Organizations and Markets in Emerging Economies ISSN 2029-4581 eISSN 2345-0037

2021, vol. 12, no. 2(24), pp. 415–439 DOI: https://doi.org/10.15388/omee.2021.12.63

Entrepreneurship and Small Island Economies

Paul Pounder (corresponding author)

St. George‘s University, Grenada

ppounder@sgu.edu

https://orcid.org/0000-0001-9926-6762

Naresh Gopal

Indian Institute of Management Ranchi, India

naresh.gopal@iimranchi.ac.in

https://orcid.org/0000-0003-0439-8303

Abstract. Over the past two decades, the study of entrepreneurship and its importance to the economy has increased in appeal to academics, practitioners and governments. This study explores entrepreneurship in small island economies within regions based on Total Entrepreneurial Activity (TEA) and Established Business Ownership (EBO) as observed in the Global Entrepreneurship Monitor (GEM) dataset. This research uses the pooled regression model to study the impact of TEA and EBO on economic growth. The findings highlight that new venture creation is a driver that improves gross domestic product (GDP); however, there are significant differences across SIDS in the orientation of TEA and EBO that suggest that other contextual issues like culture, education system, and entrepreneurial support elements influence entrepreneurial behaviour across regions as well. The more advanced of these nations like Singapore and Puerto Rico benefit from knowledge networks and scientific mobility, while the smaller economies in the Caribbean and Pacific Region show less openness to pursuing entrepreneurial endeavours. These findings provide a foundation for further research on varying types of combinations of both economic factors and contextual differences that lend to the transitioning process towards an emerging economy.

Keywords: entrepreneurship, total entrepreneurial activity, established business ownership, economic development, SIDS

Received: 7/1/2021. Accepted: 1/6/2021

Copyright © 2021 Paul Pounder, Naresh Gopal. Published by Vilnius University Press. This is an Open Access article distributed under the terms of the Creative Commons Attribution Licence, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

1. Introduction

The subject of entrepreneurship has increased its appeal to many persons and groups in varying ways over the last two decades as shown by the augmented number of publications. This allows academics, practitioners and governments to use such research to facilitate decision-making. A gap of the research exists in small and less-developed economies that witness local and regional peculiarities as most of the attention focuses on entrepreneurial studies in large and developed economies. Further, other research highlights the importance of entrepreneurship to local economies with a focus on innovation, economic growth, and job creation (Baumol, 2002; Urbano & Aparicio, 2016). These works have paved a way for identifying ways in which the government can promote entrepreneurship and identify the major factors that can spur such entrepreneurial behaviour. Therefore, as recent academic literature highlights that entrepreneurial activity is crucial to increasing economic growth in developed nations, this research sets out to develop an understanding of entrepreneurship and its impact on economic development of the Small Island Developing States (SIDS). These unique nations (see Table 1) have diverse and complex characteristics that influence the transitioning process to an emerging economy.

These nation state characteristics (economic, political/legal, social-cultural and technological) and demographic features affect the institutions and support systems that facilitate entrepreneurial activity. In addition, they provide the basis for regulations and controls to ensure competitiveness. The purpose of this research is to explore the distinctiveness of entrepreneurial activity in SIDS at varying stages of economic development.

2. Literature Review

2.1 Entrepreneurship and Economic Challenges and Opportunities SIDS Face

Discourse on the many challenges faced by SIDS provides a foundation for contextualizing this research, especially as the impact of international crises and natural disasters heavily affects their growth prospects. When compared to developed countries, SIDS in general are marginalized due to their relatively small size, isolated locations, external shocks and high reliance on foreign markets and economies. Many authors state that there is limited literature on entrepreneurship in small islands (Baldacchino et al., 2006; Booth et al., 2020). This section of the literature review provides a brief overview of articles dealing with the core concerns and prospects of SIDS.

In reviewing what was available, much of the literature research was global in scope with views on the Asia-Pacific region and challenges faced by small island economies. Saffu (2003) claims that culture influences the characteristics of entrepreneurs and accounts for key differences between the entrepreneurs in the Pacific Islands and Western entrepreneurs. This article highlights that models developed in Western context are not holistically applicable in an island economy as little consideration to uniqueness of the country and its culture is given. Further, this article recognizes that in most islands, a collectivist culture exists and as such, goals of the entrepreneur align with social obligations rather than a focus on profit. Baldacchino et al. (2006) identify that literature on entrepreneurship in small islands is rare and specify that within this field the focus reflects Pacific and European research. Some of the main challenges identified include limited resources, small domestic markets and physical isolation. The research highlights that despite the varying degree of challenges faced by island entrepreneurship, there are success stories in many of the island territories. For instance, some success identified includes Bob Marley, a musical icon from the Caribbean island of Jamaica whose music transcends island and cultural boundaries. Other venture success cases identified were in the traditional retail and wholesale sectors such as the food trade. Also noticeably mentioned was the opportunity to take advantage of information and communication technologies that could break down the barriers of islandness. Another study by Booth et al. (2020), which was global in scope with perspectives on the tourism and hospitality sector in the Asia-Pacific region, suggests that such works are important because those sectors appear as key drivers of growth for that region. The research showed that the major issues identified in the tourism sector of the Asia-Pacific region are limited fiscal space, its reliance on the sector as it is the largest contributor to GDP, tourism sustainability (protecting heritage and culture) and the high dependency on foreign exchange revenues from tourism.

Other studies considered the uniqueness of issues confronted by indigenous and rural enterprises in SIDS. Danson et al. (2014) and Burnett et al. (2017) discussed rural enterprise in an island environment, indicating that such businesses face additional and exaggerated problems that are different to other business ecosystems. Danson et al. (2014) highlighted that despite advances in technology and internet capacity, remoteness of rural local enterprises is still challenging, thus making a case for policies and strategies to consider location differences. Burnett et al. (2017), who studied entrepreneurial experiences on small islands, stressed the importance of leveraging economic and cultural development agencies to spur entrepreneurship. Wennecke et al. (2019) study on indigenous island entrepreneurship identified some motivational peculiarities of operating within such an ecosystem. Wennecke et al. (2019, p. 43) stated that “entrepreneurship in the context of an indigenous island community seems driven by certain communal values, such as supporting the local community, cultural pride, family, and place.” The concept of a ‘self-sustaining economy’ also appears to be key to the development of entrepreneurship in these communities.

Other researchers present a strategic way forward in supporting entrepreneurship in small islands. In a book chapter on the Aland Islands, Fellman et al. (2015) identified some structural handicaps to the growth of small islands, namely, no economic heft, isolationist effects of remoteness, relatively small populations, limited materials and financial resources. Despite these challenges, the islands have built a modern service economy. The article goes on to highlight three pillars of the pathway pursued: leveraging geophysical characteristics of the island to formulate economic opportunity, focusing on niche markets and branding of high quality outputs, and being creative in political and institutional initiatives.

2.2 Entrepreneurship, the Economy and Beyond

Many researchers and practitioners have explored the field of entrepreneurship. Entrepreneurship is the study of an individual’s mindset and competencies geared towards startup, the actual processes for establishing a business and the running of the new venture. Ireland and Webb (2009) espoused the idea that an entrepreneurship mind-set features strong foci on both opportunity seeking and advantage seeking behaviour. Ajzen (1991), Morris et al. (2013) and Sanchez (2013) analysed entrepreneurial behaviours and highlighted that entrepreneurial competencies focus on knowledge areas, skill sets, attitudes and intentions. Gaglio (2004) recognized the significance of cognitive variables and other forms of intellectual reasoning in the entrepreneurial process and discussed behaviours of individuals, development of competencies and the regulation of an individual’s entrepreneurial actions. Beyond entrepreneurial behaviours, Mitchell et al. (2002) advocated that across cultures, varying factors will influence new venture creation. Hodges and Kuratko (2004) provided a good summation of entrepreneurship by defining it as a dynamic process requiring vision, creation and passion.

Despite previous researchers having documented many factors surrounding entrepreneurship, much is still required to understand entrepreneurship and its impact on the economy. The field of entrepreneurship is multi-faceted and interdisciplinary, with several other dynamics that influence its development. For instance, economic constraints is one such factor manipulating the process. Stephan and Roesler (2010) ascertained that the rise of entrepreneurship aligns with understanding the contribution it makes to labour markets and economies. Additionally, previous research has shown the strong and positive relationship between entrepreneurial activity and economic growth. Holcombe (1998) highlights that “the key element in economic growth is the production of entrepreneurial opportunities” (p. 60). Further, Holcombe (1998) emphasises the significance of the “context” of entrepreneurial actions for economic development and growth. Szerb et al. (2013) recognize the contextually embedded entrepreneurial action and its contribution to economic development. In a set of empirical studies, Acs (2006) and Acs et al. (2012) used panel data from 18 countries, and Li et al. (2012) studied panel data from 29 Provinces in China to find similar results showing that entrepreneurship has a significant positive effect on economic growth. Similarly, Bygrave and Minniti (2000) suggested structuring a model to enhance entrepreneurial activity in delineating the process of economic growth.

Other studies have investigated linkages between entrepreneurial dynamics, competitiveness and the economy. Todtling and Wanzanbock (2003) highlight that innovations and rivalry among ventures are key contributors to the growth in local economies. Porter et al. (2002) evaluated competitiveness and its relationship to economic development within a nation. Several authors pointed out the importance of innovation to economic development and growth (Roper & Love, 2002; Schramm, 2006; Audretsch, 2007; Galindo & Mendez-Picazo, 2013). Island study researchers (Baldacchino, 2006; Baldacchino et al., 2009; Grydehoj, 2011) recognised that some small jurisdictions are uniquely positioned to nurture and exploit international competitiveness in their jurisdictional capacities.

Reynolds et al. (2000) suggest that the Global Entrepreneurship Model allows for studying complex relationships between entrepreneurship and economic growth. Despite this opportunity, few authors utilize this GEM dataset to examine the influence of entrepreneurial activity on the growth of small economies. Acs and Varga (2005), in their research on nine European countries, highlighted that entrepreneurial activity has a positive significant effect on development of the European economies explored. Wennekers et al. (2005) researched the level of economic development of 36 countries using 2002 data for nascent entrepreneurship and found that entrepreneurship in the start-up stage trails policy, based on the maturity of economic development. Wong et al. (2005) used a cross-sectional analysis of 2002 data from 37 countries and found that only entrepreneurial activities in the high growth areas have a significant impact on the economic growth of a country. Van Stel et al. (2005) empirically analysed 37 countries using GEM data from 2001 and found that TEA index positively affects the growth in countries with high-income levels. Van Stel et al. (2005) study also found that TEA has a negative effect on economic growth, especially in nations with lower GDP. Valliere et al. (2009) researched data for the period 2004–2005 from 44 countries to find the effect of different types of entrepreneurship on GDP growth. Valliere et al. (2009) study shows that a high proportion of economic growth is due to the intensified positioning of entrepreneurs who take advantage of the regulatory freedom and formulating new ideas in developed countries. Martin, Picazo and Navarro (2010) conducted an empirical analysis investigating the linkages between entrepreneurship, the distribution of income, and economic growth and determined that entrepreneurial activity is the key factor in the economic system and key to economic growth. Hessels et al. (2013) analysed 70 countries using regression analysis over the period 2001–2009 and concluded that entrepreneurial activities within the industries of tech innovation have a positive contribution to economic growth. Research using the GEM Model has also considered the relationship between different types of entrepreneurial activity and economic growth, namely, opportunity and necessity entrepreneurship (Reynolds et al., 2002). This distinction has shown that in developed or more advanced economies, opportunity entrepreneurship is more dominant, while in less-developed economies, necessity entrepreneurship is prevalent (Wennekers et al., 2010). Further research by Herrington et al. (2010) on the GEM Model showed the relative contribution to TEA and EBOs for efficiency driven and innovation driven economies. Despite these studies showing the value of the GEM dataset in exploring complex relationships between entrepreneurship and economic growth, there remains a gap in such work that would focus on small less-developed economies.

Beyond the macro-economic factors of the economy, many other environmental factors influence entrepreneurship. In many cases, new venture creation is due to reasons beyond economic factors, for instance, political, social, technological, and legal factors. An understanding of these additional forces will give a more comprehensive picture of entrepreneurship. In a study on pervasiveness of government regulation, Shleifer (2005) highlighted country-specific bottlenecks based on differing business environment contexts that provide social control of institutions and businesses. Martinelli (2004) and Leung et al. (2012) did research focusing on other non-economic contextual factors and highlighted that entrepreneurial attitudes and motives influence various aspects of the socio-cultural and politico-institutional environment. In addition, Caputo et al. (2016) maintain that the socio-cultural and institutional environment is regionally specific for new venture creation. Ratten (2014) analysed the ways of encouragement of entrepreneurial spirit in the business environment in developing countries. Other studies highlight that good infrastructure, efficiency of labour regulations, societal values and beliefs, specific entrepreneurial support elements and favourable entry regulations spur entrepreneurship. Winegarden (2019) indicated that by reducing regulation burdensomeness, including labour regulations, governments can give a boost to the entrepreneurial sector. Tan et al. (2000) also showed the need for adequate facilities and services to spur new venture creation and enhance entrepreneurial activity. In addition, Hofstede et al. (2004) underlined the need for society to view socio-cultural aspects of the environment as desirable and acceptable before pursuing new ventures, while Hayton et al. (2002) stressed the supportiveness and freedom to establish new ventures as a critical part of environment. Stephen et al. (2005, 2009) and, more recently, Alvarez et al. (2014) analysed the influence that regulations have on entrepreneurial activity, and indicated that the stronger the institution, the higher the likelihood of entrepreneurial activity.

Noticeably, research on entrepreneurial activity has focused mainly on developed nations and neglected less-developed economies and the regions they make up. In many ways, being small hinders the opportunities that a country and its population can pursue based on share size and limited resources (Anderson, 2000). Therefore, to counteract these limitations, a case can be made for a regional development approach that syncs with national economic decisions in order to foster economic development at both the regional and the national levels. Berglund and Johansson (2007) highlight that regional economic development encompasses growth in GDP, local income, net job creation and employment growth. As SIDS are viewed and analysed based on their various regions, this research takes into account regional context and entrepreneurship from the following three regions: Caribbean, Pacific and South East Asia. Trettin and Welter (2011) investigated the spatial aspects of entrepreneurial activities and support policies, and stressed the need for more research to gain insights on the entrepreneurs’ socio-spatial contexts under which they have to operate. Meccheri and Pelloni (2006) assessed the types of ventures, differences in the adoption of institutional assistance and the varying types of regional engagement within a heterogeneous space. Grydehoj (2014) indicated that islands like Singapore are less island-like than places like Vanuatu, as this author sees that the true character of islandness lies in rural, remote, and out-of-the-way places.

3. Methodology

This research reviews the literature at the intersection of entrepreneurship and the economy to determine the role of entrepreneurial activity and its effect on the economy. Data collection and pooling was the next step in the methodology. The basic data sets of the paper are GEM1 and GDP2 from ten SIDS in the period from 1981 to 2016. The entrepreneurship activity was selected for specific Small Island Developing States (SIDS) as defined by the United Nations Department of Economic and Social Affairs, which include the Barbados, Belize, Dominican Republic, Jamaica, Puerto Rico, Suriname, and Trinidad and Tobago from the Caribbean region; Tonga and Vanuatu from the Pacific region; and Singapore from South East Asia. Out of forty-two possible SIDS, this selected sample of 10 representative countries has data that is available for at least five successive recent years. A comparison of the chosen small economies according to some characteristics is shown in Table 1.

Table 1. Country Profiles (2016)

|

Country/ |

Population |

Exchange |

GDP |

Land |

CPI |

GDP |

Unemployment |

Spending |

Inflation |

Major |

|

Barbados |

0.287 Millions |

2.000 BBD/US$ |

5295 Millions current US$ |

430 km2 |

4.10% |

0.00% |

8.90% |

211 Million |

1.90% |

manufactures, sugar, molasses, rum and beverages |

|

Belize |

0.390 Millions |

2.000 BZD/US$ |

1901 Millions Current US$ |

22810 km2 |

0.60% |

1.00% |

7.70% |

139 Million |

1% |

sugar & molasses, bananas, citrus, marine products |

|

Dominican Republic |

10.739 Millions |

51.295 DOP/US$ |

83725 Millions current US$ |

48310 km2 |

1.81% |

4.80% |

7.10% |

1300 Million |

7.09% |

gold, medical instruments, rolled tobacco |

|

Jamaica |

2.948 Millions |

133.312 JMD/US$ |

16053 Millions current US $ |

10830 km2 |

3.91% |

1.70% |

10.70% |

812 Million |

3.70% |

aluminium & bauxite |

|

Puerto Rico |

3.142 Millions |

1 USD |

10499 Millions current US$ |

9104 km2 |

0.01% |

1.50% |

7.70% |

6221 Million |

-0.10% |

chemicals & chemical products |

|

Suriname |

0.581 Millions |

7.458 SRD/US$ |

3688 Millions current US$ |

156000 km2 |

4.39% |

2.10% |

11.20% |

87 Million |

63.80% |

bauxite, gold, precious metal scraps |

|

Trinidad & Tobago |

1.395 Millions |

6.754 TTD/US$ |

23816 Millions current US$ |

5130 km2 |

1.00% |

-1.20% |

4% |

1000 Million |

0.90% |

natural gas & oil |

|

Tonga |

0.104 Millions |

2.289 TOP/US$ |

530 Millions current US$ |

720 km2 |

4.65% |

2.80% |

1.12% |

33 Million |

3.29% |

fish & agricultural produce |

|

Vanuatu |

0.300 Millions |

114.253 VUV/US$ |

904 Millions current US$ |

12190 km2 |

2.76% |

2.60% |

2% |

40 Million |

2.90% |

fish, cocoa, medicinal plants |

|

Singapore |

5804 Millions |

1.364 SGD/US$ |

36172 Millions current US$ |

709 km2 |

0.57% |

0.73% |

3.30% |

5981 Million |

0.70% |

electronics, chemicals, machinery & equipment |

Sources: UNCTAD STAT, Trading Economics, IMF STAT, World Bank

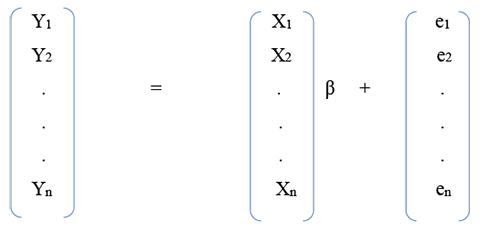

In this study, Total early-stage Entrepreneurial activity (TEA) and Established Business Ownership (EBO) data have been collected from the GEM and their respective GDP data obtained from the World Bank website. To study the impact of TEA and EBO on the economic growth, the authors used the pooled regression model (Baltagi & Griffin,1995). In this approach, the dependent variable was GDP, and the independent variables were TEA and EBO. Dielman (1983) supports this technique for analysis. Pooled regression type of model was deemed fit as it has constant coefficients representing intercepts and gradients. Therefore, the authors used this model to pool all the data and run an ordinary least squares regression model, i.e., this research method allows for estimating and summarizing relationships amongst a number of countries.

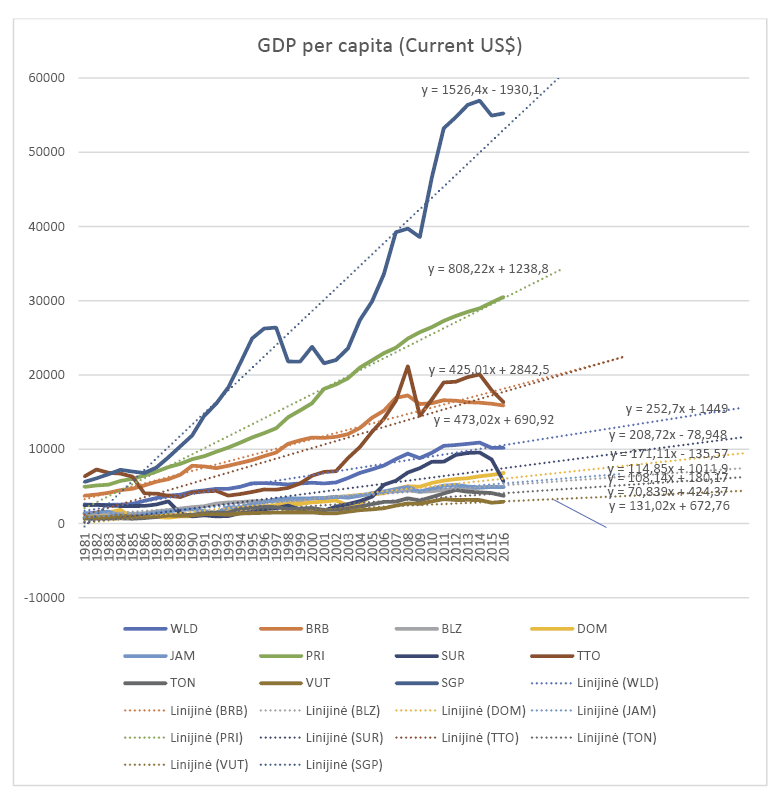

To illustrate the performance of these selected small nations, the authors gauged the propensity of GDP per capita of these nations and the World’s GDP over the period 1981 to 2016. GDP acts as a performance indicator and signifies the value of all domestically finished goods and services. In addition, the ubiquity of GDP in contemporary studies shows its relevance for inter-country comparisons. It is worth noting that where domestic currencies exist, the equivalent U.S. Dollar amounts are calculated using official annual exchange rates (World Bank, 2016). Further, formulation of a trend-line shows comparison of the small nations and the World’s average GDP. It should be noted that a trend-line is a line showing the general direction through a series of data points.

Finally, to gain more insights of other contextual factors within the entrepreneurial environment, the authors reviewed the key areas that contribute to the main differences in the entrepreneurial environments within SIDS. The focus of this section is the political/legal, socio-cultural and the technological environments with much emphasis being on the culture, education system, and entrepreneurial support elements as the main contextual factors identified. Hollensen (2020) highlights the importance of understanding the environmental characteristics of a home nation as key to setting the frame conditions for entrepreneurial activity.

4. Findings and Analysis

4.1 Analysis of Economic Factors Within the Entrepreneurial Environment

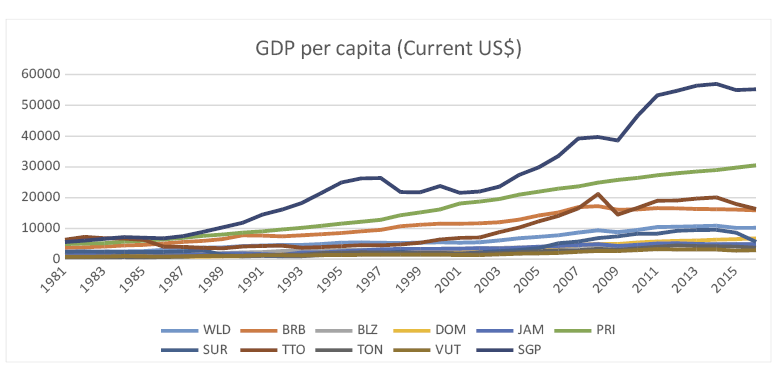

From the graphs of GDP per capita as shown in Figure 1, the SIDS like Trinidad and Tobago, Barbados, Puerto Rico and Singapore are well above the World’s average GDP per capita. While Singapore is a developed economy, Trinidad and Tobago, Barbados, and Puerto Rico are in a transformation stage and hence are viewed as emerging economies. These latter economies are noticeably moving away from a small open market system to a much more open market system as seen through their many initiatives on economic reforms, which have also influenced other non-economic reforms like education and institutional capability as discussed later. In addition to GDP per capita, the next segment highlights the Nation’s trend-line as shown in Figure 2 and the equations for the OLS as shown in Table 2.

Trinidad and Tobago, despite its size, is a recognized producer of petroleum, and this represents about 40% of GDP and 80% of the country’s exports that benefit from low input energy cost in the production of manufactured goods mainly in food and beverage. Equation 2 (Table 2) represents the trend-line observed during the period. This heavy reliance on the oil sector has proven positive for the local SME sector, as energy prices have remained low. However, should this status change, the country would need to substantially increase economic activity in sectors other than oil and gas. For instance, SMEs in tourism, agriculture, information technology, construction, and the creative industries are essential in going forward as they are leading options to drive the economy.

Barbados is a SID that is on a path of development against many odds. It has a small land size of 430 km2 and 287,000 people living within an upper-middle-income economy. The nation has three main economic drivers that include tourism, the international business sector, and foreign direct-investment. The the trend-line observed during the period is represented in Equation 3 (see Table 2). This heavy reliance on these sectors is a double-edged sword. In the good times, things are seamless, and SMEs thrive well, however, in times of contraction, these sectors consolidate and do not lead to favourable economic growth. Thus, to be sustainable, there need to be alternative options to reduce the impact of external shocks that make it difficult for future investments in the local SME sector.

Under World Bank classifications, Puerto Rico falls under a high-income economy. The main contributors to Puerto Rico’s high level of GDP per capita are due to its excellence in the manufacturing industry. The country’s main strategic clusters are in pharmaceuticals, electronics, textiles, and petrochemicals. The equation for the trend-line observed during the period is shown in Equation 4 (Table 2).

Singapore is a highly developed free-market economy that has a high level of GDP per capita. Singapore is pro-business with low taxes. Its main exports are electronics, chemicals and services (Osman‐Gani, 1999). The equation for the trend-line observed during the period is represented in Equation 5 (Table 2).

Figure 1. GDP Per Capita in SIDS (1981–2016)

Of course, these respectively high GDP numbers in the SIDS mentioned are not necessarily a reflection of development or a lack of poverty in any of the economies. Though GDP growth can make conditions right for virtuous cycles of prosperity and opportunity, under different conditions, similar rates of growth can have very different effects on development as shown in some SIDS. The rest of the SIDS including Belize, Dominican Republic, Jamaica, Suriname, Tonga, Vanuatu are below the World’s GDP.

The Belize economy has shown declines based on poor fiscal health, government inadequacies and judicial inefficiencies, due to which it has limited entrepreneurial activity. Equation 6 (Table 2) shows the trend-line observed during the period for Belize. The Dominican Republic (Equation 7, Table 2) has limited transparency, and its institutional effectiveness has challenged the capacity of new ventures to thrive (Sánchez & Senderowitsch, 2012). In addition, the inadequacies in the judicial system and laws have led to the prevalence of corruption and complications for entrepreneurs when doing business (Harper et al., 2003). In Jamaica, economic growth is constrained by weak rule of law, bureaucracy, high crime, fraud, and a high debt-to-GDP ratio (Johnson, 2014). The trend-line observed in this country during the period is represented in Equation 8. Suriname, however, faces an anaemic economic recovery, the government spending cutbacks and deficiencies in governance post the period when commodity prices fell in 2014 (Ooft, 2019). The government is severely constrained by a troublesome and disorganized regulatory framework leading to corruption. In addition, privatization has been slow and uneven (Wanjiru & Prime, 2018). Its trend-line observed during the period is represented in Equation 9. Tonga (Equation 10, Table 2) lacks fully open markets, which in turn impedes investment growth. Duncan (2016) linked the slide in growth to weak policies, limited export base, and remittance dependency. In Vanuatu, inadequate infrastructure, tariff barriers, rigid labour regulations and corruption hinder entrepreneurial activities (Henckel, 2019). The economic growth rates have been lacklustre in recent years for this economy. The trend-line observed during the period for Vanuatu is expressed in Equation 11 (Table 2).

Figure 2. Trend-lines for GDP Per Capita in SIDS (1981–2016)

In general, these economies have less favourable macroeconomic factors, such as higher inflation, poor export orientation and higher business taxes. To gauge the propensity of GDP per capita of these nations, they are compared with the World’s GDP. According to the World Bank, the 2017 nominal World’s GDP was around US$80.935 trillion, with 3.5% being the average growth rate. Equation 12 shows its trend-line observed during the period. Thus, the trend-lines for the GDP of the SIDS show upward movement with positive slope for all in comparison with the World’s GDP. However, the more affluent economies have much more positive trend-lines.

In this section we consider the model equation (1) y = a + bx, where a = intercept (at period 0); b = slope of the line; x = time period; y = forecast for demand for period x. The y-intercept of the trend-line is the point at which the trend-line has an x value of zero.

Having seen the growth of these countries with the GDP measure, the impact of TEA and EBO on the respective country’s growth provides the foundation for further testing. The Pooled Ordinary Least Squares (OLS) technique will be used to check the influence of the exogenous variable TEA on the economic growth measured using GDP. The equation for the OLS is Equation 13 (Table 2).

Table 2. Equations Representing GDP Per Capita (US$) Trend-lines and Impact of TEA on GDP

|

2) GDPTTO = 473.02x + 690.92 GDPTTO = GDP of Trinidad and Tobago, 690.92 = intercept; 473.02 = slope of the line |

3) GDPBRB = 425.01x + 2842.5 GDPBRB = GDP of Barbados, 2842.5 = intercept; |

4) GDPPRI = 808.22x + 1238.8 GDPPRI = GDP of Puerto Rico, 1238.8 = intercept; |

|

5) GDPSGP= 1526.4x – 1930.1 GDPSGP = GDP of Singapore, -1930.1= intercept; |

6) GDPBLZ = 114.85x + 1011.9 GDPBLZ = GDP of Belize, 1011.9= intercept; |

7) GDPDOM= 171.11x - 135.57 GDPDOM = GDP of Dominican Republic, -135.57 = intercept; 171.11 = slope of the line |

|

8) GDPJAM= 131.02x + 672.76 GDPJAM = GDP of Jamaica, 672.76 = intercept; |

9) GDPSUR= 208.72x - 78.948 GDPSUR = GDP of Suriname, -78.948= intercept; |

10) GDPTON= 108.14x + 180.17 GDPTON = GDP of Tonga, 180.17 = intercept; |

|

11) GDPVUT = 70.839x + 424.37 GDPVUT = GDP of Vanuatu, 424.37 = intercept; |

12) GDPWLD = 252.7x + 1449 GDPWLD = GDP of World, 1449 = intercept; |

13) GDP per capita = 28981.22 - 82.16 * TEA – 1315.40 * EBO |

In general, the model provides acceptable levels of interesting and instructive lessons. From F statistic (3.4012) one sees that Beta is not equal to zero, meaning the exogenous variable in the model is of use. The R2 value stands at 0.18, indicating that 18% of variation in GDP is described in relation to the exogenous variables in the model. The OLS result shows that the exogenous variables have a significant influence on GDP (at 5%). The estimation procedure adopts the selection of cross-section seemingly unrelated regression. In addition, to test the robustness of the standard errors, the authors look at residual diagnostics.

A pooled regression is run between the TEA and GDP per capita of selected SIDS for the selected period of five years (latest available).

GDPi,t = β0 + β1 TEAi,t + β2 EBOi,t + et equation (13)

where GDP =Gross Domestic Product, TEA = Total early-stage entrepreneurial activity, t = time, e is error term.

Or for all n groups (SIDS economies), the Pooled OLS model will be

where Y1 to Yn represent a group of endogenous or Dependent variables (GDP of selected 10 SIDS economies); X1 to Xn represent the exogenous variables (TEA of the respective SIDS economies); and e1 to en represent the exogenous variables (EBO of the respective SIDS economies).

Table 3. Summary Results of Regression Analysis and anova

|

Regression Statistics |

|

|

Multiple R |

0.424201 |

|

R Square |

0.179947 |

|

Adjusted R Square |

0.12704 |

|

Standard Error |

15164.69 |

|

Observations |

49 |

GDP per capita = 28981.22 - 82.16 * TEA – 1315.40 * EBO -----→ Equation 13

|

ANOVA |

|||||

|

|

df |

SS |

MS |

F |

Significance F |

|

Regression |

2 |

1564337740 |

7.82E+08 |

3.4012 |

0.0461 |

|

Residual |

46 |

7129000788 |

2.3E+08 |

|

|

|

Total |

48 |

8693338527 |

|

|

|

|

|

Coefficients |

Standard Error |

t Stat |

P-value |

Lower |

Upper |

Lower |

Upper |

|

Intercept |

28981.22 |

4959.08 |

5.84 |

1.91E-06 |

18867.08 |

39095.35 |

18867.08 |

39095.34 |

|

TEA |

-82.16 |

473.80 |

-0.17 |

0.863462 |

-1048.50 |

884.18 |

-1048.50 |

884.18 |

|

EBO |

-1315.40 |

898.39 |

-1.46 |

0.153215 |

-3147.68 |

516.88 |

-3147.68 |

516.88 |

The variables in Table 3 show a significant relationship among themselves, i.e., GDP with TEA and EBO among the selected SIDS. That is, the total of early-stage entrepreneurial activity and established business entrepreneurship has a negative impact on the GDP per capita for the latest five-year periods available in the GEM database. The key reason why it shows a negative impact is that the gestation period for investments is longer than the selected period of study. Thus, the results show that the SIDS investments in entrepreneurial activities are less impactful on economic growth in the short term. These entrepreneurial investments, however, in the long term may prove to be vital to the development of these small economies as entrepreneurs stick to their long-term investment plans that bolster the economy and “weather the storm” of day-to-day economy fluctuations.

In essence, some of the main themes identified concerning the variances in economic environments of the countries being analysed include differences in economic regulations and policy in each country, varying financial infrastructures, unpredictable bureaucracy and cost of adaptation of policies. These issues highlight that there is a gap from an economic standpoint between the more developed nations and the more penurious countries. The more economically disadvantaged a country remains, the bigger the struggle for an SME to thrive and prevail. Thus, the greater the constriction of the economy, the fewer chances entrepreneurs have to gain a fair and equal access to resources needed to pursue economic activity. Analysis also points to the fact that SMEs have the potential to become the engines that sustain growth for long-term development in economies like SIDS. The research shows that when economic growth becomes stronger, SMEs progressively take up the key role in enhancing industrial development and restructuring. A strong GDP and SME sector will satisfy the increasing local demand for products and services and create an opportunity for exporting. Dana et al. (2016) highlighted that planning activities within the firm to support its exporting activities is key to success in international entrepreneurship. This study strongly recommends higher adherence to strengthening GDP through SME activity and performance as a good practice. Policy makers, technical and financial support partners, entrepreneurs, and managers of SMEs may use these findings to enhance the impact and sustainability of the SME sector in SIDS.

4.2 Analysis of Non-economic Factors Within the Entrepreneurial Environment

The research has identified some non-economic contextual factors that give insights to some differences between entrepreneurial environments in SIDS that may contribute to new venture creation. This section sets out to highlight some of the main differences in entrepreneurial environments within SIDS based on the contextual factors identified: political/legal environment, socio-cultural environment and the technological environment.

4.2.1 Political/Legal Environment

This section considers the extent to which government and government policy influences entrepreneurial activity. The authors reviewed political policy and stability, supporting policies, and regulations as the major issues affecting the entrepreneurial environment. For this research, political stability delineates the existence of a predictable political environment, capable of attracting local and international investment to spur entrepreneurial activity. This stems from previous works relating political stability to the ability to facilitate market activities, productivity and labour relations (Landa & Kapstein, 2001), and investment levels (Feng 2001). Baldacchino and Milne (2000) highlighted that small island states need to preserve their endogenous local capacities of law, policy and culture as a means of mitigating against external shocks of the entrepreneurial environment. Research by Armstrong and Read (2000) has identified that dependent colonies flourished more than independent colonies when it came to quelling the effects of outside shocks. Further, Armstrong and Read (2000) suggest that smaller economies are quicker to adapt to change, as they are more flexible and less complex. Other researchers have also found that political stability affects the long term economic performance of a nation, thus indicating that more stable economies tend to exhibit more political stability and vice versa (Srebrnik, 2000).

Entrepreneurs need technical support and other advisory services in order to turn their new ventures or existing businesses into successful businesses. From an entrepreneurial support element perspective, the context of policies, programs and initiatives are required to facilitate a range of support services to varying types of entrepreneurs at differing stages. In the Caribbean, Chambers of Commerce and Small Business Development Centres help support entrepreneurs at many stages of development. The purpose of these agencies is to promote entrepreneurship and build capacity through offering technical assistance as stated by Brown (1997). There is also a push towards Youth Entrepreneurship development, which spurs entrepreneurship among young school leavers in the Caribbean. Devonish et al. (2010) point out that most countries have a Youth Business Trust, and the Region has a Caribbean Group of Youth Business Trusts. At the University of the West Indies, mthere are co-curricular courses; for instance, Student Entrepreneurial Empowerment Development (SEED) allows students to learn from the experiences of entrepreneurs and technical assistance agencies. The aim of this and other similar initiatives is to produce a business plan (Pounder, 2014). In the Pacific Rim, especially in Tonga and Vanuatu, much of the support focuses on disadvantaged groups like women, agriculturalist, indigenous persons and youth. Wonglimpiyarat (2016), in her research in South East Asia, displayed the benefits Singapore has that focus on powerful network linkages with Silicon Valley and effective innovation policies in spurring entrepreneurial success. Such network interaction with other entrepreneurs plays a notable role in joint opportunity projects at all stages of development. In addition, access to resources, information, raw materials and facilities is also part of these dynamic interactions pursued by Singapore. Wegner et al. (2016) emphasise the significance of network governance mechanisms in strengthening cooperative relationships and minimizing competitive difficulties.

4.2.2 Socio-Cultural Environment

This section sets out to consider the cultural forces and social values that affect the entrepreneurial environment. The authors review possible emerging trends in supporting entrepreneurial culture, education system, and general shared values.

Culture is a set of enduring values within nations or organizations. Mitchell et al. (2002) suggest that culture is unique to countries as differing values and beliefs affect individuals’ entrepreneurial intentions in different ways. In general, SIDS recognize the importance of culture and its influence on advancing entrepreneurship. From a cultural context, Bosma et al. (2008) and Devonish et al. (2010) revealed that the middle and low-income economies in the Caribbean display early-stage entrepreneurial activity at high rates. Further, these studies showed that the owners of early-stage entrepreneurial activity had lower expectations for individual business growth going forward. In the Caribbean, the folklore suggests that entrepreneurial opportunities are lacking, and this has stemmed from the culture highlighting extreme amounts of red tape surrounding starting a business, difficulty of accessing capital and limited tax benefits. The Caribbean region countries like Barbados, Belize, Dominican Republic, Jamaica, Suriname, and Trinidad and Tobago exhibit varying forms of these cultural aspects curtailing opportunities for new venture creation. However, as a US territory in the Caribbean, Puerto Rico is the least affected of the SIDS by such a culture, as it is common to accept failure as a part of the new venture creation process. Cave et al. (2007) state that historically the majority of indigenous cultures and values in the Pacific region have suffered forms of marginalization at the hands of colonialism and other forces of standardization of the modern world. This compels entrepreneurs from aboriginal or minority groups to operate in the informal sectors and earn lower wages. Therefore, just like the other cultures within the Pacific, Tonga and Vanuatu continue to change and evolve with time and generation thus influencing the entrepreneurial intentions. In contrast, in South East Asia, where Singapore is located, values of the South East Asians are more inclined to spur entrepreneurial drive and dynamism than those of the other societies and cultures. Many scholars like Chen (2001) and Redding (2005) have investigated the distinctive traits in South East Asian cultures that are essential ingredients and the ‘spirit’ that drives new venture creation. These studies on South EastmAsian cultures highlight the role of family, guanxi (connections) and ethnicity. Bhasin (2007) highlighted new steps explored by the Singapore administration to spur entrepreneurship through creating a culture that encourages exploring unforeseen opportunities.

The education system is the process of facilitating learning or the acquisition of knowledge, skill sets and abilities that a person must possess in order to perform specific functions. From an education system perspective, the Caribbean governments have leveraged educational and training programs to enhance entrepreneurship. Jones and English (2004, p. 416) conceptualize entrepreneurship education as “the process of providing individuals with the ability to recognise commercial opportunities and the insight, self‐esteem, knowledge and skills to act on them”. Invariably, in the Caribbean, the entrepreneurship education offered incorporates a heterogeneous assortment of interventions, comprising formal academic education and informal stand-alone training programs. These interventions aim at stimulating entrepreneurship intentions as well as supporting entrepreneurs already engaged in entrepreneurial activities. Based on academia, Pounder (2016, p. 96) highlights a “repertoire of proven soft-skill approaches that have been successfully implemented strategically by entrepreneurship teachers in the Caribbean”. The informal training usually comes in a form of workshops hosted by various government ministries, non-governmental organizations and international organizations. The goal of such training focuses on satisfying a small cohort in need of a special skill set. However, such workshops have been ineffective as persons query governments’ ability to offer training in areas that they have failed to master. In the Pacific Region, Cheung and Au (2010) discussed the status of entrepreneurship education programs at secondary schools and highlighted gaps in the system as well as provided suggestions for improvement. Tonga and Vanuatu place emphasis in the technical and vocational areas of training with apprenticeship programs. In South East Asia, Singapore has adopted a unique entrepreneurial model within its university system. The role of the National University of Singapore has aimed at stimulating growth to the economy through research, technology, and high-tech spin-offs (Wong et al., 2011). Singapore shows a more superior education system to other SIDS in this research. Fosu et al. (2020, p. 10) advocate that “education has been a major priority of the Singaporean government for long-term economic gains”. The more advanced of these nations like Singapore and Puerto benefit from knowledge networks and scientific mobility, as recognized by Trippl (2013) and Vale et al. (2013), as key anchors in regional business development.

4.2.3 Technological Environment

This section considers the technological development and adaptation that could influence entrepreneurial activity. The authors review emerging technologies, automation, research and development. Rodríguez-Pose et al. (2008) and Rigby (2015) point out technological relatedness in regional spaces and the positive effect on R&D and spin-offs. Mazzucato (2013) maintains that not enough information exists about the government policy reform and technology research investment, and this has undermined the link between entrepreneurship and technological development. Lafuente et al. (2019) highlight that by following the Kirznerian model, entrepreneurial activity benefits economies in the move to achieve equilibrium through the adaptation of the best technology frontier available. Further, Lafuente et al. (2019) suggest that appropriate adaptation of technology will enhance entrepreneurial activity. Schofer et al. (2000) highlight GDP and trade openness as fundamental to spurring a technological sound environment for economic growth. Waguespack et al. (2005) suggest there is a fundamental relationship between political institutions and technology development.

5. Concluding Discussion

In this research, we advanced the understanding of entrepreneurial activity in SIDS based on the local and regional context. The preliminary results provide evidence to the advancement of the field of entrepreneurship in small island economies in their quest to rationalize themselves as emerging economies. The research highlights that the success of new venture creation correlates with gross domestic product (GDP). In general, GDP is a monetary measure that represents economic production and growth, and this research has shown that there is an inter-linkage to total entrepreneurial activity. That is, early stage entrepreneurship and established business entrepreneurship affect GDP. When a country’s real GDP is stable or increasing, entrepreneurial ventures thrive better and enhance the spending cycle through increased hiring of employees and higher wages. Under such conditions, spending power goes up as well. The research highlights that entrepreneurship is essential for economic growth. It further shows that the contribution of entrepreneurship to economic growth varies among the SIDS with differing levels of economic development. This situation is noticeable when comparison of trend-lines among nations and the World’s GDP average is made (see Figure 2). In this regard, results of the paper confirm that the total early-stage entrepreneurial activity has an impact on the GDP per capita as shown by earlier research by Acs et al. (2005) and later by Acs et al. (2012). The GDP trend-lines are positive with many of the SIDS like Trinidad and Tobago, Barbados, Puerto Rico and Singapore being above average when compared to the world GDP and TEA averages. This result is however contrary to earlier research by Van Stel et al. (2005), which highlighted that TEA negatively affects the economic growth in countries where GDP levels are lower (as observed by SIDS). The results show the slope of the World GDP average to be 252.7 and the slopes of the SIDS explored to range from as large as 70.839 (Vanuatu) to 1526.4 (Singapore). This wide range highlights the importance of local context and externalities in addressing the relationships between entrepreneurship and the economy as supported by Glaeser et al. (2014). The differing policies towards entrepreneurship within SIDS is a distinguishing factor in influencing entrepreneurial behaviour as supported by Wennekers et al. (2005). The results show that Singapore is the strongest with TEA positively affecting economic growth. Van Stel et al. (2005) support this finding and find that TEA index positively affects the growth and development of countries with high-income levels. In addition, Singapore’s recognition as a highly developed free-market economy with a dynamic income distribution gives rise to the strong economic system that reassures entrepreneurship, as supported by Lim (1983) and Martin et al. (2010). The research shows that Singapore is a best practice and potential model to follow as lessons learned within the country offer a path to expanding the entrepreneurial activity. It is a good example for less-developed SIDS, based on policies that led them on the path of development against all odds (Fosu et al., 2020). Noticeably, industries requiring tech innovations have excelled in Singapore’s macroeconomic environment. Hessels et al. (2013) promote keeping up with tech trends to transform industries. In comparison with the South East Asian state of Singapore, the entrepreneurs of the Caribbean and Pacific Regions researched in this paper lag behind in dynamism. The appropriateness of implementing such strategic agendas as formulated by Singapore would need tailoring for less-developed economies. The main contextual factors within the Entrepreneurial Environment that highlighted this shortcoming include culture, the education spending, and entrepreneurial support elements. Culture is a key component in business and has an impact on the way the SIDS do business. The country with the strongest entrepreneurial culture was Singapore (a developed economy) and the second strongest was Puerto Rico (an emerging economy). The main reasons supporting this strong culture were that in these SIDS, persons were pro-risk and ambitious to grow their ventures (Osman‐Gani, 1999). The smaller economies in the Caribbean and Pacific Region had a higher fear of failure. In addition, the culture of these economies does not adhere to openness to pursuing entrepreneurial endeavours as proposed by Burnett et al. (2017) and Wennecke et al. (2019). Recognizing that openness is a characteristic that favours emerging economies, it is one of the factors that limits these smaller Caribbean and Pacific Region economies from reaching this stage.

Further contextual differences show that though many of the SIDS in the Caribbean act in similar ways, the SIDS (Barbados, Puerto Rico, and Trinidad and Tobago) with bigger GDP have more entrepreneurial support initiatives in place (Devonish et al., 2010). Additionally, the SIDS (Belize, Dominican Republic, Jamaica and Suriname) with smaller GDP (see Table 1) have lower education spending per capita than the SIDS with bigger GDP. These nation state characteristics have placed the SIDS with bigger GDP in a stronger mode for transitioning as emerging economies. The SIDS in the Pacific Region (Tonga and Vanuatu) have the least developed economies. The research highlights that Tonga and Vanuatu have minimum education spending per capita to develop their educational system and an inadequate entrepreneurial support system to spur new venture creation. Such SIDS with low spending on education and technical support lack dynamism in their educational system and entrepreneurial support system. Thus, they require a new or amended set of policies designed to promote entrepreneurial activity (Danson et al., 2014). Singapore is a country that adopts good practice, so other less-developed SIDS can consider adapting comparable initiatives as a pathway towards increasing entrepreneurial activity. However, more investigation of the varying types of combinations of both economic factors and contextual differences is required to assess possible new venture creation in a regional setting.

A limitation of this research is that a small number of current and consecutive observations readily available in the data set inhibited the analysis undertaken as the authors used the latest five-year periods available in the GEM database. Generally, SIDS have insufficient resources to ensure data quality and standard that is desirable, however, GEM offers support in this regard. From the standpoint of GDP, a shortcoming is that entrepreneurial activity in SIDS includes the underground economy, black market and the informal sector that are not fully captured in such an economic indicator. Future research should ideally use data for more SIDS and longer time series.

References

Acs, Z. (2006). How is entrepreneurship good for economic growth? Innovations, 1(1), 97-107.

Acs, Z., & Varga, A. (2005). Entrepreneurship, agglomeration and technological change. Small Business Economics, 24(3), 323–334.

Acs, Z., Audretsch, D., Braunerhjelm, P., & Carlsson, B. (2012). Growth and entrepreneurship. Small Business Economics, 39, 1–12.

Ajzen, I. (1991). Theory of planned behaviour. Organizational Behavior and Human Decision Processes, 50(2), 179–211.

Alvarez, C., Amoros, J. E., & Urbano, D. (2014). Regulations and Entrepreneurship: Evidence from Developed and Developing Countries. Innovar, 24, 81–89.

Anderson, A. R. (2000). Paradox in the periphery: An entrepreneurial reconstruction? Entrepreneurship and Regional Development, 12(2), 91–109.

Armstrong, H. W., & Read, R. (2000). Comparing the Economic Performance of Dependent Territories and Sovereign Microstates. Economic Development and Cultural Change, 48, 285–306.

Audretsch, D. B. (2007). The Entrepreneurial Society. Oxford: Oxford University Press.

Baldacchino, G. (2006). Islands, Island Studies, Island Studies Journal. Island Studies Journal, 1(1), 3–18.

Baldacchino, G., & Bertram, G. (2009). The beak of the finch: Insights into the economic development of small, often island economies. The Round Table: Commonwealth Journal of International Affairs, 98(401), 141–160.

Baldacchino, G., & Fairbairn, T. O. I. (2006). Entrepreneurship and small business development in small islands. Journal of Small Business & Entrepreneurship, 19(4), 331–340.

Baldacchino, G., & Milne D. (Eds.) (2000). Lessons from the Political Economy of Small Islands: The Resourcefulness of Jurisdiction. Basingstoke: Macmillan.

Baltagi, B. H., & Griffin, J. M. (1995). A dynamic demand model for liquor: The case for pooling. The Review of Economics and Statistics, 77(3), 545–554.

Baumol, W. (2002). The free-market innovation machine: Analyzing the Growth Miracle of Capitalism. Princeton: Princeton University Press.

Berglund, K., & Johansson, A. W. (2007). Entrepreneurship, discourses and conscientization in processes of regional development. Entrepreneurship and Regional Development,19(6), 499–525.

Bhasin, B. (2007). Fostering entrepreneurship: Developing a risk-taking culture in Singapore. New England Journal of Entrepreneurship, 10(2), 39–50. https://doi.org/10.1108/NEJE-10-02-2007-B004

Booth, P., Chaperon, S. A., Kennell, J. S., & Morrison, A. M. (2020). Entrepreneurship in island contexts: A systematic review of the tourism and hospitality literature. International Journal of Hospitality Management, 85, 102438.

Bosma, N., Acs, Z. J., Autio, E., Coduras, A., & Levie, J. (2008). Global Entrepreneurship Monitor. 2008 Executive Report. https://www.researchgate.net/profile/Erkko-Autio/publication/242418966_2008_Executive_Report/links/0a85e52fceb1513e59000000/2008-Executive-Report.pdf. Accessed 20 June 2019.

Brown, D. (1997). Sustainability Is Not about Money!: The Case of the Belize Chamber of Commerce and Industry. Development in Practice, 7(2), 185–189. http://www.jstor.org/stable/4028896. Accessed 25 June 2019

Burnett, K. A., & Danson, M. (2017). Enterprise and entrepreneurship on islands and remote rural environments. The International Journal of Entrepreneurship and Innovation, 18(1), 25–35.

Bygrave, W. D., & Minniti, M. (2000). The social dynamics of entrepreneurship. Entrepreneurship Theory and Practice, 24(3), 25–36.

Caputo A., Methtap, S., Pellegrini, M., Al Refai, R. (2016). Supporting Opportunities for Female Entrepreneurs in Jordan. International Journal of Entrepreneurship and Small Business, 27(2-3), 384–409.

Cave, J., Ryan, C., & Panakera, C. (2007). Cultural tourism product: Pacific island migrant perspectives in New Zealand. Journal of Travel Research, 45(4), 435–443. https://doi:10.1177/0047287506295908

Chen, Ming-Jer. (2001). Inside Chinese business: A Guide for Managers Worldwide. Boston, Massachusetts: Harvard Business School.

Cheung, C. K., & Au, E. (2010). Running a small business by students in a secondary school: Its impact on learning about entrepreneurship. Journal of Entrepreneurship Education, 13, 45–64.

Dana, L. P., Grandinetti, R., & Mason, M. C. (2016). International entrepreneurship, export planning and export performance: Evidence from a sample of winemaking SMEs. International Journal of Entrepreneurship and Small Business, 29(4), 602–626.

Danson, M., & Burnett, K. (2014). Enterprise and Entrepreneurship on Islands. In C. Henry & G. McElwee (Eds.), Exploring Rural Enterprise: New Perspectives on Research, Policy & Practice (pp. 151–174). Bingley: Emerald Group Publishing Ltd.

Devonish, D., Alleyne, P., Charles-Soverall, W., Marshall, A. Y., & Pounder, P. (2010). Explaining entrepreneurial intentions in the Caribbean. International Journal of Entrepreneurial Behaviour and Research, 16(1), 149–171.

Dielman, T. E. (1983). Pooled cross-sectional and time series data: A survey of current statistical methodology. The American Statistician, 37(2), 111–122.

Duncan, R. (2016). Sources of growth spurts in Pacific island economies. Asia & the Pacific Policy Studies, 3(2), 351–365.

Fellman, K., Kinnunen, J., Lindström, B., & Palmer, R. (2015). 4 Pathways to Successful Entrepreneurship in Small Island Economies. In G. Baldacchino (Ed.), Entrepreneurship in Small Island States and Territories (pp. 65–82). UK: Routledge.

Feng, Y. (2001). Political freedom, political instability, and policy uncertainty: A study of political institutions and private investment in developing countries. International Studies Quarterly, 45, 271–294.

Fosu, A. K., & Gafa, D. W. (2020). Development Strategies for the Vulnerable Small Island Developing States (SIDS). Department of Economics Working Paper Series (2020-73), University of Pretoria. South Africa.

Gaglio, C. M. (2004). The role of mental simulations and counterfactual thinking in the opportunity identification process. Entrepreneurship Theory and Practice, 28(6), 533–552.

Galindo, M. A., & Mendez-Picazo, M. T. (2013). Innovation, entrepreneurship and economic growth. Management Decision, 51(3), 501–514.

Glaeser, E. L., Ponzetto, G., & Tobio, K. (2014). Cities, Skills and Regional Change. Regional Studies, 48, 7–43.

Grydehøj, A. (2011). Making the most of smallness: Economic policy in microstates and subnational island jurisdictions. Space and Polity, 15(3), 183–196.

Grydehøj, A. (2014). Guest Editorial Introduction: Understanding Island Cities. Island Studies Journal, 9(2), 183–190.

Harper, D., Aycinena, D., & Marroquín, A. (2003). Extending the Analysis: Dominican Republic – An Assessment of the USAID Investors Roadmap and an Alternative New Institutional Economics Perspective on the Barriers to Entrepreneurship. Forum Series on the Role of Institutions in Promoting Economic Growth, Washington DC: USAID.

Hayton, J. C., George, G., & Zahra, S. (2002). National culture and entrepreneurship: A review of behavioural research. Entrepreneurship: Theory and Practice, 26(4), 33–52.

Henckel, T. (2006). Vanuatu’s economy: Is the glass half-empty or half-full? Pacific Economic Bulletin, 21(3), 1–20.

Herrington, M., Kew, J., & Kew, P. (2010). Tracking Entrepreneurship in South Africa: A GEM Perspective [online]. http://www.gsb.uct.ac.za/files/Gembook2009.pdf. Accessed 10 June 2019.

Hessels, J., van der Zwan, P., & Sanders, M. (2013). Entrepreneurial activity, industry orientation, and economic growth. Scales Research Reports No H201307, EIM Business and Policy Research.

Hodges, H. E., & Kuratko, D. (2004). Entrepreneurship Theory Process and Practice (6th ed.). Canada: South-Western College Publication.

Hofstede, G., Nooderhaven, N. G., Thurik, A. R., Uhlander, L. M., Wennekers, A. R., & Windelman, R. E. (2004). Culture’s role in entrepreneurship: Self-employment out of dissatisfaction. In T. E. Brown & J. Ulijn (Eds.), Innovation, Entrepreneurship and Culture: The Interaction Between Technology, Progress and Economic Growth (pp.162–203). UK: Elgar Publishing Inc.

Holcombe, R. G. (1998). Entrepreneurship and Economic Growth. Quarterly Journal of Austrian Economics, 1(2), 45–62.

Hollensen, S. (2020). Global Marketing (8th ed.). Harlow: Pearson.

Ireland, R. D., & Webb, J. W. (2007). A cross-disciplinary exploration of entrepreneurship research. Journal of Management, 33(6), 891–927.

Johnson, H. N. (2014). Jamaica: A famous, strong but damaged brand. Place Branding and Public Diplomacy, 10(3), 199–217.

Jones, C., & English, J. (2004). A contemporary approach to entrepreneurship education. Education + Training, 46(8/9), 416-423.

Lafuente, E., Ács, Z. J., Sanders, M., & Szerb, L. (2019). The global technology frontier: Productivity growth and the relevance of Kirznerian and Schumpeterian entrepreneurship. Small Business Economics, 55, 153–178.

Landa, D., & Kapstein, E. B. (2001). Review Article: Inequality, Growth and Democracy. World Politics, 53(1), 264–96.

Leung, K.-Y., Lo, C.-T., Sun, H., & Wong, K.-F. (2012). Factors influencing engineering students’ intention to participate in on-campus entrepreneurial activities. Journal of Entrepreneurship Education, 15, 1–20.

Li, H., Yang, Z., Yao, X., Zhang, H, & Zhang, J. (2012). Entrepreneurship, private economy and growth: Evidence from China. China Economic Review, 23, 948–961.

Lim, L. (1983). Singapore’s Success: The Myth of the Free Market Economy. Asian Survey, 23(6), 752–764.

Martin, M., Picazo, M.,& Navarro, J. (2010). Entrepreneurship, income distribution and economic growth. International Entrepreneurship and Management Journal, 6(2), 131–41.

Martinelli, A. (2004). The social and institutional context of entrepreneurship. In G. Corbetta, M. Huse, & D. Ravasi (Eds.), Crossroads of entrepreneurship (pp. 53–73). New York: Springer.

Mazzucato, M. (2013). The Entrepreneurial State: Debunking the Public vs. Private Myth in Risk and Innovation. London: Anthem.

Meccheri, N., & Pelloni, G. (2006). Rural entrepreneurs and institutional assistance: An empirical study from mountainous Italy. Entrepreneurship & Regional Development, 18(5), 371–392.

Mitchell, R., Smith, J. B., Morsem, E. A., Seawright, K., Peredo, A. M., & McKenzie, B. (2002). Are entrepreneurial cognitions universal? Assessing entrepreneurial cognitions across cultures. Entrepreneurship Theory and Practice, 26(4), 9–32.

Morris, M., Webb, J., Fu, J., & Singhal, S. (2013). A competency-based perspective on entrepreneurship education: Conceptual and empirical insights. Journal of Small Business Management, 51, 352–369.

Ooft, G. D. M. (2019). Inflation and economic activity in Suriname. Journal of Economics Library, 6(3), 168–185.

Osman-Gani, A. M., & Toh, T. S. (1999). International Business Competitiveness of Asia-Pacific Countries: A Singapore Perspective. Competitiveness Review, 9(1), 1–8.

Porter, M., Sachs, J., & McArthur, J. (2002). Executive summary: Competitiveness and stages of economic development. In M. Porter, J. Sachs, P. K. Cornelius, J. W. McArthur, & K. Schwab (Eds.), The Global Competitiveness Report 2001–2002 (pp. 16–25). New York: Oxford University Press.

Pounder, P. (2014). Teaching entrepreneurship: Insights into the students of the SEED programme and their perceptions of its non-traditional facilitation. Caribbean Teaching Scholar, 4(1), 39–50.

Pounder, P., (2016). Entrepreneurship Education in the Caribbean: Learning and Teaching Tools. Brock Education Journal, 26(1), 83–101.

Ratten, V. (2014). Future research directions for collective entrepreneurship in developing countries: A small and medium-sized enterprise perspective. International Journal of Entrepreneurship and Small Business, 22(2), 266–274.

Redding, G. (2005). The thick description and comparison of societal systems of capitalism. Journal of International Business Studies, 36(2), 123–155.

Reynolds, P. D., Camp, S. M., Bygrave, W. D., Autio, E., & Hay, M. (2002). Global Entrepreneurship Monitor, 2001 Executive Report. Wellesley, MA/London, UK/Kansas City, MO: Babson College/ London Business School/ Kauffman Center for Entrepreneurial Leadership.

Reynolds, P. D., Hay, M., Bygrave, W. D., Camp, S. M. & Autio, E. (2000). GEM 2000 Executive Report. Kansas, MO: Kauffman Foundation.

Rigby, D. (2015). Technological relatedness and knowledge space. Entry and exit of US cities from patent classes. Regional Studies, 49(11), 1922-1937.

Rodríguez-Pose, A., & R. Crescenzi (2008). R&D, spillovers, innovation systems and the genesis of regional growth in Europe. Regional Studies, 41, 51-67.

Roper, S., & Love, J. H. (2002). Innovation and export performance: Evidence from the UK and German manufacturing plants. Research Policy, 31(7), 1087–1102.

Saffu, K. (2003). The Role and Impact of Culture on South Pacific Island Entrepreneurs. International Journal of Entrepreneurial Behaviour and Research, 9(2), 55–73.

Sánchez, J. (2013). The impact of an entrepreneurship education program on entrepreneurial competencies and intention. Journal of Small Business Management, 51, 447–465.

Sánchez, M. E., & Senderowitsch, R. (2012). The Political Economy of the Middle Class in the Dominican Republic: Individualization of Public Goods, Lack of Institutional Trust and Weak Collective Action Policy (Research Working Paper 6049). Washington DC: World Bank.

Schofer, E., Ramirez, F. O., Meyer, J. W. (2000). The effects of science on national economic development, 1970–1990. American Sociological Review, 65(6), 866–887.

Schramm, C. J. (2006). The Entrepreneurial Imperative. New York: Harper Collins.

Shleifer, A. (2005). Understanding Regulation. European Financial Management, 11(4), 439–451.

Srebrnik, H. F. (2000). Identity, culture and confidence in the global economy. In G. Baldacchino & D. Milne (Eds), Lessons from the Political Economy of Small Islands: The Resourcefulness of Jurisdiction (pp. 56 – 71). Basingstoke: Macmillan.

Stephan, U., & Roesler, U. (2010). Health of entrepreneurs versus employees in a national representative sample. Journal of Occupational and Organizational Psychology, 83, 717–738.

Stephen, F. H., Urbano, D., & van Hemmen, S. (2005). The impact of institutions on entrepreneurial activity. Managerial & Decision Economics, 26(7), 413–419. https://doi/10.1002/mde.1254.

Stephen, F., Urbano, D., & van Hemmen, S. (2009). The responsiveness of entrepreneurs to working time regulations. Small Business Economics, 32(3), 259-276.

Szerb L, Acs, Z., Autio, E., Ortega-Argiles, R., & Komlosi, E. (2013). REDI: The Regional Entrepreneurship and Development Index – Measuring regional entrepreneurship. Final Report. http://ec.europa.eu/regional_policy/sources/docgener/studies/pdf/regional_entrepreneurship_development_index.pdf. Accessed 24 April 2019.

Tan, T-M., Tan, W.-L. and Young, J. L. (2000). Entrepreneurial infrastructure in Singapore: Developing a model and mapping participation. Journal of Entrepreneurship, 9(1), 1–33.

Todtling, F., & Wanzenbock, H. (2003). Regional differences in structural characteristics of start-ups. Entrepreneurship & Regional Development, 15(4), 351–370.

Trippl, M. (2013). Scientific mobility and knowledge transfer at the interregional and intraregional level. Regional Studies, 47(10), 1653–1667.

Trettin, L., & Welter, F. (2011). Challenges for spatially oriented entrepreneurship research. Entrepreneurship & Regional Development, 23(7/8), 1–28.

Urbano, D. & Aparicio, S. (2016). Entrepreneurship capital types and economic growth: International evidence. Technological Forecasting and Social Change, 102(C), 34-44.

Vale, M., & Carvalho, L. (2013). Knowledge networks and processes of anchoring in Portuguese biotechnology. Regional Studies, 47, 1018–1033.

Valliere, D., & Peterson, R. (2009). Entrepreneurship and economic growth: evidence from emerging and developed countries. Entrepreneurship and Regional Development, 21(5), 459–480.

van Stel, A., Carree, M., & Thurik, R. (2005). The Effect of Entrepreneurial Activity on National Economic Growth. Small Business Economics, 24, 311–321.

van Stel, A., Storey, D., & Thurik, R. (2007). The Effect of Business Regulations on Nascent and Young Business Entrepreneurship. Small Business Economics, 28, 171–186.

Waguespack, D. M., Birnir, J. K., & Schroeder, J. (2005). Technological development and political stability: Patenting in Latin America and the Caribbean. Research Policy, 34, 1570–1590.

Wanjiru, R., & Prime, K. (2018). Institutions, economic growth and international competitiveness: A regional study. In Contemporary Issues in International Business. The Academy of International Business (pp. 99–124). UK: Palgrave MacMillan.

Wegner, D., & Koetz, C. (2016). The influence of network governance mechanisms on the performance of small firms. International Journal of Entrepreneurship and Small Business, 27(4), 463–479.

Wennecke, C. W., Jacobsen, R. B., & Ren, C. (2019). Motivations for Indigenous island entrepreneurship: Entrepreneurs and behavioral economics in Greenland. Island Studies Journal, 14(2), 43–60.

Wennekers, S., Stel van A., Thurik, R., & Reynolds, P. D. (2005). Nascent entrepreneurship and the level of economic development. Small Business Economics, 24(3), 293–309.

Wennekers, S., Stel van, A., Carree, M., & Thurik, R. (2010). The relationship between entrepreneurship and economic development: Is it U-shaped? Foundations and Trends in Entrepreneurship, 6(3), 167–237.

Winegarden, W. (2019). Breaking Down Barriers to Opportunity #1 – Incenting an Entrepreneurial Society: A Regulatory Perspective. Pacific Research Institute. https://www.pacificresearch.org/wp-content/uploads/2019/04/Entrepreneurship1_fweb.pdf. Accessed 02 March 2020.

Wonglimpiyarat, J. (2016). The Role of Equity Financing to Support Entrepreneurship in Asia. The Experience of Singapore and Thailand. Technovation, 33(4–5): 163–171.

Wong, P. K., Ho, Y. P., & Autio, E. (2005). Entrepreneurship, innovation and economic growth: Evidence from GEM data. Small Business Economics, 24(3), 335–350.

Wong, P. K., Ho, Y. P., & Singh, A. (2011). Towards a ‘Global knowledge enterprise’: The entrepreneurial university model of the National University of Singapore. In P. K. Wong (Ed.), Academic Entrepreneurship in Asia: The Role and Impact of Universities in National Innovation Systems (pp. 165–198). Cheltenham: Edward Elgar.

World Bank, World Development Indicators. (2016). World Bank national accounts data, and OECD National Accounts [Data file]. Retrieved from https://data.worldbank.org/indicator/NY.GDP.MKTP.CD