Organizations and Markets in Emerging Economies ISSN 2029-4581 eISSN 2345-0037

2021, vol. 12, no. 2(24), pp. 332–352 DOI: https://doi.org/10.15388/omee.2021.12.59

Tax Planning, Corporate Governance and Financial Performance of Selected Quoted Non-Financial Companies in Nigeria (2007–2018)

John Olayiwola (corresponding author)

jolayiwola@oauife.edu.ng

Obafemi Awolowo University Ile-Ife, Nigeria

https://orcid.org/0000-0001-9116-653X

Stephanie Okoro

stephaniechinney@yahoo.com

Obafemi Awolowo University Ile-Ife, Nigeria

https://orcid.org/0000-0002-0134-584X

Abstract. This study examines the interactive effect of tax planning and corporate governance on the financial performance of 50 non-financial quoted companies in Nigeria between 2007 and 2018. The study sample that covers 9 sectors was selected purposively through stratified random sampling. Data used were collected from the audited annual reports and accounts of selected quoted companies in Nigeria and fact books published by the Nigeria Stock Exchange. A system GMM was employed to estimate the dynamic models, and results show that ownership structure (OS) and capital intensity (CI) exerted a significant and positive impact on the returns on assets. This implies that OS plays a significant role to ensure that CI triggers an increase in the return on assets of the quoted Nigerian companies. However, board diversity and thin capitalization wielded a significant and negative influence on return on assets. This study thus recommends that companies should put in place a strong corporate governance mechanism that will monitor, check and balance tax planning activities and strategies adopted by the management of quoted companies in Nigeria.

Keywords: capital intensity, thin capitalization, ownership structure, board diversity, Generalized Moment Method, Nigeria.

Received: 13/4/2021. Accepted: 12/7/2021

Copyright © 2021 John Olayiwola, Stephanie Okoro. Published by Vilnius University Press. This is an Open Access article distributed under the terms of the Creative Commons Attribution Licence, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

1. Introduction

Tax planning in the corporate organization has been adjudged to be a comprehensive and significant activity. It is of the belief that it has a high-value relevance to most corporate characteristics ranging from the performance of the firms to issues on corporate governance structures, the market value of companies, and perhaps the continuity of the business. Tax planning is the process of formulating a system to minimize or somewhat restrict the charge against an individual’s property, income, or activity, basically for the definite course of generating revenue to another party. It is a technique that corporations, individuals and trustees follow and utilize to appraise their financial profile with the sole aim of tumbling (to the barest minimum) the amount of taxes paid on corporate profit or individual income.

It is considered an important investment policy within the organization because it forces management to utilize available resources at their disposal maximally, analyze and highlight the deviations, which may arise as a result of applying the set plans after which management then determines and evaluates the cause and effect of the non-achievement of the goals and objectives in the original plan and deals with the highlighted deviations. Thus the process of tax planning involves a wide-ranging consideration and application of appropriate provisions and inducements in tax laws and enactments by economic units, which may include the reliefs entitled in acknowledgment of the pioneer status, the rules and respites applicable to the commencement and cessation of a business, the allowances given in respect of the purchase of the asset used exclusively for business purposes, venture in rural areas and the company’s location, roll-over as applied to the disposal of items in which capital gain tax is deductible, or tax savings on interest on finance cost and loss reliefs (Ogundajo & Onakoya, 2016; Fagbemi et al., 2019).

Most companies are rationally inclined to reducing their tax liabilities with the thought of maximizing after-tax earnings thereby enhancing profits and opportunities (Odunayo & Olayiwola, 2019). Nevertheless, recent empirical facts have revealed that there are implicit and explicit costs inherent in a firm that may eventually prevent such firms from optimal returns through tax planning (Abdul-Wahab & Holland, 2012; Khaoula & Moez, 2019). It is only typical for companies to have the desire to increase accounting profits and boost profitability through a policy of minimization of tax burdens and tax avoidance activities. However, an aggressive tax planning activity has been documented by some scholars to be potentially inimical to the interest and wealth of the shareholders (Henderson, 2005; Frank et al., 2009; Khaoula & Moez, 2019). This, as argued, may aggrandize the non-tax costs, especially those resulting from an aggravated agency cost, and subsequently provide an increased opportunity for fund diversions, private accumulations, and consumption as well as perquisites by companies top financial managers. Also, it should be borne in mind that most companies seldom disclose tax-associated risk management information to shareholders and other major stakeholders in the organization. All of these, therefore, impede the transparency imprint of the managers relating to tax planning activities, which subsequently inspires management to conceal narcissistic actions (Desai & Dharmapala, 2006).

The associated problem combating tax planning as a management strategy in corporate firms is agency cost and non-tax costs. These among other issues have widened the gulf between management and shareholders due to information lopsidedness between the two parties just as agency theory suggested. It has further led to acute agency conflicts. Therefore, to assuage this agency problem especially between the shareholders and managers of companies, shareholders and other major investors mostly rely on corporate governance mechanisms in guaranteeing that managers carry out the tactic of aggressive tax planning practices to enhance performance and in turn increase the shareholders’ value. It is also becoming a piece of common knowledge in the literature that management of firms can hijack the potential benefits of tax planning activities and enrich themselves through it, which could create serious conflicts and mistrust issues between managers and shareholders (Jensen & Meckling, 1976). Therefore, it becomes imperative to hold managers responsible and accountable for corporate demeanor and business performance (Wier, 2002). Corporate governance consequently plays a crucial role in the aggressive tax planning practices of the firms, as it monitors the behaviors of management, guides and advises them on the identification and implementation of tax planning strategies (Ahmed & Khaoula, 2013). Hence a good corporate governance mechanism is a yardstick of the shareholders for evaluating managers’ tax planning decisions (Abdul-Wahab, 2010).

There are handfuls of empirical facts on tax planning-financial performance nexus both in developed and developing economies. While some studies maintained an absence of a significant relationship between tax planning and performance and value of companies (Desai & Dharmapala, 2009; Kawor & Kportorgi, 2014; Khaoula & Moez, 2019), some other studies reported a direct or upward association between tax planning and performance (Wang, 2010; Chen et al., 2010; Armstron et al., 2012; Odunayo & Olayiwola, 2019), while some authors dispelled the assertion of positive influence and argued a negative relationship between them (Dyreng et al., 2008; Abdul-Wahab & Holland, 2012; Lee & Swenson, 2012). These empirical controversies may arise as a result of the different periods in which the studies were carried out and the fact that most of these studies were done across countries among which the business, macroeconomic and political environments differ considerably. Some scholars even claimed that corporate organizations make tax decisions without any recourse to agency consideration and board influence (Annuar et al., 2014), and as a result, most tax planning activities are hardly favored by shareholders (Abdul-Wahab & Holland, 2012).

It is in this light that recent empirical studies considered the role of corporate governance stratagem in the relationship between tax planning and financial performance of corporate organizations (Slemrod, 2004). These studies argued that a good corporate governance mechanism can help monitor, check and balance managers’ behavior on aggressive tax planning strategies in enhancing the financial performance of quoted companies. To this end, recent work has also been done linking the measures of corporate governance to the connection between tax planning and financial performance both in developed countries (Khaoula & Moez, 2019; Abdul-Wahab & Holland, 2012) and developing economies (outside Nigeria) (Yimbila, 2017). However, there are few insights into the role corporate governance mechanisms play in the connection between tax planning strategies employed by management and financial performance of quoted Nigerian companies, knowing fully well that adequate information about tax planning strategies is seldom disclosed in the financial statements of quoted Nigerian companies.

Given this backdrop, there is the need for rigorous research into the nexus of tax planning, corporate governance, and financial performance of quoted Nigerian companies. Hence, the importance of tax planning activities to optimally grow accounting profits, the growing demand for disclosure of tax planning strategies by companies, and ultimately the interactive effect of aggressive tax planning activities and corporate governance mechanism on the financial performance of companies in Nigeria all form the motivation for this research.

This work is therefore an attempt to empirically investigate the interactive effects of tax planning and corporate governance on the financial performance of quoted non-financial companies in Nigeria from 2007 to 2018. The interactive effect simply means the effect of an interface between two independent variables on the dependent variable. Non-financial firms are firms that operate outside the financial system but are also listed on the stock exchange. Apart from the introductory aspect, the remaining part of this article is set out as follows: Section 2 gives a brief literature review, Section 3 explicates the methods adopted, Section 4 presents the results, Section 5 entails the conclusions reached, while policy implications and recommendations are captured in the last section.

2. Literature Review

This work builds on several streams of research work, which includes studies investigating enhanced firms’ value accomplished by tax planning (e.g., Lestain & Wardhami, 2015; Ftouhiet al., 2014), effects of taxes on earnings management (Hu et al., 2015), interactions between ownership structure and corporate tax avoidance (Annuer et al., 2014; Kholbadalor, 2012; Zamani & Berzeger, 2015), the related tax planning and financial performance (Dada & Ramon, 2017; Junaid & Hauwa, 2018; Thanjunpong & Awirothananon, 2019; Ogundajo & Onakoya, 2016; Fagbemi et al., 2019; Odunayo & Olayiwola, 2019), and corporate governance and tax planning (Salawu & Adedeji, 2017; Uniamikogbo et al., 2019).

Tax planning as a vital concept in corporate finance connotes the financial and investment strategies employed by management to condense a company’s complete tax liability. The process of tax planning thus involves the employment of appropriate inducements, provisions for taxpayers grounded on the appropriate extant laws such as company income tax, value-added tax, and other promulgation and enactments (Alabi, 2001). Such exculpation includes provision for depreciation, incentives for pioneer status, commencement and cessation rule, capital and investment allowances, roll-over loss relief, free trade zone, rural area investment allowances, tax exemption benefits on loans granted to any Nigerian companies by foreign companies, among others.

Tax planning activities are, therefore, tax-saving campaigns that cleverly transfer funds from governments (tax authorities) to shareholders; therefore, habitually, it is expected to increase the after-tax value of the firm (Desai & Dharmapala, 2009). However, this position has been variously contested in an emerging financial economics literature pointing out that tax savings only increase corporate performance and value of firms on the surface, but digging deep into the intrinsic effects and considering the agency cost implications inherent in large corporations, tax planning activities may give rise to higher theft of corporate earnings, performance manipulations, creative accounting, income smoothing, insiders’ abuse, excessive executive compensations, board room politics, squabbles, etc. (Kholbadalov, 2012). Hence the cost of tax planning, which may include direct cost relating to tax avoidance, cost of tax compliance, and other agency costs, may outweigh the benefits derivable from tax planning activities. It is therefore believed that tax planning may potentially reduce the after-tax value and operating performance of the company (Wang, 2010).

Tax planning theory by Hoffman (1961) suggests that the amount which ordinarily would have flown into the coffer of tax authorities can be diverted in the course of methodical tax planning activities. That is, tax to be paid by taxpayers (in this case, corporate organizations) can be reduced to the barest minimum, through carefully planned financial activities in such a way that it will be subjected to minimum expenditure on taxes. When it comes to tax planning activities in a corporate world, most companies are involved in the course of tax planning to reduce their amount of financial obligations to relevant tax establishments by taking advantages and loopholes in the relevant tax laws and statutes. Nevertheless, not all companies have the same opportunities for tax avoidance, and that explains why some companies engage in the rigorous tax planning process, while some others are moderately involved in the process; several other factors affect corporate involvement in tax planning activities, which may include the nature of the company (i. e., companies that are involved in agricultural products may have better access to tax planning) or age of the companies (e. g., companies enjoying pioneer status), among others.

Recently, a new drift of shreds of evidence has been provided both in developed and developing economies explaining the role of good corporate governance mechanisms to the influence of tax planning on the financial performance of companies. These studies asserted that with the divorce of ownership and control in large corporations and information asymmetry between managers and shareholders, there is a high tendency for top managers to exploit tax planning strategies to their own personal advantages, which may eventually breed agency conflict and increase the cost of monitoring the managers as it is entrenched in the agency theory. It is therefore important for companies to adopt good corporate governance to monitor, check and balance the strategies employed by management to maximize shareholders’ wealth, which includes enhancing financial performance. To this end, studies have been carried out to examine the role of corporate governance mechanisms in the influence of tax planning on performance and values of companies. Lauis and Richardson (2011) assessed the effect of the board of director composition on corporate tax aggressiveness of 32 sampled corporations in Australia using the logit regression model. Their findings revealed a negative and significant association between the outside board of directors’ membership and tax aggressiveness. Kholbadalor (2012) reported a negative influence of tax avoidance on the cost of debt of companies listed on the Malaysian stock exchange, which therefore implies that tax planning stands as a surrogate for the use of debt in these companies; Abdul-Wahab and Holland (2012) also examined the joint effect of tax planning and corporate governance on the equity value of UK quoted firms from 2005 to 2007. Their results showed a constant negative association between tax planning and firms’ value, and that tax planning activities are not esteemed by shareholders because of the observable plummeting effects it has on value.

Ftouhi et al. (2014) examined the influence of tax planning on European firms. They, however, reported a negative and significant influence of tax planning on firms’ value due to high agency cost, and found that tax planning is only seen as a means of reducing tax liabilities of taxpayers. Hu et al. (2015) studied the relationship between corporate tax planning and earnings management in China’s capital markets. They discovered that when managers attempt to engage in earnings management strategy, their zeal and rationality influence their preference for trading-off conforming and non-conforming earnings management in terms of income tax costs. Lestani and Wardhani (2015) reported a robust positive and significant relationship between tax planning and the value of companies quoted on Indonesian stock exchange. However, Kawor and Kportorghi (2014) had initially observed a neutral influence of tax planning on the market performance of companies quoted on Ghanaian stock exchange and concluded that it is investors and not the management of companies that should set up a measure to ensuring that tax planning effects reflect significantly in their stakes.

Yimbila (2017) investigated the relationship between tax planning and the performance of Ghanaian banks using corporate governance mechanisms as moderators. Data of 18 banks from 2004 to 2014 were analyzed using Fixed Effect Model, results revealed that tax planning and performance have a significant negative relationship and that corporate governance moderated the relationship between the two variables. Odunayo and Olayiwola (2019) also investigated the dynamic relationship between tax planning and financial performance of 47 quoted non-financial Nigerian companies, using vector autoregression (VAR). Their findings revealed that tax planning (in the form of tax savings) enhances the financial performance of companies, hence management should espouse tax planning activities as a strategic technique. However, the fall-out in this work is that the role of corporate governance device in the interaction between tax planning and financial performance was neglected given that a good corporate governance mechanism can help reduce agency cost and risk associated with tax planning strategies.

Mark et al. (2019) examined how state ownership affects corporate tax avoidance, their findings revealed that state-owned enterprises make favorable tax decisions to the controlling shareholders, which means that the state and managers’ career concerns are used to entice these decisions. Khaoula and Moez (2019) also investigated the moderating effect of the board of directors in the association between tax planning and firm value, using a sample of 105 firms across Europe from 2005 to 2012. Their results showed a significant and negative effect of the measures of corporate governance in the relationship between tax planning and the value of the firms. Ibobo et al. (2019) evaluated the effect of board characteristics and firms’ performance on effective tax planning of the Nigerian food manufacturing sector from 2008 to 2017, employing the generalized Least Square method of analysis. The findings showed that the proxy for board characteristics exerted a significant negative influence on tax planning, while performance had a negative but insignificant impact on tax planning.

The above empirical studies have given mixed evidence of the role of corporate governance in the association between tax planning and the financial performance of companies both in developed and emerging economies. However, the interactive effect of corporate governance mechanisms and aggressive tax planning on the financial performance of Nigerian companies remains under-explored as there is a dearth of evidence on the subject matter. Additionally, the few studies that considered the joint effect of tax planning and corporate governance mechanism are principally enthralled with the usage of pooled OLS, Generalised Least Square, fixed and random effect models in analyzing the effects. The existence of endogeneity, heteroscedasticity, simultaneity and omitted variable problems is closely associated with these econometric methods, which could result in outliers and upward bias if not taken care of. This research work, therefore, also adopts the system-GMM that has been proven to be more exact and effective in controlling these inherent problems (Blundell & Bond, 1998; Blundell & Bond, 2000; Ahmed & Suardi, 2009). Therefore, this work without a doubt contributes to the pool of existing knowledge and serves as an invaluable source of information to researchers who are interested in this area, to managers, board of directors, shareholders, and other major stakeholders for policy formulation and implementation.

3. Methodology

This ex-post-facto and positivist standard research utilized data from 50 purposively selected non-financial firms quoted on the Nigerian Stock Exchange (NSE) for the period 2007 to 2018. The financial data of the companies were sourced from their respective annual reports and fact books published by the NSE. Companies with missing data were excluded from this study. The companies covered in this study are dispersed over many states in the country.

Based on the theory of Hoffman (1961) on tax planning and the recent study by Odunayo and Olayiwola (2019) the estimation model was specified as follows:

Financial Performance = ƒ (Tax Planning, Corporate Governance, Control Variables) (1)

To avoid the problem of endogeneity in the estimation process, as pointed out by Booth et al., (2001), Frank and Goyal (2009), Apanisile and Akinlo (2014), Apanisile and Olayiwola (2019), the model in equation (1) is then specified as a dynamic model as follows:

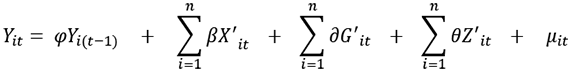

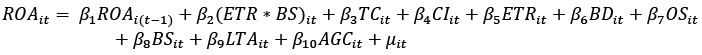

(2)

(2)

where X’ is the vector of aggressive tax planning measures (thin capitalization, effective tax rate, and capital intensity); G’ is the vector of corporate governance mechanisms, and Z’ is the vector of the control variables. Yit is the dependent variable, which is the measure of performance.

Decomposing X’it ; G’it ; Z’it the model gives:

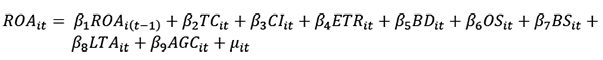

(3)

(3)

A priori expectations are: β1, β2, β3, ... ... ... β9 = –/+.

It should be noted that Equation 3 forms the baseline model for this work.

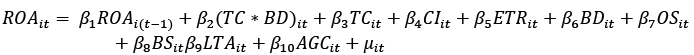

To investigate the interactive effect of tax planning and corporate governance on the financial performance of the companies, the baseline model is varied by interacting with the measures of tax planning and corporate governance. That is, (TC * BD), (CI * OS), ∧ (ETR * BS) are constructed and included one after another to test whether the influence of tax planning on financial performance is moderated by the strength of the firms’ corporate governance structures. This is also in line with the work of Abdul-Wahab and Holland (2012).

(4)

(4)

(5)

(5)

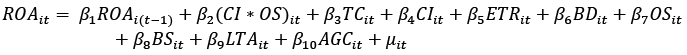

(6)

(6)

A priori expectations are: β1, β2, ... ... ... β11 = –/+.

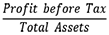

where: ROA is the measure for performance and is computed as  .

.

TC is thin capitalization, which is a proxy for tax planning (Buettner et al., 2012) computed as:  .

.

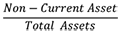

Capital intensity is also another measure for tax planning (Nwaobia & Jayeoba, 2016) computed as:

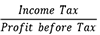

, effective tax rate is another proxy for tax planning (Khauola & Moez, 2019) computed as:

, effective tax rate is another proxy for tax planning (Khauola & Moez, 2019) computed as:  .

.

Asset to sales ratio has been used in literature as a direct measure of the agency cost (McKnight &Weir, 2009; Singh & Davidson III, 2003; Ang et al., 2000). It is computed as:

where BD =Board Diversity; OS = Ownership Structure and BS = Board Size; TA = Total Assets and LTA = Log value of the total assets; LGE = listing age of the sampled companies, and μit is the stochastic error term.

where BD =Board Diversity; OS = Ownership Structure and BS = Board Size; TA = Total Assets and LTA = Log value of the total assets; LGE = listing age of the sampled companies, and μit is the stochastic error term.

In achieving the objective of this paper, the baseline model (that is, Equation 3) and models in equations 4-6 will be estimated using generalized method of moment (GMM) techniques, and comparison will be made between the interactive models and the baseline model to see if there are significant changes between them.

4. Results and Discussion of Findings

4.1 Descriptive statistics

To examine the impact of aggressive tax planning and corporate governance on the performance of listed non-financial companies in Nigeria, we commence our examination with a descriptive analysis of the study variables. The descriptive statistics of the data series as depicted in Table 1 provides information about the sample statistics such as mean, median, minimum and maximum values, and distribution of samples measured by the skewness, kurtosis, and Jarque-Bera statistics.

A great level of uniformity was exhibited by the data series, as the mean and median values fall within the minimum and maximum values of the series. The mean value of return on asset and board diversity both stood at an approximate value of 9%. The mean value of thin capitalization was 10.59 implying that thin capitalization fluctuated more during the period relative to other variables. The standard deviation was also generally low, revealing that deviations from their mean values are minimal. However, the standard deviation of thin capitalization also stood at 99.079, signifying variability to other variables. The descriptive statistics in Table 1 also revealed that most of the study variables are positively skewed and leptokurtic relative to the normal distribution except for the measures of performance and log of total asset. Finally, the probability that the Jarque-Bera statistics exceeds (in absolute terms) the observed value is averagely low for all the data series. Therefore, normal distribution at 5% is hereby rejected.

Table 1. Descriptive Statistics of the Study Variables

|

|

ROA |

TC |

OS |

LTA |

ETR |

CI |

BS |

BD |

AGC |

|

Mean |

0.089893 |

10.59443 |

2.021170 |

7.041378 |

-0.128044 |

0.610219 |

9.264624 |

0.093640 |

2.102154 |

|

Median |

0.088193 |

0.966619 |

0.100000 |

7.208758 |

-0.246232 |

0.579675 |

9.000000 |

0.100000 |

1.041666 |

|

Maximum |

1.856075 |

1217.292 |

11.00000 |

10.30169 |

18.83773 |

9.990446 |

18.00000 |

0.333333 |

71.99336 |

|

Minimum |

-8.493631 |

-3.575098 |

0.000000 |

2.974051 |

-7.784451 |

0.003706 |

5.000000 |

0.000000 |

0.174447 |

|

Std. Dev. |

0.668677 |

99.07920 |

2.590539 |

1.162395 |

1.361660 |

0.623036 |

2.859787 |

0.091804 |

5.533521 |

|

Skewness |

-10.57532 |

11.09301 |

1.198898 |

-0.928542 |

8.760660 |

10.19320 |

1.095273 |

0.777387 |

8.371906 |

|

Kurtosis |

133.8472 |

125.9554 |

3.936918 |

5.168165 |

120.7258 |

148.1205 |

3.924180 |

2.959860 |

86.79359 |

|

Jarque-Bera |

262793.3 |

233503.4 |

99.13242 |

121.9060 |

211905.2 |

321238.6 |

84.55344 |

36.18318 |

109221.6 |

|

Probability |

0.000000 |

0.000000 |

0.000000 |

0.000000 |

0.000000 |

0.000000 |

0.000000 |

0.000000 |

0.000000 |

|

Sum |

32.27174 |

3803.399 |

725.6000 |

2527.855 |

-45.96779 |

219.0687 |

3326.000 |

33.61671 |

754.6733 |

|

Sum Sq. Dev. |

160.0721 |

3514374. |

2402.499 |

483.7162 |

663.7745 |

138.9663 |

2927.861 |

3.017229 |

10961.91 |

|

Observations |

359 |

359 |

359 |

359 |

359 |

359 |

359 |

359 |

359 |

Note. ROA – return on assets; TC – thin capitalization; OS – ownership structure; LTA – log of total assets; ETR – effective tax rate; CI – capital intensity; BS – board size; BD – board diversity; AGC – agency cost.

The ensuing phase is to examine the probable degree of relationship among the study variables. A correlation matrix has been obtained for this purpose as represented in Table 2. Results in Table 2 reveal the correlation coefficients and the direction of the relationship among the variables. Thin capitalization, capital intensity, and agency cost showed a negative relationship with the measure of performance, while ownership structure, log of total assets, effective tax rate, board size, and board diversity showed a positive association. Nevertheless, we ought to be careful in making inferences from correlation because simple bi-variate correlation in a conventional correlation matrix in Table 2 only depicts the range of the linear relationships between pairs of relationships used in this study. Also, the correlation between the variables does not connote causality. Thus, the negative or positive correlation coefficient reported in Table 2 only illustrates the extent of the linear relationship between pairs of variables used.

Table 2. Correlation Matrix

|

|

ROA |

TC |

OS |

LTA |

ETR |

CI |

BS |

BD |

AGC |

|

ROA |

1.000000 |

|

|

|

|

|

|

|

|

|

TC |

-0.017189 |

1.000000 |

|

|

|

|

|

|

|

|

|

(0.7455) |

----- |

|

|

|

|

|

|

|

|

OS |

0.069423 |

0.109482 |

1.000000 |

|

|

|

|

|

|

|

|

(0.1894) |

(0.0381)** |

----- |

|

|

|

|

|

|

|

LTA |

0.204143 |

0.087861 |

0.294305 |

1.000000 |

|

|

|

|

|

|

|

(0.0001)* |

(0.0965) |

(0.0000)* |

----- |

|

|

|

|

|

|

ETR |

0.004535 |

-0.009715 |

0.002816 |

0.040722 |

1.000000 |

|

|

|

|

|

|

(0.9318) |

(0.8545) |

(0.9576) |

(0.4418) |

----- |

|

|

|

|

|

CI |

-0.738888 |

0.037138 |

0.080862 |

-0.222315 |

-0.052803 |

1.000000 |

|

|

|

|

|

(0.0000)* |

(0.4830) |

(0.1262) |

(0.0000)* |

(0.3184) |

----- |

|

|

|

|

BS |

0.002006 |

0.160089 |

0.511947 |

0.422745 |

-0.008984 |

0.089129 |

1.000000 |

|

|

|

|

(0.9698) |

(0.0023)* |

(0.0000)* |

(0.0000)* |

(0.8653) |

(0.0918)*** |

----- |

|

|

|

BD |

0.058219 |

0.028968 |

-0.101959 |

0.001608 |

0.073531 |

-0.052432 |

0.061545 |

1.000000 |

|

|

|

(0.2713) |

(0.5843) |

(0.0536)** |

(0.9758) |

(0.1645) |

(0.3218) |

(0.2448) |

----- |

|

|

ASR |

-0.007059 |

0.007488 |

-0.064917 |

-0.320067 |

-0.043411 |

0.016687 |

-0.120841 |

-0.131087 |

1.000000 |

|

|

(0.8940) |

(0.8876) |

(0.2198) |

(0.0000)* |

(0.4122) |

(0.7527) |

(0.0220)** |

(0.0129)* |

----- |

Note. This table shows the relationship among the variables used in the study. For most of the variables, the results showed a weak relationship. Values in parentheses are probability values. *, **and *** represent level of significance at 1%, 5% and 10% respectively.

Another issue of concern is the unit root test. A major problem with time-series data is the non-stationary nature of the data. Hence, if the non-stationarity problems are not adequately catered for in the estimation procedure, it could lead to bogus regression analysis with an undesirable consequence on public and corporate policies. Therefore, a unit root test is performed using two different panel unit root test approaches: Levin et al. (2002) and Im et al. (2003). Table 3 reveals that results of the panel unit root test, both with trends and without trends, show that all the variables are stationary at levels except ownership structure, board size and board diversity, which are stationary at the 1st differential. Therefore, the null hypothesis of unit root is also hereby rejected.

Table 3. Unit Root Test

|

Variables |

Levine et al. |

Im et al. |

Levels |

||

|

With Trend |

Without trend |

With Trend |

Without Trend |

||

|

ETR |

-4.66057 |

-3.95225 |

-2.6000007 |

-3.400007 |

I(0) |

|

CI |

-297.528 |

-157.4578 |

-32.9190 |

-34.3098 |

I(0) |

|

TC |

-45.498 |

-21.8311 |

-5.05498 |

-7.5471 |

I(0) |

|

OS |

-1.46894 |

-4.06929 |

-1.59809 |

-0.34951 |

I(1) |

|

BS |

-2.15830 |

-5.41234 |

-0.41824 |

-2.60023 |

I(1) |

|

LTA |

-7.28642 |

-16.5685 |

-1.78525 |

-1.41023 |

I(0) |

|

BD |

-3.07090 |

-5.06050 |

-1.24403 |

-2.53357 |

I(1) |

|

AGC |

-4.65066 |

-5.60945 (0.0000)* |

-66.7689 |

-98.9465 |

I(0) |

|

ROA |

-4.71727 |

-10.3728 |

-0.31005 |

-1.58097 |

I(0) |

Note. *indicates 1% level of significance

4.2 Analysis and Interpretation of the Baseline Model

Three functional estimations were employed to estimate the baseline model in Equation 3; this is done to examine the effect of the individual variables of tax planning and corporate governance on the financial performance of the companies. The estimation techniques are Pooled OLS, fixed-effect model, and generalized moment method (GMM). The choice of fixed effect was informed by the outcome of Hausman’s specification test, hence Pooled OLS and fixed effect were estimated for comparison purposes. The Pooled OLS results in Table 4 showed that ETR, BS, LTA, and AGC all exerted a negative influence on the financial performance of the companies, and the influence of AGC was statistically significant at a 10% level, while others are insignificant. Also, the Pooled OLS results showed that CI, TC, OS, leverage, and BD wielded a positive influence on the financial performance of the companies, while the influence of leverage was also significant at 5% level and others insignificant. However, the results of AR (-1) and AR (-2) indicated absence of serial correlation in the estimation. The result of fixed effects, on the other hand, revealed that ETR, TC, BS, and LTA wielded negative effects on the financial performance of the companies, while BS was statistically significant at 5% and LTA significant at 10%. This conforms with the results of Pooled OLS.

Table 4. Estimates of the Baseline Model (Dependent Variable: Return on Assets)

|

Variables |

Pooled OLS |

Fixed effect |

GMM |

|

Constant |

0.718***(3.93) |

0.70***(2.93) |

- |

|

ROA (-1) |

– |

– |

0.56*** (21.14) |

|

C1 |

2.435***(4.56) |

1.71***(2.84) |

-0.7*** (-16.18) |

|

ETR |

-8.395(-0.176) |

-0.015(-0.24) |

-0.21*** (-3.44) |

|

TC |

8.05(-1.108) |

-0.016(-1.36) |

-0.31**(-2.05) |

|

OS |

0.09(0.82) |

0.082(0.68) |

0.17***(6.61) |

|

BS |

-0.145(-1.59) |

-0.28**(-2.22) |

-0.87***(-6.15) |

|

BD |

0.32(1.48) |

0.356(1.522) |

1.89***(5.69) |

|

LTA |

-0.134(-1.09) |

-1.078***(-2.58) |

-0.14***(-15.13) |

|

AGC |

-1.89***(3.96) |

5.51(0.27) |

-0.15**(-2.11) |

|

AR (1) |

– |

– |

0.54***(10.47) |

|

AR (2) |

– |

|

0.29(0.275) |

|

R2 |

0.59 |

0.66 |

– |

|

Adjusted R2 |

0.58 |

0.61 |

– |

|

F-Statistics |

84.93 |

12.03 |

– |

|

Durbin Watson |

1.62 |

1.61 |

– |

|

Hausman Test |

– |

0.000 |

– |

|

J-Statistics |

– |

– |

20.005 |

|

Instrument Rank |

– |

– |

30 |

|

No. of Observations |

271 |

271 |

299 |

|

Cross Sections included |

28 |

28 |

30 |

Note. t-values are in parentheses, due to endogeneity problems existing between TC and CI, ROA and CI, ROA and CI. The list of instruments employed for GMM include:(ROA (-2), ROA (-3), C, TC (-1), TC (-2), CI (-1), CI (-2), CI (-3) ETR(-1) OS(-1), BS(-1), BD(-1). ***, **denote significance at 1%, and 5%, respectively.

This work adopts a system-GMM estimator as proposed by Arellano and Bover (1995), to estimate the dynamic baseline models in equations 3-6. The technique is adopted to control for an omitted variable problem, heteroscedasticity, and potential endogeneity issues, as pointed out in the work of Apanisile and Akinlo (2014), and Apanisile and Olayiwola (2019). More notably, this approach is suitable for the unique data set of this work, which has the characteristics of large cross-sections and shorter time series. The dynamic models are analyzed by mutually estimating the original level and first difference regressions in contrast to the two-step difference GMM of Arellano and Bond (1991). In addition, this research work used the lagged level variables as instruments in the first-difference regression and adopted the first-difference variables as instruments in the level regression. This system-GMM estimator is also adjudged to be more accurate and efficient over the first-difference estimator of Arellano and Bond (1991), Blundell and Bond (1998), Blundell et al. (2000), Ahmed and Suardi (2009).

The results of GMM in Table 4 showed that all the measures of tax planning and corporate governance were statistically significant at a 1% level. Variables like capital intensity (0.7) and thin capitalization (0.31) all exerted a negative influence on the financial performance of quoted Nigerian companies. This implies that aggressive tax planning activities employed by managers reduce the performance of quoted companies in Nigeria. This is in line with the work of Abdul-Whab and Holland (2012), Ftouhi and Moez (2019), Dyreng et al. (2008), Lee and Swenson (2012). This also conforms with the agency theory in that in the face of asymmetry information between the companies’ managers and shareholders, there is a tendency towards moral hazards and fear of moral hazards. However, the results also revealed that the effective tax rate (0.21) wielded a negative influence on firms’ performance. It should be noted that an increase in ETR connotes less tax planning (Khaoula & Moez, 2019). This, therefore, implies that a reduction in ETR (i. e., higher tax planning activities by companies) will increase performance by approximately 21%. This is also in tune with the work of Desai and Hines (2002). Furthermore, board size (0.87), log value of total assets (0.14), and agency cost (0.15) revealed a negative impact on the financial performance of quoted Nigerian companies, while the lag value of performance ROA(-1) (0.56), ownership structure (0.17) and board diversity (1.89) wielded positive impact on the financial performance of the companies.

When relating the results of OLS, random effect, and the system-GMM, there are some dissimilarities in the degree of the coefficient evaluations due to the endogeneity and simultaneity problems that brought about ascendant prejudice in some of the OLS and random effect estimates, as well as variances in their degree of statistical significance. For robustness check, the study is over-identified as the number of instruments is greater than the estimated parameters. The number of instruments is 12, while the estimated parameter is 9. In addition, to correct for simultaneity, the first difference explanatory variables are used as instrumental variables. Lastly, for exclusion restriction, the instrumental variables are independent of the error term. This implies that the instrumental variables do not affect the dependent variables when the independent variables are held constant.

4.3 Comparison between the Dynamic Baseline and Interactive Models

From Table 5, the GMM estimate result revealed that the efforts of capital intensity (CI) and effective tax rate (ETR) on return on asset was consistently and significantly negative for both the baseline model and the interactive models. This shows two things: (a) it shows that an increase in capital intensity reduces returns on assets drastically. This is consistent with the agency theory, which states that if managers’ activities are properly monitored and evaluated by shareholders and other key stakeholders, the acquisition of company funds, perquisites, and other moral hazards by managers and members of the board of directors in the process of tax planning will be minimized. (b) It also implies that a high ETR (which is the proportion of income paid as tax) reduces performance gradually. Therefore, efforts should be made by the managers of companies to monitor ETR and ensure its reductions either through exploiting loopholes in the tax laws or by taking full advantage of reliefs open to each company. By doing so, the performance will be enhanced in the long run.

Table 5, however, presents a contradictory result in the case of thin capitalization. The table revealed that thin capitalization (TC) exerted a negative influence on performance in the estimated models 3, 5, and 6, while in the estimated model 4, TC wielded a positive influence on performance. However, the influence of TC on ROA on estimated model 5 was not significant at any conventional level. These results imply that if companies employ thin capitalization as a tax planning strategy, the performance of the firm will fall significantly, except in the case where there are indications that corporate governance measures will be adopted to oversee the activities of the managers in respect of tax planning activities. Also, from Table 5, the influence of corporate governance measures such as ownership structure and board diversity include a positive impact on the performance of these Nigerian companies. The board size significantly and negatively reduces the performance of quoted companies. The lag value of performance ROA (-1) also significantly and positively influences the current performance of the companies.

Table 5 shows that the estimated model 4 revealed the influence of the interaction between thin capitalization and board diversity on the financial performance of the companies. The table indicates that TC*BI (-0.25) had a negative and significant impact on the measures of financial performance (ROA) of quoted Nigerian companies. This further implies that the effect of board diversity (proxy for female representation) on the relationship between tax planning and financial performance is statistically significant at a 5% level and inversely affects the financial performance of quoted Nigerian companies. Additionally, the intensity of the interaction is moderately high for board diversity (-0.25), which shows that increase in the female representation on board will reduce financial performance as tax planning strategies increases. This contradicts the findings of Khoalu and Moez (2019).

From Table 5 also, estimated model 5 revealed the influence of the interaction between capital intensity and ownership structure. This table shows that the interaction between capital intensity and ownership structure CI*OS (0.14) exerts a positive and significant influence on the financial performance of quoted non-financial companies in Nigeria, which shows that the interactive effect of ownership structure in the relationship between tax planning as measured by the capital intensity and financial performance is upward or direct and significant at 1%. The strength of the interactive impact was also moderate (0.14) indicating that an addition to the equity ownership structure of the firm will positively change the relation between tax planning and performance. Invariably, this means that additional OS will trigger an increase in the financial performance of the firm by approximately 14% as capital intensity gets bigger (that is, more tax planning activities). Additional ownership structure will encourage managers to increase the level of capital assets relating to incentives the firms could enjoy either in the form of capital allowances or qualifying capital expenditure, re-investment allowance, and investment tax credits. This will subsequently boost the financial performance of the firms.

Table 5. Comparison between the Dynamic Baseline and Interactive Models (Dependent Variable: Return on Assets)

|

Variables |

Baseline Model |

Interactive Models |

||

|

Model 3 |

Model 4 |

Model 5 |

Model 6 |

|

|

ROA (-1) |

0.56***(21.14) |

0.64***(20.62) |

0.54***(12.84) |

0.58***(16.65) |

|

CI |

-0.7***(-16.18) |

-0.56**(-10.78) |

-0.92***(12.75) |

-0.79***(-15.29) |

|

ETR |

-021***(-2.05) |

-0.02***(-2.91) |

-0.02*(1.75) |

-0.08(-0.14) |

|

TC |

-0.31**(-2.05) |

0.288***(3.53) |

-0.02(1.33) |

-0.29**(-1.88) |

|

OS |

0.17***(6.61) |

0.15***(3.51) |

0.16***(3.29) |

0.17***(6.80) |

|

BS |

-0.87**(-6.15) |

-0.08**(-3.47) |

-0.1***(5.86) |

-0.86***(-5.91) |

|

BD |

1.89***(5.69) |

1.98***(3.12) |

2.29***(6.14) |

1.89***(5.19) |

|

LTA |

-0.14***(-15.13) |

-0.08***(-3.87) |

-0.23***(-11.68) |

-0.14***(-15.54) |

|

AGC |

-0.15**(-2.11) |

-0.06(-1.24) |

-0.12**(-1.90) |

-0.14**(-2.07) |

|

TC*BD |

- |

-0.25**(-3.54) |

- |

- |

|

CI*OS |

- |

- |

0.14***(4.71) |

- |

|

ETR*BS |

- |

- |

- |

-0.17(0.23) |

|

J-Statistics |

20.005 |

18.26 |

20.3 |

19.56 |

|

Instrument Rank |

30 |

30 |

30 |

30 |

|

No. of Observations |

299 |

299 |

299 |

299 |

|

Cross Sections Included |

30 |

30 |

30 |

30 |

Note. t-values are in parentheses, due to endogeneity problems existing between TC and CI, ROA and CI, ROA and CI. The list of instruments employed for GMM include: (ROA (-2), ROA (-3), C, TC (-1), TC(-2), CI (-1), CI (-2), CI (-3), ETR (-1), ETR (-2), OS (-1), BS (-1), BD (-1). ***, **, * denote significance at 1%, 5%, and 10%, respectively.

Results from Table 5 for the estimated model 6 revealed that the interaction between effective tax rate and board size wielded a negative influence on the financial performance of the companies in Nigeria. This implies that an additional member in the board will influence the financial performance of the firms as the ETR gets smaller (which is an indication of more tax planning). This, therefore, shows that an addition to the board size in the firm may inadvertently reduce the cost and risk associated with tax planning and in turn will increase the financial performance of the firms. However, the influence of the interactive effect of ETR and BS on the return of assets of quoted companies in Nigeria was not significant at any conventional level.

Also, for robustness check, the interactive models are over-identified as the number of instruments is greater than the estimated parameters. The number of instruments is 13, while the estimated parameter is 12. In addition, to correct for simultaneity, the first difference explanatory variables are used as instrumental variables. Lastly, to restrict exclusion, the instrumental variables are independent of the error term. This implies that the instrumental variables do not affect the dependent variables when the independent variables are held constant.

5. Conclusion and Policy Recommendations

This study has established the interactive effect of corporate governance mechanisms on the association between tax planning and the financial performance of quoted companies in Nigeria. The overall conclusion is that those tax planning strategies, if properly handled and monitored strictly, enhance the financial performance of quoted companies, as the study found out that ownership structure played a prominent role in ensuring that capital intensity (a proxy for tax planning) triggers an increase in the financial performance of organizations. Additionally, this study has also shown that there exists an empirical link between tax planning strategies and corporate governance system and investors’ confidence in the financial performance of the firms. A well-implemented and strategic tax planning policy and corporate governance will have an additive impact on the financial performance of firms in Nigeria. This affirms the position of Desai and Dharmapala (2009), who emphasized that tax planning will be valued by investors and promote performance where there is a strong level of corporate governance in the firms, and Wilson (2009), who also opined that the disposition of the shareholders to tax planning strategies employed by most companies is a function of the corporate governance status of the companies.

However, this study also found out that board diversity plays a role in ensuring that thin capitalization (tax planning strategy) reduces financial performance. Thin capitalization as a tax planning strategy arises as tax savings from the interest deductible from the debt. This study thus revealed that an increase in female board representation does not favor thin capitalization as a tax planning strategy because of the higher gearing level associated with it. High gearing increases the financial risk of the firm and this will, in turn, reduce the financial performance of the companies.

Based on the findings of this work, companies are advised and encouraged to:

a) Ensure that tax planning strategies are done in a way that will boost the financial performance of the companies, and not in the process of avoiding tax or adopting tax planning strategies in such a way as to increase the financial leverage unnecessarily, which raises the financial risk for the companies. This may have a plummeting effect on the company’s financial performance.

b) Put in place a strong corporate governance mechanism that will control, monitor, and check the activities and strategies adopted by the management of companies. This will reduce moral hazard and the fear of moral hazard and subsequently increase the financial performance of the companies in the long run.

c) Carry out tax audits intermittently, as this will reduce private consumption and perquisites.

Then lastly, Security and Exchange Commission (SEC), Nigerian Stock Exchange (NSE), and other regulatory bodies should enforce disclosure of tax planning strategies adopted by firms in their financial statements as this will fill the information gap concerning aggressive tax planning to major stakeholders.

6. Limitation and Suggestion for Further Studies

This study only considered the joint effect of tax planning and corporate governance on the performance of quoted non-financial companies in Nigeria. The research work is limited to 50 quoted non-financial companies representing various sectors. Further studies may consider how the performance of quoted companies will respond to temporary and permanent shocks from the measures of corporate governance and tax planning activities. Also, the interactive impact of tax planning and political environment on the performance of quoted companies is another green area.

References

Abdul-Wahab, N. S., & Holland, K. (2012). Tax planning, corporate governance and equity value. The British Business Review, 44(1), 111-124.

Ahmed, Z., & Khaoula, F. (2013). The Effects of Board of Directors’ Characteristics on Tax Aggressiveness. Research Journal of Finance and Accounting, 4(4), 1-32.

Alabi, S. (2001). Tax Planning. A Paper delivered at the Workshop on Nigerian corporate and Personal Income Tax Management Lagos, August 15th.

Anazonwu, H. O., Egbunike, F. C., & Echekoba, F. N. (2018). Agency Cost and Dividend Payout: A Study of Selected Listed Manufacturing. Indonesian Journal of Management and Business Economics, 1(1), 42-51.

Ang, J. S., Cole, R. A., & Lin, J. W. (2007). Agency Costs and Ownership Structure. The Journal of Finance, 55(1), 21-43.

Annuar, H. A., Salihu, I. A., & Obid, S. N. (2014). Corporate Ownership, Governance and Tax Avoidance: An Interactive Effects. Procedia – Social and Behavioral Sciences, 164, 150 – 160. https://doi.org/10.1016/j.sbspro.2014.11.063

Apanisile, O., & Taiwo, A. (2014). Relationship between Insurance and Economic Growth in Sub-Saharan African: A Panel Data Analysis. Modern Economy, 5(1), 120-127.

Areliano, M., & Bover, O. (1995). Another look at the instrumental variable estimation of error-components models. Journal of Econometrics, 68(1), 29-51.

Arellano, M., & Bond, S. (1991). Some Tests of Specification for Panel Data: Monte Carlo Evidence and an Application to Employment Equation. The Review of Economic Studies, 58(2), 277-297.

Awirothananon, T., & Thanjunpong, S. (2019). The Effect of Tax Planning on Financial Performance in the Stock Exchange of Thailand. International Journal of Trade, Economics and Finance, 10(1), 25-29.

Blundell, R., & Bond, S. (1998). Initial Conditions and Moment Restrictions in Dynamic Panel Data Models. Journal of Econometrics, 87(1), 115-143.

Blundell, R., & Bond, S. (2000). GMM Estimation with Persistent Panel Data: An Application to Production Functions. Econometric Reviews, 19(3), 321-340.

Bradshaw, M., Liao, G., & Ma, M. (2019). Agency Costs and Tax Planning when the Government is a Major Shareholder. Journal of Accounting and Economics, 67(1), 255-277.

Desai, M. A., & Dharmapala, D. (2006). Corporate Tax Avoidance and High-Powered Incentives. Journal of Financial Economics, 79(1), 145-179.

Dyreng, S. D., Hanlon, M., & Maydew, E. L. (2010). The Effects of Executives on Corporate Tax Avoidance. The Accounting Review, 85(4), 1163-1189.

Fagbemi, T. O., Olaniyi, T. A., & Ogundipe, A. A. (2019). The Corporate Tax Planning and Financial Performance of Systematically Important Banks in Nigeria. Economics Horizons, 21(1), 15-27.

Frank, M. Z., & Goyal, V. K. (2009). Capital Structure Decisions: Which Factors Are Reliably Important? Financial Management Association International, 38(1), 1-37.

Hoffman, W. H. (1961). The Theory of Tax Planning. Accounting Review, 36(2), 274–281.

Ibobo, I. B., Egbule, S. A., & Arukaroha, J. (2019). Effect of Board Characteristics, Firms Performance and Effective Tax Planning in Nigeria Food Manufacturing Sector. FUO Quarterly Journal of Contemporary Research, 7(3).

Im, K., Pesaran, M., & Shin, Y. (2003). Testing for Unit Roots in Heterogeneous Panels. Journal of Econometrics, 115(1), 53-74.

Jensen, M. C., & Meckling, W. H. (1976). Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure. Journal of Financial Economics, 3(4), 305-360.

Kawor, S., & Kportorgbi, H. (2014). Effect of Tax Planning on Firms Market Performance: Evidence from Listed Firms in Ghana. International Journal of Economics and Finance, 6(3), 162-168.

Khaoula, F., & Moez, D. (2019). The Moderating Effect of the Board of Directors on Firm Value and Tax Planning: Evidence from European Listed Firms. Borsa Instabul Review, 2214-8450. https:doi.org/10.1016/j.bir.2019.07.005

Khaoula, F., AYED, A., & Zemzem, A. (2015). Tax Planning and Firm Value: Evidence from European Companies. International Journal Economics Strategic Management of Business Process, 4(1), 73-78.

Kholbadalov, U. (2012). The Relationship of Corporate Tax Avoidance, Cost of Debt and Institutional Ownership: Evidence from Malaysia. Atlantic Review of Economics, 2(1), 33-45.

Kurawa, J. M., & Saidu, H. (2018). Corporate Tax and Financial Performance of Listed Nigerian Consumer Goods. Journal of Accounting and Financial Management, 4(4), 30-43.

Lanis, R., & Richardson, G. (2011). The Effect of Board of Director Composition on Corporate Tax Aggressiveness. Journal of Accounting and Public Policy, 30(1), 50-70.

Lanis, R., & Richardson, G. A. (2011). Corporate Social Responsibility and Tax Aggressiveness. doi:http://dx.doi.org/10.2139/ssrn.1904002

Lee, N., & Swenson, C. (2012). Are Multinational Corporate Tax Rules as Important as Tax Rates? International Journal of Accounting, 47(1), 155-167.

Lestari, N., & Wardhani, R. (2015). The Effect of the Tax Planning to the Firm Value with Moderating Board Diversity. International Journal of Economics and Financial Issues, 5(Special Issue), 315-323.

Levin, A., Lin, C., & Chu, C. (2002). Unit Root Tests in Panel Data: Asymptotic and Finite-Sample Properties. Journal of Econometrics, 108(1), 1-24.

Ma, M., & Thomas, W. B. (2019). Legal Environment and Corporate Tax Avoidance: Evidence from State Tax Codes. The Journal of the American Taxation Association.http://dx.doi.org/10.2139/ssrn.3403842

Mcknight, P., & Weir, C. (2009). Agency costs, corporate governance mechanisms and ownership structure in large UK publicly quoted companies: A panel data analysis. The Quarterly Review of Economics and Finance, 49(1), 139-158.

Nwaobia, A. N., & Jayeoba, O. O. (2016). Tax Planning and Firms’ liquidity. IJRDO-Journal of Business Management, 2(10), 2455-6661.

Odunayo, O. M., & Olayiwola, J. A. (2019). Corporate Tax Planning and Financial Performance in Nigerian Non-Financial Quoted Companies. African Development Review, 31(2), 202-215.

Ogundajo, G., & Onakoya, A. B. (2016). Tax Planning and Financial Performance of Nigerian Manufacturing. International Journal of Advanced Academic Research, 2(7), 64-72.

Olajide, D. S. (2017). Tax planning and Firms’ Performance in Nigeria. International Journal of Advanced Research, 5(5), 1950-1956.

Pattiasina, V., Tammubua, M. H., Numberi, A., & Patiran, A. (2019). Capital Intensity and Tax Avoidance. International Journal of Social Sciences and Humanities, 3(1), 58-71.

Richardson, G., Taylor, G., & Lanis, R. (2013). The Impact of Board Oversight Characteristics on Corporate Tax Aggressiveness: An Empirical Analysis. Journal of Accounting and Public Policy, 32(1), 68-88.

Salawu, R. O., & Adedeji, Z. A. (2017). Corporate Governance and Tax Planning among Non-Financial Quoted Companies in Nigeria. African Research Review, 11(3), 42-59.

Sapiei, N. S., Abdullah, M., & Sulaiman, N. A. (2014). Regressitivity of the corporate taxpayers’ compliance costs. Procedia – Social and Behavioral Sciences, 164(1), 26-31.

Singh, M., & Davidson III, W. N. (2003). Agency Costs, Ownership Structure and Corporate Governance Mechanisms. Journal of Banking & Finance, 27(5), 793-816.

Slemrod, J., & Crocker, K. J. (2004). Corporate Tax Evasion with Agency Costs. Journal of Public Economics, 89(9), 1593-1610.

Taylor, G., & Richardson, G. (2013). The Determinants of Thinly Capitalized Tax Avoidance Structures: Evidence from Australian Firms. Journal of International Accounting, Auditing and Taxation, 22(1), 12-25.

Uniamikogbo, E., Bennee, E., & Adeusi, S. A. (2019). Corporate Governance and Tax Aggresiveness in Nigeria. AE-FUNAI Journal of Accounting Business and Finance (FJABAF), 4(1), 20-33.

Weir, C., Laing, D., & McKnight, P. (2002). Internal and External Governance Mechanisms: Their Impact on the Performance of Large UK Public Companies. Journal of Business Finance & Accounting, 29(5), 579-611.

Wilson, R. (2009). An Examination of Corporate Tax Shelter Participants. The Accounting Review, 84(3), 969-999.

Yimbila, B. (2017). Tax Planning, Corporate Governance and Performance of Banks in Ghana. Sam Jona Library.

Appendix. List of the selected firms

1 Van Leer Containers

2 Avon Crown caps

3 Beta Glass

4 African Paints

5 D.N. Meyer

6 IPWA

7 Berger

8 CAP PLC

9 Nigerian German Chemicals

10 Dunlop

11 R.T. Briscoe

12 Evans Medical

13 UACN

14 Guinness Nigeria

15 Smithkline Beecham

16 Northern Nigeria Flour Mills

17 Seven-up Bottling Company

18 SCOA Plc

19 John Holt

20 Chellerams

21 UAC Nigeria

22 UNILEVER Plc

23 PZ Plc

24 Cement Company of Northern Nigeria

25 Costain

26 International Breweries

27 Julius Berger

28 Nigerian Breweries

29 BOC Gases

30 Benue Cement Company

31 Aluminum Extrusion

32 Nigeria Ropes

33 Vita foam

34 WAPCO

35 Nigerian Enamelware

36 Cadbury

37 First Aluminum Plc

38 Texaco

39 Vono Foam

40 Flour Mills

41 Alumaco

42 May & Baker

43 NCR

44 Neimeth

45 Triple Gee & Company

46 UTC

47 Nestlè Plc

48 Eterna Oil & Gas

49 Morisson

50 P.S. Mandrides