Organizations and Markets in Emerging Economies ISSN 2029-4581 eISSN 2345-0037

2023, vol. 14, no. 1(27), pp. 56–82 DOI: https://doi.org/10.15388/omee.2023.14.82

Austerity Measures, Infrastructure and Economic Development in South Africa (1996–2019)

Kukhanyile Mali (corresponding author)

University of the Western Cape, South Africa

https://orcid.org/0000-0002-0281-5153

kukhanyilemali@gmail.com

Johannes Sheefeni

University of the Western Cape, Bellville, South Africa

https://orcid.org/0000-0001-7260-7811

jsheefeni@uwc.ac.za

Abstract. The paper aims to establish whether austerity measures promote economic development, improve infrastructure development, and whether they exacerbate infrastructure backlogs. The methodology used is a quantitative research method, sourcing secondary quarterly data from the South African Reserve Bank. The VAR model is used to analyse data between 1994 and 2019. The results showed that austerity measures have a significantly negative role in economic development. Also, they slow down investments that are crucial for infrastructure development. The results also pointed to the exacerbation of infrastructure backlogs caused by austerity measures.

Keywords: austerity, infrastructure development, economic development, fiscal policy, neoliberalism

Received: 4/10/2022. Accepted: 21/2/2023

Copyright © 2023 Kukhanyile Mali, Johannes Sheefeni. Published by Vilnius University Press. This is an Open Access article distributed under the terms of the Creative Commons Attribution Licence, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

1. Introduction

Feldman et al. (2015) argued that infrastructure development and infrastructure projects had been a concern for economic development. They further asserted that economic and infrastructure development heavily depends on long-term investments. According to the World Economic Forum (WEF) ( 2012), Southern African countries should invest a minimum of 10% of their GDP towards social and economic infrastructure. However, South Africa did not meet the minimum infrastructure investment requirements throughout its 26 years of democracy.1 Therefore, a sustained improvement in the quality of life and economic development relies heavily on consistent and targeted investment spending.

After the democratic breakthrough in 1994, there were infrastructure backlogs that delayed development. This is due to almost 30 years of a gradual decrease in infrastructure investment between the early 1980s and early 2000s. During this period, infrastructure investment in South Africa decreased from an average of almost 30% of GDP to about 16% (National Planning Commission, 2012). Public investment was also at low levels decreasing from 8.1% of GDP in 1976 to approximately 2.6% of GDP in 2002 (Fedderke & Bogetic, 2006; Kumo, 2012). Subsequently, the infrastructure investment levels of the first decade in democratic South Africa were significantly lower than those during apartheid resulting in a missed generation of capital investment in rail, roads, ports, electricity, water, sanitation, public transport, and public housing. The macroeconomic policies pursued by the government largely preferred and prioritised debt management and deficit reduction measures instead of industrial policies that would invariably promote large infrastructure investment. As a result of low capital investments, the government was unable to effectively address infrastructure backlogs.

Although the Reagan-Thatcher agenda that was adopted advocated for less government, Feldman et al. (2015) pointed out that the government and State-Owned Enterprises (SOEs) are the only entities that had been charged with the responsibility to promote the well-being and prosperity of its people. As a result, the macroeconomic and industrial policies adopted aimed to significantly reduce unemployment, inequality, and poverty levels in South Africa. However, as neoliberalism became more widespread, and fears of a perceived debt crisis loomed, the government returned to austerity and focused on privatisation, liberalisation, and rationalisation (Sibeko, 2019; Gumede, 2007). According to Klein (2017), Varoufakis (2018), and Sibeko (2019), the IMF coerced countries in debt to pursue austerity measures to restore stability despite their devastating effects on some European nations. Also, they pointed out that the challenge with austerity measures is that they do not resolve the unemployment, poverty, and inequality challenges that some countries are experiencing.2

Academic research has been conducted on austerity; however, very little analysis has been made on its effect on development, particularly in South Africa. A study by Agnello et al. (2018) reviewed the effects of fiscal consolidation on human development in 71 countries. The paper found that fiscal austerity was associated with a reduction of human development standards, particularly spending-driven consolidations. However, this reduction in human development was especially damaging for developing countries (including Africa). South Africa was not the subject of the study but was included in the 71 countries.

Moreover, within the South African economic system, austerity measures have elements (debt, government expenditure, taxation) that interact with one another and are interlinked and interconnected.3 The interaction and interlinkage of these elements (variables) are exemplified by the study by Cherif and Hasanov (2012), Bi et al. (2012) and Abubakar (2020), who reviewed the impact of macroeconomic shocks and fiscal consolidation on debt. Cherif and Hasanov (2012) found that austerity (or fiscal consolidation) shocks, which include a reduction in government expenditure, have an impact on debt, whereas Bi et al. (2012) found that the interaction of macroeconomic variables at different levels and conditions is essential in determining debt. Abubakar (2020), after analysing sub-Saharan African economies, found that fiscal tightening during periods of government surpluses negatively affected debt. Therefore, the impact on debt is determined by the strength or weakness of the economic environment. Thus, these interactions and linkages between these elements are non-linear.4 This is shown in the aforementioned studies. The interaction of debt and austerity shocks (fiscal consolidation) has led to emergent properties. Throughout the above-mentioned studies, the emergent properties include, amongst other things, the reduction of debt at the expense of other macroeconomic indicators like growth.

As a result, the methodology used to assess its impact on development is a quantitative research method, sourcing secondary quarterly data from the South African Reserve Bank (SARB). The VAR model is used to analyze data between 1994 and 2019. A panel data set was utilized to conduct a comparative analysis between different African countries. This will assist in establishing whether austerity measures positively affect economic development, infrastructure development and exacerbate infrastructure backlogs in South Africa. Therefore, this study seeks to investigate the emergent properties resulting from interaction of austerity measures and how they influenced infrastructure and economic development in South Africa. In particular, this study will investigate the impact of austerity measures (measured as fiscal consolidation) on infrastructure development and analyze the response of economic development to the shocks in austerity measures.

1.2 Austerity in South Africa

Both economic and political pressure marred the penultimate years of apartheid. Globally, the economy was shifting towards a new economic paradigm (Bond, 2000), whereas politically, sanctions and disinvestment campaigns against the apartheid regime were underway (Svenbalrud, 2012). This was also the same period as the re-emergence of neoliberal orthodoxy and the subsequent dominance of the Reagan-Thatcher agenda.5 The South African economic system had profound consequences which ushered in a new economic configuration through the Washington consensus (Harvey, 2005; Bond, 2000). Over time, neoliberalism became more hegemonic within the global economy and, by extension, in the South African economy, despite arguments about its inherent negative features (Harvey, 2005).

The poor infrastructure investment in the 1980s did not match the infrastructure that was being developed during that period (DPME, 2019). Additionally, the infrastructure projects were not sustainable due to the rapidly declining infrastructure spending. Therefore, at the dawn of democracy, South Africa had a series of political, social, and economic hurdles that it had to overcome. All of these challenges that received scrupulous attention from the World Bank and other institutions were the macroeconomic policy that would be pursued in South Africa (Bond, 2000; Powers, 2019). These concerns were based on fears of a resurgence of Socialism and Communism in Southern African nations that received support from the Soviet Union (Bond, 2000; Harvey, 2005; Gumede, 2007; Powers, 2019). Adopting what was perceived as socialist-orientated policies at the advent of democracy in South Africa exacerbated these fears.

Nevertheless, the government adopted the Reconstruction and Development Programme (RDP) as a macroeconomic policy geared toward the reconstruction of South African society (Gumede, 2007). According to the Republic of South Africa (RSA) (1994), the de jure independence that Transkei-Bophuthatswana-Venda-Ciskei (TBVC) states enjoyed allowed them to “incur debt and deficits that fell to the National Government” (RSA, 1994). Thus, the democratic government was burdened with the careless borrowing of the previous regime (Bond, 2000; MERG, 1993). Bond (2000) went as far as criticizing the ANC negotiators for their failure to renegotiate the burdensome debt that the apartheid regime had accumulated. The rising debt levels became a precursor for implementing austerity measures, as the logic was that rising debt levels led to negative economic consequences (Sibeko, 2019).

Nonetheless, the RDP received overwhelming grassroots level support derived from the intense community and labour struggles that were continuously being fought (Gumede, 2007). Due to its multi-level participation and being people orientated, it was labelled a socialist policy and subsequently linked to failed socialist states that had supported the ANC during apartheid (Bond, 2000). According to MERG (1993), Bond (2000) and Gumede (2007), this sparked fear among government officials that if sound economic policies were not pursued, both domestic and international investors would remain skeptical about the long-term economic prospects of South Africa. This prompted the government to dismiss the RDP and capitulate to international pressure by adopting a more neoliberally friendly economic policy framework termed the Growth, Employment and Redistribution (GEAR) (Bond, 2000; Gumede, 2007; Powers; 2019).

The new macroeconomic policy argued that it would pick up where the RDP left off and realize the objectives set up (Bond, 2000; Gumede, 2007; RSA, 1994). Part of these objectives was the reduction in budget deficits, expansion of infrastructure development, and a burst of economic activity (Department of National Treasury [DNT], 1996). GEAR sought to accelerate growth, employment, and redistribution, as the name suggests. In addition, GEAR argued for restructuring of public enterprises, deregulating the financial markets, and minimizing involvement of the state in the economy (Bond, 2000; Harvey, 2005; Gumede, 2007). It also argued that the restructuring of public enterprises would be in the form of a “total sale of assets, a partial sale to strategic equity partners or the sale of the asset with the government retaining a strategic interest”.

Additionally, the government imposed austerity measures by committing to cutting expenditures to reduce the budget deficit (DNT, 1996). The reduction in government expenditure had unintended consequences on the government’s developmental imperatives. The government concedes to this fact by acknowledging in its 25-year review of South African democracy that despite attempts to address the infrastructure challenges, it still has infrastructure backlogs that delay economic development, subsequently forgoing economic growth (Department of Planning Monitoring and Evaluation [DPME], 2019).

After the shift from RDP to GEAR, periods of fiscal austerity impacted the economy (Bond, 2000; Powers, 2019). This included a mixture of public expenditure cuts and increase in taxes to balance the budget (Sibeko, 2019). Within the ruling party, there was an accepted reality that the government had to cooperate with the Bretton Woods institutions and the private sector to ensure development through private-public partnerships (Gumede, 2007; Forrer et al., 2010; Iosa & Martimort, 2012; Trebilcock & Rosenstock, 2015). While the RDP’s fiscal position argued for broad socio-economic development through reprioritized public expenditure, GEAR from the onset asserted that there needed to be a reduction in budget deficits, macroeconomic prudence, and a reprioritization of public expenditure to achieve the necessary growth levels (DNT, 1996; Gumede, 2007).

Over time, fiscal constraints have strengthened the government’s call to encourage the private sector to invest in developmental programs, namely infrastructure projects (Ramaphosa, 2020). However, the same concerns raised about fiscal constraints in the RDP, coupled with unsustainable debt levels, and infrastructure backlogs pointed out by GEAR are still haunting the government 25 years later (DPME, 2019). This was made clear in the Sustainable Infrastructure Development Symposium South Africa (SIDSSA) in June 2020. Nketiah-Amponsah and Sarpong (2019) argued that significant investment in infrastructure could substantially impact the development of the economy. However, 28 years into democracy, development impediments are yet to be resolved despite debt reduction efforts and increased investment expenditure, infrastructure bottlenecks, and sluggish economic growth. Therefore, the research will focus on the role of austerity measures in infrastructure and economic development in South Africa over the past 25 years.

2. Literature Review

This section presents the theoretical framework, outlines the theories utilized in this study, as well as the reviews of empirical literature that focuses on austerity, debt, infrastructure, and economic development. Lastly, the research gap filled by the study is also presented.

2.1 Theoretical Literature

2.1.1 Complexity theory. To fully comprehend the complexity of the South African economy, the study will use Complexity Theory. According to Cilliers (1998), Complexity Theory helps one understand complex systems. Manson (2001) defined complexity as a theory that analyzes how systems change and evolve because of their interaction with their constituent parts. Therefore, complex systems are open systems that must be able to adapt to disturbances in their environment, whereby external conditions influence their internal structure. The economic system is open, and complicated to draw borders. It is continuously influenced by the political system, agriculture (and therefore the climatic conditions), science and technology, international relationships, the stability of the society, etc. (Cilliers, 1998). Moreover, austerity measures have a complex relationship with macroeconomic outcomes. On the one hand, austerity measures manage debt and promote financial prudence; however, they slow down economic activity.

2.1.2 Neoclassical theory. The neoclassical economic theory was developed from the classical economic theory. According to Colander (2000), the term ‘Neoclassical’ was coined in the late 19th century to represent the qualitative differences that were becoming apparent in some of the approaches being taken by various economists. Furthermore, Nattrass and Varma (2014) stated that the neoclassical economic theory has assumptions that constitute the micro-foundations of the neoclassical macroeconomic models. One of these assumptions is that the neoclassical theory assumes that if the markets are left to their own devices, they will work efficiently while simultaneously ensuring market equilibrium (when supply equals demand). It further assumes that all resources are allocated optimally under perfect competition. Greenwald and Stiglitz (1987) added to the argument by stating that economic agents are rational beings seeking to maximize utility and profits, markets are perfectly competitive, agents have perfect information and stable expectations, and trade only occurs when market-clearing prices have been determined.

2.1.3 Rationale for economic theories. Economic systems are complex. The South African economic system is the sub-system of the global economic system. The South African economic system’s primary system of interest has both micro and macro agents: micro agents include consumers, producers, and firms, whereas the macro agents are the state, the private sector, and fiscal and monetary tools. According to Sibeko (2019), pursuing austerity measures is not simply a technical choice, but rather a political one that is part of the neoliberal toolkit.6 The neoclassical theory in economics has been the dominant economic thought since the shift from Keynesian economic theory in the 1980s. In South Africa, the Growth Employment and Redistribution (GEAR) economic policy introduced in 1994 embodied the neoliberal and neoclassical orthodoxies.7 Neoclassical theorists have argued that fiscal spending has only short-term benefits. Therefore, to assess economic development in South Africa, fiscal policy tools (macro agents) and how they interact are being analyzed through the lens of complexity and neoclassical theory.

2.2 Empirical Literature

2.2.1 Austerity. This section on austerity will broadly narrate the impact of austerity measures on public investments (particularly infrastructure investments), debt levels, economic growth, economic development and other macroeconomic variables like employment.

Petrova and Prodromidou (2019) conducted a study about energy poverty in Greece. The paper defines energy poverty as the inability to secure energy services for one’s home, i. e., poor energy infrastructure. Ethnographic research was undertaken in 25 households in and around the Northern city of Thessaloniki in Greece. The paper found that the austerity regime had rendered the energy poor vulnerable and governable. The paper attributes this to austerity measures that came into effect after the 2008 debt crises. The energy poor can be located both in urban and peri-urban locations.

Additionally, Islam (2018) explored the prospects for sustainable rail freight transport development in Europe during the 2008 recessionary period. For this study, eight European countries were selected based on the length of their railway lines: France, Germany, Italy, Poland, Spain, Romania, Sweden, and the United Kingdom. Of the five-transport infrastructure systems that were being examined, the study found that rail infrastructure fared the least well. This was a result of the austerity policy being implemented in rail infrastructure investment during that period.

Jacques (2021) argued that governments tend to choose the least resistance when they engage in fiscal consolidation (austerity). The paper used compositional dependent variable analysis in 17 OECD countries from 1980 to 2014 on STATA and used the Autoregressive Distributed Lag (ARDL) models for robustness checks. The author found that austerity measures (measured with the narrative approach to fiscal consolidation) are associated with a decrease in the proportion of public investment in research and development and gross fixed capital formation, and an increase in health care and pensions’ proportion of budgets.

Moreover, other scholars have stressed the devastating impact of fiscal discipline and restrictive fiscal policies (similar to austerity measures or fiscal consolidation) on economic outcomes like unemployment and poverty (Canale & Liotti, 2022; Canale et al., 2019; Canale & Liotti, 2015). These scholars produced papers that found that Eurozone countries that pursued restrictive fiscal policies negatively affected poverty, unemployment, and social inclusion levels. These papers used cross-sectional and panel data. Poverty and unemployment deprive individuals of the opportunity to develop capacities that allow them to fully participate and contribute to the economy (Canale & Liotti, 2022; Canale et al., 2019; Canale & Liotti, 2015). High levels of poverty and unemployment are constraints to economic development.

Klein (2017) provided empirical evidence from 12 countries that formed part of the Organisation for Economic Cooperation and Development (OECD) that indicated that the cost of austerity measures was contingent on the level of private debt. Also, the study found that implementing austerity measures in periods of private-debt overhang could lead to severe contractions in the economy, whereas implementing them in low debt periods has no significant impact on economic activity. The baseline data set covered 12 countries from the OECD at an annual frequency between 1978 and 2008 and used panel data. The study used the terms austerity and fiscal consolidation interchangeably—the study estimated impulse responses to exogenous changes using local projections due to their robustness to model misspecifications. Similar studies indicated that private indebtedness mattered for fiscal policy (Eggertsson & Krugman, 2012; Kaplan & Violante,2014; Andres et al. 2015).

Furthermore, Cherif and Hasanov (2012) examined debt dynamics and reviewed the effects of austerity, inflation, and growth shocks on reducing public debt using data from the United States (US). The study used a modified VAR framework that included a separate debt equation. The study extended the VAR model and included the debt-to-GDP ratio (and its lags) and macroaggregates part of the debt equation, whereby the former was an exogenous variable and the latter an endogenous variable. Times series data was used in the study covering the period between 1980 and 2007. Relating to austerity, the study concluded that in a weak economic environment, a self-defeating austerity shock is more likely than in regular times.

Alesina et al. (2015) sought to empirically measure the effects of deficit reduction policies, like fiscal austerity, on output growth. The study constructed a new narrative data set for the period between 2009 and 2013 that documented the fiscal plans implemented by several countries. This was an extension of the database estimating the effects of fiscal austerity on growth over the years preceding 2009 created by AFG for OECD countries. The study concluded that fiscal adjustments based on reduced expenditures were less damaging in output losses than those based on tax increases.

Guajardo et al. (2011) investigated the short-term effects of fiscal consolidation on OECD countries. The paper also reviewed the literature that suggested that fiscal consolidations could lead to expansionary austerity. Furthermore, the data collected included Budget Speeches, Budgets, central bank reports, IMF Staff Reports, IMF Recent Economic Developments reports, OECD Economic Surveys from OECD countries, and a multi-country dataset on tax and spending. The strategic approach to the research was similar to that of Romer and Romer (2010). The findings revealed that fiscal consolidation had contractionary effects on private domestic demand and GDP even in the high sovereign default risk economies. In contrast, literature based on measuring discretionary changes in fiscal policy using cyclically adjusted fiscal data found that fiscal contractions can be expansionary, although data is highly biased towards overstating expansionary effects.

Moreover, Jorda and Taylor (2016) investigated the effect of fiscal consolidation and economic outcomes. Also, fiscal consolidation and austerity measures were used interchangeably. The study used the inverse propensity score weighted adjustment-based method for the time series data, which monitored the austerity program imposed by the United Kingdom (UK) coalition government after the 2010 election. Additionally, the data collected was for the five years of the United Kingdom (UK) coalition government between 2010 and 2015. The study concluded that austerity constantly strains the economy, especially in depressed economies.

However, Batini et al. (2012) found that smooth and gradual fiscal consolidations (austerity) worked best with countries with high debt levels and that sheltering growth is essential for successful austerity measures to translate into lower debt-to-GDP ratios. This was revealed in their study that estimated the impact of fiscal adjustments in the US, Japan, and Europe (mainly the Euro Area, including France and Italy). Further, the study utilized regime-switching VARs to make these estimations, allowing fiscal multipliers to vary across recessions and booms. The data was collected for different periods, namely, the United States (1975 Q1– 2010 Q2), Japan (1981Q1– 2009 Q4), Italy (1981 Q1– 2007 Q4), France (1970 Q1 – 2010 Q4), and Euro Area (1985 Q1– 2009 Q4) using time series data.

2.2.2 Infrastructure and economic development. Petrović et al. (2021) assessed the effectiveness of public expenditure in emerging market economies within the EU, particularly post-socialist economies of Central and Eastern Europe. They also pointed out that the similarities between these nations are their history of centrally planned economies. The methodology used in the study was Local Projections (LP) and Structural VAR (SVAR). In addition, the data series used were quarterly data and covered the period between 1999 and 2015. The study found that increasing public investment positively affected output, employment, wages, and consumption during economic contractions. Also, public investment can be a powerful policy instrument for confronting recessions and stimulating growth.

Moreover, Nketiah-Amponsah and Sarpong (2019) investigated how infrastructure and FDI affected economic growth in Sub-Saharan Africa (SSA). The study used panel data from 46 countries between 2003 and 2017. Additionally, the data was analyzed using fixed and random effects, and generalized system method of moments (GMM) estimation techniques. The study revealed that infrastructure development is important for economic growth, while Foreign Direct Investments (FDI) only enhance growth when it interacts effectively with the requisite level of economic infrastructure. Additionally, the findings suggested that the impact of FDI on economic growth can only be maximized when some level of economic infrastructure is available. Thus, there is ample justification for a significant investment in infrastructure from the government to create a cost-effective business environment to improve economic growth.

Perkins et al. (2005) analyzed the long-term trends in the development of the South African economy and its relationship with sustained economic growth. The data was collected for different periods for different infrastructures, namely, rail (1875–2001), roads (1900–2001), air travel (1960–2001), electricity (1920–2001), and telephones (1920–2001). The estimations were based on PSS F-tests to identify directions of association between economic infrastructure and economic growth. The study revealed three interesting findings: the relationship between economic infrastructure and economic growth seems unidirectional, unsatisfactory investment in infrastructure could create bottlenecks, and South Africa’s stock of economic infrastructure has developed in phases.

Mura (2014) investigated the effects of productive public expenditures, particularly education, health, research and development (R&D), and infrastructure, on economic growth. The study used a panel-model approach with six cross-sections of six East-European countries between 1990 and 2013. The study showed that education, infrastructure, and R&D expenditure positively affected economic growth, while expenditures on health seemed to harm growth.

On the other hand, Gnade et al. (2017) analyzed the effect that basic and social infrastructure investment has on economic growth and social development in South African rural communities. The paper also compared the returns of the investment in urban and rural communities in South Africa. Using a balanced panel dataset with indicators for urban and rural municipalities, the study found that the elasticities of basic and social infrastructure investment are generally more pronounced for rural municipalities’ economic growth and social development indicators. Therefore, the findings could be used as a precursor to increase infrastructure investment in rural municipalities to stimulate rural municipalities’ economic growth and development. Thus, the inequality between rural and urban municipalities cannot be addressed adequately without addressing infrastructure.

2.2.3 Debt. Baaziz et al. (2015) investigated the relationship between the public debt ratio and real GDP growth in South Africa. There were continued concerns by policymakers, debt collectors, and lenders regarding optimal public debt levels that could threaten economic growth. The study used the STR model, which allowed regression coefficients to vary depending on the level of public debt. Also, the period under review utilized time series data of the South African economy between 1980 and 2014. The results revealed that the estimated threshold level between public debt and growth turns negative when public debt levels surpass 31.7%. Thus, debt levels above the threshold have a statistically significant negative impact on the performance of the South African economy.

Furthermore, Caner et al. (2010) pointed out that developed and developing nations have a debt threshold. Noting that austerity attempts to prevent a debt crisis, their study established that the threshold for developed nations was 77 percent public debt-to-GDP ratio, whereas that of developing nations was 64 percent. Using time series data, this paper had yearly datasets of 101 developing and developed economies from 1980 to 2008. Additionally, the threshold LS model was used. The effects of this threshold were more pronounced in developing countries.

Conversely, Herndon et al. (2014, p. 2) debunked the study by Caner et al. (2010) and cited “coding errors, selective exclusion of available data, and unconventional weighting of summary statistics”, which led to errors that failed to provide an accurate representation of the relationship between debt and growth. By disproving Reinhart and Rogoff’s claim, the study found that public debt-to-GDP ratios above 90% do not consistently reduce a country’s GDP growth.

2.3 Empirical Summary

Austerity has become synonymous with fiscal consolidation like economic growth and economic development. Also, it has been characterized as an act of political expediency rather than an economic necessity. Scholars have written extensively, producing a diverse and vast body of work regarding the austerity-debt-growth nexus. However, available research has neglected the austerity–development nexus necessary for developmental discourse. Examining debt, infrastructure, and economic development literature proves vital as austerity programs affect each of these variables. Literature investigating the austerity–growth nexus, and the austerity–debt nexus has been conducted using a mix of panel and time series data. However, most of the literature is conducted using time series and panel data.

Klein (2017), Cherif and Hasanov (2012), Alesina et al. (2015), Guajardo et al. (2011), Jorda and Taylor (2016), and Batini et al. (2012) provided key insights on the austerity-debt-growth nexus. Furthermore, Petrović et al. (2021), Nketiah-Amponsah and Sarpong (2019), Perkins et al. (2005), Mura (2014), and Gnabe et al. (2017) presented the relationship between economic and infrastructure development and sustained economic activity. In contrast, Baaziz et al. (2015) and Caner et al. (2010) elaborated on the debt-growth nexus. Canale and Liotti (2022), Canale et al. (2019), and Canale and Liotti (2015) examined the impact of fiscal tightening on unemployment and poverty levels (indicators of economic development). Finally, Petrova and Prodromidou (2019), Islam (2018), and Jacques (2021) highlighted the relationship between austerity and infrastructure development. Petrova and Prodromidou (2019) conducted ethnographic research, whereas Jacques (2021) modelled a regression analysis on STATA. These studies found that austerity has a negative relationship with infrastructure development.

The study on the role of austerity in infrastructure and economic development is the first of its kind in South Africa. Additionally, there is little to no research on the austerity-infrastructure development nexus that has employed Vector Autocorrelation (VAR) models. Thus, the model specification will show that a Vector Autocorrelation (VAR) model is used. A detailed data analysis is conducted to review the VAR estimation tests used in the study. Finally, like Mushelenga and Sheefeni (2017), the study employed will conduct time series techniques on quarterly data from 1994 to 2019 within a VAR framework.

3. Research Methodology

3.1 Model Specification and Analytical Framework

Austerity measures have served as significant macroeconomic tools for debt management, but their role in economic and infrastructure development is yet to be defined. Thus, the study utilized a quantitative method to effectively analyze the relationship and connection between austerity measures and economic and infrastructure development. Following the methods and methodology used by Cherif and Hasanov (2012), the study employed the vector autoregression (VAR) modelling technique. Alternatively, the study could have used panel data to employ the Panel System Generalised Method of Moments (GMM) model for analysis. The analysis of panel data would require a comparative analysis of different countries which would go beyond the scope of the study. The methodology applied in this study is dictated by the nature of the data available. Thus, the study will follow a time series data modelling approach. Austerity (or fiscal consolidation) can be identified by a reduction in government domestic expenditures (GDE). Infrastructure stock is represented by total gross fixed capital formation (TGFCF). Economic development is represented by real gross domestic product (RGDP). Therefore, the key variables selected for this study included government expenditure, infrastructure stock and the real gross domestic expenditure.

The VAR is a system that treats the variables of dynamic linear equations in the system as endogenous. The reduced form of the system provides an equation for each variable and specifies each variable as a function of the lagged values of their own and all other variables in the system (Sheefeni & Kaulihowa, 2016). Additionally, VAR is useful in analyzing the interrelation of the time series and the dynamic impacts of random disturbances on the system of variables. In fact, according to Enders (2004), a reduced form of VAR of order p can be estimated and expressed as:

where: yt = f (lnTGFCF, lnRGDP, lnNET_DEBT, lnC_TX, lnGDE);

Φ = matrix of coefficients of autonomous variables;

pi = matrix of coefficients of all variables in the model;

y𝑡-1 = is the vector of the lagged values of total gross fixed capital formation, real GDP, net debt, corporate tax, and Gross Domestic Expenditure (lnTGFCF, lnRGDP, lnNET_DEBT, lnC_TX and lnGDE);

εt = the vector of the error term.

Mushelenga and Sheefeni (2017) mentioned that the standard practice in empirical applications of using the VAR model is to perform the impulse response functions (IRF) analysis and its forecast error variance decomposition (FEVD). However, before the final VAR estimation, there are various procedures that should be conducted prior to that. First, the variables must be tested for stationarity to determine the order of integration using Augmented Dickey-Fuller (ADF) (Gujarati, 2003). This was followed by determining the optimal lag length for the model to determine how far in the past the model should go. In addition, the model had to be tested for stability to establish whether the VAR model satisfies the stability condition. VAR stability is established when the inverse roots of the AR polynomial have a modulus below one and lie within the unit root circle.

Thereafter, the Johansen co-integration test was conducted to test for two or more series with a long-run equilibrium or relationship. The test is based on Trace and Maximum Eigenvalues test statistics. In the presence of co-integration among variables, the Vector Error Correction Model (VECM) is used to adjust the short-run to the long-run equilibrium, whereas its absence indicates that only the VAR model can be estimated to make a short-run analysis. Next, the impulse response function which traces the response of the endogenous variables in the VAR to shocks to each of the other variables was derived. Lutkepohl (1993) explained that the generalized impulse response function (GIRF) considered historical patterns of correlations among different shocks and showed the interaction between endogenous variables sequence. Thus, the bias towards a particular school of thought can be avoided using a GIRF since it is not sensitive to the ordering of variables.

Lastly, the variance decomposition analysis provides an alternative method to the impulse response function for examining the effects of shocks on dependent variables (Sheefeni & Kaulihowa, 2016). It determines how much of the forecast error variance for any variable in the system is explained by innovations to each explanatory variable over a series of time horizons (Stock & Watson, 2001).

3.2 Data and Sources

For this study, data from 1994 to 2019, which equates to 25 years, was used. The data of the above-mentioned period was converted into quarterly frequencies. The periods whereby the macroeconomic policy was employed ran concurrently with the frequency of the data that would be used, namely, Reconstruction and Development Plan (1994-1996), GEAR (1996-2009), Accelerated and Shared Growth Initiative for South Africa (2004- 2008), New Growth Path (2010-2012), and National Development Plan (2012-2030). The secondary data was gathered mainly from the South African Reserve Bank (SARB).

4. Empirical Results and Analysis

4.1 Empirical Findings: Estimation for Infrastructure Development

4.1.1 Unit Root test. Table 1 presents the results for the ADF unit root test. The findings show that Corp_Tax was stationary in levels, whereas the rest of the variables were found to be stationary in first difference. Therefore, Corp_Tax is integrated of order zero, while the rest of the variables are integrated of order one.

Table 1

Unit Root Tests ADF in Levels and First Difference

|

Variable |

Model Specification |

Levels |

First |

Order of |

|

lnrgdp |

Intercept |

-2.217 |

-3.8395** |

I(1) |

|

Intercept and trend |

-0.228 |

-4.4660** |

I(1) |

|

|

Lntotal_gfcf |

Intercept |

-1.6117 |

-2.8972** |

I(1) |

|

Intercept and trend |

-1.3256 |

-3.1505* |

I(1) |

|

|

Lnnet_debt |

Intercept |

1.3664 |

-2.1371** |

I(1) |

|

Intercept and trend |

-1.7418 |

-2.7616** |

I(1) |

|

|

Lngde |

Intercept |

-1.3047 |

-3.0969** |

I(1) |

|

Intercept and Trend |

-0.7775 |

-3.3147* |

I(1) |

|

|

lnc_tx |

Intercept |

-3.7528** |

-14.0399** |

I(0) |

|

Intercept and trend |

-4.0175** |

-13.9902** |

I(0) |

Note. * and ** mean the rejection of the null hypothesis at 10% and 5%, respectively.

4.1.2 Stability condition. The VAR satisfies the stability condition as the AR roots were all less than one, and none lay outside the unit circle, as reported in Table 2.

Table 2

Roots of Characteristic Polynomial

|

Root |

Modulus |

|

0.993968 |

0.993968 |

|

0.963169 - 0.018993i |

0.963356 |

|

0.963169 + 0.018993i |

0.963356 |

|

-0.599991 |

0.599991 |

|

0.477286 - 0.071431i |

0.482602 |

|

0.477286 + 0.071431i |

0.482602 |

|

-0.146635 |

0.146635 |

|

0.063462 |

0.063462 |

4.1.3 Lag length criterion. Table 3 displays the optimal lag length criterion. The various information criteria are the LR test statistic, FPE, AIC, SC, and HQ. The maximum lag length on the VAR stability was four, as suggested by the SC in the criterion.

Table 3

Optimal Lag Length

|

Lag |

LogL |

LR |

FPE |

AIC |

SC |

HQ |

|

0 |

304.5702 |

NA |

2.24e-08 |

-6.261880 |

-6.155032 |

-6.218690 |

|

1 |

920.7865 |

1168.243 |

8.32e-14 |

-18.76639 |

-18.23215 |

-18.55044 |

|

2 |

966.5551 |

82.95550 |

4.48e-14 |

-19.38656 |

-18.42493 |

-18.99786 |

|

3 |

991.3578 |

42.88804 |

3.75e-14 |

-19.56995 |

-18.18093 |

-19.00849 |

|

4 |

1048.630 |

94.26131 |

1.60e-14 |

-20.42980 |

-18.61339* |

-19.69558* |

|

5 |

1071.159 |

35.20001 |

1.42e-14 |

-20.56580 |

-18.32200 |

-19.65882 |

|

6 |

1090.707 |

28.91521* |

1.34e-14* |

-20.63973* |

-17.96853 |

-19.55998 |

|

7 |

1099.336 |

12.04558 |

1.61e-14 |

-20.48618 |

-17.38759 |

-19.23368 |

|

8 |

1113.840 |

19.03597 |

1.73e-14 |

-20.45500 |

-16.92902 |

-19.02974 |

4.1.4 Co-integration and VECM results. The test used is the Johansen co-integration test which was based on both the Trace and Maximum Eigenvalues test statistic (see Table 4).

Table 4

Johansen Co-integration Test

|

Maximum Eigen Test |

Trace Test |

||||||

|

H0: rank=r |

Ha: rank=r |

Statistic |

95% Critical Value |

H0: rank=r |

Ha: rank=r |

Statistic |

95% Critical Value |

|

r = 0 |

r = 1 |

28.04701* |

27.58434 |

r = 0 |

r >= 1 |

53.20539* |

47.85613 |

|

r <= 1 |

r = 2 |

11.96234 |

21.13162 |

r <= 1 |

r >= 2 |

25.15837 |

29.79707 |

|

r <= 2 |

r = 3 |

8.476521 |

14.26460 |

r <= 2 |

r >= 3 |

13.19603 |

15.49471 |

|

r <= 3 |

r = 4 |

4.719512* |

3.841465 |

r <= 3 |

r >= 4 |

4.719512* |

3.841465 |

Note.* denotes rejection of the hypothesis at the 0.05 level. Both Max-eigenvalue and Trace tests indicate one co-integrating equation at the 0.05 level.

Both test statistic results indicated at least one co-integrating vector. This was because the t-statistics were greater than the critical value at a 5% significance level suggesting the presence of co-integration among the variables. Therefore, there was one significant long-run relationship between the given variables, hence the need to adjust the short-run to the long-run equilibrium through the VECM model.

The representation of co-integration and the long run model is presented in Table 5, derived from the VECM.

Table 5

Vector Error Correction Estimates

|

Co-integration Equation: |

Co-integration Equation1 |

|

LNTGFCF(-1) |

1.000000 |

|

LNNET_DEBT(-1) |

0.199733 |

|

|

(0.01596) |

|

|

[ 12.5127] |

|

Co-integration Equation: |

Co-integration Equation1 |

|

LNGDE(-1) |

-1.909915 |

|

|

(0.06235) |

|

|

[-30.6344] |

|

LNC_TX(-1) |

-0.430986 |

|

|

(0.13029) |

|

|

[-3.30786] |

|

C |

10.80994 |

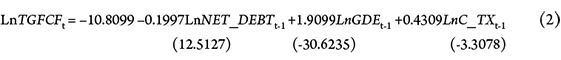

The estimated long-run equation for TGFCF is presented in Equation 2. The model was specified in logarithms. Thus, the interpretation will be in elasticity form and the signs need to be inverted.

In equation (2), the coefficients of GDE and CORP_TAX were positive. Therefore, an increase in GDE and CORPT_TAX positively impacted TGFCF. Islam (2018) had similar findings whereby the lack of investment in infrastructure during times of austerity created bottlenecks that inhibited sustainable infrastructure development. Additionally, Perkins et al. (2005) found that a significant increase in government spending (investments) positively impacted infrastructure development. On the other hand, the coefficient of NET_DEBT was negative. This suggests that an increase in NET_DEBT would have a negative impact on TGFCF. Similarly, Klein (2017) found that the level of indebtedness significantly hampers the prospects of development in a nation.

Table 6

Short Run Relationship (VECM)

|

Error |

D(LNTGFCF) |

D(LNNET_DEBT) |

D(LNGDE) |

D(LNCORP_TAX) |

|

CointEq1 |

-0.519320 |

-0.065422 |

-0.140153 |

0.148071 |

|

|

(0.12439) |

(0.06428) |

(0.08541) |

(0.07430) |

|

|

[-4.17497] |

[-1.01776] |

[-1.64101] |

[1.99280] |

Table 6 presents short run relationship. The coefficients presented in the table were adjustment coefficients that played an integral role in restoring the normalized variables to equilibrium. For this reason, Enders (2015, p. 365) argued that “if the system is to return to equilibrium, the movement of some variables would respond to the magnitude of the disequilibrium”. Thus, the adjustment coefficients brought the system back to equilibrium when there was a movement away from the long-run relationship. On the other hand, if the variables in Table 6 had adjustment coefficients of 0, it signified that they neither played a role nor impacted the short-run determination of the normalized variables (Enders, 2015). Additionally, variables that did not respond to movements away from the long-run equilibrium are weakly exogenous.

In an Error Correction Model (ECM), where the Error Correction Term (ECT) is represented, the short-term dynamics of the variables in the system were influenced by the deviation from equilibrium (Enders, 2015). For example, in Table 6, the ECT had a value of -0.51932. This implied that the system would return to equilibrium at a high rate of 0.51932, which translates to roughly 51.93% speed adjustment back to equilibrium.

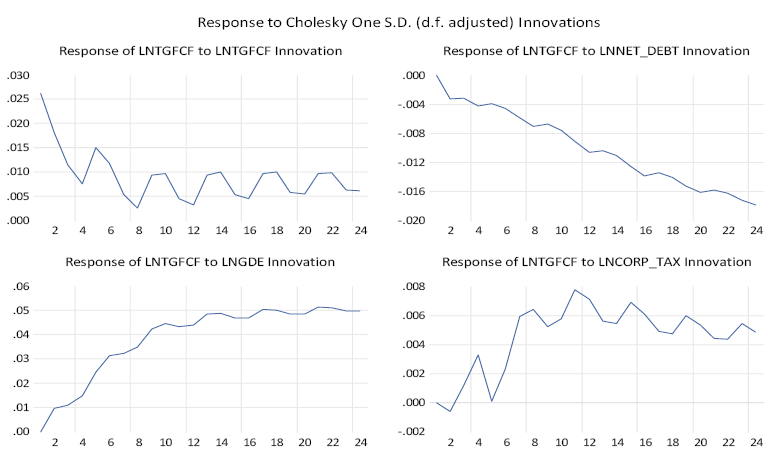

4.1.5 Impulse response function. The IRF represented in Figure 1 showed the response from four variables among themselves namely, TGFCF, GDE, NET DEBT, and C_TX. The results showed that the response of TGFCF on itself indicated an immediate positive response in the first four quarters followed by a slight increase in quarter four and a continuous decrease between quarter five and quarter eight. Thereafter, there was a consistent fluctuation (increase and decrease) between quarters 10 and 24. Evidently, the effects of the shocks appeared to be permanent in the long run as the variable found a new equilibrium level.

Secondly, the response of TGFCF to shocks to debt showed an initial positive response in quarter one, followed by a negative response after that. The response indicated that one positive standard deviation innovation would lead to revision downward of infrastructure development in the long run. Kapindula and Kaliba (2022) made similar findings when they reported that debt servicing negatively correlated with infrastructure spending, indicating that high debt costs hamper infrastructure development. Additionally, Abeysinghe (2021) found that infrastructure development increases the debt burden in the short run, augmenting the findings in Figure 1 that debt positively impacts infrastructure development in the short run.

Moreover, the response of TGFCF to shocks in government expenditure showed a positive increase in TGFCF between quarters 1 and 2. Shocks to GDE indicated an aggregated positive response to TGFCF both in the short and the long run. However, there was a periodic decrease in quarters 2 to 3, 6 to 7, 10 to 11, 17 to 18, and 21 to 22. This was consistent with economic theory that suggested that increased government spending would positively impact infrastructure development (Perkins et al., 2005). Notably, Jones and Llewellyn (2019) made similar assertions arguing that government expenditure on quality infrastructure had more significant multiplier effects than tax cuts. The effects also became permanent as the variable found a new equilibrium level.

Figure 1

Generalised Impulse Response Functions

Finally, the response of TGFCF to C_TX was overwhelmingly positive despite initially decreasing in the periods between quarters 1 and 2. In the long run, the shock to C_TX produced a steep increase between quarters 2 and 11, except for a decrease in quarters 4, 7, and 11, followed by a steady decrease from quarter 11 to quarter 24. The shock effects seemed permanent as the variables found a new equilibrium level. The results correspond with Mourmouras and Rangazas’s (2008) findings indicating that rising tax revenues allowed the government to increase its public investment. Thus, a shock to TGFCF, GDE, and C_TX positively impacted infrastructure development.

4.1.6 Forecast Error Variance Decomposition

Table 7

Variance Decomposition

|

Variance Decomposition of LNTGFCF: |

|||||

|

PERIOD |

S.E. |

LNTGFCF |

LNET_DEBT |

LNC_TX |

LNGDE |

|

1 |

0.026190 |

100.0000 |

0.000000 |

0.000000 |

0.000000 |

|

6 |

0.060572 |

42.50661 |

2.070415 |

2.415651 |

53.00732 |

|

12 |

0.120032 |

12.53297 |

3.201874 |

6.429394 |

77.83576 |

|

18 |

0.173735 |

7.403681 |

4.724395 |

6.008469 |

81.86346 |

|

24 |

0.217321 |

5.428680 |

6.461982 |

5.601179 |

82.50816 |

Table 7 shows the fluctuations in infrastructure over the horizon. It is evident that the fluctuations in infrastructure are 100% caused by itself in the first quarter. However, by the sixth quarter, over 50% of the fluctuations was due to GDE. As the horizon extends, GDE continues to dominate, with very meager effects from NET_DEBT and C_TX. FEVD analysis determined the relative importance of fluctuations in infrastructure development explained by itself as well as other variables. Therefore, infrastructure development explained most of its variations in the short term, although this trend changed in the long term, whereby most of the variations in infrastructure development were explained by government expenditure.

4.2 Empirical Findings: Estimation for Economic Development

The second objective of this study was to analyze the response of economic development to the shocks in austerity measures. This was done by deriving the generalized impulse response functions. This was done after unit root, stability condition, lag length criteria, and co-integration test.

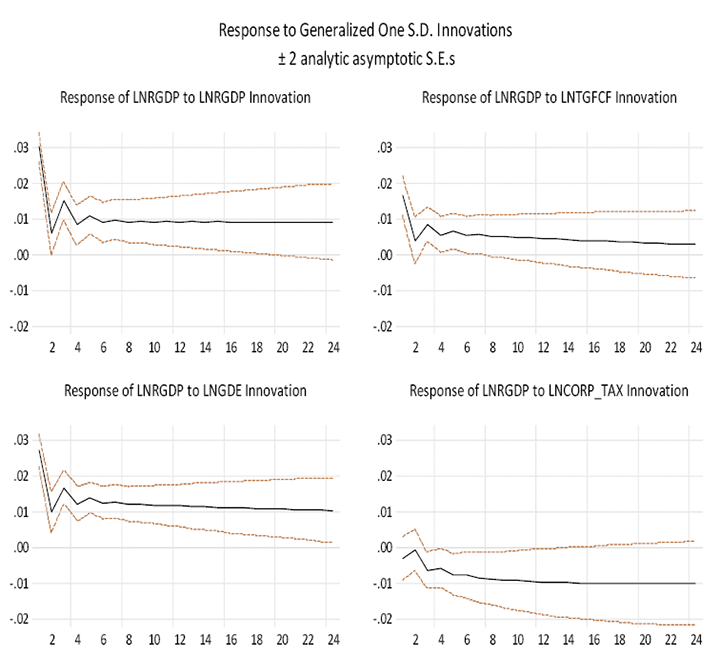

4.2.1 Impulse Response Function. The IRF represented in Figure 2 shows the response from four variables among themselves namely, Real Gross Domestic Product (RGDP), Gross Domestic Expenditure (GDE), Total Gross Fixed Capital Formation (TGFCF), and corporate tax (C_TX). The results show that the response of RGDP on itself indicated an immediate positive response in the first two quarters followed by a slight increase in quarter two onwards and a continuous decrease between quarter five and quarter eight. Thereafter, there was a consistent fluctuation (increase and decrease) between quarters 10 and 24. Evidently, the effects of the shocks appeared to be permanent and positive in the long run as the variable found a new equilibrium level.

Secondly, the response of RGDP to shocks on TGFCF showed a positive response on the RGDP between quarters 1 and 2. After Quarter 3, there appeared to be a continuous decrease. The shock effects seemed permanent as a new equilibrium level was established. The results align with economic theory that suggests that infrastructure investments have significantly impacted GDP growth (Perkins et al., 2005). Similarly, Hashimzade and Myles (2010) and Burger et al. (2016) found that infrastructure expansion (investment) had remained crucial for laying the foundation for economic growth and development, particularly public infrastructure investments that augmented private capital investments. However, uncoordinated infrastructure expenditure could have an insignificant impact on growth (Hashimzade & Myles, 2010).

Additionally, the response of RGDP to shocks to GDE showed a positive response to RGDP. Between quarters 1 and 2, there appeared to be a decrease followed by an increase after Quarter 2. Quarter 3 appeared to be the start of a continuous decrease which remained consistent from Quarter 5. The shock effects also seemed permanent as a new equilibrium level was established. Mura (2014) had similar results when finding that productive expenditure was positively correlated to growth. Ahuja and Pandit (2020) and Ansari et al. (2021) results also correspond with the findings asserting that public expenditure positively impacted economic growth and development.

Figure 2

Generalized Impulse Response Functions

Finally, the response of RGDP to C_TX was negative. There seemed to be an increase for the first quarter followed by a consistent decrease from Quarter 2. A new equilibrium level was attained after Quarter 13. Mourmouras and Rangazas (2008) obtained similar findings in line with economic theory that indicated that high tax rates have a negative impact on economic growth and development. Additionally, Myles (2009) argued that an increase in corporate tax would have an adverse effect on growth. Millot (2020) found that increased corporate taxes curtail private investments vital for growth. Corporate spending more on taxes would reduce spending on research and development, which is an essential component of stimulating economic growth.8

4.2.2 Forecast Error Variance of Decomposition. Table 8 presents the results of the FEVD over a period of 24 quarters. The study was interested in the movements of economic development following shocks to itself and other variables (GDE, C_TX, and TGFCF). Hence the study reported on the variance decomposition of economic development. It also analyzed the relative importance of other variables in influencing the movements of economic development. In Quarter 1, all the variance in economic development was explained by its own innovation with other variables being insignificant. However, from the 6th quarter, government expenditure and corporate taxes started making inroads in terms of contributing to the fluctuations in economic development as reported in Table 8.

Table 8

Variance of Decomposition

|

Variance Decomposition of LNRGDP: |

|||||

|

Period |

S.E. |

LNRGDP |

LNGDE |

LNC_TX |

LNTGFCF |

|

1 |

0.030273 |

100.0000 |

0.000000 |

0.000000 |

0.000000 |

|

6 |

0.046411 |

67.79709 |

22.40690 |

6.420894 |

3.375118 |

|

12 |

0.060656 |

54.25685 |

25.66133 |

14.80920 |

5.272625 |

|

18 |

0.071660 |

49.10432 |

23.98789 |

20.19873 |

6.709064 |

|

24 |

0.080760 |

46.64397 |

21.71126 |

23.63101 |

8.013764 |

5. Conclusion

This study investigated the role of austerity measures on economic and infrastructure development in South Africa from 1994 to 2019. The study made use of secondary quarterly data. In addition, time series techniques were used to analyze the unit root tests, stability condition, lag length criterion, co-integration tests, error correction model estimations, generalized impulse response functions (GIRF) and forecast error variance decomposition (FEVD). The results showed that investment in infrastructure stock had a favorable impact on infrastructure development in the long run. Additionally, an increase in government expenditure had a favorable impact on economic development.

5.1 Discussion

The results above show an apparent positive long-run relationship between investment in infrastructure and infrastructure development. Thus, an increase in infrastructure investment increased infrastructure development. Similarly, an increase in government expenditure positively impacted infrastructure development. As a result, government expenditure and infrastructure development are unidirectional. Petrović et al. (2021), Nketiah-Amponsah and Sarpong (2019), and Perkins et al. (2005) results showed a similar trend. On the other hand, debt and infrastructure development had a negative relationship. When the debt burden increased, infrastructure development was impacted negatively in the long run. Baaziz et al. (2015) found that debt above a particular level negatively impacted economic activity. Corporate tax had a long-run positive relationship with infrastructure development. However, the relationship started to wane, indicating corporate tax’s decreasing significance.

Moreover, the relationship between economic development and infrastructure investment was complementary. This implied that when infrastructure investment increased, there was a positive impact on economic development. Equally, the relationship between government expenditure and economic development was also positive. As a result, increase in government expenditure had a favorable impact on economic development. Conversely, the corporate tax harmed economic development. Subsequently, when corporate tax increased, economic development had a negative response.

As previously mentioned, the linkages and interconnections between austerity measures (fiscal consolidation) and both economic and infrastructure development are non-linear. This non-linearity caused by their interaction led to an emergence of various properties. Given the findings presented, the study concluded that austerity measures promote neither economic nor infrastructure development. Additionally, infrastructure backlogs are an emergent property of a lack of infrastructure development. This resulted from decreased government expenditure, a component part of austerity measures, or increasing the tax levels.

5.2 Recommendations

Based on the findings, the study recommends policies that do not hinder investments in infrastructure that could have significant multiplier effects. These could range from increased employment levels to substantial reductions in poverty levels. South Africa has adopted neoliberal policy instruments wherein austerity is one of the tools available within its arsenal. However, austerity measures (fiscal consolidation) hinder both economic and infrastructure development. Thus, re-evaluating ‘belt tightening’ policies that have already been adopted by the government is imperative. Alternatives to neoliberal economic policies must be pursued, discarding the Washington Consensus dictum “there is no alternative” to neoliberalism. The government should pursue policies promoting economic and infrastructure development as a precursor for radical socioeconomic development.

5.3 Limitations

The scope of the study was limited. The study did not assess the type of government expenditure necessary for development, nor did it establish the infrastructure that would most impact development. Therefore, future studies on the impactful infrastructure projects would be highly beneficial.

References

Abeysinghe, T. (2021). Debt Begets Debt: The Sri Lankan Welfare State and fiscal Sustainability. Asian Economic Journal, 35(4), 363–389.

Abubakar, A. (2020). Does fiscal tightening (loosening) reduce public debt? African Development Review, 32(4), 528–539. https://doi.org/10.1111/1467-8268.12458

Agnello, L., Castro, V., Jalles, J., & Sousa, R. (2018). The Impact of Fiscal Consolidation on Human Development. Journal of International Development, 30(2/3), 399–429. DOI:10.1002/jid.3309

Ahuja, D. & Pandit, D. (2020). Public Expenditure and Economic Growth: Evidence from Developing Countries. Fortune Institute of International Business Business Review. 9(3), 228–236. https://doi.org/10.1177/2319714520938901

Alesina, A., Barbiero, O., Favero, C., Giavazzi, F., & Paradisi, M. (2015). Austerity in 2009–2013. (NBER Working Paper No.20827).

Andres, J., Bosca, J. & Ferri, J. (2015). Household Debt and Fiscal Multipliers. Economica, 82, 1048–1081.

Ansari, M., Khan, F., & Singh, M. (2021). Public Expenditure and Economic Development: New Evidence from BRICS-SAARC-ASEAN region. Theoretical and Applied Economics, XXXIII(2/627), 155–174.

Baaziz, Y., Guesmi, K., Heller, D.,& Lahiani, A. (2015). Does Public Debt Matter for Economic Growth?: Evidence from South Africa. The Journal of Applied Business Research,31(6),2187–2196. https://doi.org/10.19030/jabr.v31i6.9475

Batini, N., Callegari, G., & Melina, G. (2012). Successful Austerity in the United States, Europe and Japan. (IMF Working Paper No. 12/190).

Bi, H., Leeper, E.,& Leith, C. (2012). Uncertain Fiscal Consolidations. (NBER Working Paper No. 17844).

Bond, P. (2000). The Elite Transition: From Apartheid to Neoliberalism. Pluto Press: London.

Burger, P., Siebrits, K., & Calitz, E. (2016). Fiscal Consolidation and the Public Sector Balance Sheet in South Africa. South African Journal of Economics, 84(4). DOI:10.1111/saje.12126

Cairney, P. (2012). Complexity Theory in Political Science and Public Policy. Political Studies Review, 10(3), 346–358. doi: 10.1111/j.1478-9302.2012.00270.x

Canale, R. R., & Liotti, G. (2015). Structural Adjustment and Unemployment in Eurozone Countries. Australian Economic Review, 48(2), 113–21.

Canale, R. R., Liotti, G., & Marani, U. (2019). Structural public balance adjustment and poverty in Europe. Structural Change and Economic Dynamics, 50, 227–236.

Canale, R. R., & Liotti, G. (2022). Absolute Poverty and Sound Public Finance in the Eurozone. Journal of Economic Inequality, 20, 27 – 344. https://doi.org/10.1007/s10888-021-09498-3.

Caner, M., Grennes, T., Koehler-Grip, F., & Koehler-Grip, F. (2010). Finding the Tipping Point When Sovereign Debt Turns Bad. (The World Bank Policy Research Working Paper No.5391).

Cherif, R., & Hasanov, F. (2012). Public Debt Dynamics: The Effects of Austerity, Inflation, and Growth Shocks. (International Monetary Fund Working Paper No.12/230. Washington DC: IMF.

Cilliers, P. (1998). Complexity and Postmodernism: Understanding Complex Systems. London: Routledge.

Colander, D. (2000). The Death of Neoclassical Economics. Journal of the History of Economic Thought. Vol. 22(2), 127–143. https://doi.org/10.1080/10427710050025330

Department of National Treasury. (1996). Growth Employment and Redistribution. National Treasury, Pretoria. Department of Planning Monitoring and Evaluation. (2019). Twenty-Five Year Review of South Africa: 1994-2019. Presidency, Pretoria.

Eggertsson, G. B., & Krugman, P. (2012). Debt, Deleveraging, and the Liquidity Trap: A Fisher-Minsky-Koo Approach. Quarterly Journal of Economics,127(3). 1469–1513. https://doi.org/10.1093/qje/qjs023

Enders, W. (2004). Applied Econometric Time Series. John Wiley & Sons.

Enders, W. (2015). Applied Econometric Time Series (4th ed.). John Wiley & Sons.

Fedderke, J., & Bogetić, Z. (2006). Infrastructure and Growth in South Africa: Direct and Indirect Productivity Impacts of 19 Infrastructure Measures. (Economic Research Southern Africa Working Paper No. 39).

Feldman, M. P,, Hadjimichael, T., Kemeny, T., & Lanahan, L. (2015). The Logic of Economic Development: A Definition and Model for Investment. Environment and Planning C: Government and Policy, 34(1), 5–21.

Forrer, J., Kee, J., Newcomer, K., & Boyer, E. (2010). Public-Private Partnerships and the Public Accountability Question. Public Administration Review, 70(3), 475–484.

Gnade, H., Blaauw, P., & Greyling, T. (2017). The impact of basic and social infrastructure investment on South African economic growth and development. Development Southern Africa, 34(3), 347–364.

Greenwald, B., & Stiglitz, J. (1987). Keynesian, New Keynesian and New Classical Economics. Oxford Economic Papers, 39(1), 119–133.

Guajardo, J., Leigh, D., & Pescatori, A. (2011). Expansionary Austerity: New International Evidence. (International Monetary Fund Working Paper No. 158).

Gujarati, D. (2003). Basic Econometrics (4th ed.). New York: McGraw-Hill.

Gumede, W. (2007). Thabo Mbeki and the Battle for the Soul of the ANC. Zed Books.

Harvey, D. (2005). A Brief History of Neoliberalism. New York:.Oxford University Press Inc.

Hashimzade, N., & Myles, G. (2010). Growth and Public Infrastructure. Macroeconomic Dynamics, 14(S2), 258–274. DOI:https://doi.org/10.1017/S1365100510000374

Herndon, T., Ash, M., Pollin, R. (2014). Does high public debt consistently stifle economic growth? A critique of Reinhart and Rogoff. Cambridge Journal of Economics,38(2), 257–279, https://doi.org/10.1093/cje/bet075

Iosa, E., & Martimort, D. (2012). Risk Allocation and the Costs and Benefits of Public-Private Partnerships. The RAND Journal of Economics, 43(3), 442–474.

Islam, D. (2018). Prospects for European sustainable rail freight transport during economic austerity. Benchmarking: An International Journal,25(8), 2783–2805. DOI:10.1108/BIJ-12-2016-0187

Jacques, O. (2021) Austerity and the path of least resistance: how fiscal consolidations crowd out long-term investments. Journal of European Public Policy, 28(4), 551-570, DOI: 10.1080/13501763.2020.1737957.

Jones, R., & Llewellyn, J. (2019). Improving Infrastructure. Executive Summary. National Institute of Economic Review, 250(1), R61–R68.

Jorda, O., & Taylor, A. (2016). The Time for Austerity: Estimating the Average Treatment Effect Of Fiscal Policy. The Economic Journal, 126(590), 219-255.

Kapindula, M., & Kaliba, C. (2022). The effects of external debt servicing on infrastructure spending: A case of Zambia. International Journal of Construction Management, 22(1), 41–50.

Kaplan, G., & Violante, G. (2014). A Model of the Consumption Response to Fiscal Stimulus Payments. Econometrica, 82, 1199–1239.

Klein, M. (2017). Austerity and Private Debt. Journal of Money, Credit and Banking, 49(7), 1555-1585.

Kumo, W. (2012). Infrastructure Investment and Economic Growth in South Africa: A Granger Causality Analysis. (African Development Bank Working Paper Series No. 160.

Lutkepohl, H. (1993). Introduction to Multiple Time Series Analysis. Berlin: Springer. Macroeconomic Research Group (MERG). (1993). Making Democracy Work: A Framework for Macroeconomic Policy in South Africa. IDS Bulletin, 25(1), 3–9.

Manson, S. M. (2001). Simplifying complexity: A review of complexity theory. Geoforum, 32, 405–414.

Millot, V., Johansson, A., Sorbe, S., & Turban, S. (2020). Corporate taxation and investment of multinational firms: Evidence from firm-level data. (OECD Taxation Working Papers No. 51). https://doi.org/10.1787/9c6f9f2e-en

Mourmouras, A., & Rangazas, P. (2008). Fiscal Policy and Economic Development. (IMF Working Paper 08/155).

Mura, P. (2014). How growth-friendly are productive public expenditures? An empirical analysis for Eastern Europe. Theoretical and Applied Economics, 10(599), 7–20.

Mushelenga, J., & Sheefeni, J. (2017). Exchange Rate and Economic Growth in Namibia. International Journal of Social Science and Economic Research,2(5), 3248–3264.

Myles, G. (2009). Economic Growth and the Role of Taxation Theory. (OECD Economics Department Working Paper Series No. 713).

National Planning Commission. (2012). The National Development Plan: Vision 2030. Pretoria: South African Presidency.

Nattrass, N., & Varma, G. V. (2014). Macroeconomics Simplified: Understanding Keynesian and Neoclassical Macroeconomic Systems. South Asian Journal of Macroeconomics and Public Finance, 4(1), 138–140.

Nketiah-Amponsah, E., & Sarpong, B. (2019). Effect of Infrastructure and Foreign Direct Investment on Economic Growth in Sub-Saharan Africa. Global Journal of Emerging Market Economies, 11(3),183–20.

Perkins, P., Fedderke, J., & Luiz, J. (2005). An Analysis of Economic Infrastructure Investment in South Africa. South African Journal of Economics, 73(2), 211– 228.

Petrova, S., & Prodromidou, A. (2019). Everyday politics of austerity: Infrastructure and vulnerability in times of crisis. Environment and Planning C: Politics and Space, 37(8), 1380–1399. https://doi.org/10.1177/2399654419831293

Petrović, P., Arsić, M., & Nojković, A. (2021). Increasing public investment can be an effective policy in bad times: Evidence from emerging EU economies. Economic Modelling, 94(C), 580-597.

Powers, T. (2019). Echoes of Austerity: Policy, Temporality, and Public Health in South Africa. Journal of Global and Historical Anthropology, 83, 13–24.

Ramaphosa, C. (2020). Remarks by President Cyril Ramaphosa at the Infrastructure South Africa Project Preparation Roundtable and Marketplace, Gallagher Estate, Midrand. Pretoria: The Presidency.

Republic of South Africa (RSA). (1994). White Paper on Reconstruction and Development. Government Gazette. Parliament of the Republic of South Africa, Cape Town.

Romer, C. D., & Romer, D. H. (2010). The Macroeconomic Effects of Tax Changes: Estimates Based on a New Measure of Fiscal Shocks. American Economic Review, 100(3), 763–801.

Sheefeni, J., & Kaulihowa, T. (2016). Examining the Relationship between Term Structure of Interest Rate and Economic Activity in Namibia. International Journal of Economics and Financial Research, 2(9), 161–168.

Sibeko, B. (2019). The cost of austerity: Lessons for South Africa. (Institute for Economic Justice Working Paper Series, No 2).

Statistics South Africa. (2018). BRICS joint statistical publication. Pretoria: Statistics South Africa.

Stock, J., & Watson, M. (2001). Vector Autoregressions. Journal of Economic Perspectives, 15(4), 101–115.

Svenbalrud, H. K. (2012). Apartheid and NATO: Britain, Scandinavia, and the Southern Africa Question in the 1970s. Diplomacy and States Craft, 23(4), 746–762.

Trebilcock, M., & Rosenstock, M. (2015). Infrastructure Public–Private Partnerships in the Developing World: Lessons from Recent Experience. The Journal of Development Studies, 51(4), 335–354.

Varoufakis, Y. (2018). And the Weak Suffer What They Must: Europe’s Crisis and America’s Economic Future. New York: Nation Books.

World Economic Forum (WEF). (2012). Strategic Infrastructure: Steps to Prioritize and Deliver Infrastructure Effectively and Efficiently. World Economic Forum Report.

1 Compared to other BRICS economies with the exclusion of Brazil (15.6%), China (44.4%), India (30.6%), and Russia (24%) invest more in their infrastructure than South Africa (18.5%). (StatsSA, 2018).

2 Austerity measures are self-defeating in recessionary periods. In attempting to reduce the debt levels and deficits, austerity measures depress tax revenue and private-public spending, which are essential for growth. Thus, if measures to tackle debt exacerbate poor economic performance, the debt-to-GDP ratio will increase when austerity measures are employed leaving the economy in a worse position than before.

3 The South African economic system is a complex system, and the behaviour of complex systems is difficult to predict. Cairney (2012) argues that complex systems are comprised of individual parts that interact and combine to produce systematic behaviour. Macroeconomic variables like debt, government expenditure, and taxation are part of the system.

4 Cilliers (1998) argued that the non-linearity of complex systems ensured that small causes could have large results hence it is a precondition of complexity. Similarly, Cairney (2012) stated that “they [complex systems] exhibit ‘non-linear’ dynamics produced by feedback loops in which some forms of energy or action are dampened (negative feedback) while others are amplified (positive feedback)”. Thus, small actions can have large effects, and large actions can have small effects.

5 Thereafter, the Washington Consensus was the new agenda driven by the developed Western countries (often referred to as the west).

6 Sibeko (2019) further argued that neoliberalism is characterised by “stabilisation, privatisation and rationalisation” wherein the free market is considered the “most efficient allocator of resources”. As a result, nations should aspire to reduce or eliminate “redistributive taxation and deficit spending, controls on international exchange, [trade barriers], economic regulation, public goods and service provisions, and active fiscal and monetary policies”.

7 GEAR from the onset asserted that there needed to be a “reduction in budget deficits, macroeconomic prudence, and a reprioritization of public expenditure to achieve the necessary growth levels” (DNT, 1996).

8 Expenditure on research and development (R&D) is required for product diversity and innovation.