Organizations and Markets in Emerging Economies ISSN 2029-4581 eISSN 2345-0037

2023, vol. 14, no. 3(29), pp. 670–695 DOI: https://doi.org/10.15388/omee.2023.14.10

The Linkage Between Fiscal Policy and Financial Development: Exploring the Moderating Role of Institutional Quality in Emerging Economies

Charles K. Ricky Okine

Koforidua Technical University, Ghana

charles.ricky7@ktu.edu.gh

Michael Appiah (corresponding author)

University of Dubai, United Arab Emirate

appiahjunior@yahoo.com / mappiah@ud.ac.ae

https://orcid.org/0000-0001-9314-4908

Derrick Tetteh

University of Cape Coast, Ghana

dorscon2017@gmail.com

Abstract. This paper investigates the role of fiscal policy on financial development in Sub-Saharan African economies, drawing on a sample of 23 countries from 2000 to 2021 using the panel ARDL method after evidencing stationarity and co-integration properties among the variables. Our results show that an increase in fiscal policy and institutional quality decreases financial development in the long run. An increase in taxation and expenditure by the government affects the development of finance in SSA countries. Our results also show that an increase in foreign capital and industrial growth increases financial development in the long term. The outcome evidence that the interaction between fiscal policy and institutional quality exhibits a positive effect on financial development. Causality results reveal no directional link between fiscal policy, foreign capital, industrialization, and financial development with institutional quality indicating a single direction. The study suggested that SSA countries should focus on developing policies to track the implementation of adequate fiscal policy systems and structures. Institutional coherence within and between SSA nations is required for efficient fiscal policy development.

Keywords: fiscal policy, financial development, institutional quality, panel ARDL, emerging economies

Received: 15/9/2022. Accepted: 6/7/2023

Copyright © 2023 Charles K. Ricky Okine, Michael Appiah , Derrick Tetteh. Published by Vilnius University Press. This is an Open Access article distributed under the terms of the Creative Commons Attribution Licence, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

Introduction

Financial instability was a major contributor to the recent economic crisis that began in 2007 (Neaime & Gaysset, 2018; Park, 2015). Due to the losses in the mortgage market brought on by the U.S. housing bubble bust, there was significant upheaval in the financial sector, and the global economy experienced a severe economic downturn (Blickle et al., 2019). Many nations around the world used unprecedented fiscal measures to emerge from the economic crisis. The budgetary fortunes of many industrial countries, however, have become worse because of the huge fiscal stimulus programs and the slowly following recovery. In recent years, many developing country governments have lowered their external debt and relied more on local funding, which is frequently regarded as preferable to riskier external debt (Eichengreen et al., 2005). However, the swift increase in domestic bank borrowing by numerous governments raises the issue of the policy trade-offs involved if it were to adversely influence financial development, which has been demonstrated in the literature to be connected to poorer growth and heightened macro risks (Loayza et al., 2018).

Fiscal policy has the potential to be beneficial in boosting aggregate demand and reviving a sluggish economy, according to one of the fundamental principles of macroeconomics (Munir & Riaz, 2019; Munir et al., 2019). The possible impact of fiscal policy on the growth of the financial sector is a neglected issue, nevertheless. Most often, it has been connected to the benefits of government debt for growing financial sectors (Chung-Yee et al., 2020). On the downside, it is well known that financial repression and inflation, which are harmful to financial development and growth (Chen & Sivakumar, 2021; Kitenge & Bashir, 2022), frequently have their roots in the fiscal needs of governments (Cato & Terrones, 2005; Imran & Sial, 2022). Interestingly, fiscal policy variables have frequently emerged as significant in analyses of the determinants of financial depth, despite the prominence of the “safe asset” hypothesis on the one hand and the “crowding out” hypothesis on the other. Fiscal policy is often used by governments to encourage robust, long-term growth and to lower poverty. During the recent global economic crisis, when governments intervened to stabilize financial institutions, spur growth, and lessen the crisis’s effects on vulnerable individuals, the function and goals of fiscal policy rose to prominence (see Adelowokan, 2021; Skott, 2021) in influencing various macroeconomic indicators. The research includes the connection between fiscal policy and growth (Matallah & Matallah, 2017; Nabieu et al., 2021; Ubi-Abai & Ekere, 2018), the financial market (Akitoby & Stratmann, 2008; Dumičić, 2019; Marfatia et al., 2020; Tagkalakis, 2011), and the environment (Akbar et al., 2021; Kamal et al., 2021; Katircioglu & Katircioglu, 2018; Yuelan et al., 2019). Studies have also looked into the relationship between several other variables and fiscal policy. This study involves Munir and Riaz (2019), who found that monetary and fiscal policies in the sub-region had a favorable impact on economic growth. Rodriguez (2014) evidenced that lower mean growth will come from higher volatility in a credit-constrained economy, especially if the fiscal policy is pro-cyclical and the country is less developed financially.

There is a general agreement among economists that public policies, such as fiscal and monetary policies, either interact together or interact individually to affect the level of economic activities. However, there have been a series of contentions by the Keynesians and the Monetarists on the degree and relative importance of these policies. This study is not to resolve the fiscal-monetary policy debate, but to examine the effects of fiscal policies in propelling financial development in sub-Sahara African economies. Moreover, the recent recession has put to test the efficacy of fiscal policy and how these policies interact with other macroeconomic indicators to propel financial development. Every economy aspires to be great. The governments of these economies make earnest efforts to formulate and implement macroeconomic policies that are efficient with substantial and tolerable degrees of equity or fairness. These acts do not just stimulate their economies but fulfill the critical obligation of improving the lives of citizens. The most important macroeconomic policy option governments have embarked on over the years is fiscal policy.

Nevertheless, a growing body of research—primarily from industrialized nations—indicates that there are some situations in which expansionary fiscal policy is ineffective in rescuing an economy from a downturn (Bonam & Lukkezen, 2019). The effect of more public sector expenditure or tax cuts on aggregate demand may be offset by lower private-sector investment and consumption, especially when levels of public debt are already high (Tavani & Zamparelli, 2017). Numerous OECD country studies have demonstrated that when the level of public debt is large and unsustainable, decreasing fiscal deficits can spur economic growth (Matallah & Matallah, 2017). Interest rates are often lowered because of less government borrowing to fund deficit spending, which promotes investment. The “wealth effect” stimulates private consumption and investment when interest rates are lower since they increase asset prices (Bui, 2020). Additionally, when deficits decrease, the private sector revises its projections of present and future tax liabilities, boosting investment and consumption even more (Appiah, Gyamfi et al., 2022). While fiscal tightening accomplished by raising taxes and reducing public investment typically results in contractionary and unsustainable outcomes, fiscal tightening accomplished primarily by reducing subsidies, transfers (such as pensions), and the government wage bill typically lasts longer and can be expansionary (Sindani, 2020).

As the economy strengthens, governments will start to reduce the massive fiscal stimulus packages and financial sector assistance programs as their attention will shift to the sustainability of their budgetary positions. Asset values have begun to rise in anticipation of the anticipated economic recovery (see Nordström & Laiho, 2022), which helps to bolster public budgets by increasing income. However, given that uncertainty is still high, and that the recovery might happen more gradually than anticipated, this might have a substantial impact on asset markets and asset prices in terms of volatility, which would negatively impact fiscal balances and the drive to consolidate the budget. Short-term fiscal policies are typically designed to stabilize economic activity. Fiscal policy is often a beneficial aspect of economic cycles (Matallah & Matallah, 2017). For instance, given gaps in aggregate demand, government spending is required to bolster real economic activity or to distribute resources to those who are less fortunate (Sindani, 2020). In other words, an above-trend increase in government consumption expenditures could be a beneficial instrument to bolster the economy during “difficult times” (contraction) (Akitoby & Stratmann, 2008). The other side of the behavior, which is that during “good times” (expansion), government consumption expenditure should increase below the trend, is frequently overlooked. This is done both to create room by saving the extra money for future demand-side shock smoothing and as a mechanism to prevent overheating the economy (Akitoby & Stratmann, 2008). Although the study on fiscal policies has received a lot of attention, its focus is on the fulfillment of macro and microeconomic elements.

Munir et al. (2019) noted that financial expansion and income have a favorable effect on growth. Their findings suggest that to transform our institutions and financial sectors into well-organized, potent, and reliable frameworks, sound, strategic, and result-oriented policies should be developed. These changes will guarantee the effective and efficient use of savings. Canh (2018a) indicated that fiscal policy had a beneficial impact on growth across emerging markets during the periods under study. The study found that larger crowding-in impacts of fiscal policy are promoted by improved institutions (El-Shagi & Turcu, 2021). Studies from the past demonstrate the significance of fiscal policies in influencing and fostering economic growth. Some studies (Nabieu et al., 2021; Ofori-Abebrese et al., 2017; Shakil et al., 2018) demonstrated that fiscal policy is used to control aggregate demand levels in an economy to help achieve the desired economic objectives of total employment, stability of prices of goods and services, as well as the growth of the economy. However, little is known about how fiscal policy affects the development of the financial sector, which is the engine of economic growth within the country.

In light of this, the study seeks to close a knowledge vacuum by examining how fiscal policy decisions of Sub-Saharan countries affect financial development. As far as we are aware, hardly many researchers have looked specifically at how fiscal policies affect financial development. None of them have addressed emerging markets, notably SSA nations, where the issue is especially pertinent. The macroeconomic fundamentals influencing financial development have typically included a measure of the fiscal deficit. The budget deficit, however, may be a deceptive metric. For instance, financial development might slow down in the short term if the budget deficit rises because of public investment initiatives that promise substantial returns in the future. On the other hand, financial development can increase if the fiscal deficit widens because of rising government pay costs.

There are three ways in which this article adds to the body of literature. First, it incorporates fiscal policy into an empirical model of financial development utilizing a group of nations that haven’t previously been looked at to determine the relationship between fiscal policy and financial development. This enables us to examine how changes in public spending and revenue affect financial development and determine how the influx of foreign capital and industrialization affect the financial development of SSA countries. Second, if institutions play a role in the shaping of fiscal outcomes, it is important to consider whether fiscal factors interact with institutions to influence financial development. In this way, the study explores the institutions’ moderating influence on the relationship between fiscal policy and financial development. Third, we look into the causality between fiscal policy and financial development. In terms of methodology, the study used the panel autoregressive distributed lag (ARDL) to address the potential endogeneity and stationarity problems. This kind of model can be easily expanded to integrate panel data and can accept extremely general lag patterns.

The rest of this paper is organized as follows. Section 2 presents the literature. Section 3 describes the data, model, and methodology. Section 4 discusses the results. Section 5 concludes with suggestions for policy implications.

2. Literature Review

Every government changes its expenditure levels in relation to its revenue collection through the use of fiscal policy, which aims to both monitor and have a favorable impact on the economy of the country (Zhongming et al., 2018). According to economic literature, fiscal policy is a crucial and significant tool for influencing a nation’s overall demand (Skott, 2021). It is understood that variations in the levels, variations in timing, and variations in the makeup of government expenditure and taxation do have a big impact on how the economy is doing. By lowering inequalities, fiscal policy is a crucial tool that Developing Countries (DCs) can use to hasten their development process (Azzimonti et al., 2014), promote well-being (Davis & Summers, 2014; Stiglitz, 2015), and enhance economic growth (Sawadogo, 2020; Turrini et al., 2010). Any fiscal strategy must be sound if it is to be more effective in tackling these development concerns (Dabla-Norris et al., 2015; Hameed et al., 2021). The key to mobilizing financial resources in developing nations is debt management and stable state finances (Reinhart, 2010; Reinhart et al., 2003). The research has emphasized the importance of fiscal regulations in enhancing fiscal results (Corbacho & Schwartz, 2007; Debrun et al., 2009; Debrun et al., 2008). Only a few research papers, for instance, those by Afonso and Jalles (2013) and Thornton and Vasilakis (2017) have clarified the relationship between fiscal regulations and financial market entry in developing countries examining how fiscal regulations affect risk premiums in a diverse sample of developed and emerging nations. Depending on the nature of the economy, different fiscal regulations may have varied effects. Our paper is unique in that it adds to the field by examining the variability and interacting effects of fiscal policy and institutional quality on financial development in emerging nations.

The consequences of fiscal policy have been the subject of numerous earlier studies, particularly in developed nations like the USA, Japan, and the European Union (Zhongming et al., 2018). Afonso and Strauch (2007) recently discovered that in 2002, the European fiscal policy mostly caused market swap spreads to respond by five basis points or less. According to this, Kameda (2014b) reveals that real ten-year interest rates rise by 26 to 34 basis points in response to a percentage point increase in the forecast and actual deficit-to-GDP ratio and Japan’s primary-deficit-to-GDP ratios, both forecast and actual. According to Kameda (2014a), there is little doubt that the diffusion index of financial institution attitudes affects fiscal growth. In particular, when families are experiencing cash constraints and the fiscal situation is unfavorable, government spending has non-Keynesian consequences under the demand-enhancing effects. Bhattarai and Trzeciakiewicz (2017) analyzed the UK’s fiscal policies using a DSGE model. They observed that government consumption and investment have the strongest short-term GDP multipliers, whereas capital income taxes and public investment have a long-term crowding-out effect on GDP. Furthermore, they stressed that the fiscal policy has diminishing effects in the case of a small open economy. Kirchner and van Wijnbergen (2016) claim that if banks retain a significant amount of sovereign debt, the effectiveness of expansionary fiscal policies is compromised since, in this situation, deficit-financed fiscal expansions restrict private access to credit.

The Keynesian view of fiscal policy contends that using fiscal contraction by governments during recessionary times will not promote output recovery (Jawadi et al., 2016). Considering this claim, the significance of fiscal policy increases as interest rates approach their zero lower bound. An expansionary fiscal policy is a solution in this circumstance. According to studies, different nations’ responses to fiscal policies are dependent on their size of the government, the extent of financial development, the expansion of the economy (Easterly & Rebelo, 1993). Estmann et al. (2021) argued in their study that in order to determine the appropriate interest rate, governments should look at the impact that fiscal measures have on both inflation and aggregate demand. According to Anyanwu (1999), fiscal policy’s primary objective is to foster economic conditions that are beneficial to company growth while ensuring that every such government indicators of economic stability remain unchanged. In actuality, usage of a fiscal policy as a tool in the management of a nation’s economy is its most important aspect (Olawunmi & Ayinla, 2007). Budgets, which are used by governments to manage the economy rather than just the government sector, are the primary means through which fiscal policy is implemented. Adelowokan (2021) asserts and argues that financial instability is an issue in this regard, as there is evidence that public leaders failed to make sure there were enough resources available to support their objectives. Such circumstances cause financial crises, which impede economic growth.

Grágeda et al. (2016) used the framework of a new economic model, IS-MP-AS, to position the issues of fiscal policies and financial development on economic growth within the context of Asian countries. They emphasized Iran’s fiscal policies and how these strategies had improved Iran’s economic fortunes. The study found that GDP is inversely related to the ratio of the anticipated inflation rate and GDP to budget deficit. The oil revenue and the exchange rate were also discovered to be favorably correlated with GDP. Chadha et al. (2021) looked at the relationship between budgetary factors and economic growth in a different study, i.e., how these factors affect economic expansion. These findings supported past research that indicated the importance of fiscal policy for sustained economic expansion. The study also showed that the long-run effectiveness of fiscal policy outweighs the short-run influence. Research from Ouedraogo and Sourouema (2018) demonstrates that the procyclicality of fiscal policy, which is influenced by the behavior of public investment in sub-Saharan African nations, is increased when an export-oriented strategy is employed. In a different statement, Chien et al. (2022) contend that fiscal policy can exert a crowding-out effect on private investment in developing countries through the alteration of interest rates. This underscores the importance for governments in these nations to prioritize fiscal policy to foster growth in the financial sector.

Michau (2019) examined fiscal and monetary policy in a liquidity trap using persistent inflation. Based on the new Keynesian model with structural inflation persistence, the study concluded that inflation persistence provides a significant explanation for government spending in terms of fiscal policy. The study also concludes that monetary policy is very ineffective if adaptive expectations lead to inflation persistence and that the magnitude of the optimal fiscal stimulus decreases with inflation persistence. Accordingly, the optimal fiscal stimulus for an economy is large and heavily front-loaded. Despite the substantial empirical literature on the relationship between financial development and economic growth, and fiscal policy and economic growth, there is a dearth of knowledge about the effects in developing nations. This is especially true of the role fiscal policy plays in financial development, which serves as a catalyst for economic growth in developing economies like SSA. So, this study aims to explore this relationship in emerging nations, particularly SSA nations.

3. Data, Model, and Methodology

3.1 Data

The aim of doing research involving SSA countries is on the horizon. As a result, the goal of this research is to address a knowledge vacuum by exploring the implications of fiscal policy on financial development in a sample of 23 SSA nations with a time frame from 2000 to 2021. The countries south of the Sahara Desert are chosen as the research object for the following reasons: a) Countries in Sub-Saharan Africa have significant monetary policy difficulties. Economic growth was hampered by the 2008 financial crisis, and despite the recovery, financial decisions are probably going to be below the pre-crisis norm; b) Inflation has increased in a number of the region’s countries as well, which is a problem that is sometimes made worse by fiscal dominance brought on by high public debt levels; and etc.). As the major central banks in advanced economies remove policy stimulus and raise interest rates in the coming years, several of SSA economies may also experience capital outflows. The issues are anticipated to become even more difficult because of the economic effects of the ongoing crisis in Ukraine, notably the ensuing substantial increase in oil and food cost. The expansion of the size of financial system, its effectiveness, stability, and accessibility may be referred to as financial development. Financial development includes the growth of financial markets, financial instruments, and financial institutions. Financial development (FD), which is measured with the new IMF financial development index, which includes both financial institutions and financial markets, is the factor used to depict financial development as the dependent variable in the study; the use of taxation and expenditure by the government to affect the economy is known as fiscal policy. Fiscal policy is often used by governments to encourage robust, long-term growth and to lower poverty. During the recent global economic crisis, when governments intervened to stabilize financial institutions, spur growth, and lessen the crisis effects on vulnerable individuals, the function and goals of fiscal policy rose to prominence as the key independent variable. Other variables such as foreign capital, in the form of foreign direct investment (FDI), represents an investor from one country acquiring a substantial stake and control in a business situated in another nation. These investments evolve gradually and are quantified by measuring the net inflow of investments into a country. IQ stands for institutional quality, which encompasses the rule of law, individual rights, and excellent public services. The variable was measured by transparency, accountability, and corruption in the public sector, and industrialization signifies the period of social and economic change that transforms a human group from an agrarian society into an industrial society. This process entails a comprehensive restructuring of an economy with a focus on manufacturing. It is quantified by assessing the net production of a sector, which involves summing up all outputs and subtracting intermediate inputs. These measurements are included as control variables in the study. The African Development Bank (AfDB) provides fiscal policy statistics, while the International Monetary Fund (IMF) provides financial development data as employed by Appiah, Gyamfi et al. (2022). For the other variables, the World Bank was picked as the data source. The data period and nation were chosen depending on the availability of the data. The data and data sources used in the analysis are summarized in Table 1.

3.2 Empirical Model Specification

This research aims to determine how fiscal policy affects financial development considering the moderating role of institutional quality. Following the recommendation of Appiah, Frowne et al. (2020), the effects of industrial value-added and foreign capital were also considered. In this study, the empirical technique is based on the estimation of a simple equation connecting fiscal policy, institutions, and financial development in a panel data environment while adjusting for other exogenous factors. The studies of Hauner (2006) and Duramany-Lakkoh (2020) were applied to develop the approximated equation used in this investigation. The major regression model used in the estimation is as follows:

FDit= a+ β1FISit+ β2FCit +β3IQit+β4INDit+εit………. (1)

where a denotes the intercept, i is the country, and t denotes the time, with ε denoting the error term. The coefficients to be evaluated are β1....... β4. Model 1 was modified by the moderating effects of institutional quality, as shown in the following model. An interaction variable (FIS*IQ) is created as a result of the moderating effects.

FDit= a+β1FISit+β2FCit+β3IQit+β4INDit+(β5FISit*IQit) +εit…… (2)

where FD represents financial development, FIS denotes fiscal policy, and FC stands for foreign capital, with IQ and IND signifying institutional quality and industrialization, respectively.

3.3 Methodology

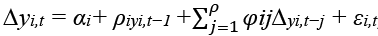

3.3.1 Panel Unit Root, Hausman Specification and Causality Test. To research the connection between fiscal policy and financial development, the study initially breaks down the stationary properties of the series by utilizing the first-generation test of the panel unit root (Pesaran et al., 1999). The study uses the first-generation test of the panel unit root developed by Levin et al. (2002), which offers more reliable results and avoids false results when compared to other unit root tests for small samples. Li, Appiah and Dodoo (2020) suggest that certain unit root tests for panel data lack consideration for variability in the autoregressive coefficient. The fundamental equation for the panel unit root tests for LLC is as follows:

i = 1, 2, ..., N; t = 1, 2, ..., T, …. (3)

i = 1, 2, ..., N; t = 1, 2, ..., T, …. (3)

where ∆yi,t represents each variable under discussion in the model. αi is the single fixed effect and p is designated for making the residuals uncorrelated above time with the null hypothesis stating that ρi = 0 and the alternative hypothesis, which also states that ρi < 0 for some i = 1, ..., N1 and ρi = 0 for i = N1 + 1, ..., N.

Hausman Specification

To select the best approach for the model, the Hausman Test is used. The hypothesis of homogeneity of the long-term policy parameter, as tested by Hausman (1978), cannot be accepted a priori. The Hausman-type test can be used to determine the effect of heterogeneity on the means of the coefficients. The PMG regressors are more efficient than the MG regressors when the parameters are homogeneous. In other words, under the null hypothesis, the efficient regressors such as PMG are preferred. Nonetheless, if the null hypothesis is rejected, the efficient estimator MG is accepted.

Causality Test

The study went on to investigate the relationship between the factors, particularly fiscal policy and financial development. According to Engle and Granger (1987), if two or more series of order one (1) are integrated and co-integrated, there may be at least one causal link in one direction. According to the Toda and Yamamoto (1995) test, the causality test is performed using the conventional Engle-Granger causality test approach. However, unlike Toda and Yamamoto (1995), Engle and Granger (1987) acknowledged causality using the Vector Error Correction (VECM) model, sparing residuals when comparing deviation from the equilibrium point of long-run co-integrating vectors.

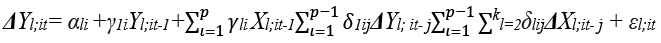

3.3.2 Panel ARDL Test. The panel ARDL method is chosen to research the long-term and short-term co-integration connections between the variables and concentrate on the ECM (error correction model) of the panel qualities to recognize the short-term dynamic. Likewise, substitute co-integration methods were utilized to achieve comparative findings, just like the conventional Johansen and Juselius (1990) techniques. Notwithstanding, the panel autoregressive distributed lag technique was favoured over co-integration in light of the extra advantages it gives. In spite of the fact that the customary co-integration approach evaluates the long-term connection inside the arrangement of equations in the unique circumstance, the panel ARDL approach utilizes an individual informed type of equation (Pesaran et al., 1999).

(4)

(4)

where Yl represents the dependent variable, Xl is the exogenous variable, as well as l = 1, 2, 3, 4, 5, 6, 7. εit is the error term, and Δ is the first difference operator. In the study, GDP is the dependent variable, the ARDL model is developed as follows:

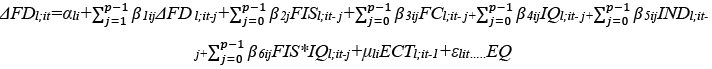

ΔFDl;it= αli+γ1iFDl;it-1+γ2iFISl;it-1+γ3i FCl;it-1+γ4iIQl;it-1+γ5iINDl;it-1+

γ6i FIS*IQl;it-1+γ7i +ΔFDl;it- j+∑kl=0δ2ijΔFISl;it- j+

∑kl=0δ3ijΔIQl;it- j+∑kl=0δ4ijΔINDl;it- j+∑kl=0δ5ijFIS*IQl;it- j+εl;it………..EQ (5)

The ARDL model ordering (ARDL(p,q)) selection is ARDL(1, 1, 1, 1, 1) based on the Akaike info criterion (AIC) model selection method.

According to Equation (5), the panel ARDL approach could be utilized with the concentrated factors paying little attention to whether they were I (0), I (1), or both I (0) and I (1) (Sulaiman et al., 2015). In Equation (6), when applying panel ARDL with various variables, it is important to note that different lags can be incorporated, but this may not align with the standard cointegration test. Additionally, utilizing panel ARDL, both long-term and short-term coefficients are given on the double (Sheng & Guo, 2016). In the end, the ARDL approach could be connected with confined simple data where the gathering of essential estimations was improved (Narayan & Narayan, 2005). In the second step, the study assumes that all variables are heterogeneous and such that the ECT estimations are suitable for the establishment of a long-run co-integration between fiscal policy and financial development. If the co-integration connections are set up, the long-term equation can be evaluated.

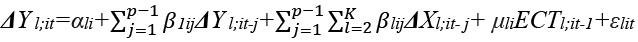

Error Correction Term Test

The short-term dynamic relationship error correction model (ECM) is evaluated. The ECM is characterized as follows:

(6)

(6)

with which the residuals εlit (l = 1, 2, 3, 4, 5, 6, 7) are independent and normally spread with the zero mean and constant variance and ECM l, it ‐ 1 (l = 1, 2, 3, 4, 5, 6,7) is the error correction term (ECT) well-defined by the long-term association. The parameter μli designates the speed of adjustment to the equilibrium level. On top of it all, GDP is the dependent variable; the ECM model is defined as follows:

(7)

(7)

3.3.3 Panel ARDL-PMG and MG Tests. As recently referenced, the estimators of the ARDL model and all parameters are realized utilizing the PMG technique, as established by Pesaran et al. (1999). This estimation system dependent on the maximum likelihood technique is considered the most predictable because it represents the individual characteristics (country, region, and so forth) and gives a superior assessment of the long-term relationship. In this manner, the PMG estimators acquired are asymptotically and normally conveyed, as expressed by Pesaran et al. (1999). While the MG (mean group) approach accounts for expected differences in coefficient heterogeneity, including adjustment parameter errors and variances in both the short and long term, the PMG approach acknowledges heterogeneity in the short-term coefficients, assuming that the long-term coefficients are uniform and consistent across all variables in the panel. The decision of such a system is particularly supported when there is motivation to trust that over the long term, homogeneity can be credited with the impact of various elements, for example, macroeconomic factors, financial development, and the fiscal policy that was available in all African countries in the study. Therefore, the study incorporates the hypothesis imposed by the PMG approach, stating that coefficients are the same for each country for long-term relationships.

Table 2

Descriptive and Correlation Statistics

|

|

FD |

FIS |

IQ |

IND |

FI |

|

Mean |

1.085667 |

3.466667 |

3.037198 |

5.652232 |

3.391448 |

|

Maximum |

3.530460 |

4.500000 |

4.500000 |

127.4461 |

40.16716 |

|

Minimum |

-0.034331 |

1.000000 |

1.500000 |

-75.04564 |

-5.208123 |

|

Std. Dev. |

0.722070 |

0.652292 |

0.702688 |

12.81752 |

6.157643 |

|

Skewness |

1.418771 |

-0.773329 |

-0.110600 |

3.366223 |

3.124667 |

|

Kurtosis |

4.609667 |

4.281761 |

2.637125 |

40.51487 |

13.86097 |

|

Jarque-Bera |

152.9884*** |

58.00402*** |

2.596238 |

20882.44*** |

2257.088*** |

|

Correlation |

|||||

|

FD |

1.0000 |

|

|

|

|

|

FIS |

-0.2951*** |

1.0000 |

|

|

|

|

IQ |

0.1815*** |

-0.0190 |

1.0000 |

|

|

|

IND |

-0.0238 |

0.0520 |

0.0772 |

1.0000 |

|

|

FI |

-0.0470 |

0.0136 |

-0.0330 |

-0.0123 |

1.0000 |

Note. ***, **, * signify 1, 5, 10% significance levels. FD=financial development, FIS=fiscal policy, FC=foreign capital, IQ=institutional quality and IND=industrialization.

Table 2 lists the descriptive and correlation measurements of variables. Finance has a mean estimate of 1.085667, with a min and max of -.0343314 and 3.53046, respectively. The sample size for Fiscal Policy is 322, but the standard deviation is .6522917. Foreign capital fluctuates between -5.208123 and 40.16716. Industrialization also has a lot of variability, as evidenced by the large standard deviation estimation (12.81752). The range of its values is between -75.04564 and 127.4461. For all variables, a corresponding translation exists. The table summarizes the relationship between the variables used in the implementation of the regression model. Except for the institutional quality measures, the correlations among a substantial portion of the variables assessed are negative, according to the findings. Table 2 provides the summary statistics for all variables in which the kurtosis of the coefficients, a measure of the distribution’s tail thickness, is very large. The kurtosis of Gaussian (normal) distribution exceeds 3, indicating that the assumption regarding the distribution of the variables in question cannot be validly made. This result is confirmed by the Jarque-Bera test for normality, which yields exceptionally high values in this case, discarding the null proposition of normality at any vital stage. The skewness for FIS and IQ is also negative, with positive values for all other variables. The Levin et al. (2002) unit root test, as shown in Table 3, indicates that the majority of the variables under examination are stationary at the level. After the initial difference, however, they all become immobile. The presence of a mixed order of integration supports the employment of the panel ARDL model, which, unlike basic co-integration tests, provides reliable findings.

4. Results and Discussions

Table 3

Unit Root Test

|

|

LLC Level |

LLC 1st Difference |

||

|

T. Stats |

P. Value |

T. Stats |

P. Value |

|

|

FD |

-3.9779 |

0.0000 |

-8.3332 |

0.0000*** |

|

FIS |

-5.7028 |

0.0000 |

-8.7028 |

0.0000*** |

|

IQ |

-3.7255 |

0.0001 |

-7.4299 |

0.0000*** |

|

IND |

-7.7271 |

0.0000 |

-9.5291 |

0.0000*** |

|

FI |

-3.8209 |

0.0001 |

-7.3637 |

0.0000*** |

Note. ***, **, *signify 1, 5, 10% significance levels. FD=financial development, FIS=fiscal policy, FC=foreign capital, IQ=institutional quality and IND-=industrialization.

Table 4

Co-integration Test

|

|

Within Dimensions |

|||

|

|

Weighted |

|||

|

Statistic |

Prob. |

Statistic |

Prob. |

|

|

Panel v-Statistic |

-24.38070 |

1.0000 |

-2.316709 |

0.9897 |

|

Panel rho-Statistic |

3.294394 |

0.999 5 |

2.537178 |

0.9944 |

|

Panel PP-Statistic |

-2.547816 |

0.0054*** |

-2.336636 |

0.0097*** |

|

Panel ADF-Statistic |

-4.733500 |

0.0000*** |

-2.890416 |

0.0019*** |

|

|

Between Dimensions |

|||

|

Statistic |

Prob |

|

|

|

|

Group rho-Statistic |

4.534621 |

1.0000 |

|

|

|

Group PP-Statistic |

-2.541283 |

0.0055*** |

|

|

|

Group ADF-Statistic |

-2.849739 |

0.0022*** |

|

|

Note. ***, **, * signify 1, 5, 10% significance levels..

The inquiry into co-integration starts with determining which aspects of the time series datasets are univariate. The idea of integration requires that the variables be arranged in such a way that they integrate into the same sequence with stationary linear mixtures. If the arrangement of data does not align with the integration sequence of the data itself, a significant association may not become apparent. If the series integrates into the same sequence, co-integration can be tested further. All variables are subjected to unit root tests for stationarity, as well as 1st Difference intercepts. Levin et al. (2002) tests (Table 3) show that all variables are stationary at the level and first difference, as a result, all the variables integrate in the same order, and I (1). Table 4 summarizes the panel co-integration test statistics for each panel dataset, both within and between dimensions. The averages of the individual autoregressive coefficients connected to the unit root estimations of the residuals for each nation in the panel are discussed in these results. The null hypothesis of no co-integration is refuted by the results from both dimensions.

Table 5

Hausman Test

|

Test Summary |

Statistic |

DF |

Prob. |

|

Cross-section random |

0.29 |

5 |

0.9978 |

In Table 5, the null hypothesis of long-run homogeneity limitation is evaluated against the alternative hypothesis using the Hausman (1978) test statistic and the corresponding p-values of the coefficients. The Hausman test failed to reject the long-term homogeneity limitation at the standard levels of significance, indicating that the PMG estimates are appropriate for this case. The Prob > chi2 value is 0.9852, which is greater than 0.05. The P-value is small; hence the PMG is an appropriate model for the estimate in this case. The Hausman tests confirm the PMG estimates, i.e., the panel is heterogeneous in the short term but homogeneous in the long run, hence the PMG estimators are explained.

Table 6

Long- and Short-Term Results

|

|

PMG Estimates |

MG Estimates |

||

|

Long-Term Results |

||||

|

|

Coefficients |

T. Stats |

|

|

|

ECT |

-.2608668 |

-3.40*** |

-.4456854 |

-4.72*** |

|

FI |

.0146694 |

53.13*** |

-.0140427 |

-0.89 |

|

FIS |

-.5410626 |

-27.03*** |

-.8840993 |

-0.34 |

|

IQ |

-.993388 |

-20.78*** |

-.8030572 |

-0.31 |

|

IND |

.0052645 |

26.61*** |

-.0042084 |

-1.97** |

|

FIS*IQ |

.2282745 |

19.04*** |

-3.643705 |

-2.78*** |

|

Short-Term Results |

||||

|

D.FI |

-.1182409 |

-0.82 |

-.0148493 |

-1.38 |

|

D.FIS |

-1.706905 |

-0.40 |

-.8840993 |

-0.34 |

|

D.IQ |

-.6090733 |

-0.17 |

-.8030572 |

-0.31 |

|

D.IND |

-.0001304 |

-0.04 |

.0009107 |

3.00*** |

|

D.FIS*IQ |

.287179 |

0.25 |

.3161973 |

0.36 |

|

CONS |

.8017595 |

3.45*** |

-12.97401 |

-2.63*** |

Note. ***, **, * signify 1, 5, 10% significance levels. F=financial development, FIS=fiscal policy, FC=foreign capital, IQ=institutional quality and IND=industrialization.

Table 6 shows the estimated values for the foreign capital, fiscal policy, institutional quality, and industrialization using panel data. The coefficients for fiscal policy (referred to as FIS) and institutional quality (referred to as IQ) showed a negative relationship. In Table 6, an interaction term between fiscal policy and institutional quality is also included. This interaction term coefficient is significantly positive, implying that SSA nations with more developed institutions and fiscal policies should account for a bigger share of financial development. It can be interpreted as a percentage increase in the level of finance in SSA countries as the subregion’s ability to absorb increase in fiscal policy and institutional efficiency improves. The increase in absorption is attributed to several variables, including the wise use of taxes and government income, according to the report. The ability to put in place adequate institutional procedures and structures is a critical aspect. As a result, increasing fiscal policy and institutional quality will increase financial development. The level and ability of countries to obtain additional financing and aid are determined by their industrial level rise (Acheampong, 2019; Appiah, Onifade et al., 2022).

The findings suggest that fiscal policy, when combined with institutional quality, has a negative and considerable impact on finance. It proves that a percentage rise in fiscal policy and institutional quality will result in a drop in finance of .5410626 and .993388, respectively. The SSA government places high importance on budgetary expansion while completely ignoring the impact of its policies on private sector investment (Canh, 2018b). According to the study, SSA governments’ use of fiscal policy to raise taxes results in money being sucked out of the economy. Fiscal policy demands a reduction in government spending and, as a result, a reduction in the amount of money in circulation. In this endeavor, Huidrom et al. (2018) discovered that fiscal policy can affect finance through a variety of channels. It relies on the relationship between fiscal policy and economic growth; at some levels of economic growth, government spending may lead to a drop in finance (Adelowokan, 2021). In these countries, the major element of public spending may have a decreasing toll on finance. A more plausible explanation is that these countries have been attempting to achieve long-term sustainable economic growth/development while also dealing with the demand for labor, etc. Furthermore, since the crisis (2007–2009), these economies have had serious problems with consumption, production, and real income growth. As a result, fiscal policy in SSA nations is espoused by increasing investment in infrastructure development, which lowers the overall finance rate (Estmann et al., 2021; Naeem et al., 2023). Fiscal policy has a negative and lowering effect on finance, according to studies (Chadha et al., 2021; Lawal et al., 2018). In the same way, the present findings contrast with the previous ones by Marfatia et al. (2020) and Pan et al. (2021), who concluded that fiscal policy has a good impact on finance.

The current scenario is supported by the fact that the coefficients given to the institutional factors are negative and significant at the 1% level, according to the results. This shows that increasing the latter lowers the level of financial system development in SSA countries. Thus, if all other factors are equal, a one-percentage-point improvement in institutional characteristics in the SSA zone results in a reduction of approximately.993388 points in financial development. These findings for the SSA support those of Appiah, Li et al. (2020) and Bandura (2020), who found that weak institutional quality explains the SSA’s low level of financial development. They disagree with the findings of Appiah, Onifade et al. (2022) and Appiah, Karim et al. (2022), which suggest that strong quality institutions contribute to the financial development of Sub-Saharan African nations. This low level of financial growth in SSA countries can be explained by the fact that policies and regulations designed to support the private sector have yet to yield the desired outcomes. As a result, political stability in this region has yet to reach the point where it can start to have a good impact on financial development. In 2014, the measure of political stability and nonviolence in the Central African Republic (CAR) was -2.7. This shows that political stability and nonviolence have deteriorated significantly.

Furthermore, foreign capital, including industrialization, had a good relationship with finance. The results reveal that an increase in foreign capital and industrialization in these nations will increase .0146694 and .0052645, respectively, on average. These findings reveal that when foreign corporations entered SSA nations, they did so with significant financial investments in foreign capital, franchises, mergers, and acquisitions of existing businesses. In such circumstances, foreign direct investments in SSA economies improve the structures, strengthen the financial markets, and increase capital circulation. Indeed, strengthening financial sector capability and financial intermediation promotes countries’ financial independence and strengthens their access to technology and capital markets (Appiah, Gyamfi et al., 2022). With a conservative and concentrated strategy, Appiah, Li, Frowne et al. (2019) and Appiah, Li & Korankye (2019) discovered that foreign capital has become more helpful in SSA countries than in other developing economies. A well-developed financial sector is required for foreign capital to have a good influence. We can deduce that Africa’s underdeveloped financial systems are unable to efficiently perform their functions and allocate financial resources. As a result, African countries must take steps to improve local conditions by expanding absorption capacity and therefore bridging the technical gap. Furthermore, government policy has an important role in maximizing foreign capital. Importing cutting-edge technology to improve local product quality, lower average production costs, and boost international market share by increasing exports can help African countries promote economic progress (Appiah, Frowne et al., 2020). The studies of Alsmadi and Oudat (2019) and Irandoust (2021) exposed that foreign capital has a detrimental effect on financial development since the influx of foreign financial institution leads to the collapse of the indigenous financial institution as the level of the capital base of these institutions is larger than these traditional finance institutions making it difficult for a fair competition.

Table 7

Causality Test

|

Test |

Obs |

F-Statistic |

Prob. |

Direction |

|

FD TO FC FC TO FD |

322 |

0.02262 2.29669 |

0.8805 0.1306 |

No-Direction |

|

FD TO FIS FIS TO FD |

322 |

0.69368 0.67254 |

0.4055 0.4128 |

No-Direction |

|

FD TO FIS*IQ FIS*IQ TO FD |

322 |

1.10223 0.39121 |

0.2946 0.5321 |

No-Direction |

|

FD TO IND IND TO FD |

322 |

0.10295 0.02050 |

0.7485 0.8862 |

No-Direction |

|

FD TO IQ IQ TO FD |

322 |

0.51488 2.82190 |

0.4736 0.0940* |

One Way Direction |

Note. * signifies a 10% significance level. FD=financial development, FIS=fiscal policy, FC=foreign capital, IQ=institutional quality and IND=industrialization.

Similarly, in the SSA panel nations, industrialization has a favorable impact on finance. A 1% rise in industrialization, for example, will raise finance by .0052645 percent in the long run. This discovery is consistent with the findings of Appiah et al. (2021) and Kothakapa et al. (2021). The following are some of the possible explanations for the positive impact of industrialization on finance: for example, as the level of industrialization rises, so does the supply of finance inside the country, because industrial development requires a large amount of money. The favorable impact of industrialization on financial development is due to increased access to external capital, as well as an increase in the number of active producers and the creation of agglomeration economies. These beneficial effects of industrialization outweigh any possible negative disintegration; companies may be considered relatively safe borrowers by local banks because they may rely on parental guarantees (Fanglin et al., 2020; Korankye et al., 2021; Li, Appiah, & Korankye, 2020). Local banks may be a component of the international network of MNEs’ home banks, allowing existing banking ties to be deployed internationally (Amoah-Binfoh et al., 2014; Antwi & Yusheng, 2019). Local banks may also be more inclined to lend when a foreign institution is engaged in the funding of industrialization since the parent company’s operations are implicitly monitored. The worldwide expansion of enterprises through industrialization is greatly facilitated by a strong financial system in the destination country. A study by Akçay (2019) points out that there is uncertainty regarding the causal link between industrialization and financial institutions. According to O’Sullivan et al. (2013), finance is a component of industrial strategies. Ayres and Warr (2005), however, emphasize that finance is both an input and an output for industrial policy and that there is a clear and direct relationship between the financial system and industrial policies: i.e., they are complements.

Panel ARDL econometric approaches can only account for the stability of long- and short-term estimators, but they can’t detect causal relationships between variables. Due to this shortcoming, the Engle and Granger (1987) causality test was used to achieve this goal. The Engle and Granger (1987) causality results are shown in Table 6. Overall institutional efficiency and financial development have a one-way causal relationship, according to the data; higher institutional quality relates to better financial development progress, implying that higher institutional quality contributes to higher financial development progress, but higher financial development progress does not always lead to higher institutional quality. This defies the widely held belief that institutions and financial development have a mutually beneficial relationship. Better institutions lead to greater financial development, while greater financial development needs the establishment of higher-quality institutions. According to Appiah, Frowne et al. (2020) and Appiah, Li et al. (2020), the efficiency of the institutional atmosphere is one of the most important variables in determining financial development.

In another scenario, the findings demonstrated a non-causal link between financial development and industrialization. It appears that neither financial development nor industrialization is mutually exclusive. A larger services sector than the manufacturing sector, on the other hand, does not invalidate Kaldor’s theories regarding the latter’s financial development-enhancing features; rather, it is a result of the economy’s maturation. However, the role of manufacturing and productivity as a source of financial development has been questioned. Ricky-Okine et al. (2020) show that recent episodes of financial development acceleration in industrialized countries were driven by productivity advances in the services sector, rather than manufacturing. Nevertheless, the researchers argue that there is no direct link between these findings and financial development.

The results also indicate a non-causal relationship between foreign capital and financial development. According to the report, a well-defined financial development policy that promotes the use of sound financial instruments will benefit foreign capital and facilitate its rapid expansion. However, since many SSA nations lack the knowledge to effectively utilize foreign capital, which is a crucial component of financial development, the direct or indirect impact of foreign capital and financial development may be limited. This is partly due to the underutilization of funds from donor countries. Consequently, governments and administrations in SSA countries must urgently enact enhanced foreign capital and financial development policies to ensure the efficient and effective utilization of foreign capital, like practices in developed countries.

However, the results indicate that there is no directional relationship from financial development to the other independent variables, suggesting that financial development does not Granger cause any of the independent variables. Therefore, it has no significant role in enhancing financial development in the long term.

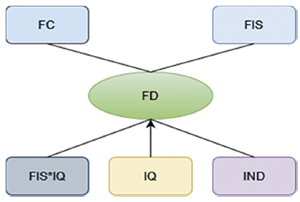

Figure 1

Causality Directions

Note. → and — represent one way and non-causality directions. FD=financial development, FIS=fiscal policy, FC=foreign capital, IQ=institutional quality and IND=industrialization.

5. Conclusions

The massive increase in funding from several companies in SSA nations has policymakers concerned. The study investigated the degree of interaction between fiscal policy tools (government expenditure and tax revenues), FC, IQ, IND, and financial development in the SSA region from 2000 to 2021. The ARDL panel model was employed in this study. Financial development is hampered by fiscal policy instruments such as government expenditure and taxation, as well as institutional quality, according to the expected results. In addition, the studies demonstrated that both foreign capital and industrialization aid financial development. It was assumed that governments could raise funds using fiscal tools (taxes and spending), however, this was not the case. In fact, the government can raise funds by cutting down spending thus avoiding unnecessary spending. In doing so there could be excess funds to be used for other important things.

Regarding the moderating effects, institutional quality lowered the negative effects of fiscal policy on financial development. The findings show that governments might reduce taxes and possibly inject money into the system by cutting spending, as well as provide incentives and lower the tax burden for the industrial and manufacturing sectors. The results of the causality tests reveal that the relationship between institutional quality and financial development is one-way. The other variables and financial success did not have any causal relationships. The findings have a policy implication that policies that are favorable to the market and active economic policy should go hand in hand with measures to encourage greater FDI. Numerous comparative advantages can come from a country’s well-developed financial sector, and these advantages make it much simpler for the country to absorb the benefits of FDI, which in turn boosts overall economic performance. The finding of this study shows that their well-established institutions and fiscal policy are the key determinants of financial strength in SSA countries. These outcomes are in line with prevailing studies. The finding displays that quality institutions are the source of financial development, and without quality institutions, the financial department cannot be enhanced.

Policy Recommendations

For stakeholders, including policymakers, regulators, and academics, access to data on specific demand for financial instruments, prospective availability, and access to finance is critical for all SSA nations to participate in the growth and advancement of financial innovations. To solve the issue of weak finance and financial sustainability in SSA economies, a collective accord is required. Furthermore, SSA governments should encourage borrowers inside and beyond the region to use zero-level exchange rate regimes. More foreign direct investment in the financial industry can be attracted by effective campaigns by SSA governments to develop reliable financial institutions. Governments should encourage private sector development to reduce reliance on foreign lenders and, as a result, profit exodus. To boost capital injection into the economy and enhance the availability of funding methods, effective tax and spending control policies should be implemented to encourage the establishment and development of industries.

Because there is no directional causality and positive link identified between fiscal policy instruments and financial development, SSA countries should focus on developing policies to track the implementation of adequate fiscal policy systems and structures. Institutional coherence within and between SSA nations is required for efficient fiscal policy development. Coordination and information exchange between economies will boost policy effectiveness and assist financial development plots and acquire traction.

Limitations and Suggestion for Future Research

According to our knowledge, this is the first study to investigate the role of fiscal policy instruments in the context of SSA countries’ financial development. However, due to a lack of data, the study does not yet cover the whole SSA panel dataset. Furthermore, because data is scarce in SSA nations, CPIA data are used as a proxy for institutional quality. Data on current budgetary policy in all SSA countries were likewise difficult to come by. As a result of the constraints of this study, various future research topics are possible; policies connected to fiscal policies and institutional quality can also be integrated into the financial sectors of SSA countries as future directions. Again, future research direction should consider the incorporation of capital control regime and exchange rate regime.

References

Acheampong, T. Y. (2019). Government as Employer of Last Resort as a Solution to Youth Unemployment in Developing Countries: Lessons from Ghana’s National Youth Employment Programme. E-Journal of International Comparative Labour Studies, 8(1), 2-27

Adelowokan, O. A. (2021). Fiscal Policy, Private Consumption, and Economic Growth among the Economic Community of West African States. Jurnal Ekonomi & Studi Pembangunan, 22(2), 289–300.

Afonso, A., & Jalles, J. T. (2013). Do Fiscal Rules Matter for Growth? Applied Economics Letters, 20(1), 34–40.

Afonso, A., & Strauch, R. (2007). Fiscal policy events and interest rate swap spreads: Evidence from the EU. Journal of International Financial Markets, Institutions and Money, 17(3), 261–276.

Akbar, M. W., Yuelan, P., Maqbool, A., Zia, Z., & Saeed, M. (2021). The nexus of sectoral-based CO2 emissions and fiscal policy instruments in the light of Belt and Road Initiative. Environmental Science and Pollution Research, 28(25), 32493–32507.

Akçay, S. (2019). Do industrialization, democracy, and financial openness promote financial development? Evidence from Turkey. Turkish Studies, 20(5), 708–727.

Akitoby, B., & Stratmann, T. (2008). Fiscal Policy and Financial Markets. The Economic JournaL, 118(533), 1971–1985.

Alsmadi, A. A., & Oudat, M. S. (2019). The effect of foreign direct investment on financial development: Empirical evidence from Bahrain. Ekonomski Pregled, 70(1), 22–40.

Amoah-Binfoh, K., Velmurugan, T., & Charles, R.-O. (2014). The Impact of Credit Facilities Given by Rural and Community Banks to Farmers–A Special Reference to Ghana. In Assessing and Developing Sustainable Business Model, 21–32.

Antwi, F., & Yusheng, K. (2019). Corporate govenance and related party transactions among banks in ghana. International Journal in Management and Social Science, 7(8), 82–97. DOI:10.13140/RG.2.2.31139.60968

Anyanwu, J. C. (1999). Fiscal Relations among the Various Tiers of Government in Nigeria. Fiscal Federalism and Nigeria’s Economic Development. NES selected papers presented at the 1999 Annual conference, Ibadan.

Appiah, M., Frowne, D. Y. I., & Tetteh, D. (2020). Capital Market and Financial Development on Growth: A Panel ARDL Analysis. Indonesian Capital Market Review, 12 (3), 28–41.

Appiah, M., Gyamfi, B. A., Adebayo, T. S., & Bekun, F. V. (2022). Do financial development, foreign direct investment, and economic growth enhance industrial development? Fresh evidence from Sub-Sahara African countries. Portuguese Economic Journal, 22, 203–227. https://doi.org/10.1007/s10258-022-00207-0

Appiah, M., Karim, S., Naeem, M. A., & Lucey, B. M. (2022). Do institutional affiliation affect the renewable energy-growth nexus in the Sub-Saharan Africa: Evidence from a multi-quantitative approach. Renewable Energy, 191, 785–795. https://doi.org/https://doi.org/10.1016/j.renene.2022.04.045

Appiah, M., Li, F., & Frowne, D. I. (2020). Financial Development, Institutional Quality and Economic Growth: Evidence from ECOWAS Countries. Organizations and Markets in Emerging Economies, 11(1), 6–17.

Appiah, M., Li, F., Frowne, D. I., & Donkor, D. T. (2019). Foreign investment and growth: A case of selected African economies. International Entrepreneurship Review, 5(3), 7–18.

Appiah, M., Li, F., & Korankye, B. (2019). Foreign investment & growth in emerging economies: panel ARDL analysis. Journal of Economics Business and Accountancy Ventura, 22(2), 274–282.

Appiah, M., Li, F., & Korankye, B. (2021). Modeling the linkages among CO2 emission, energy consumption, and industrialization in sub-Saharan African (SSA) countries. Environmental Science and Pollution Research, 28, 38506–38521. https://doi.org/10.1007/s11356-021-12412-z

Appiah, M., Onifade, S. T., & Gyamfi, B. A. (2022). Building Critical Infrastructures: Evaluating the Roles of Governance and Institutions in Infrastructural Developments in Sub-Sahara African Countries. Evaluation Review, 0(0), 1–25.

Ayres, R. U., & Warr, B. (2005). Accounting for growth: The role of physical work. Structural Change and Economic Dynamics, 16(2), 181–209.

Azzimonti, M., De Francisco, E., & Quadrini, V. (2014). Financial Globalization, Inequality, and the Rising Public Debt. American Economic Review, 104(8), 2267–2302.

Bandura, W. (2020). Trade Openness, Institutions and Financial Development in Sub-Saharan Africa. Studies in Economics and Econometrics, 44(2), 29–48.

Bhattarai, K., & Trzeciakiewicz, D. (2017). Macroeconomic impacts of fiscal policy shocks in the UK: A DSGE analysis. Economic Modelling, 61, 321–338.

Blickle, K., Brunnermeier, M. K., & Luck, S. (2019). Micro-Evidence from a System-Wide Financial Meltdown: The German Crisis of 1931. Available at SSRN 3436140.

Bonam, D., & Lukkezen, J. (2019). Fiscal and Monetary Policy Coordination, Macroeconomic Stability, and Sovereign Risk Premia. Journal of Money, Credit and Banking, 51(2–3), 581–616.

Bui, T. N. (2020). Financial Depth and the Real Estate Market: An Empirical Study of the Wealth Effect. Asian Economic and Financial Review, 10(8), 936–945.

Canh, N. P. (2018a). The effectiveness of fiscal policy: contributions from institutions and external debts. Journal of Asian Business and Economic Studies, 25(1), 50–66.

Canh, N. P. (2018b). The effectiveness of fiscal policy: Contributions from institutions and external debts. Journal of Asian Business and Economic Studies, 1–18.

Catao, L. A., & Terrones, M. E. (2005). Fiscal deficits and inflation. Journal of Monetary Economics, 52(3), 529–554.

Chadha, J., Küçük Yeşil, H., & Pabst, A. (Eds.) (2021). Designing a New Fiscal Framework: Understanding and Confronting Uncertainty (NIESR Occasional Paper LXI, 183–189).

Chen, Y., & Sivakumar, V. (2021). Investigation of finance industry on risk awareness model and digital economic growth. Annals of Operations Research, 326(6), 1–22.

Chien, F., Hsu, C.-C., Zhang, Y., Tran, T. D., & Li, L. (2022). Assessing the impact of green fiscal policies and energy poverty on energy efficiency. Environmental Science and Pollution Research, 29(3), 4363–4374.

Chung-Yee, L., Ismail, N. W., & Ai-Lian, T. (2020). Is Public Debt Asymmetrically Link to Financial Development in Malaysia? Asian Journal of Empirical Research, 10(3), 97–110.

Corbacho, A., & Schwartz, G. (2007). Fiscal responsibility laws (Vol. 58).

Dabla-Norris, M. E., Ji, Y., Townsend, R., & Unsal, M. F. (2015). Identifying Constraints toFinancial Inclusion and their Impact on GDP and Inequality: A Structural Framework for Policy. (IMF Working Paper/22).

Davis, B., & Summers, M. (2014). Applying Dale’s Cone of Experience to Increase Learning and Retention: A Study of Student Learning in a Foundational Leadership Course. In QScience Proceedings, Engineering Leaders Conference 2014 on Engineering Education, Aug 2015, Volume 2015, 6. http://dx.doi.org/10.5339/qproc.2015.elc2014.6

Debrun, X., Hauner, D., & Kumar, M. S. (2009). Independent Fiscal Agencies. Journal of Economic Surveys, 23(1), 44–81.

Debrun, X., Moulin, L., Turrini, A., Ayuso-i-Casals, J., & Kumar, M. S. (2008). Tied to the mast? National fiscal rules in the European Union. Economic Policy, 23(54), 298–362.

Dumičić, M. (2019). Linkages Between Fiscal Policy and Financial (In) Stability. Journal of Central Banking Theory and Practice, 8(1), 97–109.

Duramany-Lakkoh, E. K. (2020). The Effect of Fiscal Policy on Financial Sector Development in Sierra Leone: A Time Series Approach. International Journal of Development and Economic Sustainability, 8(4), 1–23.

Easterly, W., & Rebelo, S. (1993). Fiscal Policy and Economic Growth. Journal of Monetary Economics, 32(3), 417–458.

Eichengreen, B., Hausmann, R., & Panizza, U. (2005). The mystery of original sin. In

B. Eichengreen & R. Hausmann (Eds.), Other People’s Money: Debt Denomination and Financial Instability in Emerging Market Economies (pp. 233–265).

El-Shagi, M., & Turcu, C. (2021). Monetary, financial and fiscal fragility in 2020s. Journal of International Money and Finance, 117, 102–139.

Engle, R. F., & Granger, C. W. J. (1987). Co-Integration and Error Correction: Representation, Estimation, and Testing. Econometrica, 55(2), 251–276.

Estmann, C., Hansen, H., & Rand, J. (2021). Fiscal Policy Responses to COVID-19 in Danida Priority Countries in Sub-Saharan Africa. (Development Economics Research Group Working Paper Series, 09-2021).

Fanglin, L., Appiah, M., & Dodoo, R. N. A. (2020). The Effects Of Technology and Labour On Growth In Emerging Countries. Management Research & Practice, 12(2), 39–47.

Grágeda, M., Escudero, M., Alavia, W., Ushak, S., & Fthenakis, V. (2016). Review and multi-criteria assessment of solar energy projects in Chile. Renewable and Sustainable Energy Reviews, 59, 583–596.

Hameed, W. U., Nisar, Q. A., & Wu, H.-C. (2021). Relationships between external knowledge, internal innovation, firms’ open innovation performance, service innovation and business performance in the Pakistani hotel industry. International Journal of Hospitality Management, 92, 102–145. https://doi.org/10.1016/j.ijhm.2020.102745

Hauner, D. (2006). Fiscal Policy and Financial Development. (IMF Working Paper).

Hausman, J. A. (1978). Specification Tests in Econometrics. Econometrica, 46,(6), 1251–1271. https://doi.org/https://doi.org/10.2307/1913827

Huidrom, R., Kose, M. A., & Ohnsorge, F. L. (2018). Challenges of Fiscal Policy in Emerging and Developing Economies. (CAMA Working Paper No. 34/2016).

Imran, M., & Sial, M. H. (2022). The Existence Of Financial Intermediaries, Public Spending And Economic Growth In Selected Saarc Countries: A Panel Data Analysis. Journal of Economics, 3(1), 49–66.

Irandoust, M. (2021). FDI and Financial Development: Evidence from Eight Post-Communist Countries. Studies in Economics and Econometrics, 45(2), 102–116.

Jawadi, F., Mallick, S. K., & Sousa, R. M. (2016). Fiscal and monetary policies in the BRICS: A panel VAR approach. Economic Modelling, 58, 535–542.

Johansen, S., & Juselius, K. (1990). Maximum likelihood estimation and inference on cointegration—with applications to the demand for money. Oxford Bulletin of Economics Statistics, 52(2), 169–210. https://doi.org/https://doi.org/10.1111/j.1468-0084.1990.mp52002003.x

Kamal, M., Usman, M., Jahanger, A., & Balsalobre-Lorente, D. (2021). Revisiting the role of fiscal policy, financial development, and foreign direct investment in reducing environmental pollution during globalization mode: evidence from linear and nonlinear panel data approaches. Energies, 14(21), 69–82.

Kameda, K. (2014a). Comment Paper to Chapter. The Political Economy of Fiscal Consolidation in Japan, 8, 31–50.

Kameda, K. (2014b). What causes changes in the effects of fiscal policy? A case study of Japan. Japan and the World Economy, 31, 14–31.

Katircioglu, S., & Katircioglu, S. (2018). Testing the role of fiscal policy in the environmental degradation: The case of Turkey. Environmental Science and Pollution Research, 25(6), 5616–5630.

Kirchner, M., & van Wijnbergen, S. (2016). Fiscal Deficits, Financial Fragility, and the Effectiveness of Government Policies. Journal of Monetary Economics, 80(C), 51–68.

Kitenge, E., & Bashir, S. (2022). The effect of financial access on convergence: Evidence from the US agricultural sector. Applied Economics, 54(15), 1715–1726.

Korankye, B., Wen, Z., Appiah, M., & Antwi, L. (2021). The Nexus Between Financial Development, Economic Growth and Poverty Alleviation: PMG-ARDL Estimation. ETIKONOMI, 20(1), 1–12.

Kothakapa, G., Bhupatiraju, S., & Sirohi, R. A. (2021). Revisiting the link between financial development and industrialization: Evidence from low and middle income countries. Annals of Finance, 17(2), 215–230.

Lawal, A. I., Somoye, R. O., Babajide, A. A., & Nwanji, T. I. (2018). The effect of fiscal and monetary policies interaction on stock market performance: Evidence from Nigeria. Future Business Journal, 4(1), 16–33.

Levin, A., Lin, C.-F., & Chu, C.-S. (2002). Unit root tests in panel data: Asymptotic and finite-sample properties. Journal of Econometrics, 108(1), 1–24. https://doi.org/https://doi.org/10.1016/S0304-4076(01)00098-7

Li, F., Appiah, M., & Dodoo, R. N. A. (2020). A Co-integration Approach to the Study of Economic Growth and Environmental Impact in Ghana. NMIMS Management Review, 38(2), 31–47.

Li, F., Appiah, M., & Korankye, B. (2020). Financial Development and Economic Sustainability in ECOWAS Countries: the Role of Institutional Quality. ETIKONOMI, 19(1), 41–50. http://doi.org/10.15408/etk.v19i1.13709

Loayza, N., Ouazad, A., & Rancière, R. (2018). Financial Development, Growth, and Crisis: Is There a Trade-Off? (NBER Working Paper No. w24474). Available at SSRN: https://ssrn.com/abstract=3158913

Marfatia, H. A., Gupta, R., & Miller, S. (2020). 125 Years of time-varying effects of fiscal policy on financial markets. International Review of Economics & Finance, 70, 303–320.

Matallah, A., & Matallah, S. (2017). Does fiscal policy spur economic growth? Empirical evidence from Algeria. Theoretical and Applied Economics, 24(3), 125–146.

Michau, J.-B. (2019). Monetary and fiscal policy in a liquidity trap with inflation persistence. Journal of Economic Dynamics and Control, 100, 1–28.

Munir, K., & Riaz, N. (2019). Fiscal policy and macroecomonic stability in South Asian countries. Hacienda Pública Española (228), 13–33.

Munir, S., Rao, Z. U. R., & Sana, S. (2019). Financial Development, Fiscal Policy and Economic Growth: The Role of Institutional Quality in Pakistan. Journal of Finance and Accounting Research, 1(2), 27–47.

Nabieu, G. A. A., Bokpin, G. A., Osei, A. K., & Asuming, P. O. (2021). Fiscal rules, fiscal performance and economic growth in Sub‐Saharan Africa. African Development Review, 33(4), 607–619.

Naeem, M. A., Appiah, M., Karim, S., & Yarovaya, L. (2023). What abates environmental efficiency in African economies? Exploring the influence of infrastructure, industrialization, and innovation. Technological Forecasting and Social Change, 186, 122–132. https://doi.org/https://doi.org/10.1016/j.techfore.2022.122172

Narayan, S., & Narayan, P. (2005). An empirical analysis of Fiji’s import demand function. Journal of Economic Studies, 32(2), 158–168. https://doi.org/http://dx.doi.org/10.1108/01443580510600931

Neaime, S., & Gaysset, I. (2018). Financial inclusion and stability in MENA: Evidence from poverty and inequality. Finance Research Letters, 24, 230–237. https://doi.org/https://doi.org/10.1016/j.frl.2017.09.007

Nordström, L., & Laiho, N. (2022). Explaining IMF design of 2010 Greece loan: Bricoleurs relying on fiscal space and nonlinear multiple equilibria processes. Comparative European Politics, 21(3), 1–23.

O’Sullivan, E., Andreoni, A., Lopez-Gomez, C., & Gregory, M. (2013). What is new in the new industrial policy? A manufacturing systems perspective. Oxford Review of Economic Policy, 29(2), 432–462.

Ofori-Abebrese, G., Pickson, R. B., & Diabah, B. T. (2017). Financial Development and Economic Growth: Additional Evidence from Ghana. Modern Economy, 8(2), 282–297.

Olawunmi, O., & Ayinla, T. (2007). Fiscal policy and Nigeria Economic Growth. Journal of Research in National Development, 5(2), 1–26.

Ouedraogo, R., & Sourouema, W. S. (2018). Fiscal policy pro-cyclicality in Sub-Saharan African countries: The role of export concentration. Economic Modelling, 74, 219–229.

Pan, K., Cheng, C., Kirikkaleli, D., & Genç, S. Y. (2021). Does financial risk and fiscal decentralization curb resources curse hypothesis in China? Analyzing the role of globalization. Resources Policy, 72(2), 102–120.

Park, J. H. (2015). Financial Development, Fiscal Policy and Macroeconomic Volatility. [Doctoral dissertation, University of York].

Pesaran, Shin, & Smith. (1999). Pooled mean group estimation of dynamic heterogeneous panels. Journal of the American Statistical Association, 94(446), 621–634. https://doi.org/10.1080/01621459.1999.10474156

Pham, H. T., Gan, C., & Hu, B. (2022). Causality between Financial Development and Foreign Direct Investment in Asian Developing Countries. Journal of Risk and Financial Management, 15(5), 195–211.

Reinhart, C. M. (2010). This Time is Different Chartbook: Country Histories on Debt, Default, and Financial Crises. (NBER Working Papers,15815).

Reinhart, C. M., Rogoff, K. S., & Savastano, M. (2003). Debt intolerance. (NBER Working Paper 9908).

Ricky-Okine, C. K., Amankwaa, T., & Anane, E. (2020). Banking Sector Competition and Financial Development in Sub-Saharan Africa. International Journal of Technology and Management Research, 5(3), 58–85.

Rodriguez, C. M. (2014). Financial development, fiscal policy and volatility: Their effects on growth. The Journal of International Trade & Economic Development, 23(2), 223–266.

Sawadogo, P. N. (2020). Can fiscal rules improve financial market access for developing countries? Journal of Macroeconomics, 65, 103–114.

Shakil, M. H., Tasnia, M., & Saiti, B. (2018). Is gold a hedge or a safe haven? An application of ARDL approach. Journal of Economics, Finance and Administrative Science,23(44), pages 60-76.Sheng, P., & Guo, X. (2016). The long-run and short-run impacts of urbanization on carbon dioxide emissions. Economic Modelling, 53, 208–215. https://doi.org/10.1016/j.econmod.2015.12.006

Sindani, W. R. (2020). Effect of Public Sector Wage Bill on Public Investment and Fiscal Deficit in Kenya. International Journal of Academic Research in Business and Social Sciences, 9(7), 108–23

Skott, P. (2021). Fiscal policy and structural transformation in developing economies. Structural Change and Economic Dynamics, 56(3), 129–140.

Stiglitz, J. E. (2015). The Origins of Inequality, and Policies to Contain it. National Tax Journal, 68(2), 425–448.

Sulaiman, C., Bala, U., Tijani, B. A., Waziri, S. I., & Maji, I. K. J. S. O. (2015). Human Capital, Technology, and Economic Growth: Evidence from Nigeria. SAGE Open, 5(4), 215-238. https://doi.org/10.1177/2158244015615166.

Tagkalakis, A. (2011). Fiscal policy and financial market movements. Journal of Banking & Finance, 35(1), 231–251.

Tavani, D., & Zamparelli, L. (2017). Government spending composition, aggregate demand, growth, and distribution. Review of Keynesian Economics, 5(2), 239–258.

Thornton, J., & Vasilakis, C. (2017). The impact of fiscal rules on sovereign risk premia: International evidence. Finance Research Letters, 20, 63–67.

Toda, H. Y., & Yamamoto, T. (1995). Statistical inference in vector autoregressions with possibly integrated processes. Journal of Econometrics, 66(1–2), 225–250.

Turrini, A., Cristofoli, D., Frosini, F., & Nasi, G. (2010). Networking Literature about Determinants of Network Effectiveness. Public Administration, 88(2), 528–550.

Ubi-Abai, I., & Ekere, D. (2018). Fiscal Policy, Monetary Policy and Economic Growth in Sub-Saharan Africa. (MPRA Paper No. 91950).