Organizations and Markets in Emerging Economies ISSN 2029-4581 eISSN 2345-0037

2021, vol. 12, no. 2(24), pp. 305–331 DOI: https://doi.org/10.15388/omee.2021.12.58

Decomposition of the Sources of Real Exchange Rate Misalignment in Egypt: Evidence from the ARDL Model

Rana Hosni

Cairo University, Egypt

https://orcid.org/0000-0001-5931-4256

rana.hosni@feps.edu.eg

Abstract. This paper examines the behavior of the real exchange rate in Egypt over the period 1965–2018 by attempting to pursue three interrelated purposes. The first is to investigate the extent of deviations between the actual exchange rate and its equilibrium level and illustrate the magnitude of any currency misalignments. The second is to search for the different phases of over- and undervaluation of the local currency and explain the accompanying economic policies and/or factors leading to them. The third and ultimate purpose is to explore the role of transitory and permanent factors in deviating the actual real exchange rate from its equilibrium level. Understanding these factors should help in the design of economic policies directed to address the misalignment of the local currency. An autoregressive distributed lag (ARDL) bound test approach is used and conducted for both the bilateral and effective real exchange rates to achieve these three purposes during the selected period. To derive the equilibrium exchange rate estimate, the behavioral equilibrium exchange rate (BEER) approach is adopted. The findings reveal that the Egyptian pound was misaligned from its equilibrium value during most of the examined period. The results confirm the relative importance of the terms of trade and degree of openness variables in determining the equilibrium real exchange rate in Egypt followed by investment ratio and government consumption variables. The local currency witnessed a recent phase of overvaluation, which began in 2009, until the free float of the local currency in November 2016, after which, the Egyptian pound was found to have experienced a new phase of undervaluation till the end of the period examined. The findings show a considerable relative impact of fundamental-based factors over a prolonged period spanning from 1986 to 2003 and at the end of the period examined as well. Moreover, the documented results lend general support to the fact that both permanent or fundamental-based factors and short-run shocks prove to be important influential factors impacting currency misalignment in Egypt.

Keywords: exchange rate; misalignment; short-run shocks; fundamental factors; ARDL model; Egyptian pound; undervaluation; overvaluation.

Received: 29/4/2021. Accepted: 11/10/2021

Copyright © 2021 Rana Hosni. Published by Vilnius University Press. This is an Open Access article distributed under the terms of the Creative Commons Attribution Licence, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

1. Introduction

An economy’s real exchange rate is a critical economic indicator since it links the domestic economy with the rest of the world. Real exchange rate plays a pivotal role in impacting a country’s economic growth and competitiveness in the international markets. Consequently, any country should seek the right level of its exchange rate – that is, the equilibrium exchange rate. Deviations of the actual exchange rate from the equilibrium level can signal crucial information to policymakers, central banks and financial institutions. Particularly, any misalignment may indicate future probabilities of currency crises that can lead to realignments of the exchange rate at the end (Holtemöller & Mallick, 2013; Giannellis & Koukouritakis, 2013). Currency crises can be triggered by a misaligned (e. g., overvalued) exchange rate, which may lead to speculations by foreign investors who start an attack on the domestic currency. Furthermore, extended phases of overvaluation and undervaluation of the local currency can have vast social effects in the economy.

Williamson (1993, p. 194) regards “the proper objective of exchange rate management as the avoidance of misalignments rather than the provision of a nominal anchor”. He argues that the first rule of exchange rate management is that authorities should not be in a situation of defending or maintaining a disequilibrium exchange rate.

As such, there is a well-known view in international economics, which perceives real exchange rate misalignments as a costly channel that may impose real costs on the domestic economy. Such misalignments cause competitiveness loss in international trade, growth slowdowns, the buildup of external deficits, financial instability (in the case of an overvalued currency), and inflationary pressures (in the case of an undervalued currency). Moreover, since the real exchange rate is a decisive factor in determining the production and investment decisions of economic agents, a wrong exchange rate level can have visible impact on the economy. An undervalued exchange rate can bias the production of both importables and exportables by making the former appear very expensive for households and firms and the latter appear very profitable for producers. An overvalued currency would artificially have the opposite impact (Kheir-El Din & El-Shawarby, 2000; Siregar & Rajan, 2004).

Investigating the role of different economic factors in determining the real exchange rate and its equilibrium level is of utmost importance to all economic agents. The exchange rate literature dealing with estimating the real exchange rate and determining its equilibrium level is extensive. The literature offers different propositions both on the theoretical and empirical modelling aspects to capture the magnitude of currency misalignments.

This paper is an investigation into the extent of real exchange rate misalignment of the Egyptian pound and the phases of under- and overvaluation since the 1960s. A key interesting question regards the sources of exchange rate misalignment and whether short-run shocks or permanent factors are considered the chief contributor in deviating the actual exchange rate away from its equilibrium value. In an attempt to answer this question, the behavioral equilibrium exchange rate (BEER) approach is adopted to estimate the equilibrium exchange rate in Egypt since it provides a generic approach that is well suited for developing and emerging countries that may suffer from data limitations hindering the application of other complex models which can be impracticable to employ. Furthermore, the BEER approach does not impose any particular functional form thus making it a more flexible approach for deriving the equilibrium exchange rate of an economy by searching for the most convenient set of economic fundamentals that would yield a significant econometric relationship with the real exchange rate. Unlike other approaches, it does not include normative assumptions and only seeks for a significant econometric relationship between the real exchange rate and the fundamental variables with no prior conditions on the structure of that relationship. Based on sound theoretical foundations, these fundamental variables are chosen and used to design country specific relationships (AlShehabi & Ding, 2008; Tang & Zhou, 2013).

An autoregressive distributed lag (ARDL) model is constructed for both the bilateral and trade-weighted real exchange rates to quantify the currency misalignment in Egypt during the period from 1965 to 2018 and decompose the sources of this misalignment measure. Egypt as one of the developing countries relies heavily on both imported raw materials and intermediate goods, which accounted for nearly 31 percent and 21 percent in 2018, and 29 percent and 22 percent in 2019, respectively (World Bank WITS, 2021). Previous literature has found evidence of high inflationary effects of exchange rate changes, which in turn has an impact on the ability of the Egyptian economy to achieve an effective inflation targeting regime (see for instance, Khodeir (2012) and Helmy, Fayed and Hussien (2018)). The challenges of managing the exchange rate movements extend further to their adverse impact on both poverty and inequality in a country where 32 million people lived under the national income poverty line in 2018. The Household Income, Expenditure, and Consumption Survey (HIECS) shows that nearly 33 percent of people were poor in Egypt in 2018 as opposed to nearly 28 percent in 2015, and that there was a steady increase in income poverty rates between 1999 and 2018 (HIECS, 2018; IMF, 2020).

Moreover, as part of the economic reform program in November 2016, the Central Bank of Egypt liberalized the Egyptian pound exchange rate to be determined according to the market supply and demand dynamics (CBE, 2019/2020). This step was taken to ease the foreign currency shortages by correcting for the exchange rate misalignment and the preexisting overvaluation of the Egyptian pound (Youssef & Zaki, 2019). Flexible exchange rate policy can entail a significant challenge by affecting the domestic inflation and increasing the sensitivity of domestic prices to exchange rate fluctuations, which is known as the exchange rate pass-through.

Hence, the empirical work in the paper is motivated by multiple factors, which are specific to the case of Egypt. Firstly, there were dramatic shifts in the exchange rate regimes adopted by the Egyptian government from fixed to floating exchange rate systems throughout the examined period. Secondly, such shifts should have their impact on exchange rate fluctuations and hence the deviations of the actual exchange rate from its equilibrium level. Thirdly, research carried out on the quantitative assessment of the real exchange rate misalignment in Egypt is scant especially during the period following the outbreak of the 2011 revolution. In addition, such research work focuses on merely one real exchange rate index (either the bilateral or the effective rate), and none applies the ARDL methodology as an approach to the equilibrium exchange rate in the Egyptian case. Finally, the paper looks further into the different sources of real exchange rate misalignment in Egypt by decomposing them into transitory and permanent factors during the period under investigation. Hence, the paper contributes to the existing literature on exchange rate misalignments on the Egyptian economy by assessing the extent of the exchange rate misalignment using both a bilateral and real effective measure of the real exchange rate and hence addresses the limitations of Mohieldin and Kouchouk (2003) research that only employs a bilateral index of the real exchange rate. The use of the real effective exchange rate recognizes the fact that each country has its multiple trading partners and is considered as a more consistent measure for analyzing the equilibrium exchange rate. Moreover, this paper uses an updated and extended time series, which spans between 1965 and 2018, compared to the one included in Mongardini (1998) that based the econometric analysis of the real exchange rate during the period between 1987 and 1996. Unlike most of the relevant empirical research work tackling the topic of the real exchange rate misalignment in Egypt, the empirical work in this paper disentangles the total misalignment of the real exchange rate into two main sub-components - the transitory and permanent factors and increases the viability of the technical results to the use of policy formulation within the context of the Egyptian economy. In addition, this paper adopts the implementation of ARDL approach proposed by Pesaran and Shin (1999) and Pesaran et al. (2001) that has multiple advantages over other econometric techniques used to examine the long-run relationship among economic variables. These are mainly related to overcoming the endogeneity problems and avoiding the prerequisite to have all variables at the same level of stationarity as it can be applied whether the variables are stationary at levels, at first differences or frictionally integrated. Furthermore, it provides a tool to simultaneously estimate both the short-run and the long-run parameters such that the error correction model can integrate short-run adjustment term and the equilibrium long-run relationship while keeping the long-run information.

The rest of the paper is organized as follows: section two provides a summary for the relevant empirical literature. Section three gives an overview of the BEER approach. Section four describes the data and econometric methodology. Sections five and six outline the empirical results and their implications on the assessment of the real exchange rate, respectively. Section seven concludes.

2. Economic Relationships within the Behavioral Equilibrium Exchange Rate Approach: Recapitulation of the Literature

Given the importance of the real exchange rate as a key economic indicator in any economy, there has been an increasing attention to the assessment of the actual exchange rates and whether they deviate from their equilibrium value. Nevertheless, there are many methodological and empirical obstacles involved in the estimation of equilibrium exchange rates, which provide a wide range of estimates perceived as complements for each other. There is still an extensive controversy on the most convenient approach to be employed. Approaches vary between price-based theories (such as the purchasing power parity (PPP)) and model-based theories (such as the macroeconomic balance approach, the behavioral equilibrium exchange rate approach, the structural vector auto-regression approach). The underlying concepts and assumptions of the PPP approach have potential limitations that undermine its employment in empirical research, such as the validity of the law of one price and the presence of the Balassa-Samuelson (B-S) effect (Siregar, 2011). The shortcomings of the PPP approach had led to a substantial research in favor of the more structured models that incorporate the effects of changes in real factors on the real exchange rate. Such structural models evolved along two lines: the industrialized countries and the developing countries research, with the former typically involving the use of economy wide general equilibrium models that are facilitated by the availability of data in this case.

One of these models is the fundamental equilibrium exchange rate (FFER) approach that depends on normative judgements about the internal balance position of the economy and the response of import and export volumes to changes in the real exchange rate and is particularly significant for countries with fixed exchange rate regimes. The FEER approach involves particular evolution of fundamentals such as full employment output level and low inflation. This assumption would not fully capture the distortions of the domestic economy as it may be inconsistent with the levels of current economic fundamentals. An extension of the FEER approach was developed by Faruqee (1995) by integrating stock variables and stock-equilibrium into the analysis of the exchange rate, which delivers a sustainable real exchange rate within a stock-flow framework that accounts for both internal and external macroeconomic balance (MB). The MB approach provides a point estimate of the medium run equilibrium rather than a time path for the equilibrium exchange rate, a concept which is surrounded by significant uncertainty (Israd & Mussa, 1998).

Clark and MacDonald (1999) proposed a more positive approach to estimate equilibrium real exchange rates that is based on the econometric analysis of a set of economic fundamentals that derive the behavior of the equilibrium real exchange rate. They provided a comparison between the FEER and the BEER as tools for assessing the exchange rates. They argued that both FEER and BEER are defined to be the equilibrium real exchange rate that can be attained in the case of both internal and external balances. The difference between the two approaches stems from a conceptual perspective and a methodological one. Conceptually, they suggested that FEER is the real exchange rate that is accompanied with an arbitrary equilibrium capital account, while the BEER is the exchange rate that is determined as a function of the actual values of the economic fundamentals. Methodologically, they stated that FEER neglects the short-run cyclical conditions and transitory components while concentrating only on the components that can persist in the medium term. Therefore, the FEER involves the core concept of the MB approach captured from the normative identity of the balance of payment. However, in BEER, the behavioral reduced-form equation of real exchange rate is first estimated, which is a function of long-run, medium-run and transitory variables. Afterwards, the equilibrium rate is calculated after removing the transitory variables from the equation as well as the transitory components of the economic fundamentals using smoothing techniques.

The BEER is considered as a generic approach to calculating exchange rate misalignment by utilizing a theoretical model of the real exchange rate. It is preferred over other variants of exchange rate models as it is perceived as a method of estimating (not only calculating) an exchange rate model, which is identified to be practical in terms of rigorous statistical testing. The approach is selected for its favorable feature of capturing the systematic and fundamental changes in the real exchange rate as well. Moreover, it proposes that real determinants explain the slow mean reversion to PPP observed in the analysis of data, and, hence, is similar to internal external balance approaches. The BEER approach is considered to be tractable in terms of measuring the equilibrium exchange rate using a single equation approach.

Previous research papers have included a wide range of economic variables that are believed to determine the real exchange rate and its equilibrium value in the long run (MacDonald & Dias, 2007). Egert, Halpern and MacDonald (2005) argue that there is some kind of uncertainty when estimating the equilibrium exchange rate. This uncertainty is mainly attributed to the wide range of economic fundamentals that are used in the empirical literature, which in turn is a result of the different theoretical frameworks or only a reason of subjective choices. Furthermore, they state that the real exchange rate can be associated with economic fundamentals in a multiple long-term relationships framework. Studies generally differ in their identification of medium to long-term economic fundamentals and short-term factors affecting the real exchange rates, the choice of the incorporated long-term economic fundamentals, and the calibration methods of the long-run values of these fundamentals.

This section provides an overview of the relevant research papers and their findings. The main aim in this part is to review all research papers that employed the BEER approach, specifically, to a single country level. The choice of the economic fundamentals used is mainly dependent on data availability considerations, while the estimation methods employed are based on the characteristics and nature of data and their statistical properties.

Feyzioglu (1997) examined the long-run relationship between the real effective exchange rate of Finland and the fundamental variables of terms of trade, productivity differential and world real interest rate as well as additional dummy variables to reflect the changes in the structure of trade and frictions in both labor and goods market over the period from 1975Q1 to 1995Q2. The co-integration among the incorporated variables is investigated using the full information maximum likelihood system and indicates a positive effect of the variables on the real exchange rate.

Incorporating six fundamental variables that include terms of trade, government consumption, debt service ratio, technological innovation, a dummy for the Gulf war and fiscal deficit in his model, Mongardini (1998) applied Edward’s model using monthly data series over the period between 1987 and 1996 to estimate the equilibrium real multilateral exchange rate for the Egyptian economy. The results indicate that the Egyptian currency was experiencing an overvaluation phase before 1993, then converted to an alignment phase from 1996 onward. Mohieldin and Kouchouk (2003) constructed an index of bilateral real exchange rate misalignment in Egypt during the period from 1974 to 2001. Their model derives the equilibrium real exchange rate based on the co-integration technique and the approach developed in Edwards (1989, 1994) by using optimal steady state values of economic fundamentals. In their paper, four sets of economic fundamentals were employed: government consumption to GDP ratio, investment to GDP ratio, capital outflows and terms of trade such that the first two variables cause appreciation to the RER, while the last two variables have a depreciating impact.

Using monthly data that span between 1994:1 and 2004:6, Nuryadin (2006) applied the Johansen co-integration technique and the BEER approach to estimating the equilibrium real exchange rate in Indonesia. Based on five fundamental variables, which are net foreign assets, terms of trade, degree of trade openness, private and government consumption, the results show that the latter two variables are not statistically significant and incorrectly signed. Moreover, it is concluded that the real exchange rate moved from an undervaluation phase during the first years of the sample included to an alignment phase in the middle, and an overvaluation phase at the end of the sample period. Using dynamic OLS estimation and Johansen co-integration method, Kemme and Roy (2006) investigated the long-run co-integration relationship between both Poland’s and Russia’s real exchange rate and economic fundamentals over the period from January 1995 to December 2001. Their set of fundamental variables included terms of trade, degree of trade openness, capital flows, government consumption and a trend variable to account for productivity growth in the two countries. Their results illustrate a negative effect of both openness and terms of trade. The sign of government consumption variable varies between the two counties.

Yajie, Xiaofeng and Soofi (2007) employed the Johansen co-integration method to determine the equilibrium value of the RMB exchange rate. Terms of trade, relative price of traded to no-traded goods, foreign reserves and change in money supply were included in their model. Their findings indicate that while both per capita GDP and foreign reserves have an appreciating effect on the exchange rate, money supply has a depreciation effect. Terms of trade has an ambiguous effect on RMB. They concluded that the value of China’s currency was nearly close to its long-run equilibrium value and, hence, cast doubt on the role of China’s exchange rate policy in generating its trade surplus.

Koske (2008) applied the BEER and FEER approaches1 to evaluate the equilibrium trade-weighted exchange rate in Malaysia during the period between 1980Q1 and 2006Q1. Using the vector-error correction model (VECM) and employing the productivity, government consumption, trade openness, real GDP per capita and net foreign assets variables, the results indicate a light undervaluation of the Malaysian Ringgit.

Lebdaoui (2013) employed the Johansen co-integration technique and vector-error correction model (VECM) to estimate the equilibrium real exchange rate of the Moroccan Dirham using quarterly data that spanned from 1980 to 2012. She included seven variables in the set of economic variables that explain the behavior of the exchange rate in Morocco, which are terms of trade, government spending, relative productivity, net capital flows in real terms, foreign reserves, trade openness and a monetary policy index. Her findings suggest that with the exception of the statistically insignificant net capital flows variable, both government spending and trade openness have a depreciating effect on the Moroccan Dirham exchange rate, while the rest of variables have an appreciating effect on it.

Panday (2014) carried out the co-integration technique using both the Johansen and single-equation bounds test approaches to estimate the equilibrium exchange rate in Nepal between 1975 and 2008. Applying the BEER approach and including money supply, relative debt, productivity, trade balance and remittance flows in the model, the findings concluded that the real effective exchange rate of Nepal’s economy was overvalued over the last decade and a half of the period under analysis.

Recent studies conducting the BEER approach to estimate the exchange rate equilibrium in a panel data context include Couharde et al. (2017), Adler and Grisse (2017), Giordano (2018) and Cubeddu et al. (2019) among others. Couharde et al. (2017) computed estimates of the equilibrium real effective exchange rate in 182 countries over the period 1973–2016 using panel data estimation technique and three fundamental variables, which are productivity, net foreign assets and terms of trade. In a panel model containing 20 advanced economies between 1980 and 2013, Adler and Grisse (2017) applied different specifications by employing various economic variables (trade openness, central bank reserves, old age dependency rate, government expenditure, real interest rate, productivity, net foreign assets and terms of trade). Their main finding is that estimates of equilibrium exchange rate are sensitive to the choice of incorporated variables in the model. Giordano (2018) used quarterly data over the period 1999–2017 to compute the misalignment of both the bilateral and trade-weighted real exchange rates of the euro area and its main trading economies. She used panel co-integration technique and the common correlated effects mean group estimator, the fundamental variables included productivity, terms of trade, trade openness, government expenditure and real interest rate; her results were found to be consistent with the equilibrium exchange rate literature. In a similar version of the BEER approach, Cubeddu et al. (2019) conducted REER regressions using a wide list of economic fundamentals (cyclical factors, macroeconomic fundamentals, policy variables and structural determinants) for a sample of 49 countries between 1990 and 2016 using fixed effects OLS estimation technique. They concluded by stating that modelling real exchange rate misalignments remains a challenge since it is affected by multiple factors, such as structural distortions and country-specific fundamentals, that can be hard to model.

3. Explaining the Approach behind the Behavioral Equilibrium Exchange Rate

This paper intends to estimate the equilibrium real exchange rate in Egypt and examine the role of both transitory and fundamental variables in affecting the trend of real exchange rate misalignment during the period 1965 – 2018. The equilibrium exchange rate is derived by employing the BEER model, which is an extension of the Edwards model (1989, 1994). Edwards (1988) developed a theoretical model that explains the dynamics of the real exchange rate in developing countries such that both nominal and real factors are allowed. Only real factors – the fundamentals – can have an effect on the real exchange rate in the long run. The model considers a small economy with three types of goods: exportables, importables and nontradables. The economy is assumed to produce exportable and nontradable goods and consumes the importables and nontradables. Effective capital controls are assumed to initially exist so that there is no international capital mobility2. To finance its expenditures, the government uses non-distortionary taxes and creation of domestic credit and cannot borrow from abroad. The model presents a list of economic fundamentals that affect the equilibrium real exchange rate in the long run, namely, import tariffs, terms of trade, government consumption, capital flows and technological progress (capturing productivity impact on the equilibrium exchange rate or the Balassa-Samuelson effect). The equilibrium exchange rate is affected by changes in these fundamentals such that both an unanticipated increase in import tariffs and an increase in the international price of importable goods (i. e., a worsening in international terms of trade) can either depreciate or appreciate the equilibrium real exchange rate. Both an increase in government consumption for non-tradable goods and an increase in exogenous capital flows appreciate the real equilibrium exchange rate.

The BEER approach for estimating the equilibrium exchange rate was then amplified in Clark and MacDonald (1999), who employed a reduced-form equation to investigate the behavioral link between the real effective exchange rate and relevant economic variables for the economies of the U. S., Germany and Japan over the period 1960–1996.

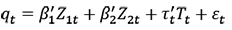

Theoretically, their BEER model uses the following equation:

(1)

(1)

The above equation provides a theoretical representation of the variables affecting the real exchange rate qt such that Z1 is a vector of economic fundamentals that are expected to have persistent long-run effect, Z2 is a vector of economic fundamentals that can have medium-run effects, and T is a vector that can have short-run transitory effects. β1, β2 and τ are vectors of reduced-form coefficients. εt is random disturbance term.

Thus, the BEER tries to examine the behavior of the real exchange rate by focusing on the given values of economic fundamentals and the sources of both cyclical and temporary factors that can have an impact on the real rate. In that sense, it estimates the current equilibrium exchange rate and yields a measure of real exchange rate misalignment called “current misalignment”. Nonetheless, the actual values of economic fundamentals incorporated in the estimation of the real exchange rate can themselves depart from their sustainable long-run values. Therefore, it can be useful to calculate another measure of misalignment called “total misalignment”, which is the difference between the actual real exchange rate and that determined by the long-run values of these economic fundamentals (Clark & MacDonald, 1999, Clark & MacDonald, 2004).

This explanation can be expressed mathematically by the following set of equations:

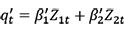

(2)

(2)

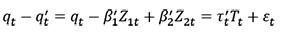

In Equation 2, q't is defined as current equilibrium exchange rate, and it is attained by setting transitory and random factors to zero. The difference between qt and q't provides a measure for current misalignment of the real exchange rate (cm), which is defined as follows:

(3)

(3)

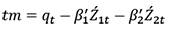

The total misalignment denoted (tm) is then obtained as in Equation 4:

(4)

(4)

Equation 4 is useful in understanding the origins of real exchange rate misalignment at any given point of time. It illustrates that the total misalignment at any point can be decomposed into the effects of both the transitory factors and the random disturbances, and the degree of divergence between the actual values of the economic fundamentals and their long-run values Ź1t and Ź2t ; the latter values are attained by employing statistical filters such as the Hodrick-Prescott filter or a Beveridge Nelson decomposition (MacDonald & Dias, 2007).

Obstfeld and Rogoff (2001) outlined an empirical puzzle called “the disconnect puzzle” that covers the weak connection between the exchange rate and the underlying fundamentals. Nominal price rigidity and trade costs can produce such disconnect in the sense that exchange rate responds wildly to shocks. This puzzle was implicitly documented in Meese and Rogoff (1983) and is based on the absence of a stable relationship between the exchange rate and economic fundamentals.

4. Data, Econometric Specification and Methodology

4.1 Data and Econometric Specification

In light of the reviewed empirical literature, this paper represents the relationship between the actual real exchange rate and economic fundamentals in Egypt using Equation 53.

(5)

(5)

In the above model, Ext is the real exchange rate of the Egyptian economy, tott represents terms of trade and is expressed as the relative price index of exports to that of imports, invt is investment captured by fixed capital formation as a percentage of GDP and measures the effect of domestic supply capacity; govt is the percentage of government consumption to GDP and determines the effects of fiscal policy; opent is the sum of exports and imports to gross domestic product used as a proxy of the Egyptian economy’s degree of openness and, hence, captures trade policy effects. All macroeconomic variables used in this study are used in the natural logarithm form by using annual time-series data for the period of 1965–20184. The data sources are the International Monetary Fund IFS, the World Bank WDI and Bruegel databases5. In Equation 5, the exchange rate is employed one time as the bilateral rate representing Egypt-US real exchange rate6 and another time as the trade-weighted real exchange rate to check the sensitivity of the ARDL model to the real exchange rate variable employed.

Theoretically, it is expected that the TOT variable can have both positive and negative effects on the real exchange rate depending on whether the income effect dominates the substitution effect. While the former effect means that an increase in TOT leads to a real exchange rate appreciation by inducing higher demand for nontradable goods, the latter effect explains how a decline in the prices of imports can cause a shift in demand from the nontradable goods sector and thus decreases the price of nontradable goods leading to a real exchange rate depreciation. The investment to GDP variable is expected to improve a country’s real exchange rate by encouraging higher levels of productivity and causing a real appreciation of the domestic currency unless this increase in productivity is driven by higher levels of imports. Both trade openness and government consumption variables have ambiguous effects in the exchange rate literature, and their expected signs cannot be a priori determined. Their effect on the real exchange rate is based on whether they derive an increase in the demand for tradable goods sector or nontradable goods sector when their ratios to GDP rise. The openness variable can lead to either an increase in the demand for imported goods through the substitution effect or an increase in the demand for the nontradables through the income effect. Similarly, if the extra spending by the government sector is channeled through the nontradable goods sector (tradable goods sector), it will elicit appreciation (deprecation) of the real exchange rate.

Further supplementary variables that are not directly explained in the theoretical literature are incorporated into the model since they are specific to the development of economic policies in Egypt. In particular, two dummy variables, dumer and dumf , are added to the model to capture the economic effects of the implementation of the economic reform and structural adjustment program (ERSAP) in 1991 and the flotation of the Egyptian pound in 2003 by the Central Bank of Egypt (CBE)7. The ERSAP lasted for a period of seven years and was mainly intended to correct for the macroeconomic distortions experienced by the Egyptian economy at that time when transforming it to a market-based economy. In relation to the exchange rate policies, the multiple exchange rate adopted before the implementation of the ERSAP was temporarily replaced by a dual exchange regime, which was then unified into one rate in October 1991. The flotation dummy is included to reflect the decision of the CBE to freely float the Egyptian pound in 2003 in an intention to improve the management of exchange rate policy such that the nominal exchange rate was no longer considered to be the nominal anchor for the monetary policy in Egypt.

4.2 Econometric Methodology

It is generally believed that most time-series data are not stationary at levels, which in turn can adversely affect the validity of the traditional econometric analysis. Unless the regression analysis between the dependent and the independent variables reveals coefficients such that the residual obtained is stationary, it can be said that the OLS results will likely be spurious. To avoid this problem, a class of models known as co-integrated processes have been employed by economic analysts and econometricians as an attempt to reach a long-run equilibrium relationship tying the different components in the model (Hamilton, 1994; Kennedy, 2008).

Among the different co-integration techniques used in the empirical literature, this paper adopts the application of the ARDL model (or bound test co-integration approach) as it has multiple advantages8. The ARDL approach was proposed by Pesaran and Shin (1999) and Pesaran et al. (2001) and, contrary to other co-integration techniques, does not require unit root pretesting for the incorporated variables in the model. It allows for the inclusion of variables that are integrated of different order (I(0), I(1) or a combination of both and is considered to be statistically robust in the case of small sample size modelling. Furthermore, the application of this technique is possible when the regressors are endogenous. According to the ARDL approach, the detection of the long-run relationship among the variables is based on the F-statistic (Wald test), which is compared to the critical value band at different significance levels (Pesaran & Shin 1999; Nkoro & Uko, 2016).

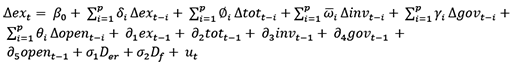

The ARDL framework for the model estimated is as follows:

(6)

(6)

where Δ is the difference operator, the terms with the summation sign represent the dynamics of the error correction model, Der , Df are the two dummies that are defined previously, and the remaining terms reflect the long-run relationship. The procedure of the co-integration starts with testing for the existence of unit root in the variables included in the equation to rule out the presence of I(2) variables in the model. The optimal lag order of the model is then chosen based on the Akaike Information Criterion (AIC). The existence of a long-run relationship among the variables can be investigated using the Wald F-test such that the null hypothesis represents the non-existence of a long-run relationship and can be denoted as H0 : δ1= δ2 = δ3 = δ4 = δ5 = 0, while the alternative, which reflects the absence of co-integration, is denoted as H1 : δ1 ⧣ δ2 ⧣ δ3 ⧣ δ4 ⧣ δ5 0. To make a decision about the existence of a co-integrating relationship among the variables, the calculated F-statistic is compared to the critical values provided by Pesaran et al. (2001). There are two sets of critical values: one that applies when all variables are I(0), and the other when the variables are (1). If the calculated F-statistic is higher than the upper bound of the critical values, then the null hypothesis is rejected irrespective of the order of integration of the variables. If the calculated F-statistic is below the lower bound of the critical values, the null hypothesis cannot be rejected, and hence, we conclude by the absence of co-integration among the variables in the model. An indecisive finding is reached when the calculated F-statistic lies inside the band of the critical value given.

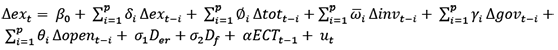

In case of the existence of a long-run relationship and after the estimation of the long-run coefficients of the model, the analysis moves forward to the estimation of short-run coefficients of the model (Equation 7).

(7)

(7)

where ECT is the error correction term reflecting the speed of adjustment with the parameter α that should be negative and statistically significant.

5. Empirical Results

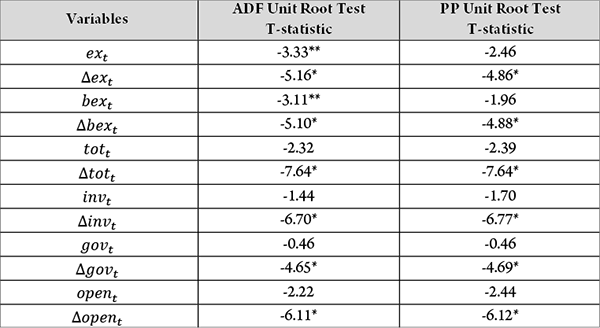

Two asymptotically equivalent tests are applied: the augmented Dicky-Fuller (ADF) test and the Phillips-Perron (PP) test. As the error term is unlikely to be white noise, the standard Dickey-Fuller test was extended to an augmented version, which includes extra lagged terms of the dependent variable in order to eliminate autocorrelation. The lag length on the extra terms can be determined by data dependent methods such as the Akaike Information criterion (AIC) or Schwartz Bayesian criterion (SBC). The ADF test may include an intercept, trend and intercept, or none of them depending on the data series properties. The PP test is similar to the ADF test. The test is a semi-parametric procedure that accounts for heteroskedasticity in the data series (Asteriou & Hall, 2007).

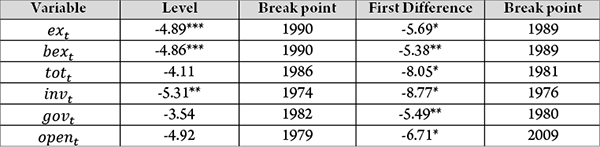

The results of the unit root tests are summarized in Table 1, which shows that both the ADF and PP tests give similar evidence on the level of stationarity for all variables with the exception of the real effective (and bilateral) exchange rate. It can be noticed from the table that while the ADF test reveals the stationarity of the real effective (and bilateral) exchange rate at level only at 5% significance level and at first difference at 1% significance level, the PP test shows that all variables are integrated of order 1 at 1% level of significance. In light of the weak signs of stationarity of the real exchange rate for the ADF test, we cannot be certain about its order of integration, indicating a case that allows for the application of the ARDL methodology, which provides further estimation advantages as explained earlier.

Table 1. Unit Root Test Using Augmented Dickey Fuller (ADF) and Philips Perron (PP)

Note. All variables are used in their logarithmic form. *and ** indicate the rejection of the null hypothesis of ADF and PP tests at 1% and 5% level of significance, respectively. An intercept was added in each equation of the unit root tests employed.

Zivot-Andrews structural break unit root test was equally employed to check for the stationarity results. Table 2 shows the results of Zivot-Andrews unit root test and reveals that the results are mixed as some variables (such as terms of trade, government consumption and openness) are non-stationary at level and are stationary in first difference form, that is, I (1). However, both real exchange rate variables and investment ratio are stationary at level at different critical values. This indicates that the result is the mixture of I (1) and I (0). Therefore, the Zivot-Andrews unit root test also supports the implementation of ARDL approach.

Table 2. Unit Root Test Results Based on Zivot-Andrews

Note. The test is carried out using both intercept and trend. *, ** and *** stand for 1%, 5% and 10% levels of significance.

After examining the order of integration of the time-series, the two-step bound test of co-integration was employed. The optimal lag order of the ARDL model was firstly chosen based on the Schwarz Criterion (SC), and the order of the model was selected to be ARDL (3, 3, 0, 0, 3) with maximum number of lags automatically set to be 4 lags. It is then appropriate to move forward to the second step in which the long-run relationship among the incorporated variables is investigated based on the F-statistic of the chosen model. The calculated F-statistic is 6.525, which is above the upper bound critical value at 1% level of significance9.

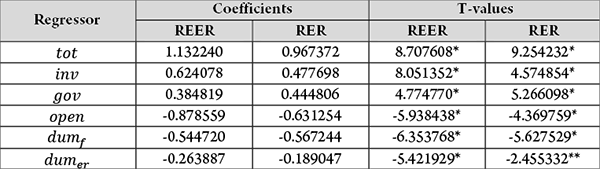

As indicated from Table 3, the variables appear to be statistically significant with signs consistent with economic theory. The terms of trade variable has a positive sign, which indicates a domination of the income effect in the case of Egypt. An increase in the TOT variable by 1% will lead to 1.13% increase in the real effective exchange rate. The coefficient of investment reflects how capital formation stimulates the real effective exchange rate such that an increase in investment variable by 1% causes 0.62% increase in the exchange rate. The government consumption has a coefficient of 0.38, reflecting an appreciation effect of 0.38% on the real effective exchange rate when it rises by 1%. This means that in the case of Egypt, government spending is mainly channeled through the increase in the demand of the non-tradeable sector giving it a larger weight than that of the tradable sector. Trade openness appears to create a depreciation effect, which reflects how commercial policy could be of less support to the import competing industries thus inducing a higher demand for the importables and a deteriorated current account balance. The magnitude of the depreciating effect is nearly 0.88% per 1% increase in the degree of trade openness. Both the dummy variables for the ERSAP and flotation appear to have a negative sign as expected since the two dummies capture the effect of policies that either chiefly or partially were directed to liberalizing and devaluing the value of the Egyptian pound.

Table 3 presents the long-run estimates of the variables when the dependent variable is altered to the bilateral real exchange rate as well. It gives similar results to the ones obtained when the real effective rate is used. This was done in an attempt to check the sensitivity of the model to the change of the real exchange rate variable (i. e., whether the reliance on the bilateral rate would imply different results from those obtained by the use of the trade-weighted rate). Moreover, it asserts that both the bilateral and effective real exchange rates can be determined by the same set of economic variables with only slight changes to the magnitude of the estimated long-run coefficients.

Table 3. The Long-run ARDL Estimates and the Contribution of Economic Fundamentals to the Equilibrium Bilateral and Effective Exchange Rates

Note. ARDL (3, 3, 0, 0, 3) is selected on the basis of SBC. The ARDL model was chosen such that the trend specification is neither constant nor trend case. *and ** indicate 1% and 5% level of significance, respectively. RER and REER indicate real bilateral exchange rate and real effective exchange rate, respectively.

Table 4. Diagnostic Tests of the ARDL Model

|

Test |

Test Statistic |

P-values |

||

|

REER |

RER |

REER |

RER |

|

|

Serial correlation LM |

1.783459 |

0.112194 |

0.1844 |

0.8942 |

|

Heteroscedasticity |

1.184904 |

4.400045 |

0.3288 |

0.0002* |

|

Normality |

3.176589 |

0.156660 |

0.204274 |

0.924659 |

Note. RER and REER indicate real bilateral exchange rate and real effective exchange rate, respectively. *indicates the rejection of the null hypothesis and the presence of heteroscedasticity for the bilateral real exchange rate model.

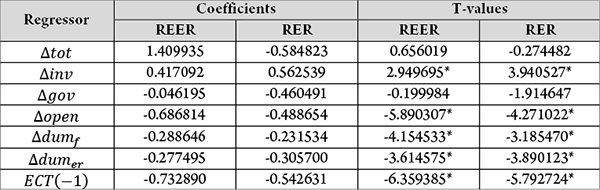

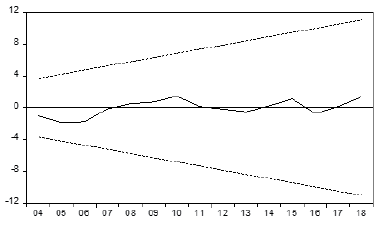

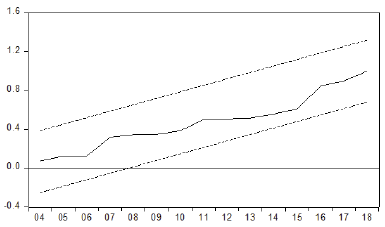

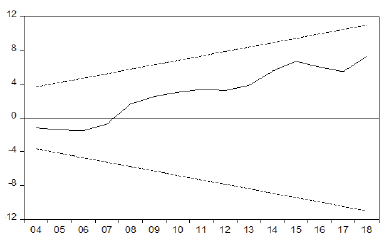

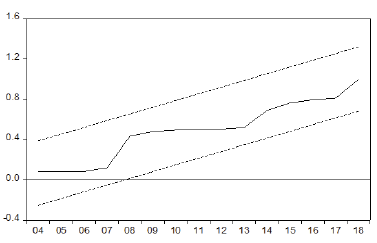

Several tests were conducted to check the reliability of the two ARDL models estimated, one for the bilateral real exchange rate model and the other for the effective real exchange rate. These tests include normality, serial correlation LM and heteroscedasticity tests along with two chief stability tests, which produce recursive estimates and are known as cumulative sum (CUSUM) and cumulative sum of squares (CUSUMSQ). Table 4 and Figures 1–4 depict the results of these diagnostic tests. As outlined in Table 3, the ARDL model for the real effective exchange rate passes through all these tests, which reflects its goodness of fit. The ARDL model estimated using the bilateral real exchange rate is evaluated to be reliable in terms of serial correlation and normality checks. However, the presence of heteroscedasticity is found for this latter model10.

Table 5. ARDL ECM – Estimates

Note.* indicates statistical significance at 1% level.

The ARDL short-run estimates are summarized in Table 5. The findings give evidence for a statistically significant and negative error correction term for both the real effective and bilateral exchange rate models. It is concluded that around 73% (54%) of the disequilibrium of the real effective (bilateral) exchange rate is adjusted each year. With the exception of the terms of trade and government consumption, all other variables appear to have a short-run effect on the real exchange rate.

Figure 1. Plot of Cumulative Sum of Recursive Residuals for REER ARDL Model (5% significance)

Figure 2. Plot of Cumulative Sum of Squares of Recursive Residuals for REER ARDL Model (5% significance)

It can be noticed from Figures 1–4 that the two ARDL models estimated in this paper for both the bilateral and effective real exchange rate can pass the stability check since the statistics produced by the CUMSUM and CUMSUMSQ plots lie within the critical bounds of the 5% significance level. This ensures that the coefficients in the two models are stable.

Figure 3. Plot of Cumulative Sum of Recursive Residuals for RER ARDL Model (5% significance)

Figure 4. Plot of Cumulative Sum of Recursive Residuals for RER ARDL Model (5% significance)

6. Implications for the Equilibrium Real Exchange Rate

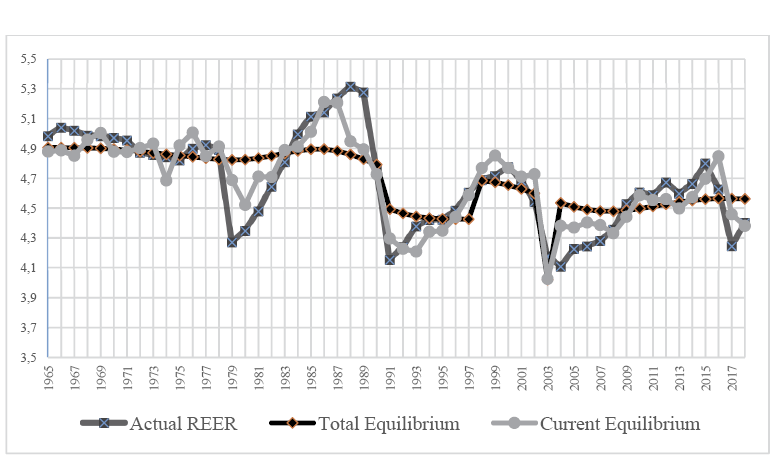

Based on the estimated models above, the equilibrium real exchange rate is calculated, and the divergence between the actual and equilibrium rates is illustrated in this section. The analysis is confined to the long-run solution obtained by the ARDL model for the real effective exchange rate since it passes all the diagnostic tests employed previously. Following the methodology adopted by Clark and MacDonald (1999, 2004), the current and total equilibrium exchange rates between 1965 and 2018 are depicted in Figure 5. It can be noticed that the total equilibrium rate is smoother than the current equilibrium rate over the period examined as the former is calculated using the smoothed values of the economic fundamentals incorporated in the ARDL model. This is done by applying the exponential smoothing method11. Thus, the current equilibrium rate is impacted by the fluctuations experienced within the economic fundamentals incorporated in the estimated model. The equilibrium rates are used to derive the different misalignment measures according to the source of deviation as explained below.

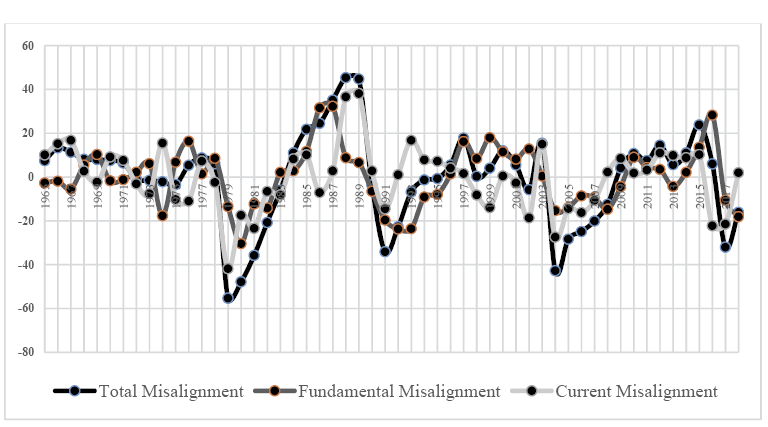

Looking further into the sources of real exchange rate misalignment in the case of Egypt, Figure 6 shows the decomposition of total misalignment into current misalignment and fundamental misalignment. The total misalignment measure is first calculated as the gap between the total equilibrium exchange rate and the actual real effective exchange rate. This measure of misalignment is then decomposed into two other sub-misalignment measures, which are the current misalignment and the fundamental misalignment. In that sense, total misalignment is caused by two main sources: the first is current misalignment reflecting the effect of transitory factors or short-run shocks, while the second is fundamental misalignment representing the effect of divergence of economic fundamentals from their long-run sustainable values. This enables a more precise investigation of the influence of each on total misalignment of the Egyptian pound over the period under examination in this paper.

An insight into this classification and the impact of each source of total misalignment throughout the examined period clarifies the relative significance of short-run shocks and permanent factors in deriving the misalignment of the real effective exchange rate. A major influence of transitory factors can be observed from the beginning of the period examined till mid-1970s. This implies that economic fundamentals tended to fluctuate closely around their long-run values. Both transitory and permanent factors appeared to contribute almost equally to the real exchange rate misalignment during the period 1979–1985.

Figure 5. Actual and Equilibrium Real Exchange Rates (1965–2018)

One distinct feature noticed from Figure 6 is the considerable role played by permanent factors during a prolonged period starting in 1986 and lasting till 2003, which reflects how permanent factors played the main role in pushing the actual exchange rate away from its equilibrium trend. Few exceptions during this period were two sub-periods including the years 1988–1989 and 2002–2003, since each of them correspond to either intended changes in the exchange rate by the conduct of monetary policy or unintended changes experienced by the Egyptian economy during that time. Mohieldin and Kouchouk (2003) point out to multiple factors such as the unsustainable macroeconomic policies adopted by the Egyptian government, a drop in capital inflows and unsatisfactory performance of the tradable sector during the first sub-period. A series of successive devaluations, which started in June 2000, can explain the role of short-run shocks to the second sub-period as well. A second noticed period of equal relative importance between both short-run shocks and permanent factors in causing the total misalignment of the local currency is that between 2004 and 2010, before the outbreak of the Egyptian 2011 revolution. The latter contributed to a regained relative importance of short-run shocks that lasted till 2017 and were the main cause behind real exchange rate deviations from the equilibrium rate. Specifically, the decision of the CBE to freely float the Egyptian pound in November 2016 marked the role of transitory factors in dominating the magnitude of total misalignment in 2017 causing the undervaluation of nearly 32 percent of the local currency. The evidence that fundamental-based factors deviated away of their long-run trends and hence a dominating major role of the total misalignment components is observed during the last year of the period (Figure 6).

Figure 6. Decomposing Total Exchange Rate Misalignment into Transitory and Permanent Factors (1965–2018)

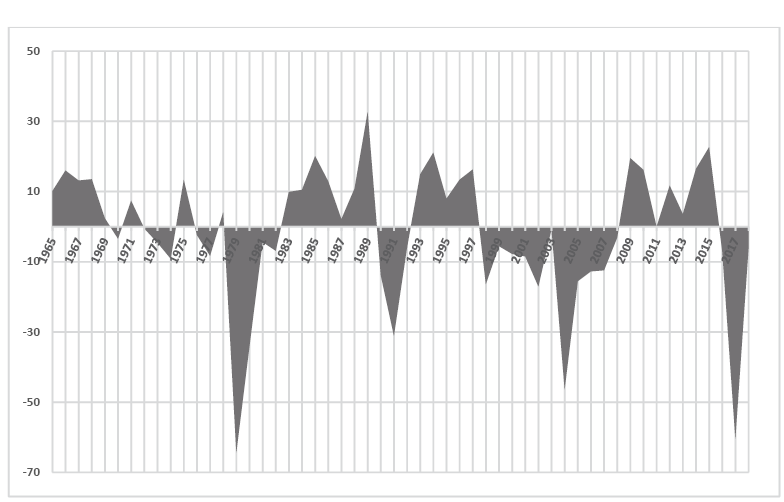

Focusing on the types of misalignment experienced by the Egyptian pound over the period (i. e., over- or undervaluation), Figure 7 detects the different phases of misalignment in the real effective exchange rate. When the actual real effective exchange rate is above the equilibrium, it is overvalued, and when it is below the equilibrium, it is undervalued. In particular, there are four distinct phases of overvaluation over the whole period: during the second half of the 1960s, before the implementation of the ERSAP in 1991; between 1993 and 1997; and lastly between 2009 and 2015. The Egyptian pound experienced four main sub-periods of undervaluation: from 1979 to 1982, after the implementation of the ERSAP in 1991, and from 1998 to 2008, in addition to the last three years of the examined period.

Before the adoption of the open door policy in 1974, the Egyptian economy was characterized as an inward-oriented economy with a dominant role of the public sector in directing the manufacturing, financial and trade sectors. The multiple exchange rate system that prevailed before the launch of the ERSAP consisted of three pools: a central bank pool, a commercial bank pool and a free market pool. This system contributed to a constant appreciation of the Egyptian pound and hence an overvalued exchange rate as outlined in Figure 7. This finding is consistent with the explanation provided by Mohieldin and Kouchouk (2003).

Figure 7. Phases of Overvaluation and Undervaluation of the Egyptian Pound (1965–2018)

The implementation of the open door policy reflected a partial movement toward liberalizing the Egyptian economy by offering guarantees and incentives to foreign capital and foreign technology (Esfahani, 1990). Thus, the overvaluation resumed back slightly in 1975 and 1978 and reached around 13 percent and 4 percent of the equilibrium rate, respectively, before the beginning of an undervalued currency phase spanning from 1979 to 1982. This undervaluation was attributed to a substantial devaluation of the Egyptian pound in 1979 causing a significant drop in the value of the Egyptian pound and undervaluation of nearly 64 percent of the equilibrium rate. Conversely, the Egyptian pound was considerably overvalued during most of the decade preceding the launch of the ERSAP program as a result of market distortions and economic imbalances experienced by the Egyptian economy at that time. The overvaluation measure ranged between around 2 percent and nearly 33 percent of the equilibrium rate between 1983 and 1989.

In 1991 and with the implementation of the economic reform program, the exchange rate was temporarily altered to a dual exchange rate system consisting of primary and secondary markets, then a unified system was introduced in October 1991, under which the Egyptian currency could be freely traded (Mongardini, 1998). This liberalization of the exchange rate system led to undervaluation of the local currency in 1991 and 1992 followed by an overvalued currency period between 1993 and 199712. The subsequent series of devaluations in 2000 and 2001 along with the exit of the official peg system in 2003 and the announcement of the flotation of the Egyptian pound led to an undervaluation phase between 1998 and 2008 (Aly & Hosni, 2018). Consequently, the undervaluation measure recorded a high level of nearly 46 percent of the equilibrium exchange rate in 2004 directly after the flotation decision of the local currency. The actual exchange rate was above the equilibrium rate again in 2009, registering a new overvaluation phase, which reached an end after allowing the local currency to freely float in November 2016, with the latter contributing to undervaluation of the Egyptian pound that reached an average of 33 percent till the end of the period under investigation.

7. Conclusions

This paper estimates the equilibrium exchange rate in Egypt applying the autoregressive distributed lag model using annual data during the period from 1965 to 2018. The estimation is carried out for both the real bilateral and effective exchange rates using a set of fundamentals that include terms of trade, government consumption, degree of trade openness, investment ratio of GDP and two dummies reflecting major changes of exchange rate policy in Egypt. The empirical analysis confirms the presence of a long-run relationship between the real exchange rate and the economic fundamentals incorporated in the ARDL model. According to the findings, all economic fundamentals are statistically significant with correct signs and reflect the relative importance of the terms of trade and openness variables in determining the equilibrium exchange rate in Egypt. This finding emphasizes the pivotal role of trade policies in influencing the value of the Egyptian pound, which clearly indicates the need to restructure and reform them in an approach that improves Egypt’s external competitiveness. Particular attention should be given to the import competing industries to withstand intense competition in the international markets while discouraging the dependence on import intensive production in the domestic economy.

The results of the ARDL model are used to derive the equilibrium exchange rate and the deviation of the actual real rate from it to capture the magnitude of misalignment of the Egyptian pound during the period under investigation. They revealed multiple phases of overvaluation and undervaluation of the local currency. The assessment of the equilibrium exchange rate suggests that the Egyptian real exchange rate experienced a close alignment to the equilibrium rate during the first half of the 1970s and was out of its equilibrium level over most of years of the examined period. The magnitude of misalignment culminated before the implementation of the ERSAP in 1991 and after the flotation of the pound in 2003. The local currency witnessed a recent phase of overvaluation, which took an upward trend especially after the outbreak of the 2011 revolution. In addition, the findings lend support to a new phase of undervaluation starting only in 2017 and lasting till the end of the period examined.

Total misalignment measure is then decomposed into two components; the first is attributed to short-run transitory shocks, while the second one is driven by long-run fundamental factors. The results documented in this paper reveal the considerable role played by permanent factors during a prolonged period between 1986 and 2003 and reflect how permanent factors played the main role in pushing the actual exchange rate away from its equilibrium trend. Nonetheless, the findings generally support the fact that both permanent or fundamental-based factors and short-run shocks prove to be important influential factors impacting the deviations of the Egyptian pound from its equilibrium level during most of the period empirically examined in this paper.

Given the results obtained in the present study, it makes sense that the central bank of Egypt conduct its monetary policy in such a way that keeps its actual real exchange rate as close as possible to its equilibrium level, and that the authorities should not be in a situation of defending a disequilibrium exchange rate since the latter provides no economic gains for the Egyptian case.

Trade policies should be directed at discouraging import intensive production. This is vital to avoid the adverse effects on the current account and strengthen the currency as well. Moreover, further incentives should be offered to domestic producers and exporters to develop their industries and better serve the domestic and international markets. This is supported by the fact that an undervalued pound does not help in promoting or boosting exports in Egypt. As such, industry modernization should be seen as a top priority for the economy. Furthermore, the empirical findings underscore the significance of adopting structural reforms to strengthen the domestic economic fundamentals and boost the resilience of the economy in absorbing any short-term shocks.

References

Adler, K., & Grisse C. (2017). Thousands of BEERs: Take Your Pick. Review of International Economics, 25(5), 1078–1104. https://doi.org/10.1111/roie.12296.

AlShehabi, O., & Ding, S. (2008). Estimating Equilibrium Exchange Rates for Armenia and Georgia. IMF Working Paper No. 110 (Washington: International Monetary Fund).

Aly, H., & Hosni, R. (2018). Examining the Nexus between Exchange Rate Volatility and Export Performance: An Empirical Evidence from the Egyptian Experience. Business and Economic Horizons, 14(3), 542–560. https://doi.org/10.22004/ag.econ.287214.

Asteriou, D., & Hall, S. G. (2007). Applied Econometrics. New York: Palgrave Macmillan.

Central Bank of Egypt (2019/2020). External Position of the Egyptian Economy, Volume No. 20.

Couharde, C., Delatte, A.-L., Grekou, C., Mignon, V., & Morvillier, F. (2017). EQCHANGE: A World Database on Actual and Equilibrium Effective Exchange Rates. CEPR Discussion Paper No. 12190.

Cubeddu, L., Krogstrup, S., Adler, G., Rabanal, P., Chi Dao, M., Hannan, S. A., Juvenal, L., Li, N., Buitron, C. O., Rebillard, C., Garcia-Macia, D., Jones, C., Rodriguez, J., Suk Chang, K., Gautam, D., & Wang, Z. (2019). The External Balance Assessment Methodology: 2018 Update. IMF Working Papers 19/65.

Clark, P. B., & Macdonald, R. (1999). Exchange Rates and Economic Fundamentals: A Methodological Comparison of BEERs and FEERs. In R. Macdonald & J. L. Stein (Eds.), Equilibrium Exchange Rates (pp. 285–322). London, UK: Kluwer Academic Publishers.

Clark, P. B., & MacDonald, R. (2004). Filtering the BEER: A Permanent and Transitory Decomposition. Global Finance Journal, 15(1), 29–56.

Darvas Z. (2012). Real Effective Exchange Rates for 178 Countries: A New Database. Bruegel Working Paper 2012/06.

Edison, H., & Vitek F. (2009). Australia and New Zealand Exchange Rates: A Quantitative Assessment. IMF Working Paper 09/07.

Edwards, S. (1988). Real and Monetary Determinants of Real Exchange Rate Behaviour: Theory and Evidence from Developing Countries. Journal of Development Economics, 29(3), 311–341. https://doi.org/10.1016/0304-3878(88)90048-X.

Edwards, S. (1989). Real Exchange Rates in the Developing Countries: Concepts and Measurement. Working Paper No. 2950 (Cambridge: National Bureau of Economic Research).

Edwards, S. (1994). Real and Monetary Determinants of Real Exchange Rate Behavior: Theory and Evidence from Developing Countries. In J. Williamson (Ed.), Estimating Equilibrium Exchange Rates (pp. 61–91). (Washington: Institute for International Economics).

Egert, B., Halpern, L. & MacDonald, R. (2005). Equilibrium Exchange Rates in Transition Economies: Taking Stock of the Issues. Journal of Economic Surveys, 20(2), 257–324. https://doi.org/10.1111/j.0950-0804.2006.00281.x.

Esfahani, H. S. (1990). The Experience of Foreign Investment in Egypt under Infitah. Bureau of Economic and Business Research, Working Paper No. 90-1710, University of Illinois at Urbana-Champaign.

El-Shazly, A. (2011). Designing an Early Warning System for Currency Crises: An Empirical Treatment. Applied Economics, 43(14), 1817–1828. First published on 10 November 2009. https://doi.org/10.1080/00036840802600657.

Feyzioglu, T. (1997). Estimating the Equilibrium Real Exchange Rate: An Application to Finland. IMF Working Paper 97/109.

Giannellis, N., & Koukouritakis, M. (2013). Exchange Rate Misalignment and Inflation Rate Persistence: Evidence from Latin American Countries. International Review of Economics and Finance, 25(C), 202–218. https://doi.org/10.1016/j.iref.2012.07.013.

Giordano, C. (2018). Price and Cost Competitiveness Misalignments of the Euro Area and of its Main Economies According to a Quarterly BEER Model, 1999–2017. Bank of Italy Occasional Papers 444.

Faruqee, H. (1995). Long-Run Determinants of the Real Exchange Rate: A Stock-Flow Perspective. IMF Staff Papers, 42(1), 80–107.

Handy, H. (1998). Egypt: Beyond Stabilization, Toward a Dynamic Market Economy. IMF Occasional Paper No.163 (Washington: International Monetary Fund).

Hamilton, J. D. (1994). Times Series Analysis. Princeton NJ: Princeton University Press.

Holtemöller, O., & Mallick, S. (2013). Exchange Rate Regime, Real Misalignment and Currency Crises. Economic Modelling. 34(C), 5–14. https://doi.org/10.1016/j.econmod.2012.09.017.

IMF (2019). The International Financial Statistics 2019 (IFS) Database.

IMF (2020). Arab Republic of Egypt. IMF Country Report No. 20/271.

Isard, P., & Mussa, M. (1998). A Methodology for Exchange Rate Assessment. In P. Isard & H. Faruqee (Eds.), Exchange Rate Assessments: Extensions of the Macroeconomic Balance Approach (pp. 4–24). International Monetary Fund Occasional Paper, Volume 167.

Kheir-El-Din, H., & El-Shawarby, S. (2000). Trade and Foreign Exchange Regime in Egypt. Working Paper No. 2034, Economic Research Forum.

Khodeir, A. N. (2012). Towards Inflation Targeting in Egypt: The Relationship between Exchange Rate and Inflation. South African Journal of Economic and Management Sciences, 15(3), 325–332. https://doi.org/10.4102/sajems.v15i3.203.

Kemme, D. M., & Roy S. (2006). Real Exchange Rate Misalignment: Prelude to Crisis. Economic Systems, 30(3), 207–230. https://doi.org/10.1016/j.ecosys.2006.02.001.

Kennedy, P. (2008). A Guide to Econometrics. USA: Blackwell Publishing.

Koske, I. (2008). Assessing the Equilibrium Exchange Rate of the Malaysian Ringgit: A Comparison of Alternative Approaches. Asian Economic Journal, 22(2), 179–208. https://doi.org/10.1111/j.1467-8381.2008.00274.x.

MacDonald, R., & Ricci L. (2003). Estimation of the Equilibrium Real Exchange Rates for South Africa. IMF Working Paper (44).

MacDonald, R., & Dias P. (2007). Behavioral Equilibrium Exchange Rate Estimates and Implied Exchange Rate Adjustments for Ten Countries. Working Papers, 2007_12, Business School - Economics, University of Glasgow.

Meese, R., & Rogoff, K. (1983). Empirical Exchange Rate Models of the Seventies: Do they Fit Out of Sample? Journal of International Economics, 14(1-2), 3–24. https://doi.org/10.1016/0022-1996(83)90017-X.

Mohieldin, M., & Kouchouk A. (2003). On Exchange Rate Policy: The Case of Egypt 1970–2001. Working Paper No. 0312, Economic Research Forum.

Mongardini, J. (1998). Estimating Egypt’s Equilibrium Real Exchange Rate. IMF Working Paper No. 5 (Washington: International Monetary Fund).

Nkoro, E., & Uko, A. K. (2016). Autoregressive Distributed Lag (ARDL) Cointegration Technique: Application and Interpretation. Journal of Statistical and Econometric Methods, 5(4), 63–91.

Nuryadin, D. (2006). Real Effective Exchange Rate Determination in Indonesia: A Behavioral Equilibrium Exchange Rate Approach. Economic Journal of Emerging Markets, 11(2), 147–158.

Lebdaoui, H. (2013). The Real Exchange Rate Misalignment: Application of Behavioral Equilibrium Exchange Rate BEER to Morocco1980Q1–2012Q4. International Journal of Economics and Finance, 5(10), 36–50. https://doi.org/10.5539/ijef.v5n10p36.

Lee, J., Maria, G., Ostry, J. D., Prati, A., Ricci, L. A., & Milesi-Ferretti, G. M. (2008). Exchange Rate Assessments: CGER Methodologies. IMF Occasional Paper No. 261 (Washington: International Monetary Fund).

Obstfeld, M., & Kenneth, R. (2001). The Six Major Puzzles in International Macroeconomics: Is there a Common Cause? NBER Macroeconomics Annual, 15, Cambridge Mass: MIT Press.

Helmy, O., Fayed, M., & Hussien, K. (2018). Exchange rate pass-through to inflation in Egypt: A structural VAR approach. Review of Economics and Political Science, 3(2), 2–19. https://doi.org/10.1108/REPS-07-2018-001.

Panday, A. (2014). Exchange Rate Misalignment in Nepal. Journal of South Asian Development. 9(1), 1–25. https://doi.org/10.1177/0973174113520581.

Panizza, U. (2001). Macroeconomic Policies in Egypt: An Interpretation of the Past and Options for the Future. ECES Working Paper No. 61.

Pesaran, M. H., & Shin, Y. (1999). An Autoregressive Distributed Lag Modelling Approach to Cointegration Analysis. In S. Strom (Ed.), Econometrics and Economic Theory in 20th Century: The Ragnar Frisch Centennial Symposium. Cambridge University Press.

Pesaran, M. H., Shin, Y., & Smith, R. J. (2001). Bounds Testing Approaches to the Analysis of Level Relationships. Journal of Applied Econometrics, 16(3), 289–326. https://doi.org/10.1002/jae.616.

Rajan, R. S., Sen, R., & Siregar, R. (2004). Misalignment of the Baht and its Trade Balance Consequences for Thailand in the 1980s and 1990s. The World Economy, 27(7), 985–1012. https://doi.org/10.1111/j.1467-9701.2004.00638.x.

Siregar, R. Y. (2011). The Concepts of Equilibrium Exchange Rate: A Survey of Literature. The South East Asian Central Banks Research and Training Centre, Staff Paper No. 81.

Tang, X., & Zhou, J. (2013). Nonlinear Relationship between the Real Exchange Rate and Economic Fundamentals: Evidence from China and Korea. Journal of International Money and Finance, 32, 304–323. https://doi.org/10.1016/j.jimonfin.2012.04.010.

Tödter, K. H. (2002). Exponential Smoothing as an Alternative to the Hodrick-Prescott Filter?. In I. Klein & S. Mittnik (Eds.), Contributions to Modern Econometrics. (Dynamic Modeling and Econometrics in Economics and Finance, vol 4.). Boston, MA: Springer. https://doi.org/10.1007/978-1-4757-3602-1_15.

Williamson, J. (1993). Exchange Rate Management. The Economic Journal, 103(416), 188–197. https://doi.org/10.2307/2234345.

Williamson, J. (1994). Estimates of FEERs. In J. Williamson (Ed.), Estimating Equilibrium Exchange Rates (pp. 177–244). Washington: Peterson Institute for International Economics.

World Bank (2019). The World Development Indicators 2019 (WDI) Database.

World Bank (2021). The World Bank World Integrated Trade Solution Database.

Yajie, W., Xiaofeng, H., & Soofi, A. S. (2007). Estimating Renminbi Equilibrium Exchange Rate. Journal of Policy Modelling, 29(3), 417–29. https://doi.org/10.1016/j.jpolmod.2006.12.003.

Youssef, H., & Zaki, C. (2019). From Currency Depreciation to Trade Reform: How to Take Egyptian Exports to New Levels? World Bank Policy Research Working Paper No. 8809.

1 FEER refers to the fundamental equilibrium exchange rate developed by Williamson (1994).

2 This assumption is later relaxed in the model.

3 The process of estimating an equilibrium exchange rate is not mechanical in the sense that a particular methodology’s estimate for a particular country may not be considered for data limitations. The inability to fully capture all relevant economic variables can have a large effect on the econometric estimates, especially in countries that have undergone rapid structural changes, which in turn would affect the reliability and certainty of the estimated relationship. Country-specific factors are considered to avoid measurement problems of the economic fundamentals included in the empirical analysis and any possible effects on the perfect fit of the estimated model (Lee et al., 2008). For instance, in the case of the Egyptian economy, the productivity differential variables capturing the Balassa-Samuelson effect could be irrelevant since the BS mechanism is not working in this case. In fact, the BS effect deals with the relative wages and productivity between the tradable and the non-tradable sectors, whereas these relationships suffer significant distortions in Egypt due to labor market rigidity. Moreover, Egypt adopted the IMF’s new budget classification system (Government Finance Statistics – GFS) in 2004/05, in line with international standards. This makes the comparison of government budget deficit historical data with recent years difficult and also statistically increases the deficit. The avoidance of using such data is perceived to improve the quality of empirical results in this paper.

Furthermore, some economic fundamentals used in the relevant empirical literature are excluded for data availability reasons. In this paper, long time series analysis is favored to capture the long-run behavior of the economic fundamentals incorporated in the econometric model and their equilibrium long-run levels. This should yield a more accurate measurement and investigation of the long-run relationship determining the real exchange rate behavior over the long run.

4 This time period is chosen to cover the most extended period of data availability.

5 Bruegel database was used to obtain the real effective exchange rate data for Egypt (see Darvas, 2012).

6 The bilateral real exchange rate was calculated by the author based on the consumer price index data for Egypt and the US and the official nominal exchange rate (L.E. per USD) between the two countries.

7 In the face of increasing economic difficulties during the early 1990s, Egypt started an economic reform program in 1991, which was designed to achieve macroeconomic stability and create a decentralized open market oriented economy. At the heart of the program were a massive fiscal adjustment, a supportive monetary policy, exchange rate liberalization and unification, and price deregulation. A series of economic reforms were included to eliminate the economic imbalances, which were prevalent at that time, especially after the insufficient partial reforms of the early 1980s and debt rescheduling measures in 1987. Important steps related to the conduct of monetary policy were undertaken at the same time; official limits on interest rates were abolished, auctions for the sale of treasury bills were introduced, and ceilings on lending to the private and public sectors were eliminated during 1992 and 1993. In other words, the direct means to conduct monetary policy, which existed before the ERSAP (e. g., credit ceilings, interest rate ceilings, and discriminatory interest rates) were abolished (Mohieldin & Kouchouk, 2003; El-Shazly, 2011).

8 Other than the ARDL bound test approach, the co-integration techniques include the Granger (1981), Engle and Granger (1987), Johansen and Juselius (1990), and Nkoro and Uko (2016).

9 The critical values range between 3.77 (lower bound) and 4.44 (upper bound) at 1% level of significance.

10 The EViews software gives three types of the heteroscedasticity test and only the “scaled explained SS gives no evidence of the presence of heteroscedasticity, which means that the conclusion is somewhat ambiguous as the test statistic is 17.29, while the corresponding probability is 0.1864.

11 escribes the exponential smoothing method as an optimal filter if the series are integrated of the first order while the Hodrick-Prescot can only be optimal for second order integrated process. The latter “amplifies all cycles if applied to difference-stationary data in the estimated trend component of more than six periods in length, with a cyclical peak depending on λ”.

12 A number of external economic shocks in 1997 such as the East Asian crisis, the Luxor tragedy and the decline in oil international price led to a deterioration in Egypt’s external position triggered mainly by an outflow of capital and a decline in tourism receipts in addition to a widening current account deficit (Handy, 2001; Panizza, 2001).