Organizations and Markets in Emerging Economies ISSN 2029-4581 eISSN 2345-0037

2023, vol. 14, no. 3(29), pp. 536–561 DOI: https://doi.org/10.15388/omee.2023.14.4

Does Insurance Sector Matter for Economic Complexity?

Folorunsho M. Ajide (corresponding author)

University of Ilorin, Nigeria

ajide2010@gmail.com,ajide.fm@unilorin.edu.ng

https://orcid.org/0000-0003-3231-2423

Tolulope T. Osinubi

Obafemi Awolowo University, Ile-Ife, Nigeria

tosinubi@oauife.edu.ng

https://orcid.org/0000-0002-5276-0365

Titus A. Ojeyinka

Obafemi Awolowo University, Ile-Ife, Nigeria

tojeyinka@oauife.edu.ng

https://orcid.org/0000-0002-4007-7120

Abstract. The study examines the impact of the insurance market on economic complexity in 28 OECD nations within a period of 1995–2020. The study also examines whether the impact of life insurance on economic complexity would be different from that of the non-life insurance sector within the insurance market. The results based on pooled mean group (PMG) estimators reveal that the insurance sector influences economic complexity positively. This finding is further substantiated after employing panel co-integrating regression and method of moment quantile regression (MM-QR). The study concludes that the insurance sector is a key instrument in upgrading the economic complexity of an economy. Since the distributional impact of economic complexity also depends on economic and financial risk, the insurance sector can assist in mitigating the risks and uphold the productive knowledge structure needed to enhance national product sophistication.

Keywords: economic sophistication, insurance, Panel Mean Group Estimation, method of moment quantile regression

Received: 4/6/2023. Accepted: 2/10/2023

Copyright © 2023 Folorunsho M. Ajide, Tolulope T. Osinubi, Titus A. Ojeyinka. Published by Vilnius University Press. This is an Open Access article distributed under the terms of the Creative Commons Attribution Licence, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

1. Introduction

Recent studies show that financial market promotes economic performance (Levine, 1997; Chang et al., 2014; Olayungbo & Akinlo, 2016; Din, Abu-Bakar & Regupathi, 2017) and, to a large extent, economic complexity (Chu, 2020; Nguyen et al., 2020; Nguyen & Su, 2021). These studies argue for the importance of the financial sector as a key driver of economic complexity (Nguyen & Su, 2021). Traditional line of thought suggests that a well-developed financial sector lowers transaction costs, eases credit constraints and serves as a conduit through which adequate resources for productive investment can be garnered (Levine, 1999). However, this notion has generated a lot of inconclusive submissions. It is not surprising that the majority of these empirical studies employ gross domestic product (GDP) per capita or GDP to proxy economic performance. The lack of conclusion might be due to variable measurement used to proxy economic performance. Further, new evidence has established that the use of economic complexity as a measure of economic performance is appropriate. Unlike GDP, economic complexity considers not only the economic component, but also the social and productive structure of the economic system (Gomez-Zaldivar et al., 2022; Ajide, 2022). These components have been found to be instrumental in determining economic progress, especially in the current era of globalization (Ojeyinka & Osinubi, 2020). Besides, economic complexity is broader in scope than economic growth because it incorporates all the aspects of production such as competency, knowledge and advancement which are critical to achieving economic emancipation (Hausmann et al., 2019). Thus, the present study employs economic complexity as a broad and better measure of economic performance.

Economic complexity is the country’s ability to diversify its production and export from traditional simple products to better, improved, and sophisticated products. The more diversified the productive base of an economy, the wider its export structure and the more complex the economy. In the literature, the economic complexity is used to gauge the production and export structure of countries (Hidalgo & Hausmann, 2009; Erkan & Yildirimci, 2015; Mastilo, 2015). It represents the accumulation of knowledge and technology with which a country is manufacturing its products for exports. In the same vein, the amount of knowledge available in an economy serves as a key determinant of the future performance of the economy (Albeaik et al, 2017; Ajide & Osinubi, 2023). Economic complexity is adjudged the best indicator of economic progress based on its emphasis on knowledge, skill, product diversity and ubiquity (Ferrarini & Scramozzino, 2016; Dogan et at., 2020).

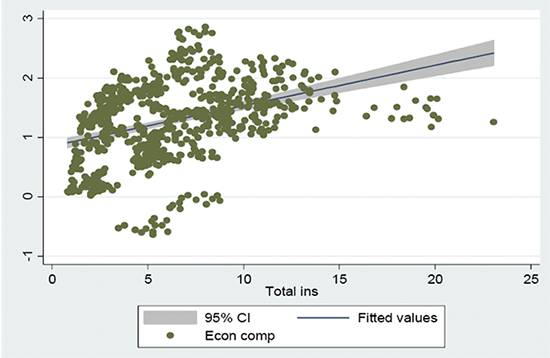

Despite the perceived role of the financial system in driving economic performance, limited studies have examined the financial development–economic complexity nexus with a focus on the role of banking and the stock market as a proxy for financial development (Chu, 2020). The neglect of the role of the insurance sector on economic complexity has necessitated this study. Therefore, the main objective of this study is to examine the impact of the insurance sector on economic complexity in selected OECD countries. As noted by Chen et al. (2012) and Din et al. (2017), the insurance sector has a significant role to play in upgrading the national economic complexity. Figure 1 contains information on the share of insurance and economic complexity of the selected OECD countries. Inference from Figure 1 reveals a positive association between economic complexity and the insurance sector in the OECD countries. This implies that countries with developed insurance markets are likely to gather sufficient resources to engage in the production of complex industrial products that will stimulate economic prosperity. A more complex economy produces sophisticated and diversified products as reflected in its productive structure, and higher per capita income of such an economy (Hidalgo & Hausmann, 2009; Coşkun et al., 2018; Neagu & Teodoru, 2019; Abassi et at., 2021). In addition, the developed countries, which are known to produce highly specialized and sophisticated manufactured products, are ranked high in the index of economic complexity and GDP per capita compared to their counterparts in developing countries which focus on agricultural-related products that are less complex and competitive.

Figure 1

The Economic Complexity (Econ comp) Index and Insurance Gross Premium (% of GDP)(Total Ins).

To understand the variations on economic complexity and total insurance among the selected countries, we present the economic complexity index (ECI) and total insurance as share of GDP for the 28 selected OECD countries in Appendix A. It shows that Japan appears as the most complex economy with the ECI of 2.5, while Australia is the least complex country with the ECI of -0.28 as against the average value of 1.06 for the entire sample. This suggests significant variations in economic complexity among the OECD countries. On average, total insurance contributes 6.24% of GDP of the entire sample with highest and lowest values recorded in the UK (12.67%) and Turkey (1.19%), respectively. This again reflects substantial variations in the performance of the insurance sector among the selected countries.

Conventionally, insurance firms collect premiums from individuals and corporations to indemnify them against unanticipated future losses. The premium collected especially from life assurance serves as a source of liquidity and provides long-term capital for productive engagement and improves economic complexity (Apergis & Poufinas, 2020). The United Nations Conference on Trade and Development (UNCTAD, 1964) identified strong national insurance and reinsurance markets as major catalysts for economic performance. On this basis, the present study aims to unearth the impact of the insurance sector on economic complexity. Thus, the present study deviates from the previous literature by focusing on economic complexity as a better and more robust measure of economic performance due to its emphasis on product and export diversification and sophistication that characterizes 21st-century economies.

In addition, the study provides fresh evidence by analyzing whether different components of the insurance business, i.e., non-life insurance and life insurance, as well as the total insurance, drive product/export diversity and ubiquity in the OECD countries. The nexus between insurance and economic complexity is a topical but unexplored area in finance literature. More specifically, in recent times, the role of insurance in achieving economic prosperity has been on the front burner of the development dialogue and thinking. Thus, it is important to unravel the influence of the insurance market as a determinant of economic complexity. As noted by Zulfiqar et al. (2020), the insurance sector performs three major functions, including risk transfer, indemnification and intermediation in a modern economy. Our proposition is based on the premise that economic complexity cannot be attained without adequate investment in knowledge-generating activities such as innovation, research and development as well as investment in sophisticated physical infrastructure. This implies that the achievement of economic complexity in a country is contingent on the availability of funds that can be made available by financial intermediation such as insurance firms. Some of the mechanisms by which insurance affects economic performance include provision of long-term funds for capital accumulation, promotion of financial stability, efficient allocation of capital, and provision of funds for research and development (Sumegi & Haiss, 2008; Chen et al., 2012; Niavand, 2019). Thus, the insurance business assists in the mobilization of long-term funds to the real sector of the economy to engage in the production of specialized, high-rated and competitive products. Besides, with the development of the insurance sector, some of the risks faced by entrepreneurs and manufacturing firms can be transferred to the insurer in exchange for a premium such that the former can concentrate on their productive activities. This reveals that the insurance sector has a significant role to play in determining a country’s degree of economic complexity.

Lastly, the study focuses on the OECD economies based on the following reasons. First, the insurance market in this economic bloc is relatively developed compared to its counterparts in less developed countries. For instance, the gross insurance penetration rate (% of GDP), which captures the development of the insurance sector in a country, for the entire OECD countries increased from 7.4% in 1990 to 8.6% in 2010 and further rose to 9.4% in 2020 (OECD, 2022). Second, the sample includes the top 10 most complex economies in the world as reported by the Atlas of Economic Complexity (2022). Third, based on the World Bank income classification, most of the countries selected are classified as high-income countries. The OECD countries provide a good ground to explore the role of the insurance market on economic complexity.

2. Literature Review

2.1 Conceptual Framework

Insurance activity is viewed as a separate form of non-banking financial sector that offers businesses and people domestic savings and risk management services. The connection between insurance and economic complexity can be viewed in three dimensions. These include “demand-following”, “supply-leading”, and “feedback” hypotheses (Alhassan & Fiador, 2014). The “demand-following” hypothesis suggests that economic complexity would increase demand for insurance services. A growing economic complexity would generate insurance demand due to different elements of risks associated with innovation and productive knowledge in economic sophistication (Romer, 1990; Robinson, 1952). Yarri (1965) found that people need life insurance to leave money to dependents as well as to provide income for retirement.

The “supply-leading” hypothesis, on the other hand, contends that a robust insurance market offers a means of effectively transferring and managing risk in order to spur economic expansion and growth of economic complexity (Patrick, 1966). The insurance system lowers the cost of risk management and risk diversification to ensure efficient resource allocation for the production of complex products. By maximizing resource use, this insurance market activity encourages more investments, productivity and economic sophistication by ensuring efficient management of pension and risk diversification. This also means a one-way causality running from insurance to economic growth. The “feedback” hypothesis, which is the third hypothesis, proposes a two-way causal relationship between insurance activity and economic complexity. This suggests that a well-developed insurance market will spur economic complexity through technological changes, product and services innovation (Schumpeter, 1912), which stimulates demand for insurance services (Levine, 1997), while economic complexity will bring about the development of the effectiveness of risk management. This results in the “feedback” causation, whereby meeting the demand for insurance services results in increased economic transformation brought by economic sophistication (Luintel & Khan, 1999).

2.2 Empirical Literature

There are many empirical studies that link insurance firms’ activities to economic performance proxied by economic growth, but the literature on economic complexity still remains scanty. The empirical studies of Hou et al. (2012), Lee et al. (2013), and Liu et al. (2016) concluded that the insurance sector had a beneficial impact on economic growth in the Eurozone, developing nations and G-7 countries, respectively. In a panel of 20 emerging and developed nations, Ul Din et al. (2017) employed three indicators of insurance activity—written premiums, density, and penetration—to analyze the connection between insurance and economic growth. The authors used a fixed effects model and came to the conclusion that life insurance has a significant and positive impact on economic growth in developing countries as measured by penetration, while there is a positive relationship between life insurance and economic growth in developed countries as measured by written premiums and density. According to their findings, non-life insurance has a beneficial impact on economic growth in developing nations across the board for all three measures, whereas in developed countries, this is only true when non-life is measured by density.

Similarly, Mohyul Din et al. (2017) investigated the same topic in six (developing, developed, and emerging) nations between 1980 and 2015 using panel auto-regressive distributed lagged (PMG/ARDL) methodology. Long-term results showed that life and non-life insurance contribute to economic growth in the six countries (United Kingdom, United States of America, China, India, Malaysia, and Pakistan). The findings showed a favorable association between life insurance and economic growth in the UK, Pakistan, and India but a short-term negative relationship in the US, Malaysia, and China. For all of the chosen countries, non-life insurance and economic growth have a significant and favorable association in the short term. More specifically, Muye and Hassan (2016) looked at the impact of Islamic insurance development on economic growth in 22 different countries between 2004 and 2012. The authors discovered a favorable and significant association between Islamic insurance1 activities and economic growth using a GMM estimating technique.

Numerous studies have shown that insurance-related activities alone are unable to have an impact on economic growth, indicating that additional conditions must be met before insurance may effectively promote economic growth. For instance, Lee et al. (2016) used an unbalanced panel of 40 countries between 1981 and 2010 to study the influence of institutions on the insurance–economic growth nexus. Their research revealed that in countries with subpar institutional quality, insurance has a detrimental impact on economic growth. According to the authors, this shows that a generally unfavorable institutional environment may prevent the expansion effect of the life insurance industries. Additionally, while waiting for the benefits of insurance to manifest in the economy, the resources are diverted from some other activities. In a different study by Lee et al. (2017), the authors used a pooled sample of 38 countries for the years 1984–2009 to show a non-linear effect of insurance on economic growth as opposed to the usual linear insurance effect. The same outcome was found while looking at the effect of globalization on economic growth.

Furthermore, some research concentrated on the relationship between insurance-related activities and economic expansion in terms of causality. Dash et al. (2018) investigated the causal link between insurance market penetration (life, non-life, and total insurance) and economic development in 19 countries in the Eurozone between 1980 and 2014. The Granger causality results revealed a unidirectional and bidirectional relationship between insurance market penetration and economic growth, however, these results varied across the nations in the Eurozone over the study period. For 41 nations, Lee et al. (2013) showed both short- and long-term two-way causalities between insurance operations and economic growth. Similar to this, Liu et al. (2016) investigated the short- and long-run causal links between insurance activity and economic growth in G-7 nations using the bootstrap Granger causality and Johansen co-integration tests. The results of the two tests showed that there is short- and long-run bidirectional causation between the two series. Using a panel vector auto-regression model between 1980 and 2012, Pradhan et al. (2014) confirmed that economic growth and the banking sector contribute to the expansion of the insurance sector in another 20 G-7 countries, supporting the “demand-following” hypothesis. Pradhan et al. (2017) used the vector auto-regression approach and Granger causality test between 1980 and 2014 to show that insurance industry and banking sector development have a considerable impact on economic growth in the long run in G-20 countries. According to another study by Hatemi-J. et al. (2019), there is a long-run correlation between insurance activity and economic growth. The study looked at the asymmetric causal relationship between insurance and economic growth in the G-7 countries between 1980 and 2014. Pradhan et al. (2016) demonstrated the existence of causal relationships for a panel of the Association of SouthEast Asian Nations (ASEAN) Regional Forum (ARF) for the years 1988–2012, including short-run bidirectional causality between insurance market penetration and economic growth.

Cristea et al. (2014) proposed that there is a causal link between insurance and economic growth in Romania. A study by Ege and Sarac (2011) using a panel data analysis for 29 OECD countries over the period 1999–2008 found a positive association between the insurance sector and economic growth. At the same time, Chang et al. (2014) employed the bootstrap panel Granger causality test to examine the nexus between insurance activity and economic growth between 1979 and 2006 in ten OECD countries. The study findings revealed that just in five of the ten OECD countries taken into account life and non-life insurance have an overall positive and significant impact on economic growth. In contrast, Zouhaier (2014) discovered a conflicting conclusion when looking at the relationship between insurance and economic growth in 23 OECD countries from 1990 to 2011. According to the study, total and non-life insurance, when measured by density, have a negative influence on economic growth, however, non-life insurance, as measured by the penetration rate, has a positive impact on economic growth. According to the author, the negative effect may be due to the degree of insurance business in the chosen countries, where all potential effects of insurance business have already been explored as a result of the industry’s development having reached its maximum threshold. A recent study by Apergis and Poufinas (2020) on 27 OECD countries between 2006 and 2016 using dynamic panel estimations showed that insurance activities, including life, non-life, and total insurance, are strongly and positively associated with economic growth. In addition, Gonzalez et al. (2021) re-investigated the relationship between insurance and growth in 90 countries using the OECD risk classification2 for the period 1980–2019 while taking into account cross-sectional dependence across the countries. From the 90 countries they chose, the authors looked at nine panels, and they discovered evidence of panel co-integration between insurance and economic growth.

In summary, there are no studies on the role of insurance in economic complexity in the OECD countries, to the best of our knowledge. In the OECD countries, research on economic complexity is less common than research on economic growth. Therefore, this research aims to close the gap. The study aims at investigating the impact of insurance on economic complexity in the OECD countries. Economic complexity is used in this regard, because it deals with a measure of the knowledge in a society as expressed in the products it produces. Also, economic complexity is more complex than economic growth because it involves diversification of productive know-how, including sophisticated, exclusive know-how that will enable nations to produce a wide range of goods, involving complex products that few other nations can produce. Going by the economic complexity index in these countries, they all have positive ECI with the exception of Chile and Australia. This suggests that nearly all the countries are extensively shifting away from agriculture and production that produces large amounts of pollution toward sophisticated knowledge-based economies. How has the insurance industry in these economies affected economic complexity? This becomes an issue to address.

3. Materials and Method

3.1 Empirical Model

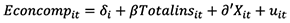

This study intends to examine the impact of the insurance sector on economic complexity in 28 OECD countries (see Appendix A) over a period of 1995–2020. The selection of countries is based on data availability and to have a balanced panel data3 for the analysis. In order to achieve this objective, the empirical model is hereby specified in equation (1):

(1)

(1)

Econcomp, represents the economic complexity index, Totalins is a proxy for total insurance, X represents a vector of control variables including GDPPCL as the gross domestic product per capita and internet as a proxy for internet penetration, and u is the error term. Furthermore, this study adds institutional variables proxied by economic freedom (Econfre), foreign direct investment (FDI) to measure the presence of multinational firms in the economy, government expenditure (Govt), remittances (Rem), and population growth (Pop). The relationship between these control variables and economic complexity has been well informed by the previous studies (see Osinubi & Ajide, 2022; Nguyen & Su, 2021; Nguyen et al., 2020). Ajide and Osinubi (2023) show that remittances provide funds to finance economic activities and enhance structural transformation. The presence of multinational firms encourages innovation and technological transformation in the economy (Nguyen & Su, 2021; Ajide, 2022). GDP per capita is said to influence economic complexity due to its ability to affect the quality of a product (Saad, 2020; Osinubi & Ajide, 2022). Internet usage enhances knowledge and skills required to expand economic complexity (Nguyen et al., 2020; Dada et al., 2023).

3.2 Estimation Techniques

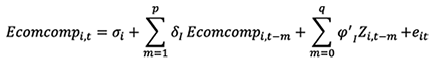

Before the estimation, the study conducts unit root test via Fisher-type based on Augmented Dickey-Fuller (ADF) test and Im-Pesaran-Shin (IPS) unit root tests. To ascertain whether there is co-integration, the study employs the Kao-panel co-integration test. To efficiently estimate the parameters and to account for the feedback impact of the variables, the study utilizes the Pooled Mean Group (PMG) estimator proposed by Pesaran et al. (1999). The PMG is efficient in accounting for the heterogeneous elements in the panel. The technique can also be used in a situation where all the variables are co-integrated of order one I(1) or where there is mixture of I(1) and I(0) (Pesaran et al., 1999). One of the advantages of the PMG is that it produces short-run and long-run coefficients for efficient inferences. A general specification of the technique is specified in equation (2):

(2)

(2)

where Zi,t is the vector of independent variables, t = 1, 2, 3…T is the time identity and i = 1, 2, 3…, N is the cross-sectional unit, m is the number of lags. Zi,t is the vector of independent variables including the key variables as defined earlier, while σi is the country’s fixed effects. Equation (2) can be re-parameterized as:

(3)

(3)

where  ,

,  and

and

.

.

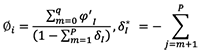

The equation (4) presents error correction model as:

(4)

(4)

is the adjustment in ECM coefficient due to divergence with explanatory variables, while short run coefficients are δ*i and φ*i . The coefficients have associations with their respective lagged values and determinants Zi,t . Øi < 0 is the condition to ensure that a long run relationship exists, significant and negative.

is the adjustment in ECM coefficient due to divergence with explanatory variables, while short run coefficients are δ*i and φ*i . The coefficients have associations with their respective lagged values and determinants Zi,t . Øi < 0 is the condition to ensure that a long run relationship exists, significant and negative.

In addition, this study employs panel dynamic ordinary least square (PDOLS) and the method of moment quantile regression (MM-QR) as a robustness test. PDOLS is also appropriate where all the variables are co-integrated of order one, that is, I(1); and it can be used to handle endogeneity or reversed causality between dependent and independent variables. The MM-QR of Machado and Santos Silva (2019) is used to analyze the conditional distributions of economic complexity as it is influenced by insurance and other independent variables in the model. MM-QR estimator provides non-crossing estimates of the quantiles. Its conditional scale and location estimates are very close or similar to Koenker and Bassett (1978).

3.3 Data and Description of Variables

This study utilizes annual data of 28 OECD countries between 1995 and 2020 obtained from various sources as described in Table 1. The list of the countries is presented in Appendix A.

Table 1

Measurement and Descriptions of Variables

|

Variable |

Symbol |

Structure |

Source of data |

|

Economic Complexity |

Econcomp. |

Economic Complexity Index |

The Atlas Observatory of Economic Complexity (http://atlas.media.mit.edu) |

|

Insurance penetration |

Total ins |

It shows the size and importance of the economy’s insurance sector. It is proxied as gross premium (% of GDP). |

OECD database |

|

Non-life insurance |

Non-life ins |

Non-life insurance premium (% of GDP) |

|

|

Life insurance |

Life ins |

Life insurance premium (% of GDP) |

|

|

Economic freedom |

EconFre |

Economic Freedom Index |

The Fraser institute |

|

Foreign direct investment |

FDI |

Foreign direct investment, net inflows (% of GDP) |

World Development Indicators’ Database |

|

Income per capita |

GDPPCL |

Gross domestic product per capita (constant 2015 US$). The natural log is taken in the process of estimation. |

|

|

Population |

Pop |

Annual population, the log is taken |

|

|

Internet penetration |

Internet |

Internet subscriptions (per 100 people) |

|

|

Government expenditure |

Govt |

Government expenditure (% of GDP) |

|

|

Remittance |

Rem |

Migrants’ remittance inflows (% of GDP) |

Source: Own compilation.

Furthermore, the average values of economic complexity index (Ecomcomp) and insurance market penetration in OECD nations are presented in Appendix A. The series include Non-life insurance penetration (Nonlifeins), life insurance penetration (Lifeins), and total insurance (Totalins) penetration. Among the OECD nations, Ireland, the United Kingdom, Korea, Japan, Denmark, Switzerland, France, Belgium, and the United States of America have the highest penetration rates of life insurance, while Turkey, Latvia, Lithuania, New Zealand, Mexico, Estonia, Greece, and the Czech Republic have the lowest penetration rates. It is interesting to note that all of the top 10 countries have higher life insurance penetration than non-life insurance penetration, while all of the bottom 10 countries have lower life insurance penetration. The top 10 countries with the largest penetration of non-life insurance are the United States, Netherlands, Switzerland, Ireland, Germany, Korea, United Kingdom, Canada, and France, while Mexico, Turkey, Greece, Lithuania, Colombia, Slovakia, Chile, Hungary, Poland, and Japan are among the ten countries with the lowest penetration of non-life insurance. Furthermore, 18 of the OECD’s member countries have a higher penetration of life insurance than non-life insurance. However, compared to life insurance penetration, non-life insurance penetration is higher in 20 countries.

As previously mentioned, the best performing countries in terms of the penetration of total insurance are Ireland, the United Kingdom, the United States of America, Korea, Switzerland, France, Denmark, Netherlands, and Japan, while the least performing nations are Turkey, Mexico, Greece, New Zealand, Colombia, and Hungary. Since total insurance penetration combines life and non-life insurance penetration, this result is not surprising. The following causes might be considered in relation to the best performing countries in terms of insurance market penetration activities. For instance, the 10 top life insurance companies represent the largest financial center for the sale of cross-border life insurance contracts in the Eurozone (GlobalData, 2022). The fourth-largest insurance sector in the European Union (EU) is found in Ireland, which has strong penetration and density in both the life and non-life sectors, according to the International Monetary Fund (IMF, 2022). Additionally, 117% of Ireland’s GDP is managed by the insurance sector, compared to 72% for the EU as a whole. The United Kingdom has one of the largest insurance markets in the world, therefore the findings there are not surprising (Rudden, 2022). Based on total domestic insurance premiums written, she claims that the United Kingdom’s insurance sector was the biggest in all Europe in 2020, placing it in fourth place internationally for life and non-life direct premiums written. The average values of Totalins, Lifeins, and Nonlifeins among the 10 nations with the best total insurance penetration are higher than the average values observed in all the OECD countries, with the exception of Lifeins in the Netherlands, where the average value is 3.65% of GDP. The remaining countries report average values that are lower than the global average for the OECD panel of countries. Specifically, when all OECD countries are combined, the average values of Totalins, Lifeins, and Nonlifeins are 6.24%, 3.76%, and 2.52% of GDP, respectively.

Countries with Econcomp values higher than 1.60 include Japan, Germany, Switzerland, Sweden, Austria, Finland, the United Kingdom, the United States of America, the Czech Republic, and Korea. However, Australia, Colombia, Greece, New Zealand, Turkey, Latvia, Lithuania, and Portugal are among the countries with the lowest Econcomp scores. The countries keep track of Econcomp values below one. With the exception of Australia, all OECD countries display positive ECI. This encouraging Econcomp indicates that nations are turning more and more toward advanced knowledge-based economies and away from agriculture and production that produces a lot of pollution (Osinubi & Ajide, 2022). Contrarily, it is clear that Australia exports agricultural and pollution-heavy goods rather than technologically advanced goods. While Turkey records the lowest non-life insurance penetration of 0.20% of GDP, the maximum value of non-life insurance penetration is found in the United States of America, with a value of 6.14% of GDP. With regard to economic complexity, Japan has the highest followed by Germany and Switzerland. The three countries have their Econcomp at 2.54, 2.22, and 2.17, respectively. Australia is at the bottom with a negative Econcomp of -0.28.

The descriptive statistics and pairwise correlation of variables are presented in Appendix B and Appendix C, respectively. Total insurance, life insurance and non-life insurance have positive associations with economic complexity. However, the real impact of the insurance sector can be evaluated from the estimated model as shown in the next section.

4. Results and Discussion

4.1 Preliminary Analysis

In order to ascertain the suitable estimation technique, this study conducts a number of preliminary tests including panel unit root tests and co-integration analysis. Fisher-type test based on Augmented Dickey-Fuller (ADF) and Im-Pesaran-Shin (IPS) unit root test are employed to ascertain the level of stationary of the variables as presented in Table 2.

Table 2

Panel Unit Root Test

|

Variables |

ADF(Fisher-type) |

Im-Pesaran-Shin |

Conclusion |

|

Econcomp |

-1.261 |

0.676 |

|

|

Δ(Econcomp) |

-27.290*** |

-9.975*** |

I(1) |

|

Totalins |

-0.705 |

-1.063 |

|

|

Δ(Totalins) |

-9.337*** |

-8.509*** |

I(1) |

|

Lifeins |

-0.479 |

-0.830 |

|

|

Δ(Lifeins) |

-9.462*** |

-8.712*** |

I(1) |

|

Nonlifeins |

-0.513 |

-0.675 |

|

|

Δ(Nonelifeins) |

-7.545*** |

-7.012*** |

I(1) |

|

EconFre |

1.365 |

-1.325 |

|

|

Δ(EconFre) |

-5.321*** |

-5.069*** |

I(1) |

|

FDI |

1.646 |

-0.628 |

|

|

Δ(FDI) |

-12.712*** |

-4.881*** |

I(1) |

|

Govt |

1.826 |

0.673 |

|

|

Δ(Govt) |

-5.190*** |

-9.184*** |

I(1) |

|

Internet |

-1.439 |

-0.961 |

|

|

Δ(internet) |

-6.566*** |

-5.023*** |

I(1) |

|

Rem |

0.914 |

1.968 |

|

|

Δ(Rem) |

-9.150*** |

-2.598*** |

I(1) |

|

Pop |

-1.162 |

-0.667 |

|

|

Δ(Pop) |

-6.621*** |

-5.295*** |

I(1) |

|

GDPPCL Δ(GDPPCL) |

-1.590 -8.076*** |

-0.686 -3.213*** |

I(1) |

Note. ***, **, * imply significance at 1%, 5% and 10%, respectively.

Table 2 shows that all the variables are stationary at first difference, meaning that they are co-integrated of order one. In order to confirm if it is true that there is a long-run relationship among the variables, the study employs the Kao-panel co-integration test as reported in Table 3.

Table 3

Kao Test for Panel Co-integration (H0: No co-integration)

|

|

Kao test statistics |

||

|

Total Insurance |

Life Insurance |

Non-life |

|

|

Modified Dickey-Fuller t |

-2.877*** |

-2.718*** |

-3.147*** |

|

Dickey-Fuller t |

-2.649*** |

-2.551*** |

-2.830*** |

|

Augmented Dickey-Fuller t |

-1.185 |

-1.092 |

-1.366* |

|

Unadjusted modified Dickey-Fuller t |

-4.413*** |

-4.242*** |

-4.770*** |

|

Unadjusted Dickey-Fuller t |

-3.358*** |

-3.268*** |

-3.557*** |

Note. Augmented lags=1; ***, **, * imply significance at 1%, 5% and 10%, respectively.

Table 3 presents the results of the Kao test for total insurance, life insurance and non-life insurance. The results reject the null-hypothesis of no co-integration in all cases. Therefore, we have evidence of long-run equilibrium among the variables in the models.

4.2 Baseline Results

Table 4 reports the results of the estimated models using a pooled mean group. Columns 1 to 3 show the results of the impact of total insurance, life insurance and non-life insurance on economic complexity, respectively. The coefficients of error correction mechanism (ECM) are negative and significant, indicating evidence of co-integration among the variables. In other words, it implies that there is evidence that all variables in the model would move together in the long run. This further supports the results of the panel co-integration tests conducted by Kao (1999). The coefficients of life insurance and non-life insurance are positive and significant, implying that the insurance sector improves economic complexity in OECD countries.

Table 4

Results from Pooled Mean Group Regression

|

Long-run |

Total Insurance |

Life Insurance |

Non-life Insurance |

|

Total ins |

0.011** (0.037) |

|

|

|

Life ins |

|

0.028*** (0.000) |

|

|

Non-life ins |

|

|

0.148*** (0.000) |

|

GDPPCL |

0.871*** (0.000) |

0.730*** (0.000) |

0.666*** (0.001) |

|

Internet |

-0.003*** (0.000) |

0.001** (0.024) |

-0.003*** (0.000) |

|

Short-run |

|

|

|

|

ECM(-1) |

-0.268*** (0.000) |

-0.207*** (0.000) |

-0.260*** (0.000) |

|

Δ(Total ins) |

0.003 (0.682) |

|

|

|

Δ(Life ins) |

|

0.002 (0.846) |

|

|

Δ(Nonlife ins) |

|

|

0.033 (0.167) |

|

Δ(GDPPCL) |

-0.168 (0.657) |

-.3359 (0.445) |

-0.031 (0.930) |

|

Δ(internet) |

-0.001* (0.084) |

-0.001 (0.215) |

-0.001 (0.107) |

|

Constant |

0.698*** (0.000) |

0.456*** (0.000) |

0.519*** (0.000) |

|

No. of group |

28 |

28 |

28 |

Note. Augmented lags=1; ***, **, * imply significance at 1%, 5% and 10%, respectively.

Economic complexity involves the ability of a nation to produce sophisticated products with the appropriate knowledge and innovation. It may also indicate an economy’s resilience to macroeconomic shocks, which may influence the riskiness of the nation (Özmen, 2019; Kondovski, 2021). Since economic complexity measures the extent of sophistication of national supply structure by providing the product and services’ export information, the insurance sector helps in mitigating the risk elements in the process, thereby encouraging firms and national authorities in maintaining the standards of productive structure of the economy through risk transfer and management. Arena (2008) asserts that the insurance market’s activity, as a provider of risk transfer and indemnification, may aid in economic development by facilitating the more effective management of various risks as well as by facilitating the mobilization of domestic savings.

Normally, economic agents would not prefer risk. Insurance sector assists in setting aside an accumulated surplus to reduce the impact of any contingency inherited in the process of productive knowledge structure and restore the position of individuals. The risk transfer function of the insurance sector reduces the fear and anxiety utilizing new innovation in the productive knowledge structure, thereby increasing the level of economic complexity in the country.

Furthermore, the results reveal that income per capita contributes to the improvement of national economic complexity. Income growth leads to economic sophistication, as seen in Hartmann et al. (2017), and further supports the submission of Gala et al. (2018) and Nguyen et al. (2020), but contradicts the results of Osinubi and Ajide (2022) and Njangang et al. (2021). The results also suggest that internet penetration reduces economic complexity for the case of total insurance and non-life insurance while it improves life insurance in the OECD economies. This confirms the studies of Nguyen and Su (2021) and Lapatinas (2019), who reveal that internet facilities are used to possess the necessary skills needed to improve or distort economic complexity of the economy.

4.3 Further Analysis

In this section, we perform a number of sensitivity analyses on the baseline results. In the first subsection, we present the results of alternative estimation techniques with additional control variables that may influence economic complexity as suggested in the literature. The results of MM-QR as a robustness check to the main results are also presented. Table 5 shows the results of panel dynamic ordinary least square (PDOLS). This technique is employed based on the fact that all the variables are co-integration of order, I(1), and it includes leads and lag values of independent variables in their first difference, and contemporaneous values to solve the problem of endogeneity and autocorrelation (Kumar et al., 2020; Pradhan et al., 2022). For comparative analysis, we also present the results of the impact of insurance activities on economic growth proxied by the Log of GDP per capita.

The results of PDOLS show that the coefficients of total, life and non-life insurance are positive and significant at one percent level. The coefficients of the economic complexity model are higher than those of the economic growth model. This further supports the findings of previous studies emphasizing that economic complexity is a better measure of economic performance due to its multidimensional nature. The indicator captures the economic, social and productive structure of the economic system (Gomez-Zaldivar et al., 2022; Ajide, 2022). Concerning the control variables, the coefficients of income per capita, economic freedom and remittances are positive and significant, revealing that they induce economic complexity in the OECD countries. The results support the implication of GDP per capita, remittance and economic freedom as documented by Hartmann et al. (2017), Saadi (2020), Nguyen and Su (2021), respectively. The coefficient of population growth is negative and significant, implying it reduces the extent of economic sophistication of nations. However, this is not consistent with the findings of Chu (2020), Osinubi and Ajide (2020).

Table 5

Results from Panel Dynamic OLS Estimations

|

|

Economic complexity |

Economic Growth |

||||

|

Total ins |

0.602*** (0.000) |

|

|

0.015*** (0.000) |

|

|

|

Life ins |

|

0.061*** (0.000) |

|

|

0.015*** (0.000) |

|

|

Non-life ins |

|

|

0.122*** (0.000) |

|

|

0.039*** (0.000) |

|

GDPPCL |

0.533* (0.074) |

0.663** (0.027) |

0.760** (0.010) |

n/a |

n/a |

n/a |

|

Internet |

0.001 (0.416) |

0.001 (0.371) |

-0.001 (0.920) |

0.001*** (0.000) |

0.001*** (0.000) |

0.001*** (0.000) |

|

EconFre |

0.107** (0.018) |

0.133*** (0.004) |

0.077* (0.083) |

0.279*** (0.000) |

0.298*** (0.000) |

0.273*** (0.000) |

|

FDI |

-0.004*** (0.000) |

-0.004*** (0.000) |

-0.001 (0.114) |

-0.001*** (0.000) |

-0.001*** (0.000) |

0.0001*** (0.000) |

|

Govt |

-0.042*** (0.000) |

-0.047*** (0.000) |

-0.044*** (0.000) |

0.015*** (0.000) |

0.014*** (0.000) |

0.014*** (0.000) |

|

Rem |

0.176*** (0.000) |

0.164*** (0.000) |

0.180*** (0.000) |

-0.060*** (0.000) |

-0.065*** (0.000) |

-0.060*** (0.000) |

|

Pop |

-0.612*** (0.000) |

-0.619*** (0.000) |

-0.623*** (0.000) |

0.063*** (0.000) |

0.064*** (0.000) |

0.062*** (0.000) |

|

R-squared |

0.203 |

0.209 |

0.207 |

0.250 |

0.261 |

0.248 |

|

Wald test |

708.40*** (0.000) |

691.83*** (0.000) |

711.65*** (0.000) |

1479.70*** (0.000) |

1564.04*** (0.000) |

1442.92*** (0.000) |

|

No of group |

28 |

28 |

28 |

28 |

28 |

28 |

Note. Augmented lags=1; ***, **, * imply significance at 1%, 5% and 10%, respectively, n/a denotes not available.

Table 6

MM-QR Results

|

|

Location |

Scale |

Q.15 |

Q.25 |

Q.50 |

Q.75 |

Q.90 |

|

Total ins |

0.061*** (0.000) |

-0.027*** (0.000) |

0.096*** (0.000) |

0.080*** (0.000) |

0.607*** (0.000) |

0.035*** (0.000) |

0.017** (0.037) |

|

EconFre |

0.134* (0.069) |

-0.017 (0.725) |

0.157 (0.151) |

0.147 (0.101) |

0.135 (0.068) |

0.118 (0.126) |

0.107 (0.253) |

|

FDI |

-0.003* (0.098) |

-0.001 (0.984) |

-0.002 (0.427) |

-0.002 (0.252) |

-0.003* (0.097) |

-0.003* (0.055) |

-0.004* (0.077) |

|

Govt |

-0.032*** (0.000) |

-0.007 (0.115) |

-0.023** (0.037) |

-0.026*** (0.002) |

-0.032*** (0.000) |

-0.039*** (0.000) |

-0.044*** (0.000) |

|

Rem |

0.110*** (0.000) |

-0.062*** (0.004) |

0.196*** (0.000) |

0.155*** (0.000) |

0.111*** (0.000) |

0.052 (0.106) |

0.014 (0.719) |

|

Internet |

-0.001 (0.152) |

-0.001 (0.907) |

-0.002 (0.370) |

-0.001 (0.258) |

-0.001 (0.152) |

-0.001 (0.150) |

-0.001 (0.219) |

|

Pop |

-0.578*** (0.000) |

-0.054* (0.078) |

-0.508*** (0.000) |

-0.539*** (0.000) |

-0.578*** (0.000) |

-0.629*** (0.000) |

-0.664*** (0.000) |

|

GDPPCL |

0.381** (0.039) |

0.309** (0.014) |

-0.014 (0.957) |

0.161 (0.471) |

0.383** (0.038) |

0.671*** (0.001) |

0.863*** (0.000) |

|

Constant |

-0.080* (0.088) |

-0.423 (0.228) |

-0.337 (0.660) |

-0.578 (0.356) |

-0.882* (0.087) |

-1.275** (0.018) |

-1.539** (0.018) |

|

No of group |

28 |

28 |

28 |

28 |

28 |

28 |

28 |

Note. Augmented lags=1; ***, **, * imply significance at 1%, 5% and 10%, respectively.

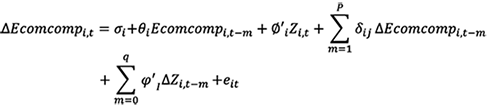

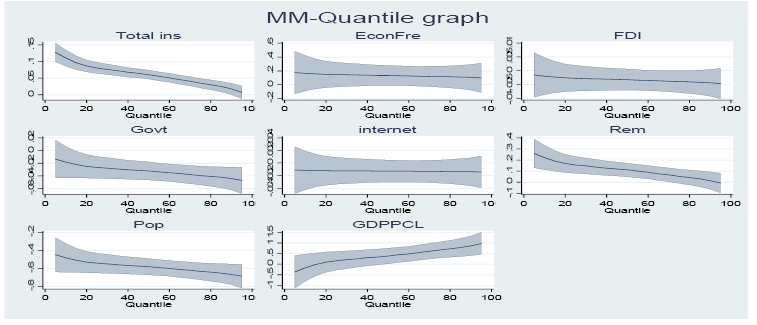

Table 6 presents the results of MM-quantile regression, while Figure 2 shows the graph of MM-QR. This technique is used to account for nonlinearity between the insurance variable and economic complexity by controlling the distributional heterogeneity via quantile approach. The MM-QR provides more information compared to the earlier techniques employed. It is not influenced by outliers because its analysis is based on conditional quantiles of dependent variables. It provides consistent and efficient estimates of the parameters in the presence of either normal distribution of error terms or its violation (Koenker & Bassett, 1978; Chernozhukov & Hansen, 2008; Ajide & Osinubi, 2020). Table 6 shows that the impact of total insurance on economic complexity is positive and statistically significant at 1 to 5 percent across the quantiles (0.15 to 0.90) of the dependent variables.

Similarly, Figure 2 reveals the positive relationship between insurance activities and economic complexity. However, coefficient insurance activities decreased as we moved from lower quantiles to upper quantiles. Unlike the PDOLS results in Table 6, the MM-QR shows that rising insurance is related to increase in economic complexity, which varies depending on the conditional distributions of the dependent variables (econcomp.). Regarding control variables, the remittances, income per capita and population growth share similar results with those of PDOLS, while the coefficient of internet is negative but not significant.

Figure 2

MM-QR Coefficients

5. Conclusion and Policy Implications

Insurance services generate substantial productive outcomes in an economy. While non-life insurance services offer risk transfer and indemnification assistance to a risk-averse firm or individual, life insurance is perceived to be a service that individual purchased for the family or the loved ones who will need care in case of unforeseen events (Apergis & Poufinas, 2020; Arena, 2008). As such, this type of insurance service has a social welfare impact. Insurance contracts involve a substantial flow of funds from the insured to the insurer, called insurance premium, and from the individual insurers to the insurance firms, in terms of benefits. Pending the time the benefits are paid, the accumulated premium is normally channeled to the financial market by way of investment and into the real economy. Insurance services offer life, income and property protection to the insured persons or firms. In relation to individuals, they help to maintain good living standards after retirement. Insurance services enable the real economy to be productive and ensure the transferability of risks among the risk-averse persons or firms within an economy. Its positive externalities in the areas of consumption, productivity, profits and employment further boost the real sector for effective utilization of economic resources. Insurance enhances innovation within an economy by providing underwriting services for new risks (Chang et al., 2014; Cristea et al., 2014).

It is on this note that we utilize the data of 28 OECD countries between 1995 and 2020 to examine the impact of the insurance market on economic complexity. The study also examines whether the impact of life insurance on economic complexity would be different from the non-life insurance sector within the insurance market. From the PMG estimator, it is revealed that increase in total insurance, life and non-life insurance is associated with economic complexity. This finding is also confirmed by PDOLS. The result is further substantiated after employing MM-QR that accounts for nonlinearity by scheming the distributional and heterogeneous features of the panel structure. The results show that the insurance market improves economic complexity, buttressing the findings of PMG and PDOLS.

In terms of theoretical implications, the study supports the “supply-leading” hypothesis, which contends that the insurance market usually offers an effective mechanism of risk transferring. The sector has a necessary apparatus of managing risk in order to spur economic expansion and growth of economic complexity. Considering that the impact of structural transformation is gaining momentum in the world and nations are racing to clinch the goals of sustainable development, the issues of economic and structural transformation are becoming top priorities for every nation. Since, human behavior is perceived to tend to risk aversion, which may lead individuals to avoid new changes including structural changes (i.e., economic complexity or sophistication), the absence of a risk transferor and management as being undertaken by insurance firms may lead to economic loss. The insurance market helps to smooth risk management by mitigating the risk aspect of the economic conditions. This study recommends that every nation should take the opportunity available in the insurance sector in order to upgrade the level of economic complexity. Insurance serves as one of the important instruments of risk indemnification, transferring and intermediation in the process of upgrading the economic complexity. Distributional impact of economic complexity also depends on a country’s risk such as political, economic and financial risk. The insurance sector can assist in mitigating the risks and uphold productive knowledge needed to enhance national product sophistication.

As envisaged in the empirical analysis of this nature, this study is not free from limitations. Due to non-availability of data, this study does not cover all the OECD nations and does not expand the period of study beyond the period of 1995–2020. Developments in the OECD’s insurance sector in earlier periods may influence our results. We encourage future studies to overcome this shortcoming. In addition, the findings of this study might have been influenced by the techniques employed. We have tried as much as possible to overcome this challenge by using different estimation techniques. Future researchers may utilize other techniques of estimation including Vector Autoregression (VAR). One of the benefits of VAR technique is that it may reflect the effects of shocks and structural issues in the model. Additionally, second generation estimating techniques could be employed to take care of spatial correlation in the model. Future studies may consider institutional context, the role of innovations and different proxies of the key variables to ascertain the issue addressed in the study.

Funding. The authors received no funding for this research.

Compliance with ethical standards.

Conflict of interest: The authors declare that they have no conflict of interest statements.

Availability of data: Data used for this study would be made available upon a reasonable request.

References

Abbasi, K. R., Lv, K., Radulescu, M., & Shaikh, P. A. (2021). Economic complexity, tourism, energy prices, and environmental degradation in the top economic complexity countries: Fresh panel evidence. Environmental Science and Pollution Research, 28(48), 68717–68731. https://doi.org/10.1007/s11356-021-15312-4

Ajide, F. M., & Osinubi, T. T. (2023). Upgrading economic complexity in Africa: The role of remittances and financial development. Global Business and Economics Review, ahead-of-print. DOI: 10.1504/GBER.2024.10052893

Ajide, F. M. (2022). Economic complexity and entrepreneurship: insights from Africa. International Journal of Development Issues, 21(2). DOI 10.1108/IJDI-03-2022-0047

Ajide, F. M., & Osinubi, T. T. (2020). COVID-19 Pandemic and Outward Foreign Direct Investment: A Preliminary Note. Sciendo (Economics), 8(2),79–88. https://sciendo.com/it/issue/EOIK/8/2

Albeaik, S., Kaltenberg, M., Alsaleh, M., & Hidalgo, C. A. (2017). Improving the Economic Complexity Index. arXiv preprint arXiv: https://doi.org/10.48550/arXiv.1707.05826

Alhassan, A. L., & Fiador, V. (2014). Insurance-growth nexus in Ghana: An autoregressive distributed lag bounds cointegration approach. Review of Development Finance, 4(2), 83–96. http://dx.doi.org/10.1016/j.rdf.2014.05.003

Apergis, N., & Poufinas, T. (2020). The role of insurance growth in economic growth: Fresh evidence from a panel of OECD countries. The North American Journal of Economics and Finance, 53, 1–16. https://doi.org/10.1016/j.najef.2020.101217

Arena, M. (2008). Does Insurance Market Activity Promote Economic Growth? A Cross‐Country Study for Industrialized and Developing Countries. Journal of Risk and Insurance, 75(4), 921–946. https://doi.org/10.1111/j.1539-6975.2008.00291.x

Atlas of Economic Complexity (2022). Country and Product Complexity Rankings. Available at https://atlas.cid.harvard.edu/rankings.

Chang, T., Lee, C. C., & Chang, C. H. (2014). Does Insurance Activity Promote Economic Growth? Further Evidence Based on Bootstrap Panel Granger Causality Test. The European Journal of Finance, 20(12), 1187–1210. DOI:10.1080/1351847X.2012.757555

Chen, P.-F., Lee, C.-C., & Lee, C.-F. (2012). How does the Development of the Life Insurance Affect Economic Growth? Some International Evidence. Journal of International Development, 24, 865–893. https://doi.org/10.1002/jid.1765

Chu, L. K. (2020). The effects of financial development on economic sophistication: Evidence from panel data. Applied Economics Letters, 27(15), 1260–1263. https://doi.org/10.1080/13504851.2019.1676866

Coşkun, N., Lopcu, K., & Tuncer, İ. (2018). The Economic Complexity Approach to Development Policy: Where Turkey Stands in Comparison to OECD plus China. Topics in Middle Eastern and North African Economies (Proceedings of Middle East Economic Association), 20(1), 112–124. http://www.luc.edu/orgs/meea/

Cristea, M., Marcu, N., & Carstina, S. (2014). The Relationship between Insurance and Economic Growth in Romania Compared to the Main Results in Europe–a Theoretical and Empirical Analysis. Procedia Economics and Finance, 8, 226–235. https://doi.org/10.1016/S2212-5671(14)00085-9

Dada, T. J., Ajide, F. M., & Al-Faryan, A. S. M. (2023): Economic Complexity and Ecological Degradation in Africa: Does Globalization Matter? The International Trade Journal. DOI: 10.1080/08853908.2023.2243328

Dash, S., Pradhan, R. P., Maradana, R. P., Gaurav, K., Zaki, D. B., & Jayakumar, M. (2018). Insurance market penetration and economic growth in Eurozone countries: Time series evidence on causality. Future Business Journal, 4(1), 50–67. https://doi.org/10.1016/j.fbj.2017.11.005

Doğan, B., Driha, O. M., Balsalobre-Lorente, D., & Shahzad, U. (2021). The mitigating effects of economic complexity and renewable energy on carbon emissions in developed countries. Sustainable Development, 29(1), 1–12. doi/epdf/10.1002/sd.2125

Ege, I., & Sarac, T. B. (2011). The relationship between the insurance sector and economic growth: An econometric analysis. International Journal of Economic Research, 2(2), 1–9.

Erkan, B., & Yildirimci, E. (2015). Economic Complexity and Export Competitiveness: The Case of Turkey. Procedia–Social and Behavioral Sciences, 195, 524–533. https://doi.org/10.1016/j.sbspro.2015.06.262

Ferrarini, B., & Scaramozzino, P. (2016). Production complexity, adaptability and economic growth. Structural Change and Economic Dynamics, 37, 52–61. https://doi.org/10.1016/j.strueco.2015.12.001

GlobalData (2022). Luxembourg Life Insurance – Key Trends and Opportunities to 2025. https://www.globaldata.com/store/report/luxembourg-life-insurance-market-analysis/

Gonzalez, M. R., Wegener, C., & Basse, T. (2022). Re-investigating the insurance–growth nexus using common factors. Finance Research Letters, 46, 1–9, https://doi.org/10.1016/j.fri.2021.102231

Gómez‐Zaldívar, M., Osorio‐Caballero, M. I., & Saucedo‐Acosta, E. J. Income inequality and economic complexity: Evidence from Mexican states. Regional Science Policy & Practice. https://doi.org/10.1111/rsp3.12580

Hausmann, R., Hidalgo, C. A., Bustos, S., Coscia, M., Simoes, A., & Yildirim, M. A. (2019). The Atlas of Economic Complexity: Mapping Paths to Prosperity. Mit Press. https://doi.org/10.7551/mitpress/9647.001.0001

Hatemi-J., A., Lee, C.-C., Lee, C.-C., & Gupta, R. (2019). Insurance activity and economic performance: Evidence from asymmetric panel causality test. International Finance, 22(2), 221–240. https://doi.org/10.1111/infi.12333

Hou, H., Cheng, S. Y., & Yu, C. P. (2012). Life Insurance and Euro Zone’s Economic Growth. Procedia–Social and Behavioral Sciences, 57, 126–131. https://doi.org/10.1016/j.sbspro.2012.09.1165

Ibrahim, M., & Alagidede, P. (2018). Nonlinearities in Financial Development–Economic Growth Nexus: Evidence from sub-Saharan Africa. Research in International Business and Finance, 46, 95–104. https://doi.org/10.1016/j.ribaf. 2017.11.001

IMF (2022). Ireland: Financial Sector Assessment Program- Technical Note on Insurance Regulation and Supervision. IMF Staff Country Reports, No. 2022/244 https://www.imf.org/en/publications/CR/Issues/2022/07/25/Ireland-Financial-Sector-Assessment-ProgramTechnical-Note-on-Insurance-Regulation-and-521284

Lee, C. C., Chang, C. H., Arouri, M., & Lee, C. C. (2016). Economic growth and insurance development: The role of institutional environments. Economic Modelling, 59, 361–369. https://doi.org/10.1016/j.econmod.2016.08.010

Lee, C. C., Lee, C. C., & Chiou, Y. Y. (2017). Insurance activities, globalization, and economic growth: New methods, new evidence. Journal of International Financial Markets, Institutions and Money, 51, 155–170. https://doi.org/10.1016/j.intfin.2017.05.006

Lee, C. C., Lee, C. C., & Chiu, Y. B. (2013). The link between life insurance activities and economic growth: Some new evidence. Journal of International Money and Finance, 32, 405–427. https://doi.org/10.16/j.jimonfin.2021.05.001

Levine, R. (1997). Financial Development and Economic Growth: Views and Agenda. Journal of Economic Literature, 35(2), 688–726.

Levine, R. (1999). Financial Development and Economic Growth: Views and Agenda. (Policy Research Working Papers. New York: World Bank). https://doi.org/10.1596/1813-9450-1678

Liu, G. C., Lee, C. C., & Lee, C. C. (2016). The nexus between insurance activity and economic growth: A bootstrap rolling window approach. International Review of Economics & Finance, 43, 299–319. https://doi.org/10.1016/j.iref.2015.11.004

Kondovski, H. (2021). The Innovative Impact of Insurance for Economic Growth: The Evidence from New EU Member States. Economics – Innovative And Economics Research Journal, 9(2), 109–122. https://doi.org/10.2478/eoik-2021-0024

Mastilo, Z. (2015). Transformation of the Economic System of the Republic of Srpska and its Adaptation to Global Processes. International Letters of Social and Humanistic Sciences, 56, 152–162. Retrieved May 3, 2023 from https://www.learntechlib.org/p/176982/

Mohy ul Din, S., Regupathi, A., & Abu-Bakar, A. (2017). Insurance Effect on Economic Growth among Economies in Various Phases of Development. Review of International Business and Strategy, 27(4), 501–519. https://doi.org/10.1108/RIBS-02-2017-0010

Neagu, O., & Mircea, C. T. (2019). The Relationship between Economic Complexity, Energy Consumption Structure and Greenhouse Gas Emission: Heterogeneous Panel Evidence from the EU Countries. Sustainability, 11(2), 497. https://doi.org/10.3390/su11020497

Nguyen, C. P., Schinckus, C., & Su, T. D. (2020). The drivers of economic complexity: International evidence from financial development and patents. International Economics, 164, 140–150. https://doi.org/10.1016/j.inteco.2020.09.004

Nguyen, C. P., Schinckus, C., Su, T. D., & Chong, F. (2018). Institutions, inward foreign direct investment, trade openness and credit level in emerging market economies. Review of Development Finance, 8, 75–88. https://doi.org/10.1016/j.rdf.2018.11.005

Nguyen, C. P., & Su, T. D. (2021). Financing the economy: The multidimensional influences of financial development on economic complexity. Journal of International Development, 33(4), 644–684. https://doi.org/10.1002/jid.3541

Niavand, H. (2019). The Role of Insurance Development in Financial and Economic Growth in Iran. Available at SSRN: https://ssrn.com/abstract=3436958 or http://dx.doi.org/10.2139/ssrn.3436958

Ojeyinka, T. A. & Osinubi T. T. (2022). The moderating role of financial development in the Globalization-Sustainable Development Nexus: Evidence from selected African Countries. Economic Change and Restructuring, 55, 1–30.

Osinubi, T. T., & Ajide, F. M. (2022). Foreign direct investment and economic complexity in emerging economies. Economic Journal of Emerging Markets, 14(2), 245–256. https://doi.org/10.20885/ejem.vol14.iss2.art9

Pradhan, R. P., Arvin, B. M., Norman, N. R., Nair, M., & Hall, J. H. (2016). Insurance penetration and economic growth nexus: Cross-country evidence from ASEAN. Research in International Business and Finance, 36, 447–458. https://doi.org/10.1016/j.ribaf.2015.09.036

Pradhan, R. P., Arvin, M. B., Nair, M., Hall, J. H., & Gupta, A. (2017). Is there a link between economic growth and insurance and banking sector activities in the G-20 countries?. Review of Financial Economics, 33(1), 12–28. https://doi.org/10.1016/j.ref.2017.02.002

Pradhan, R. P., Bahmani, S., & Kiran, M. U. (2014). The dynamics of insurance sector development, banking sector development and economic growth: Evidence from G-20 countries. Global Economics and Management Review, 19(1–2), 16–25. https://doi.org/10.1016/j.gemrev.2015.05.001

Rudden, J. (2022). Insurance industry in the United Kingdom-statistics & facts. https://www.statista.com/topics/4511/insurance-industry-uk/#topicHeader_wrapper

Saadi, M. (2020). Remittance Inflows and Export Complexity: New Evidence from Developing and Emerging Countries. The Journal of Development Studies, 56(12), 2266–2292.

Sumegi K., Haiss, P. (2008). The relationship between insurance and economic growth: Review and agenda. The IcFai Journal of Risk and Insurance, l(2), 32–56.

Ul Din, S. M., Abu-Bakar, A., & Regupathi, A. (2017). Does insurance promote economic growth: A comparative study of developed and emerging/developing economies. Cogent Economics & Finance, 5(1), 1–12. https://doi.org/10.1080/23322039.2017.1390029

Yarri, M. (1965). Uncertain Lifetime, Life Insurance, and the Theory of the Consumer. Review of Economic Studies, 32(2), 137–150. https://doi.org/10.2307/2296058

Zouhaier, H. (2014). Insurance and Economic Growth. Journal of Economics and Sustainable Development, 5(12), 102–112.

Zulfiqar, U., Mohy-Ul-Din, S., Abu-Rumman, A., Al-Shraah, A. E., & Ahmed, I. (2020). Insurance-Growth Nexus: Aggregation and Disaggregation. The Journal of Asian Finance, Economics and Business, 7(12), 665–675. https://doi.org/10.13106/jafeb.2020.vol7.no12.66

Appendix A

Average Values of Economic Complexity Index, Total Insurance, Life Insurance, and Non-Life Insurance (1995–2020)

|

S/N |

Country |

Economic |

Total |

Life |

Non-life |

|

1 |

Australia |

-0.28255 |

6.057692 |

3.729 |

2.472115 |

|

2 |

Austria |

1.831166 |

5 .2485 |

2.144692 |

3.103885 |

|

3 |

Belgium |

1.288459 |

7.329654 |

4.597885 |

2.731808 |

|

4 |

Canada |

0.757451 |

5.587583 |

2.16625 |

3.421417 |

|

5 |

Czech Republic |

1.661169 |

3.215423 |

1.239115 |

1.976385 |

|

6 |

Denmark |

1.256892 |

8.516958 |

5.711917 |

2.804958 |

|

7 |

Finland |

1.796027 |

3.728 |

2.097 |

1.843652 |

|

8 |

France |

1.521319 |

9.468962 |

5.661269 |

3.387962 |

|

9 |

Germany |

2.217331 |

6.556783 |

2.936261 |

3.620565 |

|

10 |

Greece |

0.181587 |

2.01868 |

0.97984 |

1.03892 |

|

11 |

Hungary |

1.387196 |

2.695885 |

1.253269 |

1.442654 |

|

12 |

Ireland |

1.459161 |

15.86044 |

12.10204 |

3.7328 |

|

13 |

Italy |

1.455713 |

6.638231 |

4.431577 |

2.206692 |

|

14 |

Japan |

2.539433 |

7.335654 |

5.878154 |

1.722545 |

|

15 |

Korea |

1.63402 |

10.64654 |

7.030308 |

3.616154 |

|

16 |

Mexico |

1.150854 |

1.796423 |

0.806462 |

0.989846 |

|

17 |

Netherlands |

1.152888 |

8.053423 |

3.6545 |

4.398885 |

|

18 |

New Zealand |

0.288112 |

2.513227 |

0.632333 |

2.452333 |

|

19 |

Norway |

0.687692 |

4.964577 |

2.660885 |

2.3956 |

|

20 |

Poland |

1.016159 |

3.006462 |

1.42784 |

1.633538 |

|

21 |

Portugal |

0.651348 |

6.286808 |

3.985769 |

2.301077 |

|

22 |

Slovakia |

1.37071 |

2.7262 |

1.3633 |

1.3628 |

|

23 |

Spain |

0.988794 |

5.280385 |

2.508115 |

2.772385 |

|

24 |

Sweden |

1.912085 |

6.59852 |

4.32748 |

2.27116 |

|

25 |

Switzerland |

2.16758 |

9.685154 |

5.665923 |

4.019269 |

|

26 |

Turkey |

0.380488 |

1.192708 |

0.196958 |

0.995708 |

|

27 |

United Kingdom |

1.759437 |

12.67204 |

9.44888 |

3.586731 |

|

28 |

United States of America |

1.688896 |

10.68385 |

4.542962 |

6.140769 |

|

|

Average |

1.063359 |

6.235607 |

3.759745 |

2.515287 |

Source: Authors’ computations.

Appendix B

Descriptive Statistics

|

Variable |

Obs. |

Mean |

Std. Dev. |

Min. |

Max. |

|

Econcomp. |

728 |

1.282 |

0.668 |

-0.633 |

2.858 |

|

Total ins |

728 |

6.302 |

3.713 |

0.812 |

23.056 |

|

Nonlife ins |

728 |

2.668 |

1.274 |

0.707 |

8.062 |

|

Life ins |

728 |

3.667 |

2.958 |

0.104 |

19.268 |

|

EconFre |

728 |

7.687 |

0.570 |

5.55 |

8.772 |

|

FDI |

728 |

4.356 |

10.00 |

-40.081 |

109.33 |

|

Govt |

728 |

18.980 |

3.906 |

8.119 |

27.046 |

|

Internet |

728 |

56.080 |

30.945 |

0.081 |

98.046 |

|

Rem |

728 |

0.621 |

0.720 |

0.010 |

3.944 |

|

Pop |

728 |

0.569 |

0.573 |

-1.853 |

2.890 |

|

GDPPCL |

728 |

34655.78 |

18283.56 |

5638.145 |

88413.19 |

Source: Authors’ computations.

Appendix C

Pairwise Correlation

|

Variable |

Econcomp. |

Total ins |

EconFre |

FDI |

Govt |

Internet |

Rem |

Pop |

GDPPCL |

|

Econcomp. |

1.000 |

|

|

|

|

|

|

|

|

|

Totalin |

0.377* |

1.000 |

|

|

|

|

|

|

|

|

EconFre |

0.234* |

0.510* |

1.000 |

|

|

|

|

|

|

|

FDI |

0.023 |

0.152* |

0.048 |

1.000 |

|

|

|

|

|

|

Govt |

-0.001 |

-0.026 |

0.075* |

0.071 |

1.000 |

|

|

|

|

|

Internet |

0.065 |

0.217* |

-0.461* |

0.028 |

0.269* |

1.000 |

|

|

|

|

Rem |

-0.042 |

-0.324* |

-0.340* |

0.066 |

-0.113* |

-0.093* |

1.000 |

|

|

|

Pop |

-0.346* |

0.111* |

0.194* |

-0.035 |

-0.364* |

0.031 |

-0.073* |

1.000 |

|

|

GDPPCL |

0.168* |

0.512* |

0.071* |

0.025 |

0.118* |

0.467* |

-0.420* |

0.268* |

1.000 |

Source: Authors’ computations.

1 Islamic insurance operations are based on Islamic faith and beliefs. In this insurance scheme, insured funds cannot be invested in interest based income.

2 The risk classifications could be regarded as one of the critical building blocks for rules on the least premium rate for credit risk. For more on the OECD risk classifications, visit https://www.oecd.org/trade/topics/export-credits/arrangement-and-sector-understandings/financing-terms-and-conditions/country-risk-classification/

3 This is because the version of panel quantile regression we intend to use requires balanced panel data.