Organizations and Markets in Emerging Economies ISSN 2029-4581 eISSN 2345-0037

2021, vol. 12, no. 1(23), pp. 86–105 DOI: https://doi.org/10.15388/omee.2021.12.49

The Economics of the Name Change: Long-term Adjustments towards EU/NATO or Short-term Resolution of Political Uncertainty?

Bojan Srbinoski (corresponding author)

University Carlo Cattaneo – LIUC, Italy

bsrbinoski@liuc.it

https://orcid.org/0000-0003-4815-3762

Klime Poposki

University St. Kliment Ohridski – Bitola, North Macedonia

klime.poposki@uklo.edu.mk

https://orcid.org/0000-0002-7497-5826

Ksenija Dencic-Mihajlov

University of Nis, Serbia

ksenijadm@gmail.com

https://orcid.org/0000-0002-2419-0676

Milica Pavlovic

University of Nis, Serbia

milapavlovic@yahoo.com

https://orcid.org/0000-0002-3442-4560

Abstract. North Macedonia and Greece resolved the 27-year country name dispute and removed the main hurdle for North Macedonia to start the accession processes towards the EU and NATO. The paper analyzes the stock market movements around several events related to the name issue resolution to uncover whether Macedonian companies experienced stock price adjustments according to the long-term benefits/costs of joining the EU/NATO. The dynamics of the market reactions suggest that the investors reacted systematically to the short-term political uncertainty created around the referendum rather than to the long-term perspectives of the EU/NATO integration. We integrate the knowledge from the literature which explores stock market reactions to EU enlargement/exit and political elections and provide contributions for researchers and policymakers.

Keywords: referendum, stock markets, political uncertainty, event study

Received: 10/9/2020. Accepted: 25/1/2021

Copyright © 2021 Bojan Srbinoski, Klime Poposki, Ksenija Dencic-Mihajlov, Milica Pavlovic. Published by Vilnius University Press. This is an Open Access article distributed under the terms of the Creative Commons Attribution Licence, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

Introduction

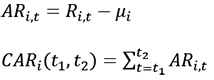

In 2018, an almost three-decades-long dispute over the name issue between North Macedonia and Greece came to an end. The bilateral agreement between the countries lifted the main barrier for North Macedonia to proceed with the EU and NATO accession processes (Kirby, 2019). Social and political tensions accompanied the whole process of the resolution, which had to pass through several phases, including a referendum in North Macedonia. Even the referendum question was framed to account for the dependence of the EU/NATO accession on the resolution of the name issue: “Are you in favor of European Union and NATO membership by accepting the agreement between the Republic of Macedonia and Republic of Greece?” Besides the social and political concerns, the process of the name change caused economic turbulences reflected on the domestic stock market. The market index MBI101 dropped by 6.4% a week after the referendum due to the low turnout. We uncover what kind of information was generated by the name change process for the Macedonian economy through the analysis of stock return patterns.

Substantial evidence exists on the stock market reaction to integration to or detachment from the EU. The most recent debate revolves around the impact of the Brexit referendum on stock market movements. The Brexit referendum caused stock prices downturn of specific sectors (Schiereck et al., 2016; Ramiah et al., 2017; Tielmann & Schiereck, 2017; Davies & Strudnicka, 2018), as well as certain adjustments on the international markets (Burdekin et al., 2018; Lobão & Santos, 2019) capturing the long-term economic effects of leaving the EU. On the other side, the integration towards the EU generated a positive impact on the stock markets of future member countries (i.e., Dvořák & Podpiera, 2006). However, the European referenda may represent ‘second-order elections’ as voters express their support or opposition towards the ruling political party or coalition (Szczerbiak & Taggart, 2004). Stock markets are sensitive around elections due to increasing political uncertainty, which once resolved, produces positive market reaction (i.e., Pantzalis et al., 2000; Fisman, 2001; Nippani & Medlin, 2002; Santa-Clara & Valkanov, 2003; Li & Born, 2006; Mattozzi, 2008; He et al., 2009). While the resolution of the name issue does not grant the EU or NATO membership, it removes the main hurdle for North Macedonia to join them. We attempt to answer whether the resolution of the name issue brought information about the long-term implications of the EU/NATO accession for the Macedonian economy, or information about the short-term resolution of political uncertainty.

The purpose of this paper is to analyze stock market movements around four events related to the name change: the signing of the agreement between North Macedonia and Greece; the referendum; the vote for initiation of constitutional changes in the Macedonian Parliament; and the approval of the agreement by the Greek Parliament. To answer the proposed question, we employ an event study methodology to calculate abnormal (ARs) and cumulative abnormal returns (CARs) for each firm in the sample. We tend to exploit the uncertainty around these events and observe stock return dynamics across the events to overcome the shortcomings of the limited sample of frequently traded stocks on the Macedonian Stock Exchange (MSE).

The empirical results show a systematic downturn in stock prices after the referendum and a systematic rise around the vote for the initiation of constitutional changes. While the process of the name change took four subsequent steps (agreement, referendum, constitutional changes, and ratification), each of which increased the probability of resolution of the name issue, the market reacted systematically only around the referendum and constitutional changes vote. These dynamics correspond to the return patterns around political elections with increasing political uncertainty (e. g., Pantzalis et al., 2000). Once the political uncertainty was resolved, the market settled down, disregarding the finalization of the name issue. We foud weak evidence for market reaction to the long-term perspectives of EU/NATO accession, which is firm-specific. We speculate that the firms become attractive investment opportunities around the resolution of the name issue due to their political connectedness, which enables them to extract the benefits of the EU/NATO integration.

To the best of our knowledge, this is the first study that explores the implications of the name issue resolution on the Macedonian economy. While the available literature focuses on developed countries, we examine the issue of an emerging market characterized by frequent political instability and highlight the sensitivity of the largest companies to the political events in North Macedonia. The increasing political uncertainty distorts the value of the companies deterring the investors away from the Macedonian market. While the government’s promises of the EU accession seem optimistic, the market carefully priced the long-term implications of joining the EU/NATO, estimating the probability of such a step forward as rather low.

Additionally, we contribute to the debate over the consequences of European referenda and Brexit on stock market movements. Although in the Macedonian case the EU/NATO accession was not granted, the results show that the referendum was perceived as a ‘second-order election’ as suggested by Szczerbiak and Taggart (2004). We suggest that the analysis of the stock market may uncover the ‘political side’ of Brexit by leveraging the literature of stock market reaction around political elections (Pantzalis et al., 2000; Fisman, 2001; Nippani & Medlin, 2002; Santa-Clara & Valkanov, 2003; Li & Born, 2006; Mattozzi, 2008; He et al., 2009) and the value of political connections (Faccio, 2006; Faccio et al., 2006; Wu et al., 2012; Cooper et al., 2010; Boubakri et al., 2012; Acemoglu et al., 2016).

The paper is organized as follows: in the next section, we provide the timeline of events related to the name issue and set up the hypotheses. In Section 3, we describe our empirical design and data. In Section 4, we present and discuss the empirical results. The last section is reserved for concluding remarks.

1. The Timeline

Greece had been blocking North Macedonia’s EU/NATO accession processes for more than a decade by using the unanimous vote rule for NATO membership and the start of EU negotiation talks. The main reason for the blockage was the name “Macedonia,” the issue of which had grave historical and identity concerns (Kirby, 2019). After taking the government power in 2017, the center-left wing party SDSM and its coalition partners set as a priority the resolution of the name issue with Greece. It took a year to reach an agreement that would provide a compromise from both sides. While the agreement removed the main barrier for the NATO membership and for opening negotiation talks with the EU, North Macedonia would have faced political turbulences if the citizens had not approved the agreement on a referendum. Four critical events highlight the conclusion of the name issue: the signing of the agreement between North Macedonia and Greece; the referendum; the vote in the Macedonian Parliament for initiation of constitutional changes; and the approval of the agreement by the Greek Parliament.

On June 17, 2018, the Prime ministers and Ministers of Foreign Affairs of both countries met and signed the agreement (so-called Prespa Agreement) with a presence of EU officials, although both sides pre-announced the reached agreement five days before the signing (Kathimerini, 2018). Besides the pre-announcement, the sealing of the agreement was uncertain due to the political tensions surrounding the event. The opposition party in North Macedonia announced public protests, while President Ivanov declared that he would not sign the agreement, calling it ‘unacceptable’ (Deutsche Welle, 2018). EU and NATO representatives welcomed the signing of the agreement declaring that it opens the path towards EU and NATO memberships.

On September 30, 2018, the citizens voted for the change of the country‘s name by answering to the referendum question: „Are you in favor of the European Union and NATO membership by accepting the agreement between the Republic of Macedonia and Republic of Greece?“ A ‘YES’ vote would bring North Macedonia closer to the EU and NATO, while ‘NO’ meant status-quo and increasing political uncertainty. The majority of citizens expressed strong support for the agreement and intention to vote on the referendum (European Western Balkans, 2018).2 However, it resulted in a low turnout (36.89%), even though the majority voted ‘YES’ (94.18%) (Source: State Election Commission). The opposition party claimed that the referendum was not valid since it did not reach the required turnout threshold of 50% (Meta, 2018). However, regardless of the turnout, the referendum outcome would instruct the Parliament to start the process of renaming the country under the condition, two-thirds of the deputies to vote for the constitutional changes. The coalition which promoted the ‘YES’ option needed an additional eight votes belonging to the opposition coalition in the Parliament to start the process of renaming. This condition intensified the political uncertainty since the opposition party was not willing to vote due to the low turnout on the referendum.

On October 19, 2018, two-thirds of Parliament deputies voted for the start of enacting constitutional changes after intensive negotiations between the ‘YES’ coalition and eight deputies from the opposing side. The constitutional amendment was approved on January 11, 2019, completing the process from the Macedonian side (Reuters, 2019). On January 25, 2019, the Greek Parliament ratified the Prespa Agreement with a tight vote, where 51% of deputies voted in favor, while 48.7% against, after the Greek Prime Minister survived a confidence vote on January 16, 2019,3 concluding the name change issue (Meta, 2019).

2. Literature Review

It is difficult to ascertain a priori the relative importance of potential benefits and costs of the EU/NATO accession for the Macedonian economy. However, we could understand possible consequences of the integration by reflecting on anticipated disruptions being caused by Brexit, as the potential costs (benefits) of EU disintegration may mirror potential benefits (costs) of EU integration.4 The companies may benefit of EU compliant tariffs, access to huge EU market and investment acceleration in response to reduced uncertainty. On the contrary, the costs arising from the compliance with EU regulation, funds outflow for EU contributions, and ‘brain-drain’ would impede growth perspectives. Since net-effect of EU integration is difficult to ascertain, the analysis of stock market movements around relevant events may unearth the market’s perception of the EU accession effects. The novel information generated around the events affects companies’ stock prices via two channels: firstly, the expectations about companies’ future earnings change according to the companies’ outlook in the new EU context; secondly, the cost of capital changes as the uncertainty of future integration fluctuates.5

The events related to joining or leaving EU provoke sectoral and systematic stock market reactions. Dvořák and Podpiera (2006) uncovered a spike in stock prices on the stock markets of the EU accession countries after the EU enlargement. Schiereck et al. (2016) detected a significant drop in the share prices of the banking sector after the Brexit announcement. Similarly, Ramiah et al. (2017) discovered that the banking sector and travel and leisure sectors experienced strong negative market reactions around Brexit, although some sectors had a positive market response. Tielmann and Schiereck (2017) found that the Brexit referendum had adverse effects on logistics and air transportation companies in the UK. Also, Davies and Strudnicka (2018) analyzed the stock market reactions after the Brexit referendum and five subsequent events and found that the market punished firms having affiliates in the UK; however, the effect was significant mainly around the referendum while it dissipated for the next events. Given the insights from this literature, we would expect consistent systematic or sectoral positive (negative) market reaction across the events whenever the uncertainty over the sealing of the Prespa Agreement resolves (increases), implying opening (closing) the pathway towards the EU/NATO.

Table 1. Event dates and hypotheses summary

|

Events/Hypothesis |

June 12th and 17th, 2018 |

September 30th, 2018 |

October 19th, 2018 |

January 16th and 25th, 2019 |

|

|

EU/NATO adjust. |

Expected effect |

Positive |

Negative |

Positive |

Positive |

|

Reasoning |

The reaching/signing of the agreement is a first step towards the resolution of the name issue and lifting the main barrier towards the EU/NATO |

The low turnout increased the political tensions and made uncertain the vote for the initiation of constitutional changes |

The Parliament vote resolved the uncertainty over the constitutional changes and increased the chances for sealing the agreement |

The Greek Parliament ratified the agreement and completed the process of the name change removing the main barrier towards the EU/NATO |

|

|

Political uncertainty |

Expected effect |

No effect |

Negative |

Positive |

No effect |

|

Reasoning |

The government set up the agreement and resolution of the name issue as priority goals since the beginning of its mandate in 2017 |

The low turnout increased the political tensions and undermined the public trust in the government |

The Parliament vote resolved the uncertainty over the future political setup until the next elections |

The vote in the Macedonian Parliament confirmed the trust in the current government, so the ratification would not affect the domestic political uncertainty |

|

Additionally, stock markets are sensitive around political elections, especially when the uncertainty over who will be the winner is high (Li & Born, 2006). Pantzalis et al. (2000) discovered a positive market reaction before and after political elections, especially with high uncertainty, while Santa-Clara and Valkanov (2003) found no excess returns around presidential elections claiming that the excess returns amplify throughout the presidential term. Political elections or politics-related news cause significant movements of share prices of politically sensitive firms (Fisman, 2001; Mattozzi, 2008). Two studies analyzed the stock returns around the 2000 US Presidential Elections, which is a specific event because of delayed acknowledgment of the winner, the process of which took 36 days after the elections. Nippani and Medlin (2002) found a negative market reaction after the elections due to the delay, and He et al. (2009) detected positive abnormal returns for Bush-favored firms and negative abnormal returns for Gore-favored firms after the elections. The case of the Macedonian referendum resembles that of the 2000 US Presidential Elections. While high turnout would have made the vote in the Parliament certain, the low turnout enabled the political parties to speculate over the meaning of the result and caused political uncertainty, which was resolved on the voting day in the Parliament. During such political uncertainty, we would expect the aggregate market reaction after the referendum to be negative and systematic. On the day of the Parliament vote, the resolution of uncertainty would instigate reversal. Table 1 summarizes the event dates and expected reactions dependent on each hypothesis.

3. Data and Methodology

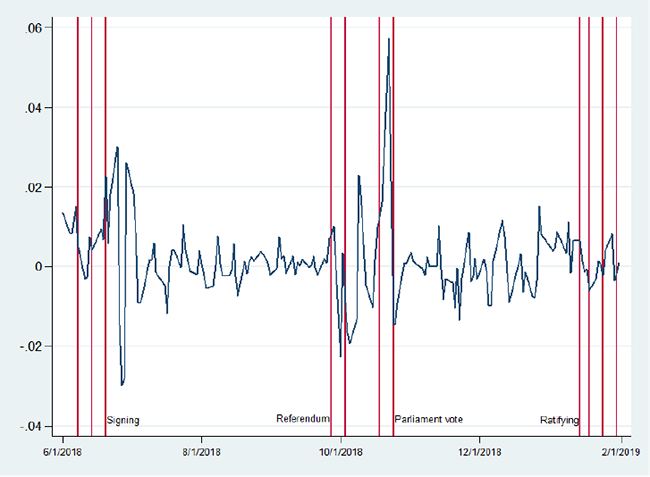

We collected daily data series for the period January 2017 – February 2019 from the Macedonian Stock Exchange (MSE). We extracted the firms with more frequent trading and created a sample of 14 firms, ten of which constituted the MSE’s main index MBI10.6 Banks have dominant presence comprising half of the sample. The rest of the sample belongs to the Manufacturing (2), Oil (2), Construction (1), Communication (1), and Tourism industry (1). We took four events (and additional two events to account for earlier market reactions) relevant for the name change process and performed event study methodology: 1) the day when the Prime Ministers of both countries announced they reached an agreement (June 12, 2018); 2) the day of signing the agreement (June 17, 2018); 3) the day of the referendum (September 30, 2018); 4) the day of vote in the Macedonian Parliament for start of enacting constitutional changes (October 19, 2018); 5) the day of confidence vote for the Greek government (January 16, 2019); and 6) the day when the Greek Parliament ratified the agreement (January 25, 2019).

Table 2 shows the descriptive statistics of stock returns for each firm and the raw stock returns on each event date. The distribution of returns is moderately skewed and leptokurtic, which makes the use of parametric tests inappropriate.7 Hence, we rely on a non-parametric test to check the significance of abnormal returns. On the next trading day after the referendum and after the Parliament vote, the stock returns had a systematic drop and spike, respectively. For the rest of the events, the event date returns showed a mild reaction. However, we included various asymmetric event windows to check for eventual delayed response.

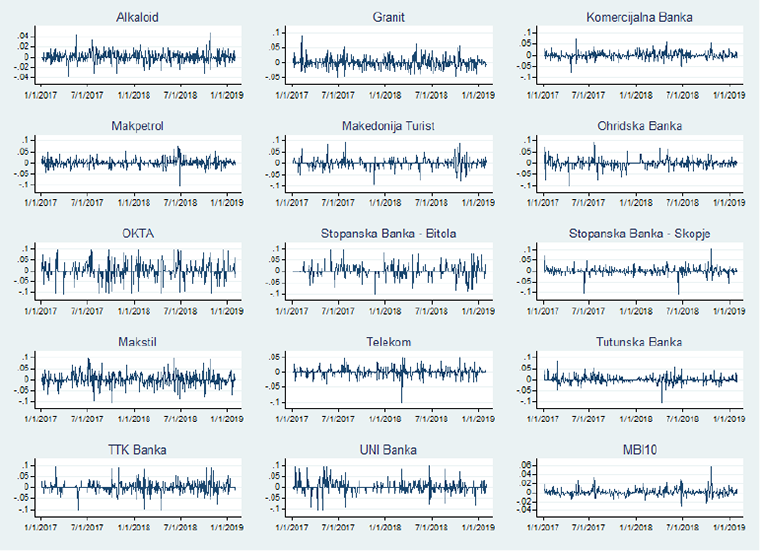

We calculated the daily returns as the first natural logarithmic difference of the underlying (closing) stock price. We estimated the abnormal returns using a historical mean model (HMM), which differs from the common practice of using market models.8 The preference for HMM compared to the market models relies on the following: 1) the sample is limited and mainly contains firms included in the MBI10 index; hence, the use of MBI10 as a market factor would significantly reduce the variance and generate unpredictable results;9 2) Dyckman et al. (1984) and Brown and Warner (1985) provided evidence that single market model and HMM produce comparable results; 3) to avoid the impact of divergence from the normality assumption of stock returns on the estimation results, we tested the significance of the abnormal returns using the Kolari and Pynnonen (2011) non-parametric generalized rank test, which does not suffer from a serial correlation of abnormal returns or event-induced volatility.10 We used the following equations to estimate abnormal returns (ARs) and cumulative abnormal returns (CARs): 11

(1)

(1)

(2)

where Ri,t is the raw stock return of firm i at time t, μi is the average return of firm i for the estimation period, t1 is the lower bound, and t2 is the upper bound of the event window. Finally, we built three portfolios to evaluate the aggregate and group reaction to the event: 1) the sample portfolio consisted of 14 stocks, 2) a banking portfolio comprised 7 banks, and 3) a non-banking portfolio was composed of 7 non-banks.12 We selected an estimation period of 215 trading days starting 30 days before the event and the following set of event windows: [-2,0], [-1,0], [0,0], [0,1] and [0,2].13

Table 2. Descriptive statistics and raw stock returns on the event dates

|

Firm |

Sector |

Descriptive Statistics |

Raw Stock Returns |

||||||||

|

Mean |

St.Dev. |

Skewness |

Kurtosis |

12/06/2018 |

18/06/2018 |

01/10/2018 |

22/10/2018 |

16/01/2019 |

28/01/2019 |

||

|

Alkaloid |

Manufacturing |

0.09% |

0.94% |

0.12 |

6.01 |

0.00% |

0.60% |

-3.10% |

4.75% |

0.02% |

-0.60% |

|

Makstil |

Manufacturing |

0.06% |

2.52% |

-0.03 |

5.75 |

5.41% |

1.90% |

-7.83% |

9.19% |

0.00% |

0.84% |

|

Granit |

Construction |

0.07% |

1.59% |

0.70 |

6.24 |

0.61% |

-0.62% |

-4.59% |

5.85% |

0.00% |

0.00% |

|

Makpetrol |

Oil industry |

0.12% |

1.63% |

0.03 |

9.16 |

-1.13% |

0.19% |

-1.05% |

4.08% |

-0.79% |

0.20% |

|

OKTA |

Oil industry |

0.15% |

3.11% |

-0.24 |

6.55 |

0.00% |

0.00% |

0.00% |

8.34% |

0.00% |

6.25% |

|

Makedonija Turist |

Tourism |

0.06% |

1.66% |

0.35 |

13.23 |

0.00% |

1.79% |

0.00% |

0.99% |

0.00% |

0.00% |

|

Telekom |

Communication |

0.03% |

1.24% |

-0.68 |

13.59 |

0.00% |

0.00% |

-3.15% |

4.75% |

0.00% |

0.33% |

|

Komercijalna banka |

Banking |

0.12% |

1.36% |

0.24 |

7.98 |

-1.05% |

3.02% |

-1.94% |

5.66% |

0.00% |

0.91% |

|

Ohridska banka |

Banking |

0.11% |

1.63% |

0.25 |

11.87 |

0.00% |

0.00% |

-2.30% |

3.75% |

0.00% |

0.60% |

|

Stopanska – Bitola |

Banking |

0.12% |

2.20% |

0.05 |

8.94 |

0.00% |

0.00% |

0.00% |

5.47% |

0.00% |

0.00% |

|

Stopanska – Skopje |

Banking |

0.09% |

1.47% |

-0.57 |

20.02 |

0.09% |

0.11% |

-0.87% |

10.33% |

-0.40% |

0.00% |

|

Tutunska banka |

Banking |

0.11% |

1.40% |

-0.15 |

12.48 |

0.00% |

0.00% |

-2.45% |

2.02% |

0.00% |

1.90% |

|

TTK banka |

Banking |

0.12% |

2.12% |

0.27 |

9.76 |

0.00% |

-0.11% |

-3.40% |

5.34% |

0.00% |

0.00% |

|

UNI banka |

Banking |

0.18% |

2.25% |

0.35 |

10.01 |

-0.08% |

1.98% |

-2.83% |

7.25% |

0.00% |

0.00% |

Source: Macedonian Stock Exchange. Authors‘ calculations

4. Empirical Results and Discussion

4.1 Market Reactions around the Referendum and the Vote for the Initiation of Enacting Constitutional Changes

Primarily, we focused on the events around which both the political uncertainty and name issue resolution uncertainty were high. We expected an adverse market reaction after the referendum due to the low turnout, which suggested a damaged trust in the government and political tensions, as well as a lack of will for resolution of the name change. Additionally, if EU/NATO perspectives were important for the market, then investors would bet on the likelihood of successful and positive referendum outcome and invest in those sectors which would benefit from the EU/NATO accession. Hence, we expected a positive (sectoral) market reaction before the referendum event date and no prior-event market reaction if a successful referendum confirmed the prior policy goals and public trust in the government.

Table 3 presents the individual and portfolio stock price movements around the referendum date (September 30, 2018). The sample portfolio experiences significant positive price movements before the referendum and significant systematic reversal after the event highlighting the market surprise and increase in uncertainty. The observed movements originate from the non-banking group of stocks since there is no significant prior-event market reaction for the banking sector. While the initial result suggests that the market identified the prosperous companies in case of EU/NATO integration, the reaction is firm-specific rather than sectoral (four firms from four different sectors experience positive price movements before the event).

Second, the vote for the start of enacting constitutional changes resolved the previously created uncertainty. Table 3 shows the market movements around the vote for constitutional changes (October 19, 2018). The resolution of uncertainty instigated a spike in stock prices across all companies (except for UNI banka) one day after the vote. The abnormal returns are positive and significant across the selected event windows before and after the event date, which suggests that the two-thirds majority was reached even two days before the vote. The results correspond to the claim of Pantzalis et al. (2000) that as the day of political elections is getting close, the uncertainty over the winner of the election is resolved, and positive price changes occur. In this case, the vote for the start of enacting constitutional changes resolved the political uncertainty, confirmed the public trust in the government, and increased the likelihood of completing the process of the name change and opening the path towards the EU and NATO.

In summary, the analysis of the previous two event dates does not answer whether the market reacted to the long-term perspectives of EU/NATO accession or the short-term resolution of political uncertainty. Before the referendum date, we observed positive abnormal returns for four firms which might be considered as prosperous firms in the case of EU/NATO accession. At the same time, before and after the constitutional changes vote, we detected positive market movements characteristic of political elections when political uncertainty is resolved. To provide further evidence, we rely on the analysis of abnormal returns around the other four events related to the name issue.

Table 3.

The table presents the cumulative (daily) abnormal return (CAR) for the following event windows: [-2, 0], [-1, 0], [0, 0], [0, 1] and [0, 2], where t = 0 is the event day. CARs are calculated based on the historical mean model ARi,t = Ri,t – μi . There are three portfolios: 1) a sample portfolio consisting of 14 stocks, 2) a banking portfolio comprising 7 banks, and 3) a non-banking portfolio composed of 7 non-banks. The significance of the CAR is evaluated using the Kolari and Pynnonen (2011) non-parametric generalized rank test. ***, **, * denote 1%, 5% and 10% significance levels, respectively.

|

Firm |

September 30, 2018 |

October 19, 2018 |

||||||||

|

CAR[-2,0] |

AR[-1,0] |

AR[0,0] |

AR[0,1] |

CAR[0,2] |

CAR[-2,0] |

CAR[-1,0] |

AR[0,0] |

CAR[0,1] |

CAR[0,2] |

|

|

Non-Banking group |

||||||||||

|

Alkaloid |

1.81% |

0.62% |

|

-3.13%*** |

-3.10%** |

2.40% |

2.36%* |

1.76%** |

6.49%*** |

4.12%*** |

|

Makstil |

11.59%*** |

4.19%* |

|

-7.84%*** |

-8.60%** |

5.99% |

5.25% |

-0.04% |

9.12%*** |

9.08%** |

|

Granit |

4.67%** |

2.25% |

|

-4.55%*** |

-5.12%** |

3.72% |

3.70%* |

0.13% |

5.99%*** |

3.47% |

|

Makpetrol |

0.66% |

0.44% |

|

-1.24% |

-1.43% |

5.74%* |

3.78% |

2.04% |

5.88%** |

3.63% |

|

OKTA |

8.44%* |

0.09% |

|

-0.11% |

-3.12% |

7.37% |

3.80% |

3.98% |

12.14%*** |

16.08%*** |

|

Makedonija Turist |

6.22%*** |

6.20%*** |

|

0.03% |

0.06% |

9.11%*** |

9.12%*** |

9.12%*** |

10.10%*** |

10.10%*** |

|

Telekom |

1.05% |

1.04% |

|

-3.15%** |

-3.14% |

2.75% |

2.77% |

2.79%** |

7.52%*** |

4.47%* |

|

Portfolio (non-banking) |

4.92%*** |

2.12%** |

|

-2.86%*** |

-3.49%** |

5.30%*** |

4.40%*** |

2.83%*** |

8.18%*** |

7.28%*** |

|

Banking group |

||||||||||

|

Komercijalna banka |

-0.52% |

-0.25% |

|

-2.21% |

-2.49% |

3.08% |

0.40% |

0.59% |

5.97%*** |

5.85%** |

|

Ohridska banka |

-0.11% |

-0.36% |

|

-2.35% |

-1.63% |

3.66% |

2.15% |

1.46% |

5.12%** |

4.60%* |

|

Stopanska – Bitola |

3.92% |

3.01% |

|

0.06% |

0.12% |

6.37%* |

6.39%** |

4.94%** |

10.41%*** |

13.35%*** |

|

Stopanska – Skopje |

-0.77% |

0.57% |

|

-0.91% |

-2.63% |

3.32% |

1.60% |

0.53% |

10.77%*** |

6.32%*** |

|

Tutunska banka |

1.71% |

1.73% |

|

-2.48%* |

-0.75% |

4.82%** |

2.73% |

2.05% |

4.05%** |

2.78% |

|

TTK banka |

2.58% |

-0.20% |

|

-3.60% |

-1.23% |

2.55% |

1.84% |

1.13% |

6.32%** |

9.32%** |

|

UNI banka |

2.66% |

-0.21% |

|

-2.91%* |

-3.00% |

-0.28% |

-0.17% |

-2.90% |

4.25% |

5.23% |

|

Portfolio (banking) |

1.35% |

0.61% |

|

-2.06%*** |

-1.66% |

3.36% |

2.13%*** |

1.11%** |

6.70%*** |

6.78%*** |

|

Portfolio (sample) |

3.14%*** |

1.37%* |

|

-2.46%*** |

-2.58%** |

4.33%*** |

3.27%*** |

1.97%*** |

7.44%*** |

7.03%*** |

Authors‘ calculations

4.2 Market Reactions around the Signing and Ratifying the Agreement

First time after 27 years, the two countries reached an agreement over the name issue and publicly announced it on the same date (June 12, 2018). On June 17, 2018, they signed the agreement despite he political turbulences. To account for a delayed market response, we analyzed the abnormal returns around both events. If the market understood the reaching and signing of the agreement as a first step towards the resolution of the name issue resulting in better outlook of joining the EU/NATO, then the sectors that would benefit most should experience a rise in the stock prices. On the other side, if the market read these two events as a confirmation of the policy goals of the current government, known since the beginning of its mandate, then no significant market reaction is expected.

Table 4 presents the abnormal returns around the announcement of reaching the agreement and around signing of the agreement capturing an eventual delayed response to the first announcement. The abnormal returns of all three portfolios (sample, banking, and non-banking) show no significant market reaction around both events. Looking at the individual stocks, we detected significant abnormal returns for four firms after the announcement on June 12 (two banks, one oil, and one manufacturing company). Only one company (Makstil) had consistent abnormal returns across all four events,14 which may point out that the company was perceived as prosperous as the country joins the EU/NATO. Additionally, one of the banks (Stopanska banka – Skopje) experienced a significant drop in prices after the announcement, which is inconsistent with its rise in prices around the vote for the start of enacting constitutional changes if the market valued the bank as a prosperous one in case of the EU/NATO accession. The absence of market response to the first two events related to the name change suggests that investors had been waiting for the evolvement of the political situation in the country rather than capturing the most prosperous stocks after the accession.

Finally, the Prespa Agreement was ratified by the Greek Parliament on January 25, 2019, completing the process of the name issue, despite the political tensions before the ratification when the Greek Prime Minister survived a confidence vote on January 16, 2019. We analyzed the abnormal returns around both events. We assumed that the market would respond positively to the finalization of the process and reward the most prosperous sectors. However, we expected no market reaction since the market already priced the resolution of domestic political uncertainty, so these events should not influence the political stance in North Macedonia.

Table 4

The table presents the cumulative (daily) abnormal return (CAR) for the following event windows: [-2, 0], [-1, 0], [0, 0], [0, 1] and [0, 2], where t = 0 is the event day. CARs are calculated based on the historical mean model ARi,t = Ri,t – μi . There are three portfolios: 1) a sample portfolio consisting of 14 stocks, 2) a banking portfolio comprising 7 banks, and 3) a non-banking portfolio composed of 7 non-banks. The significance of the CAR is evaluated using the Kolari and Pynnonen (2011) non-parametric generalized rank test. ***, **, * denote 1%, 5% and 10% significance levels, respectively.

|

Firm |

June 12, 2018 |

June 17, 2018 |

||||||||

|

CAR[-2,0] |

CAR[-1,0] |

CAR[0,0] |

CAR[0,1] |

CAR[0,2] |

CAR[-2,0] |

AR[-1,0] |

AR[0,0] |

AR[0,1] |

CAR[0,2] |

|

|

Non-Banking group |

||||||||||

|

Alkaloid |

-0.44% |

0.31% |

-0.15% |

-0.30% |

0.16% |

0.31% |

0.46% |

|

0.46% |

0.31% |

|

Makstil |

-4.73% |

-0.15% |

5.33%** |

5.25% |

7.77%* |

2.35% |

2.48% |

|

1.78% |

1.66% |

|

Granit |

-1.06% |

-0.47% |

0.62% |

1.84% |

0.03% |

-0.67% |

-1.85% |

|

-0.64% |

0.55% |

|

Makpetrol |

1.68% |

-0.03% |

-1.15% |

1.37% |

4.17%* |

5.29%*** |

2.79%** |

|

0.16% |

2.52% |

|

OKTA |

-3.79% |

-3.63% |

-0.16% |

-0.31% |

3.35% |

3.46% |

3.64% |

|

-0.18% |

3.29% |

|

Makedonija Turist |

-0.22% |

-0.14% |

-0.07% |

-0.14% |

-0.22% |

-0.15% |

-0.07% |

|

1.72% |

3.85%* |

|

Telekom |

0.56% |

0.61% |

-0.06% |

-0.12% |

-0.17% |

-0.13% |

-0.07% |

|

-0.07% |

-0.13% |

|

Portfolio (non-banking) |

-1.14% |

-0.50% |

0.62% |

1.08% |

2.16% |

1.49% |

1.05% |

|

0.46% |

1.72% |

|

Banking group |

||||||||||

|

Komercijalna banka |

-1.61% |

-1.43% |

-1.24% |

1.46% |

1.50% |

2.69% |

0.01% |

|

2.81%** |

4.61%** |

|

Ohridska banka |

-0.14% |

-0.06% |

-0.05% |

-0.09% |

-0.14% |

-0.19% |

-0.09% |

|

-0.09% |

-0.96% |

|

Stopanska – Bitola |

1.58% |

-0.23% |

-0.12% |

-0.23% |

-0.35% |

-0.23% |

-0.12% |

|

-0.12% |

-5.11% |

|

Stopanska – Skopje |

-0.54% |

0.02% |

0.10% |

-10.84%*** |

-10.94%*** |

-11.24%*** |

-0.19% |

|

0.02% |

1.80% |

|

Tutunska banka |

-0.71% |

-1.71% |

-0.12% |

1.98% |

1.86% |

1.96% |

-0.13% |

|

-0.13% |

1.06% |

|

TTK banka |

-0.18% |

-0.19% |

-0.10% |

5.21%* |

5.12% |

5.22%* |

-0.09% |

|

-0.20% |

1.79% |

|

UNI banka |

2.55% |

-0.24% |

-0.16% |

1.04% |

0.96% |

1.08% |

-0.10% |

|

1.88% |

3.33% |

|

Portfolio (banking) |

0.13% |

-0.55% |

-0.24% |

-0.21% |

-0.28% |

-0.10% |

-0.10% |

|

0.59% |

0.93% |

|

Portfolio (sample) |

-0.50% |

-0.53% |

0.19% |

0.44% |

0.94% |

0.70% |

0.48% |

|

0.53% |

1.33% |

Authors‘ calculations

Table 5 shows the individual and portfolio stock price movements around the confidence vote and ratification. We detected no abnormal returns on portfolio and individual stock level except for one bank, which is difficult to attribute to a reaction to the ratification. The domestic market was not concerned with the vote in the Greek Parliament because it did not influence the stability of the current government in North Macedonia.

Table 5

The table presents the cumulative (daily) abnormal return (CAR) for the following event windows: [-2, 0], [-1, 0], [0, 0], [0, 1] and [0, 2], where t = 0 is the event day. CARs are calculated based on the historical mean model ARi,t = Ri,t – μi . There are three portfolios: 1) a sample portfolio consisting of 14 stocks, 2) a banking portfolio comprising 7 banks, and 3) a non-banking portfolio composed of 7 non-banks. The significance of the CAR is evaluated using the Kolari and Pynnonen (2011) non-parametric generalized rank test. ***, **, * denote 1%, 5% and 10% significance levels, respectively.

|

Firm |

January 16, 2019 |

January 25, 2019 |

||||||||

|

CAR[-2,0] |

CAR[-1,0] |

CAR[0,0] |

CAR[0,1] |

CAR[0,2] |

CAR[-2,0] |

CAR[-1,0] |

CAR[0,0] |

CAR[0,1] |

CAR[0,2] |

|

|

Non-Banking group |

||||||||||

|

Alkaloid |

0.54% |

-0.03% |

0.00% |

-0.06% |

-1.28% |

0.58% |

1.19% |

1.18% |

0.58% |

0.57% |

|

Makstil |

3.43% |

-0.63% |

0.08% |

0.15% |

-7.12% |

2.92% |

2.80% |

2.68% |

3.64% |

3.76% |

|

Granit |

1.39% |

0.16% |

0.02% |

-0.08% |

-0.67% |

0.70% |

0.07% |

0.03% |

0.07% |

-1.11% |

|

Makpetrol |

-0.45% |

-1.02% |

-1.01% |

-1.43% |

-1.64% |

1.17% |

0.37% |

0.79% |

0.77% |

0.56% |

|

OKTA |

-0.34% |

-0.22% |

-0.11% |

-0.22% |

-0.34% |

0.35% |

0.45% |

0.55% |

6.70% |

3.54% |

|

Makedonija Turist |

-0.24% |

-0.16% |

-0.08% |

-0.16% |

-1.23% |

-2.16% |

-2.10% |

-2.04% |

-2.10% |

-2.16% |

|

Telekom |

0.61% |

-0.03% |

-0.02% |

-0.36% |

-0.38% |

-0.03% |

-0.02% |

-0.01% |

0.31% |

0.96% |

|

Portfolio (non-banking) |

0.71% |

-0.28% |

-0.16% |

-0.31% |

-1.81% |

0.50% |

0.39% |

0.45% |

1.42% |

0.87% |

|

Banking group |

||||||||||

|

Komercijalna banka |

-0.62% |

-1.06% |

-0.21% |

-0.48% |

-1.22% |

1.26% |

1.18% |

1.39% |

2.10% |

0.98% |

|

Ohridska banka |

-0.39% |

-0.26% |

-0.13% |

-1.76% |

-1.89% |

-0.09% |

0.01% |

0.80% |

1.29% |

1.19% |

|

Stopanska – Bitola |

1.98% |

0.03% |

0.02% |

0.03% |

0.05% |

-2.78% |

-2.86% |

-2.94% |

-2.86% |

0.16% |

|

Stopanska – Skopje |

-0.37% |

0.47% |

-0.52% |

-0.32% |

-2.36% |

0.42% |

0.55% |

1.32% |

1.19% |

1.07% |

|

Tutunska banka |

1.93% |

-0.23% |

-0.03% |

0.26% |

0.18% |

1.31% |

1.94% |

2.64%* |

4.51%** |

3.24% |

|

TTK banka |

-0.37% |

-0.24% |

-0.12% |

-0.24% |

-0.37% |

-0.31% |

-0.21% |

-0.10% |

-0.21% |

-1.05% |

|

UNI banka |

-0.19% |

-0.13% |

-0.06% |

-0.13% |

1.93% |

1.69% |

4.77% |

1.29% |

1.24% |

1.19% |

|

Portfolio (banking) |

0.28% |

-0.20% |

-0.15% |

-0.38% |

-0.53% |

0.21% |

0.77% |

0.63% |

1.04% |

0.97% |

|

Portfolio (sample) |

0.49% |

-0.24% |

-0.16% |

-0.34% |

-1.17% |

0.36% |

0.58% |

0.54% |

1.23% |

0.92% |

Authors‘ calculation

Summarizing the results across the selected events, we argue that the domestic stock market was profoundly affected by the political uncertainty which emerged between the referendum and the vote for the initiation of constitutional changes. Once the uncertainty over the future political stance was resolved, the market settled down, disregarding the completion of the name issue process and possible long-term benefits of the EU/NATO accession. The previous was especially true for the banking sector. While the evidence shows strong support for the view that the market was mainly concerned with the resolution of domestic political uncertainty, we could not firmly reject the hypothesis that the market identified several prosperous firms in the case of the EU/NATO integration.

However, the market reaction was non-sectoral, which obscures the reason investors heavily invested in those companies. Speculatively, the role of political links in extracting the benefits of the EU/NATO accession creates an advantage for politically dependent firms making them an attractive investment opportunity. Significant evidence exists that political connections provide advantages and raise the value of politically connected firms (e. g., Faccio, 2006; Faccio et al., 2006; Wu et al., 2012; Cooper et al., 2010; Boubakri et al., 2012; Acemoglu et al., 2016). Acemoglu et al. (2016) found abnormal returns for firms related to the Treasury Secretary Geithner around his appointment to the position. While the politically connected firms are not observable in our case, we could infer their political connectedness by selecting a purely political and formal event and detecting abnormal returns around that event. On June 1, 2017, the new government officials’ squad was known to the public (Dimishkovski, 2017). We selected this event for several reasons: 1) the parliamentary elections took place in December 2016, and after the political tensions, the ruling coalition was known at least one month before the election of the new governmental officials; 2) there is no price sensitive information for any firm around the period May 25 – June 5, 2017;15 3) while certain officials were known to the public before the election, several business people negotiated to become part of the government until the official elections. If individual firms had political links to the selected candidates of the new government, then we would have observed higher than normal returns for those firms.

Table 6 shows the (cumulative) abnormal returns around the election of new government officials. The market positively valued five firms around this event (Makstil, Granit, Telekom, Stopanska banka – Bitola, and UNI banka). Two of them (Makstil and Granit) experienced positive and significant abnormal returns before the referendum (Table 3), suggesting that the benefits of the EU/NATO accession could be viewed through the ‘political lenses.’ However, this speculative reasoning should be understood with caution since there is a time gap between the two events (the election of the new government and the referendum), which is relevant due to the dynamics of political connections. In general, the evidence is strong that politics heavily influence the perspectives of Macedonian companies, and the market recognizes and positively values the firms’ political connections.

Table 6

The table presents the cumulative (daily) abnormal return (CAR) for the following event windows: [-2, 0], [-1, 0], [0, 0], [0, 1] and [0, 2], where t = 0 is the event day. CARs are calculated based on the historical mean model ARi,t = Ri,t – μi . There are three portfolios: 1) a sample portfolio consisting of 14 stocks, 2) a banking portfolio comprising 7 banks, and 3) a non-banking portfolio composed of 7 non-banks. The significance of the CAR is evaluated using the Kolari and Pynnonen (2011) non-parametric generalized rank test. ***, **, * denote 1%, 5% and 10% significance levels, respectively.

|

Firm |

June 1, 2017 |

||||

|

CAR[-2,0] |

CAR[-1,0] |

CAR[0,0] |

CAR[0,1] |

CAR[0,2] |

|

|

Non-Banking group |

|||||

|

Alkaloid |

0.68% |

1.27% |

0.81% |

0.04% |

0.68% |

|

Makstil |

10.68%** |

7.36%* |

4.16% |

10.15%** |

9.96%** |

|

Granit |

2.98% |

4.38% |

3.18% |

5.22%* |

2.84% |

|

Makpetrol |

1.22% |

-0.41% |

-0.20% |

-0.41% |

-0.61% |

|

OKTA |

1.26% |

-1.78% |

-0.50% |

-1.00% |

-1.50% |

|

Makedonija Turist |

1.57% |

-0.07% |

-0.03% |

1.85% |

-0.38% |

|

Telekom |

2.75% |

2.77%* |

2.79%** |

3.17%* |

3.14% |

|

Portfolio (non-banking) |

3.02%* |

1.93% |

1.46% |

2.72%** |

2.02% |

|

Banking group |

|||||

|

Komercijalna banka |

1.19% |

1.28% |

1.38% |

-0.19% |

-0.66% |

|

Ohridska banka |

2.65% |

1.92% |

2.25% |

1.92% |

-0.93% |

|

Stopanska – Bitola |

9.17%** |

9.29%*** |

9.41%*** |

8.95%*** |

8.83%** |

|

Stopanska – Skopje |

0.94% |

1.30% |

1.12% |

1.39% |

0.83% |

|

Tutunska banka |

-5.30%** |

-1.31% |

-0.20% |

-1.41% |

-0.61% |

|

TTK banka |

-0.40% |

-0.27% |

-0.13% |

-0.27% |

0.30% |

|

UNI banka |

13.44%*** |

5.83% |

3.02% |

2.62% |

2.29% |

|

Portfolio (banking) |

3.10%** |

2.58%** |

2.41%*** |

1.86% |

1.44% |

|

Portfolio (sample) |

3.06%** |

2.25%** |

1.93%*** |

2.29%** |

1.73% |

Authors‘ calculations

Conclusion

The resolution of the name issue opened the pathway for North Macedonia to proceed with the accession processes towards the EU and NATO. We analyzed the impact of the resolution process on the domestic stock market. While the Prespa agreement was a significant step forward for North Macedonia, we found weak evidence that investors value the EU/NATO perspectives and invest in prosperous companies in case of future integration. Instead, the market was sensitive to the political uncertainty surrounding the referendum’s low turnout outcome. Once the uncertainty was resolved, the market systematically recovered and experienced positive price changes across almost all firms in the sample. The market sensitivity to political events implies a significant political connectedness of Macedonian firms. While such connectedness carries various benefits, it limits the planning horizon of the firms up to the next elections.

This study is relevant for policymakers and researchers. Firstly, the market sensitivity to political events suggests that political instability deters investors and hampers stock market development in the emerging economies. Frequent political elections significantly disrupt stock market prices reflecting the damaged value of listed firms. The policymakers should nurture healthy political climate mitigating the negative impact on firms’ values. Secondly, the firms’ political connectedness augments stock prices sensitivity to political events. The study provides weak evidence of political connectedness by reflecting on one event. Researchers may be concerned with the role of political connections during elections. Developing a measure of political connectedness should overcome data constraints and stimulate additional research in this area. Finally, the preceding analysis focuses on North Macedonia and on one event (name issue), however, its results may apply to many other countries and to many similar events. Future research may consider examining the stock market movements across many election cycles in a much broader region. Additionally, the event study methods rely on the assumption of efficient markets. Milos et al. (2020) showed that several CEE stock markets are not efficient by leveraging the Multifractal Detrended Fluctuation Analysis (MF-DFA). The examination of efficiency of Western Balkan markets using similar methodology would justify the suitability of event study methods in investigating questions on these markets.

References

Acemoglu, D., Johnson, S., Kermani, A., Kwak, J., & Mitton, T. (2016). The value ofconnections in turbulent times: Evidence from the United States. Journal ofFinancial Economics, 121(2), 368–391. https://doi.org/10.1016/j.jfineco.2015.10.001

Boubakri, N., Guedhami, O., Mishra, D., & Saffar, W. (2012). Political connections and the cost of equity capital. Journal of Corporate Finance, 18(3), 541–559.

Brown, S. J., & Warner, J. B. (1985). Using daily stock returns: The case of event studies. Journal of Financial Economics, 14(1), 3–31. https://doi.org/10.1016/0304-405X(85)90042-X

Burdekin, R. C. K., Hughson, E., & Gu, J. (2018). A first look at Brexit and global equity markets. Applied Economics Letters, 25(2), 136–140. https://doi.org/10.1080/13504851.2017.1302057

Cooper, M. J., Gulen, H., & Ovtchinnikov, A. V. (2010). Corporate Political Contributions and Stock Returns. The Journal of Finance, 65(2), 687–724. https://doi.org/10.1111/j.1540-6261.2009.01548.x

Davies, R. B., & Studnicka, Z. (2018). The heterogeneous impact of Brexit: Early indications from the FTSE. European Economic Review, 110, 1–17. https://doi.org/10.1016/j.euroecorev.2018.08.003

Deutsche Welle. (2018, June 13). Macedonian President Ivanov says he won‘t sign ‘disastrous’ name deal with Greece. Deutsche Welle. https://www.dw.com/en/macedonian-president-ivanov-says-he-wont-sign-disastrous-name-deal-with-greece/a-44212040

Dimishkovski, A. (2017, June 1). Macedonia Has New Government, but Rocky Road Ahead. The New York Times. https://www.nytimes.com/2017/06/01/world/europe/macedonia-zoran-zaev-election.html

Dvorak, T., & Podpiera, R. (2006). European Union enlargement and equity markets in accession countries. Emerging Markets Review, 7(2), 129–146.

Dyckman, T., Philbrick, D., & Stephan, J. (1984). A Comparison of Event Study Methodologies Using Daily Stock Returns: A Simulation Approach. Journal of Accounting Research, 22, 1–30. JSTOR. https://doi.org/10.2307/2490855

European Western Balkans. (2018, August 8). Pre-Referendum Poll: Majority of Macedonia‘s citizens for the agreement. European Western Balkans. https://europeanwesternbalkans.com/2018/08/08/pre-referendum-poll-majority-macedonias-citizens-agreement/

Faccio, M. (2006). Politically Connected Firms. American Economic Review, 96(1), 369–386. https://doi.org/10.1257/000282806776157704

Faccio, M., Masulis, R. W., & McConnell, J. J. (2006). Political Connections and Corporate Bailouts. The Journal of Finance, 61(6), 2597–2635. https://doi.org/10.1111/j.1540-6261.2006.01000.x

Fisman, R. (2001). Estimating the Value of Political Connections. American Economic Review, 91(4), 1095–1102. https://doi.org/10.1257/aer.91.4.1095

He, Y., Lin, H., Wu, C., & Dufrene, U. B. (2009). The 2000 presidential election and the information cost of sensitive versus non-sensitive S&P 500 stocks. Journal of Financial Markets, 12(1), 54–86. https://doi.org/10.1016/j.finmar.2008.04.004

Kathimerini. (2018, June 12). ‘We have a deal,’ Greek PM says over FYROM name row. Kathimerini. https://www.ekathimerini.com/229552/article/ekathimerini/news/we-have-a-deal-greek-pm-says-over-fyrom-name-row

Kirby, P. (2019, January 25). How they solved a 27-year name row. BBC News. https://www.bbc.com/news/world-europe-46971182

Kolari, J. W., & Pynnonen, S. (2011). Non-parametric rank tests for event studies. Journal of Empirical Finance, 18(5), 953–971. https://doi.org/10.1016/j.jempfin.2011.08.003

Li, J., & Born, J. A. (2006). Presidential Election Uncertainty and Common Stock Returns in the United States. Journal of Financial Research, 29(4), 609–622. https://doi.org/10.1111/j.1475-6803.2006.00197.x

Lobão, J., & Santos, S. (2019). Stock market reaction to brexit announcements: Evidence from a natural experiment. Global Economy Journal, 19(03), 1950018. https://doi.org/10.1142/S2194565919500180

Mattozzi, A. (2008). Can we insure against political uncertainty? Evidence from the US stock market. Public Choice, 137(1), 43–55. https://doi.org/10.1007/s11127-008-9311-0

Meta. (2018, September 30). Mickoski: The referendum was unsuccessful, the people said “No” to the Agreement with Greece. Meta. https://meta.mk/en/mickoski-the-referendum-was-unsuccessful-the-people-said-no-to-the-agreement-with-greece/

Meta. (2019, January 25). Greek Parliament ratifies Prespa Agreement. Meta. https://meta.mk/en/greek-parliament-ratifies-prespa-agreement/

Michalopoulos, S. (2019, January 16). Tsipras goes against all in Greek Parliament on North Macedonia name deal. Www.Euractiv.Com. https://www.euractiv.com/section/enlargement/news/tsipras-goes-against-all-in-greek-parliament-on-north-macedonia-name-deal/

Miloş, L. R., Haţiegan, C., Miloş, M. C., Barna, F. M., Boțoc, C. (2020). Multifractal Detrended Fluctuation Analysis (MF-DFA) of Stock Market Indexes. Empirical Evidence from Seven Central and Eastern European Markets. Sustainability, 12(2), 535. https://doi.org/10.3390/su12020535

Nippani, S., & Medlin, W. B. (2002). The 2000 Presidential Election and the stock market. Journal of Economics and Finance, 26(2), 162–169. https://doi.org/10.1007/BF02755983

Pacicco, F., Vena, L., & Venegoni, A. (2018). Event study estimations using Stata: The estudy command. Stata Journal, 18(2), 461–476.

Pantzalis, C., Stangeland, D. A., & Turtle, H. J. (2000). Political elections and the resolution of uncertainty: The international evidence. Journal of Banking & Finance, 24(10), 1575–1604. https://doi.org/10.1016/S0378-4266(99)00093-X

Ramiah, V., Pham, H. N. A., & Moosa, I. (2017). The sectoral effects of Brexit on the British economy: Early evidence from the reaction of the stock market. Applied Economics, 49(26), 2508–2514. https://doi.org/10.1080/00036846.2016.1240352

Reuters. (2019, January 11). Macedonia parliament agrees to change country’s name. Reuters. https://www.reuters.com/article/us-macedonia-name-parliament-idUSKCN1P5238

Santa‐Clara, P., & Valkanov, R. (2003). The Presidential Puzzle: Political Cycles and the Stock Market. The Journal of Finance, 58(5), 1841–1872. https://doi.org/10.1111/1540-6261.00590

Singleton, J. C., & Wingender, J. (1986). Skewness Persistence in Common Stock Returns. The Journal of Financial and Quantitative Analysis, 21(3), 335-341. https://doi.org/10.2307/2331046

Schiereck, D., Kiesel, F., & Kolaric, S. (2016). Brexit: (Not) another Lehman moment for banks? Finance Research Letters, 19, 291–297. https://doi.org/10.1016/j.frl.2016.09.003

Szczerbiak, A., & Taggart, P. (2004). The Politics of European Referendum Outcomes and Turnout: Two Models. West European Politics, 27(4), 557–583. https://doi.org/10.1080/0140238042000249920

Tielmann, A., & Schiereck, D. (2017). Arising borders and the value of logistic companies: Evidence from the Brexit referendum in Great Britain. Finance Research Letters, 20, 22–28. https://doi.org/10.1016/j.frl.2016.08.006

Wu, W., Wu, C., & Rui, O. M. (2012). Ownership and the Value of Political Connections: Evidence from China. European Financial Management, 18(4), 695–729. https://doi.org/10.1111/j.1468-036X.2010.00547.x

Appendix

Figure 1: MBI10 (daily) stock returns around the key events

Figure 2. Daily stock returns of each firm and MBI10 for the period of analysis

1 The MBI10 contains the ordinary shares of the 10 most frequently traded companies on the Macedonian Stock Exchange. In Appendix (Figure 1), we show the movements of MBI10 stock returns around the key events of the name change process.

2 According to the poll, 41.5% would vote ‘YES’, while 35.1% ‘NO’ (European Western Balkans, 2018).

3 The Greek Prime Minister called for a vote of confidence after the Minister of Defence resigned due to his stance against Prespa Agreement (Michalopoulos, 2019).

4 Ramiah et al. (2017) list the possible consequences of Brexit on British economy.

5 Stock markets significantly react around earnings announcements or recapitalization announcements (Mackinley, 1997). The first type of announcements gives information about companies’ future earnings, while the second type reveals companies’ riskiness.

6 The market capitalization of the selected 14 firms constitutes 74% of the total market capitalization on the Macedonian Stock Exchange in 2019 (Source: Macedonian Stock Exchange).

7 The persistence of positive skewness in stock returns is common (e.g., Singleton & Wingender, 1986), while the high kurtosis arises among stocks with infrequent trading. In Appendix (Figure 2), we graph the raw stock returns of each firm within the period of analysis.

8 Mackinley (1997) provides review of event study methods including constant mean return method, market model, market-adjusted return model and alternative economic models such as Capital Assets Pricing Model (CAPM) and Arbitrage Pricing Theory (APT). The use of more complex models depends on data availability.

9 We estimated a single factor market model using MBI10 as a factor. The model produced (significant) abnormal returns for some firms when daily trading was absent.

10 When stock returns are not normally distributed, nonparametric tests have greater power compared to the power of parametric tests in event study analyses of abnormal returns. Kolari and Pynnonen (2011) introduced a rank test for testing multi-day event abnormal returns. They standardized the cumulative abnormal return (CAR) as a one time point and test ranked (estimation and event) abnormal returns. The intuition is that the standardized CAR behaves like any standardized return except if event-induced effects arise.

11 The Estudy Command in STATA developed by Pacicco et al. (2018) was utilized to calculate the abnormal and cumulative abnormal returns.

12 The limited sample does not allow us to create sectoral portfolios large enough to result in diversified portfolios. The largest sector in terms of number of entities in the sample is the banking sector. We decided to build a separate portfolio for the banking sector and an alternative portfolio composed of non-financial entities.

13 Generally, the trading year on the MSE consists of 245 trading days. If the event falls on Sunday, then the event window [0,0] has no results, and the event day is considered [0,1].

14 Makstil had positive abnormal returns before the referendum and around the constitutional changes vote.

15 We searched for price sensitive or any relevant news for the firms in the sample by checking the System for Electronic Information (seinet.com.mk) from listed companies and the integrated news platform for North Macedonia (time.mk).