Organizations and Markets in Emerging Economies ISSN 2029-4581 eISSN 2345-0037

2021, vol. 12, no. 1(23), pp. 27–50 DOI: https://doi.org/10.15388/omee.2021.12.46

Individual Investments Biased by the Size of a Foreign Investor: An Experimental Study

Hamza Umer (corresponding author)

JSPS International Research Fellow (Institute of Economic Research, Hitotsubashi University), Japan

hamzaumer@akane.waseda.jp

Kashif Ahmed

Kobe university, Japan

kashif.ahmed@stu.kobe-u.ac.jp

https://orcid.org/0000-0003-1002-2898

Muhammad Naumair Jadoon

Institute of Business Administration (IBA), Karachi, Pakistan

muhammadnaumairjadoon@gmail.com

https://orcid.org/0000-0002-6042-6666

Abstract. The field of behavioral finance has actively researched behavioral elements influencing the choices of individual investors. This study also contributes to the behavioral finance and examines the effect of an increase in a foreign firm’s partial ownership in a domestic firm on the local individual investments in that domestic firm. Specifically, using a controlled lab experiment the study examines the investments of Pakistani individual investors between a purely Pakistani firm and a Pakistani firm with three different levels of Chinese ownership (portfolio, minority, majority). The experimental results show that with reference to Chinese minority ownership in a Pakistani firm, the potential investors are 47% (61%) less likely to invest in a Pakistani firm with Chinese portfolio (majority) ownership than in a purely Pakistani firm. The study uncovers an important non-monetary factor in the form of a foreign firm’s partial ownership that can significantly influence the choices of individual investors. It also makes an important contribution to the growing literature on the Chinese foreign investments specifically in Pakistan by exploring how potential individual Pakistani investors are likely to react to an increase in Chinese investments in Pakistani firms.

Keywords: behavioral finance; partial ownership; individual investments; lab experiment; China; Pakistan

Received: 16/12/2020. Accepted: 22/4/2021

Copyright © 2021 Hamza Umer, Kashif Ahmed, Muhammad Naumair Jadoon. Published by Vilnius University Press. This is an Open Access article distributed under the terms of the Creative Commons Attribution Licence, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

1. Introduction

With a rapid development in the financial markets across the world, the potential role of individual investors has increased manifold. The traditional utility maximization models assume that individual investors make rational and wealth maximizing investments, however, they do not explain the process of those investment decisions. On the other hand, behavioral finance relaxes some of the assumptions made in the traditional utility theories, tries to understand the decision process and examines the effect of non-monetary factors on the investment decisions (Nagy & Obenberger, 1994). The field of behavioural finance has made significant strides in the last two decades and enhanced our understanding of the behavioural and psychological aspects of decisions made by the individual investors. However, to the best of our knowledge, studies that examine the effect of foreign partial ownership in a domestic firm on the local individual investments in such a domestic firm are almost non-existent. In the non-behavioral finance literature, limited studies that examined the influence of partial foreign acquisitions on the behavior of domestic investors (e.g., Huang & Shiu, 2009) relied on the natural data. Unfortunately, in the natural data, confounding effects of several factors that can simultaneously influence the decisions of individual investors make it difficult to isolate the exclusive effects of foreign ownership on the investment decisions. With rapid development and growth of financial markets specifically in the emerging economies and reduced barriers to cross country business investments accompanied by market liberalization, the potential role of individual investors has increased manifold and demands an enhanced understanding of how partial acquisitions influence the behavior of individual investors. In the absence of such an understanding, foreign firms undertaking partial acquisitions with the aim of maintaining certain ratio of domestic investors might not achieve their objectives efficiently. Keeping in view enhanced cross-border investments and a limited understanding about how these investments influence the decisions of individual investors, this paper examines the influence of partial ownership on the domestic individual investments in the target domestic firm. Specifically, the paper makes the following novel contributions to the behavioral finance literature. 1) It proposes a behavioral model to understand how individual investors choose between a purely domestic firm and a domestic firm that has partial ownership of a foreign firm. The behavioral model predicts that individual investors choose a foreign-owned domestic firm over a purely domestic firm until a certain ratio of the presence of a foreign firm beyond which individual investors prefer to invest in the purely domestic firm. The proposed behavioral model is among the first ones to offer a useful theoretical background to systematically understand the decision process of individual investors dependent on the ratio of a foreign firm. Also, the proposed model offers a relatively new avenue of application of utility functions based on non-monetary parameters to study international business from a behavioral perspective. 2) The behavioral model is tested with the help of a controlled lab experiment performed in the context of Pakistan (developing economy) and China (a relatively developed economy). The use of a lab experiment enables us to control for exogenous variables that can influence investors in real life and therefore offers a controlled environment to test the behavioral model. The experimental results support the predictions of the proposed investor model; Pakistani investors are more likely to invest in the Chinese-owned Pakistani firms than purely Pakistani firms when the Chinese entity is a minority investor (22% share) as compared to the scenario in which the Chinese entity is a portfolio (9% share) or a majority investor (60% share). 3) To the best of our knowledge, this is the first study to use experimental methodology for analyzing the influence of partial acquisitions on the individual investments, and hence informs our understanding about the applicability of the experimental tools for the international business research. Specifically, as ratio of partial acquisition normally does not change in a short duration in real life, analysis of changes in partial acquisition of investment decisions would require time series data that do not perfectly control changes in numerous exogenous factors in the international market. On the other hand, by using lab experiments this can be achieved in a precise manner in a short duration with limited resources. Also, in cases where no previous natural data exist, instead of making a relatively uninformed decision, potential firms planning to undertake partial acquisitions can use experiments to measure investor behavior in the target country. 4) The study adds relatively new findings to the growing literature on the investment biases by reporting individual investment decisions biased by the foreign firm’s presence in the domestic firm. These findings can be very useful for firms planning foreign investments in a manner that does not significantly alter individual domestic investments in the target firm. 5) Lastly, the study further extends the growing literature on the Chinese foreign investments specifically in Pakistan by exploring the research question in the China – Pakistan context. As the study examines home bias from a new angle, the results offer useful behavioral insights of potential Pakistani investors to the Chinese firms planning to partially acquire Pakistani firms.

The rest of the paper is organized as follows. Section 2 offers a brief literature review. Section 3 presents the behavioral investor model and hypotheses. Section 4 reports the experimental design, while Section 5 reports result and robustness checks. The last section concludes the paper.

2. Literature Review

There are numerous studies in the existing literature that have examined different biases influencing the decisions of individual investors. A review of relatively recent studies reveals that decisions of individual investors are influenced by behavioral factors such as extraversion and neuroticism (Oehler, Wendt, Wedlich & Horn, 2018; Zhang, Xian & Fang, 2019), overconfidence (Meier, 2018), days of the week (Richards & Willows, 2019), framing of portfolios (Steul, 2006), disposition effect1 (Fogel & Berry, 2006), home bias2 (Kilka & Weber, 2000; Huberman, 2001; for a literature review of home bias please see Lewis, 1999), representativeness bias3 (Chen, Kim, Nofsinger & Rui, 2007) and cultural values (Ji, Zhang & Guo, 2008). In addition, perceptions about firms developed through channels of awareness and brand quality (Frieder & Subrahmanyam, 2005), personal experience (Schoenbachler, Gordon & Aurand, 2004; Nicolosi, Peng, & Zhu, 2009), type and structure of governance of firms (Aspara & Tikkanen, 2010; Duncan & Hasso, 2018), gender (Charness & Gneezy, 2012), risk preferences (Sokolowska & Makowiec, 2017) and other similar factors also influence the investment decisions. Along with behavioral finance literature, empirical studies have also examined various factors that affect the investor decisions. For example, Tesar and Werner (1995) examined investments in securities, corporate and government bonds based on data from Canada, Germany, Japan, the UK and the USA and found stronger preferences for the domestic firms over foreign firms even for riskless investments in bonds. Similarly, Huang and Shiu (2009) examined the relation of foreign partial ownership to the ratio of stocks held by insiders (officers and members of the board of directors) in the Taiwanese market and found that the proportion of stocks held by insiders is maximum when foreign ownership is minimum. On the other hand, there are studies such as Coval and Moskowitz (1999) that examined the effects of geographical proximity of the domestic firms on investments of money managers in the US and reported that money managers are more likely to invest in firms in their geographical proximity compared to the distantly located firms. Similarly, Massa and Simonov (2006) also report that investors prefer stocks of companies in proximity. In summary, both behavioral and non-behavioral factors can influence the individual investment decisions.

As the current study examines the effect of different ratios of a foreign acquirer, it is also relevant to discuss here different shareholder structures that are often observed in the cross-border investments. In the international business literature, if a foreign firm acquires less than 10% shares of a local firm, it is termed as ‘foreign portfolio investment’ (FPI). FPI does not offer any opportunity to the foreign investor to influence the managerial decisions of the local firms (Demirbag, Glaister & Tatoglu, 2007; Wu, Li & Selover, 2012). On the other hand, foreign investments that occupy at least 10% shares of the local firm are categorized as foreign direct investment (FDI). Foreign investors undertaking FDI can partially or completely influence the managerial decisions of the local firms (Ahmed & Bebenroth, 2019). The international business literature further classifies FDI into investments with minority control (10%-50% ownership) and majority control (more than 50% ownership) (Demirbag et al., 2007; Ouimet, 2013; Gan & Qiu, 2019; Waqar, 2020).

Numerous factors can influence a foreign investor’s ownership level in a local firm (for review please see Chhabra et al., 2021). This decision is often affected by the cultural differences that exist in the countries of foreign and local firms (Malhotra, 2012). Regulatory authorities in the target country often discourage foreign investors from having a majority stake (Cui & Jiang, 2012). From a foreign firm’s perspective, the decision is quite often driven by the foreign investor’s intention to take an active or a passive role in the managerial decisions. In the case of FPI, foreign investors are unable to influence the managerial decision of local firms (Wang & Li, 2018). In contrast, the minority control investments allow foreign investors to take a more active role in managing the local firms. At the same time, the extent of influence that foreign firms exert on the managerial decisions of their local firms is dependent on other shareholders and, more importantly, on whether other shareholders are willing to collude to resist the decisions of the foreign investors (Chang, 2004). When other shareholders are large in number and unwilling to collude, even a minority control investment gives a lot of power to the foreign investors. In contrast, foreign investors with minority control can have limited authority when other shareholders include seasoned institutional investors of the host country (Goldstein & Razin, 2006). Also, foreign investors have limited power when regulatory bodies in the host country are keen on protecting the disaggregated shareholders (La Porta et al., 2000). This brings us to the unique benefits that a majority control provides to the foreign investors. By acquiring more than 50% of local firms’ shares, the foreign investors with majority control face minimal to no resistance when taking any major or minor decisions related to their target local firm (Dang et al., 2018).

3. A Behavioral Model of an Individual Investor

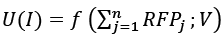

Here we propose a model to examine local investors’ choice of a purely domestic firm versus a foreign-owned domestic firm considering varying levels of the presence of a foreign firm. For a representative investor, this single period investment decision I can be represented by the following utility function:

(1)

(1)

where  = Sum of ownership ratio of j foreign investors in the target domestic firm. Foreign investments can be divided into foreign portfolio investment (FPI) and foreign direct investment (FPI). In the former, foreign investors have no role in the managerial decisions, while in the latter case, foreign investors play an active role in the managerial decisions. The current model considers both FPI and FDI as foreign investments, and no further distinction is made in this regard.

= Sum of ownership ratio of j foreign investors in the target domestic firm. Foreign investments can be divided into foreign portfolio investment (FPI) and foreign direct investment (FPI). In the former, foreign investors have no role in the managerial decisions, while in the latter case, foreign investors play an active role in the managerial decisions. The current model considers both FPI and FDI as foreign investments, and no further distinction is made in this regard.

Vector V is composed of the following variables:

M = Money for investment

R = Risk associated to the investment

r = Expected return from the investment

FB = Target firm’s business

P = Perceptions about the foreign firm. These perceptions generally depend on the past and current performance of the firm, its core business, acceptance and performance of its products, current management, expected future performance and other such variables (Nagy & Obenberger, 1994).

In the natural data on individual investments, multiple elements of the investment function specified by Equation (1) simultaneously effect the investment decision and therefore make it difficult to isolate the exclusive influence of ownership ratio of a foreign firm on the behavior of domestic investors. To control for it, we use lab experiments as they offer a controlled environment to isolate the effects of treatment variable on the behavior. In our experimental setting, we treat money for investment (M), risk (R), returns (r), and type of business of the target firm (FB) as constants. We also use a hypothetical foreign investor firm and a hypothetical domestic target firm in the experiment and hence control firm specific perceptions. As a result, the only variable that changes in the decision process is the ownership ratio of the foreign investor and subsequently, the utility function in Equation (1) with riskless investments can be modified to:

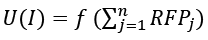

(2)

(2)

As per above equation, the investment decision depends on the ownership ratio of the foreign investors. In the current paper, the analysis is limited to only one foreign investor, however Equation (2) allows for multiple firms. For one foreign investor Equation (2) is reduced to:

In the context of this study, i.e. for a target firm of a developing economy (Pakistan) and investor from a relatively developed economy (China), we assume:

A

A

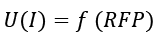

Condition A indicates that individual investor’s preference for a foreign-owned domestic firm over a purely domestic firm increases with an increase in a foreign investor’s ownership ratio. This condition is hypothesized based on the observation that most firms (specifically from the developed world) undertaking FDI have generally performed well in the past, financially are more stable and possess a relatively robust business model compared to most purely domestic firms in the developing economies (Geleilate, Magnusson, Parente & Alvarado-Vargas, 2016). Moreover, firms from the developed economies undertaking FDI often possess superior technology and better managerial skills that can be a source of competitive advantage even for the target firms (Isobe, Makino & Montgomery, 2000). All these attributes of the foreign firms undertaking FDI send positive signals to the local investors in the target country. As a result, the local investors are likely to prefer foreign-owned domestic firms over purely domestic firms as the ownership ratio of foreign investors increases in the target firm. This assumption is relevant specifically in the current paper that is set up in the context of Chinese investments in Pakistani firms because China is a comparatively developed country with a strong economic base and expanding foreign direct investments, while Pakistan is a developing economy. Apart from the China – Pakistan context, Condition A is generally applicable to investments from the developed to the developing countries.

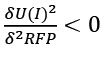

While the presence of a foreign firm can be perceived as positive, beyond a certain point, the local investors can take it negatively as well because the acquirer gains significant control in the target firm. This increasing control by a foreign entity can be perceived as invasive, opportunistic, or unfair by the nationals of the target country, and in such a scenario, target country’s individual investors can decrease their investments in the foreign-owned domestic firms (Coleman, 1993; Kostova & Zaheer, 1999). Also, as the foreign acquirer gains more than 50% stake in the target domestic firm, the domestic investors can perceive the target firm close to a foreign entity rather than a domestic one. In the aforementioned case, home bias (preference for domestic firms) can trigger investors to prefer a purely domestic firm over a domestic firm significantly owned by the foreign entity. Moreover, to some extent the notion of ‘psychological ownership’ that represents a sense of possession associated to the domestic firm can also trigger investors to prefer a purely domestic firm over an impure domestic firm and hence influence their investment decisions (Pierce, Kostova & Dirks, 2001; Kirk, McSherry & Swain, 2015, p. 187). Based on these reasons, Condition B is specified.

B

B

Even though behavioral model specifies certain outcomes related to the domestic investor’s behavior based on the ownership of foreign firms, these outcomes also indirectly reflect the extent of control exercised by the foreign acquirer. Although we do not explicitly incorporate the extent of control exercised by the foreign acquirer, it is natural to imagine a positive correlation between the extent of ownership of a foreign firm and its control in the target firm. Therefore, the investment decision is dependent on the dual nature of investment ratio that reflects the ownership as well as control exercised by the foreign acquirer.

Based on conditions A and B, a unique ownership share of foreign acquirer (RFP*) maximizes domestic individual investments (I*) in the foreign-owned domestic firm. Any share of the foreign firm less or more than this unique ownership share reduces individual investments in the foreign-owned domestic firm. RFP* that maximizes I* depends on the domestic target firm and foreign investor. It is important to discuss here a possible situation in which Condition B ( ) of the investor model cannot be traced. If RFP RFP*, Condition B cannot be identified. Only when RFP > RFP*, Condition B of the model is traceable. To maximize the possibility of observing Condition B, the experiment employed a relatively high ratio (60%) of the Chinese foreign investment in a Pakistani firm.

) of the investor model cannot be traced. If RFP RFP*, Condition B cannot be identified. Only when RFP > RFP*, Condition B of the model is traceable. To maximize the possibility of observing Condition B, the experiment employed a relatively high ratio (60%) of the Chinese foreign investment in a Pakistani firm.

Based on the investor model the hypotheses to be tested are:

Hypothesis 1: There exists a share of a foreign acquirer (RFP*) in the ownership structure of the target firm that attracts maximum domestic individual investments (I*) in bonds of the target domestic firm.

Hypotheses 2: Any share of a foreign acquirer (RFP) less than RFP* will attract individual investment I less than I*.

Hypothesis 3: Any share of a foreign acquirer (RFP) more than RFP* will attract individual investment I less than I*.

4. Experimental Methodology

Lab experiments are used for this study because they provide a controlled environment for studying the sole impacts of a variable under consideration, offer a suitable setting for finding causal relations, are relatively easier to replicate and involve decision-making with real money. Moreover, many of the key variables associated to the real investment choices (such as perceptions about the country of origin of a foreign acquirer) unobservable in the natural data can be directly observed and precisely measured in the lab experiments (Baltussen & Post, 2011; Brandts & Charness, 2011; Duxbury, 2015). However, as lab experiments are generally performed with students who might not have significant investment experience, their external validity is often questioned by the practitioners. Despite limited external validity, lab experiments with student subjects are extensively used in the existing behavioral finance and economics literature to achieve an enhanced understanding of the decision process of individual investors under various scenarios (for details please see the survey papers of Duxbury, 1995, 2015; Noussair & Tucker, 2013 that summarize numerous experiments on the individual investment decisions and asset markets using student subjects). Due to the aforementioned advantages of the lab experiments and their extensive usage in the existing literature, this study also relies on the experimental methodology.

4.1 China – Pakistan Context

The experiment in this study is set up in the China – Pakistan context. With a population of 212 million and GDP of 312.57 billion USD, Pakistan can be categorized as a developing economy4. Pakistan also exhibits traits of a developing financial market; it has comparatively fragile corporate governance, weak regulatory environment and a relatively weak rule of law as well5 (Ahmed & Hla, 2019). Despite the aforementioned organizational challenges, Pakistan’s stock market has shown exceptional performance even during the Covid-19 pandemic and has recently emerged as the best performing stock market in Asia6. As a result of this exceptional performance, Pakistan’s stock market has attracted both local and foreign investors. China, on the other hand, is a relatively developed economy and well known for its rapidly expanding foreign direct investments especially in the developing economies. The selection of the China-Pakistan context is important and interesting to explore because: 1) Pakistan and China have geographical proximity, and both countries share land border. 2) Both countries have maintained historic economic and political ties and both occupy an important position in the Asian region. 3) The investment decision in the experiment is a binary variable (a choice between a purely domestic firm and a foreign-owned domestic firm) and does not consider heterogeneity (in terms of nationality) in the foreign firms. For the aforementioned decision setting, it is appropriate to choose a host country where FDI from a single foreign country dominates other foreign countries. Pakistan fulfills this requirement as 89% of its FDI inflows come from China7 and subsequently Chinese firms are major foreign investors in the Pakistani market. 4) Chinese foreign investments specifically under the ‘One Belt & One Road’ initiative hold special economic importance to both China and Pakistan. These investments have boosted jobs, helped in poverty alleviation, sprung up infrastructure (especially road and rail networks and seaport developments), opened new avenues of trade and helped Pakistan in overcoming power shortages8. 5) Apart from foreign direct investments, Chinese investors have also been actively conducting foreign portfolio investments in Pakistan. In a recent study, Liaqat et al. (2020) find that due to increasing Chinese portfolio investments in Pakistan, the stock market performance in both countries has shown high correlation suggesting that strategic interests of both countries are aligned. 6) The public sentiment towards massive Chinese investments under the ‘One Belt & One Road’ initiative has been a mixed one: some support while others oppose them (Kanwal, Chong & Pitafi, 2019; Mahmood, Sabir & Ali, 2020). This mixed public reaction itself demands an enhanced understanding about the exclusive effects of Chinese partial ownership in the Pakistani firms on the behavior of local investors towards those Pakistani firms. For all these reasons the China – Pakistan context is selected to explore the research questions.

4.2 Experimental Design

In a lab, the investment behavior can be observed by creating either an artificial stock or a bond market. In the classical finance literature, shares are treated as equity financing, while bonds are referred to as debt financing. As returns from stocks are variable, we use a hypothetical bond market because it offers fixed returns (riskless investment) and subsequently renders the investor’s decision uninfluenced by their risk preferences. Also, in the case of stocks, the ownership of individual investors in comparison to a foreign firm’s ownership would change depending on the varying ownership ratio of the foreign firm. Therefore, apart from foreign firm’s ownership, the varying relative ownership of individual investors can play a significant role when deciding whether to invest in a purely local or an impure local firm. In order to avoid this confounding effect, we relied on the bond market. Subjects taking the role of investors in the experiment are paid on spot according to their decisions to minimize the influence of discounting and time preferences (Tanaka, Camerer & Nguyen, 2010; Castillo, Ferraro, Jordan & Petrie, 2011; Cohen, Ericson, Laibson & White, 2020). Subjects participating in the experiment are presented with a decision problem that allows them to invest money in a purely Pakistani firm or a Pakistani firm having partial Chinese ownership in it. Ackert, Church, Tompkins and Zhang (2005) provide experimental evidence that disclosing the name of the foreign firm influences portfolio of choices; in order to avoid this confounding effect, the current experiment uses hypothetical names for both Pakistani and Chinese firms. Moreover, the use of hypothetical names minimizes the possible influence of firm specific positive or negative perceptions9 and the effect of preferences for products produced by a firm on the investment decisions in that firm. It is often argued that hypothetical decisions in lab experiments cannot be treated as actual investment decisions. While this caveat of lab experiments holds significance, it is important to highlight here that even the process of real decision making is essentially hypothetical at its core. Kühberger, Schulte-Mecklenbeck and Perner (2002) argue that “the core process of real decision making consists of imagining and evaluating hypothetical options, and that this core process is the same for hypothetical decisions” (Kühberger et al., 2002, p. 1163). Hence even the hypothetical decisions made in a lab experiment can advance our understanding about the underlying process of making real investment decisions.

As already discussed in the literature review section, in the international business literature, a firm with less than 10% share in the target firm is usually categorized as ‘foreign portfolio investment’ (FPI) and cannot influence managerial decisions of the target firm (Demirbag, Glaister & Tatoglu, 2007; Wu, Li & Selover, 2012). On the other hand, firms with at least 10% shares of the target firm are categorized as foreign direct investment (FDI) and can partially or completely influence the managerial decisions of the target firm (Ahmed & Bebenroth, 2019). The international business literature further divides FDI into investments with minority control (10%-50% ownership) and majority control (more than 50% ownership) (Demirbag et al., 2007; Ouimet, 2013; Gan & Qiu, 2019; Waqar, 2020). Based on the aforementioned information, foreign firms can have three different ownership positions: portfolio investment, minority investment and majority investment10. Following the existing international business literature, we use a similar classification in the experiment, and the Chinese firm takes three investment positions: portfolio (9%); minority (22%); majority (60%). The amount of investment is 100,000 experimental units (50 Pakistani rupees)11 for all three cases while the guaranteed return offered by both types of firms (pure Pakistani versus Pakistani firm with Chinese presence) is also 100,000 experimental units. In total, subjects can earn 200,000 experimental units (100 rupees) from their investments. The decision problem presented to the subjects is reported in Table 1.

Table 1 Investment Decision Problem

|

Cases |

Ownership details of Company A |

Ownership details of Company B |

|

Case 1 |

100% ownership with Pakistani |

91% owned by Pakistani and 9% by Chinese. The decision power is fully exercised by Pakistani owners. Chinese investors do not have any decision powers. |

|

Case 2 |

100% ownership with Pakistani |

78% owned by Pakistani and 22% owned by Chinese. The decision power mainly rests with Pakistani owners, but Chinese investors can influence the management decisions. |

|

Case 3 |

100% ownership with Pakistani |

40% owned by Pakistani and 60% owned by Chinese. The decision power is fully exercised by the Chinese investors*. |

* This study classifies all companies with Chinese ownership greater than 50% (even the ones with 100% ownership) as majority investment mode. In accordance with the corporate control literature, we mention it explicitly that the decision power is fully exercised by the Chinese investors.

Subjects pick either Company A or Company B for three decision scenarios. In all three cases, Company A represents a firm with 100% Pakistani ownership, while Company B represents a Pakistani firm with increasing Chinese ownership as we move from Case 1 to Case 3. The three different ownership cases (9%; 22%; 60%) represent a case of portfolio investment (9%), minority investment (22%) and majority investment (60%), and these cutoffs are motivated by similar acquisition cutoffs used in the mergers and acquisitions literature (Demirbag et al., 2007). The selection of a relatively high cutoff for majority investment (i.e. 60%) is also driven by the motive of tracing Condition B ( ) specified in the behavioral model.

) specified in the behavioral model.

Subjects were instructed that randomly one of their three decisions would be selected for payment purposes. This random payment mechanism (also termed as Random Problem Selection Procedure by Beattie and Loomes (1997, p. 156) ensures that subjects treat each decision independently and in isolation (Beattie & Loomes, 1997). Subjects were also paid a fixed participation fee of 100 rupees. The participation fee was selected to match hourly earnings for a typical student in Pakistan, and was based on the participation fee reported in the recent experimental work of Umer (2020) in Pakistan12. The subjects were recruited by sharing information about the experiment in a microeconomics class for undergraduate students13. Those who voluntarily signed up for the experiment were directed to stay in class after the lecture and the experiment was administered. The duration of the experiment was 20 minutes, all the experimental materials (instructions, decision sheet and post experimental survey) were in the English language, and the experiment was administered with the help of paper. The experiment was performed at the Institute of Business Administration (IBA) located in Karachi, Pakistan, in the summer of 2019. The experimental instructions are presented in Appendix B.

4.3 Data Analysis

In the data analysis, the investment decision is treated as a binary variable taking on a value of 1 if the subject invests in a purely Pakistani firm and zero if the investment is in an impure Pakistani firm. For the aforementioned categorical outcome variable, first a comparison of proportions of investors opting for either purely Pakistani or impure Pakistani firms is performed with the help of a two-tailed proportions test (please see Table 2). As a robustness check, we also performed a nonparametric Kruskal-Wallis equality of proportions rank test, and the outcome is reported in the results section. Second, we performed a multi-logit regression analysis (ideal for binary outcome variables) with the aforementioned binary outcome variable and the ratio of Chinese foreign investment as the main explanatory variable (Regression 1 in Table 3) and with several control variables as well (Regression 2 in Table 3). To control for multiple decisions made by subjects during the experiment, robust standard errors clustered around individual subject IDs are employed in the both regressions. The outcomes are reported as odds ratios, which facilitates the interpretation of results in percentage terms. All statistical analysis reported in this section is performed with the help of STATA.

5. Results

75 subjects (average age = 20 years; Std. Dev.= 1.16) voluntarily participated in the experiment14. 47 (63%) of the subjects were male (average age = 20 years; Std. Dev.= 1.30), while 28 (37%) were female (average age = 19 years; Std. Dev.= 0.77). 26 (35%) of the subjects were economics major, 25 (33%) business administration, 9 (12%) in economics and mathematics, 4 (5%) in each marketing and social sciences, 2 (3%) in each finance and computer science, while 3 (4%) of the subjects had not decided on their major yet. 68 (91%) subjects had knowledge about bonds, while 10 (13%) subjects had experience of investment in either stocks or bonds.

At first a comparison between proportion of subjects opting for a purely Pakistani firm and an impure Pakistani firm with Chinese presence is performed by using the test of proportions, and the output is reported in Table 2.

The analysis of Case 1 (a purely Pakistani firm versus a Pakistani firm with Chinese 9% share in it) reveals that 59% subjects opted to invest in the purely Pakistani firm, while a significantly lower proportion of 41% opted to invest in the Pakistani firm with Chinese portfolio investment in it (p-value = 0.03). The analysis of Case 2 (a purely Pakistani firm versus a Pakistani firm with Chinese 22% share in it) reveals that 44% of the subjects invested in a purely Pakistani firm, while significantly higher 56% invested in the Pakistani firm with Chinese minority investment in it (p-value = 0.04). The analysis of Case 3 (a purely Pakistani firm versus a Pakistani firm with Chinese 60% share in it) reveals that 65% subjects invested in the purely Pakistani firm, while significantly lower 35% invested in the Pakistani firm with majority investment in it. Based on the aforementioned results, the investment ratio of the Chinese firm that attracts maximum individual investors (RFP*) turns out to be 22%, while corresponding maximized proportion of individual investors (I*) turns out to be 56%. These results support Hypothesis 1.

An assessment of subjects investing in the impure Pakistani firm with Chinese share in it reveals that as Chinese share increases from 9% to 22%, the proportion of individual investors investing in that firm increases from 41% to 56% (p-value = 0.07). This result lends support to the second hypothesis. On the other hand, as Chinese share in the Pakistani firm increases from 22% to 60%, the individual investor’s proportion decreases from 56% to 35% (p-value = 0.00), and this result supports the third hypothesis. The Kruskal-Wallis equality of proportions rank test also confirms that the proportion of subjects investing in the impure Pakistani firm with three different Chinese investment levels (9%; 22%; 60%) is statistically different (χ2(2) = 7.22, p-value = 0.03).

Table 2 Statistical Analysis of the Investment Decisions

|

|

Pakistani Share |

Chinese Share |

z-stat |

|

Case 1 |

100% |

9% |

|

|

Choice |

44/75 (59%) |

31/75 (41%) |

-2.12** (0.034) |

|

Std. Dev. |

[0.496] |

[0.496] |

|

|

Case 2 |

100% |

22% |

|

|

Choice |

33/75 (44%) |

42/75 (56%) |

2.09** (0.036) |

|

Std. Dev. |

[0.50] |

[0.50] |

|

|

z-stat |

|

-1.80* (0.072) |

|

|

Case 2 |

100% |

22% |

|

|

|

33/75 (44%) |

42/75 (56%) |

|

|

Case 3 |

100% |

60% |

|

|

Choice |

49/75 (65%) |

26/75 (35%) |

-3.76*** (0.000) |

|

Std. Dev. |

[0.48] |

[0.48] |

|

|

z-stat |

|

2.62*** (0.009) |

|

z-stat is from the two-tailed test of proportions, and the numbers next to z-stat in parentheses represent p-value. For Case 2 (a purely Pakistani firm versus a Pakistani firm with 22% Chinese presence), one-tailored test of proportions is used. Std. Dev. = Standard Deviations. *** Significant at 1%; *Significant at 10%.

To further analyze these results and control for other factors that can possibly influence the investment behavior, logistic regressions analysis is also performed. The dependent variable is investment decision, and it takes a value of 1 if the subject invests in a Pakistani firm with Chinese share in it, and it takes value of 0 if the subject invests in a Pakistani firm with no Chinese share. The robust standard errors are clustered around individual subject IDs to control for the multiple decisions made by each subject. The results in the form of odds ratios are reported in Table 3.

Table 3 Investment Behavior: Results from the Logistic Regression (Odds Ratios)

|

Variables |

Regression 1 |

Regression 2 |

|

Chinese Share (Ref = 22%) |

||

|

9% |

0.55* |

0.53* |

|

(0.17) |

(0.18) |

|

|

60% |

0.42*** |

0.39*** |

|

(0.13) |

(0.13) |

|

|

Male |

|

0.90 |

|

|

(0.24) |

|

|

Age |

|

1.11 |

|

|

(0.12) |

|

|

Investment Experience |

|

0.48* |

|

|

(0.21) |

|

|

Knowledge of bonds |

|

1.98 |

|

|

(0.99) |

|

|

Perception of China Ref (China is best friend + friend of Pakistan) |

||

|

Neither friend nor enemy |

|

0.59 |

|

|

(0.36) |

|

|

Enemy of Pakistan |

|

0.65 |

|

|

(0.34) |

|

|

Worst Enemy of Pakistan |

|

0.34* |

|

|

(0.19) |

|

|

Perception of Pakistani firms (Ref: Pakistani firms better than Chinese firms) |

||

|

Worse than Chinese |

|

2.23** |

|

|

(0.76) |

|

|

As good as Chinese |

|

1.60 |

|

|

(0.46) |

|

|

Perception of Chinese firms (Ref: Chinese firms worse than Pakistani firms) |

||

|

Better than Pakistani firms |

|

5.08*** |

|

|

(2.72) |

|

|

As good as Pakistani firms |

|

4.69*** |

|

|

(2.57) |

|

|

Constant |

1.27 |

0.02* |

|

(0.30) |

(0.05) |

|

|

Controls |

No |

Yes |

|

Pseudo R-Squared |

0.024 |

0.070 |

|

Observations |

225 |

225 |

Male = 1 if the subject is male. Robust standard errors clustered around individual IDs are in parentheses. *** p<0.01; **p<0.05; *p<0.01.

Table 3 reports output from two regressions: Regression 1 is without controls, while Regression 2 controls for demographics, investment experience, knowledge of bonds, and heterogeneity in the perceptions about Pakistani firms, Chinese firms and China as a country. The main independent variable ‘Chinese share’ represents three investment shares of the Chinese firm: portfolio (9%), minority (22%) and majority (60%), with minority investment specified as base category in the regression. The regression results for the main variable do not change even after adding several control variables, and hence the output of Regression 2 that has control variables is discussed here. The output for the main variable (Chinese Share) indicates that subjects are 47% less likely to invest in a Pakistani firm with Chinese portfolio investment and 61% less likely to invest in a Pakistani firm with Chinese majority investment than a Pakistani firm with Chinese minority investment. The regression results for the main independent variable support all three hypotheses and are also in line with results from the test of proportions and the Kruskal-Wallis test. However, it is important to mention here that the coefficient for 9% Chinese ownership is marginally significant in the regression analysis and lends a relatively weaker support to Hypothesis 2. This can be due to a relatively narrow gap between portfolio investment ratio (9%) and minority investment ratio (22%) compared to a more profound gap between minority investment and majority investment (60%). Further analysis with wider gap between the portfolio and minority investment ratios is left for future research.

The effect of gender, age, and knowledge of bonds has an insignificant effect on the investment choices. As all subjects belonged to the microeconomics class, there is not a lot of variation in age (average age = 20 years; Std. Dev.= 1.15) and knowledge about bonds (91% were knowledgeable about bonds), and this could be a factor behind the insignificant effect of age and knowledge of bonds on the investment choices. The variable ‘Investment Experience’ takes on a value of 1 if the subjects had a prior investment experience of either stocks or bonds and zero otherwise. Interestingly, the subjects with investment experience are 52% less likely to invest in a Pakistani firm that is partially owned by a Chinese firm than in a purely Pakistani firm. Even though the percentage of subjects with investment experience is relatively small (only 13%), the results indicate that experienced subjects are more likely to opt for a purely Pakistani firm. Previous bad investment experience in an impure Pakistani firm could be one possible factor making the impure Pakistani firm less attractive to the experienced investors.

The variable ‘Perception of China’ captures the influence of general perceptions about China on the investment behavior. Subjects who ranked China as “Enemy of Pakistan” are 35% less likely, while those who ranked China as “Worst Enemy of Pakistan” are 66% less likely to invest in a Pakistani firm with Chinese presence than those subjects who ranked China as a friend of Pakistan. The coefficient for the “Enemy of Pakistan” category, however, is insignificant. Only those subjects who possess strong negative feelings against China reflect these in their investment behavior as well.

Even though we used hypothetical firms in the experimental instructions, the general perceptions about Pakistani and Chinese firms operating in Pakistan can influence the investor behavior and are controlled in the regression analysis. Subjects who believe Pakistani firms are worse than Chinese firms (variable: Perceptions of Pakistani firms) are almost twice more likely to invest an impure Pakistani firm with Chinese ownership than those subjects who think Pakistani firms are better than the Chinese firms. However, subjects who believe Pakistani firms are as good as the Chinese firms do not behave differently compared to those who believe Pakistani firms are better than the Chinese firms. On the other hand, subjects who think Chinese firms are either better or as good as Pakistani firms (variable: Perceptions of Chinese firms) are approximately five times more likely to invest in the Pakistani firm with Chinese ownership in it than those subjects who believe Chinese firms are worse than Pakistani firms. These results indicate that subjects with even weak positive perceptions of Chinese firms or strong negative perceptions of Pakistani firms are more likely to choose an impure Pakistani firm with Chinese ownership over a purely domestic Pakistani firm.

5.1. Dominance Analysis

The investor model discussed in Section 3 and the lab experiment in Section 4 use investment ratios of the Chinese firm in the Pakistani firm as a major factor influencing the investment decisions of the subjects. The logistic regression results reported in Table 3 indicate that along with Chinese share, general perceptions about the Chinese and Pakistani firms also significantly influence the investment choices. Apparently, significant coefficients for perceptions about Chinese and Pakistani firms are quite large in magnitude compared to those for the main explanatory variable. One might question which is the most important explanatory variable in the regression? Even though we use Chinese share as the main explanatory variable, we cannot claim it based on the regression results reported in Table 3. In order to identify the relative importance of the main independent variable (Chinese Share) in explaining the variance of investment choice (R-squared) in the logistic regression, a dominance analysis is performed, and the results are reported in Table 4. The dominance analysis identifies the marginal contribution of an explanatory variable as change in R-squared when that variable is added to the model (Azen & Traxel, 2009). The dominance analysis indicates that the main independent variable (Chinese Share) accounts for 35% of the variance in the dependent variable captured by the logistic regression and is relatively the most dominant explanatory variable as well (Rank = 1). The dominance analysis strengthens the predictions of the investor model and validates the effectiveness of the experimental design in successfully detecting the role of Chinese share in the domestic individual investments. Apart from the main explanatory variable, general perception of the Chinese firms explains 20% of the variance, 13% of investment experience, 12% of general perception of Pakistani firms, while opinion about China explains 10% of the total variance in the investment choice captured by the logistic regression. Knowledge of bonds, age and gender played a minor role in the total variance.

Table 4 Standardized Dominance Estimates & Dominance Ranking

|

|

Estimate |

Ranking |

|

Chinese Share |

35% |

1 |

|

Male |

1% |

8 |

|

Age |

2% |

7 |

|

Investment Experience |

13% |

3 |

|

Knowledge of Bonds |

7% |

6 |

|

Opinion about China |

10% |

5 |

|

Perception of Pakistani Firms |

12% |

4 |

|

Perception of Chinese Firms |

20% |

2 |

Note: Estimate represents the value of standardized dominance estimate.

6. Discussions and Conclusions

This study proposed a behavioral investor model to examine the choice of domestic individual investors between a purely domestic firm and a domestic firm partially owned by a foreign firm. The investor model predicts a bell-shaped relation between the foreign firm’s ratio in the target firm and domestic individual investments in the target firm. The model is tested with the help of a controlled lab experiment in the China – Pakistan context. The experiment examined the individual investment choices of Pakistani subjects between a purely Pakistani firm and a Pakistani firm with varying Chinese presence: majority (60%), minority (22%) or portfolio (9%). Based on the behavioral investor model it was hypothesized that individual investors perceive Chinese minority investors positively compared to foreign portfolio or majority investors. The results from the lab experiment support the aforementioned hypothesis: individual investments in the impure Pakistani firm are maximum (56%) when Chinese ownership is 22%.

There are several caveats in the existing study that are discussed here. 1) The subjects in the experiment were students, and only 13% had an investment experience. It is possible that the experienced investors behave in a different manner and could be less prone to the behavioral biases. However, Chen et al. (2007) report that both experienced and inexperienced investors are equally prone to the behavioral biases. Hence the behavior of relatively inexperienced students in the current study might be no different than the experienced Pakistani investors. 2) The experimental subjects were educated, well connected to the world, and 91% had knowledge of the bond market. Several studies (Dhar & Zhu, 2006; Goo, Chen, Changmb & Yeh, 2010) report that educated investors are less prone to the behavioral biases in their investment decisions. Hence the behavior of educated experimental subjects observed in the current experiment might differ when compared to the actual investors with limited knowledge of the financial markets. 3) In the current experiment, the investment options were riskless. The behavioral response of individual investors to different FDI ratios when exercising decisions with uncertain and risky investments (such as stocks) could be different and might lead to a different ratio of foreign investment that attracts maximum local individual investors compared to the one observed in the current experiment. 4) The results in this study are based on a set of specified cutoffs (9% for portfolio investment, 22% for minority investment, and 60% for majority investment). As mentioned, these cutoffs are based on prior literature on mergers and acquisition, and a priori, there is no reason to expect that the results of hypothesis testing would be different if we use slightly different values. At the same time, we acknowledge that by using a slightly different cutoff of minority investments (rather than 22%), we may receive a different maximized proportion of individual investors (I*) as compared to that in our study (56%). The reason is that what percentage constitutes a minority investment may still largely be perceived differently by investors based on their biases and experiences. Although we tried to control for this element in our study by conveying clearly to the respondents the differences between minority investments and other investments types, future work could additionally examine slightly different cutoffs to check the stability of results. 5) The experiment examines the influence of varying foreign ownership on individual domestic investments in bonds (a form of lending) of the target firm. However, the ownership and lending mechanisms imply different interests and motivations. The behavior of individual investors might differ if investment in shares instead of bonds is examined.

The study has several practical implications. First, we caution individual investors to be aware of the positive bias towards minority investments. While efficiency-liquidity tradeoff provides several reasons why minority investment mode may have certain advantages over other investments modes, individual investors should take the investment decision more objectively by focusing on adjusted return provided. Second, this study provides useful implications to Chinese firms specifically and multinationals generally about potential risks associated with majority and portfolio investment modes in Pakistan’s context. Third, we provide managers in the local (Pakistani) firms a simple though useful model for recognizing potentially challenging competitors for attracting individual investors. Precisely, managers in local (Pakistani) firms should be careful when they need to attract individual investors against a firm in which the foreign investor has minority ownership. Lastly, the study suggests that foreign investors aiming to maintain a certain level of domestic investors in the target country will be better able to do so if they also consider the effects associated to their ratio in the target firm.

References

Ackert, L. F., Church, B. K., Tompkins, J., & Zhang, P. (2005). What’s in a name? An experimental examination of investment behavior. Review of Finance, 9(2), 281–304.

Ahmed, K., & Bebenroth, R. (2019). Acquisition behavior of emerging versus developed market multinationals. Organizations and Markets in Emerging Economies, 10(1), 9–30.

Ahmed, Z., & Hla, D. T. (2019). Stock return volatility and capital structure measures of nonfinancial firms in a dynamic panel model: Evidence from Pakistan. International Journal of Finance & Economics, 24(1), 604–628.

Aspara, J., & Tikkanen, H. (2010). The role of company affect in stock investments: Towards blind, undemanding, noncomparative and committed love. Journal of Behavioral Finance, 11(2), 103–113.

Azen, R., & Traxel, N. (2009). Using dominance analysis to determine predictor importance in logistic regression. Journal of Educational and Behavioral Statistics, 34(3), 319–347.

Baltussen, G., & Post, G. T. (2011). Irrational diversification: An examination of individual portfolio choice. Journal of Financial and Quantitative Analysis, 1463–1491.

Beattie, J., & Loomes, G. (1997). The impact of incentives upon risky choice experiments. Journal of Risk and Uncertainty, 14(2), 155–168.

Brandts, J., & Charness, G. (2011). The strategy versus the direct-response method: a first survey of experimental comparisons. Experimental Economics, 14(3), 375–398.

Castillo, M., Ferraro, P. J., Jordan, J. L., & Petrie, R. (2011). The today and tomorrow of kids: Time preferences and educational outcomes of children. Journal of Public Economics, 95(11–12), 1377–1385.

Chang, H. J. (2004). Regulation of foreign investment in historical perspective. The European Journal of Development Research, 16(3), 687–715.

Chari, A., Ouimet, P. P., & Tesar, L. L. (2010). The value of control in emerging markets. The Review of Financial Studies, 23(4), 1741–1770.

Charness, G., & Gneezy, U. (2012). Strong evidence for gender differences in risk taking. Journal of Economic Behavior & Organization, 83(1), 50–58.

Chen, G., Kim, K. A., Nofsinger, J. R., & Rui, O. M. (2007). Trading performance, disposition effect, overconfidence, representativeness bias, and experience of emerging market investors. Journal of Behavioral Decision Making, 20(4), 425–451.

Chhabra, A., Popli, M., & Li, Y. (2021). Determinants of Equity Ownership Stake in Foreign Entry Decisions: A Systematic Review and Research Agenda. International Journal of Management Reviews, 23–2, 244–267.

Cohen, J., Ericson, K. M., Laibson, D., & White, J. M. (2020). Measuring time preferences. Journal of Economic Literature, 58(2), 299–347.

Coleman, J. S. (1993). The rational reconstruction of society: 1992 presidential address. American Sociological Review, 58(1), 1–15.

Coval, J. D., & Moskowitz, T. J. (1999). Home bias at home: Local equity preference in domestic portfolios. The Journal of Finance, 54(6), 2045–2073.

Cui, L., & Jiang, F. (2012). State ownership effect on firms’ FDI ownership decisions under institutional pressure: A study of Chinese outward-investing firms. Journal of International Business Studies, 43(3), 264–284.

Dang, M., Henry, D., Nguyen, M. T., & Hoang, V. A. (2018). Cross-country determinants of ownership choices in cross-border acquisitions: Evidence from emerging markets. Journal of Multinational Financial Management, 44, 14–35.

Demirbag, M., Glaister, K. W., & Tatoglu, E. (2007). Institutional and transaction cost influences on MNEs’ ownership strategies of their affiliates: Evidence from an emerging market. Journal of World Business, 42(4), 418–434.

Dhar, R., & Zhu, N. (2006). Up close and personal: Investor sophistication and the disposition effect. Management Science, 52(5), 726–740.

Duncan, K., & Hasso, T. (2018). Family governance signals and heterogeneous preferences of investors. Journal of Behavioral Finance, 19(4), 381–395.

Duxbury, D. (1995). Experimental asset markets within finance. Journal of Economic Surveys, 9(4), 331–371.

Duxbury, D. (2015). Behavioral finance: insights from experiments I: Theory and financial markets. Review of Behavioral Finance, 7(1), 78–96.

Fogel, S. O. C., & Berry, T. (2006). The disposition effect and individual investor decisions: the roles of regret and counterfactual alternatives. The Journal of Behavioral Finance, 7(2), 107–116.

Frieder, L., & Subrahmanyam, A. (2005). Brand perceptions and the market for common stock. Journal of Financial and Quantitative Analysis, 40(1), 57–85.

Gan, Y., & Qiu, B. (2019). Escape from the USA: Government debt-to-GDP ratio, country tax competitiveness, and US-OECD cross-border M&As. Journal of International Business Studies, 50(7), 1156–1183.

Geleilate, J. M. G., Magnusson, P., Parente, R. C., & Alvarado-Vargas, M. J. (2016). Home country institutional effects on the multinationality–performance relationship: a comparison between emerging and developed market multinationals. Journal of International Management, 22(4), 380–402.

Goldstein, I., & Razin, A. (2006). An information-based trade off between foreign direct investment and foreign portfolio investment. Journal of International Economics, 70(1), 271–295.

Goo, Y. J., Chen, D. H., Chang, S. H. S., & Yeh, C. F. (2010). A study of the disposition effect for individual investors in the Taiwan stock market. Emerging Markets Finance and Trade, 46(1), 108–119.

Huang, R. D., & Shiu, C. Y. (2009). Local effects of foreign ownership in an emerging financial market: Evidence from qualified foreign institutional investors in Taiwan. Financial Management, 38(3), 567–602.

Huberman, G. (2001). Familiarity breeds investment. The Review of Financial Studies, 14(3), 659–680.

Isobe, T., Makino, S., & Montgomery, D. B. (2000). Resource commitment, entry timing, and market performance of foreign direct investments in emerging economies: The case of Japanese international joint ventures in China. Academy of Management Journal, 43(3), 468–484.

Ji, L. J., Zhang, Z., & Guo, T. (2008). To buy or to sell: Cultural differences in stock market decisions based on price trends. Journal of Behavioral Decision Making, 21(4), 399–413.

Kanwal, S., Chong, R., & Pitafi, A. H. (2019). Support for China–Pakistan Economic Corridor development in Pakistan: A local community perspective using the social exchange theory. Journal of Public Affairs, 19(2), e1908.

Kilka, M., & Weber, M. (2000). Home bias in international stock return expectations. The Journal of Psychology and Financial Markets, 1(3–4), 176–192.

Kirk, C. P., McSherry, B., & Swain, S. D. (2015). Investing the self: The effect of nonconscious goals on investor psychological ownership and word-of-mouth intentions. Journal of Behavioral and Experimental Economics, 58, 186–194.

Kostova, T., & Zaheer, S. (1999). Organizational legitimacy under conditions of complexity: The case of the multinational enterprise. Academy of Management Review, 24(1), 64–81.

Kühberger, A., Schulte-Mecklenbeck, M., & Perner, J. (2002). Framing decisions: Hypothetical and real. Organizational Behavior and Human Decision Processes, 89(2), 1162–1175.

La Porta, R., Lopez-de-Silanes, F., Shleifer, A., & Vishny, R. (2000). Investor protection and corporate governance. Journal of Financial Economics, 58(1–2), 3–27.

Lewis, K.K. (1999). Trying to Explain Home Bias in Equities and Consumption. Journal of Economic Literature, 37, 571–608.

Liaqat, A., Nazir, M. S., Ahmad, I., Mirza, H. H., & Anwar, F. (2020). Do stock price bubbles correlate between China and Pakistan? An inquiry of pre‐and post‐Chinese investment in Pakistani capital market under China‐Pakistan Economic Corridor regime. International Journal of Finance & Economics, 25(3), 323–335.

Mahmood, S., Sabir, M., & Ali, G. (2020). Infrastructure projects and sustainable development: Discovering the stakeholders’ perception in the case of the China–Pakistan Economic Corridor. PloS one, 15(8), e0237385.

Malhotra, S. (2012). Geographic distance as a moderator of curvilinear relationship between cultural distance and shared ownership. Canadian Journal of Administrative Sciences/Revue Canadienne des Sciences de l’Administration, 29(3), 218–230.

Massa, M., & Simonov, A. (2006). Hedging, familiarity and portfolio choice. The Review of Financial Studies, 19(2), 633–685.

Meier, C. (2018). Aggregate investor confidence in the stock market. Journal of Behavioral Finance, 19(4), 421–433.

Nagy, R. A., & Obenberger, R. W. (1994). Factors influencing individual investor behavior. Financial Analysts Journal, 50(4), 63–68.

Nicolosi, G., Peng, L., & Zhu, N. (2009). Do individual investors learn from their trading experience? Journal of Financial Markets, 12(2), 317–336.

Noussair, C. N., & Tucker, S. (2013). A collection of surveys on market experiments. Journal of Economic Surveys, 27(3), 395–397.

Oehler, A., Wendt, S., Wedlich, F., & Horn, M. (2018). Investors’ personality influences investment decisions: Experimental evidence on extraversion and neuroticism. Journal of Behavioral Finance, 19(1), 30–48.

Ouimet, P. P. (2013). What motivates minority acquisitions? The trade-offs between a partial equity stake and complete integration. The Review of Financial Studies, 26(4), 1021–1047.

Pierce, J. L., Kostova, T., & Dirks, K. T. (2001). Toward a theory of psychological ownership in organizations. Academy of Management Review, 26(2), 298–310.

Richards, D. W., & Willows, G. D. (2019). Monday mornings: Individual investor trading on days of the week and times within a day. Journal of Behavioral and Experimental Finance, 22, 105–115.

Schoenbachler, D. D., Gordon, G. L., & Aurand, T. W. (2004). Building brand loyalty through individual stock ownership. Journal of Product & Brand Management, 13(7), 488–497.

Sokolowska, J., & Makowiec, P. (2017). Risk preferences of individual investors: The role of dispositional tendencies and market trends. Journal of Behavioral and Experimental Economics, 71, 67–78.

Steul, M. (2006). Does the framing of investment portfolios influence risk-taking behavior? Some experimental results. Journal of Economic Psychology, 27(4), 557–570.

Tanaka, T., Camerer, C. F., & Nguyen, Q. (2010). Risk and time preferences: Linking experimental and household survey data from Vietnam. American Economic Review, 100(1), 557–71.

Tesar, L. L., & Werner, I. M. (1995). Home bias and high turnover. Journal of International Money and Finance, 14(4), 467–492.

Umer, H. (2020). Revisiting generosity in the dictator game: Experimental evidence from Pakistan. Journal of Behavioral and Experimental Economics, 84, 1–3.

Wang, L., & Li, S. (2018). Determinants of foreign direct and indirect investments from the institutional perspective. International Journal of Emerging Markets, 13(5), 1330–347.

Waqar, W. T. (2020). Board size and acquisition outcome: The moderating role of home country formal institutional development. Managerial and Decision Economics, 41(4), 529–541.

Wu, J., Li, S., & Selover, D. D. (2012). Foreign direct investment vs. foreign portfolio investment. Management International Review, 52(5), 643–670.

Zhang, R., Xian, X., & Fang, H. (2019). The early‐warning system of stock market crises with investor sentiment: Evidence from China. International Journal of Finance & Economics, 24(1), 361–369.

Appendix A. Post Experimental Survey Questions

1. Which of the following best describes your opinion?

|

Choices |

Respondents (Percentage) |

|

China is the best friend of Pakistan |

0 |

|

China is a friend of Pakistan |

3 (4%) |

|

China is neither a friend nor an enemy of Pakistan |

13 (17.33%) |

|

China is an enemy of Pakistan |

52 (69.33%) |

|

China is the worst enemy of Pakistan |

7 (9.33%) |

2. Have you ever invested money in stocks or bonds?

|

Choices |

Respondents (Percentage) |

|

Yes |

10 (13.33%) |

|

No |

65 (86.67%) |

3. Do you know what a bond is?

|

Choices |

Respondents (Percentage) |

|

Yes |

68 (90.67%) |

|

No |

7 (9.33%) |

4. In your opinion, Pakistani companies operating in Pakistan are:

|

Choices |

Respondents (Percentage) |

|

Better than Chinese companies |

7 (9.33%) |

|

As good as Chinese companies |

44 (58.67%) |

|

Worse than Chinese companies |

24 (32%) |

5. In your opinion, Chinese companies operating in Pakistan are:

|

Choices |

Respondents (Percentage) |

|

Better than Pakistani companies |

39 (52%) |

|

As good as Pakistani companies |

32 (42.67%) |

|

Worse than Pakistani companies |

4 (5.33%) |

Appendix B. Experimental Instructions

Thank you very much for taking out time and participating in the experiment. All the decisions that you take during the experiment and your performance will not be shared with anyone. The data collected through the experiment will be used only for the purpose of research, and anonymity shall be maintained at all levels of research.

The experiment is spread over 20 minutes. You are not allowed to communicate with each other. If anyone is found talking to someone else, he or she will be disqualified from the experiment. Kindly work on your own and if you have any questions, raise your hand. The experimenter will come to you to answer your questions. Only relevant questions will be answered. Use of mobile phones, laptops and other electronic devices is not allowed during the experiment. You will receive a participation fee of 100 rupees. Based on your decisions during the experiment you can further earn 100 rupees. Total money (participation fee along with earned money) will be provided to you in envelopes at the end of the experiment.

The decisions during the experiment are represented in experimental units. 100,000 experimental units are equal to 50 rupees.

Your Task

Suppose you have 100,000 experimental units and imagine you can invest in the bonds of Company A or in Company B. Both companies pay identical returns of 100,000 experimental units on your investment. Both companies are of Pakistani origin. Company A is 100% owned and controlled by Pakistanis. Company B has Pakistani and Chinese ownership mixed in different proportions. Depending on which country has the higher proportion of ownership, the managerial decisions rest with that country. Kindly take into account both of these variables while making decisions. You need to provide your decisions in Table 1.

Table 1

|

Cases |

Ownership details |

Owner details |

In which company would you like to invest? |

|

Case 1 |

100% ownership with Pakistani |

91% owned by Pakistani and 9% owned by Chinese. The decision power is fully exercised by Pakistani owners. Chinese investors do not have any decision powers. |

|

|

Case 2 |

100% ownership with Pakistani |

78% owned by Pakistani and 22% owned by Chinese. The decision power mainly rests with Pakistani owners, but Chinese investors can influence the management decisions. |

|

|

Case 3 |

100% ownership with Pakistani |

40% owned by Pakistani and 60% owned by Chinese. The decision power is fully exercised by the Chinese investors. |

|

If you have any questions, raise your hand and wait for the experimenter. Only relevant questions will be answered.

1 Disposition effect: Individual investors sell appreciating investments prematurely while delay loss-making investments (Fogel & Berry, 2006).

2 Home bias: Individual investors are overconfident about the relative performance of the domestic firms in comparison to the foreign firms (Duxbury, 2015).

3 Representativeness bias: Investors believe that past returns reflect future returns of a firm (Chen et al., 2007).

4 Source: The World Bank. https://data.worldbank.org/country/pakistan

5 Source: World Governance Indicators. http://info.worldbank.org/governance/wgi/Home/Reports

6 Since March, Pakistan equities have performed all other Asia countries, making it a lucrative investment hub for local and foreign investors. Source: Business Standard. https://www.business-standard.com/article/international/pakistan-asia-s-best-performing-stock-market-is-just-getting-started-120082600094_1.html

7 Source: China-Pakistan Economic Corridor (CPEC). http://www.cpecinfo.com/news/china-accounts-for-89-percent-of-pakistan-fdiinflows/NjQyMw

8 Source: China-Pakistan Economic Corridor (CPEC). http://www.cpecinfo.com/news/a-detailed-analysis-of-the-impact-of-cpec-on-pakistan/NTcyNA

9 The perceptions about China as a country and general perceptions about Chinese and Pakistani firms can however influence these decisions. These perceptions are measured with the help of a post-experimental survey and subsequently used in the analysis to control for their possible effects on the investment decisions. The survey questions and their results are reported in Appendix A.

10 Several international business studies make a distinction between the majority investment mode (51-99% ownership) and the full investment mode (100% ownership). These studies argue that full investment mode provides greater autonomy to the foreign firms. However, in accordance with the corporate control literature, this study does not make any such distinction (Chari et al., 2010; Ouimet, 2013).

11 At the time of experiment, 200 Pakistani rupees were approximately equal to 0.96 USD (104.75 Pakistani rupees = 1 USD). 100 rupees at the time of experiment were enough to buy a good meal at the university where the experiment was performed.

12 Umer (2020) used 100 Pakistani rupees as participation fee for a 30 minutes experiment. The participation fee of 100 rupees for a 20 minutes experiment used in this paper is comparable to that used by Umer (2020).

13 Recent experimental studies focusing on either international business or management research ( Pan et al., 2020) also frequently use students as experimental subjects. The use of students as experimental subjects in the current study is in line with these studies.

14 The data that supports the findings of this study are available in the supplementary materials.