Organizations and Markets in Emerging Economies ISSN 2029-4581 eISSN 2345-0037

2021, vol. 12, no. 2(24), pp. 440–458 DOI: https://doi.org/10.15388/omee.2021.12.64

Does Emigration Hurt the Economy? Evidence from Lithuania

Gindrute Kasnauskiene (corresponding author)

Vilnius University, Lithuania

gindrute.kasnauskiene@evaf.vu.lt

https://orcid.org/0000-0003-0741-6538

Remigijus Kavalnis

Vilnius University, Lithuania

remigijus.kavalnis@evaf.vu.lt

Abstract. This study explores the economic impact of population emigration with special reference to the case of Lithuania. For this reason, we developed a SVAR model and applied related IRF and FEVD tools using quarterly data for the period of 2001-2020. Our findings reveal that a positive shock in emigration is related to lower unemployment. It is also found that the increased emigration is linked to higher real wage growth but with a lower confidence interval. Moreover, our estimates suggest that international out-migration increases real GDP growth in the short term, with no significant effects in the long run perspective. Finally, we found that most of the emigrants-to-be were inactive for a long term prior to departure, which offers a new look into the consequences of Lithuanian emigration, suggesting that the economic losses of emigration could be overstated. This study contributes to the knowledge about the impact of emigration on the economy and specifies directions for further studies in the field.

Keywords: population emigration, economic development, Lithuanian economy, economic consequences

Received: 31/7/2021. Accepted: 21/9/2021

Copyright © 2021 Gindrute Kasnauskiene, Remigijus Kavalnis. Published by Vilnius University Press. This is an Open Access article distributed under the terms of the Creative Commons Attribution Licence, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

Introduction

Since Lithuania regained independence in 1990, over 1.029 million people have emigrated (Statistics Lithuania, 2020). With a current population of 2.7 million, emigration of such a scale has earned Lithuania the name of emigrants’ country (Kumpikaitė-Valiūnienė & Žičkutė, 2017). This raises questions about emigration implications for the Lithuanian economy and its long-term development.

The earlier studies suggest that due to emigration, both the domestic labour market and the development of the country are affected. By decreasing the local pool of workers, emigration tends to increase the bargaining power of the remaining Lithuanian labour force, decreasing unemployment and promoting wages. Moreover, emigration, especially of the skilled, is expected to lower GDP due to lost output and lower growth potential in the long term.

Currently, there is little research on the topic of economic implications of aggregate emigration for the Lithuanian economy, while its results can be controversial. This paper examines the emigration consequences for the main economic indicators of Lithuania using longer time series, accounting for the shock of the 2008 financial crisis as well as the inflated emigration figure in 2010. The chief contribution of this paper to the literature in the field is that it challenges the pessimistic view of emigration consequences regarding the economic development of the sending country. In addition, it contributes to filling a gap in research on an often-overlooked issue of inactivity of the Lithuanian emigrants prior to emigration.

1. Theoretical framework

1.1 Emigration and unemployment rate

This section discusses the existing evidence about the economic consequences of emigration of Lithuanian population with respect to the main impact fields. The emigration relationship with unemployment rate, wages and economic development of the source country are reviewed to contextualise our approach and raise corresponding hypotheses.

It is often suggested that emigration has an impact on the unemployment rate. For instance, using a structural vector autoregression model (SVAR), Kasnauskienė and Būdvytytė (2013) found that emigration of the highly skilled lowers unemployment rate both in the same time period and in the long run. The results seem to be supported by the structural vector error correction model (VECM), where emigration (accounting for the number of immigrants) is suggested to reduce the unemployment rate for a prolonged period of up to seven years, with the impact being the largest from the investigated factors (Kasnauskienė & Vėbraitė, 2014). Moreover, deploying a dynamic general equilibrium (DSGE) model, it was found that considering the declining labour force and the stable level of capital, higher emigration lowers unemployment, with the reduction being more pronounced for the non-qualified workers (Karpavičius, 2006). Some authors agree that if not for the emigration, the unemployment rate in Lithuania would have been significantly higher, which would put an additional strain on social tensions, particularly in the time of economic hardship (Juška & Woolfson, 2015; Sipavičienė & Stankūnienė, 2013). Thus, in line with the research results of the scholars (Karpavičius, 2006; Kasnauskienė & Būdvytytė, 2013; Kasnauskienė & Vėbraitė, 2014), it is expected that higher emigration has an unemployment-reducing effect:

H1: Higher emigration lowers unemployment rate.

1.2 Emigration and wages

Emigration is typically linked with the wage of the source country. For instance, gross monthly average wage is among the variables which correlate the most with the number of emigrants (r=0.84) (Damulienė, 2013). It is thought that higher emigration reduces the local labour supply, resulting in increased bargaining power of the domestic labour force. It was found that skilled emigration raises average net wage simultaneously and in the long term (Kasnauskienė & Būdvytytė, 2013), while higher net migration promotes real wages, with the impact being prolonged and of rather stable potency (Kasnauskienė & Vėbraitė, 2014). The results are also supported by calculations based on Cobb-Douglas production function, suggesting that emigration accounted for roughly 0.8-1% increase in wages annually, rendering a total 5.9-7.3% growth in wages over the investigated period of 2001-2008 (Kasnauskienė & Šiaudvytis, 2010). Furthermore, emigration impact on wage can depend on one’s skills, age and gender. For instance, it was found that a shock in emigration increases income for the low-skilled, while that of the qualified declines, with a comparatively stronger effect for the less qualified (Karpavičius, 2006). Moreover, investigation of the impact of EU-accession driven emigration wave revealed that while Lithuanian emigration has on average increased the wages of the remaining population, the real income of young labour force witnessed a rise of 5.5%-8.2%, while that of workers having 10-30 years of work experience did not change, and a small decline by 1% was observed for those having more than 30 years of experience (Elsner, 2013). Another study that examined implications of the same emigration wave found that a 1 pp increase in Lithuanian emigration rate raises real income of the source country male population by 0.66%, with no statistically significant effect for women (Elsner, 2011). Hence, in agreement with the findings of researchers (Kasnauskienė & Šiaudvytis, 2010; Kasnauskienė & Būdvytytė, 2013; Kasnauskienė & Vėbraitė, 2014; Elsner, 2011, 2013), we hypothesise that emigration has a positive effect on wages:

H2: Higher emigration leads to higher real wages.

1.3 Emigration and economic development

Emigration can also influence the economic development of the source country. There are differing views about how it can be affected. For instance, it is claimed that although reduced labour supply and resulting higher wages may hinder productivity in the short term (via lower labour discipline and higher costs), on the longer horizon, the relatively more expensive labour is likely to be substituted with labour-saving technology, which would boost productivity and outweigh the initial losses (Čekanavičius & Kasnauskienė, 2009). On the other hand, mass emigration of skilled and younger working-age population can lead to skill depletion in the local labour market, reducing productivity and undermining Lithuania’s long-term development (Thaut, 2009). According to Statistics Lithuania (2021), in 2001-2020, emigration consisted mainly of primary-working-age individuals, and it is estimated that approximately 20-30% of the working-age emigrants were highly skilled (Hazans, 2016; Karalevičienė & Matuzevičiūtė, 2009). The pessimistic position is also supported by the fact that one third of recent graduates chose emigration in the context of low birth rates and sharply declining university enrolment numbers (OECD, 2018). As less newly-educated individuals that could improve productivity of the economy are entering the labour market, this hinders the renewal of its skill pool and related productivity potential. Moreover, Lithuania ranks 124 among 141 nations by the ease of finding skilled workforce, which may hint that skilled labour shortage is indeed relevant for Lithuania (World Economic Forum, 2019). Kasnauskienė and Būdvytytė (2013) found that emigration of the highly-skilled reduces GDP per capita in the long run. Because of declining population and domestic demand, higher emigration is found to negatively impact GDP, with estimated short-term emigration related loss of 0.7–1% and medium-term cost of 7% of GDP, while GDP per capita rises by 0.5% per year (Karpavičius, 2006). Moreover, it is estimated that the remaining source country population lost 0.43% of 2008 GDP levels annually due to emigration over 2001-2008 (Kasnauskienė & Šiaudvytis, 2010). Of course, some emigrants can acquire high-level skills abroad only to return home and contribute to Lithuania’s economic development. However, it is believed that mass return of the skilled workers is not likely to happen since the longer one spends abroad, the less likely he or she is to return and even if they do return at an older age, this would contribute little in increasing Lithuanian GDP growth (Čekanavičius & Kasnauskienė, 2009). In addition, those few who do return are likely to leave again (OECD, 2018). Hence, of the two positions, the pessimistic view (Thaut, 2009; Kasnauskienė & Būdvytytė, 2013; Karpavičius, 2006) seems to be more warranted with negative emigration implications in the long term. Thus, we raise a hypothesis that:

H3: Higher emigration causes lower real GDP growth (particularly in the long term).

Such findings require further investigation of economic consequences of emigration and an update using different methods and longer time series.

2. Research Methodology

2.1 Methods

In this section, we present actions taken to empirically investigate our research problem and our data. The purpose of this empirical research is to evaluate the impact of emigration on the Lithuanian economy. R software was used to achieve the results.

Methods for determining the economic consequences of emigration are diverse and include correlation analysis, OLS estimation, SVAR/VECM/ADL and DSGE approaches among others. One method that makes is possible to estimate multiple linear OLS equations in one system simultaneously, examine the dynamics of emigration impact over time and is arguably less complex compared to the DSGE is a VAR model. One more important advantage of VAR is that it can be used as the basis for further analysis. For instance, it is quite simple to use VAR for Granger causality tests, structural impulse-response functions (IRF) or FEVD using SVAR model (Lütkepohl, 2011; Pfaff, 2008). Despite these advantages, the VAR-based method is not without its shortcomings. Although VAR was originally designed to address the issue of classical simultaneous equation models of placing ad hoc restrictions for identification and classification of endogenous and exogenous variables by assuming that all variables within the system are endogenous, this may still be problematic. With inclusion of more lags to satisfy the white noise condition of VAR equation residuals (especially if there are more variables in the system) the model degrees of freedom are significantly reduced, making parameter estimates less precise. The precision can be improved by placing restrictions on some of the parameters, which is done using SVAR, but this leads to the initial problem of ad hoc restrictions (Baltagi, 2002). In addition, it can be argued that since VAR models (and forecasting models in general) are just correlation-based summary descriptions of historical data while policy choices are not determined by randomness as VAR model would imply, forming policy based on VAR model is ought to be a mistake (Sims, 1986). This point could be supported by the fact that in a VAR system correlation between simultaneously occurring shocks between variables (which are endogenous and autoregressive) makes the impulse responses not unique. Nonetheless, this can be addressed with a properly constrained A matrix deploying the SVAR model whereby the impact of some contemporaneous shocks is restricted, and only the relevant shocks and impulse responses are kept (Lütkepohl, 2006). In fact, in the field of economics, it may be difficult to find such variables in one system that all explain one another perfectly well, especially in the same time period. Hence, instead of creating ad hoc restrictions, setting part of the parameters of contemporaneous impact matrix to zero corresponds to economic logic. In addition, although often tough to do in practice, the over-parametrisation issue can be addressed by choosing the more parsimonious model as well as by increasing sample size. Thus, the SVAR model reflects the nature of economic variables better than VAR as its orthogonalized impulse responses represent the actual responses of an economic system in a more accurate way (Lütkepohl, 2010). This method is very common in policy analysis (Rubio-Ramirez et al., 2010). For instance, it was used to evaluate the economic consequences of the skilled emigration in Lithuania (Kasnauskienė & Būdvytytė, 2013). Therefore, the VAR-based SVAR model allows the researcher to evaluate the impact of emigration on the selected economic variables over time and is used in further analysis.

2.2 Data

As the reviewed literature suggests, changes in emigration are expected to affect the local unemployment rate, wages and economic development of the country. Consequentially, the following variables are selected in their initial form:

grY – seasonally and working day adjusted GDP in million EUR at constant prices;

rW – net average earnings in euros at constant prices for men and women considering the whole economy without individual enterprises1;

U.sa – unemployment rate in percent for males and females aged 15-64 from urban and rural areas. Seasonal adjustment is performed using Loess smoothing procedure.

Em – number of emigrants.

To arrive at wage and GDP in constant prices, the consumer price index (CPI) for consumer goods and services was used for expressing the variables in 2015Q4 prices. All data are gathered from the Statistics Lithuanian database. All variables are observed quarterly for the period of 2001Q1-2020Q3.

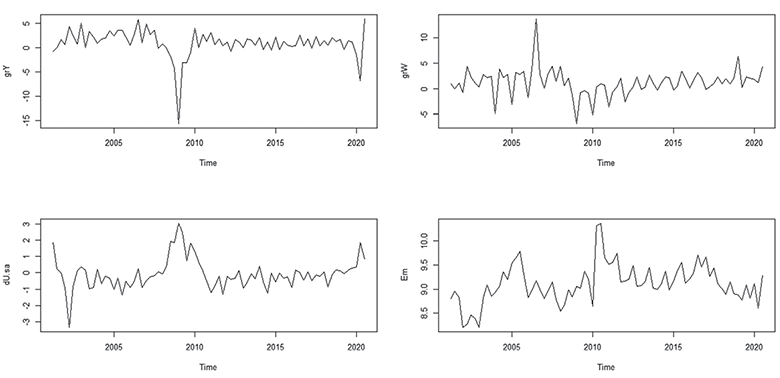

Due to observed exponential growth tendencies, the rW and rY variables are log-linearised. Although Em does not have an exponential growth tendency, it is also logged as it is closely related to the labour force, which is conventionally logged. For the three variables that are not stationary, the first-differenced forms are created. For rY and rW, they are the growth rates grY and grW approximately in percent based on the Taylor expansion, while for U.sa it is the difference in U.sa measured in percentage points dU.sa (Figure 1).

Figure 1. Dynamics of the Four Variables in their Stationary Forms

Source: Authors’ calculations based on the data provided by Statistics Lithuania.

To address variation in the stationary forms of grY, grW and U.sa in time of the negative shock of 2008 financial crisis, the CRISIS dummy is introduced for quarters 2008Q3-2009Q4. Moreover, to account for the somewhat artificial jump in emigration numbers in 2010 due to increased emigration declaration with intent of avoiding the mandatory health insurance payments (e. g., Kumpikaitė-Valiūnienė, 2019), the DUMMY2010 is added to the models. Considering the timing of the emigration jump, it seems to be related to the date of the announcement by the National Health Insurance Fund about the new regulation in mid-April of 2010 (National Health Insurance Fund, 2010). Consequentially, the DUMMY2010 is set to 1 for quarters 2010Q2-2010Q3.

The VAR model assumes that all variables are endogenous. It is found that low income and unemployment are among the key push factors for emigration (Kumpikaitė-Valiūnienė & Žičkutė, 2017; Štreimikienė et al., 2016). At the same time, it is suggested that emigration is also encouraged by low living conditions as well as inadequate material conditions, which may refer to the general condition of the economy in the form of GDP and the living wage (Štreimikienė et al., 2016; Kazlauskienė & Rinkevičius, 2006). The state of GDP is positively related to the average wage, while the wage ought to depend on the unemployment level. In addition, as discussed, emigration itself is expected to have an impact on GDP, wage and unemployment in Lithuania. Hence, this interdependence among the four predictors provides theoretical ground for calling them endogenous.

In the further analysis, all inferences are drawn using the 0.05 significance level unless indicated otherwise. Moreover, all inferences about the relationships between variables are formed in ceteris paribus terms.

3. Results

3.1 VAR model selection

After the initial analysis of variables, different sets of VAR models were considered aiming to find the best model version for SVAR. To check model stability from sample to sample, the data were split to training (67 quarters) and validation sets (last 11 quarters). Twelve different model versions were obtained, the subversions of which were analysed individually to check whether the white noise condition in all equation residuals is satisfied. The model diagnostics was performed using the Ljung-Box test for autocorrelation, multivariate ARCH tests for heteroscedasticity, stability tests for structural breaks and consulting the roots of the characteristic polynomial. The best training model candidate was later fitted on the full sample. It passed the diagnostic checks, in some cases more easily. This full model was used in further SVAR analysis.

3.2 SVAR model specification and analysis

Before specifying the SVAR model, the block-wise Granger causality was checked for each variable in the VAR model. Based on the four test results, grY was the only variable that Granger-causes the remaining ones as a group, suggesting that inclusion of this variable improves the explanatory capabilities of the model. Although other variables did not Granger-cause the remaining variables in a block-causal way, they were kept in the model based on empirical study goals. To get a sense of which contemporaneous relations between variables to include in the A matrix, the VAR model correlation matrix of residuals was considered (Table 1).

Table 1. The Contemporaneous Impact Matrix

|

|

grY |

grW |

Em |

|

|

grY |

1 |

0.55 |

-0.31 |

-0.02 |

|

grW |

0.55 |

1 |

0 |

-0.12 |

|

-0.31 |

-0.07 |

1 |

-0.10 |

|

|

Em |

-0.02 |

-0.12 |

-0.10 |

1 |

Source: Authors’ calculations based on the data provided by Statistics Lithuania.

Although the dU.sa -> grY relation (with |r| > 0.2) seemed significant based on its z-test statistic, this impact was not confirmed by further impulse - response analysis. Hence, one possible simultaneous impact link between grY and grW remained. Considering that grY typically moves prior to movement in grW (e. g., in the case of the 2008 financial crisis), the grY -> grW impact was left unrestricted, which corresponds to economic logic as Lithuania is a small open economy. Hence, in the final A matrix, 11 effects were restricted leaving one statistically significant grY -> grW effect that was also confirmed by the bootstrapped CI of the impulse - response analysis (Table 2).

Table 2. Estimated A-type Matrix for SVAR

|

|

grY |

grW |

Em |

|

|

grY |

1 |

0 |

0 |

0 |

|

grW |

-0.55 |

1 |

0 |

0 |

|

0 |

0 |

1 |

0 |

|

|

Em |

0 |

0 |

0 |

1 |

Source: Authors’ calculations based on the data provided by Statistics Lithuania.

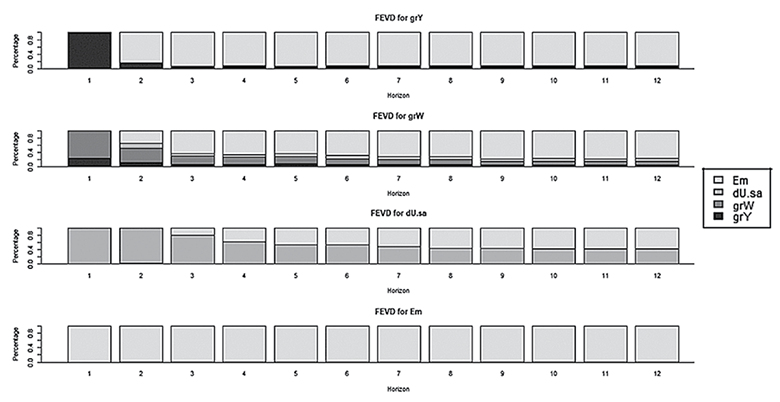

The estimated A matrix suggests that a 1 pp increase in grY corresponds to a 0.55 pp increase in grW simultaneously, while other effects are constrained. Having restricted the A matrix, the innovation accounting was performed using FEVD (Figure 2).

Figure 2. FEVD Results for Four Variables

Source: Authors’ calculations based on the data provided by Statistics Lithuania.

Em explains its own forecast error variance (FEV) for the most part over the three-year period, suggesting that emigration has some inertia. Moreover, dU.sa explains its FEV initially, but the impact of Em rises over time and, starting with the seventh quarter, Em begins to explain a larger share of the dU.sa FEV. The same tendency is observed for grW, with slightly faster domination of Em. Finally, except for the first quarter, FEV for grY is predominantly explained by variation in Em. Hence, based on the FEVD analysis results, emigration seems to play a significant role in explaining the dynamics of the economic variables discussed over time.

3.3 Main findings

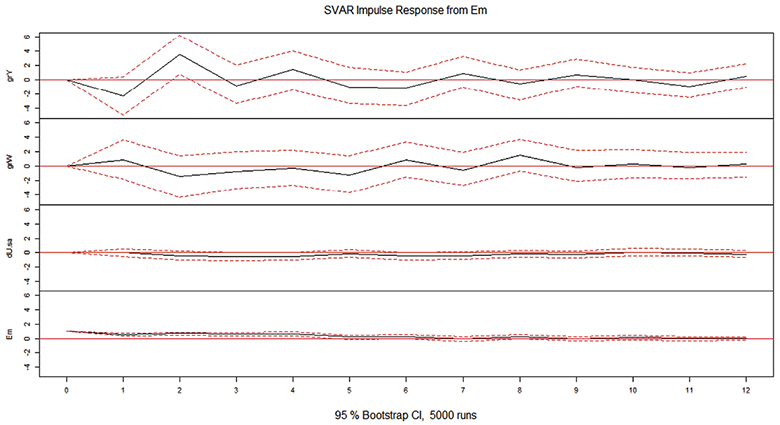

Based on the structural IRF for the SVAR model, the dynamics of the emigration impact for the economy are represented in Figure 3.

Figure 3. Structural IRF Responses to Positive Emigration Shock for a 3-year Period

Source: Authors’ calculations based on the data provided by Statistics Lithuania.

The impact of emigration on the selected economic variables is summarised in

Table 3.

Table 3. Summary of Emigration Impact for the Economy

|

Impulse in period t |

Response |

||

|

grY |

grW |

||

|

Em increases |

Increases in t+2 |

Increases in t+8* |

Decreases in t+3, t+4, t+6 |

Note. * CI – 84%.

Source: Authors’ calculations based on the data provided by Statistics Lithuania.

We found that an increase in emigration corresponds to decreased change in unemployment rate, increased real wage growth and increased real GDP growth. In line with the expected results, the hypothesis H1 is not rejected with 5% significance level, while the hypothesis H2 holds with a CI of 84%. Counter to the hypothesised effect, with 0.05 alpha level, we obtained no significant emigration impact on real GDP growth in the long term and rejected Hypothesis 3 observing a positive short-term effect.

3.4 Discussion

Firstly, an increase in emigration corresponds to decreased change in unemployment rate. Ceteris paribus, this can be explained by emigration of the previously unemployed as the unemployed person would stop looking for a job. Alternatively, the unemployment could be indirectly diminished via emigration of previously employed individuals as this could free up a job place for the previously unemployed persons. Klüsener et al. (2015) found that unemployed individuals have 1.502 times higher likelihood of emigration compared to those who are employed, which supports the direct effect. The direct effect was likely more pronounced after the crisis or at the start of the analysed data period, marked by prolonged higher unemployment levels of the population. However, considering the longer time series range in discussion, it is reasonable to suspect a greater importance of the indirect effect.

In addition, the inactive emigrants play an important role, too. Based on social security payment information for declared emigrants of 15 years of age or older, the share of those who had not worked for 1 year or longer prior to departure was 56% in 2008, 81.3% in 2009, 85% in 2010, 82.8% in 2013, 81.6% in 2014 and 83.4% in 2015, with slightly higher inactivity rates for women than for men (Statistics Lithuania, 2008; 2010; 2013; 2014; 2015). The same indicator was 81.8% in 2011 (Damulienė, 2013). These very high emigrant inactivity rates could be understandable as younger people are studying, while pension-age individuals retire. Nonetheless, considering that over these years 7.2% of emigrants (from those 15 years and older) were 15–19 years of age, 21.2% were 20-24 and 2.6% were 60 years and older, the emigrant inactivity rates can still be regarded as considerably high (Statistics Lithuania, 2021). This is supported by age-specific inactivity rates of working-age emigrants, which, according to Statistics Lithuania (2013; 2014; 2015), were around 75% for those aged 20-24 and over 80% for all individual remaining age cohorts of emigrants over 2013-2015,and by findings of Rudžinskienė & Paulauskaitė (2014). Moreover, only a trivial fraction of emigrants aged 15-64 were registered as unemployed in 2014-2015 with less than 1% share in 2015 (OECD, 2018). With a major share of emigrants being inactive and a tiny fraction unemployed prior to departure, the remaining part shall consist of the previously-employed, suggesting prevalence of the indirect unemployment-reducing effect. The indirect channel also seems to be more supported by the timing of the effect. The unemployment reduction occurs circa one year after the emigration shock, which roughly coincides with the end of unemployment benefit provisions which are granted for a maximum limit of nine months depending on the person’s unemployment insurance history (SODRA, 2020). Assuming that the unemployment insurance benefit recipients are more willing to use the increased employment opportunities once the unemployment benefits are coming to an end, the reduction in unemployment would be expected at the time suggested by the model. Hence, the unemployment reduction is better explained by outmigration of the previously employed.

The obtained direction of the impact attests to the findings of researchers who established a negative emigration relationship with unemployment rate (Čekanavičius & Kasnauskienė, 2009; Karpavičius, 2006; Kasnauskienė & Būdvytytė, 2013; Kasnauskienė & Vėbraitė, 2014). In comparison to the results of other countries, the study outcomes contest the findings that there is a positive relation between emigration and unemployment rate, which is observed in nine CEE countries one year after changes in emigration (Škuflić & Vučković, 2018). However, the obtained results for Lithuania are similar to those for eight countries that joined the EU in 2004 (EU8), where in most countries an unemployment-reducing effect of emigration was obtained during years 2004-2009 with a negligible impact in the long run (Holland et al., 2011).

Secondly, an increase in emigration corresponds to increased real wage growth, which is significant with 84% confidence interval. Assuming a homogenous labour force is represented by inelastic labour supply ceteris paribus, the reduced labour force due to emigration shifts the labour supply curve left, resulting in increased wages in the source country economy (Kasnauskienė & Šiaudvytis, 2010). This does not contradict our findings. However, it is more likely that the labour force is rather heterogenous, and no perfect substitution between workers with different skill levels or field-specific skills exists, which suggests that the wage-increasing effects are likely to be different for different groups of workers depending on the number of emigrants coming from a particular group (Elsner, 2011). For instance, it was found that emigration shock is associated with different (both in terms of direction and intensity) wage-related outcomes for skilled and non-skilled workforce as well as for workers with different levels of work experience or gender, which may explain the lower significance of the aggregate wage-increasing effect (Karpavičius, 2006; Elsner, 2013; Elsner, 2011). In addition, as most of the working-age emigrants are inactive a long term and do not actively seek employment, they may be less of contenders for the active workers in the labour market. The inactive workers are regarded as being out of the labour force while a portion of them is referred to as the potential additional labour force (Statistics Lithuania, 2020). Hence, due to inactive working-age segment of emigrants, it is reasonable for emigration to reduce the domestic labour force to a lesser extent, creating less incentives for employers to raise wages.

The obtained positive association between emigration and wage growth is consistent with the findings of other researchers who found a positive link between emigration and wages (Kasnauskienė & Būdvytytė, 2013; Kasnauskienė & Vėbraitė, 2014; Karpavičius, 2006; Elsner, 2013; Kasnauskienė & Šiaudvytis, 2010; Elsner, 2011; Damulienė, 2013). Moreover, the findings for Lithuania are in line with those for other comparable countries. For instance, it is suggested that skilled emigration has contributed positively to nominal wage growth in other eleven countries of Central, Eastern, and South-Eastern Europe (CESEE) (Atoyan et al., 2016) and that possibility of emigration increased average wage by 3.03% for skilled, and by 0.13% for unskilled workers in Poland compared to no migration case (Walerych, 2021). In addition, a mainly positive emigration impact on real wages was obtained over 2004-2009, with a positive influence in the long run for the Czech Republic, Hungary and Poland (Holland et al., 2011).

Thirdly, it was found that increased emigration in quarter t corresponds to higher real GDP growth in t+2 period with no significant effects in the long run. Keeping other things equal, the positive short-run effect could be partly explained by the composition of emigrants, where a larger share was not working for a prolonged period of time prior to departure. The fact that a group of primary-working-age people is not producing any output suggests presence of economic inefficiency as part of its human resources are not used. In addition, a share of the unemployed emigrants-to-be is receiving benefits from the taxpayer contributions. For instance, on average, 38% of the registered unemployed individuals received benefits during the years 2008-2012 (Lithuanian Employment Service, 2021). It should be taken into consideration that under normal circumstances, the unemployment benefits are discontinued after person’s declaration of emigration, and part of the unemployed who chose to emigrate stop getting the benefits from the state (Infolex, 2020). As a result, these resources are saved or can be used for more productive uses. Thus, the observed positive short-term impact for real GDP growth could be a result of increased economic efficiency as the long-term-inactive individuals leave while part of the previously unemployed stop receiving the unemployment benefits after emigration. Higher remittances could also contribute to the positive emigration effect on GDP via increased consumption of its recipients (Damuliene, 2013). If remittances are mostly used for consumption, which is the case in many countries, and not for investments, their effect on GDP would be short-lived, contributing little to the long-term growth of the econmy. The positive short-run impact is consistent with the findings of Kasnauskienė and Vėbraitė (2014) and complements the findings of Kasnauskienė and Būdvytytė (2013) in a sense that a positive short-run impact on GDP is retained excluding the population reduction effect in the denominator term of GDP per capita.

Furthermore, most of the literature reviewed seems to emphasise that Lithuanian emigrants are predominantly working age skilled individuals, emigration of which results in significant losses for the economy and lower production growth in the long-term. However, we obtained no negative emigration impact on GDP growth in the long term both timewise and in terms of periods after the emigration shock. As a larger part of the working-age persons that left the country were inactive for 1 year or longer prior to emigration, this means that they did not produce any output prior to departure, at least in the formal economy which constitutes GDP. Knowing the negative consequences of prolonged inactivity on one’s skills and mental health, a portion of these people is unlikely to transition to the active labour force even in the longer time frame. In this context, emigration would not result in large losses for the economy with little effect on GDP in the long term. Another explanation for the obtained result could be that when the aggregate emigration shock is considered, the potential loss due to reduction in qualified labour force cancels out with the potential productivity gains of increased investments in labour saving technology as noted by Čekanavičius & Kasnauskienė (2009) resulting in no substantial effect in the long term. The inclination of firms towards such investments is also supported by the observed real-wage-growth-increasing effect of emigration. It seems that the negative long-term consequences of emigration are better captured considering emigration of the skilled as suggested by Kasnauskienė & Būdvytytė (2013), which is supported by the findings that higher emigrants’ qualification is associated with lower GDP (Beržinskienė et al., 2014). This is reinforced by the results of other countries. It is estimated that on average, without emigration (especially of the skilled individuals) during 1995–2012, the cumulative real GDP growth would have been 7 pp higher in (CESEE) countries (Atoyan et al., 2016). Moreover, emigration of the skilled individuals from EU8 countries to the UK is found to decrease GDP per capita in the long run (Kasnauskienė & Palubinskaitė, 2020). With regard to the aggregate emigration, our findings for Lithuania are different to those of other countries. For instance, it was found that migration from EU8 to the fifteen countries that formed the EU before 2004 has a negative long-term impact on the source county GDP, with mostly positive effect on GDP per capita (Holland et al., 2011).

4. Limitations and Future Directions

The study is prone to certain assumptions and limitations. Having the largest available sample size of 78 observations, the distributions of variables and corresponding VAR model equation residuals (particularly for grW and grY) were found to be not normally distributed. Although the selected model passes the robustness checks, the smaller the sample, the more likely the corresponding inferences about the population are to be biased. In addition, the obtained FEVD results suggest that emigration explains a large share of the FEV of economic variables, particularly for grY. However, there are more interconnections in a complex real-world economy that could not be fitted into the four-variable system due to data and endogeneity limitations. Furthermore, as suggested by the block-wise Granger causality tests, modelling of the variables in one system does not improve model explanation capabilities for three out of four variables, suggesting that the three predictors are less endogenous than would be expected by the theory. Hence, for further research on the topic, it is recommended to repeat the study when more data is available. In addition, in order to gain a better understanding of Lithuanian emigration and its economic implications, the emigrant inactivity aspect must be given more attention.

5. Conclusion

The scale of emigration of Lithuanian population over the past 30 years has been unusually large. Indeed, there is a clear need for better understanding and characterisation of the gains and losses of emigration at the national level. Based on existing empirical studies on the economic effect of emigration, it can be concluded that emigration decreases unemployment level and promotes wages, with the former effect being more felt by the less skilled workers and the latter by the less qualified young workers and males. Moreover, with potential benefits in the short term, emigration, especially of the skilled, leads to lower output produced in the long-run perspective.

Our findings provide a new perspective on the ongoing discussion about the nexus between emigration and economic development, which remains a disputed topic over the past decades. We developed the SVAR model, applied related IRF and FEVD tools and used them to investigate the main economic implications of emigration. Three hypotheses were tested using quarterly data for the period of 2001-2020. Our findings indicate that, firstly, a positive shock in emigration is related to lower unemployment in Lithuania, which is better explained by outmigration of the previously employed. Secondly, it was found that the increased aggregate emigration is related to higher real wage growth, but with a lower confidence interval. Thirdly, our hypothesis on the negative economic impact of emigration on real GDP growth has been rejected in the short-time period, with no statistically significant effect observed in the long term.

It was also found that most of the primary-working-age emigrants were inactive for a long term before emigration, with a minority actively looking for employment. These individuals were not producing goods or services in the legal economy with some being potentially unable to escape inactivity. Hence, we suggest that the economic losses due to emigration could be overstated. On a final note, the authors believe that our findings contribute to filling the gap in the empirical knowledge on the impact of outflow of people on economic growth in a particular source country. In addition to its direct policy relevance, our paper also contributes to the broader theoretical work in the social sciences linking the subjectivity, positionality, and situated knowledge of the individual migrants with more general processes of social change (Simandan, 2016, 2019, 2020; Ehrkamp, 2017, 2019, 2020).

References

Atoyan, R., Christiansen, L., Dizioli, A., Ebeke, C., Ilahi, N., Ilyina, A., Mehrez, G., Qu, H., Raei, F., Rhee, A., Zakharova, D. (2016). Emigration and Its Economic Impact on Eastern Europe. Washington, DC: IMF.

Baltagi, B. H. (2002). Time-Series Analysis. In B. H. Baltagi, Econometrics (pp. 366-367). Berlin, Heidelberg: Springer. doi:https://doi.org/10.1007/978-3-662-04693-7_14

Beržinskienė, D., Butkus, M., & Matuzevičiūtė, K. (2014). Modelling of the Impact of Emigrants’ Qualification Structure on the National Economic Growth: The Case of Lithuania. Inzinerine Ekonomika-Engineering Economics, 23(5), 336-338. doi:http://dx.doi.org/10.5755/j01.ee.25.3.5247

Čekanavičius, L., & Kasnauskienė, G. (2009). Too High or Just Right? Cost-Benefit Approach to Emigration Question. Engineering Economics: The Economic Conditions Of Enterprise Functioning, 1(61), 29-33.

Damulienė, A. (2013). Migracijos problema Lietuvoje ir jos įtaka šalies ekonomikai. Business Systems And Economics, 3(1), 112, 114-116.

Ehrkamp, P. (2017). Geographies of migration I: Refugees. Progress in Human Geography, 41(6), 813-822. doi:https://doi.org/10.1177/0309132516663061

Ehrkamp, P. (2019). Geographies of migration II: The racial-spatial politics of immigration. Progress in Human Geography, 43(2), 363-375. doi:https://doi.org/10.1177/0309132517747317

Ehrkamp, P. (2020). Geographies of migration III: Transit and transnationalism. Progress in Human Geography, 44(6), 1202-1211. doi:https://doi.org/10.1177/0309132519895317

Elsner, B. (2011). Does Emigration Benefit the Stayers? The EU Enlargement as a Natural Experiment: Evidence from Lithuania. FEEM “Note di lavoro”, 5, 6, 14, 15, 38. doi:http://dx.doi.org/10.2139/ssrn.1735328

Elsner, B. (2013). Emigration and wages: The EU enlargement experiment. Journal of International Economics, 91(1), 154, 161-162. doi:10.1016/j.jinteco.2013.06.002

Hazans, M. (2016). Migration Experience of the Baltic Countries in the Context of Economic Crisis. In M. Kahanec and K. F. Zimmermann (Eds.), Labor Migration, EU Enlargement, and the Great Recession, 21, 34, 41-42. doi:10.1007/978-3-662-45320-9_13

Holland, D., Fic, T., Rincon-Aznar, A., Stokes, L., & Paluchowski, P. (2011). Labour mobility within the EU - The impact of enlargement and the functioning of the transitional arrangements. London: National Institute of Economic and Social Research.

Infolex. (2020, 05 08). Teisės akto straipsnis. Retrieved from Lietuvos Respublikos užimtumo įstatymas, 24 str.: http://www.infolex.lt/ta/364878:str24

Juška, A., & Woolfson, C. (2015). Austerity, labour market segmentation and emigration: the case of Lithuania. Industrial Relations Journal, 46(3), 247.

Karalevičienė, J., & Matuzevičiūtė, K. (2009). Tarptautinės emigracijos ekonominių priežasčių analizė Lietuvos pavyzdžiu. Ekonomika ir vadyba: aktualijos ir perspektyvos, 1(14), 146-148.

Karpavičius, S. (2006). Effects of Emigration on the Lithuanian Economy. Vilnius: Bank of Lithuania.

Kasnauskienė, G., & Būdvytytė, A. (2013). Economic challenges of brain circulation: The small country case. Mediterranean Journal of Social Sciences, 4(9), 742-746. doi:10.5901/mjss.2013.v4n9p740

Kasnauskienė, G., & Palubinskaitė, J. (2020). Impact of High-Skilled Migration to the UK on the Source Countries (EU8) Economies. Organizations and Markets in Emerging Economies, 11(1), 64. doi:https://doi.org/10.15388/omee.2020.11.23

Kasnauskienė, G., & Šiaudvytis, T. (2010). Gyventojų emigracijos poveikio darbo rinkai vertinimas. Lietuvos statistikos darbai, 49(1), 13, 18-20. doi:10.15388/LJS.2010.13942

Kasnauskienė, G., & Vėbraitė, L. (2014). The impact of migration on Lithuanian economy in an ageing society contex. International Journal of Business and Management, 2(4), 31, 38-40.

Kazlauskienė, A., & Rinkevičius, L. (2006). Lithuanian “Brain Drain” Causes: Push and Pull Factors. Engineering Economics, 1(46), 29, 31-33, 35.

Klüsener, S., Stankūnienė, V., Grigoriev, P., & Jasilionis, D. (2015). The Mass Emigration Context of Lithuania: Patterns and Policy Options. International Migration, 53(5), 181, 183, 185-187, 189. doi:10.1111/imig.12196

Kumpikaitė-Valiūnienė, V., & Žičkutė, I. (2017). Emigration after socialist regime in Lithuania: Why the West is still the best? Baltic Journal of Management, 12( 1), 88, 92, 93, 95-97, 104. doi:10.1108/BJM-02-2016-0053

Lithuanian Employment Service. (2021, 04 25). Darbo rinka. Retrieved from Statistiniai rodikliai: https://uzt.lt/darbo-rinka2/statistiniai-rodikliai-2-2/

Lütkepohl, H. (2006). New Introduction to Multiple Time Series Analysis. Berlin, Heidelberg, New York: Springer.

Lütkepohl, H. (2010). Impulse response function. In S. N. Durlauf & L. E. Blume (Eds.), Macroeconometrics and Time Series Analysis (pp. 145-146). London: Palgrave Macmillan. doi:https://doi.org/10.1057/9780230280830_16

Lütkepohl, H. (2011). Vector Autoregressive Models. In M. Lovric (Ed.), International Encyclopedia of Statistical Science (p. 1645). Berlin, Heidelberg: Springer. doi:https://doi.org/10.1007/978-3-642-04898-2_609

National Health Insurance Fund. (2010, 04 13). Naujienos. Retrieved from Be sveikatos draudimo neįmanomos gydymo garantijos: http://www.vlk.lt/naujienos/Puslapiai/2010-04-13-BE-SVEIKATOS-DRAUDIMO-NE%C4%AEMANOMOS-GYDYMO-GARANTIJOS-.aspx

OECD. (2018). OECD Reviews of Labour Market and Social Policies: Lithuania. Paris: OECD Publishing. doi:https://doi.org/10.1787/9789264189935-en

Pfaff, B. (2008). VAR, SVAR and SVEC Models: Implementation Within R Package vars. Journal of Statistical Software, 27(4), 2-3. doi:10.18637/jss.v027.i04

Rubio-Ramirez, J., Waggoner, D., & Zha, T. (2010). Structural Vector Autoregressions: Theory of Identification and Algorithms for Inference. The Review of Economic Studies, 77(2), 665. doi:https://doi.org/10.1111/j.1467-937X.2009.00578.x

Rudžinskienė, R., & Paulauskaitė, L. (2014). Lietuvos gyventojų emigracijos priežastys ir padariniai šalies ekonomikai. Socialinė Teorija, Empirija, Politika Ir Praktika, 8, 63, 71-72, 75. doi:https://doi.org/10.15388/STEPP.2014.0.2661

Simandan, D. (2016). Proximity, subjectivity, and space: Rethinking distance in human geography. Geoforum, 75, 249-252. doi:https://doi.org/10.1016/j.geoforum.2016.07.018

Simandan, D. (2019). Revisiting positionality and the thesis of situated knowledge. Dialogues in Human Geography, 9(2), 129-149. doi:https://doi.org/10.1177/2043820619850013

Simandan, D. (2020). Being surprised and surprising ourselves: A geography of personal and social change. Progress in Human Geography, 44(1), 99-118. doi:https://doi.org/10.1177/0309132518810431

Sims, C. A. (1986). Are forecasting models usable for policy analysis? Federal Reserve Bank of Minneapolis. Minneapolis: Federal Reserve Bank of Minneapolis.

Sipavičienė, A., & Stankūnienė, V. (2013). The social and economic impact of emigration on Lithuania. In OECD, Coping with Emigration in Baltic and East European Countries (pp. 47- 53, 55-56, 58-59). Paris: OECD Publishing. doi:http://dx.doi.org/10.1787/9789264204928-6-en

SODRA. (2020, April 2). Noriu gauti nedarbo išmoką. Retrieved from Kiek laiko ir kada mokama išmoka?: https://www.sodra.lt/lt/situacijos/noriu-gauti-nedarbo-ismoka

Statistics Lithuania. (2008). International Migration of the Lithuanian Population. Vilnius: Statistics Lithuania. Retrieved from https://osp.stat.gov.lt/statistikos-leidiniu-katalogas

Statistics Lithuania. (2010). International Migration of the Lithuanian. Vilnius: Statistics Lithuania. Retrieved from https://osp.stat.gov.lt/statistikos-leidiniu-katalogas

Statistics Lithuania. (2013). International Migration of the Lithuanian Population. Vilnius: Statistics Lithuania. Retrieved from https://osp.stat.gov.lt/statistikos-leidiniu-katalogas

Statistics Lithuania. (2014). International Migration of the Lithuanian Population. Vilnius: Statistics Lithuania. Retrieved from https://osp.stat.gov.lt/statistikos-leidiniu-katalogas

Statistics Lithuania. (2015). International Migration of the Lithuanian Population. Vilnius: Statistics Lithuania. Retrieved from https://osp.stat.gov.lt/statistikos-leidiniu-katalogas

Statistics Lithuania. (2020). Labour Market in Lithuania (2020 edition). Vilnius: Statistics Lithuania. Retrieved from Unemployment: https://osp.stat.gov.lt/documents/10180/7895519/Labour+Market+in+Lithuania+%28editon+2020%29.pdf/21fe2a63-0722-417f-85bd-7878219a077b

Statistics Lithuania. (2021, March 18). Statistics Lithuania indicators. Retrieved from Emigrants: https://osp.stat.gov.lt/statistiniu-rodikliu-analize?hash=c7fd5ee9-3c03-4f2d-96b6-b0e5c0c9b3b4#/

Škuflić, L., & Vučković, V. (2018). The effect of emigration on unemployment rates: The case of EU emigrant countries. Economic Research-Ekonomska Istraživanja, 31(1), 1832. doi:https://doi.org/10.1080/1331677X.2018.1516154

Štreimikienė, D., Bilan, Y., Jasinskas, E., & Grikšaite, R. (2016). Migration Trends in Lithuania and Other New EU Member States. Transformations in Business & Economics, 15(1 (37)), 27-31.

Thaut, L. (2009). EU Integration & Emigration Consequences: The Case of Lithuania. International Migration, 47(1), 194, 196, 199, 211-212. doi:10.1111/j.1468-2435.2008.00501.x

Walerych, M. (2021). The aggregate and redistributive effects of emigration. SGH KAE Working Papers Series, 23-24. Retrieved from https://ssl-kolegia.sgh.waw.pl/pl/KAE/Strony/WorkingPapersKAE.aspx

World Economic Forum. (2019). The Global Competitiveness Report. Cologny/Geneva: World Economic Forum. Retrieved from http://www3.weforum.org/docs/WEF_TheGlobalCompetitivenessReport2019.pdf

1 Recalculated for 2000Q1-2007Q7 considering the official LTL-EUR exchange rate of 3.4528, which applies since 02.02.2002 according to the rulings of the Government of the Republic of Lithuania (2002, No.12-417) and the Bank of Lithuania (2002, No.12-453).