Organizations and Markets in Emerging Economies ISSN 2029-4581 eISSN 2345-0037

2023, vol. 14, no. 3(29), pp. 743–762 DOI: https://doi.org/10.15388/omee.2023.14.13

Determinants of Short- and Long-Term Commercial Lending Rates in Peru, 2010–2022

Sergio Bravo Orellana

ESAN University, Peru

sbravo@esan.edu.pe

https://orcid.org/0000-0002-7168-4257

Abstract. Short- and long-term interest rates are crucial for investment and, thus, business dynamism. The injection of money depends on the ability to promote cash flows through credit which boosts productive sectors. In the last decade, among Latin American countries, Peru has stood out for its key financial system and macroeconomic stability characteristics. The Central Reserve Bank of Peru (BCRP) plays a key role in setting the reference rate given its autonomy and strong institutional trust. However, the mixed pension system injects liquidity into the financial system through its private contributions. For the purposes of this study, an autoregressive econometric model of distributed lags (ARDL) was employed. The findings reveal that the reference rate set by the BCRP establishes a long-term relationship for both short and long-term rates, empirically demonstrating the effectiveness of monetary policy. Additionally, the liquidity provided by the pension system triggers an immediate shock response in determining the short-term rate. It is also observed that the issuance of sovereign bonds is a robust tool in determining the long-term rate due to its facilitation of credit access. This research is relevant for identifying macroeconomic and financial variables and guiding the formulation of macroeconomic policies.

Keywords: interest rates, monetary politics, Peruvian market, exchange rate and multivariate analysis, short commercial lending rates and long commercial lending rates

Received: 22/6/2023. Accepted: 30/10/2023

Copyright © 2023 Sergio Bravo Orellana. Published by Vilnius University Press. This is an Open Access article distributed under the terms of the Creative Commons Attribution Licence, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

1. Introduction

In the context of a given economic scenario, the monetary authority1 sets a reference level for the interbank market interest rate termed the reference rate or monetary policy rate. Depending on inflationary or deflationary pressures on the economy, central banks modify the reference rate towards encouraging banks to change interest rates. These changes have an impact on the behaviour of economic agents. Several studies have tried to quantify the transmission of monetary policy by following various methodological strategies through univariate analysis (Cermeño, et al., 2015; Lahura, 2017; Rostagno & Castillo, 2010). However, various macro-financial factors enable banks to adapt their rates to the monetary policy rate. For this reason, this research highlights the importance of conducting a multivariate analysis (a joint study of the variables) in explaining the macroeconomic conditions that affect the financial sector as a function of changes in the reference rate. Although interest rates can be impacted by fluctuations in the reference rate, they also vary with the international context and investors’ perceptions.

Considering the above, interest rates vary not only in the short but also in the long run. This document analyses the evolution of bank funding costs to identify the determinants of lending rates. For this purpose, rates with similar terms to maturity have been incorporated into the methodology. In other words, rather than individual bank data, aggregate data are used to estimate the long-term effects of the determinants of commercial lending rates set by banking entities under an ARDL model. This approach makes it possible to test cointegration relationships between study variables using the bound test, to distinguish between the short- and long-term interest rate responses to changes in the monetary policy rate and to determine the rate of adjustment toward long-run equilibrium. This methodology is particularly suitable for this research for incorporating unit root variables into the model. Several studies on the subject have followed a similar methodological strategy to assess the pass-through effect of the monetary policy rate on lending rates (Cottarelli & Kourelis, 1994; Chumpitaz, 2007; Jobst & Kwapil, 2008; Rostagno & Castillo, 2010; Gambacorta et al., 2015; Kapuscinsky & Stanislawska, 2017; Galindo & Steiner, 2020).

Despite seeking to estimate the relationship between monetary policy and lending rates, the present study is focused on assessing the effects of macro-financial factors on lending rates with different terms to maturity, which could also affect the transmission channel of monetary policy. Some authors stand out, such as Eller and Reininger (2016), who investigated which variables help explain “the effects of long-term fixed-rate bank lending rates on loans to the private non financial sector in a sample of 21 European Union countries. For example, these authors showed that sovereign bond yields significantly and positively affect bank lending rates” (p. 54). Along these lines, Zoli (2013) assessed the effects of sovereign spreads on bond yields and their rapid pass-through to lending rates in Italian banks.

Studies carried out by the Organization for Economic Cooperation and Development (OECD) find that greater competition in credit markets and the reduction of asymmetric information would improve the transmission of monetary policy and also contribute to reducing the level of interest rates of the loans (2022). That is, the study finds that monetary policy has a pass-through effect in around 3 months considering interbank credit movements. No research has estimated the pass-through effect in Peru using the reference rate, and the available studies have focused only on the banks’ average credit rate. In the same way, studies such as the one carried out by Bringas and Tuesta (2020) explain the determination of interest rates as a simple effect of supply and demand through the interbank interest rate. That is, the approach is developed around the relevance of interbank operations without considering the effect of the reference rate.

The present study uses open-access monthly data on credit instruments and bank lending rates reported by public institutions in Peru. In the first state, the monetary policy rate, the liquidity of the financial system, which is measured through monetary aggregates of the pension system, the bank concentration index and the country risk2 were included in the ARDL model based on the hypothesis that these macro-financial factors are determinants of short-term commercial lending rates, which are set by banks for loans shorter than 360 days. In the second stage, considering the relevance of sovereign bond yields, the monetary policy rate, the liquidity of the financial system – based on the evolution of the pension fund – and the interest rate of Peruvian government bonds with a 2-year term to maturity3 were included in the ARDL model as potential determinants of long-term commercial lending rates, which are set by banks for loans longer than 360 days. This research contributes to the literature as one of the first studies to perform an econometric analysis of interest rates by the term of maturity (maturity of Sovereign Bonds). Previous studies, such as those conducted by Dittman and Yuan (2008) for emerging market economies, have shown that sovereign bonds serve as benchmarks and suggest their positive impact on fostering a dynamic corporate credit market. However, there is little research focusing on this analysis within the Peruvian context. Similarly, the pass-through effect of the reference rate, a component of monetary policy, has received less attention due to the predominant focus on interbank credit and its supply and demand dynamics. Furthermore, the liquidity provided by pension funds is a noteworthy component of Peru’s financial system, offering flexibility for operations conducted by both the monetary authority and the government.

2. Theoretical Framework

In neoclassical theory, interest rates play a key role in determining investment spending and savings and are inversely related to investment and directly related to savings. Based on this relationship, savings may precede investment (Levy, 2012).

Notwithstanding the above, for Keynes (1936) “the competition of a high interest rate on mortgages may well have had the same effect in retarding the growth of wealth from current investment in newly produced capital-assets” (p.121).

Between 1950 and 1960, Milton Friedman made significant contributions to monetary economics by developing the quantitative equation of money. His work laid the foundation for the theory of the demand for money, which posits that money serves not only as a medium of exchange but also as a financial asset. Subsequently, the post-Keynesians refuted the monetarist position, arguing that the equations of the demand for money are not very sensitive to interest rates and highlighting the importance of the relationship between the demand for money and production levels.

Money market “overnight” (up to one week) and “short-term” (up to one year) interest rate levels are strongly affected by the rates set by Central Banks (Patterson & Lygnerud, 1999). Money market rates reflect the marginal or opportunity costs of funds because banks depend on them for short-term loans. “The theory implies a positive relationship between market rates and retail lending and deposit rates” (Gigineishvili, 2011). Although long-term interest rates play a key role in monetary policy design and implementation, there is a broad consensus among economists within and outside the central banking community that the determinants of long-term interest rates remain poorly understood.

The determinants of commercial lending rates vary with the economic characteristics of each country. On the one hand, some circumstances may affect interest rate composition. On the other hand, the actions of monetary authorities and economic agents also impact commercial lending rates.

In Peru, the inflation targeting regime is employed to stabilize the foreign exchange market and, in turn, mitigate the inflationary effects stemming from external factors. According to Croce and Mohsin (2000, p. 51), “Inflation targeting can benefit developing countries in many ways, by providing a coordination device for inflation expectations”. This approach mitigates inflation effects and provides a more powerful reference rate as an instrument for the foreign exchange market.

Accordingly, directly identifying the determinants of short- and long-term commercial lending rates requires understanding the transmission channels of economic policies.

One of the ways to understand the transmission channels of monetary policy towards rates is to extend the investment-saving – liquidity preference-money supply (IS-LM) model to an open economy, which is known as the Mundell-Fleming model. This model has been applied to try to explain the relationship between aggregate demand and fiscal and monetary policies (Lizarazu, 2006).

In emerging economies, increasing interest rates may not be appropriate to counteract high lending rates if inflationary pressures are not high. In this sense, a better option is to use international reserves or other funds to increase the robustness of macroprudential policies to best-set interest rates.

In this document, the transmission channels of the study variables were accurately identified by applying the Bernanke-Blinder model, which was developed by Dancourt (2012) and applied in Peru (consult the Appendix).

3. Determinants

The present study aims at including macro-financial factors as explanatory variables of commercial lending rates, in addition to the impact exerted by the monetary policy rate through the pass-through effect. As proposed in the theoretical model, short-term lending rates have a pass-through effect on long-term lending rates under specific conditions or factors. Moreover, the determinants under study have been established by identifying the size of their effect on the macro-financial and monetary policy environment.

According to the World Bank (2022), “A narrow spread means low transaction costs, which reduces the cost of funds for investment, crucial to economic growth”4. In other words, the difference between the lending rate and the borrowing rate (spread) is a commonly accepted measure of the cost of financial intermediation. Countries with lower spreads experience higher financial development levels and penetration of financial services (Calice & Zhou, 2018).

3.1. Short-Term Commercial Lending Rate

Short-term lending rates correspond to rates with a term to maturity shorter than one year that vary with the loan’s duration. Thus, short-term lending rates are subjected to more contemporary effects than their determinants. According to Bernanke and Gertler (1995), in addition to their weak effects on the cost of capital, short-term interest rates are presumably more affected by monetary policy than long-term rates. Using the model based on the transmission channel of credit monetary policy, the direct effects of monetary policy on interest rates can be amplified by endogenous changes in the external financing premium (Dancourt, 2012).

3.1.1 Liquidity. Janampa and Tapia (2020) consider that “liquidity, indirectly, derives from money or a unit of value conditioned by exchange and forms of deposit” (p.124). Accordingly, liquidity establishes the possibility of conversion, as a measure of current investable assets. Thus, liquidity functions as a determinant of financial markets because money can behave as an instrument of monetary policy. According to Paškevičius and Norkaitytė (2011), the functionality of a liquid capital market significantly influences a country’s economic development, playing a pivotal role in facilitating efficient capital accumulation and allocation, and thereby establishing the foundations for overall economic stability.

Liquidity can influence the short-term behavior of an interest rate by either supporting an upward or downward trend in this rate. In Peru, liquidity is determined by a variable important in the local context, namely private pension funds, because, given their size, they affect the financial market.

In Peru, as in other Latin American countries, the Private Pension System (Sistema Privado de Pensiones – SPP) was formed during the 1990s. These systems generated a significant source of financial resources, which grew over time and influenced interest rates. Here, the following three channels can be identified:

(i) The evolution of the available amount in the pension fund exerts downward pressure on interest rate.

(ii) The investment in financial assets by the government and financial institutions puts pressure on interest rates.

(iii) Pension funds do not fluidly move internationally; they accumulate within the country, putting pressure on interest rates and are then authorised to invest more abroad proportionally.

3.1.2 Country Risk. The effect of the country risk premium is transferred to the domestic interest rates of the country, that is, to both its lending and borrowing rates. In this regard, we postulate that changes in this spread affect the corporate rate set by banking institutions.

In the literature, the effect of factors associated with financial market dynamics on the pass-through of interest rates has been analysed from a broader perspective. Several studies have followed this line of research seeking explanations for the weakening of monetary transmission mechanisms in recent years (Gambacorta et al., 2015; Eller & Reininger, 2016). Most studies have focused on the analysis of developed economies, such as those of the United States and northern European countries and are focused on the long term. Along those lines, Gregor and Melecky (2018)5 reported that the most important determinant of a series of lending rates is the spread between the government bond yield and the policy rate (repo rate). This variable enabled them to assess the impact of fiscal policies and sovereign risk over time and to project short-term rates and the term premium, which further affects long-term lending rates in the Czech Republic. These results reflect the potential effects of considering mark-up changes in setting lending rates.

Regarding the evolution of literature on this topic in Latin America, substantial research efforts have been undertaken to identify, in principle, whether there is a complete pass-through on lending and deposit rates (Lahura, 20056; Chumpitaz, 2007; Rostagno & Castillo, 2010; Galindo & Steiner, 2020), and this relationship has even been reviewed following the global financial crisis (GFC). However, the empirical results were mixed and generally indicated the presence of a rigid and slow pass-through (Betancourt et al., 2008; Chumpitaz, 2007; Cermeño et al., 20157).

Although a vast amount of literature has focused on analysing the transmission channel of monetary policy on lending rates in different sectors and terms (Jobst & Kwapil, 2008; Rostagno & Castillo, 20108; Galindo & Steiner, 2020), less attention has been paid to the fact that this relationship depends on various market conditions, and not only on the monetary policy stance, especially in countries of the Global South, in Latin America.

Based on the analysis above, the following hypothesis is proposed: the short-term commercial rate in domestic currency (DC) is affected by the monetary policy (Reference rate), the country risk premium, and structural variables such as the liquidity in DC of AFP and bank concentration.

3.1.3 Bank Concentration. In line with the Structure-Conduct-Performance (SCP) paradigm, market structure determines conduct and, hence, the performance of a firm (Bain, 1956), so a highly concentrated banking market could lead to collusive behaviour or increased market power, resulting in less competitive rates. The model presented above aimed at identifying the factors that explain the evolution of interest rates, also demonstrated that the interest rates of products with lower demand elasticity are less competitive. Accordingly, interest rates and their changes over time depend on the degree of banking competition in the market (van Leuvensteijn et al.9, 2013; Gregor & Milecky, 2017). However, the spreads of reference rates set by banks do not vary continuously, and the oligopolistic structure does not change continuously, which could put pressure on changes in those spreads. Therefore, bank concentration, to some extent, should affect but is unlikely to be a determinant of commercial lending rates.

3.2 Long-Term Commercial Lending Rate

BCRP (Central Reserve Bank of Peru) intervention in the interbank market does not fully account for fluctuations in long-term lending rates. Similarly, as explained above, liquidity is a determinant of lending rates, particularly of long-term lending rates because they are usually set in long-term instruments and require maintaining investment positions, except for liquidity needs.

3.2.1 Reference Rate. The monetary policy rate set by BCRP is the main instrument used to keep inflation within the target range. As asserted by Visokavičienė (2014), monetary policy entails the management of fluctuations in the money supply and is directed towards the dual objectives of controlling inflation and fostering sustainable and well-timed economic growth. Peru relies on an inflation control mechanism termed “explicit inflation targeting”. The assumption underlying this mechanism is that changes in the monetary policy rate are transmitted to the interest rates of the interbank (interbank interest rate and market rates) and banking (loan and deposit rates) markets (BCRP, 2017). In its specific context, the monetary authority seeks to stabilise the price level around a given target and to influence the financial system, which is reflected in the credit policy of banks. This transmission mechanism connects the two policy instruments, the reference rate and the reserve rate, in the short term (Cermeño et al., 2015).

3.2.2 Sovereign Bond Yield. Sovereign bond yields may be key determinants of long-term lending rates (Zoli, 2013; Eller & Reininger, 2016). According to the cost-of-funds approach, banks take sovereign bond yields as reference benchmarks for their long-term fixed lending rates because they also affect the costs of their liabilities – savings and loans – based on which banks grant loans, adding their operating margin of intermediation.

Gregor (2019) concluded that commercial banks price mortgage loans largely based on sovereign bond yields, which ultimately expresses the cost of funds for those loans. This approach and the findings described above highlight that sovereign bond yields influence long-term lending rates even in periods without sovereign debt crises, that is, in “normal times” or in periods of little change in the country’s risk premium.

The empirical literature has also emphasised that, in times of severe financial stress, linked to a sovereign crisis, there are at least two transmission channels of sovereign bond yield effects on long-term lending rates. On the one hand, a strong increase in sovereign risk could reflect the risks of sovereign default, which, in addition to impacting the economic sector, could also increase private investment costs (Carter et al., 2019; Federal Reserve Bank of New York, 2019). Thus, banks would demand a higher premium for loans to firms and households when sovereign default risks increase. But on the other hand, the sovereign risk may also affect the funding costs of banks, either by deteriorating the value of their assets or by worsening the credit rating of banks due to its strong correlation with the sovereign bond yield. The results reported by Albertazzi et al. (2014) indicate that sovereign risk (measured as the sovereign yield spread) has a significant and positive effect on the interest rates on term deposits and the cost of credit for firms and households, and a negative effect on loan growth in the financial system.

Considering the above, the second hypothesis of this study is that the long-term commercial lending rate in domestic currency (DC) is affected not only by the monetary policy rate (reference rate) and the liquidity in DC of pension funds but also by sovereign bond yields in DC.

4. Data and Descriptive Statistics

All required information is available from public databases. The study period spans from 2010 to 2020 due to data availability and, thus, avoids the structural breaks of 2008. Considering the monthly series, the sample has N=137 observations. The country of analysis is Peru. Accordingly, the estimates were applied to Peru. Table 1 presents basic data on the definition of the series used in the estimates.

Among bank lending rates, short- (for loans of up to 360 days) and long-term (for loans of more than 360 days) commercial lending rates were analysed in depth in this study. In line with the literature, the monetary policy rate was used as a reference benchmark, and the Herfindahl-Hirschman index (HHI) in DC was used as a measure of bank concentration based on the loan portfolio of banking entities. The country risk premium was measured using the Emerging Market Bond Index Global (EMBIG) spread for Peru, which is reported by the investment bank JP Morgan. The less likely a country is to honour its payment obligations, the higher its EMBIG will be. Lastly, the 2-year Peruvian government bond interest rate (in S/) was included in the model to estimate long-term commercial lending rates.

Table 1

Conceptualization, Coding, and Database of the Variables Corresponding to the Model

|

|

Concept |

Variable |

Source |

|

Dependent Variable |

|||

|

Short-term commercial interest rate in domestic currency |

Rate for loans with a term of less than 360 days |

STCOMR |

Central Reserve Bank of Peru (BCRP) |

|

Long-term commercial interest rate in domestic currency |

For corporate loans with a term greater than 360 days |

LTCOMR |

Central Reserve Bank of Peru (BCRP) |

|

Independent variables |

|||

|

Reference rate in domestic currency |

Monetary policy rate of the Central Reserve Bank of Peru |

REFRDC |

Central Reserve Bank of Peru (BCRP) |

|

2-year sovereign bond rate of return |

2-year Peruvian government bond interest rate |

2YsobR |

Central Reserve Bank of Peru (BCRP) |

|

Liquidity of pension funds (AFP) in domestic currency |

Liquidity in domestic currency managed by pension funds |

LiquidityDC |

Superintendency of banking and insurance (SBS) |

|

Herfindahl-Hirschman credit index in national currency |

Banking concentration index measured from loans in domestic currency in the Peruvian banking system |

IHHIDC |

Superintendency of banking and insurance (SBS) |

|

Country risk index |

Emerging Market Bond Index (Embig) Yield Spread for Peru |

EMBIG |

Central Reserve Bank of Peru (BCRP) |

|

Note. Compiled by the author. |

|||

Initially, the time series were analysed to assess whether they were stationary. Given that no major structural changes in the financial market occurred during the study period, the results from the Augmented Dickey-Fuller (ADF) and Phillips-Perron tests are presented below, indicating that no integrated series of order two (I(2)) or higher was found in the sample. As outlined in Table 2, all series in the sample were integrated of order one or I(1).

Table 2

Unit Root Tests (Without Intercept)

|

Ho: |

Time series with a unit root |

|||

|

By level |

By difference |

|||

|

ADF |

P. Perron |

ADF |

P. Perron |

|

|

STcomR |

0.01 |

1.12 |

-5.52 |

-3.56 |

|

LTcomR |

0.37 |

1.34 |

-7.64 |

-7.76 |

|

RefRDC |

-0.30 |

1.33 |

-9.05 |

-9.22 |

|

LiquidityDC |

1.77 |

-1.35 |

-10.00 |

-8.53 |

|

HHIDC |

0.10 |

-0.12 |

-12.21 |

-4.78 |

|

EMBIG |

-0.69 |

-0.68 |

-9.59 |

-7.05 |

|

2YsobR |

-0.72 |

-0.76 |

-6.33 |

-5.90 |

As a case in point, the results of the ADF unit root test for the variable short-term commercial lending rate (STcomR) was a non-stationary series, albeit integrated with order 1. The null hypothesis of non-stationarity was not rejected since the t-statistic was higher than the 1% threshold at -5.52. Collating these findings, Table 2 additionally outlines the results from the Phillips-Perron test. As exemplified by the short-term commercial lending rate, the same conclusion is reached: the series is non-stationary because the t-statistic is higher than the 1% threshold at 3.59.

5. Methodology

Below, the relationship between macro-financial variables and the lending rate was modelled within the framework of error correction models. Because most of the data corresponded to non-stationary time series, the autoregressive distributed lag (ARDL) model and its error correction (EC) reparameterisation was applied in this study. The ARDL model is based on the Ordinary Least Squares (OLS) method but applies to non-stationary series and series with a mixed order of integration. This model requires a sufficient number of lags to capture the data-generating process.

This modelling aims at assessing whether the linear combination of integrated series is stationary, that is, whether the linear combination is I(0). If so, the variables are cointegrated or have a long-run relationship. The results also indicate whether the non-stationary series share the stochastic trend. Conversely, a non-stationary relationship between variables indicates a spurious regression (non-stationary residuals). Spurious regressions result from variables with a similar trend, but their relationship does not make economic sense. They may be significant but lack economic interpretation. Granger and Newbold (1974) found that a linear regression between random walk variables most often has a high R2, OLS estimators of coefficients with significant t-tests, even though such estimation should not make sense. Accordingly, a key step in the subsequent analysis is to prove a cointegration (or a long-term) relationship between the series.

The ARDL model has several advantages. For this reason, in the second stage, the bound test was used to infer the co-integration relationship between variables. In contrast to the two-stage strategy developed by Engle and Granger (1987) to prove the existence of a long-term relationship that constrains the order of integration of the variables, the bound test does not require that the variables have the same order of integration, as long as they are I(0) or I(1). The series under study complied with these properties. Additionally, an ARDL approach makes it possible to distinguish between short- and long-term responses of the interest rate to changes in the monetary policy rate and to determine the speed of adjustment towards long-term equilibrium.

Following the theoretical framework described in previous paragraphs and with the data availability, two equations were derived to specify the long-term cointegration relationship as follows:

(1)

(1)

(2)

(2)

where  represents the short-term commercial lending rate, and Rcomt represents the long-term commercial lending rate. For

represents the short-term commercial lending rate, and Rcomt represents the long-term commercial lending rate. For  , the explanatory variables are the monetary policy rate, the liquidity predicted by AFP, the bank concentration index and a measure of country risk. For Rcomt, the 2-year sovereign bond yield is included in the model, as proposed in the theoretical framework. However, country risk is disregarded because this variable is measured as the spread between the yield of a risk-free instrument and its equivalent in the country under analysis. US treasury bonds are used as a risk-free instrument, and their equivalent are the bonds issued by emerging economies’ governments.

, the explanatory variables are the monetary policy rate, the liquidity predicted by AFP, the bank concentration index and a measure of country risk. For Rcomt, the 2-year sovereign bond yield is included in the model, as proposed in the theoretical framework. However, country risk is disregarded because this variable is measured as the spread between the yield of a risk-free instrument and its equivalent in the country under analysis. US treasury bonds are used as a risk-free instrument, and their equivalent are the bonds issued by emerging economies’ governments.

In the model, the lags were selected using the Akaike information criterion (AIC). Thus, the econometric specification resulted in an ARDL (3, 1, 6, 8, 0) for the short-term commercial lending rate equation. This ARDL implies that the optimal number of lags is 3 for the dependent variable, 1 for the second regressor, 6 for the third regressor, 8 for the fourth regressor, and 0 for the remaining regressors. The econometric specification resulted in an ARDL (3, 4, 0, 0) for the long-term commercial lending rate equation. This ARDL implies that the optimal number of lags is 3 for the dependent variable, 4 for the first regressor, and 0 for the remaining regressors.

6. Results

6.1 Short-Term Commercial Lending Rate Estimates

The estimates of the effect of macrofinancial variables on short-term commercial loan rates in the entire sample are presented in Table 3. This table describes the ARDL estimates, considering the short-term commercial loan rate as an endogenous variable in five specifications. These specifications evaluate the effect of a lag of the endogenous variable, with a negative coefficient (-0.096), indicating an effect that does not persist over time and has an opposite direction to marginal changes. Below, the results are explained based on the coefficients of the regressors (Standard Error), which is the most complete in terms of several variables.

The negative sign of the error correction model (ECM) coefficient reveals the short-term adjustment rate. The magnitude of the ECM coefficient suggests dissipating disequilibrium, caused by shocks in the previous month, and convergence to long-term equilibrium, as confirmed by the results of the Bound test. These results indicate a long-term equilibrium relationship with the short-term commercial lending rate in the last three econometric specifications.

Table 3

ARDL Model and Contribution to the Short-Term Commercial Lending Rate10 (1,3,4,0,0)

|

Regressors |

Estimate |

Standard |

T values |

Pr(>|t|) |

|

STCOMR (-1) * |

-0.096200 |

0.25 |

-3.012812 |

0.12 |

|

REFRDC |

0.085935 |

0.08 |

2.187206 |

0.24 |

|

LIQUIDITYDC |

-1.55E-06 |

0.02 |

-0.455725 |

0.03 |

|

HHICREDITSDC** |

-0.000149 |

0.43 |

-1.245763 |

0.14 |

|

EMBIG** |

0.000492 |

0.11 |

1.319845 |

0.11 |

Note. * p-value incompatible with the t-bound distribution;** variable interpreted as Z = Z(-1) + D(Z).

Table 4

Diagnostic Test of the ARDL Model

|

TEST |

Statistical test |

Probability |

|

LM serial correlation |

F-test (0.1904) |

0.8269 |

|

Heteroscedasticity |

F-test (1.2907) |

0.2319 |

|

Normality |

Jarque-Bera (2.19) |

0.3331 |

Note. Neither serial correlation nor heteroscedasticity was found, and the results showed the normality of the residuals.

The Lagrange Multiplier (LM) serial correlation test determined that there was no serial autocorrelation by rejecting the null hypothesis since the value was 0.82 with a null hypothesis of autocorrelation. This hypothesis was rejected because the probability was higher than 0.05%. Similarly, no heteroscedasticity was found in the model because the null hypothesis was also rejected since 0.23 was higher than the significance level of 0.05 probability, and finally, the 0.3331 probability determined the normality of the residuals.

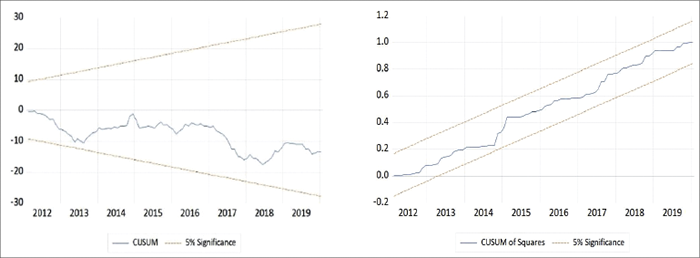

The cumulative sum control chart (CUSUM) explains the significance of the model. The 5% significance bands demonstrate that the results are in line with the model because there are no autocorrelation or heteroscedasticity biases.

Broadly speaking, the results showed that two variables are not significant determinants of short-term commercial lending rates, namely the bank concentration index and the country risk, because bank concentration cannot change abruptly in the short term, and country risk tends to be controlled by monetary policies of the BCRP. In other words, in Peru, the country’s risk does not immediately affect the variation of short-term commercial lending rates. Perhaps the effect is cushioned by the monetary policies of the BCRP, which counteracts the cycle. More specifically, when the country’s risk increases, the reference rate is raised to prevent capital flight, decreasing the incentive for capital holders to buy or sell assets, and thus the short-term commercial rate is not affected immediately or abruptly.

Figure 1

Cumulative Sum Control Chart (CUSUM) and CUSUM of Squares at 5% Significance

6.2 Long-Term Commercial Lending Rate Estimates

For more in-depth analysis by term to maturity of interest rates, Table 4 outlines estimates of a long-term commercial lending rate, that is, a rate for business loans with a term to maturity longer than 360 days. The column of coefficients (estimate) is the most complete in terms of the variables included in the model. Specifically, it shows the levels of impact in the determination of long-term interest rates. It can be seen that the impact of the reference rate explains 32% and sovereign bonds determine 39%. The long-term effects in terms of the reference rate are determined with an impact of 3 lags.

In the long-term relationship, the regressors showed that the sovereign bond yield accounts for 10% of variations in commercial lending rates, while liquidity, to a large extent, fails to explain variations in this variable. Similarly, according to the bound test, there is a long-term equilibrium relationship among the 3 variables. Liquidity is less relevant in the long term than in the short term, possibly because it determines more immediate investment decisions.

Table 5

ARDL Model for the Long-Term Commercial Lending Rate (3,2,0)

|

Regressors |

Estimate |

Standard |

T values |

Pr(>|t|) |

|

REFRDC |

0.32042 |

0.03 |

2.187206 |

0.012 |

|

LIQUIDITYDC ** |

-3.11E-07 |

0.23 |

-0.455725 |

0.24 |

|

2YSOBR |

0.3983 |

0.01 |

3.481110 |

0.03 |

Note. * p-value incompatible with the t-bound distribution.** variable interpreted as Z = Z(-1) + D(Z).

In general, in this case, the estimates showed that the long-term relationship is explained by the three variables, especially by the reference rate (and more so in the long term than in the short term). The sovereign bond yield is a determinant of variations in long-term commercial lending rates. Lastly, the liquidity estimated from the pension funds is a variable that affects both short- and long-term commercial lending rates. This result confirms that these funds are useful as a financial instrument for controlling both short- and long-term commercial lending rates.

Table 6

Diagnostic Test of the ARDL Model

|

TEST |

Statistical test |

Probability |

|

LM serial correlations |

F-test (1.6265) |

0.2013 |

|

Heteroscedasticity |

F-test (2.9065) |

0.0016* |

|

Normality |

Jarque-Bera (43.30) |

0.0000* |

Note. No serial correlation was found, but the first (*) indicates that there is heteroscedasticity, and the second (*) indicates that the residuals do not follow a normal distribution11.

Table 6 shows heteroscedasticity because the probability value of 0.0016 is lower than 0.05; thus, the null hypothesis is not rejected. Similarly, the errors are not normally distributed because the Jarque-Bera test has a probability of 0.000, which shows that the null hypothesis of non-normality is not rejected either.

Table 7

ARDL Model with an Error Correction Model (ECM) (3,2,0,4)

|

Regressors |

Coefficients |

T-values |

|

LTCOMR |

-0.19391 |

-0.006812 |

|

REFRDC |

0.08345 |

2.187206 |

|

LIQUIDITYDC** |

- |

- |

|

2YSOBR |

0.03983 |

3.481110 |

|

CointEq(-1)* |

-0.08651 |

0.00000 |

Note. (**) Liquidity does not explain the long-term relationship; therefore, ECM does not estimate the variable

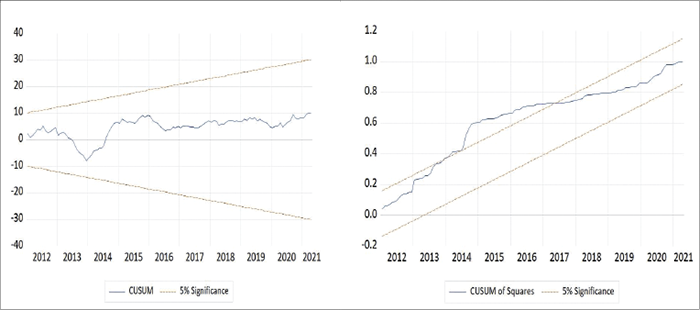

Based on the results, the error correction term CointEq(-1) shows a short-term disequilibrium adjustment of 8%. Similarly, the coefficient of -0.086 indicates that the relationship is not highly significant. In other words, the long-term cointegration relationship can be explained by variables such as the reference rate in national currency (REFRDC) and 2-year sovereign government bonds (2YSOBR). That is, there is a long-term relationship between the interest rate of long-term commercial loans and these two variables in a stable model. This is evidenced by the CUSUM tests presented in Figure 2.

Figure 2

Stability Tests CUSUM and CUSUM of Squares at 5% Significance

The CUSUM test showed that the model is stable over time. However, the CUSUM of squares test revealed a transient period of instability, which subsequently stabilizes in the following period because long-term commercial lending rates vary over time due to their composition.

7. Conclusions and Discussion

The importance of macro-financial factors in determining commercial lending rates in the Peruvian financial market was analysed by term to maturity of the interest rates. This study represents one of the pioneering investigations in this regard. For this purpose, the ARDL strategy was adopted. One of its main advantages is the use of unit root or stationary variables and multivariate analysis. However, it must be considered that the ARDL model updates the lags with a minimum of lags, which implies the need to evaluate the series independently. This is because the stationarity tests of the time series were not incorporated. However, the method is accepted to the extent that the study variables act in the correct way from a logical perspective.

The ARDL estimation using aggregated monthly data on Peru from January 2010 to January 2020 confirms a cointegration relationship with the dependent variable in the model for both short- and long-term rates. Based on data from local sources, the monetary policy rate (reference rate) has a persistent and significant effect on corporate rates despite variations in econometric specification.

Within the framework of the ARDL approach, the empirical findings confirm the initial hypothesis, which examines relationships involving short-term loan interest rates. More specifically, the liquidity provided by the AFP (Administradoras de Fondos de Pensiones) exerts a statistically significant impact on short-term commercial loan rates. The magnitude of the adjustment speed coefficient corroborates the existence of an association between liquidity and financial outcomes. Additionally, the results indicate that variations in bank concentration do not significantly influence short-term corporate rates. Within the same model, there is no empirical support for the notion that country risk significantly affects short-term commercial lending rates. This phenomenon can be attributed to the absence of a persistent effect of country risk in the long term, owing to the country’s economic robustness. In contrast to certain other nations, Peru’s country risk factor does not entail a long-term shock.

As for the second hypothesis, one of the aims of this research was to assess the direct effect of sovereign bond yields on long-term commercial lending rates set by banking institutions. Based on the estimations conducted in this study, we conclude that sovereign bond yields have a positive and significant impact on long-term commercial lending rates in a developing country such as Peru. In the long run, a 100 basis point increase in sovereign yield rates leads to a 56 basis point increase in the long-term commercial lending rate. While for the reference rate, it is found that, in the long term, it has a more circumstantial impact. That is to say, to the extent that the reference rate affects the short term, it will also have effects in the long term, as the model identified a slow equilibrium adjustment. These findings are relevant for policymakers as they enhance the collective understanding of the existing deficiencies in the transmission channel of monetary policy and underscore the importance of other macro-financial factors as supportive tools. On the other hand, the liquidity of pension funds has an equilibrium relationship with the short-term interest rate, while for the long-term rate, it is indeterminate.

Finally, this study is relevant for the Peruvian case because it applies a methodology that allows for the relationship between macroeconomic and financial variables, which are not usually evaluated through time series methodologies due to the nature of their integration orders. The results obtained are as expected, in line with the presented theoretical framework. The model used supports the importance of the role of the Central Reserve Bank of Peru; its strength has allowed, through tools such as the reference rate and the issuance of sovereign bonds and interest rates, to influence to some extent the economic stability and investment in Peru in recent years.

References

Albertazzi, U., Ropele, T., Sene, G. & Signoretti, F. M. (2014). The impact of the sovereign debt crisis on the activity of Italian banks. Journal of Banking and Finance, 46, 387–402. https://doi.org/10.1016/j.jbankfin.2014.05.005

Bain, J. S. (1956). Barriers to New Competition: Their Character and Consequences in Manufacturing Industries. Cambridge: Harvard University Press. https://www.degruyter.com/document/doi/10.4159/harvard.9780674188037/html

BCRP (2017). IMPORTANCIA DE LA TASA DE INTERÉS DE REFERENCIA DEL BCRP [IMPORTANCE OF THE BCRP REFERENCE INTEREST RATE]. https://www.bcrp.gob.pe/docs/Publicaciones/Revista-Moneda/moneda-170/moneda-170.pdf

Bernanke, B., & Blinder, A. (1988). Credit, Money, and Aggregate Demand. The American Economic Review, 78(2), 435–39. http://www.jstor.org/stable/1818164

Bernanke, B., & Gertler, M. (1995). Inside the Black Box: The Credit Channel of Monetary Policy Transmission. Journal of Economic Perspectives, 9(4), 27–48. DOI: 10.1257/jep.9.4.27

Betancourt, R., Vargas., H., & Rodríguez, N. (2008). Interest Rate Pass-Through in Colombia: A Micro-Banking Perspective. Cuadernos de Economía, 45, 29–58. https://scielo.conicyt.cl/pdf/cecon/v45n131/art02.pdf

Bringas, P., Tuesta. V. (2020). Determinants of the interbank interest rate and the importance of variability for its estimation [Determinantes de la tasa de interés interbancaria y la importancia de la variabilidad para su estimación]. https://www.bcrp.gob.pe/docs/Publicaciones/Revista-Estudios-Economicos/03/Estudios-Economicos-3-3.pdf

Calice, P., & Zhou, N. (2018). Benchmarking Costs of Financial Intermediation around the World (Policy Research Working Paper 8478). World Bank Group

Carter, T., Chen, X., & Dorich, J. (2019). Bank of Canada. Obtenido de The Neutral Rate in Canada: 2019 Update: https://ideas.repec.org/p/bca/bocsan/19-11.html#:~:text=Staff’s%20overall%20assessment%2C%20which%20is,last%20update%20in%20April%202018

Cermeño, R., Dancourt, O., Ganiko, G., & Mendoza, W. (2015). Tasas de Interés Activas y Política Monetaria en el Perú. Un Análisis con Datos de Bancos Individuales [Active Interest Rates and Monetary Policy: An Analysis with Individual Banks Data]. Documento de Trabajo 410, Departamento de Economía [Department of Economics, Pontifical Catholic University of Peru (Pontificia Universidad Católica del Perú)] – PUCP. Medium https://files.pucp.education/departamento/economia/DDD410.pdf

Chumpitaz, C. (2007). El Pass-through de Tasas de Interés en el Perú: El Enfoque de Datos de Panel Dinámico [Interest Rate Pass-through in Peru: The Dynamic Panel Data Approach]. Biblioteca del Banco Central del Uruguay. Medium. http://www.bvrie.gub.uy/local/File/JAE/2007/iees03j3020807.pdf

Cottarelli, C., & Kourelis, A. (1994). Financial Structure, Bank Lending Rates, and the Transmission Mechanism of Monetary Policy. IMF Staff Papers, 4(4). https://doi.org/10.2307/3867521

Croce, E., & Mohsin, S. (2000). Monetary Regimes and Inflation Targeting. Finance & Development, 37(3). https://www.imf.org/external/pubs/ft/fandd/2000/09/pdf/croce.pdf

Dittmar, R. F., & Yuan, K. (2008). Do Sovereign Bonds Benefit Corporate Bonds in Emerging Markets? The Review of Financial Studies, 21(5), 1983–2014. http://www.jstor.org/stable/40056875

Eller, M., & Reininger, T. (2016). The influence of sovereign bond yields on bank lending rates: the pass-through in Europe. Focus on European Economic Integration, (2), 54–78. https://ideas.repec.org/a/onb/oenbfi/y2016i2b1.html

Engle, R. F., & Granger, C. W. J. (1987). Co-Integration and Error Correction: Representation, Estimation, and Testing. Econometrica, 55(2), 251–276. https://doi.org/10.2307/1913236

Federal Reserve Bank of New York. (08 de 2019). Federal Reserve Bank of New York. Obtenido de The Yield Curve as a Leading Indicator: https://www.newyorkfed.org/research/ capital_markets/ycfaq.html

Galindo, A., & Steiner, R. (2020). Asymmetric Interest Rate Transmission in an Inflation Targeting Framework: The Case of Colombia (Borradores de Economía 1138, Banco de la Republica de Colombia [Central Bank of Colombia]). DOI: https://doi.org/10.32468/be.1138

Gambacorta, L., Illes, A., & Lombardi, J. (2015). Has the Transmission of Policy Rates to Lending Rates Changed in the Wake of the Global Financial Crisis? International Finance, 18(3), 263–280. https://doi.org/10.1111/infi.12074

Gamarra, V. (2021). El sistema de pensiones y la necesidad de una seguridad social básica https://www.spdtss.org.pe/wp-content/uploads/2021/09/Laborem8-55-84.pdf

Granger, C. W. J., & Newbold, P. (1974). Spurious regression in econometrics. Journal of Econometrics, 2(2), 111–120. https://doi.org/10.1016/0304-4076(74)90034-7

Gigineishvili, N. (2011). Determinants of Interest Rate Pass-Through: Do Macroeconomic Conditions and Financial Market Structure Matter? (IMF Working Paper No. 11/176). Medium. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1899577

Gregor, J. (2019). Interest Rate Pass-Through: A Synthesis of Empirical Analyses. [Doctoral Thesis, Technical University of Ostrava: Faculty of Economics].

Gregor, J., Melecký, M. (2018). The pass-through of monetary policy rate to lending rates: The role of macro-financial factors. Economic Modelling, 73(June), 71–88. https://doi.org/10.1016/j.econmod.2018.03.003

Janampa, A, G. J., & Tapia, J. (2020). Liquidez y rentabilidad. Una revisión conceptual y sus dimensiones [Liquidity and profitability. A conceptual review and its dimensions]. Revista de Investigación Valor Contable, 31(1), 9–30. DOI: https://doi.org/10.17162/rivc.v3i1.1229

Jobst, C., & Kwapil, C. (2008). The interest rate pass-through in Austria – effects of the financial crisis. Monetary Policy & the Economy, 4, 54–67. https://EconPapers.repec.org/RePEc:onb:oenbmp:y:2008:i:4:b:3

Jopen, G. (2013). Market Rower; Banking and Financial Mediation: An Approach from the Industrial Organisation. Economía, 36(71),75–116. https://doi.org/10.18800/economia.201301.003

Kamber, G., & Mohanty, M. (2018). Do Interest Rates Play a Major Role in Monetary Policy Transmission in China? (BIS Working Paper No. 714). Medium. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3158506

Kapuscinski, M., & Stanislawska, E. (2017). Measuring Bank Funding Costs in the Analysis of Interest Rate Pass-through: Evidence from Poland. Economic Modelling, 70(April), 288–300. https://doi.org/10.1016/j.econmod.2017.11.009

Keynes, J. M. (1936). The General Theory of Employment, Interest and Money. Fourteenth reprint (1997). Fondo de Cultura Económica [Economic Culture Trust], Mexico D.F. https://www.files.ethz.ch/isn/125515/1366_keynestheoryofemployment.pdf

Lahura, E. (2005). El efecto traspaso de la tasa de interés y la política monetaria en el Perú: 1995-2004 [The pass-through effect of the interest rate and monetary policy in Peru: 1995-2004]. Revista Estudios Económicos N° 13, Banco Central de Reserva del Perú [Central Reserve Bank of Peru].

Lahura, E. (2017). El efecto traspaso de la tasa de interés y la política monetaria en el Perú. Revista Estudios Económicos N° 33, 9–27. Banco Central de Reserva del Perú [Central Reserve Bank of Peru].

Lizarazu, E. (2006). La macroeconomía IS-LM. Una retrospección teorética estilizada. Investigación económica [online],65, (256), 103–129. ISSN 0185-1667. https://www.scielo.org.mx/scielo.php?script=sci_abstract&pid=S0185-16672006000200103&lng=es&nrm=iso

OECD. (2022). The Pass-Through of the Monetary Policy Rate into Lending Rates in Mexico. https://one.oecd.org/document/ECO/WKP(2022)35/en/pdf

Patterson, B. &, Lygnerud, K. (1999). The Determination of Interest Rates (Working Papers: Economic Affairs Series 116). Medium. https://www.europarl.europa.eu/workingpapers/econ/pdf/116_en.pdf

Paškevičius A., & Norkaitytė O. (2011). The Impact of Macroeconomic Indices Upon the Liquidity of the Baltic Capital Markets. Ekonomika, 90(4), 116–132. doi: 10.15388/Ekon.2011.0.921.

Rostagno, M., & Castillo, R. (2010). El Efecto Traspaso de la Tasa de Interés Referencial a las Tasas Bancarias en el Perú: Un Análisis de Cointegración Asimétrica Durante el Periodo 2002 – 2010 [The Pass-Through Effect of the Referential Interest Rate on Bank Rates in Peru: An Analysis of Asymmetric Cointegration During the 2002 – 2010 Period]. Revista de Temas Financieros, SBS. Retrieved from: https://www.sbs.gob.pe/Portals/0/jer/rebper_2010_vol_vi/Parte2_Martin.pdf

Van Leuvensteijn, M., Sorensen, Ch. K., Bikker, J.A., van Rixtel, A.A.R.J.M. (2013). Impact of Bank Competition on the Interest Rate Pass-Through in the Euro Area. Applied Economics. 45(11), 1359–1380.

Visokavičienė B. (2014). Monetary Policy in Advanced Economies During the Global Financial Crisis: Lessons from Lithuania, Ekonomika, 93(1), 40–56. doi: 10.15388/Ekon.2014.0.3023 https://www.journals.vu.lt/ekonomika/article/view/3023

Zoli, E. (2013). Italian Sovereign Spreads: Their Determinants and Pass-through to Bank Funding Costs and Lending Conditions (IMF Working Paper WP/13/84).

Appendix

Interest Rate Channel in the Transmission Mechanism of Monetary Policy in Peru

Using this model, the relationship between the banking system and the monetary authority can be determined through an IS-LM model. Among its monetary policy instruments, the central bank adjusts the reference interest rate to the conditions of the Peruvian market. Similarly, the legal reserve, defined as the minimum reserves of liquid assets that the financial system must maintain for monetary regulation (BCRP, 2017), is also considered in this analysis. To establish the difference between short- and long-term interest rates, a yield curve is used in the bond market, thereby creating a starting point for the short-term interest rate set by the Central Bank to function as an indicator of long-term interest rates of the banking system and the bond market.

The IS-LM model assumes that banking entities have deposits (D) derived from families, which are obtained through deficit agents, thus fulfilling an intermediary role in the financial market. On the one hand, BCRP maintains control over these deposits; as such, these banking entities do not control 100% of such deposits. For this reason, a percentage of this flow of money remains under the administration of the monetary authority, which is known as the reserve requirement ratio (Ɵ).

On the other hand, the monetary base (H) will consist of banknotes and coins issued by the central bank, known as currency in circulation (C), and deposits of the financial system controlled by the BCRP (ƟD) based on a fraction of household deposits. The model assumes that the currency in circulation is zero, so that:

H = C + Ɵ → H = ƟD

When there is no physical currency in circulation in the economy, the demand for money becomes a demand for transaction deposits. This demand directly depends on the economic activity (Y) and the price level (P) and inversely depends on the short-term bond interest rate (i), which is set by the central bank.

1 In Peru, the monetary authority is the Central Reserve Bank (Banco Central de Reserva del Perú – BCRP), which has played a key role in maintaining financial stability in the last 30 years; especially this institution is independent of political powers and based on a significant meritocratic hierarchy.

2 These variables are found in the international literature and defined in the methodology section.

3 Due to data constraints, the bank concentration index is not included in this stage.

4 Review https://databank.worldbank.org/metadataglossary/world-development-indicators/series/FR.INR.LNDP#:~:text=Interest%20rate%20spread%20is%20the,%2C%20however%2C%20limiting%20their%20comparability.

5 “Another possible determinant of the markup that we consider is the spread between the government bond yield and the monetary policy rate as a proxy for changes in the term premium and sovereign risk. […] The spread increases most the mortgage and consumer rates […]. The SME and corporate markups respond also positively to the growth in [Czech National Bank] CNB’s deposits at foreign banks. However, this result is puzzling” (Gregor & Melecky, 2018).

6 “Commercial lending rates (for corporations, large and medium-sized companies) and borrowing rates on time deposits, savings, and checking accounts are analysed. The results from August 2010 to May 2017 show that the pass-through effect: (i) is stronger on lending rates than on borrowing rates; (ii) is stronger when the terms to maturity are shorter than one year; (iii) is close to 1 when the terms to maturity are shorter than one year” (Lahura, 2005).

7 “More specifically, the pass-through of short-term interest rates is positive and lower than one (coefficient equal to 0.81), and the pass-through of long-term interest rates is higher than one (coefficient equal to 1.09)” (Chumpitaz, 2007).

8 “[…]in most series showing an interest rate pass-through effect, the coefficient was most often significantly lower than one. This result implies that the pass-through is not complete, neither in the short term nor in the long term. No notable differences were found between lending and borrowing rates, but rates with shorter terms to maturity have a stronger pass-through effect and, therefore, adjust more quickly to the reference rate than other rates, in line with the theory of the term structure of interest rates” (Rostagno & Castillo, 2010).

9 “Our results from a simple interest rate spread model show that across eight euro area countries, bank interest rate spreads on mortgage loans, consumer loans and short-term loans to enterprises are significantly lower in more competitive markets. This result implies that bank loan rates are lower under stronger competition. This may improve social welfare […]. Further, banks compensate for income losses from increased loan market competition by offering lower deposit rates” (van Leuvensteijn et al., 2013).

10 Selected based on AKI; the ARDL model was chosen so that trend specification was neither constant nor trend case. * and ** indicate 1 and 5 % significance levels, respectively.

11 Because the residuals do not follow a normal distribution, the error correction model (ECM) should be estimated to identify short-term relationships and the speed of adjustment.