Organizations and Markets in Emerging Economies ISSN 2029-4581 eISSN 2345-0037

2023, vol. 14, no. 3(29), pp. 721–742 DOI: https://doi.org/10.15388/omee.2023.14.12

The Impact of Technology Awareness, Motivation and Attitude on Intention to Pay with Cryptocurrency for Tourism Services

Rasuolė Andrulienė

Vilnius University, Lithuania

rasuole.andruliene@evaf.vu.lt

https://orcid.org/0000-0001-6664-3314

Aida Mačerinskienė (corresponding author)

Vilnius University, Lithuania

aida.macerinskiene@evaf.vu.lt

https://orcid.org/0000-0002-0137-9388

Alfreda Šapkauskienė

Vilnius University, Lithuania

alfreda.sapkauskiene@evaf.vu.lt

https://orcid.org/0000-0002-0070-4097

Saulius Masteika

Vilnius University, Lithuania

saulius.masteika@knf.vu.lt

https://orcid.org/0000-0002-1770-670X

Kęstutis Driaunys

Vilnius University, Lithuania

kestutis.driaunys@knf.vu.lt

https://orcid.org/0000-0002-8456-123X

------------------------------------------------------

This project has received funding from the Research Council of Lithuania (LMTLT), Agreement No 13.1.1-LMT-K-718-05-0006.

------------------------------------------------------

Abstract. This study aims to investigate consumer intention to pay for services in the travel and tourism industry using cryptocurrencies. This research investigates the impact of technology awareness, motivational factors and consumer attitudes on the intention to pay for tourism services using cryptocurrency by analyzing data collected from 794 respondents in the Baltic countries (Lithuania, Latvia and Estonia). The empirical findings support the extended Technology Acceptance Model (TAM) and confirm that technology awareness, motivational factors and attitudes towards cryptocurrencies have a statistically significant impact on the intention to use cryptocurrencies to pay for tourism services. The results also suggest that technology awareness has an indirect effect on intention through the mediators of motivational factors and attitude, with motivation indirectly affecting intention through the mediator of attitude towards cryptocurrencies.

Keywords: technology awareness, motivational factors, cryptocurrencies, technology acceptance model, tourism

Received: 20/7/2023. Accepted: 18/8/2023

Copyright © 2023 Rasuolė Andrulienė, Aida Mačerinskienė, Alfreda Šapkauskienė, Saulius Masteika, Kęstutis Driaunys. Published by Vilnius University Press. This is an Open Access article distributed under the terms of the Creative Commons Attribution Licence, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

Introduction

Tourism is the sector most quickly persuaded to adopt new payment methods (Quan et al., 2023), with the globalization and digitization of travel and tourism driving the need for easy-to-use and low-cost international transaction processes and payment systems (Treiblmaier et al., 2021). Although the tourism industry uses traditional and mobile payments, it increasingly encourages cryptocurrency payment methods. Cryptocurrency is a decentralized digital currency stored in an online form; it is not subject to the control of governments and banks (Alqaryouti et al., 2020). For tourism service providers, the use of cryptocurrency has maintained business, reduced commissions and increased reservations during the economic downturn caused by the COVID-19 pandemic and the war in Ukraine (El Chaarani et al., 2023). Users are no longer limited by traditional methods, and their payment methods have become more diverse (Quan et al., 2023), prompting growth in the overall number of cryptocurrency users (Makridis et al., 2023). This has prompted debate around the topic across both research and industry (Önder & Gunter, 2020).

However, although cryptocurrencies have been introduced into tourism transactions, the adoption and use of these currencies in the industry remain limited (Nam et al., 2021), leading researchers and practitioners to investigate why the tourism market does not rely on cryptocurrency technology and why travellers are reluctant to use cryptocurrencies when paying for tourism services, instead relying on traditional or mobile forms of payment. Although the tourism industry has already started to work on blockchain implementation (Korže, 2019), theory-based research in this area is still lacking, and current knowledge about traveller intention to use cryptocurrencies for payment purposes is limited (Treiblmaier et al., 2021).

The array of tourism services includes transportation, accommodation, ancillary services, sales and distribution. Investigating the use and intention to use cryptocurrencies to purchase travel services among European travellers, Leung and Dickinger (2017) found that although using cryptocurrency to purchase travel goods is not yet common, participants did tend to use it for restaurants and food delivery. Treiblmaier et al. (2021) studied travellers from the Asia-Pacific region and found that half of the respondents used cryptocurrency to pay for accommodation and airfare, while over a third used it to pay for travel packages.

The analysis of the scientific literature shows that there remains a lack of knowledge about the factors and mechanisms influencing consumer propensity to pay for tourism services using cryptocurrencies. According to Vetrichelvi and Priya (2022), awareness is a key motivator of technology use, encouraging speculation about a link between users’ technology awareness and motivation, but this relationship has yet to be studied empirically. Another important factor in increasing technology uptake is attitude (Nam et al., 2021), with empirical studies confirming the influence of attitude on the intention to pay using cryptocurrency (Schaupp & Festa, 2018; Yoo et al., 2020). According to Kazerani et al. (2017), research clarifies the characteristics and motivations of cryptocurrency users. However, for Steinmetz et al. (2021), research on the motivation to buy and use cryptocurrencies remains limited because the strength of the motivation is not investigated. That is, it is unclear whether motivation affects user attitudes towards cryptocurrencies and the intention to pay for tourism services using cryptocurrencies.

To address the identified research gaps, it is assumed that motivational factors and attitudes towards cryptocurrencies mediate between technology awareness and the intention to pay for tourism services using cryptocurrency, with attitude mediating between motivational factors and behavioural intention. Hence, the study has several main aims: (1) to investigate the effect of antecedents (technology awareness, motivational factors and attitude) on the outcome variable (behavioural intention); (2) to determine the effect of technology awareness on behavioural intention through the mediators of motivational factors and attitude; (3) to examine the influence of motivational factors on behavioural intention through the mediator of attitude.

1. Literature Review

1.1 Theoretical Background

Research on cryptocurrencies has been conducted using various user behaviour models, such as the Theory of Reasoned Action (TRA), the Theory of Planned Behavior (TPB) and the Technology Acceptance Model (TAM). These theories and models have all been widely accepted in information systems research and have been used with many modifications in various contexts (Treiblmaier et al., 2021).

The TRA was proposed by Ajzen and Fishbein (1975) based on the assumption that people are rational and systematically use the information available to them before deciding on a certain behaviour. This implies that people voluntarily control their behaviour (Ajzen, 1980). According to this theory, the antecedents of intention are attitude towards the behaviour and subjective norms. Due to the simplicity of the TRA, some studies, such as Sohaib et al. (2019), have used it to investigate the adoption and use of cryptocurrencies.

Ajzen (1991) extended the TRA by adding the construct of perceived behavioural control and calling it the TPB. The TPB has been widely used to explain and predict behavioural intentions related to the adoption and use of information technology products (Baker et al., 2007; Teo & Tan, 2012). Some researchers have used the TPB to investigate factors influencing cryptocurrency adoption (Schaupp & Festa, 2018; Walton & Johnston, 2018; Anser et al., 2020).

Based on the TRA, Davis (1989) developed the TAM to explain why a person accepts or refuses to use technology. The TAM is most commonly used by academics in the field of information systems (Kumari & Devi, 2023). According to the TAM, perceived ease of use and perceived usefulness significantly impact user attitudes towards new technologies, with intention determined by a person’s favourable or unfavourable feelings concerning the technology (Mnif et al., 2021). The TAM has been empirically validated as an instrument for predicting technology use by various researchers (Larasati & Santosa, 2017; Xie et al., 2017; Talwar et al., 2020), and it has also been used successfully in several studies investigating the factors responsible for cryptocurrency adoption (Mendoza-Tello et al., 2019; Alqaryouti et al., 2019; Albayati et al., 2020; Namahoot & Rattanawiboonsom, 2022; Silva et al., 2023). This study uses the TAM proposed by Davis (1989) because it enables investigation into the effect of the antecedents of technology awareness, attitude and motivational factors on the outcome variable of behavioural intention.

1.2 Motivation and Pull Factors

The popularity of tourism and travel is increasing worldwide, and researchers consider tourist motivation in various contexts. Motivation describes the reason for a person’s actions (Oktaviana, 2021). Durmaz and Diyarbakırlıoğlu (2011) define motivation as a process or a behavioural action caused by a motive or a combination of motives and factors. Sánchez and Hueros (2010) argue that perceived usefulness represents an extrinsic motivation of the user.

The Push-Pull-Mooring (PPM) system is one of the most commonly used technological adoption and migration research systems (Susanty et al., 2020). Researchers use individual definitions of switching behaviour to explain the application of a certain technology in a certain context (Handarkho & Harjoseputro, 2019; Tang & Chen, 2020). According to PPM theory, the factors influencing an individual’s technology migration decisions can be divided into push, pull and mooring factors (Zhang et al., 2008). Pull factors are positive attributes that attract an individual to an alternative choice (Bansal et al., 2005). According to previous studies on the adoption of mobile payment systems, perceived enjoyment, convenience and perceived benefits represent pull factors (Handarkho & Harjoseputro, 2019). This means that an important feature of payment systems is their ability to provide a simple and convenient way to transact (Özkan et al., 2010). Meanwhile, Wang et al. (2019) have highlighted that when a new payment service provides value to consumers, they tend to adopt the technology.

While millions of people are investing in cryptocurrencies, their motivations for doing so are less clear than for traditional investment solutions (Mattke et al., 2020). According to Steinmetz et al. (2021), there is limited research on consumer motivations for buying and using cryptocurrencies, but it would be useful to know what role motivational factors play in consumer decision-making processes regarding the purchase or use of cryptocurrencies. Notably, a study by Deutsche Postbank identified four motivations: independence from monetary policy, high yields, anonymity and investability (Steinmetz et al., 2021). Elsewhere, Treiblmaier et al. (2021) identified motivational factors for the use of cryptocurrencies in the tourism sector, namely, universal usability, intriguing technology, cost saving, disintermediation, privacy and easy verification. Leung and Dickinger (2017) investigated how European travellers use Bitcoin to purchase travel products and identified factors that encourage consumers to use the cryptocurrency for online travel purchases: a Bitcoin account is not tied to the owner’s identity; no credit card or bank account is required; Bitcoin works anywhere and at any time; Bitcoin payments involve lower transaction costs than other systems and do not require a PIN or signature for confirmation. The results of the study confirmed that European travellers rarely used Bitcoin for payment, but users are very positive about doing so during future trips (Leung & Dickinger, 2017). Bashir et al. (2016) investigated the factors that encourage individuals to use Bitcoin and found that anonymity, borderless finance and virtual money (without a physical basis) all had statistically significant positive impacts on attitude.

Alqaryouti et al. (2020) used structured interviews to investigate consumer knowledge and motivation for using cryptocurrency. In that study, the authors connected the two factors of the TAM model, that is, consumer knowledge of a cryptocurrency to its perceived ease of use and the consumer motivation to use the cryptocurrency to its perceived utility. The survey showed that the perceived advantages of cryptocurrency include decentralization, security, anonymity, ease of use, and low fees (Alqaryouti et al., 2020).

1.3 Technology Awareness and Knowledge

For Dinev and Hu (2007), the concept of awareness first appeared in Rogers’ (1995) innovation diffusion theory. The innovation diffusion theory argues that how an individual perceives a phenomenon influences the use of information technology (Rogers, 1995). Taherdoost et al. (2009) define awareness as “the degree to which an individual is aware about the technology” (p. 332). According to Shahzad et al. (2018), awareness is a key factor in understanding the various aspects and benefits of technology, with Dinev and Hu (2007) arguing that awareness is a precursor to the attitude formation phase of innovation diffusion. This means, according to the TPB, that awareness is the antecedent of attitude and behavioural intention. Technology awareness may increase the likelihood of adopting new developments, but the complexity of cryptocurrencies may not be easily understood by users (Sagheer et al., 2022). The adoption of cryptocurrencies is based on an individual’s current level of technology awareness and knowledge (Rashideh, 2020; Nam et al., 2021). In other words, awareness refers to efforts to provide knowledge and improve understanding of any technology (Taherdoost et al., 2009). Technology awareness influences the behavioural intentions of consumers to adopt new technology (Alaeddin & Altounjy, 2018), with the extent to which people know and understand digital currencies significantly impacting their willingness to use those currencies (Treiblmaier & Sillaber, 2021).

2. Research Model and Hypotheses

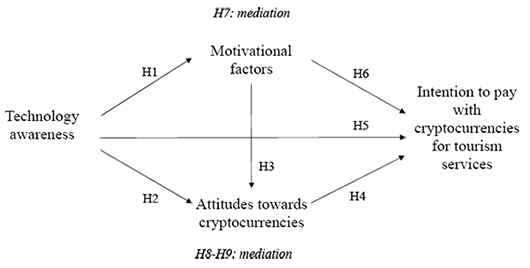

Although it is known that the determinants of the TAM help consumers to make the best decisions about technology acceptance (Shahzad et al., 2021), researchers continue to modify and evaluate the TAM to identify the most influential factors (Hamilton, 2020). Despite the fact that motivation is an essential part of consumer behaviour, studies on the relationship between motivation and other behavioural factors are surprisingly rare. This study extends the original model of technology acceptance by including technology awareness and motivation as additional variables. Furthermore, it proposes testing the relationships between technology awareness, motivational factors, attitudes, and behavioural intention (see Figure 1).

Figure 1

Research Model

Lin et al. (2020) have noted that when consumers believe that a technology will be more useful in their daily lives, they are more motivated to use and adopt the new technology. Elsewhere, Rodriguez et al. (2008) found that comfort using technology predicts motivation. Studies considering motivational factors related to cryptocurrencies generally do not ask about the cause of motivational factors. This study aims to assess the extent to which individuals are aware of cryptocurrencies and how perceptions of cryptocurrency technology influence motivational factors. This prompted us to develop the following hypothesis:

H1: Awareness about cryptocurrencies positively impacts consumer motivation to use cryptocurrencies.

Attitude is defined as a user’s positive or negative evaluation of a particular technology (or service) when performing a particular activity (Yoo et al., 2020). In this context, attitude describes how a person feels or behaves towards cryptocurrency. Technology awareness is vital and directly impacts attitude (Bharadwaj & Deka, 2021). Several studies have confirmed that technology awareness positively impacts consumer attitudes towards the use of new technologies (Dinev & Hu, 2007; Alaeddin & Altounjy, 2018; Vetrichelvi & Priya, 2022; Potas et al., 2022). Therefore, we developed the following hypothesis:

H2: Awareness about cryptocurrencies positively impacts attitude towards cryptocurrencies.

Fishbein and Ajzen (1975) defined attitude as “a learned predisposition to respond in a consistently favorable or unfavorable manner with respect to a given object” (p. 10). One of the main conditions for inducing an existing attitude is the activation of the states of an individual’s needs. Although Fishbein and Ajzen’s work did not explicitly propose a causal relationship, their theory suggests that motivation precedes attitude and that motivation can influence attitude, contributing to the understanding of attitude formation and change (Hsu et al., 2010). Previous studies have confirmed that the perceived usefulness of specific products or services determines consumer attitudes (Siraye, 2014; Kansal, 2016). Meanwhile, Alqaryouti et al. (2020) linked consumer motivation to use cryptocurrency to the perceived usefulness of the cryptocurrency, with perceived usefulness influencing attitude (Namahoot & Rattanawiboonsom, 2022). Therefore, the following hypothesis was developed:

H3: Motivational factors positively impact attitude towards cryptocurrencies.

Attitude refers to a person’s judgements about the benefits of performing an action: if an individual believes that performing an action will lead to positive outcomes, they are likely to develop a favourable attitude towards the action, contributing to behavioural intention (Han et al., 2020). Attitudes towards technology use reflect feelings that performing a given behaviour will produce a certain and desired outcome (White Baker et al., 2007). Consumer intention to use cryptocurrency is based on their attitude towards services and technology (Yoo et al., 2020). A person’s actions are influenced by their attitude; in the study context, this reflects how they feel or think about cryptocurrency (Hasan et al., 2022). Behavioural intentions quantify customer willingness to perform financial transactions with cryptocurrencies (Almuraqab, 2020). Previous studies have confirmed the direct influence of attitude on a person’s intention to use cryptocurrency (Schaupp & Festa, 2018; Walton & Johnston, 2018; Yoo et al., 2020). Therefore, we developed the following hypothesis:

H4: Attitude towards cryptocurrencies positively impacts intention to pay with cryptocurrencies for tourism services.

Technology awareness and behavioural intentions are considered the most important factors influencing technology adoption (Igbaria et al., 1994). Behavioural intentions play an important role in the acceptance or rejection of any technology: If people are aware of a given technology, their technology adoption behaviour will be positive. Previous research suggests that technology awareness and behavioural intentions are closely linked and have a positive relation (Barbu et al., 2021). According to Dinev and Hu (2007), technology awareness is an antecedent of behavioural intention. In the study context, research has confirmed that awareness is significantly and positively related to the intention to use cryptocurrencies (Dinev & Hu, 2007; Alaeddin & Altounjy, 2018; Shahzad et al., 2018; Nurbarani et al., 2022). Therefore, the following hypothesis is developed:

H5: Awareness about cryptocurrencies positively impacts the intention to pay for tourism services using cryptocurrencies.

According to Lee et al. (2005), from an extrinsic motivation perspective, consumer behaviour is driven by perceived values and benefits. Wang et al. (2019) recognized that consumers tend to adopt a technology when the new payment service provides value to them, which changes their perception of the technological service. In the research context, Handarkho and Harjoseputro (2019) defined mobile payment system features and perceived benefits as pull factors, and Leung and Dickinger (2017) revealed that the highly secure function and wide versatility of Bitcoin are the main motivators for consumers to use the cryptocurrency when purchasing travel services. Steinmetz et al. (2021) noted that empirical studies have not investigated the strength of motivation, and it is not known what role motivation play in the decision-making processes of consumers regarding the purchase or use of cryptocurrencies. Therefore, we developed the following hypothesis:

H6: Motivational factors positively impact the intention to pay for tourism services using cryptocurrencies.

According to Ayedh et al. (2020), if consumers feel that they know and understand the key components, their attitudes towards cryptocurrency and their willingness to accept it will change. Technological factors positively or negatively affect the pull factors influencing the intention to switch to mobile payment systems (Putri et al., 2020). Nonetheless, the analysis of literature reveals that there is a research gap in the relationship between technology awareness, motivational factors, attitude and intention. We hypothesize that motivational factors and attitudes towards cryptocurrencies mediate between technology awareness and the intention to pay for tourism services using cryptocurrencies. This prompts the following hypotheses:

H7: The influence of technology awareness on the intention to pay with cryptocurrencies for tourism services is partially mediated by motivational factors.

H8: The influence of technology awareness on the intention to pay for tourism services with cryptocurrencies is partially mediated by attitude towards cryptocurrencies.

Consumers tend to use services that emphasize benefits related to their core motivation and personal attitude (You et al., 2020). We hypothesize that attitude towards cryptocurrencies mediates between motivational factors and the intention to pay for tourism services with cryptocurrencies. Therefore, we have developed the following hypothesis:

H9: The influence of motivational factors on the intention to pay with cryptocurrencies for tourism services is partially mediated by attitude towards cryptocurrencies.

3. Method

Data were collected using a questionnaire featuring scales that have been successfully implemented by previous studies. The first part of the questionnaire comprised 16 statements (see Appendix A) designed to assess the four variables of our proposed model: technology awareness (TA), attitude towards cryptocurrencies (AT), motivational factors (MOT), and the intention to use cryptocurrencies to pay for tourism services (INT). Alaeddin and Altounjy’s (2018) four-point scale was used to measure technology awareness, and their three-statement attitude scale and three-statement intention scale were adapted to measure attitude and intention. The six-statement motivational factors scale was adapted from the work of Treiblmaier et al. (2021). Participants responded to each statement according to a 7-point Likert scale where 1 indicated “strongly disagree” and 7 indicated “strongly agree”. The second part of the questionnaire concerned demographic data (gender, age, education, income, country of residence, experience).

4. Research Findings

4.1 Demographic Characteristics of the Sample

A research agency collected the data via a representative survey in Lithuania, Latvia and Estonia from January to February 2023, producing a total of 794 completed questionnaires. All further analysis was performed on those data using SPSS 28.

Table 1

Profile of the Respondents

|

Variable |

Category |

Frequency |

Percentage |

|

Gender |

Male |

354 |

44.6 |

|

Female |

432 |

54.4 |

|

|

Other |

8 |

1.0 |

|

|

Age |

<29 |

224 |

28.2 |

|

30–39 |

264 |

33.2 |

|

|

40–49 |

163 |

20.5 |

|

|

≥50 |

143 |

18.1 |

|

|

Education |

High school |

307 |

38.7 |

|

College |

273 |

34.4 |

|

|

Graduate school |

214 |

27.0 |

|

|

Average monthly income of household |

Less than 2,000 euros |

486 |

61.2 |

|

2,001–3,000 euros |

197 |

24.8 |

|

|

3,001–4,000 euros |

66 |

8.3 |

|

|

More than 4,001 euros |

45 |

5.7 |

|

|

Country of residence |

Lithuania |

256 |

32.3 |

|

Latvia |

268 |

33.8 |

|

|

Estonia |

267 |

33.6 |

|

|

Other |

3 |

0.4 |

The respondents in the study represented four age groups: under 29 years (28.2%), 30–39 years (33.2%), 40–49 years (20.5%) and over 50 years (18.1%). 44.6% of the respondents were men, 54.4% were women, and 1% were others. 38.7% of the respondents were high school graduates, 34.3% had a college degree and 27% had a graduate school degree. The distribution of respondents according to the average monthly income of their household was as follows: 61.1% earned below €2,000; 24.8% earned €2,001 to €3,000; 14.1% earned €3,001 or more. 32.2% of respondents were residents of Lithuania, 33.8% were residents of Latvia, 33.6% were residents of Estonia, and 0.4% were residents of other countries (UK, Netherlands). There were no significant differences in the means of the demographic variables, so the sample is suitable for further analysis without the use of demographic control variables.

Respondents were further asked, “Have you ever used cryptocurrency (as a payment method) for shopping before?”, with 46.9% answering “yes” and 53.1% answering “no”.

4.2 Exploratory Factor Analysis

We conducted an exploratory analysis of the validity and reliability of the variables. First, a factor analysis was performed to check whether the research data were suitable for analysis. Between-factor correlations were evaluated respectively in factor analysis for technology awareness, motivational factors, attitude and intention. According to Shrestha (2021), factor analysis removes irrelevant statements from the final questionnaire. An exploratory factor analysis with a varimax rotation was conducted on the four intervention items. The exploratory factor analysis saw one item (MOT1) removed from the motivation scale. Subsequently, the fit of the model was acceptable. The Kaiser-Meyer-Oklin index was 0.925, and Bartlett’s test of sphericity (p =0.000) indicated, suggesting the data were sufficiently interrelated and that a factorial analysis was feasible. The results of the analysis of principal components appear in Table 2, showing that all factor loadings exceeded 0.6. The eigenvalues for all four compound variables exceeded 1, and the cumulative variance explained 74.59% of the total variance in response to the survey.

Table 2

Results of the Principal Components Analysis

|

|

Components |

|||

|

Factor 1 |

Factor 2 |

Factor 3 |

Factor 4 |

|

|

TA1 |

0.793 |

|

|

|

|

TA2 |

0.799 |

|

|

|

|

TA3 |

0.755 |

|

|

|

|

TA4 |

0.828 |

|

|

|

|

AT1 |

|

0.710 |

|

|

|

AT2 |

|

0.768 |

|

|

|

AT3 |

|

0.717 |

|

|

|

MOT2 |

|

|

|

0.652 |

|

MOT3 |

|

|

|

0.680 |

|

MOT4 |

|

|

|

0.726 |

|

MOT5 |

|

|

|

0.796 |

|

MOT6 |

|

|

|

0.808 |

|

INT1 |

|

|

0.776 |

|

|

INT2 |

|

|

0.839 |

|

|

INT3 |

|

|

0.812 |

|

|

Cronbach α |

0.891 |

0.880 |

0.914 |

0.839 |

|

Eigenvalue |

7.879 |

1.366 |

1.279 |

1.169 |

|

Cumulative variance explained (%) |

52.53 |

61.64 |

69.50 |

74.59 |

Note. Extraction method: Principal Components Analysis. Rotation method: Varimax.

Finally, we performed a reliability analysis of the measurement scales of our model using Cronbach’s alpha. This showed an acceptable level of reliability for all factors, with Cronbach’s alpha for each of the four variables exceeding 0.8, which is considered a benchmark for an excellent level of reliability (Streiner, 2003). Table 2 shows Cronbach’s alpha coefficients, which range from 0.839 (motivational factors) to 0.914 (behavioural intention), indicating that the instrument can be considered reliable and internally coherent. This level of reliability and validity of the measured variables was suitable for testing the hypotheses.

4.3 Hypotheses Testing

To test the hypotheses, a multiple regression analysis was conducted on the variables of technology perception, attitude, motivational factors and behavioural intention. Pearson’s bivariate correlations (r) were then performed before analyzing the generated results using multiple regression analysis. The correlation results showed that all factors have a moderate correlation (between 0.570 and 0.695).

Table 3

Correlations Between Factors

|

|

Technology |

Attitude |

Motivational |

Behavioural intention |

|

Technology awareness |

|

0.636** |

0.570** |

0.574** |

|

Attitude |

0.636** |

|

0.649** |

0.695** |

|

Motivational factors |

0.570** |

0.649** |

|

0.590** |

|

Behavioural intention |

0.574** |

0.695** |

0.590** |

|

Note. ** Correlation is significant at the 0.01 level.

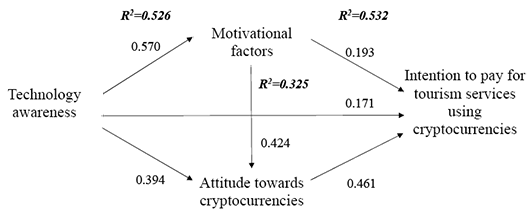

Standardized regression weights were estimated to test the hypotheses. Table 4 shows the results of the multiple regression analysis. To analyze H1, H2 and H4, multiple regression analysis with three regressors was first performed to determine the influence of technology awareness, motivation factors and attitude towards cryptocurrencies on the intention to pay for tourism services using cryptocurrencies. The regression model showed good fit (F = 299.594; p < 0.001) and explained 53.2% of the variation in intentions (adjusted R2 = 0.532). All factors had a significant positive effect on behavioural intention: attitude → intention (β = 0.461, p < 0.001), technology awareness → intention (β = 0.171, p < 0.001), motivational factors → intention (β = 0.193, p < 0.001). These regression analysis results enable confirmation of H1, H2 and H4.

To examine H3 and H5, another multiple regression analysis was performed with the influence of two regressors (technology awareness and motivational factors) on attitudes towards paying with cryptocurrencies. The linear regression model showed good fit (F = 438.950; p < 0.001) and explained 52.6% of the variation in attitude (adjusted R2 = 0.526). All factors had a significant positive effect on attitude: technology awareness → attitude (β = 0.394, p < 0.001), motivational factors → attitude (β = 0.424, p < 0.001). The regression analysis results enable confirmation of H3 and H5.

Table 4

Effects of the Variables

|

|

Behavioural intention |

Attitude |

Motivational factors |

|

Technology awareness |

0.461 |

0.394 |

0.570 |

|

Motivational factors |

0.171 |

0.424 |

|

|

Attitude |

0.193 |

|

|

|

R2 |

0.532 |

0.526 |

0.325 |

Finally, in testing the influence of technology awareness on motivation, the linear regression model showed good fit (F = 381.268; p < 0.001) and explained 32.5% of the variation in attitude (adjusted R2 = 0.325). One factor had a significant positive effect on motivational factors: technology awareness → motivational factors (β = 0.570, p < 0.001). This regression result confirms hypothesis H6.

Figure 2 summarizes the empirical results, showing the R2 coefficients of determination and standardized beta coefficients.

Figure 2

Research Results

All direct relationships tested were significant at the p<0.001 level, allowing the confirmation of all hypotheses (Table 5).

Table 5

Standardized Regression Weights

|

Hypothesis |

Relationship |

Estimate |

p-value |

Findings |

|

H1 |

Attitude → Intention |

0.461 |

p<0.001 |

Accepted |

|

H2 |

Motivational factors → Intention |

0.193 |

p<0.001 |

Accepted |

|

H3 |

Motivational factors → Attitude |

0.424 |

p<0.001 |

Accepted |

|

H4 |

Technology awareness → Intention |

0.171 |

p<0.001 |

Accepted |

|

H5 |

Technology awareness → Attitude |

0.394 |

p<0.001 |

Accepted |

|

H6 |

Technology awareness → Motivational factors |

0.570 |

p<0.001 |

Accepted |

The findings show that technology awareness is a very strong antecedent to motivational factors (β = 0.570) and attitude (β = 0.394). Motivational factors have a strong effect on intention (β = 0.424). As expected, there is strong evidence of a significant positive effect of attitude towards cryptocurrencies on intention to pay with cryptocurrencies for tourism services (β = 0.461). The direct effects of motivation and technology awareness on intention were also significant but weaker (β = 0.193 and β = 0.171, respectively).

The empirical research model assumes that the effect of the technology awareness variable on the intention to pay with cryptocurrencies for tourism services is mediated by motivational factors and attitudes towards cryptocurrencies. This implies that the technology awareness factor may have an indirect effect on desire through the mediators of motivation and attitude. Hayes (2022) SPSS PROCESS beta version 4.2 was used to test this effect. When testing whether there is a mediation effect in the research model, the direct effect, indirect effect and total effect were analyzed. Table 6 provides a summary of the mediation.

Mediation analysis was conducted to test H7. The results show that technology awareness had a statistically significant direct influence on motivation (a = 0.5950, t = 19.5261, p < 0.001), and motivational factors had a statistically significant direct influence on intention (b = 0.2989, t = 11.9077, p < 0.001). Technology awareness had a statistically significant direct effect on intention (c’ = 0.2832, t = 10.8096, p < 0.001). The indirect effect of technology awareness on the intention to pay for tourism services using cryptocurrencies through the mediation of motivational factors is equal to 0.1779. The overall effect, that is, the coefficient of direct effect and indirect effect (the link between technology awareness and intention mediated by motivation factors) was 0.4611 (t = 19.7360, p < 0.001). The results of the mediation analysis enable confirmation of H7.

The results of the mediation analysis conducted to test H8 show that technology awareness had a statistically significant direct effect on attitude towards cryptocurrencies (a = 0.4852, t = 23.1957, p < 0.001), and attitude had a statistically significant direct effect on intention (b = 0.5828, t = 17.2034, p < 0.001). Technology awareness had a statistically significant direct effect on intention (c’ = 0.1783, t = 6.8998, p < 0.001). The indirect effect of technology awareness on the intention to pay for tourism services using cryptocurrency through the mediation of attitude was equal to 0.2828. The overall effect, that is, the coefficient of direct effect and indirect effect (the relationship between technology awareness to intention mediated by attitude) was equal to 0.4611 (t = 19.7360, p < 0.001). These results enable confirmation of H8.

Finally, mediation analysis was conducted to test H9. Motivational factors were found to have a statistically significant direct influence on attitude towards cryptocurrencies (a = 0.4743, t = 24.0050, p < 0.001), while attitude had a statistically significant direct influence on intention (b = 0.5678, t = 16.5919, p < 0.001). Motivational factors had a statistically significant direct effect on the intention to pay for tourism services using cryptocurrencies (c’ = 0.1843, t = 7.3668, p < 0.001). The indirect effect of motivational factors on the intention to pay for tourism services using cryptocurrencies via the mediator of attitude was equal to 0.2693. The overall effect, that is, the coefficient of direct effect and indirect effect (the link between motivation and intention mediated by attitude) was equal to 0.4536 (t = 205421, p < 0.001). These results enable confirmation of H9.

Table 6

Mediation Analysis

|

Hypothesis |

Relationship |

Total effect |

Direct effect |

Indirect effect |

BootLLCI |

BootULCI |

Findings |

|

H7 |

Technology awareness → Motivational factors (mediator) → Intention |

0.461 |

0.283 |

0.178 |

0.1737 |

0.2696 |

Accepted |

|

H8 |

Technology awareness → Attitude (mediator) → Intention |

0.461 |

0.178 |

0.283 |

0.0268 |

0.3012 |

Accepted |

|

H9 |

Motivational factors → Attitude (mediator) → Intention |

0.454 |

0.184 |

0.269 |

0.0292 |

0.2939 |

Accepted |

5. Discussion

The research used the extended TAM to understand the impact of three antecedents (technology awareness, motivational factors and attitude) on the outcome variable (behavioural intention). The model was used to analyze the intention of consumers to pay for tourism services using cryptocurrencies.

The direct relationship between attitude and intention has received strong support both theoretically (Davis, 1989; Ajzen, 1991) and empirically (Schaupp & Festa, 2018; Walton & Johnston; Yoo et al., 2020). Therefore, as expected, the results of the current study support the notion that attitude towards cryptocurrencies has a strong direct impact on consumer intention to pay for tourism services using cryptocurrencies.

The empirical results are consistent with the findings of other studies that have recognized technology awareness as an important antecedent to behavioural intention (Dinev & Hu, 2007; Altounjy, 2018; Shazad et al., 2018; Nurbaranis et al., 2022). The direct effects of technology awareness on intention were also significant, albeit weaker.

The role of motivation in cryptocurrency payment has not been extensively analyzed, creating a significant research gap around the use of cryptocurrencies. According to the empirical results, motivational factors have a significant direct effect on the intention to pay for tourism services using cryptocurrencies.

The empirical results also confirm that technology awareness is a strong antecedent to attitudes towards cryptocurrencies. These results are consistent with the results of previous empirical studies confirming that technology awareness positively impacts consumer attitudes towards the use of new technologies (Dinev & Hu, 2007; Alaeddin & Altounjy, 2018; Bharadwaj & Deka, 2021; Vetrichelvi & Priya, 2022; Potas et al., 2022).

Although the literature has provided insights into the effect of technology awareness on motivation, previous studies have not empirically confirmed this relationship. The current study provides clear empirical evidence for the importance of this relationship by finding a very strong direct effect of technology awareness on motivational factors.

The analysis of the literature prompted the assumption that technology awareness is an antecedent to motivation and attitude and influences intention by mediating these factors. The empirical results confirm that technology awareness has an indirect impact on the intention to pay for tourism services using cryptocurrency through the partial mediation of motivational and attitude factors. It was also found that motivational factors have an indirect influence on behavioural intention via partial mediation by attitude.

These findings have important theoretical implications because the results lead to several conclusions. First, technology awareness, motivational factors and attitude towards cryptocurrencies are important predictors of the intention to pay with cryptocurrencies for tourism services and have a direct positive influence on that intention; second, technology awareness indirectly affects the intention to pay with cryptocurrencies for tourism services through the mediation of motivational factors and attitude; third, motivational factors affect the intention to pay with cryptocurrencies for tourism services indirectly through the mediation of attitude towards cryptocurrencies.

The theoretical discoveries also have certain managerial implications. The tourism business should pay attention to the external motivational factors that encourage customers to pay using cryptocurrencies. These pull factors (e.g., cryptocurrency technology is intriguing; the cost of transactions is lower compared to other payment systems; there is no need to have a credit card or bank account to have a cryptocurrency account; a cryptocurrency account is not linked to the identity of the owner; and no PIN code or signature is required to confirm cryptocurrency payments) become an important incentive to pay for services, especially for tourism services, using cryptocurrency. Therefore, the main managerial implication is that cryptocurrency payments should be considered when planning the relevant marketing (and pricing) strategies of tourism service providers or destinations, with special attention paid to the possibility of paying in various ways (i.e., traditional, mobile and cryptocurrency payments). In the post-COVID-19 era, targeting cryptocurrency investors and users can represent an additional opportunity for tourism businesses to attract consumers.

5. Limitations and Further Research

The study has several limitations that can guide future studies.

First, the chosen sample was intended to obtain a relatively significant sample from one region of the European Union, namely, the Baltic states. Differences between societies might be more measurable if we were able to compare the results with those of countries at different stages of technological progress. Although a geographical bias might not be relevant, technological progress could be an important factor.

Second, the study was developed based on a particular list of tourism services. It would be very interesting to analyze in more detail particular tourism services, such as accommodation. The accommodation sector is directly related to tourism and clearly illustrates tourism trends.

Third, because technological development fundamentally impacts consumer habits, attitudes and motivation, this study demonstrates possible changes to the TAM model that could be made in the context of future research.

References

Ajzen, I. (1991). The theory of planned behavior. Organizational Behavior and Human Decision Processes, 50(2), 179–211.

Ajzen, I., & Fishbein, M. (1975). A Bayesian analysis of attribution processes. Psychological Bulletin, 82(2), 261–277.

Alaeddin, O., & Altounjy, R. (2018). Trust, Technology Awareness and Satisfaction Effect into the Intention to Use Cryptocurrency among Generation Z in Malaysia. International Journal of Engineering & Technology, 7(4.29), 8–10.

Albayati, H., Kim, S. K., & Rho, J. J. (2020). Accepting financial transactions using blockchain technology and cryptocurrency: A customer perspective approach. Technology in Society, 62, 1–14.

Almuraqab, S. N. A. (2020). Predicting determinants of the intention to use digital currency in the UAE: An empirical study. The Electronic Journal of Information Systems in Developing Countries, 86(3), 1–12.

Alqaryouti, O., Siyam, N., Alkashri, Z., & Shaalan, K. (2019, December). Users’ Knowledge and Motivation on Using Cryptocurrency. In European, Mediterranean, and Middle Eastern Conference on Information Systems (pp. 113–122). Cham: Springer International Publishing.

Anser, M. K., Zaigham, G. H. K., Rasheed, I. M., Pitafi, A. H., Iqbal, J., & Luqman, A. (2020). Social media usage and individuals’ intentions toward adopting Bitcoin: The role of the theory of planned behavior and perceived risk. International Journal of Communication Systems, 33(17), 1–16.

Ayedh, A., Echchabi, A., Battour, M., & Omar, M. (2021). Malaysian Muslim investors’ behaviour towards the blockchain-based Bitcoin cryptocurrency market. Journal of Islamic Marketing, 12(4), 690–704.

Baker, W. E., Al‐Gahtani, S. S., & Hubona, G. S. (2007). The effects of gender and age on new technology implementation in a developing country: Testing the theory of planned behavior (TPB). Information Technology & People, 20(4), 352–375.

Bansal, H. S., Taylor, S. F., & St. James, Y. (2005). “Migrating” to New Service Providers: Toward a Unifying Framework of Consumers’ Switching Behaviors. Journal of the Academy of Marketing Science, 33(1), 96–115.

Barbu, C. M., Florea, D. L., Dabija, D. C., & Barbu, M. C. R. (2021). Customer Experience in Fintech. Journal of Theoretical and Applied Electronic Commerce Research, 16(5), 1415–1433.

Bashir, M., Strickland, B., & Bohr, J. (2016, November). What motivates people to use Bitcoin? In Social Informatics: 8th International Conference, SocInfo 2016, Bellevue, WA, USA, Proceedings, Part II 8 (pp. 347–367). Springer International Publishing.

Bharadwaj, S., & Deka, S. (2021). Behavioural intention towards investment in cryptocurrency: An integration of Rogers’ diffusion of innovation theory and the technology acceptance model. Forum Scientiae Oeconomia, 9(4), 137–159.

Davis, F. D. (1989). Perceived Usefulness, Perceived Ease of Use, and User Acceptance of Information Technology. MIS Quarterly, 319–340.

Dinev, T., & Hu, Q. (2007). The Centrality of Awareness in the Formation of User Behavioral Intention toward Protective Information Technologies. Journal of the Association for Information Systems, 8(7), 386–408.

Durmaz, Y., & Diyarbakırlıoğlu, I. (2011). A Theoretical Approach to the Strength of Motivation in Customer Behaviour. Global Journal of Human Social Science, 11(10), 37–42.

El Chaarani, H., Abiad, Z. E., El Nemar, S., & Sakka, G. (2023). Factors Affecting the Adoption of Cryptocurrencies for Financial Transactions. EuroMed Journal of Business, (ahead-of-print). https://www.emerald.com/insight/content/doi/10.1108/EMJB-04-2023-0121/full/html

Fishbein, M., & Ajzen, I. (1975). Belief, Attitude, Intention, and Behavior: An Introduction to Theory and Research. Reading, MA: Addison-Wesley.

Hamilton, M. (2020). Blockchain distributed ledger technology: An introduction and focus on smart contracts. Journal of Corporate Accounting & Finance, 31(2), 7–12.

Han, H., Al-Ansi, A., Chua, B. L., Tariq, B., Radic, A., & Park, S. H. (2020). The Post-Coronavirus World in the International Tourism Industry: Application of the Theory of Planned Behavior to Safer Destination Choices in the Case of US Outbound Tourism. International Journal of Environmental Research and Public Health, 17(18), 1–15.

Handarkho, Y. D., & Harjoseputro, Y. (2020). Intention to adopt mobile payment in physical stores: Individual switching behavior perspective based on Push–Pull–Mooring (PPM) theory. Journal of Enterprise Information Management, 33(2), 285–308.

Hasan, S. Z., Ayub, H., Ellahi, A., & Saleem, M. (2022). A Moderated Mediation Model of Factors Influencing Intention to Adopt Cryptocurrency among University Students. Human Behavior and Emerging Technologies, 2022, 1–14.

Hsu, C. H., Cai, L. A., & Li, M. (2010). Expectation, Motivation, and Attitude: A Tourist Behavioral Model. Journal of Travel Research, 49(3), 282–296.

Igbaria, M. (1994). An examination of the factors contributing to microcomputer technology acceptance. Accounting, Management and Information Technologies, 4(4), 205–224.

Kansal, P. (2016). Perceived Risk and Technology Acceptance Model in Self-service Banking: A Study on the Nature of Mediation. South Asian Journal of Management, 23(2), 51–71.

Kazerani, A., Rosati, D., & Lesser, B. (2017, August). Determining the usability of bitcoin for beginners using change tip and coinbase. In Proceedings of the 35th ACM International Conference on the Design of Communication (pp. 1–5).

Korže, S. Z. (2019). How smart tourism embrace blockchains and smart contracts. Mednarodno inovativno poslovanje [Journal of Innovative Business and Management], 11(2), 32–40.

Kumari, A., & Devi, N. C. (2023). Blockchain technology acceptance by investment professionals: A decomposed TPB model. Journal of Financial Reporting and Accounting, 21(1), 45–59.

Larasati, N., & P. I. Santosa (2017). Technology Readiness and Technology Acceptance Model in New Technology Implementation Process in Low Technology SMEs. International Journal of Innovation, Management and Technology, 8(2), 113–117.

Lee, M. K., Cheung, C. M., & Chen, Z. (2005). Acceptance of Internet-based learning medium: The role of extrinsic and intrinsic motivation. Information & Management, 42(8), 1095–1104.

Leung, D., & Dickinger, A. (2017, January). Use of Bitcoin in Online Travel Product Shopping: The European Perspective. In Information and Communication Technologies in Tourism 2017: Proceedings of the International Conference in Rome, Italy (pp. 741–754). Springer International Publishing.

Lin, W. R., Lin, C. Y., & Ding, Y. H. (2020). Factors Affecting the Behavioral Intention to Adopt Mobile Payment: An Empirical Study in Taiwan. Mathematics, 8(10), 1–19.

Makridis, C. A., Fröwis, M., Sridhar, K., & Böhme, R. (2023). The Rise of Decentralized Cryptocurrency Exchanges: Evaluating the Role of Airdrops and Governance Tokens. Journal of Corporate Finance, 79, 1–13.

Mattke, J., Maier, C., Reis, L., & Weitzel, T. (2021). Bitcoin investment: A mixed methods study of investment motivations. European Journal of Information Systems, 30(3), 261–285.

Mendoza-Tello, J. C., Mora, H., Pujol-López, F. A., & Lytras, M. D. (2019). Disruptive innovation of cryptocurrencies in consumer acceptance and trust. Information Systems and e-Business Management, 17, 195–222.

Mnif, E., Lacombe, I., & Jarboui, A. (2021). Users’ perception toward Bitcoin Green with big data analytics. Society and Business Review, 16(4), 592–615.

Nam, K., Dutt, C. S., Chathoth, P., & Khan, M. S. (2021). Blockchain technology for smart city and smart tourism: Latest trends and challenges. Asia Pacific Journal of Tourism Research, 26(4), 454–468.

Namahoot, K. S., & Rattanawiboonsom, V. (2022). Integration of TAM Model of Consumers’ Intention to Adopt Cryptocurrency Platform in Thailand: The Mediating Role of Attitude and Perceived Risk. Human Behavior and Emerging Technologies, 2022, 1–12.

Nurbarani, B. S., & Soepriyanto, G. (2022). Determinants of Investment Decision in Cryptocurrency: Evidence from Indonesian Investors. Universal Journal of Accounting and Finance, 10(1), 254–266.

Oktaviana, F. (2021). Learning Disorder of the Main Character as Reflected in The Theory of Everything Movie. Lingua, 17(2), 141–153.

Önder, I., & Gunter, U. (2022). Blockchain: Is it the future for the tourism and hospitality industry? Tourism Economics, 28(2), 291–299.

Özkan, S., Bindusara, G., & Hackney, R. (2010). Facilitating the adoption of e‐payment systems: Theoretical constructs and empirical analysis. Journal of Enterprise Information Management, 23(3), 305–325.

Potas, N., Açıkalın, Ş. N., Erçetin, Ş. Ş., Koçtürk, N., Neyişci, N., Çevik, M. S., & Görgülü, D. (2022). Technology addiction of adolescents in the COVID-19 era: Mediating effect of attitude on awareness and behavior. Current Psychology, 41(4), 1687–1703.

Putri, M. F., Purwandari, B., & Hidayanto, A. N. (2020, November). What do Affect Customers to Use Mobile Payment Continually? A Systematic Literature Review. In 2020 Fifth International Conference on Informatics and Computing (ICIC) (pp. 1–6). IEEE.

Quan, W., Moon, H., Kim, S., & Han, H. (2023). Mobile, traditional, and cryptocurrency payments influence consumer trust, attitude, and destination choice: Chinese vs Koreans. International Journal of Hospitality Management, 108, 1–12.

Rashideh, W. (2020). Blockchain technology framework: Current and future perspectives for the tourism industry. Tourism Management, 80, 1–13.

Rodriguez, M. C., Ooms, A., & Montañez, M. (2008). Students’ perceptions of online-learning quality Given comfort, motivation, satisfaction, and experience. Journal of Interactive Online Learning, 7(2), 105–125.

Rogers, E. M. (1995). Diffusion of Innovations (4th edition). New York: Free Press.

Sagheer, N., Khan, K. I., Fahd, S., Mahmood, S., Rashid, T., & Jamil, H. (2022). Factors Affecting Adaptability of Cryptocurrency: An Application of Technology Acceptance Model. Frontiers in Psychology, 13, 1–12.

Sánchez, R. A., & Hueros, A. D. (2010). Motivational factors that influence the acceptance of Moodle using TAM. Computers in Human Behavior, 26(6), 1632–1640.

Schaupp, L. C., & Festa, M. (2018, May). Cryptocurrency adoption and the road to regulation. In Proceedings of the 19th Annual International Conference on Digital Government Research: Governance in the Data Age (pp. 1–9).

Shahzad, F., Xiu, G., Wang, J., & Shahbaz, M. (2018). An empirical investigation on the adoption of cryptocurrencies among the people of mainland China. Technology in Society, 55, 33–40.

Shahzad, M. F., Khan, K. I., Saleem, S., & Rashid, T. (2021). What Factors Affect the Entrepreneurial Intention to Start-Ups? The Role of Entrepreneurial Skills, Propensity to Take Risks, and Innovativeness in Open Business Models. Journal of Open Innovation: Technology, Market, and Complexity, 7(3), 173.

Shrestha, N. (2021). Factor Analysis as a Tool for Survey Analysis. American Journal of Applied Mathematics and Statistics, 9(1), 4–11.

Silva, G., Mendes Filho, L., & Marques Júnior, S. (2023). Intention to use cryptocurrencies by tourism enterprise managers: An approach using the Technology Acceptance Model (TAM). Revista Brasileira de Pesquisa em Turismo, 16, e-2556.

Siraye, Z. (2014). Customers’ adoption of electronic banking service channels in Ethiopia: An integration of technology acceptance model and perceived risk with theory of planned behaviour. International Journal of Electronic Finance, 8, 21–34.

Smutny, Z., Sulc, Z., & Lansky, J. (2021). Motivations, Barriers and Risk-Taking When Investing in Cryptocurrencies. Mathematics, 9(14), 1655.

Sohaib, O., Hussain, W., Asif, M., Ahmad, M., & Mazzara, M. (2019). A PLS-SEM Neural Network approach for understanding Cryptocurrency Adoption. IEEE Access, 8, 1313–1315.

Steinmetz, F., Von Meduna, M., Ante, L., & Fiedler, I. (2021). Ownership, uses and perceptions of cryptocurrency: Results from a population survey. Technological Forecasting and Social Change, 173, 1–19.

Streiner, D. L. (2003). Starting at the beginning: An introduction to coefficient alpha and internal consistency. Journal of Personality Assessment, 80(1), 99–103.

Susanty, A., Handoko, A., & Puspitasari, N. B. (2020). Push-pull-mooring framework for e-commerce adoption in small and medium enterprises. Journal of Enterprise Information Management, 33(2), 381–406.

Taherdoost, H., & Masrom, M. (2009, June). An Examination of Smart Card Technology Acceptance Using Adoption Model. In Proceedings of the ITI 2009 31st International Conference on Information Technology Interfaces (pp. 329–334). IEEE.

Talwar, S., Dhir, A., Khalil, A., Mohan, G., & Islam, A. N. (2020). Point of adoption and beyond. Initial trust and mobile-payment continuation intention. Journal of Retailing and Consumer Services, 55, 1–12.

Tang, Z., & Chen, L. (2020). An empirical study of brand microblog users’ unfollowing motivations: The perspective of push-pull-mooring model. International Journal of Information Management, 52, 1–11.

Teo, T., & Tan, L. (2012). The Theory of Planned Behavior (TPB) and Pre-Service Teachers’ Technology Acceptance: A Validation Study Using Structural Equation Modeling. Journal of Technology and Teacher Education, 20(1), 89–104.

Treiblmaier, H., & Sillaber, C. (2021). The impact of blockchain on e-commerce: A framework for salient research topics. Electronic Commerce Research and Applications, 48, 1–14.

Treiblmaier, H., Leung, D., Kwok, A. O., & Tham, A. (2021). Cryptocurrency Adoption in Travel and Tourism – An Exploratory Study of Asia Pacific Travellers. Current Issues in Tourism, 24(22), 3165–3181.

Uematsu, Y., & Tanaka, S. (2019). High-dimensional macroeconomic forecasting and variable selection via penalized regression. The Econometrics Journal, 22(1), 34–56.

Vetrichelvi, M. S., & Priya, A. S. (2022). A study on awareness and attitudes towards crypto currency among college students. Specialusis Ugdymas, 1(43), 6488–6496.

Walton, A. J., & Johnston, K. A. (2018). Exploring Perceptions of Bitcoin Adoption: The South African Virtual Community Perspective. Interdisciplinary Journal of Information, Knowledge, and Management, 13, 165–182.

Wang, L., Luo, X. R., Yang, X., & Qiao, Z. (2019). Easy Come or Easy Go? Empirical Evidence on Switching Behaviors in Mobile Payment Applications. Information & Management, 56(7), 1–13.

White Baker, E., Al‐Gahtani, S. S., & Hubona, G. S. (2007). The effects of gender and age on new technology implementation in a developing country: Testing the theory of planned behavior (TPB). Information Technology & People, 20(4), 352–375.

Xie, Q., Song, W., Peng, X., & Shabbir, M. (2017). Predictors for e-government adoption: Integrating TAM, TPB, trust and perceived risk. The Electronic Library, 35(1), 2–20.

Zhang, K. Z., Cheung, C. M., Lee, M. K., & Chen, H. (2008, January). Understanding the Blog Service Switching in Hong Kong: An Empirical Investigation. In Proceedings of the 41st annual Hawaii International Conference on System Sciences (pp. 269–269).

Appendix

Scales Used in the Study

|

Technology awareness (TA) |

|

|

TA1 |

I follow the news about cryptocurrency technology. |

|

TA2 |

I follow the development of cryptocurrency technology. |

|

TA3 |

I discuss issues of cryptocurrency usage with friends and people around me. |

|

TA4 |

I read about the problems of cryptocurrency usage. |

|

Attitude towards cryptocurrencies (AT) |

|

|

AT1 |

I think it is very convenient to use cryptocurrency anytime. |

|

AT2 |

I think it is very convenient to use cryptocurrency anywhere. |

|

AT3 |

I think using cryptocurrency is a good idea. |

|

Motivational factors (MOT) |

|

|

MOT1 |

Cryptocurrency works anywhere and at any time*. |

|

MOT2 |

The underlying technology of cryptocurrency is intriguing. |

|

MOT3 |

Lower transaction costs are involved in cryptocurrency-based payments compared to traditional payment systems. |

|

MOT4 |

The establishment of a cryptocurrency account does not require a credit card or bank account. |

|

MOT5 |

Cryptocurrency accounts are not connected to information about the owner’s identity. |

|

MOT6 |

Cryptocurrency-based payments do not require a PIN or signature for verification. |

|

Behavioural intention (INT) |

|

|

INT1 |

I intend to periodically use cryptocurrency for travel-related services. |

|

INT2 |

I want to use travel-related services that enable me to pay using cryptocurrency. |

|

INT3 |

I want to use cryptocurrency to pay for travel-related services. |

Note. * Statement removed following factor analysis.