Organizations and Markets in Emerging Economies ISSN 2029-4581 eISSN 2345-0037

2021, vol. 12, no. 2(24), pp. 459–477 DOI: https://doi.org/10.15388/omee.2021.12.65

Linking the Robo-advisors Phenomenon and Behavioural Biases in Investment Management: An Interdisciplinary Literature Review and Research Agenda

Valdone Darskuviene (corresponding author)

ISM University of Management and Economics, Lithuania

valdone.darskuviene@ism.lt

https://orcid.org/0000-0002-7209-8188

Nomeda Lisauskiene

ISM University of Management and Economics, Lithuania

nomeda.lisauskiene@gmail.com

https://orcid.org/0000-0002-5152-773X

Abstract. Technological advancements bring continuous changes into the investment industry. The paper aims to provide insights on future research agenda based on a review of the current stance of research on the links between the Robo-advisors phenomenon and behavioural biases of individual investors. A qualitative investigation method has been applied for literature review on Robo-advisors and their impact on behavioural biases.

The key findings indicate that Robo-advisors can help users to make better informed and less biased decisions. However, Robo-advisors activate the investors’ automatic system processes. The resulting passive investment approach could lead to alienation of the investors from the stock market, decreasing their understanding of the investment process that could widen a gap between different clusters of investors.

The paper makes several contributions to the literature. First, it provides arguments on why a dual process theoretical framework in the relationship between financial advisory and investment behavioural biases is applicable. Second, it studies the Robo-advisor phenomenon and proposes a comprehensive definition of Robo-advisors. Third, the literature review suggests drivers of the Robo-advisors effect on the changes of behavioural biases as a future research direction.

Keywords: Robo-advisor, behavioural biases, dual process theory

Received: 3/3/2021. Accepted: 7/7/2021

Copyright © 2021 Valdone Darskuviene, Nomeda Lisauskiene. Published by Vilnius University Press. This is an Open Access article distributed under the terms of the Creative Commons Attribution Licence, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

Introduction

In theory, investors act as rational agents who maximise expected utility, hold well-diversified portfolios and trade infrequently to minimise taxes and other investment costs (Fama,1970). Studies focusing on the performance of individual investors note that they do not always behave as expected utility maximisers and tend to underperform the market. ‘The investor’s chief problem – and even his worst enemy – is likely to be himself’ (Benjamin Graham). The underperformance outcome differs due to limited cognitive resources (Simon, 1955). Tversky and Kahneman (1974) showed that heuristics or rules-of-thumb lead to systematic deviations from rational behaviour and predictable errors and biases. Irrational decisions may lead to poor financial returns and a lower level of welfare that may be particularly important considering that demographic trends press on shifting the pay-as-you-go retirement system towards a more occupational and personal insurance system that transfers responsibility from governments to individuals for their financial security after retirement.

As a solution to this dilemma, Robo-advisors have been introduced in the investment industry to provide investors with low-cost products and high-quality advice. Based on Market Data Forecast (2020), the global Robo-advisors market will grow during 2020-2025 at a compound annual growth rate of 53.4%. That will translate into a revenue of USD 97.03 billion by 2025.

In this paper, we focus on the rapidly growing body of research examining Robo-advisors applications in investment services, linking them with possibilities of reducing behavioural biases of individual investors. Technological advancements bring rapid changes into the forms, scope, characteristics of Robo-advisors, and applications for specific target customers. Therefore, the first goal of the study is to examine the Robo-advisors phenomenon and its evolvement.

Secondly, the paper discusses the emerging theoretical framework for studying Robo-advisors in investment services. The dual process theory forms the basis for automatic rules in Robo-advisors (Evans, 2008). Defaults or framing as nudges usually utilise the automatic system, while there exist a few nudges that target the deliberative system, such as those that aim to show people the consequences of their decisions (Bhandari et al., 2008; Sunstein, 2014). Defaults used in Robo-advisors can help users make better informed and less biased decisions (Jung &Weinhardt, 2018). However, research also shows that fully automated Robo-advisors activate the automatic system, and investors do not have to make any decisions, which could lead to the alienation of investors from the stock market (Tan, 2020).

In research, there is still no general agreement on the scope of advice the Robo-advisors provide and the performance measurement of Robo-advisors. The evidence of the financial performance of Robo-advisors is still mixed. Previous studies showed that Robo-advisors alleviate the effect of behavioural biases on investment decision making, however, in some cases, Robo-advisors had no impact. Therefore, the third goal of the study is to explore the links between Robo-advisors and behavioural biases.

This is a literature review type of paper. It examines the current state of research on the links between the Robo-advisors phenomenon and behavioural biases of individual investors, addresses the limitations of the research and builds propositions for future research agenda in this novel field. We contribute to the current state of the literature on the use of Robo-advisors and behavioural biases in investment in the following ways. First, we propose a comprehensive definition of Robo-advisors beyond the traditional dyad of technology and its applications. Second, in addition to existing theoretical propositions, we provide arguments for the application of a dual process theoretical framework in the relationship between financial advisory and the behavioural biases of investors. Third, we review literature in this novel field of research and present findings from the empirical studies. Because this is a new area in investment studies, we conclude with future research directions in the field.

The paper employs a qualitative investigation method. The literature review is performed based on data collection, data coding, data analysis and interpretation of results. We have searched relevant papers from 2017 to 2021 for inclusion in the comprehensive review. The following keywords: Robo-advisor, Robo-advisory, investment, investor(s), behavioural biases were used for the search. That resulted in approximately 900 articles in Google Scholar, Web of Science, Science Direct, Springer Link and Taylor&Francis databases. We filtered the papers based on the titles, abstracts and keywords. We coded the articles by objective, method and findings to achieve a better systematisation of the review. When performing a literature review, we systematised articles based on qualitative and quantitative research methods. We systematised the findings of the articles to identify the key trends in this growing field of research. The final sample used for this literature review consists of 53 articles.

The paper is organised as follows. In Section 1, the phenomenon of Robo-advisors and its evolution are discussed. In Section 2, we describe the theoretical propositions for the exploration of Robo-advisors and behavioural biases. The previous literature examining how digital investment advisors change the effects of behavioural biases is overviewed in Section 3. In Section 4, the conclusions and implications from the literature review are presented.

1. Robo-advisors phenomenon and its evolution

Heuristics lead to behavioural biases, and behavioural biases cause systematic deviations from rational behaviour (Tversky Kahneman, 1974). Irrational decisions may result in poor financial returns and a lower level of welfare. Research in behavioural finance suggests that financial education and advice provided by professional financial service advisors can successfully reduce behavioural biases (Bhandari et al., 2008; Feng & Seasholes, 2005). However, those investors who need advice or financial education to overcome their mistakes usually do not seek education or advice (Bhattacharya et al., 2012). The reasons could be different: individual investors often consider investment advice and education to be expensive, complicated, biased. As a solution to this dilemma, Robo-advisors are introduced in the investment industry to provide investors with low-cost products and high-quality advice.

Recent research focuses on examining the application of Robo-advisors – online investment advice platforms that simplify the process as automated execution allows individual investors to implement the advice they receive and to reduce their behavioural biases (D’Acunto et al., 2019; Jung & Weinhardt, 2018). From the technological point of view, Robo-advisors are a specific kind of software for advisory services: the investors input their data, investment experience, goals, risk, etc. via an initial questionnaire. Using these data, algorithms can provide specific recommendations on investment decisions and portfolio changes, or they can make the decisions and initiate appropriate actions. This raises the interest of social scientists in Robo-advisors and the links between investment performance and human behaviour. In the literature, there is no common definition of Robo-advisors. ‘Robo’ stands for an automated process using algorithms to support investment decisions, while ‘advisor’ stands for wealth management automated services provided through online channels (Deloitte, 2016). In general, the Robo-advisors term defines a digital or web application that delivers automated portfolio management advice. The literature review allowed us to summarise the existing definitions of Robo-advisors and their evolution as presented in Table 1.

Table 1. Overview of the Main Definitions of Robo-advisors

|

Source |

Definition |

Characteristics |

|

Lopez et al. (2015) |

Robo-advisors seek ‘to provide simplified financial solutions through sophisticated online platforms, eliminating or reducing the need for face-to-face interaction’. |

Decision-making role in specific stock trades; Passive investment approach |

|

Sironi (2016) |

‘Robo advisors are automated investment solutions that provide automated portfolio rebalancing using trading algorithms based on passive investment and diversification strategies, which engage individuals with digital tools featuring advanced customer experience, to guide them through a self‐assessment process and shape their investment behaviour towards rudimentary goal‐based decision making’. |

Decision-making role in portfolio management; Passive investment approach

|

|

Jung et al. (2018) |

‘Robo-advisors are digital platforms comprising interactive and intelligent user assistance components that use information technology to guide customers through an automated (investment) advisory process’. |

Decision-making role in advice and portfolio management; Interactive investment approach |

|

Maume(2019) |

‘Robo-advisor is algorithm-based software that provides specifically tailored investment recommendations to the client based on the client’s input. The final investment decision is made by the client and not by the algorithm’. |

Role in personalised advice and managing in asset management value chain; Interactive and active investment approach |

|

Shanmuganathan (2020) |

‘Robo-advisors have been identified as customized, algorithm-based goal setting and machine-operated services, which provide customers with an overview of their financial standing, and recommend them with relevant investment portfolios’. |

Role in personalised advice and managing in asset management value chain; Interactive and active investment approach |

|

Hildebrand and Bergner (2020) |

‘Conversational Robo-advisors as advisory interfaces that possess a dialogue-based process of financial advisory, which emulates fundamental properties of human-to-human conversation’. |

Role in personalised advice and managing in asset management value chain; Interactive and active investment approach with ‘the human touch’ of RA. |

The evolution of Robo-advisors definitions provided in Table 1 indicates how Robo-advisors’ role has been changing from passive investment approach to interactive and active investment approach. One of the first definitions provided by Sironi (2016) suggested that Automated Investment Solutions (AIS) would be a more appropriate name for Robo-advisors as they are neither robots nor advisors, however, “we are aware that AIS would not be a headline stealer because it does not convey the same emotional emphasis as robotics”. The discussion is ongoing whether Robo-advisors are automated asset management service or advisors that leave the final investment decision to the client. When Robo-advisors are fully automated, are they Robo-advisors or, as D’Acunto (2020) suggested, a more appropriate term would be Robo-investors or Robo-managers? The most recent definitions starting with Jung et al. (2018) include an interaction between the Robo-advisors and the investors used in active investing. Hildebr and and Bergner (2020) referred to conversational Robo-advisors that compensate for the lack of ‘human touch’ during the advisory process to provide turn-taking or the presence of social cues throughout the conversation with Robo-advisors. However, current Robo-advisors are not customised according to the personal aims of investors within the framework of individual life-cycle management yet. Usually, the Robo-advisors provide advice only concerning the assets that those Robo-advisors manage. However, more fundamental needs of individuals, like the planning of studies, retirement, real estate, are not addressed yet (Fisch et al., 2019). Based on the evolution of Robo-advisors, as presented in Table 1, and taking into account the broad context of investors’ needs and future development in intelligent data analysis and machine learning, we suggest the definition of Robo-advisors. Robo-advisors are algorithm-based software that interacts like a human, provides specifically tailored rational investment recommendations to the customer and can learn from data. The final investment decision is made either by the client or by the algorithm.

The evolution of Robo-advisors offers increased benefits to individual investors. Robo-advisors evaluate potential trades based on the underlying systems. Therefore, human errors or behavioural biases, common among individual investors, might be less prevalent in the cases of Robo-advisors involvement.

2. Theoretical Framework for Research on Robo-advisors and Behavioural Biases in Investment Services

In theory, investors hold well-diversified portfolios and trade infrequently to minimise taxes. However, overall individual investors underperform the market in the long run due to different cognitive abilities (Barber Odean, 2000). The foundations of neoclassical finance – expected utility theory, portfolio theory, capital asset pricing theory – provide a framework for defining normative behaviour. However, they do not explain the decision making and behavioural biases of investors. Research in behavioural finance improved the traditional research framework along three dimensions: first, through more realistic assumptions about individual beliefs – people deviate from Bayes’ rule; second, through more realistic assumptions about individuals preferences – replacing expected utility theory with prospect theory (Kahneman & Tversky, 1979); third, taking into account the cognitive limits, i.e., recognising that people are unable to process all the information that is relevant to their decision making. The latter is approached in dual process theory (Evans, 2008; Kahneman, 2012). The dual process theory also focuses on explaining the influence of emotions and cognition on behavioural biases.

Limited time and decision making under uncertainty lead to heuristics: shortcuts in reasoning and systematically erroneous judgments (Kahneman et al., 1982). “The term heuristics encompasses innate and automatic processes as well as learned or consciously selected rules of thumb” (Hirshleifer, 2015, p. 136). Heuristics often work well within some domains for some types of problems. Nevertheless, heuristics also imply decision errors such as representativeness, availability, anchoring (Tversky Kahneman, 1974). Kahneman (2012) described human thinking as intuitive and influenced by the associations and pointed out that the information which does not immediately come to mind is neglected – Kahneman called it WYSIATI (What You See Is All There Is). Based on the specific context and individual cognitive capacities, one of the two systems are activated: System 1 – intuitive, automatic, emotion-driven, quickly operating, or System 2 – a slower one, but reflective, logically calculating (Evans, 2008; Kahneman, 2012). Both systems function in parallel and interact with each other. Therefore, individuals respond systematically to the stimulus of physical, verbal, emotional, supposedly irrelevant factors – default and salience options (Thaler, 2016);

According to the dual process theory, one of the two systems are activated based on the specific context (Evans, 2008; Kahneman, 2012). Understanding how both systems interact and what their roles are is helpful to understand the decision anomalies in when, why, and how decision-makers act against their interests in judgements and decision-making and how to help people make effective decisions. The use of automatic rules in Robo-advisors might be examined employing the theoretical background of the dual process based theory. Automatic investment decisions tackle the self-control issue, as investors with self-control problems might plan to make rational decisions but might become emotional when the actual decision time comes. Automating the decision-making process leads to more rationality: by using System 2, programmers can avoid behavioural biases and heuristics of System 1 (Liaudinskas, 2019). Decision support systems like recommendation agents or defaults used in Robo-advisors can help users make better informed and less biased decisions (Jung & Weinhardt, 2018).

When joining Robo-advisors, investors answer questions about their financial goals, timeline, risk tolerance. Robo-advisors then either automatically build a portfolio based on those responses or suggest a few portfolio choices to investors. Some Robo-advisors allow investors to modify the portfolios recommended by the Robo-advisors: an investor can remove some stocks and replace them with different ones (Shanmuganathan, 2020). Investors might use defaults in Robo-advisors because they want to relinquish a part of their responsibility (Jung & Weinhardt, 2018). However, fully automated Robo-advisors promote passive investment attitudes that might reduce investor motivations to take part in the stock market and acquire financial knowledge in the first place. There is a risk that, on the one hand, Robo-advisors increase the inclusion into the stock market, but on the other hand, Robo-advisors prevent investors from actively managing their portfolios, and new forms of exclusion might arise (Tan, 2020). The alternative is to have advice with a few options produced by Robo-advisors based on the profile of investors. The active choice puts into action the deliberative system: the investors have time to think and decide, therefore learning is activated. Behavioural policies usually design the defaults that lead to losing the capacity of active choice of individuals. Van Gestel, Adriaanse and De Ridder (2020) experimentally tested the effectiveness of defaults through automatic and deliberative systems and found that the default effect was not attenuated when participants deliberated their decision. This implied that default nudges are not dependent on elaborate processing to be effective. However, the study showed that participants who received deliberation instructions made different choices, which suggested that the availability of cognitive resources does not directly imply engagement of these resources. Therefore, to activate the deliberative system, information must be appropriately structured and presented for decision making.

The previous paragraph may be understood to contain an implicit bias in interpreting the literature that an active investment approach is superior to a passive investment approach. However, neither approach can be said to be superior or inferior with a sufficient degree of certainty at this stage. The research of both active and passive investment approaches is still limited, and the results are mixed as further discussed in Section 3.

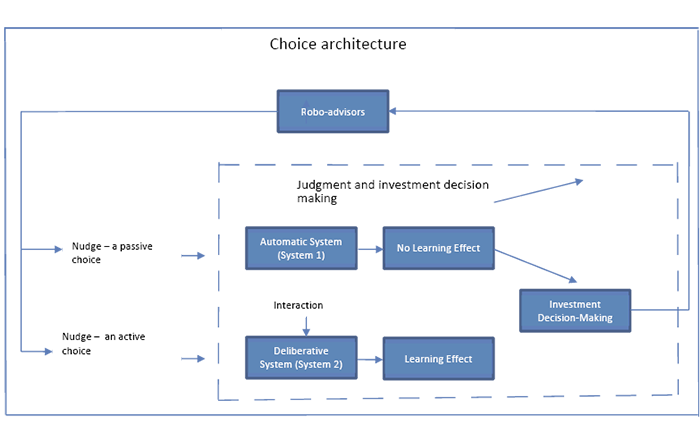

Thaler and Sunstein (2009) stated that it is possible to mitigate cognitive biases by deliberately designing how information is presented and nudging individuals via automatic and deliberative systems to achieve desired results. Thaler and Sunstein (2009) defined the term nudge as any aspect of the choice architecture that predictably alters people’s behaviour without forbidding any options or significantly changing their economic incentives. Figure 1 supplements Jung and Weinhardt (2018) by splitting nudges into passive and active choice and adding the learning effect.

Figure 1. Interaction between Robo-advisors and Behavioural Biases in Investment Decision-making, Based on Jung and Weinhardt (2018)

Choice architecture postulates that nudges can influence and improve financial decision-making. It shapes the interaction between the information system, the Robo-advisors, and investment decision-making. Depending on the nudge type, either the automatic system (System 1) or the deliberative (System 2) is activated. If Robo-advisors provide default options and process investment decisions automatically without investors’ involvement, the investors can relinquish themselves and take no part in the investment process. This type of nudging derives from a passive investment approach. An alternative may be to have Robo-advisors provide a few options so that investors have to choose. In this case, the investors take time to think before making the investment decision. We conclude from the above discussion on the theoretical framework that this type of nudging derives from an active investment approach.

Robo-advisors enable more people to participate in financial markets. However, those investors might no longer actively manage their portfolios due to the passive attitudes imposed by Robo-advisors. The risk could increase when Robo-advisors featuring a passive investment attitude are offered to individuals with lower wealth and no investment experience (Abraham et al., 2019). OECD (2017) listed a few risks, such as lack of consumer safety and trust in digital financial services, new types of exclusion for some populations (elderly, women, first-time users of technology) driven by particular policies, excess reliance on digitally delivered credit or over-indebtedness of some groups (youth, students, low-income segment), misuse of personal financial data. Robo-advisors can provide active choice aimed at encouraging individuals to take part in the stock market. Different types of nudges could have diverse effects on investment decision making, therefore, it is important to understand how the passive and active investment approaches of Robo-advisors affect the behaviour of investors.

3. Robo-advisors Effect on Investors’ Behavioural Biases

The field of research on multiple uses of Robo-advisors is rapidly growing. However, research examining the Robo-advisors application in investment services and their effect on the behavioural biases of individual investors is limited. We reviewed qualitative and empirical studies in the field to distinguish three key research areas: research on technologies and regulation, research on applications of Robo-advisors, and research on the impact of Robo-advisors on investment and risks.

The typology of key research areas on Robo-advisors in investments and their characteristics is presented in Table 2.

We have distinguished a broad research area, which serves as the background for the development of research methodology on Robo-advisors in the investment industry. Baker (2018), Fisch et al. (2019), Maume (2019) examined fundamental characteristics of Robo-advisors that raise challenges to the development of the regulatory framework. The studies investigated transparency and ethical characteristics by examining such issues as adequate disclosure about the Robo-advisors and the services they provide. The researchers indicated the need to ensure that the Robo-advisors provide suitable advice to the investors and the possibility to track the accountability of the Robo-advisors by storing all interactions on the individual level. Such studies formed a background for the development of methodology for further research on Robo-advisors. The main theoretical framework employed in Robo-advisors research is based on classical Modern Portfolio Theory. The current trend is to improve this framework rather than to develop entirely new approaches (Beketov et al., 2018). New methodological approaches, including network analysis and specific exploration-exploitation algorithms that focus on portfolio choices linking costs with autonomous trading decisions, were adopted to examine Robo-advisors role in investment portfolio research (Alsabah et al., 2019; Snihovyi, 2018). A few studies focused on the effective design of Robo-advisors that could lead to easier interaction, efficiency in helping investors to achieve their goals with a certain accuracy, completeness and reliability, greater levels of trust and transparency (Boreiko; Massarotti, 2020; Hildebrand & Bergner, 2020; Jung et al., 2018). The studies indicated the emerging methodological framework of information design and choice architecture. In case it is further developed, empirical studies based on it might help draw investors’ attention to key characteristics of Robo-advisors, provide better advice and experiences and be better equipped to comply with regulatory requirements (Adam et al., 2019; Bourgeron, 2018; Salo & Haapio, 2017).

Table 2. Typology of Research Areas on Robo-advisors in Investments

|

Research areas |

Characteristics |

Origins |

|

Methodological background of Robo-advisors research |

Transparency and ethical issues |

Maume (2019), Fisch et al. (2019), Baker (2018) |

|

Investment portfolio building |

Beketov et al. (2018), Snihovyi (2018), Alsabah et al. (2019) |

|

|

Design and choice architecture |

Jung et al. (2018), Boreiko and Massarotti (2020), Hildebrand and Bergner (2020), Adam et al. (2019), Salo and Haapio (2017), Bourgeron (2018) |

|

|

Applications of Robo-advisors |

The determinants of adopting Robo-advisors |

Dietvorst et al. (2015), Szeli (2020), Rühr et al. (2019), Rühr (2020), Niszczota and Kaszás (2020), Balwani et al. (2019), Zhang et al. (2021) Tauchert and Mesbah (2019) |

|

Characteristics of the users of Robo-advisors |

Brenner and Meyll (2020), Goldbach et al. (2019), Polansky et al. (2019); Rossi and Utkus (2020), Hohenberger (2019), Glaser et al. (2019), Belanche et al. (2019); Brenner and Meyll (2020), Todd and Seay (2020) |

|

|

Robo-advisors and investments risks |

General implications and risks of Robo-advisors |

D’Acunto et al. (2019), Faloon and Scherer (2017), Jung et al. (2019), Hayes (2019), Tao et al. (2021), Shanmuganathan (2020), Rühr et al. (2019), Horn and Oehler (2020), Puhle (2019), Au and Krahnhof (2020) |

|

Robo-advisors impact on the change of behavioural biases |

Bhatia et al. (2020), Braeuer et al. (2017), D’Acunto et al. (2019), D’Hondt (2019), Jung and Weinhardt (2018), Liaudinskas (2019), Polansky et al. (2019), Rohner (2018), Loos et al. (2020) |

|

|

Robo-advisors and financial literacy, experience |

LLitterscheidt and Streich (2020), Hohenberger (2019), Braeuer et al. (2017), Tan (2020), Polansky et al. (2019), Loos et al. (2020), Rossi and Utkus (2020) |

Information technology is used in financial markets extensively, however, the adoption of Robo-advisors level remains low (Bhatia et al., 2020). Therefore, some studies focus on the characteristics of Robo-advisors to customise and personalise their applications from different perspectives. In the area of application of Robo-advisors, the studies investigated the determinants of adopting Robo-advisors, such as the level to which the Robo-advisors are automated, the extent to which the investors can control the system, humanisation of Robo-advisors, and the performance of Robo-advisors (Balwani et al., 2019; Rühr, 2020; Rühr et al., 2019; Szeli, 2020; Tauchert & Mesbah, 2019; Zhang et al., 2021). The characteristics of the users of Robo advisors were examined using personality factors: (extroverts versus introverts), age, gender, income, financial literacy, investing characteristics associated with having used an automated investment solution, algorithm aversion, fear to be victimised by investment fraud (Brenner & Meyll, 2020; Dietvorst et al., 2015; Glaser et al., 2019; Hohenberger, 2019; Niszczota & Kaszás, 2020; Polansky et al., 2019; Rossi & Utkus, 2020; Todd & Seay, 2020).

Finally, we have distinguished a separate area of research on Robo-advisors and investment risks. To generalize, these studies compare the behaviour of investors and decisions of adopters versus non-adopters or before adoption and after adoption. The studies on general implications and risks of Robo-advisors investigated the effects of Robo-advisors on the investors’ performance and behaviour: portfolio diversification, volatility, risk, trading results (Au & Krahnhof, 2020; D’Acunto et al., 2019; Hayes, 2019; Horn & Oehler, 2020; Puhle, 2019; Rühr et al., 2019; Shanmuganathan, 2020; Tao et al., 2021). Faloon and Scherer (2017) investigated the individualisation of Robo-advisors, Jung et al. (2019) discussed the strengths, weaknesses, opportunities and risks of Robo-advisors. Studies investigated the impact of Robo-advisors on the change of behavioural biases in general (Bhatia et al., 2020; Braeuer et al., 2017; Rohner, 2018). A few studies focused on Robo-advisors effect on specific behavioural biases: disposition effect, trend-chasing and rank effect (D’Acunto et al., 2019), home bias (Loos et al., 2020), disposition effect (D’Hondt, 2019; Liaudinskas, 2019), decision inertia (Jung & Weinhardt, 2018). Studies on Robo-advisors, financial literacy and experience evaluated the effect of financial literacy and experience on the usage of Robo-advisors (Braeuer et al., 2017; Hohenberger, 2019; Litterscheidt & Streich, 2020; Polansky et al., 2019), and the effect of Robo-advisors on the financial literacy and experience. (Loos et al., 2020; Rossi & Utkus, 2020; Tan, 2020).

As Robo- advisors grow in scale and modalities (from traditional, non-conversational interfaces to the natural language processing capabilities of conversational interfaces), cross-disciplinary research of new technologies and augmented investors decision making is emerging.

We have selected for a detailed review several studies that represent typical research methods used to examine links between Robo-advisors and behavioural biases: real-time experiments, qualitative studies and a laboratory experiment. The selected studies are summarised in Table 3.

Table 3. Methods and Implications of Research on Robo-advisors Impact on the Change of Investors’ Behavioural Biases

|

Research methods |

Research design |

Major findings |

Relevance to research on investors’ experience and financial literacy |

Origins |

|

Interviews |

Interviews from a different perspective with experts from digital advice providers, financial services companies |

Robo-advisors might mitigate investor’s behavioural biases. However, Robo-advisors are not yet self-sufficient to accurately perform risk analysis for retail investors. |

Interviews with experts, financial literacy is not studied.

|

Bhatia et al. (2020), Polansky et al. (2019) |

|

Field Experiments

|

Comparing choices of self-directed individuals with those who use Robo-advisors |

Robo-advisors guidance motivates the choice of better diversified and lower-cost funds in savings plans. |

Less experienced individual investors use the Robo-advisors. |

Braeuer et al. (2017) |

|

Comparing choices of individual investors before and after investors access Robo-advisors |

Robo-advisors reduce but do not eliminate disposition effect, trend-chasing, rank effect, and home bias. |

Users of the Robo-advisors are more sophisticated. Robo-advisors have opposite effects on investors’ performance based on their level of sophistication. |

D’Acunto et al. (2019), Loos et al. (2020) |

|

|

The high-frequency transaction-level data. |

Disposition effect among professional human stock day-traders, but virtually no disposition effect among algorithmic traders. |

Decisions of the professional day- traders are studied. |

Liaudinskas (2019) |

|

|

Real-time Experiments |

The notion of AI Alter Egos, shadow Robo-advisors |

AI Alter Ego reduces the disposition effect and trading frequency. Compared to passive ETFs, the evidence is mixed. |

High risk-averse and low- income investors significantly gain from Robo-advisors. |

D’Hondt (2019) |

|

Indices compared to the Robo-advisors strategy |

Robo-advisors solutions can save costs up to 4.4% per year. |

- |

Rohner (2018) |

|

|

Laboratory Experiment |

An experiment with three treatments: control, default nudge and warning message |

Nudges can reduce financial decision inertia. Inertia is also linked to financial literacy and gender. |

- |

Jung and Weinhardt (2018) |

In recent literature, several papers have focused on insights based on interviews as a research method. Bhatia et al. (2020) noted that developers of Robo-advisors need to be aware of the biases to eliminate them from the questionnaires. However, the study investigated the mitigation of behavioural biases as cognitive errors in general, without specifying those biases. Polansky et al. (2019) explored how digital advice providers execute decumulation strategies to manage pay-outs during retirement and noted that Robo-advisors offer an opportunity to steer investors away from biases likely to lead to detrimental behaviour: overconfidence, loss aversion, mental accounting, framing, and more.

Several studies focus on field experiments to investigate the issues. Braeuer et al. (2017) analysed the impact of savings defaults in the Robo-advisors context and found that Robo-advisors have a significant positive effect compared to self-directed savings plans in increased diversification, increased choice of passive investment in ETFs and less costly ETFs. Their results suggest that automatic order execution can counteract a lack of self-control and inertia. However, they did not investigate Robo-advisors effect on the change of a particular behavioural bias. The authors noted that less experienced individual investors use Robo-advisors, while the more experienced rely more on self-directed participation. Liaudinskas (2019) found that the disposition effect is substantial among human professional day-traders but close to zero among algorithms suggesting that automating the decision-making process and using deliberative system programmers can help achieve rationality and avoid behavioural biases. D’Acunto et al. (2019) found that Robo-advisors reduced but did not eliminate the disposition effect, trend-chasing, and the rank effect. Also, they showed that Robo-advisors increased portfolio diversification and decreased volatility for those that held less than five stocks before adoption, while it did not affect diversification for investors that held more than ten stocks before adoption. Hence, Robo-advisors had the opposite effects on investors’ performance based on their level of sophistication. The study suggested that users of Robo-advisors were more sophisticated, had a higher amount of assets under management, a higher trading activity than non-users, which contradicts Braeuer et al. (2017). Loos et al. (2020) found that the investors increased their portfolio diversification and reduced home bias after joining Robo-advisors. They showed that after starting to use the Robo-advisors services, portfolio efficiency of investors, such as the number of investments, geographical diversification and the fraction of index or passive funds, improved compared to the non-Robo-advisors part of their investment, which suggests that investors learn from Robo-advisors.

Additional insights are brought by investigating the phenomenon using real-time experiments. D’Hondt (2019) used a data set including the 2008 financial crisis and found that shadow Robo-advisors, AI Alter Ego, alleviated the disposition effect, however, compared to passive ETF investment, the evidence is mixed – during the non-crisis time median AI Alter Ego performed worse than the market benchmarks. Rohner (2018) empirically showed that investors are misguided by emotions creating a ‘behavioural gap’, which is the difference between the performance of equity or bond indices and the realised performance of average equity or bond investor. Therefore, Robo-advisors that apply a strict rebalancing regime compared to those that try to time the market could help the investors. Investors would rebalance their portfolio back to its strategic weights: they would sell the winning assets and buy the lowest returning assets. However, Rohner (2018) evaluated the ‘behavioural gap’ without specifying any particular behavioural bias.

Studies employing laboratory experiments provided additional insights into the research field. Jung and Weinhardt (2018) investigated whether Robo-advisors can help overcome decision inertia in investment decisions. The results indicate a significant influence of both nudges – defaults and warning messages – on alleviated decision inertia. Default nudges are more robust to overcome decision inertia compared to warning messages.

Recent research on the effects of the use of advanced investment technologies on investor behaviour made significant advancements. However, the performed literature review shows that research of applications of Robo-advisors of different design employing passive investment approach versus active investment approach is limited. Also, the findings on the impact of Robo-advisors on the change of investors’ behavioural biases are mixed. Liaudinskas (2019) investigated the passive investment approach and the impact of algorithms on behavioural biases without any possible intervention from the investors’ side. Braeuer et al (2017) explored how external anchors and guidance can influence investment decisions in an experimental setting where investors needed to make an active decision by choosing one of the portfolios recommended by Robo-advisors. They found that investors who are financially able to contribute more will do so, even though the Robo-advisors provide a default value. D’Acunto et al (2019) in their study allowed the active choice to the investors. In this experiment, Robo-advisors had different effects across investors based on their extent of diversification before Robo-advisors adoption. Jung and Weinhardt (2018) laboratory experiment found that default nudges (i.e., a passive approach) are more robust to overcome decision inertia compared to the warning message (i.e., an active approach). A deeper understanding of how Robo-advisors of different design that employ passive investment approach versus active investment approach affect specific behavioural biases, performance and investment results of investors could help use Robo-advisors and ensure higher participation in the stock market.

4. Conclusions and Implications for Future Research

The literature review has examined the current state as well as the limitations of the research to date. It has provided arguments as to why the dual-process theoretical framework should be applied in examining the relationship between the application of Robo-advisors in investment services and investors’ behavioural biases. The literature review has shown that the effects of the application of automatic rules in Robo-advisors might be examined based on a theoretical framework of the dual process based theory. Defaults or framing as nudges usually utilise the automatic system. However, a few nudges that aim to show investors the consequences of their decisions target the deliberative system (Bhandari et al., 2008; Sunstein, 2014). Defaults used in Robo-advisors can help market participants make better informed and less biased decisions (Jung & Weinhardt, 2018). However, fully automated Robo-advisors activate the automatic system processes, and the investors do not have to make any decisions themselves any more. The passive investment approach could result in investors’ alienation from the stock market. The option of active choice in modern Robo-advisors puts into action the deliberative system that may activate the learning process. The increased level of automation may require different approaches to ensure that investors understand their decisions. Otherwise, the spill-over effect of alienation could lead to decreased participation in the stock market.

As the literature review has indicated, there is a lack of agreement among researchers on the scope of advice Robo-advisors provide as well as on their characteristics. Based on analysis of the stage of their development, we have suggested an extended definition of Robo-advisors to be employed for further research in the field. The application of most Robo-advisors is limited to advice and management of a specific investment portfolio. However, along with developments in intelligent data analysis and machine learning, Robo-advisors are becoming more sophisticated, and personalised tools for investors should be addressed in further research of Robo-advisors application in the investment area.

Studies investigated Robo-advisors impact on the change of behavioural biases in general (Bhatia et al., 2020; Braeuer et al., 2017; Rohner, 2018). A few studies focused on Robo-advisors effect on specific behavioural biases: disposition effect, trend-chasing and rank effect (D’Acunto et al., 2019), home bias (Loos et al., 2020), disposition effect (D’Hondt, 2019; Liaudinskas, 2019), decision inertia (Jung & Weinhardt, 2018). Based on the literature review, we can conclude that research on Robo-advisors role and effects on behavioural biases in the investment area is still limited and focuses mainly on examining a limited number of behavioural biases. The results of the studies are mixed. Therefore further research is expedient to investigate the impact of Robo-advisors on the broader range of behavioural biases, especially research aimed at a better understanding of the underlying mechanisms of causality.

The research on behavioural biases documents why some investors are less prone to the biases than others, e.g. cultural differences, gender, age, information, sophistication, trading experience, etc. (Feng & Seasholes, 2005; Grinblatt & Keloharju, 2001), genetic and neurological factors (da Silva et al., 2020; Teixeira et al., 2015), emotional and cognitive factors (Wynes, 2020). So far, the research has not investigated the use of Robo-advisors by individual investors in the context of biological, neurological and socio-cultural factors. Research on the effects of moderating and mediating factors could provide an understanding of how and when different factors affect the impact of Robo-advisors on the change of behavioural biases. The existing research gaps can be addressed by raising the following research questions: How significant are biological, neurological and socio-cultural factors, how do they interact? Do important mediating and moderating mechanisms exist? Further research might focus on Robo-advisors when they become better adapted to different demographics, life stages and learning styles of individuals: how different designs of Robo-advisors including a passive investment approach versus an active investment approach affect specific behavioural biases and investment decisions. Future research could dig deeper into the broader implications on the investment industry of Robo-advisors tailored to the needs of particular categories of investors, increasing the personalisation of Robo-advisors.

Literature review suggests that the following questions remain open: what financial decisions should individual investors make independently, and what decisions should they delegate to Robo-advisors, depending on individual-specific factors, such as biological, neurological and socio-cultural. Further research in the above-suggested fields might provide answers and solutions to the investment industry as to what extent Robo-advisors could remove the influence of investors’ behavioural biases and decrease entry barriers to the stock market.

References

Abraham, F., Schmukler, S. L., & Tessada, J. (2019). Robo-Advisors: Investing through Machines. Research and Policy Briefs (134881). The World Bank.

Adam, M., Toutaoui, J., Pfeuffer, N., & Hinz, O. (2019). Investment Decisions with Robo-advisors: The Role of Anthropomorphism and Personalized Anchors in Recommendations. In Proceedings of the 27th European Conference on Information Systems (ECIS), Stockholm & Upsala, Sweden, June 8-14. https://aisel. aisnet. org/ecis2019_rp/33.

Alsabah, H., Capponi, A., Ruiz Lacedelli, O., & Stern, M. (2019). Robo-Advising: Learning Investors’ Risk Preferences via Portfolio Choices. Journal of Financial Econometrics. http://dx.doi.org/10.2139/ssrn.3228685

Au, C.-D., & Krahnhof, P. (2020). The Role of Robo-Advisors in the German Banking Market–Critical Analysis on Human Versus Digital Advisory Services. In Proceedings of IASTEM International Conference, Brussels, Belgium, Institute for Technology and Research.

Baker, T. (2018). Regulating Robo Advice Across the Financial Services Industry. SSRN Electronic Journal. doi:10.2139/ssrn.2932189

Balwani, D., Dash, A., Das, A., Das, L., Misra, D., & Ghose, D. (2019). Robo-Advisory: An Investor’s Perception. International Journal of Psychosocial Rehabilitation, 23(3).

Barber, B. M., & Odean, T. (2000). Trading Is Hazardous to Your Wealth: The Common Stock Investment Performance of Individual Investors. The Journal of Finance, 55(2), 773-806.

Beketov, M., Lehmann, K., & Wittke, M. (2018). Robo Advisors: Quantitative Methods Inside the Robots. Journal of Asset Management, 19(6), 363-370. https://dx.doi.org/10.1057/s41260-018-0092-9

Belanche, D., Casaló, L. V., & Flavián, C. (2019). Artificial Intelligence in FinTech: Understanding Robo-advisors Adoption among Customers. Industrial Management & Data Systems. https://doi.org/10.1108/IMDS-08-2018-0368

Bhandari, G., Hassanein, K., & Deaves, R. (2008). Debiasing Investors with Decision Support Systems: An Experimental Investigation. Decision Support Systems, 46(1), 399-410. https://dx.doi.org/10.1016/j.dss.2008.07.010

Bhatia, A., Chandani, A., & Chhateja, J. (2020). Robo Advisory and its Potential in Addressing the Behavioral Biases of Investors—A Qualitative Study in Indian Context. Journal of Behavioral and Experimental Finance, 25, 100281.

Bhattacharya, U., Hackethal, A., Kaesler, S., Loos, B., & Meyer, S. (2012). Is Unbiased Financial Advice to Retail Investors Sufficient? Answers from a Large Field Study. The Review of Financial Studies, 25(4), 975-1032.

Boreiko, D., & Massarotti, F. (2020). How Risk Profiles of Investors Affect Robo-advised Portfolios. Frontiers in Artificial Intelligence, 3, 60.

Bourgeron, T., Lezmi, E., & Roncalli, T. (2018). Robust Asset Allocation for Robo-Advisors. SSRN Electronic Journal. doi:10.2139/ssrn.3261635

Braeuer, K., Hackethal, A., & Scheurle, S. (2017). Fund Savings Plan Choices with and without Robo-Advice. Observatoire de l’épargne européenne. http://www.oee.fr/files/fund_savings_plan_choices.pdf

Brenner, L., & Meyll, T. (2020). Robo-advisors: A Substitute for Human Financial Advice? Journal of Behavioral and Experimental Finance, 25, 100275.

D’Acunto, F., Prabhala, N., & Rossi, A. G. (2019). The Promises and Pitfalls of Robo-advising. The Review of Financial Studies, 32(5), 1983-2020.

D’Hondt, C., De Winne, R., Ghysels, E., & Raymond, S. (2019). Artificial Intelligence Alter Egos: Who Benefits from Robo-nvesting? Journal of Empirical Finance, 59, 278-299 (2020). https://arxiv.org/abs/1907.03370

da Silva, E. B., Silva, T. C., Constantino, M., Amancio, D. R., & Tabak, B. M. (2020). Overconfidence and the 2D: 4D Ratio. Journal of Behavioral and Experimental Finance, 100278.

Deloitte. (2016). The Expansion of Robo-advisory in Wealth Management. https://www2.deloitte.com/content/dam/Deloitte/de/Documents/financial-services/Deloitte-Robo-safe.pdf

Dietvorst, B. J., Simmons, J. P., & Massey, C. (2015). Algorithm Aversion: People Erroneously Avoid Algorithms after Seeing Them Err. Journal of Experimental Psychology: General, 144(1), 114.

Evans, J. S. B. T. (2008). Dual-Processing Accounts of Reasoning, Judgment, and Social Cognition. Annual Review of Psychology, 59(1), 255-278. https://dx.doi.org/10.1146/annurev.psych.59.103006.093629

Faloon, M., & Scherer, B. (2017). Individualization of Robo-Advice. The Journal of Wealth Management, 20(1), 30-36. https://dx.doi.org/10.3905/jwm.2017.20.1.030

Fama, E. F. (1970). Efficient Capital Markets: A Review of Theory and Empirical Work. The Journal of Finance, 25(2), 383-417.

Feng, L., & Seasholes, M. S. (2005). Do Investor Sophistication and Trading Experience Eliminate Behavioral Biases in Financial Markets? Review of Finance, 9(3), 305-351. https://dx.doi.org/10.1007/s10679-005-2262-0

Fisch, J. E., Labouré, M., & Turner, J. A. (2019). The Emergence of the Robo-advisor. In J. Agnew & O. S. Mitchell (Eds.), The Disruptive Impact of FinTech on Retirement Systems (pp.13-37). Oxford, UK: Oxford University Press. DOI:10.1093/oso/9780198845553.003.0002

Glaser, F., Iliewa, Z., Jung, D., & Weber, M. (2019). Towards Designing Robo-advisors for Unexperienced Investors with Experience Sampling of Time-series Data. In Information Systems and Neuroscience (pp. 133-138). Springer.

Goldbach, C., Kayar, D., Pitz, T., & Sickmann, J. (2019). Transferring Decisions to an Algorithm: A Simple Route Choice Experiment. Transportation Research Part F: Traffic Psychology and Behaviour, 65, 402-417.

Grinblatt, M., & Keloharju, M. (2001). What Makes Investors Trade? The Journal of Finance, 56(2), 589-616. https://dx.doi.org/10.1111/0022-1082.00338

Hayes, A. S. (2019). The Active Construction of Passive Investors: Roboadvisors and Algorithmic ‘low-finance’. Socio-Economic Review, 19(1). DOI:10.1093/ser/mwz046

Hildebrand, C., & Bergner, A. (2020). Conversational Robo Advisors as Surrogates of Trust: onboarding Experience, Firm Perception, and Consumer Financial Decision Making. Journal of the Academy of Marketing Science, 1-18.

Hirshleifer, D. (2015). Behavioral Finance. Annual Review of Financial Economics, 7(1), 133-159. doi:10.1146/annurev-financial-092214-043752

Hohenberger, C., Lee, C., & Coughlin, J.F (2019). Acceptance of Robo-advisors: Effects of Financial Experience, Affective Reactions, and Self-enhancement Motives. Financial Planning Review, e1047. https://dx.doi.org/10.1002/cfp2.1047

Horn, M., & Oehler, A. (2020). Automated Portfolio Rebalancing: Automatic Erosion of Investment Performance? Journal of Asset Management, 1-17.

Jung, D., Dorner, V., Weinhardt, C., & Pusmaz, H. (2018). Designing a Robo-advisor for Risk-averse, Low-budget Consumers. Electronic Markets, 28(3), 367-380. doi:10.1007/s12525-017-0279-9

Jung, D., Dorner, V., Glaser, F., Morana, S. (2018). Robo-Advisory: Digitalization and Automation of Financial Advisory. Business & Information Systems Engineering, 60(1), 81-86.

Jung, D., Glaser, F., & Köpplin, W. (2019). Robo-Advisory: Opportunities and Risks for the Future of Financial Advisory. In Advances in Consulting Research (pp. 405-427). Springer.

Jung, D., & Weinhardt, C. (2018). Robo-Advisors and Financial Decision Inertia: How Choice Architecture Helps to Reduce Inertia in Financial Planning Tools. In 39th International Conference of Information Systems (ICIS 2018), San Francisco.

Kahneman, D. (2012). Thinking, Fast and Slow. Penguin Books.

Kahneman, D., Slovic, P., & Tversky, A. (1982). Judgement Under Uncertainty: Heuristics and Biases: Cambridge University Press.

Liaudinskas, K. (2019). Human vs. Machine: Disposition Effect Among Algorithmic and Human Day-traders. Working Papers 1133, Barcelona Graduate School of Economics.

Litterscheidt, R., & Streich, D. J. (2020). Financial Education and Digital Asset Management: What’s in the Black Box? Journal of Behavioral and Experimental Economics, 101573.

Loos, B., Previtero, A., Scheurle, S., & Hackethal, A. (2020). Robo-advisers and Investor Behavior. University of Technology of Sidney.

Lopez, J. C., Babcic, S., & De La Ossa, A. (2015). Advice Goes Virtual: How New Digital Investment Services Are Changing the Wealth Management Landscape. Journal of Financial Perspectives, 3(3).

Market Data Forecast (2020). Global Robo Advisory Market Research Report. https://www.marketdataforecast.com/market-reports/robo-advisory-market

Maume, P. (2019). Regulating Robo-Advisory. Texas International Law Journal, 55, 49-87.

Niszczota, P., & Kaszás, D. (2020). Robo-fund Aversion: People Prefer it When Humans and not Computers Make Investment Decisions with Moral Undertones. PsyArXiv. March, 13.

OECD. (2017). G20/OECD INFE: Report on ensuring financial education and consumer protection for all in the digital age.

Polansky, S., Chandler, P., & Mottola, G. R. (2019). The Big Spenddown: Digital Investment Advice and Decumulation. In J. Agnew & O. S. Mitchell (Eds.), The Disruptive Impact of FinTech on Retirement Systems (pp.129-148). Oxford University Press.

Puhle, M. (2019). The Performance and Asset Allocation of German Robo-Advisors. Society and Economy, 41(3), 331-351.

Rohner, P., Uhl, M. (2018). Robo-Advisors vs. Traditional Investment Advisors-An Unequal Game. Journal of Wealth Management, 21(1), 44-50.

Rossi, A., & Utkus, S. (2020). The Needs and Wants in Financial Advice: Human versus Robo-advising. Working Paper, Georgetown University.

Rühr, A. (2020). Robo-Advisor Configuration: An Investigation of User Preferences and the Performance-Control Dilemma. Proceedings of the 28th European Conference on Information Systems (ECIS), An Online AIS Conference, June 15-17, 2020. https://aisel.aisnet.org/ecis2020_rp/94

Rühr, A., Berger, B., & Hess, T. (2019). Can I Control My Robo-Advisor? Trade-Offs in Automation and User Control in (Digital) Investment Management. Americas Conference on Information Systems (AMCIS) Cancun, Mexico, 25.

Rühr, A., Streich, D., Berger, B., & Hess, T. (2019). A Classification of Decision Automation and Delegation in Digital Investment Management Systems. Proceedings of the 52nd Hawaii International Conference on System Sciences (HICSS) at Wailea, Hawaii, volume 52. https://doi.org/10.24251/HICSS.2019.174

Salo, M., & Haapio, H. (2017). Robo-Advisors and Investors: Enhancing Human – Robot Interaction Through Information Design. In E. Schweighofer et al. (Eds.), Trends and Communities of Legal Informatics. Proceedings of the 20th International Legal Informatics Symposium IRIS 2017 (Österreichische Computer Gesellschaft, Wien 2017), pp. 441–448. http://dx.doi.org/10.2139/ssrn.2937821

Shanmuganathan, M. (2020). Behavioural Finance in an Era of Artificial Intelligence: Longitudinal Case Study of Robo-advisors in Investment Decisions. Journal of Behavioral and Experimental Finance, 100297.

Simon, H. A. (1955). A Behavioral Model of Rational Choice. The Quarterly Journal of Economics, 69(1), 99-118.

Sironi, P. (2016). My Robo Advisor was an iPod–Applying the Lessons from Other Sectors to FinTech Disruption. In S. Chishti & J. Barberis (Eds.), The FinTech Book: The Financial Technology Handbook for Investors, Entrepreneurs and Visionaries (152-154). https://doi.org/10.1002/9781119218906.ch41

Snihovyi, O., Ivanov, O., & Kobets, V. (2018). Implementation of Robo-Advisors Using Neural Networks for Different Risk Attitude Investment Decisions. Paper presented at the International Conference on Intelligent Systems (IS). https://doi.org/10.1109/IS.2018.8710559

Sunstein, C. R. (2014). Nudging: A Very Short Guide. Journal of Consumer Policy, 37(4), 583-588.

Szeli, L. (2020). UX in AI Trust in Algorithm-based Investment Decisions. Junior Management Science, 5(1), 1-18.

Tan, G. K. S. (2020). Robo-advisors and the Financialization of Lay Investors. Geoforum,117, 46-60. https://doi.org/10.1016/j.geoforum.2020.09.004

Tao, R., Su, C.-W., Xiao, Y., Dai, K., & Khalid, F. (2021). Robo Advisors, Algorithmic Trading and Investment Management: Wonders of Fourth Industrial Revolution in Financial Markets. Technological Forecasting and Social Change, 163, 120421.

Tauchert, C., & Mesbah, N. (2019). Following the Robot? Investigating Users’ Utilization of Advice from Robo-Advisors. https://aisel.aisnet.org/icis2019/smart_service_science/smart_service_science/8/

Teixeira, A. M., Tabak, B. M., & Cajueiro, D. O. (2015). The 2D:4D ratio and Myopic Loss Aversion (MLA): An Experimental Investigation. Journal of Behavioral and Experimental Finance, 5, 81-84. https://dx.doi.org/10.1016/j.jbef.2015.02.005

Thaler, R. H. (2016). Behavioral Economics: Past, Present, and Future. American Economic Review, 106(7), 1577-1600.

Todd, T. M., & Seay, M. C. (2020). Financial Attributes, Financial Behaviors, Financial‐advisor‐use Beliefs, and Investing Characteristics Associated with Having Used a Robo‐advisor. Financial Planning Review, 3(3), e1104.

Tversky, A., & Kahneman, D. (1974). Judgment under Uncertainty: Heuristics and Biases (Vol. 185): Cambridge University Press.

Wynes, M. J. (2020). Anger, Fear, and Investor’s Information Search Behavior. Journal of Behavioral Finance, 1-17.

Zhang, L., Pentina, I., & Fan, Y. (2021). Who do you choose? Comparing Perceptions of Human vs Robo-advisor in the Context of Financial Services. Journal of Services Marketing.