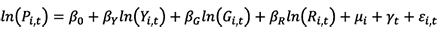

Based on models proposed by IMF (Chami et al., 2008) and UN (Das et al., 2011), to analyse remittances’ effect on poverty, the general econometric specification of Cobb–Douglas function relating remittances and poverty for panel data can be written as:

, (1)

, (1)

where the subscript i stands for the country, subscript t is the year, μi stands for time-fixed, i.e. country-specific effects, γt – for time-varying effects common to all countries, εi,t is idiosyncratic error term. Pi,t is the poverty indicator.

We used four alternative variables to measure poverty. The first three are indices from the Foster–Greer–Thorbecke family of poverty metrics2 (Foster et al., 1984). FGT0, or the poverty headcount ratio (PHCR), simply shows the part of a society that lives below the poverty line. FGT1, or the poverty gap index (PGI), measures how intense poverty is. The poverty gap index has an advantage over the headcount ratio. The latter simply counts all the people below the poverty line, in a given society, considering them as equally poor. Meanwhile, the poverty gap index shows the depth of poverty by estimating how far, on the average, the poor are from the poverty line. The third one is FGT2, or the squared poverty gap index (SPGI) used to measure the severity of poverty. Squaring the poverty gap for each household or individual, this index allows giving greater weight to those that are far below the poverty line compared with those that are closer to it. All three indices use 1.9 (PPP, current international $) per day poverty line and are considered as the measures of the absolute extreme poverty. The fourth one is a risk of poverty index (RPI), which measures the proportion of persons whose equalised disposable income after social transfers fell below the risk-of-poverty threshold (60 % of the national median equalised disposable income). This index is considered as a measure of relative poverty.

Yi,t stands for per capita gross national income, previously known as gross national product, (PPP, constant international $). Per capita gross national income in WB’s World Development Indicators database is provided in constant LCU. For comparability, this variable is adjusted, using PPP conversion factor (LCU per international $). Gi,t is the Gini index that measures income inequality. Ri,t stands for remittances (% of GDP), which is the sum of two items defined in the sixth edition of the IMF’s Balance of Payments Manual: (i) personal transfers (all current transfers between resident and non-resident individuals) and (ii) compensation of employees (income of border, seasonal, and other short-term workers who are employed in an economy where they are not residents and of residents employed by non-resident entities).

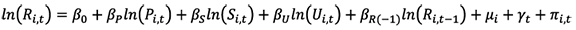

Eq. (1) is likely to suffer from endogeneity problem since remittances and poverty are linked by bidirectional relation. Considering remittances as an endogenous variable, we can assume that increasing remittances could have a negative effect on poverty, at the same time poverty could positively affect remittances by encouraging emigration, which is followed by remittances. Following Gupta et al. (2007) and Das et al. (2011), we can address the problem of remittances endogeneity by using external instrumental variables and three-stage least squares (3SLS) approach. This approach combines system equation, known as seemingly unrelated regression, with two-stage least squares (2SLS) estimation. Econometric specification of the second equation used to explain remittances for panel data can be written as:

, (2)

, (2)

where Si,t stands for schooling, which in our case is measured by a percentage of the population with higher education, Ui,t – for the unemployment rate, and Ri,t–1 is lagged remittances included in the equation assuming that previous remittances positively affect future remittances, i.e. if previously emigrants were inclined to send a lot/little remittances, they will act the same in the near future with no major changes in their behaviour. All variables and their summary statistics are presented in Table 2.

TABLE 2. Variables and summary statistics

|

Variable |

Description |

Measurement |

Mean |

Std. dev. |

Min. |

Max. |

Source |

|

PHCR |

Poverty headcount ratio at $1.90 a day (2011 PPP) |

% of population |

1.68 |

1.96 |

0.230 |

7.96 |

World Bank’s PovcalNet database |

|

PGI |

Poverty gap at $1.90 a day (2011 PPP) |

% |

0.70 |

0.70 |

0.06 |

2.86 |

|

|

SPGI |

Squared poverty gap at $1.90 a day (2011 PPP) |

% |

0.44 |

0.39 |

0.01 |

1.75 |

|

|

RPI |

Risk of poverty index. Below 60 % of the national median equalised disposable income |

% |

42.60 |

4.18 |

35.90 |

51.40 |

Eurostat |

|

Y |

Per capita gross national income |

PPP, constant international $ |

20.363 |

4.568 |

11.100 |

29.420 |

World Bank’s World Development Indicators database |

|

R |

Remittances |

% of GDP |

2.63 |

1.39 |

0.38 |

6.07 |

|

|

G |

The Gini index |

% |

33.70 |

3.48 |

24.70 |

39.60 |

Eurostat |

|

S |

Share of population (25-64) with higher education (Tertiary education (levels 5-8)) |

% |

21.30 |

6.57 |

9.60 |

33.30 |

|

|

U |

Unemployment rate |

% |

10.20 |

3.53 |

4.25 |

18.70 |

Unlike the 2SLS approach for a system of equations, which would estimate the coefficients of each structural equation separately, the 3SLS estimates all coefficients simultaneously. It also allows the correlation of the structural disturbances across equations, thus improving the efficiency of equation-by-equation estimation, but at the same time, it assumes that within each structural equation the disturbances are both homoscedastic and serially uncorrelated, and thus implies that the disturbance covariance matrix within each equation is diagonal. Testing whether we hold these assumptions is crucial while estimating the model.

4. Estimations

Tables 3 and 4 report our initial estimates of Eq. (1), using classical estimators in the panel data context. A low p-value of test for differing group intercepts suggests that time-constant country-specific factors, i.e. μi cannot be ignored but rather modelled as differing intercepts using least squares dummy variable estimator or omitted (as in our case) after demeaned transformation. Hausman’s test results count against the hypothesis that random effects estimates are consistent in favour of fixed effects estimates. This could be because correlates with some of the independent variables cause endogeneity problem.

TABLE 3. Pooled ordinary least squares, fixed and random effects estimates. Dependent variables – poverty headcount ratio and poverty gap index

|

Variable |

Parameter |

|

Dependent variable – ln(PHCRi,t) |

|

Dependent variable – ln(PGIi,t) |

||||

|

|

POLS |

FE |

RE |

|

POLS |

FE |

RE |

||

|

Intercept |

β0 |

|

13.31 |

11.23 |

-2.84 |

|

-3.26 |

4.14 |

-5.16 |

|

|

(11.73) |

(12.40) |

(6.06) |

|

(11.96) |

(10.20) |

(6.37) |

||

|

ln(Yi,t) |

βY |

|

-2.45** |

-1.60 |

-0.53 |

|

-1.14 |

-1.11 |

-0.48 |

|

|

(0.99) |

(1.20) |

(0.41) |

|

(0.96) |

(1.30) |

(0.40) |

||

|

ln(Gi,t) |

βG |

|

3.08* |

1.21 |

2.23** |

|

3.95** |

1.64 |

2.52** |

|

|

(1.33) |

(1.58) |

(0.88) |

|

(1.48) |

(1.54) |

(0.92) |

||

|

ln(Ri,t) |

βR |

|

-0.31 |

0.34* |

0.34** |

|

-0.17 |

0.37** |

0.37** |

|

|

(0.34) |

(0.17) |

(0.14) |

|

(0.37) |

(0.13) |

(0.12) |

||

|

Robust test for differing group intercepts(1) |

|

[<0.01] |

|

[<0.01] |

|||||

|

Breusch-Pagan test(2) |

|

[<0.01] |

|

[<0.01] |

|||||

|

Hausman test(3) |

|

[0.01] |

|

[0.02] |

|||||

|

Pesaran CD test for cross-sectional dependence(4) |

|

[0.13] |

|

[0.12] |

|||||

|

Sample size |

|

70 |

70 |

70 |

|

70 |

70 |

70 |

|

|

R2 |

|

0.47 |

0.27 |

0.27 |

|

0.33 |

0.32 |

0.22 |

|

Notes: Robust (using HCCME) standard errors are presented in parentheses. All estimates include time dummies. *, **, *** indicate statistical significance at the 10%, 5%, and 1% levels, respectively. POLS refers to pooled ordinary least squares (OLS), FE to fixed effects, and RE to random effects estimates. Adjusted R-squared and within R-squared is reported for pooled OLS and fixed effects estimates, respectively, and for the random effects – squared correlation between observed and estimated values of the dependent variable is presented. P-values are presented in the brackets. (1) A low p-value counts against the null hypothesis that the pooled OLS model is adequate, in favour of the fixed effects alternative. (2) A low p-value counts against the null hypothesis that the pooled OLS model is adequate, in favour of the random effects alternative. (3) A low p-value counts against the null hypothesis that the random-effects model is consistent, in favour of the fixed-effects model. (4) A low p-value counts against the null hypothesis: cross-sectional independence.

TABLE 4. Pooled ordinary least squares, fixed and random effects estimates. Dependent variables – squared poverty gap index (severity of poverty) and risk of poverty index

|

Variable |

Parameter |

|

Dependent variable – ln(SPGIi,t) |

|

Dependent variable – ln(RPIi,t) |

||||

|

|

POLS |

FE |

RE |

|

POLS |

FE |

RE |

||

|

Intercept |

β0 |

|

-15.67 |

-0.16 |

-7.82 |

|

3.44 |

7.39** |

2.74*** |

|

|

(12.65) |

(12.34) |

(7.59) |

|

(1.97) |

(1.64) |

(0.64) |

||

|

ln(Yi,t) |

βY |

|

-0.18 |

-0.63 |

-0.32 |

|

-0.11 |

-0.35 |

0.03 |

|

|

(0.98) |

(1.60) |

(0.47) |

|

(0.16) |

(0.22) |

(0.04) |

||

|

ln(Gi,t) |

βG |

|

4.71** |

1.41 |

2.68** |

|

0.40** |

-0.10 |

0.20 |

|

|

(1.64) |

(2.10) |

(1.16) |

|

(0.13) |

(0.18) |

(0.20) |

||

|

ln(Ri,t) |

βR |

|

-0.03 |

0.41* |

0.42** |

|

-0.05 |

0.03 |

0.02 |

|

|

(0.43) |

(0.17) |

(0.16) |

|

(0.03) |

(0.03) |

(0.04) |

||

|

Robust test for differing group intercep ts(1) |

|

[<0.01] |

|

[<0.01] |

|||||

|

Breusch-Pagan test(2) |

|

[<0.01] |

|

[<0.01] |

|||||

|

Hausman test(3) |

|

[0.01] |

|

[<0.01] |

|||||

|

Pesaran CD test for cross-sectional dependence(4) |

|

[0.14] |

|

[0.13] |

|||||

|

Sample size |

|

70 |

70 |

70 |

|

70 |

70 |

70 |

|

|

R2 |

|

0.47 |

0.27 |

0.19 |

|

0.33 |

0.32 |

0.09 |

|

Note: see the notes under Table 3

The fixed effects estimates suggest that the development level, i.e. per capita gross national income, negatively correlates with absolute as well as relative poverty. This direction of the relationship is logical since more developed countries deal better with pulling out people from poverty (especially extreme poverty), but the estimated effect is not statistically significant. Income inequality appeared to be positively correlated with all three indicators used to measure absolute poverty, and negatively with relative poverty. In all cases, correlation is statistically insignificant. Considering remittances, correlation with poverty is positive, and in the case of absolute poverty, this correlation is statistically significant. These findings contradict theoretical insights and empirical evidence in many countries that remittances are an important source of income for households in the lowest income group, helping them to escape extreme poverty. From the econometric point of view, this evidence might be biased, since poverty and remittances, as previously discussed, could be interrelated. Table 5 reports 3SLS estimates, i.e. when 2SLS estimation is combined with system equation, one of which is used to explain endogenous variable, i.e. remittances.

TABLE 5. Three-stage least squares estimates

|

Variable |

Parameter |

|

Poverty |

|

Poverty |

|

Squared |

|

Risk of |

||||

|

|

ln(PHCRi,t) |

ln(Ri,t) |

|

ln(PGIi,t) |

ln(Ri,t) |

|

ln(SPGIi,t) |

ln(Ri,t) |

|

ln(RPIi,t) |

ln(Ri,t) |

||

|

ln(Yi,t) |

βY |

|

−2.21*** |

|

|

−0.93 |

|

|

−0.04 |

|

|

−0.11* |

|

|

|

(0.58) |

|

|

(0.63) |

|

|

(0.77) |

|

|

(0.06) |

|

||

|

ln(Gi,t) |

βG |

|

3.47*** |

|

|

4.24*** |

|

|

4.92*** |

|

|

0.41*** |

|

|

|

(0.91) |

|

|

(0.99) |

|

|

(1.20) |

|

|

(0.09) |

|

||

|

ln(Ri,t) |

βR |

|

−0.55*** |

|

|

−0.37** |

|

|

−0.20 |

|

|

−0.06*** |

|

|

|

(0.15) |

|

|

(0.16) |

|

|

(0.20) |

|

|

(0.02) |

|

||

|

ln(PHCRii,t) |

βPHCR |

|

|

0.06 |

|

|

|

|

|

|

|

|

|

|

|

|

(0.06) |

|

|

|

|

|

|

|

|

|

||

|

ln(PGIi,t) |

βPGI |

|

|

|

|

|

0.06 |

|

|

|

|

|

|

|

|

|

|

|

|

(0.07) |

|

|

|

|

|

|

||

|

ln(SPGIi,t) |

βSPGI |

|

|

|

|

|

|

|

|

0.05 |

|

|

|

|

|

|

|

|

|

|

|

|

(0.07) |

|

|

|

||

|

ln(RPIi,t) |

βRPI |

|

|

|

|

|

|

|

|

|

|

|

0.33 |

|

|

|

|

|

|

|

|

|

|

|

|

(0.58) |

||

|

ln(Si,t) |

βS |

|

|

0.65*** |

|

|

0.58*** |

|

|

0.53*** |

|

|

0.57*** |

|

|

|

(0.16) |

|

|

(0.15) |

|

|

(0.14) |

|

|

(0.16) |

||

|

ln(Ui,t) |

βU |

|

|

0.47*** |

|

|

0.44** |

|

|

0.42** |

|

|

0.37** |

|

|

|

(0.17) |

|

|

(0.17) |

|

|

(0.17) |

|

|

(0.16) |

||

|

ln(Ri,t–1) |

βR(–1) |

|

|

0.55*** |

|

|

0.57*** |

|

|

0.58*** |

|

|

0.59*** |

|

|

|

(0.08) |

|

|

(0.08) |

|

|

(0.08) |

|

|

0.08 |

||

|

Intercept |

β0 |

|

9.81 |

−2.40*** |

|

−6.07 |

−2.11*** |

|

−17.64* |

−1.91*** |

|

3.35*** |

−3.28 |

|

|

(8.02) |

(0.67) |

|

(8.69) |

(0.60) |

|

(10.62) |

(0.55) |

|

(0.83) |

2.54 |

||

|

Breusch-Pagan test for diagonal covariance matrix(1) |

|

[0.11] |

|

[0.08] |

|

[0.42] |

|

[0.49] |

|||||

|

Hansen-Sargan over-identification test(2) |

|

[0.26] |

|

[0.41] |

|

[0.68] |

|

[0.08] |

|||||

|

Sample size |

|

70 |

70 |

|

70 |

70 |

|

70 |

70 |

|

70 |

70 |

|

|

Adj. R2 |

|

0.45 |

0.72 |

|

0.31 |

0.72 |

|

0.19 |

0.72 |

|

0.44 |

0.70 |

|

Notes: Standard errors are presented in parentheses. *, **, *** indicate statistical significance at the 10%, 5%, and 1% levels, respectively. All estimates include time dummies. P-values are presented in the brackets. (1) A low p-value counts against the null hypothesis that the disturbance covariance matrix within each equation is diagonal. (2) A low p-value counts against the null hypothesis that the over-identifying restrictions are valid.

Breusch-Pagan and Hansen-Sargan tests indicate that all 3SLS estimates are homoscedastic, serially uncorrelated, and with valid over-identifying restrictions. Moreover, Adjusted R-squared suggests that selected variables explain a major part (over 70 per cent) of the remittances’ variation. Estimates of Eq. (1) provide evidence that the development level negatively correlates with poverty, and there is especially statistically significant correlation with the proportion of a population that exists, or lives, below the poverty line. It means that in more developed countries, there is a lower proportion of extremely poor people, but the depth and the severity of the poverty within this proportion are not very related (at least in CEE countries) with the development level. Income inequality is positively related with poverty, and in the case of absolute poverty, estimated coefficients of elasticity are very high, suggesting that absolute poverty is very sensitive to income inequality changes, which is not the case considering relative poverty.

Emigrants’ remittances are negatively correlated with poverty in CEE countries. One per cent increase in remittances to GDP ratio is estimated to reduce the proportion of a population that exists, or lives, below the poverty line by 0.55 per cent, the depth of poverty by 0.37 per cent, and the risk of poverty by 0.06 per cent. It is estimated that the severity of poverty is negatively but statistically insignificantly related to remittances. These results support the statement that emigration from CEE countries, followed by remittances to families back home, helps to reduce their poverty, which might be considered as a positive outcome of emigration.

Estimates of Eq. (2) show that poverty has a positive but statistically not significant effect on remittances. A bigger share of the population with tertiary education is positively and statistically significantly related to remittances. This positive correlation could be explained in two ways. First, the bigger proportion of the population with higher education increases the probability that there will also be more educated people among emigrants, which could lead to higher earning abroad and thus bigger remittances to their families back home. Second, higher education increases probability for emigrants to be more financially literate and to perceive how important remittances for their families are. Thus, emigrants’ income probably will be directed not for consumption in the destination country but for remittances to their families back home. It is estimated that unemployment positively correlates with remittances. This relationship could be due to the fact that unemployment in the home country is one of the major reasons for emigration followed by remittances. In addition, higher unemployment and lower-income level in the home country increase the need and importance of remittances as a source of income. We also found a positive correlation between current and lagged remittances. It shows that emigrants’ remittances are quite persistent and not subject to cyclical fluctuation, contrary to other forms of international money flows.

Conclusion

Poverty in CEE economies is associated with a difficult transition period. The transition economies have experienced a sudden outbreak of poverty as their economic system has changed. As a response to poverty, a wave of emigration has risen, accompanied by remittances. The poverty-reducing effect of remittances is the result of a series of economic factors, as emigrants’ money transfers increase household income. Increased income increases consumption, savings and investment. The share of remittances for consumption and investment has an impact on the country’s economy. If most of the remittances are spent on consumption, there is a potential risk of inflation, while investing in value-added areas brings long-term, persistent, and poverty-reducing effects on the country’s economy. Despite the poverty-reducing effect, the benefits of remittances are a source of debate, as they can increase income inequality and create economic dependence.

The results of the research prove that remittances reduce poverty. Our estimations show that a 10-per cent increase in remittances to GDP ratio will lead to a decline, on average, by 5.5 per cent in poverty headcount, and also by 3.7 per cent in poverty depth and 0.6 per cent in the risk of poverty in CEE countries. Our results, in terms of the effect’s direction, are in line with the findings of Pekovic (2017), who examined poverty in the CIS and Balkan countries, but much smaller in terms of estimated magnitude of the effect. The greater effect was found by Yoshino et al. (2017) in the Asian region (the spread of poverty would decrease by 8.5 per cent, the poverty gap by 22.5 per cent, and the poverty severity by 16 per cent). Authors (Gupta et al., 2009; Anyanwu & Erhijakpor, 2010; Das et al., 2011; Akobeng, 2016; Azizi, 2019) have determined remittance-poverty reduction effect, but the impact is smaller while analysing African countries as well as in Latin America (Vacaflores, 2018).

Remittances, however, should not be the main measure of poverty-reduction policy in transition economies, as not all residents receive remittances, nor is the impact of labour loss due to emigration assessed while analysing remittance poverty-reducing effect. In terms of policy recommendations: firstly, the countries should manage the transaction costs as high transaction cost encourages migrants to remit through informal channels. Secondly, it is important to know the remittance recipients and the remittance spending behaviour as remittances could become productive investment if they are transmitted to business activities, savings or dwellings. Improving remittance data at household level would provide better insight in characteristics of remittance recipients, remittance spending behaviour and real volume of remittances because they would also include informal flows.

The main limitations of the research are related to available data on poverty indices. A short period of available data does not allow estimating lagged poverty effects of remittances within the framework of the applied model. We might assume that long-term effects could differ from the short-term effects estimated in our research. Longer-term effects could be bigger or smaller, depending on how remittances are used. Including data for the more recent period, i.e. 2016 – 2018, could lead to finding stronger poverty effects of remittances since the intra-EU mobility rates along with the remittances are increasing after the Financial Crisis.

References

Adams R. H. (2005a). Remittances, Poverty and Investment in Guatemala. In C. Ozden & M. Schiff (Eds.), International Migration, Remittances and the Brain Drain (pp. 53–80). New York: Palgrave Mcmillan.

Adams, R. H., & Page, J. (2003a). Poverty, Inequality and Growth in Selected Middle East and North Africa Countries, 1980–2000. World Development, 31, 2027–2048

Adams, R. H., & Page, J. (2003b). International Migration, Remittances and Poverty in Developing Countries. Policy Research Working Paper 3179. The World Bank, Washington D.C.

Adams, R. H., & Page, J. (2005b). Do international migration and remittances reduce poverty in developing countries? World Development, 33(10), 1645–1669.

Akobeng, E. (2016). Out of inequality and poverty: Evidence for the effectiveness of remittances in Sub-Saharan Africa. The Quarterly Review of Economics and Finance, 60, 207–223.

Ali, I., Jaleel, A. C., & Bhagat, R. B. (2019). Migration, Remittances and Poverty Reduction. In R. Mamgain (Ed.), Growth, Disparities and Inclusive Development in India (pp. 177–190). Singapore: Springer.

Anyanwu, J.C., Erhijakpor, A.E.O (2010). Do International Remittances Affect Poverty in Africa? African Development Review, 22(1), 51–91

Azam, M., Haseeb, M., & Samsudin, S. (2016). The impact of foreign remittances on poverty alleviation: Global evidence. Economics and Sociology, 9(1), 264–281.

Azizi, S. (2019). The impacts of workers’ remittances on poverty and inequality in developing countries. Empirical Economics, 1–23.

Bouoiyour, J., & Miftah, A. (2014). The effects of remittances on poverty and inequality: Evidence from rural southern Morocco. Working Papers, hal-01880333. Retrieved from: https://hal-univ-pau.archives-ouvertes.fr/hal-01880333/document

Bourdet, Y., & Falck, H. (2006). Emigrants’ remittances and Dutch disease in Cape Verde. International Economic Journal, 20(3), 267–284.

Cattaneo, C. (2005). International Migration and Poverty: Cross-Country Analysis. Centro Studi Luca Agliano, Torino.

Chami, R., Barajas, A., Cosimano, T., Fullenkamp, C., Gapen, M., & Montiel, P. (2008). Macroeconomic consequences of remittances. International Monetary Fund: Occasional Paper, 259. Retrieved from: https://www.imf.org/external/pubs/ft/op/259/op259.pdf.

Chami, R., Fullenkamp, C., & Jahjah, S. (2003). Are Immigrant Remittance Flows a Source of Capital for Development? IMF Working Paper 03/189. Retrieved from: https://www.imf.org/external/pubs/ft/wp/2003/wp03189.pdf

Das, A., Banga, R., & Sahu, P. K. (2011). Impact of remittances on poverty in developing countries. Technical report, United Nations. Retrieved from: https://unctad.org/en/docs/ditctncd20108_en.pdf

Foster, J., Greer, J., & Thorbecke, E. (1984). A class of decomposable poverty measures. Econometrica: Journal of the Econometric Society, 761–766.

Gupta, S., Patillo, C., & Wagh, S. (2007). Impact of remittances on poverty and financial development in Sub-Saharan Africa. International Monetary Fund: Working Paper 07/38. Retrieved from: https://www.imf.org/external/pubs/ft/wp/2007/wp0738.pdf.

Gupta, S., Pattillo, C. A., & Wagh, S. (2009). Effect of remittances on poverty and financial development in Sub-Saharan Africa. World Development, 37(1), 104–115.

Huay, C. S., & Bani, Y. (2018). Remittances, poverty and human capital: evidence from developing countries. International Journal of Social Economics, 45(8), 1227–1235.

Iheke, O. R. (2012). The effect of remittances on the Nigerian economy. International Journal of Development and Sustainability, 1(2), 614–621.

Imai, K. S., Gaiha, R., Ali, A., & Kaicker, N. (2014). Remittances, growth and poverty: New evidence from Asian countries. Journal of Policy Modeling, 36(3), 524–538.

Inoue, T. (2018). Financial development, remittances, and poverty reduction: Empirical evidence from a macroeconomic viewpoint. Journal of Economics and Business, 96, 59–68.

Inoue, T., & Hamori, S. (2016). Effects of remittances on poverty reduction in Asia. In T. Kinkyo, T. Inoue, & S. Hamori (Eds.), Financial linkages, remittances, and resource dependence in East Asia (pp. 101–117).New Jersey: World Scientific.

Javid, M., Arif, U., & Qayyum, A. (2012). Impact of remittances on economic growth and poverty. Academic Research International, 2(1), 433–447.

Kakhkharov, J. (2015). Remittances in Transition Economies: Measurement, Determinants, and Implications for the Financial System (PhD Thesis, Griffith University). Retrieved from: https://research-repository.griffith.ed u.au/bitstream/handle/10072/366769/Kakhkharov_2016_01Thesis.pdf?sequence=1

Kašinskis, K. (2009). Migrantų piniginių pervedimų tendencijos ir reikšmė ekonomikai. OIKOS. Lietuvių migracijos ir diasporos studijos, 2 (8), 35–50.

Kumar, B. (2019). The impact of international remittances on poverty alleviation in Bangladesh. Remittances Review, 4(1), 67–86.

Maimbo, S.M., & Ratha, D. (2005). Remittances: Development Impact and Future Prospects. The International Bank for Reconstruction and Development, Washington.

Matuzevičiūtė, K., & Balčiūnas, S. (2012). Emigrantų elgsena susijusi su piniginiais pervedimais ir jų panaudojimu: Lietuvos atvejis. Ekonomika ir vadyba: aktualijos ir perspektyvos, 4 (28), 142–151.

Mehedintu, A., Soava, G., & Sterpu, M. (2019). The Effect of Remittances on Poverty in the Emerging Countries of the European Union. Sustainability, 11(12), 32–65.

Pekovic, D. (2017). The effect of remittances on poverty alleviation in transition countries. Journal of International Studies, 10(4), 37–46.

Ratha, D. (2013). The impact of remittances on economic growth and poverty reduction. Migration policy institute: Policy Brief, 8, 1–11. Retrieved from: https://www.migrationpolicy.org/research/impact-remittances-economic-growth-and-poverty-reduction.

Ratha, D., Mohapatra, S., Ozden, C., Plaza, S., Shaw, W., & Shimeles, A. (2011). Leveraging migration for Africa: Remittances, skills, and investments. The World Bank, 2011.

Shirazi, N. S., Javed, S. A., & Ashraf, D. (2018). Remittances, Economic Growth and Poverty: A Case of African OIC Member Countries. The Pakistan Development Review, 57(2), 121–143.

Slddiqui, R., & Kemal, A. R. (2006). Remittances, trade liberalisation, and poverty in Pakistan: The role of excluded variables in poverty change analysis. The Pakistan Development Review, 45(3), 383–415.

Tolorunju, E. T., Dipeolu, A. O., & Sanusi, R. A. (2018). Effects of Domestic Remittances on Poverty Status of Rural Households in Ogun State, Nigeria. Nigerian Journal of Agricultural Economics, 8(2066–2018–4625), 31–37.

United Nations Development Programme (2011). Towards Human Resilience: Sustaining MGD Progress in an Age of Economic Uncertainty. United Nations Development Programme, Bureau for Development Policy, New York. Retrieved from: https://www.undp.org/content/undp/en/home/librarypage/povertyreduction/inclusive_development/towards_human_resiliencesustainingmdgprogressinanageofeconomicun.html.

Vacaflores, D. E. (2018). Are remittances helping lower poverty and inequality levels in Latin America? The Quarterly Review of Economics and Finance, 68, 254–265.

Vargas-Silva, C., Jha, S., & Sugiyarto, G. (2009). Remittances in Asia: Implications for the fight against poverty and the pursuit of economic growth. ADBEconomics Working Paper Series, 182. Retrieved from: https://www.econstor.eu/bitstream/10419/109359/1/ewp-182.pdf

Wagle, U. R., & Devkota, S. (2018). The impact of foreign remittances on poverty in Nepal: A panel study of household survey data, 1996–2011. World Development, 110, 38–50.

World Bank Group (2018). Migration and Remittances: recent Development and Outlook. Migration and Development Brief, 30. Retrieved from: http://documents. worldbank.org/curated/en/805161524552566695/Special-topic-transit-migration.

Yoshino, N., Farhad, T.H., & Miyu, O. (2017). International Remittances and Poverty reduction: Evidence from Asian Developing Countries. ADBI Working Paper Series, 759. Retrieved from: https://www.adb.org/publications/international-remittances-and-poverty-reduction.

1 Besides missing observations, for some countries poverty is estimated using consumption instead of income and household welfare indicators.

2 These poverty metrics can be estimated using data on consumption or on income and household welfare indicators. In our research we used the Foster–Greer–Thorbecke indices based on income and household welfare.