Organizations and Markets in Emerging Economies ISSN 2029-4581 eISSN 2345-0037

2020, vol. 11, no. 1(21), pp. 128–151 DOI: https://doi.org/10.15388/omee.2020.11.27

Equilibrium and the Adjustment Process in the Number and Scope of Co-operatives in Morocco

Adil Outla (Corresponding author)

Economy, finance and development LAB, Abdelmalek Essadi University of Tangier, Morocco

outlaadil@gmail.com

https://orcid.org/0000-0002-0902-0214

Moustapha Hamzaoui

Economy, finance and development LAB, Abdelmalek Essadi University of Tangier, Morocco

moustaphahamzaoui@gmail.com

Abstract. The paper discusses the government policy that encourages the emergence of co-operatives and analyzes the co-operatives in light of their growth in number. It establishes a static equilibrium and highlights the co-operatives’ adjustment process (dynamic equilibrium).

The methodology/approach consists of the development of a theoretical model, using the Nash equilibrium for the co-operative market, and the determination of a static equilibrium. It presents the data which includes variable measurements for the adjustment process for agricultural, artisanal, and fishery co-operatives in order to analyze the stochastic process of entry-and-exit flow of co-operatives. Accordingly, the paper estimates the co-operatives’ growth index speed of adjustment (SOA) as a function of the mean-reversion Ornstein–Uhlenbeck (OU) process.

The theoretical results indicate that co-operatives’ earnings depend on the number of co-operatives, market-demand, and the capacity constraint. They also show that the margin for new entrants is a dynamic gap that especially depends on demand, capacity constraint and the profits. The empirical results indicate that co-operatives growth-index process is significantly mean reverting for all sectors, and the speed of adjustment for artisanal co-operatives is significantly higher than for those in agriculture and the fisheries.

Keywords: equilibrium; entry-and-exit flow; mean-reverting; entrants; speed of adjustment

Received: 6/2/2019. Accepted: 3/13/2020

Copyright © 2020 Adil Outla , Moustapha Hamzaoui. Published by Vilnius University Press. This is an Open Access article distributed under the terms of the Creative Commons Attribution Licence, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

1. Introduction

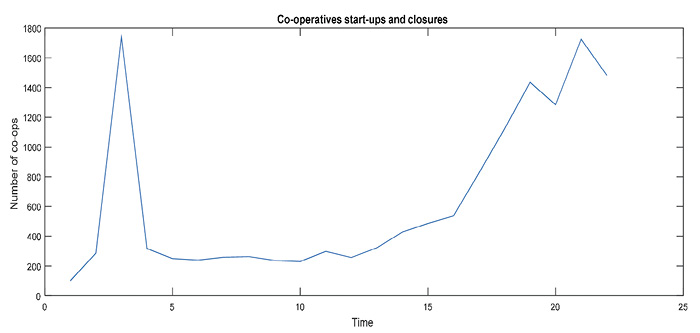

In recent times, co-operatives have been regarded as organizations that have the potential to promote socio-economic development, reduce poverty (Bibby & Shaw, 2005; Birchall, 2004; Münkner, 2012) and control the socio-economic destiny of local communities (Nemon, 2000). The creation of co-operatives is an important force behind employment creation, economic growth and workers’ wellbeing (Czternasty, 2014; Verheul et al., 2002; ICA, 2013). Accordingly, in Morocco, cooperatives are considered the “future of Moroccan economy” (2015)1 under supervision of the Moroccan government through the Co-operative Development Office (ODCO)2. The authorities undertake the initiatives related to co-operatives creations towards structures developing social activities in the framework of the human development initiative (CESE, 2015)3. The Moroccan government has adopted a new law (law N 112.12) that establishes a clear definition of a cooperative as an enterprise and simplifications of the legal procedures of creating co-operatives. Co-operatives have been able to grow in number achieving an amount of financial performance (see Figure 1 that shows the evolution of co-operatives from 1994 to 2015). By the end of 2015, there were 15,498 co-operatives for all sectors. Table 1.1 shows the financial performance (capital structure and the annual turnover) by important sectors and regions. It reveals that there were 10,540 agricultural co-operatives, 2,497 artisanal co-operatives, and 153 fishery co-operatives. The agricultural co-operatives are with higher financial performance with 1,545,834.90 dollar of annual capital and 9,268,143.95 dollar of annual turnover. This is followed by artisanal co-operatives with 121,875.15 of annual capital and 152,087.49 of annual turnover, and fishery co-operatives with 7,499.66 dollar of annual capital and 9,662.42 related to turnover.

Table 1.2 shows additional statistics representing the classification by number and financial performance by regions.

The government policy is promoting the emergence of co-operatives. However, after formation, nascent co-operatives face market conditions where it is important to generate revenue in order to survive (Alexander & Sara, 2014) and meet a minimum accepted standard of living (Conroy et al., 2006). Cooperatives are entering as a potential player in a market game that requires managerial skills, positioning strategies and negotiations with the dominant players (Couderc & Marchini, 2011). In connection to this, numerous authors consider co-operatives as entrepreneurs (Cook et al., 2004; Dana & Dana, 2008; Di Domenico et al., 2010, Defourny & Nyssens, 2010; Perista & Nogueira, 2004; Zahra et al., 2009), others consider that cooperatives and businesses are established for similar reasons (Perotin, 2006). Thus, co-operatives as social enterprises are constrained to maintain their financial viability through market competition (Benos et al., 2018). However, this need for cooperatives for a competitive positioning seems to contradict their main social mission and their alternative social model of the capitalist model. For this, some authors consider that cooperatives do not spontaneously meet the conditions of the neoclassical economic framework (Mooney & Gray, 2002, p. iv), others claim that the model framing the cooperatives is likely linked to the needs of members to maintain the balance of limited income-resource and to future income-needs (Ireland & Webb, 2009).

The first step in co-operatives formation is determined by the free-entry to memberships that is based on the benefit that each individual can take (Sexton, 1986), but in subsequent time, this may turn to a free-ride in dealing with the context. This is because individuals in co-operatives are supposed to act on how they think the context and government institution functions and not on how it really operates (North, 1990). Accordingly, some authors suggest that the behaviors of co-operatives are guided by emotions instead of economic rationality (Boone & Ozcan, 2016), and others consider that co-operatives are in ambiguous relationship with the context (Russell & Hanneman, 1992). The free-ride behavior in co-operatives is related to the assumption of bounded rationality of members’ capability to comprehend complex issues (Chaddad & Iliopoulos, 2013) and the attachment to individual feelings instead of economic rational (Boone & Ozcan, 2016). Therefore, some authors suggest that members of co-operatives may not be aware of market barriers and market opportunities due to their lack of management skills and entrepreneurial capabilities (Figueiredo & Franco, 2018; Steinerowski, 2012; Zahra et al., 2009; Kirzner, 2008, p. 11; Conte & Jones, 1991; Pelling & High, 2005). In this sense, the model of Giannakas and Fulton (2005) analyzed a mixed duopoly of co-operatives and addressed the difficulty of members to capitalize long-term growth opportunities, which may lead to a situation that is not in equilibrium.

Table 1.1. Co-operatives financial capital and turnover by sectors in 2015

|

Sectors |

Number of |

Turnover Amount |

Capital Amount |

|

Agricultural |

10,540 |

9,268,143.95 |

1,545,834.90 |

|

Artisanal |

2,497 |

152,087.49 |

121,875.15 |

|

Fishery |

153 |

9,662.42 |

7,499.66 |

|

TOTAL |

13,190 |

9,559,249.32 |

1,675,209.73 |

Note: Financial capital and turnover for Moroccan cooperatives by sectors for 2015, (ODCO, 2016)

Thus, the problem analyzed in this paper is related to the fact that co-operatives are considered to be hybrid enterprises based on their socio-economic duality that combines social, participatory and commercial principles of entrepreneurs (Mooney et al., 1996). The focus in this paper is on the sequence that is ulterior to the free-entry in memberships discussed by Sexton (1986). Our hypothesis here is based on the concept of bounded rationality (Simon, 1982; Dacin & Tracey, 2011) and the entrepreneurial capabilities constraints (del Val & Fuentes, 2003; Figueiredo & Franco, 2018) to analyze the stability in the number of co-operatives. Numerous studies analysed the number of co-operatives (e.g., Perotin, 2006; Bresnahan & Reiss, 1991), but with different approaches. Our approach is new and based on the Nash equilibrium and speed of adjustment. The paper does not focus on co-operatives governance and membership’s attitude and formation, for this you can see Sexton (1986), Boone and Ozcan (2016), Grashuis and Su (2019), and Pennerstorfer and Weiss (2012). First, we present the theoretical model, using the Nash equilibrium for the co-operative market and the determination of a static equilibrium. Then, we present the data, which includes variable measurements for the adjustment process, and we analyze the adjustment stochastic process in the number of co-operatives.

Table 1.2. Co-operatives financial capital and turnover by regions in 2015

|

Regions |

Number |

Turnover Amount |

Capital Amount |

|

Souss-Massa |

1,395 |

4,052,717.72 |

869,377.01 |

|

Casablanca-Settat |

1,779 |

1,316,114.92 |

2,313,762.29 |

|

Béni Mellal-Khénifra |

1,203 |

1,013,064.27 |

255,545.15 |

|

Marrakech-Safi |

1,406 |

843,127.39 |

594,755.00 |

|

Tanger-Tetouan - Al Hoceima |

1,485 |

778,982.48 |

394,339.45 |

|

l‘Oriental |

1,215 |

530,118.57 |

525,896.66 |

|

Rabat -Salé -kénitra |

1,665 |

443,948.60 |

911,140.44 |

|

Fès-Meknès |

1,835 |

282,294.34 |

417,055.38 |

|

Laâyoune -Sakia El Hamra |

1,293 |

160,520.76 |

12,924.59 |

|

Drâa-Tafilalet |

999 |

129,176.58 |

93,139.82 |

|

Guelmim-Oued Noun |

1,157 |

5,695.62 |

58,555.72 |

|

Dakhla -Oued Ed Dahab |

298 |

3,488.02 |

3,349.90 |

|

TOTAL |

15,730 |

9,559,249.32 |

6,449,841.47 |

Note: Financial capital and turnover for Moroccan cooperatives by regions for 2015, (ODCO, 2016)

Figure 1. Moroccan co-operatives evolution for the period 1994-2015

Note: The sample period is from 1994 to 2015. The figure shows the Moroccan co-operatives evolution (Annual total number of all sectors; ODCO 2016).

2. Conceptual game theory model and co-operatives’ static equilibrium

Within entrepreneurial capabilities and innovation in co-operatives (Daft, 1978), members face structural changes of the market in terms of the number of co-operatives. In this case, it is important to question both the static and dynamic equilibrium in terms of the number of co-operatives. Conceptualizing co-operatives equilibrium is lacking in theoretical research and scientific explorations. The theory presented in this paper aims to fill this gap and draw a conclusion about the economic behavior of co-operatives. Our theoretical analysis is based on different assertions about the objectives of co-operatives, especially the economic implication of novo entrants.

In order to determine the theoretical foundations for co-operatives equilibrium, we specify some important assertions. The co-operatives market is characterized by a number of co-operatives whose members are not completely informed about the market-demand function and market-entry-barriers (naive expectation of new entrepreneurs and bounded rationality) but who are, nevertheless, seeking to maximize their benefits (Green, 2002), through their production capacity, without considering other strategies. The significant demand affected by consumers’ preferences for the products of co-operatives can lead sellers to intuitively affect the price. In this position, the co-operatives market can be much closer to an oligopoly, with exception of entry-and-exit barriers and the well-informed-agent assumptions of the oligopoly market. Co-operatives market is supposed to be in lack of these two assumptions. Otherwise, encouraging co-operative emergence can cause a market shift to a position that might be much closer to the one of perfect competition (a big number of co-operatives and a big number of consumers), but with differences in terms of capabilities that are supposed to be weak in co-operatives market. The rationale behind this argument is that entrepreneurial skills are assumed to depend on the adaptive tensions of the cyclic shifting from a managed economy toward an entrepreneurial one, or what Kirchhoff (1994) calls dynamic capitalism. Second, members of co-operatives are adjusting their decisions from the perspective of their framing interest (Bijman et al., 2013) and feelings instead of economic rational (Boone & Ozcan, 2016). Thus, organization complexity in co-operatives arises as a result of members bounded by rationality and heterogeneity (Simon, 1982; Chaddad & Iliopoulos, 2013; Dacin & Tracey 2011). The “Co-operatives -market” can be summarized by the following essential assumptions:

• Members seek for utilities or benefits

• Price taker: New entrants have no power over setting prices at prior time

• No barriers to entry or exit: each producer does not take into account others’ strategies

• Naive expectations: agents who are not well-informed (bounded rationality)

• Capacity-constraint assumption: supply is correlated to production capacity (membership)

• Homogeneous products: The products are perfect substitutes for each other, (i.e., the qualities and characteristics of market goods or services do not vary between different suppliers).

We assume that co-operatives are characterized by a high degree of product homogeneity, whose members face similar cost functions, and demand conditions. Future interactions with competitive factors and market performance may be the result of an increase in entrepreneurial capabilities that enable co-operatives to face market forces and risks, and recognize entry barriers. In our model, our weight factor is the number of co-operatives. The other factors that are completely connected to the number of co-operatives are profits, the capacity constraint, and demand (this interaction between factors is important to determine the equilibrium points). The literature discusses other factors that affect co-operative supply, such as promotional effort (Yu-Chung Tsao, 2015) and inventory control (Zhang et al., 2008). In our model we suppose that in Morocco, the novo entrants are weak in terms of adaptive learning for investing part of earnings to promote products and also to face risk. They are more concerned with membership principals and production capacity. Boone and Ozcan (2016) argued that de novo co-operatives prefer to operate for a higher volume of their supplies instead of diversification. Supply is demonstrated to have a positive impact on total process innovation activity of co-operatives (Giannakas & Fulton , 2005); others argue that the evolution of co-operatives depends on members’ sense of identity (Akerlof & Kranton, 2005), commitment, loyalty, and cohesion. For instance, Münkner (2012) argues that co-operatives are as good as their members make them, and for a member to become loyal, his life needs must be satisfied (Maslow, 1943). This idea, suggested by Münkner confirms that co-operatives must upgrade their production and sales processes while incurring costs, such as the effort required to stabilize revenue. For more details related to co-operatives’ values and principles, see Birchall, (2011), Mazzarol and Mamouni (2011), Münkner (2012).

2.1. Model set up

We use the methodology of the Nash equilibrium to determine the equilibrium number of co-operatives and earnings. Many researchers have used this methodology for different types of markets, e.g., for the electricity market (Xuena et al., 2015). We start by building a model of co-operatives (labeled i = 1, 2…, n) that produce products that are supposed to be substitutable, and where players make their choices during discrete periods t = 0, 1, 2... Let Qi(t) represent the output of co-operative i during period t. The market price p(t) in period t is determined by total supply Q(t) = Q1(t)+ QW(t) through a demand function f(Q) = P(t). We consider a linear form for p (t).

(1)

(1)

denotes the rival co-operatives’ output.

denotes the rival co-operatives’ output.

Market demand, D, at time period t is expressed by the following linear demand curve.

(2)

(2)

Demand is a linearly decreasing function of “a” and “β”, commonly considered by co-operatives theorists as the case of a downward-sloping demand. P(t) is the market price at time t; “a” and “β” are non-negative coefficients. β is a theoretical parameter that describes the magnitude of demand elasticity for co-operatives; a relatively small value of β indicates a relatively high demand elasticity. This parameter makes up the difference between the ordinary products of IOFs and co-operatives’ products and allows the co-operatives to increase supply.

In the Moroccan context, the co-operative products may not be like industrial products. They are known to be driven from natural resources, and this may impact the preference of consumers for labeled products of co-operatives, especially the Novo entrants (de novo) co-operatives that are associated with a strong focused identity (Boone & Ozcan, 2016); a representative example of this are the Moroccan Argan oil co-operatives that satisfy demand in national and international markets of traditional and natural local products (Ibourk & Amaghouss, 2014; Montanari, 2019).

Co-operatives’ products can cause demand to be prone to lower magnetic elasticity as compared to traditional products. This means the co-operatives are about to put into the market something that does not exist in novel Schumpeterian or novel entrepreneurship (Baumol 1968, 2002; Schumpeter, 1934).

In the co-operative type of entrepreneurship, if the production capacity, the value of the products and the entrepreneurial capabilities, respectively, do not change during a period of time, then the rate of entry (number of co-operatives) and demand are plausible factors that affect the market share.

The situation in the co-operatives market will strongly depend on the beta parameter with the following theoretical forms:

• ε > β > 1: Demand is not affected by possible increases in price. Rather, the demand, here, is due to preferences for co-operative products, in other words, to the value of preference β.

• β = 1: A further increase in the price starts to negatively affect demand.

• 0 < β <1: A scenario of high elasticity that can induce a shift in the demand curve.

2.2. Co-operatives equilibrium

Based on our theoretical assumptions, if demand is strong enough to consume total supply, co-operatives will be constrained by their production capacity. For simplification, we assume that co-operatives are operating under constant unit costs Ci, so Ci > 0. The demand function is formulated as follows:

(3)

(3)

α is the parameter that describes the production capacity level. A small value of  induces a large market share, and above a certain value ε' (high loss in production capacity), the co-operative exits. This parameter is describes loss in production capacity, which induces a stop in sales. We assume that production capacity K depends on parameter α with

induces a large market share, and above a certain value ε' (high loss in production capacity), the co-operative exits. This parameter is describes loss in production capacity, which induces a stop in sales. We assume that production capacity K depends on parameter α with  . n' is the number of users (membership), and L is the co-operative productivity that depends on n' workers W and M other production factors. Productivity for the cooperatives is contingent on the productivity of its members (Grashuis & Su, 2019).

. n' is the number of users (membership), and L is the co-operative productivity that depends on n' workers W and M other production factors. Productivity for the cooperatives is contingent on the productivity of its members (Grashuis & Su, 2019).

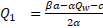

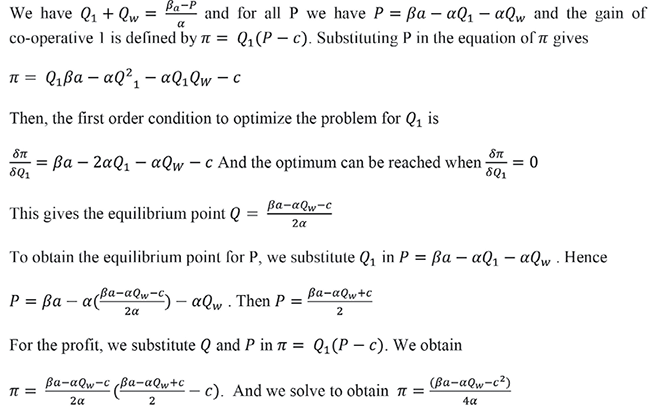

The actual problem is for co-operatives to seek utility, subject to local constraints. Following the Nash equilibrium methodology, the first order condition for the optimization problem gives the equilibrium points of outputs Q, price P, and benefit π, for co-operative 1.

Proposition 1. The problem has a unique Nash equilibrium. The proofs are provided in the appendix.

(4)

(4)

=

=  (5)

(5)

(6)

(6)

(6) Shows the equilibrium point that makes the earnings of co-operative 1. The earnings depend especially on alpha parameter and the quantity produced by the other co-operatives. When ε > β > 1, the co-operatives are likely beneficial to produce as much as their capacity constraint is small.

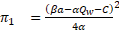

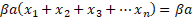

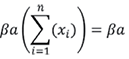

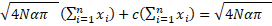

Proposition 2. We generalize the problem for N co-operatives. The proofs are provided in the appendix.

The results are shown in Table 1. The results suggest that co-operatives’ earnings depend essentially on the number of co-operatives, demand conditioned by β and a, and the capacity constraint α. In the case of strong demand—one that absorbs all of the new supply from the new entrant—the co-operatives market equilibrium can remain stable. But, with elastic or stable demand under the hypothesis of limited entrepreneurial capabilities, the number of co-operatives that emerge will negatively affect supply and co-operatives’ revenues, thereby may cause co-operative destructions. Thus, when co-operatives are constrained by their number, the market-share constraint for co-operatives’ substitutable product is as follows:

(7)

(7)

Thus, we can write (7) in the following form:

(8)

(8)

xi is the production of co-operative i; and

From the formula for the equilibrium shown in Table 1, we obtain the following result, which characterizes the demand for co-operatives’ products in the equilibrium situation:

+ C (9)

+ C (9)

Substituting (9) into (8), we obtain:

( + C (10)

+ C (10)

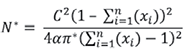

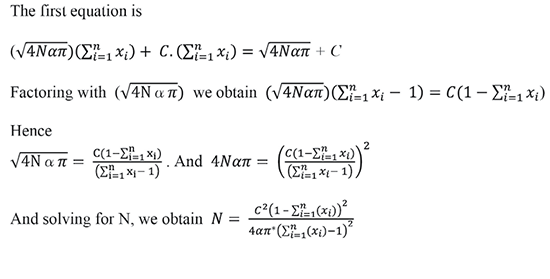

Proposition 3. Solving the problem of obtaining N, which ensures the flow of total outputs, we obtain

(11)

(11)

The proofs are provided in the appendix.

In (11), with  , there will be no free space for new entrants. The margin for new entrants is a dynamic gap that especially depends on demand and profits. High boundaries in demand can free up space for new entrants seeking to benefit and allow for risk reduction and profits, which in turn helps to avoid co-operative destruction. Otherwise, moving (improving) the equilibrium point of profits reduces the gap for new entrants. The specific number of co-operatives will be primarily dependent on general demand, which involves production capacity (Verheul et al., 2002), a population growth that is associated with potential consumers (Keeble & Walker, 1994; Reynolds et al., 1995; Armignton & Zoltan, 2002; Bosma et al., 2008), and a zero-profit equilibrium level of demand, as suggested by Schmalensee (1992) and Sutton (1991). This result suggests that co-operatives are in a number of basic scenarios. Improvements in entrepreneurial capabilities lend to visibility in entry barriers through users’ adaptive learning, since new entries will be conditioned by market opportunities (Mueller, 1986). In this case, when there is always a well-informed agent who can make individual decisions on entering if opportunities exist, then co-operatives’ members become entrepreneurs who are entitled to both wages and profits. In this market cycle, public policies can finally be specified and clearly defined, with entrepreneurship at the core. In contrast, a lack of entrepreneurial skills negatively affects co-operatives’ performance (Press et al., 2008), and the market may be characterized by the invisibility of entry barriers for co-operatives. In this latter case, the co-operative system might be characterized by the dynamics of their numbers, with the number of entries and exits being the dynamics. The number of co-operatives may impact earnings and account for the flow of co-operative destructions, which, in turn, causes new co-operative formations. From this point of view, we need to study the adjustment process of co-operatives in terms of their number, so as to understand whether the growth index is a mean-reversion or random-walk process. If the co-operatives growth index reverts to the mean (i.e., stationary process), the co-operative flow eventually returns the number to its equilibrium level. The next section will bring empirical investigations to the process of the co-operative growth index.

, there will be no free space for new entrants. The margin for new entrants is a dynamic gap that especially depends on demand and profits. High boundaries in demand can free up space for new entrants seeking to benefit and allow for risk reduction and profits, which in turn helps to avoid co-operative destruction. Otherwise, moving (improving) the equilibrium point of profits reduces the gap for new entrants. The specific number of co-operatives will be primarily dependent on general demand, which involves production capacity (Verheul et al., 2002), a population growth that is associated with potential consumers (Keeble & Walker, 1994; Reynolds et al., 1995; Armignton & Zoltan, 2002; Bosma et al., 2008), and a zero-profit equilibrium level of demand, as suggested by Schmalensee (1992) and Sutton (1991). This result suggests that co-operatives are in a number of basic scenarios. Improvements in entrepreneurial capabilities lend to visibility in entry barriers through users’ adaptive learning, since new entries will be conditioned by market opportunities (Mueller, 1986). In this case, when there is always a well-informed agent who can make individual decisions on entering if opportunities exist, then co-operatives’ members become entrepreneurs who are entitled to both wages and profits. In this market cycle, public policies can finally be specified and clearly defined, with entrepreneurship at the core. In contrast, a lack of entrepreneurial skills negatively affects co-operatives’ performance (Press et al., 2008), and the market may be characterized by the invisibility of entry barriers for co-operatives. In this latter case, the co-operative system might be characterized by the dynamics of their numbers, with the number of entries and exits being the dynamics. The number of co-operatives may impact earnings and account for the flow of co-operative destructions, which, in turn, causes new co-operative formations. From this point of view, we need to study the adjustment process of co-operatives in terms of their number, so as to understand whether the growth index is a mean-reversion or random-walk process. If the co-operatives growth index reverts to the mean (i.e., stationary process), the co-operative flow eventually returns the number to its equilibrium level. The next section will bring empirical investigations to the process of the co-operative growth index.

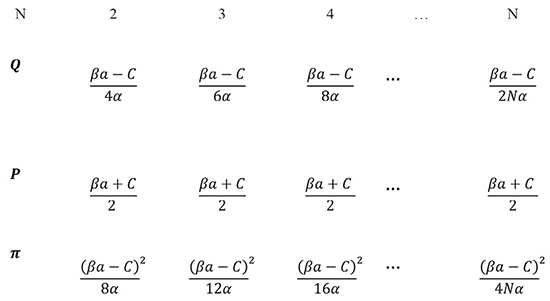

Table 1. Co-operatives Nash equilibrium

Note: The Nash equilibrium generalized for the homogeneous products of N co-operatives. The last line shows the generalized results, with the equilibrium point in terms of profit.

3. Number of co-operatives and the adjustment process

3.1. Data and methodology

The objective was to analyse co-operatives in terms of their number. The game theory was needed to determine the equilibrium points in terms of the number of co-operatives. This section establishes the dynamic equilibrium by analyzing the adjustment process of co-operatives growth.

To have a clear idea about how the number of co-operatives influences the dynamic changes that take place in the equilibrium process, we study the dynamic equilibrium by analyzing whether the growth in the number of co-operatives is a random-walk or mean-reversion process. If the process is mean reverting, then we determine the speed of adjustment to the equilibrium. The model to capture the speed of adjustment in terms of the number of co-operatives (dynamic equilibrium) is based on time series data.

The dataset consists of the semi-annual changes in the number of co-operatives, which we then convert to the growth index ξ. The specificity of the growth index is related to co-operatives dynamics, while other studies use a ratio of “number of co-operatives and total working population” in order to represent co-operatives growth (Díaz-Foncea & Marcuello, 2015), and the total number of entries and exits for spatial analysis (Perotin, 2006). The method included in this paper uses a co-operatives growth index as one indicator in order to analyze the speed of adjustment and capture the complete picture on the growth and dynamics of co-operatives (creations - destructions cycles). Thus, the growth index measure is likely a valuable indicator for policy makers who wish to stimulate co-op creation and ensure they do not meet a speedy demise.

This is a composite index that includes agricultural, artisanal and fishery co-operatives as follows:

(12)

(12)

where nt is the number of co-operatives in time t, and nt–1 is the number of co-operatives in time t–1. Our approach is to estimate the models that describe changes in the co-operatives’ growth index that defines changes in the co-operatives number. This dynamic implies that the conditional mean and the variance of the changes in the co-operatives’ growth index depend on the level of ξt .

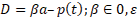

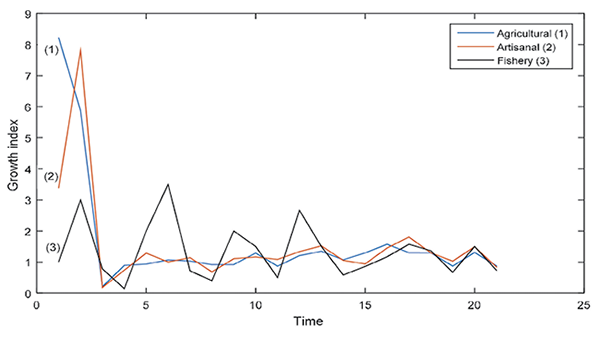

The data are obtained from the Moroccan Co-operative Development Office (ODCO). The sample period is from 1994 to 2015, and all of our tests are conducted using EVIEWS 7.0. Figure 2 below shows the growth-index dynamics for the agricultural, artisanal, and fishery co-operatives for the period 1994 to 2015. While these are high importance sectors in terms of Moroccan socio-economics, the co-operatives included in this series have shown the importance of including the availability of complete data over a long sample period, as this renders the results of our study more convincing. Also, the co-operative sectors included in these series are in harmony with our theoretical model on co-operatives owning products and seeking revenue.

To empirically test the returns assumption, we test the null hypothesis of the mean-reversion stationary stochastic process. Testing for stationary is equivalent to testing for mean reversion (Brigo et al., 2008).

The best and most popular tests for this hypothesis are the augmented Dickey and Fuller tests (1979, 1981, ADF) and the Phillips–Perron tests (1988, PP). These tests allow highlighting the nature of the processes of co-operatives as a random walk process or a mean-reverting process. The stationary assumption is a must allowing the use of models analyzing the speed of adjustment.

Fig. 2. Growth index dynamics

Note: The period is from 1994 to 2015. The figure shows the co-operatives growth-index dynamics

for agricultural, artisanal, and fishery co-operatives.

for agricultural, artisanal, and fishery co-operatives.

3.2. Summary statistics and mean reversion measurement

Table 2 shows the summary statistics we calculated for the co-operatives growth index included in the study. A quick glance at the results reveals that agricultural co-operatives had the highest growth index (8.22) over the period under review (1994 to 2015), with an average of 1.63 new co-operatives per year and a minimum growth index of about 20 percent, while fishery co-operatives showed the lowest growth index (3.5000), with a minimum growth rate of about 14 percent. The same classification applies to standard deviations for co-operatives in these sectors. We can also find that the growth index in these three sectors is highly leptokurtic. The measures of skewness show that all of them are positively skewed. Furthermore, the results of the Jarque–Bera tests suggest that the growth index is non-normal for agricultural and artisanal co-operatives and normally distributed for fishery co-operatives.

Table 3 presents the results of the conventional univariate unit root tests (ADF and PP). We can see that this rejects the non-stationary hypothesis for the three sectors. Therefore, we can conclude that the co-operatives growth index is a significantly mean-reverting (I (0) stationary) process for all sectors. The mean reversion appears in the constant intercept, in the scope of the trend function, and in both. The results lend support to the mean-reversion process. This means that shocks to the co-operatives growth index are all temporary, and the growth index eventually returns to the trend path. Additionally, this indicates that the volatility of the growth-index changes with the boundaries over time. This means that the same shocks to the co-operatives growth index are repeated over time, which contributes to adjusting the ratio toward an equilibrium level. This assumption confirms a return to the long-term mean target level over time (the second scenario in Proposition 3). For the ordinary firms, excess profits attract competitors (in the absence of significant barriers to entry), causing a lowering of firms’ profits. This process persists until the profit rate returns to its competitive level, possibly causing firm destructions.

Table 2. Summary statistics

|

|

Min. |

Mean. |

Max. |

Std Dev |

Skewness |

Kurtosis |

Jarque |

|

Agricultural |

0.2079 |

1.6358 |

8.2272 |

1.8592 |

2.8363 |

9.7389 |

67.8932*** (0.0000) |

|

Artisanal |

0.1800 |

1.5387 |

7.8148 |

1.5582 |

3.364314 |

13.9603 |

144.7283*** (0.0000) |

|

Fishery |

0.1428 |

1.3401 |

3.500 |

0.8856 |

0.9513 |

3.1712 |

3.1935 (0.2025) |

Note: The sample period is from 1994 to 2015.

*** Significance at the 1% level, P-value in parentheses

The existing literature on profit persistence generally follows the mean-reverting view of firms’ profits that is called “the competitive environment.” However, while co-operative firms are not in the competitive game (weak-capabilities assumption), the cause of mean reversion may be simultaneously co-operative members’ irrational behavior in view of their lack of capabilities, and the government support for co-operatives start-ups, and the associated risks of new entrants and market size. For policymakers, mean-reversion is a cause for concern. This is because it enables forecasting future movements in the growth index that are based on past ones, since forecasting that is based on a mean-reverting process proves to be quite different from forecasting that is based on a random-walk process. This process is the “risk discounting effect” (Sarkar, 2003) that can be specified and used by policy makers to reduce the systematic risk of entry-and-exit flow.

Table 3. Unit root test results (ADF and PP) for the co-operatives growth index

|

Sectors |

ADF tests |

PP tests |

||

|

No trend |

With trend |

No trend |

With trend |

|

|

Agricultural |

-5.959*** |

-5.106*** |

-13.863*** |

-13.513*** |

|

Artisanal |

-3.843*** |

-20.397*** |

-4.142*** |

-4.245** |

|

Fishery |

-7.196*** |

-5.734*** |

-5.569*** |

-10.253*** |

Notes: The table reports ADF and PP tests for the mean-reversion hypothesis for the co-operatives growth index. For the ADF, the lag length is optimally chosen using the sequential procedure suggested by Campbell and Perron (1991), using the maximum lag length to eliminate serial correlation in the residuals. For the PP tests, the truncation lag is set to 12. ***Significance at the 1% level; **Significance at the 5% level; *Significance at the 10% level; with p-value in parentheses

3.3. Model behavior and speed of adjustment

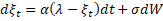

The mean-reversion process for co-operative emergence is the result of a stochastic process. Recidivism exists because co-operative emergence is the flow of entries and exits. A change in the number of co-operatives is a process of mean reversion that continuously and immediately returns the number to its original static state when it hits a certain boundary. Co-operatives-growth-index oscillations can be modeled as a function of the mean-reversion Ornstein–Uhlenbeck (OU) process. Then, we explore the Ornstein–Uhlenbeck process in relation to the continuous time growth index process, as follows:

(13)

(13)

where the long-term mean level and the speed of adjustment are λ and α , respectively. dW is a standard Wiener process, and σ is the volatility, which reflects the different assumptions about the stochastic process under which the growth index evolves. The volatility that is correlated to the growth index is the continued change in the number of co-operatives, and the mean equilibrium level is a key characteristic of stable growth of the index ξt .

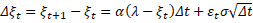

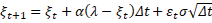

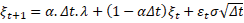

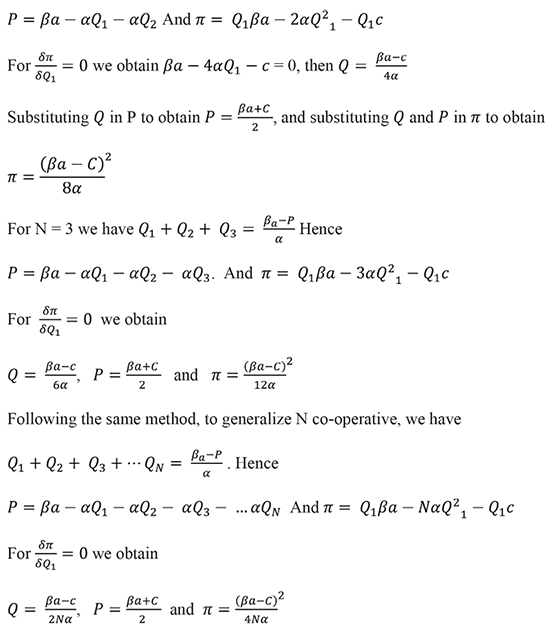

It can be easily shown that when using Itô’s lemma (Shreve, 2004), the discrete model corresponds to the following form:

(14)

(14)

(15)

(15)

(16)

(16)

The index’s expected level of future growth is a weighted average between the most recent value of index growth, ξt , and the mean-reversion level of index growth λ. The speed of adjustment is determined by the parameter α.

3.4. Calibration of the model

In our case, estimates that use the GMM method (Hansen, 1982) are most suitable when explaining the dynamics of index growth and the speed of adjustment. This method has a number of important advantages. First, it does not require that the distribution of the process change be normal; it requires only that it is stationary and ergodic, and that the relevant expectations exist. These requirements are consistent with our data and testing of the mean-reversion process. Second, the GMM estimators and the standard errors are consistent, even if the disturbances are conditionally heteroskedastic.

The process in Eq. (16) is intuitively an AR (1) process that can be described by the following equation (Brigo et al., 2008):

(17)

(17)

Then, we transform the regression coefficients in Eq. 16 to derive the parameters of the model.

The adjustment dynamics are defined by the speed of adjustment α.

For b = (1 – αΔt) we have

where the speed of adjustment is equivalent to (1 – b) with constant increment Δt = 1,

(Paula et al., 2016).

And from Eq. 6 we have c = α.Δt.λ

By substituting α into this equation we obtain

The guideline is to estimate the parameters in discrete time Eq. (17) and make a transformation to obtain the speed of adjustment and the long-term mean equilibrium level.

3.5. Speed of adjustment

This study is based on the use of the co-operatives growth index to report the parameter estimates under Eq.16 and its equivalence under Eq.17. The parameters are estimated from the different simple-growth-index time series and the normalized-growth-index time series to allow for a comparative analysis across sectors. Table 4 reports the parameter estimates with the associated P-value. This estimate provides a number of interesting insights about the dynamics of the co-operatives growth index. First, the Wald test confirms a rejection of the null hypothesis that the parameters are equal to 0, significantly for all sectors (P < 0.001). Second, our findings on the speed of adjustment provide important insights. We find that the growth index of agricultural co-operatives is adjusted at a speed of 59%, with a half-life of 1.169 years. This implies that, for co-operatives in this sector, it takes approximately 1.17 years to remove half of the shock effect on the growth index; in other words, the 59% speed of adjustment suggests that every year, on average, the growth index gets roughly 59% closer to the mean target level. For the artisanal co-operatives, the growth index is adjusted at a speed of 61%, with a half-life of 1.132 years. This suggests that every year, on average, the growth index gets roughly 61% closer to the mean target level. Finally, for fishery co-operatives, the growth index is adjusted at a speed of 52%, with a half-life of 1.321 years. This suggests that every year, on average, the growth index gets roughly 52% closer to the mean target level. A comparison between sectors confirms that the artisanal co-operatives growth index rapidly reverts to its mean target level. This means that co-operative creations (destructions) are rapidly followed by co-operative destructions (formations). This implies that shocks to the artisanal co-operatives growth index have a high effect in comparison to other sectors. Put another way, the artisanal market is more fragile.

Table 4. Estimation results for the speed of adjustment

|

|

Agricultural |

Artisanal |

Fishery |

|

|

Simple ξ |

||

|

b |

-0.169** |

-0.132*** |

-0.321*** |

|

c |

1.236*** |

1.263*** |

1.683*** |

|

Mean. Level β |

1.057 |

1.115 |

1.270 |

|

Adj. Speed α |

1.169 |

1.132 |

1.321 |

|

Wald test |

147.893*** |

143.695*** |

296.087*** |

|

|

Normalized ξ |

||

|

b |

-0.169*** |

-0.133*** |

-0.321*** |

|

c |

0.123*** |

0.139*** |

0.445*** |

|

Mean. Level β |

0.105 |

0.122 |

0.336 |

|

Adj. Speed α |

1.169 |

1.133 |

1.321 |

|

Wald test |

116.067*** |

104.858*** |

237.872*** |

Note: Estimation for the sample period 1994-2015, applied for the co-operatives’ sample ξ and normalized-growth-index  . We estimated the results for agricultural, artisanal, and fishery co-operatives. The parameters are estimated for discrete time under Eq.19 and its equivalence under Eq.20, using the Generalized Method of Moments, with the t-statistic given in parentheses. ***Significance at the 1% level; **Significance at the 5% level

. We estimated the results for agricultural, artisanal, and fishery co-operatives. The parameters are estimated for discrete time under Eq.19 and its equivalence under Eq.20, using the Generalized Method of Moments, with the t-statistic given in parentheses. ***Significance at the 1% level; **Significance at the 5% level

Conclusion, implications, and outlook

Our theoretical model and results claim the importance of exploring the co-operative flow for several reasons. In particular, it is important to understand the trend adjustment process of the co-operatives cycle in order to preserve co-operatives equilibrium and prevent their fast death. We suggest structural policies that reduce the fragility of the market by targeting a low speed of adjustment in the growth index (stabilization). We place particular emphasis on the need to do so for artisanal co-operatives.

Scale constraints are likely to be related to the invisibility of entry barriers that may lead to continuing entries and closures, thereby risking the possibility of returns being under a mean-reversion process. Our results call into question the impact of policies that seek to increase new co-operatives formations. Moroccan policy was to stimulate starts; there is a risk of volatile entry-and-exit behavior that affects the equilibrium points. Co-operatives suggest that output is the first objective. This may differ from those of IOFs, both in the short and long run, especially if the demand curve is downward sloping. The results of this paper suggest that an additional set of instruments may also be valuable in generating the co-operatives growth index and policies that focus on allowing the industry structure to adjust in the right direction. For example, the government policy targeting co-operatives’ total number leads to individuals with limited human capital being encouraged to start co-operatives. The co-operatives market is not yet well established (Stenholm et al., 2013), and members of co-operatives are unlikely to develop businesses in the absence of help from other policies.

The government should think more about offering an enabling environment through adaptive tensions as “push factors” that help the economy convergence from a managed one to an entrepreneurial one and help co-operatives develop their business plans and capabilities. When adaptive tensions are constructed, the government may focus on the short-term policy that encourages co-operative formations. In contrast, we recommend that policy makers be more specific in their analyses of market factors (competition, demand, profitability) by giving more weight to long-term policies for social welfare. Some scholars have suggested solving this problem for small businesses by controlling the industry sector (Kim, 2006).

References

Armignton, C., & Acs, Z. J. (2002). The determinants of regional variation in new firm formation. Regional Studies, 36(1), 33–45.

Agiza, H.N. (1998). Explicit stability zones for cournot game with 3 and 4 competitors. Chaos, Solitons & Fractals, (9),1955–1966.

Agliari, A., Gardini, L, & Puu, T. (2000). The dynamics of a triopoly cournot game. Chaos, Solitons & Fractals, 11 (2000), 2531–2560.

Akerlof, G., & Kranton, R. (2005). Identity and the economics of organizations. Journal of Economic Perspectives, 16, 9–32.

Alexander, B.R., & Sara V.B. (2014). Rural co-operative resilience: The case of Malawi. Journal of Co-operative Organization and Management, 2 (2014), 43–52.

Baumol, W. J. (1968). Entrepreneurship and Economic Theory. American Economic Review, 58(2), 64–71.

Baumol, W. J. (2002). The free-market innovation machine. Princeton: Princeton University.

Benos, T., Kalogeras, N., Wetzels, M., Ruyter, K. D., & Pennings, J. M. (2018). Harnessing a ‘currency matrix’for performance measurement in cooperatives: A multi-phased study. Sustainability, 10(12), 4536.

Bibby, A., & Shaw, L. (2005). Making a difference: Co-operative solutions to global poverty. Manchester: United Kingdom Co-operative College.

Birchall, J. (2004). Co-operatives and the millennium development goals. Geneva: ILO.

Birchall, J. (2011). People-centred businesses: Co-operatives, mutuals and the idea of membership. London, New York: Palgrave Macmillan.

Boone, C., & Özcan, S. (2016). Strategic Choices at Entry and Relative Survival Advantage of Cooperatives versus Corporations in the US Bio‐Ethanol Industry, 1978‐2015. Journal of Management Studies, 53(7), 1113–1140.

Bosma, N., van Stel, A., & Suddle, K. (2008). The geography of new firm formation:

Evidence from independent start-ups and new subsidiaries in the Netherlands. International Entrepreneurship Management Journal, 4, 129–146.

Bresnahan, T.F., & Reiss, P.C. (1991). Entry and competition in concentrated markets. Journal of Political Economy, 99, 977–1009.

Brigo, D. N., Dalessandro A., Neugebauer, M., & Triki, F. (2008). A Stochastic processes toolkit for risk management. Journal of Risk Management for Financial Institutions, 2008arXiv0812.4210B.

Campbell, J.Y., & Perron, P. (1991). Pitfalls and opportunities: What macroeconomists should know about unit roots. National Bureau of Economic Research. In Macroeconomics Annual (pp. 141–201). Cambridge, MA:MIT Press.

Chaddad, F., & Iliopoulos, C. (2013). Control rights, governance, and the costs of ownership in agricultural cooperatives. Agribusiness, 29(1), 3–22.

Couderc, J.-P., Marchini, A. (2011). Governance, commercial strategies and performances of wine cooperatives: an analysis of Italian and French wine producing regions. International Journal of Wine Business Research, 23(3), 235–257.

Cook, M., Chaddad F.R., & Iliopoulos, C. (2004). Advances in Co-operative Theory since 1990: A Review of Agricultural Economics Literature. Rotterdam: Erasmus Univbersity Rotterdam.

Conte, M. A., & Jones, D. C. (1991). On the entry of employee owned firms: theory and evidence from US manufacturing industries, 1870–1960. Working Paper No. 91/5, Department of Economics, Hamilton College, Clinton, NY.

Czternasty, W. (2014). The position of cooperatives in the new social economy. Management, 18(1), 488–503.

Dacin, P. A., Dacin, M. T., & Matear, M. (2010). Social entrepreneurship: Why we don’t need a new theory and how we move forward from here. Academy of Management Perspectives, August, 37–57.

Daft, R. L., (1978). A dual-core model of organizational innovation. Academy of Management Journal, 21, 193–210.

Dana, L. P., & Dana, T., E. (2008). Collective entrepreneurship in a Mennonite community in Paraguay. Latin American Business Review, 8(4), 82–96.

Defourny, J., & Nyssens, M. (2010). Social enterprise in Europe: at the crossroads of market, public policies and third sector. Policy and Society, 29, 231–242.

Del Val, M. P., & Fuentes, C. M. (2003). Resistance to Change: A Literature Review and Empirical Study. Management Decision, 41(2), 148–155.

Dıáz-Foncea, M., & Marcuello, C. (2014). Spatial patterns in new firm formation: are cooperatives different?. Small Business Economics, 014-9581-5.

Di Domenico, M. L., Haugh, H., & Tracey, P. (2010). Social bricolage: Theorizing social value creation in social enterprises. Entrepreneurship Theory and Practice, 34(4), 681–703.

Dickey, D. A., & Fuller, W. (1979). Distribution of the estimators for autoregressive time series with a unit root. Journal of the American Statistical Association, 74, 427–431.

Dickey, D. A., & Fuller, W.A. (1981). Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica, 49, 1057–1072.

E. Ahmed, H. N., & Agiza, H. N. (1998). Dynamics of a Cournot game with n-competitors. Chaos, Solitons & Fractals, 91513–1517.

Figueiredo, V., Franco, M. (2018). Wine cooperatives as a form of social entrepreneurship: Empirical evidence about their impact on society. Land Use Policy, 79, 812–821. https://doi.org/10.1016/j.landusepol.2018.09.022

Fulton, M. E., & Giannakas, K. (2001). Organizational Commitment in a Mixed Oligopoly: Agricultural Co-operatives and Investor-Owned Firms. American Journal of Agricultural Economics, 83(5), 1258–1265.

Giannakas, K., & Fulton, M. (2005). Process Innovation Activity in a Mixed Oligopoly: The Role of Cooperatives. American Journal of Agricultural Economics, 87(2), 406–422.

Grashuis, J., & Su, Y. (2019). A Review of the Empirical Literature on Farmer Cooperatives: Performance, Ownership and Governance, Finance, and Member Attitude: A Review of the Empirical Literature on Farmer Cooperatives. Annals of Public and Cooperative Economics, 90, 77–102. https://doi.org/10.1111/apce.12205

Green, S. L. (2002). A rational Choice Theory: An overview. Paper prepared for the Baylor University Faculty Development Seminar on Rational Choice Theory.

Hendrikse G.W.J., Conroy, A. C., Blackie, M. J., Whiteside, A., Malewezi, J. C., & Sachs, J. D. (2006). In Restructuring Agricultural Co-operatives, Poverty, AIDS and hunger. Breaking the poverty trap in Malawi. New York: Palgrave Macmillan.

ICA International Co-operative Alliance. (2013). Blue print for a co-operative decade. Retrieved from http://ica.co-op/sites/default/files/mediaitems/ICA%20Blueprint%20-%20Final%20-%20Feb%2013%20EN.pdf> Accessed 14.01.15.

Ireland, R.D., & Webb, J. (2009). Crossing the great divide of strategic entrepreneurship: transitioning between explorations and exploitation. Business Horizons, 52, 469–479.

Isaiah, O., & Ukaegbu, B. (2015). The impact of profitability on capital structure and speed of adjustment: An empirical examination of selected firms in Nigerian Stock Exchange. Research in International Business and Finance, 35, 111–121.

Keeble, D., & Walker, S. (1994). New firms, small firms and dead firms: Spatial patterns and determinants in the United Kingdom. Regional Studies, 28(4), 411–427.

Kim, P. (2006). Organizing processes and founding activities of new ventures (Unpublished Doctoral Dissertation). University of North Carolina.

Kirchhoff, B. A. (1994). Entrepreneurship and Dynamic Capitalism: The Economics of Business Firm Formation and Growth. Westport, CT: Praeger.

Kirzner, I. M. (2008). The Alert and Creative Entrepreneur: A Clarification, IFN Working Paper No. 760, 2008, Research Institute of Industrial Economics, August 11.

Maslow, A. H. (1943). A theory of human motivation. Psychological Review, 50(4), 370–96.

Mazzarol, T., & Mamouni, L. E. (2011). Resilient organizations: Offense versus defense.

Article submitted for the Australia and New Zealand Academy of Management, (ANZAM) Annual Conference.

Mooney, P. H., Roaring, J., & Gray, T. W. (1996). The de/repolitization of cooperation and the discourse of conversation. Rural Sociology, 61, 559–576.

Mooney, P., & Gray, T. (2002). Co-operative conversion and restructuring in theory and practice. Research report 185. United States Department of Agriculture, Rural Business Co-operative.

Mueller, D. C. (1977). The persistence of profits above the norm. Economica, 44, 369–380.

Mueller, D. C. (1986). Profits in the long run. Cambridge: Cambridge University Press.

Münkner, H. H. (2012). Co-operation as a remedy in times of crisis, agricultural co-operatives in the world. Their roles for rural development and poverty reduction. Euricse Working Paper, No. 41 j 12. Trento: EURICSE.

Nemon, H. (2000). Community economic development in distressed urban neighborhoods: A case study of the Philadelphia Empowerment Zone (Unpublished dissertation). Philadelphia, PA: University of Pennsylvania.

North, D. (1990). Institutions, Institutional Change and Economic Performance. Cambridge: Cambridge University Press.

Paula, C., María, T., Tascón, F., Borja, A.T., & Alberto, D. M. (2016). Target leverage and speed of adjustment along the lifecycle of European listed firms. BRQ Business Research Quarterly, (2016).

Pelling, M., & High, C. (2005). Understanding adaptation: What can social capital offer assessments of adaptive capacity?. Global Environmental Change, 15(4), 308–319.

Pennerstorfer, D., & Weiss, C. R. (2012). Product quality in the agri-food chain: Do cooperatives offer high-quality wine?. European Review of Agricultural Economics, 40(1), 143–162.

Phillips, P.C.B., & Perron, P. (1988). Testing for a unit root in a time series regression. Biometrika, 75, 335–346.

Press, B., T., Collion, M. H., de Janvry, A., Rondot, P., & Sadoulet, E., (2008). Do village organizations make a difference in African rural development? A study for Senegal and Burkina Faso. World Development, 36(11), 2188–2204.

Puu, T. (2006). On the stability of Cournot equilibrium when the number of competitors increases. Retrieved from https://hal.archives-ouvertes.fr/hal-00589719

Reynolds, P., Miller, B., & Maki, W. R. (1995). Explaining regional variation in business births and deaths: US 1976– 88. Small Business Economics, 7, 389–407.

Russell, R., & Hanneman, R. (1992). Co-operatives and the business cycle: The Israeli case. Journal of Comparative Economics, 16, 701–715.

Sarkar, S. (2003). The effect of mean reversion on investment under uncertainty. Journal of Economic Dynamics and Control, 28(2), 377–396.

Schmalensee, R. (1992). Sunk costs and market structure: A review article. Journal of Industrial Economics, 40, 125–134.

Schumpeter, J. (1934). The Theory of Economic Development. Boston, MA: Harvard University Press.

Sexton, R. J., 1986. The Formation of Cooperatives: A Game‐Theoretic Approach with Implications for Cooperative Finance, Decision Making, and Stability. American Journal of Agricultural Economics, 68, 214–225. https://doi.org/10.2307/1241423

Shreve, S. (2004). Stochastic Calculus for Finance II, Vol. 2. Retrieved from http://efinance.org.cn/cn/FEshuo/stochastic.pdf

Simon, H. A. (1982). Models of bounded rationality. Cambridge, MA: MIT Press.

Stenholm, P., Acs, Z. J., & Wuebker, R. (2013). Exploring country-level institutional arrangements on the rate and type of entrepreneurial activity. Journal of Business Venturing, 28, 176–193.

Steinerowski, A. (2012). Can social enterprise contribute to creating sustainable rural communities? – Using the lens of structuration theory to analyse the emergence of rural social enterprise. Local Economy, 27(2), 167–182.

Sutton, J. (1991). Sunk Costs and Market Structure. Cambridge: MIT Press.

Tsao, Y.-C. (2015). Co-operative promotion under demand uncertainty. International Journal of Production Economics, 167, 45-49.

Verheul, I., Wennekers, S., Audretsch, D.B., & Thurik, R. (2002). An eclectic theory of entrepreneurship: Policies, institutions, and culture. Tinbergen Institute Discussion Paper. Retrieved from http://ssrn.com/abstract=1511547.

Xuena, A., Zhang, S., & Li, X. (2015). Cournot equilibrium model for electricity markets with interruptible load program and wind power. http://journals.sagepub.com/doi/abs/10.1177/0142331213492788

Zahra, S. E., Gedajlovic, E., Neubaum, D. O., & Shulman, J. M. (2009). A typology of social entrepreneurs: Motives, search processes and ethical challenges. Journal of Business Venturing, 24(5), 519–532.

Zhang, J.L., Chen, J., Lee, C.Y. (2008). Joint optimization on pricing, promotion and inventory control with stochastic demand. International Journal of Production Economics, 116(2), 190–198.

Zhou, J. Zhen, Y., & Li, K. (2015). Understanding farmer co-operatives’ self-inspection behavior to guarantee agri-product safety in China. Food Control, 59 (2016), 320–327.

Appendices

Proposition 1. The problem has a unique Nash equilibrium

Proof

Proposition 2. Generalizing the problem for N co-operatives

Proof

In the case of two co-ops in a local area, demand is defined as

Co-operative 1 is constrained by its production capacity, which is limited by the maximum demand and the co-operative’s neighbor, which is considered to have a similar cost function and, in most general cases, the same opportunities. We suppose that when co-operative 1 is at the maximum capacity of production, then demand will be equitably shared with its co-operative neighbor. In most general cases, co-operatives operate at the same level of production and cost function that ensure that they share demand. But the new entrant may be constrained by a high lack of production capacity, that is, one that is approximately equal to  .

.

For simplicity and in order to generalize the problem, we suppose that demand is shared equitably depending on the production capacity. With the same method above of optimizing the problem in Proposition 1, we solve for co-operative 1, and have the following:

Proposition 3. N which ensures the flow of total outputs.

Proof

1 International co-operative alliance (2015). Morocco’s strategy for co-operative growth, direct link : https://www.ica.coop/en/media/news/moroccos-strategy-co-operative-growth

2 Co-operative development office, direct link : http://www.odco.gov.ma/

3 Economic, Social and Environmental Council of Morocco. (20015). [http://www.ces.ma/Documents/PDF/Auto-saisines/AS-19-2015-economie-sociale-et-solidaire/Rapport-AS19-2015-VF.pdf], n.d. URL http://www.ces.ma/Pages/Accueil.aspx (accessed 1.18.20).