Organizations and Markets in Emerging Economies ISSN 2029-4581 eISSN 2345-0037

2021, vol. 12, no. 2(24), pp. 258–284 DOI: https://doi.org/10.15388/omee.2021.12.56

Economic Consequences of Covid-19 Pandemic: An Analysis of Exchange Rate Behaviour

Maheswar Sethi (corresponding author)

Department of Commerce, Berhampur University, India

maheswar.sethi1989@gmail.com

https://orcid.org/0000-0002-7456-9203

Sakti Ranjan Dash

Department of Commerce, Berhampur University, India

shaktiranjan.srd@gmail.com

https://orcid.org/0000-0002-6423-2906

Rabindra Kumar Swain

Department of Commerce, Utkal University, India

rabindraswain2@gmail.com

https://orcid.org/0000-0001-8434-3817

Seema Das

Department of Commerce, Berhampur University, India

dasseema275@gmail.com

https://orcid.org/0000-0002-5148-5699

Abstract. This paper examines the effect of Covid-19 on currency exchange rate behaviour by taking a sample of 37 countries over a period from 4th January 2020 to 30th April 2021. Three variables, such as daily confirmed cases, daily deaths, and the world pandemic uncertainty index (WPUI), are taken as the measure of Covid-19. By applying fixed-effect regression, the study documents that the exchange rate behaves positively to the Covid-19 outbreak, particularly to daily confirmed cases and daily deaths, which implies that the value of other currencies against the US dollar has been depreciated. However, the impact of WPUI is insignificant. On studying the time-varying impact of the pandemic, the study reveals that the Covid-19 has an asymmetric impact on exchange rate over different time frames. Further, it is observed that though daily confirmed cases and daily deaths show a uniform effect, WPUI puts an asymmetric effect on the exchange rate owing to the nature of economies.

Keywords: Covid-19 pandemic; economic disruption; uncertainty; exchange rate; asymmetric effect

Received: 27/2/2021. Accepted: 11/10/2021

Copyright © 2021 Maheswar Sethi, Sakti Ranjan Dash, Rabindra Kumar Swain, Seema Das. Published by Vilnius University Press. This is an Open Access article distributed under the terms of the Creative Commons Attribution Licence, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

1. Introduction

It was 31st December 2019 when the World Health Organization (WHO) became aware of the spread of pneumonia-like disease in the Wuhan city of China. On 7th January 2020, the Chinese authority identified such a disease as Novel Corona Virus (Covid-19). WHO declared it as a pandemic on 11th March 2020. As of 30th April 2021, the virus had already reached more than 200 countries with 150,125,783 confirmed cases and 3,159,547 death cases globally1. The effect of the virus has been severely felt by countries such as China, France, Russia, South Africa, Brazil, Italy, India, the United Kingdom, Spain, and the United States. Though the world has witnessed many epidemics like the Plague, Ebola, Zika, Lassa fever, etc., the scale and growth speed of Covid-19 makes it unique among them. WHO has termed it the most severe pandemic in the last 100 years, and in line with this, Gates (2020) also termed it “the once-in-a-century-pathogen”.

The pandemic has created not only a health crisis but also an economic and social crisis across the globe. The economic activities at the national and global level are at a standstill as the spread of the virus disrupted the movement of people and goods. The imposition of lockdown and social distancing norms encompassing suspension in the movement of people and goods within the national boundaries has led to demand-supply mismatch and has disrupted the national supply chain. Many enterprises have also been negatively affected by government restrictions such as the imposition of lockdown and social distancing (Ceylan et al., 2020). The major socio-cultural events and their supporting events have been suspended in the social sphere, further affecting economic activities. At the global level, the suspension of economic activities such as international travel, tourism, export, import, etc., has dramatically affected the global supply chain resulting in economic damage. As a consequential effect, Covid-19 has significantly affected the extent of social behaviour, income, consumption, spending pattern, travel habits, supply chains with a sequential impact on lifestyle, markets, and economy across the globe. These chains of effects show how the Covid-19 emanated as a health hazard and spiralled into the economic sphere of the countries.

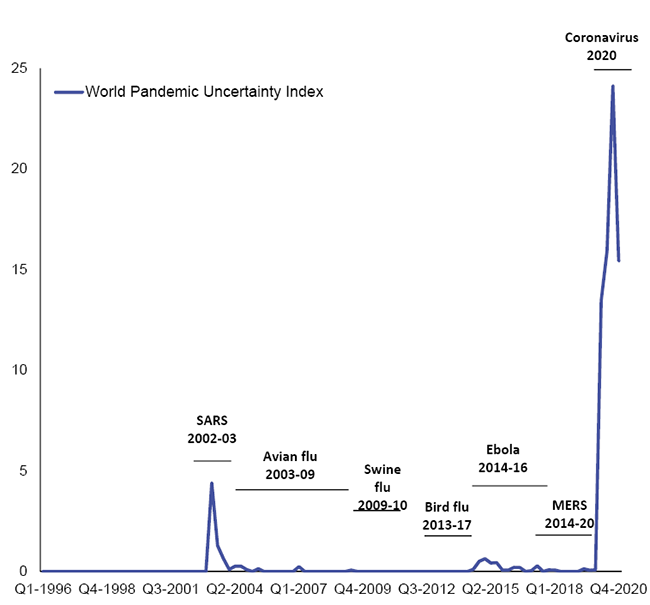

The consequence of the global financial crisis in 2009 was so severe that it led to massive structural changes in the financial and commodity market, causing an asymmetric effect on portfolio allocation, market efficiency, and volatility (Rapach & Strauss, 2014). While Nwosa (2021) documents that Covid-19 has a more adverse effect on the market than the 2009 global recession. The Covid-19 pandemic disrupted all spheres of human beings creating uncertainty around the globe as it is unprecedented, and there is no definite solution available till now to mitigate such crisis. As per ILO (International Labour Organisation) report, global working hours were lost at 8.8 percent in 2020 relative to the 4th quarter of 2019. This working hour loss is equivalent to 255 million full-time jobs and approximately four times greater than during the global financial crisis in 2009. With the experience of these severe fallouts in economic, social and health fronts, the uncertainty among people compounded further. As per the world uncertainty index database2, the WPUI (World Pandemic Uncertainty Index) has reached its all-time high during Covid-19 (See Figure 1).

Figure 1. Trend of WPUI in various Epidemics and Pandemics

Source: World Uncertainty Index. https://worlduncertaintyindex.com/data/

Realizing the severity of the Covid-19 pandemic, researchers around the globe have tried to explore its influence on various dimensions of business and economy, such as global supply chains (Bonadio et al., 2020; Qin et al., 2020), employment (Montenovo et al., 2020; Yu et al., 2020), industrial production (Altig et al., 2020; Appiah-Otoo & Issac, 2020), household consumption (Binder, 2020; Liu et al., 2020), innovation ability (Han & Qian, 2020), financial markets (Hoshikawa & Yoshimi, 2021; Ashraf, 2020; Baker et al., 2020; Iyke, 2020b; Lan et al., 2020; Liu et al., 2020; Mishra et al., 2020; Narayan, 2020; Prabheesh, 2020; Salisu & Sikiru, 2020; Yan & Qian, 2020), oil prices (Nwosa, 2021) and government intervention on economic activities during Covid-19 (Feng et al., 2021, Ertuğrul et al., 2020; Haldar & Sethi, 2020; Phan & Narayan, 2020; Song et al., 2020). However, the exchange rate is one of the crucial aspects of financial markets, and it plays a significant role in the economic development of every country, stability of the country’s external environment, and foreign trade. Hence, the exchange rate needs considerable attention from researchers and policymakers to assess the impact of Covid-19 on it.

The Covid-19 ridden supply chain has created a change in demand and supply for currencies of all the countries across the globe for international trade and settlement, which in turn has created a fluctuation in the exchange rate of the currencies against the US dollar. As per the CNBC report dated 14th April 20203, when the value of some of the emerging markets’ currency against USD was under stress due to oil price shock created by overproduction, the outbreak of Covid-19 dampened it further as the virus made shrinkage in the oil demand. Such risk has affected emerging markets and other economies as they have knock-on impact due to regional trade links. Hence, given the severe impact of Covid-19 on every economy across the globe, there is sufficient reason to believe that the impact of Covid-19 has certainly touched the exchange rate of the economies. So, at this juncture, the analysis of exchange rate behaviour is a matter of study. In this context, researchers such as Narayan (2020), Iyke (2020b), Nwosa (2021), Ozturk and Cavdar (2021), Sharma et al. (2021), Feng et al. (2021), Aloui (2021), Konstantakis et al. (2021), Hoshikawa and Yoshimi (2021), Aslam et al. (2020) and Camba and Camba (2020) have paid their attention to the impact of Covid-19 on exchange rate. Given the above scenario, the present work aims at analyzing the impact of Covid-19 measured in terms of confirmed cases, deaths, and uncertainty created by the pandemic on the exchange rate. This paper contributes to the existing literature on the exchange rate in various ways. Firstly, unlike other studies being limited to a specific country, this paper depicts the effect of the Covid-19 pandemic on the exchange rate from a large sample of 37 countries. Secondly, it provides insights on the impact of the pandemic on the exchange rate owing to the time frame and the level of economic development of the country, i. e., emerging and developed economies. Thirdly, this is the first paper to assess the impact of the WPUI on the exchange rate.

The remainder of the paper continues in the following manner: the second section deals with the literature review, the third section describes the empirical methodology, the fourth section depicts the empirical results, and the final section concludes the study.

2. Literature Review

2.1 Theories of Exchange Rate and Covid-19

A natural disaster is considered as an important factor having potential to disrupt the economic fundamentals of the national as well as global economies (Farhi & Gabaix, 2016). Among all the economic fundamentals, one of the most affected assets price is the exchange rate (Iyke, 2020b). Though Covid-19 is considered to be the most severe disaster in the last 100 years, the world has seen many others and witnessed their economic implications in real markets as well as financial markets. Such low-frequency-high-impact (LFHI) disasters put a significant threat to the supply chain (Hosseini et al., 2019; Ivanov et al., 2017; Kinra et al., 2020). The effect of such events cascades to other aspects of the economy through the supply chain, which is called a ripple effect (Ivanov et al., 2014). The 2011 earthquake at Fukushima (contributor of metallic paint to global supply chain) and 2011 flood in Thailand (contributor of computer chips to global supply chain) disrupted production within a small geographic and economic area but put its magnified and rippling effect on other economies as such production was highly critical to the global supply chain. Hence, Wuhan, being a crucial industrial centre in the global map, has affected the global supply chain. Further, as the spread of the contagion has covered almost the entire world, it is presumed to have affected the global supply chain, which in turn must have affected the real markets and financial markets around the world. Goodell (2020), in his recent study, presented extensive literature on the economic consequences of natural disasters such as nuclear war and local disaster or climate change and reported that Covid-19 pandemic is creating a never experienced global economic losses. In this regard, a thorough analysis of the economic consequences of the Covid-19 pandemic in terms of exchange rate behaviour is the context of this study.

The analysis of exchange rate behaviour requires establishing the link between the effect of the Covid-19 pandemic and the theoretical underpinnings of the exchange rate behaviour. There are several theories that explain the behaviour of the exchange rate. The rational expectation theory of Muth (1961) states that people’s expectations of what will happen in the future cause a change in the value of the underlying assets. So, the current expectation of the people about the exchange rate movement has the potential to drive the exchange rate in the future (MacDonald & Taylor, 1992). The happening of unprecedented events alters the people‘s expectations and the exchange rate (Frenkel, 1981). So, Covid-19 being an unprecedented and unexpected event is presumed to affect the global exchange rate.

The efficient market hypothesis of Fama (1970) states that in an efficient forex market, the exchange rate reflects all the information concerning the exchange rate. In line with this, Firoj and Khanom (2018), Makovský (2014), Wickremasinghe (2008), and Frenkel (1981) suggest that the exchange rate behaviour is sensitive to available information that determines the efficiency of the forex market. So, the information on the Covid-19 infection and government intervention in terms of the shutdown, lockdown, etc. across the globe influence the people’s expectations regarding economic activities, which in turn can affect the exchange rate of the economies. Further, information plays a pivotal role in the construction of optimal portfolios. In this regard, McKinnon’s (1969) portfolio balance theory postulates that any economic event has a direct bearing on the asset return, which compels the agents to revise their asset portfolio for optimising the risk-return trade off. This behaviour creates a flucation in the demand and supply of currencies in the international market, which in turn causes varition in the value of currencies (Dooley & Isard, 1983; Khan & Abbas, 2015). In an open economy, the value of a currency is greatly influenced by capital flows (Gelman et al., 2015), and any increase and decrease in the interest rate cause a change in capital flow, leading to exchange rate fluctuation, which is termed as ‘interest rate parity’ (Aref-Adib & Martin, 2020). Further, the inflow of capital causes appreciation of home currency under a flexible exchange rate system. However, under a fixed exchange rate system, the inflow of capital translates into an inflationary rise of the money supply via the central bank’s intervention (Islami & Welfens, 2013). During Covid-19, the governments of many countries have increased the money supply by changing monetary policy to counter the negative consequence of Covid-19 (Aref-Adib & Martin, 2020). But the change in money supply and the change in the prices in the goods market do not move at the same pace, and such mismatch is immediately reflected in the forex market (Aslam et al., 2020). It is because the exchange rate reacts much faster in the short run than goods market, and such overreaction of exchange rate fades out in the long run as promulgated by Dornbusch (1976) in the exchange rate overshooting hypothesis. So, the exchange rate is expected to witness more fluctuation in the initial stage of Covid-19 infection than in later stages. Phan and Narayan (2020) revealed that Covid-19 represents a greater global shock disrupting the economic fundamentals of nations across the globe leading to variation in demand and supply of currencies and exchange rate. Such variation in demand and supply of a particular country’s currency emerges from the balance of payment (BOP) condition as proposed in the BOP theory of exchange rate of Allen and Kenen (1980). The above discussion concerning theories of exchange rate and Covid-19 scenario provides a detailed understanding as to how the shocks brought about by the Covid-19 pandemic have led to economic disruption and the channels though which Covid-19 can affect the exchange rate.

2.2 Empirical Studies on Covid-19 and Exchange Rate

Since the introduction of the floating exchange rate system in 1973, the currency value of any economy depends on its macroeconomic fundamentals. In the world of globalization, every economy is interconnected, thereby creating inter-dependency and a network of economies. This inter-connectivity among the economies creates an interplay between the demand and supply of currency in the foreign exchange market, which determines the exchange rate among the currencies (Bhanumurthy, 2006). In this context, a good number of works are available on factors affecting the exchange rate of the economies. The factors like net trade, the balance of payment, productivity growth, net capital flow, net foreign assets position, relative price level, interest rate, output, money supply, national income, portfolio preference, assets supplies, current account developments, and oil prices, among several other relative economic variables, are the prominent factors affecting the exchange rate (Bacchetta & Wincoop, 2006; Frankel, 1992; Stockman, 1980; Bhanumurthy, 2006; Tronzano, 2001; Heller, 1978; Bergstrand, 1991; Chinn, 2006). So, the exchange rate of a country is a function of the state of the countries’ economy in relation to its global counterparts (Devpura, 2021; Duro et al., 2020). Prior studies by Narayan et al. (2018) have documented a plausible impact of unforeseen events like the terrorist attack on the economy and the exchange rate of various countries where some countries’ currencies appreciated, while some currencies depreciated in response to such an event. In line with this, Covid-19 being an unforeseen event has drawn the attention of many researchers to gauge its economic consequences. Nwosa (2021) documents that Covid-19 has more adverse effects on the economy and market than the 2009 and 2016 global recession. Gietel-Basten (2020) find a more significant effect of Covid-19 on the global economy in the form of distortion in the international labour migration that affects the remittance flow among the countries. Venkatachary et al. (2020) report severe economic fallout across the globe due to Covid-19 pandemic. Zekra (2020) documents that Covid-19 has destroyed the global economy. In Romania’s context, Serbanel (2020) demonstrates that the Covid-19 pandemic has severely affected the Romanian economy, particularly the health business, labour market, and households. Further, due to its massive effect on a large segment of the European economy and disruption in global supply and trade balance, there is a likely global recessionary situation. Akinsanmi (2020), in a study on China, Germany, UK, and US, reports that Covid-19 has negatively affected the ability of the people to contribute to the economic activities, which in turn has created economic instability and economic distortions.

The economic distortions caused by the pandemic can be broadly categorized into demand shock, supply shock, and financial shock. All these shocks have the potential to affect the macroeconomic fundamentals of the economy, including the exchange rate. De and Sun (2020) opined that the exchange rate serves as both a shock absorber and a source of shock. The empirical result of Camba and Camba (2020) reveals that Covid-19 daily infection has a negative impact on the peso/dollar exchange rate in the Philippines, and Iqbal et al. (2020) report a negative impact of the Covid-19 breakout on the exchange rate of China. Rietz (1988), Barro (2006), Berkman et al. (2011), and Farhi and Gabaix (2016) have developed different models of the exchange rate in which the possibility of rare but extreme disaster is a prominent factor affecting the movements of exchange rates. Sharma et al. (2021), and Ozturk and Cavdar (2021) identified that exchange rate fluctuation tends to increase due to shutdowns amid Covid-19. Covid-19 has changed the determinants of the Euro/USD exchange rate and made the exchange rate more volatile (Konstantakis et al., 2021). There is a co-movement between Covid-19 cases and the exchange rate, and the impact of the pandemic on the exchange rate is significant and long-term in nature (Sharma et al., 2021). Iyke (2020b) identifies Covid-19 as a new determinant of the exchange rate. Narayan (2020) reveals that the Covid-19 pandemic has a temporary effect on the shock to the Yen-US exchange rate. However, Sharma et al. (2021) find a significant and long-term impact of the pandemic on the exchange rate, suggesting a contradiction and asymmetric effect of Covid-19 on the exchange rate. Hence, there is a strong reason to appreciate the fact that the pandemic has directly affected the economic fundamentals, financial markets, and exchange rate of the affected economies.

Hacche (1983) opined that the demand and supply condition in the foreign exchange market depends on the state of financial and real markets, which in turn are affected by the exchange rate. However, fluctuation in exchange rate raises the chances of financial market risks and foreign investment uncertainty (Byrne & Davis, 2005; Devereux, 2004), and the exchange rate affects the stock market performance during the pandemic period (Nwosa, 2021). Exchange rate uncertainty creates inflation uncertainty, which affects individuals’ consumption decisions (Alexander, 1952; Iyke & Ho, 2020). So there is a complex and vicious circle among the various other macro-economic variables and exchange rates. The efforts of the government to contain the spread of the Covid-19 virus like lockdown, shutdown, suspension of movement of people and goods became more intensive and stringent with the increase in daily confirmed cases and deaths, which made the economic distortion more aggravated at national as well as the global level (Gopinath, 2020). The government’s intervention in terms of policy response such as income support fiscal measures, international aids, etc. has resulted in exchange rate volatility but not the rise of Covid-19 confirmed cases (Feng et al., 2021). Farhi and Gabaix (2016) opined that the country’s exposure to the disaster risk is different and time-varying. Aloui (2021) reveals that during Covid-19, the effect of monetary policy intervention by the Eurozone government in the form of Quantitative Easing on the Euro/USD exchange rate varies over time.

Islami and Welfens (2013) show that stock market dynamics also affect exchange rate because domestic stock market performance in comparison to other stock markets causes inflow and outflow of capital, leading to the fluctuation in the exchange rate. In this regard, on studying how the real effect of Covid-19 gets amplified through financial channels, Ramelli and Wagner (2020) document that investors remain bearish to US stocks with exposure to China and the international market. However, with improvement in the situation in China as compared to Europe and the US, investors turned positive to US stocks. Ashraf (2020) studied the stock market response of 64 countries to the Covid-19 and established an adverse and asymmetric reaction of stocks across the globe to Covid-19, which is a fundamental reason for investors to reconstruct their portfolios. As a result, there is fluctuation in the demand and supply of currencies in the foreign exchange market resulting in variation in the exchange rate. Hoshikawa and Yoshimi (2021) demonstrate that an increase in Covid-19 infection leads to a rise in stock market volatility and a decrease in foreign investors’ holdings, which gives rise to a reduction in the value of the domestic currency. The increased attention of investors to Covid-19 influences stock return and volatility (Iyke & Ho, 2021). Rai and Garg (2021) opine that the volatility spillover between the stock market and exchange rate return is dynamic and negative during Covid-19 in BRIICS economies. It implies that a decrease in stock market return translates into an increase in the exchange rate. Further, such an effect is more prominent during the initial lockdown period than the later periods.

The above literature clarifies that though several studies have been undertaken to reveal the impact of Covid-19 on various aspects of the economy, the literature on the effect of Covid-19 on the exchange rate is very scant, and the existing shreds of evidence are limited to a specific country. Further, the impact of Covid-19 on exchange rate due to change in time and level of economic development of countries is unheeded in prior works. Hence, in the above backdrop, this study aims to examine the exchange behaviour amidst the Covid-19 situation by revealing the effect of daily Covid-19 confirmed cases, death cases, and WPUI created due to Covid-19 on the exchange rate with a sample of 37 countries over a period from 4th January 2020 to 30th April 2021.

The study is unique and adds to the existing knowledge base in three ways: Firstly, we provide more insight into the studies, like Rietz (1988), Barro (2006), Farhi and Gabaix (2016), and Iqbal et al. (2020), examining the effect of the different disaster on the exchange rate of the countries. Secondly, we add to the recently evolving literature examining the impact of Covid-19 on the economy, such as J. Abel and Gietel-Basten (2020), Venkatachary et al., (2020), Zekra ( 2020), Cerami et al., (2020), Serbanel (2020), and Akinsanmi (2020). Thirdly, we contribute to the existing stock of literature in terms of the asymmetric effect of Covid-19 on the exchange rate owing to time and economies.

3. Methodology

3.1 Data and Sample

We constructed the sample by gathering data on the number of daily Covid-19 confirmed cases and death cases from the website of WHO. The data set starts from 4th January 2020 and ends on 30th April 2021. We also collected data on WPUI4 over the sample period constructed by Ahir et al. (2018). We included such an index as pandemic has impacted societies both in terms of economic and psychological front and created many uncertainties such as trade, social, cultural, and financial market uncertainties (Lazzerini & Putoto, 2020; Ho & Gan, 2021; Iyke, 2020a). The daily confirmed cases, daily deaths, and WPUI of respective sample countries are taken as independent variables, while the daily confirmed cases, daily deaths, and WPUI of the USA are considered as control variables to capture the impact of the USA Covid-19 situation on the exchange rate. Further, we collected data on the nominal effective exchange rate for each country against the US dollar from the website of IMF (International Monetary Fund). We took the exchange rate of each sample country against the US dollar as the US dollar plays a special role in international financial markets for international payments and settlements (Rebucci et al., 2021).

We adopted several criteria to filter the data. We removed those countries for which daily Covid-19 confirmed cases, death cases, WPUI data, and exchange rate data were not available. Lastly, we gathered data on the globalization index as a country-level control variable from the KOF Index of Globalization published by the KOF Swiss Economic Institute. It counts for the cross-country difference in the level of economic, social, and political integration with the rest of the world. After applying the filter criteria, we ended up with a sample of 37 countries. Further, we removed days with missing figures because though Covid-19 confirmed and death cases data are available for each day, the exchange rate data are unavailable for weekends and holidays. Finally, our dataset consists of 37 countries with 10,002 observations from 4th January 2020 to 30th April 2021.

Table 1. Information on Sample Countries

|

Sl. No. |

Country |

Status of Economy* |

Date of 1st Covid-19 |

|

1 |

Algeria |

Emerging |

25-02-20 |

|

2 |

Australia |

Advanced |

25-01-20 |

|

3 |

Botswana |

Emerging |

01-04-20 |

|

4 |

Brazil |

Emerging |

26-02-20 |

|

5 |

Brunei Darussalam |

Emerging |

10-03-20 |

|

6 |

Canada |

Advanced |

26-01-20 |

|

7 |

Chile |

Emerging |

03-03-20 |

|

8 |

China |

Emerging |

04-01-20 |

|

9 |

Colombia |

Emerging |

06-03-20 |

|

10 |

Czechia |

Advanced |

02-03-20 |

|

11 |

Denmark |

Advanced |

27-02-20 |

|

12 |

India |

Emerging |

30-01-20 |

|

13 |

Israel |

Advanced |

22-02-20 |

|

14 |

Japan |

Advanced |

14-01-20 |

|

15 |

Republic of Korea |

Advanced |

19-01-20 |

|

16 |

Kuwait |

Emerging |

24-02-20 |

|

17 |

Malaysia |

Emerging |

25-01-20 |

|

18 |

Mauritius |

Emerging |

18-03-20 |

|

19 |

Mexico |

Emerging |

28-02-20 |

|

20 |

New Zealand |

Advanced |

28-02-20 |

|

21 |

Norway |

Advanced |

26-02-20 |

|

22 |

Oman |

Emerging |

24-02-20 |

|

23 |

Peru |

Emerging |

07-03-20 |

|

24 |

Philippines |

Emerging |

30-01-20 |

|

25 |

Poland |

Emerging |

04-03-20 |

|

26 |

Qatar |

Emerging |

29-02-20 |

|

27 |

Russian Federation |

Emerging |

02-03-20 |

|

28 |

Saudi Arabia |

Emerging |

02-03-20 |

|

29 |

Singapore |

Advanced |

23-01-20 |

|

30 |

South Africa |

Emerging |

05-03-20 |

|

31 |

Sweden |

Advanced |

31-01-20 |

|

32 |

Switzerland |

Advanced |

24-02-20 |

|

33 |

Thailand |

Emerging |

13-01-20 |

|

34 |

Trinidad and Tobago |

Emerging |

13-03-20 |

|

35 |

United Arab Emirates |

Emerging |

29-01-20 |

|

36 |

The United Kingdom |

Advanced |

01-02-20 |

|

37 |

Uruguay |

Emerging |

15-03-20 |

Source: *International Monetary Fund, **World Health Organization.

3.2 Model Specification

To study the effect of confirmed Covid-19 cases, death cases, and WPUI on exchange rate behaviour, we performed a panel data analysis. We resort to panel data analysis technique over event study technique as first; the spread of Covid-19 is not a one-point happening, rather, it spreads over days in a country. Second, panel data has the edge of capturing the time-varying effect of the independent variable on the dependent variable. Third, panel data considers the variation in variables arising from cross-sectional units and time, and minimizes multicollinearity (Koop & Steel, 2001), unobservable heterogeneity (Hsiao, 2003; Moulton, 1986), heteroscedasticity, and estimation bias (Baltagi, 2008; Wooldridge, 2010). Panel diagnostic test has been undertaken to choose a more consistent model among ordinary least squares (OLS), fixed effect (FE), and random effect (RE) models. The result of the Hausman test (see Appendix) concludes that the fixed effect model is more consistent for the data.

By using the panel data analysis, we specify 3 separate empirical fixed effect regression models for Confirmed cases, Deaths, and WPUI as follows:

Yct= α + β1Confirmed Cases ct+ β2 Control Variables ct+ γt+ εct- (1)

Yct= α + β1Deaths ct+ β2 Control Variables ct+ γt+ εct- (2)

Yct= α + β1 WPUIct+ β2 Control Variables ct+γt+ εct- (3)

where,

c = Cross-sectional unit, i. e., country;

t = Time dimension, i. e., each day;

Confirmed Cases= Number of persons tested positive for Covid-19;

Deaths= number of persons who died of Covid-19;

WPUI= Uncertainty created in a country due to Covid-19.

Control variables include USA Daily Confirmed Cases, USA Daily Deaths, USA WPUI, and the Globalization index of each country.

γt = Daily fixed effects;

εct = Error term.

The 3 models specified above are used for measuring the impact of Covid-19 on the exchange rate behaviour for the whole sample, which has been reported in Table 4. Further, the same models were also used for sub-sample analysis to measure the impact of Covid-19 on exchange rate behavior over time and economies, reported in Table 5 and Table 6, respectively.

We have taken daily confirmed cases and daily deaths as a proxy for Covid-19, as the prevalence and spread of the pandemic is visible through the number of people tested positive for Covid-19 and the number of people who died of Covid-19 (Ashraf, 2020). WPUI is also another proxy of Covid-19, as the Covid-19 pandemic is a health-related uncertainty, and it has led to the economic and political uncertainties measured through WPUI (Ho & Gan, 2021). USA Daily Confirmed Cases, USA Daily Deaths, and USA WPUI are taken as control variables to count for the Covid-19 situation prevailing in the USA. To capture the impact of all economic developments on the exchange rate, we considered the KOF index of globalization as the control variable. This is because globalization is a multidimensional concept encompassing economic, social, and political aspects that go beyond indicators such as trade openness and capital movements (Gygli et al., 2019; Potrafke, 2015). Further, the KOF Index of Globalisation is superior to other measures of Globalization (Potrafke, 2015), and it is the most widely used index in international economic literature (Eppinger & Potrafke, 2016; Osterloh, 2012; Quinn et al., 2011; Villaverde & Maza, 2011).

4. Empirical Results

This section provides the empirical results consisting of summery statistics, correlation matrix and regression evidence.

Summary Statistics

Table 2. Summary Statistics

|

Variables |

Mean |

Minimum |

Maximum |

Std. Dev. |

|

Exchange Rate/USD |

174.730 |

0.081 |

4153.900 |

630.260 |

|

Daily Confirmed Cases |

3967.600 |

0.000 |

386450.000 |

14467.000 |

|

Daily Deaths |

91.341 |

0.000 |

4195.000 |

265.410 |

|

WPUI |

24.574 |

1.851 |

90.768 |

20.463 |

|

USA Daily Confirmed Cases |

66390.000 |

0.000 |

299560.000 |

59681.000 |

|

USA Daily Deaths |

1117.000 |

0.000 |

6409.000 |

918.500 |

|

USA WPUI |

11.227 |

7.272 |

43.573 |

10.955 |

|

Globalization Index |

74.627 |

55.950 |

91.190 |

9.520 |

Source: Authors’ calculation.

Table 2 reports the summary statistics of the variables taken in this study. The exchange rate results indicate a considerable variation in the exchange rate of different countries against the USD and signal asymmetry in countries‘ economic growth and economic fundamentals across the globe. The result of daily confirmed cases, daily deaths, and WPUI document that there is higher variation in daily confirmed cases than daily deaths and WPUI across the countries, which shows an asymmetric spread of Covid-19 daily infection across the globe.

Correlation Matrix

Table 3. Correlation Matrix

|

Variables |

(1) |

(2) |

(3) |

(4) |

(5) |

(6) |

(7) |

(8) |

|

(1) Exchange Rate/USD |

1 |

|

|

|

|

|

|

|

|

(2) Daily Confirmed Cases |

0.095 |

1 |

|

|

|

|

|

|

|

(3) Daily Deaths |

0.086 |

0.736 |

1 |

|

|

|

|

|

|

(4) WPUI |

-0.134 |

-0.017 |

-0.078 |

1 |

|

|

|

|

|

(5) USA Daily Confirmed Cases |

-0.014 |

0.093 |

0.100 |

-0.131 |

1 |

|

|

|

|

(6) USA Daily Deaths |

0.001 |

0.049 |

0.101 |

-0.083 |

0.630 |

1 |

|

|

|

(7) USA WPUI |

0.016 |

-0.094 |

-0.114 |

0.180 |

-0.373 |

-0.392 |

1 |

|

|

(8) Globalization Index |

-0.129 |

-0.152 |

-0.157 |

-0.073 |

-0.022 |

-0.023 |

0.051 |

1 |

Source: Authors’ calculation.

Table 3 reports the Pearson’s correlation matrix among variables under study. The correlation coefficient ranges from 0.001 to 0.736, which signifies the absence of collinearity among the variables (Gujarati, 2004). Further, we check multicollinearity by using variance inflation factor (VIF). The highest VIF is 2.717, which states that multicollinearity is not present among the variables (Chatterjee & Hadi, 1977; O’Brien, 2007).

Impact of Covid-19 on Exchange Rate

Table 4 reports the results of the regression measuring the effect of Covid-19 daily confirmed cases, daily deaths, and WPUI on exchange rate behaviour. The exchange rate is taken as the dependent variable and is measured as each country‘s exchange rate against the USD. Daily confirmed cases, daily deaths, and WPUI are taken as the measure for Covid-19. The USA daily confirmed cases, USA deaths, and USA WPUI count for the Covid-19 situation in the USA. KOF Index of Globalization counts for the cross-country difference in the extent of economic integration with the rest of the world. T statistics are reported in parentheses. *, ** and *** indicate statistical levels of significance at 10%, 5%, and 1% respectively.

Table 4. Impact of Covid-19 on Exchange Rate Behaviour

|

Variables |

Daily Exchange Rate against USD |

||

|

Daily Confirmed Cases |

0.001*** |

|

|

|

|

(4.298) |

|

|

|

Daily Deaths |

|

0.001*** |

|

|

|

|

(2.977) |

|

|

WPUI |

|

|

-0.001 |

|

|

|

|

(-0.127) |

|

USA Daily Confirmed Cases |

-0.001 |

|

|

|

|

(-0.944) |

|

|

|

USA Daily Deaths |

|

-0.001 |

|

|

|

|

(-0.929) |

|

|

USA WPUI |

|

|

0.001 |

|

|

|

|

(0.928) |

|

Globalization Index |

0.009*** |

0.009*** |

0.009*** |

|

|

(11.11) |

(10.52) |

(11.62) |

|

Daily fixed-effects |

Yes |

Yes |

Yes |

|

Intercept |

1.549*** |

1.567*** |

1.479** |

|

|

(20.77) |

(20.59) |

(23.14) |

|

Observations |

10002 |

10002 |

10002 |

|

Adjusted R2 |

0.154 |

0.153 |

0.153 |

Source: Authors’ calculation.

The results presented in Table 4 show a positive effect of daily confirmed cases and daily deaths on the exchange rate, which indicates that the currency of other countries against the USD has weakened due to economic disruption caused by the Covid-19 pandemic. This results confirm the rational expectation hypothesis of the exchange rate. However, the WPUI has an insignificant impact on the exchange rate, indicating that with the increase in uncertainty of the respective countries, their currencies did not see any significant change in the value against the USD. It means that the exchange rate market is responsive to the incidence of Covid-19 confirmed cases and deaths but not to the incidence of uncertainty created due to the pandemic. This result goes in line with the findings of Duro et al. (2020) and contradicts the result of Camba and Camba (2020). This result also supplements the studies by Sharma et al. (2021) and Chang et al. (2021) measuring the effect of Covid-19 on exchange rate fluctuation. Looking at the macroeconomic measurement, i. e., globalization index, we can infer that currencies of more globalized countries have depreciated more as the incidence of Covid-19 spread across the globe due to the interlinking of the economies.

Impact of Covid-19 on Exchange Rate Behaviour over Time

To get insight into the impact of Covid-19 on the exchange rate over time, the entire data set was classified into 3 different phases. We considered the first 100th case of each country as the first phase because at the initial stage of the Covid-19 spread, there were no stringent restrictions by the governments on the movement of people and economic activities. Hence, such period is considered as a unique phase. This classification goes in line with Phan and Narayan (2020). After the 100th case, an alarming situation was created in every country; as a result, the governments resorted to several measures such as shutdown, lockdown, social distance, suspension of movement of people, etc., to contain the spread of the virus, and such measures were continued for one month in most of the countries in the globe (Oxford Covid-19 Government Response Tracker, BBC Research 2020)5. Hence, we classified one month following the first 100th case as the second phase. Further, after the 30 days following the first 100th case, the countries witnessed an exponential growth in the spread of the Covid-19 virus. Hence, we classified the remaining period after 30 days of the 100th case, i. e., till 30th April 2021, as the third phase.

Table 5. Impact of Covid-19 on Exchange Rate Behaviour over Time

|

Variables |

Daily Exchange Rate against USD |

||||||||

|

First Phase |

Second Phase |

Third Phase |

|||||||

|

Daily Confirmed Cases |

0.044*** |

|

|

0.003*** |

|

|

0.001** |

|

|

|

|

(3.21) |

|

|

(5.21) |

|

|

(2.28) |

|

|

|

Daily Deaths |

|

0.001 |

|

|

-0.001** |

|

|

0.001 |

|

|

|

|

(0.24) |

|

|

(-2.04) |

|

|

(0.27) |

|

|

WPUI |

|

|

-0.011*** |

|

|

-0.001 |

|

|

0.001 |

|

|

|

|

(-3.093) |

|

|

(-1.02) |

|

|

(0.60) |

|

USA Daily Confirmed Cases |

-0.001 |

|

|

-0.001 |

|

|

-0.001*** |

|

|

|

|

(-0.20) |

|

|

(-0.24) |

|

|

(-2.95) |

|

|

|

USA Daily Deaths |

|

0.001 |

|

|

-0.001 |

|

|

-0.001*** |

|

|

|

|

(0.20) |

|

|

(-0.19) |

|

|

(-2.84) |

|

|

USA WPUI |

|

|

0.149* |

|

|

-0.031 |

|

|

0.223** |

|

|

|

|

(1.778) |

|

|

(-0.97) |

|

|

(2.10) |

|

Globalization Index |

|

|

|

|

|

|

.006*** |

0.006*** |

0.006*** |

|

|

|

|

|

|

|

|

(8.81) |

(8.70) |

(9.02) |

|

Daily fixed-effects |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

|

Intercept |

1.874 *** |

1.856*** |

|

2.290*** |

2.612 |

1.759 |

1.755* |

1.747*** |

0.115 |

|

|

(12.45) |

(53.84) |

(0.309) |

(24.18) |

(1.44) |

(0.661) |

(31.10) |

(30.18) |

(0.15) |

|

Observations |

605 |

605 |

605 |

696 |

696 |

696 |

8690 |

8690 |

8690 |

|

Adjusted R2 |

0.354 |

0.340 |

0.304 |

0.204 |

0.172 |

0.168 |

0.191 |

0.190 |

0.190 |

Source: Authors’ calculation.

Table 5 demonstrates the results of the regression measuring the impact of Covid-19 daily confirmed cases, daily deaths, and WPUI on the exchange rate over time. The exchange rate is taken as the dependent variable and is measured as each country‘s exchange rate against the USD. Daily confirmed cases, daily death, and WPUI are taken as the measure for Covid-19. The USA daily confirmed cases, USA deaths, and USA WPUI count for the Covid-19 situation in the USA. KOF Index of Globalization counts for the cross-country difference in the extent of economic integration with the rest of the world. In our data classification, there is variation in the length of each phase, and the first two phases belong to the same year, while the third phase belongs to two different years. Hence, being an annual data, the globalization index remains the same for the first and second phase and remains different for the third phase. As a result, the effect of the globalization index was omitted in the first and second phases because of fixed-effects use within estimator for demeaning the data. However, the effect of globalization was reported for the third phase. Statistics are reported in parentheses. *, ** and *** indicate statistical significance levels at 10%, 5%, and 1% respectively.

The regression evidence presented in Table 5 shows that daily confirmed cases remain positive and significant in all the phases, which corroborates with the findings of Duro et al., (2020) and contradict the results of Camba and Camba (2020). It is also observed that the impact of daily confirmed cases is more pronounced in the first phase than in the second and third phases. Death remains insignificant in the first and third phases while negatively affecting the exchange rate only in the second phase. The effect of WPUI remains negative in the first phases implying an appreciation in the currency of sample countries due to uncertainties. However, the impact of WPUI becomes insignificant in the later phases. The results show that all the Covid-19 proxies influence the exchange rate asymmetrically both in degree and direction. More specifically, though the increase in daily confirmed cases leads to depreciation in the value of the currencies in all the phases, such depreciation is more pronounced in the first phase and fades out gradually over later phases. Similarly, death cases also have a time-varying impact on the exchange rate, which appreciated in the second phase. In contrast, the exchange rate did not see significant changes in the first and third phases due to daily deaths. Further, WPUI exhibits an appreciation in the exchange rate during the first phase, while such an effect is absent in the later phases. So, the above ambivalent results evidence that Covid-19 exerted an asymmetric impact on exchange rate behaviour over time. This phenomenon agrees with Dornbusch’s exchange rate overshooting hypothesis that the exchange rate reacts more in the initial stage of an event, and gradually the reaction fades out. It also corroborates the Farhi and Gabaix (2016) revelation that the country’s exposure to the disaster risk is different and time-varying.

Impact of Covid-19 on Exchange Rate Behaviour of Economies

Though Covid-19 pandemic was first detected in one of the emerging nations, at the initial period, its spread was rampant in developed nations, and later on, it spread over emerging nations. This difference in the spread of the pandemic was accentuated through differences in the economic fundamentals of the countries. Such differences can be witnessed in the form of population density, economic growth, industrialization, ease of doing business, technological advancement, the standard of living, infrastructure, the balance of payment, growth of GDP, fiscal discipline, consumer market, financial system (Awan & Khan, 2015), unemployment rate, public debt (IMF, 2010), demographic dividend (Hagemann & Nicoletti, 1988), health care system and life expectancy (Minois, 1989), etc. So there is a logical stand to believe that there is an asymmetric effect of the pandemic on both emerging and advanced economies. The hypothesized asymmetric effect is reflected in Table 5, showing the impact of Covid-19 daily confirmed cases, daily deaths, and WPUI on the exchange rate. The exchange rate is taken as the dependent variable and is measured as each country’s exchange rate against the USD. Daily confirmed cases, daily death, and WPUI are taken as the measure for Covid-19. The USA daily confirmed cases, USA deaths, and USA WPUI count for the Covid-19 situation in the USA. KOF Index of Globalization counts for the cross-country difference in the extent of economic integration with the rest of the world. T statistics are reported in parentheses. *, ** and *** indicate statistical levels of significance at 10%, 5%, and 1% respectively.

Table 6. Impact of Covid-19 on Exchange Rate Behaviour of Economies

|

Variables |

Daily Exchange Rate against USD |

|||||

|

Emerging Economies |

Advanced Economies |

|||||

|

Daily Confirmed Cases |

0.001*** |

|

|

0.001*** |

|

|

|

|

(3.80) |

|

|

(2.79) |

|

|

|

Daily Deaths |

|

0.001*** |

|

|

0.001* |

|

|

|

|

(2.28) |

|

|

(1.67) |

|

|

WPUI |

|

|

0.002*** |

|

|

-0.001*** |

|

|

|

|

(9.37) |

|

|

(-9.32) |

|

USA Daily Confirmed Cases |

-0.001** |

|

|

-0.001*** |

|

|

|

|

(-2.52) |

|

|

(-2.73) |

|

|

|

USA Daily Deaths |

|

-0.001** |

|

|

-0.001** |

|

|

|

|

(-2.56) |

|

|

(-2.33) |

|

|

USA WPUI |

|

|

0.002 |

|

|

0.001 |

|

|

|

|

(0.00) |

|

|

(0.00) |

|

Globalization Index |

0.009*** |

0.009*** |

0.010 *** |

0.014 *** |

0.014*** |

0.009*** |

|

|

(12.51) |

(11.80) |

(13.75) |

(3.75) |

(3.63) |

(2.63) |

|

Daily fixed-effects |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

|

Intercept |

1.883*** |

1.902*** |

1.792 |

0.550 * |

15.388*** |

0.906 |

|

|

(34.91) |

(33.95) |

(0.00) |

(1.74) |

(6.975) |

(0.00) |

|

Observations |

6177 |

6117 |

6117 |

3761 |

3761 |

3761 |

|

Adjusted R2 |

0.210 |

0.296 |

0.219 |

0.123 |

0.121 |

0.141 |

Source: Authors’ calculation.

The regression evidence presented in Table 6 shows that daily confirmed cases and daily deaths positively affect the exchange rate of both emerging and advanced economies. It means the economic dislocations triggered by the pandemic in terms of confirmed cases and deaths have led to depreciation in the currency value irrespective of economies. However, the impact of WPUI is positive in the emerging economy, but negative in the case of advanced economies. It implies that with the growth of intensity of the pandemic uncertainty, the currency value of advanced economies has gained. In contrast, the currency value of emerging economies has weakened, which exhibits a difference in the effect of WPUI on exchange rate behaviour. Looking at the severity of the impact of WPUI, our finding aligns with the work of Devpura (2021) that the effect of Covid-19 is less on developed economies than emerging economies. So we can conclude that pandemic has an asymmetric impact on the currency value of emerging and advanced economies in terms of pandemic induced uncertainty.

5. Conclusion

In our attempt to examine the effect of Covid-19 on exchange rate, the study reveals that daily confirmed cases and daily deaths positively affect the exchange rate. It means that the currency of other countries has weakened against USD in response to daily confirmed cases and daily deaths due to the Covid-19 pandemic. However, the uncertainty created due to Covid-19 pandemic does not significantly affect the exchange rate. Further, the study demonstrates an asymmetric effect of Covid-19 in terms of daily confirmed cases, daily deaths, and WPUI on exchange rate owing to the time, where the impact of daily confirmed cases is more pronounced in the first phase than the later phases. The daily deaths have a negative effect on the exchange rate only in the second phase, but the effect is absent in the first and third phases. The WPUI has a negative impact in the first phase but does not have a significant impact in the second and third phase, which means that in the initial stage of the Covid-19 spread, the currency of other countries against the USD had appreciated, but afterward, the exchange rate became irresponsive to the WPUI. As far as the asymmetric effect of Covid-19 on the exchange rate of advanced and emerging economies is concerned, the study reveals that the currency of both emerging and advanced economies has witnessed significant depreciation against the USD due to Covid-19 daily confirmed cases and daily deaths. Further, due to uncertainty created out of Covid-19, emerging economies‘ currency has depreciated, while the currency of advanced economies has appreciated. Finally, the study concludes that the economic consequences of the Covid-19 pandemic are uneven in terms of daily confirmed cases, daily deaths, and WPUI. Further, such consequences are also uneven owing to the timeframe and level of economic development of the countries. The outcome of this study will help the policymakers of different economies in devising suitable economic policy interventions by which the negative consequence of Covid-19 on the economy, more specifically on the exchange rate, can be mitigated.

Funding

This research has not received any grant from funding agencies in the public, commercial, or not-for-profit sectors.

Acknowledgment

The authors would like to acknowledge the comments provided by the Editor and the anonymous reviewers, which helped us in improving this paper.

References

Abel, J. G., & Gietel-Basten, S. (2020). International remittance flows and the economic and social consequences of COVID-19. Environment and Planning A, 0(0), 1–3. https://doi.org/10.1177/0308518X20931111

Ahir, H., Bloom, N., & Furceri, D. (2018). The World Uncertainty Index. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.3275033

Akinsanmi, T. (2020). An Empirical Examination of the Socio-Economic Consequences of Corona Virus Disease 2019 (Covid-19) Outbreak in US, UK, Germany and China: A Structural Equation Modelling Approach. International Affairs and Global Strategy, 84, 22–37. https://doi.org/10.7176/iags/68-04

Alexander, S. S. (1952). Effects of a Devaluation on a Trade Balance. Published by Palgrave Macmillan Journals on behalf of the International Monetary Fund Stable URL: https://www.jstor.org/stable/3866218.

Allen, P. R., & Kenen, P. B. (1980). Asset Markets and Economic Integration: A Synthesis. Cambridge University Press.

Aloui, D. (2021). The COVID-19 pandemic haunting the transmission of the quantitative easing to the exchange rate. Finance Research Letters, March, 102025. https://doi.org/10.1016/j.frl.2021.102025

Altig, D., Baker, S., Barrero, J. M., Bloom, N., Bunn, P., Chen, S., ... & Thwaites, G. (2020). Economic uncertainty before and during the COVID-19 pandemic. Journal of Public Economics, 19(1). https://doi.org/http: //dx.doi.org/10.1016/j.jpubeco.2020.104274

Appiah-Otoo, & Issac (2020). Does COVID-19 affect domestic credit? Aggregate and bank level evidence from China. Asian Economics Letters, 1(3). https://doi.org/http://dx.doi.org/10.46557/001c.18074

Aref-Adib, C., & Martin, S. (2020). Economic impacts of and policy responses to the coronavirus pandemic : Early evidence from Nigeria Camron Aref-Adib and Sarah Martin Key messages. Supporting Economic Transfermation, February, 1–2.

Ashraf, B. N. (2020). Stock markets’ reaction to COVID-19: Cases or fatalities? Research in International Business and Finance, 1–18. https://doi.org/10.1016/j.ribaf.2020.101249

Aslam, F., Aziz, S., Nguyen, D. K., Mughal, K. S., & Khan, M. (2020). On the efficiency of foreign exchange markets in times of the COVID-19 pandemic. Technological Forecasting and Social Change, 161(August), 120261. https://doi.org/10.1016/j.techfore.2020.120261

Awan, A. G., & Khan, R. E. A. (2015). Comparative analysis of the Literature of Economic Growth in the perspective of Advanced and Emerging Economies. Science International, 6(11), 39–49.

Bacchetta, P., & Wincoop, E. V. (2006). Can Information Heterogeneity Explain the Exchange Rate Determination Puzzle ? The American Economic Review, 96(3), 552–576.

Baker, S., Bloom, N., Davis, S., Kost, K. J., Sammon, M. C., & Viratyosin, T. (2020). The Unprecedented Stock Market Impact of COVID-19 (0898-2937). https://doi.org/http://dx.doi.org/10.3386/ w26945

Baltagi, B. H. (2008). Econometric Analysis of Panel Data. John Wiley & Sons Ltd, The Atrium, Southern Gate, Chichester, West Sussex, England.

Barro, R. J. (2006). Rare disasters and asset markets in the twentieth century. Quarterly Journal of Economics, 121(3), 823–866. https://doi.org/10.1162/qjec.121.3.823

Bergstrand, J. H. (1991). Structural Determinants of Real Exchange Rates and National Price Levels: Some Empirical Evidence. The American Economic Review, 81(1), 325–334.

Berkman, H., Jacobsen, B., & Lee, J. B. (2011). Time-varying rare disaster risk and stock returns. Journal of Financial Economics, 101(2), 313–332. https://doi.org/10.1016/j.jfineco.2011.02.019

Bhanumurthy, N. R. (2006). Macroeconomic Fundamentals and Exchange Rate Dynamics in India: Some Survey Results. Economic and Political Weekly, 41(March 18), 1101–1107.

Binder, C. (2020). Coronavirus fears and macroeconomic expectations. The Review of Economics and Statistics, 1–27. https://doi.org/http://dx.doi.org/10.1162/rest_a_00931

Bonadio, B., Huo, Z., Levchenko, A. A., & Pandalai-Nayar, N. (2020). Global supply chains in the pandemic (0898-2937). https://doi.org/http://dx.doi.org/10.3386/w27224

Byrne, J. P., & Davis, E. P. (2005). The Impact of Short- and Long-run Exchange Rate Uncertainty on Investment : A Panel Study of Industrial Countries. Oxford Bulletin of Economics and Statistics, 67(3), 307–329.

Camba, A. L., & Camba, A. C. (2020). The Effect of COVID-19 Pandemic on the Philippine Stock Exchange, Peso-Dollar Rate and Retail Price of Diesel. Journal of Asian Finance, Economics and Business, 7(10), 543–554. https://doi.org/10.13106/jafeb.2020.vol7.no10.543

Cerami, C., Santi, G. C., Galandra, C., Dodich, A., Cappa, S. F., Vecchi, T., & Crespi, C. (2020). Covid-19 Outbreak In Italy: Are We Ready for the Psychosocial and the Economic Crisis? Baseline Findings From the PsyCovid Study. Frontiers in Psychiatry, 11(June), 1–9. https://doi.org/10.3389/fpsyt.2020.00556

Ceylan, R. F., Ozkan, B., & Mulazimogullari, E. (2020). Historical evidence for economic effects of COVID-19. The European Journal of Health Economics, 21(6), 817–823. https://doi.org/http://dx.doi.org/10.1007/s10198-020-01206-8

Chang, C. P., Feng, G. F., & Zheng, M. (2021). Government fighting pandemic, stock market return and COVID-19 virus outbreak. Emerging Market Finance and Trade, forthcoming. https://doi.org/http://dx.doi.org/10.1080/1540496X.2021.1873129

Chatterjee, S., & Hadi, A. S. (1977). Regression Analysis by Example (5th ed.). John Wiley & Sons Inc.

Chinn, M. D. (2006). A primer on real effective exchange rates: Determinants, overvaluation, trade flows and competitive devaluation. Open Economies Review, 17(1), 115–143. https://doi.org/10.1007/s11079-006-5215-0

De, K., & Sun, W. (2020). Is the exchange rate a shock absorber or a source of shocks? Evidence from the U.S. Economic Modelling, 89, 1–9. https://doi.org/10.1016/j.econmod.2019.10.015

Devereux, M. B. (2004). Monetary policy rules and exchange rate flexibility in a simple dynamic general equilibrium model. Journal of Macroeconomics, 26(2), 287–308.

Devpura, N. (2021). Effect of COVID-19 on the relationship between Euro/USD exchange rate and oil price. MethodsX, 8. https://doi.org/10.1016/j.mex.2021.101262

Dooley, M. P., & Isard, P. (1983). The Portfolio-Balance Model of Exchange Rates and Some Structural Estimates of the Risk Premium. IMF Staff Papers, 30(4), 683–702.

Dornbusch, R. (1976). Expectations and exchange rate dynamics. Journal of Political Economy, 85, 1161–1176.

Duro, A. T., Morounfoluwa, A. O., & Iyabode, O. M. (2020). Corona Virus (Covid-19) Pandemic and Nigerian Financial Market. Available at SSRN 3656284, 1–7.

Eppinger, P., & Potrafke, N. (2016). Did Globalisation Influence Credit Market Deregulation? World Economy, 39(3), 426–443. https://doi.org/10.1111/twec.12282

Ertuğrul, H. M., Güngör, B. O., & Soytaş, U. (2020). The effect of the COVID-19 outbreak on the Turkish diesel consumption volatility dynamics. Energy Research Letters, 1(3). https://doi.org/http://dx.doi.org/10.46557/001c.17496

Fama, E. F. (1970). Efficient Capital Markets: A Review of Theory and Empirical Work. The Journal of Finance, 25(2), 383–417.

Farhi, E., & Gabaix, X. (2016). Rare Disasters and Exchange Rate. The Quarterly Journal of Economics, 131(February), 1–52. https://doi.org/10.1093/qje/qjv040.Advance

Feng, G. F., Yang, H. C., Gong, Q., & Chang, C. P. (2021). What is the exchange rate volatility response to COVID-19 and government interventions? Economic Analysis and Policy, 69, 705–719. https://doi.org/10.1016/j.eap.2021.01.018

Firoj, M., & Khanom, S. (2018). Efficient Market Hypothesis : Foreign Exchange Market of Bangladesh. International Journal of Economics and Financial Issues, 8(6), 99–103.

Frankel, J. A. (1992). Measuring International Capital Mobility: A Review. The American Economic Review, 82(2), 197–202.

Frenkel, J. A. (1981). Flexible exchange rates, prices and the role of “news”: Lessons from the 1970s. Journal of Political Economy, 89, 665–705.

Gates, B. (2020). Responding to Covid-19 — A Once-in-a-Century Pandemic? The New England Journal of Medicine, 1677–1679.

Gelman, M., Jochem, A., Reitz, S., & Taylor, M. P. (2015). Real financial market exchange rates and capital flows. Journal of International Money and Finance, 54, 50–69. https://doi.org/10.1016/j.jimonfin.2015.02.004

Goodell, J. W. (2020). COVID-19 and finance: Agendas for future research. Finance Research Letters, 35(April). https://doi.org/10.1016/j.frl.2020.101512

Gopinath, G. (2020). The Great Lockdown: Worst Economic Downturn Since the Great Depression – IMF Blog. Global Economy, 1–10.

Gujarati, D. (2004). Basic Econometrics (4th ed.). The McGraw-Hill Companies.

Gygli, S., Haelg, F., Potrafke, N., & Sturm, J.-E. (2019). The KOF Globalisation Index-revisited. The Review of International Organizations, 14(3), 543–574.

Hacche, G. (1983). The Determinants of Exchange Rate Movements (No. 07; OECD Economics Department Working Papers). https://doi.org/https://dx.doi.org/10.1787/412364058261

Haldar, A., & Sethi, N. (2020). The effect of country-level factors and government intervention on the incidence of COVID-19. Asian Economics Letters, 1(2). https://doi.org/http://dx.doi.org/10.46557/001c.17804

Han, H., & Qian.Y. (2020). Did enterprises’ innovation ability increase during the COVID-19 pandemic? Evidence from Chinese listed companies. Asian Economics Letters, 1(3). https://doi.org/http://dx.doi.org/10.46557/001c.18072

Heller, H. R. (1978). Determinants of Exchange Rate Practices. Journal of Money, Credit and Banking, 10(3), 308–321.

Ho, L. T., & Gan, C. (2021). Foreign Direct Investment and World Pandemic Uncertainty Index: Do Health Pandemics Matter? Journal of Risk and Financial Management, 14(3), 107. https://doi.org/10.3390/jrfm14030107

Hoshikawa, T., & Yoshimi, T. (2021). The Effect of the COVID ‐19 Pandemic on South Korea’s Stock Market and Exchange Rate. The Developing Economies, 1–17. https://doi.org/10.1111/deve.12276

Hosseini, S., Ivanov, D., & Dolgui, A. (2019). Review of quantitative methods for supply chain resilience analysis. Transportation Research Part E: Logistics and Transportation Review, 125(March), 285–307. https://doi.org/10.1016/j.tre.2019.03.001

Hsiao, C. (2003). Analysis of Panel Data (2nd ed.). Cambridge University Press. www.cambridge.org

Iqbal, N., Fareed, Z., Shahzad, F., He, X., Shahzad, U., & Lina, M. (2020). The nexus between COVID-19, temperature and exchange rate in Wuhan city: New findings from partial and multiple wavelet coherence. The Science of the Total Environment, 729, 138916. https://doi.org/10.1016/j.scitotenv.2020.138916

Islami, M., & Welfens, P. J. J. (2013). Financial market integration, stock markets and exchange rate dynamics in Eastern Europe. International Economics and Economic Policy, 10(1), 47–79. https://doi.org/10.1007/s10368-013-0229-8

Ivanov, D., Dolgui, A., Sokolov, B., & Ivanova, M. (2017). Literature Review on Disruption Recovery in the Supply Chain. International Journal of Production Research, 55(20), 6158–6174. https://doi.org/10.1080/00207543.2017.1330572

Ivanov, D., Sokolov, B., & Dolgui, A. (2014). The Ripple Effect in Supply Chains: Trade-off “efficiency-flexibility- resilience” in disruption management. International Journal of Production Research, 52(7), 2154–2172. https://doi.org/10.1080/00207543.2013.858836

Iyke, B.N. (2020). Economic policy uncertainty in times of COVID-19 pandemic. Asian Economics Letters, 1(2). https://doi.org/http://dx.doi.org/10.46557/001c.17665

Iyke, B. N., (2020). The Disease Outbreak Channel of Exchange Rate Return Predictability: Evidence from COVID-19. Emerging Markets Finance and Trade, 56(10), 2277–2297. https://doi.org/10.1080/1540496X.2020.1784718

Iyke, B. N., & Ho, S. Y. (2020). Consumption and exchange rate uncertainty: Evidence from selected Asian countries. The World Economy, 43(9), 2437–2462. https://doi.org/10.1111/twec.12900

Iyke, B. N., & Ho, S. Y. (2021). Investor attention on COVID-19 and African stock returns. MethodsX, 8, 101195. https://doi.org/10.1016/j.mex.2020.101195

Khan, A., & Abbas, Z. (2015). Portfolio balance approach: An empirical testing. Journal of Economics and International Finance, 7(6), 137–143. https://doi.org/10.5897/jeif2014.0579

Kinra, A., Ivanov, D., Das, A., & Dolgui, A. (2020). Ripple effect quantification by supplier risk exposure assessment. International Journal of Production Research, 58(18), 5559–5578. https://doi.org/10.1080/00207543.2019.1675919

Konstantakis, K. N., Melissaropoulos, I. G., Daglis, T., & Michaelides, P. G. (2021). The euro to dollar exchange rate in the Covid-19 era: Evidence from spectral causality and Markov-switching estimation. International Journal of Finance and Economics, September 2020, 1–19. https://doi.org/10.1002/ijfe.2524

Koop, G., & Steel, M. F. (2001). Bayesian Analysis of Stochastic Frontier Models. A Companion to Theoretical Econometrics. Blackwell (Oxford), 520-573.

Lan, C., Huang, Z., Huang, & W. (2020). Systemic risk in China’s financial industry due to the COVID-19 pandemic. Asian Economics Letters, 1(3). https://doi.org/http://dx.doi.org/10.46557/001c.18070

Lazzerini, M., & Putoto, G. (2020). COVID-19 in Italy: Momentous decisions and many uncertainties. The Lancet Global Health, 8(5), e641–e642. https://doi.org/10.1016/S2214-109X(20)30110-8

Liu, M., Choo, W-C., & Lee, C. C. (2020). The response of the stock market to the announcement of global pandemic. Emerging Markets Finance and Trade, 56(15), 3562–3577. http://dx.doi.org/10.1080/1540496X.2020.1850441

Liu, T., Pan, B., & Yin, Z. (2020). Pandemic, mobile payment, and household consumption: Micro-evidence from China. Emerging Markets Finance and Trade , 56(10), 2378–2389.

MacDonald, R., & Taylor, M. P. (1992). Exchange rate economics: A survey. IMF Staff Papers, 39, 1–57.

Makovský, P. (2014). Modern approaches to efficient market hypothesis of FOREX – the central European case. Procedia Economics and Finance, 14(14), 397–406. https://doi.org/10.1016/S2212-5671(14)00728-X

McKinnon, R. I. (1969). Portfolio Balance and International Payments Adjustment. In A. R. Mundell & A. K. Swoboda (Eds.), Monetary Problems of the International Economy (pp. 199–234). University of Chicago Press.

Mishra, A. K., Rath, B. N., & Dash, A. K. (2020). Does the Indian financial market nosedive because of the COVID-19 outbreak, in comparison to after demonetisation and the gst? Emerging Markets Finance and Trade, 56(10), 2162–2180. https://doi.org/10.1080/1540496X.2020.1785425

Montenovo, L., Jiang, X., Rojas, F. L., Schmutte, I. M., Simon, K. I., Weinberg, B. A., & Wing, C. (2020). Determinants of Disparities in Covid-19 Job Losses (0898-2937). https://doi.org/. http://dx.doi.org/10.3386/ w27132.

Moulton, B. R. (1986). Random group effects and the precision of regression estimates. Journal of Econometrics, 32(3), 385–397.

Muth, J. F. (1961). Rational Expectations and the Theory of Price Movements. Econometrica, 29(3), 315–335.

Narayan, P. K. (2020). Did bubble activity intensify during COVID-19? Asian Economics Letters, 1(2). https://doi.org/http://dx.doi.org/10.46557/001c.17654

Narayan, Paresh Kumar. (2020). Has COVID-19 Changed Exchange Rate Resistance to Shocks? Asian Economics Letters, 1, 3–6. https://doi.org/10.46557/001c.17389

Nwosa, P. I. (2021). Oil price, exchange rate and stock market performance during the COVID-19 pandemic: Implications for TNCs and FDI inflow in Nigeria. Transnational Corporations Review, 13(1), 125–137. https://doi.org/10.1080/19186444.2020.1855957

O’Brien, R. M. (2007). A caution regarding rules of thumb for variance inflation factors. Quality and Quantity, 41(5), 673–690. https://doi.org/10.1007/s11135-006-9018-6

Osterloh, S. (2012). Words speak louder than actions: The impact of politics on economic performance. Journal of Comparative Economics, 40(3), 318–336. https://doi.org/10.1016/j.jce.2012.05.004

Ozturk, M. B. E., & Cavdar, S. C. (2021). The Contagion of Covid-19 Pandemic on The Volatilities of International Crude Oil Prices, Gold, Exchange Rates and Bitcoin. Journal of Asian Finance, Economics and Business, 8(3), 171–179. https://doi.org/10.13106/jafeb.2021.vol8.no3.0171

Phan, D. H. B., & Narayan, P. K. (2020). Country responses and the reaction of the stock market to COVID-19—A preliminary exposition. Emerging Markets Finance and Trade, 56(10), 2138–2150. https://doi.org/http://dx.doi.org/10.1080/1540496X.2020.1784719

Potrafke, N. (2015). The evidence on globalisation. World Economy, 38(3), 509–552. https://doi.org/10.1111/twec.12174

Prabheesh, K. (2020). Dynamics of foreign portfolio investment and stock market returns during the COVID-19 pandemic: Evidence from India. Asian Economics Letters, 1(2). https://doi.org/http://dx.doi.org/10.46557/001c.17658

Qin., M, Liu, X., & Zhou, X. (2020). COVID-19 shock and global value chains: Is there a substitute for China? Emerging Markets Finance and Trade, 56(15), 3588–3598. https://doi.org/http://dx.doi.org/10.1080/1540496X.2020.1855137

Quinn, D., Schindler, M., & Toyoda, A. M. (2011). Assessing measures of financial openness and integration. IMF Economic Review, 59(3), 488–522. https://doi.org/10.1057/imfer.2011.18

Rai, K., & Garg, B. (2021). Dynamic correlations and volatility spillovers between stock price and exchange rate in BRIICS economies: Evidence from the COVID-19 outbreak period. Applied Economics Letters, 00(00), 1–8. https://doi.org/10.1080/13504851.2021.1884835

Ramelli, S., & Wagner, A. F. (2020). Feverish Stock Price Reactions to the Novel Coronavirus. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.3550274

Rapach, D., & Strauss, J. (2014). Structural Breaks and Garch Models of Exchange Rate Volatility. Journal of Applied Econometrics, 21(August 2012), 1–21. https://doi.org/10.1002/jae

Rebucci, A., Hartley, J. S., & Jiménez, D. (2021). An Event Study of Covid-19 Central Bank Quantitative Easing in Advanced and Emerging Economies. In NBER Working Paper 27339 (Vol. 53, Issue 9).

Rietz, T. A. (1988). The equity risk premium a solution. Journal of Monetary Economics, 22(1), 117–131. https://doi.org/10.1016/0304-3932(88)90172-9

Salisu, A. A., & Sikiru, A. A. (2020). Pandemics and the Asia-Pacific islamic stocks. Asian Economics Letters, 1(1). https://doi.org/http://dx.doi.org/10.46557/001c.17413

Serbanel, C. I. (2020). The Ripple Effect of COVID-19 in Romania’ s Economic Environment. “Ovidius” University Annals, Economic Sciences Series, XX(1), 510–517.

Sharma, G. D., Tiwari, A. K., Jain, M., Yadav, A., & Erkut, B. (2021). Unconditional and conditional analysis between Covid-19 cases, temperature, exchange rate and stock markets using wavelet coherence and wavelet partial coherence approaches. Heliyon, 7(2), e06181. https://doi.org/10.1016/j.heliyon.2021.e06181

Song, P., Zhang, X., & Zhao, Y. (2020). . Exogenous shocks on the dual-country industrial network: A simulation based on the policies during the COVID-19 pandemic. Emerging Markets Finance and Trade, 56(15), 3554–3561. http://dx.doi.org/10.1080/1540496X. 2020.1854723

Stockman, A. C. (1980). A theory of exchange rate determination and adjustment. Weltwirtschaftliches Archiv, 88(4), 673–698. https://doi.org/10.1007/BF02708113

Tronzano, M. (2001). Macroeconomic fundamentals and exchange rate credibility. Further evidence on the Italian experience from a regime-switching approach. Scottish Journal of Political Economy, 48(4), 442–460. https://doi.org/10.1111/1467-9485.00208

Venkatachary, S. K., Prasad, J., Samikannu, R., Baptist, L. J., Alagappan, A., & Ravi, R. (2020). Covid-19 – an Insight Into Various Impacts on Health, Society and Economy. International Journal of Economics and Financial Issues, 10(4), 39–46. https://doi.org/10.32479/ijefi.9925

Villaverde, J., & Maza, A. (2011). Globalisation, Growth and Convergence. World Economy, 34(6), 952–971. https://doi.org/10.1111/j.1467-9701.2011.01359.x

Wickremasinghe, G. B. (2008). Predictability of Exchange Rates in Sri Lanka: Asian Academy of Management Journal of Accounting and Finance, 3(2), 43–59.

Wooldridge, J. M. (2010). Econometric Analysis of Cross Section and Panel Data. The MIT Press, Cambridge, MA.

Yan, L., & Qian, Y. (2020). The impact of COVID-19 on the Chinese stock market: An event study based on the consumer industry. Asian Economics Letters, 1(3). https://doi.org/http://dx.doi.org/10.46557/001c.18068

Yu, Z., Xiao, Y, & Li, Y. (2020). The response of the labor force participation rate to an epidemic: Evidence from a cross-country analysis. Emerging Markets Finance and Trade, 56(10), 2390–2407. https://doi.org/http://dx.doi.org/10.1080/1540496X.2020.1784717

Zekra, L. (2020). COVID-19 Pandemic and Global Economic Impact. “Ovidius” University Annals, Economic Sciences Series, XX(1), 237–244.

Appendix

Table A1. Hausman Test Results for Selection of Models

|

Model |

Hausman test statistic |

Selection |

|

|

Impact of Covid-19 on Exchange Rate Behaviour |

|||

|

|

Impact of Daily Confirmed Cases on Exchange Rate |

H = 2.76885 with p-value = prob. (chi-square (3) > 2.76885) = 0.428653 |

FE Model |

|

Overall Analysis |

Impact of Daily Deaths on Exchange Rate |

H = 1.37162 with p-value = prob. (chi-square (3) > 1.37162) = 0.7122 |

FE Model |

|

|

Impact of WPUI on Exchange Rate |

H = 2.18319 with p-value = prob. (chi-square (3) > 2.18319) = 0.535268 |

FE Model |

|

Impact of Covid-19 on Exchange Rate Behaviour over Time |

|||

|

First Phase |

Impact of Daily Confirmed Cases on Exchange Rate |

H = 9.96236 with p-value = prob. (chi-square (2) > 9.96236) = 0.00686596 |

FE Model |

|

Impact of Daily Deaths on Exchange Rate |

H = 6.01013 with p-value = prob. (chi-square (2) > 6.01013) = 0.0495356 |

FE Model |

|

|

Impact of WPUI on Exchange Rate |

H = 5.02012 with p-value = prob. (chi-square (2) > 5.02012 ) = 0.0395346 |

FE Model |

|

|

Second Phase |

Impact of Daily Confirmed Cases on Exchange rate |

H = 7.24323 with p-value = prob. (chi-square (2) > 7.24323) = 0.0267395 |

FE Model |

|

Impact of Daily Deaths on Exchange rate |

H = 0.331746 with p-value = prob. (chi-square (2) > 0.331746) = 0.847154 |

FE Model |

|

|

Impact of WPUI on Exchange rate |

H = 3.12454 with p-value = prob. (chi-square (2) > 3.12454) = 0.20966 |

FE Model |

|

|

Third Phase |

Impact of Daily Confirmed Cases on Exchange Rate |

H = 7.34963 with p-value = prob. (chi-square (3) > 7.34963) = 0.0615507 |

FE Model |

|

Impact of Daily Deaths on Exchange Rate |

H = 1.43081 with p-value = prob. (chi-square (3) > 1.43081) = 0.698329 |

FE Model |

|

|

Impact of WPUI on Exchange Rate |

H = 1.9418 with p-value = prob. (chi-square (3) > 1.9418) = 0.584574 |

FE Model |

|

|

Impact of Covid-19 on Exchange Rate Behaviour of Economies |

|||

|

Emerging Economies |

Impact of Daily Confirmed Cases on Exchange Rate |

H = 1.53492 with p-value = prob. (chi-square (3) > 1.53492) = 0.674234 |

FE Model |

|

|

Impact of Daily Deaths on Exchange Rate |

H = 2.34138 with p-value = prob. (chi-square (3) > 2.34138) = 0.50464 |

FE Model |

|

|

Impact of WPUI on Exchange Rate |

H = 0.492556 with p-value = prob. (chi-square (3) > 0.492556) = 0.920524 |

FE Model |

|

Advanced Economies |

Impact of Daily Confirmed Cases on Exchange Rate |

H = 1.56398 with p-value = prob. (chi-square (3) > 1.56398) = 0.667583 |

FE Model |

|

|

Impact of Daily Deaths on Exchange Rate |

H = 2.04598 with p-value = prob. (chi-square (3) > 2.04598) = 0.562918 |

FE Model |

|

|

Impact of WPUI on Exchange Rate |

H = 3.55574 with p-value = prob. (chi-square (3) > 3.55574) = 0.313604 |

FE Model |

Source: Author’s own calculation.

Note. A low p-value counts against the null hypothesis that the random effects model is consistent, in favour of the fixed effects model.

4 https://worlduncertaintyindex.com/data/