Organizations and Markets in Emerging Economies ISSN 2029-4581 eISSN 2345-0037

2022, vol. 13, no. 2(26), pp. 426–442 DOI: https://doi.org/10.15388/omee.2022.13.87

Does Religious Proximity Affect FDI Location Choice? An Empirical Analysis of Outward FDI from Morocco to 54 Host Countries

Jihad Ait Soussane (corresponding author)

University of Ibn Tofail, Marocco

https://orcid.org/0000-0002-1113-4835

jihad.aitsoussane@gmail.com

Dalal Mansouri

University of Ibn Tofail, Marocco

https://orcid.org/0000-0003-2952-8864

mansouri.dalal@gmail.com

Zahra Mansouri

University of Ibn Tofail, Marocco

https://orcid.org/0000-0002-3363-1584

zahra.mansouri@uit.ac.ma

Abstract. The present paper investigates the effect of religious distance on the choice of location of Moroccan Multinational Enterprises (MNEs) when investing abroad. The main research hypothesis considers the religion as an element of the psychic distance between the home country and host countries that can affect the FDI location decision. The results of the Robust Weighted Least Squares (RWLS) estimation method using panel data of outward FDI flows from Morocco to 54 host countries from 2007 to 2020 show that the more the local Muslim population is important in the host country, the more it receives FDI from Morocco. The results of the study are highly relevant to policymakers as they prove that the religion is important for inward and outward foreign direct investment. On the one hand, policy makers in charge of FDI attractiveness in the host country have to adopt religious strategies accompanied by public–private partnerships to integrate main foreign religions to facilitate the integration of MNEs and reduce their transaction costs. On the other hand, policy makers in charge of promoting outward FDI from the home country have to establish a liaison office in host countries to support the MNEs and facilitate their internationalization process.

Keywords: foreign direct investment, multinational enterprises, internationalization, psychic distance, religious distance, Robust Least Squares

Received: 5/2/2022. Accepted: 13/10/2022

Copyright © 2022 Jihad Ait Soussane, Dalal Mansouri, Zahra Mansouri. Published by Vilnius University Press. This is an Open Access article distributed under the terms of the Creative Commons Attribution Licence, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

1. Introduction

Globalization presents itself as an inevitable phenomenon, which has reframed the functioning of the international economic scene through the removal of economic, cultural and social borders, increased competition, and the emergence of new challenges on an international scale. Since the 2000s, the Moroccan economy has shown continuous growth with low inflation levels, accompanied by an increasing openness of its economy through the intensification of trade flows and bilateral foreign direct investment (FDI). Statistics show that Moroccan outward FDI reached 360 million USD in 2020, representing 28% of its inward foreign direct investment this year (Office des Change, 2022). In addition, the African continent receives the most of Moroccan outward FDI (67.6% in 2020 against 63.2% in 2019 and 49.4% in 2018). Furthermore, Moroccan outward FDI concentrates in the financial and insurance sectors representing 59% of the total FDI.

According to Toumi (2009), the FDI location choice could be explained, among others, by socio-cultural considerations that may influence the decision-making of MNEs. Besides shared history and language, these considerations could cover other issues, such as the shared religion, which is an essential factor that would allow the understanding of the decision of MNEs regarding their location choice. Moreover, and in the same perspective, Ghemawat (2001) emphasizes the concept of distance that not only refers to the geography but also to other aspects related to culture and similar aspects like the religious similarity.

The religious similarity promotes friendly and trusting relationships, facilitates large contracts, and establishes several economic partnerships. The Moroccan soft power related to religion makes it possible to support the Moroccan economic extension in host countries through several components, particularly foreign investments.

Moreover, religion is one of the factors of psychic distance. It contributes to evolving values and behavioral norms specific to a given culture (Weber, 1904). The empirical literature has recognized the relationship between religion and the attractiveness of FDI, which share the same religious and behavioral norms, promotes trust and cooperation between countries.

Therefore, religious proximity becomes a catalyst for trust and attraction of FDI (Greif, 1994): the more the two countries share the same religion, the more trust between them is generated, which has a positive impact on the volume of economic transactions between the counterpart countries (Guiso et al., 2009).

The objective of this paper is investigating the effect of religious proximity between Morocco and host countries on outward FDI. The econometric study based on the panel data of 54 host countries selected according to the significance of Moroccan foreign investments during the period 2007–2020, using the percentage of the Muslim population living in the host countries as a proxy variable of religious proximity.

The present paper constitutes a novel contribution to the literature of FDI location choice by studying the effect of religious proximity on outward FDI. The only empirical study that investigated this subject is the paper by Hergueux (2012), who analyzed the panel data of inward FDI using religious proximity as a dummy variable. Our paper fills the research gap by investigating the religious proximity as an FDI location factor at one country level and using the percentage of Muslim population rather than a dummy variable to enrich the analysis.

In the empirical results, we found that religious proximity between Morocco and host countries is an FDI location factor. In other words, all things being equal, the more Muslim population the host country has, the more likely it receives FDI from Morocco, in comparison to its counterparts that have lesser Muslim population.

The rest of the paper is organized as follows: The second section will expose the theoretical framework on which our research topic is grounded. As an element of psychic distance, religion can explain the firm internationalization. The third section will develop a research hypothesis within a conceptual framework, while the fourth section will explain the empirical research design to answer the research questions. And finally, the fifth section will present and discuss the results.

2. Theoretical Background of the Role of Religious Proximity in FDI Location

The fundamental theoretical frameworks are grounded in internationalization models. In this matter, Johanson and Vahlne (1977) developed the Uppsala model or U-model, according to which the process of internationalization is sequential and linear. There are three underlying assumptions for the U-model:

i. The firm is already expanded in the home market;

ii. Internationalization is the consequence of a series of incremental decisions; and,

iii. There is an attitude towards expanding the firm’s activities abroad.

According to the authors, the internationalization process goes through four stages: (1) There is no export strategy, which means the home market is still developing and has not reached its maturity yet; (2) after the local market starts reaching maturity, the firm exports its goods through intermediaries; (3) after achieving a high level of exports, the firm creates sales subsidiaries and (4) after gaining experience and enough knowledge about local customs and understanding consumer behavior, the firm starts producing at the local level for domestic consumers via horizontal FDI.

Johanson and Vahlne’s (1977) U-model argues that internationalization is a process of accumulating and exploiting resources and learning in an incremental process. Hence, the U-model contributes to the understanding of the internationalization process as follows: First, the internationalization process is gradual. The gradualism approach means that a successful internationalization requires committing several errors to achieve effective strategies and more realistic visions and acquiring knowledge, especially when information asymmetry is significant. Second, psychic distance is a set of socio-cultural differences. The MNE internationalizes to a psychically closer country.

Johanson and Vahlne (1977) were the first to study the role of psychic distance between the host country and the home country. The psychic distance is defined “as the sum of the factors preventing the flow of information from and to the market. Examples are differences in language, education, business practices, culture, and industrial development” (Johansaon & Vahlne, 1977, p. 64). Those factors may limit the MNE from acquiring more relevant information about host economics, worsen the information asymmetry, and cripple the internationalization process. We argue that religion is one of the psychic distance factors. Indeed, Weber (1904) confirms that religion contributes to values and behavioral norms development in a given society.

Our study suggests that religion plays a significant role in narrowing psychic distance. However, the Uppsala model focuses only on horizontal FDI, i. e., market-seeking FDI, sensitive to consumer choices and behavior. We argue that vertical FDI is also affected by psychic distance.

Thus, the second theoretical model refers to the theory of social networks where Johanson and Mattsson (1988) developed the Uppsala model. According to this model, internationalization is a cumulative process where relationships with foreign actors are established and continuously maintained to achieve a firm’s objectives. Therefore, internationalization success depends more on a firm’s ability to create a network than on a specific advantage. In other words, the international process is a product of interactions, development, and maintenance of relationships during time: a firm internationalization is the product of a social network internationalization.

The social network theoretical model suggests that a firm internationalization occurs within three levels:

• 1st, extension: the firm seeks to build a network on its own or join existing networks.

• 2nd, penetration: the firm enhances its position within the social networks to increase allocated resources.

• 3rd, integration: the firm is part of several social networks. By establishing financial, technological, and market relations, the firm gradually widens its connections outside national borders. This network approach focuses on the issues and opportunities associated with establishing relationships with foreign partners, like clients, suppliers, government.

We suggest that the social network theoretical model helps to understand the role of religious ties on a firm internationalization success and FDI location choice. The international management literature has documented the economic benefits of religious similarity. The existence of religious ties between expatriates and local agents in the host country strengthens interpersonal relationships and friendships that promote communication (Fan et al., 2017). Moreover, theoretical literature, such as social identity theory and self-categorization, has highlighted the difficulties that expatriates face when information asymmetry and communication problems are significant especially when employees have different social identities than expatriates (Makela et al., 2012). In other words, higher religious proximity means that expatriates encounter fewer problems related to the management of the local branch compared to a religiously distanced country.

The theory of social networks explains the contribution of religious ties to internationalization success that consist of elements of personal relationships such as religion. The associated interactions of expatriate executives with local entities can extend to employees, suppliers, customers, competitors, and the government (Gao, 2003). Indeed, the sharing of religion is an essential categorical factor for establishing social networks. Therefore, the importance of religious-based social networks lies in their intermediation between expatriate executives and local agents to facilitate the exchange and sharing of the most relevant information to streamline economic operations linked to buying, selling, and acquiring information. All these assets reduce foreignness liabilities.

We can argue that the religious proximity as a determinant of internalization could be approached by the OLI paradigm introduced by Dunning (1988), where the author claims that socio-cultural and institutional factors constitute elements of specific advantages of host countries (Location) that maximize firm-specific advantages (Ownership). The OLI paradigm explains a firm internationalization by considering different determinants of FDI location choice. In other words, making a successful internalization (I) requires finding a country (Location) having advantages that allow the MNE to maximize its specific advantages (Ownership). To identify location-specific advantages to location, Dunning (1988) proposed a paradigm called “Environment-Systems-Policies” (ESP). On the one hand, “Systems” refers to social and cultural factors within host economies that may attract FDI.

As the research topic deals with the religion factor, we could say that religion is one of the socio-cultural factors that widen foreignness liabilities. Hence, we consider the religious similarity between the host country and the home country as a comparative advantage by reducing market imperfections: a small religious distance reduces transaction costs caused by differences in social norms, business climate, information asymmetries, and reduces market risks related to consumer’s choices and behavior. On the other hand, “Policies” refers to the institutional quality of host countries related to policies and good governance. Hence, we extend the understanding of the role of good institutional quality in FDI attractiveness by introducing good governance. Literature has recognized the effect of good governance on FDI attractiveness, which includes specific indicators such as corruption index, country-risk, freedom of speech, the rule of law, freedom of thought, political stability (Wei, 2000; Schneider et al., 1985).

3. The Effect of Religious Similarity on FDI Location Choice: Literature Review

Based on the theoretical framework discussed above, we present a conceptual framework to build a relationship between religious factors and FDI as follows.

The main hypothesis claims that there is an effect of religious bias on the location of FDI by arguing that the religious similarity between the country of origin and the host country explains the level of FDI and bilateral trade. Guiso et al. (2009) show that the impact of religious distance is more significant when it comes to differentiated goods because trans-border operations are more sensitive to trust than to homogeneous goods. The authors interpret this as evidence that the effect of religious proximity on economic exchanges occurs by the medium of bilateral trust. In other words, the role of the religious similarity between two countries in the success of the internationalization of the MNE depends on the nature of the underlying goods of the economic transactions: the religious distance is not significant in the case of the homogeneity of goods and consequential in the case of the heterogeneity of goods.

Shared religion generates trust as a mediating variable:

Researchers in the disciplinary field of sociology consider that religion, like culture, is a powerful vehicle for transmitting values and behavioral norms specific to a group of believers in a given society and which are deeply supported by the faith of these believers convinced in its sacredness.

Therefore, sharing the same religion with a counterpart generates trust as an essential condition for economic cooperation. Although the mediating role that trust plays between religious proximity and economic cooperation is addressed sufficiently by theory, empirical analysis suffers from the difficulty of asserting such a hypothesis because of the absence of reliable data on the levels of bilateral trust between religious counterparts. Nevertheless, Guiso et al. (2009), as the first to deal with the issue empirically, used the responses collected from surveys to calculate a matrix of bilateral trust levels for 18 European countries. They concluded that sharing the same religion between two countries generates trust like in the case of Spain and Italy, and subsequently, they found that trust has a positive effect on the volumes of economic transactions between the peer countries.

The quality role of formal institutions in the impact of religion on trust as a moderating variable: According to the theory of institutions, what distinguishes legal norms (formal institutions) from cultural or religious norms (informal institutions) is that failure to comply with legal rules systematically involves recourse to the judicial system. Therefore, the proper execution of laws encourages the attractiveness of FDI following the literature mentioned in the section above. In other words, the low quality of formal institutions in the host country is a deterrent to FDI. Moreover, according to Geif (1994), the sharing of the same religious and behavioral norms between two partner countries promotes trust and cooperation between them, and for this purpose, the religious similarity becomes a catalyst for trust and attraction of FDI. Otherwise, the trust can occur even if the partner countries are religiously and culturally distanced. That would happen under the premise that establishment of a functioning formal institution requires engaging very high costs (fixed and variable), a high institutional quality mitigates the illicit behaviors of economic agents (parasitism, patronage, opportunism, corruption), generates trust and strengthens economic cooperation between partner countries. In other words, the contribution of religious and cultural similarity becomes minimal and insignificant when the host country has good governance and strong institutions. Therefore, the difference in institutional quality between FDI receiving countries explains the divergence in the impact of religious proximity on trust, and hence, the level of FDI received. In other words, religious similarity only promoted economic cooperation when the partner country suffered from failed formal institutions.

Conversely, religious similarity does not affect economic relations when the partner country has good formal institutions. Empirically, using GDP per capita as a proxy variable for the effectiveness of public institutions, Guo (2004) studied the case of the United States and China and found that religious similarity with their partner countries becomes less important when the GDP per capita is high. Hergueux (2012) analyzed data on the stock of bilateral FDI between 27 countries of origin and 190 host countries between 2006 and 2008. He found that religious, colonial, and linguistic proximity positively impacts FDI. Furthermore, the combined effect of rule of law/corruption and religious similarity discourages FDI.

4. Research Design and Methodology

4.1. Sample Description and Data Sources

The empirical study works on the panel data of 54 host countries1 during the period 2007–2020. The sample selection is due to the significance of foreign investment of Moroccan firms in those countries. Therefore, those absent from the data are because the investment within them is too non-significant to consider.

We collected data on foreign direct investment from Office des Changes2. We withdrew data on the percentage of Muslim population from the database of Pew Research Center3. The data on other explanatory and control variables (tariffs, comparative advantages, human capital index, doing business, institutional quality) are taken from World Integrated Trade Solution (WITS)4 and the World Bank5.

4.2. Description of Variables

4.2.1. Main variables

According to our research topic, we aim to identify the role of religious proximity on the location decision of Moroccan firms in host countries. Therefore, foreign direct investment (FDI) is the practical proxy variable usually used when dealing with this research topic on internationalization and multinational corporation. Particularly, the variable used for the empirical analysis is the flow of outward FDI of Moroccan transnationals.

For the main explanatory variable related to religious proximity, we use the main dominant religion of Morocco: Islam. Therefore, we measure the religious distance/proximity by the percentage of the Muslim population living in the host country.

4.2.2. Control variables

Our data on Moroccan FDI are mixed and do not distinguish between vertical and horizontal foreign direct investment, which leads us to use the knowledge-capital model (KCM) introduced by Carr et al. (2001). That conceptual model aims to identify the type of FDI by computing other location factors of FDI: trade tariffs, market size, distance, and factor endowment. In other words, location factors explain the type of FDI. According to the knowledge-capital model, horizontal FDI is affected positively by market size, tariffs, and geographical distance. The vertical FDI is affected negatively by distance and tariffs, and positively impacted by input endowment.

The control variables included in the empirical model are described in Table 1.

Table 1

Description of Control Variables

|

Variable |

Description |

|

Distance variable |

It is the geographical direct linear distance between the centers of mass (or center of gravity) of the host countries and Morocco in km. |

|

Revealed comparative advantage |

Based on the Ricardian trade model, it indicates the competitiveness of a country that has on other countries in terms of factor endowment. The revealed comparative advantage is the exports share of a product in the total exports of a given country divided by the exports share of the product in the total exports of a zone reference. |

|

Weighted average tariffs effectively applied |

The average of effectively applied rates weighted by the product import shares corresponding to each partner host country |

|

Gross Domestic Product |

It indicates the sum of gross value added, at purchaser’s prices, by all resident producers in the economy plus any product taxes and minus any subsidies not included in the value of the products. It is used as a proxy for market size. |

|

Human capital index |

It measures labor productivity based on health and education systems. In other words, it indicates the productivity as a future worker of a child born today relative to the benchmark of full health and complete education. This global index score ranges from 0 for the worst human capital to 1 for the best human capital. |

|

Ease of doing business |

The simple average of all sub-indicators of doing business: starting a business, dealing with construction permits, getting electricity, getting credit, protecting minority investors, registering property, paying taxes, trading across borders, resolving insolvency and enforcing contracts. It ranges from 0 for the worst business climate to 100 for the best business climate. |

|

Institutional quality |

We use the rule of law index as a proxy for the institutional quality, which reflects “perceptions of the extent to which agents have confidence in and abide by the rules of society, and in particular the quality of contract enforcement, property rights, the police, and the courts, as well as the likelihood of crime and violence”. This index is ranged between -2.5 for the weakest rule of law and 2.5 for the strongest rule of law. |

4.3. Empirical Model

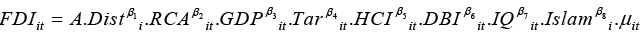

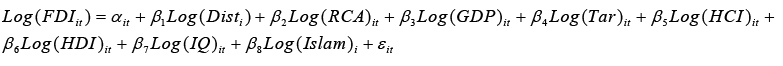

To identify the effect of religious proximity on the FDI location decision, inspired by the work of Hergueux (2012) and Carr et al. (2001), we formulate the empirical model as follows:

The logarithmic transformation gives:

where FDIit denotes the flow of outward Moroccan FDI in millions of USD into host country i in year t; Disti denotes the geographical distance in km between Morocco and the host country I; RCAit indicates the revealed comparative advantage of country i in year t; GDPit denotes the gross domestic product in the current USD in host country i in year t; Tarit indicates the weighted average tariffs effectively applied on Morocco exports by host country i in year t; HCIit indicates the human capital index of country i in year t; DBIit indicates the ease of doing business score of country i in year t; IQit indicates the institutional quality of country i in year t; Islami indicates the percentage of the Muslim population living in country i; αit denotes the specific fixed effect of each country to control for the omitted factors relatively stable over time, and εit is the normally distributed error term.

The main hypothesis is that the higher the percentage of the Muslim population living in the host country, the more FDI is attracted to this territory.

4.4. Estimation Method

We use the Robust Weighted Least Squares (RWLS) estimation method because the Ordinary Least Squares (OLS) estimation methods are much less robust under the existence of observations outside the norm for the regression model which are called the outliers. Those outliers would not accurately reflect the underlying statistical association between the dependent and explanatory variables. In other words, outliers tend to pull the least squares estimators fit too far in their direction by receiving much more weight than they deserve.

The ordinary least squares estimation methods assume that the weight attached to each observation is supposed to be on average 1/n in a data set with n observations. However, the outliers may receive considerably more weight than other observations, which leads to distorted estimates of the regression coefficients. This distortion results in outliers that are difficult to identify since their residuals are much smaller than they would otherwise be (if the distortion was not present).

Therefore, the estimators of Robust Weighted Least Squares reduce the influence of these outliers to provide more robust data by down-weighting them, which makes their residuals larger and easier to identify. In our paper, we use the M-estimation technique introduced by Huber (1973), which addresses the outliers of the dependent variable, where there are large residuals because its values differ noticeably from the regression model norm. Subsequently, Robust Weighted Least Squares (RWLS) provide an alternative to other least squares estimation methods by requiring less restrictive assumptions regarding normality and homoscedasticity using the Welsch function as the best of other weight functions (Yulita et al., 2018).

5. Results and Discussion

Before presenting the estimation of the empirical model, Table 2 presents the descriptive statistics of all variables as follows:

Table 2

Descriptive Statistic of the Variables

|

Variables |

Mean |

Median |

Maximum |

Minimum |

Std. Dev. |

N of Observations |

Jarque-Bera statistic |

|

FDI |

68.64333 |

0.000000 |

883.8000 |

0.000000 |

194.7454 |

30 |

168.7167*** |

|

Dist |

6428.493 |

3578.650 |

71658.00 |

1209.000 |

12555.59 |

30 |

781.1044*** |

|

RCA |

138.4333 |

145.0000 |

171.0000 |

73.00000 |

29.55146 |

30 |

2.741593 |

|

GDP |

4.92x1011 |

1.08x1011 |

3.40 x1012 |

3.43 x109 |

8.65x1011 |

30 |

45.76841*** |

|

Tar |

5.960514 |

2.062306 |

22.54637 |

0.000000 |

6.507388 |

30 |

4.594034 |

|

HCI |

0.597392 |

0.641635 |

0.847186 |

0.303838 |

0.177201 |

30 |

3.257181 |

|

DBI |

63.47333 |

67.05000 |

88.10000 |

38.40000 |

15.72323 |

30 |

2.591173 |

|

IQ |

0.615843 |

0.855343 |

2.241065 |

-1.389122 |

1.185031 |

30 |

2.777774 |

|

Islam |

0.261250 |

0.080000 |

0.990000 |

0.001000 |

0.328987 |

30 |

7.934022** |

Note. ***, **, * indicate the significance level at 1%, 5% and 10% respectively.

The mean and the median of the variables FDI, Dist, GDP and Islam are notably far apart, which indicates the non-random distribution of these variables. In addition, Jarque-Bera’s statistic confirms the observation by rejecting the null hypothesis that the variables are distributed randomly at the significance level of 1% for the variables FDI, Dist, GDP and at the significance level of 5% for the variable Islam. Those results indicate that we need the estimation method of RWLS that deals with normality issues besides heteroscedasticity. In addition, the minimum value of some variables is inferior to 1, which leads to a technical issue when conducting logarithmic transformation. Thus, we add +1 to the observations when transforming FDI, Tar, HCI, Islam, and + 2 to IQ, so all the values are superior to 1.

The second step prior to the interpretation of the empirical estimations is to check the strength of the model and its significance. Firstly, we test the heteroscedasticity, which is the main bias that the model encounters regarding spurious regression. As explained in the previous section, the RWLS method allows us to produce unbiased estimators and to rely on the results under the heteroscedasticity issues. In other words, heteroscedasticity increases the variance of the coefficient estimates, which could falsely declare them statistically significant or insignificant. Hence, to reduce estimations issues related to heteroscedasticity, we use weighted data, within the framework of RWLS, by assigning a proper weight to each observation based on the variance of its fitted value. In other words, RWLS gives small weights to outliers with higher variance to shrink their squared residuals.

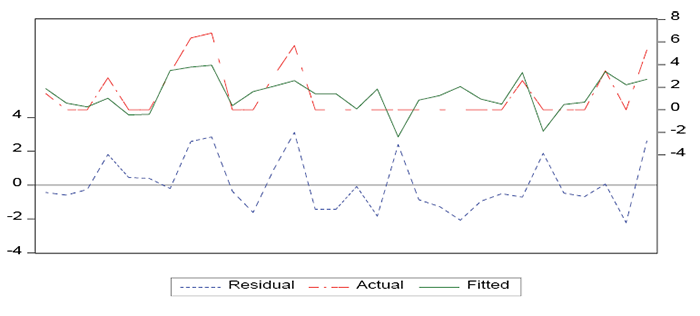

Practically, the detection of the heteroscedasticity is conducted by observing the residual, actual, and fitted. So, when there is an unequal scatter of residuals or error terms, it indicates a systematic change in their spear over the range of measured values as presented in Figure 1.

Figure 1

Scatterplot of Residual, Actual, and Fitted Values of the Dependent Variable

We notice how the residuals spread randomly, which means that they are distributed normally. Thus, this confirms the absence of heteroscedasticity and autocorrelation in the model. In addition, the actual and fitted values of Log(FDI+1) are aligned with each other. Therefore, it indicates the robustness of the model and how much it fits well the observed data. In addition, we use the correlogram and Q-statistic to check if there is the presence of auto-correlation between residuals as presented in Table 3.

Table 3

Q-statistic Results

|

Lag specification |

AC |

PAC |

Q statistic |

P-value |

|

1 |

0.077 |

0.077 |

0.1951 |

0.659 |

|

2 |

-0.027 |

-0.033 |

0.2199 |

0.896 |

|

3 |

-0.137 |

-0.133 |

0.8832 |

0.829 |

|

4 |

0.079 |

0.101 |

1.1143 |

0.892 |

|

5 |

0.011 |

-0.011 |

1.1187 |

0.952 |

|

6 |

0.056 |

0.043 |

1.2449 |

0.975 |

|

7 |

-0.024 |

-0.008 |

1.2688 |

0.989 |

|

8 |

-0.068 |

-0.074 |

1.4682 |

0.993 |

|

9 |

-0.020 |

0.006 |

1.4857 |

0.997 |

|

10 |

0.040 |

0.026 |

1.5613 |

0.999 |

|

11 |

-0.041 |

-0.065 |

1.6443 |

0.999 |

|

12 |

0.120 |

0.145 |

2.4083 |

0.998 |

|

13 |

-0.050 |

-0.071 |

2.5515 |

0.999 |

|

14 |

0.089 |

0.099 |

3.0285 |

0.999 |

|

15 |

-0.008 |

0.016 |

3.0330 |

1.000 |

|

16 |

0.028 |

-0.021 |

3.0876 |

1.000 |

The results show that for all lag specifications, the Q statistics are non-significant by not rejecting the null hypothesis that there is no autocorrelation of errors. This confirms the previous finding that the distribution of residuals is random. Now, we investigate the normality assumption as presented in Table 4.

Table 4

Normality Tests

|

Mean |

Median |

Maximum |

Minimum |

Skewness |

Kurtosis |

Jarque-Bera |

Probability |

|

0.038146 |

-0.397588 |

3.115370 |

-2.216318 |

0.629540 |

2.285737 |

2.619318 |

0.269912 |

According to the Jarque-Bera test, we cannot reject the null hypothesis that the residuals are normally distributed. In particular, the value of Skewness indicates that the probability distribution of errors is asymmetrical, which confirms the random distribution of error terms, and the value of the Kurtosis statistic equals 2.28, which indicates that the distribution is leptokurtic.

The last assumption is that there is no collinearity between the predictors, i. e., explanatory variables, because it makes their coefficients less exact, creates overfitting problems and causes estimation biases. Thus, highly correlated explanatory variables make it difficult to select the variables for the model because changing explanatory variables could affect the value of coefficients: it is not easy to interpret the unstable coefficient that changes each time we add a predictor. Thus, checking multicollinearity allows for avoiding such estimation biases. The simplest method is the plot correlation matrix of all independent variables as presented in Table 5.

After plotting the correlation matrix, we can see the pairwise correlation between all the independent variables. The results show that there is some significant correlation between the explanatory variables, which indicates the possibility of collinearity between these variables.

Table 5

Coefficient Correlation Matrix

|

Variables |

Dist |

RCA |

GDP |

Tar |

HCI |

DB |

IQ |

Islam |

|

Dist |

-0.184 |

-0.161 |

-0.031 |

-0.010 |

0.046 |

-0.029 |

0.250 |

-0.184 |

|

RCA |

1.000 |

0.555 |

-0.589 |

0.802 |

0.791 |

0.776 |

-0.279 |

1.000 |

|

GDP |

0.555 |

1.000 |

-0.340 |

0.495 |

0.450 |

0.431 |

-0.323 |

0.555 |

|

Tar |

-0.589 |

-0.340 |

1.000 |

-0.703 |

-0.687 |

-0.655 |

0.098 |

-0.589 |

|

HCI |

0.802 |

0.495 |

-0.703 |

1.000 |

0.946 |

0.961 |

-0.429 |

0.802 |

|

DB |

0.791 |

0.450 |

-0.687 |

0.946 |

1.000 |

0.951 |

-0.330 |

0.791 |

|

IQ |

0.776 |

0.431 |

-0.655 |

0.961 |

0.951 |

1.000 |

-0.391 |

0.776 |

|

Islam |

-0.279 |

-0.323 |

0.098 |

-0.429 |

-0.330 |

-0.391 |

1.000 |

-0.279 |

Table 6

The Effect of Religious Proximity on Outward FDI from Morocco

|

Variables |

Coefficient |

Std. error |

Z-statistic |

|

C |

-18.85345*** |

2.049067 |

-9.200995 |

|

Log(Dist) |

-0.160151** |

0.066757 |

-2.399009 |

|

Log(RCA) |

5.658779*** |

0.357918 |

15.81028 |

|

Log(GDP) |

0.248425*** |

0.044893 |

5.533673 |

|

Log(Tar) |

1.065335*** |

0.057991 |

18.37065 |

|

Log(HCI) |

19.61665*** |

1.477639 |

13.27567 |

|

Log(DBI) |

-5.030602*** |

0.655336 |

-7.676365 |

|

Log(IQ) |

-3.526135*** |

0.225402 |

-15.64378 |

|

Log(Islam) |

2.038966*** |

0.213036 |

9.570989 |

|

R2 |

0.411655 |

||

|

Adjusted R2 |

0.18724 |

||

|

Rw2 |

0.502850 |

||

|

Adjusted Rw2 |

0.502850 |

||

|

Sample |

1756 |

||

|

Included Observations |

30 |

||

|

Rn2 statistic |

1540.735*** |

||

Note. ***, **, * indicate the significance level at 1%, 5% and 10% respectively. Estimation method: RWLS with M-estimate. The covariance type for the estimate is the Huber type with Welsch function for the weight. Scale used is Huber. The dependent variable is Log(FDI). In order to avoid estimation error due to non positive and zero values, we transform some variable as follows: Log(FDI+1), Log(Tar+1); Log(HCI+1), Log(IQ+2) and Log(Islam+1).

Source: the authors’ estimates.

Table 6 summarizes the empirical results of the estimated model using the RWLS method. After checking the robustness of the model regarding normality, heteroscedasticity, autocorrelation, and multicollinearity, we proceed to interpret the empirical results as follows: Islam being the official and the dominant religion in Morocco, the estimates show that sharing the Islamic religion between Morocco and host countries is an FDI location factor. In particular, the variable Islam positively affects Moroccan FDI at the significance level of 1%. In other words, an increase of 1% in the Muslim population of the host country leads to an increase in FDI outflows from Morocco by 2.04 %. Therefore, having Islam as a common religion makes it easier for MNE to adapt to the host economy due to cultural proximity, which confirms the study of Hergueux (2012).

Furthermore, it seems that the Moroccan outward FDI is mostly horizontal because the estimations show that the GDP, human capital, tariff, and RCA positively affect FDI at the significance level of 1%, where an increase of 1% in their value causes an increase in Moroccan FDI by 0.24%, 19.61%, 1.06 %, and 5.65 % respectively.

5. Conclusion

This paper has, essentially, examined the effect of religious proximity as a factor of psychic distance on Moroccan outward FDI using panel data of 54 host countries during the period 2007–2020, and using a gravity model to measure the sensitivity of the flows of these FDI to religious distance. We chose the percentage of Muslim population living in the host counties as the proxy of religious proximity.

As a result, we found that religious distance is indeed an obstacle to Moroccan MNEs as the percentage of the Muslim population in the host countries is different, thus confirming the main hypothesis. In other words, Ceteris Paribus, the host countries having larger Muslim population are more likely to receive FDI from Morocco than their counterparts that have lesser Muslim communities.

Given the above, the results of this study would make it possible to provide stakeholders, both at the level of the home and host country, with answers that will serve and guide the appropriate policies. In this sense, religious differences must be considered when investing abroad, particularly concerning the alignment of inward and outward FDI strategies with their religious ones to take advantage of these FDI.

At the managerial level, MNEs must consider the religious factor when they decide to invest elsewhere, either by recruiting employees with different religious background or by providing training in local religions for their staff without having to resort to mediators or other services to internalize transaction costs when the religion in the host country is different from those of the source country. Also, learning about some global religions makes it possible to multiply investment opportunities, either concerning the attractiveness of FDI or in the opposite direction.

Indeed, the strengthening of religious capacities gives a MNE more flexibility regarding the choice of location of their activities abroad. Thus, these capacities would constitute an advantage for the firm and make it more competitive internationally. In addition, domestic companies wishing to attract FDI from countries whose official religions are different from those adopted in the host country can adopt religious strategies accompanied by public-private partnerships to integrate global religions or religions practiced in the target countries to attract the attention of FDI, which could see their transaction costs reduced.

Regarding the policy implications related to outward FDI, public officials can establish a liaison office in the host country to support MNEs during their activity and facilitate their internationalization process. At the host country level, the attractiveness of inward FDI requires the adaptation of incentive measures in favor of potential MNEs, by coordinating local religion policies with those relating to investments, as well as the integration of the other religions in the education system. In addition, given that religion is associated with culture, public decision-makers must consider the establishment of cultural institutes or religion education centers in the target host countries, which could be advantageous for MNEs wishing to invest in these countries.

The limitation of our paper is that it uses macroeconomic data to test the effect of religion on FDI location choice, which limits our understanding of the mechanisms leading to investment based on the religious factor. The firm-level analysis would enrich the results that could be undertaken in future projects.

References

Carr, D. L., Markusen, J. R., & Maskus, K. E. (2001). Estimating the Knowledge-Capital Model of the Multinational Enterprise. American Economic Review, 91(3), 693–708.

Dunning, J. H. (1988). The Eclectic Paradigm of International Production: A Restatement and Some Possible Extensions. Journal of International Business Studies, 19, 1–31.

Fan., S. X., Cregan, C., Harzing, A. W., & Kohler, T. (2017). The Benefits of Being Understood: The Role of Ethnic Identity Confirmation in Knowledge Acquisition by Expatriates. Human Resource Management, 57(1), 327–339.

Gao, T. (2003). Ethnic Chinese networks and international investment: Evidence from inward FDI in China. Journal of Asian Economics, 14(4), 611–629.

Ghemawat, P. (2001). Distance Still Matters, The Hard Reality of Global Expansion. Harvard Business Review, 79(8), 137–147.

Greif, A. (1994). Cultural Beliefs and the Organization of Society: A Historical and Theoretical Reflection on Collectivist and Individualist Societies. Journal of Political Economy, 102(5), 912–950.

Guiso, L., Sapienza, P., & Zingales, L. (2009). Cultural Biases in Economic Exchanges? Quarterly Journal of Economics, 124(3), 1095–1131.

Guo, R. (2004). How Culture Influences Foreign Trade: Evidence from the U.S. and China. The Journal of Socio-Economics, 33, 785–812.

Hergueux, J. (2012). How does Religion Bias the Allocation of Foreign Direct Investment? The Role of Institutions. University of de Strasbourg, Working paper n° 2012-06.

Hymer, S. H. (1976). The international operations of national firms: A study of direct foreign investment (Ph.D.Thesis). Massachusetts Institute of Technology, Department of Economics.

Johanson, J., & Mattsson, L.G. (1988). Internationalization in Industrial Systems—A Network Approach. In N. Hood & J.Vahlne (Eds.), Strategies in Global Competition (pp. 287-314). Croom Helm, New York.

Johanson, J., & Vahlne, J. E. (1977). The Internationalization Process of the Firm: A Model of Knowledge Development and Increasing Foreign Market Commitments. Journal of International Business Studies, 8, 23–32.

Makela, K., Andersson, U., & Seppala, T. (2012). Interpersonal similarity and knowledge sharing within multinational organizations. International Business Review, 21(3), 439–451.

Schneider, F. & Frey, B. S. (1985). Economic and Political Determinants of Foreign Direct Investment. World Development, 13(2), 161–175.

Toumi, S. (2009). Facteurs d’attractivité des investissements directs étrangers en Tunisie. L’Actualité économique, 85(2), 209–37.

Weber, M. (1904). The Protestant Ethic and the Spirit of Capitalism. London: Unwin.

Wei, S. J. (2000). How Taxing is Corruption on International Investors? Review of Economics and Statistics, 82(1), 1–11. https://www.oc.gov.ma/fr/etudes-et-statistiques/series-statistiques

1 The sample countries are Algeria, Germany, Andorra, Saudi Arabia, Austria, Bahrain, Belgium, Benin, Brazil, Burkina Faso, Cameroon, Congo, Ivory Coast, Denmark, Egypt, United Arab Emirates, Spain, United States, France, Gabon, Ghana, Great Britain, Guinea, Guinea-Bissau, India, Jordan, Kenya, Kuwait, Lebanon, Luxembourg, Madagascar, Mali, Malta, Mauritius, Mauritania, Monaco, Niger, Nigeria, Norway, Uganda, Netherlands, Portugal, Qatar, Central African Republic, Democratic Republic of Congo, Rwanda, Senegal, Singapore, Slovakia, Sweden, Switzerland, Tanzania, Chad, Togo and Tunisia.

2 https://www.oc.gov.ma/fr/etudes-et-statistiques/series-statistiques

3 https://www.pewresearch.org/

4 https://wits.worldbank.org/

5 https://data.worldbank.org/