Organizations and Markets in Emerging Economies ISSN 2029-4581 eISSN 2345-0037

2023, vol. 14, no. 3(29), pp. 508–535 DOI: https://doi.org/10.15388/omee.2023.14.3

The Effect of Institutional Quality on Economic Growth: Evidence from Tripartite Approaches in the Context of War-Torn Countries

Sadik Aden Dirir

University of Djibouti, Djibouti

sadikaden1999@gmail.com

https://orcid.org/0000-0002-8159-5442

Abstract. This paper is undertaken to investigate the role of institutional quality in proportion to the economic growth of war-torn countries during the last 20 years. Within this framework, the paper employed three different models to investigate the link that exists between good governance indicators and economic growth. According to the results, the long-run PMG model indicated that political stability and regulatory quality increase war-torn countries’ economic development. Contrarily, it has been demonstrated that the situation of law and corruption in these countries reduces economic growth. Neither the long-term nor short-term estimations from the MG and DFE models showed any noteworthy results. Next, the FMOLS and DOLS revealed that political stability, voice and accountability have a favorable effect on the economic development of these nations. On the other hand, these nations’ regulatory standards had a very detrimental impact on economic growth. Lastly, the fixed-effects model showed that a 1% improvement in these nations’ political stability will result in a 4.5% increase in GDP. This research will aid managers, academics, and policymakers in determining the course of actions needed in their areas of specialization or nations of interest to ensure economic growth and put in place an effective institutional framework through enforced supervision.

Keywords: governance, institutional quality, economic growth, war-torn countries

Received: 8/12/2022. Accepted: 6/7/2023

Copyright © 2023 Sadik Aden Dirir. Published by Vilnius University Press. This is an Open Access article distributed under the terms of the Creative Commons Attribution Licence, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

1. Introduction

The vulnerability and degradation of nations that are unable to control developments on their own pose the biggest threat to the global peace framework at the worldwide and local levels. Most frequently, in poor nations ripped apart by civil conflicts and destabilizing tendencies, public organizations and institutions lose their power and efficiency (Rotfeld, 1999).

Nearly all conflicts from 1960 have occurred in emerging nations, whose economies are likely to be hindered by following losses in human resources, decreased investments, infrastructure devastation, and interruptions of the trading volume (Awaworyi Churchill & Yew, 2018). Reduced human labor is formed as a result of military service, battle casualties, and the need for arms, particularly in nations that are not at the lead of weapon creation. Conflicts can cause international investors to move their money to less dangerous and more stable and prosperous nations.

In d’Agostino et al. (2016) view, a robust economy demands innovation and fresh insights that must be placed in practice in the market, investors who choose which businesses to fund through the advancement phases, and firms and buyers who are receptive to and responsive to innovative ideas. In their perspective, a nation’s economic structures and industrial environment, rather than solely the legal system and protection of property rights, have an influence on the participants in the creative process and as a result, may either contribute to or remove from the vibrancy of an economy. Development in nations that have recently experienced a conflict will mostly come through imitation and adaptation (Desli, 2017). Additionally, lenders are difficult to come by, so the current regime must support creative business people and local farmers through the usage of efficient and accessible assistance in the shape of immediate incentives and borrowing opportunities in order for them to build a functioning economy and minimize assistance reliance (Zaman, 2019).

According to Zhao et al. (2017), for state assistance to hold hope, post-conflict economic rebuilding should involve macroeconomic stability and radical transformation initiatives in addition to the general restoration of human and physical infrastructure. It must also include the fundamental economic underpinnings, such as a set of suitable legislative, administrative regulations and a conducive business environment, required to encourage market-based participation, employment opportunities, and development (Kulyk, 2019). In the reconciliation and state-building studies, economic rebuilding is an important but underappreciated topic that is portrayed as standard (Raik, 2019).

Initially in the postwar transition, with inadequate institutions, little technical capacity, and severe funding restrictions, policymakers must confront substantial macroeconomic instability and fiscal and monetary management concerns. This is especially challenging given the divisiveness and geopolitical, social, and organizational deficiencies that constitute the consequence of conflict (Çinar, 2017). In the near future, funding and technical support are essential and should be directed at strengthening the state’s ability to establish an environment that is suitable for profitable development and investment (Mubashra, 2018).

Governments must work quickly to resuscitate the financial market by fostering an environment that is conducive to investment, with the help of contributors. This comprises updated institutions, a suitable legislative and administrative structure, a functional financial sector, a lean and efficient bureaucracy, and personal development strategies. It is crucial for economic expansion to generate widespread employment during post-conflict transformations (Bender et al., 2018). The changeover to peace won’t be durable until the general populace experiences a “peace dividend” in the form of improved accessibility to fundamental facilities and services as well as a perceptible rise in their level of life (McCloskey, 2016).

The sustainability of economic rehabilitation depends on sufficient employment creation. But over the last twenty years, the post-conflict environment has made it extremely challenging to create occupations that are both feasible and legal. In addition to having severe human repercussions for war-torn nations, the inability to economically rehabilitate has also been expensive for the donor world in regard to defense, security, and peacebuilding spending (Peng et al., 2017).

In conformity with Farzanegan (2022), political controversy and sustainable growth are connected, among other things, and policy analysts have been studying them for many years. Separatist extremism and its many consequences on the economic structure are among the several aspects of geopolitical conflict that continue to intrigue both sociologists and economists. Testa (2021) suggests that there are numerous ways that war could hinder a country’s economic growth, outside the direct effect it has on the allocation of public expenditures to comparatively reduced sources like military spending. Key macroeconomic consequences include the reduction of an active population owing to mandatory military service, increased unpredictability that deters both domestic and external economic players, decreased tourism earnings because of increasing safety worries, and the disappearance of industry-specific advancements.

Economic progress would not happen in the absence of peace, and security and stability without development are unlikely to be sustained, making the relationship between stability and economic success essential. Growth in the economy is impacted by war both directly and indirectly. The key factors influencing growth in the economy are the acquisition of infrastructure and human capital. Disputes and violence obliterate both people and material resources, as well as the governmental structures that support economic progress.

As per Lee (2021), excessive levels of violence cause businesses to lose faith in a nation both locally and internationally, which lowers both domestic and foreign investment. In addition, disruption and instability cause migration of both people and financial resources outside, which is detrimental to economic progress. Nations that are engaged in protracted conflicts devote a significant amount of money and people to resolving the conflict while spending less on the economic and social equipment that is essential for the creation of personal and material capital. As a result, war has a negative impact on these nations’ economic development (Dorr & Shin, 2021).

Numerous papers investigated the role of institutional quality in economic growth, particularly in developed, emerging, and low-income countries. However, few studies had only shed the light on the institutional framework of war-torn countries. Hence, we believe that more study is required to evaluate the function of organizations and institutions and their influencing elements in the economy as a potential catalyst of economic growth. Based on that, the aim of this research is to determine the contribution of accountable governments in economic development, with a particular focus on countries experiencing conflicts. Furthermore, the objective is to identify the key institutional drivers of economic growth.

The research is organized as follows: the second section gives a summary of the relevant conceptual and empirical literature, the third section presents and describes the methodologies utilized to address the research issues, and section four focuses on the interpretation of the findings. The final section of this paper is devoted to the conclusion.

2. Review of the Literature

Conflicts result in considerable human misery as well as significant economic and societal consequences, as experience has often demonstrated. Conflicts can hinder economic expansion and capital expenditure both during the dispute and also subsequent due to the loss of life, damage to infrastructure, social resources, and organizations, political unrest, and increased instability they bring with them (Chheang, 2022). This makes it complicated to disengage the “conflict trap.” Conflicts also frequently make it more difficult to manage the nation’s finances by reducing tax income by cutting off a portion of the income taxes while increasing military spending. As a result, budget deficits and public debt increase, and resources are diverted aside from societal and contextual investment, amplifying the crippling effects of the wars (Sheremirov & Spirovska, 2022).

Afolabi (2019) contends that when considering economic expansion and development, contemporary market structures should be regarded. According to Douglass (1955), reliable institutions are essential for the fundamental efficiency of the contemporary economic framework. Institutions offer a clear legal framework, a formalized judicial branch to uphold ownership rights and resolve conflicts, and a framework of contracts and trade that lowers the transaction costs for businesses. Although certain institutions in developing countries are more established in comparison to others, the plurality of them is still in their infancy. The evidence has looked at the absence of institutional progress in the nation as a source of macroeconomic instability and may explain it by the negative impacts on economic progress and development (Al Hawaj & Buallay, 2022).

The strength of the institutions determines the institutional landscape. Exploitative economic systems are created to take revenue and capital from one segment of the population in order to benefit another segment, while inclusive economic forces promote equitable markets (Youssef & Diab, 2021).

Graham et al. (1999) classified institutional activities into three categories. The initial step is the creation of laws and regulations. Entities in this section include local councils, legislative bodies, and similar organizations. The administration and granting of laws and regulations fall under the second section of institutional roles. Courts, committees, supervision, and governing bodies are the institutions at issue here. The delivery of public resources is the third function of an institution. These include the organizations that ensure the delivery of various essential public services. There are several justifications for institutional quality, which may be broken down into three groups for examination. The first consists of accessibility and distribution of the resources that are easily obtainable. Next, there is the political influence of resource distribution; embezzlement and co-optation are examples of political situations. The third concerns the structural factors that affect the precision with which long-term objectives are determined, the concentration of power among economic actors and outside governmental action.

The effect of institutional quality on FDI has received considerable attention in recent research. It is often believed that nations with sound governance may draw in more FDI (Obamuyi & Olayiwola, 2019). Nevertheless, the assets cannot be protected in a setting with poor governance. Multinational investments and foreign direct investment are significantly influenced by institutional factors, including corruption, political constraints, and the preservation of intellectual property. Staats and Biglaiser (2012) contend that panel data analysis shows that law enforcement and judicial strength are crucial factors influencing foreign direct investment inflows in 17 Latin American nations.

Other empirical research has concentrated on the relationship between institutional quality and worker efficiency. For instance, Mustafa and Jamil (2018) studied 12 Asian nations and discovered that average worker output was positively correlated with regulatory effectiveness and government efficiency. Del Mar Salinas-Jiménez and Salinas-Jiménez (2007) showed that several corruption indices are inversely correlated with the labor force across a sample of 22 OECD nations. In contrast, an analysis of data from 23 European nations by Jankauskas and Šeputienė (2007) reveals that a number of governance variables are strongly and favorably associated with labor productivity.

Dawson (1998) contends in his research that socioeconomic freedom has a direct impact on progress via productivity of all factors and an indirect impact on progress via investment. Using a dynamic border model, Klein and Luu (2003) investigated the link between peace and security, economic growth, and economic freedom. They concluded that political stability and economic freedom both enhance market prosperity and employment levels. They discovered that economic freedom and stability measures have a favorable and substantial influence on worker productivity in their analysis, which looked at a sample of 39 nations between 1975 and 1990.

The impact of institutions on local resources has been examined in a number of empirical studies. Numerous empirical investigations have revealed a substantial association between the effectiveness of tax collection and the integrity of institutions, despite the fact that institutional factors are typically argued for their quality. Accordingly, some scholars contend that nations with weak institutional frameworks are unable to create efficient tax systems, and as a result, these nations consistently struggle to collect taxes (Alqooti, 2020).

According to Ajaz and Ahmad (2010), developing nations frequently struggle to raise sufficient money via taxation because these nations experience a variety of institutional issues during the earnings process. Using a panel of 25 developing nations spanning the years 1990–2005, they examined the impact of both institutional and structural determinants on tax collection. They demonstrate that institutional factors have a considerable influence on all taxes while using the generalized method of moments (GMM). Nonetheless, although excellent governance helps to improve tax collection performance, corruption has a detrimental impact on it.

A steady rhythm of lending institutions and EG is dependent on institutions, which are described as limitations or strategy games created by humans. Legal, social, and property rights restrictions are also part of the institutions that help ensure equality of opportunity, which is unfortunately hampered by the government system and corruption (Potrafke, 2019). Additionally, excellent institutions will have a high level of control in relation to the monitoring institutions and the legislative framework that is followed. In addition, the investment risk, also known as the financial profile, plays a significant role in revealing the caliber of the organization. The vulnerability includes the state’s capacity to maintain a contract’s validity or prevent seizure, repatriation of the revenue, and inadequate funding (Debski et al., 2018).

In their paper, Digdowiseiso and Sugiyanto (2021) mention that the function of institutions plays a part in the health of the political system and social engagement, both of which have an impact on the economic system of a country. Institutions influence the development and growth of the financial sector and are reliable predictors of economic expansion. The importance of institutions is growing as a nation attempts to increase its financial growth, whether it is nationally or through international trade (Pacific et al., 2017). The cross-border operation will raise performance through the deployment of resources and the transmission of technology, in addition to assisting in raising the quantity required for investment. In exchange, an economic expansion might be encouraged (Ahmed et al., 2022).

Salman et al. (2019) came to the conclusion in current publications that institutions have a favorable effect on economic growth. Nevertheless, Acemoglu et al. (2015) did not discover a connection between institutions and economic expansion. Barro (1996) discovered a non-linear link between democracy and economic growth, finding that if it exceeds a certain point, democracy may both positively and adversely impact economic growth. More research is needed to determine, as Law et al. (2013) hypothesized, if there is a specific institutional ceiling for the best possible economic development. By examining the function of institutions, Sawadogo (2021) came to the conclusion that there is a level of institutions that have an impact on economic growth.

Aisen and Veiga (2013) used a dataset of 169 nations and a GMM to assess the impact of political turmoil on economic growth. They found that political instability lowers per capita economic expansion. Acemoglu et al. (2014) showed that democracy raises GDP per capita by around 20% over time using dynamic panel quantile regression with grouped fixed effects, OSLS, and GMM. Di Vita (2017) used REM and Quantile Regressions Models (QRM) to study the effect of institutional efficiency on economic progress in Italian regions and noted that the sophistication of regulatory oversight time to resolve litigation is a barrier to the GDP growth of the region and per capita income.

According to research conducted by Vianna and Mollick (2018) on the economic performance of 192 Latin American nations between 1996 and 2015, each 0.1-point rise in institutional quality leads to a 3.9% increase in gross domestic product per capita in the region. Acemoglu et al. (2015) discovered no causal connection between earnings and democracy, in alignment with Jaunky (2013), who investigated the association between democracy and economic growth in Africa using the VECM, GMM, FMOLS, and DOLS methods and demonstrated that there are no short-term effects of democracy on growth and vice versa.

On the contrary, Marakbi and Turcu (2016) used a gradual transition table regression design to examine the effects of institutional performance and fraud on the economic progress of 128 advanced and developing countries between 1984 and 2012. They found a non-linear relationship between corruption and economic growth with adjustments in institutional quality. Ndjokou and Tsopmo (2017) investigated the connections between institutional quality, mineral wealth, and economic expansion in Sub-Saharan Africa. They used the Panel Transition Regression (PSTR) and GMM dynamic board model to establish the benchmark of institutional quality in the connection between natural resources and economic growth.

In regard to economic development, Ouoba and Sawadogo (2019) identified an institutional threshold for government stability (index > 5.59) and corruption (index > 1.3). According to Chong (2020), there is a non-linear correlation between institutions and economic growth in the Trans-Pacific Partnership Agreement that were signatories between 2002 and 2015; better institutional quality contributes to increased economic activity, and vice versa as institutional quality rises above 0.638 thresholds.

Šiljak and Nielsen (2022) looked into the integration of institutions in Bosnia and Herzegovina. They concluded that if a nation has effective institutions, it is going to possess protected property rights, a sturdy and non-corrupt legal system, effective industries, a small and enabling state, a low fiscal financial strain, and stable macroeconomics that will help it draw FDI, which will subsequently boost growth rates. The authors continue by pointing out that Bosnia and Herzegovina lacks all the traits of effective institutions, with the exception of some level of macroeconomic stability. They proceed to say Bosnia and Herzegovina is one of the least politically stable nations in Europe with one of the worst effective administrations, making it the nation with the highest political risk. It also has poor state structures and is severely fragmented. The racially divided nation has an alliance government but is not a democracy. The economic and political environments are burdened by these elements, which also slow down economic expansion. Bad institutions are expensive at the very least, excessive laws are cumbersome and cost to conduct business; at the very worst, economies cannot flourish if there are insecure political institutions that cause conflict or war. These observations provide us with concrete evidence of how the institutional structure of a country can affect its development and international integration (Kouadio & Gakpa, 2022).

3. Methodology

3.1 Data Sources and Variables

The paper is undertaken to investigate the contribution of institutional quality on economic growth in war-torn countries from 2000 to 2021. The reason behind considering war-torn countries as focus nations is because of their complex economic, political, and institutional structure. Additionally, post-conflicts and ongoing war countries are well-known for their divergent reforms in proportion to other countries. Hereby, the present paper selected six countries experiencing ongoing conflicts namely Afghanistan, Syria, Iraq, Yemen, Libya, and Cameroon. To proceed with the study, the paper performed tripartite approaches that consist of three different models. First, we performed a panel autoregressive distributed lag model (ARDL) approach to assess both the long- and short-run relationship that exists between the variables. The panel ARDL model is widely used by authors to investigate long-run co-integration (see Sardar et al., 2022; Radmehr et al., 2022; Karangwa & Su, 2023). Next, we utilized Fully Modified Ordinary Least Square (FMOLS) and Dynamic Ordinary Least Square (DOLS) models to capture the co-integration between the indicators of accountable government and economic growth. Rationally, if a long-run association is discovered among the variables, carrying out a co-integration to ascertain the robustness of the model is necessary (Olamide et al., 2022; Liu & Zhang, 2022; Sultana et al., 2022). Finally, due to the panel data structure of the study and because the model incorporates a small number of years, we tested the fixed-effects model to observe the effect of the variables (Prenovitz et al., 2023; Zheng et al., 2023). Furthermore, the GDP annual growth of war-torn countries is adopted to measure the economic situation. Similar studies were conducted by Nguyen et al. (2018) and Radzeviča et al. (2018), in which the authors employed the GDP annual growth as a measurement of the economic situation in the Baltic and emerging countries. What is more, indicators for institutional quality such as Control of Corruption, Government Effectiveness, Political Stability, Absence of Violence/Terrorism, Regulatory Quality, Voice and Accountability, and Rule of Law were selected. The motivation for nominating these variables as a measurement unit for institutional quality is supported by Lehne et al. (2014) and Alonso and Garcimartín (2013). The authors provided evidence of the components of institutional quality through cross-country analysis and discovered that the mentioned variables are the most appropriate. In addition, these indicators are well-established measures of institutional quality and are generally considered to be reliable measures of good governance. Next, as noted earlier, institutional quality is a complex concept that encompasses many different factors. Thus, by including multiple indicators in our model, we will be capturing different dimensions of institutional quality. Lastly, these indicators are widely available and consistently measured over time and across countries, we can ensure that the regression model is based on robust and reliable data. The data are extracted from the World Bank Database particularly (World Development Indicators, and Worldwide Governance indicators).

Table 1

Description of Variables

|

Notation |

Description |

Expected Signs |

Information |

|

GDP |

GDP growth (annual %) |

|

World Development indicators |

|

C |

Control of Corruption: Estimate |

- |

Worldwide Governance indicators |

|

GE |

Government Effectiveness: Estimate |

- |

|

|

PS |

Political Stability and Absence of Violence/Terrorism: Estimate |

- |

|

|

RQ |

Regulatory Quality: Estimate |

- |

|

|

VA |

Voice and Accountability: Estimate |

+ |

|

|

RL |

Rule of Law: Estimate |

+ |

3.2 Econometric Models Presentation

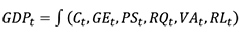

The main aim of this study is to assess the factors that can affect the economic growth. To ascertain the interaction between these variables, the current study utilized the following economic functions:

(1)

(1)

• Panel Autoregressive Distributed Lag Model (ARDL)

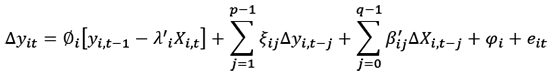

In this paper, in order to explore the factors that have an impact on the economic growth of war-torn countries, we used a panel ARDL that consists of Pooled Mean Group (PMG), mean group (MG), and dynamic fixed effect (DFE) with additional simple OLS regression developed by Pesaran et al. (1999). For a number of reasons, this model is expected to deliver more reliable findings than the customary dynamic panel models because the data include a modest number of countries (N = 6 countries) relative to the chosen period (T = 20 years). As suggested by Arrelano and Bond (1991), a longer time period entails an increasing number of instruments that may affect the test validity and, consequently, the null hypothesis of instrument exogeneity. For the periods t = 1, 2,..,T and the nations I = 1, 2,..,N, the model is expressed as follows:

(2)

(2)

(3)

(3)

In the equation above, the dependent variable is ∆GDPit . Additionally, we have the Xit which implies that the vector of the independent variables includes control of corruption (Cit), government effectiveness (GEit ), political stability and absence of terrorism (PSit), regulatory quality (RQit), voice accountability (VAit ), and rule of law (RLit). λ'i are the lag coefficients of our main factors; ζij and βij are the short-run dynamic coefficients.

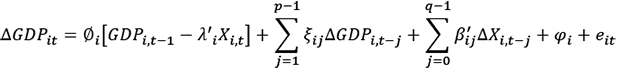

• Fully Modified Ordinary Least Square (FMOLS) and Dynamic Ordinary Least Square (DOLS)

The DOLS uses a parametric approach to estimate a long-term connection in a model where the variables are still co-integrated but are incorporated in a distinct order (Stock & Watson, 1993). This model incorporates leads and lags to account for simultaneous bias and small sample bias. Less-squares estimates can be used to derive the DOLS estimators, which are asymptotically accurate and unbiased even when the endogenous problem is present. Additionally, the parameters take into account potential autocorrelation and residual non-normality (Herzer, 2006). Moreover, fully modified OLS (FMOLS) is used in this study to confirm the reliability of the DOLS results. Hansen and Phillips (1990) invented the FMOLS regression to maintain the top co-integrating estimates. The FMOLS method helps to take into consideration the effects of serial correlation as well as the endogeneity in the predictor factors caused by co-integrating. The equation for both models is expressed as follows:

(4)

(4)

(5)

(5)

B stands for the long-run elasticity in equation (4). The descriptor Ø is the “coefficient” and refers to the distinction between the leads and lags of I(1) regressors. The above coefficients are used to account for residuals that may be endogenous, autocorrelative, or non-normal. They are regarded as nuisance parameters. Furthermore, in equation (5) we perceive that Z+t , Z*t and λ+12 terms eliminate the autocorrelation problem and unobserved heterogeneity. Standard Wald tests can be performed using the FMOLS estimator because it is monotonically impartial and employs a stable mixture-normal asymptotic distribution.

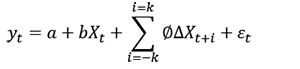

• Fixed Effects Model

This model will help us to analyze the causes of changes within the countries. It also alters the factors (variables) by using time as an average point. The formula is presented as follows:

(6)

(6)

(7)

(7)

In this formula, ai(I=1, n) is the unknown intercept for each entity (n entity-specific intercepts). Yit is our dependent variable, which is GDP, where i is the entity and t is the time. Additionally, xit stands for a one independent variable, whereas β1 is considered as the main coefficient of that independent variable. Finally, we have uit, which implies the errors term.

4. Findings

Table 2 displays the obtained summary statistics of the variables. The outcome indicates that the mean value for GDP is 2.70%, with maximum and minimum values of 86.82% to -50.33%. The standard deviation denotes a 13.60 variation. Additionally, we perceive that PS, and RQ are the most volatile among the remaining variables, with relative standard deviations of 1.04, and 0.42. This suggests that in order to lessen volatility rates, political stability and regulatory quality must be adapted to economic growth in war-torn nations. Finally, the results depict that all of the variables, with the exception of government effectiveness, regulatory quality, and voice and accountability, have positively skewed distributions.

Table 2

Descriptive Statistics

|

|

GDP |

C |

GE |

PS |

RQ |

RL |

VA |

|

Mean |

2.706545 |

-1.276910 |

-1.252891 |

-1.685339 |

-1.292857 |

-1.376671 |

-1.378594 |

|

Maximum |

86.82675 |

-0.399797 |

-0.439207 |

0.831897 |

-0.615789 |

-0.476457 |

-0.801567 |

|

Minimum |

-50.33852 |

-1.781923 |

-2.348561 |

-3.180352 |

-2.282205 |

-2.090172 |

-2.050344 |

|

Std. Dev. |

13.60825 |

0.257874 |

0.405293 |

1.049027 |

0.426721 |

0.400704 |

0.351613 |

|

Skewness |

1.316847 |

0.324206 |

-0.571218 |

0.679499 |

-0.483565 |

0.295267 |

-0.433180 |

|

Kurtosis |

16.30114 |

2.747254 |

2.885990 |

2.185333 |

2.263690 |

2.258801 |

1.787757 |

|

Jarque-Bera |

1011.211 |

2.663757 |

7.249863 |

13.80807 |

8.126201 |

4.939581 |

12.21063 |

|

Observations |

132 |

132 |

132 |

132 |

132 |

132 |

132 |

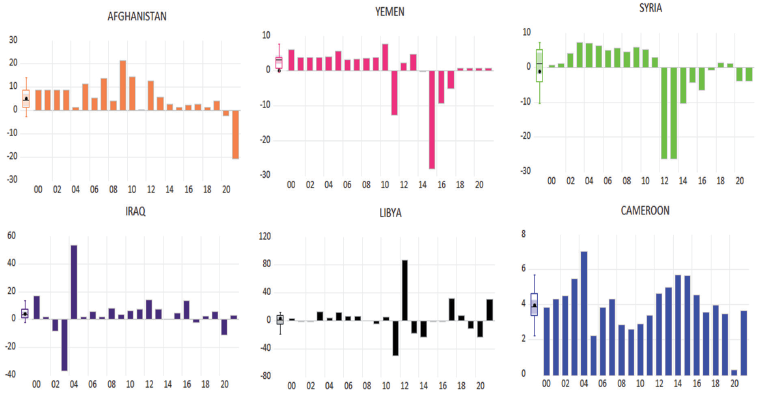

Figure 1 expresses the annual economic growth of the selected war-torn countries for this study. We observe that Libya’s economy has been heavily impacted by the civil war that began in 2011, which has disrupted oil production and exports, the main source of revenue for the country. The economy has also been affected by political instability and the COVID-19 pandemic. Despite some decline in 2017 to 2019, the GDP growth rate increased significantly in 2021 mainly due to higher oil revenue. Next, Cameroon’s economy has seen moderate growth over the last 20 years, but it has been impacted by a variety of factors, including a decline in oil production, the ongoing conflict in some regions, and the COVID-19 pandemic. Additionally, the country has been facing significant social and political challenges, including protests and violence in the Anglophone regions. Third, Afghanistan’s economy has been heavily influenced by the ongoing war and political instability. Despite initial rapid growth in the early 2000s due to international aid and reconstruction efforts, the country’s economic growth has been volatile and uncertain. Additionally, the COVID-19 pandemic has further impacted the economy, causing a decline in GDP growth in 2020. Simultaneously, Syria’s economy has been devastated by the ongoing civil war, which began in 2011. The country has experienced significant inflation, a collapse in infrastructure, and a decline in oil production, which has traditionally been a major source of revenue for the country. The GDP growth rate for Syria is not available for 2020, but it is likely that the ongoing conflict and the pandemic have further worsened the economic situation. Further, Iraq’s economy has also been heavily impacted by war and instability, particularly after the U.S. invasion in 2003. However, the country has seen some growth in recent years due to increased oil production and investment in infrastructure. Nevertheless, the COVID-19 pandemic and political unrest have continued to impact the economy and led to a decline in GDP growth in 2020. Yemen’s economy has been affected by a combination of factors, including political instability, conflict, and an ongoing humanitarian crisis. Despite some growth in the early 2010s, the economy has declined significantly in recent years, exacerbated by the COVID-19 pandemic. Additionally, the ongoing conflict has disrupted food and fuel supplies, leading to widespread poverty and hunger. Nevertheless, in the last 5 years, the country appears to generate slow and stable economic growth that barely reaches 1%.

Figure 1

The Economic Growth of War-torn Countries During the Last 20 Years

Table 3 illustrates the results of the correlation matrix. According to the results, we remark that all the variables are positively correlated with GDP. This implies that economic growth increases in value when the voice and accountability, control of corruption, government effectiveness, political stability, regulatory quality, and rule of law increase and vice versa. Finally, since all of the correlated coefficients are under 0.75, linkages between the explanatory variables do not indicate the existence of multicollinearity (Shrestha, 2020).

Table 3

Matrix of Correlation

|

Variables |

GDP |

C |

GE |

PS |

RQ |

RL |

VA |

|

GDP |

1.000000 |

|

|

|

|

|

|

|

C |

0.042448 |

1.000000 |

|

|

|

|

|

|

GE |

0.102515 |

0.734117 |

1.000000 |

|

|

|

|

|

PS |

0.094971 |

0.761389 |

0.647076 |

1.000000 |

|

|

|

|

RQ |

0.034627 |

0.571810 |

0.729075 |

0.353552 |

1.000000 |

|

|

|

RL |

0.039666 |

0.797252 |

0.715284 |

0.786966 |

0.503795 |

1.000000 |

|

|

VA |

0.171840 |

0.080894 |

0.373645 |

-0.099840 |

0.512632 |

-0.049616 |

1.000000 |

It is important to highlight that the provided correlation matrix is insufficient to make inferences about how the explanatory factors affect the dependent variables, demanding further empirical testing of the correlations. As a result, to check the existence of multicollinearity, the Variance Inflation Factor (VIF) is performed (Belsley, 1991). This test is employed to estimate the degree of variance among the selected variables. Accordingly, if the VIF value is equal to or greater than 10, we will have the presence of multicollinearity between the outcome variable and the explanatory variables (Myers, 1990). Hence, in accordance with Table 4, the result of the mean VIF displays a value of 3.39, which is less than 10. Therefore, we conclude no evidence of multicollinearity among the predictors. Further, the study performed the Breusch-Pagan-Godfrey test to assess if the model is suffering from heteroskedasticity. The outcome presented values greater than 1%, 5%, and 10% significance levels, hence the model is free from heteroskedasticity.

Table 4

The Diagnostic Test

|

Variance Inflation Factor |

|

|

Variables |

VIF values |

|

C |

3.77 |

|

RQ |

2.78 |

|

GE |

4.28 |

|

PS |

3.45 |

|

RL |

4.15 |

|

VA |

1.91 |

|

Mean VIF |

3.39 |

|

Breusch-Pagan test for heteroskedasticity |

|

|

Prob > chi2 |

0.2583 |

This study includes a panel data structure of 6 countries. Therefore, in order to determine whether the data is stable and the variables are stationary, the unit root test must be considered before proceeding with the regression. Hereby, Table 5 shows the results of the Im-Pesaran-Shin as well as the Levin-Lin-Chu test to assess the stationarity of the variables. Within this context, starting with the Levin-Lin-Chu, all the variables turned out to be stationary at first difference except for GDP, and VA was revealed to be stationary at both levels and first difference. Furthermore, the Im-Pesaran-Shin test supported the result and demonstrated that all the variables used in the study do not contain a unit root. Hence, we can proceed with the regression models.

According to the Pedroni (1999) co-integration test presented in Table 6, all the variables are co-integrated at a 1% significance level. Panel 1 exhibits that four of the seven Pedroni residual co-integration tests confirm that the variables are co-integrated. Additionally, Kao (1999) test disclosed that all the variables co-integrated at a 1% significance level. Hence, we conclude the presence of a long-run co-integration among the variables, as a result, we will continue performing the FMOLS and DOLS models.

Table 5

Unit Root Test

|

Levin-Lin-Chu |

|||||||

|

Variables |

At level |

At first difference |

Decision |

||||

|

Statistic |

Note |

Lag |

Statistic |

Note |

Lag |

|

|

|

GDP |

-3.326*** |

Stationary |

1 |

-6.942*** |

Stationary |

1 |

I (0) I (1) |

|

C |

0.396 |

Not stationary |

1 |

-8.183*** |

Stationary |

1 |

I (1) |

|

GE |

0.079 |

Not stationary |

1 |

-4.169*** |

Stationary |

1 |

I (1) |

|

PS |

-0.814 |

Not stationary |

1 |

-3.787*** |

Stationary |

1 |

I (1) |

|

RQ |

-0.229 |

Not stationary |

1 |

-1.791** |

Stationary |

1 |

I (1) |

|

RL |

0.560 |

Not stationary |

1 |

-4.268*** |

Stationary |

1 |

I (1) |

|

VA |

-1.948** |

Stationary |

1 |

-3.124*** |

Stationary |

1 |

I (0) I (1) |

|

GDP |

-3.415*** |

Stationary |

1 |

-8.126*** |

Stationary |

1 |

I (0) I (1) |

|

C |

0.630 |

Not stationary |

1 |

-7.040*** |

Stationary |

1 |

I (1) |

|

GE |

0.100 |

Not stationary |

1 |

-4.002*** |

Stationary |

1 |

I (1) |

|

PS |

0.031 |

Not stationary |

1 |

-3.651*** |

Stationary |

1 |

I (1) |

|

RQ |

-0.116 |

Not stationary |

1 |

-3.500*** |

Stationary |

1 |

I (1) |

|

RL |

0.850 |

Not stationary |

1 |

-3.992*** |

Stationary |

1 |

I (1) |

|

VA |

-0.701 |

Not stationary |

1 |

-4.171*** |

Stationary |

1 |

I (1) |

Note. ***, **, and * denote 1%, 5%, and 10% level of significance, respectively.

Table 6

Panel Co-integration Results

|

Panel 1: Pedroni test |

||

|

Pedroni panel co-integration test – within-dimension |

||

|

|

Statistic |

Prob. |

|

Panel v-Statistic |

1.931970 |

0.0267 |

|

Panel rho-Statistic |

-0.296599 |

0.3834 |

|

Panel PP-Statistic |

-7.856646*** |

0.0000 |

|

Panel ADF-Statistic |

-2.354458*** |

0.0093 |

|

Pedroni panel co-integration test – between-dimension |

||

|

Group rho-Statistic |

1.151117 |

0.8752 |

|

Group PP-Statistic |

-6.563068*** |

0.0000 |

|

Group ADF-Statistic |

-2.735706*** |

0.0031 |

|

Panel 2: Kao residual co-integration Test |

||

|

|

Statistic |

Prob. |

|

ADF |

-4.886743*** |

0.0000 |

Note. ***, **, and * denote 1%, 5%, and 10% level of significance, respectively.

Table 7 reports both the long-run and the short-run results of the PMG, MG, and, DFE estimators for the institutional quality in proportion to economic growth. Starting with the long-run estimates, particularly the PMG model, the findings reveal that C, PS, RQ, and RL have an influence on the GDP and it is significant at a 1% level. This denotes that an increase of 1% in political stability and regulatory quality raises the economic growth of war-torn countries by 23.86% and 17.57%, respectively. Meanwhile, the control of corruption and rule of law were revealed to decrease economic growth by 43.71% and 17.07%, respectively. On the other hand, the short-run estimate presented unidentical output to the long-run results. For instance, in the short-run, the PMG model revealed no prominent significance in all the variables except for RQ, which uncovered a positive impact on the GPD of war-torn countries. This suggests that during the short period, an increase of 1% in regulatory quality appears to assist in promoting economic growth by 17%. Finally, the MG and DFE models demonstrated no remarkable outcome in both the long-term and short-term estimates.

Table 7

Panel ARDL Estimates

|

The Long-run Estimates |

The Short-run Estimates |

|||||

|

Dep. GDP |

||||||

|

|

PMG |

MG |

DFE |

PMG |

MG |

DFE |

|

C |

-43.71*** |

-116.5 |

-9.260 |

-49.43 |

-26.06 |

-0.154 |

|

(8.453) |

(105.1) |

(8.893) |

(45.58) |

(28.45) |

(12.68) |

|

|

GE |

-4.924 |

52.13 |

6.073 |

-0.398 |

3.719 |

-1.711 |

|

(3.450) |

(34.37) |

(6.002) |

(12.41) |

(11.99) |

(10.25) |

|

|

PS |

23.86*** |

21.38 |

3.691 |

1.708 |

-6.659 |

-5.999 |

|

(2.716) |

(23.76) |

(2.287) |

(5.639) |

(10.42) |

(5.315) |

|

|

RQ |

17.57*** |

-69.45 |

-5.930 |

16.99** |

13.92 |

-8.558 |

|

(5.156) |

(74.71) |

(5.426) |

(6.821) |

(9.025) |

(9.888) |

|

|

RL |

-17.07*** |

-12.07 |

3.425 |

30.15 |

10.85 |

1.384 |

|

(4.568) |

(59.90) |

(5.629) |

(47.48) |

(30.66) |

(12.16) |

|

|

VA |

-3.770 |

144.1 |

7.340 |

-14.13 |

-1.495 |

6.856 |

|

(6.776) |

(98.32) |

(5.041) |

(18.73) |

(19.87) |

(9.714) |

|

|

ECT |

|

|

|

0.618*** |

0.957*** |

1.336*** |

|

|

|

|

(0.148) |

(0.246) |

(0.0933) |

|

|

Constant |

|

|

|

14.03*** |

-41.47 |

-16.30 |

|

|

|

|

(3.669) |

(47.83) |

(10.39) |

|

Note. ***, **, and * denote 1%, 5%, and 10% level of significance, respectively; standard errors are presented in parentheses.

After analyzing the Panel ARDL result, we will observe the outcome of OLS, FMOLS, DOLS, and fixed effects results demonstrated in Table 8. Starting with the OLS outcome, we perceive that only VA has an impact on the GDP. This suggests that a 1% increase in voice and accountability will result in a 10.37% expansion in GDP. Next, we perceive identical outcomes between FMOLS and DOLS. For instance, political stability, and voice and accountability have a positive influence on economic growth in both models. Nevertheless, there is a notable difference in the case of regulatory quality. For example, we remark that in the FMOLS model, RQ is significant at a 10% significance level, while the other models showcase no prominent significance.

Table 8

Co-integration and Fixed Effects Estimates

|

Variables |

Dep. GDP |

|||

|

OLS |

FMOLS |

DOLS |

FE |

|

|

C |

-4.122 |

-9.565 |

-10.20 |

-10.20 |

|

(8.884) |

(7.330) |

(7.415) |

(9.809) |

|

|

GE |

1.375 |

3.454 |

3.791 |

3.792 |

|

(6.018) |

(5.153) |

(5.505) |

(7.283) |

|

|

PS |

2.727 |

4.631** |

4.571** |

4.571* |

|

(2.088) |

(1.975) |

(2.049) |

(2.712) |

|

|

RQ |

-5.222 |

-8.700* |

-7.647 |

-7.648 |

|

(4.611) |

(4.905) |

(5.042) |

(6.671) |

|

|

RL |

0.102 |

1.172 |

3.319 |

3.320 |

|

(5.993) |

(4.884) |

(4.929) |

(6.521) |

|

|

VA |

10.37** |

11.874** |

10.030** |

10.03 |

|

(4.633) |

(4.586) |

(4.694) |

(6.210) |

|

|

Observation |

132 |

132 |

132 |

132 |

Note. ***, **, and * denote 1%, 5%, and 10% level of significance, respectively; standard errors are presented in parentheses.

5. Discussion

Battles or severe confrontations in Sierra Leone, Angola, Afghanistan, Liberia, the Democratic Republic of the Congo (DRC), and Sudan, each of which featured violent disputes over the abundance of natural resources, have recently come to an end. However, there remains a deficiency of knowledge regarding whether and in what ways violent and illegal manipulation of natural resources as well as the prevalent poverty of economic life throughout war generate differentiated barriers for designing responsible government and long-lasting institutions as well as putting into practice initiatives for post-conflict intergovernmental relations and reconstruction.

Stable economies are distinct in comparison to war-torn economies in a number of ways. Nations generally undergo low and declining GDP, significant demographic migrations, prevalent insecurity, deteriorating facilities, macroeconomic discrepancy, limited state revenue, a greater focus on agriculture, deteriorated social indicators, and bad governance during times of war. Shortly after the fighting has ended, the cumulative weight of these issues hinders growth and investment returns. There are some advantages: funders are frequently eager to support rebuilding, there is frequently a mass of emigrants who may provide funding or even expertise, and political and economic change is generally simple to implement due to the lack of established interests to obstruct it.

This is based on the assumption that creating an ecosystem that fosters economic development in war-torn nations requires high-quality institutions. In order to ensure sustained improvement and development, investigations conducted by Buntaine et al. (2017) have stressed the importance of excellent institutional quality. The main barriers to economic development in Africa and Latin America are the justice system’s confusion and exploitation of gray areas, as well as mismanagement, corruption, tax fraud, poorly specified property rights, and the presence of ineffective institutions that make those nations risky and unattractive. Contrarily, Asian nations had witnessed substantial economic growth as a result of high-quality institutions, in contrast to war-torn countries and underdeveloped nations, which are defined by substantial unemployment and poverty. In response, states and international organizations began to concentrate on improving institutions in developing nations by modeling them after those in developed nations. Notwithstanding this worldwide institutional uniformity, there is little agreement on the efficacy of these changes.

Institutions in emerging economies tend to be monopolistic rather than competitive, to create transfer operations rather than manufacturing operations, and to limit possibilities rather than create them. Hardly do these institutions result in expenditures that will boost productivity. In light of this, institutions must support and encourage acts that increase wealth, such as investing in research, investment, and teaching; protecting private property; and deterring exploitative, capital-destructive activity (e.g., misconduct, bribery, and corruption). In addition, institutions have an impact on factors other than only productivity expansion, such as human and material resources, investment, and technological advancements, all of which contribute to an economic growth.

Additionally, the chance of an economic downturn is substantially influenced by combining economic and institutional variables, and in times of crisis, bad governance causes far greater losses. For instance, the likelihood of economic collapse is significantly increased in settings with corruption, unstable political regimes, a lack of public justice, and stable currency regimes. Additionally, while not as strong as the aforementioned reasons, inadequate administrative quality, social violence, and the existence of both foreign and local conflicts are considered major elements that cause economic disruption. Economic contraction may be more likely to occur in nations with weak regulations because of the probability of fluctuating market assumptions and speculative market volatility due to the unpredictable market environment. Conversely, in nations with stronger institutional frameworks, those institutions support the economy by sustaining macroeconomic forecasts, lowering uncertainty, and limiting excessive capital flight.

As an illustration, Afghanistan has been facing significant challenges related to institutional quality due to the ongoing conflict, corruption, and weak rule of law. The government has been working on improving governance and anti-corruption measures, but progress has been slow. Syria’s institutional quality has been severely impacted by the ongoing conflict and political instability, leading to a breakdown of the rule of law, weak governance, and widespread corruption. The government has been unable to provide basic services and maintain law and order, which has led to the displacement of millions of people. Iraq’s institutional quality has also been impacted by political instability and weak governance. Corruption remains a major challenge, and the country ranks low on indicators such as control of corruption and rule of law. The government has been working on reforms to improve institutional quality, but progress has been slow. Simultaneously, Yemen’s institutional quality has been severely impacted by the ongoing conflict and political instability. The country ranks low on indicators such as government effectiveness, control of corruption, and rule of law. Additionally, the government’s ability to provide basic services has been severely affected, leading to a humanitarian crisis.

Moreover, the ongoing conflict has further weakened institutions and governance, leading to a breakdown of law and order. Libya’s economy is heavily reliant on oil exports, which have been disrupted by the ongoing conflict. The country has struggled to maintain its oil production capacity, which has impacted government revenues and the availability of foreign exchange. Additionally, the COVID-19 pandemic has further impacted the economy. According to the IMF, Libya’s economy contracted by 62% in 2020, reflecting the impact of the conflict and the pandemic. Cameroon was not an exception, the country has been facing significant social and political challenges, particularly in the Anglophone regions, where separatist movements have been demanding independence. The government has been accused of human rights abuses in its response to the separatist movements, and corruption remains a major challenge. In comparison to other war-torn countries, Cameroon has been doing great. For instance, the country is heavily reliant on agriculture, which accounts for over a quarter of its GDP. The government has been working on economic reforms, including diversification of the economy and infrastructure development, but progress has been slow. According to the IMF, Cameroon’s economy contracted by 1.2% in 2020, reflecting the impact of the pandemic.

Within this context, the study was conducted to investigate the role of institutional quality on economic growth, particularly in war-torn countries from 2020 to 2021. To carry out the research, we performed three different models to assess the impact of the factors. First, we used the Panel ARDL technique to evaluate the variables’ long- and short-term relationships with one another. Then, to capture the co-integration between the indicators of accountable government and economic growth, we used the FMOLS and DOLS models. Last but not least, given the study’s panel data format, we examined the fixed-effects model to observe the effect of the variables.

The findings revealed distinctive outcomes across the different approaches. Starting with the panel ARDL model, the long-run estimates particularly the PMG revealed that political stability and regulatory quality raises the economic growth of war-torn countries. These outcomes are in agreement with the empirical findings of Zhuang et al. (2010), who discovered that Asian economies depend on government effectiveness, regulatory quality, and rule of law. Simultaneously, Gibogwe et al. (2022) revealed that institutional quality has a significant affirmative (0.047) causal long-run effect on economic growth. Meanwhile, the control of corruption and rule of law were revealed to decrease economic growth by 43.71%, and 17.07%, respectively. On the other hand, the short-run estimate presented unidentical output to the long-run results. For instance, in the short run, the PMG model revealed no prominent significance in all the variables except for regulatory quality, which uncovered a positive impact on the GPD of war-torn countries. Finally, the MG and DFE models demonstrated no remarkable outcome in both the long-term and short-term estimates. Next, the co-integration approach that consists of FMOLS and DOLS reported that political stability and voice and accountability have a positive impact on the economic growth of war-torn countries. In contrast, the regulatory quality of these countries presented a significant negative influence on economic growth. Finally, the fixed-effects model demonstrated that a 1% increase in the political stability of these countries will result in a 4.5% rise in GDP.

While it is true that war and conflict can pose significant challenges to economic growth, it is important to note that even in the midst of conflict, there may still be opportunities for economic growth. For instance, during a conflict, certain industries may experience growth due to increased demand for their goods or services. In addition, governments and non-governmental organizations (NGOs) may invest in infrastructure projects such as roads, hospitals, and schools, which can provide employment opportunities and stimulate economic activity. Moreover, peace and stability may emerge in some parts of a war-torn country, creating pockets of economic activity and growth. For example, certain regions may become safe havens for businesses and investors due to the presence of a stable government or a strong civil society. Furthermore, political stability and regulatory quality are not binary variables, meaning that even in the midst of a conflict, there may still be degrees of political stability and regulatory quality that can facilitate economic growth. For instance, a government that is able to maintain a certain level of law and order, provide basic services such as electricity and water, and protect property rights may still be able to attract investment and promote economic growth, even if the overall security situation is challenging.

To sum up, several differences among the selected countries in terms of their institutional and economic situations can be extracted from this paper. For instance, Afghanistan and Syria have experienced a significant economic decline due to ongoing conflict, while Cameroon has seen moderate economic growth over the last 20 years. Next, Yemen and Libya rank very low on indicators such as control of corruption and rule of law, while Cameroon ranks slightly higher but still faces significant challenges related to corruption and weak rule of law. What is more, these countries also differ in terms of their political stability. Afghanistan, Syria, and Libya have experienced protracted conflicts, while Cameroon has seen significant social and political challenges, particularly in the Anglophone regions. Another major difference is the dependence on natural resources. For example, some of the countries, such as Libya and Iraq, are heavily dependent on oil exports, while others, such as Cameroon, have a more diversified economy. Lastly, the impact of the COVID-19 pandemic has also varied among the countries, with some experiencing a significant economic decline (e.g., Libya, Yemen), while others have seen moderate growth or contraction (e.g., Cameroon).

6. Recommendations

Given the significant challenges that these countries face, there are several practical recommendations that could help to address their institutional and economic issues:

• Address corruption: Corruption is a significant challenge in many of these countries and can have a negative impact on economic growth and social stability. Governments in these countries should prioritize efforts to address corruption by strengthening anti-corruption measures, improving transparency and accountability, and enforcing laws and regulations.

• Improve governance: Weak governance is a key factor contributing to the institutional and economic challenges in these countries. Governments should work to improve governance by strengthening institutions, increasing political accountability, and promoting good governance practices.

• Invest in education and human capital: Many of these countries have low levels of education and human capital, which can limit economic growth and development. Governments should prioritize investment in education and human capital development to build a skilled workforce and create more opportunities for economic growth.

• Promote economic diversification: Countries that are heavily dependent on natural resources, such as oil, are vulnerable to fluctuations in commodity prices and other external factors. Governments should prioritize efforts to diversify their economies by promoting non-resource sectors, supporting entrepreneurship and innovation, and attracting foreign investment.

• Encourage regional cooperation: Regional cooperation can help to promote economic growth, stability, and security in these countries. Governments should work to build stronger regional partnerships by promoting trade, sharing resources and expertise, and collaborating on issues such as security and environmental challenges.

Overall, addressing these challenges will require a comprehensive approach that involves political, economic, and social reforms. By prioritizing these practical recommendations, governments in these countries can work to improve their institutional and economic situation and promote long-term development and stability.

7. Conclusion

Development and economic progress do not take place in a closed system of politics and institutions. Economic decisions are governed by institutions, social norms, and political processes, which act as an intermediary. As long as there are favorable economic possibilities, a governance environment defined by safety, the application of the law, and social collaboration will encourage wealth development. Nevertheless, in numerous societies, particularly those that have experienced armed conflict, the political system is frequently chaotic, institutions fall short of being the ideal system of laws that would reduce transaction costs, and interpersonal relationships are marked by dispute and even extremism. In the end, lack of development is primarily an issue of turbulent politics, broken institutions, and vastly varied social systems in addition to a challenge of a shortage of resources. In light of this, the current study investigated the role of institutional quality in promoting the economic growth of six selected war-torn countries. Interestingly, the selected countries may be located in different geographic zones, have different levels of development, or even have different constitutions. However, experiencing a large-scale conflict brings these countries under the same umbrella. Finally, the paper outlines and explains how institutional quality and adequate governance might hasten the pace of economic development. It also contributes to the body of existing knowledge by assessing the current situation of countries experiencing conflicts. Additionally, researching factors that encourage economic progress will help us comprehend the novel approaches required in order to exploit these factors. In this context, this study will assist managers, scholars, and lawmakers in identifying the appropriate types of measures required in their fields of expertise or countries of interest in order to guarantee economic growth and implement an efficient institutional framework through supervision and rigorous administration. Further, the paper also provides a comprehensive framework that focuses on a wide range of macro factors, allowing researchers to further investigate their effects and verify novel hypotheses about how they may influence a country’s performance.

References

Acemoglu, D., Naidu, S., Restrepo, P., & Robinson, J. A. (2019). Democracy Does Cause Growth. Journal of Political Economy, 127(1), 47–100. https://doi.org/10.1086/700936

Acemoglu, D., Naidu, S., Restrepo, P., & Robinson, J. A. (2015). Democracy, Redistribution, and Inequality. In Handbook of the Income Distribution (Vol. 2, pp. 1885–1966). Elsevier. https:// doi.org/10.1016/B978-0-444- 59429-7.00022-4

Afolabi, J. O. (2019). The Impact of Governance on Economic Development in West Africa: A system GMM dynamic panel approach. Acta Universitatis Danubius. Economica, 15(3).

Ahmed, F., Kousar, S., Pervaiz, A., & Shabbir, A. (2022). Do institutional quality and financial development affect sustainable economic growth? Evidence from South Asian countries. Borsa Istanbul Review, 22(1), 189–196. https://doi.org/10.1016/j.bir.2021.03.005

Ajaz, T., & Ahmad, E. (2010). The Effect of Corruption and Governance on Tax Revenues. The Pakistan Development Review, 405-417. http://www.jstor.org/stable/4142866

Al Hawaj, A. Y., & Buallay, A. M. (2022). A worldwide sectoral analysis of sustainability reporting and its impact on firm performance. Journal of Sustainable Finance & Investment, 12(1), 62–86. https://doi.org/10.1080/20430795.2021.1903792

Alonso, J. A., & Garcimartín, C. (2013). The Determinants of Institutional Quality. More on the Debate. Journal of International Development, 25(2), 206–226. https://doi.org/10.1002/jid.1710

Alqooti, A. A. (2020). Public Governance in the Public Sector: A Literature Review. International Journal of Business Ethics and Governance, 3(3), 14–25. DOI: 10.51325/ijbeg.v3i3.47

Arellano, M., & Bond, S. (1991). Some Tests of Specification for Panel Data: Monte Carlo Evidence and an Application to Employment Equations. The Review of Economic Studies, 58(2), 277–297. https://doi.org/10.2307/2297968

Awaworyi Churchill, S., & Yew, S. L. (2018). The effect of military expenditure on growth: An empirical synthesis. Empirical Economics, 55(3), 1357–1387. https://doi.org/10.1007/s00181-017-1300-z

Barro, R. J. (1996). Determinants of Economic Growth: A Cross-Country Empirical Study. (NBER Working Papers 5698). National Bureau of Economic Research. Retrieved from https://ideas.repec.org/p/ nbr/nberwo/5698.html

Belsley, D. A. (2014). Conditioning Diagnostics. Wiley StatsRef: Statistics Reference Online. https://doi.org/10.1002/9781118445112.stat03140

Bender, S., Bloom, N., Card, D., Van Reenen, J., & Wolter, S. (2018). Management Practices, Workforce Selection, and Productivity. Journal of Labor Economics, 36(S1), S371–S409. https://doi.org/10.1086/694107.

Buntaine, M. T., Parks, B. C., & Buch, B. P. (2017). Aiming at the Wrong Targets: the Domestic Consequences of International Efforts to Build Institutions. International Studies Quarterly, 61(2), 471–488. https://doi.org/10.1093/isq/sqx013

Chheang, V. (2022). Cambodia’s Changing Public Diplomacy and Nation Branding. In Winning Hearts and Minds: Public Diplomacy in ASEAN (pp. 30–37). https://doi.org/10.1142/9789811250446_0004

Chong, C. Y. (2020). Nonlinear impact of institutional quality on economic performance within the comprehensive and progressive agreement for trans-pacific partnership. In Understanding Digital Industry (pp. 396–399). Routledge. https://doi. org/10.1201/9780367814557-94

Çinar, M. (2017). The effects of terrorism on economic growth: Panel data approach. Zbornik radova Ekonomskog fakulteta u Rijeci: časopis za ekonomsku teoriju i praksu, 35(1), 97–131. https://doi.org/10.18045/zbefri.2017.1.97

d’Agostino, G., Dunne, J. P., & Pieroni, L. (2016). Government Spending, Corruption, and Economic Growth. World Development, 84, 190–205. https://doi.org/10.1016/j.worlddev.2016.03.011

Dawson, J. W. (1998). Institutions, Investment, and Growth: New Cross‐Country and Panel Data Evidence. Economic Inquiry, 36(4), 603–619. https://doi.org/10.1111/j.1465–7295.1998.tb01739.x

Debski, J., Jetter, M., Mösle, S., & Stadelmann, D. (2018). Gender and corruption: The neglected role of culture. European Journal of Political Economy, 55, 526–537. https://doi.org/10.1016/j.ejpoleco.2018.05.002

Del Mar Salinas-Jiménez, M., & Salinas-Jiménez, J. (2007). Corruption, efficiency, and productivity in OECD countries. Journal of Policy Modeling, 29(6), 903–915. https://doi.org/10.1016/j.jpolmod.2007.07.002

Desli, E. G. (2017). Investigating the Dynamic Interaction between Military Spending and Economic Growth. Review of Development Economics, 21(3), 511–526. https://doi.org/10.1111/rode.12268

Digdowiseiso, K., & Sugiyanto, E. (2021). How Effective is Institutional Quality for the Creation of Small & Medium Enterprises (SMEs) in Indonesia? Economics & Sociology, 14(1), 263–274. DOI: 10.14254/2071-789X.2021/14-1/17

Di Vita, G. (2018). Institutional quality and the growth rates of the Italian regions: The costs of regulatory complexity. Papers in Regional Science, 97(4), 1057–1081. https://doi.org/10.1111/pirs.12290

Dorr, D. C., & Shin, A. J. (2021). War, inequality, and taxation. Economics & Politics, 33(2), 315-342. https://doi.org/10.1111/ecpo.12168

Farzanegan, M. R. (2022). The Economic Cost of the Islamic Revolution and War for Iran: Synthetic Counterfactual Evidence. Defense and Peace Economics, 33(2), 129–149. https://doi.org/10.1080/10242694.2020.1825314

Graham, C., Birdsall, N. L., & Sabot, R. H. (Eds.). (1998). Beyond Tradeoffs: Market Reform and Equitable Growth in Latin America. Brookings Institution Press.

Gibogwe, V., Nigo, A. R., & Kufuor, K. (2022). Institutional Quality and Economic Growth in Tanzania (No. 115400). University Library of Munich, Germany.

Hansen, B., & Phillips, P. C. B. (1990). Estimation and Inference in Models of Cointegration: A Simulation Study. Advances in Econometrics, 8.

Herzer, D., & Nowak-Lehmann D, F. (2006). Is there a long-run relationship between exports and imports in Chile? Applied Economics Letters, 13(15), 981–986. https://doi.org/10.1080/13504850500425832

Jankauskas, V., & Šeputienė, J. (2007). The Relation between Social Capital, Governance and Economic Performance in Europe. Business: Theory and Practice, 8(3), 131–138. https://doi.org/10.3846/btp.2007.19

Jaunky, V. C. (2013). Democracy and economic growth in Sub-Saharan Africa: A panel data approach. Empirical Economics, 45, 987–1008. https://doi.org/10.1007/s00181-012-0633-x

Kao, C. (1999). Spurious regression and residual-based tests for cointegration in panel data. Journal of Econometrics, 90(1), 1–44. https://doi.org/10.1016/S0304-4076(98)00023-2

Karangwa, A., & Su, Z. (2023). Towards a Multidimensional Model for Evaluating the Sustainable Effect of FDI on the Development of Host Developing Countries: Evidence from Africa. Sustainability, 15(5), 4662. https://doi.org/10.3390/su15054662

Klein, P. G., & Luu, H. (2003). Politics and Productivity. Economic Inquiry, 41(3), 433–447. https://doi.org/10.1093/ei/cbg019

Kouadio, H. K., & Gakpa, L. L. (2022). Do Economic Growth and Institutional Quality Reduce Poverty and Inequality in West Africa?. Journal of Policy Modeling, 44(1), 41-63. https://doi.org/10.1016/j.jpolmod.2021.09.010

Kulyk, V. (2019). Identity in Transformation: Russian-speakers in post-Soviet Ukraine. Europe-Asia Studies, 71(1), 156–178. https://doi.org/10.1080/09668136.2017.1379054

Law, S. H., Lim, T. C., & Ismail, N. W. (2013). Institutions and economic development: A Granger causality analysis of panel data evidence. Economic Systems, 37(4), 610–624. https://doi. org/10.1016/j.ecosys.2013.05.005

Lee, J. (2021). The international context of the Cold War in East Asia: Processes of security and economic co-operation between alliances. SN Social Sciences, 1(3), 1–21. https://doi.org/10.1007/s43545-021-00073-1

Lehne, J., Mo, J., & Plekhanov, A. (2014). What Determines the Quality of Economic Institutions? Cross-Country Evidence. (EBRD Working Paper No. 171). Available at http://dx.doi.org/10.2139/ssrn.3121122

Liu, X., & Zhang, M. (2022). The Impact of Market Integration on Renewable Energy Technology Innovation: Evidence from China. Sustainability, 14(21), 13778. https://doi.org/10.3390/su142113778

Marakbi, R., & Turcu, C. (2016). Corruption, institutional quality and growth: A panel smooth transition regression approach. JEL Classification C, 34, D73. Retrieved from https://www. semanticscholar.org/paper/ Corruption%2C-InstitutionalQuality-and-Growth%3A-a-Marakbi-Turcu/01a3b74fc2c65d1f8467f 150293ebe1daa0286a4

McCloskey, D. N. (2016). Bourgeois Equality: How Ideas, not Capital or Institutions, Enriched the World. University of Chicago Press.

Mubashra, S. (2018). The Impact of Counter-terrorism Effectiveness on the Economic Growth of Pakistan: An Econometric Analysis. (MPRA Paper No. 84847). https://mpra.ub.uni-muenchen.de/id/eprint/84847

Mustafa, G., & Jamil, M. (2018). Testing the Governance-Productivity Nexus for Emerging Asian Countries. The Lahore Journal of Economics, 23(1), 143–169.

Myers, R. H., & Myers, R. H. (1990). Classical and Modern Regression with Applications (Vol. 2, p. 488). Belmont, CA: Duxbury Press. https://lib.ugent.be/catalog/rug01:000851135

Ndjokou, I. M. M. M., & Tsopmo, P. C. (2017). The effects on the economic growth of natural resources in Sub-Saharan Africa: Does the quality of institutions matters? Economics Bulletin, 37(1), 248–263. https://econpapers.repec.org/RePEc:ebl:ecbull:eb-16-00550

Nguyen, C. P., Su, T. D., & Nguyen, T. V. H. (2018). Institutional Quality and Economic Growth: The Case of Emerging Economies. Theoretical Economics Letters, 8(11), 1943. https://doi.org/10.4236/tel.2018.811127

North, D. C. (1955). Location Theory and Regional Economic Growth. Journal of Political Economy, 63(3), 243–258. https://doi.org/10.1086/257668

Obamuyi, T. M., & Olayiwola, S. O. (2019). Corruption and economic growth in India and Nigeria. Journal of Economics & Management, 35(1), 80–105. doi: 10.22367/jem.2019.35.05

Olamide, E., Ogujiuba, K. K., Maredza, A., & Semosa, P. (2022). Poverty, ICT and Economic Growth in SADC Region: A Panel Cointegration Evaluation. Sustainability, 14(15), 9091. https://doi.org/10.3390/su14159091

Ouoba, Y., & Sawadogo, R. (2019). Natural resources effect on economic growth: The role of institutional quality. Journal of Policy Modeling. Retrieved from http://www. econmodels. com/uplo ad7282/18468cfe824ca4067afca26 e9de00b1c. pdf.

Pacific, Y. K. T., Ramadhan, A. A., & Gabriella, N. M. A. (2017). Does Control of Corruption Accelerate Economic Growth in Botswana? Global Journal of Human-Social Science Research, 17(6), 41–50.

Pedroni, P. (1999). Critical values for cointegration tests in heterogeneous panels with multiple regressors. Oxford Bulletin of Economics and Statistics, 61(S1), 653–670. https://doi.org/10.1111/1468-0084.0610s1653

Peng, M. W., Ahlstrom, D., Carraher, S. M., & Shi, W. S. (2017). An institution-based view of global IPR history. Journal of International Business Studies, 48(7), 893–907. https://doi.org/10.1057/s41267-016-0061-9

Pesaran, M. H., Shin, Y., & Smith, R. P. (1999). Pooled mean group estimation of dynamic heterogeneous panels. Journal of the American Statistical Association, 94(446), 621–634. 10.1080/01621459.1999.10474156

Potrafke, N. (2019). Electoral cycles in perceived corruption: International empirical evidence. Journal of Comparative Economics, 47(1), 215–224. https://doi.org/10.1016/j.jce.2018.11.003

Prenovitz, E. C., Hazlett, P. K., & Reilly, C. S. (2023). Can Markets Improve Recycling Performance? A Cross-Country Regression Analysis and Case Studies. Sustainability, 15(6), 4785. https://doi.org/10.3390/su15064785

Radmehr, R., Ali, E. B., Shayanmehr, S., Saghaian, S., Darbandi, E., Agbozo, E., & Sarkodie, S. A. (2022). Assessing the Global Drivers of Sustained Economic Development: The Role of Trade Openness, Financial Development, and FDI. Sustainability, 14(21), 14023. https://doi.org/10.3390/su142114023

Radzeviča, A. M., Bulderberga, K., & Krasnopjorovs, O. (2018). The Role of Institutional Quality in Economic Growth: Implications for the Baltic States. [Unpublished Thesis] Stockholm School of Economics, SSE RIGA.

Raik, K. (2019). The Ukraine Crisis as a Conflict over Europe’s Political, Economic, and Security Order. Geopolitics, 24(1), 51–70. https://doi.org/10.1080/14650045.2017.1414046

Rotfeld, A. D. (1999). The future of arms control and international security. In A Future Arms Control Agenda: Proceedings of Novel Symposium 118 (pp. 3–14).

Salman, M., Long, X., Dauda, L., & Mensah, C. N. (2019). The impact of institutional quality on economic growth and carbon emissions: Evidence from Indonesia, South Korea, and Thailand. Journal of Cleaner Production, 241, 118331. https://doi.org/10.1016/j. jclepro.2019.118331

Sardar, S., Khan, D., Khan, A., & Magda, R. (2022). The Influence of Aid for Trade on Human Development in South Asia. Sustainability, 14(19), 12169. https://doi.org/10.3390/su141912169

Sawadogo, R., & Semedo, G. (2021). Financial inclusion, income inequality, and institutions in sub-Saharan Africa: Identifying cross-country inequality regimes. International Economics, 167, 15–28. https://doi.org/10.1016/j.inteco.2021.05.002

Sheremirov, V., & Spirovska, S. (2022). Fiscal multipliers in advanced and developing countries: Evidence from military spending. Journal of Public Economics, 208, 104631 https://doi.org/10.1016/j.jpubeco.2022.104631

Shrestha, N. (2020). Detecting Multicollinearity in Regression Analysis. American Journal of Applied Mathematics and Statistics, 8(2), 39–42. DOI:10.12691/ajams-8-2-1

Staats, J. L., & Biglaiser, G. (2012). Foreign Direct Investment in Latin America: The Importance of Judicial Strength and Rule of Law. International Studies Quarterly, 56(1), 193–202. https://doi.org/10.1111/j.1468-2478.2011.00690.x

Stock, J. H., & Watson, M. W. (1993). A Simple Estimator of Cointegrating Vectors in Higher-order Integrated Systems. Econometrica: Journal of the Econometric Society, 783–820. https://doi.org/10.2307/2951763

Sultana, N., Rahman, M. M., & Khanam, R. (2022). Informal Sector Employment and Economic Growth: Evidence from Developing Countries in SDG Perspective. Sustainability, 14(19), 11989. https://doi.org/10.3390/su141911989