Organizations and Markets in Emerging Economies ISSN 2029-4581 eISSN 2345-0037

2023, vol. 14, no. 3(29), pp. 621–643 DOI: https://doi.org/10.15388/omee.2023.14.8

The Relationship Between Financial Development and the Composite Stock Price Index in Emerging Market Countries: A Panel Data Evidence

Ariodillah Hidayat (corresponding author)

Sriwijaya University, Indonesia

ariodillahhidayat@fe.unsri.ac.id

https://orcid.org/0000-0002-6520-5985

Liliana

Sriwijaya University, Indonesia

liliana@unsri.ac.id

https://orcid.org/0000-0002-5499-7729

Harunurrasyid

Sriwijaya University, Indonesia

Harunrasyid0902@gmail.com

https://orcid.org/0000-0002-9808-9925

Xenaneira Shodrokova

Sriwijaya University, Indonesia

Xenaneira12@gmail.com

https://orcid.org/0009-0003-8034-6617

Abstract. This study examines the influence of financial development variables on the Composite Stock Price Index (CSPI) in Emerging Market Countries. This study uses secondary data obtained from the International Monetary Fund and Yahoo Finance, with an annual data period of 2000–2020. Panel data regression analysis using the random effects model was performed to analyze data. The results showed that Financial Market Access Index (FMAI) and Financial Market Depth Index (FMDI) variables had a positive and significant relationship affecting CSPI, while Financial Market Efficiency Index (FMEI) had a negative and significant relationship to CSPI. The FMEI results negatively affecting CSPI indicate the need for improvements in financial market efficiency. Increased efficiency can help ensure that relevant and accurate information is available quickly and fairly to all parties, driving better investment decisions.

Keywords: financial development, Composite Stock Price Index, emerging market

Received: 12/4/2023. Accepted: 9/10/2023

Copyright © 2023 Ariodillah Hidayat, Liliana, Harunurrasyid, Xenaneira Shodrokova. Published by Vilnius University Press. This is an Open Access article distributed under the terms of the Creative Commons Attribution Licence, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

1. Introduction

The capital market is an important factor in the economy because it provides an overview of the economic condition of a country (Christensen et al., 2016). The development of a country‘s capital market can be seen from the stock price index used. One index that investors often see when investing in many countries is the Composite Stock Price Index (CSPI). Capital markets of emerging markets globally have become increasingly important in recent years and are attracting more attention from investors (Bortz & Kaltenbrunner, 2018). In emerging countries, capital markets play an important role in facilitating economic growth by giving firms access to capital and allowing individuals to invest in that economic growth potential (Mateut, 2018). China, Indonesia, Brazil, India, and Mexico are emerging markets with significant economies, high growth potential, and global impact. As stock markets evolve, they offer opportunities to understand unique trends, sensitivity to change, as well as the interaction of local and regional factors. The large population and increasing participation in the stock market provide insight into how financial developments affect individual investments and stock market growth (Sivaramakrishnan et al., 2017).

A large amount of literature has been developed to assess the impact of financial development on economic growth, investment, stock markets and economic stability (Dabla-Norris et al., 2012). The underdeveloped economic status and imperfections in credit markets and weak financial institutions in emerging market countries provide a background to the importance of examining financial developments in these economies (Barik & Pradhan, 2021). In emerging market countries, the financial sector is often not fully mature and unable to support sustainable economic growth. Imperfections in access to financial services and weak credit market mechanisms can hinder investment, growth of small and medium enterprises, and access to funding for individuals (Fletschner, 2009). Financial development is a very important prerequisite in advancing emerging market economies. Moreover, financial development plays a role as a foundation in increasing financial inclusion (Sharma, 2016). By increasing access to financial services for previously marginalized individuals and companies, financial development can open doors for many people to participate in financial markets, invest, and access financial services (Beck et al., 2009). This will trigger many economic benefits and strengthen equality and poverty alleviation.

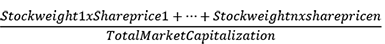

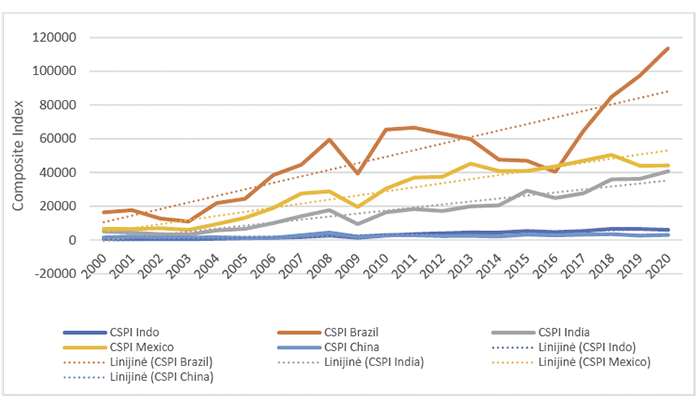

Figure 1

Trends in Composite Stock Price Index (CSPI) in Emerging Market Countries

Source: Yahoo Finance (2000–2020).

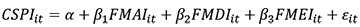

Based on Figure 1, CSPI trends in all countries show an increase. The year 2008 was a significant turning point for almost all countries in terms of their CSPI movements. The global financial crisis in 2008 resulted in a sharp decline in the stock markets of almost all countries, including Indonesia, Brazil, Mexico, India, and China. Some countries take longer to recover than others (Frank & Hesse, 2009). The stock markets of Brazil and Mexico showed significant fluctuations throughout this period. The 2008 global financial crisis severely affected the stock markets of both, and volatility remained high into the following years. China has a unique phenomenon in the tremendous growth of the stock market in the early 2000s, experiencing its highest peak in 2007 before being affected by the global crisis. Despite the fluctuations, China managed to maintain a long-term growth trend. Indonesia experienced marked fluctuations in its stock market, affected by global conditions and domestic policies (Bernstein & Cashore, 2012). These phenomena collectively reflect the complexity of the stock market and the complexity of the interaction between the various factors that shape market trends over a long period of time.

Financial developments have significant potential in influencing a country’s CSPI. In this case, variables that reflect financial developments, including the Financial Market Access Index (FMAI), Financial Market Depth Index (FMDI), and Financial Market Efficiency Index (FMEI), play an important role in shaping stock market movements. Wider access to financial services, reflected in high FMAI, encourages greater participation of investors and companies in the stock market (Beck et al., 2009). Better access to funding sources allows companies to grow their business, resulting in growth and an increase in share value. The depth of financial markets, as measured by FMDI, has a positive impact on CSPI. Deeper financial markets provide investors with a wide array of financial instruments, allowing them to diversify their investment portfolios as well as better manage risk (Cummins & Weiss, 2009). The efficiency of financial markets, as measured by FMEI, has major implications for CSPI. A market that is efficient in portraying relevant and accurate information can help investors make better decisions, thus encouraging their participation in the stock market (Murray et al., 2013). In addition, efficient markets reflect rapidly changing information in stock prices, creating opportunities for investors to respond to as well as benefit from accurate price movements.

This research stems from the drive to answer critical questions about the factors underlying stock market movements on a global scale, namely in emerging markets. With a focus on measurable variables of financial development, this study explores the complex relationships between financial conditions, economic stability, and stock market performance. In an effort to understand this dynamic, this study provides new insights related to how financial development variables concretely play an important role in shaping the trend of CSPI movements in the five countries. The results of this study have the potential to provide valuable guidance for decision makers, regulators, as well as market participants to understand how the complex interaction between financial factors impacts the stock market. By combining empirical data and theoretical concepts, this study confirms the importance of financial development factors in shaping stock market dynamics amid growing global economic turmoil.

The remainder of the study is outlined as follows. Section 2 reviews literature. Section 3 explores the data and methodology. Movement of variables, empirical results and discussion are reported in Section 4. Section 5 presents a conclusion and policy implications for emerging countries.

2. Literature Review

One of the issues of modern financial research is the volatility of price changes in the stock market. Composite Stock Price Index (CSPI) is a composite index of all types of stocks listed on a country‘s stock exchange (Pinem, 2019). Changes in individual stock prices in the market occur due to demand and supply factors (Baffes et al., 2015). The share price is calculated by considering the weight of each share in the index which is based on the stock market capitalization (the total market value of the company’s shares). Research related to the Composite Price Index has been conducted before. Research by Hidayat et al. (2021) examined the CSPI in Indonesia during the Covid-19 period. Alareeni and Hamdan (2020) examined the movement of the CSPI during Covid-19 in the United States. Fang and You (2014) examined the impact of oil price shocks on the stock prices of emerging economies, namely China, India, and Russia.

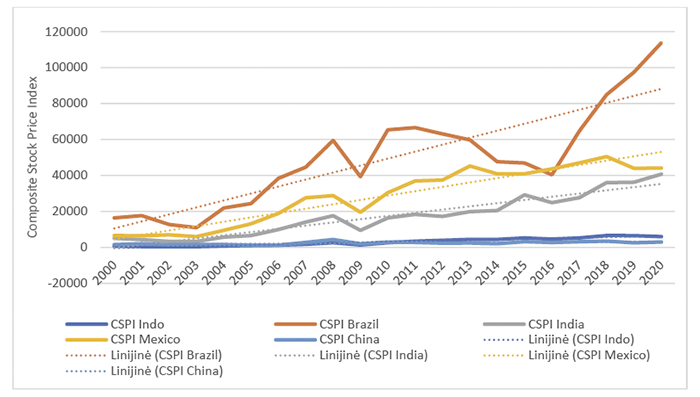

Financial Development theory refers to the study of the relationship between the financial system and economic growth (Guru & Yadav, 2019). This theory attempts to explain how the development of the financial system affects economic growth and how economic growth affects the development of the financial system (Cevik & Rahmati, 2020). A well-functioning financial system helps channel savings into investment, and can increase the availability of credit for companies and households, thus supporting economic growth (Ho & Iyke, 2018). Financial development can generally be divided into two categories: financial institution and financial market (Zhang & Naceur, 2019). Financial institution refers to various organizations that offer financial services, such as banks, insurance companies, pension funds, and other non-bank financial intermediaries (Chepkemoi et al., 2019). Financial market indicators focus on the stock market and debt market development (Pan & Mishra, 2018).

Figure 2

Financial Development Index Pyramid

Source: Čihák et al. (2012).

Financial development in emerging market countries has been discussed by several researchers. According to Ozili (2018), digital finance and financial inclusion have not sufficiently penetrated broad segments of the population such as emerging markets. Park and Mercado (2015) found that financial inclusion significantly reduced poverty, and there is also evidence that it lowers income inequality in emerging market countries. According to Atkiinson and Messy (2013), low levels of financial inclusion are associated with low levels of financial literacy in emerging market countries. In this digital age, access to information and financial technology can change the way individuals and communities manage their finances and participate in the global economy (Bayliss et al., 2019). Adu et al. (2013) investigated the long-term growth effects of financial development in Ghana. Nasreen et al. (2020) examined the role of financial globalization, institutions and economic growth on the development of the financial sector in European countries. Financial development composite index covers various dimensions of financial markets, namely depth, access and efficiency and four-way classification of institutions, as suggested by Rodrik (2005) and Law et al. (2018). Lenka (2021) investigated the linkage between financial inclusion and financial development in India during the period 1980–2017. Gupta and Mahakud (2019) examined the impact of financial development on corporate investment in terms of its effect on financing constraints. Dabla-Norris et al. (2012) found that the positive impact of innovation on productivity was greater in countries with well-developed financial markets, and significantly greater in high-tech industries. The study of Hassan et al. (2011) provides evidence on the role of financial development in calculating economic growth in low- and middle-income countries classified by geographic region.

Financial development is thought to be able to influence CSPI. The higher the level of access to financial services, the greater the participation of investors and companies in the stock market, which can contribute to an increase in the value of CSPI (Gomber et al., 2018). Qamruzzaman and Karim (2020) studied the effect of FMAI on CSPI and found that the influence of access to the market has a causality relationship with CSPI. Thus, it is suspected that there is a positive influence between the Financial Market Access Index (FMAI) and the CSPI. Furthermore, the variables Financial Depth Index (FMDI) and CSPI are thought to have a positive relationship. As the financial system deepens, individuals and companies have better access to funds from financial markets (Olusegun et al., 2013). This may encourage companies to seek additional funding for expansion and development. According to Lenka (2021), who researches financial inclusion in India, when the financial system is deeper, it can increase financial inclusion, and eventually increase the price of stock indices. In addition, it is suspected that the Financial Market Efficiency Index (FMEI) has a positive effect on CSPI. More efficient markets tend to have prices that reflect information quickly and accurately. This makes investors more confident in making investment decisions (Shah et al., 2018).

Although there are several studies on the effect of financial development on CSPI, research on the composite index of emerging market countries is still limited. In addition, related literature covers financial inclusion and macroeconomic variables. However, this research overcomes this gap by examining financial access, depth, and efficiency which are proxies for financial development. This research emphasizes the role of financial development as a means of increasing access, efficiency, and depth to the stock market in emerging countries. In other words, financial development is an important part of alleviating poverty and prosperity through expanding the stock market.

3. Methodology

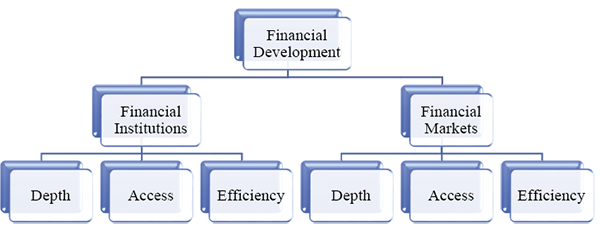

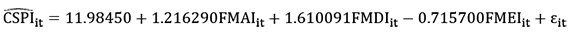

This study discusses the factors that affect the Composite Stock Price Index in the emerging market countries (Indonesia, Brazil, India, Mexico, and China). The data in this study used annual data for the period 2000–2020. This research uses secondary data obtained from the International Monetary Fund (IMF) and Yahoo Finance. The data analysis method used was descriptive analysis and regression analysis of panel data using the random effects model. In this analysis, Econometric Views (EViews) version 10 tool is used. In the panel data, the same cross section unit was surveyed in some time (Gujarati, 2003). Regression analysis with panel data basically has three techniques to regress the usual OLS approach (Pooled Least Square), fixed effects model, and random effects model. The form of panel data regression model in this study is

where CSPI = Composite Stock Price Index; α = constant; β1, β2, β3 = coefficient of independent variables; FMAI = Financial Markets Access Index; FMDI = Financial Markets Depth Index; FMEI = Financial Markets Efficiency Index; i = individual; t = t-period; ε = error term.

Table 1

Operational Variables

|

Variable |

Formula/ Measurement |

Source |

|

Composite Stock Price Index (CSPI) |

Statistical tool that groups together many different equities, securities, or indexes in order to create a representation of overall market or sector performance.

|

Yahoo Finance |

|

Financial Market Access Index (FMAI) |

The Financial Access Index uses a percentage of market capitalization outside the 10 largest companies for proxy access to the stock market. Higher levels of stock market concentration should reflect greater difficulty in accessing the stock market for newer or smaller issuers. For bond market access, the number of financial and nonfinancial corporate issuers in domestic and foreign debt markets in a given year per 100,000 adults (Svirydzenka, 2016) is used. |

IMF |

|

Financial Market Depth Index (FMDI) |

The depth sub-index includes the size of the stock market (capitalization, or the value of listed shares) and how active it is (stocks traded), the outstanding volume of international debt securities of sovereigns and international and domestic debt securities of financial and nonfinancial corporations (Svirydzenka, 2016). |

IMF |

|

Financial Market Efficiency Index (FMEI) |

Financial market efficiency sub-index relies on the stock market turnover ratio – the ratio of the value of stocks traded to stock market capitalization. A higher turnover should indicate higher liquidity and greater efficiency in the market. In the bond market, the most commonly used variable is the tightness of the bid-ask spread (Svirydzenka, 2016). |

IMF |

Source: Yahoo Finance and International Monetary Fund (IMF), 2020–2020.

Some literature also uses the Financial Market Access, Depth, and Efficiency Index as a proxy for financial development; analysis starts from Svirydzenka (2016), subsequently followed by several researchers such as Cihak et al. (2013), Mohieldin et al. (2019), and Dogan et al. (2020).

4. Results and Discussion

4.1 Variable Movement Analysis

Based on Figure 3, in general, there is an upward trend in CSPI in each country over a significant period of time. Brazil has the highest trend in CSPI increase compared to other countries. Brazil experienced strong economic growth in the period, especially in the 2000s and early 2010s (Sotomayor, 2019). This is supported by political stability and government policies that support economic growth. The Brazilian government has encouraged the development of the stock market through various policies, such as increased transparency and investor protection (Abdmouleh et al., 2015). This gives investors confidence to invest in the Brazilian stock market. During the period, there was an increase in the participation of local and foreign investors in the Brazilian stock market (Regan, 2017).

Figure 3

Composite Stock Price Index (CSPI) Movement

Source: International Monetary Fund (IMF), 2000–2020.

The second country that has the highest CSPI upward trend is Mexico. Mexico experienced steady economic growth in the period, supported by government policies that promoted the growth of diverse economic sectors, including manufacturing, agriculture, and tourism (Siddiqui, 2015). As Mexico’s largest trading partner, the United States provides a large market for Mexican products and services (Ramirez, 2017). Mexico implemented various economic reform policies in the period, such as privatization of the energy and telecommunications sectors, deregulation of industry, and improvement of financial access (Avilés, 2020; Bruhn & Love, 2014). This strengthens the stock market and increases investor confidence.

The CSPI trend for Indonesia and China shows constant growth. Although the financial sector in Indonesia and China has grown rapidly during the period, there have been some structural issues affecting stock market performance. Some examples of such problems include a lack of transparency and accountability in the financial sector, as well as limited access of individual investors to the stock market (Turner, 2014). CSPI Indonesia and China had relatively high volatility during the period (Singhania, 2013). Although the increase is not significant, fluctuations in stock prices can cause investors anxiety and reduce investor participation in the stock market. It can be seen that there is an influence of certain global events on the movement of CSPI in each country.

Figure 4

Financial Markets Access Index (FMAI) Movement

Source: International Monetary Fund (IMF), 2000–2020.

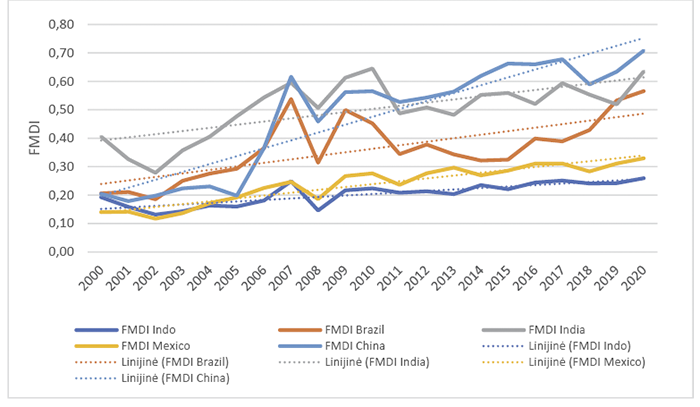

China had the lowest FMAI index among other countries in 2000, but experienced a significant upward trend to reach the highest index among other countries in 2020. This shows that China has made many efforts to improve financial market access in the country over the past two decades (Liang & Guo, 2015). The development of technology and the internet in China has opened up financial market accessibility for retail investors(Huang & Zhao, 2017). Since the early 2000s, investors in China have been able to easily invest in financial markets through online trading platforms and mobile apps. A significant upward trend in FMAI has also occurred in Brazil. Brazil has undertaken economic policy reforms aimed at improving the accessibility of financial markets. Deregulation of financial markets has opened up the accessibility of foreign investors and encouraged increased investor participation.

During the period 2000–2020, FMAI in Indonesia, Mexico, and India experienced a decline. Foreign investors still invest little in the Indian financial market due to reasons of complicated financial market regulation, high political and security risks, as well as lack of economic stability (Thukral & Sridhar, 2015). Financial services in India are still not of high quality, thus affecting investors’ accessibility to financial markets (Garg & Agarwal, 2014). Financial market infrastructure in India still needs to be developed, especially in terms of technology and internet access, which can affect investors’ accessibility to financial markets.

Based on Figure 5, it can be seen that all countries show a positive trend in FMDI. The highest upward trend is noteceable in China. In 2000, China began implementing significant market reform policies, including financial market liberalization, deregulation, and privatization, which exerted a major influence on the improvement of FMDI (Huang & Wang, 2017). China’s economy grew rapidly during the period 2000–2020, which opened up investment opportunities in financial markets. High economic growth has also increased the number of investors and strengthened investor confidence in China’s financial markets. During the period 2000–2020, China built a rapidly growing stock exchange, including the Shanghai Stock Exchange and Shenzhen Stock Exchange, which has increased market liquidity and provided investment accessibility to financial markets.

The second country with the highest increase in FMDI is Brazil. In the early 2000s, Brazil went through a period of severe economic crisis. However, after that, the country experienced significant economic stability that brought investor confidence and strengthened financial markets. During the period 2000–2020, the central bank of Brazil (Banco Central do Brazil) carried out a tight monetary policy to control inflation. This strengthened the Brazilian currency, improved fiscal conditions, and strengthened investor confidence in financial markets (Massuda et al., 2018). Meanwhile, Indonesia has the lowest FMDI and has experienced an insignificant increase. Indonesia is one of the countries that is highly dependent on commodity exports, such as crude oil, natural gas, and coal. This dependence on commodity export revenue sources makes the Indonesian economy vulnerable to fluctuations in the world commodity prices, which can affect financial market stability (Mukherjee & Sovacool, 2014). Although the Indonesia Stock Exchange has existed for a long time, the Indonesian capital market is still relatively small compared to other countries in Asia (Wu, 2014). This is due to the lack of investor participation, both domestic and foreign, as well as the low awareness and financial literacy of the Indonesian people (Dewi et al., 2020).

Figure 5

Financial Markets Depth Index (FMDI) Movement

Source: International Monetary Fund (IMF), 2000–2020.

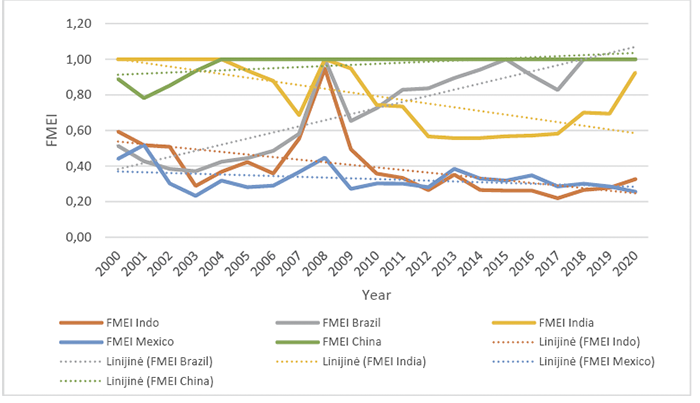

Figure 6

Financial Markets Efficiency Index (FMEI) Movement

Source: International Monetary Fund (IMF), 2000–2020.

FMEI is an index that measures the efficiency of financial markets in a country. Based on Figure 6, Brazil experienced the most significant increase. Brazil’s financial markets have experienced significant product and technological innovation over the past two decades. These innovations include the development of derivative products, online trading, the use of information technology, and the development of alternative trading systems (Aloise & Macke, 2017). This helps improve the efficiency of financial markets and provides wider access for investors. In addition, the country that also experiences a constant increase in FMEI is China. Although China’s financial market has undergone significant reforms in the 2000s, the Chinese government still enforces strict regulations in order to maintain market stability and prevent high volatility (Giglio, 2021). This could result in a constant increase in FMEI due to restrictions on certain trading and investment activities.

The most significant downward trend in FMEI is observed in India and Indonesia. In India and Indonesia, capital market regulation is still relatively less effective and efficient than in other countries. Dependence on certain sectors such as the financial and commodity sectors could be a factor influencing the decline in FMEI in India and Indonesia (McEwan et al., 2020). This makes the capital markets in both countries less diversified, making them vulnerable to market fluctuations.

4.2 Econometric Analysis

Based on Table 2, the average values for all three variables (FMAI, FMDI, FMEI) are negative, indicating that the data average is below zero. The median value is also negative for all three variables, indicating that the data is skewed to the left. FMAI has the lowest median value (-1.065154), followed by FMDI (-1.168039) and FMEI (-0.541866). The maximum value for FMAI is -0.569621, while for FMDI and FMEI, the maximum value is -0.345454 and 0.000000, respectively. This shows that the data for all three variables are concentrated on the left side of the distribution. The minimum value for FMAI is -2.340509, while for FMDI and FMEI, the minimum value is -2.146620 and -1.517239, respectively. This shows that the data of the three variables are spread over a wide range. The highest standard deviation was for FMEI (0.509089), followed by FMDI (0.479047) and FMAI (0.372864). This shows that the data for FMEI is more scattered than the other two variables. A negative skewness indicates that the data distribution tends to be skewed to the left, meaning that the tail of the data distribution is longer on the left side. The result of a kurtosis greater than 3 (normal kurtosis) indicates that the data distribution is sharper and has thicker tails than the normal distribution. This indicates that there is a potential for significant differences from the normal distribution in these variables.

Table 2

Descriptive Statistics

|

|

FMAI |

FMDI |

FMEI |

CSPI |

|

Mean |

-1.183247 |

-1.141134 |

-0.561732 |

9.110030 |

|

Median |

-1.065154 |

-1.168039 |

-0.541866 |

9.151040 |

|

Maximum |

-0.569621 |

-0.345454 |

0.000000 |

11.64186 |

|

Minimum |

-2.340509 |

-2.146620 |

-1.517239 |

5.962139 |

|

Std. Dev. |

0.372864 |

0.479047 |

0.509089 |

1.419904 |

|

Skewness |

-0.861693 |

-0.063873 |

-0.266359 |

-0.195894 |

|

Kurtosis |

3.260454 |

1.859253 |

1.532411 |

1.997109 |

|

Jarque-Bera |

13.29080 |

5.764598 |

10.66452 |

5.071888 |

|

Probability |

0.001300 |

0.056006 |

0.004833 |

0.079187 |

|

Sum |

-124.2409 |

-119.8190 |

-58.98191 |

956.5532 |

|

Sum Sq. Dev. |

14.45885 |

23.86656 |

26.95385 |

209.6772 |

|

Observations |

105 |

105 |

105 |

105 |

|

Cross sections |

5 |

5 |

5 |

5 |

Source: EViews data (2000–2020).

Table 3

Heteroskedasticity Test

|

Heteroskedasticity Test: Breusch-Pagan-Godfrey |

|||

|

F-statistic |

3.633142 |

Prob. F |

0.3941 |

|

Obs*R-squared |

20.70013 |

Prob. Chi-Square |

0.3536 |

|

Scaled explained SS |

0.041813 |

Prob. Chi-Square |

1.0000 |

Source: EViews, 2023.

Table 4

Multicollinearity Test

|

|

C |

FMEI |

FMDI |

FMAI |

|

C |

0.08806 |

0.00366 |

0.00905 |

0.06215 |

|

FMEI |

0.00366 |

0.03390 |

0.00273 |

-0.01562 |

|

FMDI |

0.00905 |

0.00273 |

0.02430 |

-0.01705 |

|

FMAI |

0.06215 |

-0.01562 |

-0.01705 |

0.07635 |

Source: EViews, 2023.

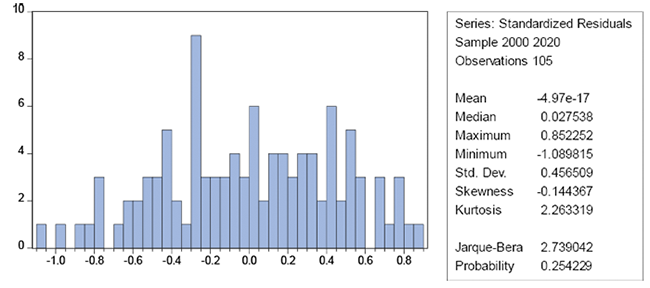

Based on Figure 7, it can be seen that the probability value of Jarque is 0.2542 > 0.05, meaning that the residual research data is normally distributed. From the results of the heteroscedasticity test using the Breusch-Pagan Godfrey method, the probability value was 0.3536 > 0.05, so it can be concluded that there were no symptoms of heteroscedasticity in the research model (Table 3). From the results of the multicollinearity test in Table 4, it can be seen that the correlation value is below 0.8, so it can be concluded that there is no multicollinearity problem in the research variables.

Figure 7

Normality Test

Source: EViews, 2023.

The final selection of models in this study is based on the Hausman Test and the Lagrange Multiplier (LM) test which show that the best model is the random effects model (REM). The following are the estimated results of panel data regression testing based on the random effects model (REM).

Table 5

Panel Regression Results Using the Random Effects Model

|

Variable |

Coefficient |

Std. Error |

t-Statistic |

Prob. |

|

Constants |

11.98450 |

0.256278 |

46.76360 |

0.0000*** |

|

FMAI |

1.216290 |

0.158633 |

7.667328 |

0.0000*** |

|

FMDI |

1.610091 |

0.123833 |

13.00210 |

0.0000*** |

|

FMEI |

-0.715700 |

0.129533 |

-5.525237 |

0.0000*** |

|

Random Effects (Cross) |

|

|

|

|

|

INDONESIA |

-0.449633 |

R-Squared |

0.336825 |

|

|

BRAZIL |

0.470168 |

Adjusted R-Squared |

0.317127 |

|

|

INDIA |

0.129026 |

F-Statistics |

17.09925 |

|

|

MEKSIKO |

0.233357 |

Prob(F-statistic) |

0.000000 |

|

|

CHINA |

-0.382918 |

|

|

|

|

R-squared |

0.336825 |

|

|

|

|

Prob(F-statistic) |

0.000000 |

|

|

|

Note. *= significant at 10 percent; **= significant at 5 percent, ***= significant at 1 percent.

Source: EViews data (2000–2020).

The results of the F-statistical test show that the probability value of F-statistics is smaller than the significance level of 5% (0.0000 < 0.05), simultaneously independent variables affect CSPI. The coefficient of determination which shows that variable variations can explain the variation of FMAI, FMDI, and FMEI variables can explain the CSPI variable by 33.68 percent while the remaining 76.94 percent is influenced by variables that are not included in the research model.

Based on Table 5, FMAI, FMDI, and FMEI have a significant effect on the CSPI. This means that based on the value of the FMAI coefficient, β1 = 1.2163 shows that an increase in FMAI by 1 percent will increase CSPI by 1.22 percent, β2 = 1.6100 explains that every 1 percent increase in FMDI will increase CSPI by 1.61 percent. Meanwhile, based on the value of the FMEI coefficient, β3 = -0.7157 means that every increase in FMEI will reduce CSPI by 0.71 percent.

Table 6

Emerging Market Intercept Results

|

Country |

Intercept |

Individual Constants |

|

INDONESIA |

-0.449633 |

11.534867 |

|

BRAZIL |

0.470168 |

12.454668 |

|

INDIA |

0.129026 |

12.113526 |

|

MEKSIKO |

0.233357 |

12.217857 |

|

CHINA |

-0.382918 |

11.601582 |

Source: EViews (2000–2020).

Random effects models estimate panel data in which nuisance variables can be linked over time and across individuals. Based on Table 6, the random effects model has differences in intercepts accommodated by error terms of each country. Brazil and Mexico have the highest individual constant values, while Indonesia has the lowest.

4.3. Discussion

The Financial Markets Access Index has a positive and significant effect on the Composite Stock Price Index. FMAI measures the level of financial market accessibility of a country, which includes accessibility to the stock market, bond market, and financial institutions (Haini, 2020). The higher the FMAI, the easier investors can access financial markets in the country (Veron & Wolff, 2016). Better financial market accessibility makes it easier for investors to invest in financial markets (Bakar & Yi, 2016). The easier it is for investors to access financial markets, the greater the number of investors who invest in financial markets. This can lead to increased demand for stocks and other financial assets, ultimately increasing stock prices (including the CSPI). This can increase a company’s ability to expand its business, increase profits, and ultimately affect stock performance.

Financial Markets Depth Index (FMDI) is one indicator that measures the depth of a country’s financial markets. Financial market depth is measured by looking at how many transactions occur in a country’s financial market (Kim & Song, 2017). The more transactions that occur in the financial market, the more liquid the financial market is. The positive and significant influence between FMDI and the CSPI can be explained as follows. The greater the depth of the financial market, the easier it is for investors to buy or sell stocks, thereby increasing trading activity in the stock market (Agbloyor et al., 2013). High trading activity can increase demand for stocks listed on the stock exchange, thereby encouraging an increase in stock prices and stock indices (Wang et al., 2013). Deeper financial markets also provide more sources of financing for companies. In a deep financial market environment, companies can easily obtain funds from investors by issuing stocks or bonds (El-Wassal, 2013). Deeper financial markets also provide opportunities for investors to diversify portfolios (Ahmed & Huo, 2021). Investors can choose to invest in various types of financial instruments, such as stocks, bonds, or mutual funds. By diversifying a portfolio, investors can reduce the investment risk they incur. The deeper the financial markets, the more choices of financial instruments available to investors to diversify their portfolios. This is in line with research conducted by Zhang and Ben Naceur (2019).

The negative and significant effect of the Markets Efficiency Index (FMEI) on the CSPI can be caused by several factors. One factor is that too high market efficiency can result in investors’ tendency to speculate and transact more actively, which can ultimately lead to market instability and high price fluctuations (Shah et al., 2018). In addition, high market efficiency can also reduce arbitrage opportunities and make it harder for investors to seek greater profits. This can reduce investors’ interest in investing in the stock market, thus negatively affecting stock prices. When FMEI increases, it means that the market is more efficient and the information available is easier for investors to obtain. However, if the market is efficient, then the available information is already reflected in the stock price and does not have an additional influence on stock price movements. Therefore, high FMEI tends to have a negative influence on stock price movements (CSPI). This is in accordance with the results of Gârleanu and Pedersen (2018).

The highest value in Brazil indicates that the average value of the composite stock price index in the country tends to be higher if all independent variables are constant or zero(Claessens & Yurtoglu, 2013). Brazil has a larger financial market and more stable financial stability than other emerging market countries, as can be seen from the increasing trend of the country’s CSPI, FMAI, FMDI, and FMEI (Zhang et al., 2013). In addition, Brazil has many government policies that support the growth of financial markets(Chkili & Khuong, 2014). The second country with the highest intercept is Mexico. This is in line with the movement of the CSPI, FMAI, FMDI, and FMEI index trends which have never been at the lowest, and almost all of them experience a positive trend. While the country with the lowest intercept value is Indonesia, this can also be seen from the movement of Indonesia’s CSPI, FMAI, FMDI, and FMEI trends which are always lower than other countries studied. Although Indonesia’s financial market continues to develop and mature, its size is still smaller than other countries’ financial markets (Tilley, 2020). This small size of financial markets can affect intercept values in regression, as smaller financial markets tend to have higher levels of volatility (Vinh et al., 2020). Indonesian government policies that lack support for financial market growth and market efficiency can also affect the intercept value. Although Indonesia has carried out various policy reforms to boost financial market growth, there is still room for further improvement. After Indonesia, China is at the lowest level of intercept value – judging from the movement of the CSPI trend, it turns out that China is the second lowest among other countries. CSPI in Indonesia and China had relatively high volatility during the study period. Although the increase is not significant, fluctuations in stock prices can cause investors anxiety and reduce investor participation in the stock market.

5. Conclusions and Recommendations

Based on the estimation results of the panel data regression model using the random effects model, it was found that FMAI and FMDI variables have a positive and significant relationship affecting CSPI, while FMEI has a negative and significant relationship with CSPI. Based on the intercept value of each country, it was found that the highest intercept was Brazil. This indicates that the average value of the Composite Stock Price Index in that country tends to be higher if all independent variables are constant or zero. The findings show that Brazil has a larger economy and more developed financial markets, while Indonesia is the country with the lowest intercept.

The results of FMAI and FMDI have a positive effect on CSPI, indicating that policies that promote wider access to financial services and increase financial market depth can have a positive impact on stock market growth. Therefore, governments and regulators can encourage innovation in the financial sector, including the development of more inclusive and diverse financial products and services. This can include efforts to expand the scope of financial services in rural areas as well as for the micro and small business sector. The FMEI results negatively affecting CSPI indicate the need for improvements in financial market efficiency. Increased efficiency can help ensure that relevant and accurate information is available quickly and fairly to all parties, driving better investment decisions. In this regard, measures to strengthen transparency, supervision and regulatory implementation in financial markets can contribute to improved market efficiency. The results also show the importance of maintaining a balance between financial development and market stability. Although financial development is a prerequisite for financial inclusion and economic growth, regulators also need to pay attention to risks that may arise from increased access and activity in financial markets. Security as well as investor protection need to be a focus in designing policies that lead to sustainable financial development.

Indonesia had the lowest FMAI index of the five countries in the year at the beginning of the period but has increased gradually over the past two decades, indicating that there is still room to continue to improve financial market access in Indonesia. The Indonesian government can encourage financial innovation by providing incentives and support for financial companies and start-ups. Financial innovation will accelerate the development of financial markets and enable people to gain access to better financial products. The Government of Indonesia can strengthen international partnerships with other countries to gain experience and knowledge in building strong financial markets. International partnerships will strengthen national economies and help accelerate the growth of financial markets. Another country that has the lowest intercept is China. China has different economic characteristics from other countries. Although China is a country with a strong economy, not all regions in China have the same financial standards and equitable financial development. The education level and financial literacy of the people in China still need to be improved. This can affect people’s understanding of financial products, and their effective use to advance the economy and improve welfare.

References

Abdmouleh, Z., Alammari, R. A. M., & Gastli, A. (2015). Review of policies encouraging renewable energy integration & best practices. Renewable and Sustainable Energy Reviews, 45, 249–262. https://doi.org/10.1016/j.rser.2015.01.035

Adu, G., Marbuah, G., & Mensah, J. T. (2013). Financial development and economic growth in Ghana: Does the measure of financial development matter? Review of Development Finance, 3(4), 192–203. https://doi.org/10.1016/j.rdf.2013.11.001

Agbloyor, E. K., Abor, J., Adjasi, C. K. D., & Yawson, A. (2013). Exploring the causality links between financial markets and foreign direct investment in Africa. Research in International Business and Finance, 28(1), 118–134. https://doi.org/10.1016/j.ribaf.2012.11.001

Ahmed, A. D., & Huo, R. (2021). Volatility transmissions across international oil market, commodity futures and stock markets: Empirical evidence from China. Energy Economics, 93, 104741. https://doi.org/10.1016/j.eneco.2020.104741

Alareeni, B. A., & Hamdan, A. (2020). ESG impact on performance of US S&P 500-listed firms. Corporate Governance (Bingley), 20(7), 1409–1428. https://doi.org/10.1108/CG-06-2020-0258

Aloise, P. G., & Macke, J. (2017). Eco-innovations in developing countries: The case of Manaus Free Trade Zone (Brazil). Journal of Cleaner Production, 168, 30–38. https://doi.org/10.1016/j.jclepro.2017.08.212

Atkinson, A., & Messy, F. (2013). Promoting Financial Inclusion through Financial Education: OECD/INFE Evidence, Policies and Practice (OECD Working Papers on Finance, Insurance and Private Pensions, No. 34). OECD Publishing. https://doi.org/10.1787/5k3xz6m88smp-en

Avilés, J. M. (2020). A tale of two reforms: Telecommunications reforms in Mexico. Telecommunications Policy, 44(7). https://doi.org/10.1016/j.telpol.2020.101942

Baffes, J., Kose, M. A., Ohnsorge, F., & Stocker, M. (2015). The Great Plunge in Oil Prices: Causes, Consequences, and Policy Responses. SSRN Electronic Journal, 1(2), 15–22. https://doi.org/10.2139/ssrn.2624398

Bakar, S., & Yi, A. N. C. (2016). The Impact of Psychological Factors on Investors’ Decision Making in Malaysian Stock Market: A Case of Klang Valley and Pahang. Procedia Economics and Finance, 35(October 2015), 319–328. https://doi.org/10.1016/s2212-5671(16)00040-x

Barik, R., & Pradhan, A. K. (2021). Does financial inclusion affect financial stability: Evidence from BRICS nations? The Journal of Developing Areas, 55(1). https://doi.org/10.1353/jda.2021.0023

Bayliss, K., Fine, B., & Robertson, M. (2019). Material Cultures of Financialisation. In Economics, Finance, Business & Industry, Politics & International Relations. Routledge. doi.org/10.4324/9781351002103

Beck, T., Demirgüç-Kunt, A., & Honohan, P. (2009). Access to Financial Services: Measurement, Impact, and Policies. World Bank Research Observer, 24(1), 119–145. https://doi.org/10.1093/wbro/lkn008

Bernstein, S., & Cashore, B. (2012). Complex Global Governance and Domestic Policies: Four Pathways of Influence. International Affairs, 88(3), 585–604. https://doi.org/10.1111/j.1468-2346.2012.01090.x

Bortz, P. G., & Kaltenbrunner, A. (2018). The International Dimension of Financialization in Developing and Emerging Economies. Development and Change, 49(2), 375–393. https://doi.org/10.1111/dech.12371

Cevik, S., & Rahmati, M. H. (2020). Searching for the finance–growth nexus in Libya. Empirical Economics, 58(2), 567–581. https://doi.org/10.1007/s00181-018-1593-6

Chepkemoi, B. P., Ndung’u, S., & Kahuthia, J. (2019). Market Risk and Financial Performance of Listed Non-Bank Financial Institutions in Kenya. International Academic Journal of Economics and Finance, 3(3), 343–355. http://www.iajournals.org/articles/iajef_v3_i3_343_355.pdf

Chkili, W., & Khuong, D. (2014). Exchange rate movements and stock market returns in a regime-switching environment : Evidence for BRICS countries. Research in International Business and Finance, 31, 46–56. https://doi.org/10.1016/j.ribaf.2013.11.007

Christensen, H. B., Hail, L., & Leuz, C. (2016). Capital-Market Effects of Securities Regulation: Prior Conditions, Implementation, and Enforcement. Review of Financial Studies, 29(11), 2885–2924. https://doi.org/10.1093/rfs/hhw055

Cihak, M., Demirguc-Kunt, A., Feyen, E., & Levine, R. (2013). Financial Development in 205 Economies (NBER Working Paper Series No. 18946). https://doi.org/10.3386/w18946

Čihák, M., Demirgüç-Kunt, A., Feyen, E., & Levine, R. (2012). Benchmarking Financial Systems around the World. Global Financial Development Report 2013, August, 15–43. https://doi.org/10.1596/9780821395035_ch01

Claessens, S., & Yurtoglu, B. B. (2013). Corporate governance in emerging markets : A survey. Emerging Markets Review, 15, 1–33. https://doi.org/10.1016/j.ememar.2012.03.002

Cummins, J. D., & Weiss, M. A. (2009). Convergence of insurance and financial markets: Hybrid and securitized risk-transfer solutions. Journal of Risk and Insurance, 76(3), 493–545. https://doi.org/10.1111/j.1539-6975.2009.01311.x

Dabla-Norris, E., Kersting, E. K., & Verdier, G. (2012). Firm Productivity, Innovation, and Financial Development. Southern Economic Journal, 79(2), 422–449. https://doi.org/10.4284/0038-4038-2011.201

Dewi, V. I., Febrian, E., Effendi, N., Anwar, M., & Nidar, S. R. (2020). Financial Literacy and its Variables: The Eevidence from Indonesia. Economics and Sociology, 13(3), 133–154. https://doi.org/10.14254/2071-789X.2020/13-3/9

Dogan, E., Madaleno, M., & Altinoz, B. (2020). Revisiting the nexus of financialization and natural resource abundance in resource-rich countries: New empirical evidence from nine indices of financial development. Resources Policy, 69(September), 101839. https://doi.org/10.1016/j.resourpol.2020.101839

El-Wassal, K. A. (2013). The Development of Stock Markets: In Search of a Theory. International Journal of Economics and Financial Issues, 3(3), 607–624.

Fang, C. R., & You, S. Y. (2014). The impact of oil price shocks on the large emerging countries’ stock prices: Evidence from China, India and Russia. International Review of Economics and Finance, 29, 330–338. https://doi.org/10.1016/j.iref.2013.06.005

Fletschner, D. (2009). Rural Women’s Access to Credit: Market Imperfections and Intrahousehold Dynamics. World Development, 37(3), 618–631. https://doi.org/10.1016/j.worlddev.2008.08.005

Frank, N., & Hesse, H. (2009). Financial Spillovers to Emerging Markets During the Global Financial Crisis. Czech Journal of Economics and Finance, 59(6), 507–521. https://doi.org/10.5089/9781451872514.001

Garg, S., & Agarwal, P. (2014). Financial Inclusion in India – a Review of Initiatives and Achievements. Journal of Business and Management, 16(6), 52–61.

Gârleanu, N., & Pedersen, L. H. (2018). Efficiently Inefficient Markets for Assets and Asset Management. Journal of Finance, 73(4), 1663–1712. https://doi.org/10.1111/jofi.12696

Giglio, F. (2021). Fintech: A Literature Review. International Business Research, 15(1), 80. https://doi.org/10.5539/ibr.v15n1p80

Gomber, P., Kauffman, R. J., Parker, C., & Weber, B. W. (2018). On the Fintech Revolution: Interpreting the Forces of Innovation, Disruption, and Transformation in Financial Services. Journal of Management Information Systems, 35(1), 220–265. https://doi.org/10.1080/07421222.2018.1440766

Gujarati, D. (2003). Ekonometri Dasar. Terjemahan: Sumarno Zain. Erlangga.

Gupta, G., & Mahakud, J. (2019). Alternative measure of financial development and investment-cash flow sensitivity: Evidence from an emerging economy. Financial Innovation, 5(1), 1–28. https://doi.org/10.1186/s40854-018-0118-9

Guru, B. K., & Yadav, I. S. (2019). Financial development and economic growth: Panel evidence from BRICS. Journal of Economics, Finance and Administrative Science, 24(47), 113–126. https://doi.org/10.1108/JEFAS-12-2017-0125

Haini, H. (2020). Examining the relationship between finance, institutions and economic growth: Evidence from the ASEAN economies. Economic Change and Restructuring, 53(4), 519–542. https://doi.org/10.1007/s10644-019-09257-5

Hassan, M. K., Sanchez, B., & Yu, J. S. (2011). Financial development and economic growth: New evidence from panel data. Quarterly Review of Economics and Finance, 51(1), 88–104. https://doi.org/10.1016/j.qref.2010.09.001

Hidayat, A., Liliana, & Andaiyani, S. (2021). Factors Affecting the Composite Stock Price Index during Covid-19 Pandemic Crisis. Journal of Economics and Policy (JEJAK), 14(2), 333–344. https://doi.org/https://doi.org/10.15294/jejak.v14i2.27682

Ho, S. Y., & Iyke, B. N. (2018). Finance-growth-poverty nexus: A re-assessment of the trickle-down hypothesis in China. Economic Change and Restructuring, 51(3), 221–247. https://doi.org/10.1007/s10644-017-9203-8

Huang, T., & Zhao, Y. (2017). Revolution of securities law in the Internet Age : A review on equity crowd-funding. Computer Law & Security Review: The International Journal of Technology Law and Practice, 27(2). https://doi.org/10.1016/j.clsr.2017.05.016

Huang, Y., & Wang, X. (2017). Building an Efficient Financial System in China : A Need for Stronger Market Discipline. Asian Economic Policy Review, 12, 188–205. https://doi.org/10.1111/aepr.12173

Kim, H., & Song, J. (2017). Filling institutional voids in emerging economies: The impact of capital market development and business groups on M&A deal abandonment. Journal of International Business Studies, 48(3), 308–323. https://doi.org/10.1057/s41267-016-0025-0

Law, S. H., Kutan, A. M., & Naseem, N. A. M. (2018). The role of institutions in finance curse: Evidence from international data. Journal of Comparative Economics, 46(1), 174–191. https://doi.org/10.1016/j.jce.2017.04.001

Lenka, S. K. (2021). Relationship between financial inclusion and financial development in India: Is there any link? Journal of Public Affairs, July, 1–10. https://doi.org/10.1002/pa.2722

Liang, P., & Guo, S. (2015). Social interaction, Internet access and stock market participation-–An empirical study in China. Journal of Comparative Economics, 43(4), 883–901. https://doi.org/10.1016/j.jce.2015.02.003

Massuda, A., Hone, T., Antonio, F., Leles, G., Castro, M. C. De, & Atun, R. (2018). The Brazilian health system at crossroads: Progress, crisis and resilience. BMJ Journal, 3(4), 1–8. https://doi.org/10.1136/bmjgh-2018-000829

Mateut, S. (2018). Subsidies, financial constraints and firm innovative activities in emerging economies. Small Business Economics, 50(1), 131–162. https://doi.org/10.1007/s11187-017-9877-3

McEwan, A., Marchi, E., Spinelli, R., & Brink, M. (2020). Past, present and future of industrial plantation forestry and implication on future timber harvesting technology. Journal of Forestry Research, 31(2), 339–351. https://doi.org/10.1007/s11676-019-01019-3

Mohieldin, M., Hussein, K., & Rostom, A. (2019). On financial development and economic growth in Egypt. Journal of Humanities and Applied Social Sciences, 1(2), 70–86. https://doi.org/10.1108/jhass-08-2019-0027

Mukherjee, I., & Sovacool, B. K. (2014). Palm oil-based biofuels and sustainability in southeast Asia: A review of Indonesia, Malaysia, and Thailand. Renewable and Sustainable Energy Reviews, 37, 1–12. https://doi.org/10.1016/j.rser.2014.05.001

Murray, T., Stephens, L., Woolf, B. P., Wing, L., Xu, X., & Shrikant, N. (2013). Supporting social deliberative skills online: The effects of reflective scaffolding tools. In Lecture Notes in Computer Science (including subseries Lecture Notes in Artificial Intelligence and Lecture Notes in Bioinformatics): Vol. 8029 LNCS (Issue 2002). https://doi.org/10.1007/978-3-642-39371-6_36

Nasreen, S., Mahalik, M. K., Shahbaz, M., & Abbas, Q. (2020). How do financial globalization, institutions and economic growth impact financial sector development in European countries? Research in International Business and Finance, 54(April 2019), 101247. https://doi.org/10.1016/j.ribaf.2020.101247

Olusegun, A. A., Salami, O. G., & Oluseyi, O. A. (2013). Impact of Financial Sector Development on the Nigerian Economic Growth. American Journal of Business and Management, 2(4), 347–356. https://doi.org/10.11634/216796061302361

Ozili, P. K. (2018). Impact of digital finance on financial inclusion and stability. Borsa Istanbul Review, 18(4), 329–340. https://doi.org/10.1016/j.bir.2017.12.003

Pan, L., & Mishra, V. (2018). Stock market development and economic growth: Empirical evidence from China. Economic Modelling, 68(July 2017), 661–673. https://doi.org/10.1016/j.econmod.2017.07.005

Park, C., & Mercado, R. V. (2015). Financial Inclusion, Poverty, and Income Inequality in Developing Asia (Asian Development Bank Economics Working Paper Series No. 426). https://doi.org/http://dx.doi.org/10.2139/ssrn.2558936

Pinem, D. B. (2019). Analysis of Global Stock Exchange Index, Foreign Exchange Rate, Interest Rate and Inflation Rate Influences CSPI in Indonesia Stock Exchange (Period of January 2014 – 2015). European Journal of Business and Management Research, 4(6), 4–7. https://doi.org/10.24018/ejbmr.2019.4.6.162

Qamruzzaman, M., & Karim, S. (2020). Do Remittance and Financial Innovation cause stock price through Financial Development: An Application of Nonlinear Framework. Fourrages, October. https://www.researchgate.net/profile/Md-Qamruzzaman/publication/344693240_Do_Remittance_and_Financial_Innovation_causes_stock_price_through_Financial_Development_An_Application_of_Nonlinear_Framework/links/5f89cdb892851c14bccc458d/Do-Remittance-and-Financ

Ramirez, L. H. (2017). Evolution of International Trade Mexico-United States of American NAFTA-TPP: Challenges and Opportunities (XVI). https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2921017

Regan, M. (2017). Capital markets, infrastructure investment and growth in the asia pacific region. International Journal of Financial Studies, 5(1). https://doi.org/10.3390/ijfs5010005

Rodrik, D. (2005). Chapter 14 Growth Strategies. Handbook of Economic Growth, 1(Suppl. Part A), 967–1014. https://doi.org/10.1016/S1574-0684(05)01014-2

Shah, S. Z. A., Ahmad, M., & Mahmood, F. (2018). Heuristic biases in investment decision-making and perceived market efficiency. Qualitative Research in Financial Markets, 10(1), 85–110. https://doi.org/10.1108/qrfm-04-2017-0033

Sharma, D. (2016). Nexus between financial inclusion and economic growth: Evidence from the emerging Indian economy. Journal of Financial Economic Policy, 8(1), 13–36. https://doi.org/10.1108/JFEP-01-2015-0004

Siddiqui, K. (2015). Trade Liberalization and Economic Development: A Critical Review. International Journal of Political Economy, 44(3), 228–247. https://doi.org/10.1080/08911916.2015.1095050

Singhania, M. (2013). Volatility in Asian stock markets and global financial crisis. Journal of Advances in Management Research, 10(3), 333–351. https://doi.org/10.1108/JAMR-01-2013-0010

Sivaramakrishnan, S., Srivastava, M., & Rastogi, A. (2017). Attitudinal factors, financial literacy, and stock market participation. International Journal of Bank Marketing, 35(5), 818–841. https://doi.org/10.1108/IJBM-01-2016-0012

Sotomayor, O. (2019). Growth with reduction in poverty and inequality: Did Brazil show the way? Journal of Economic Inequality, 17(4), 521–541. https://doi.org/10.1007/s10888-019-09418-6

Svirydzenka, K. (2016). Introducing a New Broad-based Index of Financial Development (IMF Working Papers, 16(05). https://doi.org/10.5089/9781513583709.001

Thukral, S., & Sridhar, S. (2015). Review of factors constraining the development of Indian corporate bond markets. Qualitative Research in Financial Markets, 7(4), 429–444. https://doi.org/10.1108/QRFM-01-2015-0002

Tilley, L. (2020). Review of International Political Economy Extractive investibility in historical colonial perspective: The emerging market and its antecedents in Indonesia perspective. Review of International Political Economy, 1–20. https://doi.org/10.1080/09692290.2020.1763423

Turner, B. (2014). Asian Development Bank Institute. In B.Turner (Ed.), The Statesman’s Yearbook. Palgrave Macmillan, London. https://doi.org/10.1007/978-1-349-67278-3_116

Veron, N., & Wolff, G. B. (2016). Capital Markets Union: A Vision for the Long Term. Journal of Financial Regulation, 2(2), 130–153. https://doi.org/10.1093/jfr/fjw006

Vinh, X., Tuan, T., & Tran, A. (2020). Finance Journal Modelling volatility spillovers from the US equity market to ASEAN stock markets. Pacific-Basin Finance Journal, 59(November 2019), 101246. https://doi.org/10.1016/j.pacfin.2019.101246

Wang, Y., Wu, C., & Yang, L. (2013). Oil price shocks and stock market activities: Evidence from oil-importing and oil-exporting countries. Journal of Comparative Economics, 41(4), 1220–1239. https://doi.org/10.1016/j.jce.2012.12.004

Wu, T. (2014). Unconventional Monetary Policy and Long-Term Interest Rates (IMF Working Papers, Vol. 14, Issue 189). https://doi.org/10.5089/9781498317245.001

Zhang, J., Jiang, C., Qu, B., & Wang, P. (2013). Market concentration, risk-taking, and bank performance: Evidence from emerging economies. International Review of Financial Analysis, 30(71303255), 149–157. https://doi.org/10.1016/j.irfa.2013.07.016

Zhang, R., & Ben Naceur, S. (2019). Financial development, inequality, and poverty: Some international evidence. International Review of Economics and Finance, 61(March 2017), 1–16. https://doi.org/10.1016/j.iref.2018.12.015