Organizations and Markets in Emerging Economies ISSN 2029-4581 eISSN 2345-0037

2021, vol. 12, no. 2(24), pp. 377–398 DOI: https://doi.org/10.15388/omee.2021.12.61

Bank Liquidity Hoarding Strategies in Uncertain Times: New Evidence from an Emerging Market with Bank-level Data

Van Dan Dang

Banking University of Ho Chi Minh City, Vietnam

dandv@buh.edu.vn

ORCID: https://orcid.org/0000-0001-5524-8765

Hoang Chung Nguyen (corresponding author)

Thu Dau Mot University, Vietnam

chungnh@tdmu.edu.vn

ORCID: https://orcid.org/0000-0002-4067-0434

Abstract. The paper explores the impact of uncertainty on bank liquidity hoarding, particularly providing new insights on the nature of the impact by bank-level heterogeneity. We consider the cross-sectional dispersion of shocks to key bank variables to estimate uncertainty in the banking sector and include all banking items to construct a comprehensive measure of bank liquidity hoarding. Using a sample of Vietnamese banks during 2007–2019, we document that banks tend to increase total liquidity hoarding in response to higher uncertainty; this pattern is still valid for on- and off-balance sheet liquidity hoarding. Further analysis with bank-level heterogeneity indicates that the impact of banking uncertainty on liquidity hoarding is significantly stronger for weaker banks, i. e., banks that are smaller, more poorly capitalized, and riskier. In testing the “search for yield” hypothesis to explain the linkage between uncertainty and bank liquidity hoarding, we do not find it to be the case. Our findings remain extremely robust after multiple robustness tests.

Keywords: banking uncertainty, cross-sectional dispersion, emerging market, liquidity hoarding, search for yield

Received: 6/9/2021. Accepted: 17/11/2021

Copyright © 2021 Van Dan Dang, Hoang Chung Nguyen. Published by Vilnius University Press. This is an Open Access article distributed under the terms of the Creative Commons Attribution Licence, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

1. Introduction

Exploring the effects of uncertainty on financial intermediaries has been a fast-growing stream in the recent literature. Accordingly, it is indicated that multiple aspects of bank operations have been significantly affected by uncertainty. For example, during periods of higher uncertainty, banks may increase loan spreads (Ashraf & Shen, 2019), reduce financial stability (Wu et al., 2020), exhibit value depreciation (He & Niu, 2018), and get more exposed to credit risk (Danisman et al., 2021). Notably, most of the attention has been paid to bank lending, positing that an increase in uncertainty causes a strong unfavorable impact on loan growth (Bordo et al., 2016; Hu & Gong, 2019; Nguyen et al., 2020; Valencia, 2017).

This study expands the existing literature by exploring the impact of uncertainty on bank liquidity hoarding — constituting a key channel through which uncertainty could drive the economy. The core function of banks in the economy is to create liquidity to supply to real sectors (Berger & Bouwman, 2009), so hoarding liquidity could be seen as a way of banks destroying such function (Caballero & Krishnamurthy, 2008). Besides, one should be aware that excessive liquidity hoarding is detrimental to the transmission potency of monetary policy and banks’ portfolio returns (Agénor & Aynaoui, 2010). For a certain situation, liquidity hoarding may increase systemic risks via spillover effects since the behavior of liquidity hoarding and asset fire sale actions by stressed banks could trigger down other banks (Diamond & Rajan, 2011).

To conduct the analysis, we approach uncertainty in the banking system, which is measured by a new uncertainty indicator that exploits bank-level data as suggested by Buch et al. (2015), and employ a comprehensive measure of bank liquidity hoarding, which considers all balance sheet items as proposed by Berger et al. (2020). In principle, one cannot reflect uncertainty directly, so multiple different proxies have been created in the literature to capture uncertainty in an indirect route. Some major uncertainty proxies could be listed, such as stock price volatility, disagreement among macro forecasters, or text-based measures (refer to the comprehensive review by Al-Thaqeb and Algharabali (2019) for more detailed information). Overall, all these measures are constructed to estimate specific dimensions of uncertainty. Compared with different uncertainty measures used thus far to examine the link between uncertainty and bank reactions, our uncertainty measure based on the cross-sectional dispersion of shocks to bank-level variables could display some prominent advantages. For example, it does not ask for a high frequency of market data as market-based uncertainty proxies (Buch et al., 2015) or cast some doubt about the accuracy and reliability of the newspapers as text-based uncertainty indices (Baker et al., 2016).

While the literature conventionally employs liquid assets or other simple proxies to analyze how banks hold liquidity, Berger et al. (2020) improve on these by far more comprehensive measures. Under their emphasis, we are aware that banks could hoard liquidity on- and off-balance sheets. So, we not only look into total liquidity hoarding, but also pay attention to the disaggregate components of on- and off-balance sheet hoarding to better anatomize the research issue. Besides, when treating the levels of comprehensive liquidity hoarding as primary measures in regressions, we also perform some robustness checks using conventional simple liquidity holding proxies.

We conducted our work by gathering data from Vietnam, an emerging and small open market, for the period 2007–2019. Vietnam displays a favorable environment to estimate the link between uncertainty in banking and liquidity hoarding. It is a representative state-oriented economy that regularly adjusts policies to operate the economy. Furthermore, Vietnam is still in transition, so policymakers have numerous policies to encourage economic transition (Vo, 2016). As a result, Vietnam is likely to be subject to intense uncertainty shocks, thus potentially delivering important implications to the economy. For the financial market, banks always play the most dominant part, offering the critical financing source to fuel the economy (Dang, 2020a). Hence, the liquidity hoarding of banks should be an indicator worth analyzing in further detail. Especially over the past decades, the Vietnamese economy and banking sector have witnessed important sources of uncertainty, such as the 2008 global financial crisis, the bad debt boom in 2012, and the comprehensive restructuring project in banking to pursue international management standards (Huynh & Dang, 2021).

Bearing in mind that our uncertainty measure is common to all banks, similar to almost any paper in the literature strand, a question that naturally arises is that different banks may react differently to uncertainty shocks. Answering this question may shed some light on the underlying mechanisms through which banking uncertainty influences bank liquidity hoarding. Hence, apart from examining whether there exists a link between banking uncertainty and bank liquidity hoarding, we investigate how this link is driven by bank-level heterogeneity. In other words, we desire to see how banks’ response in liquidity holding to uncertainty varies according to their financial strength or bank-specific characteristics. To this end, our empirical model incorporates interaction terms between uncertainty with bank characteristics or balance sheet strengths, including bank size, bank capital, bank risk, and return gaps. Interestingly, this approach aligns with (i) a growing literature strand attributing more sensitive responses to monetary shocks for banks with weaker financial strengths and limited access to alternative funding (Kashyap & Stein, 2000; Kishan & Opiela, 2006), and (ii) some notable arguments that potentially attribute the relationship between uncertainty and bank liquidity hoarding to the precautionary motive (Allen & Gale, 2004) or the “search for yield” incentive (Dell’Ariccia et al., 2014).

Though sharing a similar topic with some prior papers, our study still exhibits some critical differences, thereby bringing corresponding contributions to fill the research gaps in the literature. First, in this paper we concentrate on using bank-level data as Buch et al. (2015) proposed to exhibit micro uncertainty instead of the text-based economic policy uncertainty index. Our contribution here is to highlight uncertainty associated explicitly with the banking system. While the measures of economic policy uncertainty capture all potential aggregate-level sources of uncertainty, we characterize uncertainty stemming solely from banking activities. Second, we look at a single small emerging market that prior studies ignore. In general, emerging economies display higher uncertainty levels across different economic and financial indicators compared to advanced ones (Wu et al., 2020). Furthermore, the extent to which uncertainty affects the financial markets is much more prominent in emerging economies than in developed markets (Nguyen et al., 2020). Thus, more research should be performed from different financial markets so that the bank liquidity holding behavior amid uncertainty could be well explained. Third, we provide new evidence on how bank-level heterogeneity affects the link between uncertainty and bank liquidity hoarding. To this end, we include a variety of bank characteristics in the model, namely, bank size, bank capital, bank risk, and return gaps. These moderating factors are not fully highlighted in the prior works. As such, our findings enable us to offer valuable insights into the arguments related to bank conditions and the importance of bank-level heterogeneity in explaining the bank liquidity hoarding behavior in response to uncertainty shocks. In sum, our empirical analysis not only develops new findings on the link between bank liquidity hoarding and uncertainty in the banking sector but also lends some perspectives to prudential authorities in Vietnam and other emerging markets as well, where the adverse impacts of banking uncertainty and the changes in the banking market should have gained far more attention due to increasing financial reforms and fluctuations over the last few decades.

We proceed with the rest of our paper as follows. Section 2 reviews related literature. Section 3 presents methodology and data for empirical analysis. Section 4 deals with the regression results and discussions. Finally, section 5 concludes and draws relevant policy implications.

2. Literature Review

Theoretically, one could expect uncertainty to encourage on- and off-balance sheet liquidity hoarding in multiple routes. Banks may hoard more liquid assets for a precautionary reason to protect themselves against future liquidity shortages (Allen & Gale, 2004). These liquid assets could be cash and securities (on the balance sheet) or derivative contracts that operate as liquid assets (off the balance sheet). Banks could also store more liquidity by providing less credit since their borrowers could be hurt by increased uncertainty (Bernanke, 1983), or postpone investments and spending for certain periods (Bloom et al., 2013). The decreased credit is on the asset side of bank balance sheets (e. g., reduced loans granted) or off-balance sheets (e. g., in the form of fewer loan commitments or financial guarantees). When it comes to the liability side, deposits at banks may increase since depositors consider their banks as “safe shelters” for their assets, especially due to the function of insurance schemes (Gatev & Strahan, 2006). Under this mechanism, banks may raise more deposits to build up liquidity buffers during periods of heightened uncertainty.

However, the theory also suggests some ways through which uncertainty could reduce bank liquidity hoarding. In times of increased uncertainty, depositors may require higher deposit rates as a risk premium; thereby, banks are forced to reduce their deposits and other loanable funds (Brogaard & Detzel, 2015). Besides, when facing more uncertainty, banks are filled with more incentives to “search for yield” more aggressively, causing banks to prefer “high-risk and high-return” investments. The reason is that due to eroded profits, derived from lower funding demands of firms and increased funding costs of banks, banks may try to search for yield if their return target is fixed (Dell’Ariccia et al., 2014). In this regard, the banking items could be on the balance sheet, such as increased risky loans, or off the balance sheet, such as more loan commitments. Overall, we can expect the link between uncertainty and bank liquidity holding to be theoretically ambiguous, thus making it an interesting empirical question to be answered.

Empirical studies in the literature on the impact of uncertainty on bank liquidity hoarding are very limited. In fact, we know of only two papers by Berger et al. (2020) and Ashraf (2020) that explore this impact and document that banks hoard more liquidity in times of higher economic policy uncertainty. Employing a novel measure of bank liquidity hoarding allowing for all US banking items, Berger et al. (2020) add to their work that the link between economic policy uncertainty and liquidity hoarding is strengthened for banks with less liquidity and increased peer-bank spillover effects. Using banking data from 21 major countries, Ashraf (2020) also differentiates their research by discovering that the impact of economic policy uncertainty on bank liquid assets is more pronounced for banks having more expected loan losses.

3. Methodology and data

3.1 Banking uncertainty and liquidity hoarding measures

3.1.1 Banking uncertainty measure. We employ the uncertainty measure using bank-level data as Buch et al. (2015) suggested, explicitly containing information dedicated to banking-system-specific uncertainty. The mechanism behind our micro uncertainty measure is that future outcomes turn less predictable in the event of increased uncertainty. From the perspective of banks, less predictability due to greater uncertainty could be displayed by a broader distribution of shocks to bank variables. For the theoretical model, Buch et al. (2015) highlight the distribution of shocks to banks’ loan rates; for the empirical model, they propose a measure to capture uncertainty in banking via the dispersion of shocks to some key bank-level variables, including the growth rate of bank assets, short-term funding, and the level of bank profitability. Adopting the two-step procedure by Buch et al. (2015) to empirically calculate the dispersion of shocks, we first regress the following equation to obtain bank-year-specific shocks for each bank-level variable:

Xi,t = αi + βt + εi,t (1)

where Xi,t is each of three bank-level variables at bank i in year t, separately. αi denotes bank fixed effects, and βt captures time fixed effects; both of these components are to rule out the effect of any bank-specific or time-variant factors on the bank-level variable. As the component of main interest, the residuals εi,t stand for the level of bank shocks to bank-level variables. Thus, we rely on these residuals to generate the cross-sectional dispersion across all bank-level shocks by estimating their standard deviation as follows:

Uncertaintyt = SD (εi,t) (1)

The result brings us the measure of uncertainty for the Vietnamese banking system in year t. Notably, our uncertainty measure is consistent with that of Bloom et al. (2018), who pay attention to the micro uncertainty of US manufacturing firms using firm-level data.

3.1.2 Bank liquidity hoarding measure. We employ the method introduced by Berger et al. (2020) to produce a comprehensive measure of bank liquidity hoarding. Accordingly, this novel measure assigns banking items weights of +0.5 and –0.5, depending on their positions that could be relied on to define whether the items contribute to or subtract from bank liquidity hoarding. In more detail, when banks hoard liquidity due to holdings of liquid assets (e. g., cash and securities on the balance sheet) and derivatives that share similar features with liquid assets (but off-balance sheet), these items receive positive weights. In sharp contrast, illiquid assets (e. g., loans of different types) and illiquid off-balance-sheet items (e. g., loan guarantees and commitments) take negative weights since their decrease may diminish current and future liquid assets. Additionally, given that banks also hoard liquidity by attracting deposits to expand liquid assets subsequently, liquid liabilities (e. g., customer deposits) obtain positive weights.

While classifying banking items as liquid and illiquid, slightly different from Berger et al. (2020), we modify Berger and Bouwman’s (2009) original metrics to adopt more appropriate and effective measures for the Vietnamese banking industry, consistent with the suggestions of Berger et al. (2019) and Dang (2020b) for emerging countries. Ultimately, as suggested by Berger et al. (2020), we compute total bank liquidity hoarding (LHtotal) as follows:

LHtotal = LHonbalance + LHoffbalance (3)

where the on-balance sheet liquidity hoarding (LHonbalance) and the off-balance sheet liquidity hoarding (LHoffbalance) are calculated as follows:

LHonbalance = (+0.5)×Liquid assets + (–0.5)×Illiquid assets + (+0.5)×Liquid liabilities (4)

LHoffbalance = (+0.5)×Liquid derivatives + (–0.5)×Illiquid guarantees (5)

The classification of banking items required to calculate liquidity hoarding measures is reported in Table 1. We then normalize all liquidity hoarding values by total assets in the regression stage so that our key variables are comparable across sample banks.

Table 1. Items Classification for Comprehensive Bank Liquidity Hoarding

|

Liquid assets |

Liquid liabilities |

Liquid derivatives |

|

Securities |

Customer deposits |

All derivatives |

|

Cash and due from other institutions |

Trading liabilities |

|

|

Illiquid assets |

|

Illiquid guarantees |

|

Corporate loans |

|

Loan commitments |

|

Consumer/Retail loans Other assets |

|

Letters of credit commitments |

|

As suggested by Berger et al. (2020), we compute total bank liquidity hoarding (LHtotal) as follows: • LHtotal = LHonbalance + LHoffbalance • LHonbalance = (+0.5)×Liquid assets + (–0.5)×Illiquid assets + (+0.5)×Liquid liabilities • LHoffbalance = (+0.5)×Liquid derivatives + (–0.5)×Illiquid guarantees |

||

3.2 Empirical model specification

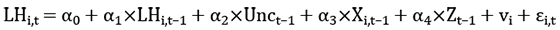

To examine the impact of banking uncertainty on liquidity hoarding, we utilize the baseline model specification as follows:

(6)

(6)

where i captures banks and t denotes years. The dependent variable LH is the measure of bank liquidity hoarding. Following suggestions of the previous literature, we consider the dependent variable lagged by one year as an independent variable to highlight the persistence of bank behavior. Unc stands for the uncertainty proxy. X includes bank-level control variables, and Z consists of macroeconomic control variables. vi is bank fixed effects, and εi,t is unobserved error terms. All explanatory variables are lagged by one year to cautiously alleviate the potential effects of the endogeneity problem. Also, bank liquidity hoarding may not react immediately to economic decisions and events. We wipe out extreme outliers in bank-level variables by winsorizing them at the 2.5% and 97.5% levels (Dang & Huynh, 2021; Kupiec et al., 2017; Sakuragawa et al., 2021).

The former literature well supports the inclusion of bank-level controls. We control bank size because larger banks may gain easier access to the funding market so that they have confidence while operating with less liquid assets (Delechat et al., 2012). We allow for bank risk based on the argument that riskier banks tend to hold a larger buffer of liquid assets due to the precautionary motive (Ashraf, 2020). For bank capital, its consideration is motivated by the fact that more poorly capitalized banks may possess more substantial incentives to expand their liquid assets and enhance their capital adequacy ratios (Affinito et al., 2019). Under the “search for yield” hypothesis, banks may choose to invest in “high risk and high return” assets, implying a reduction in liquidity holdings when their profits are hurt (Dell’Ariccia et al., 2014). Similarly, the presence of macroeconomic factors as control variables is also widely accepted in the literature. We take into account economic cycles as banks may hoard less liquidity when the economy expands at a higher rate (Aspachs et al., 2011). Besides, an increase in policy rates causes banks to raise their lending rates accordingly (e. g., in the event of contractionary monetary policy), likely resulting in a decline in lending demands, and thus banks have to keep more liquidity (Adesina, 2019). Overall, the construction of all control variables is depicted in Table 2.

Table 2. Variable Definitions and Summary Statistics

|

|

Observations |

Mean |

Standard deviation |

Median |

Definitions |

|

LHtotal |

383 |

18.18 |

9.71 |

18.36 |

Total liquidity hoarding/Assets (%) |

|

LHonbalance |

383 |

17.14 |

8.52 |

17.63 |

On-balance sheet liquidity hoarding/Assets (%) |

|

LHoffbalance |

383 |

1.04 |

4.66 |

1.24 |

Off-balance sheet liquidity hoarding/Assets (%) |

|

Bank size |

383 |

32.01 |

1.22 |

32.02 |

Logarithm of assets |

|

Bank capital |

383 |

9.87 |

4.36 |

8.55 |

Book value equity/Assets (%) |

|

Bank risk |

383 |

1.27 |

0.50 |

1.15 |

Loan loss provisions/Gross loans (%) |

|

Search for yield |

383 |

–0.04 |

0.46 |

–0.02 |

Return-on-asset ratio minus its past-three-years average (%); higher values indicate lower incentives to “search for yield” |

|

Unc (asset) |

383 |

21.94 |

6.75 |

22.04 |

Dispersion of shocks to asset variable (%) |

|

Unc (funding) |

383 |

24.23 |

7.89 |

22.98 |

Dispersion of shocks to funding variable (%) |

|

Unc (profit) |

383 |

1.27 |

0.39 |

1.13 |

Dispersion of shocks to profit variable (%) |

|

Economic growth |

383 |

6.25 |

0.64 |

6.24 |

Annual GDP growth rate (%) |

|

Policy rates |

383 |

8.02 |

2.54 |

6.50 |

Refinancing rates (%) |

Our dynamic panel model is estimated using the two-step system generalized method of moments (GMM) estimator (Arellano & Bover, 1995; Blundell & Bond, 1998). We apply the econometric procedure introduced by Roodman (2009) to limit the number of lags used as instruments in the model and then evaluate the consistency of the GMM estimations by necessary diagnostic tests. We need results to confirm the validity of the set of instruments employed (the Hansen test), the absence of the second-order autocorrelation in residuals (the AR(1)/AR(2) tests), and the significant contribution of the lagged dependent variable in explaining bank liquidity hoarding.

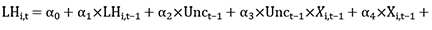

We further explore the possible mechanisms behind the impact of banking uncertainty on bank liquidity hoarding. We use the interaction terms of uncertainty with bank-level characteristics (including bank size, capital, risk, and search for yield), then adding them into the regression equation as follows:

(7)

(7)

The coefficients of the interaction term could tell us whether the uncertainty impact depends on bank heterogeneity.

3.3 Data

We retrieved data from annual financial reports of Vietnamese commercial banks over the period from 2007 to 2019. We excluded all banks without financial reports for at least five consecutive years. We also did the same for banks that do not publish sufficient information to calculate liquidity hoarding measures. As a result, our sample covers 31 Vietnamese commercial banks with a total of 383 observations. Besides, we rely on the World Development Indicators and the State Bank of Vietnam to source macroeconomic data.

Table 2 defines and describes all main variables. The LHtotal variable has a mean of 18.18%, revealing that on average, banks hoard liquidity of 18.18% of total assets. The means of the LHonbalance and LHoffbalance variables are 17.14% and 1.04%, respectively, implying that banks hoard most of their liquidity on the balance sheet. The large standard deviations of all three uncertainty measures indicate considerable volatility in the banking sector during the period under research. Besides, looking at the significant variations across banks, shown by the extensive ranges of extreme values and the large standard deviations of all bank-level variables, we could emphasize the advantages of using bank-level fluctuations to explore the nature of bank liquidity hoarding.

Table 3. Matrix of Pearson Correlation Coefficients among Variables

|

|

(1) |

(2) |

(3) |

(4) |

(5) |

(6) |

(7) |

(8) |

(9) |

(10) |

(11) |

(12) |

|

(1) LHtotal |

1.000 |

|

|

|

|

|

|

|

|

|

|

|

|

(2) LHonbalance |

0.813*** |

1.000 |

|

|

|

|

|

|

|

|

|

|

|

(3) LHoffbalance |

0.471*** |

–0.082* |

1.000 |

|

|

|

|

|

|

|

|

|

|

(4) Bank size |

0.106** |

0.002 |

0.201*** |

1.000 |

|

|

|

|

|

|

|

|

|

(5) Bank capital |

–0.178*** |

–0.144*** |

–0.093* |

–0.518*** |

1.000 |

|

|

|

|

|

|

|

|

(6) Bank risk |

–0.037 |

0.045 |

–0.099* |

0.409*** |

–0.235*** |

1.000 |

|

|

|

|

|

|

|

(7) Search for yield |

0.189*** |

0.005 |

0.334*** |

0.179*** |

–0.109** |

–0.067 |

1.000 |

|

|

|

|

|

|

(8) Unc (asset) |

–0.238*** |

0.035 |

–0.481*** |

–0.392*** |

0.306*** |

–0.045 |

–0.112** |

1.000 |

|

|

|

|

|

(9) Unc (funding) |

–0.238*** |

0.001 |

–0.429*** |

–0.376*** |

0.317*** |

–0.022 |

–0.114** |

0.870*** |

1.000 |

|

|

|

|

(10) Unc (profit) |

0.106** |

–0.105** |

0.369*** |

0.142*** |

–0.161*** |

–0.137*** |

0.317*** |

–0.314*** |

–0.137*** |

1.000 |

|

|

|

(11) Economic growth |

0.157*** |

–0.054 |

0.389*** |

0.220*** |

–0.254*** |

–0.185*** |

0.409*** |

–0.391*** |

–0.499*** |

0.380*** |

1.000 |

|

|

(12) Policy rates |

–0.250*** |

–0.022 |

–0.413*** |

–0.318*** |

0.322*** |

0.104** |

–0.161*** |

0.616*** |

0.584*** |

–0.501*** |

–0.449*** |

1.000 |

Note. *** p < 0.01, ** p < 0.05, * p < 0.1

Table 3 reports the pairwise correlations between all variables. As expected, the correlation between total and on-balance sheet liquidity hoarding is positive and excessively high, supporting the notion that the total liquidity hoarding is driven mainly by items on the balance sheet. The two measures of uncertainty based on the dispersion of shocks to asset and funding variables are close to each other (high correlation between these two variables), and together different from the dispersion of shocks to profitability variable. So, if we achieve consistent results with all three uncertainty measures, we will be able to conclude that our findings are enormously robust. Interestingly, the discrepancy of the pairwise correlations between alternative uncertainty and liquidity measures suggests a need for further regression analysis to examine the effects of uncertainty on bank liquidity hoarding after controlling for other suitable determinants. Besides, other correlation coefficients with relatively low values indicate that multicollinearity should not be a severe problem in this study.

4. Results

4.1 Baseline estimations

In the following part, we report the regression results based on the dynamic model estimated using the two-step system GMM. As an important note, the results of the Hansen test, the AR(1)/AR(2) tests, and the statistically significant coefficients on the lagged dependent variable suggest that our regression framework is properly designed.

Table 4 presents the results in the baseline model using the total liquidity hoarding measure as the dependent variable. In columns 1–3, our estimations control for bank-level variables; in columns 4–6, we additionally include macroeconomic controls. To test the sensitivity of the results, we separately employ three measures of banking uncertainty based on the dispersion of shocks to different bank variables. The results indicate that the coefficient on uncertainty is significantly positive in all columns, regardless of the uncertainty measures used. These results suggest a rise in bank liquidity hoarding following periods of higher uncertainty in banking. The impact found is economically sizable as well. For example, a one standard deviation increase in uncertainty captured by the dispersion of shocks to assets, funding, and profitability (6.75, 7.89, and 0.39, respectively) may increase the total liquidity hoarding normalized by total assets by 1.904 (6.75*0.282), 1.649 (7.89*0.209), and 0.276 (0.39*0.708) percentage points, respectively (columns 4–6). These changes are acceptable given that the mean of the LHtotal variable is 18.18%.

We further decompose total liquidity hoarding into its two components, on- and off-balance sheet liquidity hoarding, to better recognize which liquidity hoarding items are mainly driven by banking uncertainty. To perform the test, we replace the independent variable LHtotal with its components LHonbalance or LHoffbalance. Table 5 shows the results of LHonbalance variable, and Table 6 displays the estimates for the LHoffbalance variable. A common pattern emerges: the coefficient estimates on different uncertainty measures are consistently positive and statistically significant in all columns with both disaggregate liquidity hoarding variables. These results strongly confirm the view that banks tend to hoard liquidity both on and off-balance sheets when uncertainty elevates. The face values of coefficients also highlight the economic significance of our results. For example, one-standard-deviation increase in Unc (asset), Unc (funding), and Unc (profit) are estimated to result in 1.384 (6.75*0.205), 1.633 (7.89*0.207), and 0.500 percentage points (0.39*1.283) increase in on-balance sheet liquidity hoarding, respectively (based on columns 4–6 of Table 5). Similarly, one-standard-deviation increase in Unc (asset), Unc (funding), and Unc (profit) may cause an increase in off-balance sheet liquidity hoarding by 0.790 (6.75*0.117), 0.663 (7.89*0.084), and 0.563 percentage points (0.39*1.444), respectively (based on columns 4–6 of Table 6). These fluctuations are plausible given that the average values of the LHonbalance and LHoffbalance variables are 17.14% and 1.04%, respectively.

Table 4. Uncertainty and Total Liquidity Hoarding

|

|

Dependent variable: LHtotal |

|||||

|

(1) |

(2) |

(3) |

(4) |

(5) |

(6) |

|

|

Lagged dependent variable |

0.642*** |

0.636*** |

0.701*** |

0.705*** |

0.653*** |

0.643*** |

|

|

(0.035) |

(0.033) |

(0.034) |

(0.038) |

(0.040) |

(0.041) |

|

Unc (asset) |

0.263*** |

|

|

0.282*** |

|

|

|

|

(0.036) |

|

|

(0.042) |

|

|

|

Unc (funding) |

|

0.231*** |

|

|

0.209*** |

|

|

|

|

(0.037) |

|

|

(0.052) |

|

|

Unc (profit) |

|

|

0.531* |

|

|

0.708* |

|

|

|

|

(0.295) |

|

|

(0.415) |

|

Bank size |

0.291 |

0.108 |

0.901*** |

0.179 |

0.034 |

0.493 |

|

|

(0.406) |

(0.420) |

(0.340) |

(0.382) |

(0.429) |

(0.421) |

|

Bank capital |

0.204** |

0.130* |

0.209*** |

0.264*** |

0.125* |

0.199** |

|

|

(0.081) |

(0.071) |

(0.079) |

(0.084) |

(0.072) |

(0.082) |

|

Bank risk |

0.651** |

0.502 |

–0.240 |

0.742** |

0.508 |

0.227 |

|

|

(0.288) |

(0.319) |

(0.262) |

(0.294) |

(0.320) |

(0.295) |

|

Search for yield |

–1.475*** |

–0.891** |

–1.616*** |

–1.928*** |

–1.174*** |

–1.437*** |

|

|

(0.376) |

(0.357) |

(0.410) |

(0.437) |

(0.448) |

(0.450) |

|

Economic growth |

|

|

|

1.039*** |

0.531 |

1.600*** |

|

|

|

|

|

(0.389) |

(0.488) |

(0.393) |

|

Policy rates |

|

|

|

0.192*** |

0.064 |

0.158* |

Note. *** p < 0.01, ** p < 0.05, * p < 0.1. The dynamic model is estimated using the two-step system GMM. Standard errors are given in parentheses. Diagnostic tests are reported with p-values. Please refer to Table 1 for the definitions of all variables.

Overall, banks in an emerging market tend to increase total liquidity hoarding and its on- and off-balance sheet parts during higher uncertainty. As a common mechanism, banks may store liquidity for the precautionary motive of avoiding potential liquidity shocks (Allen & Gale 2004). Our findings are in line with those demonstrated in the paper of Berger et al. (2020), which documents that banks hoard liquidity overall and through all components in response to uncertainty. However, it is necessary to clarify that while the prior authors look into economic policy uncertainty in the US banking market, we pay attention to micro uncertainty in the Vietnamese banking sector. Our approach expands the present literature strand under research.

Table 5. Uncertainty and On-balance Sheet Liquidity Hoarding

|

|

Dependent variable: LHonbalance |

|||||

|

(1) |

(2) |

(3) |

(4) |

(5) |

(6) |

|

|

Lagged dependent variable |

0.667*** |

0.638*** |

0.606*** |

0.753*** |

0.681*** |

0.601*** |

|

|

(0.040) |

(0.040) |

(0.034) |

(0.042) |

(0.042) |

(0.047) |

|

Unc (asset) |

0.058** |

|

|

0.205*** |

|

|

|

|

(0.027) |

|

|

(0.040) |

|

|

|

Unc (funding) |

|

0.064** |

|

|

0.207*** |

|

|

|

|

(0.026) |

|

|

(0.041) |

|

|

Unc (profit) |

|

|

1.519*** |

|

|

1.283*** |

|

|

|

|

(0.345) |

|

|

(0.417) |

|

Bank size |

–0.183 |

–0.261 |

–0.057 |

0.146 |

0.071 |

–0.032 |

|

|

(0.239) |

(0.256) |

(0.255) |

(0.206) |

(0.273) |

(0.308) |

|

Bank capital |

0.141*** |

0.128*** |

0.081* |

0.242*** |

0.192*** |

0.103** |

|

|

(0.041) |

(0.044) |

(0.043) |

(0.056) |

(0.060) |

(0.048) |

|

Bank risk |

0.355 |

0.480 |

0.129 |

0.203 |

0.132 |

0.145 |

|

|

(0.318) |

(0.310) |

(0.334) |

(0.329) |

(0.290) |

(0.343) |

|

Search for yield |

–2.679*** |

–2.525*** |

–1.990*** |

–2.714*** |

–2.357*** |

–2.294*** |

|

|

(0.274) |

(0.270) |

(0.252) |

(0.335) |

(0.318) |

(0.336) |

|

Economic growth |

|

|

|

–0.595*** |

–1.395*** |

–0.048 |

|

|

|

|

|

(0.218) |

(0.325) |

(0.352) |

|

Policy rates |

|

|

|

0.257*** |

0.241*** |

–0.013 |

|

|

|

|

|

(0.048) |

(0.050) |

(0.051) |

|

Observations |

352 |

352 |

352 |

352 |

352 |

352 |

|

Banks |

31 |

31 |

31 |

31 |

31 |

31 |

|

Instruments |

24 |

24 |

24 |

26 |

26 |

26 |

|

AR(1) test |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

|

AR(1) test |

0.708 |

0.833 |

0.627 |

0.580 |

0.698 |

0.672 |

|

Hansen test |

0.422 |

0.405 |

0.378 |

0.398 |

0.514 |

0.319 |

Note. *** p < 0.01, ** p < 0.05, * p < 0.1. The dynamic model is estimated using the two-step system GMM. Standard errors are in parentheses. Diagnostic tests are reported with p-values. Please refer to Table 1 for the definitions of all variables.

Table 6. Uncertainty and Off-balance Sheet Liquidity Hoarding

|

|

Dependent variable: LHoffbalance |

|||||

|

(1) |

(2) |

(3) |

(4) |

(5) |

(6) |

|

|

Lagged dependent variable |

0.808*** |

0.830*** |

0.840*** |

0.792*** |

0.795*** |

0.804*** |

|

|

(0.008) |

(0.008) |

(0.009) |

(0.009) |

(0.010) |

(0.011) |

|

Unc (asset) |

0.177*** |

|

|

0.117*** |

|

|

|

|

(0.005) |

|

|

(0.004) |

|

|

|

Unc (funding) |

|

0.116*** |

|

|

0.084*** |

|

|

|

|

(0.002) |

|

|

(0.005) |

|

|

Unc (profit) |

|

|

1.718*** |

|

|

1.444*** |

|

|

|

|

(0.042) |

|

|

(0.114) |

|

Bank size |

0.208*** |

0.211*** |

0.465*** |

0.223*** |

0.180** |

0.397*** |

|

|

(0.034) |

(0.045) |

(0.050) |

(0.040) |

(0.070) |

(0.048) |

|

Bank capital |

0.044*** |

0.024*** |

0.042*** |

0.070*** |

0.045** |

0.098*** |

|

|

(0.004) |

(0.005) |

(0.011) |

(0.013) |

(0.022) |

(0.019) |

|

Bank risk |

–0.655*** |

–0.739*** |

–0.634*** |

–0.580*** |

–0.698*** |

–0.334*** |

|

|

(0.045) |

(0.032) |

(0.074) |

(0.053) |

(0.062) |

(0.093) |

|

Search for yield |

0.073 |

0.308*** |

0.080 |

0.294*** |

0.550*** |

0.123 |

|

|

(0.075) |

(0.048) |

(0.087) |

(0.070) |

(0.058) |

(0.115) |

|

Economic growth |

|

|

|

0.360*** |

0.175*** |

0.680*** |

|

|

|

|

|

(0.038) |

(0.041) |

(0.060) |

|

Policy rates |

|

|

|

–0.099*** |

–0.161*** |

–0.089*** |

|

|

|

|

|

(0.010) |

(0.011) |

(0.020) |

|

Observations |

352 |

352 |

352 |

352 |

352 |

352 |

|

Banks |

31 |

31 |

31 |

31 |

31 |

31 |

|

Instruments |

24 |

24 |

24 |

26 |

26 |

26 |

|

AR(1) test |

0.000 |

0.001 |

0.001 |

0.001 |

0.001 |

0.001 |

|

AR(1) test |

0.857 |

0.761 |

0.728 |

0.798 |

0.761 |

0.724 |

|

Hansen test |

0.261 |

0.468 |

0.281 |

0.286 |

0.237 |

0.709 |

Note. *** p < 0.01, ** p < 0.05. The dynamic model is estimated using the two-step system GMM. Standard errors are given in parentheses. Diagnostic tests are reported with p-values. Please refer to Table 1 for the definitions of all variables.

4.2 Augmented estimations

To more deeply understand how uncertainty drives bank liquidity hoarding, we examine bank-level heterogeneity by concentrating on the role of bank-level characteristics, including bank size, capital, bank risk, and bank incentives to “search for yield”. We report all results in Table 7. We first realize that for all standalone dispersion measures, their coefficients are significant and positive, thereby strengthening our previously obtained result that banks hoard more liquidity in response to higher uncertainty in banking.

Table 7. Uncertainty and Liquidity Hoarding across Heterogeneous Banks

|

|

Dependent variable: LHtotal |

Dependent variable: LHonbalance |

Dependent variable: LHoffbalance |

||||||

|

(1) Unc (asset) |

(2) Unc (funding) |

(3) Unc (profit) |

(4) Unc (asset) |

(5) Unc (funding) |

(6) Unc (profit) |

(7) Unc (asset) |

(8) Unc (funding) |

(9) Unc (profit) |

|

|

Lagged dependent variable |

0.672*** |

0.642*** |

0.682*** |

0.582*** |

0.684*** |

0.686*** |

0.829*** |

0.832*** |

0.782*** |

|

|

(0.043) |

(0.045) |

(0.050) |

(0.057) |

(0.056) |

(0.055) |

(0.019) |

(0.014) |

(0.017) |

|

Uncertainty |

5.257*** |

8.656** |

184.234*** |

3.402* |

3.284** |

32.114 |

3.435*** |

1.923*** |

122.904*** |

|

|

(1.963) |

(3.660) |

(21.093) |

(1.949) |

(1.662) |

(43.711) |

(0.550) |

(0.206) |

(8.725) |

|

Uncertainty* Bank size |

–0.163*** |

–0.266** |

–5.600*** |

–0.091 |

–0.102** |

–0.947 |

–0.003*** |

–0.067*** |

–0.021*** |

|

|

(0.059) |

(0.111) |

(0.645) |

(0.058) |

(0.050) |

(1.322) |

(0.000) |

(0.012) |

(0.004) |

|

Uncertainty* Bank capital |

–0.031** |

–0.035*** |

–0.644*** |

–0.037*** |

–0.020*** |

–0.252** |

–0.003** |

–0.008*** |

–0.072*** |

|

|

(0.013) |

(0.011) |

(0.106) |

(0.012) |

(0.005) |

(0.117) |

(0.001) |

(0.001) |

(0.016) |

|

Uncertainty* Bank risk |

0.007 |

0.033** |

0.968** |

0.251*** |

0.009 |

0.718** |

0.039*** |

0.031*** |

0.665*** |

|

|

(0.021) |

(0.014) |

(0.398) |

(0.072) |

(0.019) |

(0.302) |

(0.005) |

(0.005) |

(0.101) |

|

Uncertainty *Search for yield |

0.024 |

–0.034 |

0.689 |

–0.019 |

–0.028 |

–0.375 |

0.001 |

2.150*** |

0.001 |

|

|

(0.035) |

(0.033) |

(0.890) |

(0.040) |

(0.025) |

(0.396) |

(0.000) |

(0.388) |

(0.000) |

|

Bank-level controls |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

|

Macroeconomic controls |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

|

Observations |

352 |

352 |

352 |

352 |

352 |

352 |

352 |

352 |

352 |

|

Banks |

31 |

31 |

31 |

31 |

31 |

31 |

31 |

31 |

31 |

|

Instruments |

30 |

30 |

30 |

30 |

30 |

30 |

30 |

30 |

30 |

|

AR(1) test |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.001 |

0.001 |

0.001 |

|

AR(1) test |

0.571 |

0.730 |

0.377 |

0.151 |

0.325 |

0.346 |

0.893 |

0.859 |

0.872 |

|

Hansen test |

0.509 |

0.212 |

0.445 |

0.513 |

0.317 |

0.225 |

0.505 |

0.598 |

0.338 |

Note. *** p < 0.01, ** p < 0.05, * p < 0.1. The dynamic model is estimated using the two-step system GMM. Standard errors are in parenthesis. Diagnostic tests are reported with p-values. Please refer to Table 1 for the definitions of all variables.

We turn to the interaction terms of uncertainty with various bank characteristics. In particular, exploring the influence caused by bank size, most columns indicate that the coefficients on the interaction term are significantly negative. This pattern suggests a weaker uncertainty effect for banks with a larger size, or in other words, uncertainty boosts liquidity hoarding more for smaller banks. Next, the interaction term of uncertainty and bank capital enters negatively and significantly in all columns, implying that the impact of uncertainty on bank liquidity hoarding is significantly smaller as bank capital rises. For the role of bank risk, the positive and significant coefficients for its interaction term with uncertainty reflect that bank risk could significantly intensify the impact of uncertainty on bank liquidity hoarding. Finally, the coefficient for the interaction term between uncertainty and the “search for yield” variable is not statistically significant in most regressions. Thus, we can conclude that the effect of banking uncertainty on liquidity hoarding is not driven by banks’ incentives to search for yield.

In sum, our results reveal that the impact of uncertainty on liquidity hoarding is more prominent in smaller, more poorly capitalized, and riskier banks. In other words, weaker banks should be more affected by the fluctuation of the banking sector in Vietnam. These results strongly confirm the precautionary motive since weak banks are vulnerable to adverse shocks and less stable than strong banks (Beck & Narayanamoorthy, 2012). Our findings are in line with the literature strand that documents that the reactions in bank lending to monetary shocks are more pronounced at weaker banks, as these banks have more limited access to alternative funding under challenging times with more financing constraints (Kashyap & Stein, 2000; Kishan & Opiela, 2006). Our work supports the previous finding by Ashraf (2020) regarding how the association of uncertainty with bank risk shapes bank liquidity holdings. More interestingly, our findings on the interaction between uncertainty with bank size and capital firmly emphasize the precautionary motive amid uncertainty, which adds novelty in the literature on the effects of uncertainty on bank liquidity hoarding.

4.3 Robustness checks

We now conduct additional robustness checks to identify whether our findings remain unchanged while employing alternative measures of bank liquidity hoarding and a different econometric framework. We first replace our novel liquidity hoarding proxies with traditional liquidity measures, using the ratio of liquid assets to total assets and the ratio of liquid assets to deposits plus short-term funding. These traditional liquidity variables are also tested in the related work of Ashraf (2020).

We next re-estimate our baseline and augmented model with new dependent variables based on another econometric methodology. To this end, we use the least squares dummy variable corrected (LSDVC) estimator (Bruno, 2005). This estimator could be regarded as a perfect alternative analysis method for the dynamic GMM design if the panel data is strongly unbalanced, and the number of cross-sectional units in the sample is small. Such features are dominant in our sample. Some recent papers are increasingly interested in combining GMM and LSDVC estimators in dynamic panel models to offer efficient, consistent, and robust estimates (Dahir et al., 2019; Wang et al., 2019).

Table 8. Robustness Checks with The Traditional Liquidity Ratio Using The LSDVC Estimator

|

|

Dependent variable: Liquid assets/Assets |

||||||||

|

(1) Unc (asset) |

(2) Unc (funding) |

(3) Unc (profit) |

(4) Unc (asset) |

(5) Unc (funding) |

(6) Unc (profit) |

(7) Unc (asset) |

(8) Unc (funding) |

(9) Unc (profit) |

|

|

Lagged dependent variable |

0.414*** |

0.481*** |

0.576*** |

0.364*** |

0.376*** |

0.434*** |

0.292*** |

0.205*** |

0.384*** |

|

|

(0.020) |

(0.019) |

(0.018) |

(0.025) |

(0.022) |

(0.028) |

(0.032) |

(0.028) |

(0.033) |

|

Uncertainty |

0.188*** |

0.110*** |

2.446*** |

0.176*** |

0.052* |

1.507*** |

2.833 |

1.139 |

69.167** |

|

|

(0.015) |

(0.010) |

(0.346) |

(0.037) |

(0.031) |

(0.327) |

(2.374) |

(2.117) |

(34.993) |

|

Uncertainty* Bank size |

|

|

|

|

|

|

–0.066 |

–0.052 |

–2.243** |

|

|

|

|

|

|

|

|

(0.071) |

(0.066) |

(1.085) |

|

Uncertainty* Bank capital |

|

|

|

|

|

|

–0.045*** |

–0.030*** |

–0.347*** |

|

|

|

|

|

|

|

|

(0.015) |

(0.005) |

(0.106) |

|

Uncertainty* Bank risk |

|

|

|

|

|

|

0.366*** |

0.403*** |

5.328*** |

|

|

|

|

|

|

|

|

(0.068) |

(0.066) |

(0.983) |

|

Uncertainty* Search for yield |

|

|

|

|

|

|

–0.033 |

–0.018 |

–0.171 |

|

|

|

|

|

|

|

|

(0.032) |

(0.033) |

(0.541) |

|

Bank-level controls |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

|

Macroeconomic controls |

No |

No |

No |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

|

Observations |

352 |

352 |

352 |

352 |

352 |

352 |

352 |

352 |

352 |

|

Banks |

31 |

31 |

31 |

31 |

31 |

31 |

31 |

31 |

31 |

Note. *** p < 0.01, ** p < 0.05, * p < 0.1. The dynamic model is estimated using the LSDVC estimator (Arellano-Bond). Bootstrapped standard errors (100 iterations) are given in parentheses. Please refer to Table 1 for the definitions of all variables.

Table 9. Robustness Checks with The Liquidity-to-deposit Ratio Using The LSDVC Estimator

|

|

Dependent variable: Liquid assets/Deposits |

||||||||

|

(1) Unc (asset) |

(2) Unc (funding) |

(3) Unc (profit) |

(4) Unc (asset) |

(5) Unc (funding) |

(6) Unc (profit) |

(7) Unc (asset) |

(8) Unc (funding) |

(9) Unc (profit) |

|

|

Lagged dependent variable |

0.463*** |

0.538*** |

0.627*** |

0.403*** |

0.411*** |

0.532*** |

0.270*** |

0.179*** |

0.391*** |

|

|

(0.021) |

(0.019) |

(0.018) |

(0.026) |

(0.027) |

(0.037) |

(0.032) |

(0.041) |

(0.043) |

|

Uncertainty |

0.323*** |

0.183*** |

4.151*** |

0.417*** |

0.164*** |

1.529*** |

0.376 |

8.930*** |

180.847*** |

|

|

(0.025) |

(0.017) |

(0.396) |

(0.039) |

(0.041) |

(0.438) |

(3.269) |

(3.360) |

(42.293) |

|

Uncertainty* Bank size |

|

|

|

|

|

|

–0.063 |

–0.299*** |

–5.658*** |

|

|

|

|

|

|

|

|

(0.052) |

(0.103) |

(1.301) |

|

Uncertainty* Bank capital |

|

|

|

|

|

|

–0.044** |

–0.018* |

–0.115 |

|

|

|

|

|

|

|

|

(0.022) |

(0.010) |

(0.143) |

|

Uncertainty* Bank risk |

|

|

|

|

|

|

0.567*** |

0.625*** |

7.164*** |

|

|

|

|

|

|

|

|

(0.094) |

(0.087) |

(1.182) |

|

Uncertainty* Search for yield |

|

|

|

|

|

|

0.022 |

–0.052 |

–1.023 |

|

|

|

|

|

|

|

|

(0.097) |

(0.057) |

(0.879) |

|

Bank-level controls |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

|

Macroeconomic controls |

No |

No |

No |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

|

Observations |

352 |

352 |

352 |

352 |

352 |

352 |

352 |

352 |

352 |

|

Banks |

31 |

31 |

31 |

31 |

31 |

31 |

31 |

31 |

31 |

Note. *** p < 0.01, ** p < 0.05, * p < 0.1. The dynamic model is estimated using the LSDVC estimator (Blundell-Bond). Bootstrapped standard errors (100 iterations) are given in parentheses. Please refer to Table 1 for the definitions of all variables.

Our estimation results with robustness checks are presented in Tables 8–9. We do not report the results for control variables to save space, but they are always available upon request. Once again, we find that uncertainty in banking has a strong positive impact on the holdings of liquid assets. The significance of the interaction terms provides solid evidence that bank-level factors, including bank size, capital, and bank risk, can affect the impact of uncertainty on liquidity holding as greatly as exhibited earlier; the insignificance of the interaction term between uncertainty and search-for-yield variables confirms that the “search for yield” incentive plays no role in shaping the uncertainty impact. Taken together, our findings obtained in the study are persistently robust.

5. Conclusion

The study empirically investigates the impact of banking uncertainty on bank liquidity hoarding in Vietnam from 2007 to 2019. We do this by approaching uncertainty in the banking system, measured by a new uncertainty that exploits bank-level data as suggested by Buch et al. (2015) and utilizing a comprehensive measure of bank liquidity hoarding that considers all balance sheet items as proposed by Berger et al. (2020).

Our key findings are as follows. First, banks tend to hoard more total liquidity in response to higher uncertainty in banking. While decomposing total liquidity hoarding for a better understanding, we find that the pattern is still valid for liquidity hoarding on- and off-balance sheets. Second, exploring the bank-level heterogeneity confirms a weaker banking uncertainty effect on liquidity hoarding with an increase in bank size/capital and a decrease in bank risk. Alternatively speaking, the impact of banking uncertainty on bank liquidity hoarding is significantly stronger for weaker banks. Our “search for yield” hypothesis to explain the linkage between uncertainty and liquidity hoarding has not been confirmed. Our findings remain extremely robust after multiple robustness tests, including (i) replacing the two-step system GMM estimator with the LSDVC technique, (ii) controlling for variables with and without macroeconomic factors, and regressing models with and without interaction terms, (iii) using the dispersion of shocks to three alternative bank-level variables to capture banking uncertainty, and (iv) replacing novel comprehensive liquidity hoarding measures with conventional proxies.

We can draw some implications based on the findings of our paper. Overall, we indicate that uncertainty in banking is valuable information that monetary authorities in emerging economies have to consider in their policy frameworks. Necessary actions in mitigating uncertainty to lower bank liquidity hoarding may yield effective outcomes to favorably drive the real economy. Furthermore, our findings also have other insightful implications regarding financial reforms that monetary authorities should adopt as complementary measures to neutralize the impact of uncertainty on bank liquidity hoarding. More precisely, our evidence of the bank-level heterogeneity suggests that encouraging the reinforced financial strength of banks could make their liquidity hoarding more resistant to uncertainty shocks.

It is worth emphasizing that in this paper, we treat our uncertainty measure as a singular source of uncertainty exclusively derived from the banking sector. Moreover, we recognize that our study is restricted by featuring only Vietnam with data limitations. Hence, other measures to capture uncertainty at various levels from different markets are pending for future studies to explore, possibly confirming or contradicting our results and thus expanding the present issue under research. Besides, another interesting aspect that we could consider is the heterogeneity in bank hoarding behaviors caused by state ownership. For example, state-owned banks could behave differently compared to other banks in the system and even ignore the “search for yield” incentive since they gain government support. This issue raises further additional research questions for future works.

References

Adesina, K. S. (2019). Basel III liquidity rules: The implications for bank lending growth in Africa. Economic Systems, 43(2). https://doi.org/10.1016/j.ecosys.2018.10.002

Affinito, M., Albareto, G., & Santioni, R. (2019). Purchases of sovereign debt securities by banks during the crisis: The role of balance sheet conditions. Journal of Banking and Finance, 105575. https://doi.org/10.1016/j.jbankfin.2019.06.007

Agénor, P. R., & Aynaoui, K. El. (2010). Excess liquidity, bank pricing rules, and monetary policy. Journal of Banking and Finance, 34(5), 923–933. https://doi.org/10.1016/j.jbankfin.2009.10.003

Al-Thaqeb, S. A., & Algharabali, B. G. (2019). Economic policy uncertainty: A literature review. Journal of Economic Asymmetries, 20,e00133. https://doi.org/10.1016/j.jeca.2019.e00133

Allen, F., & Gale, D. (2004). Competition and financial stability. Journal of Money, Credit, and Banking, 36(3b), 453–480. https://doi.org/10.1353/mcb.2004.0038

Arellano, M., & Bover, O. (1995). Another look at the instrumental variable estimation of error-components models. Journal of Econometrics, 68(1), 29–51. https://doi.org/10.1016/0304-4076(94)01642-D

Ashraf, B. N. (2020). Policy uncertainty and bank liquidity hoarding: International evidence. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.3574193

Ashraf, B. N., & Shen, Y. (2019). Economic policy uncertainty and banks’ loan pricing. Journal of Financial Stability, 44(C). https://doi.org/10.1016/j.jfs.2019.100695

Aspachs, O., Nier, E. W., & Tiesset, M. (2011). Liquidity, Banking Regulation and the Macroeconomy. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.673883

Baker, S. R., Bloom, N., & Davis, S. J. (2016). Measuring economic policy uncertainty. Quarterly Journal of Economics, 131(4), 1593–1636. https://doi.org/10.1093/qje/qjw024

Beck, P. J., & Narayanamoorthy, G. S. (2012). Did the SEC impact banks’ loan loss reserve policies and their informativeness? Journal of Accounting and Economics, 56(2–3), 42–65. https://doi.org/10.1016/j.jacceco.2013.06.002

Berger, A. N., Boubakri, N., Guedhami, O., & Li, X. (2019). Liquidity creation performance and financial stability consequences of Islamic banking: Evidence from a multinational study. Journal of Financial Stability, 44(C). https://doi.org/10.1016/j.jfs.2019.100692

Berger, A. N., & Bouwman, C. H. S. (2009). Bank liquidity creation. Review of Financial Studies, 22(9), 3779–3837. https://doi.org/10.1093/rfs/hhn104

Berger, A. N., Guedhami, O., Kim, H. H., & Li, X. (2020). Economic policy uncertainty and bank liquidity hoarding. Journal of Financial Intermediation, 100893. https://doi.org/10.1016/j.jfi.2020.100893

Bernanke, B. S. (1983). Irreversibility, uncertainty, and cyclical investment. Quarterly Journal of Economics, 98(1), 85–106. https://doi.org/10.2307/1885568

Bloom, N., Floetotto, M., Jaimovich, N., Saporta-Eksten, I., & Terry, S. J. (2018). Really uncertain business cycles. Econometrica, 86(3), 1031–1065. https://doi.org/10.3982/ecta10927

Bloom, N., Kose, M. A., & Terrones, M. E. (2013). Held back by uncertainty. Finance and Development, 50(1), 38–41.

Blundell, R., & Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics, 87(1), 115–143. https://doi.org/10.1016/S0304-4076(98)00009-8

Bordo, M. D., Duca, J. V., & Koch, C. (2016). Economic policy uncertainty and the credit channel: Aggregate and bank level U.S. evidence over several decades. Journal of Financial Stability, 26, 90–106. https://doi.org/10.1016/j.jfs.2016.07.002

Brogaard, J., & Detzel, A. (2015). The asset-pricing implications of government economic policy uncertainty. Management Science, 61(1), 3–18. https://doi.org/10.1287/mnsc.2014.2044

Bruno, G. S. F. (2005). Estimation and inference in dynamic unbalanced panel-data models with a small number of individuals. Stata Journal, 5(4), 473–500. https://doi.org/10.1177/1536867x0500500401

Buch, C. M., Buchholz, M., & Tonzer, L. (2015). Uncertainty, bank lending, and bank-level heterogeneity. IMF Economic Review, 63(4), 919–954. https://doi.org/10.1057/imfer.2015.35

Caballero, R. J., & Krishnamurthy, A. (2008). Collective risk management in a flight to quality episode. Journal of Finance, 63(5), 2195–2230. https://doi.org/10.1111/j.1540-6261.2008.01394.x

Dahir, A. M., Mahat, F., Razak, N. H. A., & Bany-Ariffin, A. N. (2019). Capital, funding liquidity, and bank lending in emerging economies: An application of the LSDVC approach. Borsa Istanbul Review, 19(2), 139–148. https://doi.org/10.1016/j.bir.2018.08.002

Dang, V. D. (2020a). Bank funding and liquidity in an emerging market. International Journal of Economic Policy in Emerging Economies, 13(3), 256–272. https://doi.org/10.1504/ijepee.2020.109054

Dang, V. D. (2020b). Do non-traditional banking activities reduce bank liquidity creation? Evidence from Vietnam. Research in International Business and Finance, 54. https://doi.org/10.1016/j.ribaf.2020.101257

Dang, V. D., & Huynh, J. (2021). Bank funding, market power, and the bank liquidity creation channel of monetary policy. Research in International Business and Finance, 59. https://doi.org/10.1016/J.RIBAF.2021.101531

Danisman, G. O., Demir, E., & Ozili, P. (2021). Loan loss provisioning of US banks: Economic policy uncertainty and discretionary behavior. International Review of Economics and Finance, 71, 923–935. https://doi.org/10.1016/j.iref.2020.10.016

Delechat, C., Henao Arbelaez, C., Muthoora, P. S., & Vtyurina, S. (2012). The determinants of banks’ liquidity buffers in Central America. IMF Working Papers series 301. https://doi.org/10.5089/9781616356675.001

Dell’Ariccia, G., Laeven, L., & Marquez, R. (2014). Real interest rates, leverage, and bank risk-taking. Journal of Economic Theory, 149(1), 65–99. https://doi.org/10.1016/j.jet.2013.06.002

Diamond, D. W., & Rajan, R. G. (2011). Fear of fire sales, illiquidity seeking, and credit freezes. Quarterly Journal of Economics, 126(2), 557–591. https://doi.org/10.1093/qje/qjr012

Gatev, E., & Strahan, P. E. (2006). Banks’ advantage in hedging liquidity risk: Theory and evidence from the commercial paper market. Journal of Finance, 61(2), 867–892. https://doi.org/10.1111/j.1540-6261.2006.00857.x

He, Z., & Niu, J. (2018). The effect of economic policy uncertainty on bank valuations. Applied Economics Letters, 25(5), 345–347. https://doi.org/10.1080/13504851.2017.1321832

Hu, S., & Gong, D. (2019). Economic policy uncertainty, prudential regulation and bank lending. Finance Research Letters, 29, 373–378. https://doi.org/10.1016/j.frl.2018.09.004

Huynh, J., & Dang, V. D. (2021). Loan portfolio diversification and bank returns: Do business models and market power matter? Cogent Economics and Finance, 9(1). https://doi.org/10.1080/23322039.2021.1891709

Kashyap, A. K., & Stein, J. C. (2000). What do a million observations on banks say about the transmission of monetary policy? American Economic Review, 90(3), 407–428. https://doi.org/10.1257/aer.90.3.407

Kishan, R. P., & Opiela, T. P. (2006). Bank capital and loan asymmetry in the transmission of monetary policy. Journal of Banking and Finance, 30(1), 259–285. https://doi.org/10.1016/j.jbankfin.2005.05.002

Kupiec, P., Lee, Y., & Rosenfeld, C. (2017). Does bank supervision impact bank loan growth? Journal of Financial Stability, 28, 29–48. https://doi.org/10.1016/J.JFS.2016.11.006

Nguyen, C. P., Le, T. H., & Su, T. D. (2020). Economic policy uncertainty and credit growth: Evidence from a global sample. Research in International Business and Finance, 51(C). https://doi.org/10.1016/j.ribaf.2019.101118

Roodman, D. (2009). How to do xtabond2: An introduction to difference and system GMM in Stata. Stata Journal, 9(1), 86–136. https://doi.org/10.1177/1536867x0900900106

Sakuragawa, M., Tobe, S., & Zhou, M. (2021). Chinese housing market and bank credit. Journal of Asian Economics, 76, 101361. https://doi.org/10.1016/J.ASIECO.2021.101361

Valencia, F. (2017). Aggregate uncertainty and the supply of credit. Journal of Banking and Finance, 81, 150–165. https://doi.org/10.1016/j.jbankfin.2017.05.001

Vo, X. V. (2016). Finance in Vietnam-an overview. Afro-Asian Journal of Finance and Accounting, 6(3), 202–209. https://doi.org/10.1504/AAJFA.2016.079311

Wang, Y., Wang, K., & Chang, C. P. (2019). The impacts of economic sanctions on exchange rate volatility. Economic Modelling, 82, 58–65. https://doi.org/10.1016/j.econmod.2019.07.004

Wu, J., Yao, Y., Chen, M., & Jeon, B. N. (2020). Economic uncertainty and bank risk: Evidence from emerging economies. Journal of International Financial Markets, Institutions and Money, 68(C). https://doi.org/10.1016/j.intfin.2020.101242